As filed with the Securities and Exchange Commission on August 31, 2007

| Registration No. 333-137977 |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SB-2/A3

REGISTRATION STATEMENT

under the

SECURITIES ACT OF 1933

NORTHERN ETHANOL, INC.

(Name of small business issuer in its charter)

Delaware (State or jurisdiction of incorporation or organization) | 2869 (Primary Standard Industrial Classification Code Number) | 34-2033194 (I.R.S. Employer Identification Number) |

Northern Ethanol, Inc.

193 King Street East

Suite 300

Toronto, Ontario, M5A 1J5, Canada

(416) 366-5511

(Address and telephone number of principal executive offices and principal place of business)

Gordon Laschinger, President

Northern Ethanol, Inc.

193 King Street East

Suite 300

Toronto, Ontario, M5A 1J5, Canada

(416) 366-5511

(Name, address and telephone number of agent for service)

Copies of all communications to:

Andrew I. Telsey, Esq.

Andrew I. Telsey, P.C.

12835 E. Arapahoe Road

Tower I Penthouse #803

Englewood, Colorado 80112

(303) 768-9221

(303) 768-9224 FAX

Approximate date of proposed sale to public:

As soon as practicable after this Registration Statement becomes effective.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. /X/

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box | / / |

CALCULATION OF REGISTRATION FEE

Title of Each Class of

Securities to be Registered

| |

Amount to be

Registered

| |

Proposed Maximum

Offering Price Per

Share (1)

| |

Proposed Maximum

Aggregate Offering

Price (1)

| |

Amount of Registration Fee

| |

Common Stock, $.001 par

value per share ................ | | 4,096,500 | (2) | $ | 1.00 | | $ | 4,096,500 | | $ | 438.33 | * |

TOTAL ......................... | | 4,096,500 | | $ | 1.00 | | $ | 4,096,500 | | $ | 438.33 | |

______________________

* | The Registrant previously submitted a filing fee of $457.05. |

(1) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(e) under the Securities Act of 1933. |

(2) | Represents the number of shares of Common Stock issued to the selling stockholders pursuant to our September 2006 private placement. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

Subject to Completion, dated August 31, 2007

PRELIMINARY

PROSPECTUS

Northern Ethanol, Inc.

Common Stock

4,096,500 Shares

This Prospectus relates to the resale by the selling stockholders (the “Selling Stockholders”) of 4,096,500 shares of our common stock (the “Common Stock” or the “Securities”). The Selling Stockholders may sell their shares of our Common Stock from time to time at the initial price of $1.50 per share until our common shares are quoted on the NASD’s OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. See “DETERMINATION OF OFFERING PRICE,” “SELLING STOCKHOLDERS” and “PLAN OF DISTRIBUTION.”

We will pay the expenses of registering these shares. We will not receive any proceeds from the sale of shares of Common Stock in this Offering. All of the net proceeds from the sale of our Common Stock will go to the Selling Stockholders.

Our Common Stock is not currently listed for trading on any exchange. As of the date of this Prospectus an application has been filed on our behalf to list our Common Stock for trading on the OTC Bulletin Board (the “OTCBB”). There can be no assurances that our Common Stock will be approved for trading on the OTCBB, or any other trading exchange.

Investing in these Securities involves significant risks. Investors should not buy these Securities unless they can afford to lose their entire investment.

SEE “RISK FACTORS” BEGINNING ON PAGE 8.

The information in this Prospectus is not complete and may be changed. This Prospectus is included in the registration statement that was filed by Northern Ethanol, Inc. with the Securities and Exchange Commission. The Selling Stockholders may not sell these Securities until the registration statement becomes effective. This Prospectus is not an offer to sell these Securities and is not soliciting an offer to buy these Securities in any State where the offer or sale is not permitted.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is [_____________], 200__

1

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS | 22 |

DETERMINATION OF OFFERING PRICE | 22 |

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 23 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

| FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 23 |

DESCRIPTION OF BUSINESS | 37 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 59 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 60 |

DESCRIPTION OF SECURITIES | 62 |

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION

| FOR SECURITIES ACT LIABILITIES | 63 |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS | 68 |

FINANCIAL STATEMENT INDEX | F-1 |

2

PROSPECTUS SUMMARY

This summary provides an overview of certain information contained elsewhere in this Prospectus and does not contain all of the information that you should consider or that may be important to you. Before making an investment decision, you should read the entire Prospectus carefully, including the “RISK FACTORS” section, the financial statements and the notes to the financial statements. In this Prospectus, the terms “Northern,” “Company,” “we,” “us” and “our” refer to Northern Ethanol, Inc. and its operating subsidiaries. References to “$” in this Prospectus are to U.S. dollars and all references to “C$” are to Canadian dollars.

We were incorporated as “Beaconsfield I, Inc.” in the State of Delaware on November 29, 2004, to pursue a business combination. In July 2006, the holders of a majority of our then issued and outstanding Common Stock approved an amendment to our Certificate of Incorporation wherein we did change our name to “Northern Ethanol, Inc.” to better reflect our current business plan that is described below. We are currently considered a “development stage” company.

In July 2006, we engaged in a forward split of our Common Stock whereby we issued ten (10) shares of our Common Stock for every one (1) share then issued and outstanding. All references in this Prospectus to our issued and outstanding Common Stock are provided on a post-forward split basis, unless otherwise indicated.

Following the aforesaid forward stock split, we commenced a private offering of our Common Stock. This offering closed successfully in September 2006. We sold an aggregate of 4,096,500 shares of our Common Stock to 48 “accredited investors” (as that term is defined in both the Canadian and U.S. securities laws) at a price of $1.00 per share and received aggregate net proceeds of $3,846,500 therefrom. The proceeds from the September 2006 private placement financed our working capital requirements, including salaries and benefits, and capital expenditures on property, plant and equipment through March 31, 2007.

In April 2006, we adopted a revised business plan for the purpose of developing two (2) ethanol plants in Ontario, Canada. In conjunction with the adoption of this new business plan, we retained new management, including Mr. Gordon Laschinger, our Chief Executive Officer, President and Chairman of our Board of Directors. In July 2006, Mr. Steven Reader agreed to become our Chief Operating Officer, and in November 2006, Mr. Richard Smith became our Chief Financial Officer. In September 2006, we completed the restructuring of our current Board of Directors. See “MANAGEMENT.”

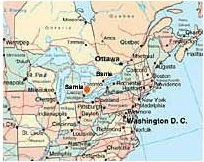

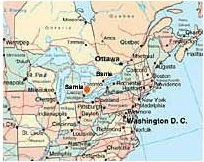

On April 20, 2006, we executed a 25-year lease, with two ten-year renewal options, on a 35 acre property located in Barrie, Canada with a related party (See “CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS” and “DESCRIPTION OF BUSINESS”). The Barrie plant location will require the conversion of the existing site’s servicing infrastructure from a former brewery to an ethanol production facility. In addition, on July 30, 2007, we executed an Agreement of Purchase and Sale with LANXESS Inc. to acquire a 30 acre industrial site in Sarnia, Canada (See “DESCRIPTION OF BUSINESS”). We paid a refundable interest bearing deposit amount of C$10,000 on execution of the Agreement. We chose industrial sites for our plants due to their inherent favorable characteristics in terms of having the correct zoning, ample process water, natural gas pipelines, rail sidings in-place and proximity to local and international markets. Both Barrie and Sarnia have access to Great Lakes Seaway shipping for corn feedstock and are also serviced by Canadian National Railway, CSX Transportation and Canadian Pacific Railway. The Barrie site had been the focus of an earlier 2005 engineering study by Wardrop Engineering Inc., which had concluded it was feasible site for a major ethanol plant. The Wardrop study was conducted for another unrelated company that could not raise the required capital, at which point the study was made available to us. A September 2006 study performed by Muse Stancil & Co. of Dallas, Texas ranked the Sarnia and Barrie Plant sites as the second and ninth most competitive locations to supply the Northeastern United States market relative to 61 other North American ethanol plants currently in production or under construction that could reasonably supply ethanol to the region. We paid Muse Stancil

3

$70,000 to perform the study. Both sites have been studied to ensure that all necessary utilities are available and feedstock procurement will not be an impediment.

Effective July 24, 2006, we entered into a five-year Project Development Agreement (the “Delta-Barrie Agreement”) with Delta-T Corporation, Williamsburg, Virginia (“Delta”), wherein Delta shall provide us professional advice, business and technical information, design and engineering and related services in order to assist us in assembling all of the information, permits, agreements and resources necessary for construction of an ethanol plant having the capacity to produce 108 million gallons per year in Barrie, Ontario, Canada. We paid Delta the non-refundable sum of $100,000 in advance for such services. (See a complete description of the terms of the Delta-Barrie Agreement under “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION – PLAN OF OPERATION” in this Prospectus.)

