Exhibit 99.1

| Corporate Development Supply Chain Sales Finance Legal Operations Human Resources Dv Sc Sa Fi Le Op Hr CF Industries Holdings, Inc. NYSE: CF Merrill Lynch Ag Chemicals Conference June 5, 2008 |

| 2 For CF Industries Today . . . Steve Wilson Chairman, President & CEO |

| 3 Safe Harbor Statement Certain statements contained in this presentation may constitute "forward-looking statements" within the meaning of federal securities laws. All statements in this presentation, other than those relating to historical information or current condition, are forward-looking statements. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from such statements. These risks and uncertainties include: the relatively expensive and volatile cost of North American natural gas; the cyclical nature of our business; changes in global fertilizer supply and demand and its impact on markets and selling prices; the nature of our products as global commodities; intense global competition in the consolidating markets in which we operate; conditions in the U.S. agricultural industry; weather conditions; our inability to accurately predict seasonal demand for our products; the concentration of our sales with certain large customers; the impact of changing market conditions on our forward pricing program; the reliance of our operations on a limited number of key facilities; the significant risks and hazards against which we may not be fully insured; reliance on third party transportation providers; unanticipated adverse consequences related to the expansion of our business; our inability to expand our business, including the significant resources that could be required; potential liabilities and expenditures related to environmental and health and safety laws and regulations; our inability to obtain or maintain required permits and governmental approvals; acts of terrorism; difficulties in securing the supply and delivery of raw materials we use and increases in their costs; losses on our investments in securities; loss of key members of management and professional staff; and the other risks and uncertainties included from time to time in our filings with the Securities and Exchange Commission. We undertake no obligation to update or revise any forward-looking statements. |

| 4 Today’s Presentation • A quick overview of CF Industries and its competitive strengths • Our view on ’08 plantings and fertilizer demand ... and their implications for ’09 • Our strategic initiatives to grow and diversify |

| 5 A Quick Overview of CF Industries • A leading North American manufacturer and distributor of nitrogen and phosphate fertilizer • The two largest nitrogen fertilizer complexes in North America • A large, integrated phosphate operation in Central Florida, with excellent reserve position |

| 6 A Quick Overview of CF Industries • Extensive Corn Belt based distribution system • Corn Belt* market share in fertilizer year 2006: – 26% nitrogen – 19% phosphate • Nitrogen marketed primarily in North America; typically export 20-25% of phosphate volume • Global growth platform via KEYTRADE acquisition *ND, SD, NE, MN, IA, MO, IL, OH, IN & WI |

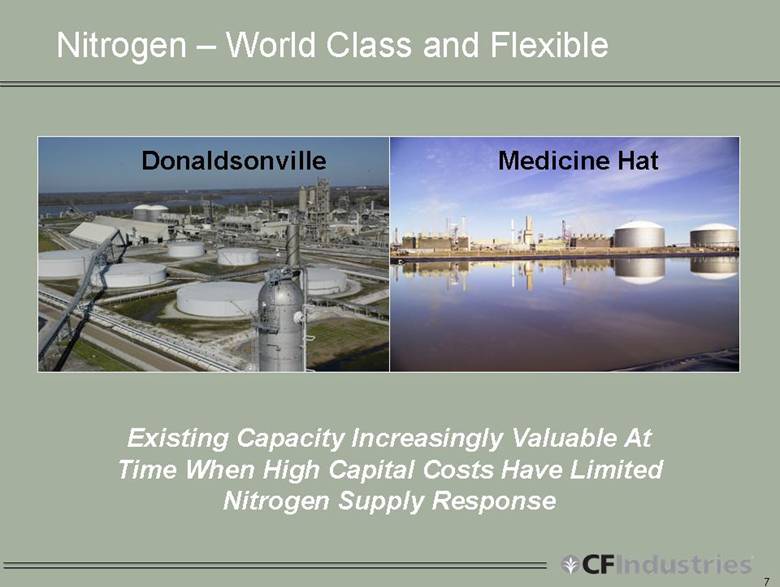

| 7 Nitrogen – World Class and Flexible Existing Capacity Increasingly Valuable At Time When High Capital Costs Have Limited Nitrogen Supply Response Donaldsonville Medicine Hat |

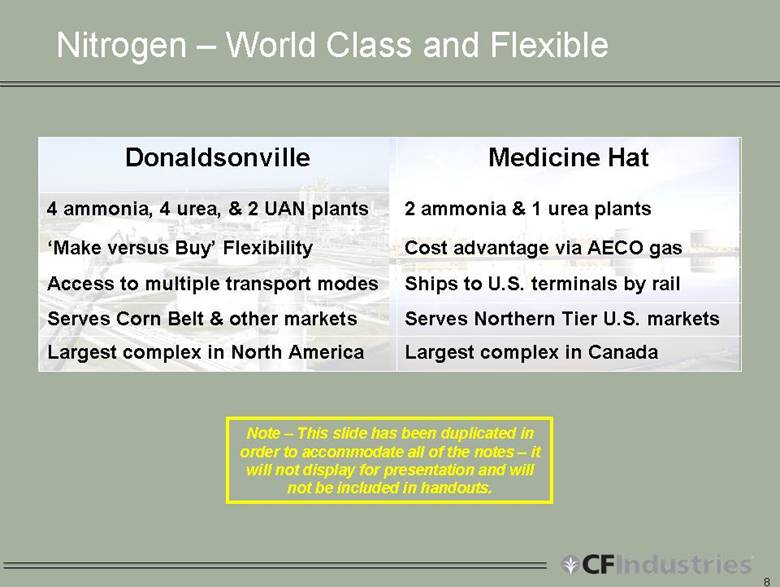

| 8 Nitrogen – World Class and Flexible Largest complex in Canada Largest complex in North America Serves Northern Tier U.S. markets Serves Corn Belt & other markets Ships to U.S. terminals by rail Access to multiple transport modes Cost advantage via AECO gas ‘Make versus Buy’ Flexibility 2 ammonia & 1 urea plants 4 ammonia, 4 urea, & 2 UAN plants Medicine Hat Donaldsonville Note – This slide has been duplicated in order to accommodate all of the notes – it will not display for presentation and will not be included in handouts. |

