- RUTH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ruths Hospitality (RUTH) DEF 14ADefinitive proxy

Filed: 20 Apr 23, 4:02pm

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

Notice Of Annual Meeting of Stockholders

When Tuesday, May 23, 2023 1:00 P.M. – Eastern Time

Where Ruth’s Chris Steak House 480 N. Orlando Ave., Suite 100 Winter Park, Florida 32789

How to vote

In Person: Stockholders with evidence of stock ownership may attend and vote at the annual meeting.

Via the Internet: www.proxypush.com/RUTH

By Mail: Complete, sign and mail the enclosed proxy card

By Telephone (Toll Free): 1-866-703-0782 | April 20, 2023

To our Stockholders:

On behalf of the Board of Directors of Ruth’s Hospitality Group, Inc. (the “Company” or “Ruth’s”), you are cordially invited to attend our 2023 Annual Meeting of Stockholders. At the meeting, the holders of the Company’s outstanding common stock will act on the following matters:

| |||||||

| Voting Matters | Board Recommendation | Page | ||||||

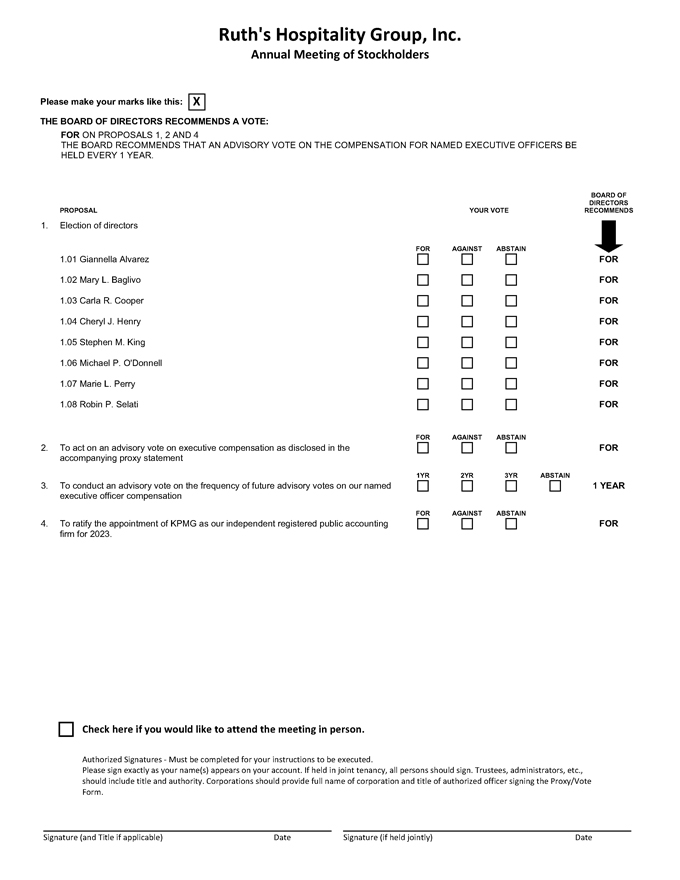

Proposal 1: To elect as directors the nominees named in the accompanying proxy statement | ✓ FOR each director nominee | 8 | ||||||

Proposal 2: To act on an advisory vote on executive compensation as disclosed in the accompanying proxy statement | ✓ FOR | 35 | ||||||

Proposal 3: To conduct an advisory vote on the frequency of future advisory votes on our named executive officer compensation | ✓ ONE YEAR | 66 | ||||||

Proposal 4: To ratify the appointment of our independent registered public accounting firm | ✓ FOR | 67 | ||||||

We will also act upon any other matters properly brought before the annual meeting.

Stockholders of record at the close of business on March 29, 2023 are entitled to notice of and to vote at the annual meeting and any postponements or adjournments thereof.

Whether or not you expect to be present at the meeting, please vote your shares by following the instructions on the accompanying proxy card or voting instruction card. If your shares are held in the name of a bank, broker or other record holder, their voting procedures should be described on the voting form they send to you. Any person voting by proxy has the power to revoke it at any time prior to its exercise at the meeting in accordance with the procedures described in the accompanying proxy statement. We encourage you to vote via the Internet or by telephone. | ||||||||

By order of the Board of Directors,

Marcy Norwood Lynch

Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

2023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON TUESDAY, MAY 23, 2023

This proxy statement and our 2022 Annual Report to Stockholders are available at www.proxydocs.com/RUTH

TABLE OF CONTENTS

PROXY STATEMENT

The Board of Directors of Ruth’s Hospitality Group, Inc. (which we also refer to as “Ruth’s,” “the Company,” “we,” “us,” or “our”) is soliciting proxies from its stockholders to be used at the annual meeting of stockholders to be held on Tuesday, May 23, 2023, beginning at 1:00 P.M., at Ruth’s Chris Steak House, 480 N. Orlando Ave., Suite 100, Winter Park, Florida 32789, and at any postponements or adjournments thereof. This proxy statement contains information related to the annual meeting. This proxy statement, accompanying form of proxy, and the Company’s annual report are first being sent to stockholders on or about April 20, 2023.

PROXY SUMMARY

This summary highlights information collected elsewhere in this proxy statement or in our corporate governance documents published on our website: www.rhgi.com. This summary does not contain all of the information you should consider. We encourage you to read this proxy statement in its entirety before voting.

Company Overview

Ruth’s Hospitality Group, Inc., headquartered in Winter Park, Florida, is the largest fine dining steakhouse company in the United States as measured by the total number of Company-owned and franchisee-owned restaurants, with 131 Ruth’s Chris Steak House locations in the United States, and 23 international franchisee-owned restaurants in Aruba, Canada, China, Hong Kong, Indonesia, Japan, Mexico, the Philippines, Singapore and Taiwan, for a total of 154 restaurants worldwide at the end of 2022, specializing in USDA Prime grade steaks served in Ruth’s Chris’ signature fashion – “sizzling.”

| 2 | Nasdaq: RUTH |  |

|

PROPOSAL 1 ELECTION OF DIRECTORS |

∎ For further information, please see page 8. | ||

| ✓ Your Board of Directors recommends a vote FOR each of the Director nominees | ||||

Director Nominees

Our Board of Directors (the “Board”) recommends that you vote “for” all of the director nominees listed below. Set forth below is summary information about each director nominee, with more detailed information about the qualifications and experience of each director nominee contained under Proposal 1 – Election of Directors beginning on page 8 of this proxy statement.

Committee Membership | ||||||||||||||

| Nominee and Principal Occupation | Age | Director Since | A | C | NG | CSR | ||||||||

Giannella Alvarez Former Chief Executive Officer of Beanitos, Inc. | 63 | 2016 | ○ | ○ | ○ | |||||||||

Mary L. Baglivo Chief Executive Officer of The Baglivo Group; former Chief Executive Officer and Chair, Americas at Saatchi & Saatchi Worldwide. | 65 | 2017 | ○ | ○ |  | |||||||||

Carla R. Cooper Former President & Chief Executive Officer of Daymon Worldwide | 72 | 2003 | ○ |  | ||||||||||

Cheryl J. Henry President, Chief Executive Officer, and Chairperson of the Board of Ruth’s Hospitality Group, Inc. | 49 | 2018 | ○ | |||||||||||

Stephen M. King Former Chief Executive Officer and former Chairman of the Board of Dave & Buster’s Entertainment, Inc. | 65 | �� | 2018 |  | ||||||||||

Michael P. O’Donnell Former Chief Executive Officer and former Chairman of the Board of Ruth’s Hospitality Group, Inc. | 67 | 2008 | ○ | |||||||||||

Marie L. Perry Chief Financial Officer, ASGN Incorporated | 57 | 2018 | ○ | ○ | ||||||||||

Robin P. Selati Senior Advisor of Madison Dearborn Partners, LLC | 57 | 1999 |  | ○ | ||||||||||

A Audit C Compensation NG Nominating & Corporate Governance CSR Corporate & Social Responsibility  Chair

Chair

○ Member

Our Business and Strategy

We develop and operate fine dining restaurants under the trade name Ruth’s Chris Steak House. As of December 25, 2022, there were 154 Ruth’s Chris Steak House restaurants, making us one of the largest upscale steakhouse companies in the world. The Ruth’s Chris brand reflects our 57-year plus commitment to the core values instilled by our founder, Ruth Fertel, of caring for Guests by delivering the highest quality food, beverages and genuine

| 3 | Nasdaq: RUTH |  |

hospitality in a warm and inviting atmosphere. Today, we operate Ruth’s Chris Steak House restaurants around the world while staying true to our founder’s values and our New Orleans roots.

