Exhibit 99.1

2022 First Quarter Financial Results May 4, 2022 NYSE: CF

2 Safe harbor statement All statements in this presentation by CF Industries Holdings, Inc. (together with its subsidiaries, the “Company”), other th an those relating to historical facts, are forward - looking statements. Forward - looking statements can generally be identified by their use of terms s uch as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will” or “would” and similar terms and phrases, including references to assumptions. Forward - looking statements are not guarantees of future performance and are subject to a number of as sumptions, risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materiall y f rom such statements. These statements may include, but are not limited to, statements about strategic plans and management’s expectati ons with respect to the production of green and blue (low - carbon) ammonia, the development of carbon capture and sequestration projects, the transit ion to and growth of a hydrogen economy, greenhouse gas reduction targets, projected capital expenditures, statements about future finan cia l and operating results, and other items described in this presentation. Important factors that could cause actual results to differ material ly from those in the forward - looking statements include, among others, the cyclical nature of the Company’s business and the impact of global supply and demand on the Company’s selling prices; the global commodity nature of the Company’s nitrogen products, the conditions in the internati ona l market for nitrogen products, and the intense global competition from other producers; conditions in the United States, Europe and other ag ricultural areas, including the influence of governmental policies and technological developments on the demand for agricultural products; the vol atility of natural gas prices in North America and the United Kingdom; weather conditions and the impact of severe adverse weather events; the s eas onality of the fertilizer business; the impact of changing market conditions on the Company’s forward sales programs; difficulties in securi ng the supply and delivery of raw materials, increases in their costs or delays or interruptions in their delivery; reliance on third party pro vid ers of transportation services and equipment; the Company’s reliance on a limited number of key facilities; risks associated with cyber security; a cts of terrorism and regulations to combat terrorism; risks associated with international operations; the significant risks and hazards involved i n p roducing and handling the Company’s products against which the Company may not be fully insured; the Company’s ability to manage its indebtedness a nd any additional indebtedness that may be incurred; the Company’s ability to maintain compliance with covenants under its revolving cr edit agreement and the agreements governing its indebtedness; downgrades of the Company’s credit ratings; risks associated with changes in t ax laws and disagreements with taxing authorities; risks involving derivatives and the effectiveness of the Company’s risk measurement an d h edging activities; potential liabilities and expenditures related to environmental, health and safety laws and regulations and permitting requir eme nts; regulatory restrictions and requirements related to greenhouse gas emissions; the development and growth of the market for green and blu e ( low - carbon) ammonia and the risks and uncertainties relating to the development and implementation of the Company’s green and blue ammoni a p rojects; risks associated with expansions of the Company’s business, including unanticipated adverse consequences and the significant res ources that could be required; risks associated with the operation or management of the strategic venture with CHS (the “CHS Strategic Ve ntu re”), risks and uncertainties relating to the market prices of the fertilizer products that are the subject of the supply agreement with CHS ove r the life of the supply agreement, and the risk that any challenges related to the CHS Strategic Venture will harm the Company’s other business relat ion ships; and the impact of the novel coronavirus disease 2019 (COVID - 19) pandemic on our business and operations. More detailed information about factors that may affect the Company’s performance and could cause actual results to differ materially from those in any forward - looking state ments may be found in CF Industries Holdings, Inc.’s filings with the Securities and Exchange Commission, including CF Industries Holdings , I nc.’s most recent annual and quarterly reports on Form 10 - K and Form 10 - Q, which are available in the Investor Relations section of the Company’s web site. It is not possible to predict or identify all risks and uncertainties that might affect the accuracy of our forward - looking statements and, consequently, our descriptions of such risks and uncertainties should not be considered exhaustive. There is no guarantee that any of the event s, plans or goals anticipated by these forward - looking statements will occur, and if any of the events do occur, there is no guarantee what effect they will have on our business, results of operations, cash flows, financial condition and future prospects. Forward - looking statements are given only as of the date of this presentation and the Company disclaims any obligation to update or revise the forward - looking statements, whether as a r esult of new information, future events or otherwise, except as required by law.

3 Note regarding non - GAAP financial measures The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). Management believes that EBITDA, adjusted EBITDA, free cash flow, and free cash flow yield, which are non - GAAP financial measures, provide additional meaningful information regarding the Company's performance and financial strength. Non - GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company's reported results prepared in accordance with GAAP. In addition, because not all companies use identical calculations, EBITDA, adjusted EBITDA, free cash flow, and free cash flow yield included in this presentation may not be comparable to similarly titled measures of other companies. Reconciliations of EBITDA, adjusted EBITDA, free cash flow, and free cash flow yield to the most directly comparable GAAP measures are provided in the tables accompanying this presentation. EBITDA is defined as net earnings attributable to common stockholders plus interest expense - net, income taxes, and depreciation and amortization. Other adjustments include the elimination of loan fee amortization that is included in both interest and amortization, and the portion of depreciation that is included in noncontrolling interest. The Company has presented EBITDA because management uses the measure to track performance and believes that it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the industry. Adjusted EBITDA is defined as EBITDA adjusted with the selected items included in EBITDA as summarized in the tables accompanying this presentation. The Company has presented adjusted EBITDA because management uses adjusted EBITDA, and believes it is useful to investors, as a supplemental financial measure in the comparison of year - over - year performance. Free cash flow is defined as net cash provided by operating activities, as stated in the consolidated statements of cash flows, reduced by capital expenditures and distributions to noncontrolling interests. Free cash flow yield is defined as free cash flow divided by market value of equity (market cap).The Company has presented free cash flow and free cash flow yield because management uses these measures and believes they are useful to investors, as an indication of the strength of the Company and its ability to generate cash and to evaluate the Company’s cash generation ability relative to its industry competitors. It should not be inferred that the entire free cash flow amount is available for discretionary expenditures.

4 First quarter 2022 highlights (1) See appendix for reconciliation of EBITDA and adjusted EBITDA (2) Represents cash provided by operating activities (cash from operations) less capital expenditures less distributions to nonco ntr olling interest; see appendix for reconciliation of free cash flow EBITDA (1) Net earnings Net earnings per diluted share Adjusted EBITDA (1) $1.65 B 1Q 2022 $398 M 1Q 2021 $4.21 1Q 2022 $0.70 1Q 2021 LTM Cash from operations LTM Free cash flow (2) Average selling prices for 1Q 2022 were higher than 1Q 2021 across all segments due to strong global demand and decreased global supply availability as higher global energy costs drove lower global operating rates and geopolitical factors disrupted the global fertilizer supply chain Sales volumes for 1Q 2022 were higher than 1Q 2021 due to greater supply availability from higher capacity utilization rates in North America Cost of sales for 1Q 2022 was higher than 1Q 2021 primarily due to higher natural gas costs For 1Q 2022 the average cost of natural gas reflected in cost of sales was $6.48 per MMBtu compared to $3.22 per MMBtu for 1Q 2021 Repurchased ~1.3 million shares during the first quarter of 2022 for $100M $3.69 B 1Q 2022 $1.68 B 1Q 2022 $398 M 1Q 2021 $883 M 1Q 2022 $151 M 1Q 2021 $2.80 B 1Q 2022

5 Executing on projects to support global transition to clean energy economy 2020 2021 2022 2023 2024 Announced commitment to clean energy economy focused on green and blue ammonia production and carbon reduction goals - Reduce total CO 2 equivalent emissions by 25% per ton of product by 2030 (2015 baseline year) - Achieve net - zero carbon emissions by 2050 Construction and installation of 20 - megawatt green ammonia electrolysis plant began at the Donaldsonville complex Announced construction of CO 2 dehydration and compression units at Donaldsonville and Yazoo City Expected completion of front - end engineering design (FEED) study for greenfield blue ammonia production facility FID expected on constructing a greenfield blue ammonia production facility Mitsui & Co., Ltd & CF Industries announce intention to jointly develop export - oriented greenfield facility in the United States to produce blue ammonia CF Industries believes it will be able to produce 1.7 million tons of blue ammonia annually – equivalent to 1 million tons of net - zero carbon ammonia

