Exhibit 99.1

2012 Global Consumer Conference May 23, 2012 RUTH’S HOSPITALITY GROUP citi

This communication contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may”, “will”, “expect,” “intend,” “indicate,” “anticipate,” “believe,” “forecast,” “estimate,” “plan,“ “guidance,” “outlook,” “could, “ “should,” “continue” and similar terms used in connection with statements regarding the outlook of Ruth’s Hospitality Group, Inc., (the “Company”, “Ruth’s Chris Steak House”, “Mitchell’s Fish Market”, “Ruth’s Hospitality” or any subsidiary or division of Ruth’s Hospitality Group). Such statements include, but are not limited to, statements about the Company’s: expected financial performance and operations, expected costs, the competitive environment, future financing plans and needs, overall economic condition and its business plans, objectives, expectations and intentions. Other forward-looking statements that do not relate solely to historical facts include, without limitation, statements that discuss the possible future effects of current known trends or uncertainties or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed or assured. Such statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties that could cause the Company’s actual results and financial position to differ materially from the Company’s expectations. Such risks and uncertainties include, but are not limited to, the following: market volatility, risks from food safety or food-borne illness, the impact of negative publicity surrounding our restaurants or the consumption of beef or seafood, the impact on revenues of shifts in customers tastes, our ability to compete with other restaurant concepts who may have greater financial, marketing and other resources, supply shortages, increased food, beverage, labor or other costs, significant disruptions in the supply of food and beverages by our suppliers, labor shortages or increases in labor costs/benefits, federal/state/local regulations, operational shortcomings of our franchisees that may be affect or reputation and brand, reduced royalty revenues from our franchisees, litigation, restrictions from our senior credit agreement that may restrict our ability to operate our business and pursue other business strategies, a potential impairment in the carrying value of our goodwill or other intangible assets, economic downturns and the impact on consumer spending habits, failure or weakness of our internal controls, and other risks and uncertainties listed from time to time in the Company’s reports to the Securities and Exchange Commission. There may be other factors not identified above of which the Company is not currently aware that may affect matters discussed in the forward-looking statements, and may also cause actual results to differ materially from those discussed. All forward-looking statements are based on information currently available to the Company. Except as may be required by applicable law, Ruth’s Hospitality Group assumes no obligation to publicly update or revise any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting such estimates. Additional factors that may affect the future results of the Company are set forth in the section entitled “Risk Factors” in the Company’s Annual Report on Form 10-K for the period ended December 25, 2011, or as supplemented in the Company’s subsequently filed periodic reports, which are available at www.sec.gov and at www.rhgi.com. Disclaimer Ruth’s Hospitality Group Highlights

Leading restaurant company focused on the upscale dining segment –Iconic Steak House Brand –Premier Upscale-Casual Seafood Concept Strong restaurant base with solid unit economics –Well established, diversified operating base of company owned and franchise locations –Profitable with consistent traffic and revenue growth Positioned for future growth opportunities Ruth’s Hospitality Group Highlights

