Investor presentation February 9, 2017 EXHIBIT 99.2

Safe harbor 2 Forward-looking statements. This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance. These forward-looking statements are based on management’s expectations as of February 9, 2017 and assumptions which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. The use of words such as "intends" and “expects,” among others, generally identifies forward-looking statements. However, these words are not the exclusive means of identifying such statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements and may include statements relating to future revenues, expenses, margins, profitability, net income / (loss), earnings per share and other measures of results of operations and the prospects for future growth of Expedia, Inc.’s business. Actual results and the timing and outcome of events may differ materially from those expressed or implied in the forward-looking statements for a variety of reasons, including, among others: an increasingly competitive global environment; our failure to modify our current business models and practices or to adopt new business models or practices in order to compete in a dynamic industry; changes in search engine algorithms and dynamics or other traffic-generating arrangements; our failure to maintain and expand our relationships and contractual agreements with travel suppliers or travel distribution partners; declines or disruptions in the travel industry; our failure to maintain and expand our brand awareness or increased costs to do so; our failure to invest in and adapt to technological developments or industry trends; risks related to our acquisitions, investments or significant commercial arrangements; risks related to HomeAway’s transition to a primarily transaction-based business; risks relating to our operations in international markets; our failure to comply with current laws, rules and regulations, or changes to such laws, rules and regulations; adverse application of existing tax laws, rules or regulations are subject to interpretation by taxing authorities; interruption, security breaches and lack of redundancy in our information systems; unfavorable amendment to existing tax laws, rules or regulations or enactment of new unfavorable laws, rules or regulations; adverse outcomes in legal proceedings to which we are a party; risks related to payments and fraud; fluctuations in foreign exchange rates; volatility in our stock price; liquidity constraints or our inability to access the capital markets when necessary or desirable; our failure to comply with governmental regulation and other legal obligations related to our processing, storage, use, disclosure and protection of personal information, payment card information and other consumer data; our failure to retain or motivate key personnel or hire, retain and motivate qualified personnel, including senior management; changes in control of the Company; management and director conflicts of interest; risks related to actions taken by our business partners and third party service providers, including failure to comply with our requirements or standards or the requirements or standards of governmental authorities, or any cessation of their operations; risks related to the failure of counterparties to perform on financial obligations; risks related to our long-term indebtedness, including our failure to effectively operate our businesses due to restrictive covenants in the agreements governing our indebtedness; our failure to protect our intellectual property and proprietary information from copying or use by others, including potential competitors; and other risks detailed in Expedia, Inc.’s public filings with the SEC, including those described in our annual report on Form 10-K for year ended December 31, 2016 and any updates to those factors set forth in Expedia, Inc.’s subsequent quarterly reports on Form 10-Q or current reports on Form 8-K. Except as required by law, we undertake no obligation to update any forward-looking or other statements in this presentation, whether as a result of new information, future events or otherwise. Non-GAAP measures. Reconciliations to GAAP measures of non-GAAP measures included in this presentation are included in the Appendix. These measures are intended to supplement, not substitute for, GAAP comparable measures. Investors are urged to consider carefully the comparable GAAP measures and reconciliations. Industry / market data. Industry and market data used in this presentation have been obtained from industry publications and sources as well as from research reports prepared for other purposes. We have not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. Trademarks & logos. Trademarks and logos are the property of their respective owners. © 2017 Expedia, Inc. All rights reserved. CST: 2029030-50

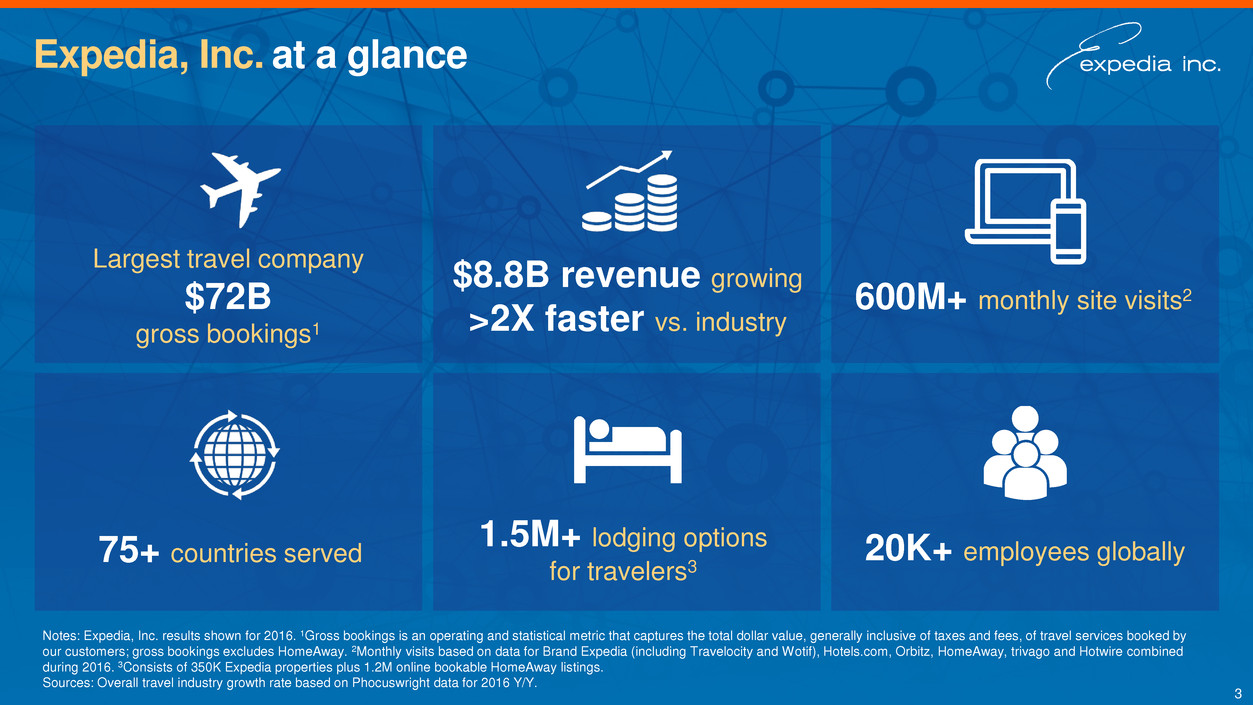

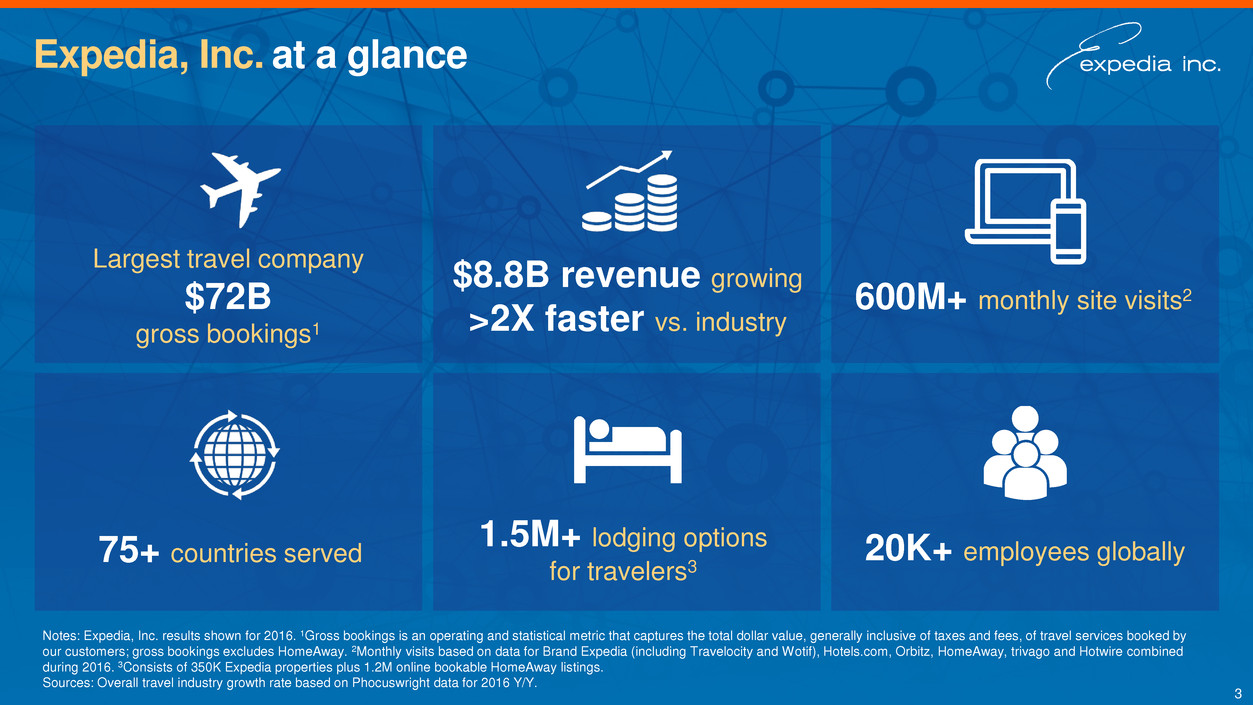

Expedia, Inc. at a glance 3 Notes: Expedia, Inc. results shown for 2016. 1Gross bookings is an operating and statistical metric that captures the total dollar value, generally inclusive of taxes and fees, of travel services booked by our customers; gross bookings excludes HomeAway. 2Monthly visits based on data for Brand Expedia (including Travelocity and Wotif), Hotels.com, Orbitz, HomeAway, trivago and Hotwire combined during 2016. 3Consists of 350K Expedia properties plus 1.2M online bookable HomeAway listings. Sources: Overall travel industry growth rate based on Phocuswright data for 2016 Y/Y. Largest travel company $72B gross bookings1 $8.8B revenue growing >2X faster vs. industry 20K+ employees globally 600M+ monthly site visits2 75+ countries served 1.5M+ lodging options for travelers3

Key investment highlights 4 Operating the world’s largest, diversified travel platform2 Harnessing significant scale and technological advantages3 Leading brands with proprietary channels4 Strong financial performance on solid trajectory5 Track record of successful M&A and smart capital allocation6 1 Huge addressable market

Huge opportunity in $1.3T global market Notes: Expedia’s share of travel market defined as gross bookings during 2016. Travel market size estimates based on Phocuswright data for 2017. Sources: Phocuswright estimates and Expedia data. Global leader with significant headroom for further growth 50% of total travel market Total travel market ~$1.3T 20% 6% 5% 7% 13% 3% 2% 2% 5 67% 50% Online travel segment 37% 34% United States and Canada EMEA Asia Pacific Latin America $383B $445B $392B $64B 2017 total travel market Expedia, Inc. Other

World’s largest, diversified travel platform 6 Notes: Expedia, Inc. data shown as of 12/31/16. 1Monthly visitors based on data for Brand Expedia (including Travelocity and Wotif), Hotels.com, Orbitz, HomeAway, trivago and Hotwire combined during 2016. 2Offline travel agents based on number of sales agents in Global Customer Operations, Expedia Affiliate Network (EAN), HomeAway, Classic Vacations, CruiseShipCenters, Travel Agent Affiliate Program (TAAP). Unmatched breadth & choice of products Unrivaled global distribution opportunities Broad and diversified SUPPLY Properties 350K+ Airlines 500+ Car rental companies 150+ Online bookable vacation rentals 1.2M+ Unique activities 25K+ The Expedia, Inc. global travel platformHigh volume & diversity of DEMAND Calls handled annually 55M Monthly visits1 600M+ in 75+ countries Active corporate travelers 1.6M+ Powering 150K+ offline travel agents2 Scale and relevance Ability to test & innovate faster Best in class customer & partner experiences

