UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21761

Keeley Funds, Inc.

(Exact name of registrant as specified in charter)

141 West Jackson Boulevard

Suite 2150

Chicago, IL 60604

(Address of principal executive offices) (Zip code)

Kevin Keeley

141 West Jackson Boulevard

Suite 2150

Chicago, IL 60604

(Name and address of agent for service)

Registrant’s telephone number, including area code: 312-786-5000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

|

KEELEY Small Cap Dividend Value Fund |

|

KEELEY Small-Mid Cap Value Fund |

|

KEELEY Mid Cap Dividend Value Fund |

Annual Report

September 30, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.keeleyfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive all future reports on paper free of charge, please contact your financial intermediary, or, if you invest directly with the Funds, you may call 800-422-3554 or send an email request to info@keeleyteton.com.

KEELEY FUNDS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Class A Shares | | | | | | Class I Shares | | | | |

| | | Average Annual Returns – September 30, 2020 (a)(b) | | | | | | Average Annual Returns –September 30, 2020 (a) | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception | | Gross Expense

Ratio | | Expense Ratio after Adviser Reimburse-

ments | | | | | | | | 1 Year | | 5 Year | | 10 Year | | Since Inception | | Gross Expense Ratio | | Expense Ratio after Adviser Reimburse-

ments | | | | | | | | |

KEELEY Small Cap Dividend Value | | (21.08)% | | 1.74% | | 6.16% | | 7.22% | | 1.60% | | 1.44% | | | | | | | | (17.08)% | | 2.96% | | 6.94% | | 7.95% | | 1.38% | | 1.19% | | | | | | | | |

KEELEY Small-Mid Cap Value | | (18.72) | | 2.52 | | 7.42 | | 4.69 | | 1.53 | | 1.40 | | | | | | | | (14.69) | | 3.73 | | 8.19 | | 5.32 | | 1.28 | | 1.15 | | | | | | | | |

KEELEY Mid Cap Dividend Value | | (17.26) | | 4.18 | | — | | 9.50 | | 1.39 | | 1.22 | | | | | | | | (13.15) | | 5.41 | | — | | 10.33 | | 1.14 | | 0.97 | | | | | | | | |

| (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price and reinvestment of dividends and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.keeleyfunds.com for performance information as of the most recent month end. Investors should carefully consider the investment objectives, risks, charges, and expenses of a Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.keeleyfunds.com. The prospectuses contain expense reimbursement information and should be read carefully before investing. The gross expense ratios and expense ratios after Adviser reimbursements are from the current prospectus dated January 28, 2020. |

| (b) | Includes the effect of the maximum 4.50% sales charge at the beginning of the period. |

| | | | |

| | | Inception Dates |

| | | Class A Shares | | Class I Shares |

KEELEY Small Cap Dividend Value | | 12/01/09 | | 12/01/09 |

KEELEY Small-Mid Cap Value | | 08/15/07 | | 08/15/07 |

KEELEY Mid Cap Dividend Value | | 10/03/11 | | 10/03/11 |

The KEELEY Funds file complete schedules of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters of each fiscal year on Form N-PORT. Shareholders may obtain this information at www.keeleyfunds.com by calling the Funds at 800-422-3554. The Funds’ Form N-PORT is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Proxy Voting

Each Fund files Form N-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Funds’ proxy voting policies, procedures, and how the Funds voted proxies relating to portfolio securities are available without charge, upon request, by (i) calling 800-422-3554; (ii) writing to The KEELEY Funds at One Corporate Center, Rye, NY 10580-1422; and (iii) visiting the SEC’s website at www.sec.gov.

2

Performance Discussion (Unaudited)

Small Cap Dividend Value Fund

To Our Shareholders,

It has been a tough year to be a value investor. It has been tougher to be a small-cap value investor. It has been even tougher to be a small-cap value investor focused on dividend-paying stocks.

For large-cap stocks as measured by the S&P 500 Index, the year ending September 30, 2020 turned out to be a pretty good year. While it had some scary moments, it ended up about 15% for the twelve months. The even larger cap Russell Top 200 gained an even more impressive 20%! As you go down the capitalization spectrum, however, things fall off. The Russell Mid Cap Index gained only 4.6% and the Russell 2000 Index barely broke even.

While the market’s gains were driven by the megacap growth stocks, mid-cap and small-cap growth stocks also dramatically outperformed value stocks. In each of the three capitalization ranges, growth stocks produced strong returns while value stocks generated negative returns. For the Russell Top 200, the spread between growth and value was a stunning 45%, plus 41% for the Russell Top 200 Growth vs. negative 4% for the Russell Top 200 Value Index. In mid-cap and small-cap, the spread was a more modest 31%, but the gains were smaller for growth and the losses were larger for value. For large-cap stocks, the spread between the performance of growth and value stocks has never been this wide. For mid-cap and small-cap stocks, the performance was even wider in the late-90s. At the end of February 2000, the trailing twelve-month performance of the Russell MidCap Growth Index was a positive 87% compared to a negative 6% for the Russell MidCap Value Index! Those were also tough times to be a value manager, but those who survived saw great things in the following years.

We probably do not need to list another reason why the year 2020 is unusual, but we will because it explains much of the reason for why Keeley’s Dividend Value Funds have not performed as well as we expected in a volatile and down market. The strategy of buying stocks of companies that pay dividends has not worked over the last year. The last year has been one where unprofitable companies have been the best performers. The 496 companies in the Russell 3000 Index that were expected to be unprofitable this year on September 30, 2019 are up 40.5% on average, while the 2,326 companies that were expected to be profitable have seen their stocks fall 4.4% on average. (The other ~200 did not have consensus earnings estimates.)

Typically, dividend-paying stocks provide good participation in rising markets and very good protection in falling markets. That has not been the case over the last year. When the markets sold off sharply in the first calendar quarter, dividend-paying stocks fell along with the rest of them as Financials fell on rising credit concerns and REITs fell on concerns about what widespread lockdowns would do to the tenants of the companies. As the market has rebounded, it has been led by sectors that generally have a low propensity to pay dividends (Technology and Health Care) or have a small representation in the small- and mid-cap indices (Consumer Staples).

Over the last year, dividend-paying stocks in the Russell Midcap Value Index have fallen 9.4% compared to a 7.3% decline for the Index overall and a 3.6% gain for the non-dividend-paying stocks. In the Russell 2000 Value Index, the spread was even wider; -22.5% for dividend-payers vs. -14.9% for the Index and +1.2% for non-dividend-payers. These are historically wide spreads. It is interesting that the other years where we saw non-dividend paying stocks outperform dividend paying stocks by this magnitude have generally been years when an economic recovery began. It seems that 2020 qualifies for this definition, but it was also a year when an economic downturn began.

To recap: Large cap stocks trounced small cap stocks, growth stocks outperformed value stocks, and non-dividend-paying stocks beat dividend-paying stocks. That is the worst possible combination for our dividend-focused strategies. So, where do we go from here?

We are actually quite optimistic. First, the long-term records of small-cap stocks, value stocks, and dividend-paying stocks is superior to that of large-cap stocks, growth stocks, and non-dividend-paying stocks. There have certainly been periods in the past where these types of stocks lagged, and there will almost certainly be periods where they underperform in the future. It is very hard to pick the timing on the change in these cycles and we would have expected a turn sooner. We have thought that value stocks were undervalued relative to growth stocks all year, and small-cap stocks have been attractive relative to large cap stocks based on historical patterns. We can now point to an additional reason to be bullish on small and mid-cap dividend-paying stocks. They are attractive from the standpoint of generating income! Small-cap (and mid-cap) dividend-paying stocks yield more than large-cap dividend-paying stocks, which in turn yield more than bonds.

In response to the slowing economy brought on by the lockdown measures to control the spread of the COVID-19 pandemic, the Fed cut short-term rates aggressively. This dragged down long-term rates as well. Even with rates moving a little higher recently, the yield on the ten-year treasury remains well below 1% and near historic lows. The rise in the overall market offset a little by slightly higher dividend payouts has reduced the yield on the market as measured by the larger cap focused indices (Russell Top 200), but not as much as the fall in the ten-year yield. As a result, RT200 yield/10-year Treasury yield has risen to 235% at the end of the third quarter compared to 91% at year-end. While equities have yielded more than Treasuries before, this condition is unusual as it has only happened in about 11% of months since 1978.

Even more unusual is the relationship between the yield on small cap stocks and large cap stocks. The yield on small caps has been higher than that of large caps since June and at the end of September, the yield on the Russell 2000 was 1.64% vs. 1.62% for the Russell Top 200. That has only happened in about 8% of months since 1978. Almost all of these months were between 1998 and 2001. The combination of higher equity yields and higher small cap yields never happened before June.