In September 2006, we entered into a similar five-year agreement with Delta relating to our proposed Sarnia ethanol plant (the “Delta-Sarnia Agreement”) and paid Delta an initial non-refundable amount of $70,000 for such services, with the balance of $30,000 due upon issuance of an air permit by the Province of Ontario. (See a complete description of the terms of the Delta-Sarnia Agreement under “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION – PLAN OF OPERATION” in this Prospectus.) References to the Delta-Barrie Agreement and Delta-Sarnia Agreement are hereinafter jointly referred to as the “Delta Agreements” unless otherwise indicated.

The Delta Agreements provide for Delta to assist us in the development and analysis of the operating costs, plant specifications, compliance with environmental issues, product marketing, industry economics, technical and other assistance. The relationship between Delta and us is deemed exclusive during the five-year term of the Delta Agreements.

On March 9, 2007, we executed a term sheet with Aker Kvaerner Songer Canada Ltd. (“AKSC”) for the development of an engineering, procurement and construction (“EPC”) contract using Delta technology for the Barrie site. This term sheet provides for us to pay AKSC an initial non-refundable engagement fee of $500,000. We have not paid this fee as of the date of this Prospectus because we are reviewing our options on ethanol plant technology providers and engineering procurement and construction contractors. As we have not paid this fee, AKSC is under no obligation to provide a fixed price contract. We are in discussions with other ethanol plant technology providers and we may pursue offers from them. In the event that we accept another ethanol plant technology provider’s offer, Delta has a first right of refusal for 60 days to assume any agreements made with other ethanol plant technology vendors. If we continue with Delta, we will pay this fee to AKSC , as well as an additional non-refundable fee of $500,000 on receipt of the fixed EPC contract price for our Barrie plant. If Delta decides not to assume our agreement with another ethanol plant technology provider, we will engage an EPC contractor acceptable to the other ethanol plant technology provider and establish an EPC contract price.

Providing the EPC contract price is acceptable and financing is obtained, we expect to execute the EPC contract within 60 days of receiving the fixed EPC contract price and commence construction at the Barrie site immediately thereafter. (See a complete description of the terms of the AKSC-EPC Agreement, as well as discussion of the financing necessary to allow us to implement our business plan, under “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION – PLAN OF OPERATION” in this Prospectus.) We are also reviewing our options on ethanol plant technology providers and engineering procurement and construction contractors for our Sarnia location. We have not received a term sheet from AKSC regarding the Sarnia facility at this time.

AKSC is a multinational EPC firm with extensive experience erecting and constructing facilities in Canada. Delta’s primary role in the projects will be to provide the process technology and engineering. This will include all of the prime processes in the receiving and milling of the corn, the cook process, fermentation process, distillation process, molecular sieve and centrifuge process, chemical storage area, fuel and ethanol storage and

4

load-out as well as DDGS drying, storage and load-out. AKSC will erect the Delta process components as well as engineer, procure and construct the balance of plant equipment for such items as the boiler house, cooling towers, all utility tie-ins, plant fire water system, and any water treatment systems. Under the EPC contract, AKSC will be responsible for all labor supply and project completion risk (i.e. project completed on schedule, at the contract price, meeting design specifications). The fixed price EPC contract will be guaranteed by AKSC’s parent company, Aker Kvaerner ASA of Baerum, Norway, a leading global provider of engineering and construction services, technology products and integrated solutions with NOK14 billion (approximately $2.3 billion) in annual revenue. The Delta plant design that we have selected is based on plant designs and components currently being utilized by other Delta customers. Any differences in our plant designs from the standard Delta design will be to provide for higher reliability and performance. Not all current projects undertaken by Delta appear on their website due to client preferences with regards to confidentiality.

In August 2006, we retained the services of the engineering firm of Charles G. Turner & Associates for an initial term to December 31, 2006, to monitor the design, equipment selection, construction and commissioning phases of the projects on an hourly fee basis. Also in August 2006, we contracted with Parrish & Heimbecker Ltd. (“P&H”) to provide corn procurement and co-product merchandizing services on a fee per shipment basis for a five year period after the opening of our first ethanol production facility. (See a complete description of the terms of these agreements under “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION – PLAN OF OPERATION” in this Prospectus.)

Effective December 13, 2006, we executed an engagement letter and indicative term sheets with WestLB AG (“WestLB”) whereby WestLB has conditionally agreed to provide arrangement, placement and underwriting services on senior debt and subordinate debt financing (to a maximum of approximately $365 million) for up to 75% of the construction costs of our Barrie and Sarnia facilities on a “best efforts” basis. The term “best efforts” means that WestLB believes that they can syndicate the debt financing we require but that there is no guarantee that they will be successful or that the terms will be as indicated in their term sheets until they market the transaction and receive firm commitments from a syndicate of lenders for the funds required on acceptable terms to us. Among other things, the provision of the 75% financing in accordance with the engagement letter and indicative term sheets is conditional on our obtaining subordinate debt or equity investment for the remaining 25% of construction costs. We have had discussions with investment bankers, financial institutions and private investors about obtaining subordinate debt or equity investment but, as of the date of this Prospectus, we have received no binding commitments. We may not be able to obtain sufficient funding from one or more investors or other financial institutions, or if such funding is obtained, that it may not be on terms that are otherwise acceptable to us. If we are unable to secure adequate financing, or financing on acceptable terms is unavailable for any reason, we may be forced to abandon our construction of one or more, or even all, of our planned ethanol production facilities. (See a complete description of the terms under “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION – PLAN OF OPERATION” in this Prospectus.) We paid a non-refundable retainer deposit of $200,000 to WestLB on execution of the engagement letter and indicative term sheets using funds from the net proceeds of $3,846,500 received from the September 2006 private placement. We also agreed to pay WestLB’s costs and expenses in connection with the financing. As of the date of this Prospectus, we have paid $87,378 for costs incurred by WestLB’s legal and engineering advisors from funds borrowed under the Line of Credit Agreement with Union Capital Trust discussed below. There is no termination date to the WestLB engagement letter.

In order to allow us to continue to implement our business plan, on March 30, 2007 we entered into a Line of Credit Agreement with Union Capital Trust, Nassau, Bahamas (“Union”), wherein Union has agreed to provide us with a $6 million unsecured line of credit. Interest accrues at the rate of twelve percent (12% per annum) and is payable monthly. Principal and unpaid interest is due on or before March 30, 2008. As of the date of this Prospectus we have drawn down an aggregate of $469,192 on this line of credit. The trustee of the Union line of credit is a related party. (See “CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS”)

5

On July 9, 2007, we entered into a Line of Credit Agreement with Aurora Beverage Corporation, (“Aurora”) wherein Aurora has agreed to provide us with a $1 million unsecured line of credit. Interest accrues at the rate of eight percent (8% per annum) and is payable monthly. Principal and unpaid interest is due on or before July 8, 2008. As of the date of this Prospectus, we have drawn down an aggregate of $348,000 on this line of credit. Aurora is a related party. (See “CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS”)

As of June 30, 2007 and December 31, 2006, we had an accumulated deficit of $5,340,348 and $3,276,873, respectively. For the six months ended June 30, 2007 and for the year ended December 31, 2006, we incurred net losses of $2,063,475 and $3,245,400, respectively. Once our ethanol plants are built and become operational, there are no assurances that we will be able to attain, sustain or increase profitability on a quarterly or annual basis. A downturn in the demand for ethanol would significantly and adversely affect our sales and profitability.

Our principal executive offices are located at 193 King Street East, Suite 300, Toronto, Ontario, M5A 1J5, Canada, telephone: (416) 366-5511. For more information on us, prospective investors are encouraged to review the filings available with the Securities and Exchange Commission at www.sec.gov. All prospective investors are invited to visit our website at www.northern-ethanol.com. Prospective investors should be aware that the information contained on our website is not a part of this Prospectus. Investors should rely only upon the information contained herein.

ABOUT THE OFFERING

Common Stock Offered by Selling Shareholders | 4,096,500 shares. This number represents approximately 4% of the total number of shares outstanding following this Offering. |

Common Stock Outstanding Before and After the Offering | 104,096,500 shares (1). |

Use of Proceeds | We will not receive any proceeds from the sale of the Common Stock. |

(1) Because we are not selling any of our Common Stock as part of this offering, the number of issued and outstanding shares of our Common Stock will remain the same following this offering.

