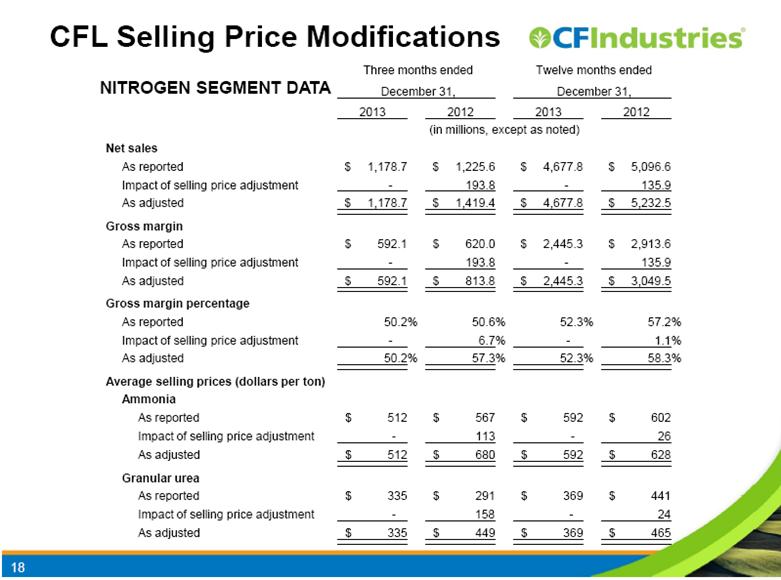

| CFL Selling Price Modifications 16 Prior to April 30, 2013, CF Industries, Inc. (CF Industries) owned 49% of the voting common shares and 66% of the non-voting preferred shares of Canadian Fertilizers Limited (CFL), an Alberta, Canada based nitrogen fertilizer manufacturer and had the right to purchase 66% of the production of CFL. Also prior to April 30, 2013, Viterra, Inc. (Viterra) held 34% of the equity ownership of CFL and had the right to purchase up to 34% of CFL’s production. Both CF Industries and Viterra were entitled to receive distributions of net earnings of CFL based upon their respective purchases from CFL. CFL was a variable interest entity that was consolidated in the Company’s financial statements. On April 30, 2013, CF Industries completed the acquisitions of all of the outstanding interests in CFL that it did not already own and CFL became a wholly owned subsidiary of the Company. CF Industries’ and Viterra’s purchases of nitrogen fertilizer products from CFL were made under product purchase agreements, and the selling prices were determined under the provisions of these agreements. An initial selling price was paid to CFL based upon CFL’s production cost plus an agreed-upon margin once title passed as the product was shipped. At the end of the year, the difference between the market price of products purchased from CFL and the price based on production cost plus an agreed-upon margin was paid to CFL. The sales revenue attributable to this difference was accrued by the Company on an interim basis. Until April 30, 2013 when CFL became a wholly owned subsidiary in the Company’s financial statements, net sales and accounts receivable attributable to CFL were solely generated by transactions with Viterra, as all transactions with CF Industries were eliminated in consolidation in the Company’s financial statements. In the fourth quarter of 2012, the CFL Board of Directors approved amendments to the product purchase agreements retroactive to January 1, 2012 that modified the selling prices that CFL charged for products sold to Viterra and CF Industries which eliminated the requirement to pay to CFL the difference between the market price and the price based on production cost plus an agreed-upon margin. The following summarizes the selling prices in the product purchase agreements that impacted the Company’s results both before and after the effective date of the amendment. For 2012 and between January 1, 2013 and April 30, 2013, the Company’s consolidated financial statements reflect production cost plus an agreed-upon margin based selling prices for products purchased from CFL including sales made by CFL to Viterra. Starting on April 30, 2013, CFL became a wholly owned subsidiary of CF Industries. Once CFL became a wholly owned subsidiary, CF industries began purchasing all of the output of CFL for resale and reported those sales in its consolidated financial statements at market based selling prices. As a result, the financial results for 2013 include four months of selling prices based on production cost plus an agreed-upon margin and eight months of market based selling prices. These selling price amendments to the product purchase agreements impact the comparability of the Company’s financial results. These changes affect the year-over-year comparability of net sales, gross margin, operating earnings, earnings before income taxes and net earnings attributable to noncontrolling interest, but do not impact the comparability of the Company’s net earnings attributable to common stockholders or net cash flows for the same period. In order to provide comparable information for the periods presented, certain financial information is being provided for the prior year comparable periods adjusted as if the current year CFL pricing calculation pattern of four months of cost based pricing and eight months of market based pricing had been used in the prior year comparable periods. |