Confidential Hexion Lender Presentation June 2019

Forward-Looking Statements Certain statements in this presentation are forward-looking statements within the meaning of and made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In addition, our management may from time to time make oral forward-looking statements. All statements, other than statements of historical facts, are forward- looking statements. Forward-looking statements may be identified by the words “believe,” “expect,” “anticipate,” “project,” "might", “plan,” “estimate,” “may,” “will,” “could,” “should,” “seek” or “intend” and similar expressions. Forward-looking statements reflect our current expectations and assumptions regarding our business, the economy and other future events and conditions and are based on currently available financial, economic and competitive data and our current business plans. Actual results could vary materially depending on risks and uncertainties that may affect our operations, markets, services, prices and other factors as discussed in the Risk Factors section of our filings with the Securities and Exchange Commission (the “SEC”) and those described in filings made by the Company with the U.S. Bankruptcy Court for the District of Delaware. While we believe our assumptions are reasonable, we caution you against relying on any forward-looking statements as it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to: the ability of the Company to continue as a going concern, the Company’s ability to obtain Bankruptcy Court approval with respect to motions in the Chapter 11 cases, the ability of the Company and its subsidiaries to successfully execute a plan of reorganization with respect to Chapter 11 cases, the Company’s ability to generate or raise cash and maintain a cash balance sufficient to fund continued investments, capital needs, restructuring payments and service its debt, the potential adverse effects of Chapter 11 proceedings on the Company’s liquidity, results of operations, brand or business prospects, the ability to execute the Company’s businesses and restructuring plan, increased legal costs related to the Bankruptcy filing and other potential litigation, the Company’s ability to maintain contracts that are critical to its operations and to maintain normal terms with customers, suppliers and service providers, the Company’s ability to maintain product reliability and quality and to retain key executives, managers and employees, and the ability of the Company’s non-U.S. subsidiaries to continue to operate their businesses in the normal course, a weakening of global economic and financial conditions, interruptions in the supply of or increased cost of raw materials, changes in governmental regulations and related compliance and litigation costs, the loss of, or difficulties with the further realization of, cost savings in connection with our strategic initiatives, pricing actions by our competitors that could affect our operating margins, and other unknown factors. All forward-looking statements are expressly qualified in their entirety by this cautionary notice. The forward-looking statements made by us speak only as of the date on which they are made. Factors or events that could cause our actual results to differ may emerge from time to time. We undertake no obligation to publicly update or revise any forward- looking statement as a result of new information, future events or otherwise, except as otherwise required by law. 2

Hexion Presenters Craig Rogerson George Knight Mark Bidstrup President & Executive Vice President & Senior Vice President & Chief Executive Officer Chief Financial Officer Treasurer . Has almost 40 years of experience in . Has more than 20 years of chemicals . Has more than 15 years of chemicals . Has over 15 years of experience in the chemicals industry industry experience and has served in industry experience the chemicals industry a variety of positions across Hexion . Joined Hexion in July 2017 . Served in a variety of roles across . Prior to current role, he was CFO of . Prior to his current position, George Hexion including Division CFO for . Prior to joining Hexion, Craig served the Monomers, Dispersions & served as Senior Vice President of Epoxy Phenolic Resins and Forest as Chairman, President and Chief Powders business Finance and Treasurer from 2010 – Products Executive Officer of Chemtura 2016 and served in a similar role for . Has held a variety of finance roles Corporation from 2008 – 2017 . Joined Hexion’s predecessor Momentive Performance Materials within Hexion and previously worked company Borden Chemical in 2001 as . Has also served as President, Chief in public accounting . Joined Hexion’s predecessor Division CFO of the Performance Executive Officer and Director of company Borden Chemical in 1997 . ResinsReceived Group his bachelor’s degree in Hercules Incorporated from 2003 – and served in a variety of roles accounting and finance and MBA 2008 . Has also worked for Borden Foods in from The Ohio State University . Has also worked for Duracell a variety of roles . Joined Hercules in 1979, serving in a International, Inc. as Assistant . CFA charterholder and a CPA variety of leadership positions until . Previously held positions at Corporate Controller and then as Asia (inactive) 1997 when he left to become PricewaterhouseCoopers Pacific Finance Director President and CEO of Wacker . Received his bachelor’s degree in Silicones Corporate, but re-joined in . Received his bachelor’s degree in accounting from The Ohio State 2003 economics from St. Anselm College University and his master’s degree in accounting . Received a chemical engineering from Syracuse University degree from Michigan State University 3

Meeting Agenda I. Transaction Overview II. Key Credit Highlights III. Business Unit Highlights IV. Financial Overview V. Appendix 4

Executive Summary . Hexion is a leading specialty chemical company serving global industrial markets through a broad range of thermoset technologies and specialty products while providing technical support for customers in a diverse range of applications and industries – LTM Q1’19 Revenue of $3,737 million and Segment EBITDA of $425 million . In connection with the Company’s emergence from Chapter 11, Hexion is looking to raise a $350mm ABL Revolving Credit Facility, a $1,200mm First Lien Term Loan (of which $600mm is a Euro-denominated loan) and $450mm of unsecured debt – Additional $300mm equity rights offering rounds out the exit financing transaction – Proceeds will be used to repay amounts outstanding under the DIP Facility, repay $1,3831 million of the prepetition First Lien Notes, provide for working capital needs, pay for fees & expenses and for general corporate purposes . Pro forma net secured and total net leverage of 3.1x and 4.2x, respectively, based on LTM Q1’19 Segment EBITDA of $425 million . The contemplated transactions will result in a strong, appropriately-capitalized Hexion with substantial liquidity, consistently positive operating cash flow and lower interest burden – Increased operational and financial flexibility – Opportunities for long-term success through reinvestment in the business and continued deleveraging . The Company will be represented by an independent Board of Directors, and the stock is expected to be publicly traded upon emergence (1) Represents $1,450mm payment less $67mm of adequate protection payments already paid in April 2019 5

Formation of Hexion and Subsequent Key Events – A History of Strategic Actions Sale of its Performance Sale of Global Adhesives, Inks and Powder Adhesives Coatings, Resins Business Additives & Sale of North Acrylic Coatings, America Hexion and and Monomers April 1st, Hexion Coatings & Momentive businesses enters Ch. 11 as Composite cease to have a Sale of JV Hexion explores part of its Resins Business common holding interest to HA- various asset financial company USA, Inc. sales restructuring 2005 2006-07 2007 2008 2010 2011 2014 2016 2018 2019 Hexion formed Six Opportunistic In July ‘07, sign In Dec. ’08, In Oct. ‘10, through Bolt-on Definitive entered announce Plan Overview combination of Acquisitions Agreement to settlement combination with leaders in the Rhodia coatings Acquire agreement and Momentive All business segments operating as specialty Akzo Nobel Huntsman Corp. release with Performance normal and all trade creditors will be chemicals Coatings & Inks (NYSE: HUN) Huntsman Materials Inc. paid in full industry: Rohm and Haas terminating (“MPM”) $300mm in new cash equity via Wax merger Capital Orica Resins structures and backstopped rights offering Wright Chemical legal entity New ownership and independent Board Arkema GmbH structures of Directors remain separate Anticipated emergence on around July 1st (~3 months from filing) Reorganized company is in position to sustain long-term growth through cyclical environments 6

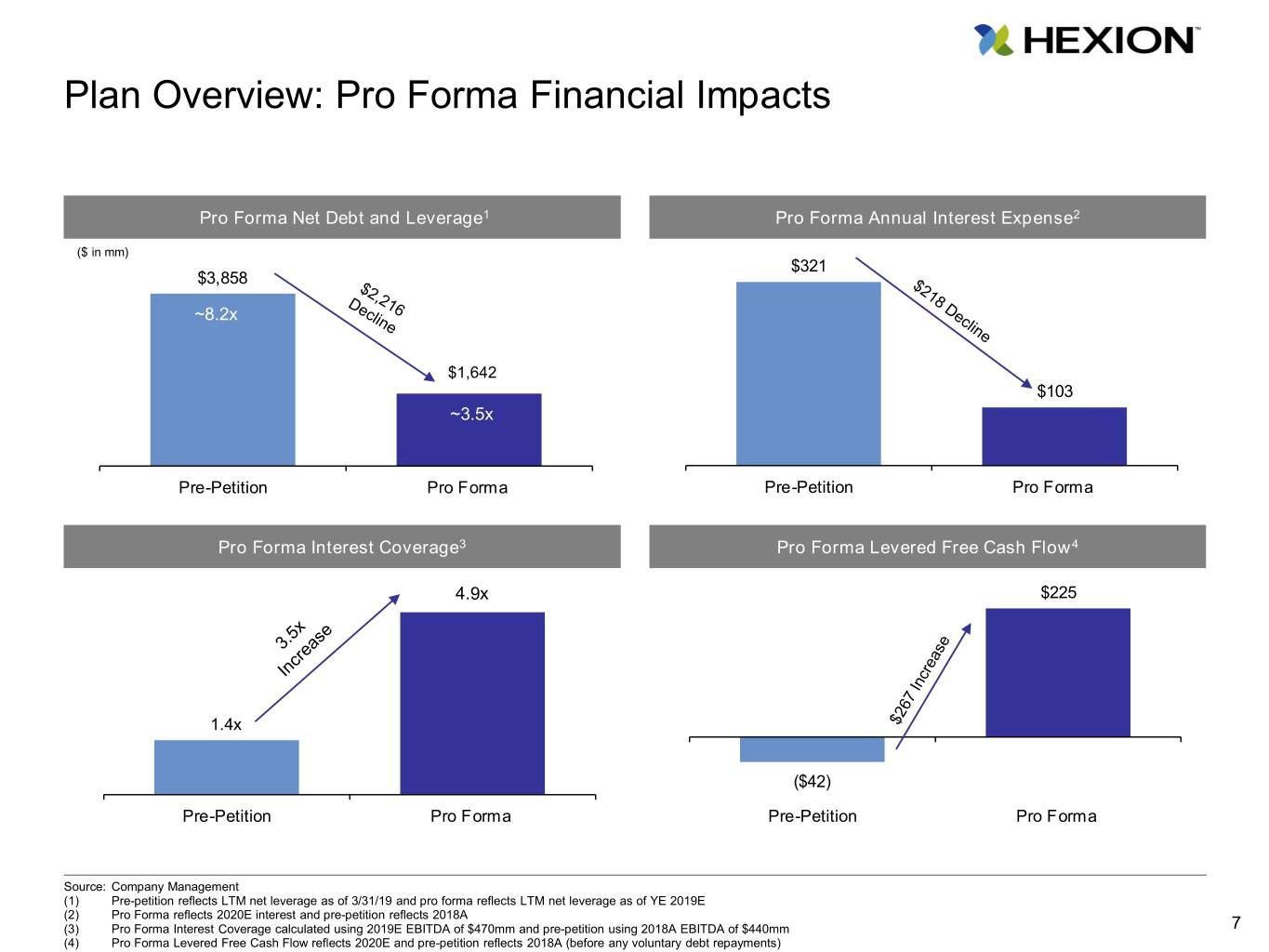

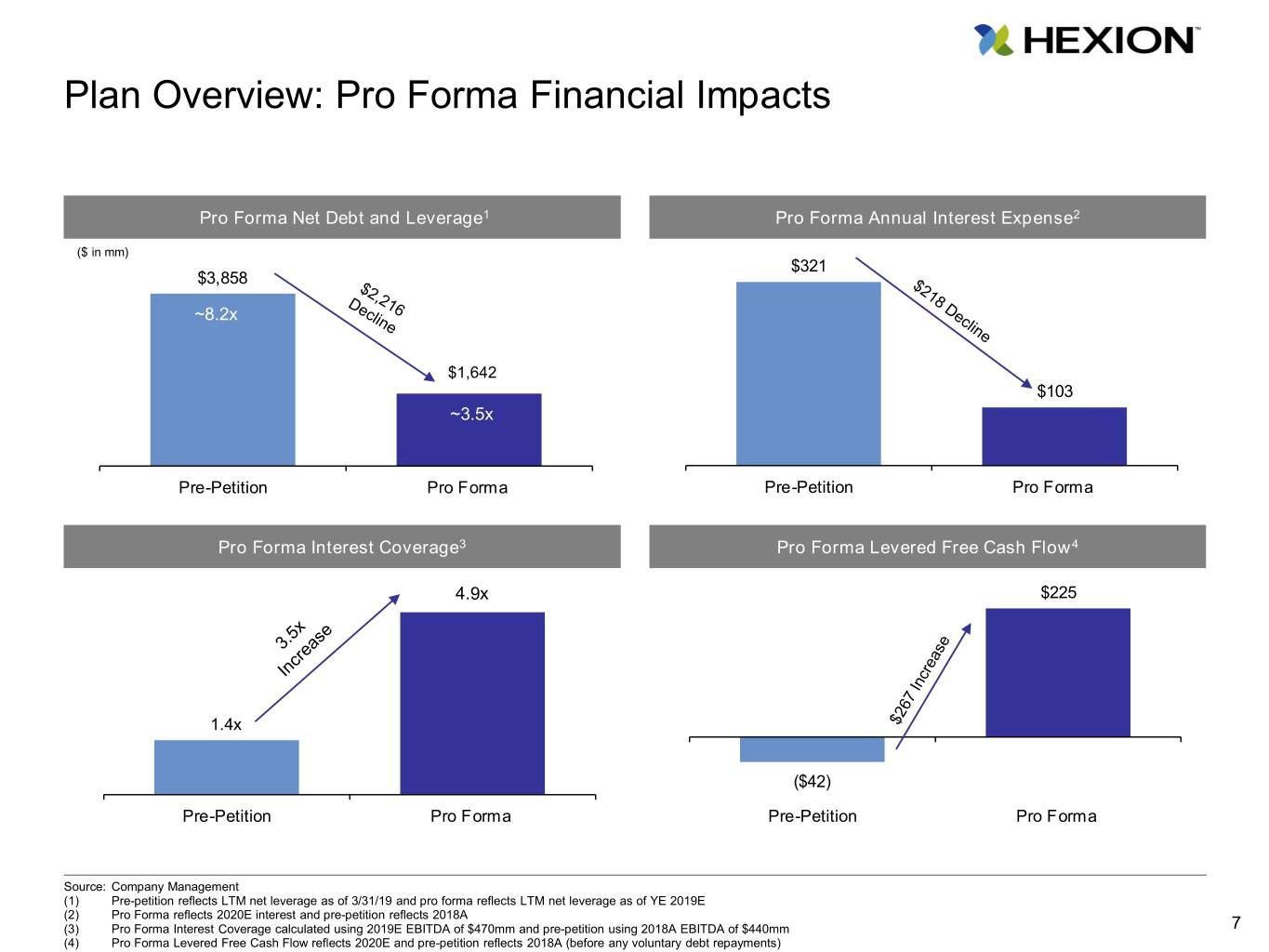

Plan Overview: Pro Forma Financial Impacts Pro Forma Net Debt and Leverage1 Pro Forma Annual Interest Expense2 ($ in mm) $321 $3,858 ~8.2x $1,641$1,642 $103 ~3.5x Pre-Petition Pro Forma Pre-Petition Pro Forma Pro Forma Interest Coverage3 Pro Forma Levered Free Cash Flow4 4.9x4.6x $225 1.4x ($42) Pre-Petition Pro Forma Pre-Petition Pro Forma Source: Company Management (1) Pre-petition reflects LTM net leverage as of 3/31/19 and pro forma reflects LTM net leverage as of YE 2019E (2) Pro Forma reflects 2020E interest and pre-petition reflects 2018A (3) Pro Forma Interest Coverage calculated using 2019E EBITDA of $470mm and pre-petition using 2018A EBITDA of $440mm 7 (4) Pro Forma Levered Free Cash Flow reflects 2020E and pre-petition reflects 2018A (before any voluntary debt repayments)

I. Transaction Overview

Sources & Uses / Pro Forma Capitalization Below analysis reflects the exit sources & uses, as well as the pro forma capitalization as of 6/30/2019 Sources & Uses Pro Forma Capitalization Sources ($mm) PF as of x Q1'19 LTM Illustrative Pro Forma Leverage 6/30/2019 EBITDA5 % of EV New Equity Investment¹ $300 New ABL Revolver $— New First Lien Term Loan² 1,200 New First Lien Term Loan 1,200 New unsecured debt 450 Foreign Debt & Sale Leasebacks 186 Cash from Balance Sheet 4 Total Secured Debt $1,386 3.3x 44.7% Total Sources $1,954 Net Secured Debt $1,325 3.1x 42.7% New unsecured debt 450 Total Debt $1,836 4.3x 59.2% Uses ($mm) Net Debt $1,775 4.2x 57.3% Repayment of First Lien Notes³ $1,383 Implied Equity Value $1,325 3.1x 42.7% 6 Repayment of DIP Term Loan 350 Total Enterprise Value $3,100 7.3x 100.0% Repayment of DIP ABL 37 Pro Forma Liquidity Backstop Financing & Structuring Fees4 104 Cash Balance $61 Payment of Transaction & Professional Fees 80 Total Uses $1,954 ABL Revolver Commitment $350 (-) Drawn Amount — (-) Letters of Credit7 (50) Total ABL Availability $300 Total Liquidity $361 Source: Company Management Note: Uses exclude payment of prepetition payables due post emergence (1) Reflects the gross value of issuance of new equity in the Debtors pursuant to the Rights Offering (2) Of which $600mm is a Euro-denominated Term Loan (3) Repayment of $1,450mm pre‐petition 1L Notes net of adequate assurance payment of $67mm in April to reduce the outstanding amount of the debt (4) Reflects backstop financing & structuring fees for the Rights Offering and new debt; backstop fees may be paid in shares or cash, at the election of the holders per the RSA (5) Based on Q1 2019 LTM Segment EBITDA of $425mm (6) Total Enterprise Value of $3.1bn is the midpoint of the Plan valuation, per Disclosure Statement (7) Assumes $50mm of L/Cs outstanding 9

Summary of terms – ABL Revolver Borrowers Hexion Inc. and certain of its Canadian, U.K., Dutch, and German subsidiaries (same as existing DIP ABL) Guarantors The direct parent of Hexion Inc. and certain material domestic and foreign subsidiaries of the ABL Borrowers (substantially similar to the existing DIP ABL) Facility size $350mm Maturity/Tenor 5 Years Security First priority lien on cash, accounts receivables, inventory, certain non-U.S. machinery and equipment and related proceeds (“ABL Collateral”); second priority lien on TL Collateral Borrowing base 90% advance rate on eligible investment grade A/R, plus 85% on eligible non-investment grade A/R, plus Lesser of (i) 70% of eligible inventory and (ii) 85% NOLV of eligible inventory, plus 80% of NOLVIP of eligible M&E plus 75% of FMV of eligible real estate in non-US jurisdictions, subject to: Combined PP&E cap of lesser of 20% of total commitments and borrowing base Dutch PP&E cap of 50% of total PP&E component 100% of unrestricted cash of U.S. and Canadian loan parties capped at lesser of 15% of total commitments and the borrowing base Usual and customary reserves Non-US and Canadian borrowing base capped at greater of 50% of total commitments and borrowing base Financial covenant Springing FCCR of 1.0x when Excess Availability < the greater of (i) 10% of the lesser of total commitments and BB (“Line Cap”) and (ii) $30mm (“Availability Trigger Event”) Negative covenants Usual and customary, with unlimited RPs and investments subject to pro forma (i) Excess Availability ≥ the greater of 20% of the Line Cap or $48.125mm or (ii) FCCR of 1.0x and Excess Availability ≥ the greater of 15% of the Line Cap and $43.75mm Cash dominion Springing cash dominion upon Availability Trigger Event Reporting Monthly borrowing base reporting; weekly upon Availability Trigger Event Field exam and 1x field exam & appraisals, each annually; 2x if Excess Availability < greater of (i) 15% of the Line Cap or (ii) $43.75mm appraisals Administrative Agent J.P. Morgan Chase Bank, NA 10

Summary of terms – Term Loan B Facility overview Term Loan B (USD) Term Loan B (EUR) Borrower Hexion Inc. (“US Borrower”) Hexion International Coöperatief U.A. (“Dutch Borrower”) Guarantors The direct parent of the US Borrower and certain material The US Loan Parties and material foreign subsidiaries of the domestic subsidiaries of the US Borrower (the “US Loan Parties”) Dutch Borrower Amount $600mm ~€540mm ($600mm USD equivalent) Tenor 7 years 7 years Security 1st priority lien on US TL Collateral (including 65% pledge of 1st 1st priority lien on Foreign TL Collateral tier foreign subsidiaries) 2nd priority lien on Foreign ABL Collateral 2nd priority lien on US ABL Collateral Same liens/priority on US assets as USD Term Loan B Collateral allocation Both tranches of the Term Loan B will be subject to a customary collateral allocation mechanism on terms to be agreed mechanism Call protection 101 soft call for 6 months Amortization 1.00% per annum (USD tranche only); bullet at maturity Use of proceeds Refinance DIP RC/TLB and existing notes, finance the Plan, payment of fees and expenses related to emergence from bankruptcy and general corporate purposes Financial covenants None Incremental Free and clear basket: greater of 1.0x PF Adjusted EBITDA and $425mm Ratio-based incremental: 1st lien: Net First Lien Leverage Ratio ≤ 3.50x Secured: Net Secured Leverage Ratio ≤ 4.00x Unsecured: Either (i) FCCR ≥ 2.0x or (ii) Net Total Leverage Ratio ≤ 4.50x 50bps MFN for 12 months Mandatory prepayments Mandatory prepayments required from proceeds of: 100% of net cash proceeds of non-ordinary course asset sale proceeds, with 15-month reinvestment rights, 50% if Net First Lien Leverage Ratio < 2.5x and > 2.0x, 0% if < 2.0x 100% of debt issuance proceeds (other than permitted debt) ECF sweep: 50% if Net First Lien Leverage Ratio > 2.5x, 25% if ≤ 2.5x and > 2.0x, 0% if ≤ 2.0x Negative covenants Usual and customary for transactions of this type, including: Limitations on indebtedness Limitations on restricted payments and investments Limitations on liens Limitations on transaction with affiliates Limitations on asset sales, mergers and consolidations and other fundamental changes Administrative Agent J.P. Morgan Chase Bank, NA 11