If we dig deeper and only compare the yields on dividend-paying stocks, the income advantage increases. The average yield on dividend paying stocks in the Russell Top 200 is now 2.63% whereas the average yield on the dividend-paying stocks in the Russell 2000 is an impressive 3.72%. These are up from 2.42% and 2.99% at year-end. While yields have fallen broadly in the capital and money markets, the decline in share prices has more than offset cuts in dividends so that dividend-paying equities are attractive from a yield perspective.

3

So what does this all mean? We think these conditions point to a couple things. First, there is likely more skepticism about whether smaller companies will be able to sustain their dividends than exists for larger companies. This is partly correct, in our opinion, although smaller companies have been quicker to reduce or suspend dividends so far. The reason for the potential vulnerability is that nearly 40% of the dividends in the Russell 2000 come from Financials stocks. So far, they have not cut dividends much, but if the recovery stalls, they may have to boost reserves further which might necessitate dividend cuts. By contrast, almost 50% of dividends in the Russell Top 200 come from Technology, Healthcare, and Consumer Staples, sectors that have seen some positive impacts from the COVID-19 pandemic.

The other takeaway is that there are still a lot of stocks that could be significantly undervalued. While the 2020 and 2021 outlooks are lower, the longer-term prospects for many companies may not have changed significantly (although the outlook for some has). It is our job to find those and we are confident that we will be able to do so.

Portfolio Results

In the fiscal year ended September 30, 2020, the Keeley Small Cap Dividend Fund’s net asset value (NAV) total return declined 17.35% compared with a 14.88% decline in total return for its benchmark, the Russell 2000 Value Index. We believe the Fund trailed its benchmark, and our expectations, primarily for the reasons we have explained above but we will provide more detail on the performance of the Fund in the next few paragraphs.

When we disaggregate relative performance into the impact from Sector Allocation decisions and the impact from Stock Selection efforts, we find that Sector Allocation added a little bit to relative performance while Stock Selection hurt a little. While the Fund is relatively sector neutral, we find that small underweights in the poor performing Financials and Energy sectors helped performance a little, while a small underweight in the good-performing Technology sector hurt relative performance a little. Our Stock Selection decisions had the biggest positive impact in the Financials, Utilities, and Health Care sectors, while the Fund’s holdings in the Materials, Consumer Discretionary, Consumer Staples, and Technology sectors were the biggest laggards.

| | ● | | The Financial sector declined more than the overall Index, but the Fund’s holdings meaningfully outperformed those of the Index. Strong gains in the shares of Brightsphere Investment Group and Virtu Financial accounted for most of the superior performance. Brightsphere’s share price ran up after the company made some strategic transactions to position itself better to grow assets under management. Virtu, on the other hand, is a market-maker of a wide variety of financial instruments around the world and benefitted from a pick-up in volumes and volatility. The Fund’s holdings in bank stocks were a detractor as investors feared a replay of the Global Financial Crisis. |

| | ● | | Historically, Utilities have been a safe haven in market downdrafts and stellar performers when interest rates fell sharply. That has not been the case in 2020 as Utilities shares have actually fallen more than the overall Index. The Fund’s holdings held up relatively better as its position in Atlantica Yield benefitted from that company’s ongoing recovery and a flight toward ESG–oriented investments. The acquisition of El Paso Electric by private equity funds also helped a little. |

| | ● | | The Fund only owned two Healthcare stocks during the year. They were the same two as last year, Ensign Group and Chemed. Both stocks performed very well as both companies weathered the volatility in the healthcare services industry in the time of the COVID epidemic very well. |

| | ● | | The Materials sector was the biggest detractor for the Fund. Most of the weakness was due to declines in Kaiser Aluminum and Mercer International. Both companies felt a disproportionate impact from the COVID pandemic. At Kaiser, the COVID pandemic has battered the airline industry and hurt aircraft suppliers, a key customer base for the company. At Mercer, the pandemic has slowed trade and closed the key China market for the company’s products. |

| | ● | | We did a lot of things right in the Consumer Discretionary sector, but not enough as it was one of the best performing sectors. The main thing that hurt performance was a lack of ownership of the stocks of retailers, particularly those focused on the home. The Fund’s biggest detractor in this sector was Kontoor Brands, a recent spinout from VF Corporation of the Lee and Wranglers jeanswear business. While the COVID related slowdown led the company to suspend its dividend, we are optimistic that it will resume its payout over the next quarter or two. |

| | ● | | The Consumer Staples sector was the second best performing sector in the market (behind Healthcare) as COVID-related lockdowns pushed consumers into grocery stores. This is a small sector in the small cap universe and the Fund held only one stock in the sector this year. That holding, Primo Water, performed well, but not quite as well as the sector. |

| | ● | | Performance of the Fund’s Technology investments was disappointing, particularly compared to the positive overall returns of the sector. While Perspecta and Hackett Group shares fell, the main cause of the Fund’s shortfall was a steep drop in the shares of Plantronics. We had been optimistic that the company’s acquisition of Polycom would drive a large uptick in earnings, but poor execution on the integration and some product transitions drove large earnings shortfalls. We sold the stock after the decline in earnings created concerns about its ability to remain in compliance with its debt covenants. |

In conclusion, we thank you for investing alongside us in the Keeley Small Cap Dividend Value Fund.

4

| | | | | | | | | | | | | | |

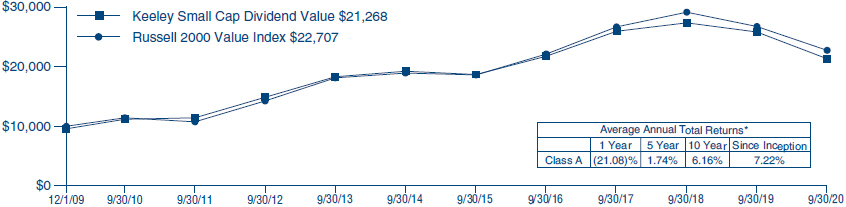

Average Annual Returns Through September 30, 2020 (a) (Unaudited) | |

| | | 1 Year | | | 5 Year | | 10 Year | | Since

Inception

(12/01/09) | | | |

Small Cap Dividend Value Fund Class A | | | (21.08) | % | | 1.74% | | 6.16% | | 7.22% | | | | |

Russell 2000 Value Index | | | (14.88) | | | 4.11 | | 7.09 | | 7.86 | | | | |

In the current prospectuses dated January 28, 2020, the proforma expense ratio for Class A Shares is 1.60%, and the net expense ratio is 1.44% after contractual reimbursements by Keeley-Teton Advisors, Inc. (the Adviser). See page 22 for the expense ratios for the year ended September 30, 2020. Class A Shares have a maximum sales charge of 4.50%, which is included in the figures. | |

(a) Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.keeleyfunds.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.keeleyfunds.com. Another share class is available and has different performance characteristics. See page 2 for performance of the other share class. The Russell 2000 Value Index ® is an unmanaged index that measures the performance of the small-cap value segment of the U.S. equity market universe and includes those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000® Index is an unmanaged index that measures the performance of the smallest 2,000 companies by market capitalization of the Russell 3000® Index. Investing in small capitalization securities involves special challenges because these securities may trade less frequently and experience more abrupt price movements than large capitalization securities. Dividends are considered reinvested. You cannot invest directly in an index. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE SMALL CAP DIVIDEND VALUE FUND CLASS A AND THE RUSSELL 2000 VALUE INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

5

Small-Mid Cap Value Fund (Unaudited)

To Our Shareholders,

The last several years have been difficult times to be a value investor. This has been doubly true for small- and mid-cap value investors. Large cap stocks have dramatically outperformed their small-cap brethren and simple, secular growth stories have worked regardless of their valuation while stocks of companies in change have found it difficult to gain traction. This created a tough environment for the Keeley Small-Mid Cap Value fund and it slightly lagged its benchmark over the last year. Later in this letter, we will outline some of the specific reasons for the underperformance, but we first wanted to talk about the areas of the market that we find interesting and discuss how we are positioning the Fund.

Over the last year, the Russell 2500 Index, an Index of small- and mid-cap stocks (SMID), rose 2%. This compares with a 20% increase in the Russell Top 200, an Index of large-cap stocks. This has been going on for several years so that the spread between the 200 and 2500 is 10% annualized over three years and 7% annualized over five years. If we look at the performance of value stocks and growth stocks, we see a similar trend with the Russell 2500 Growth Index outperforming the Russell 2500 Value Index by 36%, 16%, and 10% annualized over the one, three, and five-year periods.

This is not the first time, large cap stocks have outperformed SMID stocks or growth stocks have outperformed value stocks for a multi-year. Performance of asset sub-classes has tended to unfold in multi-year cycles. The length of the cycles has varied, but tends to run until it stops. Valuation can sometimes give clues to whether or not the cycle has nearly reached its end, but not always. It also may be more effective at identifying when a value cycle will end than a growth cycle. We would note that the five-year annualized return spread in favor of growth has only been this wide during the last forty years in the period from 1998-2000 and has only favored large caps by this much in February 2000.