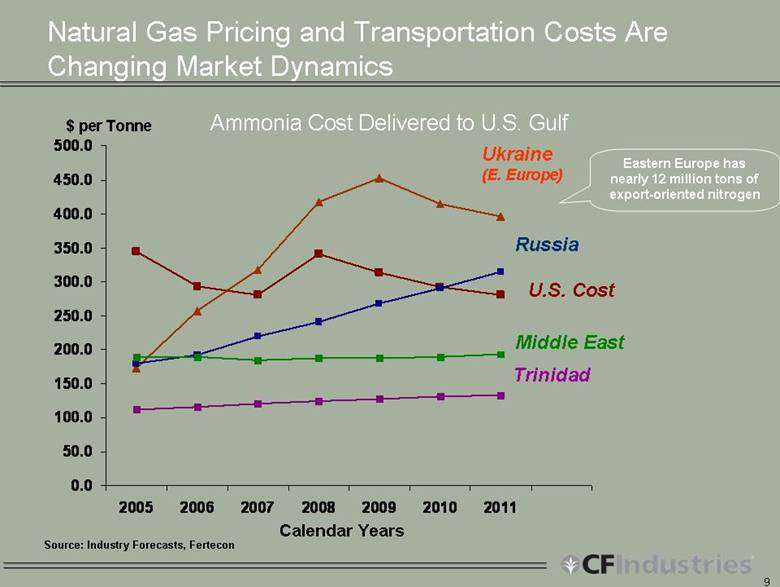

| 9 Natural Gas Pricing and Transportation Costs Are Changing Market Dynamics 0.0 50.0 100.0 150.0 200.0 250.0 300.0 350.0 400.0 450.0 500.0 2005 2006 2007 2008 2009 2010 2011 Calendar Years Source: Industry Forecasts, Fertecon U.S. Cost Ukraine (E. Europe) Russia $ per Tonne Middle East Trinidad Eastern Europe has nearly 12 million tons of export-oriented nitrogen Ammonia Cost Delivered to U.S. Gulf |

| 10 Phosphate: ‘Uncharted Waters’ • CF Industries operates an integrated phosphate business in Central Florida • Phosphate rock mine and beneficiation plant are industry’s newest We Are 100% Self-Sufficient in Phosphate Rock |

| 11 • Rock reserve position is strong, with 24 years of proven reserves – 15 of them fully permitted at 12/31/07 We Are 100% Self-Sufficient in Phosphate Rock Phosphate: ‘Uncharted Waters’ |

| 12 • Plant City chemical plant has 2.1 million tons of DAP and MAP capacity • De-bottlenecking in ‘07 added approximately 60,000 more tons in ‘08 • Port of Tampa facilities provide access to export markets Phosphate: ‘Uncharted Waters’ |

| 13 India DAP Production Cost – Imported Rock ($/Tonne) Source: Fertecon, FMB, Green Markets Skyrocketing Sulfur And Rock Prices Have Pushed Production Costs Up, Especially For Nonintegrated Producers Estimated Cost For Non-integrated Producer In India 0 100 200 300 400 500 600 700 J0 7 F M A M J J A S O N DJ08 F M A MCu r Sulfur - Vancouver ($/LT) Rock FOB Morocco (/$/tonne) $216 $720 $111 $38 0 200 400 600 800 1000 1200 May 06 May 07 May 08 Upgrading Ammonia Rock Sulfur International Price |

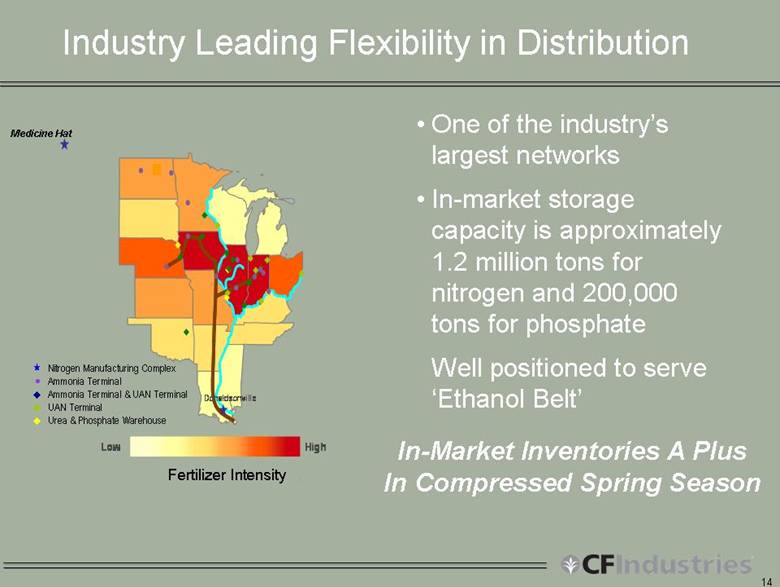

| 14 Nitrogen Manufacturing Complex • Ammonia Terminal Ammonia Terminal & UAN Terminal UAN Terminal Urea & Phosphate Warehouse Industry Leading Flexibility in Distribution • One of the industry’s largest networks • In-market storage capacity is approximately 1.2 million tons for nitrogen and 200,000 tons for phosphate • Well positioned to serve ‘Ethanol Belt’ Fertilizer Intensity Medicine Hat Nitrogen Complex Ammonia Terminal and UAN Terminal Urea Warehouse Ammonia Terminal UAN Terminal Low High Donaldsonville Medicine Hat In-Market Inventories A Plus In Compressed Spring Season |

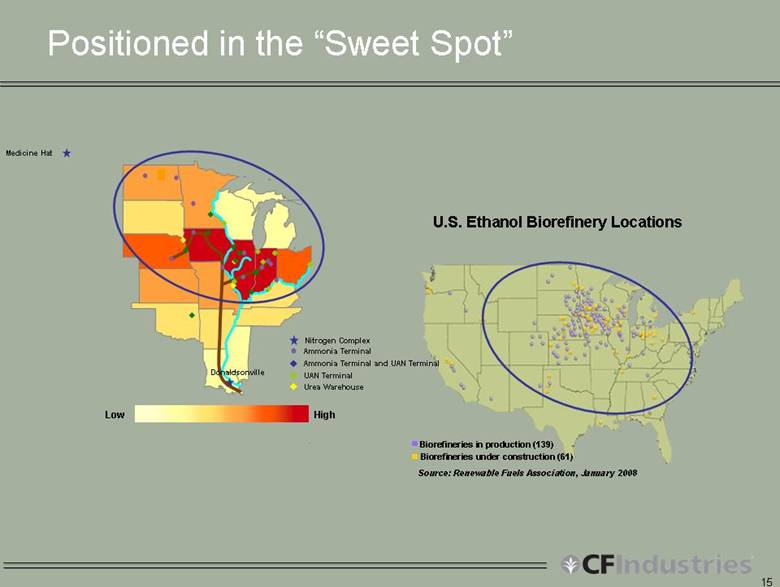

| 15 Positioned in the “Sweet Spot” U.S. Ethanol Biorefinery Locations Medicine Hat Nitrogen Complex Ammonia Terminal and UAN Terminal Urea Warehouse Ammonia Terminal UAN Terminal Low High Donaldsonv ille • Biorefineries in production (139) Biorefineries under construction (61) Source: Ren ewable Fuels A sso ciation, Janu ary 2008 |