6

SUMMARY FINANCIAL DATA

SELECTED FINANCIAL DATA

The following summary of our financial information as at December 31, 2006, 2005, and for the years ended December 31, 2006 and 2005, has been derived from, and should be read in conjunction with, our audited financial statements included elsewhere in this Prospectus. The summary of our financial information as at June 30, 2007 and for the six month periods ended June 30, 2007 and 2006 and the period from inception (November 29, 2004) through June 30, 2007 has been derived from, and should be read in conjunction with, our unaudited interim financial statements also included elsewhere in this Prospectus.

STATEMENT OF INCOME: | Six Months Ended June 30 | | Year Ended December 31 | | Period From Inception (Nov. 29, 2004) through June 30 |

| 2007 | | 2006 | | 2006 | | 2005 | | 2007 |

| | | | | | | | | | | | | | |

Net revenues | $ | - | | $ | - | | $ | - | | $ | - | | $ | - |

Gross profit | $ | - | | $ | - | | $ | - | | $ | - | | $ | - |

Total operating expenses | $ | 2,063,475 | | $ | 936,402 | | $ | 3,245,400 | | $ | 27,765 | | $ | 5,340,348 |

Loss from operations | $ | (2,063,475) | | $ | (936,402) | | $ | (3,245,400) | | $ | (27,765) | | $ | (5,340,348) |

Income tax benefit (expense) | $ | - | | $ | - | | $ | - | | $ | - | | $ | - |

Net loss | $ | (2,063,475) | | $ | (936,402) | | $ | (3,245,400) | | $ | (27,765) | | $ | (5,340,348) |

| | | | | | | | | | | | | | |

Net income per share – diluted | $ | (0.02) | | $ | (0.01) | | $ | (0.03) | | $ | (0.00) | | | |

Weighted common shares outstanding (1) | | 104,096,500 | | | 101,097,790 | | | 102,534,308 | | | 101,500,000 | | | |

____________________

(1) | Post forward split. Effective July 3, 2006, our shareholders approved an increase in our authorized capital stock from 80,000,000 shares of $0.0001 par value stock to 350,000,000 shares of authorized capital stock, consisting of 250,000,000 shares of Common Stock having a par value of $0.0001 per share, and 100,000,000 shares of Preferred Stock, having a par value of $0.0001 per share. On July 5, 2006, we affected a ten for one forward split of our issued and outstanding Common Stock to holders of record on that date. Throughout this Prospectus, Common Stock amounts have been adjusted to reflect this change on a retroactive basis. |

BALANCE SHEET: | | June 30, 2007 | | December 31, 2006 | | December 31, 2005 | |

| | | | | | | | | | |

Cash | | $ | 2,758 | | $ | 567,249 | | $ | 13,390 | |

Current assets | | $ | 1,006,441 | | $ | 1,563,079 | | $ | 23,640 | |

Total assets | | $ | 20,977,955 | | $ | 19,240,759 | | $ | 23,640 | |

Current liabilities | | $ | 3,403,903 | | $ | 266,898 | | $ | 5,098 | |

Total liabilities | | $ | 20,919,785 | | $ | 16,298,265 | | $ | 5,098 | |

Total stockholders’ equity | | $ | 58,170 | | $ | 2,942,494 | | $ | 18,542 | |

7

RISK FACTORS

An investment in our Common Stock is a risky investment. In addition to the other information contained in this Prospectus, prospective investors should carefully consider the following risk factors before purchasing shares of our Common Stock offered hereby. We believe that we have included all material risks.

RISKS RELATED TO OUR PROPOSED OPERATIONS

We have incurred losses in the past and expect to incur greater losses until our ethanol production begins. We are a development stage company and we have not yet commenced operations. As of June 30, 2007 and December 31, 2006, we had an accumulated deficit of $5,340,348 and $3,276,873, respectively. For the six months ended June 30, 2007 and for the year ended December 31, 2006, we incurred net losses of $2,063,475 and $3,245,400, respectively. We expect to incur significantly greater losses at least until the completion of our initial ethanol production facility in Barrie, Ontario. We estimate that the earliest completion date of this facility and, as a result, our earliest date of ethanol production will not occur until the second quarter of 2009. Until then, we expect to rely on cash from debt and equity financing to fund all of the cash requirements of our business. Until we successfully build and begin operating our proposed ethanol plants, we will experience negative cash flow. Once our ethanol plants are built and become operational, there are no assurances that we will be able to attain, sustain or increase profitability on a quarterly or annual basis. A downturn in the demand for ethanol would significantly and adversely affect our sales and profitability.

Ethanol competes with other existing products and other alternative products could also be developed for use as fuel additives. Our revenue will be derived primarily from sales of ethanol. Ethanol competes with MTBE (methyl tertiary butyl ether) as an oxygenate in gasoline to meet both oxy-fuel and reformulated gasoline requirements. Until recently, MTBE has been the most widely used oxygenate to meet the requirements of the Clean Air Act Amendments of 1990. Because of its favorable handling qualities and the fact that it is a petroleum product, MTBE has been the preferred oxygenate for the petroleum industry. However, MTBE has shown significant adverse environmental and health safety characteristics that have led to the decision by several key States to ban its use. Specifically, MTBE is highly persistent and has been identified as a potential carcinogen. MTBE has been detected in drinking water supplies in almost all areas where it is used. Reflecting these issues, California, New York, Connecticut, New Jersey and more than twenty other States have banned the use of MTBE.

We expect to be completely focused on the production and marketing of ethanol and its co-products for the foreseeable future. We may be unable to shift our business focus away from the production and marketing of ethanol to other renewable fuels or competing products. Accordingly, an industry shift away from ethanol or the emergence of new competing products may reduce the demand for ethanol. A downturn in the demand for ethanol would significantly and adversely affect our sales and profitability.

In addition to selling ethanol, we will also sell the co-products of ethanol production – dried distillers grains (DDGS) and carbon dioxide (“CO2”) and the markets for these products may decrease in the future. The primary use of DDGS is for livestock feed as a replacement for traditional animal feeds such as soy-meal. In the United States, cattle (both dairy and beef) have so far been the primary users of DDGS as livestock feed, but larger quantities of DDGS are making their way into the feed rations of hogs and poultry. In 2005, ethanol dry mills in the United States produced approximately 9 million tons of distillers grains. Of this, approximately 75-80% was fed to dairy and cattle, 18-20% to swine, and 3-5% to poultry. Due to the fact that DDGS have a long shelf life, they are suitable for transportation to markets all over the world. In 2005, the United States exported more than 1 million tons of distillers grains. In recent years, large markets for DDGS have developed in Europe, led by Ireland and the United Kingdom, as well as in Canada, Mexico, China, Japan, and Taiwan. Asia has a long history of importing U.S. grain because of its large population and limited space in which

8

to grow crops. Worldwide, there is a large market for animal feed but DDGS generally need to displace other feeds as buyers will base their selection primarily on cost competitiveness. As increasing volumes of ethanol production come on-line, the amount of DDGS in the marketplace should increase proportionately. This may put downward pressure on prices and presents a risk to our business. At today’s prices, it is estimated that DDGS sales will represent approximately 19% of our total sales.

Carbon dioxide is produced during the fermentation stage of the ethanol production process. This excess gas is captured and sold to carbon dioxide resellers. The carbon dioxide market is well established and consists of three major segments: the beverage market (27%), the food market (43%), and the industrial market (30%). The market is cyclical in that demand increases during the summer as beverage and food demands create shortages and higher spot prices. Transportation is a limiting factor when sourcing carbon dioxide. On average, transportation costs account for 50% of the delivered cost of carbon dioxide. For that reason, customers generally must be within 200 miles of the plant. As increasing volumes of ethanol production come on-line, it is possible that the market prices for CO2 will soften due to a finite amount of demand and an increasing supply. At today’s prices, it is estimated that CO2 sales will represent approximately 0.4% of our total sales.

Carbon dioxide is believed to contribute to global warming. Future government regulations to reduce carbon dioxide emissions may impact our ability to produce ethanol. Carbon dioxide is the most common of the compounds collectively referred to as greenhouse gases. In the recently released Summary for Policymakers, the Intergovernmental Panel on Climate Change (IPCC) indicated that “most of the observed increase in globally averaged temperatures since the mid-20th century is very likely due to the observed increase in anthropogenic greenhouse gas concentrations” (IPCC, 2007). The IPCC assigns a rating of “very likely” when the expected outcome of a result is greater than 90%.

