Searchable text section of graphics shown above

[LOGO]

Keefe, Bruyette & Woods

Investor Presentation

May 31, 2006

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve known and unknown risks, uncertainties and other factors that may cause Centennial Bank Holdings, Inc.’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, the following: general economic and business conditions in those areas in which Centennial operates; demographic changes; competition; fluctuations in interest rates; the integration of acquired businesses costs more, takes longer, is less successful than expected, or cannot be realized within the expected time frame; continued ability to attract and employ qualified personnel; costs and uncertainties related to the outcome of pending litigation; changes in business strategy or development plans; changes in governmental legislation or regulation; changes that may occur in the securities markets; changes in credit quality; the availability of capital to fund the expansion of Centennial’s business; economic, political and global changes arising from natural disasters, the war on terrorism, the conflict with Iraq and its aftermath; and other “Risk Factors” referenced in Centennial’s Annual Report on Form 10-K filed with the Securities and Exchange Commission, as supplemented from time to time. When relying on forward-looking statements to make decisions with respect to Centennial, readers are cautioned to consider these and other risks and uncertainties. Centennial can give no assurance that any goal or plan set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements, which speak only as of the date made. The forward-looking statements are made as of the date of this presentation, and Centennial does not intend, and assumes no obligation, to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

Investors and security holders are urged to read Centennial’s Annual Report on Form 10-K, quarterly reports on Form 10-Q and other documents filed by Centennial with the SEC. The documents filed by Centennial with the SEC may be obtained at Centennial’s website at www.cbhi.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Centennial by directing a request to: Centennial Bank Holdings, Inc., 1331 Seventeenth St., Suite 300, Denver, CO 80202. Attention: Investor Relations. Telephone 303-296-9600.

[LOGO]

2

Investment Hypothesis

• Growing economy drives organic growth

• Large market with fragmented competition

• Top quartile profitability drives share value

• Low earnings volatility enhances share value

3

Centennial Overview

[GRAPHIC]

• Colorado Front Range Commercial Bank

• $2.9 billion in assets

• Second Largest Independent in Colorado

• Listed on NASDAQ in October, 2005

Sources: SNL DataSource, Castle Creek Research

4

Accomplishments Since Inception

• Fully integrated five banks

• Developed and implemented consistent deposit products

• Repositioning deposit structure

• Improved efficiency significantly

• Building a strong management team

• Instituted common policies and procedures

5

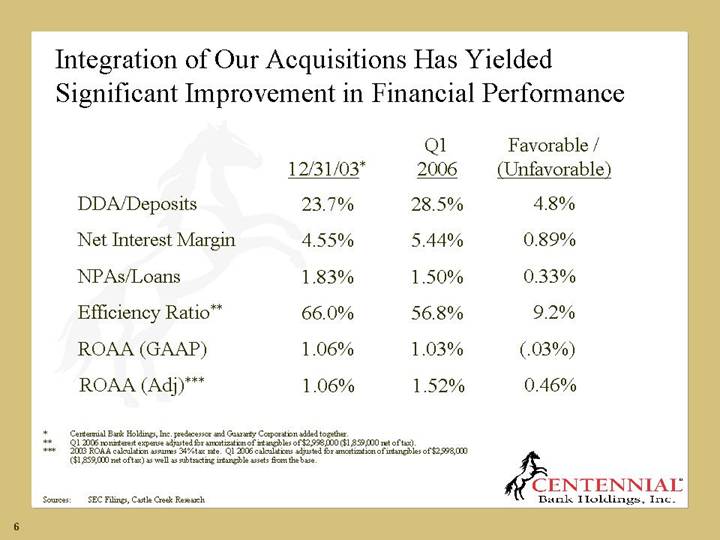

Integration of Our Acquisitions Has Yielded Significant Improvement in Financial Performance

| | | | Q1 | | Favorable / | |

| | 12/31/03* | | 2006 | | (Unfavorable) | |

| | | | | | | |

DDA/Deposits | | 23.7 | % | 28.5 | % | 4.8 | % |

| | | | | | | |

Net Interest Margin | | 4.55 | % | 5.44 | % | 0.89 | % |

| | | | | | | |

NPAs/Loans | | 1.83 | % | 1.50 | % | 0.33 | % |

| | | | | | | |

Efficiency Ratio** | | 66.0 | % | 56.8 | % | 9.2 | % |

| | | | | | | |

ROAA (GAAP) | | 1.06 | % | 1.03 | % | (.03 | )% |

| | | | | | | |

ROAA (Adj)*** | | 1.06 | % | 1.52 | % | 0.46 | % |

* Centennial Bank Holdings, Inc. predecessor and Guaranty Corporation added together.

** Q1 2006 noninterest expense adjusted for amortization of intangibles of $2,998,000 ($1,859,000 net of tax).

*** 2003 ROAA calculation assumes 34% tax rate. Q1 2006 calculations adjusted for amortization of intangibles of $2,998,000 ($1,859,000 net of tax) as well as subtracting intangible assets from the base.

