1

Introductions

Jim Cleary

President and Chief Executive Officer

Mary Pat Thompson

Senior Vice President & Chief Financial Officer

2

Disclaimer/Forward-Looking Statements

This presentation may contain forward-looking statements based on current

management expectations. Numerous factors, including those related to

market conditions may cause results to differ materially from those

anticipated in forward-looking statements. Many of the factors that will

determine the Company’s future results are beyond the ability of the

Company to control or predict. These statements are subject to risks and

uncertainties and, therefore, actual results may differ materially. Potential

investors should not place undue reliance on forward-looking statements,

which reflect management’s views only as of the date hereof. The Company

undertakes no obligation to revise or update any forward-looking statements,

or to make any other forward-looking statements, whether as a result of new

information, future events or otherwise.

3

introduction

Mission Statement

MWI will be the best resource to the

veterinary profession by delivering

superior value, efficiency and innovation.

5

Investment Highlights

Favorable industry dynamics driving demand for

animal health products

Market leading position with national footprint and

expansion opportunities

Broad product portfolio and value-added services

Longstanding relationships with diversified customer

and vendor bases

Premier sales and marketing franchise

Strong and consistent financial performance driven by

organic growth

Experienced management team

6

Our Company

Leading distributor of animal

health products to

veterinarians across U.S.

