AtriCure Investor Presentation Creating a World Class Afib Platform © 2021 AtriCure, Inc. All rights reserved. AtriCure 1

Forward Looking Statements This presentation contains “forward-looking statements,” which are statements related to future events that by their nature address matters that are uncertain. All forward-looking information is inherently uncertain and actual results may differ materially from assumptions, estimates or expectations reflected or contained in the forward-looking statements as a result of various factors. For details on the uncertainties that may cause AtriCure’ s actual results to be materially different than those expressed in its forward-looking statements, see its Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the SEC and available at http://www.sec.gov, which contain risk factors. Forward-looking statements address AtriCure’ s expected future business, financial performance, financial condition as well as results of operations, and often contain words such as “intends,” “estimates,” “anticipates,” “hopes,” “projects,” “plans,” “expects,” “seek,” “believes,” "see," “should,” “will,” “would,” “target,” and similar expressions and the negative versions thereof. Such statements are based only upon current expectations of AtriCure. Any forward-looking statement speaks only as of the date made. Reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to differ materially from those expressed or implied. Forward-looking statements include statements that address activities, events or developments that AtriCure expects, believes or anticipates will or may occur in the future. Forward-looking statements are based on AtriCure’ s experience and perception of current conditions, trends, expected future developments and other factors it believes are appropriate under the circumstances and are subject to numerous risks and uncertainties, many of which are beyond AtriCure’ s control. These risks and uncertainties include, but are not limited to: whether AtriCure will be able to successfully implement commercialization plans for CONVERGE; whether the market opportunity for CONVERGE is consistent with the Company’s expectations and market research; AtriCure’ s ability to execute on the commercial launch of CONVERGE on the timeline expected, or at all; whether AtriCure will be able to generate its projected net product revenue on the timeline expected, or at all; the effects of the COVID-19 outbreak on AtriCure’ s business and results of operations, including the effects of suspension or halting of elective surgeries; other matters that could affect the availability or commercial potential of CONVERGE and AtriCure’ s other products and product candidates; whether AtriCure’ s ongoing clinical trials will meet the specified endpoints and will be approved by FDA and any other required regulatory authorities; competition from new and existing products and procedures in the highly competitive medical device industry; and other important factors, including, AtriCure’ s expectations regarding its financial performance and capital requirements, any of which could cause AtriCure’ s actual results to differ from those contained in the forward-looking statements or otherwise discussed in AtriCure’ s reports filed with the SEC. With respect to the forward-looking statements, AtriCure claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. AtriCure undertakes no obligation to publicly update or revise any forward-looking statements to reflect new information or future events or otherwise unless required by law. © 2021 AtriCure, Inc. All rights reserved. AtriCure 2

Non-GAAP Financial Measures To supplement AtriCure’ s consolidated financial statements prepared in accordance with accounting principles generally accepted in the United States of America, or GAAP, AtriCure provides certain non-GAAP financial measures as supplemental financial metrics in this presentation. Adjusted EBITDA is calculated as Net loss before other income/expense (including interest), income tax expense, depreciation and amortization expense, share-based compensation expense, acquisition costs, legal settlement costs, and change in fair value of contingent consideration liabilities. Management believes in order to properly understand short-term and long-term financial trends, investors may wish to consider the impact of these excluded items in addition to GAAP measures. The excluded items vary in frequency and/or impact on our continuing results of operations and management believes that the excluded items are typically not reflective of our ongoing core business operations and financial condition. Further, management uses adjusted EBITDA for both strategic and annual operating planning. Adjusted loss per share is a non-GAAP measure which calculates the net loss per share before non-cash adjustments in fair value of contingent consideration liabilities and legal settlement costs. The non-GAAP financial measures used by AtriCure may not be the same or calculated in the same manner as those used and calculated by other companies. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for AtriCure’ s financial results prepared and reported in accordance with GAAP. We urge investors to review the reconciliation of these non-GAAP financial measures to the comparable GAAP financials measures, and not to rely on any single financial measure to evaluate our business. © 2021 AtriCure, Inc. All rights reserved. AtriCure 3

We are passionately focused on reducing the global Afib epidemic and healing the lives of those affected Large Markets Addressing an underserved and growing patient population Strong Portfolio Existing products and solutions driving consistent growth Bright Future Novel therapies supported by growing body of clinical evidence © 2021 AtriCure, Inc. All rights reserved. AtriCure 4

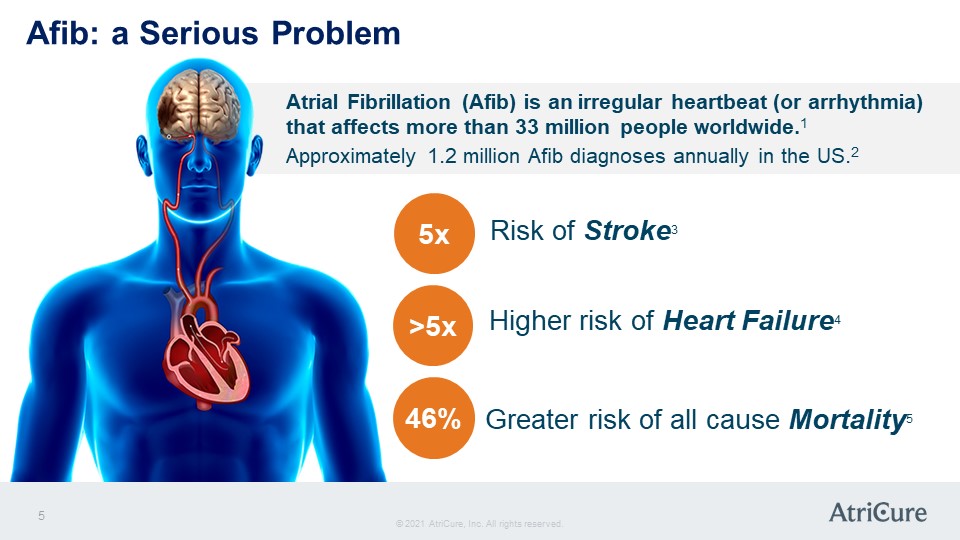

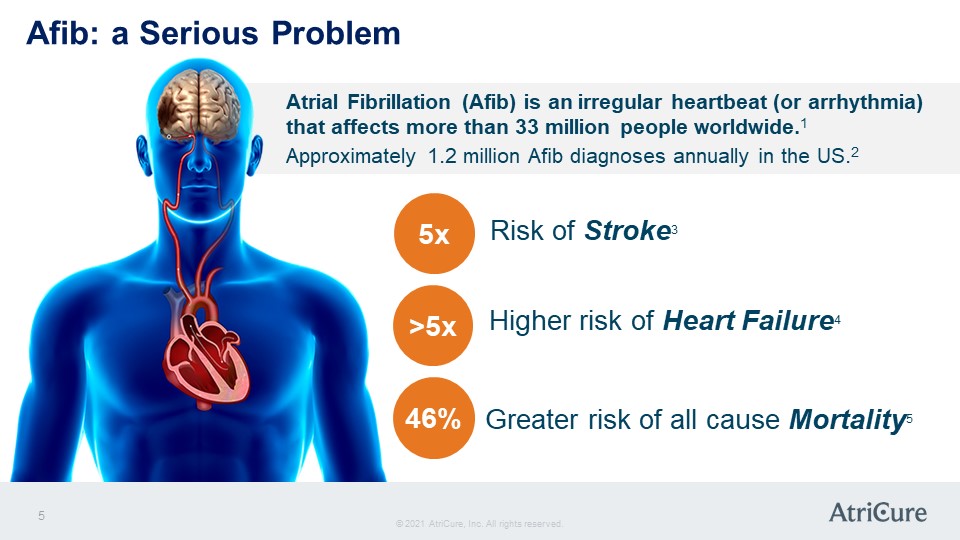

Afib: a Serious Problem Atrial Fibrillation (Afib) is an irregular heartbeat (or arrhythmia) that affects more than 33 million people worldwide.1 Approximately 1.2 million Afib diagnoses annually in the US.2 5x Risk of Stroke3 >5x Higher risk of Heart Failure 46% Greater risk of all cause Mortality 5 © 2021 AtriCure, Inc. All rights reserved. AtriCure

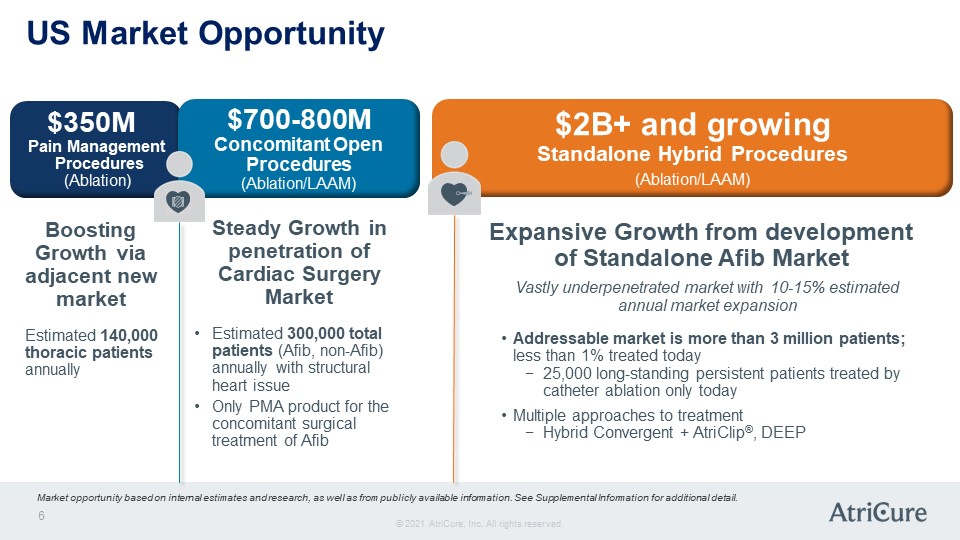

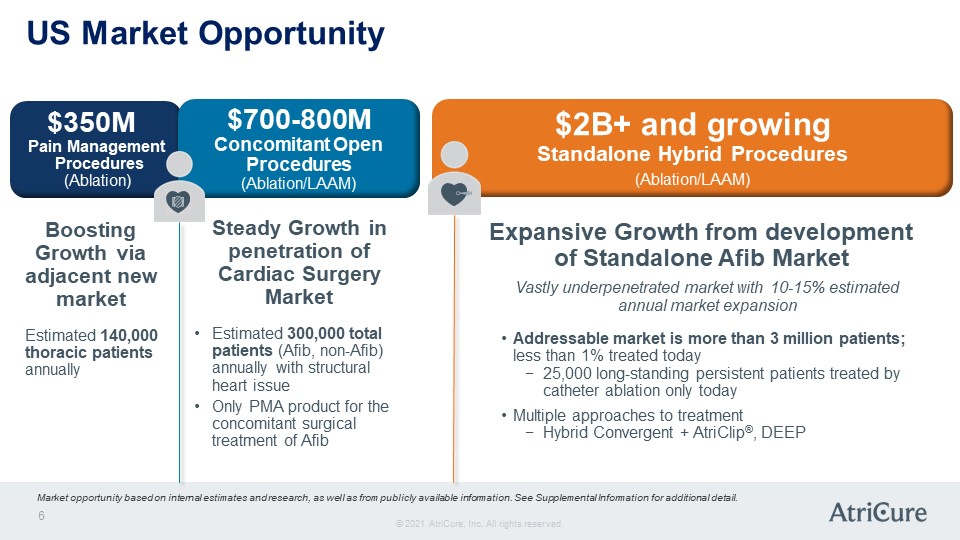

US Market Opportunity $350M Pain Management Procedures (Ablation) Boosting Growth via adjacent new market Estimated 140,000 thoracic patients annually $700-800M Concomitant Open Procedures (Ablation/LAAM) Steady Growth in penetration of Cardiac Surgery Market Estimated 300,000 total patients (Afib, non-Afib) annually with structural heart issue Only PMA product for the concomitant surgical treatment of Afib $2B+ and growing Standalone Hybrid Procedures (Ablation/LAAM) Expansive Growth from development of Standalone Afib Market Vastly underpenetrated market with 10-15% estimated annual market expansion Addressable market is more than 3 million patients; less than 1% treated today 25,000 long-standing persistent patients treated by catheter ablation only today Multiple approaches to treatment Hybrid Convergent + AtriClip®, DEEP Market opportunity based on internal estimates and research, as well as from publicly available information. See Supplemental Information for additional detail. © 2021 AtriCure, Inc. All rights reserved. AtriCure 6