6 (1) Data taken from the December 17, 2021 CRU Ammonia Database (2) Represents CF Industries’ historical North American production and CRU’s capacity estimates for CF Industries (3) Calculated by removing CF Industries’ annual reported production and capacity from the CRU data for all North American ammoni a p roduction peer group (4) ~1.3 million tons represents the difference between CF Industries’ actual trailing 5 - year average ammonia production of 9.2 mill ion tons at 96% of capacity utilization and the 7.9 million tons CF Industries would have produced if operated at the 82% CRU North American benchmark ex clu ding CF Industries 96% 97% 96% 84% 84% 82% 80% 82% 84% 86% 88% 90% 92% 94% 96% 98% 100% 2019 2020 2021 North American Ammonia Percent of Capacity Utilization (1) 5 - Year Rolling Avg. Percent of Capacity CF North America (2) North America Excl. CF (3) CF’s 14% greater capacity utilization yields an additional ~1.3 million tons of ammonia annually (4) Outstanding safety performance drives industry leading production capacity utilization 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Total injuries per 200,000 work hours Total Recordable Incident Rate BLS Fertilizer Manufacturing CF Industries CF Industries safety performance greatly exceeds industry average

7 Financial results – first quarter 2022 I n millions, except percentages, per MMBtu and EPS Q1 20 22 Q1 2021 Net sales $ 2,868 $ 1,048 Gross margin 1,698 289 - As percent age of net sales 59.2 % 27.6 % Net earnings attributable to common stockholders $ 883 $ 151 Net earnings p er diluted share 4.21 0.70 EBITDA ( 1 ) 1,675 398 Adjusted EBITDA ( 1 ) 1,648 398 Diluted weighted - average common shares outstanding 209.9 216.0 Cost of n atural gas used for production in cost of sales ( 2 ) (per MMBtu) $ 6.48 $ 3.22 Average daily market price of natural gas - Henry Hub (Louisiana) 4.60 3.38 Average daily market price of natural gas - National Balancing Point (United Kingdom) 30.20 6.90 Depreciation and amortization 208 204 Capital expenditures 63 71 (1) See reconciliations of EBITDA and adjusted EBITDA to the most directly comparable GAAP measures in the appendix (2) Includes the cost of natural gas used for production and related transportation that is included in cost of sales during the per iod under the first - in, first - out inventory method. Includes realized gains and losses on natural gas derivatives settled during the period. Excludes unre ali zed mark - to - market gains and losses on natural gas derivatives. For the three months ended March 31, 2021, excludes the $112 million gain on net sett lem ent of certain natural gas contracts with suppliers in February 2021