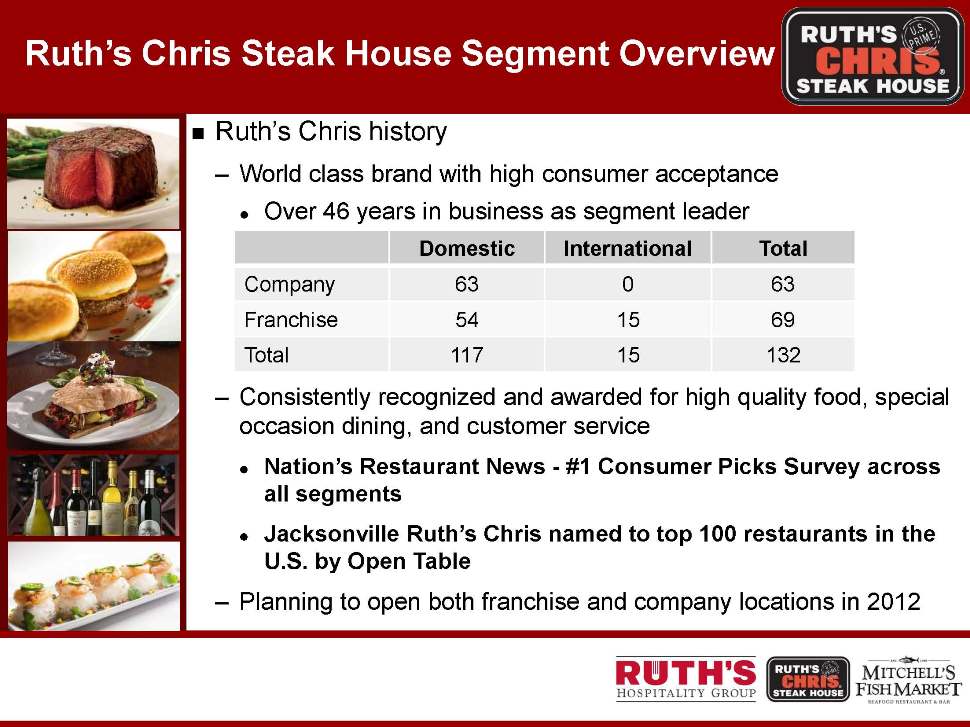

Ruth’s Chris history –World class brand with high consumer acceptance Over 46 years in business as segment leader –Consistently recognized and awarded for high quality food, special occasion dining, and customer service Nation’s Restaurant News - #1 Consumer Picks Survey across all segments Jacksonville Ruth’s Chris named to top 100 restaurants in the U.S. by Open Table –Planning to open both franchise and company locations in 2012 Ruth’s Chris Steak House Segment Overview Strong Franchise Positioning Domestic International Total Company 63 0 63 Franchise 54 15 69 Total 117 15 132

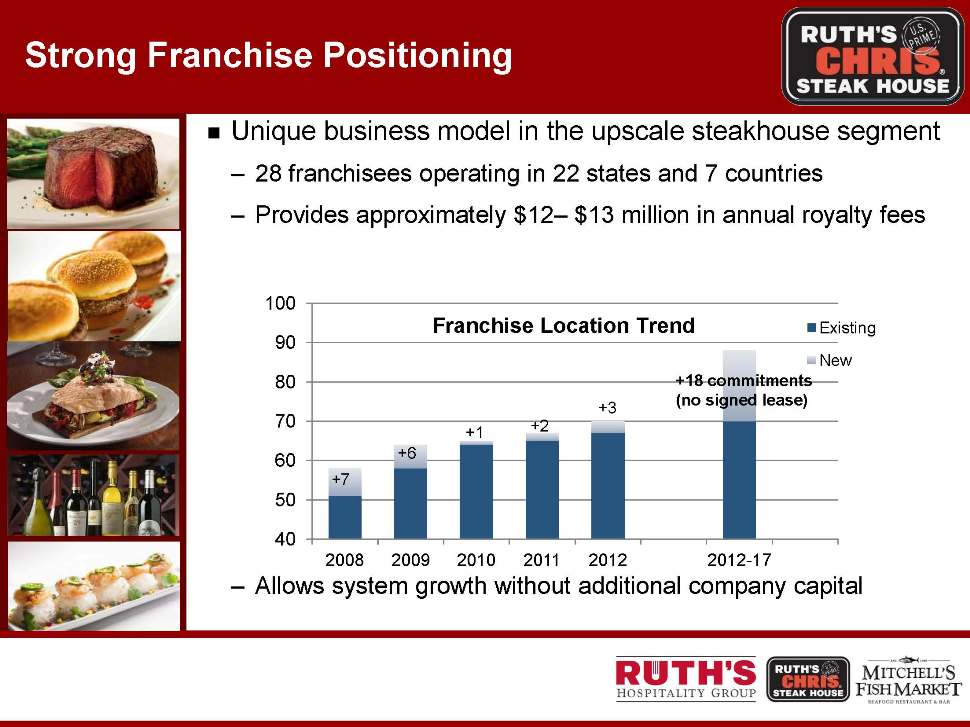

Strong Franchise Positioning Unique business model in the upscale steakhouse segment –28 franchisees operating in 22 states and 7 countries –Provides approximately $12– $13 million in annual royalty fees –Allows system growth without additional company capital 40 50 60 70 80 90 100 2008 2009 2010 2011 2012 2012-17

Marketing Strategies Three core segments with differing needs –Special Occasion –Corporate Business –Core Guests/Regular Customers Goal: To broaden relevance and maintain special occasion business –Ruth’s Classics/Happy Hour/Beverage programs –Focused on growing revenues through traffic before using price Brand focused communication Re-investing through remodels