Hexion Simplified Organizational Structure US Borrower / Issuer Management Investors Dutch Borrower Holding Company TBD . $350mm New ABL Revolver (1) US Parent Guarantor . USD $600mm Term Loan (2) 35% . USD $450mm Senior Hexion Inc. Guarantor of US TL Unsecured Notes Guarantor of EUR TL Certain Domestic JVs and Foreign Minor NL Coop Holdings LLC Subsidiaries Subsidiaries (DE) 65% . EUR $600mm Hexion International (3) (USD-equivalent) Coöperatief U.A. (“CO-OP”) Term Loan Certain Foreign Subsidiaries Facility ABL Facility Term Loan B (USD) Term Loan B (EUR) Borrower • Hexion Inc. and certain Canadian, U.K., • US Borrower • Dutch Borrower Dutch and German subsidiaries Guarantors • US Parent Guarantor • US Parent Guarantor • Material foreign subsidiaries of Dutch Borrower (6) • Wholly-owned US subsidiaries (“US • US Subsidiary Guarantors • US Parent Guarantor Subsidiary Guarantors”) • US Borrower and US Subsidiary Guarantors • Certain material foreign subsidiaries Collateral • 1st priority lien on US and foreign ABL • 1st priority lien on US TL Collateral including 65% pledge of • 1st priority lien on Foreign TL Collateral (4) Collateral stock of first-tier foreign subsidiaries • 2nd priority lien on Foreign ABL Collateral nd (5) • 2 priority lien on TL Collateral • 2nd priority lien on US ABL Collateral • Same liens on US assets as USD Term Loan • 1st priority lien on US TL Collateral • 2nd priority lien on US ABL Collateral Collateral • ABL Facility will be subject to customary Both tranches of the Term Loan B will be subject to a customary collateral allocation mechanism allocation collateral allocation mechanism (1) ABL Borrowers: Hexion Inc., Hexion Canada Inc., Hexion B.V., Hexion UK Limited and Hexion GmBH (2) Financial reporting entity 12 (3) $2.1bn Revenue and $189mm of EBITDA as of 12/31/18 (4) ABL Collateral consists of cash, accounts receivables, inventory, certain non-U.S. machinery and equipment and related proceeds (5) TL Collateral consists of substantially all material, non-ABL assets including tangible and intangible property, intellectual property and equity interest in the borrowers, guarantors and certain subsidiaries; subject to certain exclusions (6) Foreign jurisdictions include Canada, England and Wales, the Netherlands and Germany

Transaction Timeline June 2019 July 2019 S M T W T F S S M T W T F S 1 1 2 3 4 5 6 2 3 4 5 6 7 8 7 8 9 10 11 12 13 9 10 11 12 13 14 15 14 15 16 17 18 19 20 16 17 18 19 20 21 22 23 24 25 26 27 28 29 21 22 23 24 25 26 27 30 28 29 30 31 Transaction key date Bankruptcy key date Market holiday Week of: Key events June 10 Lender Meeting in London (6/10) 341 Hearing (“Creditor’s meeting”) (6/11) Lender Meeting in NYC (6/12) Rights Offering Subscriptions due (6/14) June 24 Plan Confirmation Order entered (6/24) ABL / TLB commitments due (6/25) Allocations communicated (6/26) July 1 Close and fund (7/1) Emerge from bankruptcy (7/1) Equity Rights Offering funds (7/1) 13

II. Key Credit Highlights

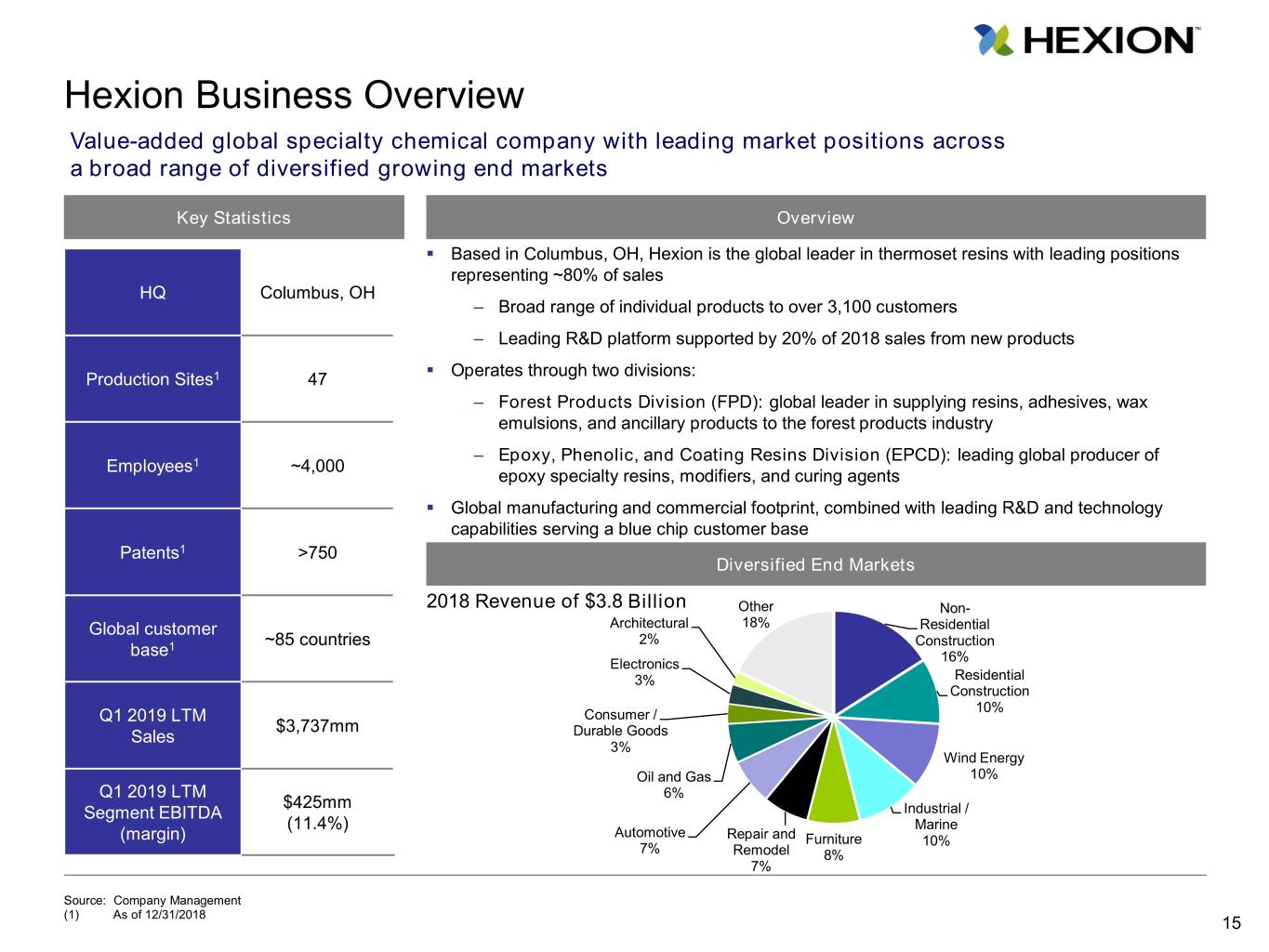

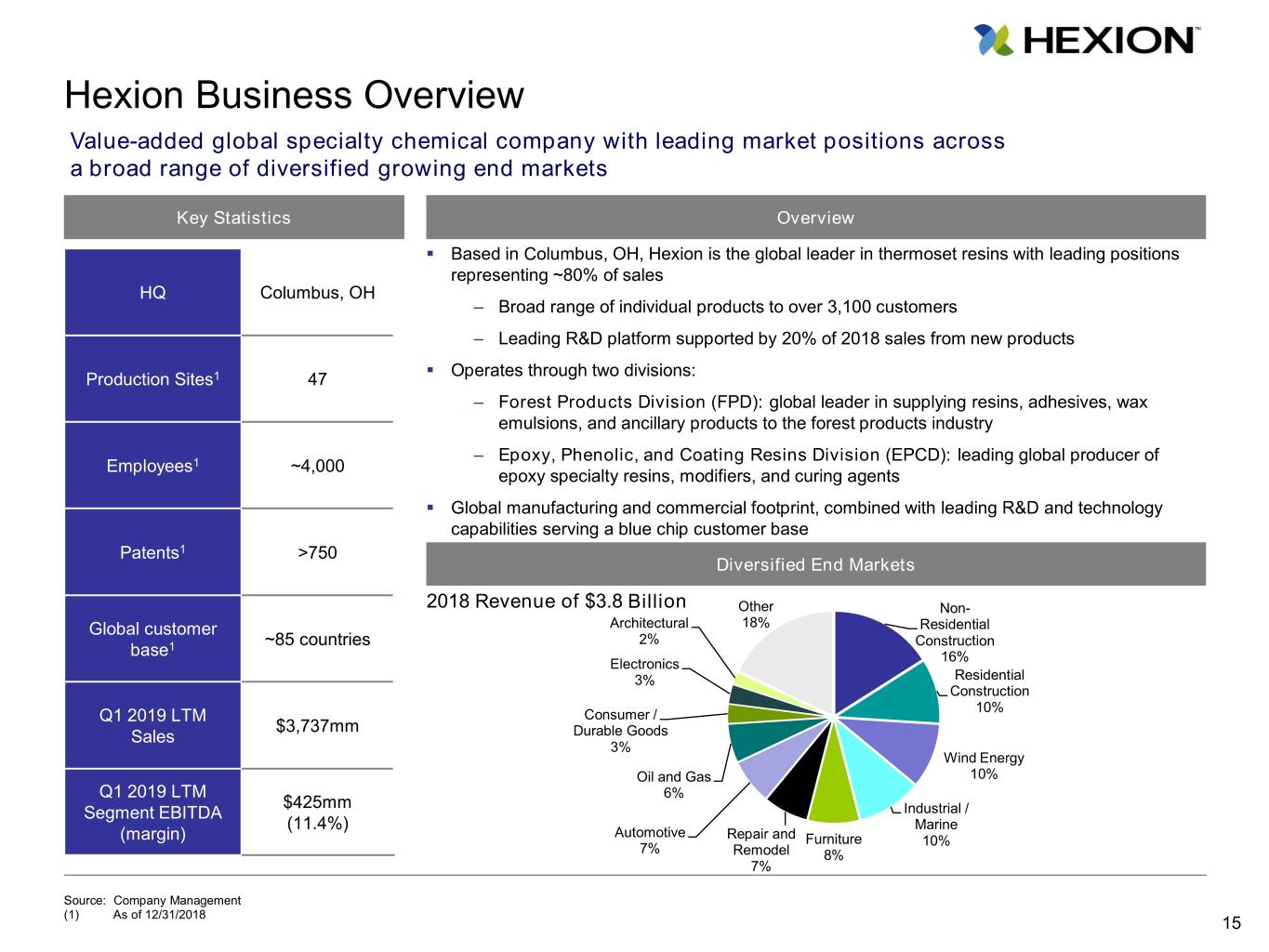

Hexion Business Overview Value-added global specialty chemical company with leading market positions across a broad range of diversified growing end markets Key Statistics Overview . Based in Columbus, OH, Hexion is the global leader in thermoset resins with leading positions representing ~80% of sales HQ Columbus, OH – Broad range of individual products to over 3,100 customers – Leading R&D platform supported by 20% of 2018 sales from new products . Operates through two divisions: Production Sites1 47 – Forest Products Division (FPD): global leader in supplying resins, adhesives, wax emulsions, and ancillary products to the forest products industry – Epoxy, Phenolic, and Coating Resins Division (EPCD): leading global producer of Employees1 ~4,000 epoxy specialty resins, modifiers, and curing agents . Global manufacturing and commercial footprint, combined with leading R&D and technology capabilities serving a blue chip customer base Patents1 >750 Diversified End Markets 2018 Revenue of $3.8 Billion Other Non- Global customer Architectural 18% Residential 2% 1 ~85 countries Construction base 16% Electronics 3% Residential Construction 10% Q1 2019 LTM Consumer / $3,737mm Sales Durable Goods 3% Wind Energy Oil and Gas 10% Q1 2019 LTM 6% $425mm Segment EBITDA Industrial / (11.4%) Marine Automotive (margin) Repair and Furniture 10% 7% Remodel 8% 7% Source: Company Management (1) As of 12/31/2018 15

Business Highlights Hexion benefits from leading market positions in a diversified value-added product portfolio serving growing end markets 1 Leading market position across key business segments Diversified product portfolio with broad exposure to attractive end-markets serving a blue- 2 chip customer base 3 Industry-leading R&D and technical service capabilities 4 Significant investment in manufacturing footprint serving growing global end markets 5 Appropriate capital structure with strong and stable free cash flow profile 6 Experienced management team with extensive chemical industry knowledge Source: Market Research, Company Management 16

1 Leading Market Positions Across Key Business Segments #1 #1 #2 Forest Product Resins Specialty Epoxy Resins Base Epoxy Resins #1 global supplier of merchant formaldehyde #1 global supplier of infusion resins and bonding #2 supplier of Liquid Epoxy Resins (LER) in and engineered wood adhesives to major pastes for wind turbine blades North America and Europe for use primarily in engineered wood producers coatings and construction applications #1 #1 #2 Versatic Acids™ & Derivatives Phenolic Specialty Resins Resin-Coated Proppants #1 global supplier of neodecanoic acid (NDA) #1 supplier of phenolic specialty resins and #2 global supplier of resin-coated proppants for and its derivatives VeoVa™ Vinyl Ester and engineered thermoset molding compounds in the oil and gas industry Cardura™ Glycidyl Ester for use in architectural North America and Europe for use in and automotive coatings automotive, aerospace and industrial applications 17

1 Business Unit Overview Global leader in FPD and EPCD with a diverse business mix and exposure to a broad range of growing end markets Forest Products Epoxy, Phenolic & Coatings Resins Division Division N.A. Formaldehyde Wood Adhesives BERI EPS Versatics PSR Oilfield 1 Revenue: $1,671mm $539mm $689mm $202mm $549mm $53mm LTM EBITDA: $286mm $84mm $62mm $38mm $40mm ($16mm) 3/31 3/31 Financials Margin: 17% 16% 9% 19% 7% n/m . Essential chemical . Key ingredients for . Base Epoxy Resins & . Epoxy Specialty . Global producer of . Leading global . Leading producer of precursor wood products Intermediates (“BERI”) Resins specialty monomers producer of Phenolic phenolic resin . Produces . Produces wood is a leading producer (“EPS”) is a leading that provide superior Specialty Resins encapsulated sand for formaldehyde for the adhesives, used for of epoxy and epoxy supplier of specialty value in diverse (“PSR”) and oilfield applications merchant markets, as binding ingredients in intermediates epoxy materials coatings and engineered thermoset well as for internal wood products including bonding construction molding compounds uses paste, formulations Description infusion systems and waterborne coatings New Product launch offers #1 global supplier of #1 supplier of wood #2 supplier of LER in #1 global supplier of #1 global supplier of #1 supplier of phenolic unique opportunity to merchant formaldehyde adhesives to major North America and Europe infusion resins and bonding neodecanoic acid (NDA) specialty resins and improve strategic engineered wood pastes for blade and its derivatives engineered thermoset positioning in the Oil & Gas producers manufacturers VeoVa™ Vinyl Ester and molding compounds in Position end markets Cardura™ Glycidyl Ester North America and Europe Automotive Furniture Architectural Energy Automotive Wind Energy Coatings Consumer Goods Construction/ Industrial Oil & Gas End Repair & Waterborne Markets Construction Construction Agriculture Remodel Coatings Automotive 2 58% 17% 12% 8% 8% (3%) % of % Total Total EBITDA - titors Compe Selected Selected Source: Company Management (1) Excludes corporate overhead expenses (2) Based on total Q1 2019 LTM Segment EBITDA of $425 million, excludes corporate overhead expenses, as well as EPCD administrative expenses 18

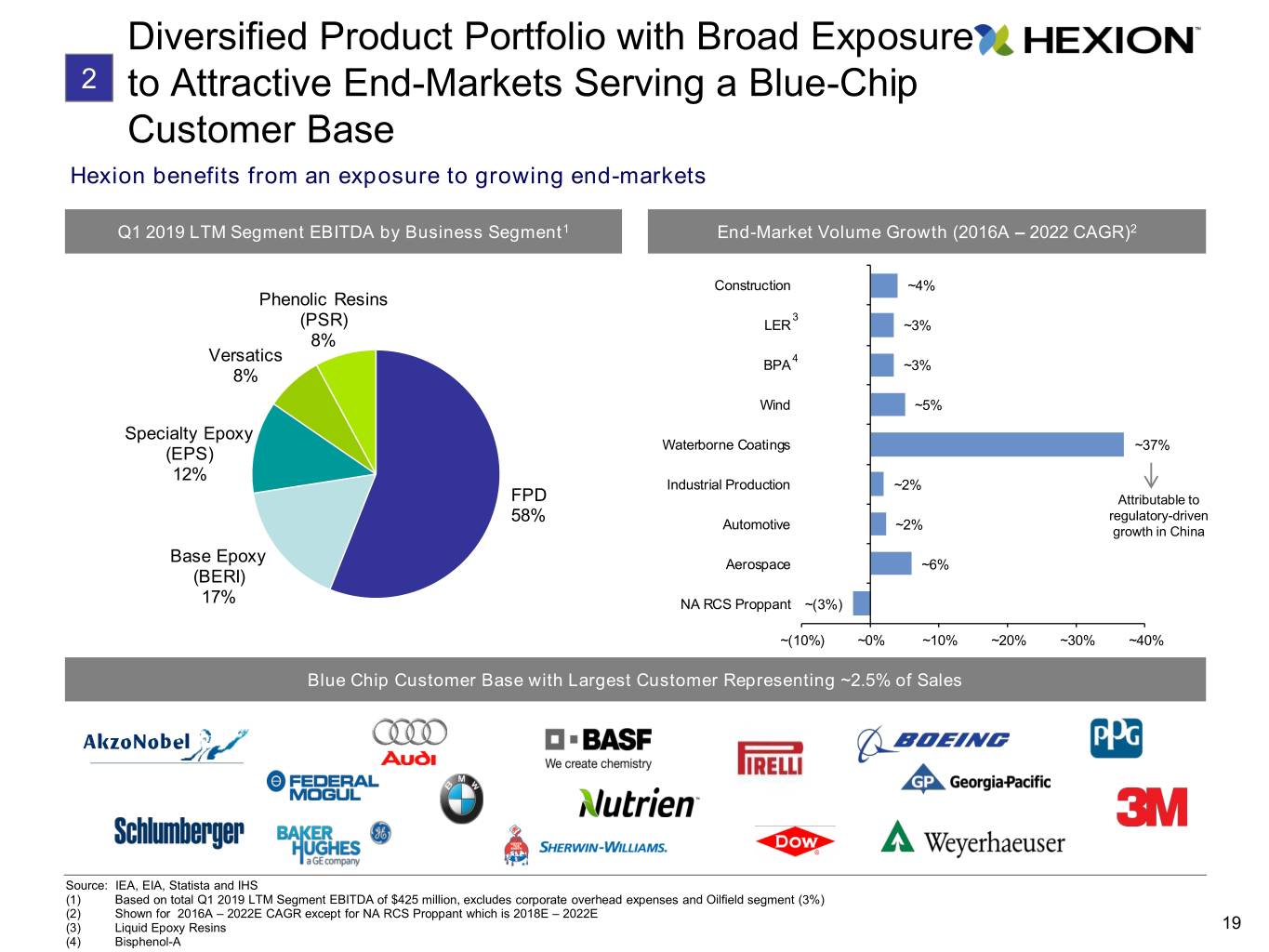

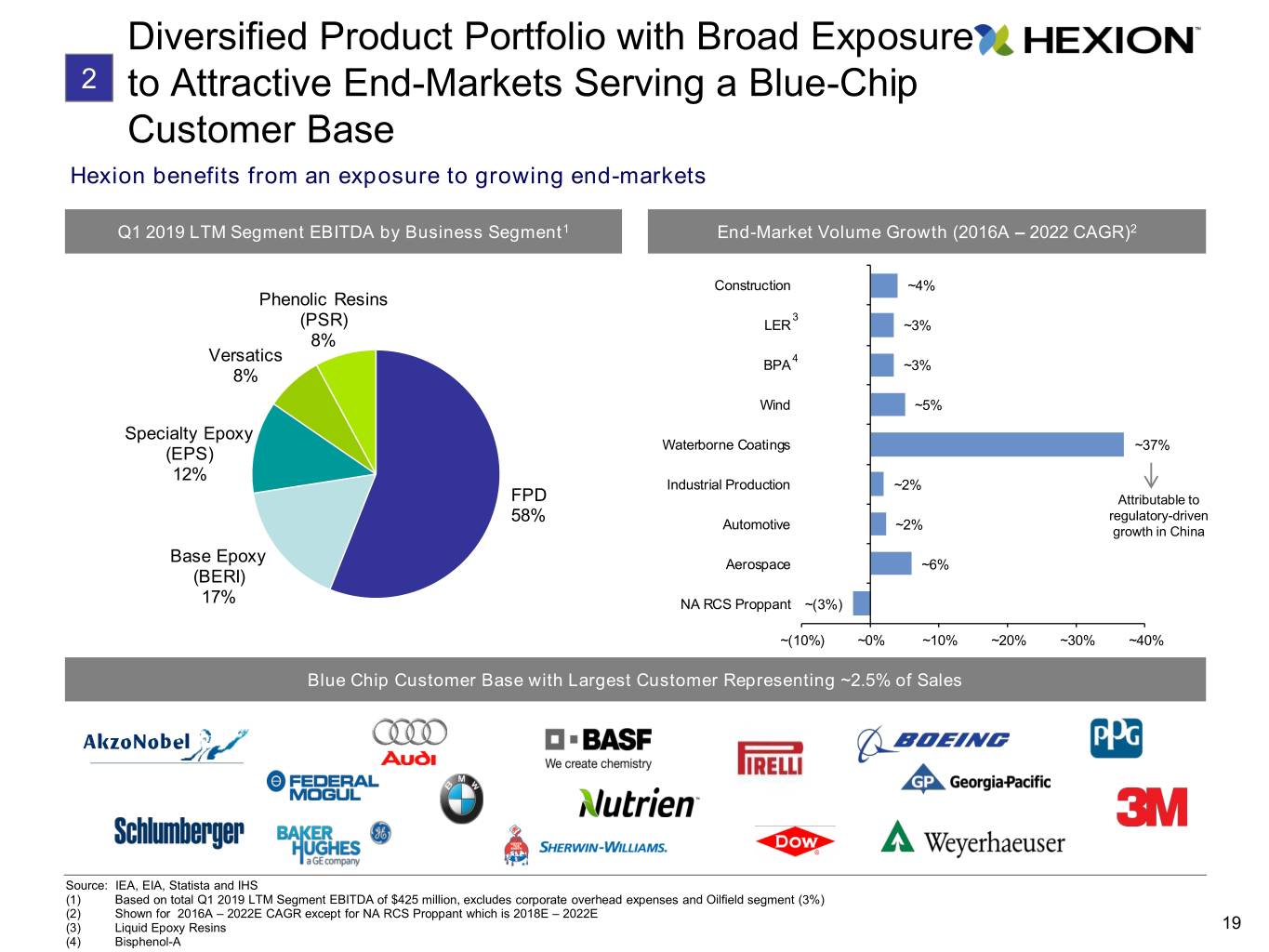

Diversified Product Portfolio with Broad Exposure 2 to Attractive End-Markets Serving a Blue-Chip Customer Base Hexion benefits from an exposure to growing end-markets Q1 2019 LTM Segment EBITDA by Business Segment1 End-Market Volume Growth (2016A – 2022 CAGR)2 Construction ~4% Phenolic Resins Oilfield (PSR) 3 (3%) LER ~3% 8% Versatics 4 BPA ~3% 8% Wind ~5% Specialty Epoxy Waterborne Coatings ~37% (EPS) 12% Industrial Production ~2% FPD Attributable to 58% regulatory-driven Automotive ~2% growth in China Base Epoxy Aerospace ~6% (BERI) 17% NA RCS Proppant ~(3%) ~(10%) ~0% ~10% ~20% ~30% ~40% Blue Chip Customer Base with Largest Customer Representing ~2.5% of Sales Source: IEA, EIA, Statista and IHS (1) Based on total Q1 2019 LTM Segment EBITDA of $425 million, excludes corporate overhead expenses and Oilfield segment (3%) (2) Shown for 2016A – 2022E CAGR except for NA RCS Proppant which is 2018E – 2022E (3) Liquid Epoxy Resins 19 (4) Bisphenol-A