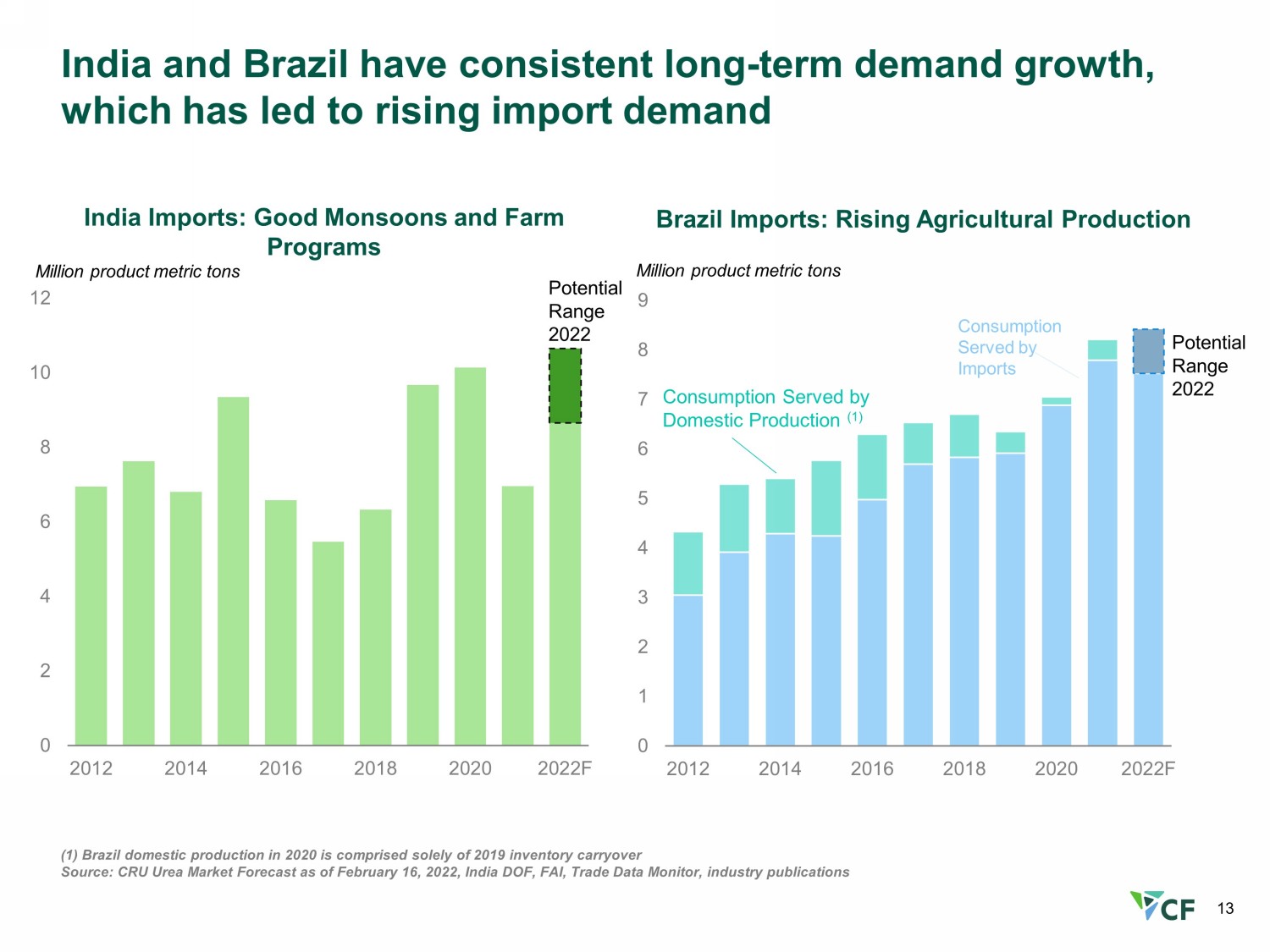

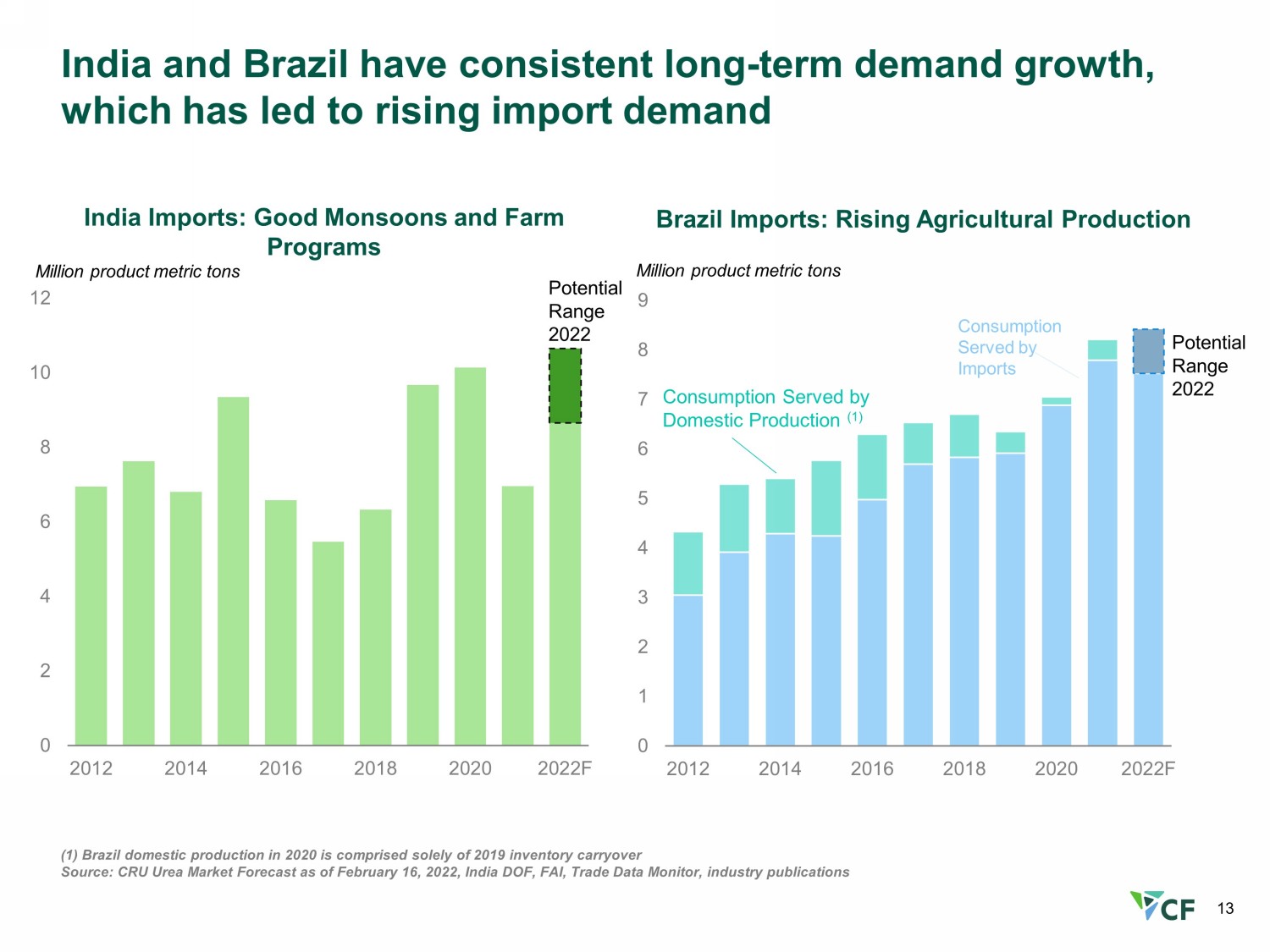

8 Strong global nitrogen outlook Global supply and demand Regional nitrogen dynamics Global energy differentials While producers in low - cost regions appear to be operating at high rates in 2022, global nitrogen supply continues to be limited by curtailments in Europe/Asia due to high energy prices, ongoing export restrictions/disruptions from Russia Global demand expected to remain robust; the need to replenish global grain stocks is driving grains futures prices to the highest levels in a decade, supporting high levels of planting and fertilizer application Management projects U.S. corn plantings will be 91 - 93 million acres in 2022 with crop production returns projected at historical highs India expected to continue to tender regularly through 2022 to meet necessary urea demand; imports into India expected to be ~8 million metric tons Urea consumption in Brazil to remain strong in 2022; more than 90% of AN imports to Brazil originated from Russia in recent years, purchasers may substitute other nitrogen fertilizers due to current export barriers from Russia Natural gas curves in Europe remain elevated partly due to the Russian invasion of Ukraine and uncertainty about gas flow from Russia; forward curves remain high, challenging producer profitability and forcing European production into the position of global marginal producer Urea exports from China expected to be limited through at least 1H 2022 as the Chinese government has implemented measures to discourage urea exports Energy differentials between Europe/Asia versus low - cost regions remain significant, steepening the global nitrogen cost curve and increasing margins for low - cost North American producers Favorable energy spreads for North American producers expected to persist into 2023

9 Decade - l ow stocks - to - use ratio drives higher grain values, expected to require at least two more years to replenish (1) Crop futures prices represent Marketing Y ear ( September – August) average daily settlement of the front month future contracts for 2010/11 through 2020/21; 2021/22 represents average daily settlement from September 2021 through February 2022 month - to - date and forward curve through Au gust 2022 Source: USDA, CME, CF Global Coarse Grains Stocks - to - Use Ratio vs Corn Futures Prices (1) Percent $0 $1 $2 $3 $4 $5 $6 $7 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 2010/11 2015/16 2020/21 World-ex China Crop Futures Price (RHS) USD per Bushel Global Oilseeds Stocks - to - Use Ratio vs Soybean Futures Prices (1) Percent $0 $2 $4 $6 $8 $10 $12 $14 $16 0% 5% 10% 15% 20% 25% 30% 2010/11 2015/16 2020/21 World-ex China Crop Futures Price (RHS) USD per Bushel