The restaurant industry in which we compete is a mature segment, and we have a long operating history in upscale fine dining. The restaurant business is highly cyclical and results can be affected by consumer spending, commodity prices, and real estate costs. Our approach is to maintain a strategy focused on multi-year, long-term results.

Historically, the Company’s strategy is to deliver a total return to stockholders by maintaining a healthy core business, growing with a disciplined investment approach and returning excess capital to stockholders. The Company strives to maintain a healthy core business by growing sales through traffic, managing operating margins and leveraging its infrastructure. In March 2020, the World Health Organization declared the novel coronavirus (COVID-19) a pandemic and the United States declared it a National Public Health Emergency, which resulted in the Company focusing on a shorter-term strategy that preserved liquidity and maximized restaurant operating income. The Company has returned to a balanced strategy that is focused on maintaining a healthy balance sheet and a healthy core business, being disciplined in evaluating future growth opportunities and returning excess capital to stockholders. The Company evaluates disciplined growth opportunities in markets with attractive sales attributes and solid financial returns. The Company believes that its franchisee program is a point of competitive differentiation and looks to grow its franchisee-owned restaurant locations as well. From time to time, the Company may also consider acquiring franchisee-owned restaurants at terms that it believes are beneficial to the Company.

Corporate Governance Highlights

Our corporate governance principles reflect our commitment to diversity and reflect feedback we have received from our stockholders. Some of our corporate governance highlights include:

| § | A diverse and highly skilled Board that provides a range of viewpoints |

| § | 63% of the Board is comprised of women directors |

| § | Our Chairperson of the Board is a woman |

| § | 50% of the Board’s Committee Chair positions are held by women |

| § | 25% of the Board is comprised of African American and Hispanic directors |

| § | 38% of the Board is comprised of directors with a tenure of 5 years or less – emphasizing our commitment to Board refreshment |

| § | 75% of the Board is comprised of independent directors |

| § | Declassified Board |

| § | A strong and experienced Lead Independent Director |

| § | Independent directors hold executive sessions without management present |

| § | All standing Board committees are composed of 100% independent directors |

| § | Majority voting standard for director elections |

| § | Annual Board and committee evaluations |

| § | Annual review of succession planning |

| § | Annual three day meeting focused on strategic objectives and strategic planning |

| § | Limits on number of outside directorships |

| § | Named Executive Officers (“NEO”) and directors are subject to stock ownership guidelines and stock retention requirements |

| § | Executives and directors are prohibited from engaging in short sales, derivatives trading, and hedging transactions, and we impose restrictions on pledges and margin account use |

| 4 | Nasdaq: RUTH |  |

| § | Code of business conduct applicable to all Team Members, officers and directors |

| § | Board oversight of cybersecurity and other Enterprise Risk Management matters |

| § | Board oversight of environmental, social, and governance (“ESG”) matters |

Stockholder Engagement

As part of our continuing efforts to better understand stockholders’ key concerns, we continued our stockholder outreach initiative in 2022. Additional information about our stockholder engagement efforts and how we have used the insight gained from discussions with our stockholders can be found on page 35 of this proxy statement. The Company and the Board of Directors are committed to engaging with our stockholders and will continue to seek opportunities for dialogue with our stockholders on various matters.

|

PROPOSAL 2 ADVISORY VOTE ON EXECUTIVE COMPENSATION |

∎ For further information, please see page 35. | ||

| ✓ Your Board of Directors recommends a vote FOR the approval of Named Executive Officer compensation. | ||||

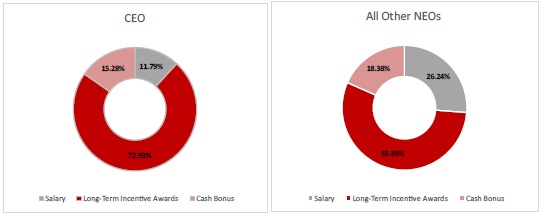

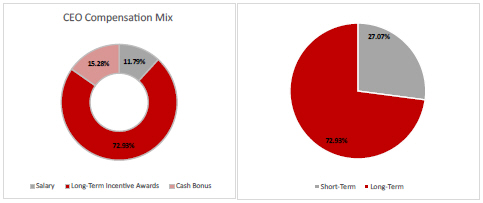

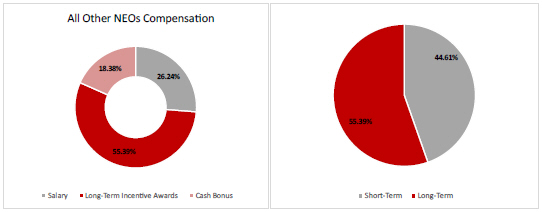

Our Compensation Program

The objective of our executive compensation program is to maintain a close link between pay and performance, both long-term and short-term. We believe the compensation of our executives should be closely tied to the performance and growth of the Company, so their interests are aligned with the long-term interests of our stockholders. Additionally, our executive compensation programs and policies are intended to support the development and retention of a strong executive team, provide appropriate incentives that support our business strategy and values, build and retain a talented team, and mitigate risks associated with compensation. We strive to provide a total compensation package that fairly and equitably rewards our senior leadership as a team and as individuals, and we expect superior performance from each of them, individually, and collectively, as a team.

Executive Compensation Highlights

As the world and the Company faced its third year of impacts from the COVID-19 pandemic, we continued to display resilience and agility in the face of uncertainty and constantly changing restrictions on restaurant operations throughout the world. As of December 25, 2022, all Company-owned and managed Ruth’s Chris Steak House restaurant dining rooms were open and our revenues, results of operations and cash flows exceeded levels comparable to periods prior to the pandemic.

In 2021, in response to feedback from stockholders and large proxy advisory services companies, as well as a review of the executive compensation practices of our peer group and other restaurant companies, we undertook a review of our compensation and benefits programs at all levels of the organization to address several key issues. As described in greater detail in the “Compensation Discussion and Analysis” section of this Proxy Statement, the Compensation Committee engaged an independent compensation consultant, Frederic W. Cook & Co., Inc. (“FW Cook”), to assist it in its review of our management compensation levels and programs to ensure that our executive compensation program is commensurate with those of public companies similar in size and scope to us.

| 5 | Nasdaq: RUTH |  |

During its engagement, FW Cook participated in meetings of the Compensation Committee and advised it with respect to compensation trends and practices, plan design, and the reasonableness of individual awards.

As part of FW Cook’s work throughout 2021, we implemented significant changes to our executive compensation structure for 2022 and beyond. We believe that this overhaul to the executive compensation system will better reflect not only the pay-for-performance structure the Company has had in place for many years, but will also take into account a wider range of financial and non-financial metrics, incentivizing not only positive financial performance, but also the achievement of the non-financial goals we put in place at the beginning of each fiscal year.

In 2022, the Company transitioned to a three-year, forward-looking Long Term Incentive award program for its executives. Prior to the 2022 Long Term Incentive equity awards, such awards were earned on a backward-looking basis, meaning the performance in a fiscal year resulted in equity grants early the following year. Working closely with FW Cook, the Compensation Committee elected to discontinue this backward-looking approach based on its review of competitive market practices and input from our stockholders and from certain proxy advisory services companies. As a result, equity grants in 2022 under the Long Term Incentive award program were made with a three-year forward-looking approach, with the first of those grants scheduled to vest – if certain performance targets are achieved over that three year period – in 2025, three years after the grant. Under the new forward-looking program, each year of the performance period, the Compensation Committee determines whether, and at what percentage, the performance goals are met for the preceding year. At the end of the three-year performance period, the Compensation Committee will evaluate the performance levels for each of the three years and establish a percentage, between 0% and 200%, at which the equity grants will be paid out, if at all. Failure to achieve the pre-established minimum performance threshold amounts would result in no payout being made in 2025 (for the 2022 grants), thereby putting executive Long Term Incentive award grants fully at risk if performance minimum targets are not achieved.