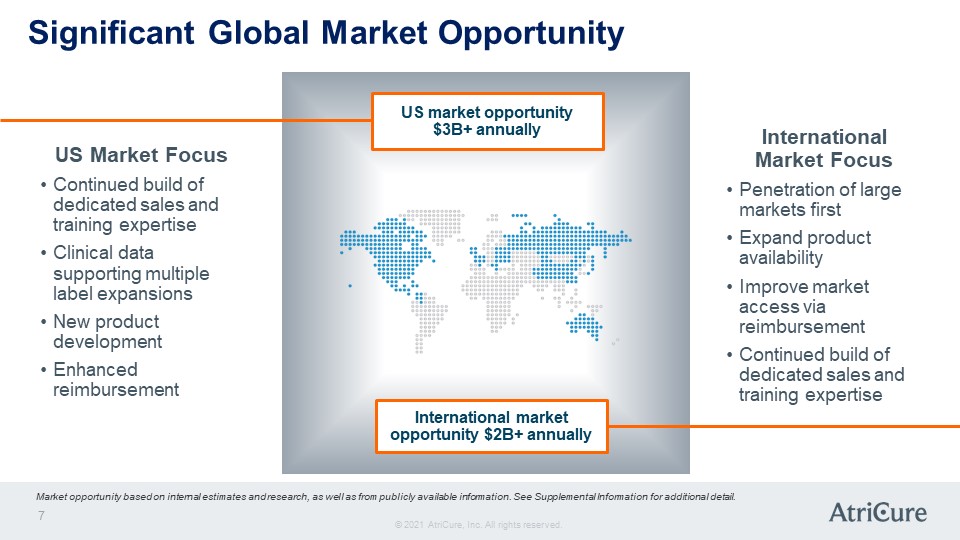

Significant Global Market Opportunity US Market Focus Continued build of dedicated sales and training expertise Clinical data supporting multiple label expansions New product development Enhanced reimbursement US market opportunity $3B+ annually International market opportunity $2B+ annually International Market Focus Penetration of large markets first Expand product availability Improve market access via reimbursement Continued build of dedicated sales and training expertise Market opportunity based on internal estimates and research, as well as from publicly available information. See Supplemental Information for additional detail. © 2021 AtriCure, Inc. All rights reserved. AtriCure 7

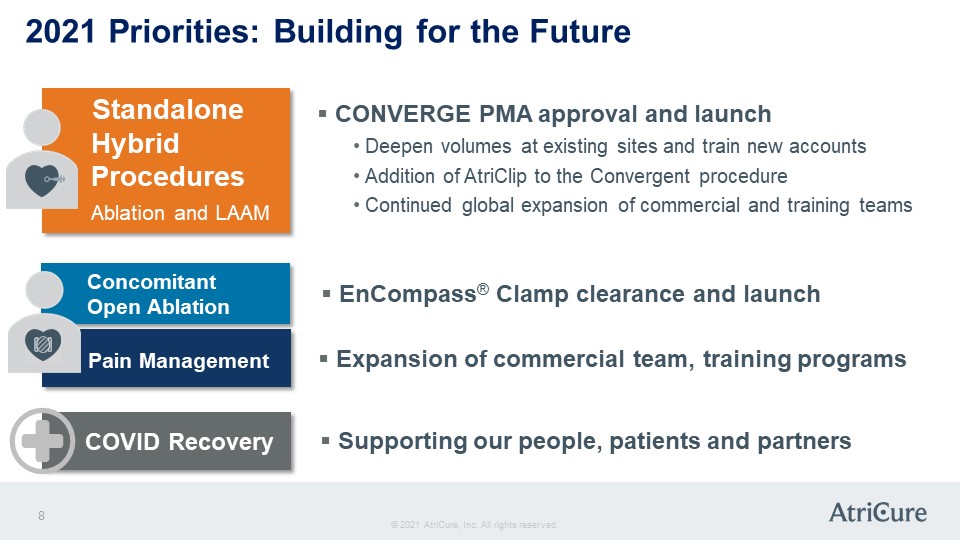

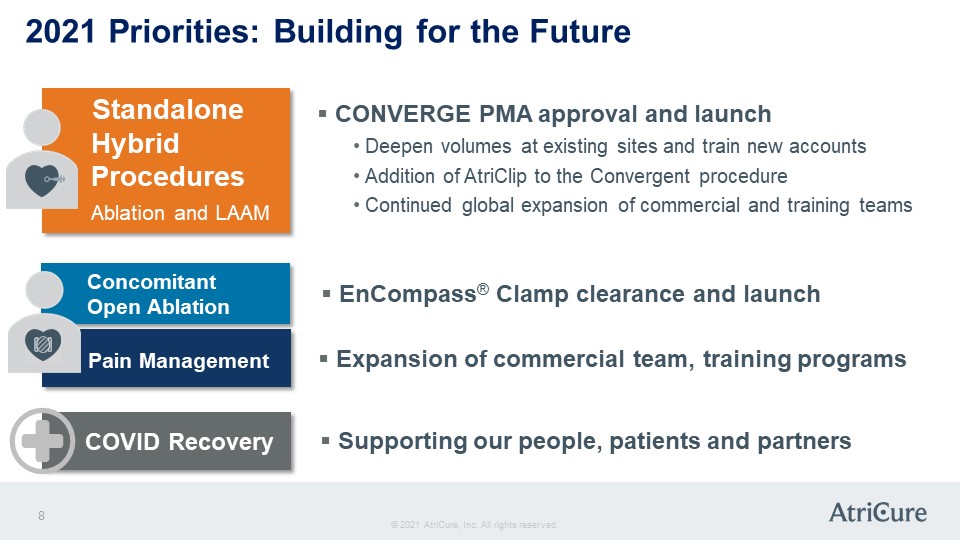

2021 Priorities: Building for the Future Standalone Hybrid Procedures Ablation and LAAM CONVERGE PMA approval and launch Deepen volumes at existing sites and train new accounts Addition of AtriClip to the Convergent procedure Continued global expansion of commercial and training teams Concomitant Open Ablation EnCompass® Clamp clearance and launch Pain Management Expansion of commercial team, training programs COVID Recovery Supporting our people, patients and partners © 2021 AtriCure, Inc. All rights reserved. AtriCure 8

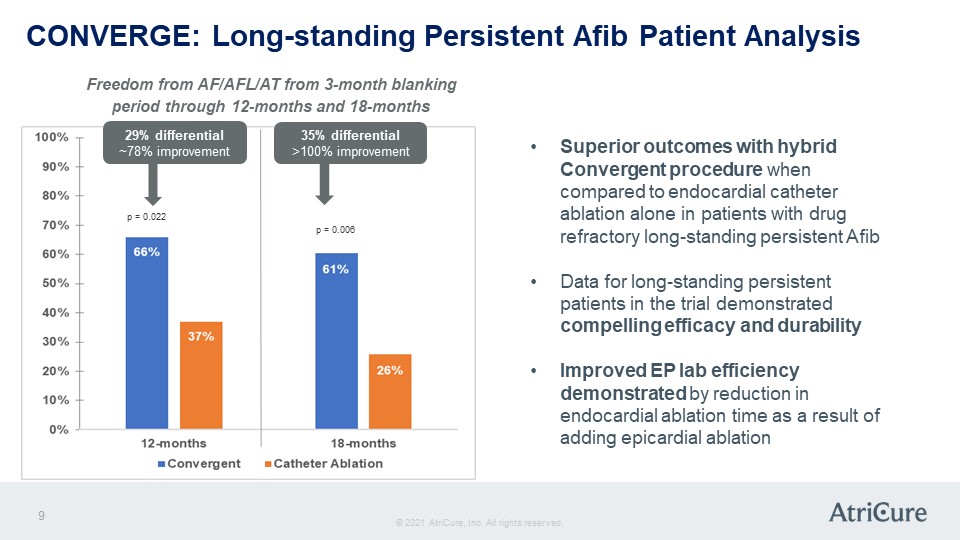

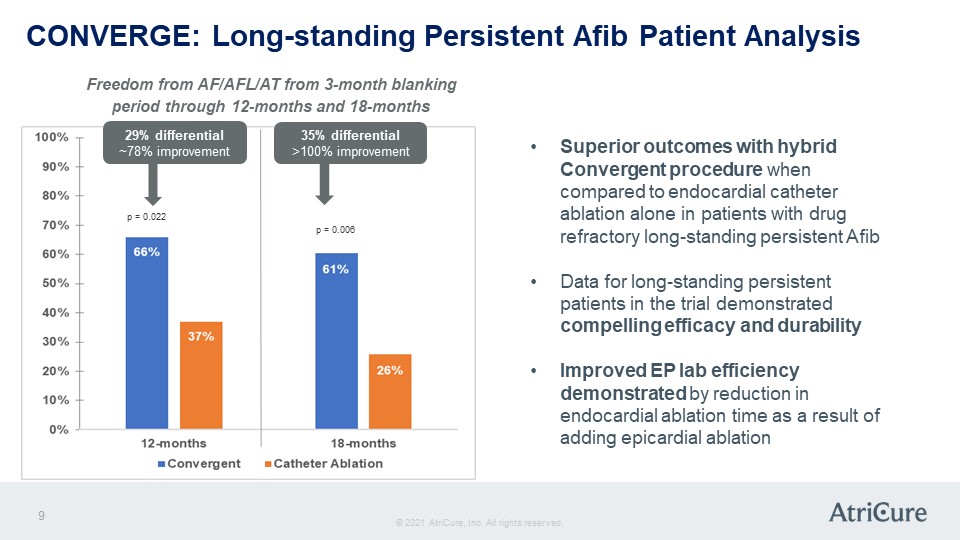

CONVERGE: Long-standing Persistent Afib Patient Analysis Freedom from AF/AFL/AT from 3-month blanking period through 12-months and 18-months 29% differential ~78% improvement 35% differential >100% improvement p = 0.022 66% 37% 12-months p = 0.006 61% 26% 18-months 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Covergent Catheter Ablation Superior outcomes with hybrid Convergent procedure when compared to endocardial catheter ablation alone in patients with drug refractory long-standing persistent Afib Data for long-standing persistent patients in the trial demonstrated compelling efficacy and durability Improved EP lab efficiency demonstrated by reduction in endocardial ablation time as a result of adding epicardial ablation © 2021 AtriCure, Inc. All rights reserved. AtriCure 9