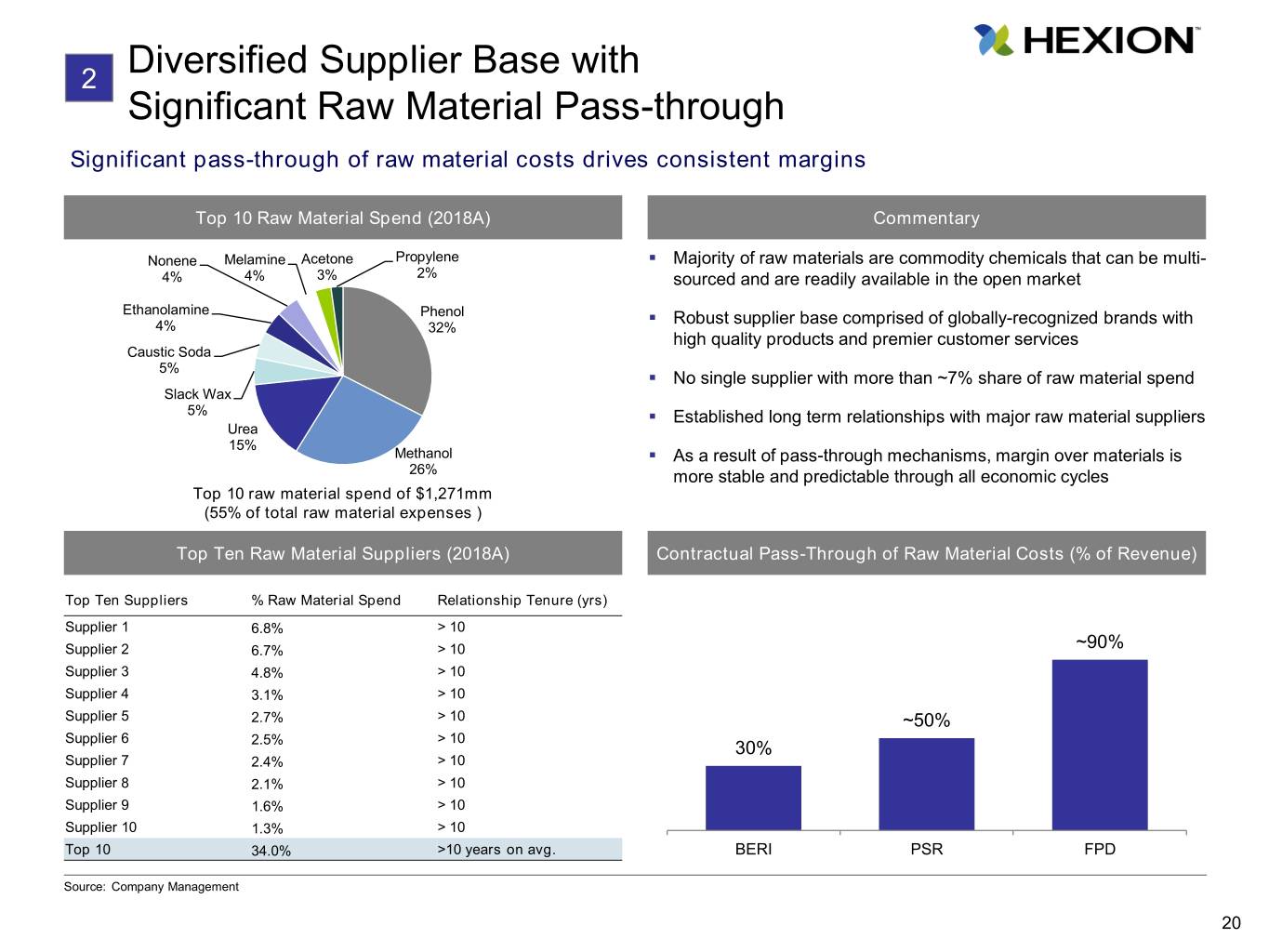

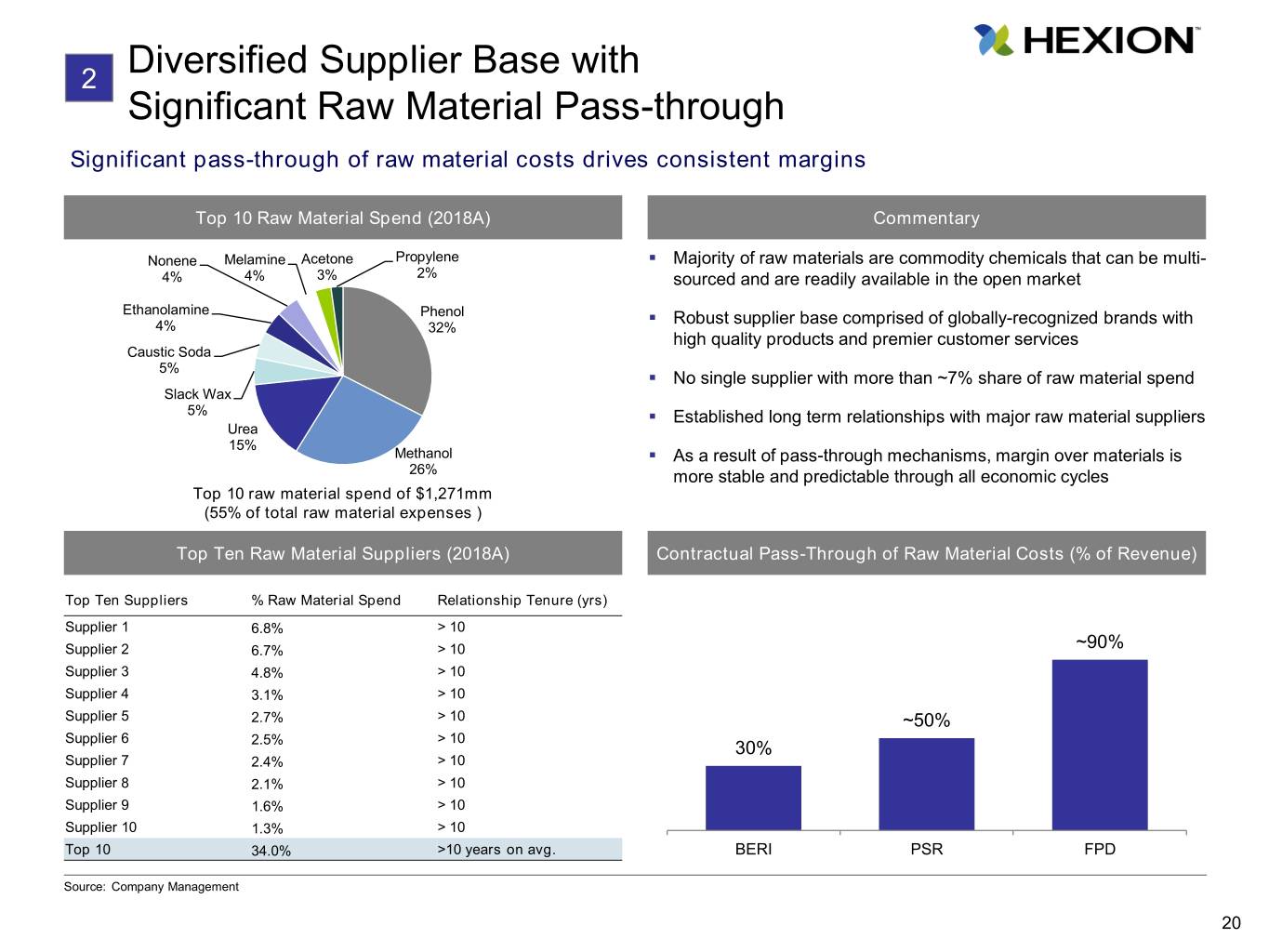

2 Diversified Supplier Base with Significant Raw Material Pass-through Significant pass-through of raw material costs drives consistent margins Top 10 Raw Material Spend (2018A) Commentary Nonene Melamine Acetone Propylene . Majority of raw materials are commodity chemicals that can be multi- 4% 4% 3% 2% sourced and are readily available in the open market Ethanolamine Phenol . Robust supplier base comprised of globally-recognized brands with 4% 32% high quality products and premier customer services Caustic Soda 5% . No single supplier with more than ~7% share of raw material spend Slack Wax 5% . Established long term relationships with major raw material suppliers Urea 15% Methanol . As a result of pass-through mechanisms, margin over materials is 26% more stable and predictable through all economic cycles Top 10 raw material spend of $1,271mm (55% of total raw material expenses ) Top Ten Raw Material Suppliers (2018A) Contractual Pass-Through of Raw Material Costs (% of Revenue) Top Ten Suppliers % Raw Material Spend Relationship Tenure (yrs) Supplier 1 6.8% > 10 Supplier 2 6.7% > 10 ~90% Supplier 3 4.8% > 10 Supplier 4 3.1% > 10 Supplier 5 2.7% > 10 ~50% Supplier 6 > 10 2.5% 30% Supplier 7 2.4% > 10 Supplier 8 2.1% > 10 Supplier 9 1.6% > 10 Supplier 10 1.3% > 10 Top 10 34.0% >10 years on avg. BERI PSR FPD Source: Company Management 20

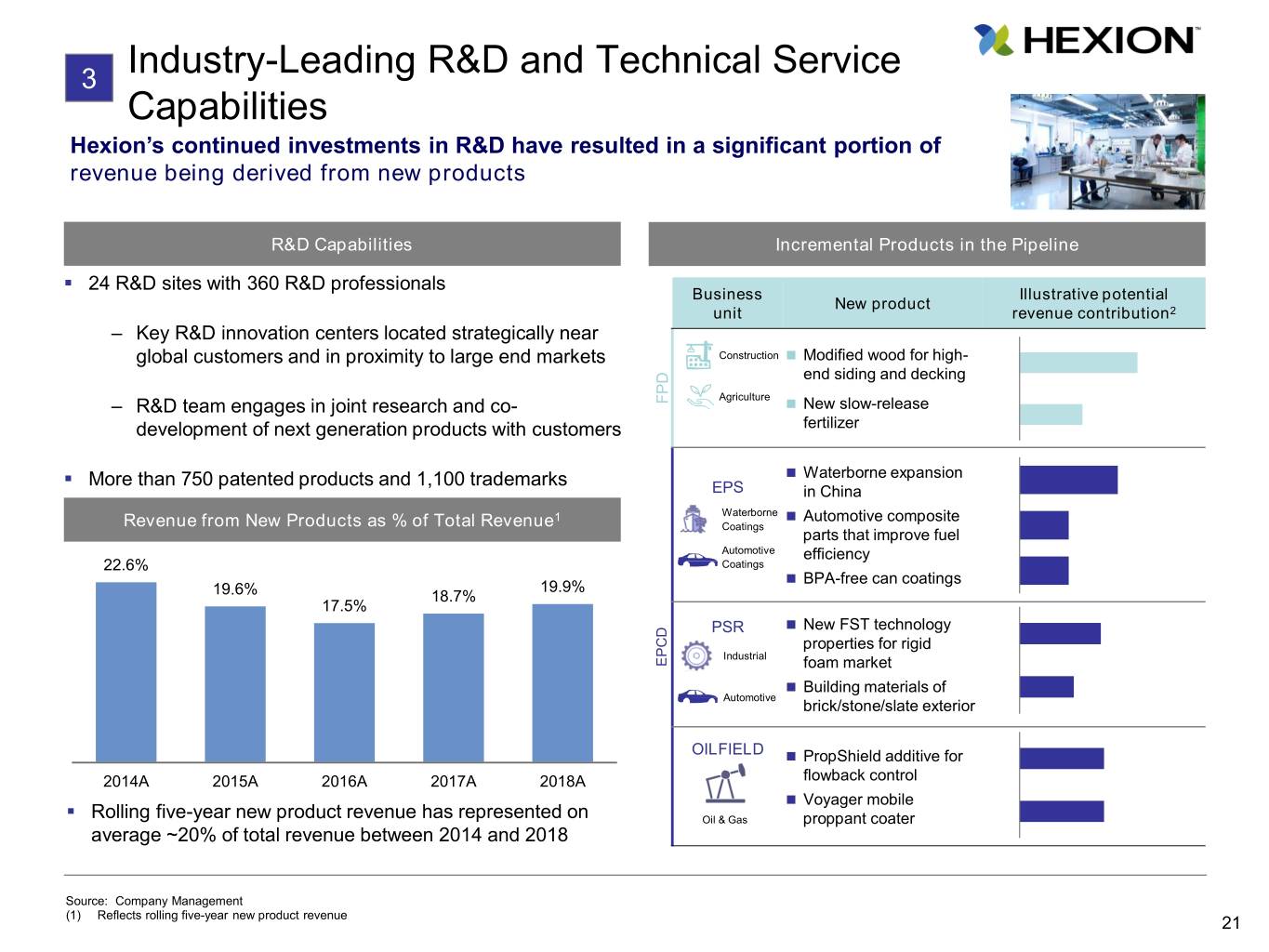

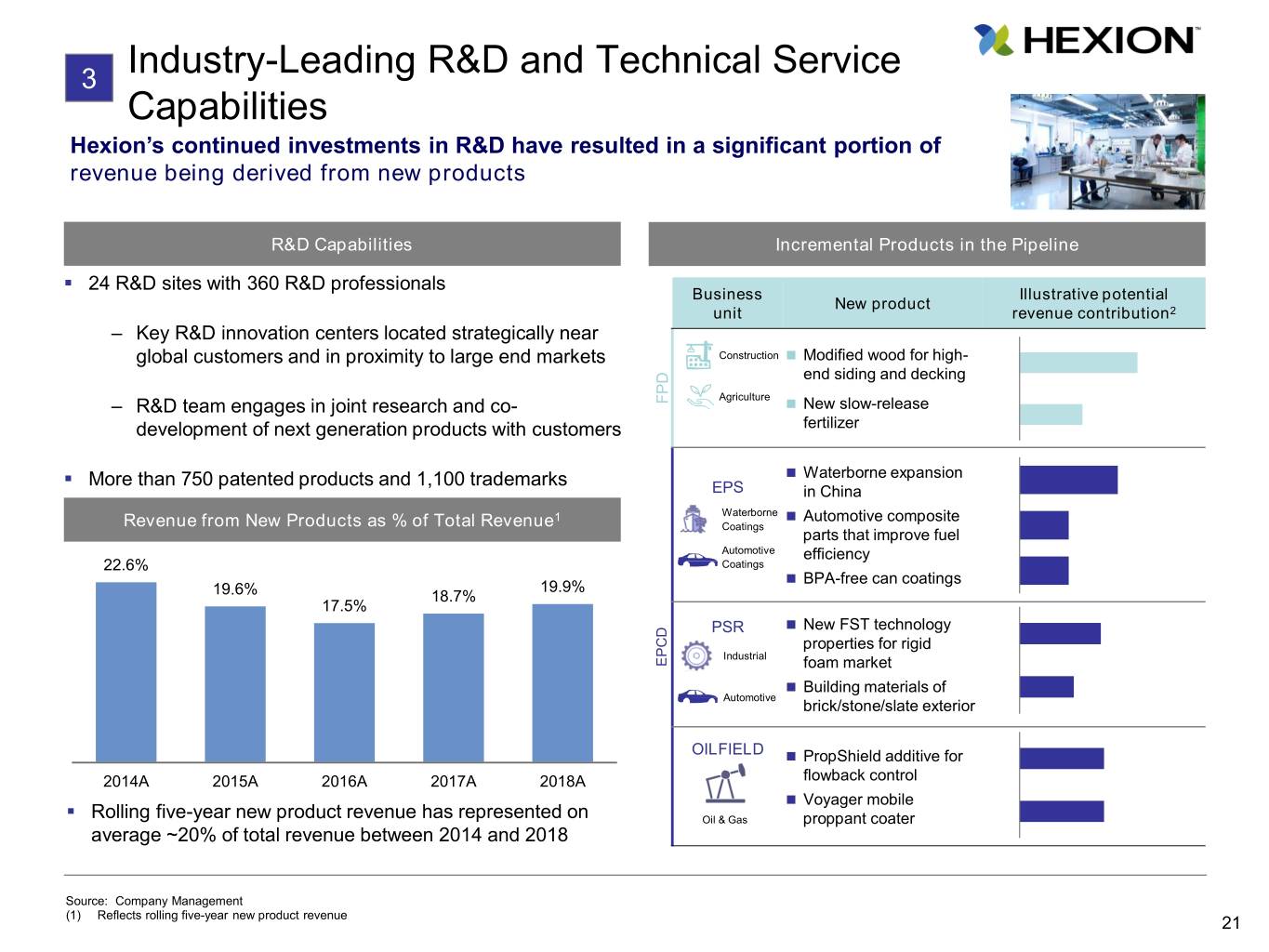

3 Industry-Leading R&D and Technical Service Capabilities Hexion’s continued investments in R&D have resulted in a significant portion of revenue being derived from new products R&D Capabilities Incremental Products in the Pipeline . 24 R&D sites with 360 R&D professionals Business Illustrative potential New product unit revenue contribution2 – Key R&D innovation centers located strategically near global customers and in proximity to large end markets Construction Modified wood for high- end siding and decking Agriculture – R&D team engages in joint research and co- FPD New slow-release development of next generation products with customers fertilizer . More than 750 patented products and 1,100 trademarks Waterborne expansion EPS in China 1 Waterborne Automotive composite Revenue from New Products as % of Total Revenue Coatings parts that improve fuel Automotive efficiency 22.6% Coatings BPA-free can coatings 19.9% 19.6% 18.7% 17.5% PSR New FST technology properties for rigid Industrial EPCD foam market Building materials of Automotive brick/stone/slate exterior OILFIELD PropShield additive for 2014A 2015A 2016A 2017A 2018A flowback control Voyager mobile . Rolling five-year new product revenue has represented on Oil & Gas proppant coater average ~20% of total revenue between 2014 and 2018 Source: Company Management (1) Reflects rolling five-year new product revenue 21