In 2022, the Company also included in its non-equity Home Office Bonus Program (the “Bonus Plan”) objective and measurable non-financial goals, in addition to financial performance goals based on EBITDA and adjusted EBITDA. The Bonus Plan calculations for 2022 were based on 80% financial goals and 20% strategic objectives, with maximum, target, and threshold requirements set for each such goal. For fiscal year 2022, management identified, and the Compensation Committee adopted, the following strategic objectives to be included in the Strategic Objectives portion of the bonus: (i) progress on data and digital milestones; (ii) progress on ESG initiatives; and (iii) opening of new restaurants. The 80/20 weighting of financial and strategic objectives allowed participants in the Bonus Plan to not only work toward financial targets across the Company, but allowed for interactive input and contributions toward objective strategic goals throughout the fiscal year.

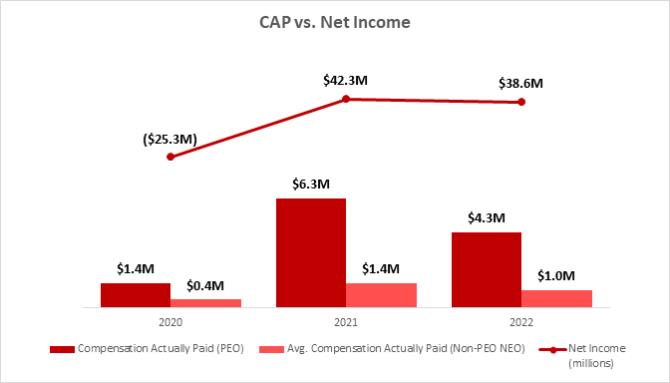

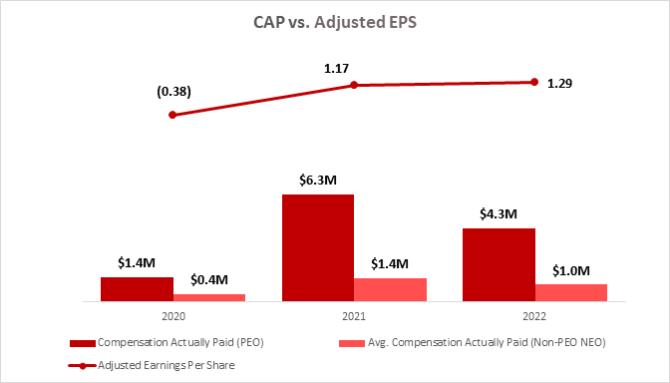

Although fiscal 2022 began with the spread of the Omicron variant of COVID-19, restaurant sales in 2022 were $475.4 million compared to $402 million in 2021. Operating income in 2022 was $47 million, or 9.3% of total revenues, compared to $49.7 million in 2021. Net income in 2022 was $38.6 million, or $1.15 per diluted share, compared to net income of $42.3 million, or $1.23 per diluted share, in 2021. The Company’s fiscal 2022 EBITDA was 99.65% of its Bonus Plan financial target, and the Compensation Committee determined that the Company achieved its Bonus Plan strategic targets for 2022. After careful consideration of the Company’s, the executives’ and Team Members’ performance in 2022, the Compensation Committee of the Board of Directors approved payments to our Home Office Team Members, including our Named Executive Officers, of 99.72% of their bonus potential under the Bonus Plan. Because all payouts were earned within the parameters of the pre-established Bonus Plan, no Committee discretion was used.

| 6 | Nasdaq: RUTH |  |

Executive Compensation Best Practices

Our key executive compensation practices are summarized below. We believe these practices promote alignment with the interests of our stockholders and are consistent with market best practices.

WHAT WE DO:

✓ Review and consider stockholder feedback in structuring executive compensation. ✓ Grant annual restricted stock awards based on retention/tenure and annual Performance Share Unit (PSUs) awards that vest upon achievement of forward-looking performance metrics. ✓ Apply multi-year vesting requirements to all equity awards to facilitate retention and ensure performance alignment, generally these are 3 years post-grant. ✓ Retain an independent compensation consultant to advise the Compensation Committee. ✓ Review external market data when making compensation decisions. ✓ Prohibit hedging. ✓ Prudently exercise discretion to be responsive to the cyclical nature of our business and advance our goal of creating value for our stockholders. ✓ Generally set our total compensation target opportunities at the median level for our market. ✓ Maintain stock ownership guidelines for all Named Executive Officers and Directors. Ensure guidelines are achieved. ✓ Conduct an annual “Say-on-Pay” vote. | WHAT WE DON’T DO:

û No automatic, annual increase in executive salaries. û No exchange of underwater options for cash. û No option repricing without stockholder approval. û No gross-ups. û No short-selling, trading in derivatives or engaging in hedging transactions by executives or directors. û No excessive perquisites. û No high percentage of fixed compensation. û No guaranteed minimum payouts or uncapped award opportunities. û No compensation or incentives that encourage unnecessary or excessive risk taking. |

PROPOSAL 3 ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION |

∎ For further information, please see page 66. | |

✓ Your Board of Directors recommends a vote FOR the inclusion annually of future advisory votes on our Named Executive Officer compensation. | ||

The Company is required to submit for stockholder vote, at least once every six years, a non-binding advisory resolution to determine whether the advisory stockholder vote on executive compensation should occur every one, two or three years. In this Proposal No. 3, we are asking our stockholders to cast a non-binding advisory vote regarding the frequency of future advisory votes on executive compensation. Stockholders may vote for a frequency of every one, two, or three years, or may abstain.

This advisory vote on frequency is required pursuant to Section 14A of the Securities Exchange Act, as amended. As an advisory vote, the results of this vote will not be binding on the Board of Directors or the Company.

| 7 | Nasdaq: RUTH |  |

Although the vote is advisory and non-binding, the Board of Directors values the opinions of our stockholders, and will consider the outcome of this advisory vote when determining the frequency of the advisory vote to approve named executive officer compensation. The proxy card gives you four choices for voting on this item. You may choose whether the say-on-pay vote should be conducted EVERY ONE (1) YEAR, EVERY TWO (2) YEARS or EVERY THREE (3) YEARS. You may also abstain from voting on this item. You are not voting to approve or disapprove the Board’s recommendation on this item.

PROPOSAL 4 RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

∎ For further information, please see page 67. | |

✓ Your Board of Directors recommends a vote FOR the ratification of the appointment of KPMG as our independent registered public accounting firm for 2023. | ||

Our Audit Committee has appointed KPMG LLP as our independent registered public accounting firm for fiscal 2023 and has further directed that our Board submit the selection of KPMG LLP for ratification by the stockholders at the annual meeting. During fiscal 2022, KPMG LLP served as our independent registered public accounting firm and also provided certain audit-related services as described on page 67. The stockholder vote is not binding on our Audit Committee. If the appointment of KPMG LLP is not ratified, our Audit Committee will evaluate the basis for the stockholders’ vote when determining whether to continue the firm’s engagement, but may ultimately determine to continue the engagement of the firm or another audit firm without re-submitting the matter to the stockholders. Even if the appointment of KPMG LLP is ratified, our Audit Committee may, in its sole discretion, terminate the engagement of the firm and direct the appointment of another independent auditor at any time during the year if it determines that such an appointment would be in the best interests of the Company and our stockholders.

Representatives of KPMG LLP are expected to attend the annual meeting, where they will be available to respond to appropriate questions and, if they desire, to make a statement.

CORPORATE GOVERNANCE MATTERS

PROPOSAL 1 ELECTION OF DIRECTORS |

✓ Your Board of Directors recommends a vote FOR election of each of the eight Director nominees |

Our Board currently is composed of eight directors, with each director serving until the next annual meeting or until their successor is elected. The eight candidates nominated by our Board for election as directors at the 2023 annual meeting of stockholders are also identified below.

All of the nominees have indicated to the Company that they will be available to serve as directors. If any nominee named herein for election as a director should, for any reason, become unavailable to serve prior to the annual meeting, our Board may, prior to the annual meeting, (i) reduce the size of our Board to eliminate the position for which that person was nominated, (ii) nominate a new candidate in place of such person or (iii) leave the position

| 8 | Nasdaq: RUTH |  |

vacant to be filled at a later time. The information presented below for the nominees has been furnished to the Company by the nominees.

Board of Directors

Board Composition and Refreshment

Our Board is responsible for the oversight and continued success of our Company, which was founded in 1965 by a single working mother, Ruth Fertel, and which is now led, for the first time since Ruth Fertel, by a woman Chairperson of the Board, President, and Chief Executive Officer. Our core values reflect our roots in the legacy of Ruth Fertel and include a commitment to attracting a broad range of skills and experiences to our Board, our executive team, and our Team Members across the Company, all rooted in a commitment to providing the best steak house experience to our Guests.