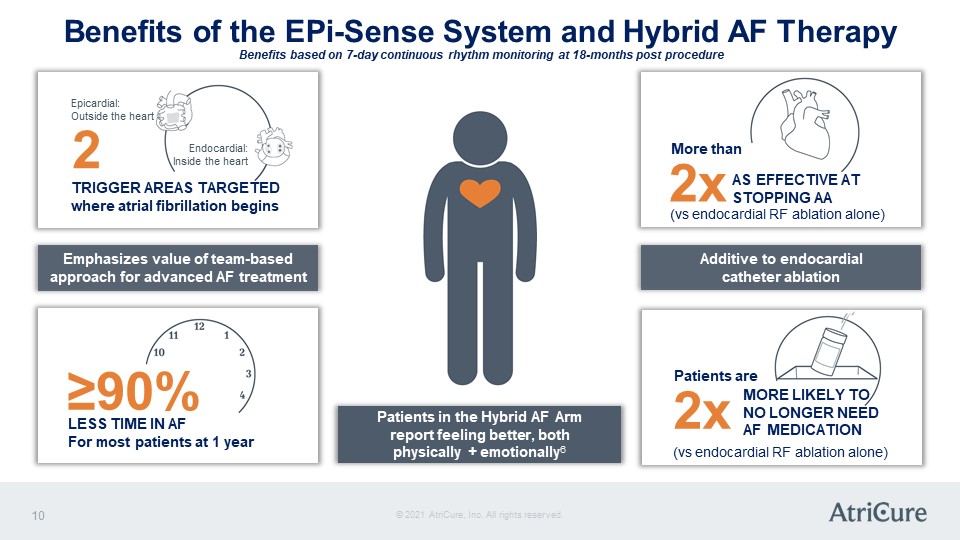

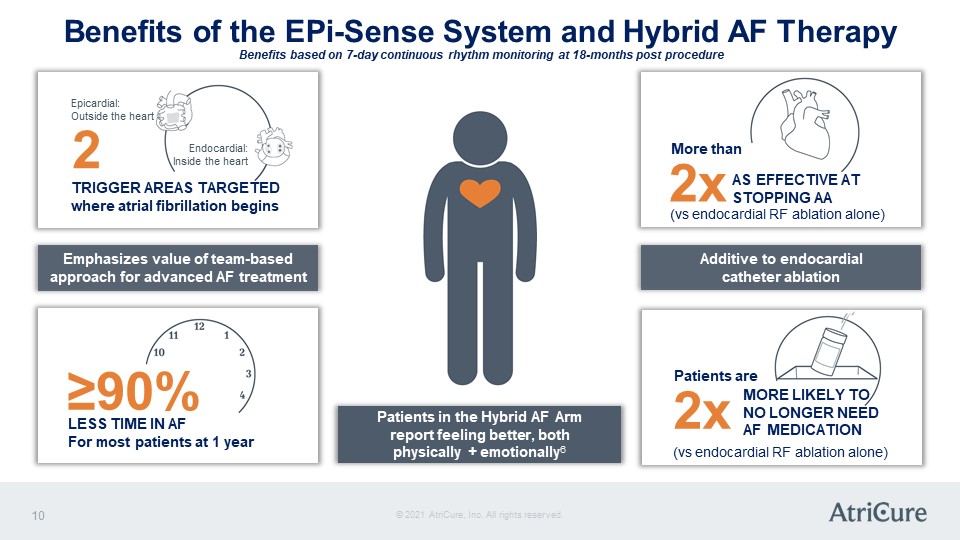

Benefits of the EPi-Sense System and Hybrid AF Therapy Benefits based on 7-day continuous rhythm monitoring at 18-months post procedure Epicardial: Outside the heart 2 Endocardial: Inside the heart TRIGGER AREAS TARGETED where atrial fibrillation begins Emphasizes value of team-based approach for advanced AF treatment ≥90% LESS TIME IN AF For most patients at 1 year Patients in the Hybrid AF Arm report feeling better, both physically + emotionally6 More than 2x AS EFFECTIVE AT STOPPING AA (vs endocardial RF ablation alone) Additive to endocardial catheter ablation Patients are 2x MORE LIKELY TO NO LONGER NEED AF MEDICATION (vs endocardial RF ablation alone) © 2021 AtriCure, Inc. All rights reserved. AtriCure 10

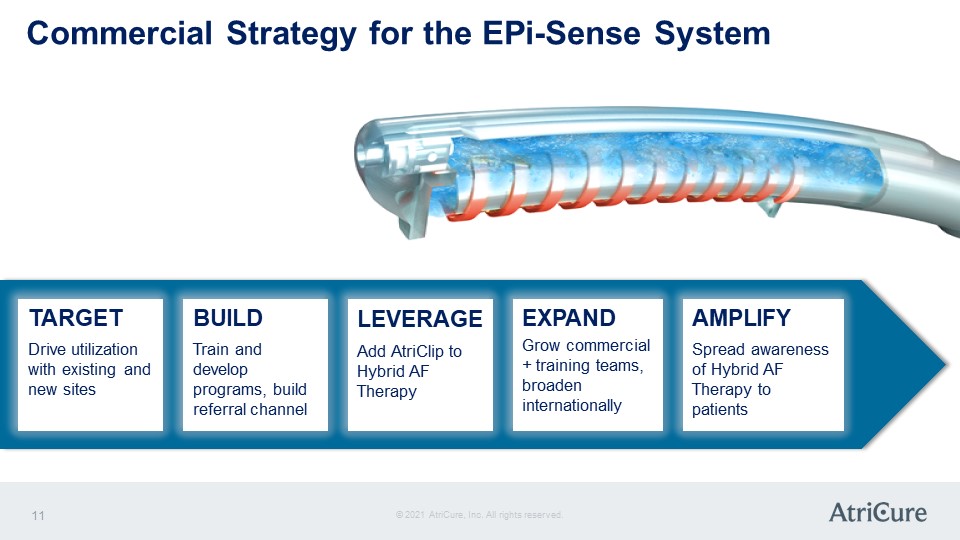

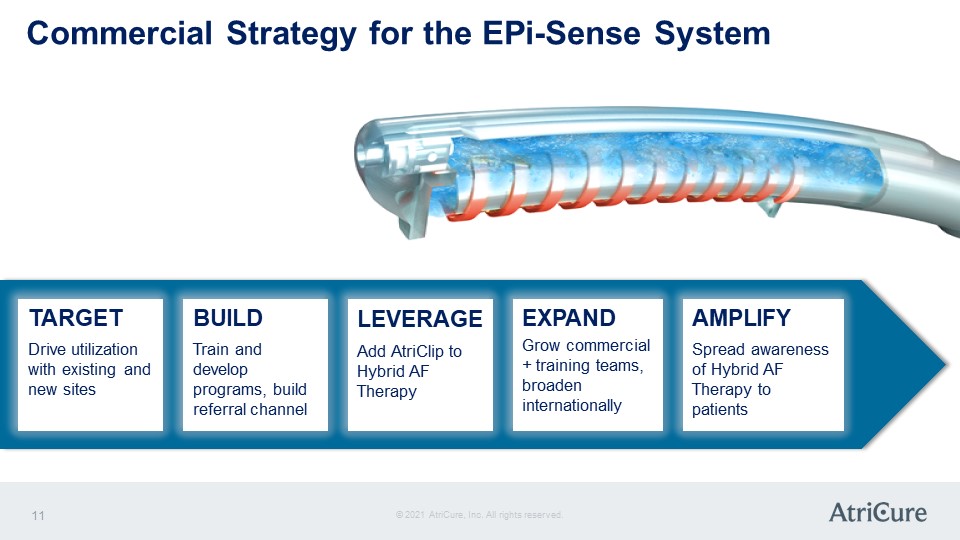

Commercial Strategy for the EPi-Sense System TARGET Drive utilization with existing and new sites BUILD Train and develop programs, build referral channel LEVERAGE Add AtriClip to Hybrid AF Therapy EXPAND Grow commercial + training teams, broaden internationally AMPLIFY Spread awareness of Hybrid AF Therapy to patients © 2021 AtriCure, Inc. All rights reserved. AtriCure 11

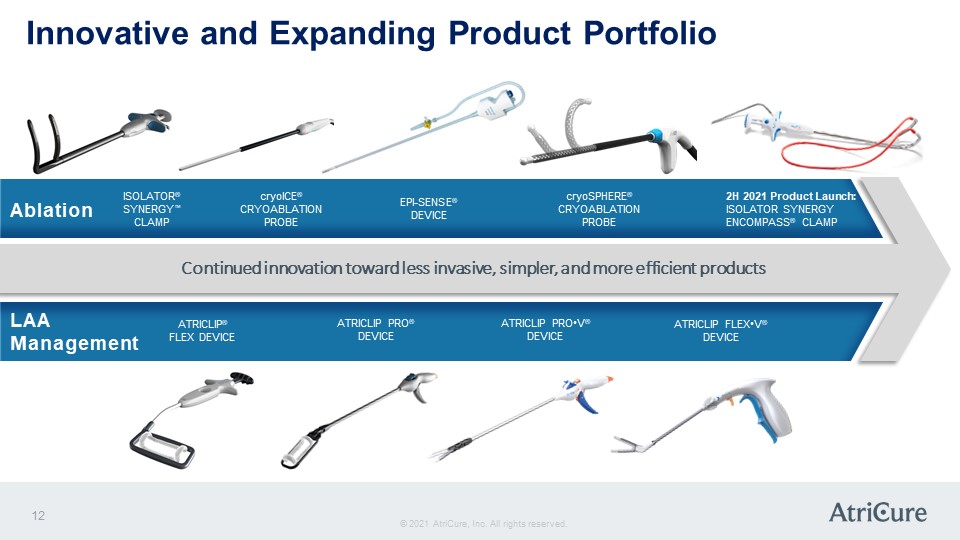

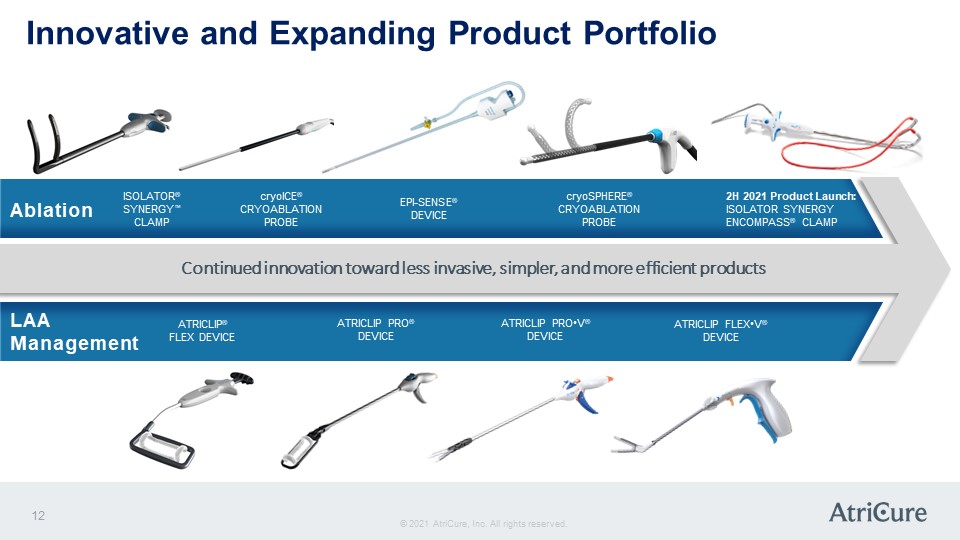

Innovative and Expanding Product Portfolio Ablation ISOLATOR® SYNERGY™ CLAMP cryoICE® CRYOABLATION PROBE EPI-SENSE® DEVICE cryoSPHERE® CRYOABLATION PROBE 2H 2021 Product Launch: ISOLATOR SYNERGY ENCOMPASS® CLAMP LAA Management ATRICLIP® FLEX DEVICE ATRICLIP PRO® DEVICE ATRICLIP PRO•V® DEVICE ATRICLIP FLEX•V® DEVICE © 2021 AtriCure, Inc. All rights reserved. AtriCure 12