A number of proposals are being considered around the world to combat increased greenhouse gas emissions. The specifics of these proposals vary. Typically, one of the overarching objectives is to reduce anthropogenic greenhouse gas emissions. Proposals include methods as varied as improving energy efficiency, adopting energy sources that create minimal greenhouse gas emissions (e.g., generating electricity from wind or solar energy), or shifting from fossil fuels to alternative fuels derived from renewable sources (e.g., deriving ethanol from corn). Therefore, current proposals to combat global warming do not appear to be contrary to, or pose a risk of a material adverse impact on, the proposed project to derive ethanol from corn.

In order to complete the construction of our planned ethanol production facilities, we will require the infusion of significant additional debt and equity funding. We anticipate that we will need to raise approximately $454 million in equity investment and/or debt financing to complete construction of our initial two ethanol production facilities in Barrie and Sarnia, Ontario (See “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – PLAN OF OPERATION”). There are no assurances that we will be able to obtain this financing and/or investment.

Effective December 13, 2006, we executed an engagement letter and indicative term sheets with WestLB AG (“WestLB”) whereby WestLB has conditionally agreed to provide arrangement, placement and underwriting services on senior debt and subordinate debt financing for 75% of the cost of constructing our Barrie and Sarnia facilities up to a maximum of $1.35 per gallon of annual plant capacity in senior debt and $0.34 per gallon of annual plant capacity in subordinated debt. Combined, the Barrie and Sarnia plants are expected to have annual plant capacity of 216 million gallons on an undenatured basis. As such, WestLB would conditionally provide up to $365 million of financing. 75% of the combined construction cost estimate of $454 million for the Barrie and Sarnia facilities would equate to $340 million. Interest during construction of the two plants of $33 million was estimated at the interest rate on the senior financing conditionally offered at London Interbank Offering Rate (“LIBOR”) plus an anticipated spread of 325 to 350 basis points and at LIBOR plus an anticipated spread of 1000 basis points on the subordinate financing. Currently LIBOR is at 5.4%, so that the interest rate on the senior financing would be 8.65% to 8.9% and the interest rate on the subordinate financing would be 15.4%. On a

9

construction cost of $454 million, the senior financing would total $272,400,000, bear an annual interest cost of approximately $24.2 million at current rates when fully drawn and would be repaid in quarterly installments over 6 years following completion of construction. The subordinate financing would amount to $68,100,000, bear an annual interest cost of approximately $10.5 million at current rates when fully drawn and would be repaid over 8 years from advance, with repayment terms to be negotiated. Among other things, the provision of the WestLB financing in accordance with the engagement letter and indicative term sheets is conditional on our obtaining subordinate debt or equity investment for the remaining 25% of construction costs. We have had discussions with investment bankers, financial institutions and private investors about obtaining subordinate debt or equity investment but as of the date of this Prospectus we have received no binding commitments. We may not be able to obtain sufficient funding from one or more investors or other financial institutions, or if such funding is obtained, that it will be on terms that we have anticipated or that are otherwise acceptable to us. If we are unable to secure adequate financing, or financing on acceptable terms is unavailable for any reason, we may be forced to abandon our construction of one or more, or even all, of our planned ethanol production facilities. (See a complete description of the terms under “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS – PLAN OF OPERATION” in this Prospectus.)

If we are unable to raise the required senior debt and subordinate debt financing with WestLB, we will lose our non-refundable retainer deposit and we may be liable to pay significant termination fees. In December 2006, we paid a non-refundable retainer deposit of $200,000 to WestLB on execution of the engagement letter and indicative term sheets. We also agreed to pay all of WestLB’s expenses in connection with arrangement, placement and underwriting of the financing. As of the date of this Prospectus, we have paid $87,378 for costs incurred by WestLB’s legal and engineering advisors. If WestLB is unable to secure adequate financing, or financing on acceptable terms is unavailable for any reason, we will lose the $200,000 non-refundable retainer deposit and we will not be able to recover expenses paid. In the event that we chose to terminate the WestLB engagement and we enter into a similar debt financing with another lender within 12 months of terminating WestLB, we will be required to pay WestLB a termination fee of $10,000,000.

Holders of our Common Stock may suffer significant dilution in the future. As of the date of this Prospectus we do not have sufficient capital available to allow us to build the two ethanol plants discussed herein. As a result, it is possible that we may elect to raise additional equity capital by selling shares of our Common Stock or other securities in the future to raise the funds necessary to allow us to implement our business plan. If we do so, investors herein will suffer significant dilution.

Our capital structure will be highly leveraged because we plan to fund a substantial majority of the construction costs of our planned ethanol production facilities through the issuance of a significant amount of debt. Our debt levels and debt service requirements could have important consequences which could reduce the value of your investment, including:

• | limiting our ability to borrow additional amounts for operating capital or other purposes and causing us to be able to borrow additional funds only on unfavorable terms; |

| |

• | reducing funds available for operations and distributions because a substantial portion of our cash flow will be used to pay interest and principal on our debt; |

| |

• | making us vulnerable to increases in prevailing interest rates; |

| |

• | placing us at a competitive disadvantage because we may be substantially more leveraged than some of our competitors; |

| |

10

• | subjecting all or substantially all of our assets to liens, which means that there may be no assets left for our stockholders in the event of a liquidation; and |

| |

• | limiting our ability to adjust to changing market conditions, which could increase our vulnerability to a downturn in our business or general economic conditions. |

If cash flow from operations is insufficient to pay our debt service obligations it is possible that we could be forced to sell assets, seek to obtain additional equity capital or refinance or restructure all or a portion of our debt on substantially less favorable terms. In the event that we are unable to refinance all or a portion of our debt or raise funds through asset sales, sales of equity or otherwise, we may be forced to liquidate and you could lose your entire investment. However, while no assurances can be provided, based upon our discussions and negotiations with financing entities as of the date of this Prospectus, we do believe that our proposed business plan is viable and that we will obtain the additional financing necessary to develop our ethanol plants.

Our success depends, to a significant extent, upon the continued services of Gordon Laschinger, our President and Chief Executive Officer, who has no prior experience in the ethanol industry. While Mr. Laschinger has developed key personal relationships with our expected suppliers and customers, most of these individuals have significantly more experience than Mr. Laschinger in the ethanol industry. This may place us at a competitive disadvantage because we will greatly rely on these relationships in the conduct of our proposed operations and the execution of our business strategies. The loss of Mr. Laschinger could also result in the loss of our favorable relationships with one or more of our suppliers and customers. We have entered into an employment agreement with Mr. Laschinger and that agreement provides for a termination date of April 30, 2009. In addition, we do not maintain “key person” life insurance covering Mr. Laschinger or any other executive officer. The loss of Mr. Laschinger could also significantly delay or prevent the achievement of our business objectives.

We will be competing with other established ethanol production and marketing companies who have greater experience and resources than we currently have. We will have several significant competitors in the ethanol production industry including GreenField Ethanol Inc. (Formerly Commercial Alcohols Inc.), currently the largest producer of ethanol in Canada, Archer-Daniels-Midland Company, (“ADM”), the largest producer of ethanol in the United States, VeraSun Energy, Corp. and Aventine Renewable Energy Holdings, Inc, both large U.S. ethanol producers, and Suncor Energy Inc., which has an ethanol plant in Sarnia, and others. These companies are presently producing ethanol in substantial volume, have greater financial resources and have more experienced personnel than we presently do. We are not currently producing any ethanol. Those competitors who are presently producing ethanol have greater capital resources than we currently do. As a result, this will be a significant obstacle that we will need to overcome in order to become successful. In addition, our lack of experience in our chosen industry relative to many of our significant competitors may cause us to fail to anticipate or respond adequately to new developments and other competitive pressures. This failure could reduce our competitiveness and cause a decline in our market share, sales and profitability.

We will be competing with other ethanol production companies, animal farmers and other corn users for our feedstock. The principal raw material we expect to use to produce ethanol and its co-products is corn. We expect that corn feedstock costs will represent approximately 79% of operating costs. The profitability of our business fluctuates greatly with changes in the price of corn. For each $0.10 per bushel increase in the cost of corn, our total corn cost increases by $8,059,701 per year. Significant increases in the price of corn will have substantial negative impacts on the profitability of our plants.

Feedstock costs may rise in the future as a result of the increased competition from additional ethanol plants beginning production and continued growth and demand from other users such as animal farmers and corn oil

11

manufacturers. The supply of corn may be insufficient to meet this competing demand and as a result corn prices may rise, resulting in lower profit margins or making the production of ethanol uneconomical. Corn prices as measured by the United States Department of Agriculture, or USDA, reported as prices received, had increased 57% over the previous year by December 2006. The USDA’s December 2006 crop report estimated that corn bought by ethanol plants will represent approximately 17% of the 2006/2007 crop year’s total corn supply, up from 13% in the prior crop year. Increasing ethanol capacity could boost demand for corn and result in sustained prices at a current levels or a further increase in corn prices.