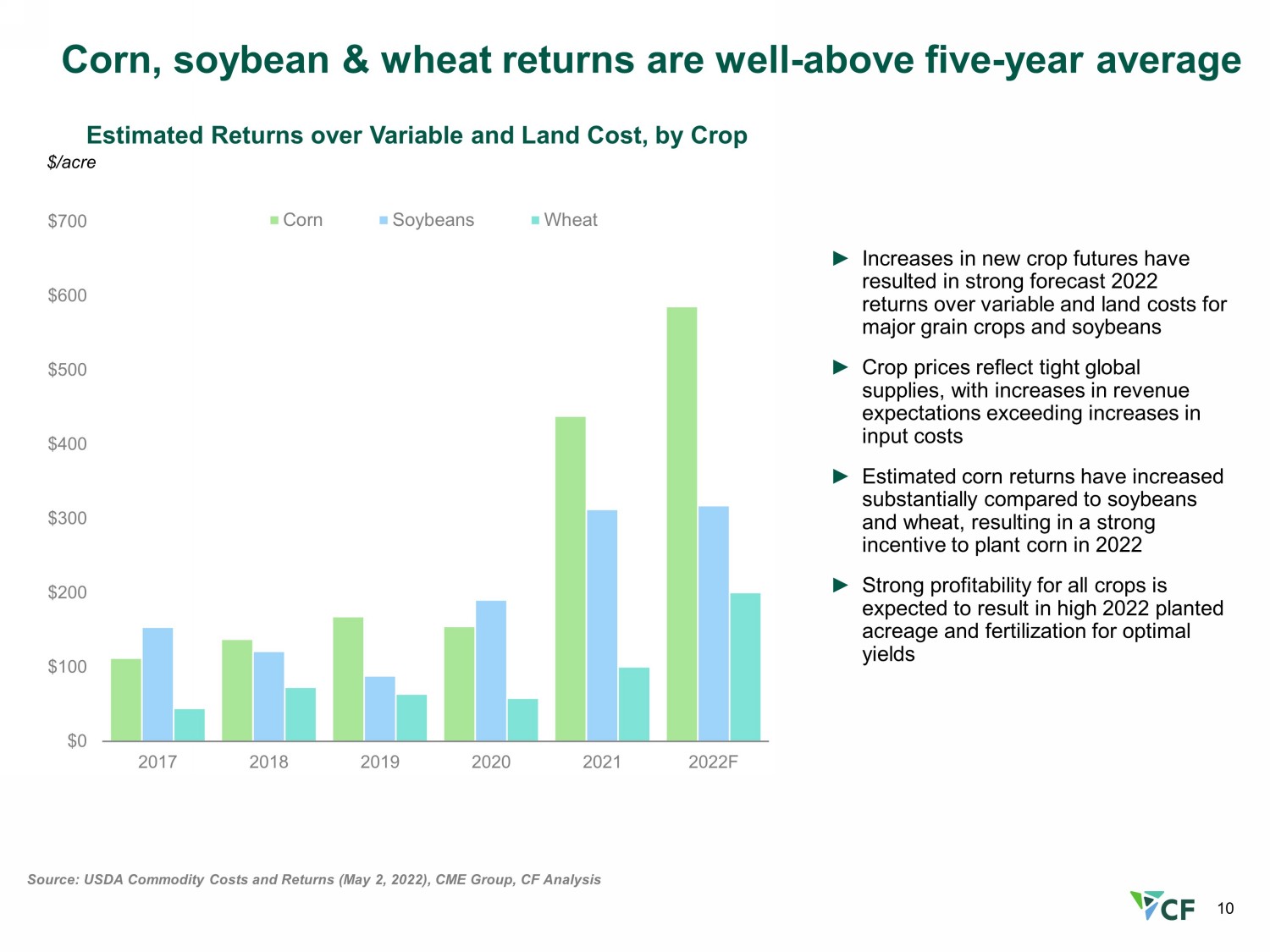

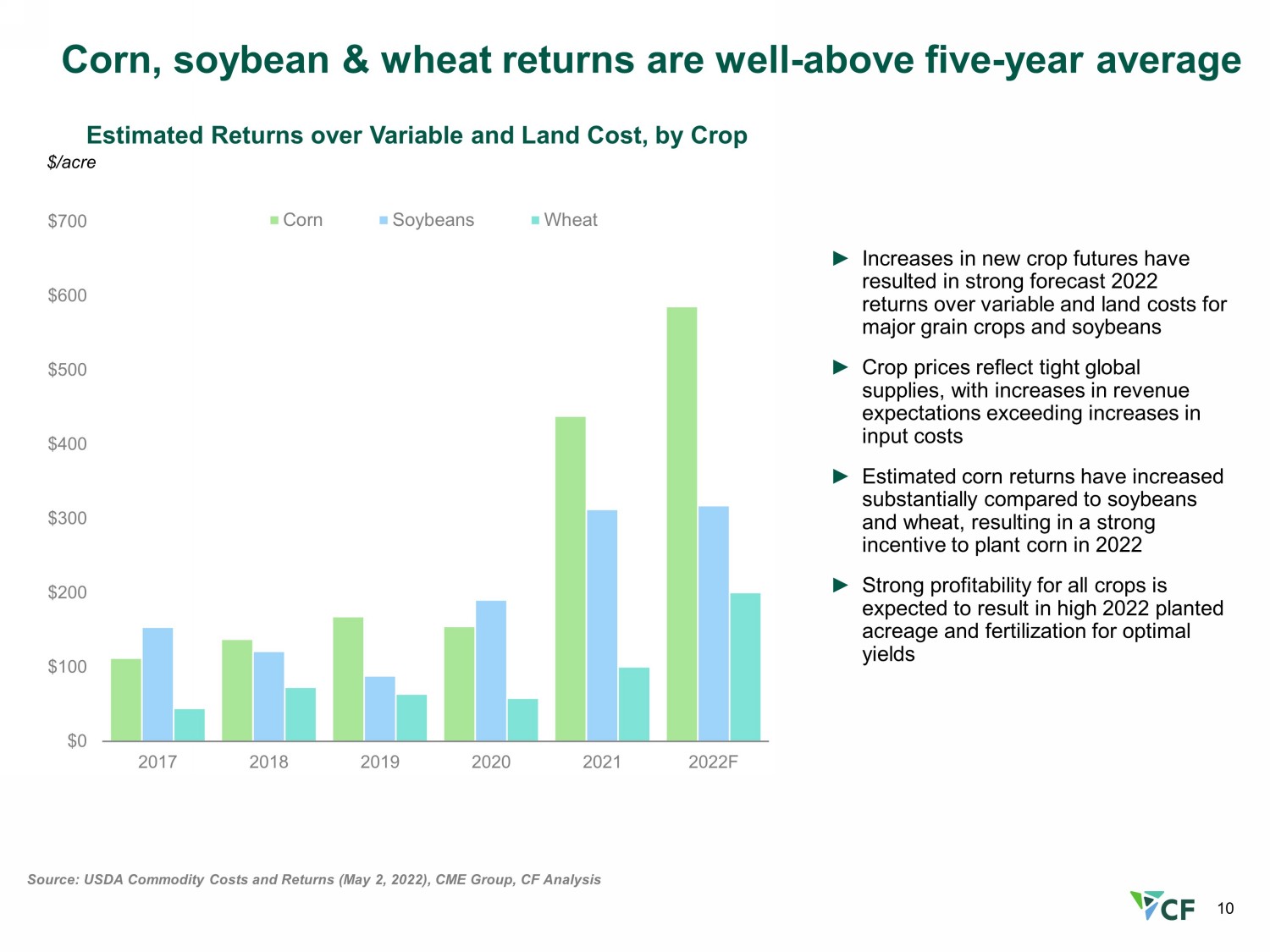

10 Corn, soybean & wheat returns are well - above five - year average Source: USDA Commodity Costs and Returns (May 2, 2022), CME Group, CF Analysis $0 $100 $200 $300 $400 $500 $600 $700 2017 2018 2019 2020 2021 2022F Corn Soybeans Wheat Estimated Returns over Variable and Land Cost, by Crop $/acre ► Increases in new crop futures have resulted in strong forecast 2022 returns over variable and land costs for major grain crops and soybeans ► Crop prices reflect tight global supplies, with increases in revenue expectations exceeding increases in input costs ► Estimated corn returns have increased substantially compared to soybeans and wheat, resulting in a strong incentive to plant corn in 2022 ► Strong profitability for all crops is expected to result in high 2022 planted acreage and fertilization for optimal yields

11 0 5 10 15 20 25 Merch. Ammonia Urea AN UAN Exports Domestic Production Spare Capacity Russia/Ukraine highly impactful in global agricultural and fertilizer supply and trade Russia/Ukraine Crop Production/ Exports Million Metric Tons, 2018 - 2020 3 year - average Russia Nitrogen Supply and Exports Share of Global Exports 23% 14% 47 % 27 % Million Metric Tons Product, 2018 - 2020 3 year - average Share of Global Exports 18 % 29 % 76% 0 20 40 60 80 100 120 Corn Wheat Sunflower Oil Exports Production