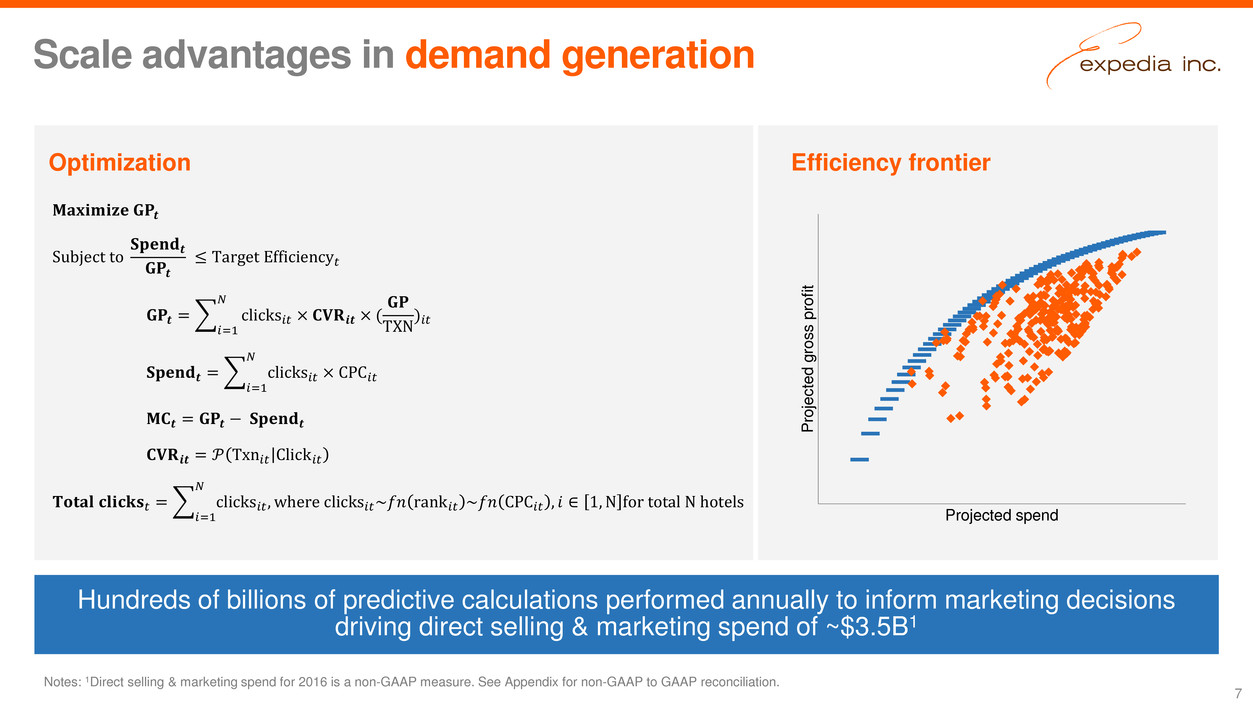

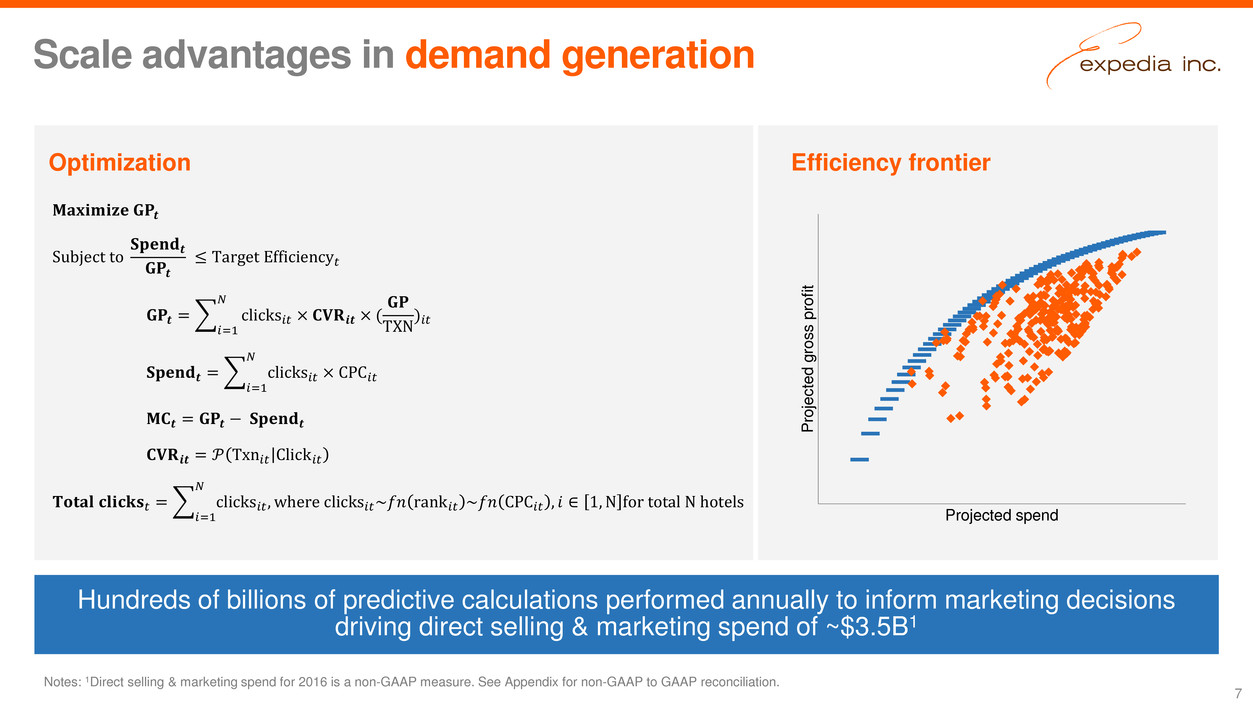

Scale advantages in demand generation 7 Notes: 1Direct selling & marketing spend for 2016 is a non-GAAP measure. See Appendix for non-GAAP to GAAP reconciliation. Hundreds of billions of predictive calculations performed annually to inform marketing decisions driving direct selling & marketing spend of ~$3.5B1 Optimization �������������������������������� ������������ Subject to ������������������������ ������������ ≤ Target Efficiency���� ������������ =� ����=1 ���� clicks�������� × ������������ �������� × ( �������� TXN )�������� ������������������������ =� ����=1 ���� clicks�������� × CPC�������� ������������ = ������������ − ������������������������ ������������ �������� = ���� Txn�������� Click �������� �������������������� ���������������������������� =� ����=1 ���� clicks�������� , where clicks��������~�������� rank �������� ~�������� CPC�������� , ���� ∈ 1, N for total N hotels P ro je ct ed g ro ss p ro fit Projected spend Efficiency frontier

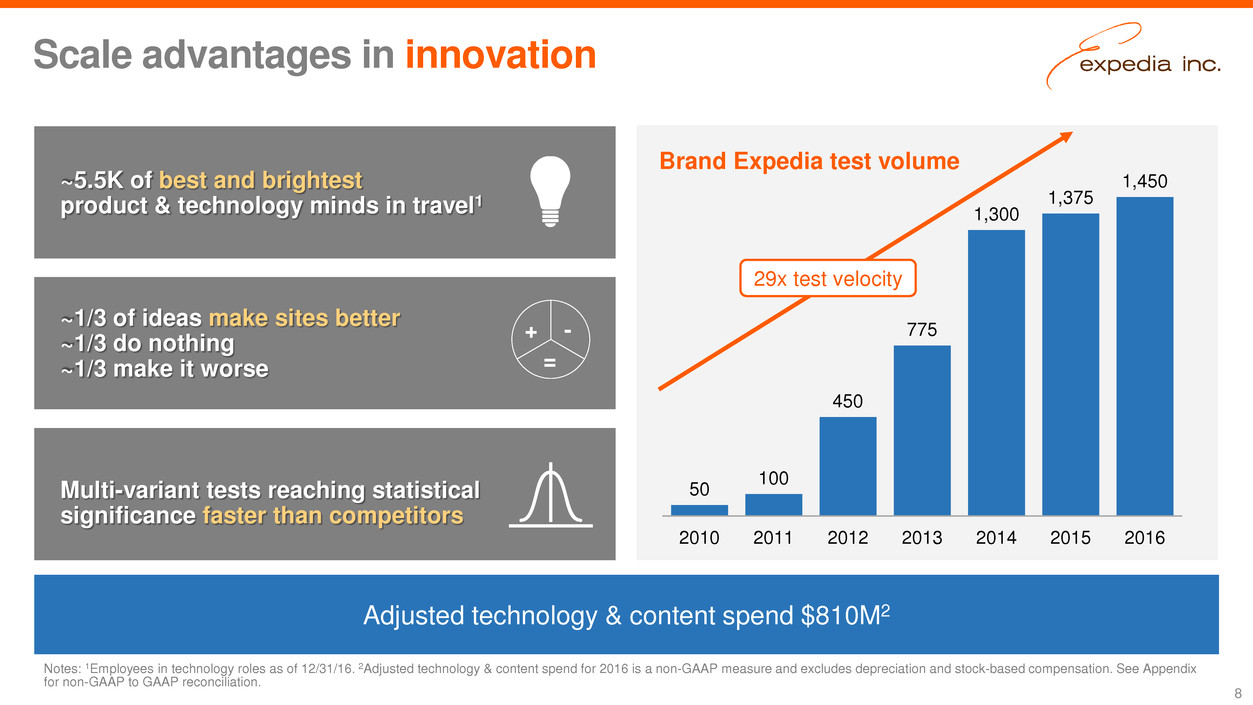

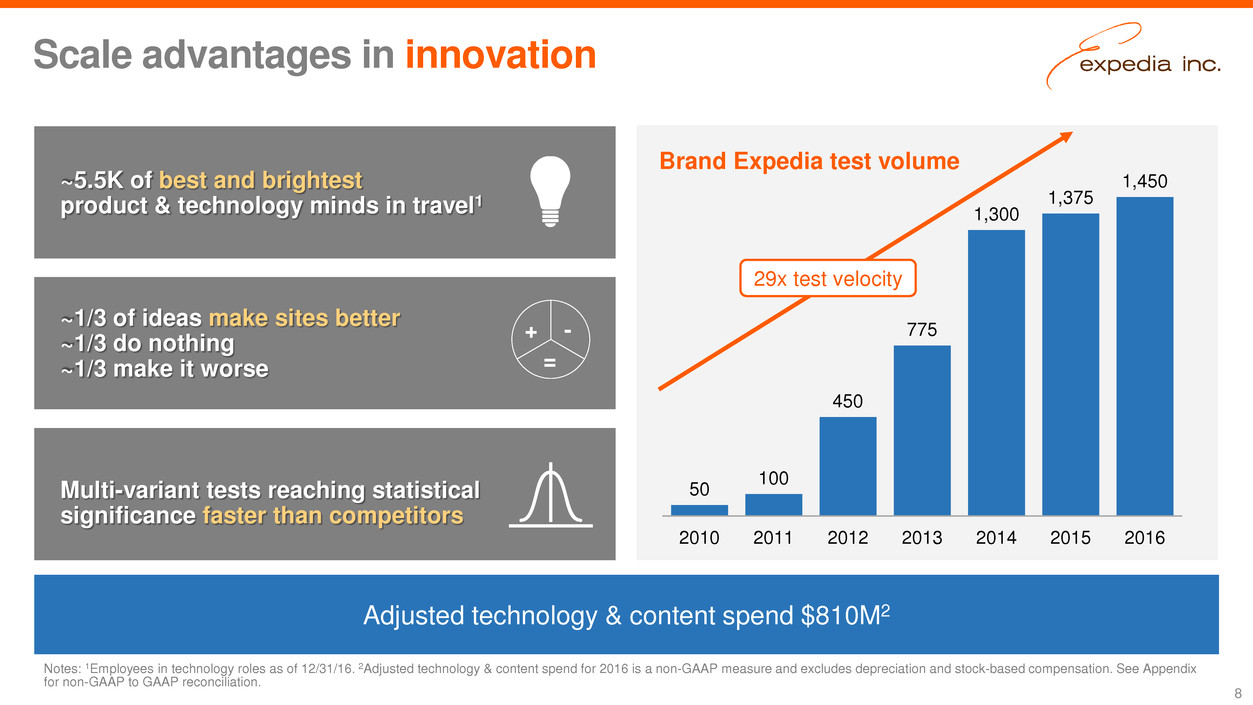

Scale advantages in innovation 8 Notes: 1Employees in technology roles as of 12/31/16. 2Adjusted technology & content spend for 2016 is a non-GAAP measure and excludes depreciation and stock-based compensation. See Appendix for non-GAAP to GAAP reconciliation. 50 100 450 775 1,300 1,375 1,450 2010 2011 2012 2013 2014 2015 2016 ~1/3 of ideas make sites better ~1/3 do nothing ~1/3 make it worse + - = ~5.5K of best and brightest product & technology minds in travel1 Multi-variant tests reaching statistical significance faster than competitors 29x test velocity Adjusted technology & content spend $810M2 Brand Expedia test volume