The development of our two proposed ethanol plants will result in a period of rapid growth that will impose a significant burden on our current administrative and operational resources. If we are able to obtain the financing necessary to implement our business plan, of which there can be no assurance, our ability to effectively manage our growth will require us to substantially expand the capabilities of our administrative and operational resources by attracting, training, managing and retaining additional qualified personnel, including additional members of management, technicians and others. To successfully develop our two proposed ethanol plants, we will need to manage the construction of these facilities, as well as operating, producing, marketing and selling the end products generated by these facilities. There can be no assurances that we will be able to do so. Our failure to successfully manage our growth will have a negative impact on our anticipated results of operations.

Our proposed business of producing and selling ethanol is subject to significant supply and demand fluctuations. An increase in production of ethanol could have a negative impact on our anticipated revenues. We may increase inventory levels in anticipation of rising ethanol prices and decrease inventory levels in anticipation of declining ethanol prices. As a result, we are subject to the risk of ethanol prices moving in unanticipated directions, which could result in declining or even negative gross profit margins for our business. Accordingly, our business will be subject to fluctuations in the price of ethanol and these fluctuations may result in lower or even negative gross margins and which could materially and adversely affect our profitability.

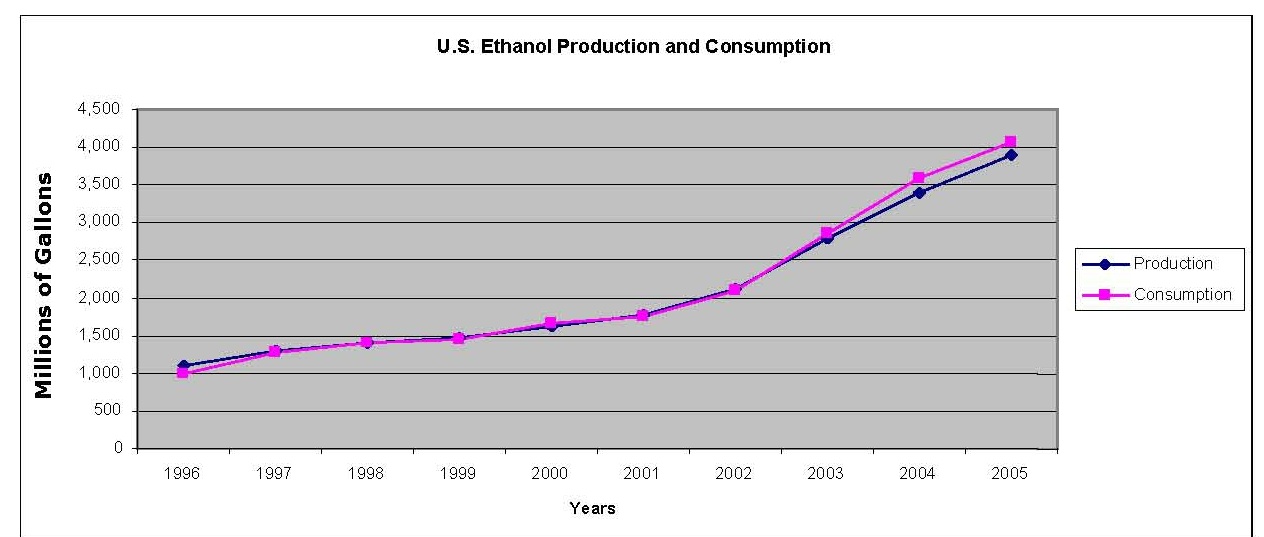

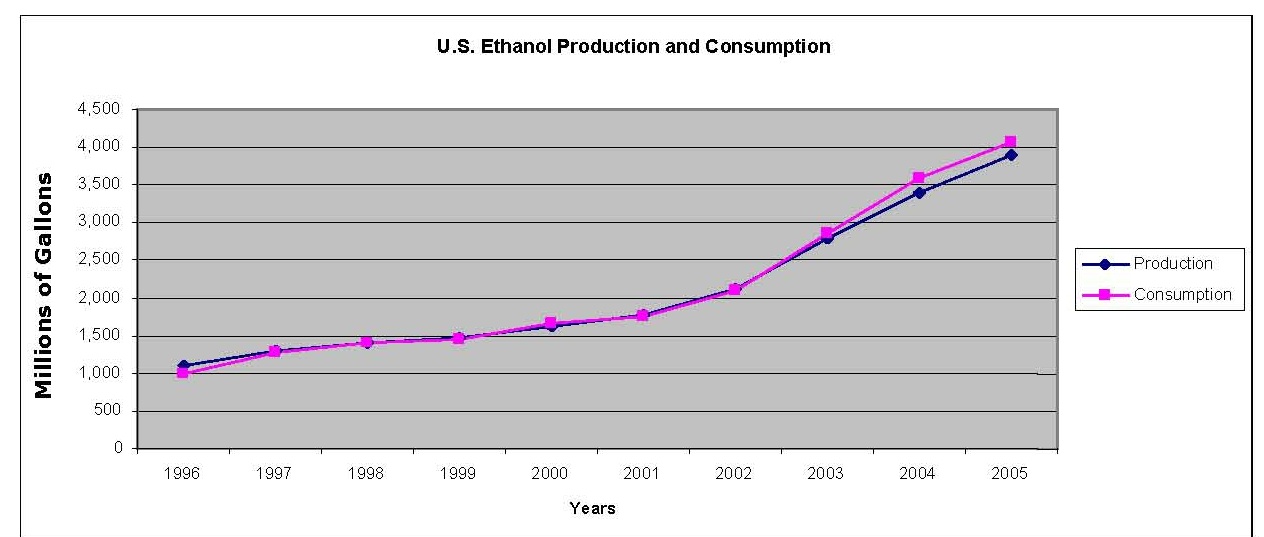

We believe that the production of ethanol is expanding rapidly. According to the Renewable Fuels Association, current ethanol production capacity in the United States stands at 5,633mm gallons per year. According to Ethanol Producer Magazine, in Canada, current production capacity is roughly 198mm gallons per year. There is capacity under construction of 6,194mm gallons in the United States and 180mm gallons in Canada. In the markets where we expect to compete, including Ontario, Quebec, Indiana, Ohio, Pennsylvania, New York and New Jersey, there is current production capacity of 395mm gallons per year, with capacity under construction of 1,170mm gallons per year.

US Ethanol Production 1999-2006

| | January 1999 | | January 2000 | | January 2001 | | January 2002 | | January 2003 | | January 2004 | | January 2005 | | January 2006 | |

| | | | | | | | | | | | | | | | | |

Total Ethanol Plants | | 50 | | 54 | | 56 | | 61 | | 68 | | 72 | | 81 | | 95 | |

| | | | | | | | | | | | | | | | | |

Ethanol Production Capacity | | 1701.7 mgy | | 1748.7 mgy | | 1921.9 mgy | | 2347.3 mgy | | 2706.8 mgy | | 3100.8 mgy | | 3643.7 mgy | | 4336.4 mgy | |

| | | | | | | | | | | | | | | | | |

Plants Under Construction | | 5 | | 6 | | 5 | | 13 | | 11 | | 15 | | 16 | | 31 | |

| | | | | | | | | | | | | | | | | |

12

Capacity Under Construction | | 77 mgy | | 91.5 mgy | | 64.7 mgy | | 390.7 mgy | | 483 mgy | | 598 mgy | | 754 mgy | | 1778 mgy | |

______________________

Source: Renewable Fuels Association - http://www.ethanolrfa.org/industry/statistics/

Increases in the demand for ethanol may not be commensurate with increasing supplies of ethanol. Increased production of ethanol may lead to lower ethanol prices. The increased production of ethanol could also have other adverse effects. For example, increased ethanol production will lead to increased supplies of co-products from the production of ethanol, such as DDGS and CO2. Those increased supplies could lead to lower prices for those co-products. We cannot predict the future price of ethanol or DDGS. Any material decline in the price of ethanol or DDGS will adversely affect our sales and profitability. Further, the increased production of ethanol could result in increased demand for corn. This could result in higher prices for corn and cause higher ethanol production costs. Additionally, due to the fact that the price of ethanol usually moves with the price of wholesale unleaded gasoline, we will not be able to pass any increases in corn costs on to the customer. Our results of operations will suffer greatly if corn prices increase while gasoline prices decrease.