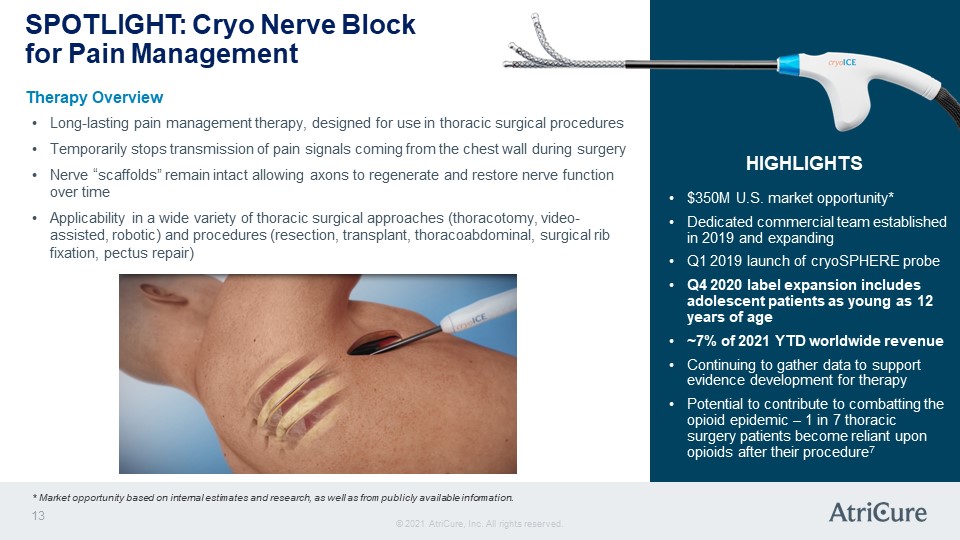

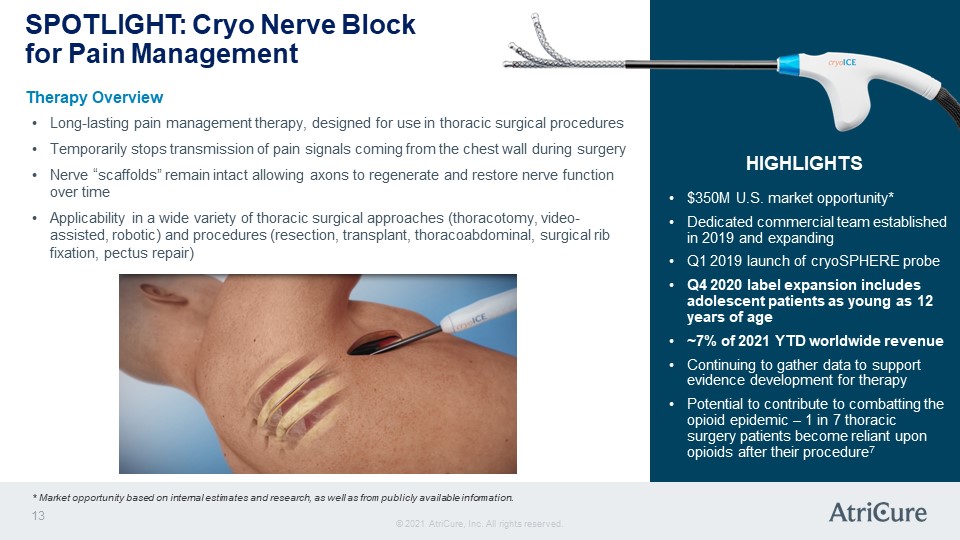

SPOTLIGHT: Cryo Nerve Block for Pain Management Therapy Overview Long-lasting pain management therapy, designed for use in thoracic surgical procedures Temporarily stops transmission of pain signals coming from the chest wall during surgery Nerve “scaffolds” remain intact allowing axons to regenerate and restore nerve function over time Applicability in a wide variety of thoracic surgical approaches (thoracotomy, video-assisted, robotic) and procedures (resection, transplant, thoracoabdominal, surgical rib fixation, pectus repair) HIGHLIGHTS $350M U.S. market opportunity* Dedicated commercial team established in 2019 and expanding Q1 2019 launch of cryoSPHERE probe Q4 2020 label expansion includes adolescent patients as young as 12 years of age ~7% of 2021 YTD worldwide revenue Continuing to gather data to support evidence development for therapy Potential to contribute to combatting the opioid epidemic – 1 in 7 thoracic surgery patients become reliant upon opioids after their procedure7 * Market opportunity based on internal estimates and research, as well as from publicly available information. © 2021 AtriCure, Inc. All rights reserved. AtriCure 13

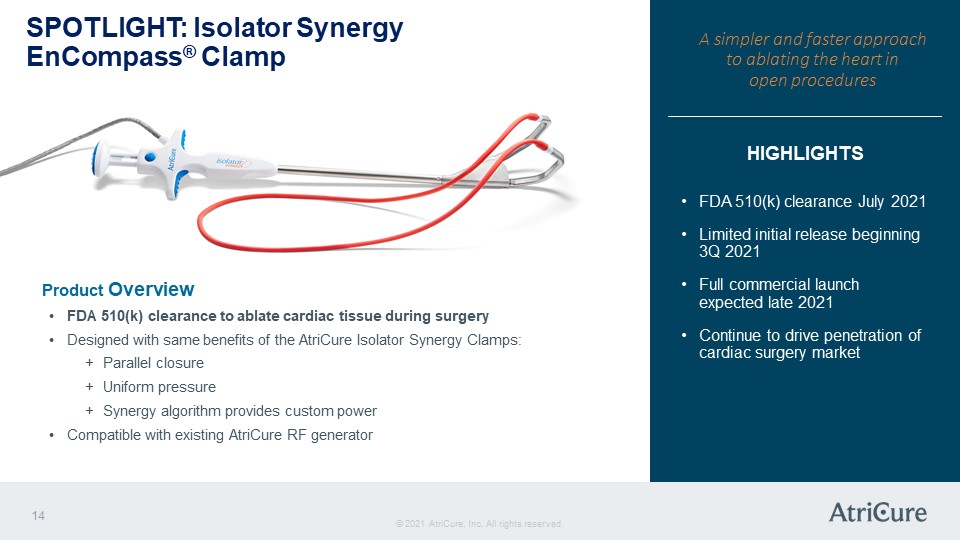

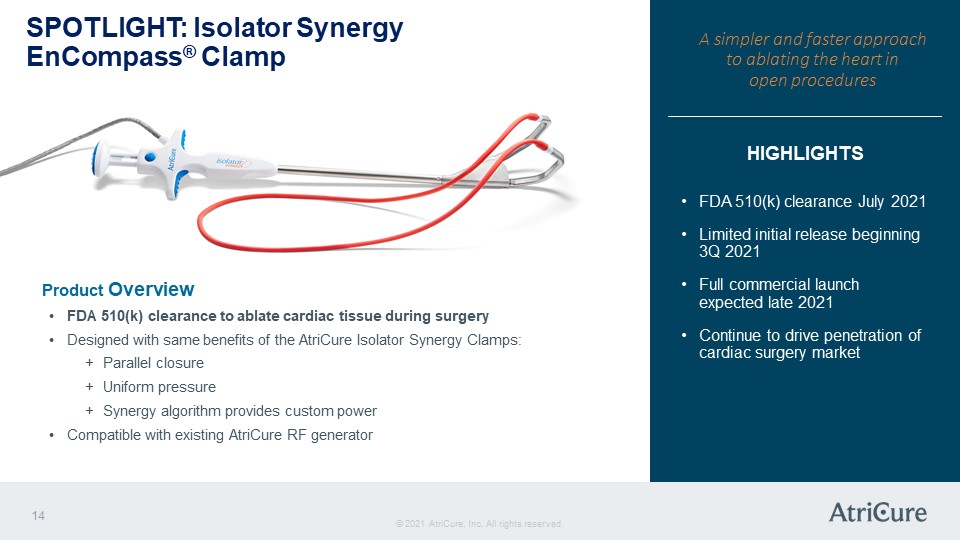

SPOTLIGHT: Isolator SynergyEnCompass® Clamp Product Overview FDA 510(k) clearance to ablate cardiac tissue during surgery Designed with same benefits of the AtriCure Isolator Synergy Clamps: Parallel closure Uniform pressure Synergy algorithm provides custom power Compatible with existing AtriCure RF generator A simpler and faster approach to ablating the heart in open procedures HIGHLIGHTS FDA 510(k) clearance July 2021 Limited initial release beginning 3Q 2021 Full commercial launch expected late 2021 Continue to drive penetration of cardiac surgery market © 2021 AtriCure, Inc. All rights reserved. AtriCure 14

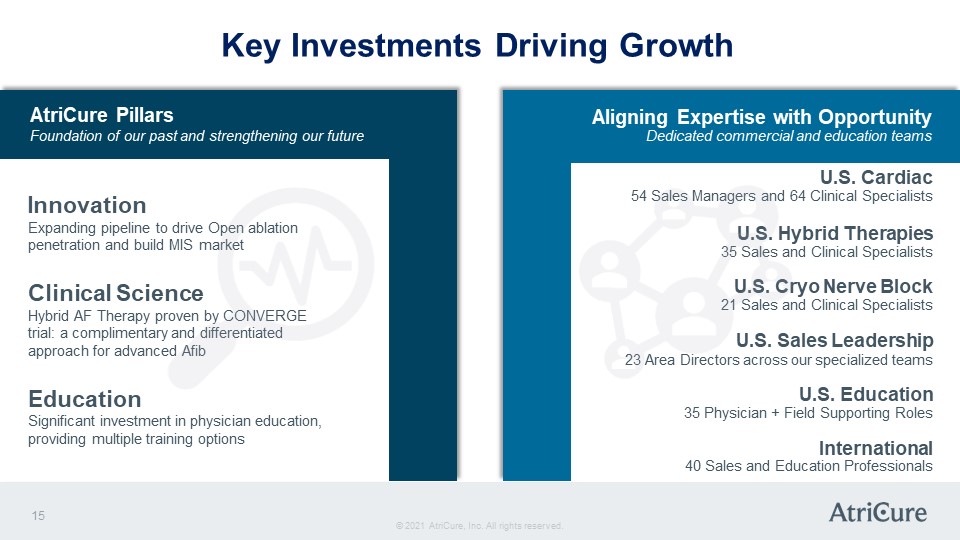

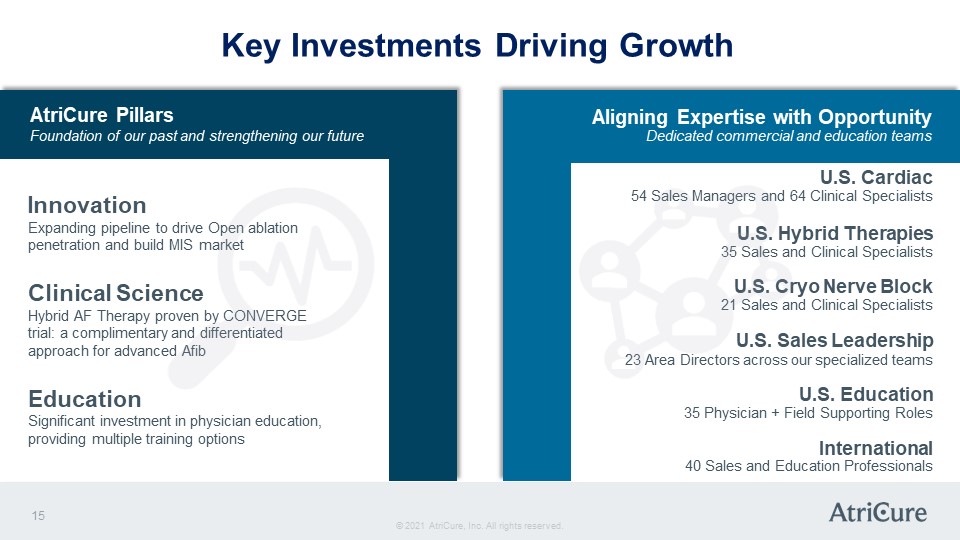

Key Investments Driving Growth AtriCure Pillars Foundation of our past and strengthening our future Innovation Expanding pipeline to drive Open ablation penetration and build MIS market Clinical Science Hybrid AF Therapy proven by CONVERGE trial: a complimentary and differentiated approach for advanced Afib Education Significant investment in physician education, providing multiple training options Aligning Expertise with Opportunity Dedicated commercial and education teams U.S. Cardiac 54 Sales Managers and 64 Clinical Specialists U.S. Hybrid Therapies 35 Sales and Clinical Specialists U.S. Cryo Nerve Block 21 Sales and Clinical Specialists U.S. Sales Leadership 23 Area Directors across our specialized teams U.S. Education 35 Physician + Field Supporting Roles International 40 Sales and Education Professionals © 2021 AtriCure, Inc. All rights reserved. AtriCure 15