30 years of operating history

Over 15,000 veterinary

clinics nationwide

Over 11,000 products

sourced from more than

400 vendors

Strong and consistent

financial performance

7

Recent Developments

Acquired Securos, Inc. which is a leading provider of veterinary

orthopedic products

IT - Launched an updated e-commerce platform and implemented

RF receiving at distribution centers

Leased a 105,000 square-foot distribution center in the Kansas

City area and will begin operating in October 2007

Fiscal year 2006 through August 2007: MWI increased capacity

by successfully opening, moving or expanding 7 distribution

centers

November 2006: Extended Banfield contracts through November

2009

Continued expansion of value-added services, including e-

commerce, inventory management and pharmacy fulfillment

Established Specialty Resources Group, a new division of MWI

8

industry overview

Attractive Industry Dynamics

Large, fragmented U.S. market with favorable

growth characteristics

54,000 practicing veterinarians

27,000 veterinary clinics

400 vendors

Diversified customer and vendor bases

Distributors play vital role

Frequent, small orders

Clinics avoid storing and managing inventory

Importance of sales representatives

Long-term relationships

Product information / consultation

No third party reimbursement risk

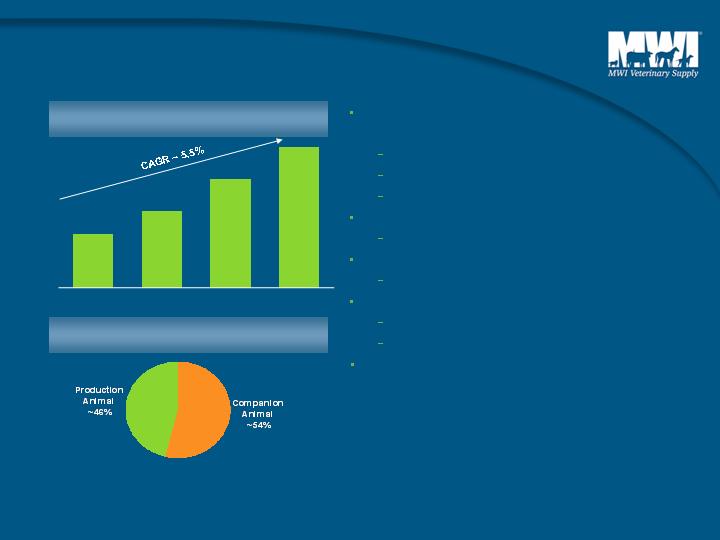

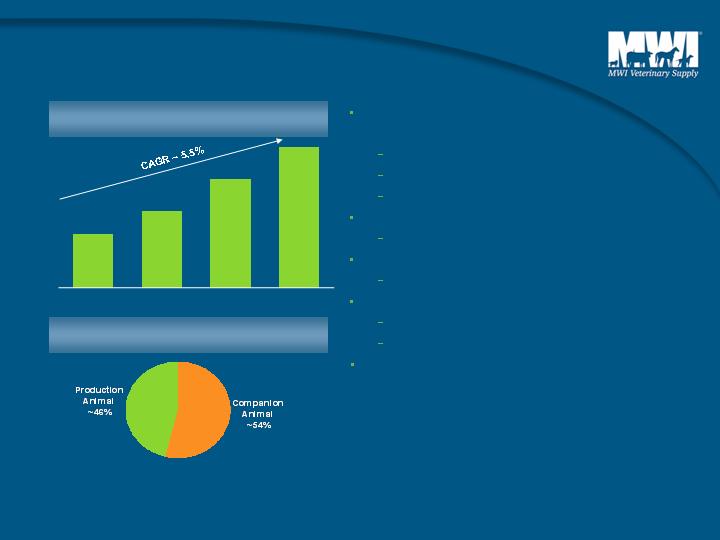

U.S. Animal Health Product Sales

2005 U.S. Animal Health Product

Sales By Segment

$5.0 + Billion

Source: Animal Health Institute, American Veterinary Medical Association, and Company estimates

($ in billions)

10

$5.0 +

$4.5

$5.0

$4.7

2002

2003

2004

2005

Consists of approximately:

90 million cats

73 million dogs

7 million horses

Other pets

Increased spending driven by:

Human-animal bond

Rising numbers of households with pets

Focus on animal health /

preventative care

Technology migration from human health

to veterinary medicine

Aging pet population

Companion Animal Market

Large market with attractive growth profile

Note: Number of cats, dogs, and horses are for the U.S. only.

Source: Dogs and Cats for 2004 – APPMA. 2005-2006 Pet Owner’s Survey. Horses for 2004 – US Equine Market, Brakke Consulting.

11

Includes cattle, swine, poultry, and

other food-producing animals

97 million cattle

61 million swine

Spending driven by:

Economic decisions

Improved productivity / yield

Disease prevention

Production Animal Market

Significant market with volume driven by large order sales

Source: USDA Agriculture statistics

12

Importance of Distributors

Customers

Vendors

Single source for multiple

products

Timely product delivery

Reduced number of

vendors

Inventory management

Product information

Consultation

Cost-effective access to

a fragmented market

Logistics and distribution

Sales and marketing

support

Ability to move market

share

Flexible selling models

Distributors

13

Competitive Landscape

Key Competitors (1)

Competitive market

Competition from both numerous

vendors and distributors

Competing factors include:

Customer relationships

Service and delivery

Product selection

Price

e-business capabilities

Industry consolidation well under

way

(1) Excludes vendors and other national, regional, local and specialty distributors.

14

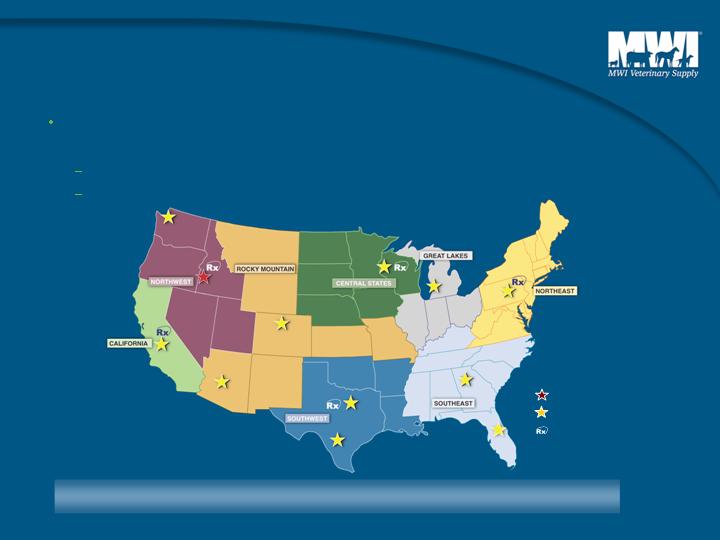

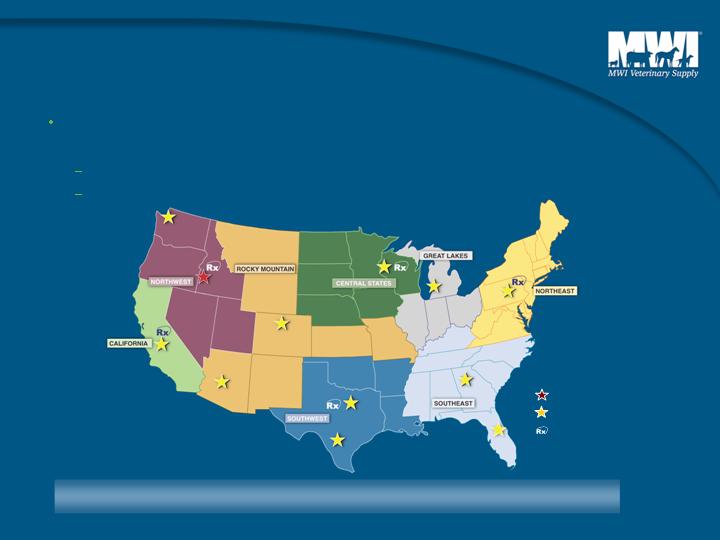

company overview

The MWI Edge:

Leading National Distributor

Decentralized distribution network facilitates regional market

responsiveness

12 strategically located distribution centers throughout the U.S.

5 pharmacies distributing Rx products to end-users nationwide

Same day shipment on 98% of orders placed

DO NOT DELETE:

E:\Dtp 05\500 Set\545 Series\54581\CURRENT FILE\Artwork\..\Artwork\Map.cdr

HEADQUARTERS AND WAREHOUSE

WAREHOUSE

PHARMACY

16

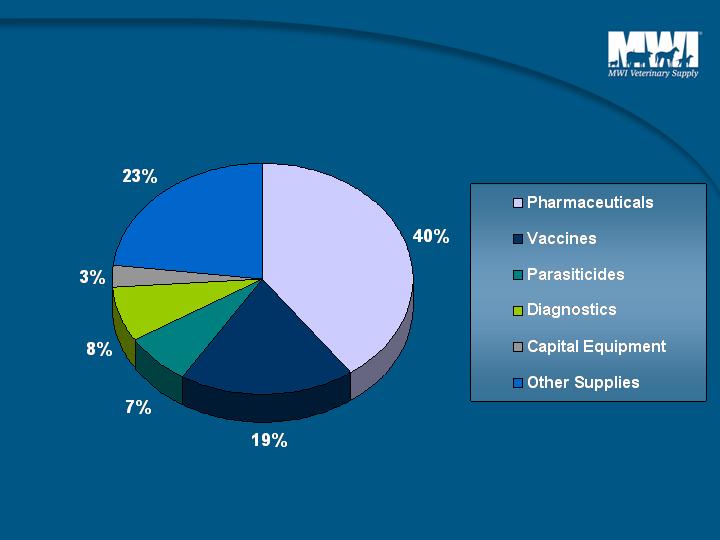

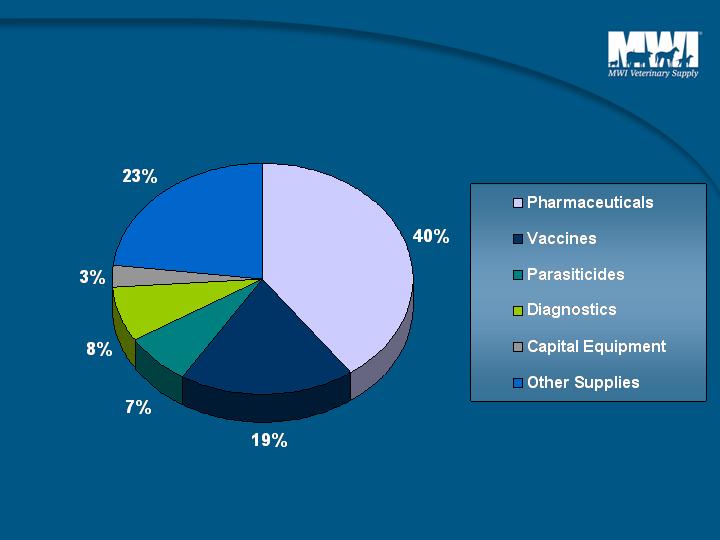

The MWI Edge:

Broad Product Portfolio

Over 11,000 products stocked in MWI warehouses

Over 7,000 additional products available by special order

Continually evaluate product portfolio to improve offerings

Key products include:

Pharmaceuticals,

Vaccines and Parasiticides

Diagnostics, Capital

Equipment and Supplies

Veterinary Pet Food and

Nutritional Products

17

The MWI Edge:

2006 Product Revenue Mix

18

The MWI Edge:

Expansive Vendor Network

Sources products from

over 400 vendors

Provides cost-effective

access to large and

diverse customer base

Serves as a principal

distributor for key vendors

Length of relationship with

many key vendors over 10

years

MWI’s size and reach have become increasingly

important to its vendor base

19

Flexible Selling Arrangements –

Agency Relationships

Do not purchase and take inventory of products

Upon receipt of order, transmit order to vendor, who picks,

packs and ships order

Receive commission payment for soliciting order

Agency relationships with several leading animal health

product vendors

Gross billings of $151.4 million, generating commission

revenue of $7.8 million in FY 2006

20

The MWI Edge:

Strong Customer Relationships

Nation’s largest private

veterinary practice

Customer for over 10 years

Highly efficient ordering

process

Feeders’ Advantage

Buying group of several of

the largest cattle feeders in

U.S.