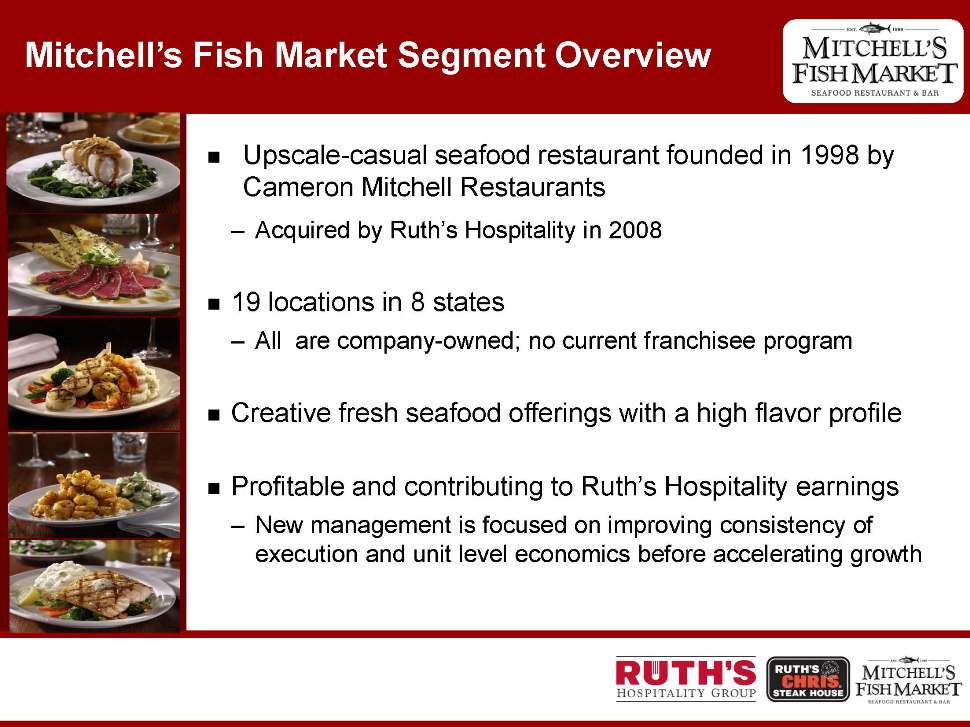

Mitchell’s Fish Market Segment Overview Upscale-casual seafood restaurant founded in 1998 by Cameron Mitchell Restaurants –Acquired by Ruth’s Hospitality in 2008 19 locations in 8 states –All are company-owned; no current franchisee program Creative fresh seafood offerings with a high flavor profile Profitable and contributing to Ruth’s Hospitality earnings –New management is focused on improving consistency of execution and unit level economics before accelerating growth

Marketing Strategies Solidify brand positioning by leveraging growing consumer desire for healthy/seafood dining –Highlighting innovative menu of both surf and turf offerings Average lunch check of $23, dinner check of $40 Applying Ruth’s Chris expertise in banquet/corporate dining Evolving strategy to expand our loyal fan base –Smaller operating base requires enhanced local marketing initiatives –Shifting more to on-line / social media tactics –Enhanced local store marketing efforts Community involvement Third-party endorsement Increased word of mouth

Financial Overview

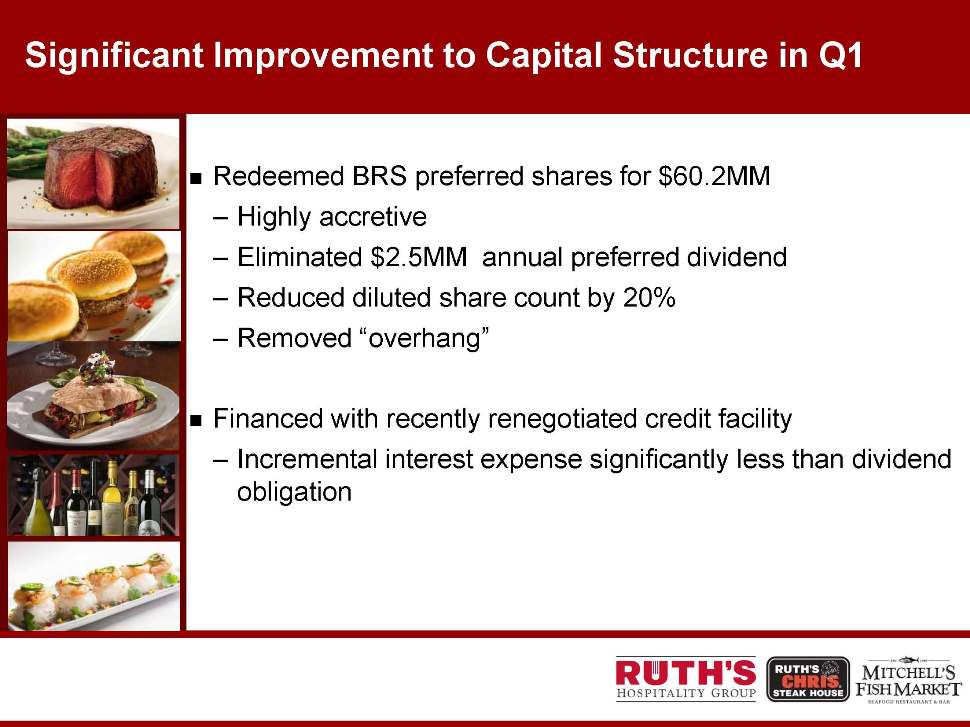

Significant Improvement to Capital Structure in Q1 Redeemed BRS preferred shares for $60.2MM –Highly accretive –Eliminated $2.5MM annual preferred dividend –Reduced diluted share count by 20% –Removed “overhang” Financed with recently renegotiated credit facility –Incremental interest expense significantly less than dividend obligation