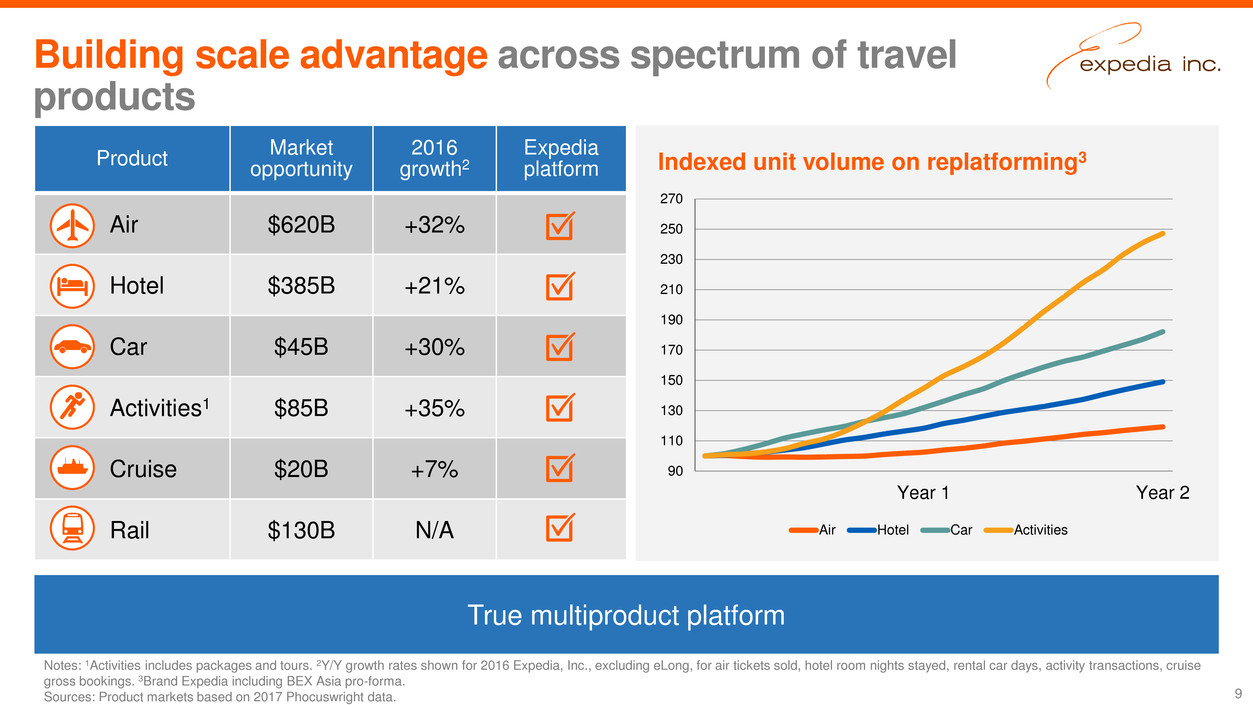

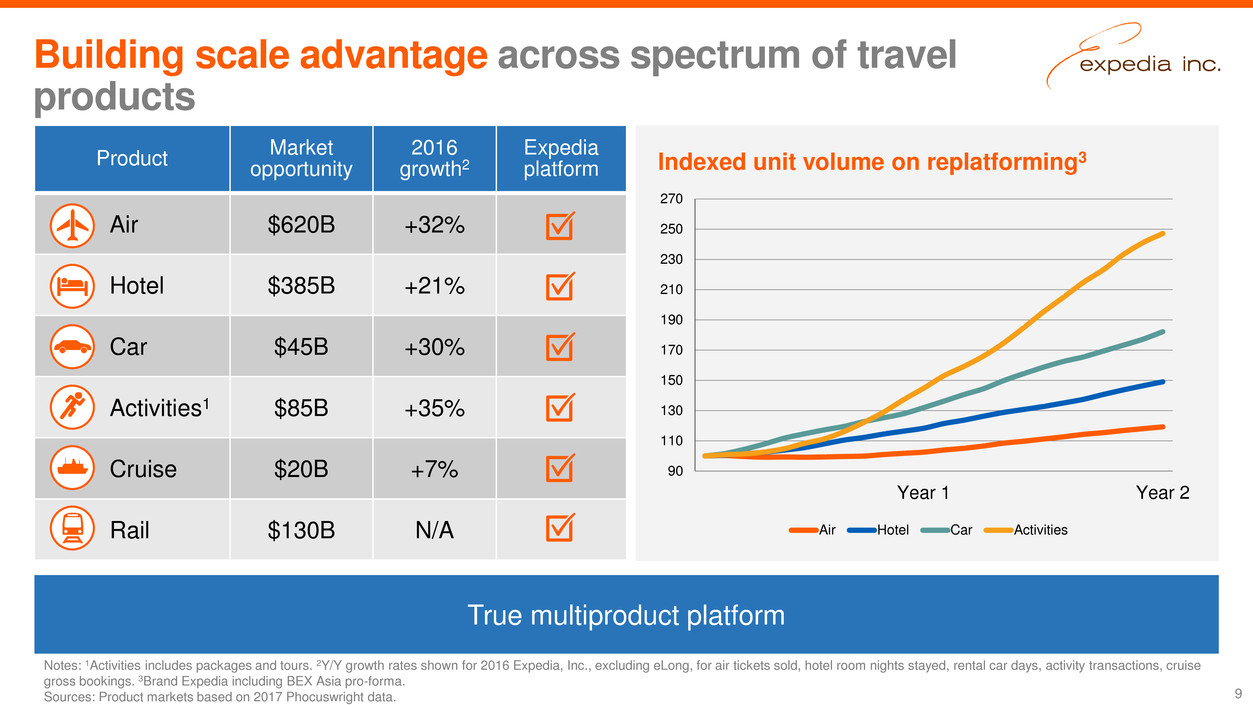

Building scale advantage across spectrum of travel products 9 Notes: 1Activities includes packages and tours. 2Y/Y growth rates shown for 2016 Expedia, Inc., excluding eLong, for air tickets sold, hotel room nights stayed, rental car days, activity transactions, cruise gross bookings. 3Brand Expedia including BEX Asia pro-forma. Sources: Product markets based on 2017 Phocuswright data. Product Market opportunity 2016 growth2 Expedia platform Air $620B +32% Hotel $385B +21% Car $45B +30% Activities1 $85B +35% Cruise $20B +7% Rail $130B N/A True multiproduct platform Indexed unit volume on replatforming3 90 110 130 150 170 190 210 230 250 270 Year 1 Year 2 Air Hotel Car Activities

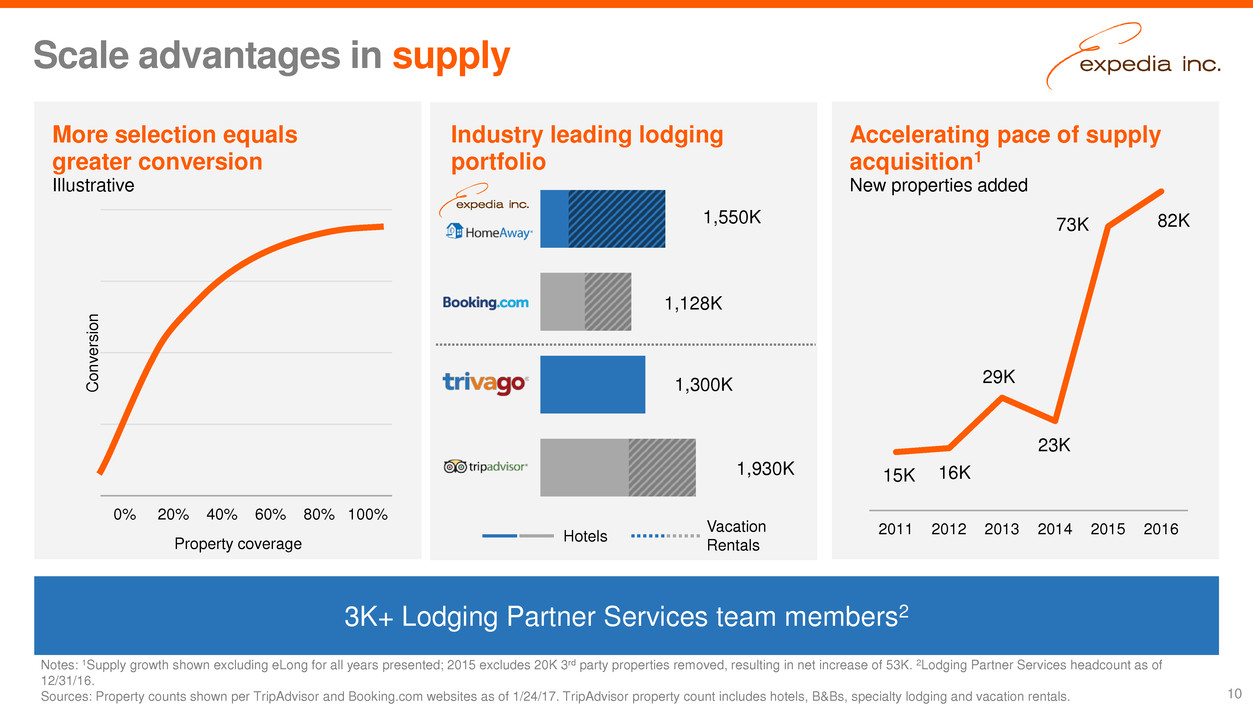

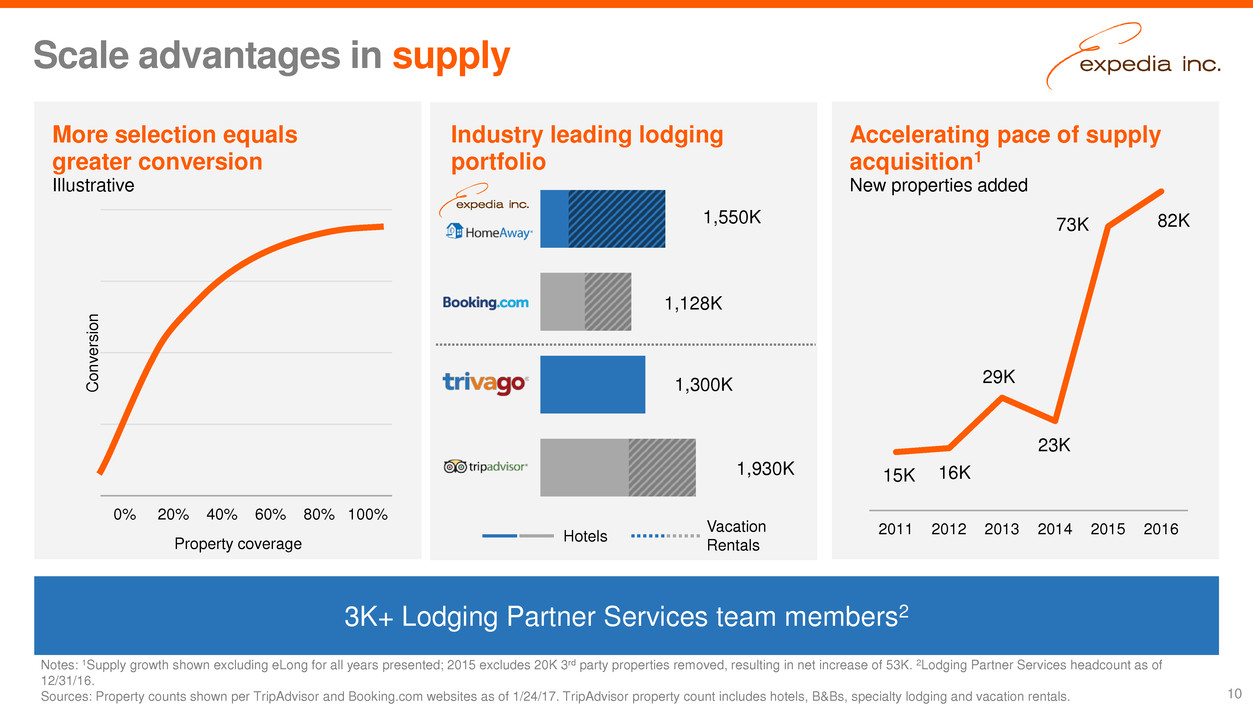

Scale advantages in supply 10 Notes: 1Supply growth shown excluding eLong for all years presented; 2015 excludes 20K 3rd party properties removed, resulting in net increase of 53K. 2Lodging Partner Services headcount as of 12/31/16. Sources: Property counts shown per TripAdvisor and Booking.com websites as of 1/24/17. TripAdvisor property count includes hotels, B&Bs, specialty lodging and vacation rentals. 3K+ Lodging Partner Services team members2 More selection equals greater conversion Illustrative Industry leading lodging portfolio Accelerating pace of supply acquisition1 New properties added 0% 20% 40% 60% 80% 100% C on ve rs io n Property coverage 2011 2012 2013 2014 2015 2016 15K 16K 29K 23K 73K1,550K 1,128K 1,300K 1,930K Hotels Vacation Rentals 82K