As a group, our director nominees have broad skills and experience. A majority of our directors have served as the chief executive officer of a public or private company. Over fifty-five percent of our directors are women. Our directors range in age from 49 to 72, with the average being 62 years of age. As a group, they possess a range of important skills including hospitality industry experience, corporate strategy, accounting and finance leadership, international operations, real estate, and ESG experience.

Our Board has been meaningfully refreshed, with five of our seven independent directors joining the board since 2016. We believe this reflects a good mix of new directors, who bring fresh perspectives, and tenured directors, who have contributed to developing our strategy over time and who possess an in-depth knowledge of our history and operations. A majority of non-management directors ensures robust debate and objectivity in the boardroom, while diversity of gender, age, and ethnicity contributes to a diverse range of views.

Selection of Directors

Our Board seeks a diverse group of candidates who possess the background, skills, and expertise to make a significant contribution to our Board, the Company, and its stockholders. Desired qualities to be considered include:

| § | high-level leadership experience in business or administrative activities and significant accomplishments |

| § | breadth of knowledge about issues affecting the Company |

| § | proven ability and willingness to contribute special competencies to Board activities |

| § | personal integrity |

| § | loyalty to the Company and concern for its success and welfare |

| § | willingness to apply sound and independent business judgment |

| § | no present conflicts of interest |

| § | availability for meetings and consultation on Company matters |

| § | willingness to assume broad fiduciary responsibility |

| § | willingness to become a Company stockholder |

Our Nominating and Corporate Governance Committee considers all nominees for election as directors of the Company, including all nominees recommended by stockholders, in accordance with the mandate contained in its charter. The Company has used a third-party search firm in the past to help identify, evaluate and conduct due diligence on potential director candidates. In evaluating candidates, the Committee reviews all candidates in the same manner, regardless of the source of the recommendation. The policy of our Nominating and Corporate

| 9 | Nasdaq: RUTH |  |

Governance Committee is to consider individuals recommended by stockholders for nomination as a director in accordance with the procedures described below.

Board Diversity Matrix

The following matrix details the current gender identity and demographic background of the members of our Board of Directors. The format of the diversity matrix complies with Nasdaq’s Listing Rule 5606 and requires annual disclosure of board-level diversity statistics.

Board Diversity Matrix (As of April 20, 2023)

| ||||||

Total Number of Directors | 8 | |||||

| Female | Male | Nonbinary | ||||

Part I: Gender Identity | ||||||

Directors | 5 | 3 | - | |||

Part II: Demographic Background | ||||||

African American or Black | 1 | - | - | |||

Alaskan Native or Native American | - | - | - | |||

Asian | - | - | - | |||

Hispanic or LatinX | 1 | - | - | |||

White | 4 | 3 | - | |||

Two or More Races or Ethnicities | 1 | - | - | |||

LGBTQIA+ | - | |||||

Did Not Disclose Demographic Background | - | |||||

| 10 | Nasdaq: RUTH |  |

Director Biographies

The following summarizes information about each of the nominees and the continuing directors as of the date of this proxy statement, including their business experience, public company director positions held currently or at any time during the last five years, involvement in certain legal or administrative proceedings, if applicable, and the experiences, qualifications, attributes, or skills that qualify our nominees and the continuing directors to serve as directors of the Company. The nominees were evaluated and recommended by the Nominating and Corporate Governance Committee in accordance with its process for nominating directors.

Age 63

Director since February 2016

Committees ● Audit ● Nominating & Corporate Governance ● Corporate & Social Responsibility |

Giannella Alvarez Independent Director

Ms. Alvarez has significant P&L, executive and governance leadership experience in public and private companies across a wide range of industry sectors, including operations in the US, Latin America, Europe, Asia and across the globe. She has served as Chief Executive Officer of Beanitos, Inc., a privately held food company based in Austin, TX and sold to the Good Bean Co. in December 2018. Prior to that, she was President and Chief Executive Officer of Harmless Harvest, Inc., an organic food and beverage company based in San Francisco, CA, which she sold to Danone. Prior to that, she served as Executive Vice President of the multi-billion dollar Pet Business at Del Monte Corporation, sold to J. M. Smucker Co. She also served as Group President and Chief Executive Officer for Barilla Americas at Barilla S.p.A., a global company headquartered in Parma, Italy. Prior to that, she held senior global management positions with The Coca-Cola Company (NYSE: KO), Kimberly-Clark Corporation (NYSE: KMB), and The Procter & Gamble (NYSE: PG).

Directorships (within the past 5 years) Ms. Alvarez currently serves as a director of Driscoll’s, Trulieve (CSE: TRUL), and is Chairperson of the Board of Del Real Foods. She has been an Advisory Board member at NYU Stern School Center for Sustainable Business since 2019. She also served as a director of Domtar Corporation (NYSE: UFS) from 2012 through 2021.

Skills and Qualifications Ms. Alvarez has extensive experience in strategic planning, branding, marketing, innovation and technology, as well as ESG, business sustainability ROI, and scaling businesses. She has corporate governance and global executive leadership skills with P&L responsibility for multi-billion dollar public and private companies, including managing on the ground operations across a wide range of industries in the U.S., Latin America, Europe, Asia, and across the globe.

|

| 11 | Nasdaq: RUTH |  |

Age 65

Director since May 2017

Committees ● Nominating & Corporate Governance ● Compensation ● Corporate & Social Responsibility (Chair) |

Mary Baglivo Independent Director

Ms. Baglivo is Chief Executive Officer of The Baglivo Group, a brand strategy advisory consulting firm. She previously served in the Senior Administrations of large research universities. She was Chief Marketing Officer and Vice Chancellor of Marketing and Communications at Rutgers University from 2017 to 2018, and Chief Marketing Officer and Vice President of Global Marketing at Northwestern University from 2013 to 2017. Prior to her work in higher education, Ms. Baglivo was the Chairman and Chief Executive Officer of the Americas at Saatchi & Saatchi from 2008 to 2013 and Chief Executive Officer New York from 2004 to 2008. Prior to joining Saatchi, she was President of Arnold Worldwide from 2002-2004 and Chief Executive Officer of Panoramic Communications from 2001 to 2002.

Directorships (within the past 5 years) Ms. Baglivo currently serves on the board of directors of Host Hotels & Resorts (Nasdaq: HST) and urban Edge Properties (NYSE: UE), and served on the board of PVH Corp (Nasdaq: PVH) from 2007 until 2021.

Skills and Qualifications Ms. Baglivo has extensive knowledge and experience in brand strategy, consumer research, and marketing and media across channels including; digital, social media, print and broadcast, as well as public relations, internal communications and crisis communications. Based on her extensive experience as a director on public and private company boards, Ms. Baglivo has depth of knowledge in governance. She is also highly experienced in ESG issues, having served on dedicated Corporate Responsibility Committees in business categories including global apparel.

|

| 12 | Nasdaq: RUTH |  |

Age 72

Director since December 2003

Committees ● Nominating & Corporate Governance (Chair) ● Compensation

|

Carla Cooper Independent Director

Ms. Cooper was President and Chief Executive Officer of Daymon Worldwide from 2009 until 2015. Ms. Cooper served as Senior Vice President of Quaker, Tropicana and Gatorade Sales for PepsiCo, Inc. (NYSE: PEP) from 2003 to 2009. From 2001 to 2003, Ms. Cooper served as President of Kellogg Company’s (NYSE: K) Natural and Frozen Foods Division. From 2000 to 2001, Ms. Cooper was Senior Vice President and General Manager of Foodservice for Kellogg Company. From 1988 to 2000, Ms. Cooper was employed in various positions with Coca-Cola USA, including as Vice President, Customer Marketing.

Directorships (within the past 5 years) None

Skills and Qualifications Ms. Cooper has extensive experience in sales, marketing and franchising in the food industry and has insight into vendor relationships.

| |

Age 49

Director since August 2018

Committees Corporate & Social Responsibility

|

Cheryl Henry Chairperson of the Board, President and Chief Executive Officer

Ms. Henry has served as President and Chief Executive Officer of the Company since August 2018 and was appointed to the Board of Directors as of that date. In 2021, Ms. Henry became Chairperson of the Board of Directors. Prior to that she was President and Chief Operating Officer from July 2016 to August 2018. Ms. Henry served as Senior Vice President and Chief Branding Officer from August 2011 to July 2016 and from June 2007 to August 2011 served in various roles with the Company, including as Chief Business Development Officer. Prior to joining the Ruth’s Hospitality Group team, she was the Chief of Staff for the Mayor of Orlando.

