Exhibit 99.1

1 1 2017 Third Quarter Financial Results November 1, 2017 NYSE: CF 2020 First Quarter Supplemental Materials May 2020 NYSE: CF

2 Safe harbor s tatement All statements in this communication by CF Industries Holdings, Inc. (together with its subsidiaries, the “Company”), other t han those relating to historical facts, are forward - looking statements. Forward - looking statements can generally be identified by their use of terms s uch as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” or “would” and similar terms and phrases, including references to assumptions. Forward - looking statements are not guarantees of future performance and are subject to a number of as sumptions, risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materiall y f rom such statements. These statements may include, but are not limited to, statements about strategic plans and statements about futur e f inancial and operating results. Important factors that could cause actual results to differ materially from those in the forward - looking statements include, among others, the impact of the novel coronavirus disease 2019 (COVID - 19) pandemic, including measures taken by governmental authoriti es to slow the spread of the virus, on our business and operations; the cyclical nature of the Company’s business and the impact of global supply and demand on the Company’s selling prices; the global commodity nature of the Company’s fertilizer products, the conditions in the international market for nitrogen products, and the intense global competition from other fertilizer producers; conditions in the United States, Europe and other agricultural areas; the volatility of natural gas prices in North America and Europe; difficulties in securing the supply and delivery of raw mat eri als, increases in their costs or delays or interruptions in their delivery; reliance on third party providers of transportation services and eq uip ment; the significant risks and hazards involved in producing and handling the Company’s products against which the Company may not be fully insured; the Co mpany’s ability to manage its indebtedness and any additional indebtedness that may be incurred; the Company's ability to maintain compliance with covenants under its revolving credit agreement and the agreements governing its indebtedness; downgrades of the Company’s credit ratings; risks associated with cyber security; weather conditions; risks associated with changes in tax laws and disagreements with taxing authorities; the Company’s reliance on a limited number of key facilities; potential liabilities and expenditures related to environmental, he alt h and safety laws and regulations and permitting requirements; future regulatory restrictions and requirements related to greenhouse gas emissions; ri sks associated with expansions of the Company’s business, including unanticipated adverse consequences and the significant resources that could b e r equired; the seasonality of the fertilizer business; the impact of changing market conditions on the Company’s forward sales programs; ris ks involving derivatives and the effectiveness of the Company’s risk measurement and hedging activities; risks associated with the operation or management of the strategic venture with CHS Inc. (the "CHS Strategic Venture "), risks and uncertainties relating to the market prices of the fertilizer products that are the subject of the supply agreement with CHS Inc. over the life of the supply agreement and the risk that any challenges rel ated to the CHS Strategic Venture will harm the Company's other business relationships; risks associated with the Company’s Point Lisas Nitro gen Limited joint venture; acts of terrorism and regulations to combat terrorism; risks associated with international operations; and deteriora tio n of global market and economic conditions. More detailed information about factors that may affect the Company’s performance and could cause actual results to differ materially from those in any forward - looking statements may be found in CF Industries Holdings, Inc.’s filings with the Securiti es and Exchange Commission, including CF Industries Holdings, Inc.’s most recent annual and quarterly reports on Form 10 - K and Form 10 - Q, which are available in the Investor Relations section of the Company’s website . Forward - looking statements are given only as of the date of this presentation and the Company disclaims any obligation to update or revise the forward - looking statements, whether as a result of new information, fut ure events or otherwise, except as required by law.