Some of the areas in which the Keeley Small-Mid Cap Value Fund has historically invested have been challenging over the last several years. For example, the Fund has always looked at investing in companies after they were spun-out of other companies. A significant number of academic studies have documented the effectiveness of this strategy going as far back as 1965. In the last several years, these stocks have not performed as well. The 2016 vintage performed okay, but 2017 underperformed and 2018 was dismal. It is too early to evaluate 2019. We do not think anything has fundamentally changed in why these stocks have historically been attractive and we think this will once again be a fruitful area for investment.

We are also looking at some additional areas to target our efforts. For example, our research suggests that stocks which have underperformed, but where there has been a change in CEO offer potential once the new leader has had the opportunity to implement some changes. We are more systematically evaluating this universe of stocks.

We believe that investing in corporate change will always be an area where research and active management can produce benchmark-beating returns. Because there may be a lack of information or because it may be difficult to analyze, it is likely to remain an area that we can find stocks that are misunderstood. Overall, we are very optimistic about the prospects for the Keeley Small-Mid Cap Value Fund.

Portfolio Results

In the fiscal year ended September 30, 2020, the Keeley Small Mid Cap Value Fund’s net asset value (NAV) total return declined 14.9% compared with a 12.6% decline in total return for its benchmark, the Russell 2500 Value Index.

When we disaggregate relative performance into the impact from Sector Allocation decisions and the impact from Stock Selection efforts, we find that Sector Allocation contributed a very slight amount to relative performance while Stock Selection accounted for the relative underperformance. Despite minimal net impact from Sector Allocation, the Fund’s overweights and underweights impacted returns in specific sectors. Overweights in the Industrials and Technology sectors helped the Fund. Underweights in the Financials and Real Estate Sectors also helped. On the other hand, an underweight position in the Health Care sector hurt performance. From a Stock Selection standpoint, the Fund’s holdings in the Industrials, Financials, and Utilities sectors performed better than those sectors in the Index, while its holdings in Consumer Discretionary, Technology, and Communications Services lagged those of the benchmark.

| | ● | | The Industrials sector posted a positive return of more than 6%, while the benchmark was negative by about 5%. Strong gains from Chart Industries, Fortune Brands Home & Security and auto auction firms Copart and IAA accounted for most of the superior performance. Chart capitalized on COVID-19 through a significant amount of orders from industrial gas customers that provide oxygen to hospitals and through a faster focus on renewable energy projects due to various stimulus packages approved around the world. Fortune Brands Home & Security, whose brands include Moen plumbing and Omega cabinets, saw strength from homebound consumers’ reemphasis on repair and remodel of their homes, as well as from accelerated new housing starts. The auto auction firms benefited from very strong demand for cars – and not enough supply – as well as from improved volumes as more drivers got back on the road and from an ongoing business shift to online auctions only. |

| | ● | | The Financial sector was down more than 20% for the year, but the Fund’s Stock Selection significantly helped performance. Brightsphere Investment Group was the only real bright spot, but several other stocks produced gains in a sector that performed notably badly. Banks such as PacWest Bancorp and Synovus Financial were the leading detractors in the sector. |

| | ● | | The Utilities sector was surprisingly disappointing over the last year in light of the volatility in the stock market and the plunge in interest rates. It performed worse than the benchmark with a loss of a little more than 20%. The Fund’s holding performed much better, largely on the strength of the shares of American Water Works. The stock screens well on ESG criteria and flows into those strategies seem to have boosted the shares of stocks that score well. The Fund’s other three utility stocks performed largely in line with the sector. |

| | ● | | The Consumer Discretionary sector was negative for the year, and the Fund’s performance was dragged down more by lodging-related stocks. Playa Hotels & Resorts and Ryman Hospitality Group both were negatively affected by pandemic-related travel restrictions, which brought revenues to near-zero. Both firms are on a slow road back as they reopen their destination hospitality locations. The pain in lodging overshadowed good performance from homebuilder TRI Pointe Group, which |

6

| | benefited from continued pandemic-fueled housing demand, and from boat- and engine-maker Brunswick Corporation, which saw a quick rebound in the marine market. |

| | ● | | The overall Technology sector eked out small gains in the just-ended fiscal year, but the Fund’s holdings fell. While the Fund had a couple of big winners with TTEC Holdings (outsourced customer experience) and Black Knight (mortgage processing), they were more than offset by declines in WEX Inc. (transaction processing for transportation), Extreme Networks (networking equipment), and GTY Technology (IT Services to state and local governments). WEX’s fuel card services are being used less leading to lower revenues and earnings, while Extreme and GTY have found it more difficult to close new business. |

| | ● | | The Fund’s underperformance in the Materials sector was entirely due to weakness from Kaiser Aluminum, which encountered dramatically slower production from both its aerospace and its automotive end markets. While the company is guiding to a nice rebound in automotive, expectations remain low for any rebound in aerospace, given COVID-19 and lower aviation travel. Kaiser’s underperformance more than overshadowed good performance from the Fund’s three other Materials names, including Valvoline and Huntsman. |

In conclusion, we thank you for investing alongside us in the Keeley Small Mid Cap Value Fund.

7

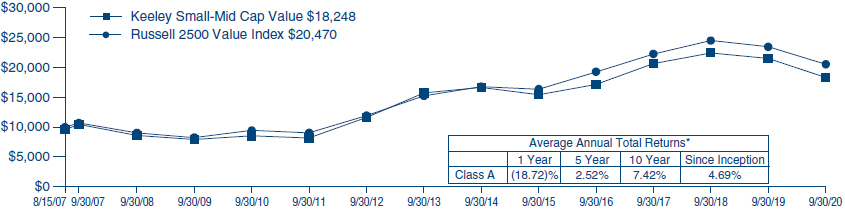

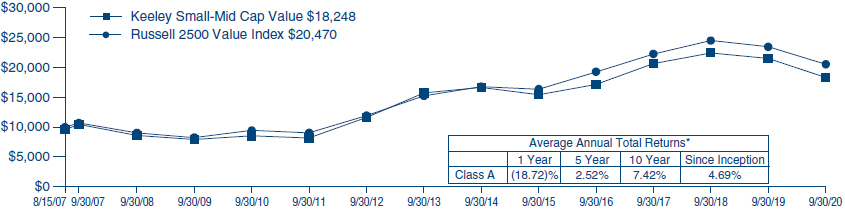

| | | | | | | | |

| Average Annual Returns through September 30, 2020 (a) (Unaudited) | | 1 Year | | 5 Year | | 10 Year | | Since

Inception

(8/15/2007) |

Small-Mid Cap Value Fund Class A | | (18.72)% | | 2.52% | | 7.42% | | 4.69% |

Russell 2500 Value Index | | (12.62)% | | 4.65% | | 8.01% | | 5.61% |

In the current prospectuses dated January 28, 2020, the gross expense ratio for Class A Shares is 1.53%, and net expense ratio is 1.40% after contractual reimbursements by Keeley-Teton Advisors, Inc. (the Adviser). See page 23 for the expense ratios for the year ended September 30, 2020. Class A Shares have a maximum sales charge of 4.50%, which is included in the figures. |

(a) Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.keeleyfunds.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.keeleyfunds.com. Another share class is available and has different performance characteristics. See page 2 for performance of other share class. The Russell 2500® Value Index is an unmanaged index that measures the performance of the small to mid-cap value segment of the U.S. equity universe and includes those Russell 2500® Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2500® Index is an unmanaged index that measures the performance of the 2,500 smallest companies by market capitalization of the Russell 3000® Index. Dividends are considered reinvested. You cannot invest directly in an index. |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE SMALL-MID CAP VALUE FUND CLASS A AND THE RUSSELL 2500 VALUE INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

8

Mid Cap Dividend Value Fund (Unaudited)

To Our Shareholders,

It has been a tough year to be a value investor. It has been tougher to be a mid cap value investor. It has been even tougher to be a mid cap value investor focused on dividend-paying stocks.

For large-cap stocks as measured by the S&P 500 Index, the year ending September 30, 2020 turned out to be a pretty good year. While it had some scary moments, it ended up about 15% for the twelve months. The even larger cap Russell Top 200 gained an even more impressive 20%! As you go down the capitalization spectrum, however, things fall off. The Russell Mid Cap Index gained only 4.6% and the Russell 2000 Index barely broke even.

Returns were concentrated in the top megacap growth companies. The three largest contributors (Apple, Microsoft, and Amazon) to the Russell Top 200’s gains contributed twelve percentage points of the index’s total return despite being only fourteen percent of the Index at the beginning of the period. The top seventeen contributors accounted for all of the Index’s total return. That would not be unusual in a year of very modest returns, but it seems unusual in a year with strong gains. As a point of reference, in 2017 the Russell Top 200 was up 23%, but it took 112 stocks to account for all the Index’s gains. You see a similar trend in 2009 and 2012 where it took 79 and 111 stocks to account for the gains, although 1999’s strong gains were driven by just 25 stocks.