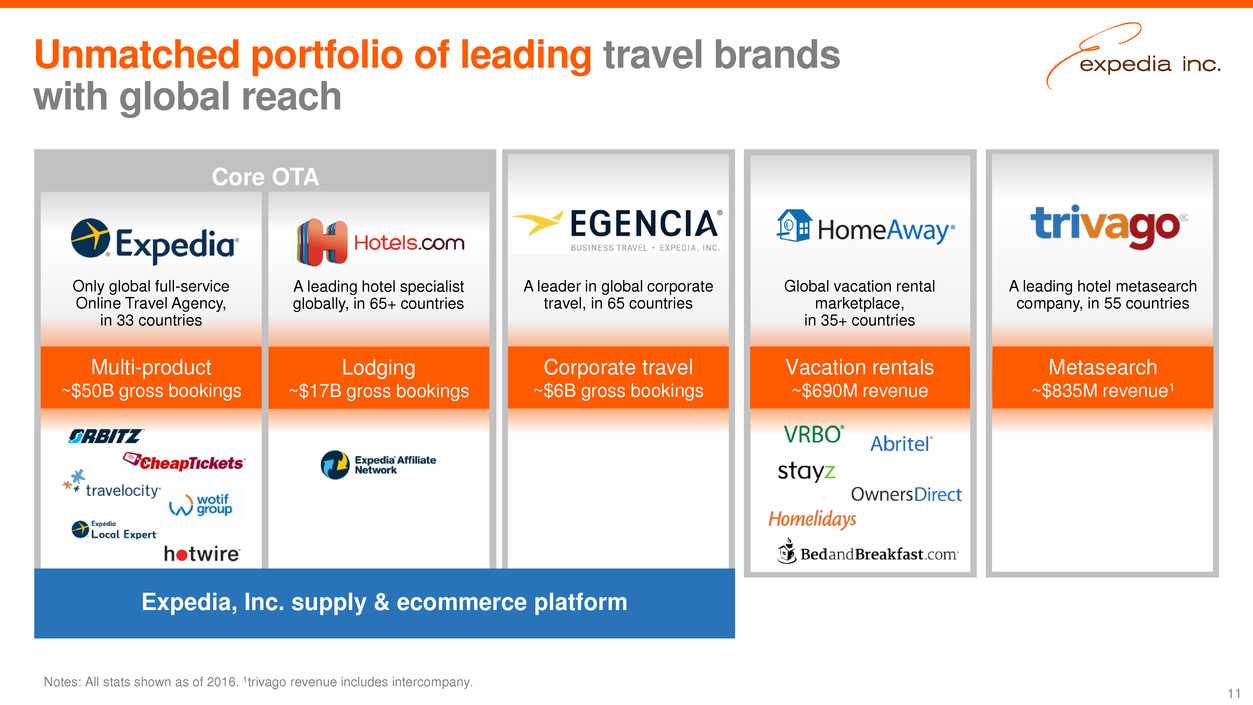

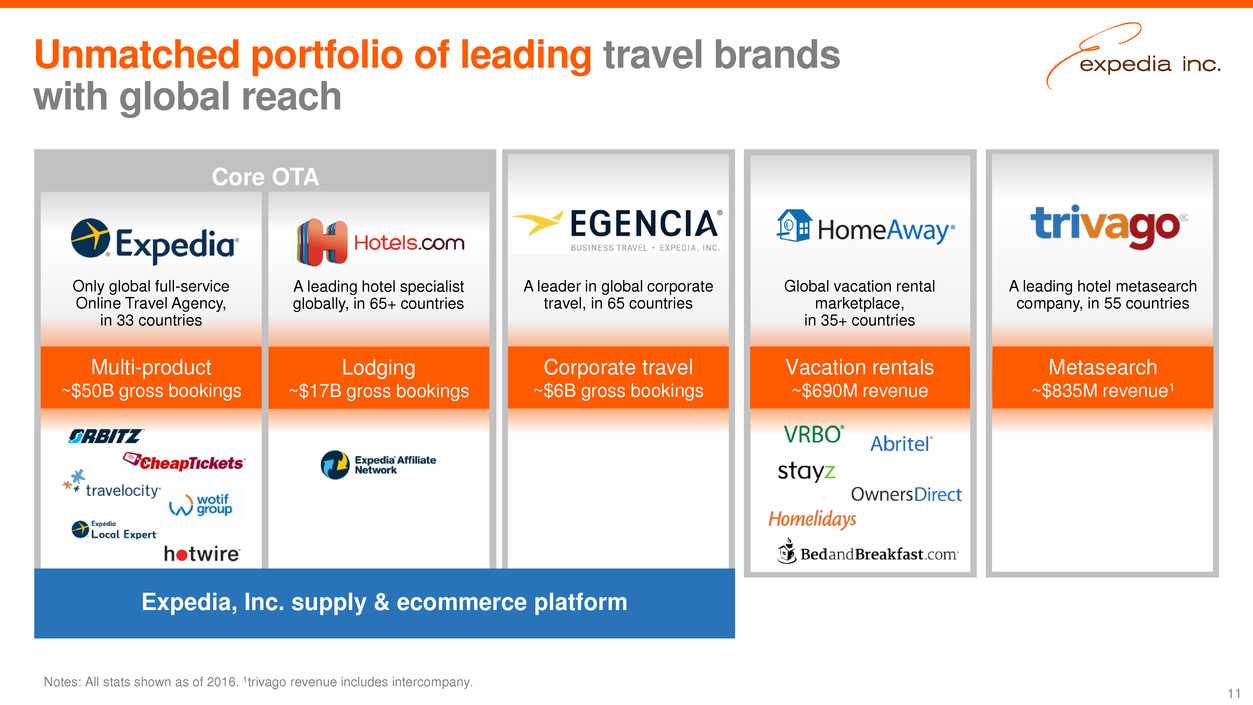

Unmatched portfolio of leading travel brands with global reach 11 Notes: All stats shown as of 2016. 1trivago revenue includes intercompany. Core OTA Lodging ~$17B gross bookings A leading hotel specialist globally, in 65+ countries A leading hotel metasearch company, in 55 countries Metasearch ~$835M revenue1 A leader in global corporate travel, in 65 countries Corporate travel ~$6B gross bookings Global vacation rental marketplace, in 35+ countries Vacation rentals ~$690M revenue Multi-product ~$50B gross bookings Only global full-service Online Travel Agency, in 33 countries Expedia, Inc. supply & ecommerce platform

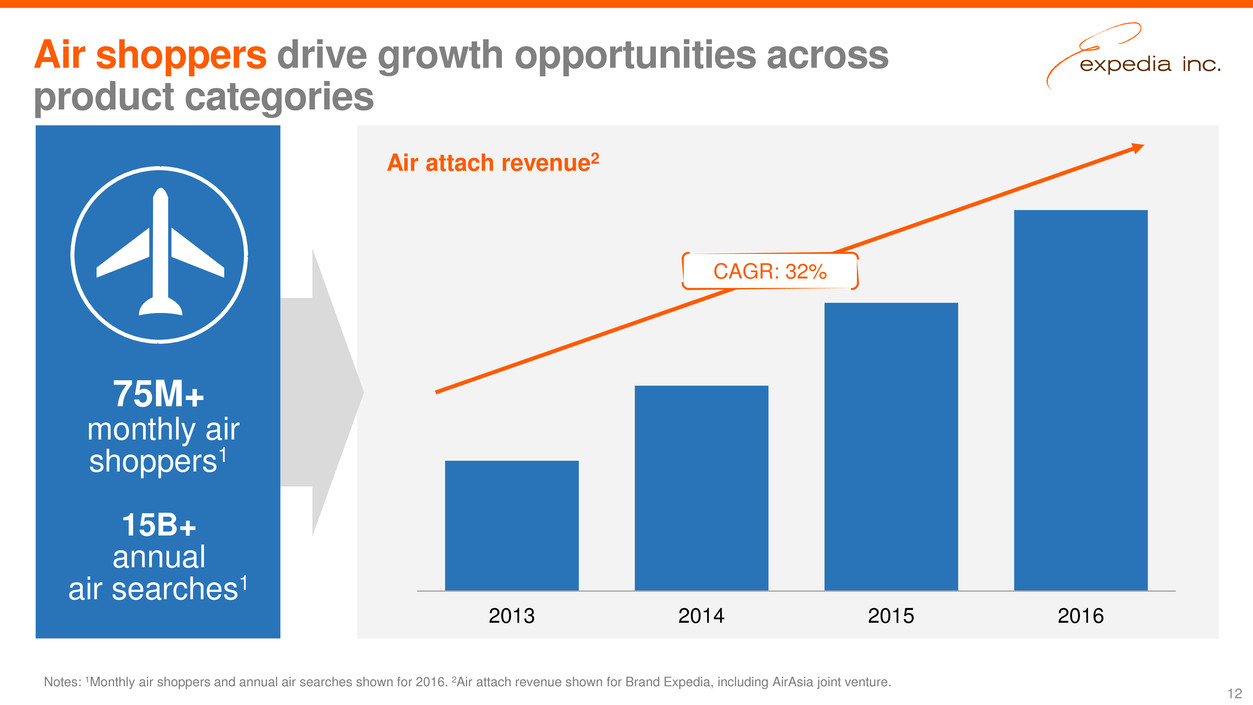

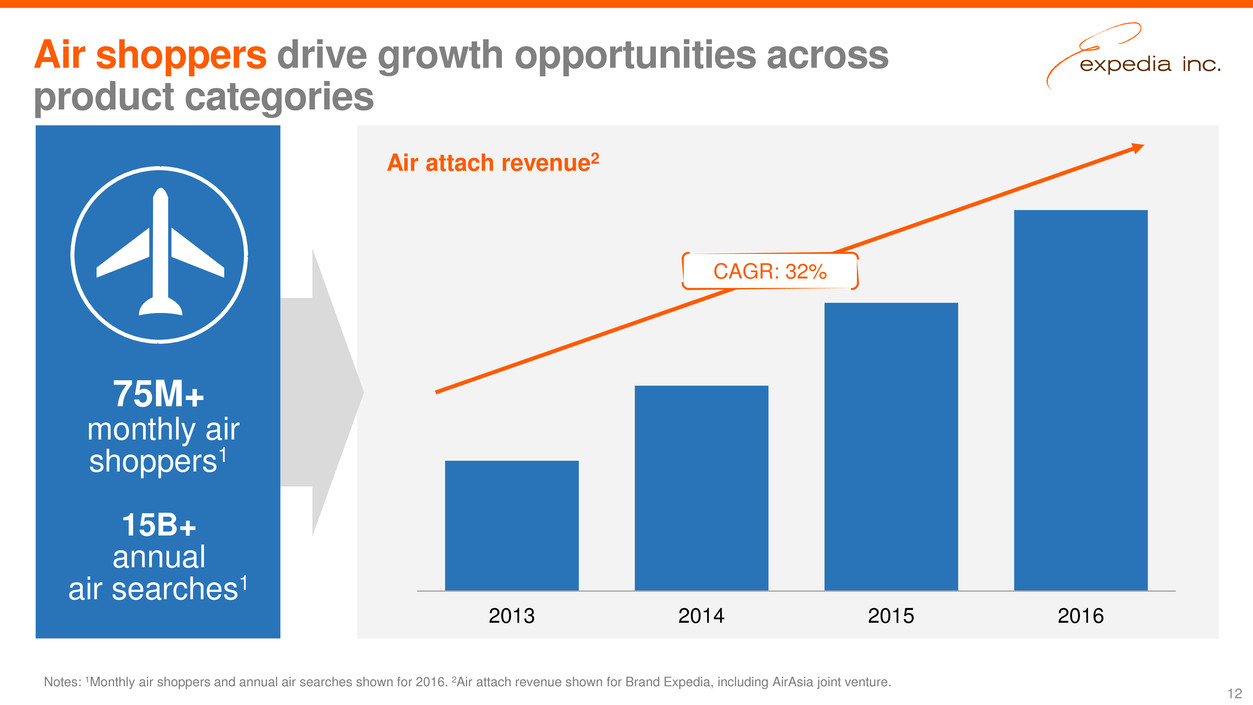

Air shoppers drive growth opportunities across product categories 12 Notes: 1Monthly air shoppers and annual air searches shown for 2016. 2Air attach revenue shown for Brand Expedia, including AirAsia joint venture. 2013 2014 2015 2016 Air attach revenue2 CAGR: 32% 75M+ monthly air shoppers1 15B+ annual air searches1