3 Note regarding n on - GAAP f inancial m easures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). Managemen t b elieves that EBITDA, adjusted EBITDA, free cash flow, free cash flow to adjusted EBITDA conversion, and free cash flow yield, which are non - GAAP financial measures, provide additional meaningful information regarding the Company's performance and financial strength. No n - G AAP financial measures should be viewed in addition to, and not as an alternative for, the Company's reported results prepared in ac cordance with GAAP. In addition, because not all companies use identical calculations, EBITDA, adjusted EBITDA, free cash flow, and free c ash flow yield included in this presentation may not be comparable to similarly titled measures of other companies. Reconciliations of EBIT DA, adjusted EBITDA, free cash flow, and free cash flow yield to the most directly comparable GAAP measures are provided in the tables acc omp anying this presentation. EBITDA is defined as net earnings attributable to common stockholders plus interest expense - net, income taxes, and depreciatio n and amortization. Other adjustments include the elimination of loan fee amortization that is included in both interest and amort iza tion, and the portion of depreciation that is included in noncontrolling interest. The Company has presented EBITDA because management uses the measure to track performance and believes that it is frequently used by securities analysts, investors and other interested parties i n t he evaluation of companies in the industry. Adjusted EBITDA is defined as EBITDA adjusted with the selected items included in EBITDA as summarized in the tables accompan yin g this presentation. The Company has presented adjusted EBITDA because management uses adjusted EBITDA, and believes it is useful to investors, as a supplemental financial measure in the comparison of year - over - year performance . Free cash flow is defined as net cash provided by operating activities, as stated in the consolidated statements of cash flow s, reduced by capital expenditures and distributions to noncontrolling interests. Free cash flow to adjusted EBITDA conversion is defined as free cash flow divided by a djusted EBITDA. Free cash flow yield is defined as free cash flow divided by market value of equity (market cap). The Company has pre sen ted free cash flow, free cash flow to adjusted EBITDA conversion, and free cash flow yield because management uses these measures and believes they are useful to investors, as indications of the strength of the Company and its ability to generate cash and to eva luate the Company’s cash generation ability relative to its industry competitors. It should not be inferred that the entire free cash flow amount is available for discretionary expenditures.