While the market’s gains were driven by the mega cap growth stocks, mid-cap and small-cap growth stocks also dramatically outperformed value stocks. In each of the three capitalization ranges, growth stocks produced strong returns while value stocks generated negative returns. For the Russell Top 200, the spread between growth and value was a stunning 45%, plus 41% for the Russell Top 200 Growth vs. negative 4% for the Russell Top 200 Value Index. In mid-cap and small-cap, the spread was a more modest 31%, but the gains were smaller for growth and the losses were larger for value. For large-cap stocks, the spread between the performance of growth and value stocks has never been this wide. For mid-cap and small-cap stocks, the performance was even wider in the late-90s. At the end of February 2000, the trailing twelve-month performance of the Russell MidCap Growth Index was a positive 87% compared to a negative 6% for the Russell MidCap Value Index! Those were also tough times to be a value manager, but those who survived saw great things in the following years.

We probably do not need to list another reason why the year 2020 is unusual, but we will because it explains much of the reason for why Keeley’s Dividend Value Funds have not performed as well as we expected in a volatile and down market. The strategy of buying stocks of companies that pay dividends has not worked over the last year. The last year has been one where unprofitable companies have been the best performers. The 496 companies in the Russell 3000 Index that were expected to be unprofitable this year on September 30, 2019 are up 40.5% on average, while the 2,326 companies that were expected to be profitable have seen their stocks fall 4.4% on average. The other ~200 did not have consensus earnings estimates.

Typically, dividend-paying stocks provide good participation in rising markets and very good protection in falling markets. That has not been the case over the last year. When the markets sold off sharply in the first calendar quarter, dividend-paying stocks fell along with the rest of them as Financials fell on rising credit concerns and REITs fell on concerns about what widespread lockdowns would do to the tenants of the companies. As the market has rebounded, it has been led by sectors that generally have a low propensity to pay dividends (Technology and Health Care) or have a small representation in the small- and mid-cap indices (Consumer Staples).

Over the last year, dividend-paying stocks in the Russell MidCap Value Index have fallen 9.4% compared to a 7.3% decline for the Index overall and a 3.6% gain for the non-dividend-paying stocks. In the Russell 2000 Value Index, the spread was even wider; -22.5% for dividend-payers vs. -14.9% for the Index and +1.2% for non-dividend-payers. These are historically wide spreads. It is interesting that the other years where we saw non-dividend paying stocks outperform dividend paying stocks by this magnitude have generally been years when an economic recovery began. It seems that 2020 qualifies for this definition, but it was also a year when an economic downturn began.

To recap: Large cap stocks trounced small cap stocks, growth stocks outperformed value stocks, and non-dividend-paying stocks beat dividend-paying stocks. That is the worst possible combination for our dividend-focused strategies. So, where do we go from here?

We are actually quite optimistic. First, the long-term records of small-cap stocks, value stocks, and dividend-paying stocks is superior to that of large-cap stocks, growth stocks, and non-dividend-paying stocks. There have certainly been periods in the past where these types of stocks lagged, and there will almost certainly be periods where they underperform in the future. It is very hard to pick the timing on the change in these cycles and we would have expected a turn sooner. We have thought that value stocks were undervalued relative to growth stocks all year, and small-cap stocks have been attractive relative to large cap stocks based on historical patterns. We can now point to an additional reason to be bullish on small and mid-cap dividend-paying stocks. They are attractive from the standpoint of generating income! Small-cap (and mid-cap) dividend-paying stocks yield more than large-cap dividend-paying stocks, which in turn yield more than bonds.

In response to the slowing economy brought on by the lockdown measures to control the spread of the COVID-19 pandemic, the Fed cut short-term rates aggressively. This dragged down long-term rates as well. Even with rates moving a little higher recently, the yield on the ten-year treasury remains well below 1% and near historic lows. The rise in the overall market offset a little by slightly higher dividend payouts has reduced the yield on the market as measured by the larger cap focused indices (Russell Top 200), but not as much as the fall in the ten-year yield. As a result, RT200 yield/10-year Treasury yield has risen to 235% at the end of the third quarter compared to 91% at year-end. While equities have yielded more than Treasuries before, this condition is unusual as it has only happened in about 11% of months since 1978.

Even more unusual is the relationship between the yield on small cap stocks and large cap stocks. The yield on small caps has been higher than that of large caps since June and at the end of September, the yield on the Russell 2000 was 1.64% vs. 1.62% for the Russell Top 200. That has only happened in about 8% of months since 1978. Almost all of these months were between 1998 and 2001. The combination of higher equity yields and higher small cap yields never happened before June.

If we dig deeper and only compare the yields on dividend-paying stocks, the income advantage increases. The average yield on dividend paying stocks in the Russell Top 200 is now 2.63% whereas the average yield on the dividend-paying stocks in the Russell 2000 is an impressive 3.72%. These are up from 2.42% and 2.99% at year-end. While yields have fallen broadly in the capital and money markets, the decline in share prices has more than offset cuts in dividends so that dividend-paying equities are attractive from a yield perspective.

9

So what does this all mean? We think these conditions point to a couple things. First, there is likely more skepticism about whether smaller companies will be able to sustain their dividends than exists for larger companies. This is partly correct, in our opinion, although smaller companies have been quicker to reduce or suspend dividends so far. The reason for the potential vulnerability is that nearly 40% of the dividends in the Russell 2000 come from Financials stocks. So far, they have not cut dividends much, but if the recovery stalls, they may have to boost reserves further which might necessitate dividend cuts. By contrast, almost 50% of dividends in the Russell Top 200 come from Technology, Healthcare, and Consumer Staples, sectors that have seen some positive impacts from the COVID-19 pandemic.

The other takeaway is that there are still a lot of stocks that could be significantly undervalued. While the 2020 and 2021 outlooks are lower, the longer-term prospects for many companies may not have changed significantly (although the outlook for some has). It is our job to find those and we are confident that we will be able to do so.

Portfolio Results

In the fiscal year ended September 30, 2020, the Keeley Mid Cap Dividend Fund’s net asset value (NAV) total return declined 13.4% compared with a 7.3% decline in total return for its benchmark, the Russell MidCap Value Index. We believe the Fund trailed its benchmark, and our expectations, primarily for the reasons we have explained above but we will provide more detail on the performance of the Fund in the next few paragraphs.

When we disaggregate relative performance into the impact from Sector Allocation decisions and the impact from Stock Selection efforts, we find that Sector Allocation detracted a very slight amount from relative performance while Stock Selection produced the vast majority of relative underperformance. While the Fund is relatively sector neutral, we find that an overweight in the strong performing Materials sector provided a lift, while a small underweight in the strong-performing Technology sector hurt relative performance. Our Stock Selection decisions had the biggest positive impact in the Financial sector, while the Fund’s holdings in the Communication Services, Technology and Industrials sectors were the biggest laggards.

| | ● | | The Financial sector declined more than the overall Index, but the Fund’s holdings meaningfully outperformed those of the index. Strong gains in the shares of Ameriprise and Virtu Financial accounted for most of the superior performance. Ameriprise’s shares ran up after strong net flows. Virtu, on the other hand, is a market-maker of a wide variety of financial instruments around the world and benefitted from a pick-up in volumes and volatility. Some of the Fund’s holdings in bank stocks, such as Comerica and Popular, detracted as investors feared a replay of the Global Financial Crisis, while others, like Umpqua Holdings, held up relatively better. |

| | ● | | The Communication Services sector was the biggest detractor for the Fund. Both Fund holdings in the sector underperformed, although broadcaster Nexstar Holdings only lagged by a modest amount on a relative basis and should perform well as it reports results from 2020 political advertising. The Fund’s other holding, film exhibitor Cinemark Holdings, dramatically declined as COVID-19 shutdowns reduced Cinemark’s revenues to near-zero. We remain confident that Cinemark can rebound with patrons returning to theaters once a vaccine is developed. |

| | ● | | Performance of the Fund’s Technology investments was disappointing, particularly compared to the positive overall returns of the sector. While audio technology firm Dolby Laboratories was up nicely, it wasn’t enough to offset declines at government IT services firm Perspecta and automotive IT provider CDK Global. Perspecta underperformed both the benchmark and its government IT services peers after it lost its largest contract early in 2020. |

| | ● | | Industrials were a mixed bag for the Fund, which was not good enough in a sector that performed better than the overall market. While the Fund benefitted from strong gains in building products manufacturer Fortune Brands Home and Security and infrastructure builder Quanta Services, weakness in GrafTech International, Air Lease, and nVent more than offset these gains. GrafTech supplies electrodes used in steelmaking while Air Lease is a leading lessor of commercial aircraft. These businesses have been more negatively impacted by the deterioration in the economy related to the COVID pandemic than most other companies. |

In conclusion, we thank you for investing alongside us in the Keeley Mid Cap Dividend Value Fund.