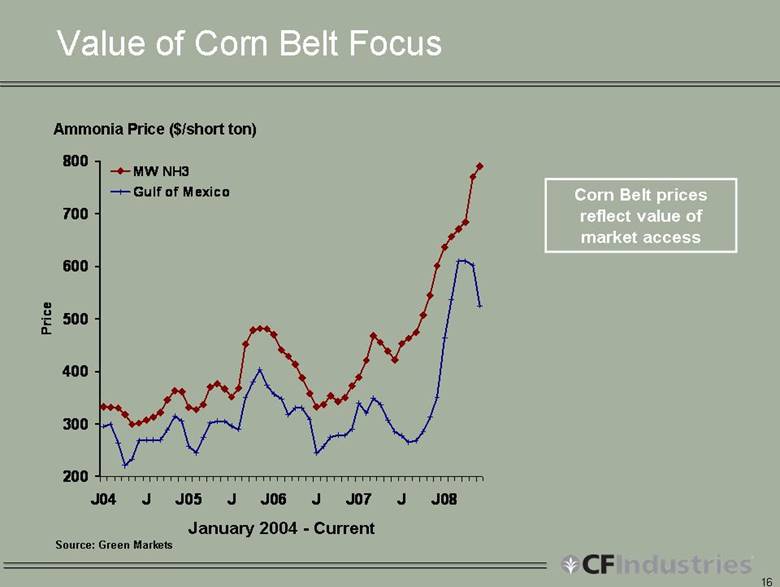

| 16 Value of Corn Belt Focus Source: Green Markets January 2004 - Current Ammonia Price ($/short ton) Corn Belt prices reflect value of market access 200 300 400 500 600 700 800 J04 J J05 J J06 J J07 J J08 Price MW NH3 Gulf of Mexico |

| 17 The ‘Expected’ ’08 Scenario • Supply/demand balance for major crops is tight – globally • Add in strong – and sustained – new demand from biofuels • Prices for major crops have reflected the supply/ demand balance • Crop prices encouraged farmers to increase total acreage • To maximize profits, farmers needed to optimize fertilizer application on those acres • USDA predicts another year of record farm income: $96.6 million China’s Recent Export Taxes Have Further Tightened the Market! |

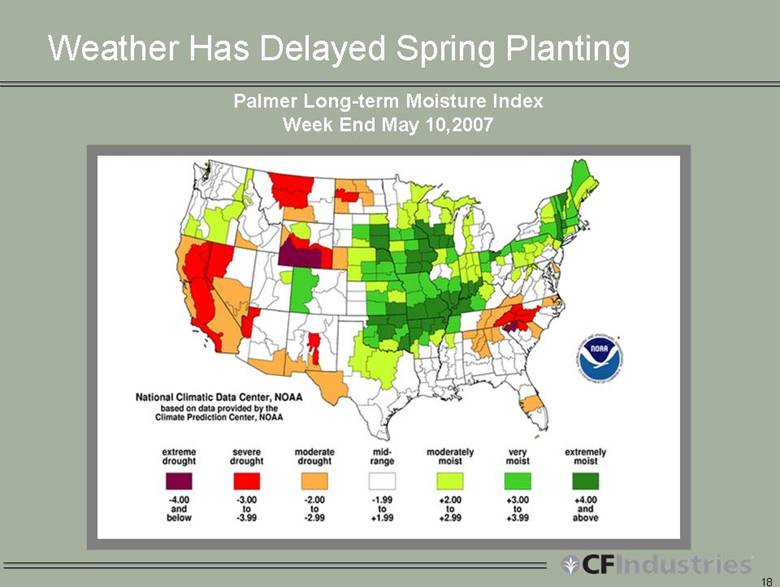

| 18 Weather Has Delayed Spring Planting Palmer Long-term Moisture Index Week End May 10,2007 |

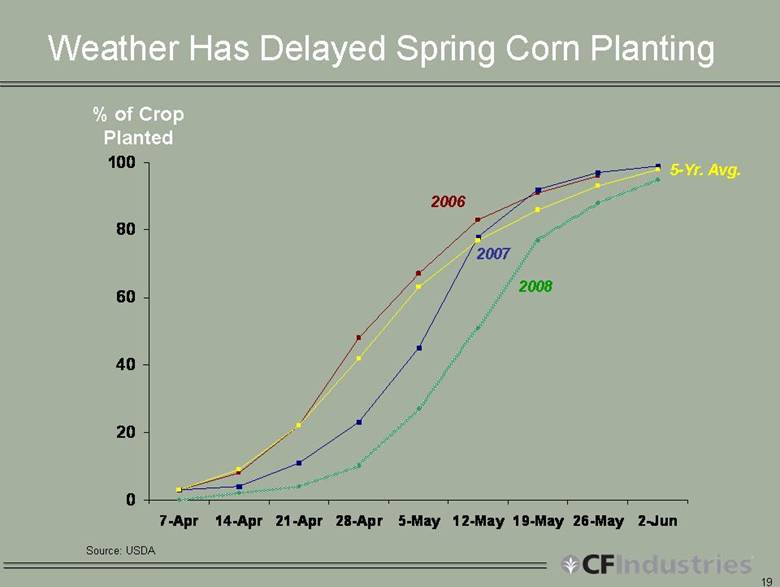

| 19 Weather Has Delayed Spring Corn Planting Source: USDA % of Crop Planted 0 20 40 60 80 100 7-Apr 14-Apr 21-Apr 28-Apr 5-May 12-May 19-May 26-May 2-Jun 2008 5-Yr. Avg. 2006 2007 |