Directorships (within the past 5 years) Ms. Henry previously served on the Board of Trustees of the Culinary Institute of America and on the Board of Governors of the Center for Creative Leadership.

Skills and Qualifications Ms. Henry has experience in strategic planning, operations, real estate development, marketing, consumer branding, franchising, and has executive leadership skills.

|

| 13 | Nasdaq: RUTH |  |

Age 65

Director since January 2018

Committees Audit Committee (Chair)

|

Stephen M. King Independent Director

Mr. King served on the Board of Directors of Dave & Buster’s Entertainment, Inc. (Nasdaq: PLAY) from 2006 until 2021, and was its Chairman of the Board from 2017 until April 2021. Mr. King served as Dave & Buster’s Chief Executive Officer from September 2006 until August 2018, and from March 2006 until September 2006, Mr. King served as its Senior Vice President and Chief Financial Officer. From 1984 to 2006, he served in various capacities for Carlson Restaurants Worldwide Inc., a company that owns and operates casual dining restaurants worldwide, including Chief Financial Officer, Chief Administrative Officer, Chief Operating Officer and President and Chief Operating Officer of International.

Directorships (within the past 5 years) Skiptown (2022 to the present) Dave & Buster’s Entertainment, Inc. (2006 to 2021)

Skills and Qualifications Mr. King has extensive knowledge and experience as a former chief executive of a publicly traded restaurant and entertainment company as well as accounting and finance experience.

|

| 14 | Nasdaq: RUTH |  |

Age 67

Director since August 2008

Committees Corporate & Social Responsibility

|

Michael P. O’Donnell

Mr. O’Donnell served as Executive Chairman of our Board from August 2018 until December 2020, was Chairman of the Board from October 2010 to May 2021, was a director and Chief Executive Officer from August 2008 to August 2018, and was President from August 2008 to July 2016. Mr. O’Donnell has spent more than 25 years in the restaurant industry, having been formerly the Chairman of the Board of Directors, President and Chief Executive Officer of Champps Entertainment, Inc. from March 2005 until the company was sold in 2007. Prior to that, Mr. O’Donnell served in several leadership positions in the restaurant industry, including President and Chief Executive Officer of New Business and President of Roy’s for Outback Steakhouse, Inc., President and Chief Operating Officer of Miller’s Ale House, Chairman, President and Chief Executive Officer of Ground Round Restaurants, Inc. and key operation positions with T.G.I. Friday’s and Pizza Hut.

Directorships (within the past 5 years) Mr. O’Donnell currently serves as Chairman of the Board of California Pizza Kitchen and as a director with Hickory Tavern. During the previous five years, Mr. O’Donnell also served as a director of Logan’s Roadhouse and as Vice Chairman of the Rollins College Board of Trustees.

Skills and Qualifications In addition to his leadership skills, Mr. O’Donnell has extensive experience with other restaurant companies and is very knowledgeable of the restaurant industry.

|

| 15 | Nasdaq: RUTH |  |

Age 57

Director since August 2018

Committees ● Audit ● Compensation

|

Marie L. Perry Independent Director

Ms. Perry is the Chief Financial Officer of ASGN Incorporated (NYSE: ASGN). Ms. Perry was the Senior Vice President and Chief Financial Officer of Brink’s, U.S. until February 2022, was Chief Financial Officer, Executive Vice President and Chief Administrative Officer of Jamba, Inc. (Nasdaq: JMBA) from August 2016 until September 2018 and served as its Executive Vice President, Finance, from May 2016 to August 2016. From 2003 to 2016, Ms. Perry held roles leading all aspects of the finance team at Brinker International, Inc. (NYSE: EAT) including having served as interim CFO during a 12-month period, and most recently, serving as Senior Vice President, Controller and Treasurer. Ms. Perry also held senior finance and accounting roles at American Airlines (Nasdaq: AAL) and KPMG LLP.

Directorships (within the past 5 years) None

Skills and Qualifications Ms. Perry has experience as a chief financial officer of a publicly traded restaurant company as well as accounting and finance experience.

|

| 16 | Nasdaq: RUTH |  |

Age 57

Director since September 1999

Committees ● Compensation (Chair) ● Nominating & Corporate Governance

|

Robin P. Selati Lead Independent Director

Mr. Selati has served as a member of our Board of Directors since September 1999, and served as Chairman of our Board of Directors from April 2005 to September 2006 and from April 2008 to October 2010. Mr. Selati is the President of Saxonwold Capital Inc. (a private investment vehicle) and a Senior Advisor of Madison Dearborn Partners, LLC (“Madison Dearborn”). He joined Madison Dearborn in 1993 and was a Managing Director through 2017. Before 1993, Mr. Selati was with Alex. Brown & Sons Incorporated.

Directorships (within the past 5 years) Mr. Selati currently serves as a director of Redberry Group and Blue Note Holdings, LLC. During the previous five years, Mr. Selati also served as a director for B.F. Bolthouse Holdco LLC, CDW Corporation (Nasdaq: CDW), Things Remembered, Inc., Performance Health, and The Yankee Candle Company, Inc.

Skills and Qualifications Mr. Selati is very knowledgeable of the capital markets, public company strategies and executive compensation, has been a successful investor in the restaurant industry for over two decades, and currently sits (and previously sat) on the boards of several public and private restaurant companies.

|

Communication with the Board of Directors

Our Board and management team value the opinions and feedback of our stockholders, and we engage with stockholders throughout the year on a variety of issues, including our corporate governance practices. Stockholders may send communications to the Company’s directors as a group or individually by writing to those individuals or the group: c/o the Corporate Secretary, 1030 W. Canton Avenue, Suite 100, Winter Park, Florida 32789. The Corporate Secretary will review all correspondence received and will forward all correspondence that is relevant to the duties and responsibilities of our Board or the business of the Company to the intended director(s). Examples of inappropriate communications include business solicitations, advertising and communications that are frivolous in nature, communications that relate to routine business matters (such as product inquiries, complaints or suggestions), or communications that raise grievances that are personal to the person submitting them. Upon request, any director may review any communication that is not forwarded to the directors pursuant to this policy.

Stockholder Nominations

Stockholders may recommend director candidates for our 2024 annual meeting for consideration by our Nominating and Corporate Governance Committee. Any such recommendations should include the nominee’s name, qualifications for Board membership, confirmation of the person’s willingness to serve, and the information that would be required to be furnished if the stockholder were directly nominating such person for election to the Board and should be directed to the Corporate Secretary at the address of our principal executive offices set forth

| 17 | Nasdaq: RUTH |  |

herein. The Nominating and Corporate Governance Committee recommends, and the Board selects, director candidates using the criteria and priorities established from time to time. The composition, skills and needs of the Board change over time and will be considered in establishing the desirable profile of candidates for any specific opening on the Board.

A stockholder wishing to nominate their own candidate for election to our Board at our 2024 annual meeting must deliver timely notice of such stockholder’s intent to make such nomination in writing to the Corporate Secretary at our principal executive offices no earlier than January 24, 2024 and no later than February 23, 2024. To be timely, a stockholder’s notice must be delivered to or mailed and received at our principal executive offices no less than 90 nor more than 120 days prior to the date of the first anniversary of the previous year’s annual meeting. In the event the annual meeting is scheduled to be held on a date more than 30 days prior to or delayed by more than 60 days after such anniversary date, notice must be so received no later than the close of business on the 10th day following the earlier of the day on which notice of the date of the meeting was mailed or public disclosure of the meeting was made.