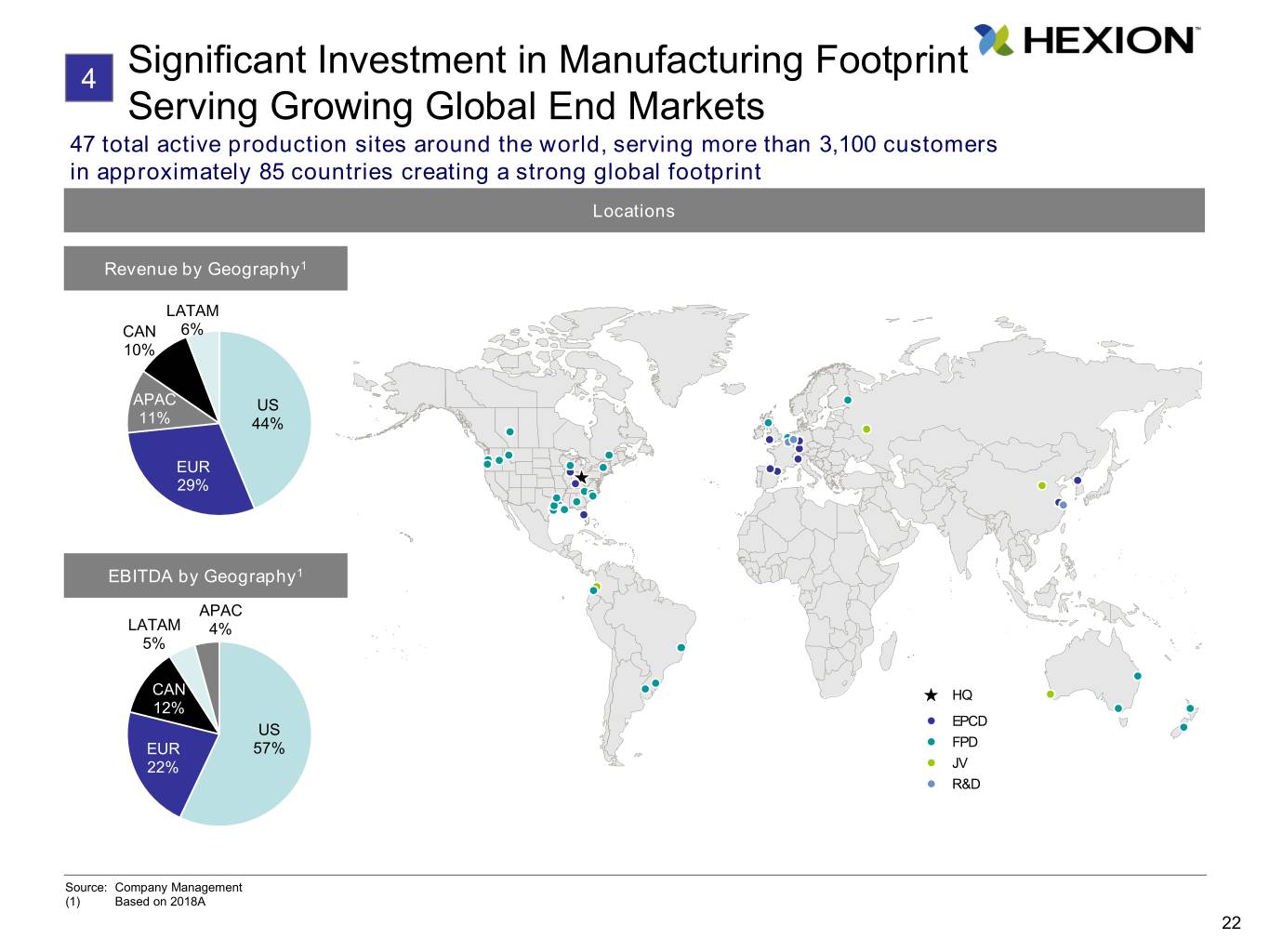

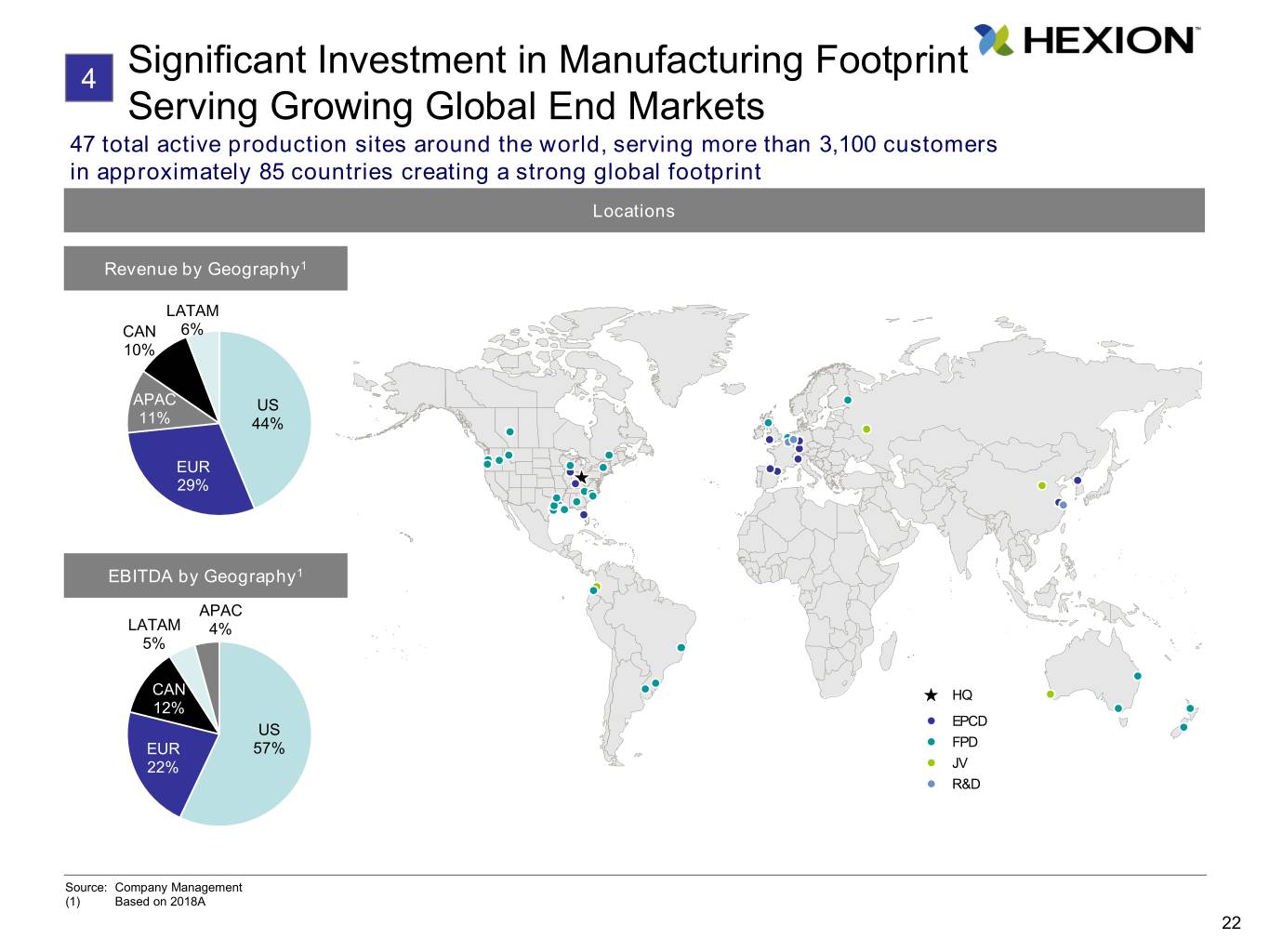

4 Significant Investment in Manufacturing Footprint Serving Growing Global End Markets 47 total active production sites around the world, serving more than 3,100 customers in approximately 85 countries creating a strong global footprint Locations Revenue by Geography1 LATAM CAN 6% 10% APAC US 11% 44% EUR 29% EBITDA by Geography1 APAC LATAM 4% 5% CAN HQ 12% EPCD US EUR 57% FPD 22% JV R&D Source: Company Management (1) Based on 2018A 22

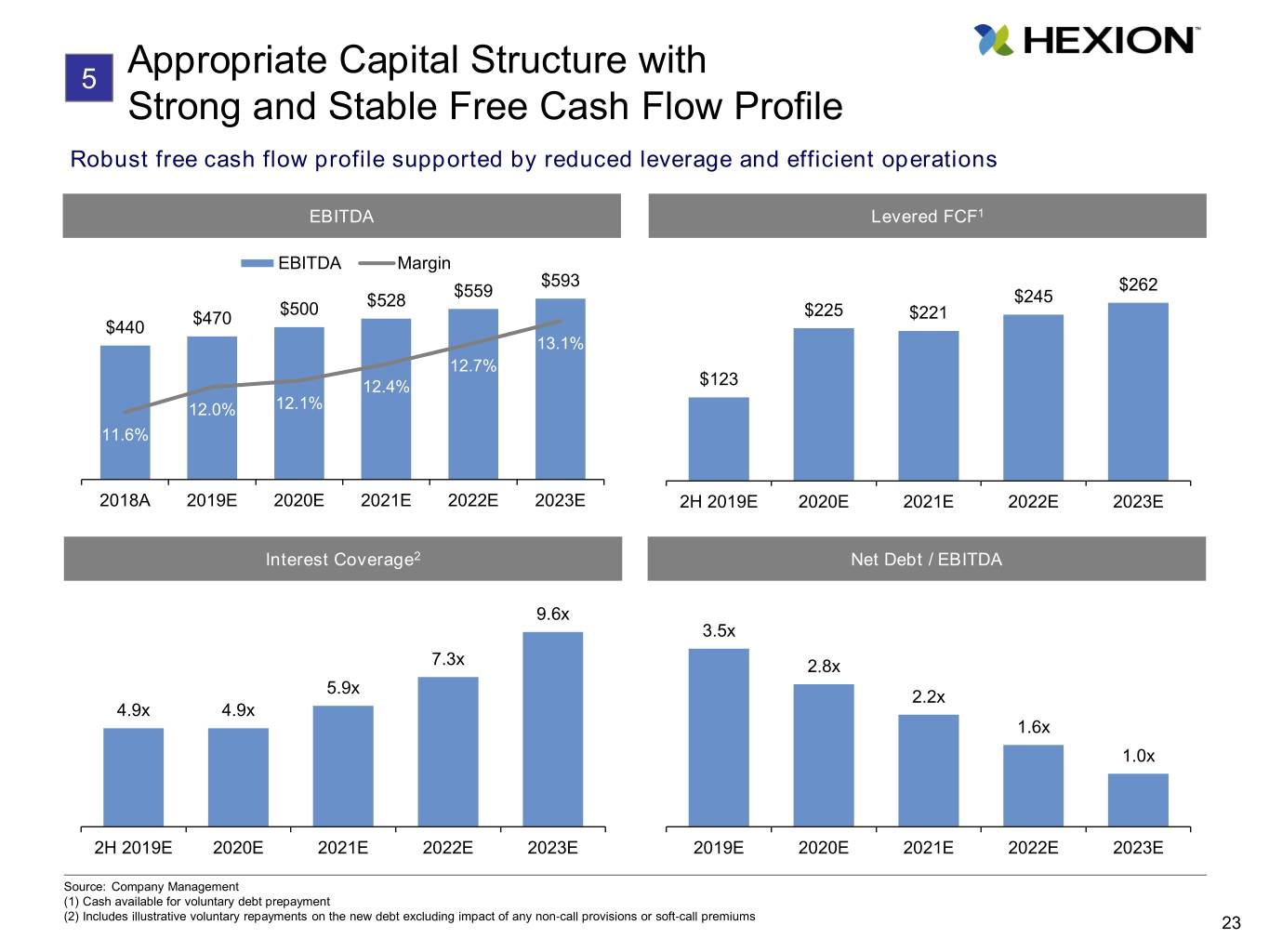

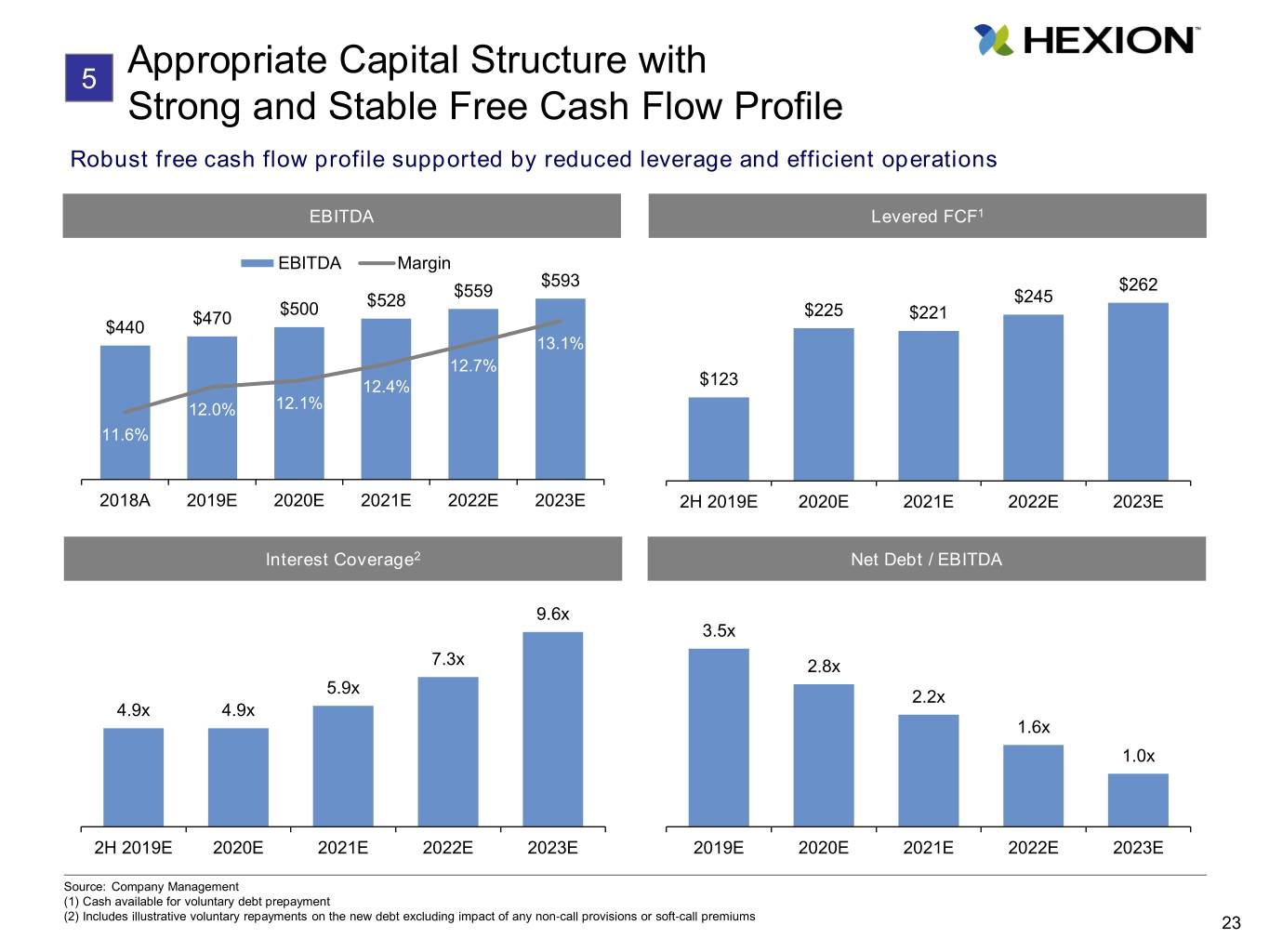

5 Appropriate Capital Structure with Strong and Stable Free Cash Flow Profile Robust free cash flow profile supported by reduced leverage and efficient operations EBITDA Levered FCF1 EBITDA Margin $593 $262 $559 $245 $500 $528 $470 $225 $221 $440 13.1% 12.7% 12.4% $123 12.0% 12.1% 11.6% 2018A 2019E 2020E 2021E 2022E 2023E 2H 2019E 2020E 2021E 2022E 2023E Interest Coverage2 Net Debt / EBITDA 9.6x 3.5x 7.3x 2.8x 5.9x 2.2x 4.9x 4.9x 1.6x 1.0x 2H 2019E 2020E 2021E 2022E 2023E 2019E 2020E 2021E 2022E 2023E Source: Company Management (1) Cash available for voluntary debt prepayment (2) Includes illustrative voluntary repayments on the new debt excluding impact of any non‐call provisions or soft‐call premiums 23

6 Experienced Management Team Experienced senior leadership team with an average of ~25 years of industry experience Craig Rogerson CEO Hexion tenure: 1 Industry tenure: 39 Doug Johns Matt Sokol Paul Barletta George Knight John Auletto EVP & General EVP / Chief EVP, Operations EVP/CFO EVP/HR Counsel Administrative Officer Hexion tenure: 11 Hexion tenure: 9 Hexion tenure: 21 Hexion tenure: 17 Hexion tenure: 1 Industry tenure: 30+ Industry tenure: 25+ Industry tenure: 21 Industry tenure: 20+ Industry tenure: 10+ Mark Bidstrup Nathan Fisher SVP & Treasurer EVP, Procurement Hexion tenure: 17 Hexion tenure: 14 Industry tenure: 17 Industry tenure: 20+ 24

III. Business Unit Highlights

1 Forest Products Division (“FPD”) Business Unit Overview Global leader in formaldehyde and wood adhesives Overview Total Revenue By Geography & Industry . Largest global merchant supplier of Formaldehyde and wood Geography Mix(1) Industry Mix(1) adhesives to major engineered wood producers . Wood adhesives estimated to be 24% driven by new EMEA Other 12% 10% construction, 40% driven by repair and remodel Energy 8% Other . Serves a variety of end markets including construction, Asia Pacific Construction chemicals, agriculture and oil and gas 8% 35% Agriculture . Vertically integrated regional manufacturing footprint supporting Latin 8% diversified, long tenured customer base – growing with America customers and following industry trends 13% North . Partner-of-choice in the North American formaldehyde market America New Home – ~40% of North American formaldehyde capacity by 67% Construction 20% volume but ~60% of merchant sales volume Furniture 19% Selected Customers Industry Snapshot1 North American Growth Forecast by End Market ’17 – ’22 ~7% ~2% ~2% ~2% ~1% Selected Competitors ~(1%) Single Family Multi-Family New Residential R&R Commercial Industrial Other New Construction Construction Production Source: IEA and L.E.K Consulting LLC.(Industry Snapshot) (1) Based on LTM period ending September 30, 2018 26

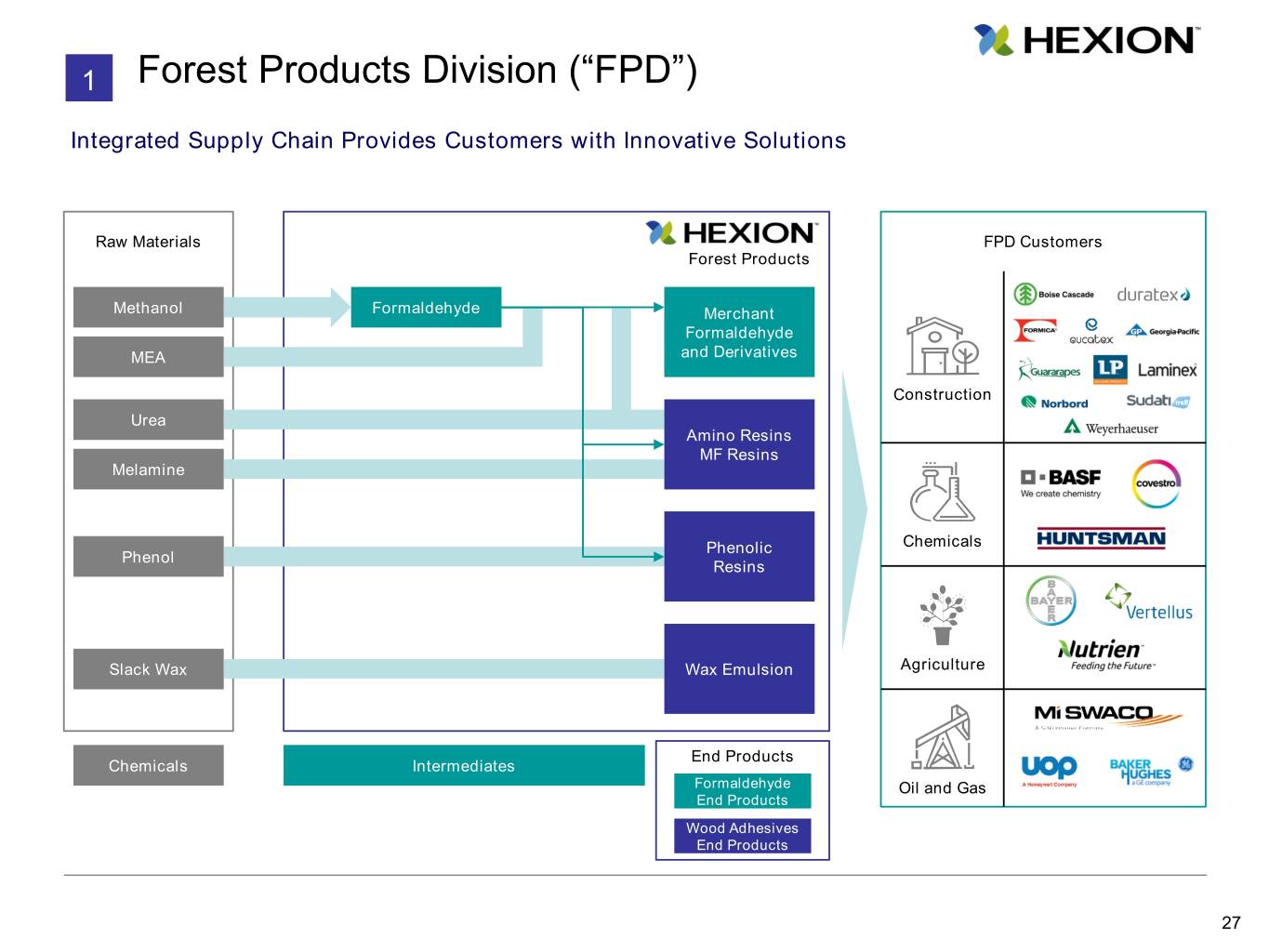

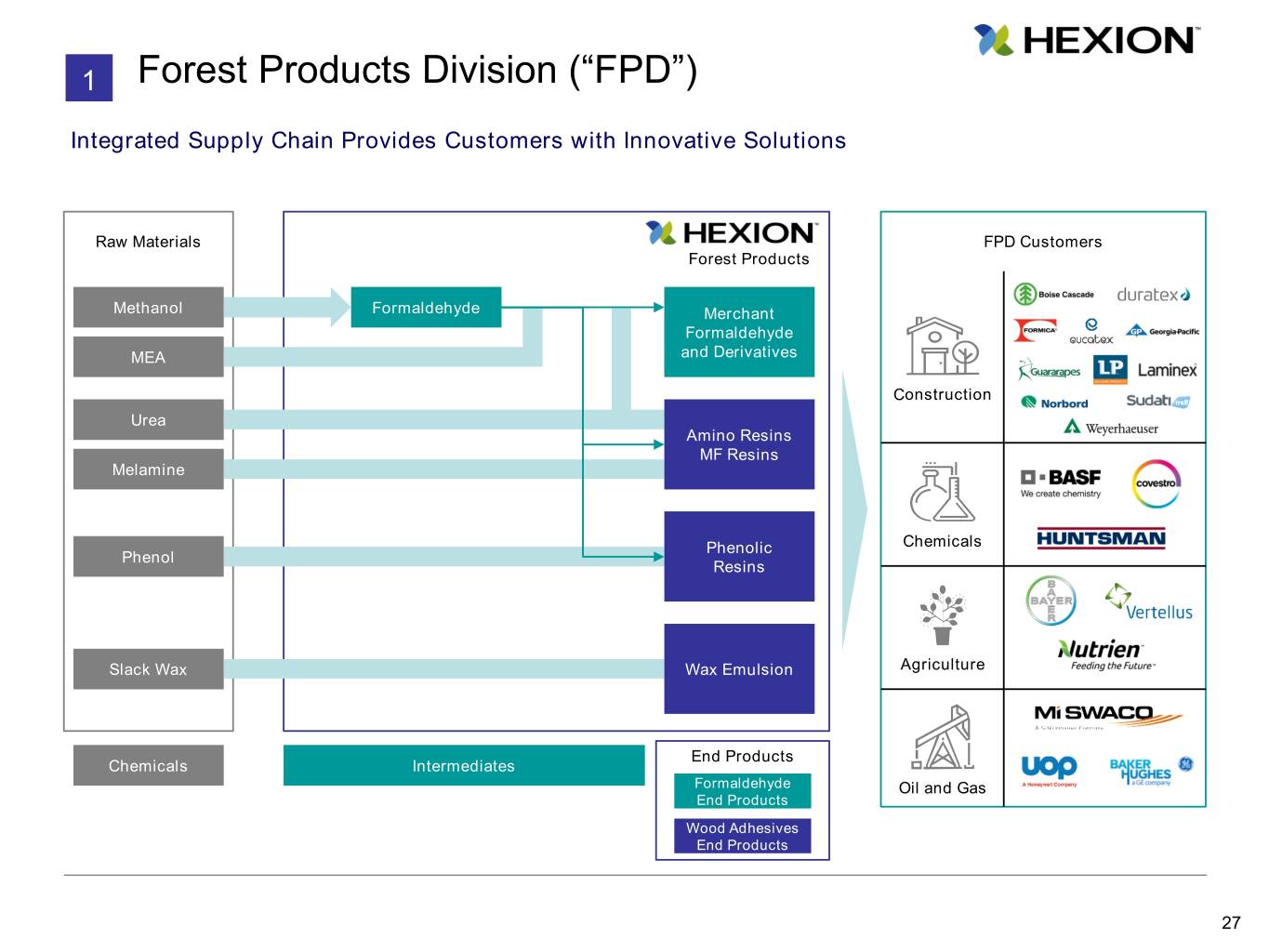

1 Forest Products Division (“FPD”) Integrated Supply Chain Provides Customers with Innovative Solutions Raw Materials FPD Customers Forest Products Methanol Formaldehyde Merchant Formaldehyde MEA and Derivatives Construction Urea Amino Resins MF Resins Melamine Phenolic Chemicals Phenol Resins Slack Wax Wax Emulsion Agriculture End Products Chemicals Intermediates Formaldehyde Oil and Gas End Products Wood Adhesives End Products 27