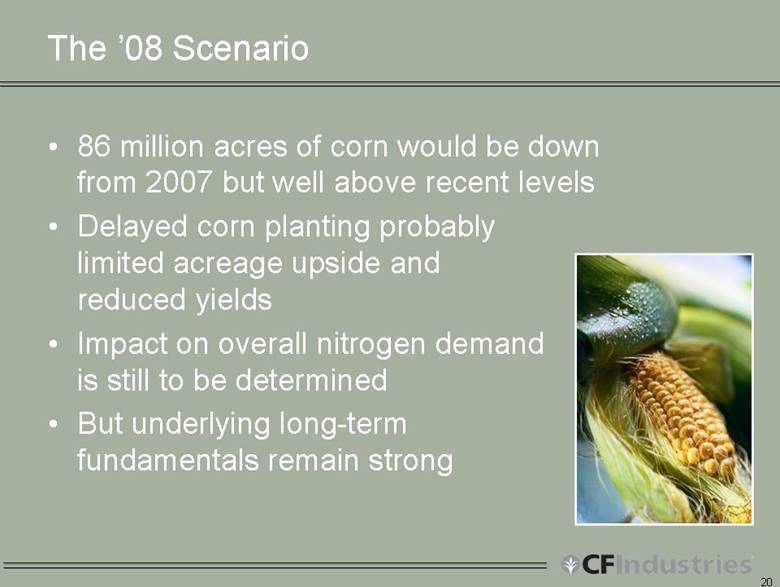

| 20 The ’08 Scenario • 86 million acres of corn would be down from 2007 but well above recent levels • Delayed corn planting probably limited acreage upside and reduced yields • Impact on overall nitrogen demand is still to be determined • But underlying long-term fundamentals remain strong |

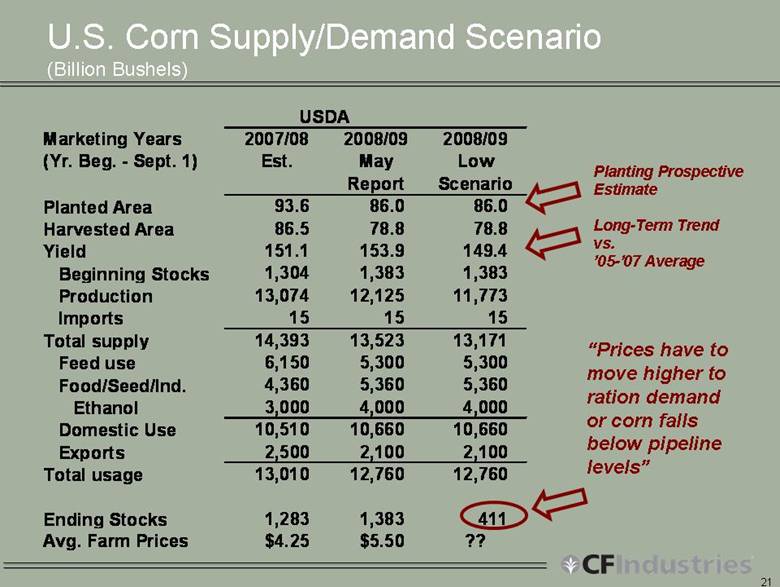

| 21 U.S. Corn Supply/Demand Scenario (Billion Bushels) “Prices have to move higher to ration demand or corn falls below pipeline levels” Long-Term Trend vs. ’05-’07 Average Planting Prospective Estimate Marketing Years 2007/08 2008/09 2008/09 (Yr. Beg. - Sept. 1) Est. May Low Report Scenario Planted Area 93.6 86.0 86.0 Harvested Area 86.5 78.8 78.8 Yield 151.1 153.9 149.4 Beginning Stocks 1,304 1,383 1,383 Production 13,074 12,125 11,773 Imports 15 15 15 Total supply 14,393 13,523 13,171 Feed use 6,150 5,300 5,300 Food/Seed/Ind. 4,360 5,360 5,360 Ethanol 3,000 4,000 4,000 Domestic Use 10,510 10,660 10,660 Exports 2,500 2,100 2,100 Total usage 13,010 12,760 12,760 Ending Stocks 1,283 1,383 411 Avg. Farm Prices $4.25 $5.50 ?? USDA |

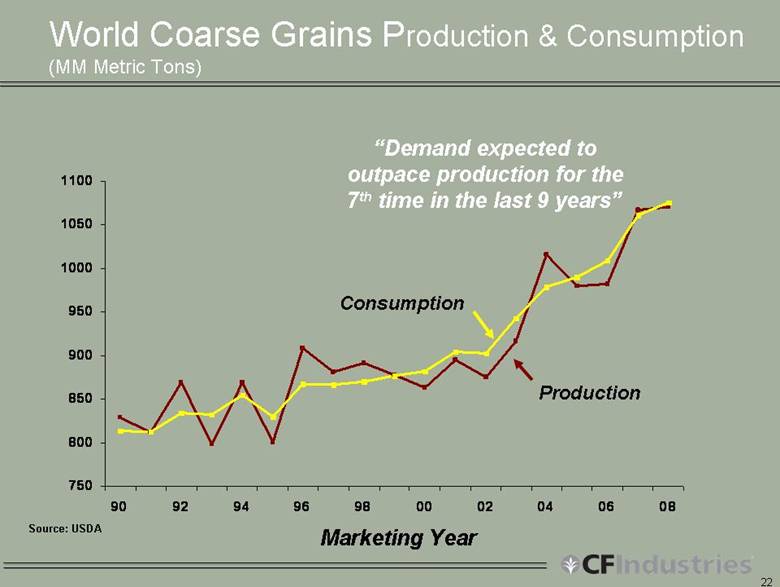

| 22 World Coarse Grains Production & Consumption (MM Metric Tons) 750 800 850 900 950 1000 1050 1100 90 92 94 96 98 00 02 04 06 08 Source: USDA Consumption Production “Demand expected to outpace production for the 7th time in the last 9 years” Marketing Year |