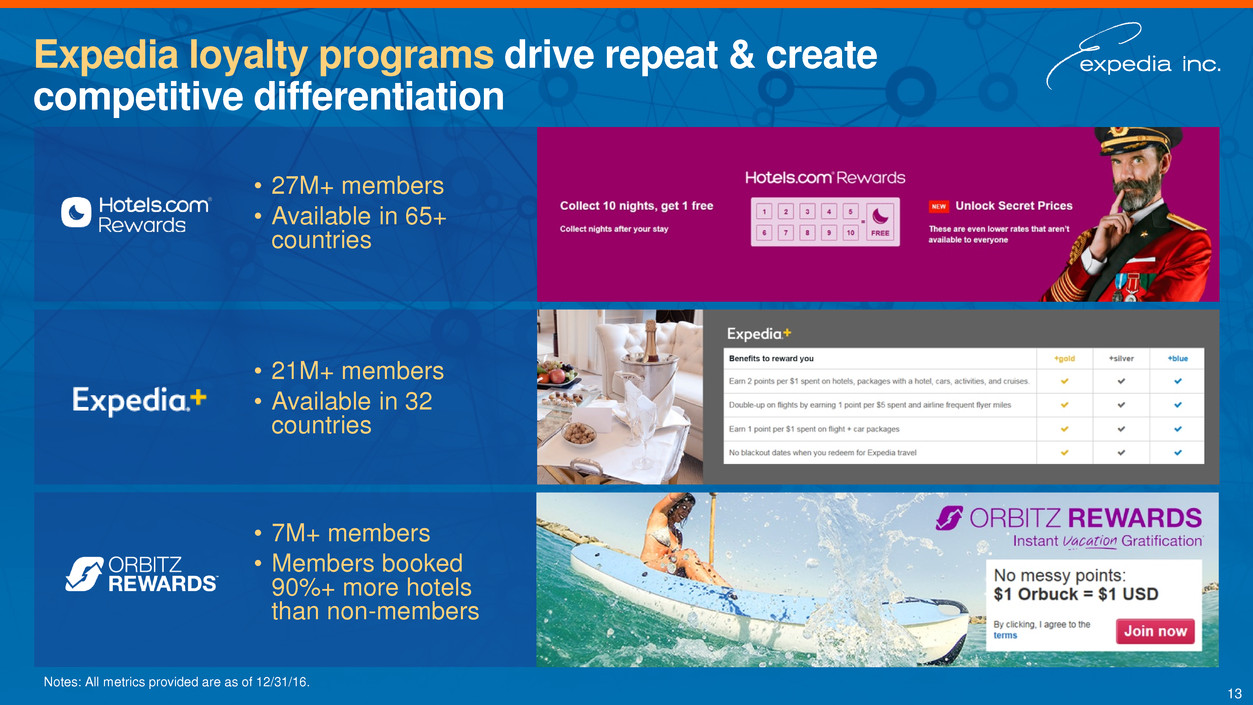

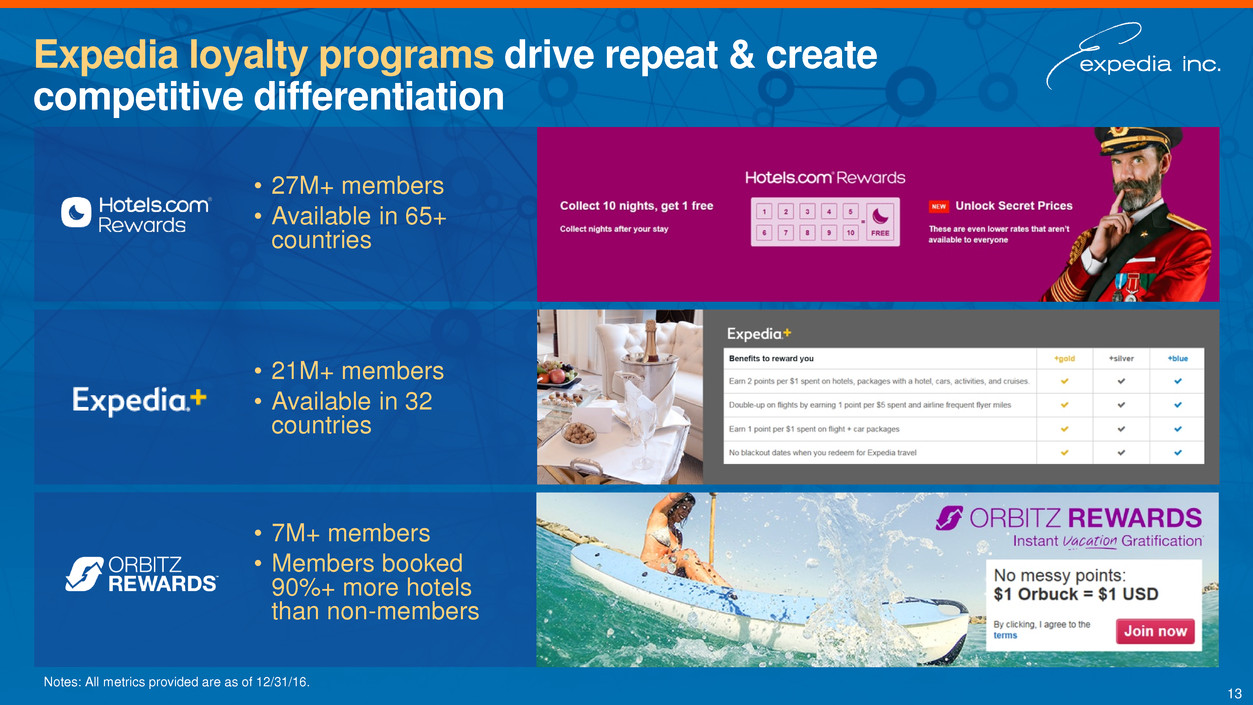

Expedia loyalty programs drive repeat & create competitive differentiation 13 Notes: All metrics provided are as of 12/31/16. • 21M+ members • Available in 32 countries • 7M+ members • Members booked 90%+ more hotels than non-members • 27M+ members • Available in 65+ countries

Investments in mobile drive growth & engagement 180M+ cumulative app downloads1 Over 45% of traffic arrives via mobile3 14 App users repeat >2x more frequently than average user2 Notes: 1Cumulative app downloads as of 12/31/16 for all Expedia, Inc. brands. 2Brand Expedia average over 2016. 3Mobile traffic stat based on Brand Expedia, Hotels.com, Orbitz, Wotif, and HomeAway mobile traffic in Q4 2016. 4Based on Expedia, Inc. transactions in 2016. Nearly 1 in 3 transactions booked via mobile4

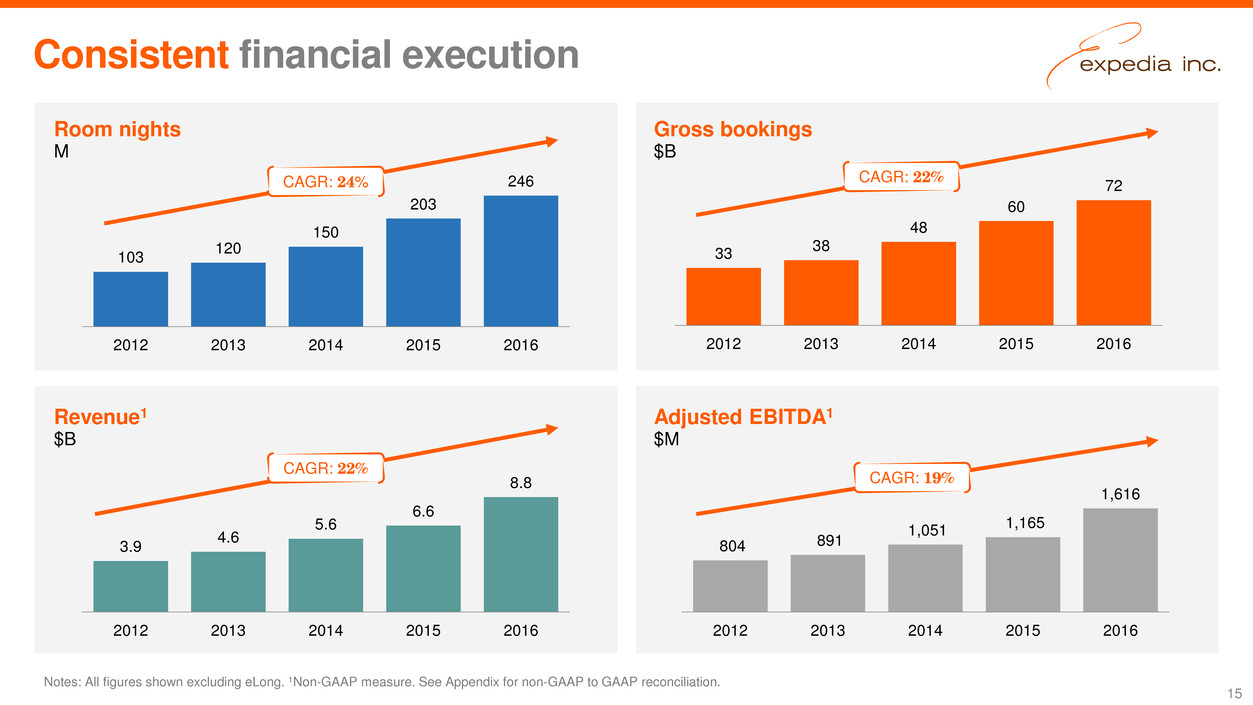

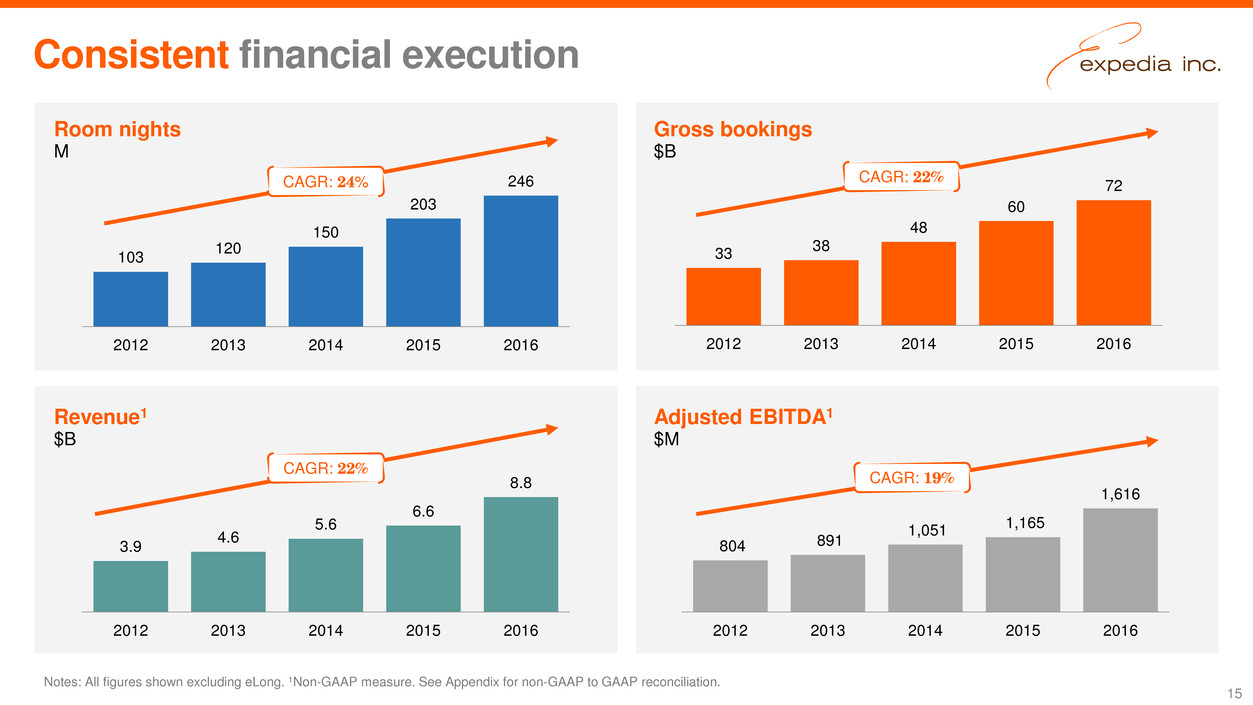

Consistent financial execution Notes: All figures shown excluding eLong. 1Non-GAAP measure. See Appendix for non-GAAP to GAAP reconciliation. Room nights M Revenue1 $B Gross bookings $B Adjusted EBITDA1 $M 103 120 150 203 246 2012 2013 2014 2015 2016 33 38 48 60 72 2012 2013 2014 2015 2016 3.9 4.6 5.6 6.6 8.8 2012 2013 2014 2015 2016 804 891 1,051 1,165 1,616 2012 2013 2014 2015 2016 CAGR: 24% CAGR: 22% CAGR: 22% CAGR: 19% 15