Significant Improvement to Capital Structure in Q1 Redeemed BRS preferred shares for $60.2MM –Highly accretive –Eliminated $2.5MM annual preferred dividend –Reduced diluted share count by 20% –Removed “overhang” Financed with recently renegotiated credit facility –Incremental interest expense significantly less than dividend obligation Mar 10 June 10 Sep 10 Dec 10 Mar 11 Jun 11 Sep 11 Dec 11 Mar 12

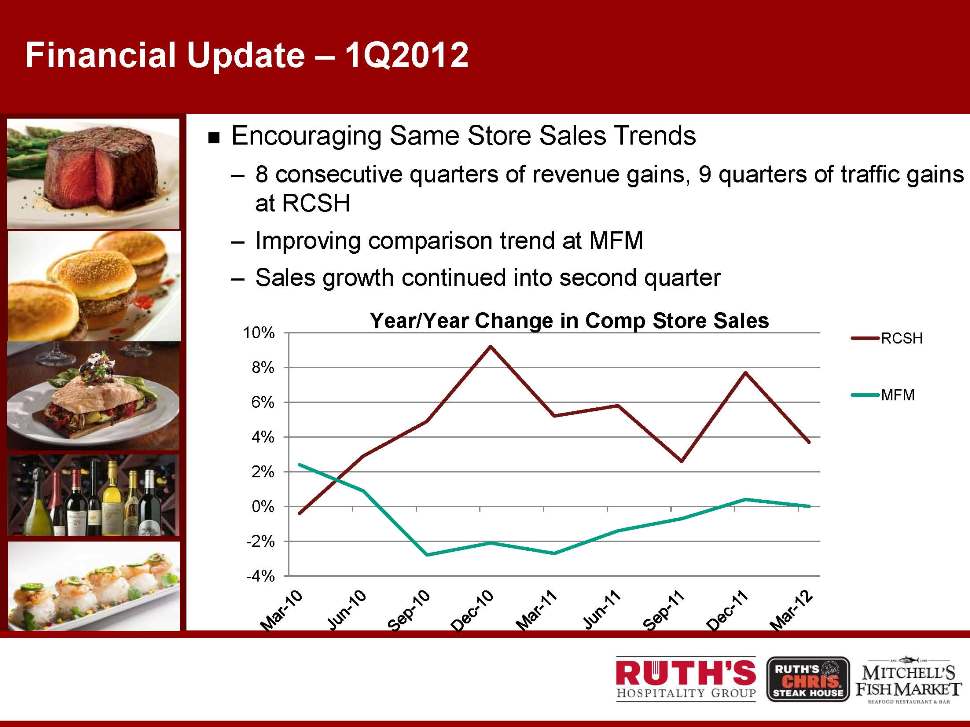

Financial Update – 1Q2012 Total revenues grew 3.4% to $101.0MM Beef cost inflation was 16% EBITDA increased 1.5% to $13.7MM and EBITDA margin decreased 20bp to 13.6%1 Pro forma Net income available to preferred and common shareholders increased 11% to $6.2MM and as a percent of sales increased 40bp to 6.1%1 Debt balance at quarter -end was $77MM - up from $22MM at year-end ($60.2MM BRS transaction). –Expect to continue to pay down debt in 2012 1 excludes loss on impairment, restructuring benefit, loss on disposal , debt issuance costs and discontinued operations

2012 Outlook – Challenges & Opportunities Economic outlook remains uncertain –Encouraged by Q1 sales / Q2 trend Expect continued pressure on beef costs Uncertainty regarding employee healthcare costs Executing on growth opportunities –Resume growth at Ruth’s Chris with both corporate and franchised locations

Investing in the Future Remodel of existing locations –In the last two years, over 1/3 of company locations have been remodeled /refreshed Relocation –Portland, OR successful relocated in 2011 resulting in initial sales growth of over 40% –Evaluating similar opportunities for 2012-2013 New locations –Cherokee, NC opened May, 21, 2012 –Cincinnati, OH under construction – anticipated Q412 –Actively evaluating additional opportunities for 2012-2013

Arlington, VA- Remodel

Bethesda, MD - Remodel

Parsippany, NJ - Remodel

Manhattan NY - Remodel

Roseville, CA – Patio

Portland, OR - Relocated

Portland, OR - Relocated

Grand Rapids, MI – New Franchise

Grand Rapids, MI – New Franchise

Well established Restaurant Company with segment leading brands focused on upscale dining Demonstrated record of growing sales through traffic growth Mitchell’s is profitable and contributing to earnings –Refinement needed before growth can be accelerated Ruth’s Chris Steak House is well positioned for future growth both at the company and franchise level Ruth’s Hospitality Group Summary

Q&A