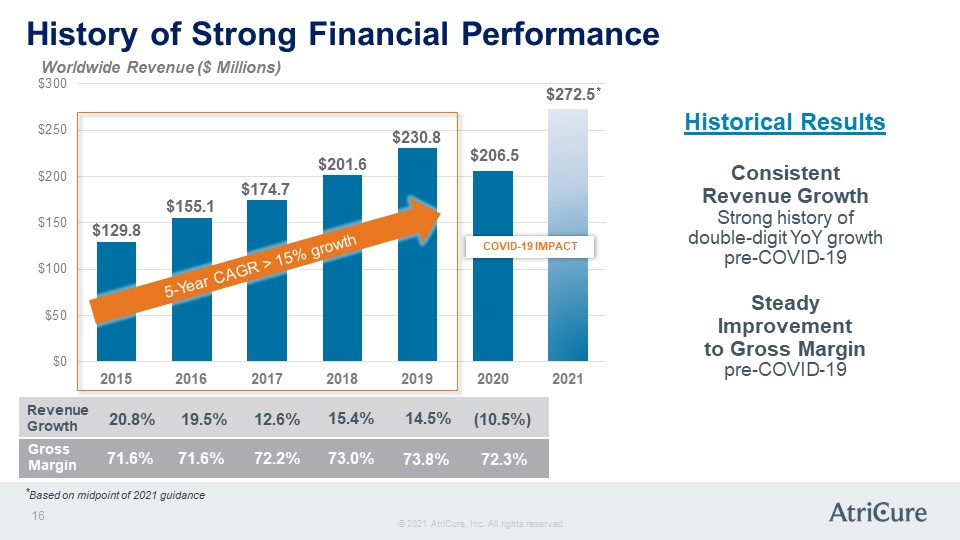

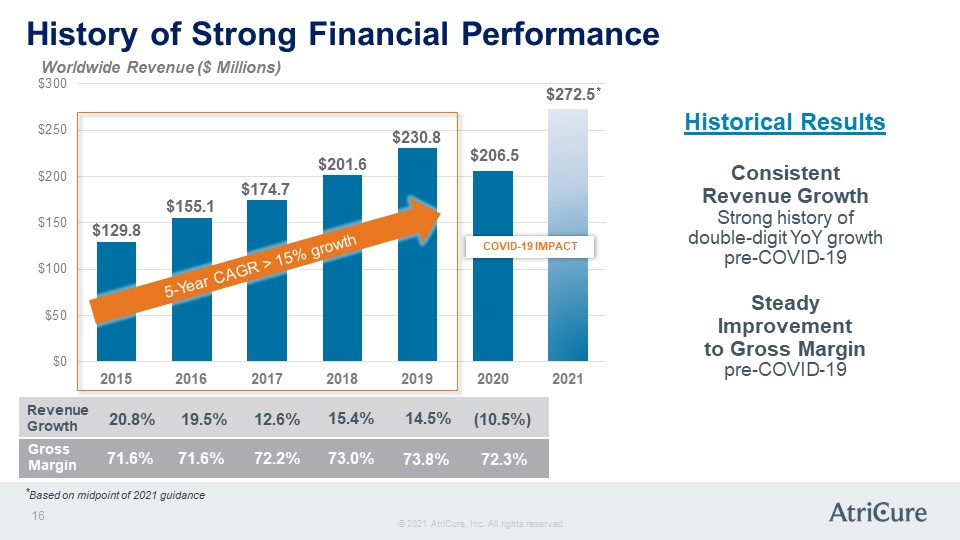

History of Strong Financial Performance Worldwide Revenue ($ millions) Historical Results Consistent Revenue Growth Strong history of double-digit YoY growth pre-COVID-19 Steady Improvement to Gross Margin pre-COVID-19 $0 $50 $100 $150 $200 $250 2015 129.8 2016 $155.1 2017 $174.7 2018 $201.6 2019 $230.8 2020 $206.5 2021 $272.5* COVID-19 Impact Revenue Growth 20.8% 19.5% 12.6% 15.4% 14.5% (10.5%) Gross Margin 71.6% 71.6% 72.2% 73.0% 73.8% 72.3% © 2021 AtriCure, Inc. All rights reserved. AtriCure 16

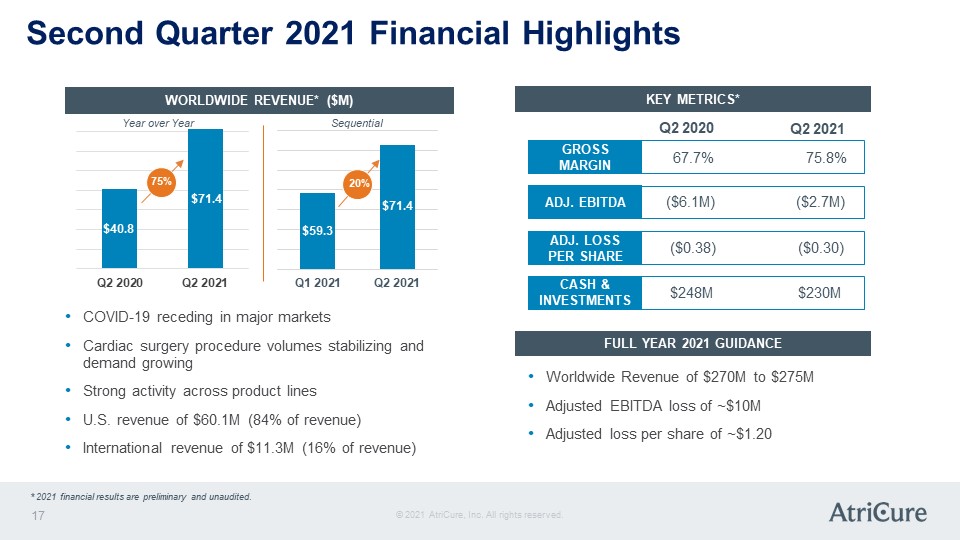

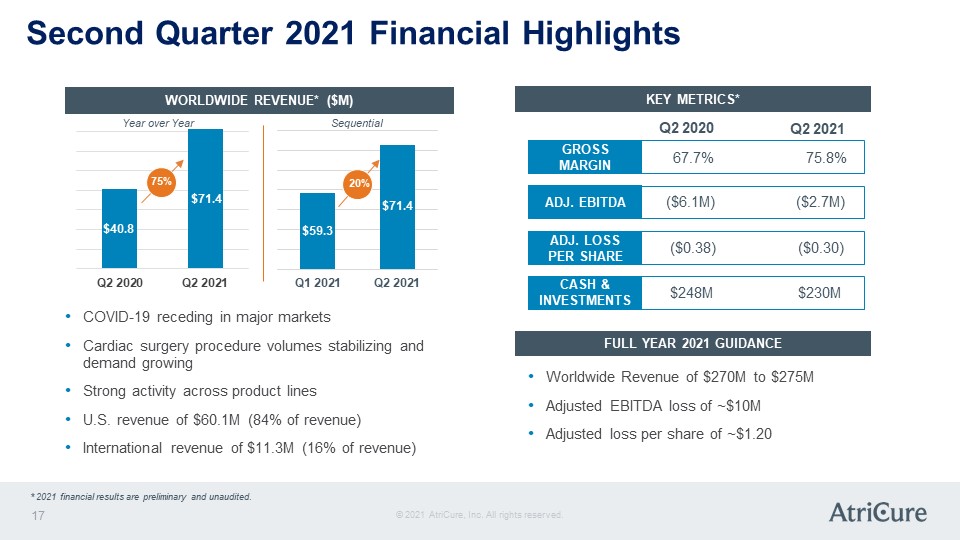

Second Quarter 2021 Financial Highlights WORLDWIDE REVENUE* ($M) Year over Year Sequential Q2 2020 $40.8 75% Q2 2021 $71.4 Q1 2021 $59.3 20% Q2 2021 $71.4 COVID-19 receding in major markets Cardiac surgery procedure volumes stabilizing and demand growing Strong activity across product lines U.S. revenue of $60.1M (84% of revenue) International revenue of $11.3M (16% of revenue) KEY METRICS* GROSS MARGIN 67.7% 75.8% ADJ. EBITDA ($6.1M) ($2.7M) ADJ. LOSS PER SHARE ($0.38) ($0.30) CASH & INVESTMENTS $248M $230M FULL YEAR 2021 GUIDANCE Worldwide Revenue of $270M to $275M Adjusted EBITDA loss of ~$10M Adjusted loss per share of ~$1.20 © 2021 AtriCure, Inc. All rights reserved. AtriCure 17

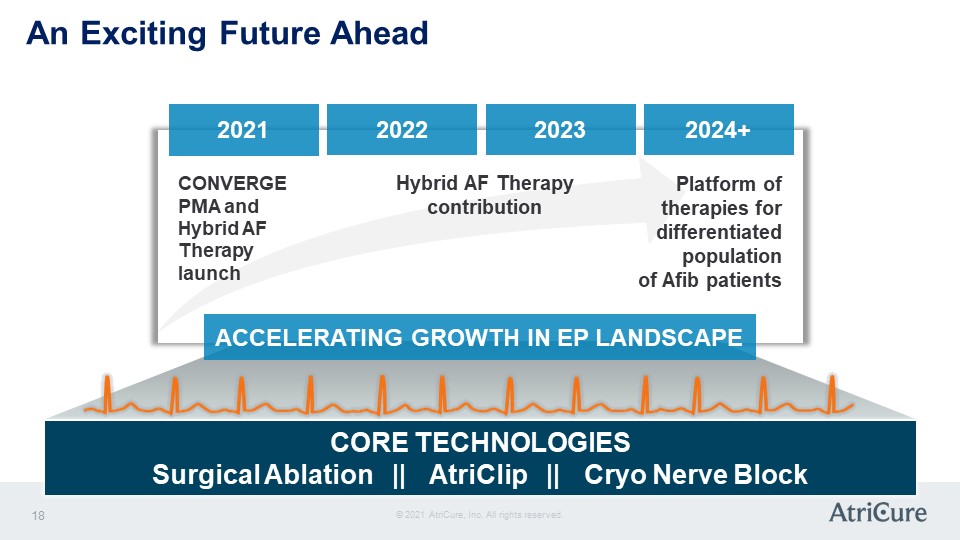

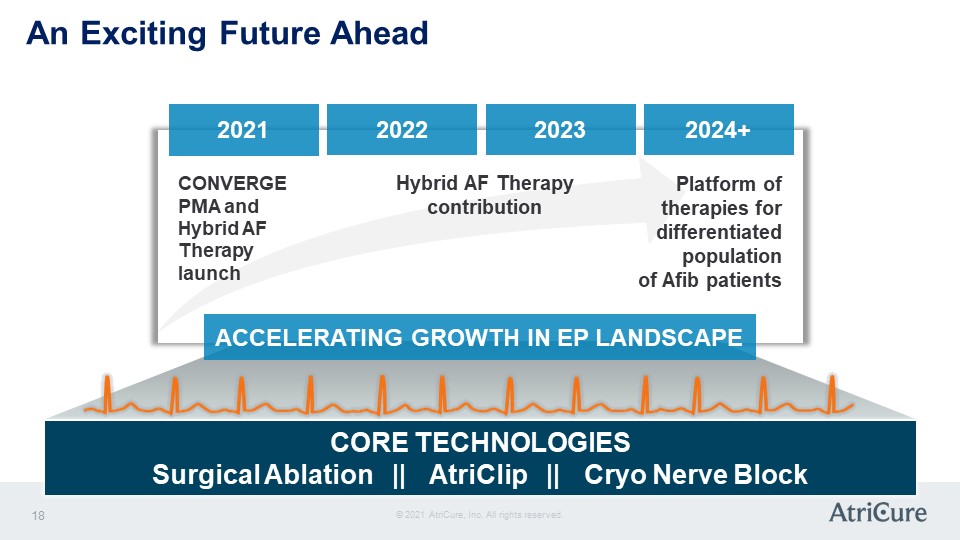

An Exciting Future Ahead 2021 2020 2023 2024+ CONVERGE PMA and Hybrid AF Therapy launch Hybrid AF Therapy contribution Platform of therapies for differentiated population of Afib patients ACCELERATING GROWTH IN EP LANDSCAPE CORE TECHNOLOGIES Surgical Ablation || AtriClip || Cryo Nerve Block © 2021 AtriCure, Inc. All rights reserved. AtriCure 18

Thank You! © 2021 AtriCure, Inc. All rights reserved. AtriCure 19

Supplemental Information References for any comments, statistics, or figures in this presentation are available upon request. © 2021 AtriCure, Inc. All rights reserved. AtriCure 20