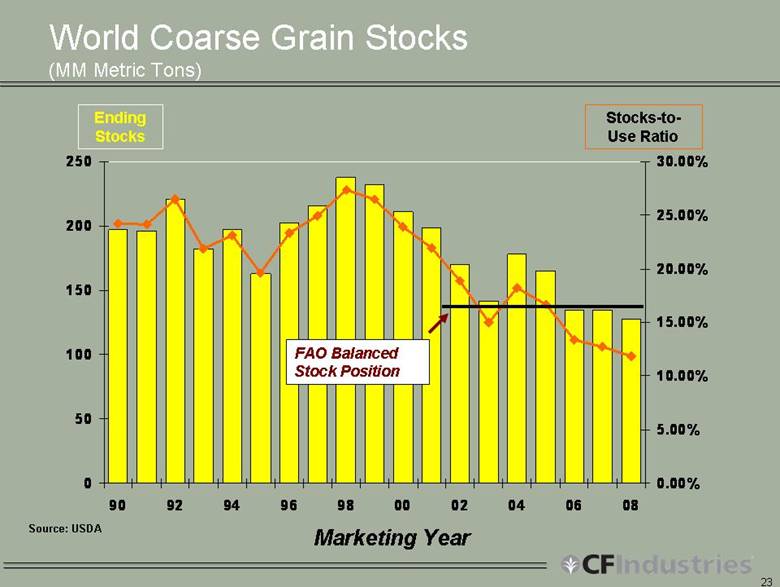

| 23 World Coarse Grain Stocks (MM Metric Tons) 0 50 100 150 200 250 90 92 94 96 98 00 02 04 06 08 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% Source: USDA Marketing Year FAO Balanced Stock Position Ending Stocks Stocks-to- Use Ratio |

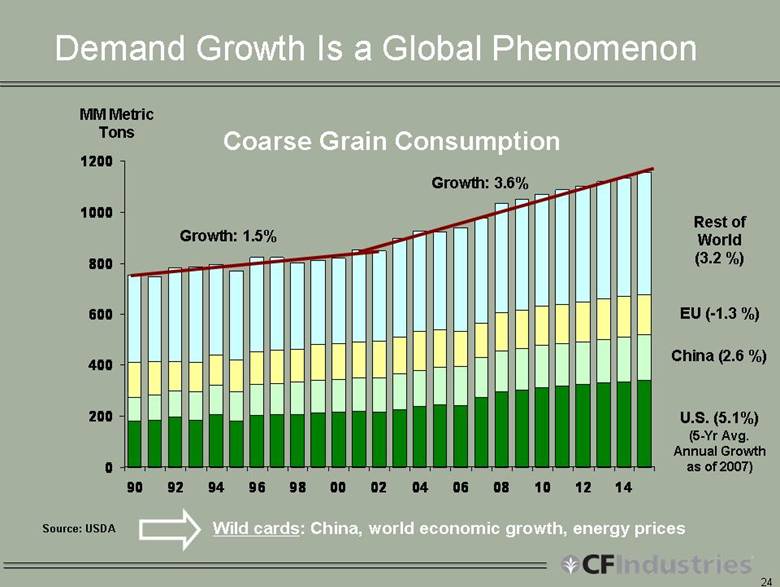

| 24 Demand Growth Is a Global Phenomenon 0 200 400 600 800 1000 1200 90 92 94 96 98 00 02 04 06 08 10 12 14 Source: USDA Rest of World (3.2 %) EU (-1.3 %) China (2.6 %) U.S. (5.1%) Growth: 1.5% Growth: 3.6% MM Metric Tons Coarse Grain Consumption Wild cards: China, world economic growth, energy prices (5-Yr Avg. Annual Growth as of 2007) |

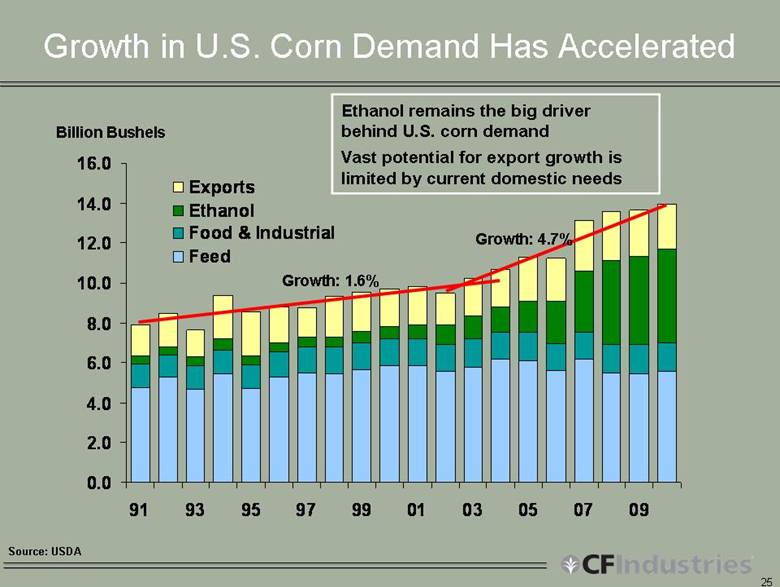

| 25 Growth in U.S. Corn Demand Has Accelerated Billion Bushels Source: USDA 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 91 93 95 97 99 01 03 05 07 09 Exports Ethanol Food & Industrial Feed Ethanol remains the big driver behind U.S. corn demand Vast potential for export growth is limited by current domestic needs Growth: 1.6% Growth: 4.7% |

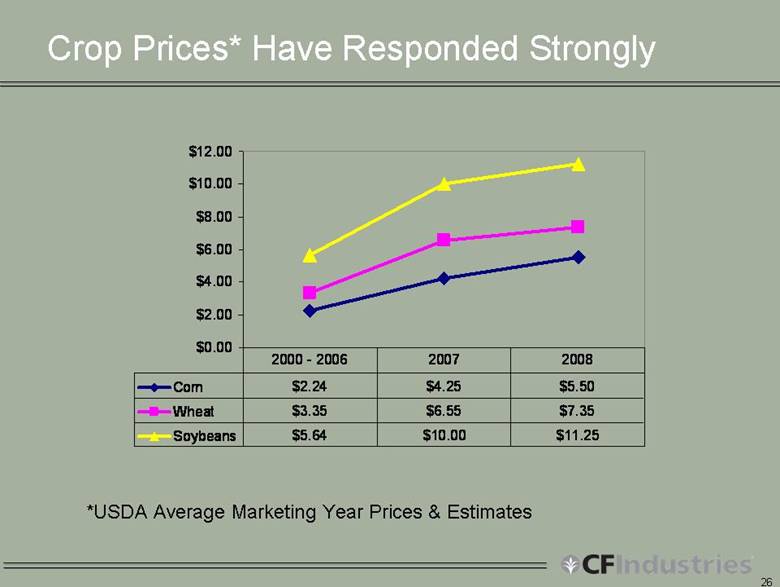

| 26 Crop Prices* Have Responded Strongly *USDA Average Marketing Year Prices & Estimates $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 Corn $2.24 $4.25 $5.50 Wheat $3.35 $6.55 $7.35 Soybeans $5.64 $10.00 $11.25 2000 - 2006 2007 2008 |

