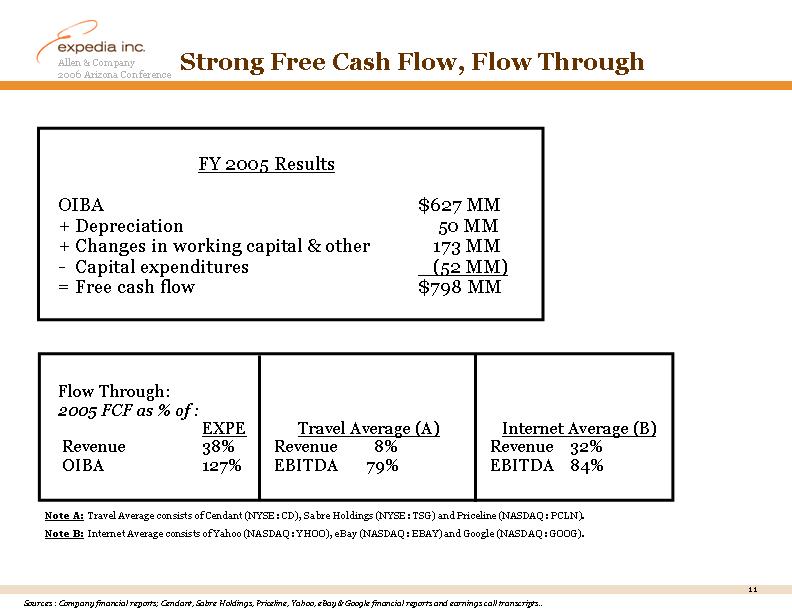

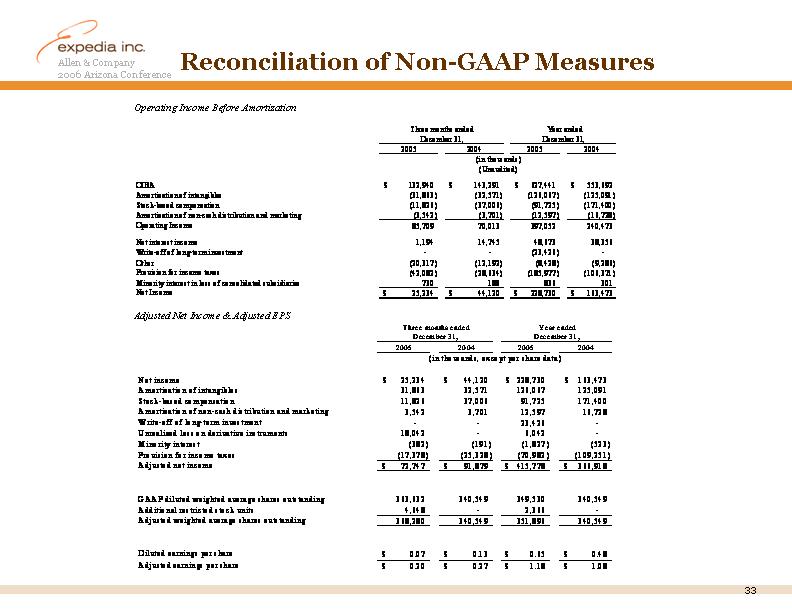

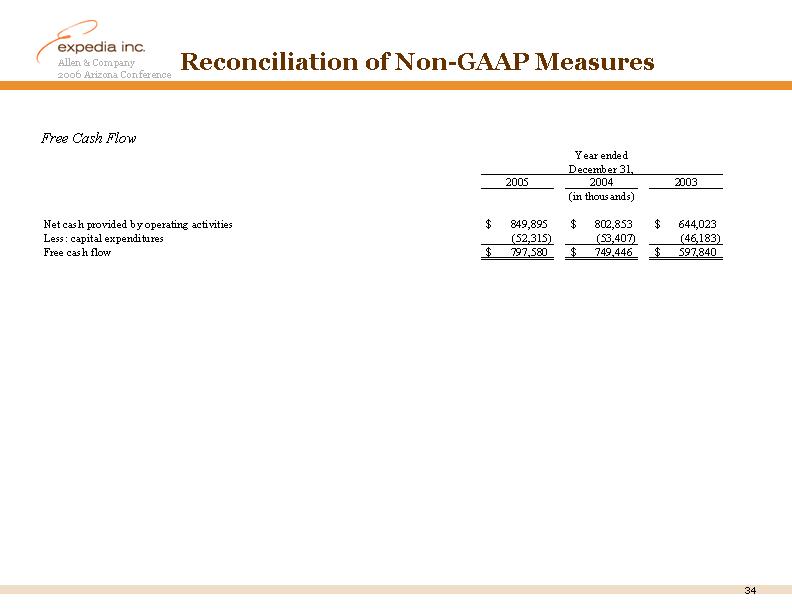

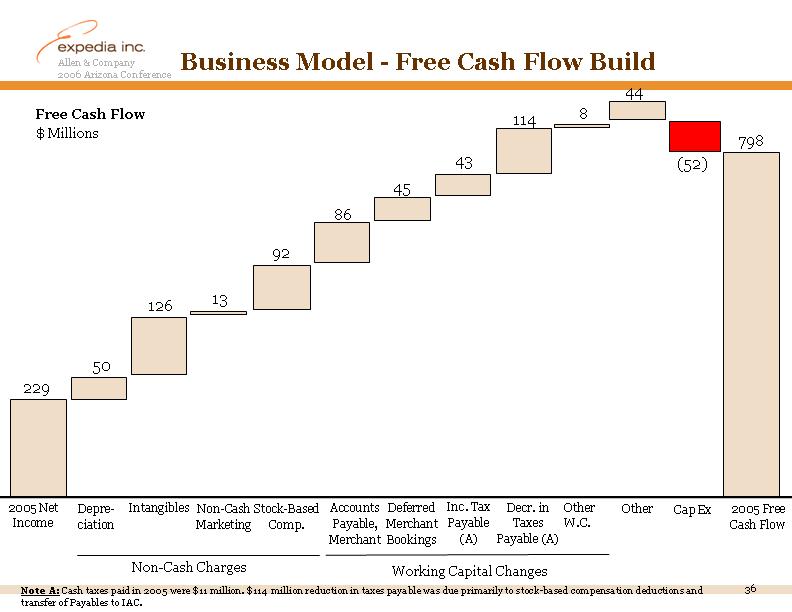

| Definitions of Non-GAAP Measures The following are defined as non-GAAP measures by the SEC: Operating Income Before Amortization is defined as operating income plus: (1) amortization of non-cash distribution and marketing expense, (2) stock-based compensation expense, (3) amortization of intangible assets and goodwill impairment, if applicable and (4) certain one-time items, if applicable. Management believes this measure is useful to investors because it represents the combined operating results of Expedia, Inc.'s businesses, taking into account depreciation, which we believe is an ongoing cost of doing business, but excluding the effects of other non-cash expenses that may not be indicative of our core business operations. Operating Income Before Amortization has certain limitations in that it does not take into account the impact to Expedia, Inc.'s statements of income of certain expenses, including non-cash compensation, non-cash payments to partners, and acquisition-related accounting. Due to the high variability and difficulty in predicting certain items that affect net income, such as interest rates and tax rates, Expedia, Inc. is unable to provide reconciliation to net income on a forward-looking basis without unreasonable efforts. Adjusted Net Income generally captures all items on the statements of income that have been, or ultimately will be, settled in cash and is defined as net income available to stockholders plus (1) amortization of non-cash distribution and marketing expense, (2) stock-based compensation expense, (3) amortization of intangible assets and goodwill impairment, if applicable, (4) one-time items, net of related tax, and minority interest, (5) mark to market gains and losses on derivative liabilities and (6) discontinued operations, net of tax. We believe Adjusted Net Income is useful to investors because it represents Expedia, Inc.'s combined results, taking into account depreciation, which