10

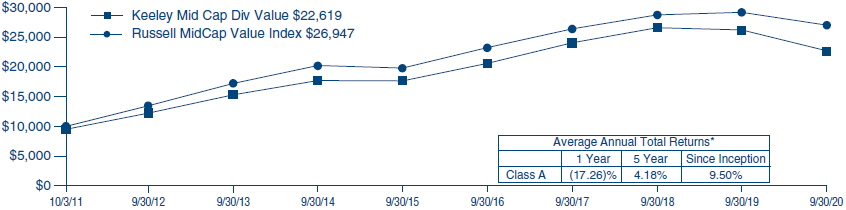

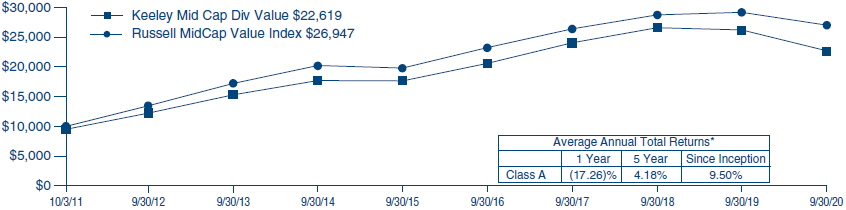

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Returns Through September 30, 2020 (a) (Unaudited) | |

| | | | | | 1 Year | | | 5 Year | | | Since

Inception

(10/03/11) | | | | |

Mid Cap Dividend Value Fund Class A | | | | | | | (17.26)% | | | | 4.18% | | | | 9.50% | | | | | |

Russell MidCap Value Index | | | | | | | (7.30) | | | | 6.38 | | | | 11.65 | | | | | |

In the current prospectuses dated January 28, 2020, the gross expense ratio for Class A Shares is 1.39%, and the net expense ratio is 1.22%, after contractual reimbursements by Keeley-Teton Advisors, Inc. (the Adviser). See page 24 for the expense ratios for the year ended September 30, 2020. Class A Shares have a maximum sales charge of 4.50% which is included in the figures. (a) Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.keeleyfunds.com for performance information as of the most recent month end. The Adviser reimbursed expenses to limit the expense ratio. Had such limitation not been in place, returns would have been lower. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.keeleyfunds.com. Another share class is available and has different performance characteristics. See page 2 for performance of the other share class. The Russell Midcap® Value Index is an unmanaged index that measures the performance of the mid-cap value segment of the U.S. equity universe and includes those Russell Midcap Index companies with lower price-to-book ratios and lower forecasted growth values. The Russell Midcap® Index is an unmanaged index that measures the performance of the 800 smallest companies by market capitalization of the Russell 1000® Index. Dividends are considered reinvested. You cannot invest directly in an index. | |

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN THE MID CAP DIVIDEND VALUE FUND CLASS A AND THE RUSSELL MIDCAP VALUE INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

11

KEELEY Funds

Disclosure of Fund Expenses (Unaudited)

For the Six Month Period from April 1, 2020 through September 30, 2020

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All mutual funds have operating expenses. As a shareholder of a fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways:

Actual Fund Return: This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’s actual return during the past six months, and the Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value

divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return: This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown. In this case – because the hypothetical return used is not the Fund’s actual return – the results do not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which are described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The ���Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the fiscal year ended September 30, 2020.

Expense Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual Fund Return | | Hypothetical 5% Return |

| | | Beginning

Account Value 04/01/20 | | Ending

Account Value

09/30/20 | | Annualized

Expense

Ratio | | | Expenses

Paid During

Period* | | Beginning

Account Value

04/01/20 | | Ending

Account Value

09/30/20 | | | Annualized

Expense

Ratio | | | Expenses

Paid During

Period* | |

KEELEY Small Cap Dividend Value Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,219.10 | | | | 1.29% | | | | $7.16 | | | | $1,000.00 | | | | $1,018.55 | | | | 1.29% | | | | $6.51 | |

Class I | | | $1,000.00 | | | | $1,221.10 | | | | 1.04% | | | | $5.77 | | | | $1,000.00 | | | | $1,019.80 | | | | 1.04% | | | | $5.25 | |

KEELEY Small-Mid Cap Value Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,305.80 | | | | 1.39% | | | | $8.01 | | | | $1,000.00 | | | | $1,018.05 | | | | 1.39% | | | | $7.01 | |

Class I | | | $1,000.00 | | | | $1,307.50 | | | | 1.14% | | | | $6.58 | | | | $1,000.00 | | | | $1,019.30 | | | | 1.14% | | | | $5.76 | |

KEELEY Mid Cap Dividend Value Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | $1,000.00 | | | | $1,228.10 | | | | 1.20% | | | | $6.68 | | | | $1,000.00 | | | | $1,019.00 | | | | 1.20% | | | | $6.06 | |

Class I | | | $1,000.00 | | | | $1,229.80 | | | | 0.95% | | | | $5.30 | | | | $1,000.00 | | | | $1,020.25 | | | | 0.95% | | | | $4.80 | |

| * | Expenses are equal to the Funds’ annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (183 days), then divided by 366. |

12

Summary of Portfolio Holdings (Unaudited)

The following tables present portfolio holdings as a percent of net assets as of September 30, 2020:

| | | | | | | | | | | | | | |

KEELEY Small Cap Dividend Value Fund | |

Financial Services | | | 17.2 | % | | | | | | Paper and Forest Products | | | 2.2 | % |

Energy and Utilities | | | 13.4 | % | | | | | | Hotels and Gaming | | | 1.7 | % |

Banking | | | 13.1 | % | | | | | | Automotive | | | 1.7 | % |

Health Care | | | 8.9 | % | | | | | | Electronics | | | 1.5 | % |

Building and Construction | | | 7.0 | % | | | | | | Equipment and Supplies | | | 1.3 | % |

Business Services | | | 6.2 | % | | | | | | Consumer Services | | | 1.2 | % |

Diversified Industrial | | | 4.8 | % | | | | | | Machinery | | | 0.9 | % |

Computer Software and Services | | | 3.8 | % | | | | | | Entertainment | | | 0.4 | % |

Retail | | | 3.5 | % | | | | | | Other Assets and Liabilities (Net) | | | 0.0 | %* |

| | | | | | | | | | | | | | |

Metals and Mining | | | 3.3 | % | | | | | | | | | 100.0 | % |

| | | | | | | | | | | | | | |

Consumer Products | | | 3.1 | % | | | | | | * Amount represents less than 0.05%. | | | | |

Other Investment Companies | | | 2.4 | % | | | | | | | | |

Broadcasting | | | 2.4 | % | | | | | | | | |

KEELEY Small-Mid Cap Value Fund | | | | | | | |

Financial Services | | | 16.7 | % | | | | | | Banking | | | 3.3 | % |

Diversified Industrial | | | 12.5 | % | | | | | | Broadcasting | | | 2.6 | % |

Energy and Utilities | | | 11.6 | % | | | | | | Other Investment Companies | | | 2.4 | % |

Computer Software and Services | | | 7.8 | % | | | | | | Equipment and Supplies | | | 1.4 | % |

Building and Construction | | | 7.0 | % | | | | | | Food and Beverage | | | 1.3 | % |

Health Care | | | 6.2 | % | | | | | | Automotive: Parts and Accessories | | | 1.0 | % |

Consumer Products | | | 5.8 | % | | | | | | Metals and Mining | | | 0.8 | % |

Business Services | | | 5.3 | % | | | | | | Other Assets and Liabilities (Net) | | | 0.4 | % |

| | | | | | | | | | | | | | |

Retail | | | 5.0 | % | | | | | | | | | 100.0 | % |

| | | | | | | | | | | | | | |

Hotels and Gaming | | | 4.7 | % | | | | | | | | | | |

Specialty Chemicals | | | 4.2 | % | | | | | | | | | | |

KEELEY Mid Cap Dividend Value Fund | |

Financial Services | | | 17.0 | % | | | | | | Other Investment Companies | | | 1.7 | % |

Energy and Utilities | | | 16.4 | % | | | | | | Metals and Mining | | | 1.6 | % |

Health Care | | | 9.6 | % | | | | | | Consumer Services | | | 1.4 | % |

Specialty Chemicals | | | 6.9 | % | | | | | | Real Estate | | | 1.3 | % |

Building and Construction | | | 6.8 | % | | | | | | Automotive: Parts and Accessories | | | 1.2 | % |

Business Services | | | 6.2 | % | | | | | | Broadcasting | | | 1.1 | % |

Hotels and Gaming | | | 4.2 | % | | | | | | Banking | | | 0.7 | % |

Consumer Products | | | 4.0 | % | | | | | | Equipment and Supplies | | | 0.5 | % |