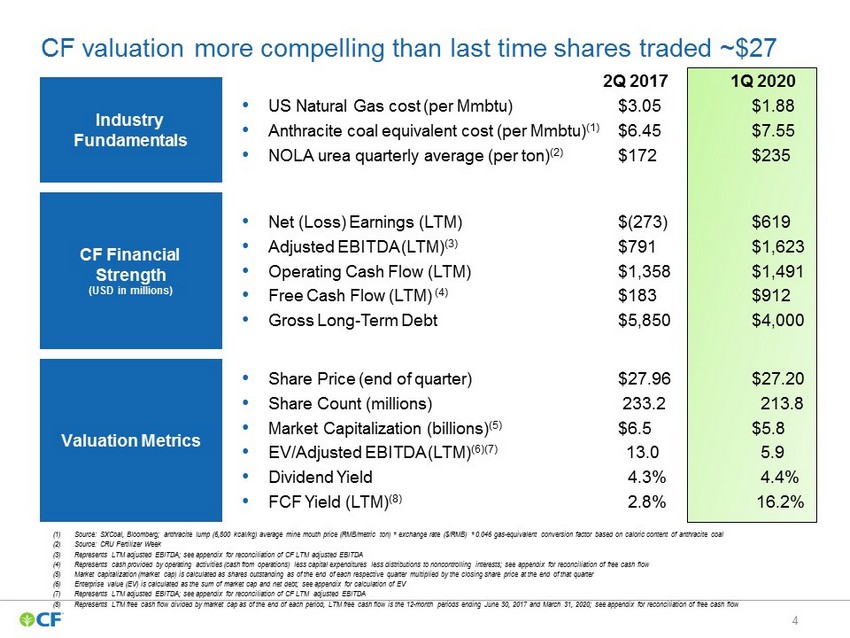

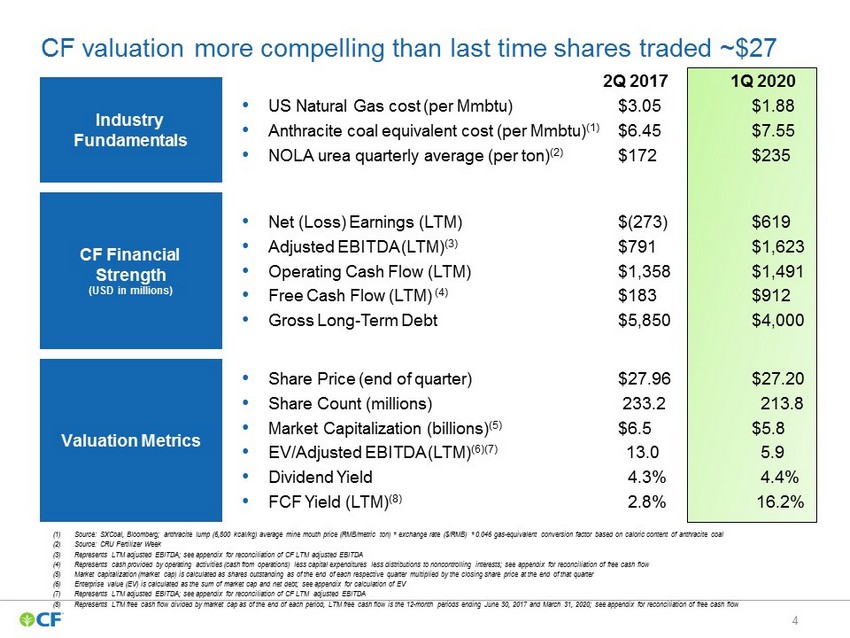

4 CF valuation more c ompelling than last time shares traded ~$27 (1) Source: SXCoal , Bloomberg; anthracite lump (6,800 kcal/kg) average mine mouth price (RMB/metric ton) * exchange rate ($/RMB) * 0.046 gas - equiv alent conversion factor based on caloric content of anthracite coal (2) Source: CRU Fertilizer Week (3) Represents LTM adjusted EBITDA; see appendix for reconciliation of CF LTM adjusted EBITDA (4) Represents cash provided by operating activities (cash from operations) less capital expenditures less distributions to nonco ntr olling interests; see appendix for reconciliation of free cash flow (5) Market capitalization (market cap) is calculated as shares outstanding as of the end of each respective quarter multiplied by the closing share price at the end of that quarter (6) Enterprise value (EV) is calculated as the sum of market cap and net debt; see appendix for calculation of EV (7) Represents LTM adjusted EBITDA; see appendix for reconciliation of CF LTM adjusted EBITDA (8) Represents LTM free cash flow divided by market cap as of the end of each period, LTM free cash flow is the 12 - month periods ending June 30, 2017 and March 31, 2020; see appendix for reconciliation of free cash flow • US Natural Gas cost (per Mmbtu ) $3.05 $1.88 • Anthracite coal equivalent cost (per Mmbtu ) ( 1 ) $6.45 $7.55 • NOLA urea quarterly average (per ton) (2) $172 $235 Industry Fundamentals Valuation Metrics • Share Price (end of quarter) $27.96 $27.20 • Share Count (millions) 233.2 213.8 • Market Capitalization (billions) (5) $6.5 $5.8 • EV/Adjusted EBITDA (LTM) (6)(7) 13.0 5.9 • Dividend Yield 4.3% 4.4% • FCF Yield (LTM) (8) 2.8% 16.2% CF Financial Strength (USD in millions) • Net (Loss) Earnings (LTM) $(273) $619 • Adjusted EBITDA (LTM) (3) $791 $1,623 • Operating Cash Flow (LTM) $1,358 $1,491 • Free Cash Flow (LTM) (4) $183 $912 • Gross Long - Term Debt $5,850 $4,000 2Q 2017 1Q 2020