management believes is an ongoing cost of doing business, but excluding the impact of other non-cash expenses and items not directly tied to the recurring core operations of our businesses. Adjusted EPS is defined as Adjusted Net Income divided by weighted fully diluted shares outstanding for Adjusted EPS purposes. We include dilution from options and warrants per the treasury stock method and include all shares relating to restricted stock units ("RSU") in shares outstanding for Adjusted EPS. This differs from the GAAP method for including RSUs, which treats them on a treasury method basis. Shares outstanding for Adjusted EPS purposes are therefore higher than shares outstanding for GAAP EPS purposes. We believe Adjusted EPS is useful to investors because it represents, on a per share basis, Expedia's consolidated results, taking into account depreciation, which we believe is an ongoing cost of doing business, as well as other charges which are not allocated to the operating businesses such as interest expense, taxes and minority interest, but excluding the effects of other non-cash expenses not directly tied to the core operations of our businesses. Adjusted Net Income and Adjusted EPS have the same limitations as Operating Income Before Amortization. In addition, Adjusted Net Income does not include all items that affect our net income and net income per share for the period. Therefore, we think it is important to evaluate these measures along with our consolidated statements of income. Free Cash Flow is defined as net cash flow provided by operating activities less capital expenditures. Management believes Free Cash Flow is useful to investors because it represents the operating cash flow that our operating businesses generate, less capital expenditures but before taking into account other cash movements that are not directly tied to the core operations of our businesses, such as financing activities or certain investing activities. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. Therefore, it is important to evaluate Free Cash Flow along with the consolidated statements of cash flows. |