Sources: SEC Filings, Castle Creek Research

6

Many Accomplishments But Challenges Remain

• Growth has been weak

• Increasing senior leadership

• Working to change loan mix

• Hiring experienced lenders

• Increasing calling and marketing efforts

7

Many Accomplishments But Challenges Remain

• Growth has been weak

• Service quality has been inconsistent

• Completed major integrations

• Assembled stronger operating leadership

• Creating unified service culture

8

Many Accomplishments But Challenges Remain

• Growth has been weak

• Service quality has been inconsistent

• Credit quality has improved slowly

• Promoted new Chief Credit Officer

• Changing policies and procedures

• Continuing to intensify loan review process

• Focusing more attention on documentation

9

Centennial is Well Positioned

• Experienced management team

• Favorable long-term market characteristics

• Large market share

• Disciplined management process

• Simple business model

• Shareholder focused

10

Centennial Bank Holdings, Inc.

Denver, CO

11

Non-GAAP Financial Measures

This presentation includes financial information determined by methods other than in accordance with U.S. GAAP. Centennial provides these non-GAAP financial measures to provide meaningful supplemental information regarding Centennial’s operational performance and to enhance investors’ overall understanding of Centennial’s core financial performance. Management believes that these non-GAAP financial measures allow for additional transparency and are used by some investors, analysts and other users of the company’s financial information as performance measures. These non-GAAP financial measures are presented for supplemental informational purposes only for understanding Centennial’s operating results and should not be considered a substitute for financial information presented in accordance with GAAP. These non-GAAP financial measures presented by Centennial may be different from non-GAAP financial measures used by other companies.

12

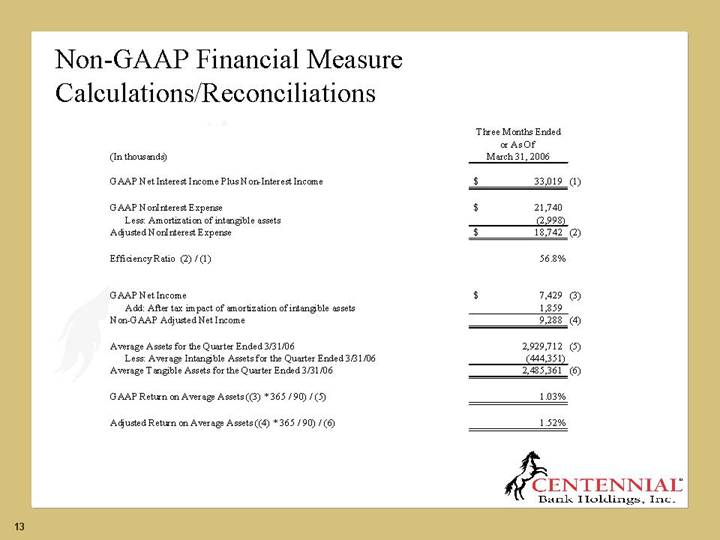

Non-GAAP Financial Measure Calculations/Reconciliations

| | Three Months Ended | |

| | or As Of | |

(In thousands) | | March 31, 2006 | |

| | | |

GAAP Net Interest Income Plus Non-Interest Income | | $ | 33,019 | (1) |

| | | |

GAAP NonInterest Expense | | $ | 21,740 | |

Less: Amortization of intangible assets | | (2,998 | ) |

Adjusted NonInterest Expense | | $ | 18,742 | (2) |

| | | |

Efficiency Ratio (2) / (1) | | 56.8 | % |

| | | |

GAAP Net Income | | $ | 7,429 | (3) |

Add: After tax impact of amortization of intangible assets | | 1,859 | |

Non-GAAP Adjusted Net Income | | 9,288 | (4) |

| | | |

Average Assets for the Quarter Ended 3/31/06 | | 2,929,712 | (5) |

Less: Average Intangible Assets for the Quarter Ended 3/31/06 | | (444,351 | ) |

Average Tangible Assets for the Quarter Ended 3/31/06 | | 2,485,361 | (6) |

| | | |

GAAP Return on Average Assets ((3) * 365 / 90) / (5) | | 1.03 | % |

| | | |

Adjusted Return on Average Assets ((4) * 365 / 90) / (6) | | 1.52 | % |

13

Daniel M. Quinn

• Professional

• Joined Centennial Bank Holdings’ Board of Directors in 2005

• President of Quinn Financial, LLC, a financial services company, since July 2003

• 24 years with U.S. Bank, headquartered in Minneapolis, MN

• Vice Chairman of Commercial Banking for U.S. Bank, from 1999 to 2003

• Previous positions include President of U.S. Bank in Colorado (formerly Colorado National Bank)

• Education

• Graduated from University of Minnesota in 1978 with a finance degree

• Attended University of Minnesota Graduate School of Business in 1978 and 1979

• Other Information

• Colorado resident since 1990

• Active in Denver community

• Currently serves on Denver Metro Boy Scouts Board of Directors

• Previously served in board positions with the Denver Metro Chamber of Commerce, Downtown Denver Partnership and Kempe Foundation

• Avid golfer and skier

• Lives in Denver with his family

14

Centennial Bank Holdings, Inc.

Denver, CO

15