We cannot rely on long-term ethanol orders or commitments by our customers for protection from the negative financial effects of a decline in the price for ethanol. The ethanol industry does not use fixed price long-term contracts. According to the Renewable Fuels Association (www.ethanolRFA.org /industry/statistics/), between 90% and 95% of the ethanol in the U.S. and Canada is sold pursuant to six to twelve month contracts, negotiated between the ethanol producer and the oil refiner or gasoline blender. As such, we believe that we will not be able to rely on long-term (over one year) contracts for the sale of our product. Entering into a long-term contract would require us to give the buyer a significant discount to current market prices. We believe that if and when we commence operations it will be more profitable for us to sell into the spot market and through a mixture of short-term (less than one year) contracts.

The Chicago Board of Trade launched an ethanol futures contract in March 2005. As of the date of this Prospectus, there has been limited trading activity in ethanol futures. There is no certainty that this market will develop sufficient liquidity to provide an effective means of hedging against a decline in ethanol prices. As a result, the limited certainty of ethanol orders can make it difficult for us to forecast our sales and allocate our resources in a manner consistent with our actual sales. Our expense estimates are based in part on our expectations of future sales and, if our expectations regarding future sales are inaccurate, we may be unable to reduce costs in a timely manner to adjust for sales shortfalls.

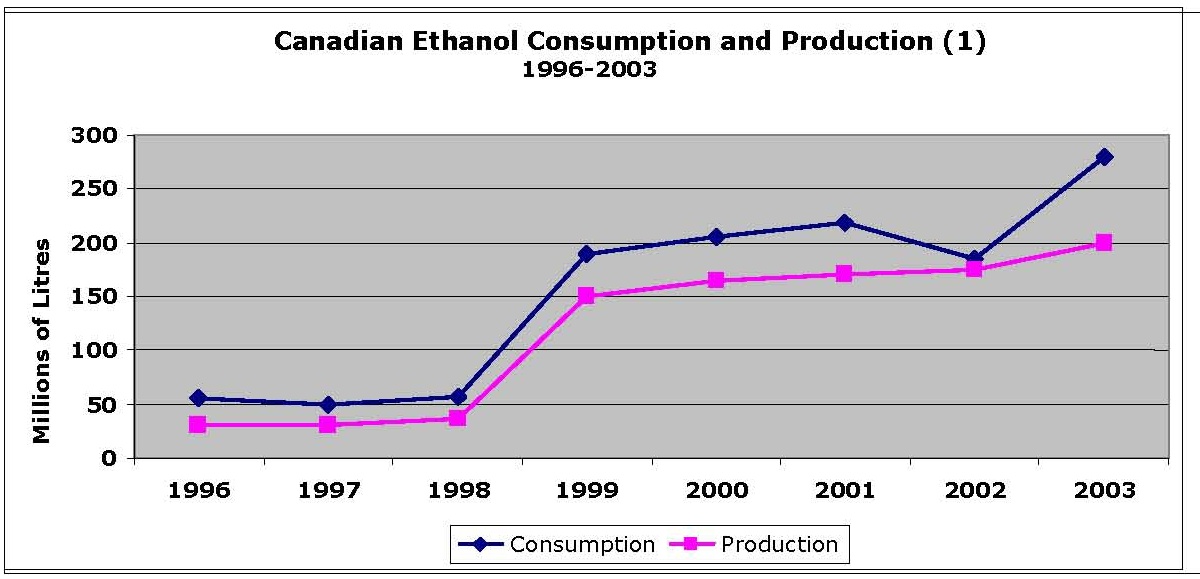

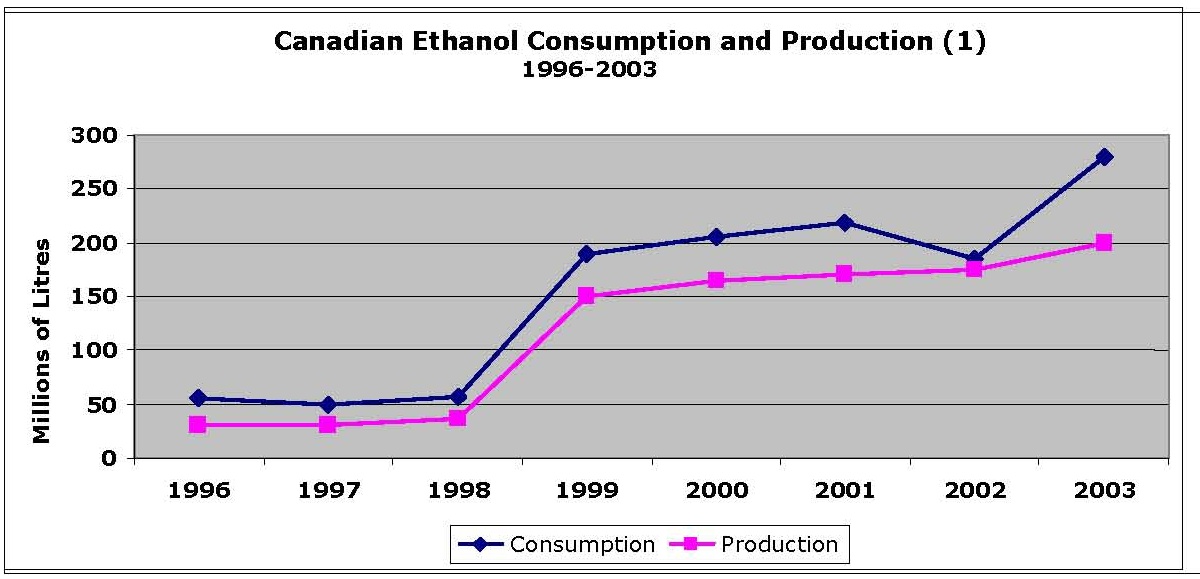

The market for fuel ethanol in Canada is extremely similar to the market in the United States. With free trade, the border is essentially invisible to ethanol producers and cross-border selling is common. We intend to sell our product in the market that nets us the highest price at the time.

We will be dependent on a small number of customers because there are a finite number of petroleum refiners and mixers in North America. We intend to sell our ethanol to petroleum refiners and gasoline blenders in the Northeastern United States and Central Canada. According to Eco Energy Inc., there are upwards of fifty potential customers in our target market with whom they currently work. Our proposed Barrie location is close to Imperial Oil’s facility in Toronto, Ontario and Petro-Canada’s facility in Oakville, Ontario, Canada. Our Sarnia site is in close proximity to large refineries owned by Shell Canada and Suncor Energy. This comparatively small group of potential customers represents a risk compared to if our sales were less concentrated within a larger number of customers because a smaller group of customers can exert greater influence on our selling prices. If we lose a customer or a customer becomes insolvent, we could experience a significant decrease

13

in revenue. As many of our costs and expenses will be relatively fixed, a reduction in revenue could decrease our profit margins and adversely affect our business, financial condition and results of operations. We expect that the costs of transportation will allow us to ship our ethanol production competitively within a 300 mile radius of our Barrie and Sarnia facilities, although if there are shortages in markets outside of this area, market conditions at times may allow us to ship beyond this radius.

We have not conducted any significant business operations as yet and have been unprofitable to date. Accordingly, there is no prior operating history by which to evaluate the likelihood of our success or our contribution to our overall profitability. We may never complete construction of an ethanol production facility and commence significant operations or, if we do complete the construction of an ethanol production facility, it may not be successful in contributing positively to our profitability.

The market price of ethanol is dependent on many factors, including the price of gasoline, which is in turn dependent on the price of petroleum. These fluctuations may cause our results of operations to fluctuate significantly. Petroleum prices are highly volatile and difficult to forecast due to frequent changes in global politics and the world economy. The distribution of petroleum throughout the world is affected by incidents in unstable political environments, such as Iraq, Iran, Kuwait, Saudi Arabia, the former U.S.S.R. and other countries and regions. The industrialized world depends critically on oil from these areas and any disruption or other reduction in oil supply can cause significant fluctuations in the prices of oil and gasoline. As we cannot predict the future price of oil or wholesale gasoline, this may lead to unprofitable prices for the sale of ethanol due to significant fluctuations in market prices. For example, the New York spot price of wholesale unleaded gasoline and ethanol rose from approximately $1.70 per gallon and $2.00 per gallon, respectively, in December 2005 to approximately $2.30 and over $4.00 per gallon, respectively, in June 2006. Recently, wholesale gasoline and ethanol prices have moved in the same range, trading at approximately $1.99 and $1.86 per gallon, respectively, as of August 15,2007. If the price of gasoline and petroleum decline, we believe that the price of ethanol may be adversely affected. Fluctuations in the market price of ethanol may cause our profitability to fluctuate significantly.