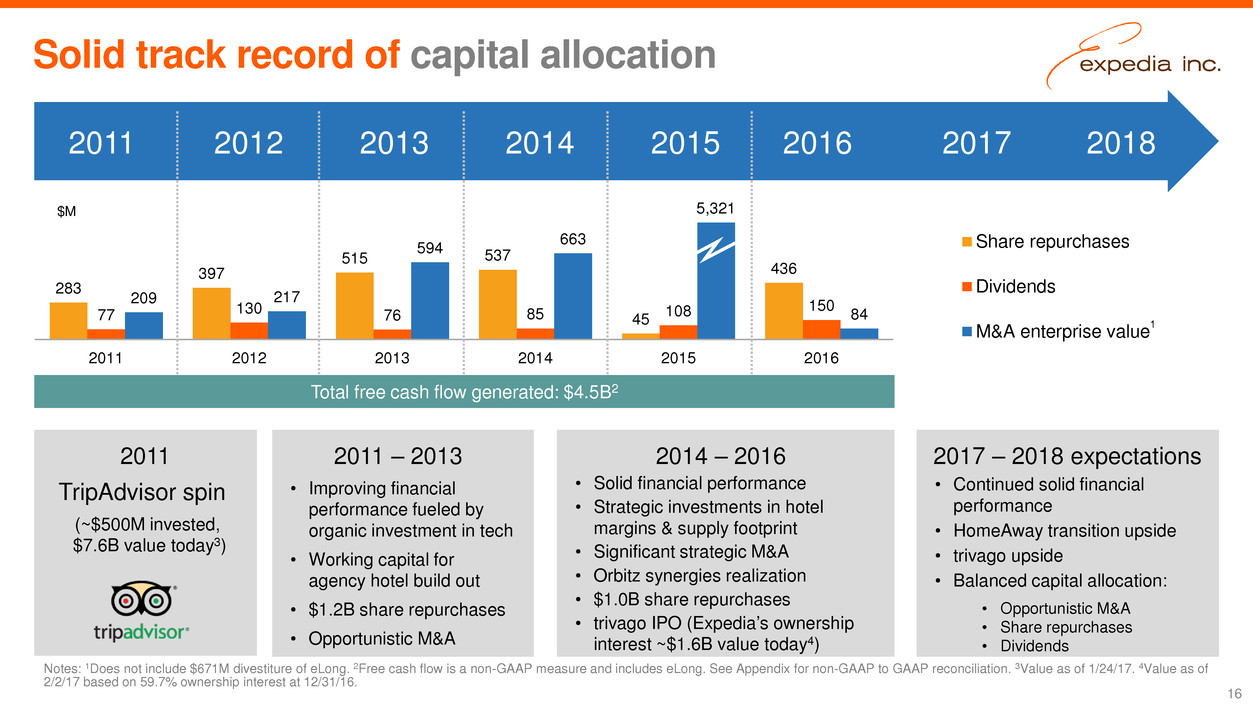

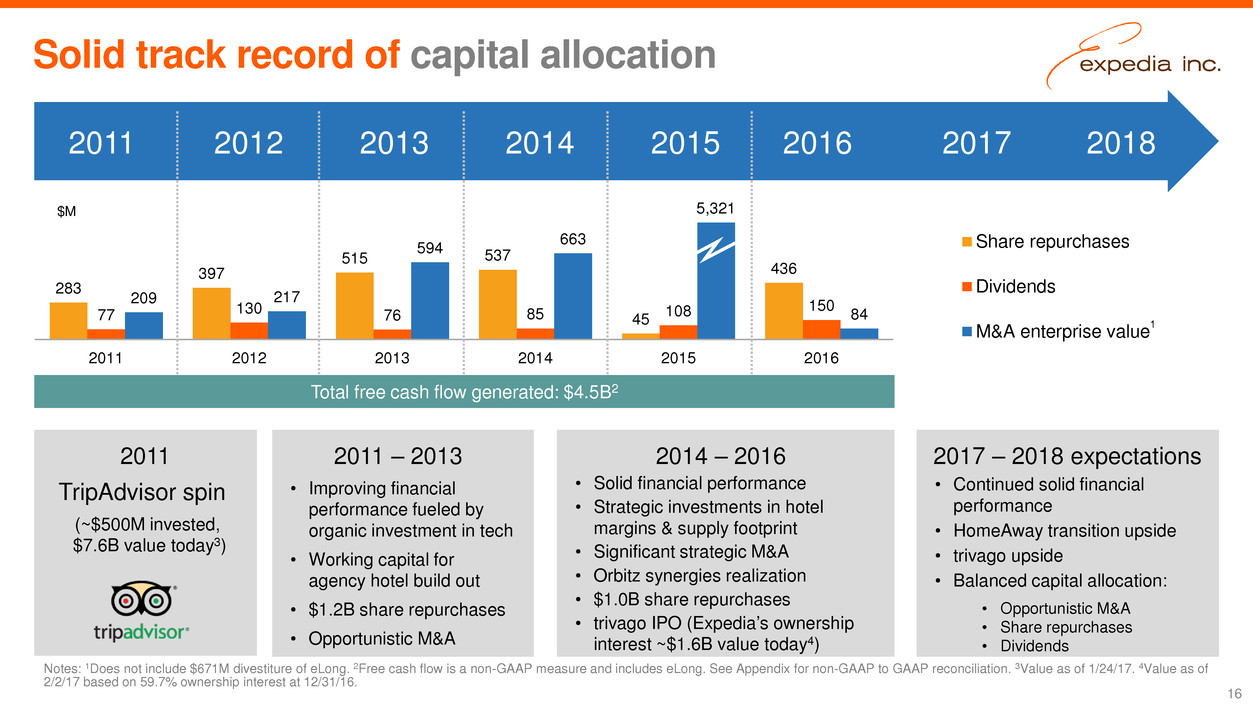

Solid track record of capital allocation 16 2011 2012 2013 2014 2015 2016 2017 2018 2011 – 2013 • Improving financial performance fueled by organic investment in tech • Working capital for agency hotel build out • $1.2B share repurchases • Opportunistic M&A 2014 – 2016 • Solid financial performance • Strategic investments in hotel margins & supply footprint • Significant strategic M&A • Orbitz synergies realization • $1.0B share repurchases • trivago IPO (Expedia’s ownership interest ~$1.6B value today4) 2017 – 2018 expectations • Continued solid financial performance • HomeAway transition upside • trivago upside • Balanced capital allocation: • Opportunistic M&A • Share repurchases • Dividends 2011 TripAdvisor spin (~$500M invested, $7.6B value today3) 283 397 515 537 45 436 77 130 76 85 108 150 209 217 594 663 5,321 84 2011 2012 2013 2014 2015 2016 Share repurchases Dividends M&A enterprise value1 $M Total free cash flow generated: $4.5B2 Notes: 1Does not include $671M divestiture of eLong. 2Free cash flow is a non-GAAP measure and includes eLong. See Appendix for non-GAAP to GAAP reconciliation. 3Value as of 1/24/17. 4Value as of 2/2/17 based on 59.7% ownership interest at 12/31/16.