| 27 Outlook for 2009 Fertilizer Demand • Nitrogen - strong upside possible – Corn acreage could move above 93 million – Nitrogen application rates on corn could rebound due to strong corn prices – High nitrogen demand on corn could be partially offset by lower demand on other crops/pasture – Fall ’08 Season (ammonia) could be strong • Phosphates – gains could be modest – Could see some price resistance, particularly on acreage other than corn – If so, application rates flat to down |

| 28 An Optimistic ‘Present,’ But What about The Future? |

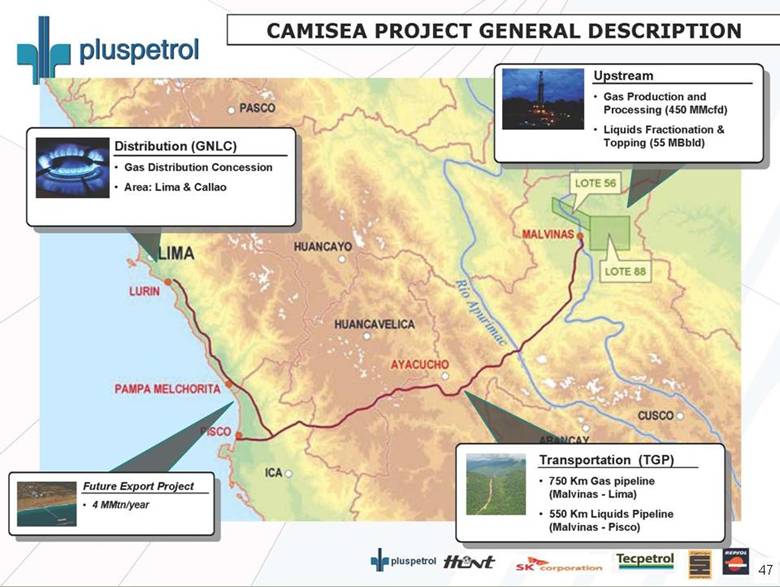

| 29 • Acquisition of 50 percent of KEYTRADE, 3 million tonne per year global fertilizer trader • Markets in fertilizer in 65 nations • Acquisition provides established, extensive global platform to pursue growth and diversification • Presence in Perú and rest of Central & South America Specific Strategic Initiatives: Global Platform for Marketing & Sourcing |

| 30 • On November 19, CF Industries won bidding for natural gas pact in Perú • Proposed facility is world-scale nitrogen complex • Markets in region include Perú, Central & South America, and Mexico Specific Strategic Initiatives: Proposed Nitrogen Complex in Perú |

| 31 Specific Strategic Initiatives: Uranium Recovery • Uranium recovery opportunity at Plant City Phosphate Complex – Extracted from phosphate fertilizer production – Key is procuring long-term supply contracts with utilities – Economic returns promising |

| 32 Specific Strategic Initiatives: Gasification Project • Gasification/ammonia complex at Donaldsonville Nitrogen Complex – Reduce dependence on North American natural gas by converting substantial portion of complex to low-cost petcoke/coal blend – Increase operational flexibility – Evaluating alternative technologies and configurations |

| 33 Discipline in Capital Deployment • We have a strong balance sheet and continue to generate positive cash flow • We have demonstrated strong operational discipline in coping with challenging and volatile business environments • We are committed to demonstrating the same discipline in capital deployment, implementing our ‘Grow and Diversify’ strategy |

| 34 Positioned to Win • Worldwide demand for grain has created robust crop pricing and fertilizer demand • After a wet early spring, corn crop is in the ground • CF Industries is well positioned to capitalize on today’s opportunity |

| 35 Save the Date November 17 – 18, 2008 CF Industries 2008 Analyst & Investor Day Marriott Tampa Airport Tampa, Florida Watch for details . . . . . |

| 36 |

| APPENDIX |

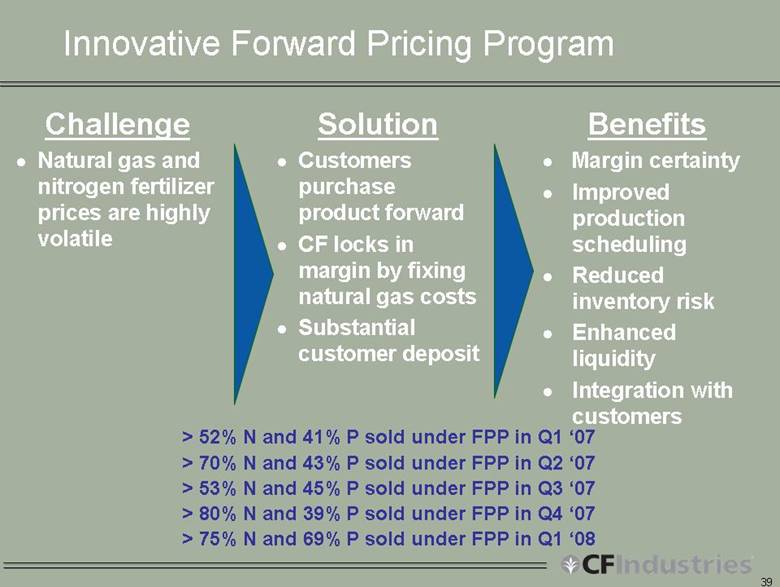

| 38 Innovative Forward Pricing Program • Locks in assured supply and price for customers – and nitrogen margins – for CF Industries • Prices and margins reflect expectations for market conditions • Our forward prices for phosphate reflect higher sulfur and ammonia costs In Q1’s Rising Natural Gas Cost Environment, We Benefited From The FPP’s Locked-In Natural Gas Costs |