We will be subject to extensive air, water and other environmental regulations in connection with the construction and operation of our planned ethanol production facilities. We cannot predict in what manner or to what extent governmental regulations will harm our business or the ethanol production and marketing industry in general. Our proposed business is subject to extensive regulation by federal and provincial governmental agencies in Canada, where we intend to initially produce and sell ethanol. If we acquire an ethanol plant in the US or elect to build a new ethanol facility in the US, this business will also be subject to such extensive regulation. See “DESCRIPTION OF BUSINESS – BUSINESS.” The production and sale of ethanol is subject to regulation by agencies of the US Federal Government, including, but not limited to, the Environmental Protection Agency (the “EPA”) in the US as well as other agencies in each jurisdiction in which ethanol is produced, sold, stored or transported. In Canada, the production and sale of ethanol is subject to regulation by Environment Canada, through the Canadian Environmental Protection Act 1999, and in Ontario as well by the Ontario Ministry of the Environment.

Environmental laws and regulations that are expected to affect our planned operations are extensive and have become progressively more stringent. Applicable laws and regulations are subject to change, which could be made retroactively. Violations of environmental laws and regulations or permit conditions can result in substantial penalties, injunctive orders compelling installation of additional controls, civil and criminal sanctions, permit revocations and/or facility shutdowns. If significant unforeseen liabilities arise for corrective action or other compliance, our sales and profitability could be materially and adversely affected. See “DESCRIPTION OF BUSINESS – INDUSTRY OVERVIEW.”

14

In addition, the production of ethanol involves the emission of various airborne pollutants, including particulates, carbon monoxide, oxides of nitrogen and volatile organic compounds. We also may be required to obtain various other water-related permits, such as a water discharge permit and a storm-water discharge permit, a water withdrawal permit and a public water supply permit. If for any reason we are unable to obtain any of the required permits, construction costs for our planned ethanol production facilities are likely to increase. In addition, the facilities may not be fully constructed at all. Compliance with regulations may be time-consuming and expensive and may delay or even prevent sales of ethanol in Ontario or in other jurisdictions.

We will need to obtain various construction permits relating to our proposed ethanol plants and there can be no assurances that we will be able to obtain these permits, or that we will not incur significant delay in obtaining the same. As of the date of this Prospectus we have begun obtaining those permits required relating to the construction of our proposed ethanol plants. Each of our proposed locations is located on an existing industrial site. Existing industrial sites typically require fewer permits because they already have road and rail access permits, water intake and discharge permits. We will be required to obtain a Site Plan Approval. The Site Plan Approval process entails submitting a detailed layout of the proposed plant including a landscape plan and items such as building finishes and an artist’s rendering showing what the plant will look like from various street level views. While we do not believe that we will encounter any problem obtaining this permit from the local municipalities because the sites have existing fire suppression and storm water management systems in place, there can be no assurances that we will not experience a problem or delay in obtaining these permits. The general time period required for this permit is 90 days. We have filed the application for the relevant permits on our proposed Barrie plant and expect to receive site plan approval by September 2007. For the Sarnia site, we have recently commenced this process and expect to receive our Site Plan Approval permit in 2007.

For our two proposed locations, Environmental Permits are issued by the Ministry of the Environment of Ontario. In March 2007, we applied for this permit for the Barrie plant and expect to receive the final permit in September 2007. We expect that our Site Plan Approval permit and environmental permits for Sarnia, once submitted, will be processed within the same time frame as the Barrie permits. The receipt of environmental permits on existing industrial sites tends to be less onerous than on greenfield sites. Other permits that will be required are standard building permits that our EPC contractor will obtain as part of the obligations included in the EPC contract. There can be no assurances that we will obtain all permits in a timely manner, or at all. Failure to obtain all necessary permits will have a significant negative impact on our proposed plan of operation.

We face a risk that the Government of Canada may institute a corn countervailing duty that could increase feedstock costs for our proposed Canadian plants. The Ontario corn market relies on imports from the United States to increase liquidity. The most recent corn countervailing duty was brought about in September 2005, by the Ontario Corn Producers. Originally, the Corn Producer’s successfully lobbied for a provisional countervailing duty that was effective from December 15, 2005 until April 18, 2006. On April 17, 2006, the Canadian International Trade Tribunal (CITT) found that the importation of grain corn from the U.S. had not caused and is not threatening to cause material injury to domestic Canadian corn producers despite a determined legal and public relations effort by Canadian corn producers to persuade the CITT that U.S. subsidies, together with alleged dumping by U.S. producers of corn in Canadian markets, were indeed causing such injury. In the event that a corn countervailing duty is enacted again, it is not expected to apply to product shipped back to the United States. Therefore, if we import U.S. corn into Canada and then export ethanol and DDGS to the U.S., we expect that we will be able to draw the duty back. However, we would not be able to recover the corn countervailing duty on any US produced corn used to make ethanol for sale in the Canadian market and we could be faced with higher corn prices in Ontario given the Ontario market’s reliance on imported US corn.

Delays in our ability to obtain the financing necessary to commence construction of our proposed ethanol plants, delays in the construction of our planned ethanol production facilities or defects in materials and/or workmanship may occur. As of the date of this Prospectus we have not begun

15

construction of our proposed ethanol plants, nor do we have any commitment for all of the financing that is required to commence construction. No assurances can be provided that we will obtain the same.

Further, construction projects often involve delays in obtaining permits and encounter delays due to weather conditions, fire, the provision of materials or labor or other events. In addition, changes in interest rates or the credit environment or changes in political administrations at the federal, provincial, state or local levels that result in policy change towards ethanol or our project in particular, could cause construction and operation delays. Any of these events may adversely affect our ability to commence our proposed operations, which may expose us to additional unknown risks that arise due to such a delay. See “RISK FACTORS.” As of the date of this Prospectus, we expect the timeframe to the commencement of ethanol production at our planned Barrie facility to be as follows:

| 1. | Based on Ontario Ministry of Environment guidelines and communications, receive Ontario Ministry of Environment permit in September 2007. |

| 2. | Based on consulting engineer’s experience, receive City of Barrie site plan approval in September 2007. |

| 3. | Based on EPC term sheet signed March 9, 2007 with AKSC and discussions with other EPC contractor and ethanol plant technology providers, develop and negotiate EPC contract and receive EPC pricing from EPC contractor and ethanol plant technology provider in October 2007. |

| 4. | If another EPC contractor and ethanol plant technology provider selected, allow 60 days for Delta to decide whether to assume agreement. Sign an EPC contract with AKSC and Delta or another combination of EPC contractor and ethanol plant technology provider by December 2007. |

| 5. | Based on requirements of WestLB indicative term sheets dated December 13, 2006, close debt and or equity financing in December 2007. |

| 6. | With financing closed, give EPC contractor full notice to proceed with detailed engineering work in December 2007. |

| 7. | Based on discussions with AKSC and other EPC contractors, completion of site preparation work in February 2008. |

| 8. | Based on discussions with AKSC and other EPC contractors, EPC contractor mobilizes to site in February 2008. |

| 9. | Based on discussions with AKSC and other EPC contractors, first pour of concrete in March 2008. |

| 10. | Based on discussions with AKSC and other EPC contractors, start of plant commissioning in March 2009. |

| 11. | Based on EPC term sheet signed March 9, 2007 with AKSC and discussions with other EPC contractor and ethanol plant technology providers, full operations of plant in June 2009 |

We expect the Sarnia plant start up will follow the Barrie timeline by approximately three months.

Any significant increase in the final construction costs of our proposed facilities will adversely affect our capital resources. Based upon discussions that we have had with AKSC, with other EPC contractor and ethanol plant technology providers and WestLB, all of whom are experienced in constructing ethanol plants, we have estimated that the construction cost of our proposed two facilities to be approximately $454 million. The estimated cost of these facilities is based on the target EPC price range included in the AKSC term sheet executed on March 9, 2007 for our Barrie plant, on discussions with other EPC contractor and ethanol plant technology providers, engineering estimates, and on WestLB’s experience with other ethanol construction projects that they have financed, but the final construction cost of the facility may be significantly higher when firm EPC prices are received. We expect to receive a fixed EPC contract price from AKSC or other EPC contractor and ethanol plant technology providers for our Barrie Plant in October 2007 and approximately 90 days later for Sarnia. Once executed, the EPC contracts will guarantee a fixed price for the Barrie and Sarnia plants and that they will achieve 95% of their design capacity. Final construction costs however may vary from EPC contract prices due to possible price escalation factors that may be agreed to in the EPC contract on certain material inputs, force majeure events that the EPC contractor can not control and that may be exempted in the EPC contract from the fixed price guarantee, and change orders that we may request over the course of construction. While we intend to seek

16

additional funding to deal with any adverse contingencies that may arise before construction is completed, or at the very least have such potential sources of funding in place if this situation occurs, there can be no assurances that we will be able to raise this additional capital to fund the cost of these variances if they occur.