Machinery | | | 3.8 | % | | | | | | Entertainment | | | 0.3 | % |

Diversified Industrial | | | 3.7 | % | | | | | | Other Assets and Liabilities (Net) | | | (0.2 | )% |

| | | | | | | | | | | | | | |

Electronics | | | 3.5 | % | | | | | | | | | 100.0 | % |

| | | | | | | | | | | | | | |

Computer Software and Services | | | 3.2 | % | | | | | | | | | | |

Food and Beverage | | | 3.1 | % | | | | | | | | | | |

Retail | | | 2.0 | % | | | | | | | | | | |

13

KEELEY Small Cap Dividend Value Fund

Schedule of Investments — September 30, 2020

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| | | |

| | COMMON STOCKS — 97.6% | | | | | | | | |

| | Automotive — 1.7% | | | | | | | | |

| 89,560 | | Winnebago Industries Inc. | | $ | 3,162,106 | | | $ | 4,627,565 | |

| | | | | | | | | | |

| | | |

| | Banking — 13.1% | | | | | | | | |

| 161,031 | | Atlantic Union Bankshares Corp. | | | 5,177,928 | | | | 3,441,232 | |

| 209,032 | | BancorpSouth Bank | | | 3,158,673 | | | | 4,051,040 | |

| 32,106 | | BOK Financial Corp. | | | 1,509,168 | | | | 1,653,780 | |

| 136,064 | | Columbia Banking System Inc. | | | 4,438,549 | | | | 3,245,126 | |

| 146,501 | | First Bancorp/Southern Pines NC | | | 3,056,959 | | | | 3,066,266 | |

| 114,040 | | Glacier Bancorp Inc. | | | 4,126,076 | | | | 3,654,982 | |

| 111,325 | | Independent Bank Group Inc. | | | 5,623,973 | | | | 4,918,339 | |

| 228,080 | | OceanFirst Financial Corp. | | | 5,728,888 | | | | 3,122,415 | |

| 30,773 | | Prosperity Bancshares Inc. | | | 2,133,492 | | | | 1,594,965 | |

| 184,509 | | The Bank of NT Butterfield & Son Ltd. | | | 6,373,488 | | | | 4,110,860 | |

| 71,210 | | Wintrust Financial Corp. | | | 4,128,862 | | | | 2,851,961 | |

| | | | | | | | | | |

| | | |

| | | | | 45,456,056 | | | | 35,710,966 | |

| | | | | | | | | | |

| | | |

| | Broadcasting — 2.4% | | | | | | | | |

| 72,073 | | Nexstar Media Group Inc., Cl. A | | | 3,337,896 | | | | 6,481,525 | |

| | | | | | | | | | |

| | |

| | Building and Construction — 7.0% | | | | | |

| 141,379 | | KB Home | | | 3,515,916 | | | | 5,427,540 | |

| 298,440 | | KBR Inc. | | | 4,624,224 | | | | 6,673,118 | |

| 382,350 | | Primoris Services Corp. | | | 7,000,737 | | | | 6,897,594 | |

| | | | | | | | | | |

| | | |

| | | | | 15,140,877 | | | | 18,998,252 | |

| | | | | | | | | | |

| | | |

| | Business Services — 6.2% | | | | | | | | |

| 403,649 | | City Office REIT Inc. | | | 4,715,552 | | | | 3,035,440 | |

| 201,200 | | Healthcare Services Group Inc. | | | 4,942,974 | | | | 4,331,836 | |

| 292,192 | | Outfront Media Inc., REIT | | | 7,457,300 | | | | 4,251,394 | |

| 141,486 | | STAG Industrial Inc., REIT | | | 3,816,814 | | | | 4,313,908 | |

| 93,415 | | The Hackett Group Inc. | | | 1,517,651 | | | | 1,044,380 | |

| | | | | | | | | | |

| | | |

| | | | | 22,450,291 | | | | 16,976,958 | |

| | | | | | | | | | |

| | |

| | Computer Software and Services — 3.8% | | | | | |

| 253,102 | | Perspecta Inc. | | | 5,874,853 | | | | 4,922,834 | |

| 102,707 | | TTEC Holdings Inc. | | | 3,897,678 | | | | 5,602,667 | |

| | | | | | | | | | |

| | | |

| | | | | 9,772,531 | | | | 10,525,501 | |

| | | | | | | | | | |

| | | |

| | Consumer Products — 3.1% | | | | | | | | |

| 296,263 | | Culp Inc. | | | 4,825,271 | | | | 3,679,586 | |

| 196,100 | | Kontoor Brands Inc. | | | 5,203,858 | | | | 4,745,620 | |

| | | | | | | | | | |

| | | |

| | | | | 10,029,129 | | | | 8,425,206 | |

| | | | | | | | | | |

| | | |

| | Consumer Services — 1.2% | | | | | | | | |

| 102,846 | | National Storage Affiliates Trust, REIT | | | 3,069,941 | | | | 3,364,093 | |

| | | | | | | | | | |

| | | |

| | Diversified Industrial — 4.8% | | | | | | | | |

| 34,569 | | ESCO Technologies Inc. | | | 1,139,096 | | | | 2,784,879 | |

| 144,813 | | Hillenbrand Inc. | | | 2,935,854 | | | | 4,106,897 | |

| 38,315 | | John Bean Technologies Corp. | | | 1,384,603 | | | | 3,520,765 | |

| 217,134 | | Olin Corp. | | | 3,872,429 | | | | 2,688,119 | |

| | | | | | | | | | |

| | | |

| | | | | 9,331,982 | | | | 13,100,660 | |

| | | | | | | | | | |

| | | |

| | Electronics — 1.5% | | | | | | | | |

| 61,417 | | Dolby Laboratories Inc., Cl. A | | | 3,865,277 | | | | 4,070,719 | |

| | | | | | | | | | |

| | | |

| | Energy and Utilities — 13.4% | | | | | | | | |

| 81,366 | | ALLETE Inc. | | | 3,462,582 | | | | 4,209,877 | |

| 302,139 | | Atlantica Sustainable Infrastructure plc. | | | 5,814,956 | | | | 8,644,197 | |

| 75,181 | | Black Hills Corp. | | | 4,271,362 | | | | 4,021,432 | |

| 298,069 | | Covanta Holding Corp. | | | 5,139,133 | | | | 2,310,035 | |

| 199,048 | | Delek U.S. Holdings Inc. | | | 4,675,366 | | | | 2,215,404 | |

| 18,845 | | Evolution Petroleum Corp. | | | 127,271 | | | | 42,213 | |

| 362,538 | | Parsley Energy Inc., Cl. A | | | 2,924,403 | | | | 3,393,356 | |

| 391,598 | | Primo Water Corp. | | | 5,064,532 | | | | 5,560,692 | |

| 207,675 | | South Jersey Industries Inc. | | | 6,541,456 | | | | 4,001,897 | |

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| | | |

| 4,626 | | Texas Pacific Land Trust | | $ | 1,807,428 | | | $ | 2,088,916 | |

| | | | | | | | | | |

| | | |

| | | | | 39,828,489 | | | | 36,488,019 | |

| | | | | | | | | | |

| | | |

| | Entertainment — 0.4% | | | | | | | | |

| 101,029 | | Cinemark Holdings Inc. | | | 3,737,463 | | | | 1,010,290 | |

| | | | | | | | | | |

| | | |

| | Equipment and Supplies — 1.3% | | | | | | | | |

| 39,230 | | Regal Beloit Corp. | | | 3,081,823 | | | | 3,682,520 | |

| | | | | | | | | | |

| | | |

| | Financial Services — 17.2% | | | | | | | | |

| 99,559 | | Air Lease Corp. | | | 2,072,330 | | | | 2,929,026 | |

| 319,155 | | Alpine Income Property Trust Inc., REIT | | | 5,801,520 | | | | 4,962,860 | |

| 571,407 | | Brightsphere Investment Group Inc. | | | 5,316,609 | | | | 7,371,150 | |

| 31,601 | | FBL Financial Group Inc., Cl. A | | | 1,308,116 | | | | 1,523,168 | |

| 385,330 | | FNB Corp. | | | 4,314,916 | | | | 2,612,537 | |

| 57,862 | | James River Group Holdings Ltd. | | | 1,938,161 | | | | 2,576,595 | |

| 690,877 | | Oaktree Specialty Lending Corp. | | | 3,723,399 | | | | 3,343,845 | |

| 180,716 | | Pacific Premier Bancorp Inc. | | | 3,781,933 | | | | 3,639,620 | |

| 258,017 | | Provident Financial Services Inc. | | | 3,497,582 | | | | 3,147,807 | |

| 213,983 | | Silvercrest Asset Management Group Inc., Cl. A | | | 1,986,907 | | | | 2,238,262 | |