12 Sharply higher natural gas prices in Europe and Asia have widened spreads to North American benchmark prices Global Energy Price 2019 - 2022F USD/ tonne North American Production Margin Advantage (1) 0 5 10 15 20 25 30 35 40 45 2019 2020 2021 2022 Henry Hub natural gas TTF natural gas Chinese anthracite coal - lump JKM natural gas 0 100 200 300 400 500 600 700 800 900 1000 Ammonia (2) Urea TTF Anthracite (3) ‘19 ‘20 ’21 ’22F TTF Anthracite (3) USD/MMBtu (1) Advantage per tonne based on annualized costs including settled feedstock prices through April 2022 and May to December 2022 based on forward cur ve and projections as of April 25, 2022; Coal MMBtu price includes efficiency factor of 1.3 (additional coal required for hydrogen y iel d equivalent to feedstock natural gas) (2) North American production assumed to be 37.2 MMBtu per tonne of ammonia for feedstock and fuel, European production assumed at 37.8 MMBtu per tonne for feedstock and fuel, Chinese production assumed to be 1.2 tonnes of coal and 1300 KWH for feedstock and power (3) Forecast Chinese anthracite coal prices are derived from thermal prices in Wood Mackenzie’s China Coal Short Term Outlook Œ Note: dotted lines represent forward price curves Source: ICE, Bloomberg, SX Coal, Wood Mackenzie, CF Analysis Spreads projected to remain wide through 2022 Higher natural gas costs expected through 2022 ‘19 ‘20 ’21 ’22F ‘19 ‘20 ’21 ’22F ‘19 ‘20 ’21 ’22F The data and information provided by Wood Mackenzie should not be interpreted as advice and you should not rely on it for any pu rpose. You may not copy or use this data and information except as expressly permitted by Wood Mackenzie in writing. To the fullest extent permitted by law, Wood Mackenzie accepts no responsibility for you r use of this data and information except as specified in a written agreement you may have entered into with Wood Mackenzie for the provision of such data and information Versus:

13 India and Brazil have consistent long - term demand growth, which has led to rising import demand (1) Brazil domestic production in 2020 is comprised solely of 2019 inventory carryover Source: CRU Urea Market Forecast as of February 16, 2022, India DOF, FAI, Trade Data Monitor, industry publications 0 2 4 6 8 10 12 2012 2014 2016 2018 2020 2022F 0 1 2 3 4 5 6 7 8 9 2012 2014 2016 2018 2020 2022F India Imports: Good Monsoons and Farm Programs Million product metric tons Potential Range 2022 Brazil Imports: Rising Agricultural Production Million product metric tons Consumption Served by Domestic Production (1) Consumption Served by Imports Potential Range 2022

14 Capital management Capital structure and allocation Clean energy initiatives Capital expenditures CF Industries’ Board of Directors declared a quarterly dividend of $0.40 per common share, a 33% increase over the previous dividend Repurchased ~ 1.3 million shares in 1Q 2022 for $100 million under the current $1.5B share repurchase authorization through 2024 In April 2022, the Company achieved its gross debt target by redeeming in full all of the $500 million outstanding principal amount of its 3.450% Senior Notes due 2023 Mitsui & Co., Ltd. and CF Industries announced their intention to jointly develop a greenfield ammonia production facility in the United States - A front - end engineering design (FEED) study will commence shortly - Final investment decision (FID) on the construction of the blue ammonia production facility expected in 2023 CF Industries is investing $200 million to construct a CO 2 dehydration and compression facility at its Donaldsonville Complex, to be complete in 2024 - Facility will have capacity to dehydrate and compress up to 2M tons of CO 2 per year - The Donaldsonville Complex will be able to produce up to 1.7M tons of blue ammonia per year, equivalent to 1M tons of net - zero carbon ammonia Capital expenditures (capex) in 1Q 2022 were $63 million Capex for full year 2022 expected to be $500 - $550 million, which includes capital expenditures at the Company’s Donaldsonville Complex related to green and blue ammonia projects