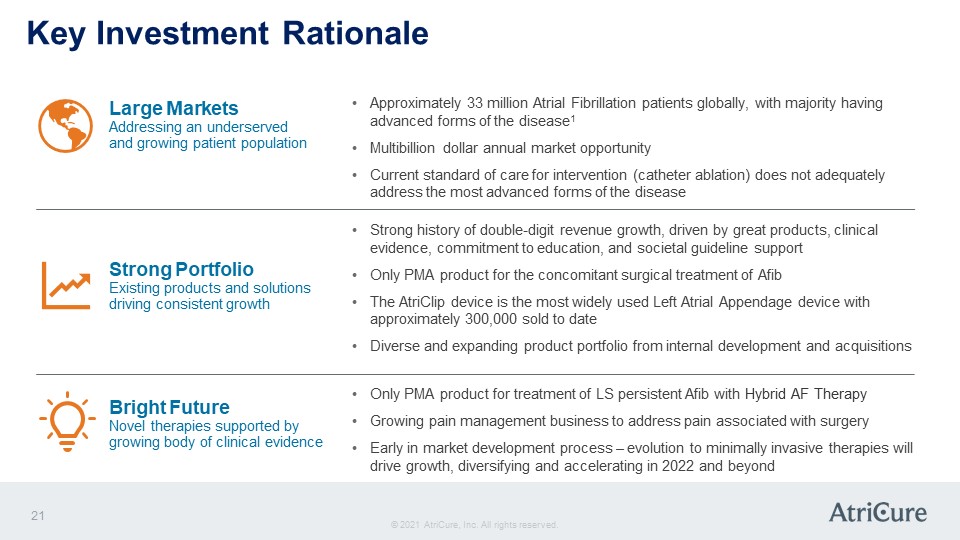

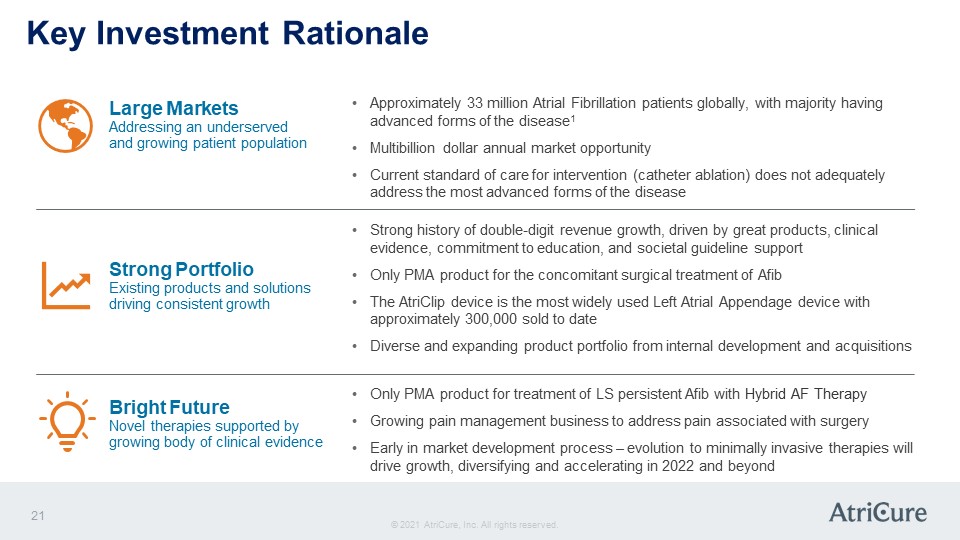

Key Investment Rationale Large Markets Addressing an underserved and growing patient population Approximately 33 million Atrial Fibrillation patients globally, with majority having advanced forms of the disease1 Multibillion dollar annual market opportunity Current standard of care for intervention (catheter ablation) does not adequately address the most advanced forms of the disease Strong Portfolio Existing products and solutions driving consistent growth Strong history of double-digit revenue growth, driven by great products, clinical evidence, commitment to education, and societal guideline support Only PMA product for the concomitant surgical treatment of Afib The AtriClip device is the most widely used Left Atrial Appendage device with approximately 300,000 sold to date Diverse and expanding product portfolio from internal development and acquisitions Bright Future Novel therapies supported by growing body of clinical evidence Only PMA product for treatment of LS persistent Afib with Hybrid AF Therapy Growing pain management business to address pain associated with surgery Early in market development process – evolution to minimally invasive therapies will drive growth, diversifying and accelerating in 2022 and beyond © 2021 AtriCure, Inc. All rights reserved. AtriCure 21

COVID-19 Response Positioning AtriCure for long-term growth Health & Safety Provide a safe work environment for our employees Enabling employees to work remotely and evaluating hybrid workplans Providing personal protection and other measures to ensure the safety of those working in our offices Limiting non-essential travel Maintaining Operations Deliver products and support to our customers Maintaining manufacturing, assembly, fulfillment – modified to adhere to safety recommendations Continuing case coverage support Utilizing online and mobile training venues to educate our customers While our plans will continue to evolve in response to changes caused by the COVID-19 pandemic, we remain committed to the AtriCure Team and to the execution of our strategic initiatives. © 2021 AtriCure, Inc. All rights reserved. AtriCure 22

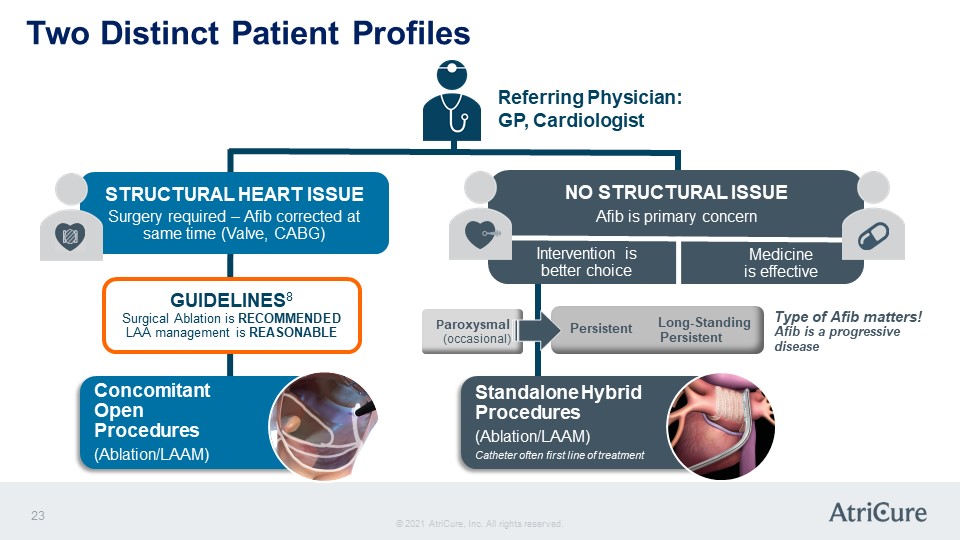

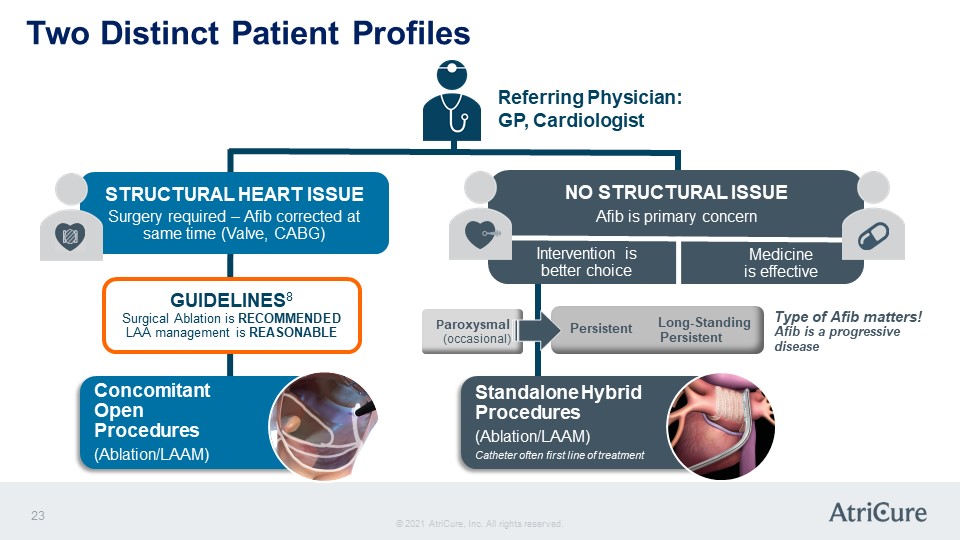

Two Distinct Patient Profiles Referring Physician: GP, Cardiologist STRUCTURAL HEART ISSUE Surgery required – Afib corrected at same time (Valve, CABG) GUIDELINES8 Surgical Ablation is RECOMMENDED LAA management is REASONABLE Concomitant Open Procedures (Ablation/LAAM) NO STRUCTURAL ISSUE Afib is primary concern Intervention is better choice Medicine is effective Paroxysmal (occasional) Persistent Long-Standing Persistent Type of Afib matters! Afib is a progressive disease Standalone Hybrid Procedures (Ablation/LAAM) Catheter often first line of treatment © 2021 AtriCure, Inc. All rights reserved. AtriCure 23

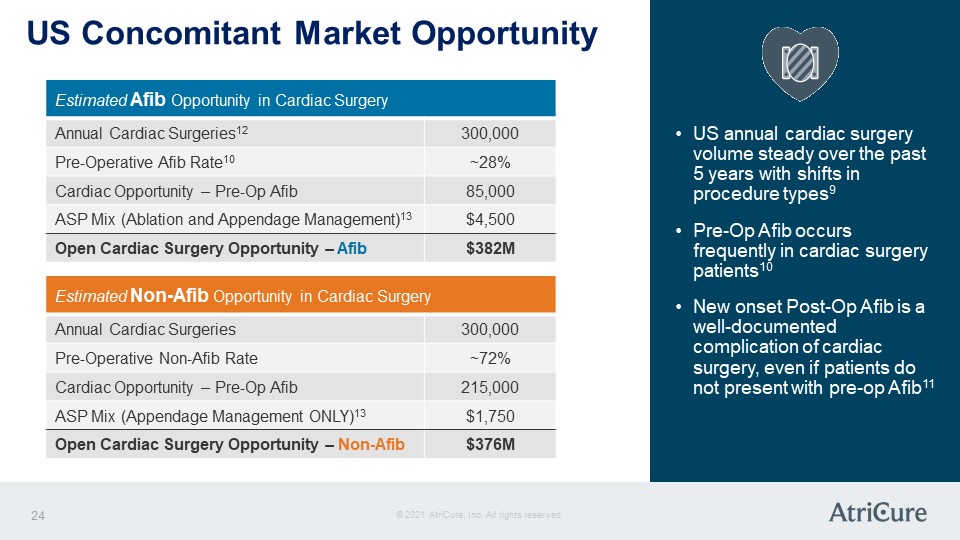

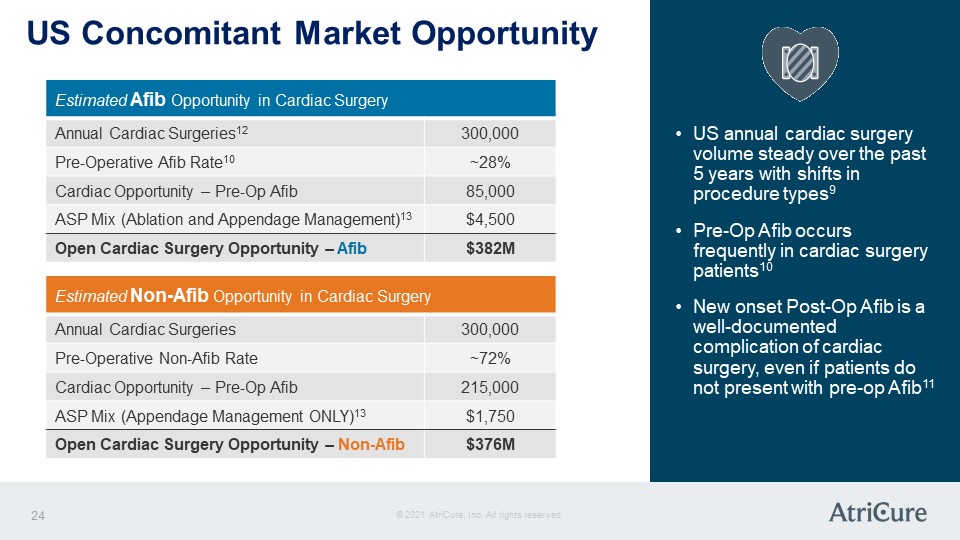

US Concomitant Market Opportunity Estimated Afib Opportunity in Cardiac Surgery Annual Cardiac Surgeries12 300,000 Pre-Operative Afib Rate10 ~28% Cardiac Opportunity – Pre-Op Afib 85,000 ASP Mix (Ablation and Appendage Management)13 $4,500 Open Cardiac Surgery Opportunity – Afib $382M Estimated Non-Afib Opportunity in Cardiac Surgery Annual Cardiac Surgeries 300,000 Pre-Operative Non-Afib Rate ~72% Cardiac Opportunity – Pre-Op Afib 215,000 ASP Mix (Appendage Management ONLY)13 $1,750 Open Cardiac Surgery Opportunity – Non-Afib $376M US annual cardiac surgery volume steady over the past 5 years with shifts in procedure types9 Pre-Op Afib occurs frequently in cardiac surgery patients10 New onset Post-Op Afib is a well-documented complication of cardiac surgery, even if patients do not present with pre-op Afib11 © 2021 AtriCure, Inc. All rights reserved. AtriCure 24