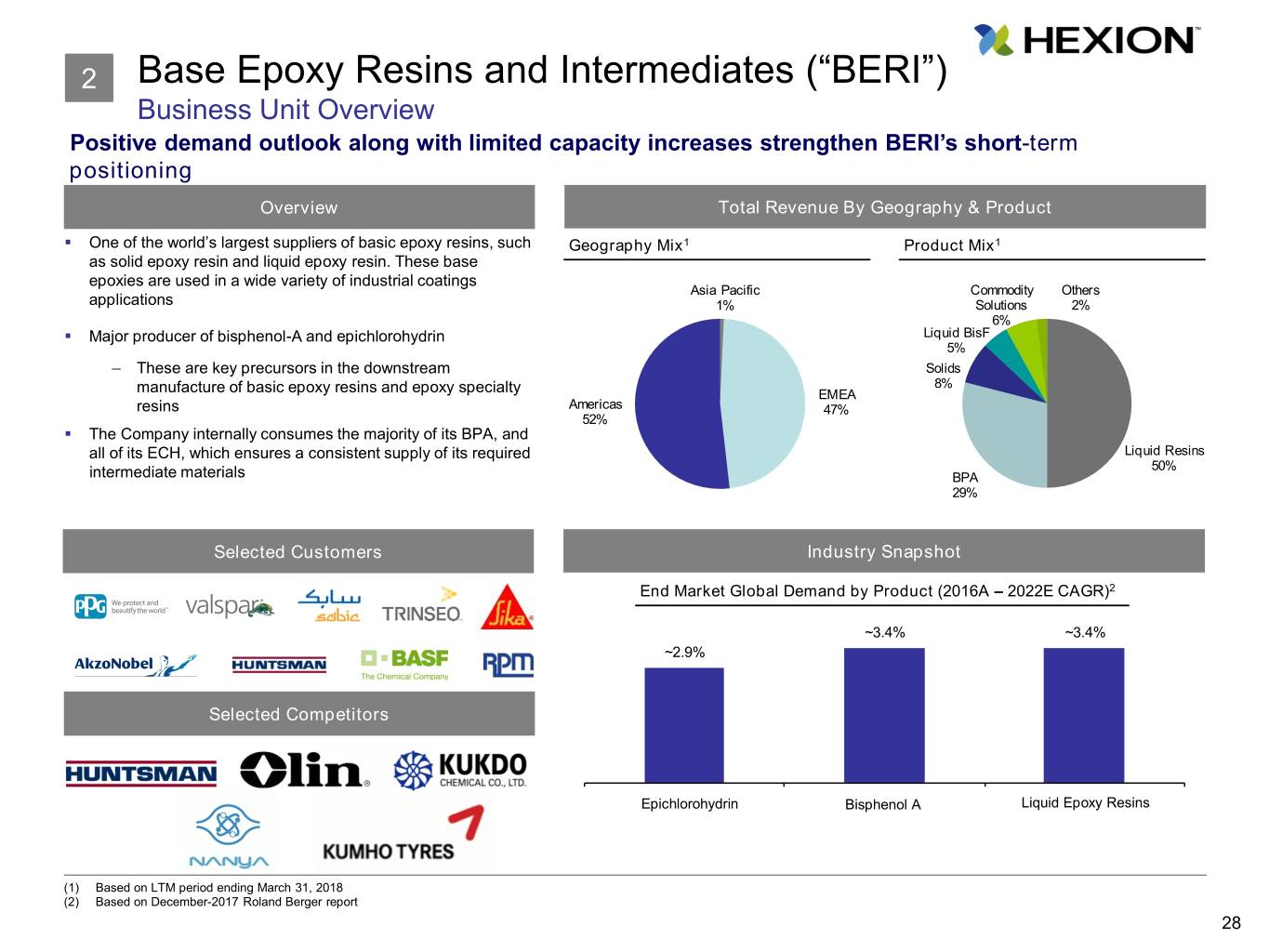

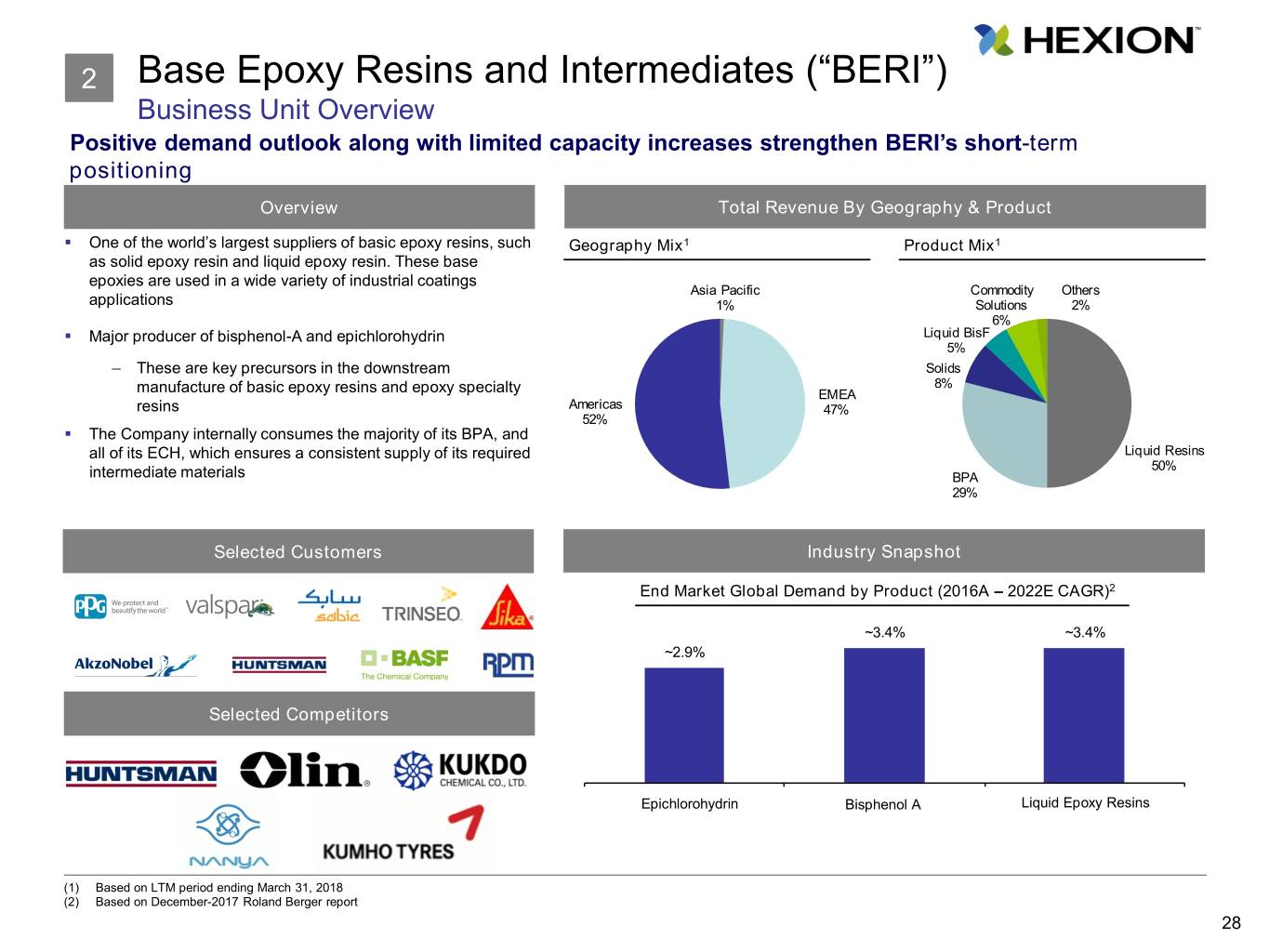

2 Base Epoxy Resins and Intermediates (“BERI”) Business Unit Overview Positive demand outlook along with limited capacity increases strengthen BERI’s short-term positioning Overview Total Revenue By Geography & Product . One of the world’s largest suppliers of basic epoxy resins, such Geography Mix1 Product Mix1 as solid epoxy resin and liquid epoxy resin. These base epoxies are used in a wide variety of industrial coatings Asia Pacific Commodity Others applications 1% Solutions 2% 6% . Major producer of bisphenol-A and epichlorohydrin Liquid BisF 5% – These are key precursors in the downstream Solids 8% manufacture of basic epoxy resins and epoxy specialty EMEA resins Americas 47% 52% . The Company internally consumes the majority of its BPA, and all of its ECH, which ensures a consistent supply of its required Liquid Resins 50% intermediate materials BPA 29% Selected Customers Industry Snapshot End Market Global Demand by Product (2016A – 2022E CAGR)2 ~3.4% ~3.4% ~2.9% Selected Competitors EpichlorohydrinECH BisphenolBPA A Liquid EpoxyLER Resins (1) Based on LTM period ending March 31, 2018 (2) Based on December-2017 Roland Berger report 28

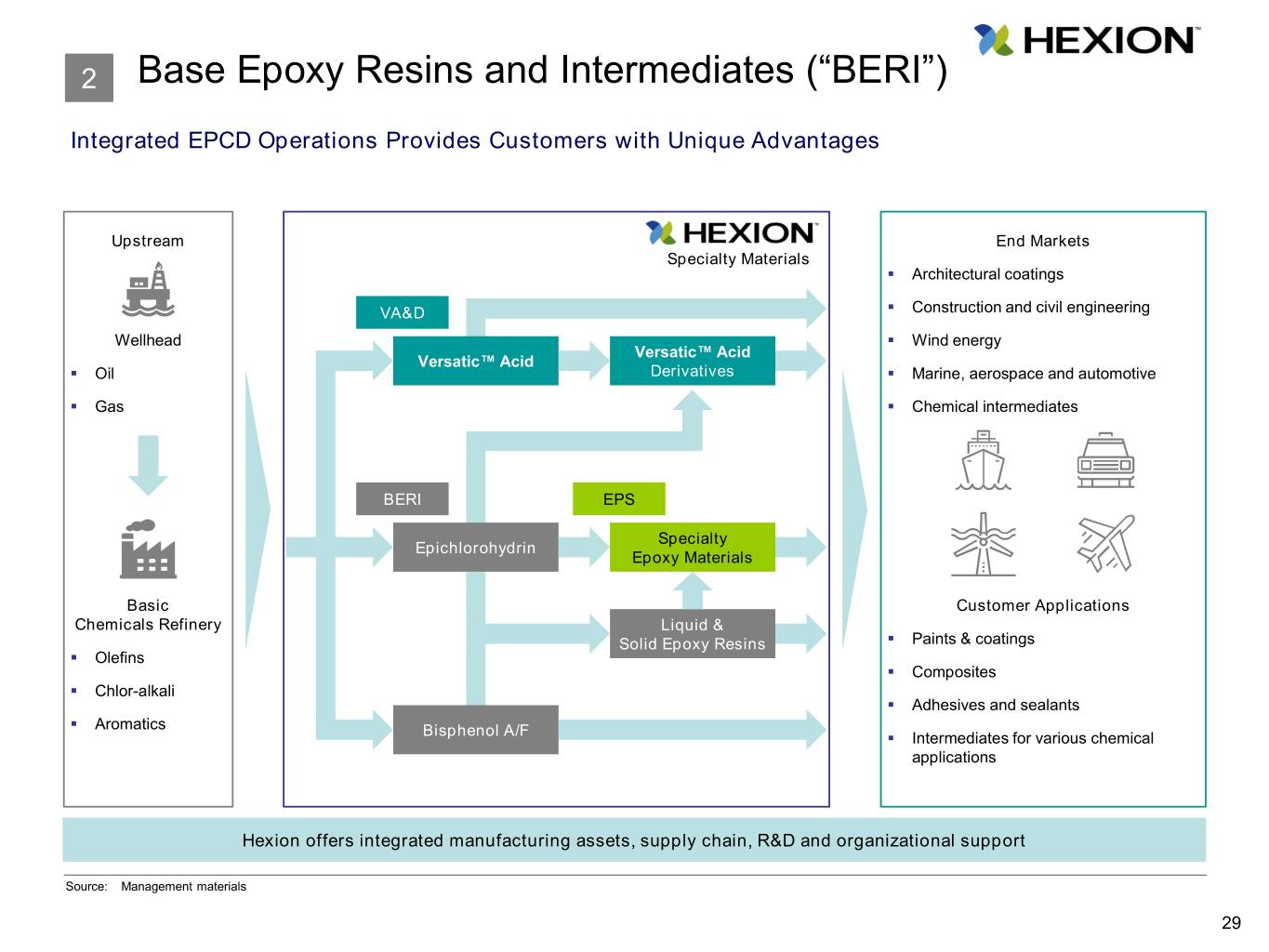

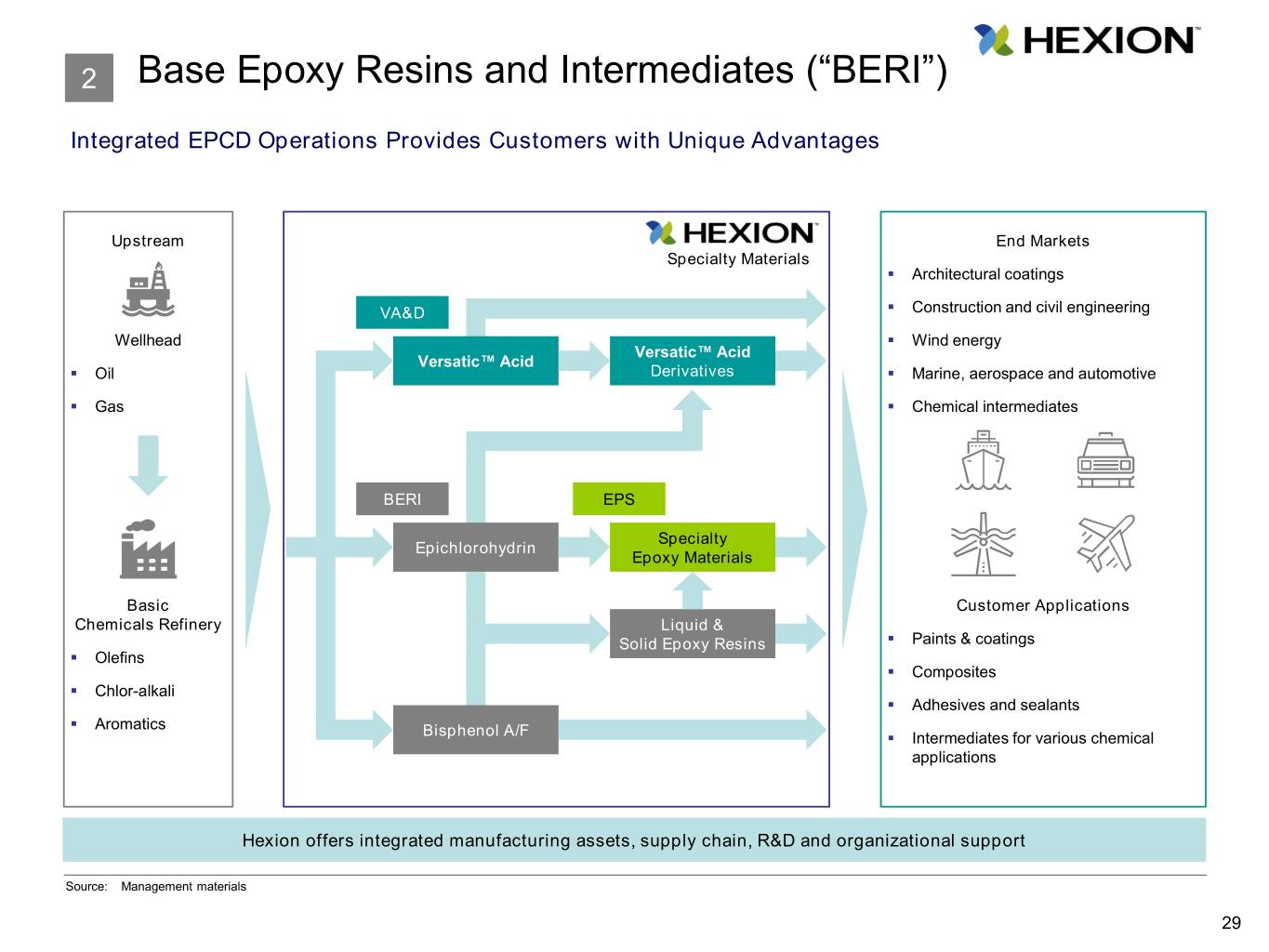

2 Base Epoxy Resins and Intermediates (“BERI”) Integrated EPCD Operations Provides Customers with Unique Advantages Upstream End Markets Specialty Materials . Architectural coatings VA&D . Construction and civil engineering Wellhead . Wind energy Versatic™ Acid Versatic™ Acid . Oil Derivatives . Marine, aerospace and automotive . Gas . Chemical intermediates BERI EPS Specialty Epichlorohydrin Epoxy Materials Basic Customer Applications Chemicals Refinery Liquid & Solid Epoxy Resins . Paints & coatings . Olefins . Composites . Chlor-alkali . Adhesives and sealants . Aromatics Bisphenol A/F . Intermediates for various chemical applications Hexion offers integrated manufacturing assets, supply chain, R&D and organizational support Source: Management materials 29