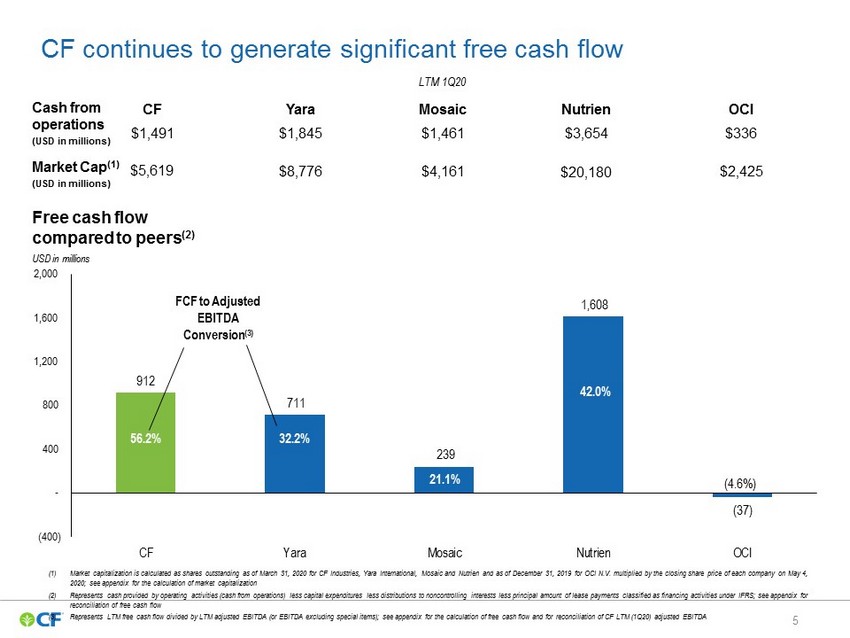

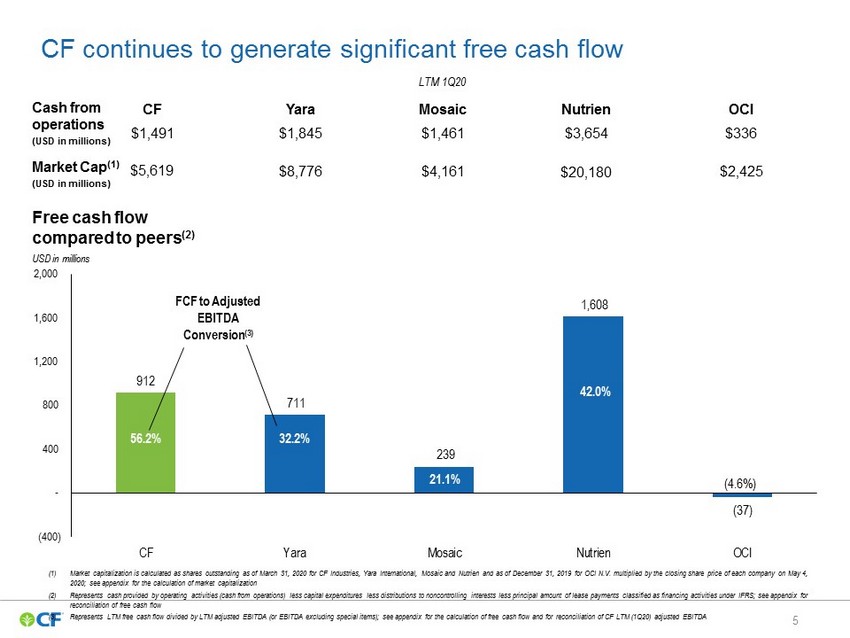

5 (1) Market capitalization is calculated as shares outstanding as of March 31, 2020 for CF Industries, Yara International, Mosaic and Nutrien and as of December 31, 2019 for OCI N.V. multiplied by the closing share price of each company on May 4, 2020; see appendix for the calculation of market capitalization (2) Represents c ash p rovided by operating a ctivities (cash from operations) less capital expenditures less distributions to noncontrolling interests less principal amount of lease payments classified as financing activities under IFRS; see appendix for reconciliation of free cash flow (3) Represents LTM free cash flow divided by LTM adjusted EBITDA (or EBITDA excluding special items); see appendix for the calcul ati on of free cash flow and for reconciliation of CF LTM (1Q20) adjusted EBITDA 912 711 239 1,608 (37) (400) - 400 800 1,200 1,600 2,000 CF Yara Mosaic Nutrien OCI CF continues to generate significant free cash flow Free cash flow compared to peers (2) USD in millions Cash from operations (USD in millions) Market Cap (1) (USD in millions) CF $1,491 OCI $336 Nutrien $3,654 Mosaic $1,461 Yara $1,845 $5,619 $8,776 $4,161 $20,180 $2,425 42.0% (4.6%) 21.1% 32.2% 56.2% FCF to Adjusted EBITDA Conversion (3) LTM 1Q20