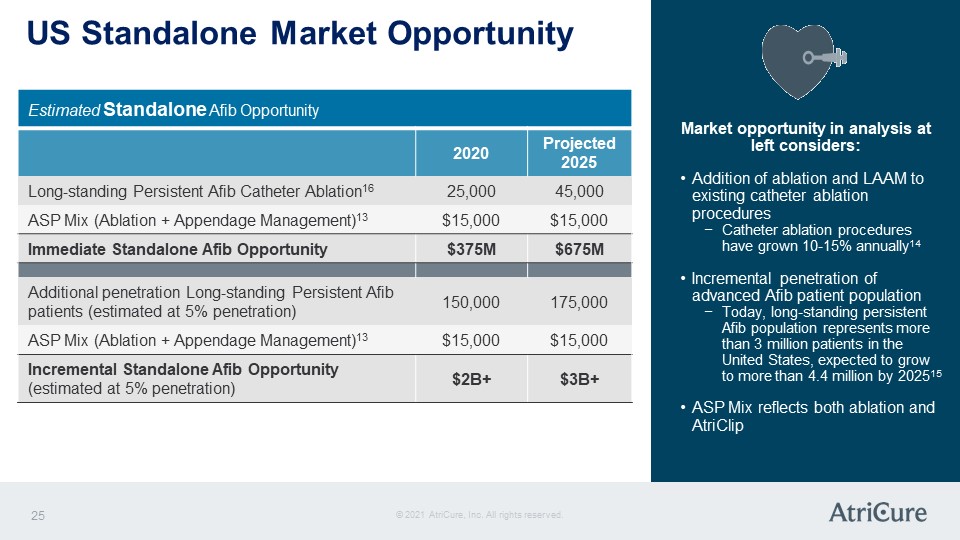

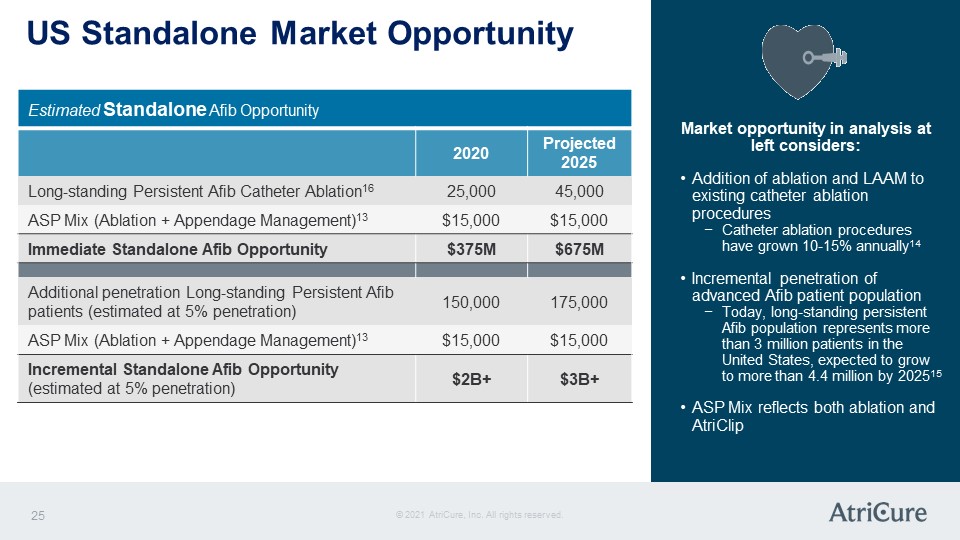

US Standalone Market Opportunity Estimated Standalone Afib Opportunity 2020 Projected 2025 Long-standing Persistent Afib Catheter Ablation16 25,000 45,000 ASP Mix (Ablation + Appendage Management)13 $15,000 $15,000 Immediate Standalone Afib Opportunity $375M $675M Additional penetration Long-standing Persistent Afib patients (estimated at 5% penetration) 150,000 175,000 ASP Mix (Ablation + Appendage Management)13 $15,000 $15,000 Incremental Standalone Afib Opportunity (estimated at 5% penetration) $2B+ $3B+ Market opportunity in analysis at left considers: Addition of ablation and LAAM to existing catheter ablation procedures Catheter ablation procedures have grown 10-15% annually14 Incremental penetration of advanced Afib patient population Today, long-standing persistent Afib population represents more than 3 million patients in the United States, expected to grow to more than 4.4 million by 202515 ASP Mix reflects both ablation and AtriClip © 2021 AtriCure, Inc. All rights reserved. AtriCure 25

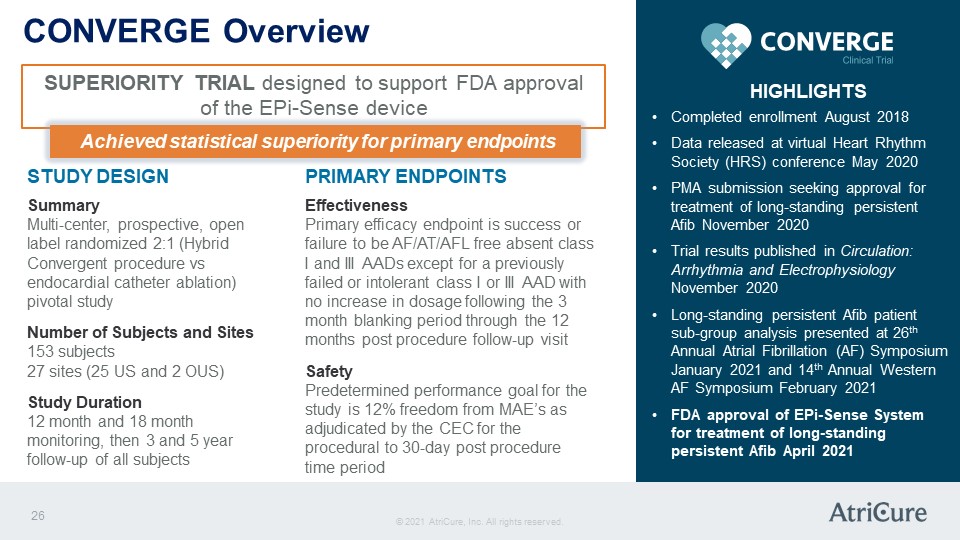

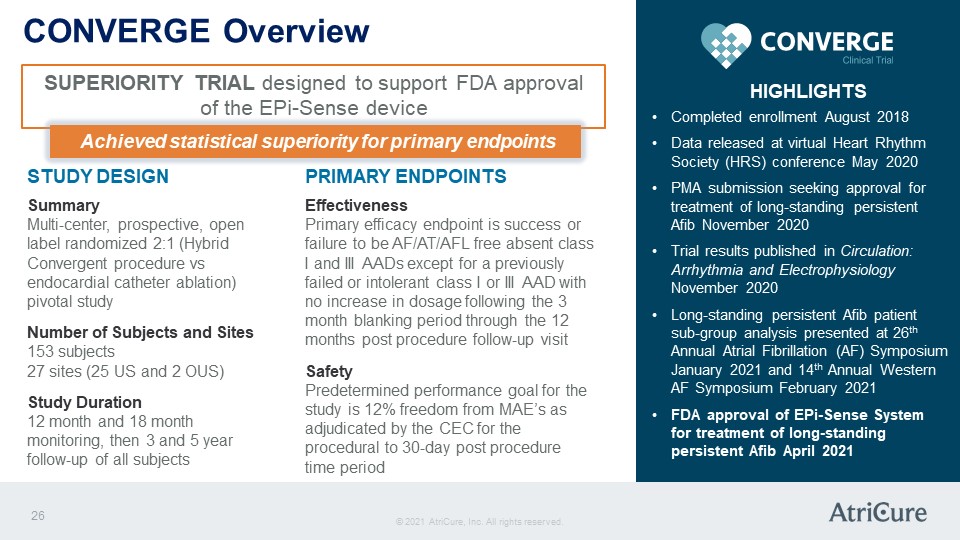

CONVERGE Overview SUPERIORITY TRIAL designed to support FDA approval of the EPi-Sense device Achieved statistical superiority for primary endpoints STUDY DESIGN Summary Multi-center, prospective, open label randomized 2:1 (Hybrid Convergent procedure vs endocardial catheter ablation) pivotal study Number of Subjects and Sites 153 subjects 27 sites (25 US and 2 OUS) Study Duration 12 month and 18 month monitoring, then 3 and 5 year follow-up of all subjects PRIMARY ENDPOINTS Effectiveness Primary efficacy endpoint is success or failure to be AF/AT/AFL free absent class I and III AADs except for a previously failed or intolerant class I or III AAD with no increase in dosage following the 3 month blanking period through the 12 months post procedure follow-up visit Safety Predetermined performance goal for the study is 12% freedom from MAE’s as adjudicated by the CEC for the procedural to 30-day post procedure time period CONVERGE Clinical Trial HIGHLIGHTS Completed enrollment August 2018 Data released at virtual Heart Rhythm Society (HRS) conference May 2020 PMA submission seeking approval for treatment of long-standing persistent Afib November 2020 Trial results published in Circulation: Arrhythmia and Electrophysiology November 2020 Long-standing persistent Afib patient sub-group analysis presented at 26th Annual Atrial Fibrillation (AF) Symposium January 2021 and 14th Annual Western AF Symposium February 2021 FDA approval of EPi-Sense System for treatment of long-standing persistent Afib April 2021 © 2021 AtriCure, Inc. All rights reserved. AtriCure 26

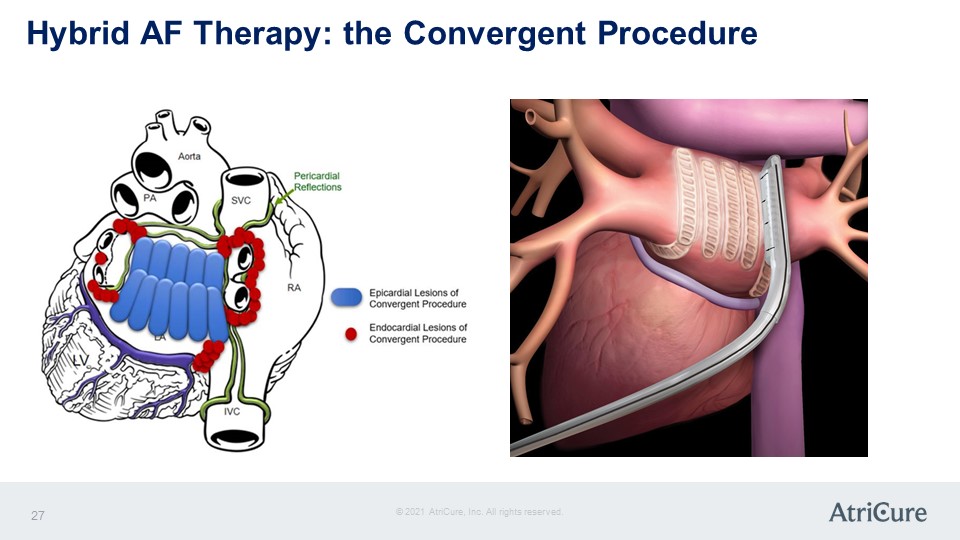

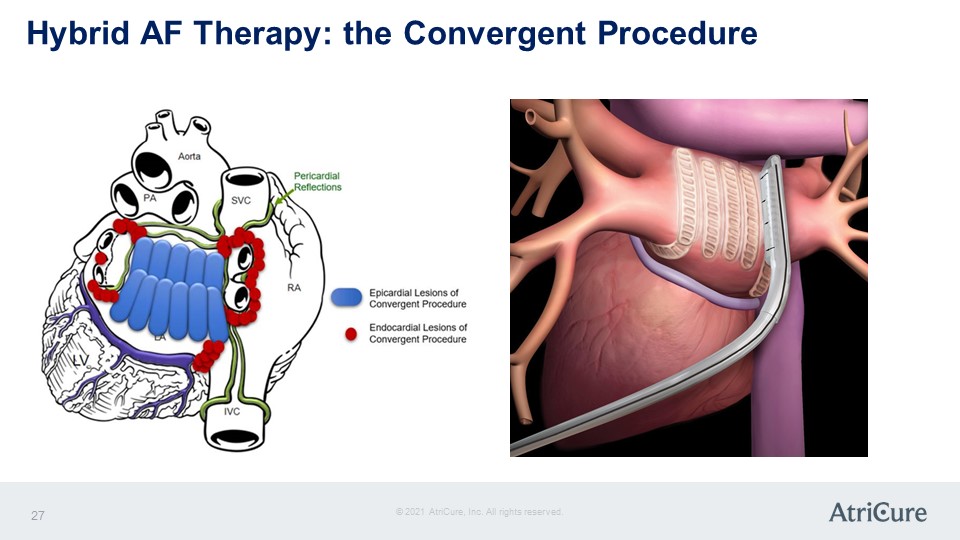

Hybrid AF Therapy: the Convergent Procedure LV PA Aorta SVC Pericardial Reflections RA IVC Epicardial Lesions of Convergent Procedure Endocardial Lesions of Convergent Procedure © 2021 AtriCure, Inc. All rights reserved. AtriCure 27