To be in proper form, a stockholder’s notice must set forth:

| (i) | as to each person whom the stockholder proposes to nominate for election as a director at such meeting, |

| § | the name, age, business address and residence of the person; |

| § | the principal occupation or employment of the person; |

| § | the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the person; |

| § | a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, between or among the stockholder, the beneficial owner, if any, on whose behalf the nomination is being made and each proposed nominee; |

| § | a completed and signed written questionnaire delivered to the Secretary of the Company at the principal executive offices of the Company (in the form to be provided by the Secretary of the Corporation within 10 days of a written request for such form); |

| § | a written representation agreement (in the form to be provided by the Secretary of the Corporation within 10 days of a written request for such form); |

| § | any other information relating to the person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Regulation 14A under the Exchange Act; and |

| (ii) | as to the stockholder or beneficial owner giving the notice, |

| § | the name and record address of such stockholder; |

| § | the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by such stockholder; |

| § | a representation that the stockholder is a stockholder of record entitled to vote at the applicable meeting and will continue to be a stockholder of record of the Company entitled to vote at such meeting through the date of such meeting; |

| § | a description of all arrangements or understandings between such stockholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such stockholder; |

| § | a description of any agreements or arrangements to mitigate loss, manage risk or benefit of share price changes or increase or decrease the voting power with respect to the Company’s stock; |

| § | a representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the person(s) named in the notice; and |

| 18 | Nasdaq: RUTH |  |

| § | any other information relating to such stockholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Regulation 14A under the Exchange Act. |

The Company may require any proposed nominee to furnish such other information as listed in the Bylaws of the Company or as may be reasonably required to determine the eligibility of such proposed nominee to serve as a director or to determine independence. Such notice must be accompanied by a written consent of each proposed nominee to being named as a nominee and to serve as a director, if elected. In addition, stockholders who intend to solicit proxies in reliance on the SEC’s universal proxy rule for director nominees submitted under the advance notice requirements of our by-laws must comply with the additional requirements of Rule 14a-19, including delivery of written notice that sets forth all information required by Rule 14a-19(b) under the Exchange Act.

The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Stockholder Nomination for Director.” In accordance with our Bylaws, stockholder nominations that do not comply with the submission deadline are not required to be recognized by the presiding officer at the annual meeting. Timely nominations will be brought before the meeting but will not be part of the slate nominated by our Board of Directors and will not be included in our proxy materials.

Board Tenure Policy

As an alternative to term limits, the Nominating and Corporate Governance Committee reviews the performance of each director in determining whether to nominate directors for re-election. The Board does not believe it is appropriate to establish term limits for its members because such limits may deprive the Company and the Board of the contribution of directors who have been able to develop, over time, valuable experience and insights into the Company.

Pursuant to the Company’s Corporate Governance Guidelines, adopted in August 2022, an individual who would be age 75 at the time of election shall not be nominated for initial election to the Board. However, the Nominating and Corporate Governance Committee may recommend and the Board may approve the nomination for re-election of a director who would be age 75 at the time of election, if, in light of all the circumstances, the Board determines, on the recommendation of the Nominating and Corporate Governance Committee, that it is in the best interests of the Company and its stockholders.

The Board’s Role and Responsibilities

Overview

The Company’s business is operated by its Team Members, managers and officers, under the direction of the Chief Executive Officer and the oversight of the Board. The Board is elected annually by the stockholders to oversee management and to assure that the long-term interests of the stockholders are being served. The Board selects the Chief Executive Officer, acts as an advisor and counselor to senior management, and ultimately monitors the Company’s performance. Both the Board and management recognize that the long-term interests of the Company and its stockholders are advanced by the quality of the relationships we have with Our People – Guests, Team Members, Franchise Owners, Vendor Partners, Community and Investors.

| 19 | Nasdaq: RUTH |  |

Role in Risk Management

Our Board is actively involved in the oversight of risks that could affect the Company. Day-to-day risk management is the responsibility of management, which has implemented, with the Board’s oversight, an Enterprise Risk Management process to identify, assess, manage, and monitor risks that our Company faces. The Audit Committee of the Board provides assistance to the Board in fulfilling its oversight responsibilities regarding the evaluation of the adequacy and effectiveness of the Company’s policies with respect to risk assessment and risk management, including those related to information technology and network security (with a focus on legal, regulatory, accounting, financial reporting and internal controls-related risks). As set forth in our Audit Committee charter, which was revised in August 2022, the Audit Committee also periodically meets separately with management, the internal auditors and the independent auditor to discuss issues and concerns warranting Audit Committee attention, including significant identified risks to the Company and the steps management has taken to minimize such risks and elicit recommendations for the improvement of the Company’s risk assessment and mitigation procedures.

Our Board receives regular reports directly from officers responsible for oversight of particular risks within the Company. With respect to cybersecurity, the Board receives regular updates from management regarding the Company’s efforts to prevent information security incidents, detect unusual activity, and to be prepared to respond appropriately should an incident occur.

Our Board believes that our compensation policies and practices are reasonable and properly align our Team Members’ interests with those of our stockholders. Our Board believes that there are a number of factors that cause our compensation policies and practices to not have a material adverse effect on the Company. In addition, our Compensation Committee, and its external advisor, implemented changes for fiscal 2022 to our compensation policies and practices that we believe will improve the alignment between Company performance and executive compensation, and the Compensation Committee continues to review our compensation policies and practices to ensure that such policies and practices do not encourage our executive officers and other Team Members to take action that is likely to create a material adverse effect on the Company.

Code of Conduct

The Company’s Team Members, officers and directors are required to abide by the Company’s Code of Conduct and Business Ethics (the “Code of Ethics”), which is intended to ensure that the Company’s business is conducted in a consistently legal and ethical manner. The Code of Ethics covers all areas of professional conduct, including, among other things, conflicts of interest, competition and fair dealing, corporate opportunities and the protection of confidential information, as well as strict compliance with all laws, regulations and rules. Any waiver or changes to the policies or procedures set forth in the Code of Ethics in the case of officers or directors may be granted only by our Board and will be disclosed on our website within four business days. The full text of the Code of Ethics is published on the Investor Relations section of our website at www.rhgi.com.

Management Succession Planning

The Board is responsible for approving and maintaining a succession plan for the Chief Executive Officer and senior executives. To assist the Board, the Chief Executive Officer annually provides an assessment of senior officers and their potential to succeed her. The Chief Executive Officer also provides the Board with an assessment of persons considered potential successors for certain other key senior management positions. The Nominating and

| 20 | Nasdaq: RUTH |  |

Corporate Governance Committee oversees the development and periodic update of appropriate processes to address emergency Chief Executive Officer succession planning in the event of extraordinary circumstances.

Board Structure

Board Leadership Structure

Our Board does not have a policy on whether the same person should serve as both the Chief Executive Officer and Chairperson of the Board or, if the roles are separate, whether the Chairperson should be selected from the non-employee directors or should be a Team Member. Our Board believes that it should have the flexibility to periodically determine the leadership structure that it believes is best for the Company.

During 2018, we completed a multi-year succession planning process which culminated in the election of Cheryl J. Henry to the Board of Directors and to the position of President and Chief Executive Officer. As part of this planned executive transition, the Board elected Michael P. O’Donnell to the position of Executive Chairman of the Company. In December 2020, as part of the long-term succession and retirement planning process, Mr. O’Donnell retired from the Company as Executive Chairman, and continued his leadership role as Chairman of the Board of Directors until May 2021. In May 2021, Ms. Henry was appointed Chairperson of the Board of Directors, making her the first woman to hold this position at the Company since it went public in 2005. Robin P. Selati continues to serve as our Lead Independent Director.

Ms. Henry, in her role as Chairperson of the Board and Chief Executive Officer, consults periodically with the Lead Independent Director on Board matters and on issues facing the Company. In addition, the Lead Independent Director serves as the principal liaison between the Chairperson of the Board and the independent directors and presides at executive sessions of non-management directors at regularly scheduled Board meetings. Our Board believes that these executive sessions are beneficial to the Company because they provide a forum where the independent directors can discuss issues without management present.

Director Independence

We believe that a substantial majority of the members of our Board should be independent non-employee directors. Seven of our nine directors, namely Ms. Alvarez, Ms. Baglivo, Ms. Cooper, Mr. King, Ms. Perry, and Mr. Selati qualify as “independent directors” in accordance with Nasdaq’s independence requirement. Although Mr. O’Donnell is no longer employed by the Company, he is not currently considered an independent director under Nasdaq’s independence rules because he was employed by the Company within the last three years. All of the members of our standing committees are independent in accordance with the applicable independence requirements for the committees on which they serve. All of the members of our Audit Committee have been determined to be financially literate and both Mr. King and Ms. Perry have been determined to be “Audit Committee Financial Experts.”