Appendix

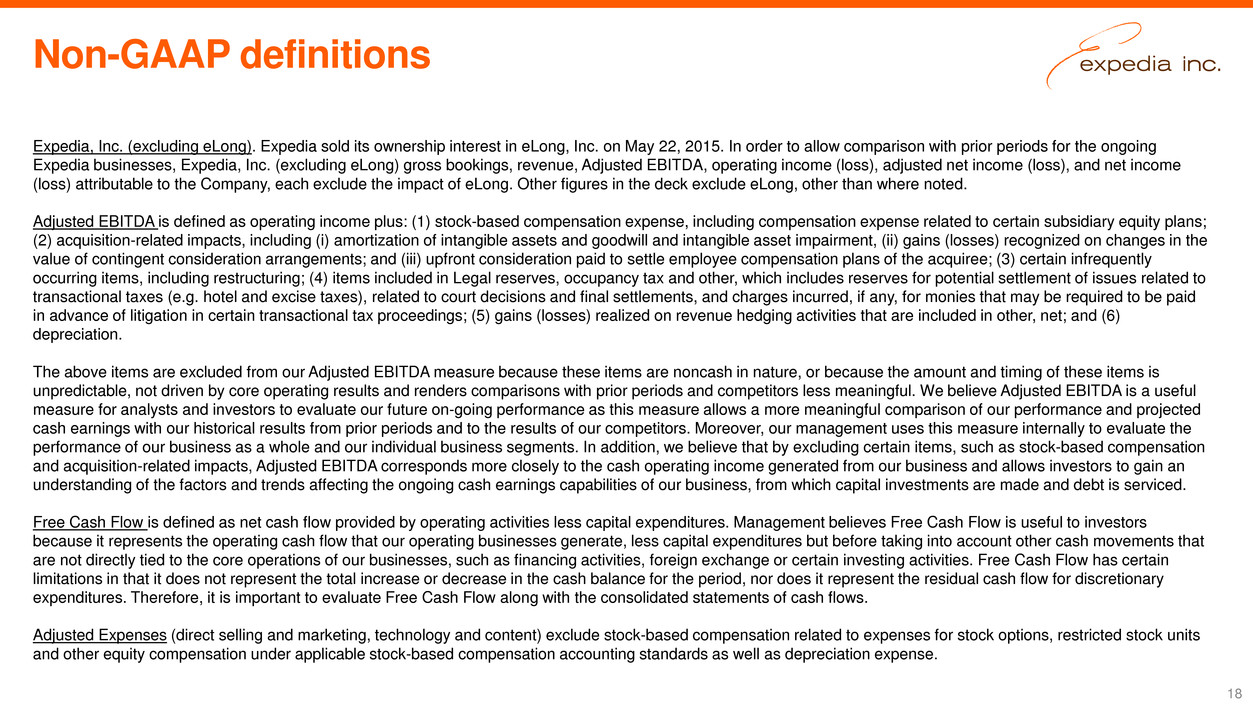

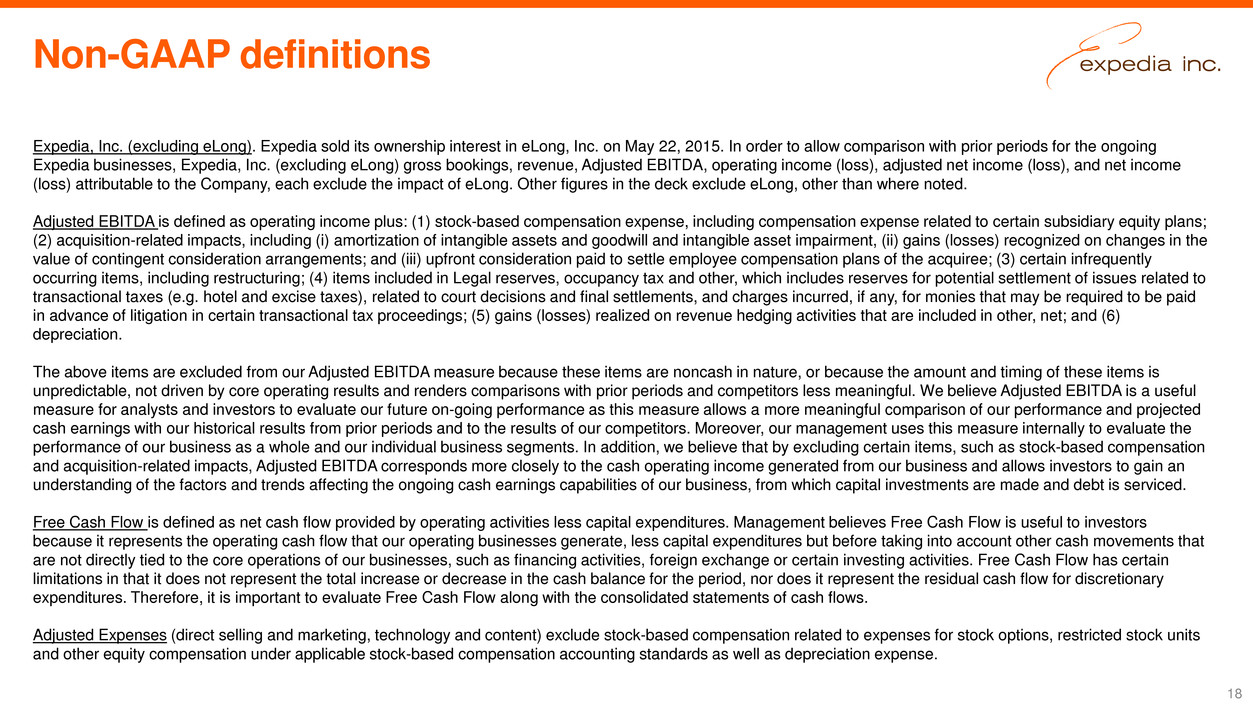

Non-GAAP definitions Expedia, Inc. (excluding eLong). Expedia sold its ownership interest in eLong, Inc. on May 22, 2015. In order to allow comparison with prior periods for the ongoing Expedia businesses, Expedia, Inc. (excluding eLong) gross bookings, revenue, Adjusted EBITDA, operating income (loss), adjusted net income (loss), and net income (loss) attributable to the Company, each exclude the impact of eLong. Other figures in the deck exclude eLong, other than where noted. Adjusted EBITDA is defined as operating income plus: (1) stock-based compensation expense, including compensation expense related to certain subsidiary equity plans; (2) acquisition-related impacts, including (i) amortization of intangible assets and goodwill and intangible asset impairment, (ii) gains (losses) recognized on changes in the value of contingent consideration arrangements; and (iii) upfront consideration paid to settle employee compensation plans of the acquiree; (3) certain infrequently occurring items, including restructuring; (4) items included in Legal reserves, occupancy tax and other, which includes reserves for potential settlement of issues related to transactional taxes (e.g. hotel and excise taxes), related to court decisions and final settlements, and charges incurred, if any, for monies that may be required to be paid in advance of litigation in certain transactional tax proceedings; (5) gains (losses) realized on revenue hedging activities that are included in other, net; and (6) depreciation. The above items are excluded from our Adjusted EBITDA measure because these items are noncash in nature, or because the amount and timing of these items is unpredictable, not driven by core operating results and renders comparisons with prior periods and competitors less meaningful. We believe Adjusted EBITDA is a useful measure for analysts and investors to evaluate our future on-going performance as this measure allows a more meaningful comparison of our performance and projected cash earnings with our historical results from prior periods and to the results of our competitors. Moreover, our management uses this measure internally to evaluate the performance of our business as a whole and our individual business segments. In addition, we believe that by excluding certain items, such as stock-based compensation and acquisition-related impacts, Adjusted EBITDA corresponds more closely to the cash operating income generated from our business and allows investors to gain an understanding of the factors and trends affecting the ongoing cash earnings capabilities of our business, from which capital investments are made and debt is serviced. Free Cash Flow is defined as net cash flow provided by operating activities less capital expenditures. Management believes Free Cash Flow is useful to investors because it represents the operating cash flow that our operating businesses generate, less capital expenditures but before taking into account other cash movements that are not directly tied to the core operations of our businesses, such as financing activities, foreign exchange or certain investing activities. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. Therefore, it is important to evaluate Free Cash Flow along with the consolidated statements of cash flows. Adjusted Expenses (direct selling and marketing, technology and content) exclude stock-based compensation related to expenses for stock options, restricted stock units and other equity compensation under applicable stock-based compensation accounting standards as well as depreciation expense. 18

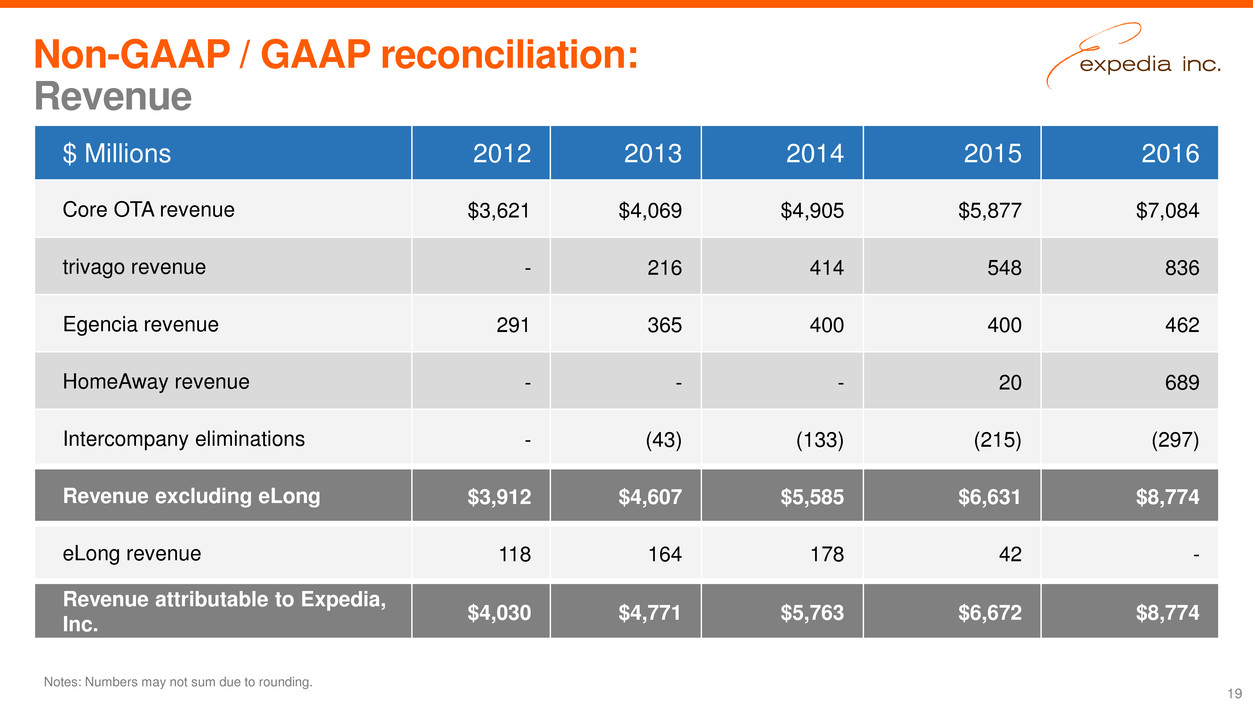

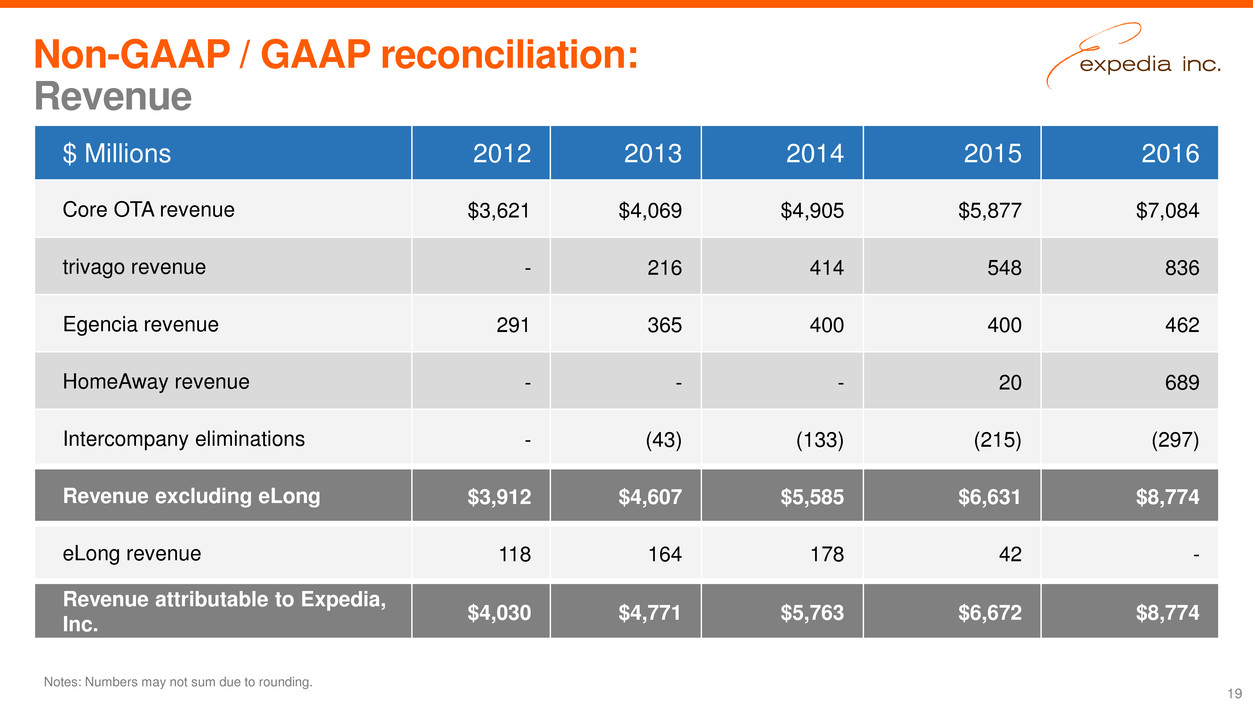

Non-GAAP / GAAP reconciliation: Revenue Notes: Numbers may not sum due to rounding. $ Millions 2012 2013 2014 2015 2016 Core OTA revenue $3,621 $4,069 $4,905 $5,877 $7,084 trivago revenue - 216 414 548 836 Egencia revenue 291 365 400 400 462 HomeAway revenue - - - 20 689 Intercompany eliminations - (43) (133) (215) (297) Revenue excluding eLong $3,912 $4,607 $5,585 $6,631 $8,774 eLong revenue 118 164 178 42 - Revenue attributable to Expedia, Inc. $4,030 $4,771 $5,763 $6,672 $8,774 19