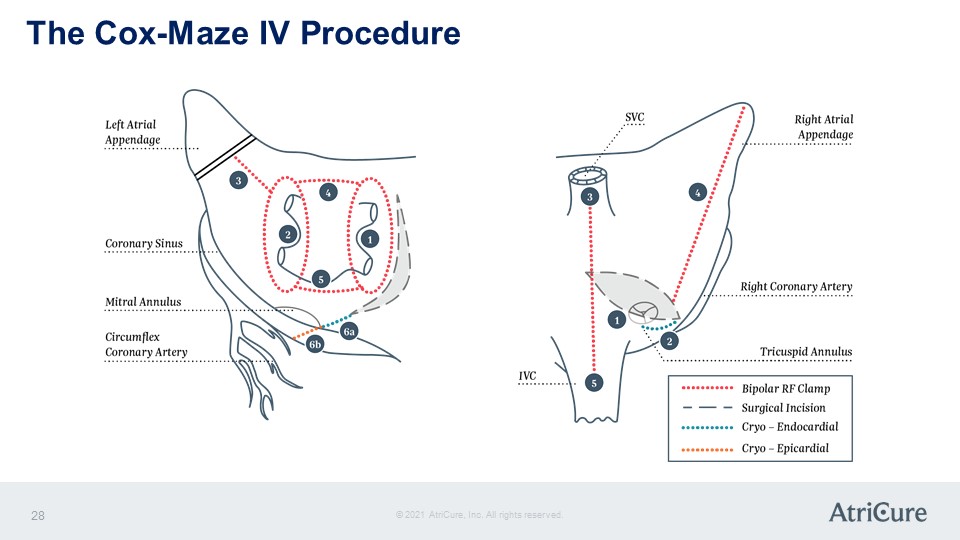

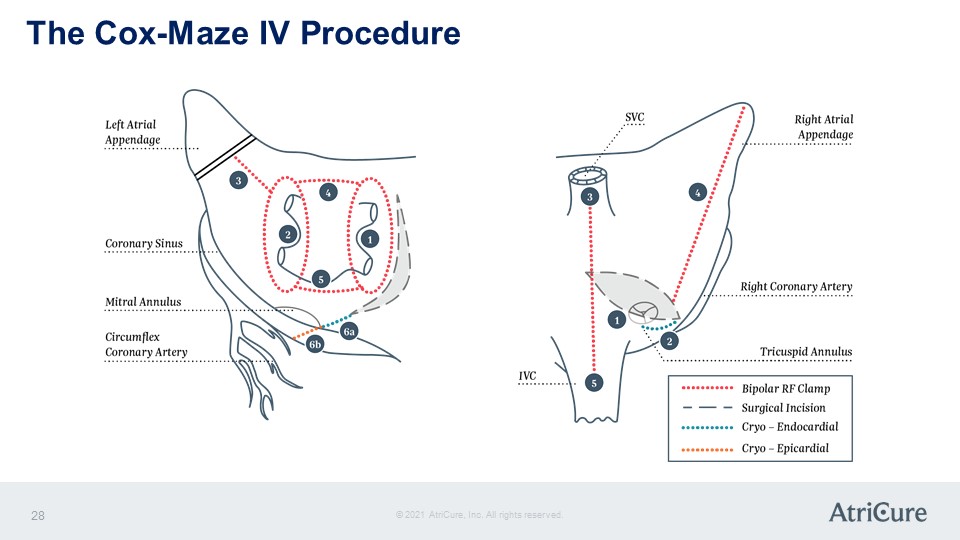

The Cox-Maze IV Procedure Left Atrial Appendage Coronary Sinus Mitral Annulus Circumflex Coronary Artery 1 2 3 4 5 6a 6b SC Right Atrial Appendage Right Coronary Artery Tricuspid Annulus IVC 1 2 3 4 5 Bipolar RF Clamp Surgical Incision Cryo- Edocardial Cryo – Epicardial © 2021 AtriCure, Inc. All rights reserved. AtriCure 28

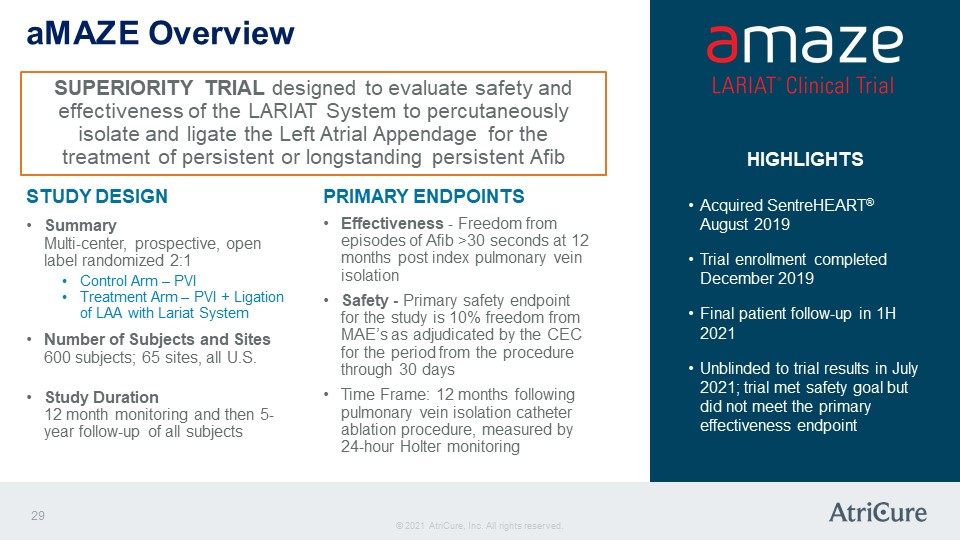

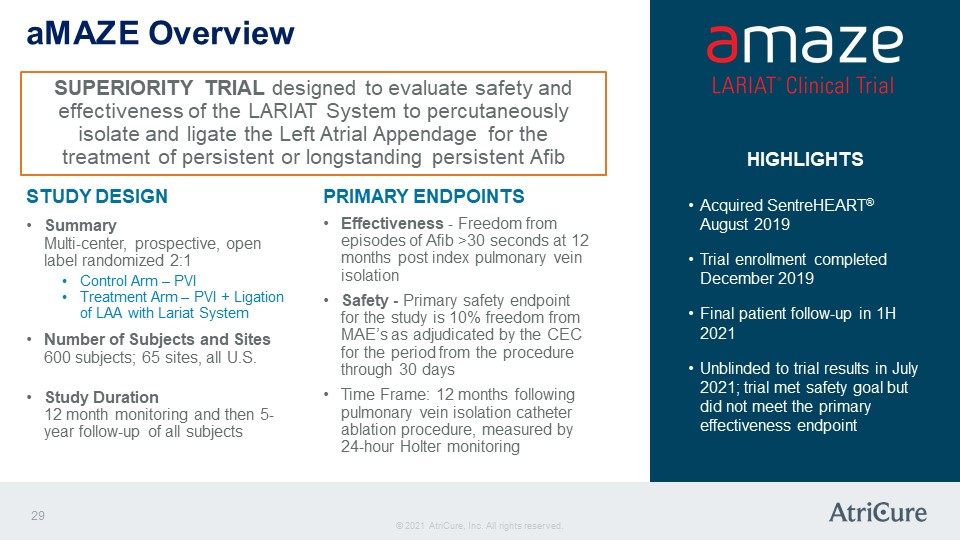

aMAZE Overview SUPERIORITY TRIAL designed to evaluate safety and effectiveness of the LARIAT System to percutaneously isolate and ligate the Left Atrial Appendage for the treatment of persistent or longstanding persistent Afib STUDY DESIGN Summary Multi-center, prospective, open label randomized 2:1 Control Arm – PVI Treatment Arm – PVI + Ligation of LAA with Lariat System Number of Subjects and Sites 600 subjects; 65 sites, all U.S. Study Duration 12 month monitoring and then 5-year follow-up of all subjects PRIMARY ENDPOINTS Effectiveness - Freedom from episodes of Afib >30 seconds at 12 months post index pulmonary vein isolation Safety - Primary safety endpoint for the study is 10% freedom from MAE’s as adjudicated by the CEC for the period from the procedure through 30 days Time Frame: 12 months following pulmonary vein isolation catheter ablation procedure, measured by 24-hour Holter monitoring amaze LARIAT Clinical Trial HIGHLIGHTS Acquired SentreHEART® August 2019 Trial enrollment completed December 2019 Final patient follow-up in 1H 2021 Unblinded to trial results in July 2021; trial met safety goal but did not meet the primary effectiveness endpoint © 2021 AtriCure, Inc. All rights reserved. AtriCure 29

References and Abbreviations Note Reference 1 Worldwide Epidemiology of Atrial Fibrillation: A Global Burden of Disease 2010 Study 2 The American Journal of Cardiology (2013), 112: 1142-1147 3 J Geriatr Cardiol. 2016 Oct; 13(10): 880–882, doi: 10.11909/j.issn.1671-5411.2016.10.004 4 Santhanakrishnan R et al., “AF Begets Heart Failure and Vice Versa,” Circulation, 133 (2016):484-492 5 Odutayo, A. et al. (2016). Atrial fibrillation and risks of cardiovascular disease, renal disease, and deaths systematic review and meta analysis. BMJ 2016; 354:i4482 6 IFU for EPi-Sense® Guided Coagulation System Data: PMA# P200002 7 The Society of Thoracic Surgeons, Current News Release (1/30/2018): 1 in 7 Lung Surgery Patients at Risk for Opioid Dependence 8 The Society of Thoracic Surgeons 2017 Clinical Practice Guidelines for the Surgical Treatment of Atrial Fibrillation 9 STS Adult Cardiac Surgery Database, 2018/2019 Harvest Executive Summary 10 McCarthy, P.M. et al. (2019). Prevalence of atrial fibrillation before cardiac surgery and factors associated with concomitant ablation. J Thorac Cardiovasc Surg, PII: S0022-5223(19)31361-3, DOI: 10.1016/J.JTCVS.2019.06.062. 11 Lin et al, Stroke 2019 Jun; 50(6):1364-1371. doi: 10.1161/STROKEAHA.118.023921. Epub 2019 May 2. 12 Harvested from data previously available through the Society of Thoracic Surgeons 13 Average Selling Prices (ASPs) are management estimates based on a mix of products used for the various procedures 14 Estimated based on various catheter company presentations 15 Medical management estimate: Colilia, et al. Estimates of Current and Future Incidence and Prevalence of Atrial Fibrillation in the U.S. Adult Population. Am Journal of Cardiology 2013, 112: 1142-1147 Persistent patient estimate: Berisso et al Epidemiology of atrial fibrillation: European perspective Clin Epidemiol. 2014; 6: 213–220 16 Estimated based on Advisory Board data, along with various scientific presentations Key Abbreviations Afib or AF Atrial Fibrillation AA Atrial Arrythmia AAD Anti-Arrhythmic Drugs AFL Atrial Flutter AT Atrial Tachycardia CABG Coronary Artery Bypass Graft CEC Clinical Events Committee EP Electrophysiologist FDA Food & Drug Administration LAA Left Atrial Appendage LAAM LAA Management LS Long-standing MAE Material Adverse Event PMA Pre-Market Approval PVI Pulmonary Vein Isolation RF Radio Frequency © 2021 AtriCure, Inc. All rights reserved. AtriCure 30