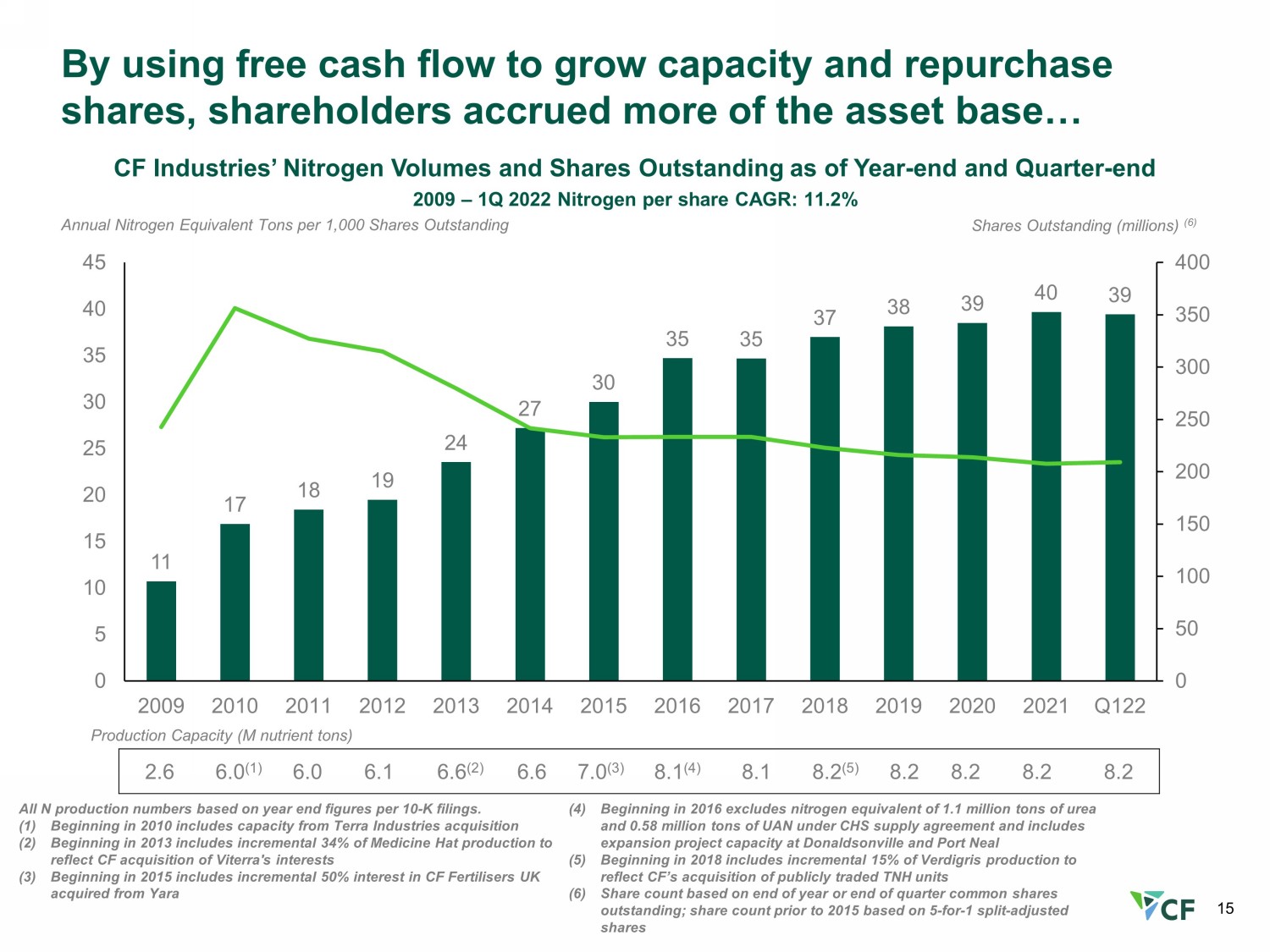

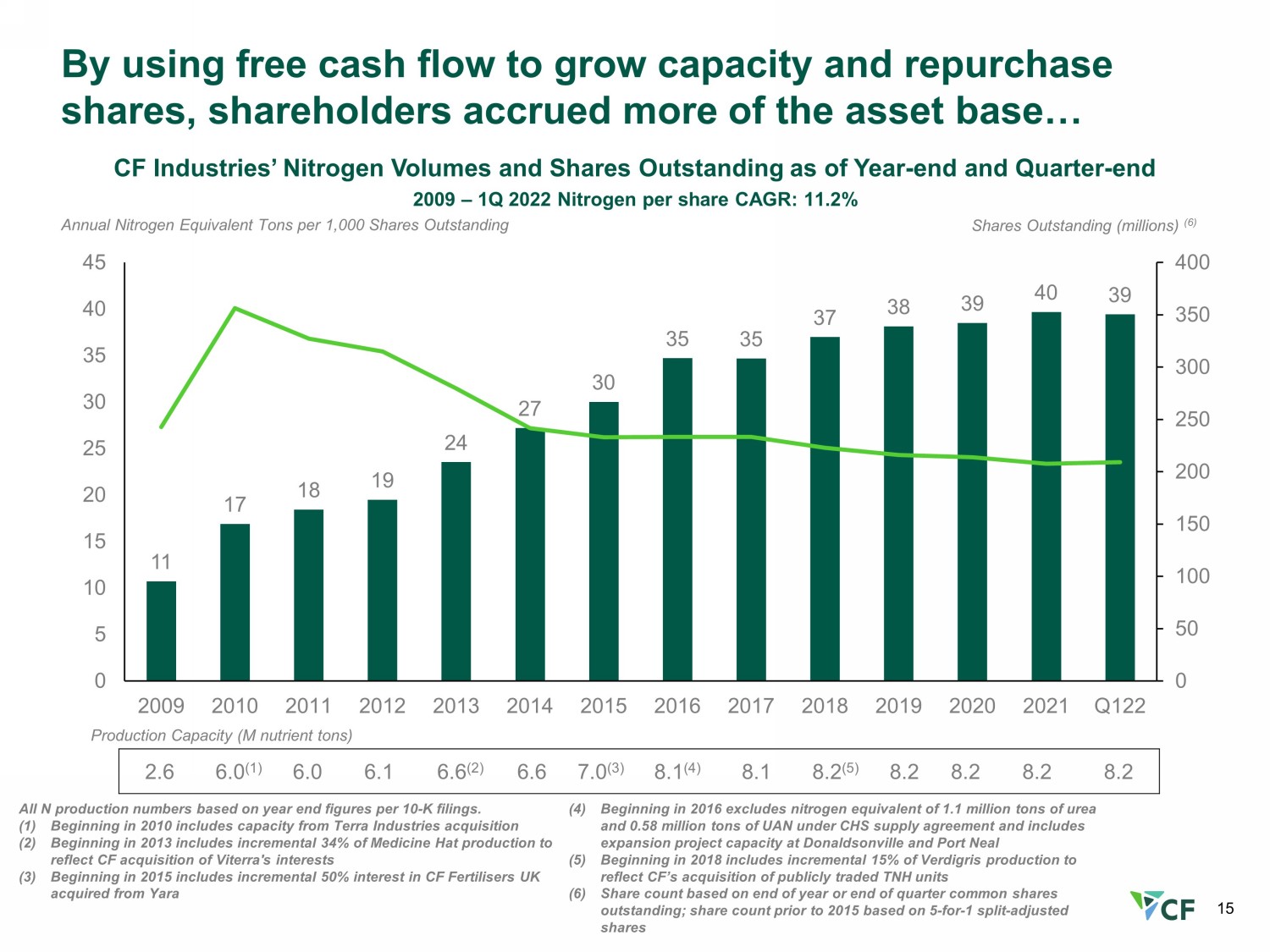

15 2.6 6.0 (1) 6.0 6.1 6.6 (2) 6.6 7.0 (3) 8.1 (4) 8.1 8.2 (5) 8.2 8.2 8.2 8.2 All N production numbers based on year end figures per 10 - K filings. (1) Beginning in 2010 includes capacity from Terra Industries acquisition (2) Beginning in 2013 includes incremental 34% of Medicine Hat production to reflect CF acquisition of Viterra's interests (3) Beginning in 2015 includes incremental 50% interest in CF Fertilisers UK acquired from Yara (4) Beginning in 2016 excludes nitrogen equivalent of 1.1 million tons of urea and 0.58 million tons of UAN under CHS supply agreement and includes expansion project capacity at Donaldsonville and Port Neal (5) Beginning in 2018 includes incremental 15% of Verdigris production to reflect CF’s acquisition of publicly traded TNH units (6) Share count based on end of year or end of quarter common shares outstanding; share count prior to 2015 based on 5 - for - 1 split - adjusted shares Production Capacity (M nutrient tons) Annual Nitrogen Equivalent Tons per 1,000 Shares Outstanding CF Industries’ Nitrogen Volumes and Shares Outstanding as of Year - end and Quarter - end Shar es Outstanding (millions) (6) 2009 – 1Q 2022 Nitrogen per share CAGR: 11.2% 11 17 18 19 24 27 30 35 35 37 38 39 40 39 0 50 100 150 200 250 300 350 400 0 5 10 15 20 25 30 35 40 45 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q122 By using free cash flow to grow capacity and repurchase shares, shareholders accrued more of the asset base…