| 39 > 52% N and 41% P sold under FPP in Q1 ‘07 Challenge • Natural gas and nitrogen fertilizer prices are highly volatile Benefits • Margin certainty • Improved production scheduling • Reduced inventory risk • Enhanced liquidity • Integration with customers Solution • Customers purchase product forward • CF locks in margin by fixing natural gas costs • Substantial customer deposit > 70% N and 43% P sold under FPP in Q2 ‘07 > 53% N and 45% P sold under FPP in Q3 ‘07 > 80% N and 39% P sold under FPP in Q4 ‘07 > 75% N and 69% P sold under FPP in Q1 ‘08 Innovative Forward Pricing Program |

| 40 Continued Growth for Ethanol • Margins for ethanol are positive, thanks to increased prices for ethanol and Distillers Dried Grains • U.S. Renewable Fuel Standard mandates 15 billion gallons of corn-based ethanol by 2015 • Capacity today is 7.9 billion gallons, with 5.6 billion more due to come on stream by end of ’08 • Process technology/logistical improvements are ongoing Corn demand for ethanol could increase from 3.1 billion bushels in’ 07, to 4.1 billion in ’08, and 4.45 billion in ‘09 |

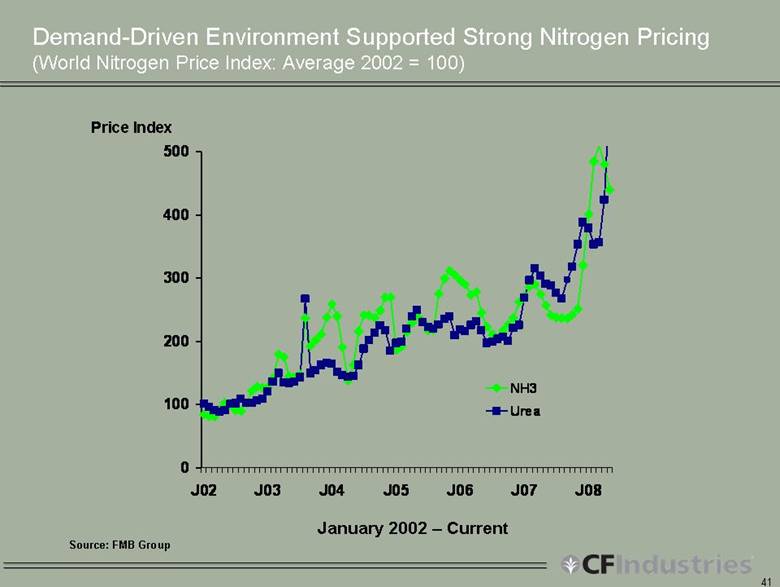

| 41 Demand-Driven Environment Supported Strong Nitrogen Pricing (World Nitrogen Price Index: Average 2002 = 100) 0 100 200 300 400 500 J02 J03 J04 J05 J06 J07 J08 NH3 Urea Source: FMB Group January 2002 – Current Price Index |

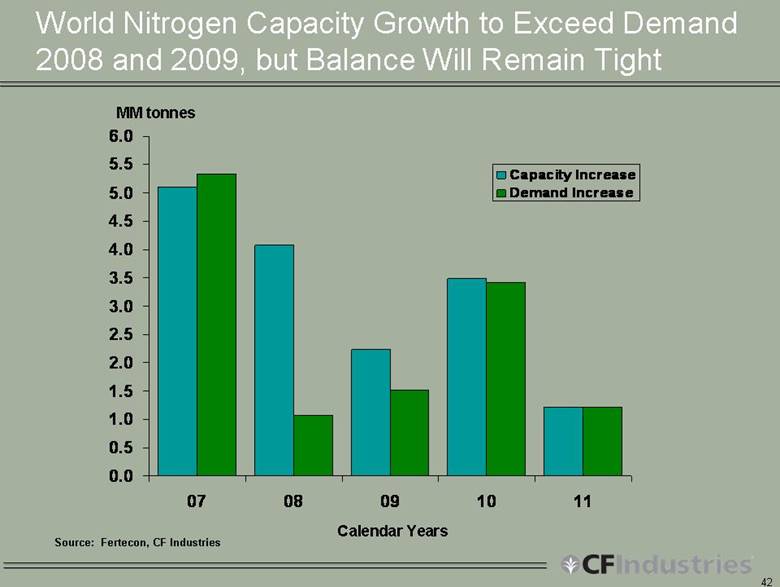

| 42 World Nitrogen Capacity Growth to Exceed Demand 2008 and 2009, but Balance Will Remain Tight 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 07 08 09 10 11 Capacity Increase Demand Increase Calendar Years Source: Fertecon, CF Industries MM tonnes |

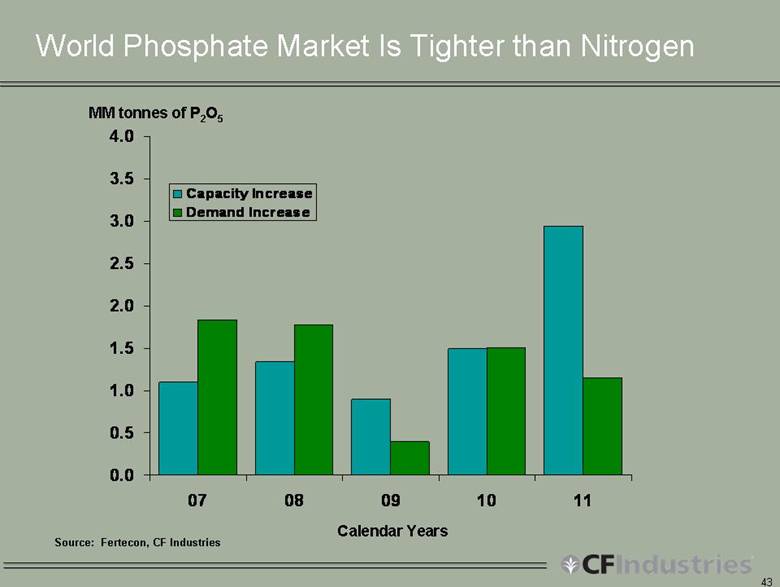

| 43 World Phosphate Market Is Tighter than Nitrogen 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 07 08 09 10 11 Capacity Increase Demand Increase Calendar Years Source: Fertecon, CF Industries MM tonnes of P2O5 |