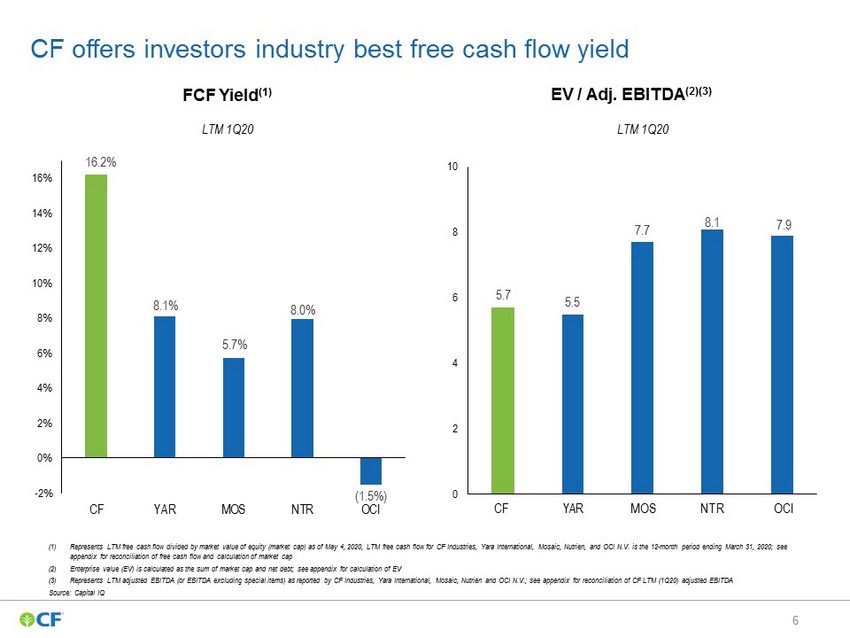

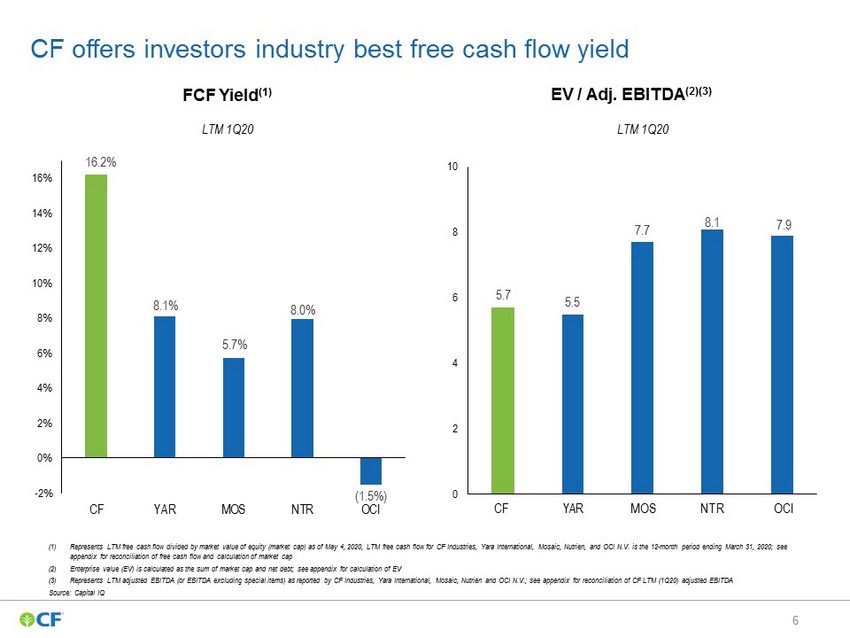

6 5.7 5.5 7.7 7.9 8.1 0 2 4 6 8 10 16.2% 8.1% 5.7% 8.0% (1.5%) -2% 0% 2% 4% 6% 8% 10% 12% 14% 16% CF YAR MOS NTR OCI CF offers investors industry best free cash flow yield CF YAR MOS NTR OCI EV / Adj. EBITDA (2)(3) FCF Yield (1) (1) Represents LTM free cash flow divided by market value of equity (market cap) as of May 4, 2020, LTM free cash flow for CF Ind ust ries, Yara International, Mosaic, Nutrien , and OCI N.V. is the 12 - month period ending March 31, 2020; see appendix for reconciliation of free cash flow and calculation of market cap (2) Enterprise value (EV) is calculated as the sum of market cap and net debt; see appendix for calculation of EV (3) Represents LTM adjusted EBITDA (or EBITDA excluding special items) as reported by CF Industries, Yara International, Mosaic, Nut rien and OCI N.V.; see appendix for reconciliation of CF LTM (1Q20) adjusted EBITDA Source : Capital IQ LTM 1Q20 LTM 1Q20