| 105,368 | | Solar Capital Ltd. | | | 2,050,782 | | | | 1,670,083 | |

| 78,449 | | South State Corp. | | | 7,138,129 | | | | 3,777,319 | |

| 178,078 | | Synovus Financial Corp. | | | 4,598,571 | | | | 3,769,911 | |

| 151,450 | | Virtu Financial Inc., Cl. A | | | 3,272,779 | | | | 3,484,865 | |

| | | | | | | | | | |

| | | |

| | | | | 50,801,734 | | | | 47,047,048 | |

| | | |

| | Health Care — 8.9% | | | | | | | | |

| 257,154 | | CareTrust REIT Inc. | | | 3,073,038 | | | | 4,576,055 | |

| 13,584 | | Chemed Corp. | | | 4,708,526 | | | | 6,525,074 | |

| 360,825 | | Sabra Health Care REIT Inc. | | | 4,325,582 | | | | 4,973,973 | |

| 145,062 | | The Ensign Group Inc. | | | 2,561,519 | | | | 8,277,238 | |

| | | | | | | | | | |

| | | |

| | | | | 14,668,665 | | | | 24,352,340 | |

| | | | | | | | | | |

| | | |

| | Hotels and Gaming — 1.7% | | | | | | | | |

| 51,590 | | Marriott Vacations Worldwide Corp. | | | 4,899,200 | | | | 4,684,888 | |

| | | | | | | | | | |

| | | |

| | Machinery — 0.9% | | | | | | | | |

| 47,864 | | Astec Industries Inc. | | | 2,236,081 | | | | 2,596,622 | |

| | | | | | | | | | |

| | | |

| | Metals and Mining — 3.3% | | | | | | | | |

| 102,877 | | Compass Minerals International Inc. | | | 5,687,849 | | | | 6,105,750 | |

| 55,302 | | Kaiser Aluminum Corp. | | | 1,855,492 | | | | 2,963,634 | |

| | | | | | | | | | |

| | | |

| | | | | 7,543,341 | | | | 9,069,384 | |

| | | | | | | | | | |

| | |

| | Paper and Forest Products — 2.2% | | | | | |

| 566,648 | | Mercer International Inc. | | | 7,661,104 | | | | 3,739,877 | |

| 52,633 | | PotlatchDeltic Corp., REIT | | | 1,852,610 | | | | 2,215,849 | |

| | | | | | | | | | |

| | | |

| | | | | 9,513,714 | | | | 5,955,726 | |

| | | | | | | | | | |

| | | |

| | Retail — 3.5% | | | | | | | | |

| 53,702 | | Jack in the Box Inc. | | | 4,636,995 | | | | 4,259,106 | |

| 112,223 | | Penske Automotive Group Inc. | | | 2,028,811 | | | | 5,348,548 | |

| | | | | | | | | | |

| | | |

| | | | | 6,665,806 | | | | 9,607,654 | |

| | | | | | | | | | |

| | | |

| | TOTAL COMMON STOCKS | | | 268,592,402 | | | | 266,775,936 | |

| | | | | | | | | | |

| | | |

| | RIGHTS — 0.0% | | | | | | | | |

| | Broadcasting — 0.0% | | | | | | | | |

| 851,756 | | Media General Inc., CVR†(a) | | | 0 | | | | 1 | |

| | | | | | | | | | |

See accompanying notes to financial statements.

14

KEELEY Small Cap Dividend Value Fund

Schedule of Investments (Continued) — September 30, 2020

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| | |

| | SHORT TERM INVESTMENT — 2.4% | | | | | |

| | Other Investment Companies — 2.4% | | | | | |

| 6,591,757 | | Fidelity Government Portfolio,

Cl. I, 0.010%* | | $ | 6,591,757 | | | $ | 6,591,757 | |

| | | | | | | | | | |

| | | |

| | TOTAL

INVESTMENTS — 100.0% | | $ | 275,184,159 | | | | 273,367,694 | |

| | | | | | | | | | |

| | |

| | Other Assets and Liabilities (Net) — 0.0% | | | | (107,510 | ) |

| | | | | | | | | | |

| | | |

| | NET ASSETS — 100.0% | | | | | | $ | 273,260,184 | |

| | | | | | | | | | |

| * | 1 day yield as of September 30, 2020. |

| (a) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

| † | Non-income producing security. |

| CVR | Contingent Value Right |

| REIT | Real Estate Investment Trust |

See accompanying notes to financial statements.

15

KEELEY Small-Mid Cap Value Fund

Schedule of Investments — September 30, 2020

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| | COMMON STOCKS — 97.2% | | | | | |

| | Automotive: Parts and Accessories — 1.0% | | | | | |

| 5,594 | | Visteon Corp.† | | $ | 439,617 | | | $ | 387,217 | |

| | | | | | | | | | |

| | | |

| | Banking — 3.3% | | | | | | | | |

| 16,650 | | PacWest Bancorp | | | 558,028 | | | | 284,382 | |

| 16,695 | | The Bank of NT Butterfield & Son Ltd | | | 463,391 | | | | 371,965 | |

| 29,571 | | Umpqua Holdings Corp. | | | 508,189 | | | | 314,044 | |

| 6,700 | | Wintrust Financial Corp. | | | 317,629 | | | | 268,335 | |

| | | | | | | | | | |

| | | |

| | | | | 1,847,237 | | | | 1,238,726 | |

| | | | | | | | | | |

| | | |

| | Broadcasting — 2.6% | | | | | | | | |

| 10,525 | | Nexstar Media Group Inc., Cl. A | | | 763,188 | | | | 946,513 | |

| | | | | | | | | | |

| | |

| | Building and Construction — 7.0% | | | | | |

| 11,589 | | Fortune Brands Home & Security Inc. | | | 180,112 | | | | 1,002,680 | |

