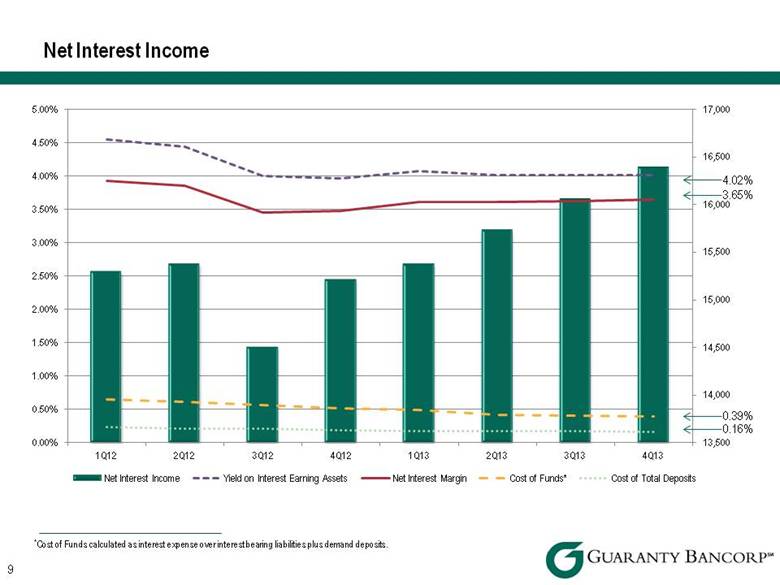

| Income Statement 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 Net Interest Income $ 15,300 $ 15,383 $ 14,511 $ 15,217 $ 15,378 $ 15,739 $ 16,062 $ 16,391 Provision for Loan Losses 1,000 500 - (3,500)2 - - 142 154 Noninterest Income 3,099 2,911 3,815 3,766 2,950 3,711 3,664 3,474 Noninterest Expense 14,482 17,5161 14,194 17,9222 15,192 13,879 13,936 13,681 Tax Expense (Benefit) - (5,914)1 1,302 1,441 864 1,753 1,797 1,942 Net Income $ 2,917 $ 6,192 $ 2,830 $ 3,120 $ 2,272 $ 3,818 $ 3,851 $ 4,088 Balance Sheet 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13 Cash and Equivalents $ 105,273 $ 142,133 $ 167,823 $ 171,217 $ 60,891 $ 35,613 $ 33,465 $ 28,077 Investments 401,357 398,151 436,386 458,927 512,188 484,971 471,257 442,300 Loans 1,109,897 1,110,161 1,118,968 1,158,749 1,180,607 1,240,555 1,293,252 1,320,424 Allowance for Loan Losses (30,075) (29,307) (28,597) (25,142) (24,060) (20,218) (20,450) (21,005) Other Assets 129,992 129,401 140,398 123,187 107,214 125,207 118,667 141,236 Total Assets $1,716,444 $1,750,539 $1,834,978 $1,886,938 $1,836,840 $1,866,128 $1,896,191 $1,911,032 Deposits $1,338,928 $1,378,937 $1,395,096 $1,454,756 $1,442,317 $1,449,251 $1,482,515 $1,528,457 Other Liabilities 203,243 191,481 254,809 243,982 204,981 231,553 225,408 193,181 Total Liabilities $1,542,171 $1,570,418 $1,649,905 $1,698,738 $1,647,298 $1,680,804 $1,707,923 $1,721,638 Stockholders’ Equity $174,273 $180,121 $185,073 $188,200 $189,542 $185,324 $188,268 $189,394 Total Liabilities and Stockholders’ Equity $1,716,444 $1,750,539 $1,834,978 $1,886,938 $1,836,840 $1,866,128 $1,896,191 $1,911,032 Quarterly Financial Statement Summary (in thousands) 16 1 Second quarter 2012 the Company recognized a $2.8 million branch closure impairment in addition to a $5.9 million reversal of its deferred tax asset valuation allowance. 2 Fourth quarter 2012 the Company recognized a $3.5 million credit provision as a result of reduced credit risk in the loan portfolio and a $3.0 million write-down on the Company’s largest OREO property. |