7 Appendix

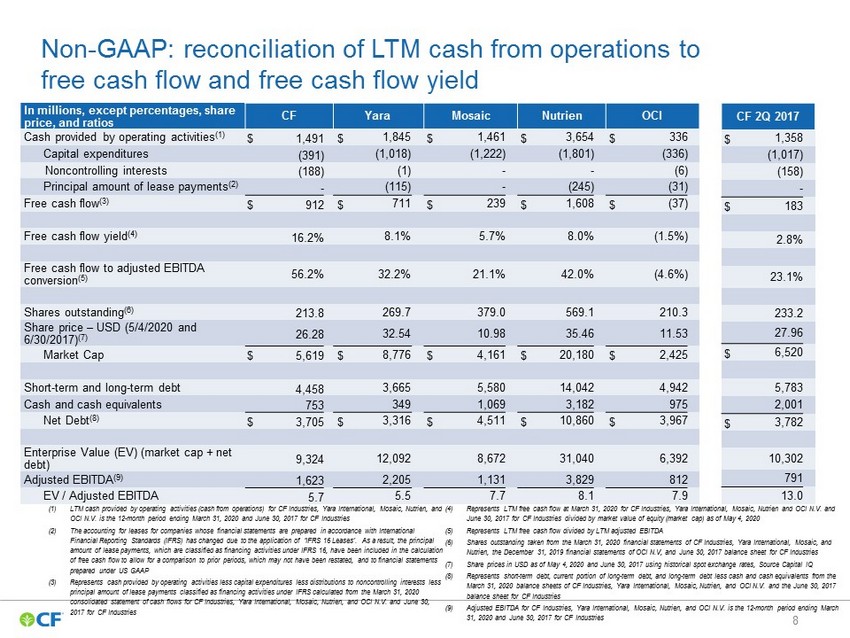

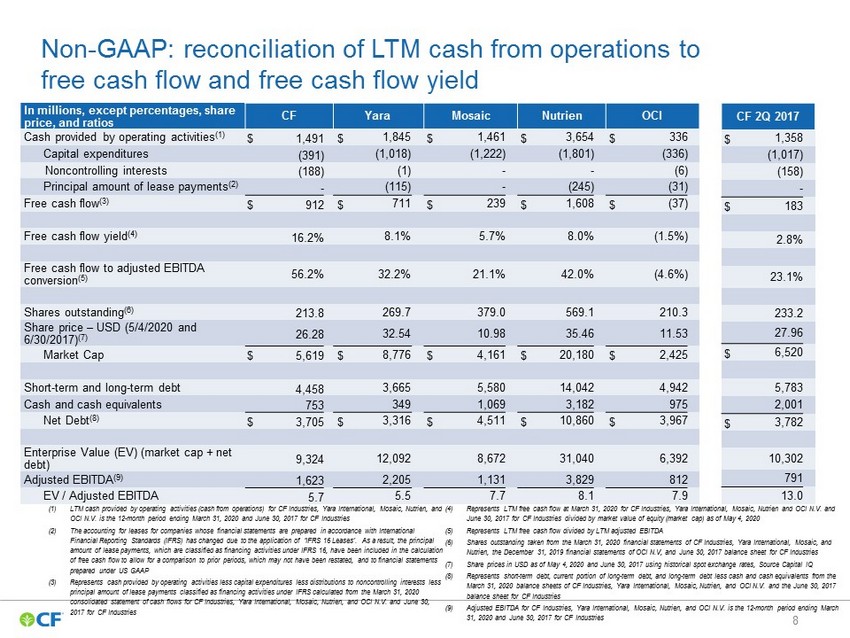

8 Non - GAAP: reconciliation of LTM cash from operations to free cash flow and free cash flow yield In millions , except percentages , share price, and ratios CF Yara Mosaic Nutrien OCI Cash provided by operating activities (1) $ 1,491 $ 1,845 $ 1,461 $ 3,654 $ 336 C apital expenditures (391) (1,018) (1,222) (1,801) (336) Noncontrolling interests (188) (1) - - (6) Principal amount of lease payments (2) - (115) - (245) (31) Free cash flow (3) $ 912 $ 711 $ 239 $ 1,608 $ (37) Free cash flow yield (4) 16.2% 8.1% 5.7% 8.0% (1.5%) Free cash flow to ad justed EBITDA conversion (5) 56.2% 32.2% 21.1% 42.0% (4.6%) Shares outstanding (6) 213.8 269.7 379.0 569.1 210.3 Share price – USD (5/4/2020 and 6/30/2017) (7) 26.28 32.54 10.98 35.46 11.53 Market Cap $ 5,619 $ 8,776 $ 4,161 $ 20,180 $ 2,425 Short - term and long - term debt 4,458 3,665 5,580 14,042 4,942 Cash and cash equivalents 753 349 1,069 3,182 975 Net Debt (8) $ 3,705 $ 3,316 $ 4,511 $ 10,860 $ 3,967 Enterprise Value (EV) (market cap + net debt) 9,324 12,092 8,672 31,040 6,392 Adjusted EBITDA (9) 1,623 2,205 1,131 3,829 812 EV / Adjusted EBITDA 5.7 5.5 7.7 8.1 7.9 (1) LTM cash provided by operating activities (cash from operations) for CF Industries, Yara International, Mosaic, Nutrien , and OCI N.V. is the 12 - month period ending March 31, 2020 and June 30, 2017 for CF Industries (2) The accounting for leases for companies whose financial statements are prepared in accordance with International Financial Reporting Standards (IFRS) has changed due to the application of ‘IFRS 16 Leases’. As a result, the principal amount of lease payments, which are classified as financing activities under IFRS 16, have