Executive Sessions

At the conclusion of each regularly scheduled Board meeting, the Board will meet in executive session without management present other than Ms. Henry. In addition, the seven independent members of the Board meet in executive session alone, with no members of management present.

| 21 | Nasdaq: RUTH |  |

Board Committees

The Board has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating & Corporate Governance (“NCG”) Committee. Each of the committees is governed by a written charter, copies of which are available on the Investor Relations section of our website at www.rhgi.com. Each committee member satisfies the applicable independence requirements of the Nasdaq Global Select Market for the committees on which they serve. In addition, each Audit Committee member satisfies the current financial literacy requirements and independence requirements of the SEC, applicable to audit committee members.

In August 2022, the Board created a new Corporate and Social Responsibility (“CSR”) Committee to assist the Board in its oversight of the Company’s sustainability and social-related risks and strategies, external reporting, and workplace environment and culture. In particular, the CSR Committee was created to assist the Board in protecting the Company’s brand trust through its performance as a sustainable and socially responsible organization. The CSR Committee will also assist the Board in fulfilling its enterprise risk oversight responsibility by periodically assessing and responding as appropriate to risks relating to food sourcing/supplier diversity and sustainability, environment/climate change, community engagement, philanthropy, diversity, equity and inclusion and management and employee health and well-being. The CSR Committee will, at least twice a year, meet to evaluate, discuss, and, as appropriate, direct the disclosure of the Company’s risks relating to corporate social responsibility and sustainability, including the environment, human rights, labor, health and safety, workforce diversity, supply chain, and similar matters affecting Company stakeholders.

Below is a table indicating committee membership and a description of each committee of the Board. Each Committee is responsible for reporting regularly on its activities to the full Board.

| Committee Membership | ||||||||

| Members | Audit | Compensation | NCG | CSR | ||||

| Giannella Alvarez | ○ | ○ | ○ | |||||

| Mary L. Baglivo | ○ | ○ |  | |||||

| Carla R. Cooper | ○ |  | ||||||

| Cheryl J. Henry | ○ | |||||||

| Stephen M. King |  | |||||||

| Michael P. O’Donnell | ○ | |||||||

| Marie L. Perry | ○ | ○ | ||||||

| Robin P. Selati |  | ○ | ||||||

Chair ○ Member

Chair ○ Member

| 22 | Nasdaq: RUTH |  |

| Audit Committee | ||

Current Members Stephen M. King (Chair) Giannella Alvarez Marie L. Perry

Meetings in 2022 8

Financial Experts Stephen M. King Marie L. Perry |

Roles and Responsibilities § Monitoring the integrity of financial statements and financial reporting process, disclosure controls and procedures, internal control over financial reporting, systems of internal accounting and financial controls, independent auditors’ qualifications and independence, performance of the independent auditors and internal audit function, and compliance with legal and regulatory requirements

§ Selecting and overseeing independent auditors; reviewing and evaluating qualifications, performance and independence of independent auditors and the lead audit engagement partner; approving audit and non-audit services, including the overall scope of the audit; discussing annual audited and quarterly financial statements with management and the independent auditor, and other matters required to be communicated to our Audit Committee

§ Discussing earnings press releases, financial information and earnings guidance

§ Monitoring complaints through the ethics hotline and other established reporting channels

§ Reviewing related party transactions

§ Meeting separately, periodically, with management, our internal audit staff, and the independent auditor

§ Reviewing the audit firm’s annual report on internal quality control procedures and any material issues raised by the most recent internal quality control review, or peer review, of the auditing firm

§ Setting clear hiring policies for employees or former employees of the independent auditors

§ Reviewing and monitoring the Company’s policies regarding risk assessment and risk management, including those related to information technology and network security

§ Handling such other matters that are specifically delegated by our Board of Directors from time to time | |

| 23 | Nasdaq: RUTH |  |

| Compensation Committee | ||

Current Members Robin P. Selati (Chair) Mary L. Baglivo Carla R. Cooper Marie L. Perry

Meetings in 2022 5 |

Roles and Responsibilities § Reviewing executive compensation principles and philosophy § Reviewing and approving the compensation of our directors, Chief Executive Officer and other executive officers § Overseeing overall compensation and benefits programs and policies § Administering stock plans and other incentive compensation plans § Reviewing and approving employment contracts and other similar arrangements between us and our executive officers § Evaluating risks relating to employment policies and the Company’s compensation and benefits systems in order to make recommendations to our Board § Handling such other matters that are specifically delegated to our Compensation Committee by our Board of Directors from time to time

Compensation Committee Interlocks and Insider Participation During fiscal 2022, Robin P. Selati, Mary L. Baglivo, Carla R. Cooper, and Marie L. Perry served as members of our Compensation Committee. No member of our Compensation Committee had a relationship with the Company that requires disclosure under Item 404 of Regulation S-K. During fiscal 2022, none of our executive officers served as a member of the Board of Directors or Compensation Committee, or other Committee serving an equivalent function, of any entity that has one or more executive officers who served as members of our Board of Directors or our Compensation Committee. None of the members of our Compensation Committee is an officer or employee of the Company, nor have they ever been an officer or employee of the Company. | |

| Nominating & Corporate Governance Committee | ||

Current Members Carla R. Cooper (Chair) Giannella Alvarez Mary L. Baglivo Robin P. Selati

Meetings in 2022 4 | Roles and Responsibilities § Evaluating the composition, size and governance of our Board of Directors and its committees and making recommendations regarding future planning and the appointment of directors to our committees § Establishing a policy for considering stockholder nominees for election to our Board of Directors § Evaluating and recommending candidates for election to our Board of Directors § Evaluating and making recommendations to our Board of Directors regarding stockholder proposals § Overseeing our Board of Directors’ performance and self-evaluation process and developing continuing education programs for our directors § Reviewing and monitoring compliance with our ethics policies | |

| 24 | Nasdaq: RUTH |  |

Corporate and Social Responsibility Committee

| ||

Current Members Mary L. Baglivo (Chair) Giannella Alvarez Cheryl J. Henry Michael P. O’Donnell

Meetings in 2022 2 |

Roles and Responsibilities § Evaluating the Company’s performance as a sustainable and socially responsible organization § Assessing risks relating to food sourcing/supplier diversity and sustainability, environment/climate change, community engagement, philanthropy, diversity, equity and inclusion and management and employee health and well-being § Assessing, monitoring and making recommendations to the Board with respect to matters related to sustainability and social responsibility (including without limitation those related to food sourcing/supplier diversity and sustainability, environment/climate change, community engagement, philanthropy, diversity, equity and inclusion and management and employee health and well-being) § Evaluating management’s implementation of the Company’s overall corporate and social responsibility strategy, including identification, assessment and monitoring of and response to the Company’s major corporate social responsibility priorities, policies and goals | |

Board Practices, Policies, and Processes

Board Meetings and Attendance

Our Board held twelve (12) meetings during fiscal 2022. Directors are expected to attend Board meetings and committee meetings for which they serve, and to spend the time needed to meet as frequently as necessary to properly discharge their responsibilities. Each director attended at least 95% of the aggregate number of meetings of our Board and our Board committees on which they served during the period.

The Company has no policy requiring directors and director nominees to attend its annual meeting of stockholders; however, all directors and director nominees are encouraged to attend. Ms. Henry, our Chairperson of the Board, represented our Board at the 2022 annual meeting of stockholders.

Board and Committee Performance Evaluation

Our Board expanded our evaluation process in 2018 to ensure it continued to be robust and vigorous. The Nominating and Corporate Governance Committee oversees the evaluation process and selected an external facilitator to assist with the process in 2022. In 2022, each Board member completed a written self-assessment regarding their experience on, and effectiveness and performance of, the Board of Directors and each Committee on which they served in 2022. The facilitator reviewed, analyzed, and compiled the results of the written self-assessments, and presented a summary of the results on a “no names” basis to the Nominating and Corporate Governance Committee and the Board of Directors during executive sessions, and identified any themes or issues that emerged. The Board considered the results and identified ways in which Board processes and effectiveness may be enhanced.

| 25 | Nasdaq: RUTH |  |

Directors Orientation and Continuing Education

The Company has an orientation process to acquaint new directors with the strategic plans, business, industry environment, history, current circumstances, key priorities and issues and the top managers of the Company. Periodic briefing sessions are also provided to members of the Board on subjects that would assist them on discharging their duties. Directors are also encouraged to participate in external continuing education programs, as they or the Board determines is desirable or appropriate from time to time.