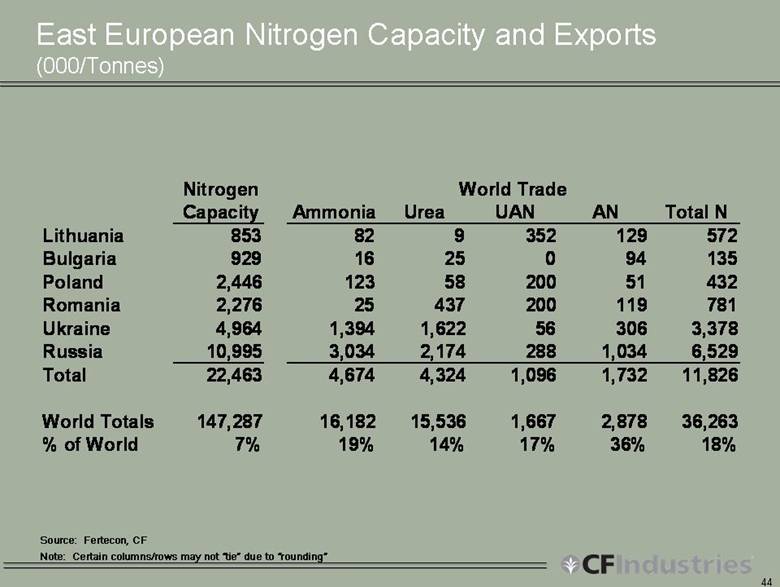

| 44 East European Nitrogen Capacity and Exports (000/Tonnes) Source: Fertecon, CF Note: Certain columns/rows may not “tie” due to “rounding” Nitrogen Capacity Ammonia Urea UAN AN Total N Lithuania 853 82 9 352 129 572 Bulgaria 929 16 25 0 94 135 Poland 2,446 123 58 200 51 432 Romania 2,276 25 437 200 119 781 Ukraine 4,964 1,394 1,622 56 306 3,378 Russia 10,995 3,034 2,174 288 1,034 6,529 Total 22,463 4,674 4,324 1,096 1,732 11,826 World Totals 147,287 16,182 15,536 1,667 2,878 36,263 % of World 7% 19% 14% 17% 36% 18% World Trade |

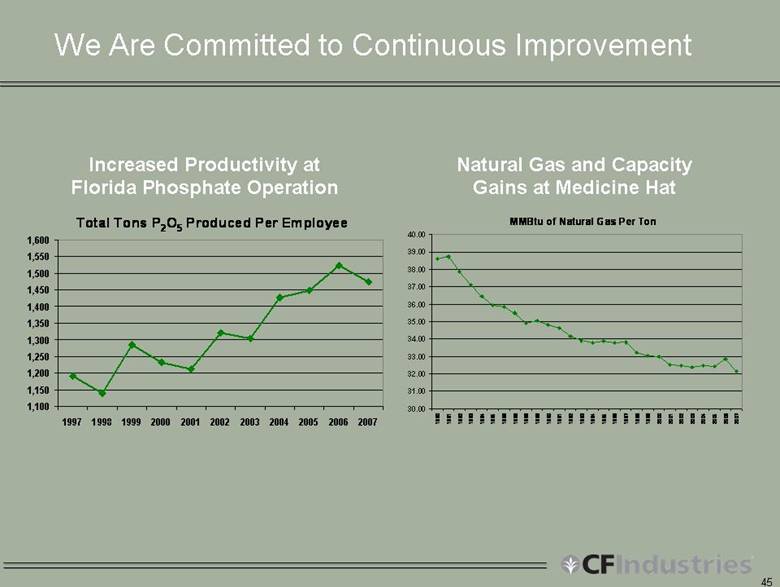

| 45 Increased Productivity at Florida Phosphate Operation Natural Gas and Capacity Gains at Medicine Hat MMBtu of Natural Gas Per Ton 30.00 31.00 32.00 33.00 34.00 35.00 36.00 37.00 38.00 39.00 40.00 1980 1981 1982 1983 1984 1985 1986 1986 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 We Are Committed to Continuous Improvement Total Tons P2O5 Produced Per Employee 1,100 1,150 1,200 1,250 1,300 1,350 1,400 1,450 1,500 1,550 1,600 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 |

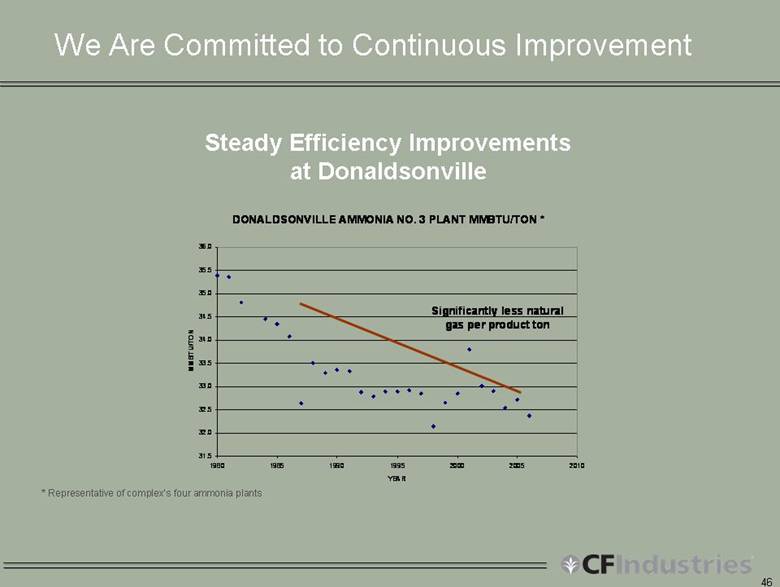

| 46 Steady Efficiency Improvements at Donaldsonville * Representative of complex’s four ammonia plants DONALDSONVILLE AMMONIA NO. 3 PLANT MMBTU/TON * 31.5 32.0 32.5 33.0 33.5 34.0 34.5 35.0 35.5 36.0 1980 1985 1990 1995 2000 2005 2010 YEAR MMBTU/TON Significantly less natural gas per product ton We Are Committed to Continuous Improvement |

| 47 • Insert map of Peru / Camisea Project General Description, page 23 of pdf file. 4 |