been included in the calculation of free cash flow to allow for a comparison to prior periods, which may not have been restated, and to financial statements prepared under US GAAP (3) Represents c ash provided by operating activities less capital expenditures less distributions to noncontrolling interests less principal amount of lease payments classified as financing activities under IFRS calculated from the March 31, 2020 consolidated s tatement of cash f lows for CF Industries, Yara International, Mosaic, Nutrien, and OCI N.V. and June 30, 2017 for CF Industries (4) Represents LTM free cash flow at March 31, 2020 for CF Industries, Yara International, Mosaic, Nutrien and OCI N.V. and June 30, 2017 for CF Industries divided by market value of equity (market cap) as of May 4, 2020 (5) Represents LTM free cash flow divided by LTM adjusted EBITDA (6) Shares outstanding taken from the March 31, 2020 financial statements of CF Industries, Yara International, Mosaic, and Nutrien, the December 31, 2019 financial statements of OCI N.V, and June 30, 2017 balance sheet for CF Industries (7) Share prices in USD as of May 4, 2020 and June 30, 2017 using historical spot exchange rates, Source Capital IQ (8) Represents short - term debt, current portion of long - term debt, and long - term debt less cash and cash equivalents from the March 31, 2020 balance sheets of CF Industries, Yara International, Mosaic, Nutrien, and OCI N.V. and the June 30, 2017 balance sheet for CF Industries (9) Adjusted EBITDA for CF Industries, Yara International, Mosaic, Nutrien , and OCI N.V. is the 12 - month period ending March 31, 2020 and June 30, 2017 for CF Industries CF 2Q 2017 $ 1,358 (1,017) (158) - $ 183 2.8% 23.1% 233.2 27.96 $ 6,520 5,783 2,001 $ 3,782 10,302 791 13.0