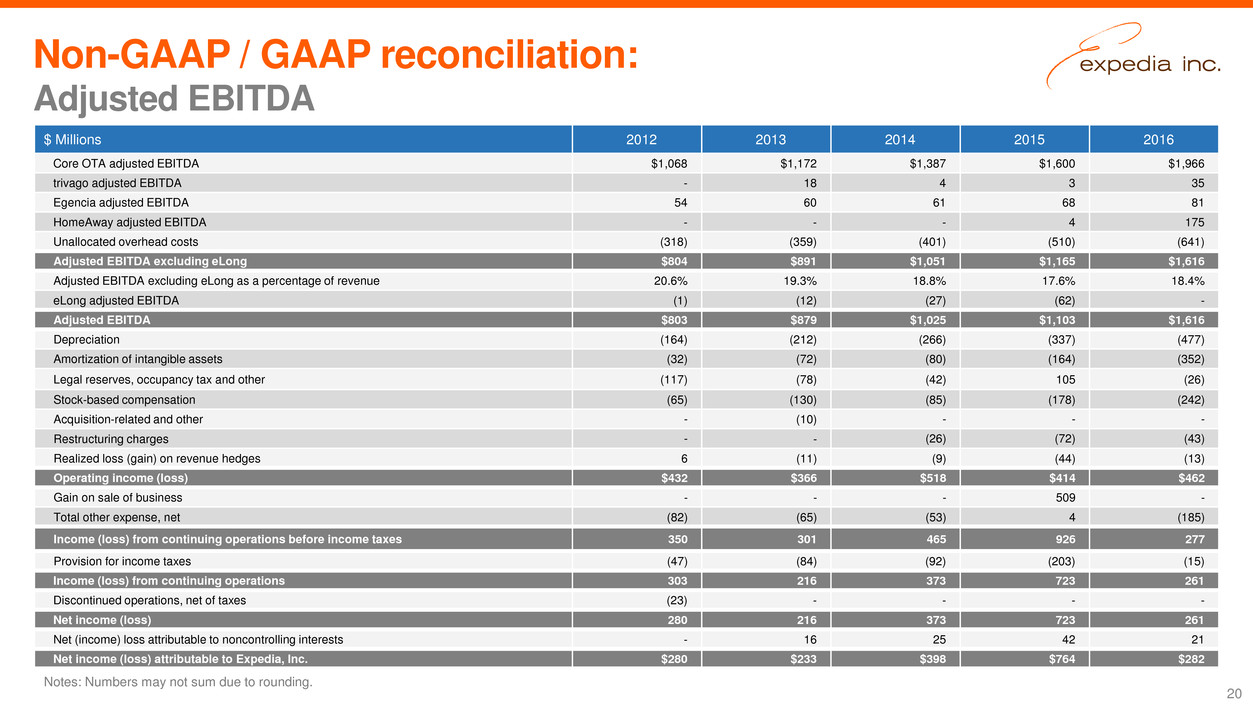

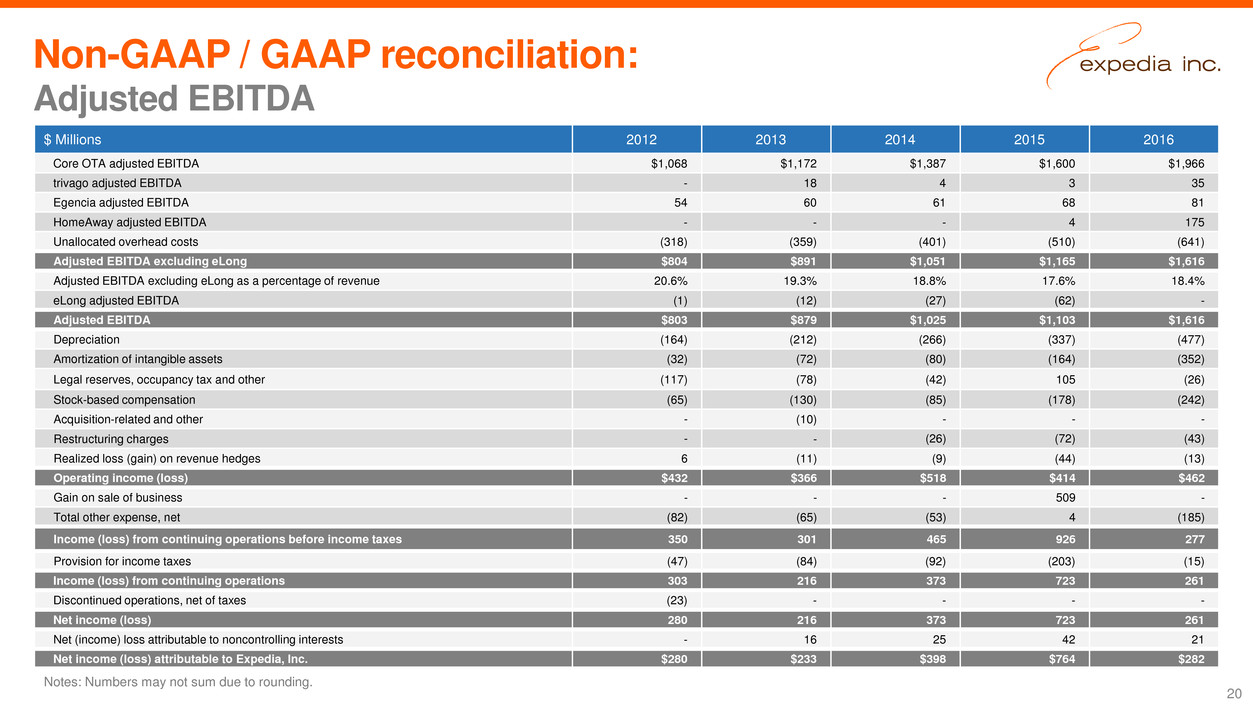

$ Millions 2012 2013 2014 2015 2016 Core OTA adjusted EBITDA $1,068 $1,172 $1,387 $1,600 $1,966 trivago adjusted EBITDA - 18 4 3 35 Egencia adjusted EBITDA 54 60 61 68 81 HomeAway adjusted EBITDA - - - 4 175 Unallocated overhead costs (318) (359) (401) (510) (641) Adjusted EBITDA excluding eLong $804 $891 $1,051 $1,165 $1,616 Adjusted EBITDA excluding eLong as a percentage of revenue 20.6% 19.3% 18.8% 17.6% 18.4% eLong adjusted EBITDA (1) (12) (27) (62) - Adjusted EBITDA $803 $879 $1,025 $1,103 $1,616 Depreciation (164) (212) (266) (337) (477) Amortization of intangible assets (32) (72) (80) (164) (352) Legal reserves, occupancy tax and other (117) (78) (42) 105 (26) Stock-based compensation (65) (130) (85) (178) (242) Acquisition-related and other - (10) - - - Restructuring charges - - (26) (72) (43) Realized loss (gain) on revenue hedges 6 (11) (9) (44) (13) Operating income (loss) $432 $366 $518 $414 $462 Gain on sale of business - - - 509 - Total other expense, net (82) (65) (53) 4 (185) Income (loss) from continuing operations before income taxes 350 301 465 926 277 Provision for income taxes (47) (84) (92) (203) (15) Income (loss) from continuing operations 303 216 373 723 261 Discontinued operations, net of taxes (23) - - - - Net income (loss) 280 216 373 723 261 Net (income) loss attributable to noncontrolling interests - 16 25 42 21 Net income (loss) attributable to Expedia, Inc. $280 $233 $398 $764 $282 Non-GAAP / GAAP reconciliation: Adjusted EBITDA Notes: Numbers may not sum due to rounding. 20

Non-GAAP / GAAP reconciliation: Free cash flow Notes: Numbers may not sum due to rounding and include eLong. $ Millions 2011 2012 2013 2014 2015 2016 TOTAL Cash provided by operations $826 $1,237 $763 $1,367 $1,368 $1,564 $7,125 Capital expenditures (208) (236) (309) (328) (787) (749) (2,617) Free cash flow $618 $1,001 $455 $1,039 $581 $815 $4,509 21

Non-GAAP / GAAP reconciliation: Direct selling & marketing expense Notes: Numbers may not sum due to rounding. $ Millions 2016 Direct selling & marketing expense $3,530 Indirect selling & marketing expense 762 Total adjusted selling & marketing expense $4,292 Stock-based compensation 47 Depreciation 29 Selling & marketing expense attributable to Expedia, Inc. $4,367 22

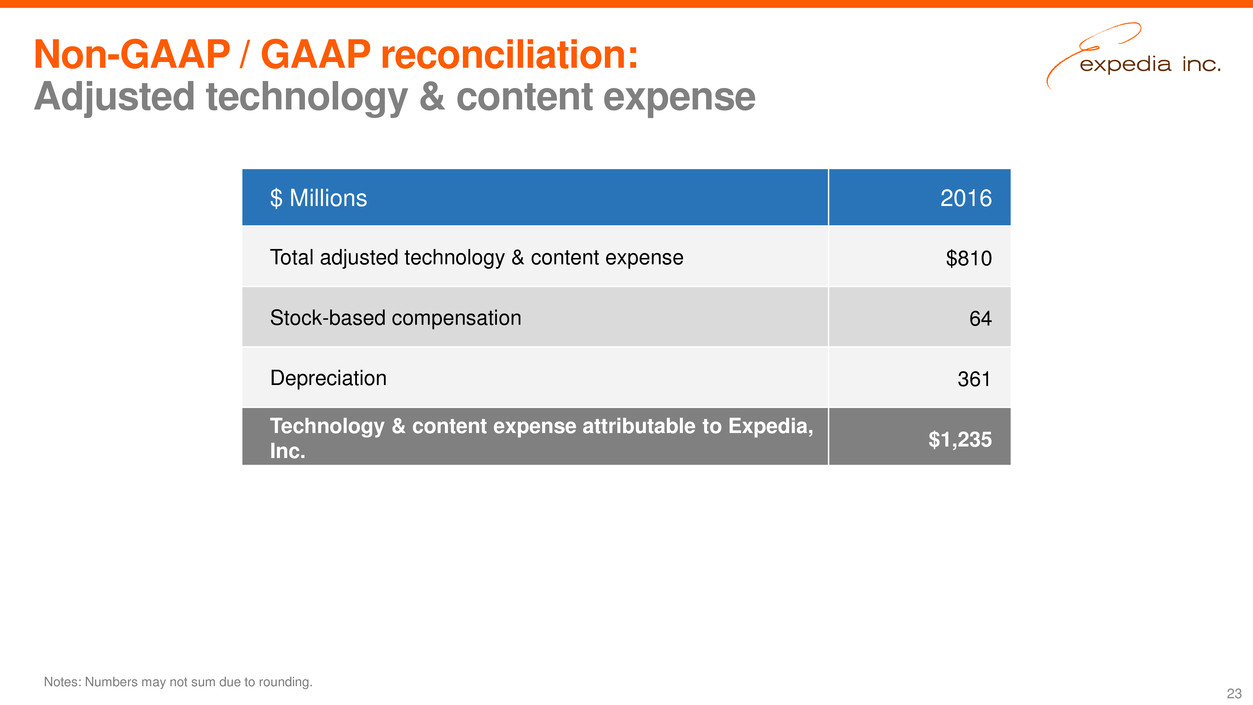

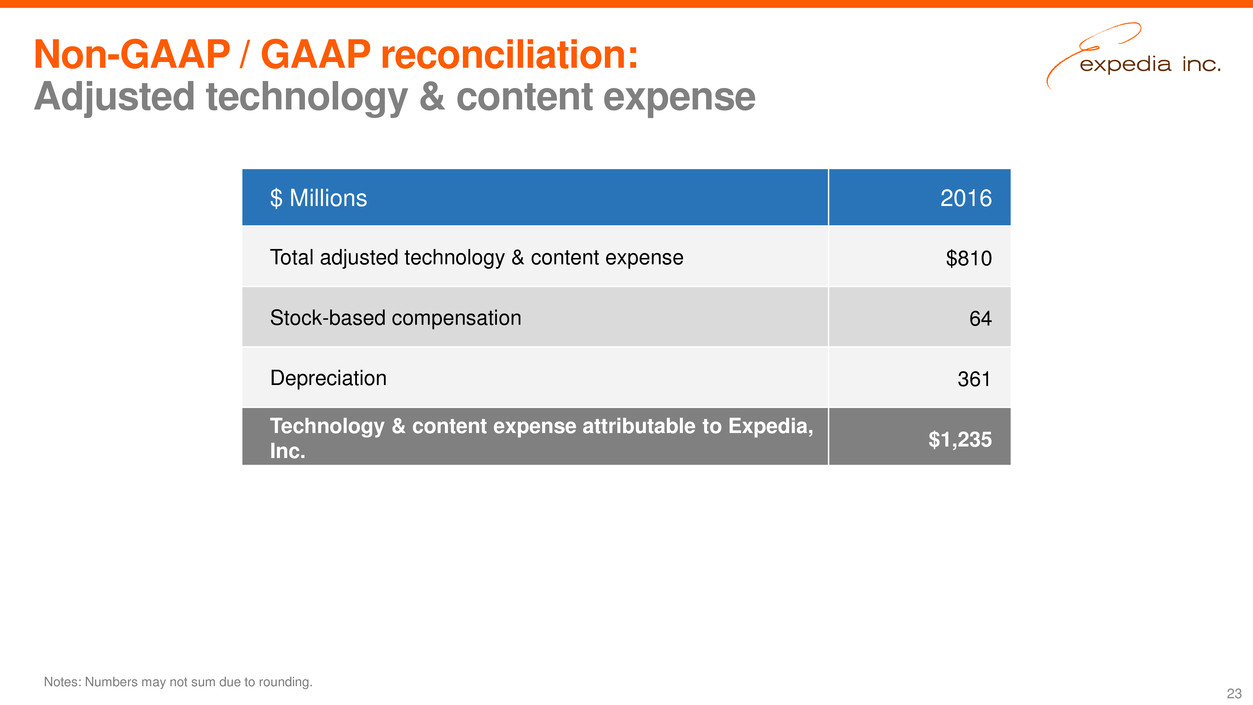

Non-GAAP / GAAP reconciliation: Adjusted technology & content expense Notes: Numbers may not sum due to rounding. $ Millions 2016 Total adjusted technology & content expense $810 Stock-based compensation 64 Depreciation 361 Technology & content expense attributable to Expedia, Inc. $1,235 23