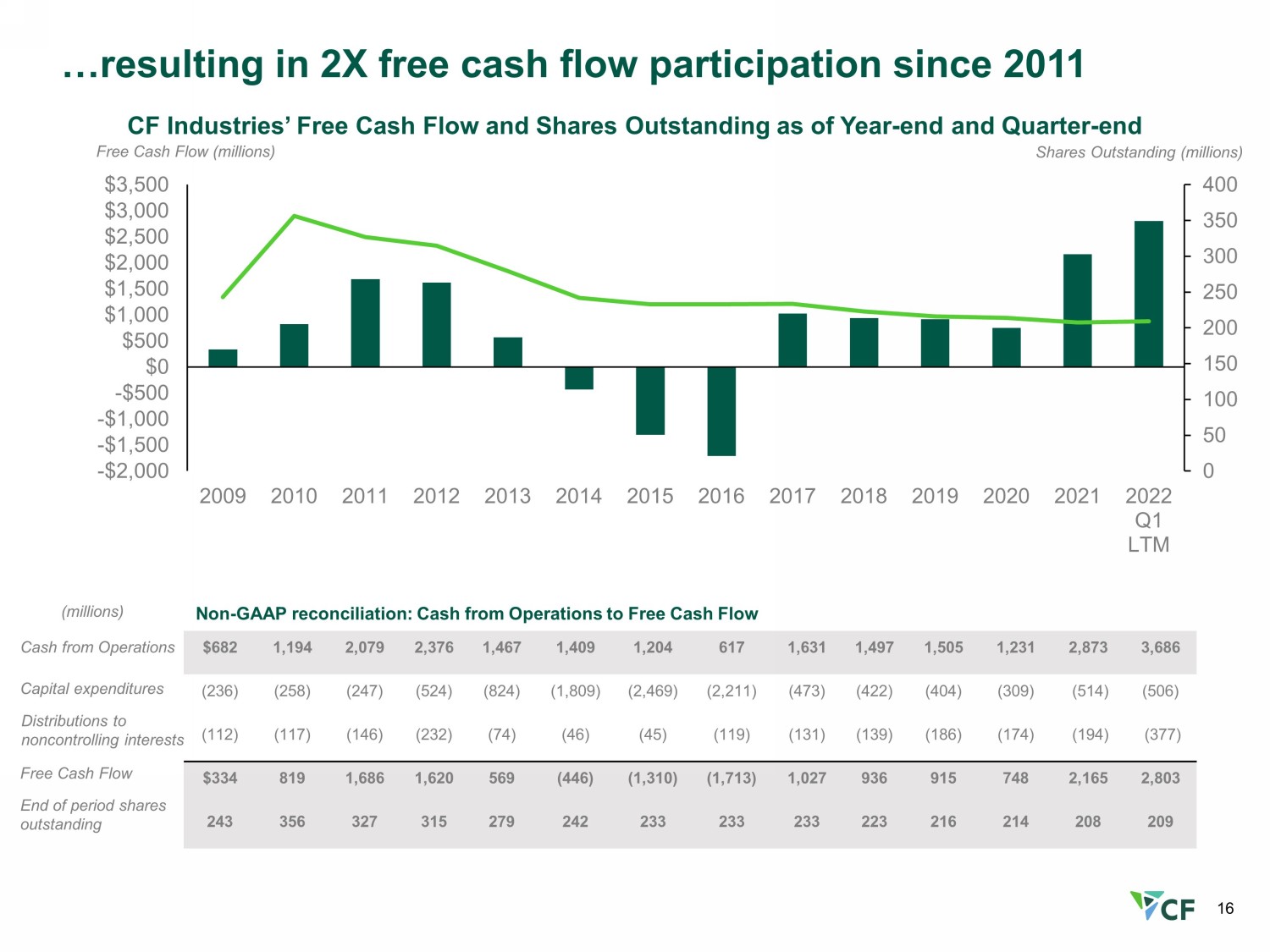

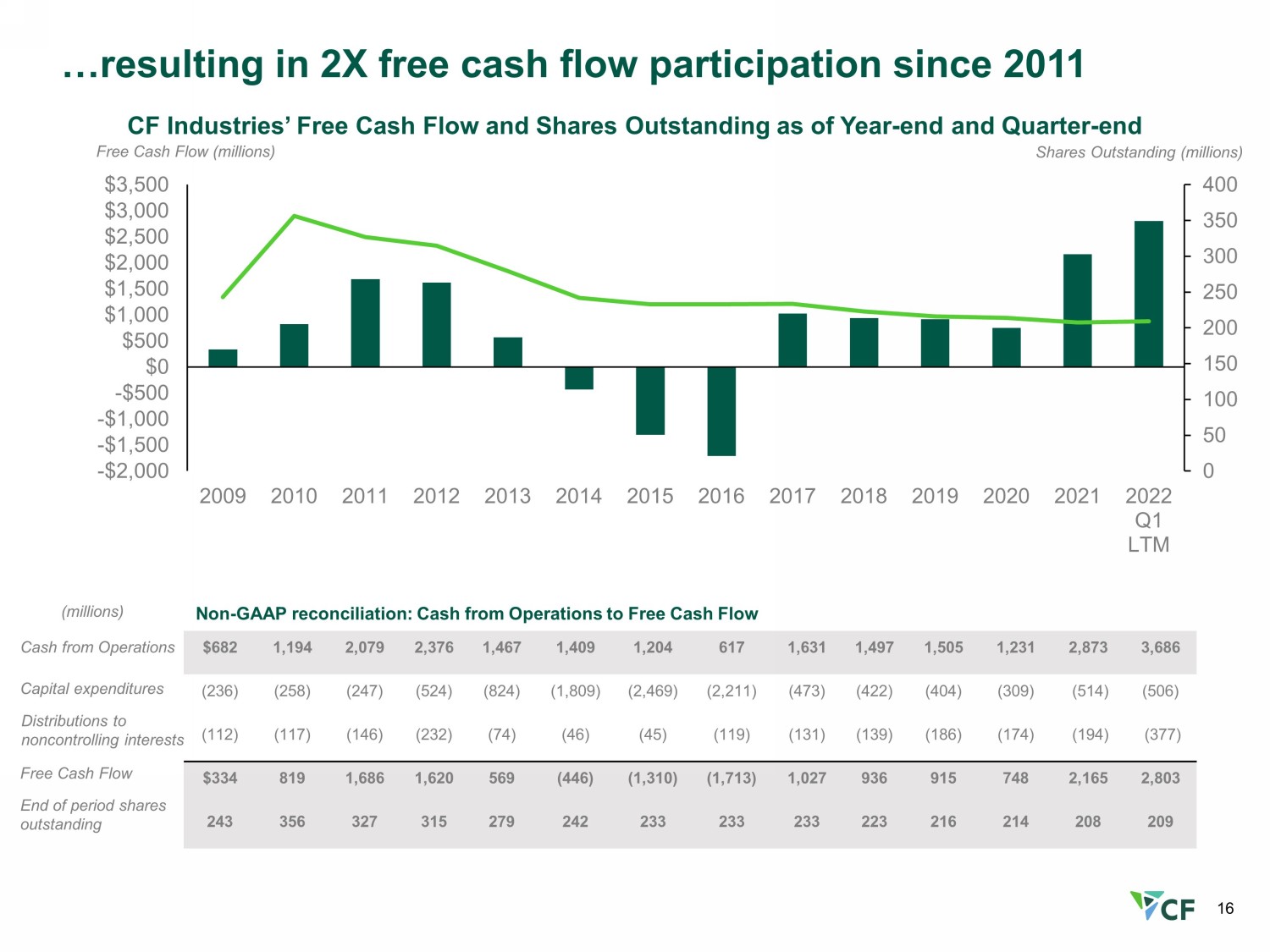

16 Free Cash Flow (millions) CF Industries’ Free Cash Flow and Shares Outstanding as of Year - end and Quarter - end Shar es Outstanding (millions) 0 50 100 150 200 250 300 350 400 -$2,000 -$1,500 -$1,000 -$500 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Q1 LTM …resulting in 2X free cash flow participation since 2011 $682 1,194 2,079 2,376 1,467 1,409 1,204 617 1,631 1,497 1,505 1,231 2,873 3,686 (236) (258) (247) (524) (824) (1,809) (2,469) (2,211) (473) (422) (404) (309) (514) (506) (112) (117) (146) (232) (74) (46) (45) (119) (131) (139) (186) (174) (194) (377) $334 819 1,686 1,620 569 (446) (1,310) (1,713) 1,027 936 915 748 2,165 2,803 243 356 327 315 279 242 233 233 233 223 216 214 208 209 End of period shares outstanding Cash from Operations Capital expenditures Distributions to noncontrolling interests Free Cash Fl ow (millions) Non - GAAP reconciliation: Cash from Operations to Free Cash Flow

17 14.2 9.8 8.7 8.6 6.0 5.6 2017 2018 2019 2020 2021 Q1 2022 LTM 2017 - 2021 average ratio EV/Adj. EBITDA (2)(3) Equity appears undervalued given high free cash flow yield 10.3% 9.7% 8.9% 9.0% 14.7% 13.0% 2017 2018 2019 2020 2021 Q1 2022 LTM 2017 - 2021 average yield Free Cash Flow Yield (1) (1) Represents annual and Q1 2022 LTM free cash flow divided by market value of equity (market cap) as of December 31 st of each year and March 31 st 2022 for Q1 2022 LTM; see appendix for reconciliation of free cash flow and calculation of market cap (2) Enterprise value (EV) is calculated as the sum of market cap and net debt; see appendix for calculation of EV and net debt (3) Represents annual adjusted EBITDA and Q1 2022 LTM adjusted EBITDA; see appendix for reconciliation of adjusted EBITDA