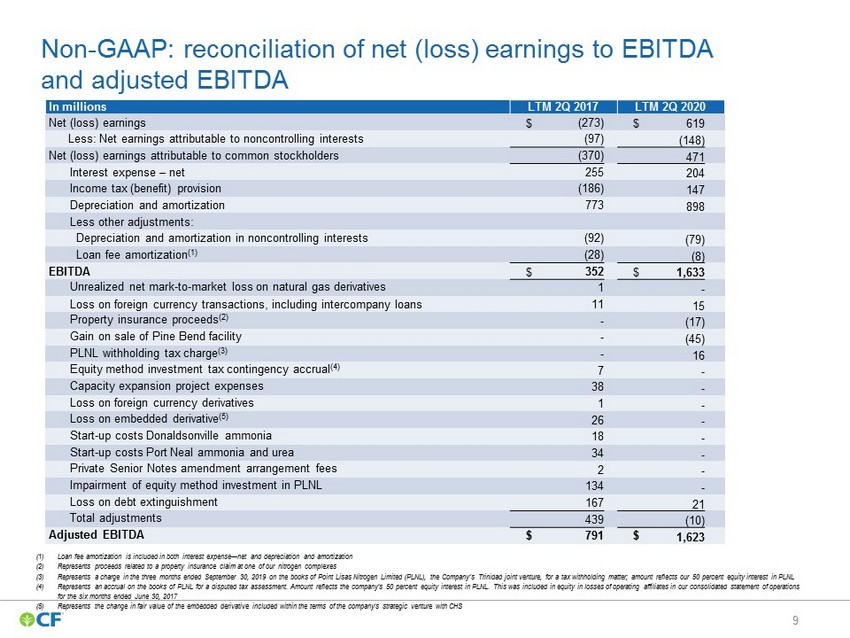

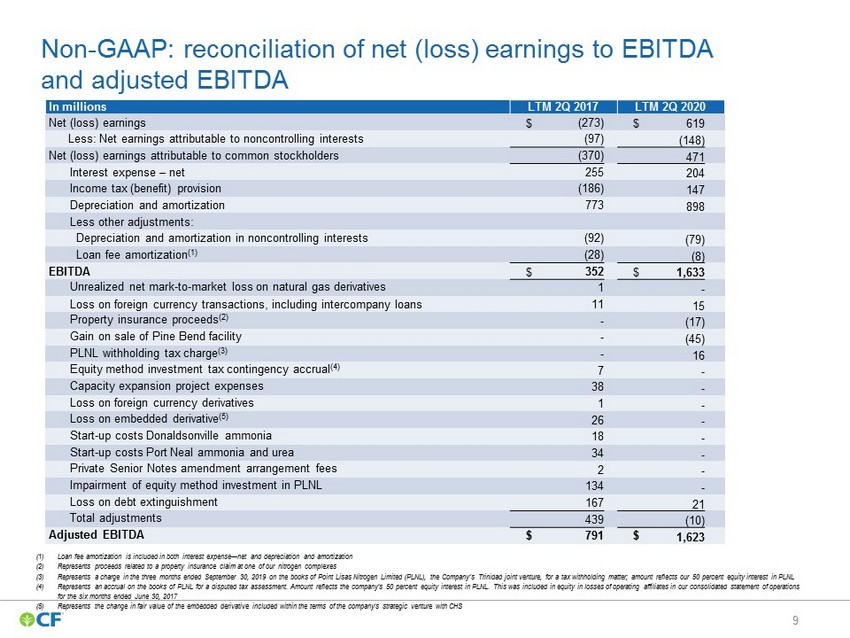

9 Non - GAAP: reconciliation of net (loss) earnings to EBITDA and adjusted EBITDA In millions LTM 2Q 2017 LTM 2Q 2020 Net (loss) earnings $ (273) $ 619 Less: Net earnings attributable to noncontrolling interests (97) (148) Net (loss) earnings attributable to common stockholders (370) 471 Interest expense – net 255 204 Income tax (benefit) provision (186) 147 Depreciation and amortization 773 898 Less other adjustments: Depreciation and amortization in noncontrolling interests (92) (79) Loan fee amortization (1) (28) (8) EBITDA $ 352 $ 1,633 Unrealized net mark - to - market loss on natural gas derivatives 1 - Loss on foreign currency transactions, including intercompany loans 11 15 Property insurance proceeds (2) - (17) Gain on sale of Pine Bend facility - (45) PLNL withholding tax charge (3) - 16 Equity method investment tax contingency accrual (4) 7 - Capacity expansion project expenses 38 - Loss on foreign currency derivatives 1 - Loss on embedded derivative (5) 26 - Start - up costs Donaldsonville ammonia 18 - Start - up costs Port Neal ammonia and urea 34 - Private Senior Notes amendment arrangement fees 2 - Impairment of equity method investment in PLNL 134 - Loss on debt extinguishment 167 21 Total adjustments 439 (10) Adjusted EBITDA $ 791 $ 1,623 (1) Loan fee amortization is included in both interest expense — net and depreciation and amortization (2) Represents proceeds related to a property insurance claim at one of our nitrogen complexes (3) Represents a charge in the three months ended September 30, 2019 on the books of Point Lisas Nitrogen Limited (PLNL), the Company’s Trinidad joint venture, for a tax withholding matter; amount reflects our 50 percent e qu ity interest in PLNL (4) Represents an accrual on the books of PLNL for a disputed tax assessment. Amount reflects the company's 50 percent equity int ere st in PLNL. This was included in equity in losses of operating affiliates in our consolidated statement of operations for the six months ended June 30, 2017 (5) Represents the change in fair value of the embedded derivative included within the terms of the company's strategic venture w ith CHS