| 40,991 | | KBR Inc. | | | 672,528 | | | | 916,559 | |

| 36,589 | | TRI Pointe Group Inc.† | | | 417,526 | | | | 663,724 | |

| | | | | | | | | | |

| | | |

| | | | | 1,270,166 | | | | 2,582,963 | |

| | | | | | | | | | |

| | | |

| | Business Services — 5.3% | | | | | | | | |

| 11,788 | | IAA Inc.† | | | 401,756 | | | | 613,801 | |

| 6,975 | | Lamar Advertising Co., Cl. A, REIT | | | 238,207 | | | | 461,536 | |

| 19,400 | | Outfront Media Inc., REIT | | | 297,896 | | | | 282,270 | |

| 4,279 | | WEX Inc.† | | | 142,614 | | | | 594,653 | |

| | | | | | | | | | |

| | | |

| | | | | 1,080,473 | | | | 1,952,260 | |

| | | | | | | | | | |

| | |

| | Computer Software and Services — 7.8% | | | | | |

| 8,207 | | Black Knight Inc.† | | | 119,475 | | | | 714,419 | |

| 11,306 | | CDK Global Inc. | | | 307,823 | | | | 492,829 | |

| 16,868 | | Perspecta Inc. | | | 369,786 | | | | 328,083 | |

| 12,200 | | Teradata Corp.† | | | 256,442 | | | | 276,940 | |

| 11,638 | | TTEC Holdings Inc. | | | 439,324 | | | | 634,853 | |

| 8,997 | | Verint Systems Inc.† | | | 257,179 | | | | 433,475 | |

| | | | | | | | | | |

| | | |

| | | | | 1,750,029 | | | | 2,880,599 | |

| | | | | | | | | | |

| | | |

| | Consumer Products — 5.8% | | | | | | | | |

| 11,308 | | Brunswick Corp. | | | 588,779 | | | | 666,154 | |

| 22,020 | | Kontoor Brands Inc. | | | 459,793 | | | | 532,884 | |

| 6,936 | | PVH Corp. | | | 529,494 | | | | 413,663 | |

| 9,102 | | Spectrum Brands Holdings Inc. | | | 460,065 | | | | 520,270 | |

| | | | | | | | | | |

| | | |

| | | | | 2,038,131 | | | | 2,132,971 | |

| | | | | | | | | | |

| | | |

| | Diversified Industrial — 12.5% | | | | | | | | |

| 12,014 | | Altra Industrial Motion Corp. | | | 429,964 | | | | 444,158 | |

| 11,043 | | Chart Industries Inc.† | | | 343,126 | | | | 775,992 | |

| 10,534 | | ESCO Technologies Inc. | | | 366,149 | | | | 848,619 | |

| 44,627 | | GrafTech International Ltd. | | | 464,253 | | | | 305,249 | |

| 27,500 | | Harsco Corp.† | | | 379,523 | | | | 382,525 | |

| 10,463 | | ITT Inc. | | | 189,635 | | | | 617,840 | |

| 9,069 | | John Bean Technologies Corp. | | | 92,598 | | | | 833,350 | |

| 24,765 | | nVent Electric plc | | | 607,535 | | | | 438,093 | |

| | | | | | | | | | |

| | | |

| | | | | 2,872,783 | | | | 4,645,826 | |

| | | | | | | | | | |

| | | |

| | Energy and Utilities — 11.6% | | | | | | | | |

| 5,627 | | American Water Works Co. Inc. | | | 233,446 | | | | 815,240 | |

| 18,361 | | Delek U.S. Holdings Inc. | | | 399,256 | | | | 204,358 | |

| 38,800 | | Diamond S Shipping Inc.† | | | 284,634 | | | | 266,556 | |

| 9,482 | | Diamondback Energy Inc. | | | 620,635 | | | | 285,598 | |

| 7,164 | | Evergy Inc. | | | 389,577 | | | | 364,075 | |

| 27,935 | | MDU Resources Group Inc. | | | 549,395 | | | | 628,538 | |

| 22,643 | | NRG Energy Inc. | | | 210,596 | | | | 696,046 | |

| 32,993 | | Parsley Energy Inc., Cl. A | | | 554,959 | | | | 308,814 | |

| 35,731 | | Primo Water Corp. | | | 465,711 | | | | 507,380 | |

| 504 | | Texas Pacific Land Trust | | | 257,881 | | | | 227,586 | |

| | | | | | | | | | |

| | | |

| | | | | 3,966,090 | | | | 4,304,191 | |

| | | | | | | | | | |

| | | |

| | Equipment and Supplies — 1.4% | | | | | | | | |

| 10,074 | | A.O. Smith Corp. | | | 91,019 | | | | 531,907 | |

| | | | | | | | | | |

| | | | | | | | | | |

Shares | | | | Cost | | | Market

Value | |

| | | |

| | Financial Services — 16.7% | | | | | | | | |

| 24,734 | | Air Lease Corp. | | $ | 523,245 | | | $ | 727,674 | |

| 6,417 | | BOK Financial Corp. | | | 291,316 | | | | 330,540 | |

| 46,338 | | Brightsphere Investment Group Inc. | | | 441,751 | | | | 597,760 | |

| 38,935 | | Equitable Holdings Inc. | | | 792,735 | | | | 710,174 | |

| 18,300 | | FG New America Acquisition Corp.† | | | 183,000 | | | | 183,183 | |

| 38,529 | | FNB Corp. | | | 446,725 | | | | 261,227 | |

| 20,800 | | FS KKR Capital Corp. II | | | 272,026 | | | | 305,968 | |

| 2,923 | | Hudson Executive Investment Corp.† | | | 29,493 | | | | 30,428 | |

| 20,100 | | Live Oak Acquisition Corp., Cl. A† | | | 200,290 | | | | 202,608 | |

| 19,300 | | New Providence Acquisition Corp., Cl. A† | | | 193,386 | | | | 194,351 | |

| 12,233 | | Popular Inc. | | | 664,550 | | | | 443,691 | |

| 6,455 | | Prosperity Bancshares Inc. | | | 393,977 | | | | 334,563 | |

| 7,655 | | South State Corp. | | | 433,583 | | | | 368,588 | |

| 25,441 | | Synovus Financial Corp. | | | 783,040 | | | | 538,586 | |

| 12,000 | | Virtu Financial Inc., Cl. A | | | 276,707 | | | | 276,120 | |

| 14,546 | | Voya Financial Inc. | | | 357,861 | | | | 697,190 | |

| | | | | | | | | | |

| | | |

| | | | | 6,283,685 | | | | 6,202,651 | |

| | | | | | | | | | |

| | | |

| | Food and Beverage — 1.3% | | | | | | | | |

| 7,276 | | Lamb Weston Holdings Inc. | | | 271,846 | | | | 482,181 | |

| | | | | | | | | | |

| | | |

| | Health Care — 6.2% | | | | | | | | |

| 31,936 | | CareTrust REIT Inc. | | | 411,940 | | | | 568,301 | |

| 2,872 | | Laboratory Corp. of America Holdings† | | | 324,471 | | | | 540,711 | |

| 44,273 | | Sabra Health Care REIT Inc. | | | 629,870 | | | | 610,303 | |

| 10,151 | | The Ensign Group Inc. | | | 434,785 | | | | 579,216 | |

| | | | | | | | | | |

| | | |

| | | | | 1,801,066 | | | | 2,298,531 | |

| | | | | | | | | | |

| | | |

| | Hotels and Gaming — 4.7% | | | | | | | | |

| 17,071 | | Gaming and Leisure Properties Inc., REIT | | | 435,947 | | | | 630,432 | |

| 50,522 | | Playa Hotels & Resorts NV† | | | 407,828 | | | | 211,687 | |

| 21,819 | | VICI Properties Inc., REIT | | | 431,474 | | | | 509,910 | |

| 7,832 | | Wyndham Hotels & Resorts Inc. | | | 453,856 | | | | 395,516 | |

| | | | | | | | | | |

| | | |

| | | | | 1,729,105 | | | | 1,747,545 | |

| | | | | | | | | | |

| | | |

| | Metals and Mining — 0.8% | | | | | | | | |

| 5,234 | | Kaiser Aluminum Corp. | | | 135,672 | | | | 280,490 | |

| | | | | | | | | | |

| | | |

| | Retail — 5.0% | | | | | | | | |

| 11,708 | | Copart Inc.† | | | 177,758 | | | | 1,231,213 | |

| 13,129 | | Penske Automotive Group Inc. | | | 222,649 | | | | 625,728 | |

| | | | | | | | | | |

| | | |

| | | | | 400,407 | | | | 1,856,941 | |

| | | | | | | | | | |

| | | |

| | Specialty Chemicals — 4.2% | | | | | | | | |

| 6,939 | | Ashland Global Holdings Inc. | | | 31,687 | | | | 492,114 | |

| 26,070 | | Huntsman Corp. | | | 303,609 | | | | 579,015 | |

| 25,157 | | Valvoline Inc. | | | 169,754 | | | | 478,989 | |

| | | | | | | | | | |

| | | |

| | | | | 505,050 | | | | 1,550,118 | |

| | | | | | | | | | |

| | | |

| | TOTAL COMMON STOCKS | | | 27,245,564 | | | | 36,021,630 | |

| | | | | | | | | | |

| | |

| | SHORT TERM INVESTMENT — 2.4% | | | | | |

| | |

| | Other Investment Companies — 2.4% | | | | | |

| 901,214 | | Fidelity Government Portfolio, Cl. I, 0.010%* | | | 901,214 | | | | 901,214 | |

| | | | | | | | | | |

| | | |

| | TOTAL INVESTMENTS — 99.6% | | $ | 28,146,778 | | | | 36,922,844 | |

| | | | | | | | | | |

| | |

| | Other Assets and Liabilities (Net) — 0.4% | | | | 147,346 | |

| | | | | | | | | | |

| | |

| | NET ASSETS — 100.0% | | | $ | 37,070,190 | |

| | | | | | | | | | |

| * | 1 day yield as of September 30, 2020. |

| † | Non-income producing security. |

| REIT | Real Estate Investment Trust |

See accompanying notes to financial statements.

16

KEELEY Mid Cap Dividend Value Fund

Schedule of Investments — September 30, 2020

| | | | | | | | | | |

Shares | | | | Cost | | | Market Value | |

| | | |

| | COMMON STOCKS — 98.5% | | | | | | | | |

| | |

| | Automotive: Parts and Accessories — 1.2% | | | | | |

| 17,943 | | Autoliv Inc. | | $ | 1,272,146 | | | $ | 1,307,686 | |

| | | | | | | | | | |

| | |

| | Banking — 0.7% | | | | | |

| 68,709 | | Umpqua Holdings Corp. | | | 1,070,784 | | | | 729,690 | |

| | | | | | | | | | |

| | |

| | Broadcasting — 1.1% | | | | | |

| 14,208 | | Nexstar Media Group Inc., Cl. A | | | 1,406,874 | | | | 1,277,725 | |

| | | | | | | | | | |

| | |

| | Building and Construction — 6.8% | | | | | |

| 30,396 | | Fortune Brands Home & Security Inc. | | | 1,374,649 | | | | 2,629,862 | |

| 79,307 | | KB Home | | | 2,045,889 | | | | 3,044,596 | |

| 15,515 | | Vulcan Materials Co. | | | 1,495,648 | | | | 2,102,903 | |

| | | | | | | | | | |

| | | |

| | | | | 4,916,186 | | | | 7,777,361 | |

| | | | | | | | | | |

| | |

| | Business Services — 6.2% | | | | | |

| 63,326 | | Hudson Pacific Properties Inc., REIT | | | 2,041,465 | | | | 1,388,739 | |

| 61,426 | | Iron Mountain Inc., REIT | | | 1,779,674 | | | | 1,645,603 | |

| 25,013 | | Lamar Advertising Co., Cl. A, REIT | | | 1,451,089 | | | | 1,655,110 | |