18 CF Industries EBITDA sensitivity table Table illustrates the CF Industries business model across a broad range of industry conditions $50/ton urea realized movement implies ~$750M change in EBITDA on an annual basis (1) Based on 2019 sales volumes of approximately 19.5 million product tons, 2019 gas consumption of 344 million MMBtus and 2021 n itr ogen product sales price relationships. Changes in product prices and gas costs are not applied to the CHS minority interest or industrial cont rac ts where CF Industries is naturally hedged against changes in product prices and gas costs (2) Assumes that a $50 per ton change in urea prices is also applied proportionally to all nitrogen products and is equivalent to a $34.78 per ton change in UAN price, $36.96 per ton change in AN price, a $89.14 per ton change in ammonia price, and a $21.20 per ton change in the pr ice of the Other segment EBITDA Sensitivity to Natural Gas and Urea Prices (1) $ billions CF Realized Natural Gas Cost ($/MMBtu) CF Realized Urea Price ($/ton) (2) 4.00 4.50 5.00 5.50 6.00 6.50 7.00 7.50 8.00 $400 $2.7 $2.6 $2.5 $2.3 $2.2 $2.0 $1.9 $1.8 $1.6 $450 $3.5 $3.3 $3.2 $3.1 $2.9 $2.8 $2.6 $2.5 $2.4 $500 $4.2 $4.1 $4.0 $3.8 $3.7 $3.5 $3.4 $3.3 $3.1 $550 $5.0 $4.8 $4.7 $4.6 $4.4 $4.3 $4.2 $4.0 $3.9 $600 $5.7 $5.6 $5.5 $5.3 $5.2 $5.0 $4.9 $4.8 $4.6 $650 $6.5 $6.4 $6.2 $6.1 $5.9 $5.8 $5.7 $5.5 $5.4 $700 $7.2 $7.1 $7.0 $6.8 $6.7 $6.6 $6.4 $6.3 $6.1 $750 $8.0 $7.9 $7.7 $7.6 $7.4 $7.3 $7.2 $7.0 $6.9 $800 $8.8 $8.6 $8.5 $8.3 $8.2 $8.1 $7.9 $7.8 $7.6

Appendix

20 Non - GAAP: reconciliation of net earnings to EBITDA and adjusted EBITDA (1) Loan fee amortization is included in both interest expense – net and depreciation and amortization (2) Represents expense incurred due to the deferral of certain plant turnaround activities as a result of the COVID - 19 pandemic. (3) Represents costs written off upon the cancellation of a project at one of our nitrogen complexes In millions Q1 20 22 Q1 2021 Q1 2022 LTM FY 2021 FY 2020 Net earnings $ 1,051 $ 175 $ 2,136 $ 1,260 $ 432 Less: Net earnings attributable to noncontrolling interest (168) (24) (487) (343) (115) Net earnings attributable to common stockholders 883 151 1,649 917 317 Interest expense – net 205 48 340 183 161 Income tax provision 401 18 666 283 31 Depreciation and amortization 208 204 892 888 892 Less other adjustments: Depreciation and amortization in noncontrolling interest (21) (22) (94) (95) (80) Loan fee amortization (1) (1) (1) (4) (4) (5) EBITDA $ 1,675 $ 398 $ 3,449 $ 2,172 $ 1,316 Unrealized net mark - to - market (gain) loss on natural gas derivatives (33) (6) (2) 25 (6) COVID impact: Special COVID - 19 bonus for operational workforce - - - - 19 COVID impact: Turnaround deferral (2) - - - - 7 Loss on foreign currency transactions, including intercompany loans 6 - 12 6 5 Asset impairments - - 521 521 - Engineering cost write - off (3) - - - - 9 Loss on sale of surplus land - - - - 2 Property insurance proceeds - - - - (2) Loss on debt extinguishment - 6 13 19 - Total adjustments (27) - 544 571 34 Adjusted EBITDA $ 1,648 $ 398 $ 3,993 $ 2,743 $ 1,350

21 Non - GAAP: reconciliation of net earnings to EBITDA and adjusted EBITDA, continued (1) For the year ended December 31, 2019, amount relates only to CF Industries Nitrogen, LLC (CFN). For the years ended December 31, 2018, and 2017 , amount includes CFN and Terra Nitrogen Company, L.P. (TNCLP), as we purchased the remaining publicly traded common units of TNCLP on April 2, 2018 (2) Loan fee amortization is included in both interest expense – net and depreciation and amortization (3) Represents proceeds related to a property insurance claim at one of the Company’s nitrogen complexes (4) Represents a charge in the year ended December 31, 2019 on the books of Point Lisas Nitrogen Limited (PLNL), the company’s Trinidad joint venture for a tax withholding matter; amount reflects our 50 percent equity interest in PLNL (5) Represents an accrual recorded in the year ended December 31, 2017 on the books of PLNL, for a disputed tax assessment. Amount reflects our 50 percent equity interest in PLNL; this is included in equity in earnings of operating affiliates in our consolidated statements of operations (6) Represents the loss on the embedded derivative included within the terms of the company’s strategic venture with CHS In millions FY 2019 FY 20 18 FY 2017 Net earnings $ 646 $ 428 $ 450 Less: Net earnings attributable to noncontrolling interests (153) (138) (92) Net earnings attributable to common stockholders 493 290 358 Interest expense – net 217 228 303 Income tax provision (benefit) 126 119 (575) Depreciation and amortization 875 888 883 Less other adjustments: Depreciation and amortization in noncontrolling interests (1) (82) (87) (101) Loan fee amortization (2) (9) (9) (12) EBITDA $ 1,620 $ 1,429 $ 856 Unrealized net mark - to - market loss (gain) on natural gas derivatives 14 (13) 61 (Gain) loss on foreign currency transactions, including intercompany loans (1) (5) 2 Gain on sale of Pine Bend facility (45) - - Property insurance proceeds (3) (15) (10) - Costs related to acquisition of TNCLP units - 2 - PLNL tax withholding charge (4) 16 - - Equity method investment tax contingency accrual (5) - - 7 Loss on embedded derivative (6) - - 4 Loss on debt extinguishment 21 - 53 Gain on sale of equity method investment - - (14) Total adjustments (10) (26) 113 Adjusted EBITDA $ 1,610 $ 1,403 $ 969

22 Non - GAAP: reconciliation of cash from operations to free cash flow and free cash flow yield In millions , except percentages , share price, and ratios FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 Q1 2022 LTM Cash provided by operating activities $ 1,631 $ 1,497 $ 1,505 $ 1,231 $ 2,873 $ 3,686 C apital expenditures (473) (422) (404) (309) (514) (506) Distributions to noncontrolling interests (131) (139) (186) (174) (194) (377) Free cash flow $ 1,027 $ 936 $ 915 $ 48 $ 2,165 $ 2,803 Free cash flow yield (1) 10.3% 9.7% 8.9% 9.0% 14.7% 13.0% Shares outstanding as of period end 233.3 222.8 216.0 214.0 207.6 209.0 Share price as of period end (2) 42.54 43.51 47.74 38.71 70.78 103.06 Market Cap $ 9,925 $ 9,694 $ 10,312 $ 8,284 $ 14,694 $ 21,540 Short - term and long - term debt 4,692 4,698 3,957 3,961 3,465 3,462 Cash and cash equivalents 835 682 287 683 1,628 2,617 Net Debt (3) $ 3,857 $ 4,016 $ 3,670 $ 3,278 $ 1,837 $ 845 Enterprise Value (EV) (market cap + net debt) 13,782 13,710 13,982 11,562 16,531 22,385 Adjusted EBITDA 969 1,403 1,610 1,350 2,743 3,993 EV / Adjusted EBITDA 14.2 9.8 8.7 8.6 6.0 5.6 (1) Represents annual and Q1 2022 LTM free cash flow divided by market value of equity (market cap) as of December 31 st for each year and as of March 31 st for Q1 2022 LTM (2) Source Capital IQ (3) Represents short - term debt, current portion of long - term debt, and long - term debt less cash and cash equivalents from our balanc e sheet as of December 31 st for each year and as of March 31 st for Q1 2022 LTM