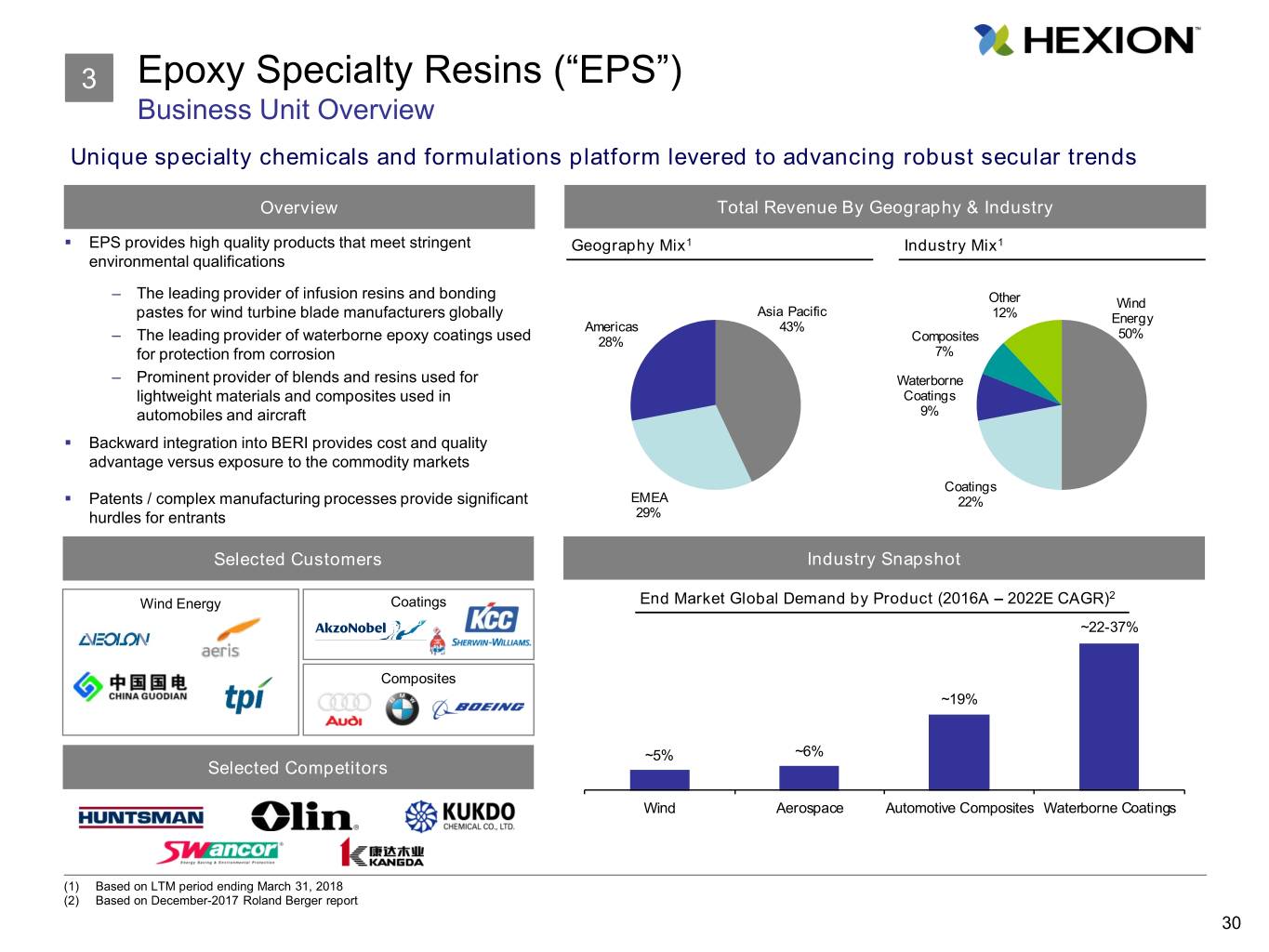

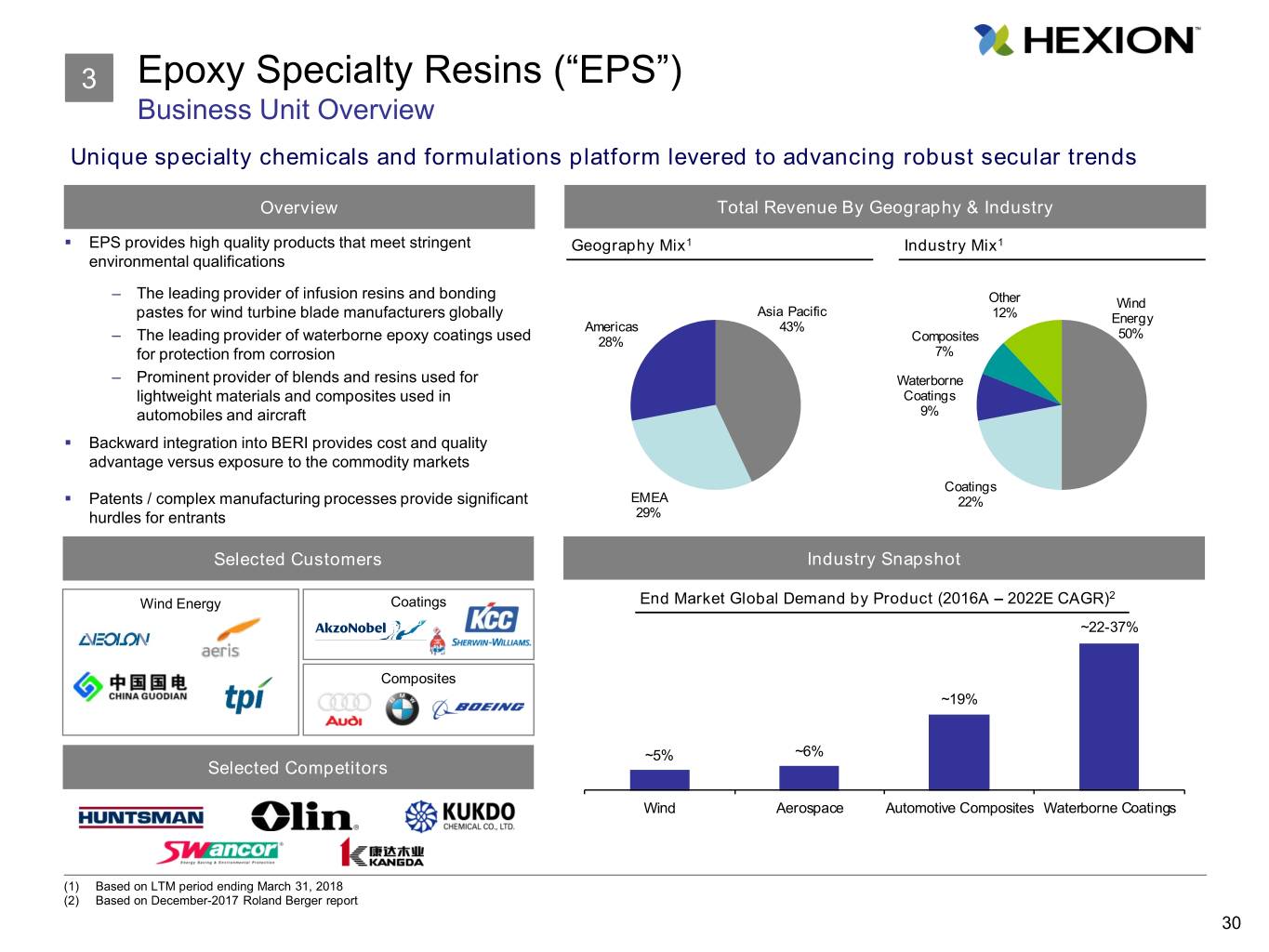

3 Epoxy Specialty Resins (“EPS”) Business Unit Overview Unique specialty chemicals and formulations platform levered to advancing robust secular trends Overview Total Revenue By Geography & Industry . EPS provides high quality products that meet stringent Geography Mix1 Industry Mix1 environmental qualifications – The leading provider of infusion resins and bonding Other Wind Asia Pacific pastes for wind turbine blade manufacturers globally 12% Energy Americas 43% 50% – The leading provider of waterborne epoxy coatings used 28% Composites for protection from corrosion 7% – Prominent provider of blends and resins used for Waterborne lightweight materials and composites used in Coatings automobiles and aircraft 9% . Backward integration into BERI provides cost and quality advantage versus exposure to the commodity markets Coatings . Patents / complex manufacturing processes provide significant EMEA 22% hurdles for entrants 29% Selected Customers Industry Snapshot 2 Wind Energy Coatings End Market Global Demand by Product (2016A – 2022E CAGR) ~22-37% Composites ~19% ~5% ~6% Selected Competitors Wind Aerospace Automotive Composites Waterborne Coatings (1) Based on LTM period ending March 31, 2018 (2) Based on December-2017 Roland Berger report 30

4 Versatics Business Unit Overview Superior VersaticTM Acid & Derivatives offerings to architectural, industrial and automotive industries Overview Total Revenue By Geography & Product . Global producer of specialty monomers that provide superior Geography Mix1 Product Mix1 value in diverse coatings and construction formulations . Versatic Acid – Synthetic tertiary acid with highly branched structure Americas EMEA providing diverse formulation properties Versatic Acid VeoVa Ester 21% 49% – Imparts unique chemical properties in a cost-effective way 23% 46% to a wide variety of applications . VeoVa Ester – Vinyl ester of Versatic™ Acid primarily used for decorative paints and mortar admixtures – Enhances decorative paints’ aesthetics and durability and improves performance of RDP end uses Asia Pacific 30% . Cardura Ester Cardura Ester 31% – Primarily used in acrylic polyols and polyester polyols to make resins for high performance automotive and industrial coatings Selected Customers Industry Snapshot Versatic™ Acid VeoVa™ Ester Cardura™ Ester End-Market Global Demand by Product (2016A – 2022E CAGR)2 ~4% ~3% ~2-3% ~3% Selected Competitors Decorative Coatings Construction Adhesives Automotive Coatings Industrial Coatings (1) Based on LTM period ending March 31, 2018 (2) Growth rates based on December-2017 Roland Berger report. 31

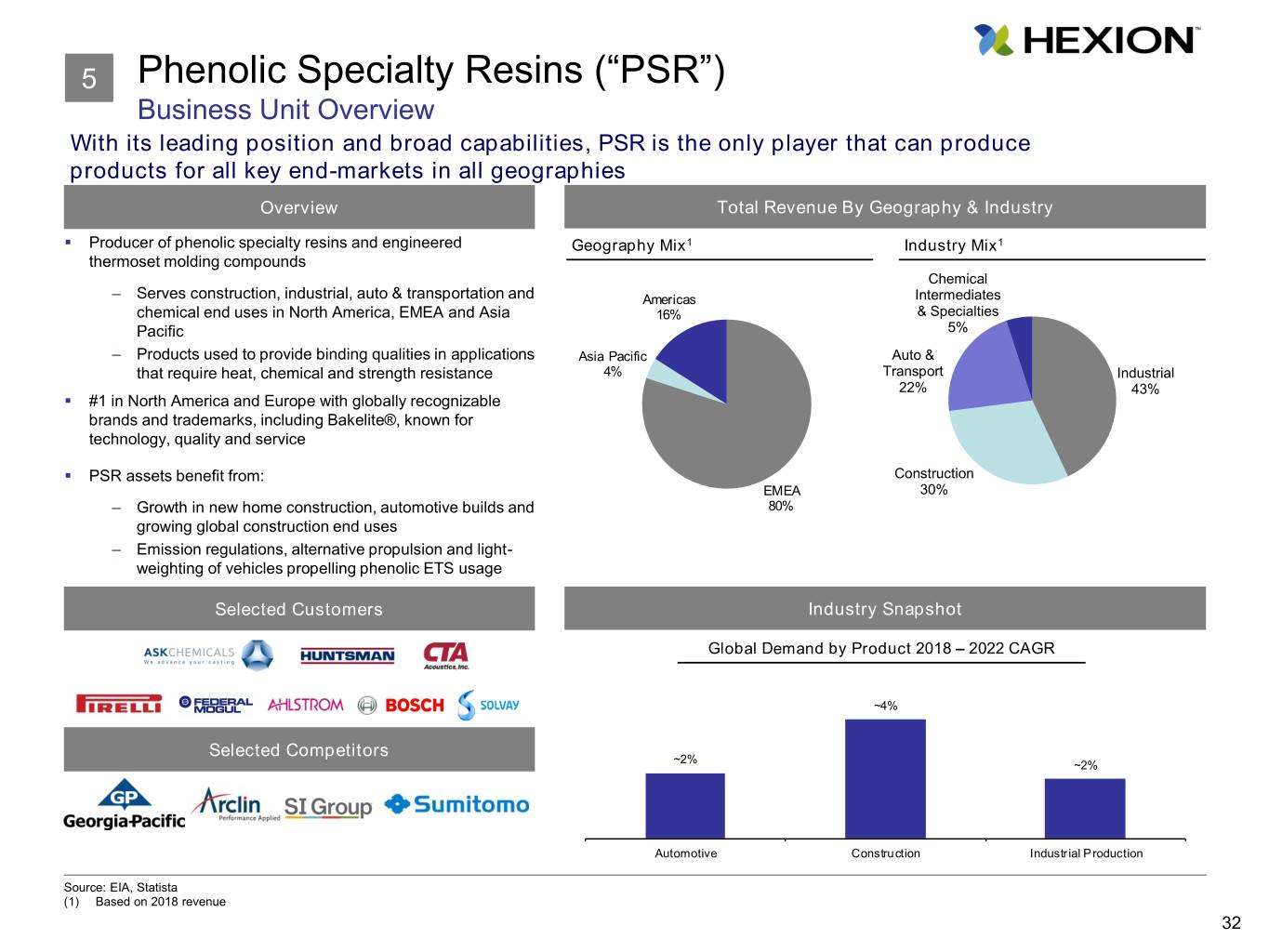

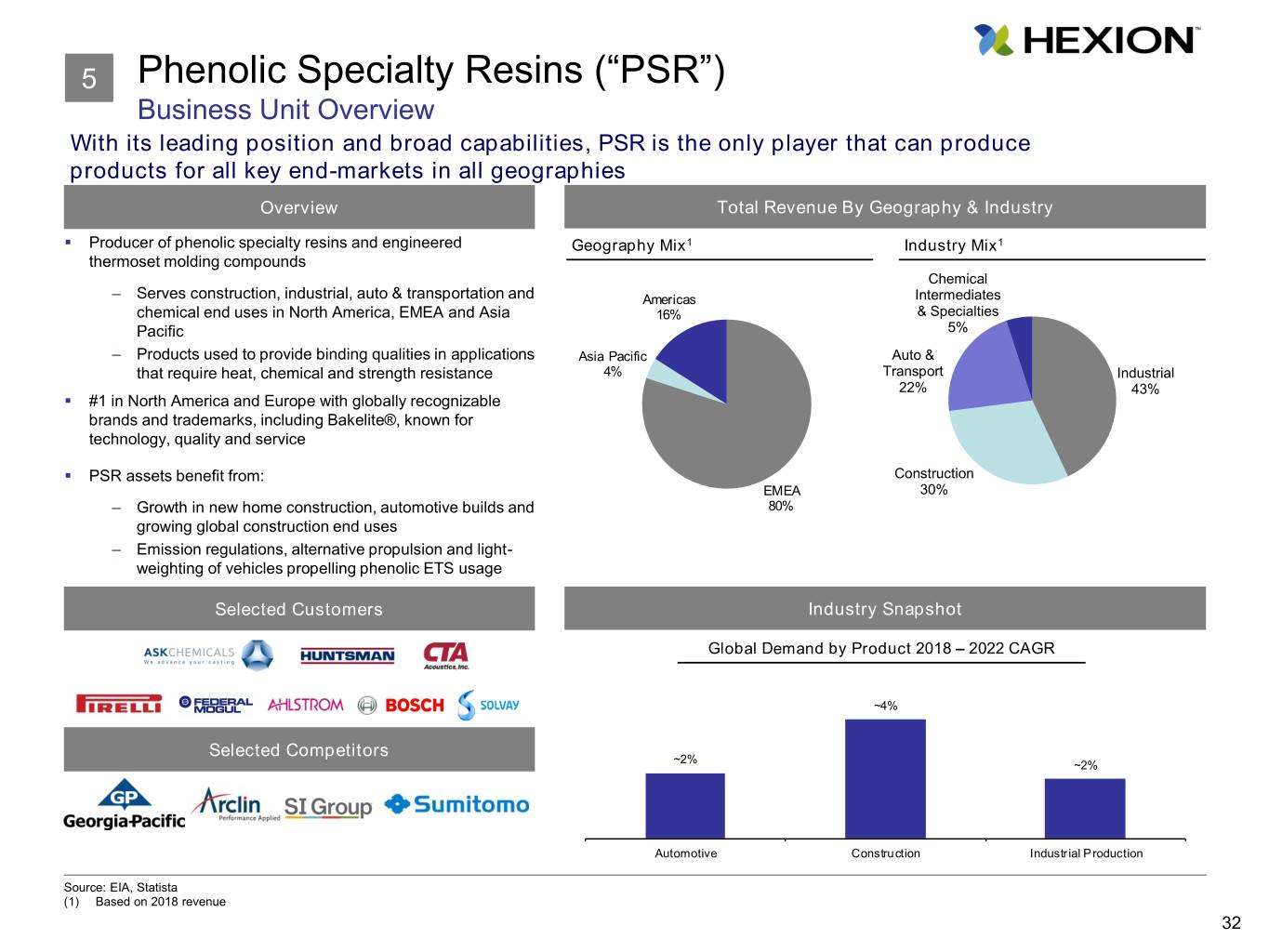

5 Phenolic Specialty Resins (“PSR”) Business Unit Overview With its leading position and broad capabilities, PSR is the only player that can produce products for all key end-markets in all geographies Overview Total Revenue By Geography & Industry . Producer of phenolic specialty resins and engineered Geography Mix1 Industry Mix1 thermoset molding compounds Chemical – Serves construction, industrial, auto & transportation and Americas Intermediates chemical end uses in North America, EMEA and Asia 16% & Specialties Pacific 5% – Products used to provide binding qualities in applications Asia Pacific Auto & that require heat, chemical and strength resistance 4% Transport Industrial 22% 43% . #1 in North America and Europe with globally recognizable brands and trademarks, including Bakelite®, known for technology, quality and service . PSR assets benefit from: Construction EMEA 30% – Growth in new home construction, automotive builds and 80% growing global construction end uses – Emission regulations, alternative propulsion and light- weighting of vehicles propelling phenolic ETS usage Selected Customers Industry Snapshot Global Demand by Product 2018 – 2022 CAGR ~4% Selected Competitors ~2% ~2% Automotive Construction Industrial Production Source: EIA, Statista (1) Based on 2018 revenue 32

6 Oilfield Business Unit Overview Hexion is a key innovator and leader in the oilfield services chemical market Overview Total Revenue By Geography . Leading producer of phenolic resin encapsulated sand for oilfield applications . Historically has been a very high growth and highly profitable segment . Recent decline in global oil prices has driven E&P’s to uncoated sand . Proven NPD pipeline supports future growth – PropShieldTM, launched in August 2018, provides customers with a cost-effective way to treat proppant flowback, a significant source of cost due to downtime and equipment repair – VoyagerSM, a resin coating service, enables strategic and efficient placement near transload sites and sand Americas, mines 100% Selected Customers Industry Snapshot Global Demand by Product 2018 - 2022 ~5% Selected Competitors ~(3%) ~(7%) NA Sand Proppant NA RCS Proppant NA Ceramic Proppant Source: IHS 33

IV. Financial Overview

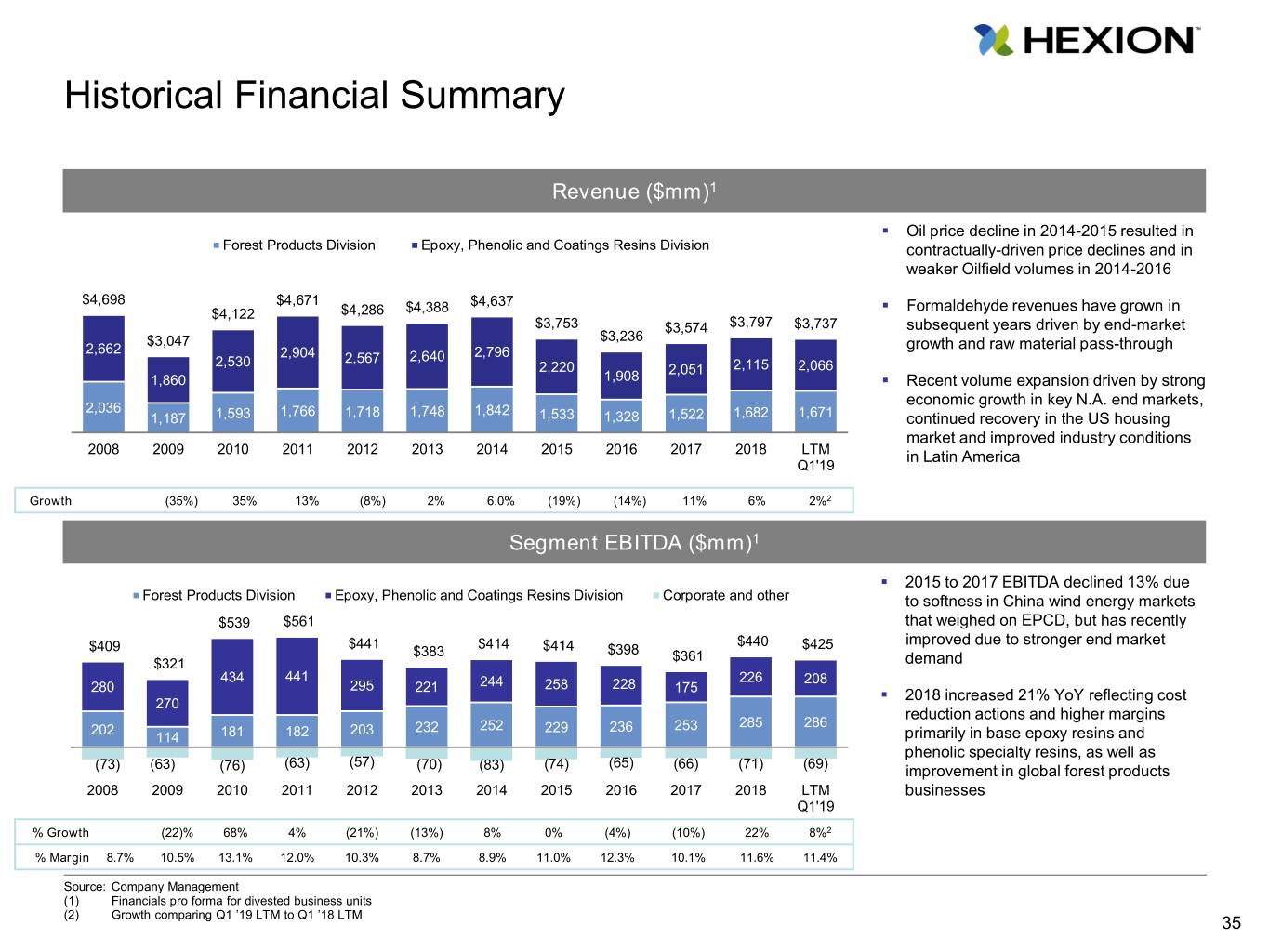

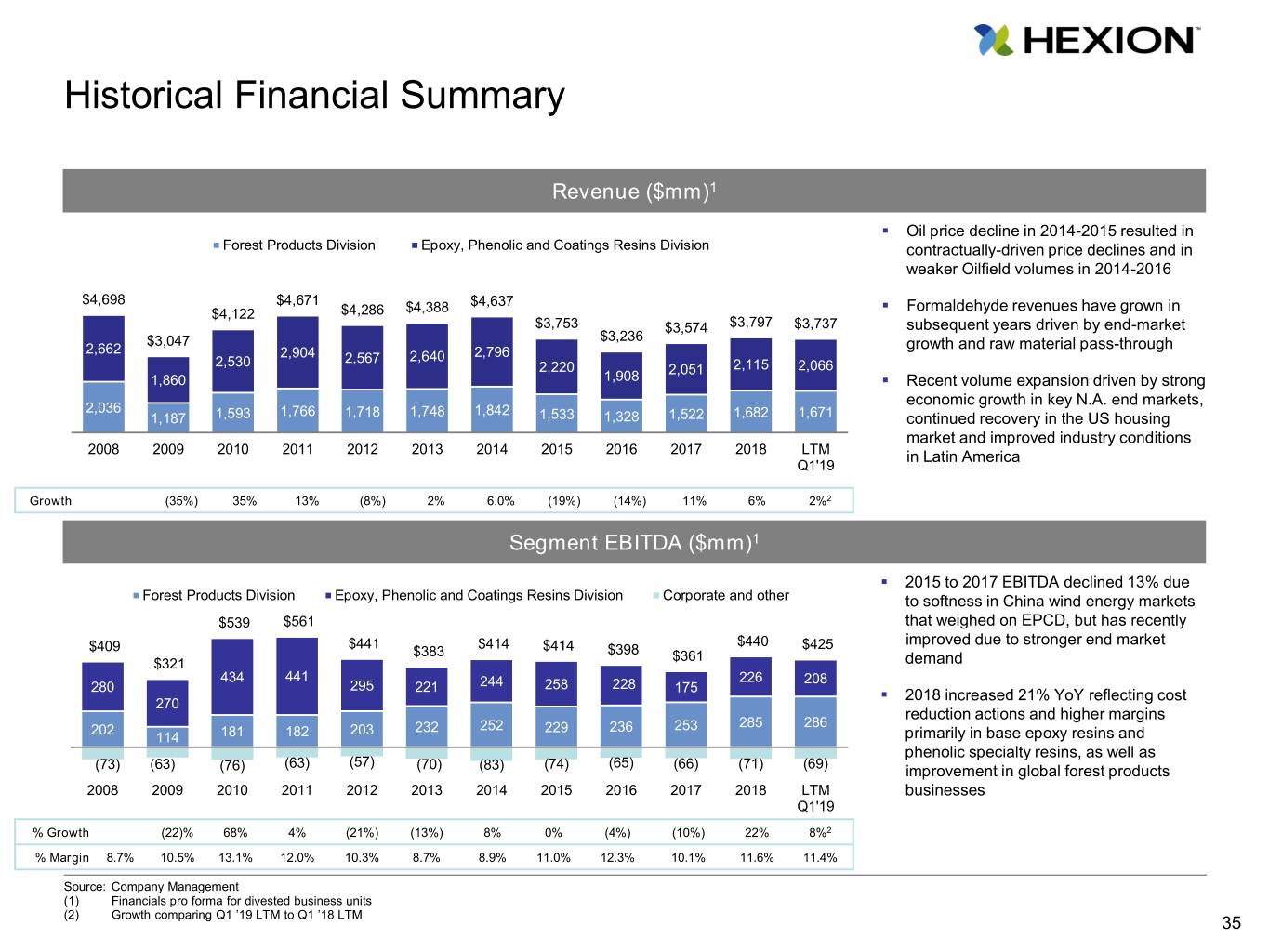

Historical Financial Summary Revenue ($mm)1 . Oil price decline in 2014-2015 resulted in Forest Products Division Epoxy, Phenolic and Coatings Resins Division contractually-driven price declines and in weaker Oilfield volumes in 2014-2016 $4,698 $4,671 $4,637 . Formaldehyde revenues have grown in $4,122 $4,286 $4,388 $3,753 $3,574 $3,797 $3,737 subsequent years driven by end-market $3,047 $3,236 growth and raw material pass-through 2,662 2,904 2,796 2,530 2,567 2,640 2,220 2,051 2,115 2,066 1,860 1,908 . Recent volume expansion driven by strong economic growth in key N.A. end markets, 2,036 1,766 1,842 1,187 1,593 1,718 1,748 1,533 1,328 1,522 1,682 1,671 continued recovery in the US housing market and improved industry conditions 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 LTM in Latin America Q1'19 Growth (35%) 35% 13% (8%) 2% 6.0% (19%) (14%) 11% 6% 2%2 Segment EBITDA ($mm)1 . 2015 to 2017 EBITDA declined 13% due Forest Products Division Epoxy, Phenolic and Coatings Resins Division Corporate and other to softness in China wind energy markets $539 $561 that weighed on EPCD, but has recently $409 $441 $414 $414 $440 $425 improved due to stronger end market $383 $398 $361 $321 demand 434 441 226 295 244 258 228 208 280 221 175 . 2018 increased 21% YoY reflecting cost 270 reduction actions and higher margins 285 286 202 203 232 252 229 236 253 114 181 182 primarily in base epoxy resins and phenolic specialty resins, as well as (63) (57) (65) (73) (63) (76) (70) (83) (74) (66) (71) (69) improvement in global forest products 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 LTM businesses Q1'19 % Growth (22)% 68% 4% (21%) (13%) 8% 0% (4%) (10%) 22% 8%2 % Margin 8.7% 10.5% 13.1% 12.0% 10.3% 8.7% 8.9% 11.0% 12.3% 10.1% 11.6% 11.4% Source: Company Management (1) Financials pro forma for divested business units (2) Growth comparing Q1 ’19 LTM to Q1 ’18 LTM 35