Customer for 10 years

Highly efficient ordering

process

Corporate Clients

Independent

Veterinary Practices

Often small, privately-held

Place at least one order / week

Independent veterinary

practices and producers

account for >80% of our

product sales

Loyal customer base:

Over 66% of sales from

accounts over 5 years old

Over 79% of sales from

accounts over 3 years old

21

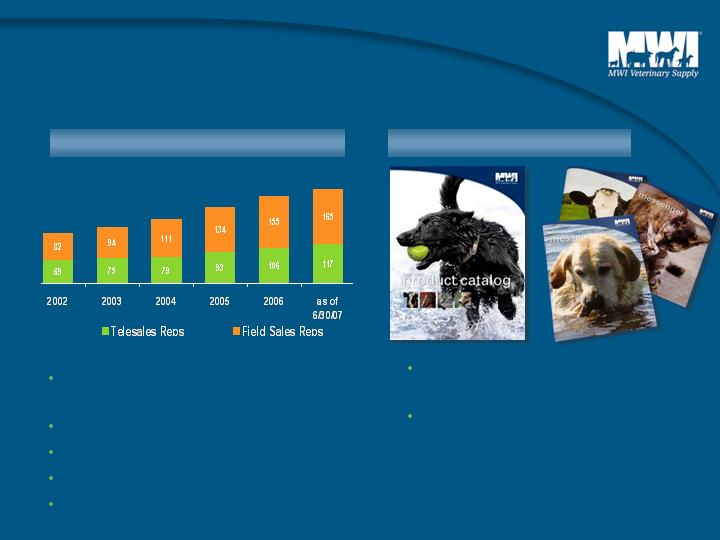

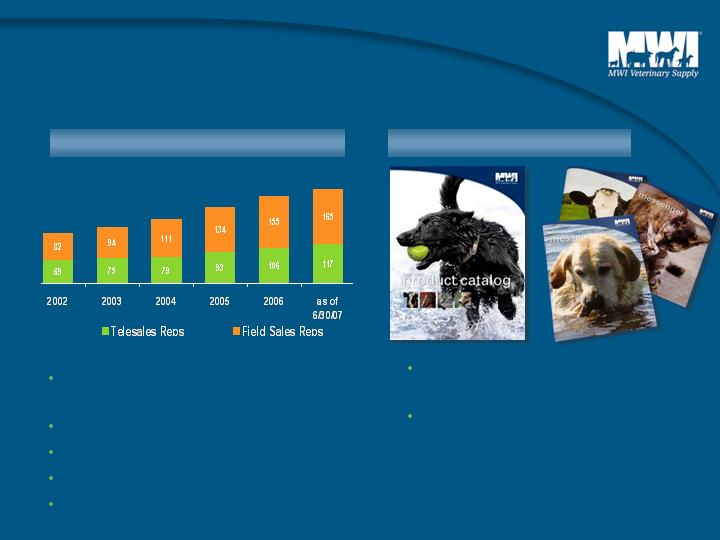

The MWI Edge:

Premier Sales and Marketing Franchise

Sales Representatives

FYE Sept 30,

Dual coverage approach with

frequent contact

Act as business consultants

Continuous training initiatives

Performance driven compensation

Significant industry experience

Direct Marketing

Over 450,000 pieces of direct

marketing material distributed

Comprehensive and specialty

catalogs, loyalty programs,

product / vendor programs,

flyers, order stuffers

282

261

227

190

169

151

22

The MWI Edge:

Value-Added Services

E-Commerce Platform

Technology systems closely integrated with customers’

day-to-day operations

E-Commerce Product Sales

as a Percent of Total Sales

18%

21%

23%

24%

23

The MWI Edge:

Value-Added Services

Value-added services increase loyalty of customer base

E-commerce platform

Pharmacy fulfillment

SWEEP™ Inventory management system

Equipment procurement consultation

Special order fulfillment

Educational seminars

Pet cremation

24

MWI Growth Strategy

Expand Number

of Veterinarians

Served

Offer Innovative,

Differentiated

Solutions to

Veterinarians

Increase Share of

Spend from

Existing

Customers

Pursue Strategic

Acquisitions

Expand

Agreements with

Existing and New

Vendors

Increase Overall

Productivity and

Profitability

25

Pursue Strategic

Acquisitions

Specialty Resources Group,

a division of MWI

Objective:

Diversify revenue and enhance profitability through acquisition and

development of niche animal health products and services

Tactics:

Acquire manufacturers and marketers of non-pharma specialty animal

health products and services

Secure exclusive licenses and agreements

Leverage MWI sales force and customer relationships

Recent Developments:

June 8, 2007 completed acquisition of Securos and IVDN

26

financial overview

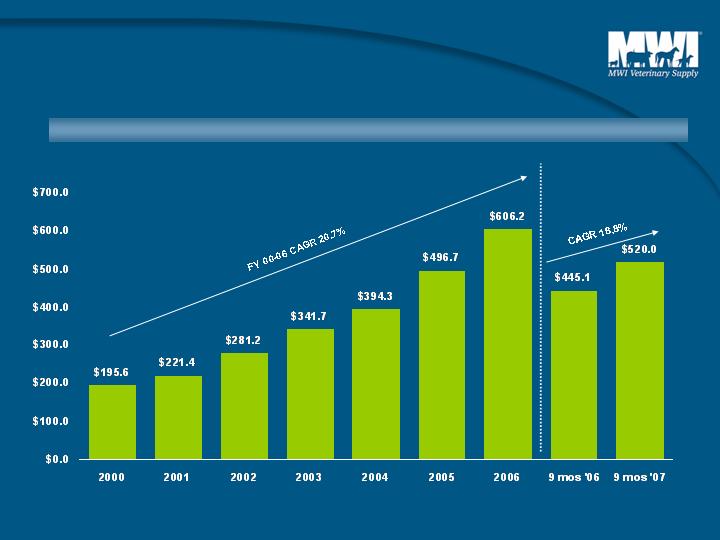

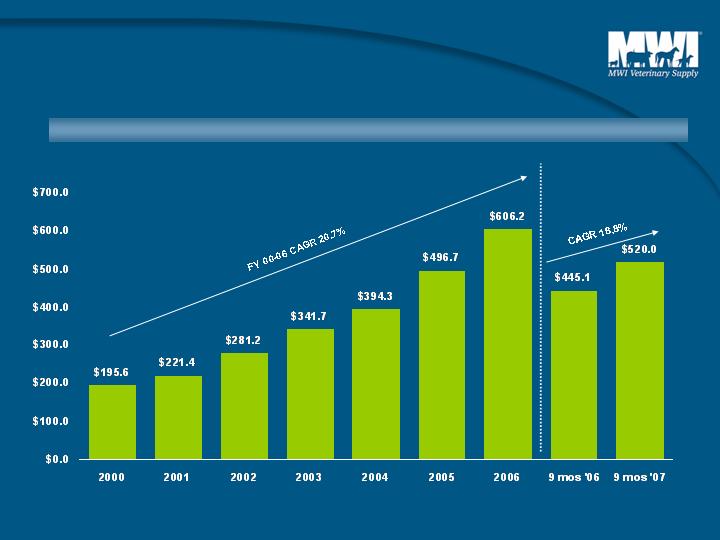

Strong Growth in Revenues

Total Revenues

($ in millions)