Corporate Governance Guidelines

In August 2022, the Board revised our Corporate Governance Guidelines, which are available at www.rhgi.com. These governance standards embody many of our long-standing practices, policies and procedures, which are the foundation of our commitment to best practices and enhancing stockholder value.

Transactions with Related Persons

During fiscal 2022, the Company was not a party to any transaction or series of similar transactions in which the amount involved exceeded or will exceed $120,000 and in which any current director, executive officer, holder of more than 5% of our capital stock, or any member of the immediate family of any of the foregoing, had or will have a direct or indirect material interest.

As part of our quarterly internal certification of our financial statements, officers of the Company must either certify that they are not aware of any related party transactions or they must disclose any such transactions.

The Audit Committee is responsible for review, approval or ratification of “related-person transactions” between Ruth’s Hospitality Group, Inc. or its subsidiaries and related persons, in accordance with the terms of our written Related Party Transactions Policy. Under SEC rules, a related person is a director, officer, nominee for director or 5% stockholder of the Company since the beginning of the last fiscal year and their immediate family members. In the course of its review and approval or ratification of a related party transaction, the Audit Committee considers:

| § | the nature of the related party’s interest in the transaction; |

| § | the material terms of the transaction, including the amount involved and type of transaction; |

| § | the importance of the transaction to the related party and to the Company; |

| § | whether the transaction would impair the judgment of a director or executive officer to act in our best interest and the best interest of our stockholders; and |

| § | any other matters that the Audit Committee deems appropriate. |

Any member of the Audit Committee who is a related party with respect to a transaction under review may not participate in the deliberations or vote on the approval or ratification of the transaction. However, such a director may be counted in determining the presence of a quorum at a meeting of the committee that considers the transaction.

| 26 | Nasdaq: RUTH |  |

Director Compensation

Director Compensation for 2022

The following table describes components of non-employee director compensation in effect for fiscal 2022:

| Compensation Element | Current Director Compensation | |

| Annual Retainer | $65,000 annual fee for service on the Board of Directors | |

| Lead Independent Director Additional Annual Retainer | $25,000 | |

| Additional Annual Retainer for Committee Service | $9,000 for Audit Committee $7,500 for Compensation Committee $5,000 for Nominating & Corporate Governance Committee | |

| Committee Chair Additional Annual Retainer | $15,000 for Audit Committee $10,000 for Compensation Committee $7,500 for Nominating & Corporate Governance Committee | |

| Meeting Fees | None | |

| Equity Award | Annual restricted stock unit grants equal to that number of shares with a value on the date of grant of 1.75 multiplied by the annual base cash retainer for service on the Board of Directors (totaling $113,750 in 2022), with such grants vesting annually in equal installments over a three-year period, subject to continued service on the Board of Directors. |

Cash fees are paid quarterly. We reimburse all directors for reasonable out-of-pocket expenses that they incur in connection with their service as directors.

Directors who are also employees receive no compensation for serving as directors. Non-employee directors are not eligible to participate in the deferred compensation plan for executive officers but the Company has a deferred compensation plan for non-employee directors. Information regarding Ms. Henry’s compensation is reflected in the tables beginning on page 50 under “Executive Compensation Tables.”

| 27 | Nasdaq: RUTH |  |

Director Compensation Table

The following table summarizes the compensation paid to the non-employee directors of the Company in 2022:

| Name | Fees Earned or Paid in Cash | Stock Awards(1) | All Other Compensation(2) | Total | ||||||||||||

Giannella Alvarez | $79,000 | $113,754 | $9,465 | $196,666 | ||||||||||||

Mary Baglivo | $77,500 | $113,754 | $8,146 | $199,396 | ||||||||||||

Carla R. Cooper | $85,000 | $113,754 | $5,374 | $204,124 | ||||||||||||

Stephen M. King | $89,000 | $113,754 | $10,191 | $212,941 | ||||||||||||

Michael P. O’Donnell | $65,000 | $113,754 | $4,639 | $183,389 | ||||||||||||

Marie L. Perry | $81,500 | $113,754 | $5,374 | $200,624 | ||||||||||||

Robin P. Selati | $112,500 | $113,754 | $5,374 | $231,624 | ||||||||||||

| (1) | The amounts in this column include the aggregate grant date fair value of Restricted Stock Unit awards computed in accordance with FASB ASC Topic 718, except that in accordance with SEC rules, the amounts do not reflect an estimate for forfeitures related to service-based vesting conditions. |

| (2) | All other compensation includes dividends and/or dividend equivalent units earned on unvested shares of restricted stock. |

ADDITIONAL INFORMATION WITH RESPECT TO DIRECTOR EQUITY AWARDS

The following table summarizes the outstanding equity awards held by our non-employee directors as of the end of fiscal 2022:

Stock Awards(1) | ||||||||

| Name | Number of Shares of Restricted Stock and Restricted Stock Units that have not Vested (#) | Market Value of and Restricted | ||||||

Giannella Alvarez | 10,247 | $157,804 | ||||||

Mary Baglivo | 10,386 | $159,944 | ||||||

Carla R. Cooper | 9,880 | $152,152 | ||||||

Stephen M. King | 10,501 | $161,715 | ||||||

Michael P. O’Donnell | 8,150 | $125,510 | ||||||

Marie L. Perry | 9,880 | $152,152 | ||||||

Robin P. Selati | 9,880 | $152,152 | ||||||

| (1) | Represents restricted stock units granted under the 2018 Omnibus Incentive Plan. Market value calculated based on the closing price of our common stock on the last business day in the fiscal year ending on December 25, 2022 of $15.40. These shares of restricted stock units vest annually in equal installments over a three-year period beginning on the date of grant. |

| 28 | Nasdaq: RUTH |  |

Stock Ownership Guidelines for Non-Employee Directors

For fiscal 2022, each non-employee director was required to own common stock of the Company equal in value to two times their base annual retainer for service on our Board. For purposes of our non-employee director stock ownership guidelines, a director’s “annual retainer” excludes any retainer for serving as a member or as a chair of any Board committees and any meeting fees. Shares subject to stock options and unvested or unearned performance shares will not count toward the minimum ownership requirement. Restricted stock and restricted stock units (whether or not vested) will count toward the minimum ownership requirement. Non-employee directors have three years to achieve their targeted level. All non-employee directors satisfied our stock ownership guidelines as of the end of fiscal 2022.

Anti-Hedging and Pledging Policy

Our insider trading policy prohibits our directors, Named Executive Officers, other elected and appointed officers, designated Team Members who are subject to specific preclearance procedures under the Company’s insider trading policy, and any other Team Members who receive performance-based compensation, from engaging in hedging or other specified transactions. Specifically, this policy prohibits such persons from: engaging in hedging or derivative transactions, such as prepaid variable forward contracts, equity swaps, collars and exchange funds or other similar or related transactions; trading in puts, calls, options, warrants or other similar derivative instruments involving Company securities; or engaging in short sales of Company securities. The Insider Trading Policy also prohibits pledging Company securities as collateral for loans or other transactions without advance approval from our Chief Financial Officer or General Counsel.

None of the shares of Company stock held by our executive officers or directors are pledged or subject to any hedging transaction.

| 29 | Nasdaq: RUTH |  |

ESG Program and Policies

At Ruth’s Chris, we believe in doing well by doing good. Our Board and its committees are committed to sustainability, including integrating environmental, social, and governance (“ESG”) principles into our business strategy in ways that optimize opportunities to make positive impacts while advancing long-term financial and reputational goals. Our mission is to protect the environment; serve our Guests and communities; empower our People; and create value for our stockholders. Our dedication to environmental sustainability and addressing climate change remains in full force through a plan that seeks to balance short-term and long-term solutions.

ESG Board Oversight

In 2020 and 2021, we revamped our ESG strategy to align with the broader transformation of our ESG plan. Our executive leadership team and Board recognized the importance of embedding environmental and social priorities within our business operations and approved an enhanced and modernized ESG strategy intended to drive additional progress on initiatives that promote sustainability, diversity, equity and inclusion (“DEI”), and increased transparency. We believe that our emphasis on ESG priorities will help drive sustainable business practices that are crucial to our long-term growth. Against this backdrop, we engaged an extensive audience of internal, enterprise-wide leadership, subject matter experts and external stakeholders, and completed an updated SASB assessment. These activities informed our updated ESG strategy and sustainability priorities. The four tenets of our ESG strategy include: (1) Our People, (2) Guests & Community, (3) Environmental Responsibility, and (4) Governance.