Performance Summary: Q1 ’19 vs. Prior Year Revenue EBITDA Margin ($mm) FPD EPCD Total1 $946 $540 $886 $406 $395 $491 12.5% 17.2% 13.0% 11.6% 16.5% 10.6% YoY Performance $67 $68 $70 $52 $118 $103 Q1 2018 Q1 2019 Q1 2018 Q1 2019 Q1 2018 Q1 2019 FPD . FPD revenue decline reflected primarily foreign currency translation and slightly lower volume offset by positive pricing . FPD EBITDA increased slightly YoY due to strength in the global formaldehyde business, partially offset by the timing of North American housing starts impacting the North American Resins business . Global formaldehyde volumes increased ~ 8% YoY with strength in both North America and Latin America regions EPCD . EPCD revenue reflected lower volumes primarily due to oilfield business and foreign currency translation . EPCD EBITDA declines were driven by a weakening BPA market due to sluggish automotive and polycarbonate demand, Commentary which pressured BERI epoxy margins, as well as continued resin-coated sand pricing pressures in Oilfield, partially offset by strength in specialty epoxy resins (China wind energy and waterborne coatings) – Positive outlook for Chinese wind energy industry in 2019, benefiting from a further declining idle rate and strong growth in offshore, supporting specialty epoxy growth in FY‘19 – BERI Q1 volumes flat YoY despite shipment delays related to the network security incident; BERI Q1’19 EBITDA is in line with expectations and remains healthy at 16% margins but trails prior year results as margins peaked in Q1 of 2018 due to tightening of supply / demand in Q4 of 2017; pricing stable vs. expectations, and base epoxy pricing initiatives have been announced for Q2’19 in NA and EU – Liquid epoxy resin (LER) supply / demand dynamics expected to remain favorable for the foreseeable future Q1 2019 performance was in line with expectations Source: Company Management (1) Total includes corporate admin costs 36

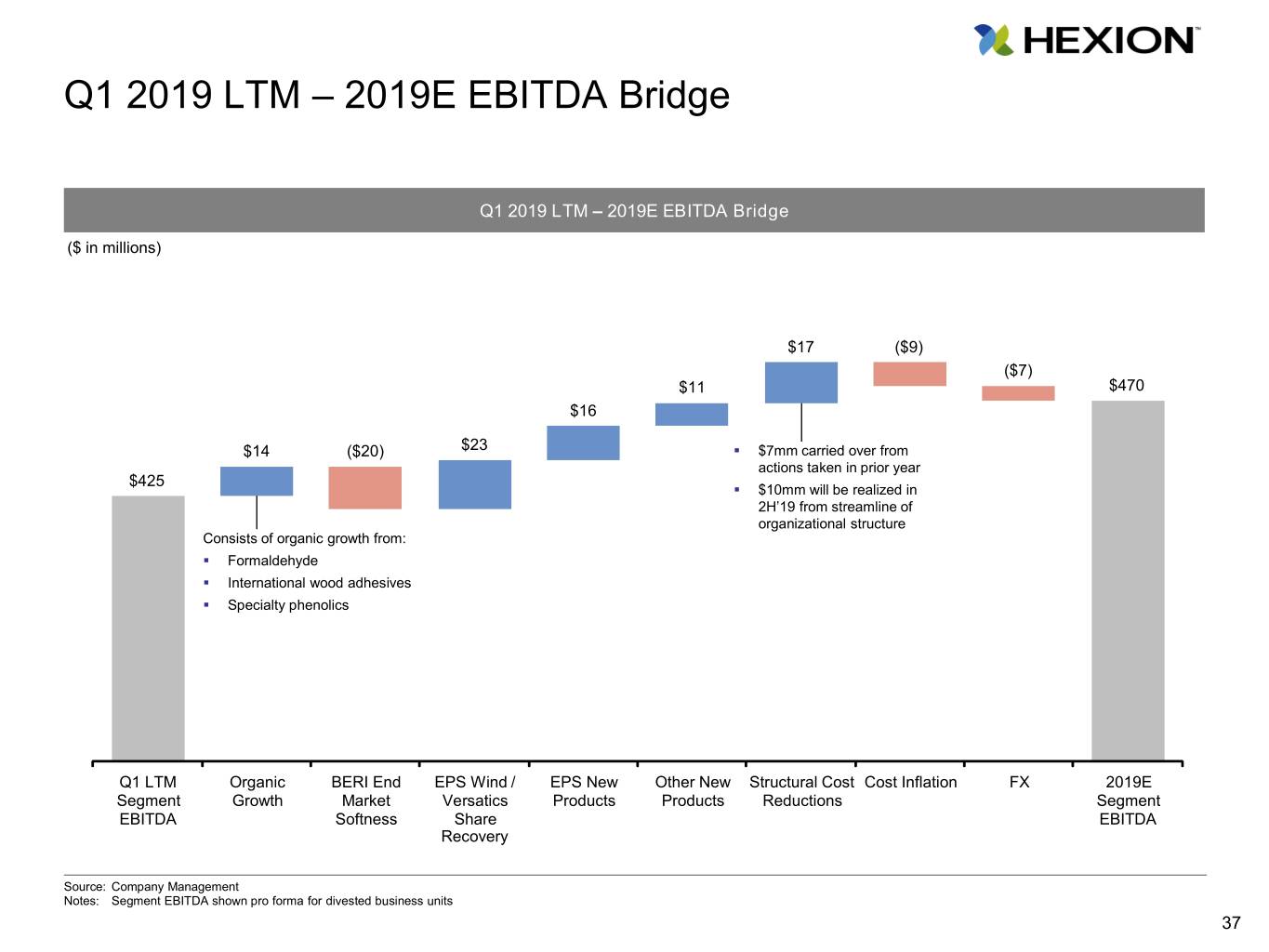

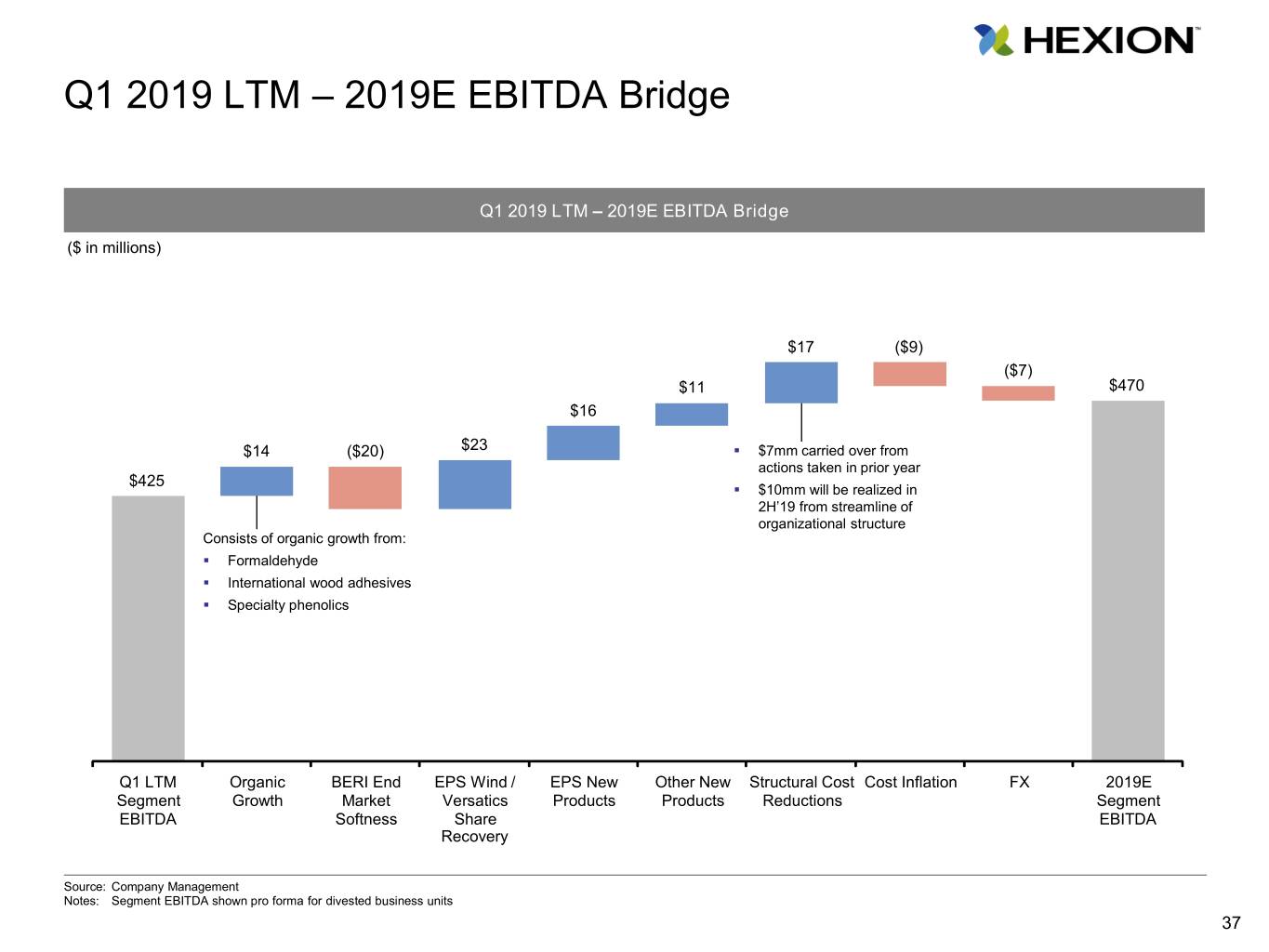

Q1 2019 LTM – 2019E EBITDA Bridge Q1 2019 LTM – 2019E EBITDA Bridge ($ in millions) $17 ($9) ($7) $11 $470 $16 $14 ($20) $23 . $7mm carried over from actions taken in prior year $425 . $10mm will be realized in 2H’19 from streamline of organizational structure Consists of organic growth from: . Formaldehyde . International wood adhesives . Specialty phenolics Q1 LTM Organic BERI End EPS Wind / EPS New Other New Structural Cost Cost Inflation FX 2019E Segment Growth Market Versatics Products Products Reductions Segment EBITDA Softness Share EBITDA Recovery Source: Company Management Notes: Segment EBITDA shown pro forma for divested business units 37

Long-term Business Plan – Consolidated Financials Key Assumptions Revenue by Segment . Long-term volume growth assumptions by business unit – Third-party research reports on end markets FPD EPCD – Driven by Management’s assessment of end market demand $4,395 $4,531 $4,130 $4,263 and competitive dynamics $3,912 . Raw materials prices, increased at 1% per annum $2,505 $2,592 $2,682 . Margin over Materials (MoM) per ton for most business units is $2,311 $2,417 assumed to be flat . Fixed manufacturing overhead assumed to increase annually between 1% - 2% after productivity gains $1,601 $1,714 $1,758 $1,803 $1,849 . SG&A costs assumed to increase at 1% - 2% annually . Capital expenditures projected to remain at levels consistent with 2019E 2020E 2021E 2022E 2023E historical normalized levels Growth 3.0% 5.6% 3.2% 3.1% 3.1% – Average maintenance capital expenditures and EHS spend of $65-$85mm EBITDA by Segment Capex FPD EPCD Admin $593 $120 $120 $528 $559 $110 $110 $470 $500 $99 $307 $331 $248 $266 $287 $296 $312 $321 $334 $346 ($74) ($78) ($80) ($81) ($83) 2019E 2020E 2021E 2022E 2023E 2019E 2020E 2021E 2022E 2023E Margin 12.0% 12.1% 12.4% 12.7% 13.1% % of Rev 2.5% 2.7% 2.6% 2.7% 2.6% Growth 6.7% 6.5% 5.5% 5.9% 6.1% Source: Company Management 38

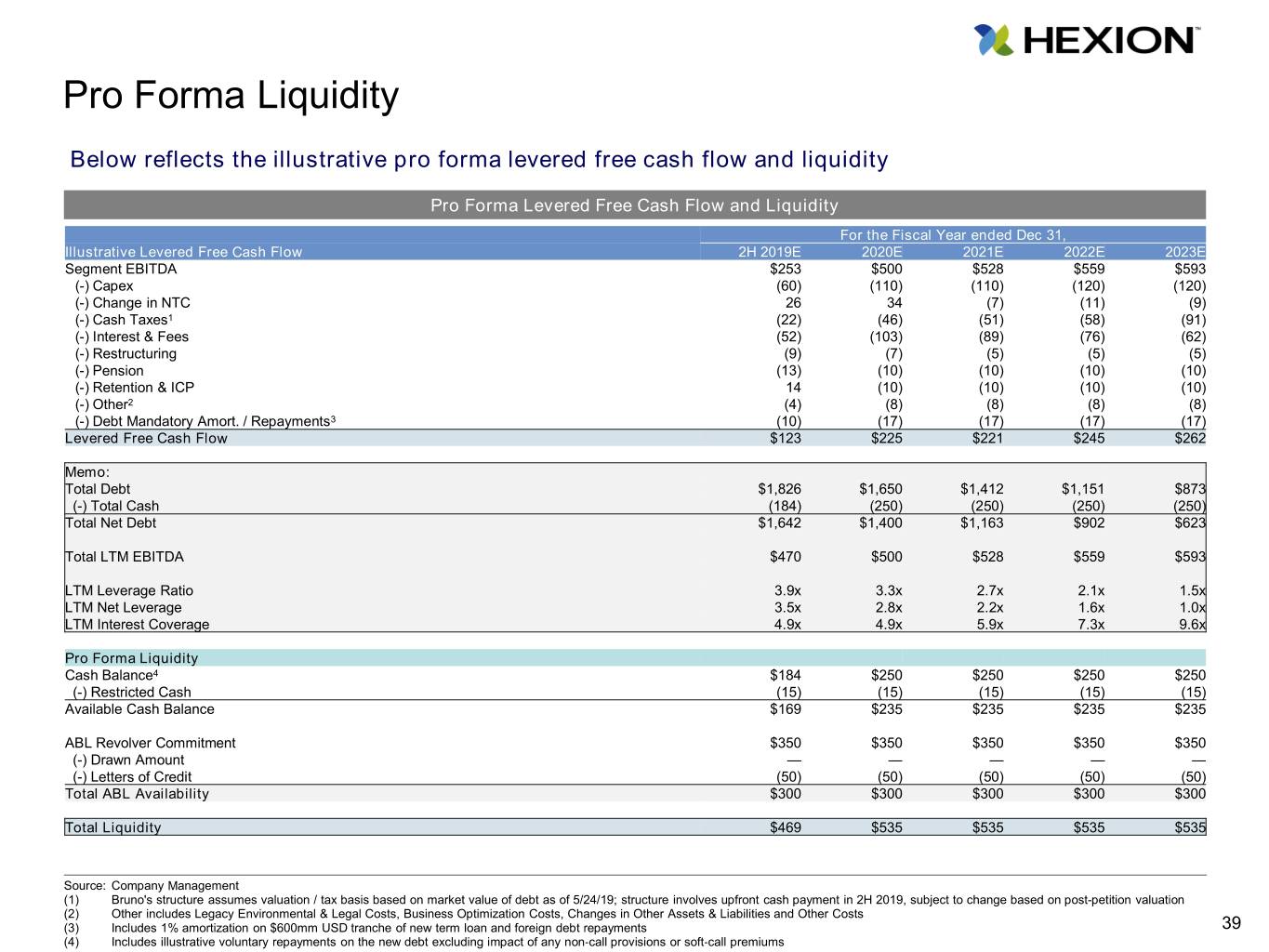

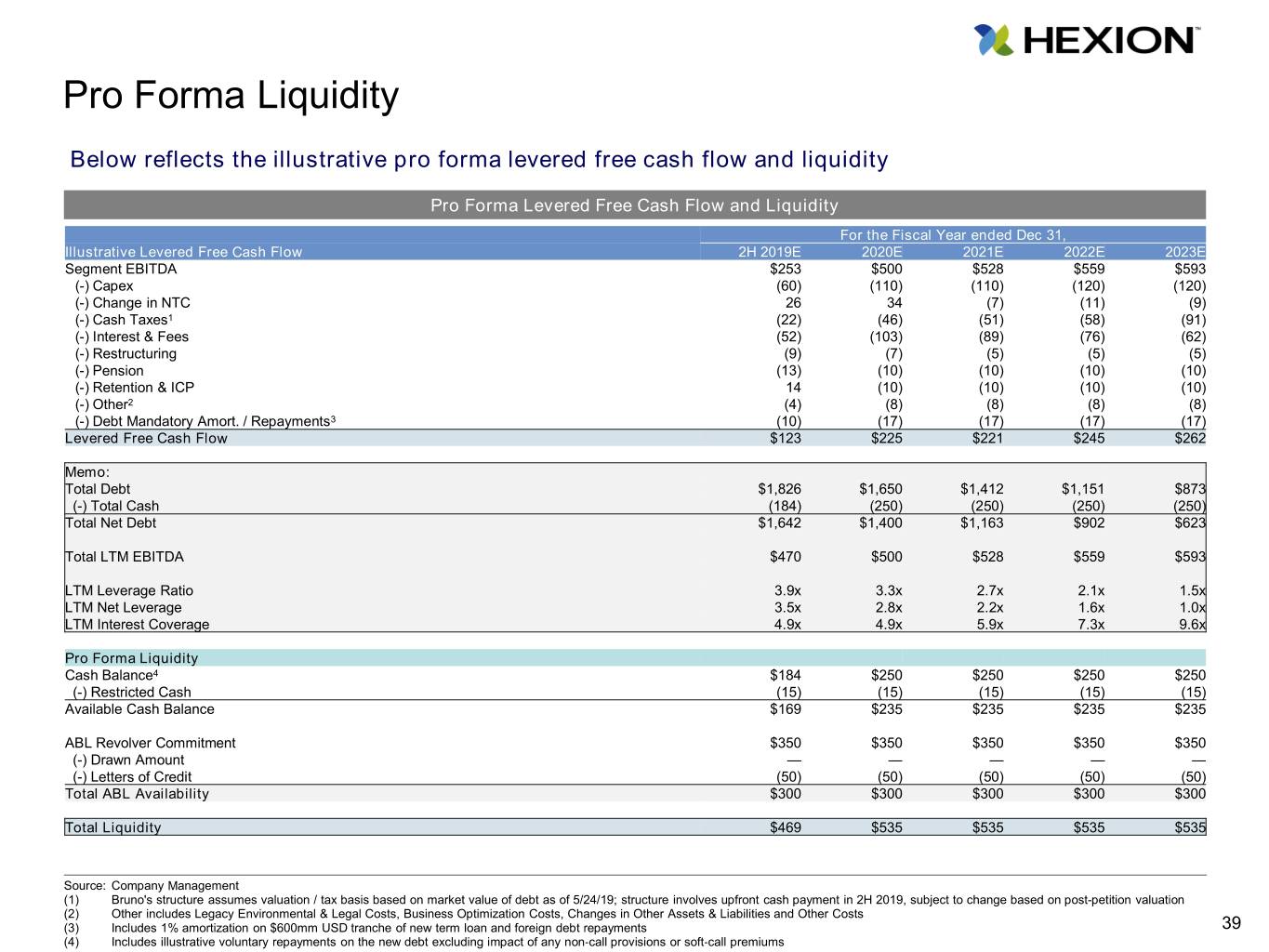

Pro Forma Liquidity Below reflects the illustrative pro forma levered free cash flow and liquidity Pro Forma Levered Free Cash Flow and Liquidity For the Fiscal Year ended Dec 31, Illustrative Levered Free Cash Flow 2H 2019E 2020E 2021E 2022E 2023E Segment EBITDA $253 $500 $528 $559 $593 (-) Capex (60) (110) (110) (120) (120) (-) Change in NTC 26 34 (7) (11) (9) (-) Cash Taxes1 (22) (46) (51) (58) (91) (-) Interest & Fees (52) (103) (89) (76) (62) (-) Restructuring (9) (7) (5) (5) (5) (-) Pension (13) (10) (10) (10) (10) (-) Retention & ICP 14 (10) (10) (10) (10) (-) Other2 (4) (8) (8) (8) (8) (-) Debt Mandatory Amort. / Repayments3 (10) (17) (17) (17) (17) Levered Free Cash Flow $123 $225 $221 $245 $262 Memo: Total Debt $1,826 $1,650 $1,412 $1,151 $873 (-) Total Cash (184) (250) (250) (250) (250) Total Net Debt $1,642 $1,400 $1,163 $902 $623 Total LTM EBITDA $470 $500 $528 $559 $593 LTM Leverage Ratio 3.9x 3.3x 2.7x 2.1x 1.5x LTM Net Leverage 3.5x 2.8x 2.2x 1.6x 1.0x LTM Interest Coverage 4.9x 4.9x 5.9x 7.3x 9.6x Pro Forma Liquidity Cash Balance4 $184 $250 $250 $250 $250 (-) Restricted Cash (15) (15) (15) (15) (15) Available Cash Balance $169 $235 $235 $235 $235 ABL Revolver Commitment $350 $350 $350 $350 $350 (-) Drawn Amount — — — — — (-) Letters of Credit (50) (50) (50) (50) (50) Total ABL Availability $300 $300 $300 $300 $300 Total Liquidity $469 $535 $535 $535 $535 Source: Company Management (1) Bruno's structure assumes valuation / tax basis based on market value of debt as of 5/24/19; structure involves upfront cash payment in 2H 2019, subject to change based on post-petition valuation (2) Other includes Legacy Environmental & Legal Costs, Business Optimization Costs, Changes in Other Assets & Liabilities and Other Costs (3) Includes 1% amortization on $600mm USD tranche of new term loan and foreign debt repayments 39 (4) Includes illustrative voluntary repayments on the new debt excluding impact of any non‐call provisions or soft‐call premiums