FYE Sept 30,

28

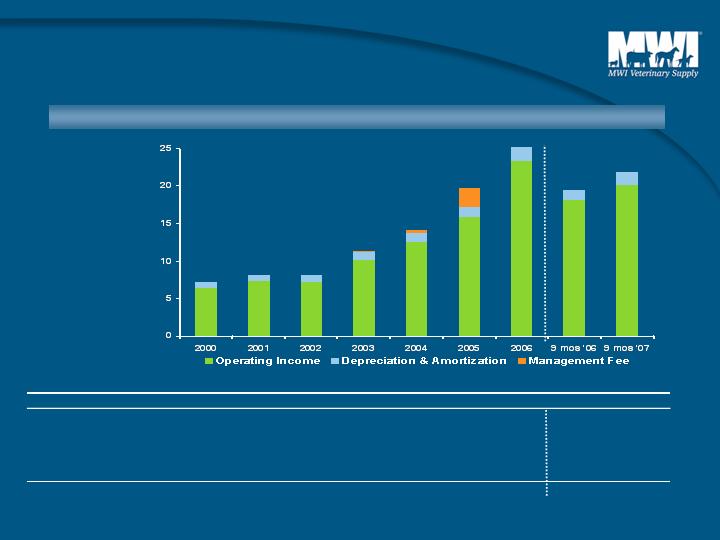

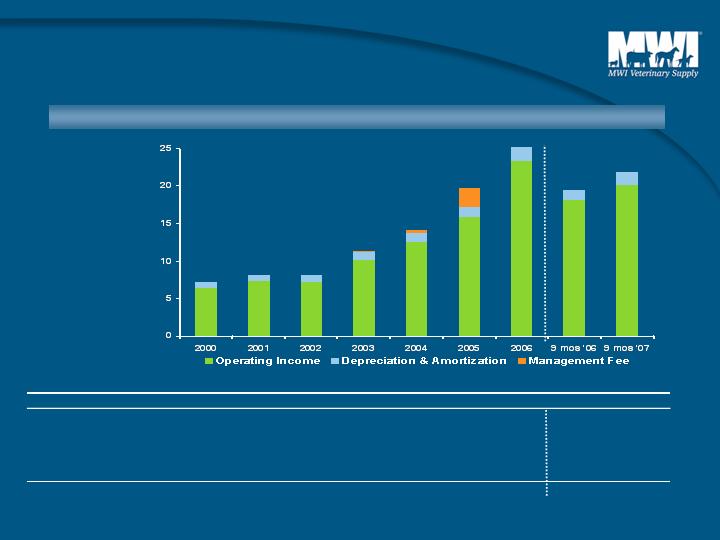

Strong Growth in Operating Income

Operating Income FYE Sept 30

($ in millions)

* includes the effect of rebate earnings of approximately $2.5 million (pre-tax) earned in fiscal year 2006 that historically

would have been earned in our fiscal year 2007 first quarter ended December 31, 2006.

29

($ in millions)

2000

2001

2002

2003

2004

2005

2006

9 mos '06

9 mos '07

Management Fee

-

-

$0.1

$0.3

$0.4

$2.5

$0.0

$0.0

$0.0

Depreciation & Amortization

0.8

0.8

0.9

1.0

1.1

1.5

2.0

1.4

1.8

Operating Income

6.4

7.3

7.2

10.2

12.6

15.8

23.7

18.1

20.1

*

Condensed Consolidated Balance Sheets

($ in thousands)

$ 188,244

$ 230,559

$ 245,754

Total Liabilities & Stockholders' Equity

86,694

129,626

155,377

Stockholders' Equity

390

292

195

Long-term debt

650

505

453

Deferred income taxes

100,510

100,136

89,750

Total Current Liabilities

6,438

7,016

5,849

Accrued expenses & other current liabilities

69,382

82,561

83,804

Accounts payable

$ 24,690

$ 10,559

$ 0

Line-of-credit

Liabilities

$ 188,244

$ 230,559

$ 245,754

Total Assets

148,409

187,791

197,753

Total Current Assets

2,493

3,153

2,810

Other current assets

68,786

85,083

85,444

Inventories

77,099

99,518

97,170

Receivables, net

$ 31

$ 37

$ 12,329

Cash

9/30/2005

9/30/2006

6/30/2007

Assets

30

Financial Highlights

Year to Date Highlights

Revenues were up 17% to $520.0 million compared to

the same period last year

Net income was up 19% to $12.6 million compared to

the same period last year

Cash flow from operations was $17.4 million

compared to $1.0 million for the same period last year

Internet sales to independent veterinary practices and

producers grew by 48% and pharmacy sales grew by

more than 45% compared to the same period last year

31

Financial Highlights

Consistent organic growth

Stable, recurring revenue base…over 95% consumables

Minimal capital expenditure requirements

Strong returns on net assets and invested capital

Flexible and Strong Balance Sheet

32

conclusion

Investment Highlights

Favorable industry dynamics driving demand for

animal health products

Market leading position with national footprint and

expansion opportunities

Broad product portfolio and value-added services

Longstanding relationships with diversified customer

and vendor bases

Premier sales and marketing franchise

Strong and consistent financial performance driven by

organic growth

Experienced management team

34