There is a risk that, because of the proposed location of our ethanol plants, we may incur additional costs for corn, water, electricity and natural gas, the raw materials required for the production of ethanol. The September 2006 Muse Stancil report, commissioned by us to assess the feasibility of our Barrie and Sarnia locations for ethanol production, estimated that these facilities will process approximately 78 million bushels of corn each year at expected annual production of 216 million gallons of ethanol and will require significant and uninterrupted supplies of water, electricity and natural gas. The prices for corn, electricity and natural gas have fluctuated significantly in the past and may fluctuate significantly in the future. In addition, droughts, severe winter weather and other problems may cause delays or interruptions of various durations in the delivery of corn to our facilities, reduce corn supplies and increase corn prices.

In 2006, approximately 218 million bushels of corn were grown in Ontario and an additional 96 million bushels were grown in Quebec. We anticipate sourcing approximately one-third (26,865,670 bushels) of the corn needs locally, with the balance (53,731,340 bushels) being purchased from the United States. A study performed by Muse Stancil & Co. suggests that we should expect to incur freight costs of $0.18 per bushel or $4,835,820 annually from Ohio to Sarnia, Ontario, and $0.70 per bushel or $18,805,969 annually from Ohio to Barrie, Ontario. The transportation of a large proportion of our corn presents a risk to us, as we would be negatively affected by increases in transportation costs.1

The anticipated freight costs may also be higher than expected in the event of severe winter weather conditions. The locations chosen for our plants present a weather risk to us because significant snowfalls may result in transportation delays. Sarnia, Ontario receives annual snowfall of 51 inches on average and Barrie, Ontario receives average annual snowfall of 128 inches. However, while no assurances can be provided, we believe that having three ways to transport corn, including via truck, rail, and freighter on the Great Lakes, will help reduce the risk of weather-related delays.2

Additionally, local water, electricity and gas utilities may not be able to reliably supply the water, electricity and natural gas that our Barrie and Sarnia facilities will need or may not be able to supply such resources on acceptable terms. Although a stable supply exists for gas, water and electricity in the Barrie and Sarnia areas, localized conditions such as drought or severe weather conditions may affect the supply of raw materials to these areas from time to time over the life of the plants. Each proposed plant will require approximately 10,500 cubic ft. of gas per day, 1,000,000 US gallons of water per day and an average of 16 MW/hr of electricity. The loss of any of these utilities would cause us to shut down the plant until normal utilities are restored. We may not be able to successfully anticipate or mitigate fluctuations in the prices of raw materials and energy through the implementation of hedging and contracting techniques. Our hedging and contracting activities may not lower our prices of raw materials and energy, and in a period of declining raw materials or energy prices, these hedging and contracting strategies may result in our paying higher prices than our competitors. In addition, we may be unable to pass increases in the prices of raw materials and energy to our customers. Higher raw materials and energy prices will generally cause lower profit margins and may even result in losses. Accordingly, our potential sales

_________________________

1 SOURCES: http://www.statcan.ca/Daily/English/061207/d061207a.htm Muse Stancil & Co., Corn and Distillers Grains Report – pg 3

2 SOURCES: http://www.theweathernetwork.com/weather/stats/pages/C02024.htm?CAON0601; http://www.theweathernetwork.com/weather/stats/pages/C02022.htm?CAON0040

17

and profitability may be significantly and adversely affected by the prices and supplies of raw materials and energy.

We may be exposed to potential risks relating to our internal controls over financial reporting and our ability to have those controls attested to by our independent auditors. As directed by Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX 404”), the Securities and Exchange Commission adopted rules requiring public companies to include a report of management on the company’s internal controls over financial reporting in their annual reports, including Form 10-KSB. In addition, the independent registered public accounting firm auditing a company’s financial statements must also attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting as well as the operating effectiveness of the company’s internal controls. We have not yet been subject to these requirements. We are evaluating our internal control systems in order to allow our management to report on, and our independent auditors to attest to, our internal controls, as a required part of our annual report on Form 10-KSB beginning with our reports for the fiscal year ended December 31, 2007. A recent release from the SEC has indicated that newly public companies may be granted an additional year after becoming public to demonstrate the effectiveness of their internal controls as required under SOX 404.

While we expect to expend significant resources in developing the necessary documentation and testing procedures required by SOX 404, there is a risk that we will not comply with all of the requirements imposed thereby. At present, there is no precedent available with which to measure compliance adequacy. Accordingly, there can be no positive assurance that we will receive a positive attestation from our independent auditors.

In the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or we are unable to receive a positive attestation from our independent auditors with respect to our internal controls, investors and others may lose confidence in the reliability of our financial statements and our ability to obtain equity or debt financing could suffer.

RISKS RELATED TO OUR COMMON STOCK

There is no trading market for our securities and there can be no assurance that such a market will develop in the future. We have filed a registration statement on Form SB-2 with the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended, registering those shares that we issued in our recent private offering, of which this Prospectus is a part. In addition, an application to have our Common Stock listed for trading on the OTC Electronic Bulletin Board operated by the National Association of Securities Dealers, Inc. (“NASD”) has also been filed and is currently being reviewed. The process of obtaining a listing for our Common Stock on the OTCBB involves a market maker submitting an application with the NASD. The NASD then reviews the application and issues comments, or questions, concerning our Company and the class of stock (Common Stock) for which a listing has been requested. There is no assurance that our application for listing on the OTCBB will be approved, or if so approved that a market will develop in the future or, if developed, that it will continue. In the absence of a public trading market, an investor may be unable to liquidate his investment in our Company.

We do not have significant financial reporting experience, which may lead to delays in filing required reports with the Securities and Exchange Commission and suspension of quotation of our securities on the OTCBB, which will make it more difficult for you to sell your securities. If we are successful in listing our Common Stock for trading on the OTCBB, of which there can be no assurance, the OTCBB limits quotations to securities of issuers that are current in their reports filed with the Securities and Exchange Commission. Because we do not have significant financial reporting experience, we may experience delays in filing required reports with the Securities and Exchange Commission (the “SEC”) following the effectiveness of the registration statement to which this Prospectus is a part. Because issuers whose securities are

18

qualified for quotation on the OTCBB are required to file these reports with the Securities and Exchange Commission in a timely manner, the failure to do so may result in a suspension of trading or delisting from the OTCBB. We have been late in filing some of the reports we have been required to file with the SEC but are reviewing our internal procedures to ensure that future reports are filed in a timely manner.

If we are successful in listing our Common Stock for trading on the OTCBB, there are no automated systems for negotiating trades on the OTCBB and it is possible for the price of a stock to go up or down significantly during a lapse of time between placing a market order and its execution, which may affect your trades in our securities. Because there are no automated systems for negotiating trades on the OTCBB, they are conducted via telephone. In times of heavy market volume, the limitations of this process may result in a significant increase in the time it takes to execute investor orders. Therefore, when investors place market orders, an order to buy or sell a specific number of shares at the current market price, it is possible for the price of a stock to go up or down significantly during the lapse of time between placing a market order and its execution.

Our stock will be considered a “penny stock” so long as it trades below $5.00 per share. This can adversely affect its liquidity. If and when trading commences our Common Stock, will be considered a “penny stock” so long as it trades below $5.00 per share and as such, trading in our Common Stock will be subject to the requirements of Rule 15g-9 under the Securities Exchange Act of 1934. Under this rule, broker/dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements. The broker/dealer must make an individualized written suitability determination for the purchaser and receive the purchaser’s written consent prior to the transaction.

SEC regulations also require additional disclosure in connection with any trades involving a “penny stock,” including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and its associated risks. In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from recommending transactions in our securities, which could severely limit the liquidity of our securities and consequently adversely affect the market price for our securities. In addition, few broker or dealers are likely to undertake these compliance activities. Other risks associated with trading in penny stocks could also be price fluctuations and the lack of a liquid market.

We do not anticipate payment of dividends, and investors will be wholly dependent upon the market for the Common Stock to realize economic benefit from their investment. As holders of our Common Stock, you will only be entitled to receive those dividends that are declared by our Board of Directors out of retained earnings. We do not expect to have retained earnings available for declaration of dividends in the foreseeable future. There is no assurance that such retained earnings will ever materialize to permit payment of dividends to you. Our Board of Directors will determine future dividend policy based upon our results of operations, financial condition, capital requirements, reserve needs and other circumstances.