V. Appendix

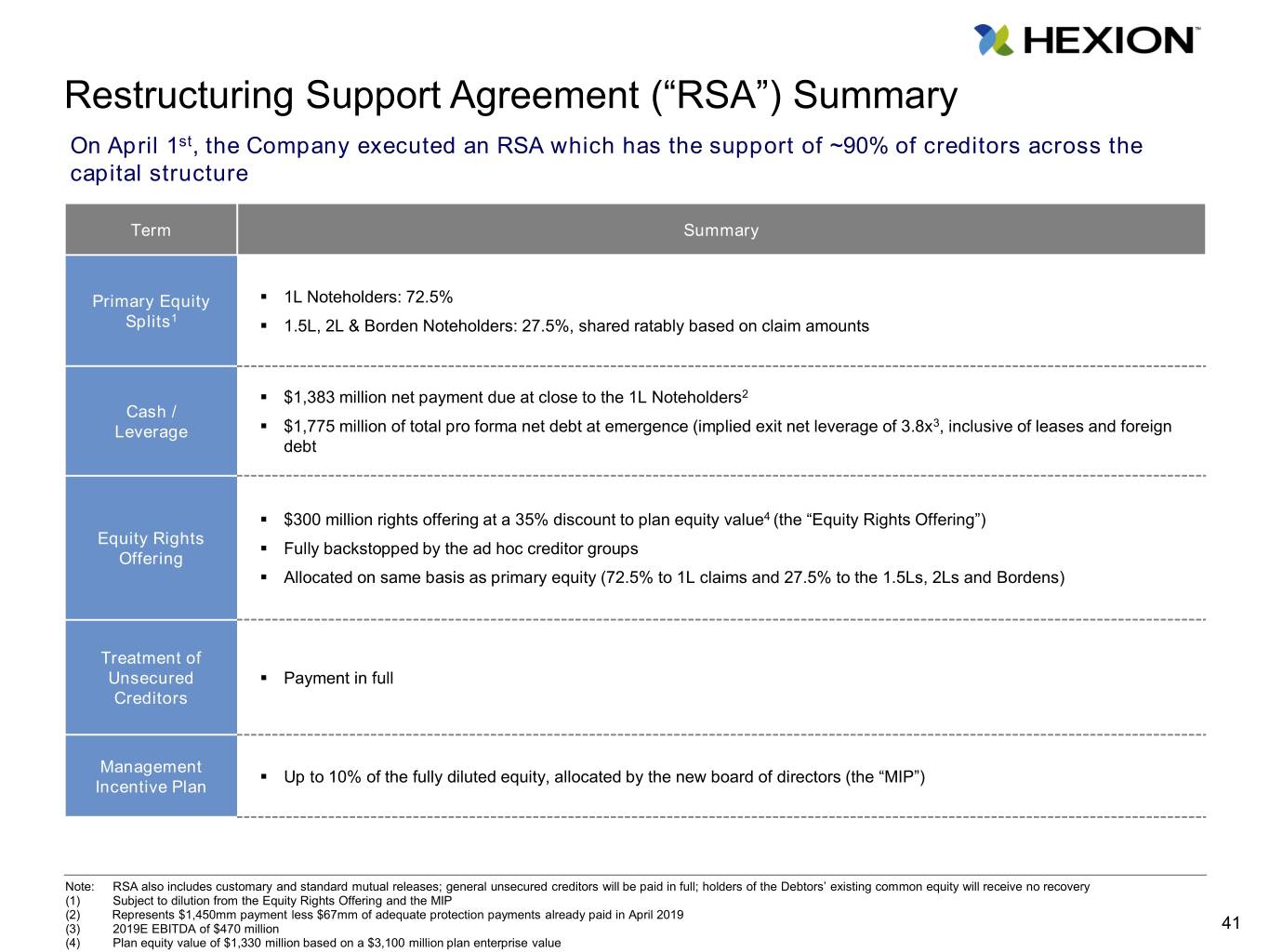

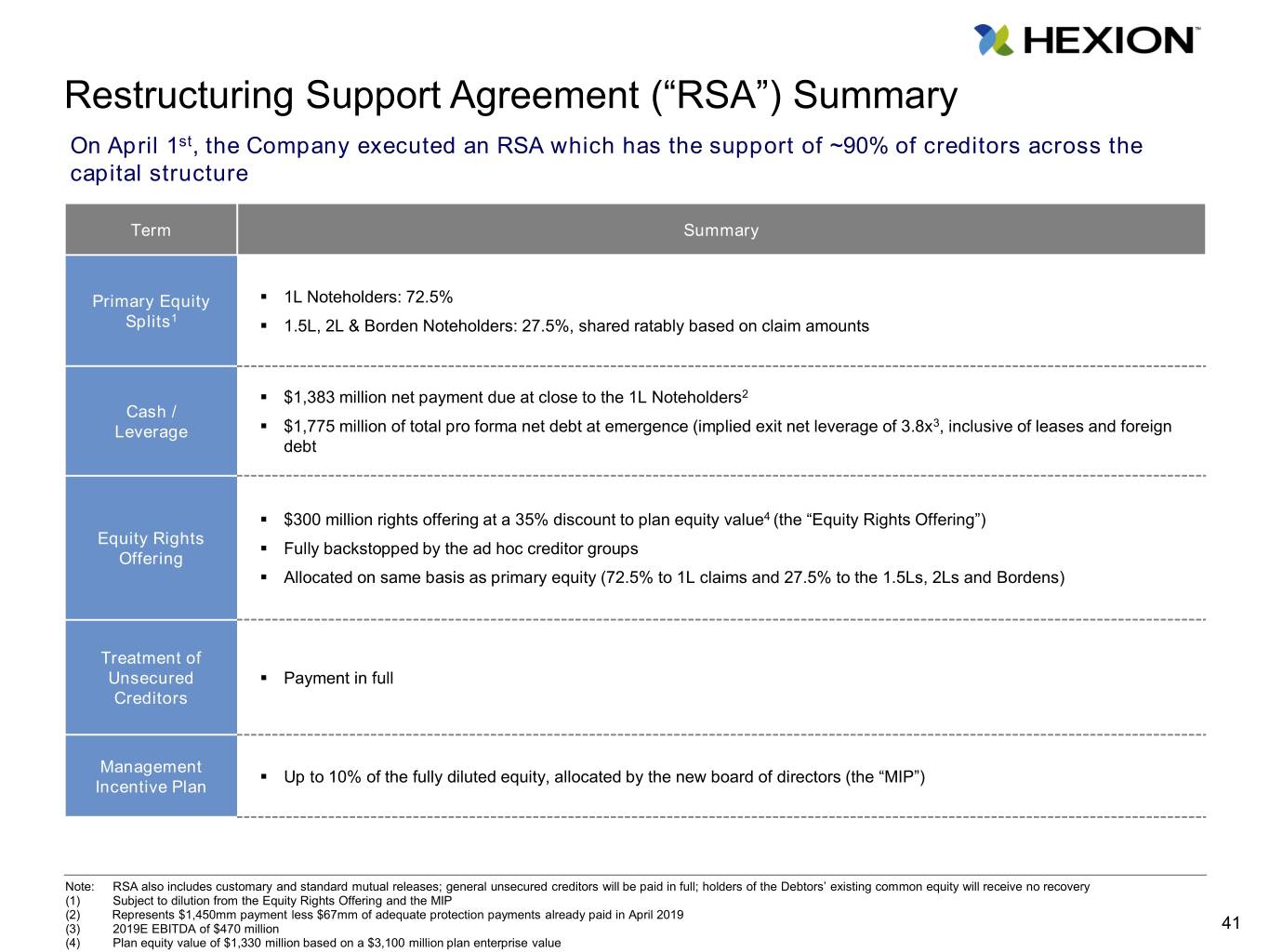

Restructuring Support Agreement (“RSA”) Summary On April 1st, the Company executed an RSA which has the support of ~90% of creditors across the capital structure Term Summary Primary Equity . 1L Noteholders: 72.5% Splits1 . 1.5L, 2L & Borden Noteholders: 27.5%, shared ratably based on claim amounts . $1,383 million net payment due at close to the 1L Noteholders2 Cash / 3 Leverage . $1,775 million of total pro forma net debt at emergence (implied exit net leverage of 3.8x , inclusive of leases and foreign debt . $300 million rights offering at a 35% discount to plan equity value4 (the “Equity Rights Offering”) Equity Rights . Fully backstopped by the ad hoc creditor groups Offering . Allocated on same basis as primary equity (72.5% to 1L claims and 27.5% to the 1.5Ls, 2Ls and Bordens) Treatment of Unsecured . Payment in full Creditors Management . Up to 10% of the fully diluted equity, allocated by the new board of directors (the “MIP”) Incentive Plan Note: RSA also includes customary and standard mutual releases; general unsecured creditors will be paid in full; holders of the Debtors’ existing common equity will receive no recovery (1) Subject to dilution from the Equity Rights Offering and the MIP (2) Represents $1,450mm payment less $67mm of adequate protection payments already paid in April 2019 (3) 2019E EBITDA of $470 million 41 (4) Plan equity value of $1,330 million based on a $3,100 million plan enterprise value

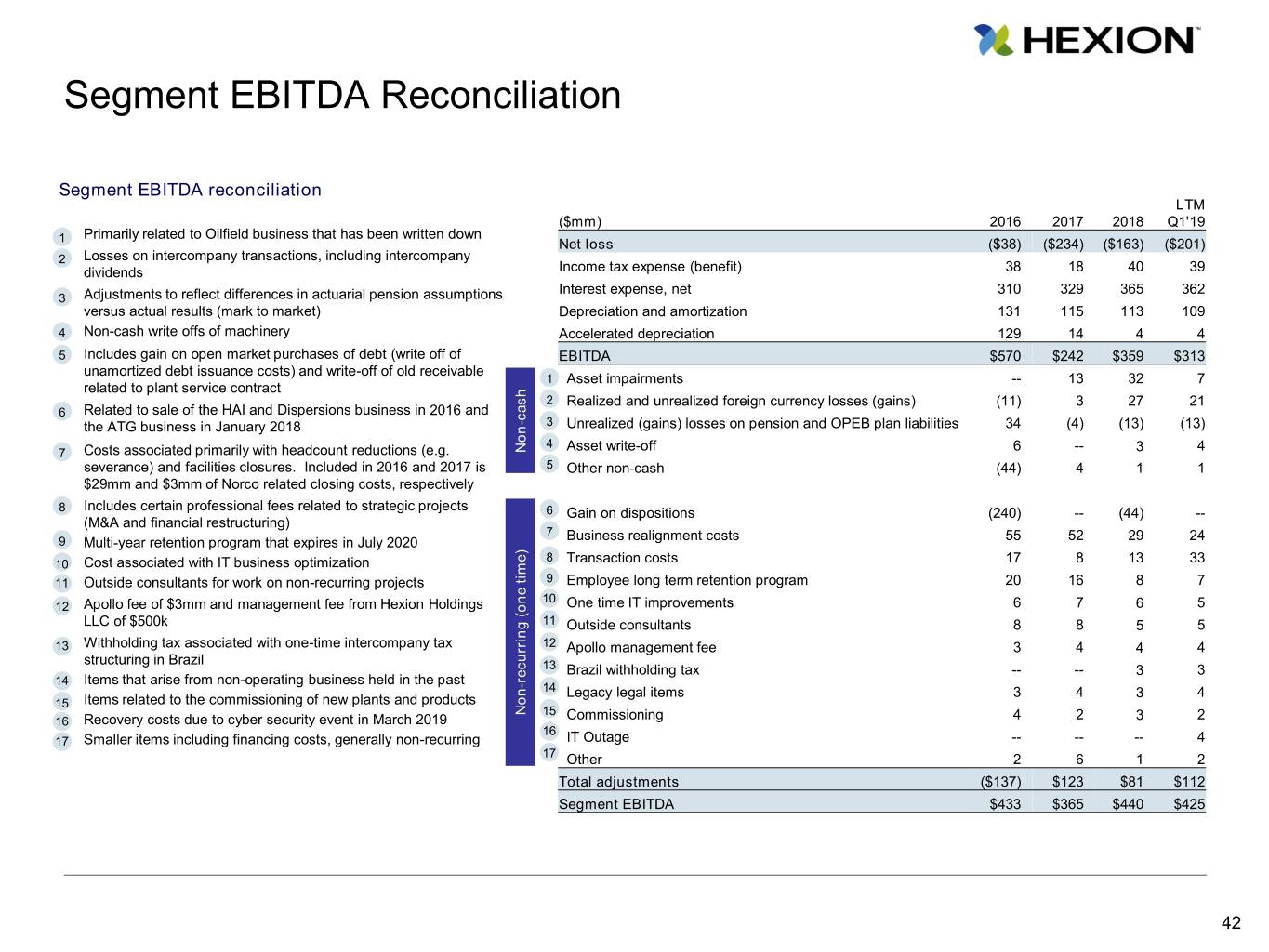

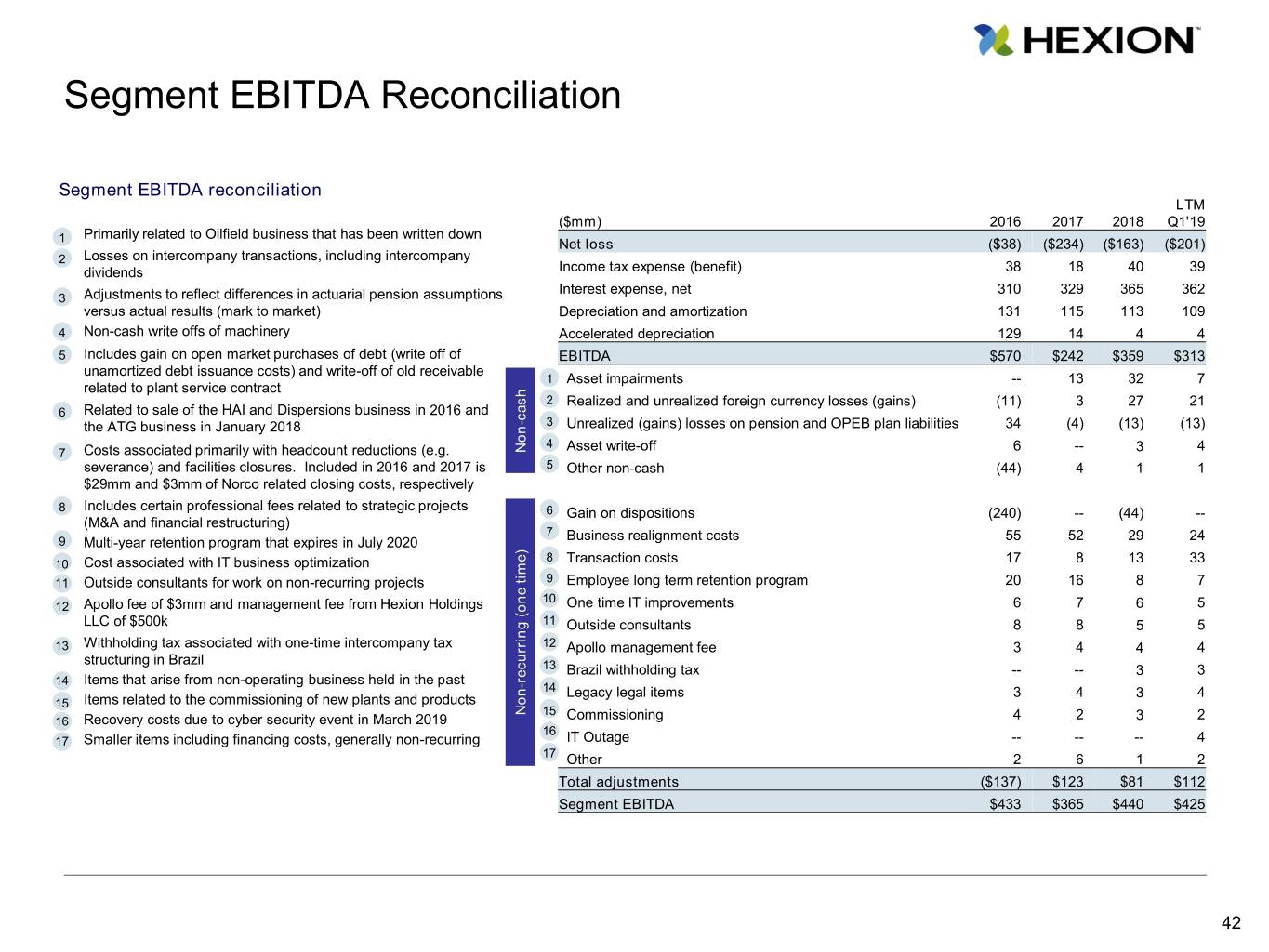

Segment EBITDA Reconciliation Segment EBITDA reconciliation LTM ($mm) 2016 2017 2018 Q1'19 Primarily related to Oilfield business that has been written down 1 Net loss ($38) ($234) ($163) ($201) 2 Losses on intercompany transactions, including intercompany dividends Income tax expense (benefit) 38 18 40 39 Interest expense, net 310 329 365 362 3 Adjustments to reflect differences in actuarial pension assumptions versus actual results (mark to market) Depreciation and amortization 131 115 113 109 4 Non-cash write offs of machinery Accelerated depreciation 129 14 4 4 5 Includes gain on open market purchases of debt (write off of EBITDA $570 $242 $359 $313 unamortized debt issuance costs) and write-off of old receivable 1 Asset impairments -- 13 32 7 related to plant service contract 2 Realized and unrealized foreign currency losses (gains) (11) 3 27 21 6 Related to sale of the HAI and Dispersions business in 2016 and cash the ATG business in January 2018 - 3 Unrealized (gains) losses on pension and OPEB plan liabilities 34 (4) (13) (13) 4 Non Asset write-off 6 -- 4 7 Costs associated primarily with headcount reductions (e.g. 3 severance) and facilities closures. Included in 2016 and 2017 is 5 Other non-cash (44) 4 1 1 $29mm and $3mm of Norco related closing costs, respectively Includes certain professional fees related to strategic projects 8 6 Gain on dispositions (240) -- (44) -- (M&A and financial restructuring) 7 Business realignment costs 55 52 29 24 9 Multi-year retention program that expires in July 2020 8 10 Cost associated with IT business optimization Transaction costs 17 8 13 33 11 Outside consultants for work on non-recurring projects 9 Employee long term retention program 20 16 8 7 10 12 Apollo fee of $3mm and management fee from Hexion Holdings One time IT improvements 6 7 6 5 LLC of $500k 11 Outside consultants 8 8 5 5 13 Withholding tax associated with one-time intercompany tax 12 Apollo management fee 3 4 4 4 structuring in Brazil 13 Brazil withholding tax -- -- 3 3 14 Items that arise from non-operating business held in the past time) (one recurring - 14 Legacy legal items 3 4 3 4 15 Items related to the commissioning of new plants and products Non 15 16 Recovery costs due to cyber security event in March 2019 Commissioning 4 2 3 2 16 17 Smaller items including financing costs, generally non-recurring IT Outage -- -- -- 4 17 Other 2 6 1 2 Total adjustments ($137) $123 $81 $112 Segment EBITDA $433 $365 $440 $425 42

Glossary of Terms TERM ABBREV. TERM ABBREV. Base Epoxy Resins and Intermediates BERI Liquid Epoxy Resins LER Bisphenol A BPA Margin Over Materials MOM Bisphenol F BPF Medium-Density Fiberboard MDF Coating, Civil Engineering, Adhesives and Distributors CCAD Melamine Formaldehyde Resins MF Coatings, Adhesives, Sealants and Elastomers CASE Methylene Diphenyl Disocyanate MDI Combined-Cycle Gas Turbines CCGT Neodecanic Acid NDA Concentrated Solar Power CSP Oriented Strand Board OSB Engineered Thermosets ETS Original Equipment Manufacturers OEM Environmental, Health and Safety EHS Performance Adhesives PA Epichlorohydrin ECH Phenolic Specialty Resins PSR Epoxy Specialty Resins EPS Plywood PW European Phenolic Resins Association EPRA Polycarbonate PC Fire, Smoke and Toxicity FST Redispersible Powders RDP Forest Products Division FPD Slow Release Nitrogen SRN Formaldehyde HCHO Versatic Acid and Derivatives VA&D Gas Turbine GT Volatile Organic Compound VOC Laminate and Derivatives LMD Waterborne WB Levelized Cost of Energy LCOE 43