Filed Pursuant to Rule 424(b)(3)

Registration No. 333-165572

Case New Holland Inc.

Offer to Exchange

$1,000,000,000 7 3/4% Senior Notes due 2013

for

$1,000,000,000 7 3/4% Senior Notes due 2013

that have been registered under

the Securities Act of 1933, as amended

We are offering to exchange our 7 3/4% Senior Notes due 2013, or the “new notes,” for our currently outstanding 7 3/4% Senior Notes due 2013, or the “old notes.” We sometimes refer to the new notes and the old notes collectively as the “notes.”

| | • | | The exchange offer expires at 5:00 p.m., New York City time, on May 13, 2010, unless extended. |

| | • | | We will exchange all old notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer. |

| | • | | You may withdraw tendered old notes at any time prior to the expiration of the exchange offer. |

| | • | | The new notes are substantially identical to the old notes, except that the new notes have been registered under the Securities Act of 1933, as amended, and will not contain restrictions on transfer or have registration rights. The new notes will represent the same debt as the old notes, and we will issue the new notes under the same indenture. |

| | • | | We do not intend to apply for listing of the new notes on any securities exchange or to arrange for them to be quoted on any quotation system. |

| | • | | The exchange offer is not subject to any conditions other than that the exchange offer does not violate applicable law or any applicable interpretation of the staff of the Securities and Exchange Commission. |

| | • | | The exchange of old notes for new notes will not be a taxable event for U.S. federal income tax purposes. See “Certain U.S. Federal Income Tax Considerations — Treatment of Exchanges under Exchange Offer.” |

| | • | | We will not receive any proceeds from the exchange offer. |

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act of 1933, as amended. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, starting on the expiration date of the exchange offer and ending on the close of business one year after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

For a discussion of factors that you should consider before you participate in the exchange offer, see “Risk Factors” beginning on page 12.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be distributed in the exchange offer or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 15, 2010.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

PRESENTATION OF FINANCIAL AND CERTAIN OTHER INFORMATION

CNH Global N.V. (“CNH” or “CNH Global”), is incorporated in and under the laws of The Netherlands. CNH combines the operations of New Holland N.V. (“New Holland”) and Case Corporation (“Case”), as a result of their business merger on November 12, 1999. As used in this prospectus, all references to “New Holland” or “Case” refer to (1) the pre-merger business and/or operating results of either New Holland or Case (now a part of CNH America LLC (“CNH America”)) on a stand-alone basis, or (2) the continued use of the New Holland and Case product brands.

We prepare our annual consolidated financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The consolidated financial statements are expressed in U.S. dollars and, unless otherwise indicated, all financial data set forth in this prospectus is expressed in U.S. dollars. Our worldwide agricultural equipment and construction equipment operations are collectively referred to as “Equipment Operations.” Our worldwide financial services operations are referred to as “Financial Services.”

As of December 31, 2009, Fiat S.p.A. and its subsidiaries (“Fiat” or the “Fiat Group”) owned approximately 89% of our outstanding common shares through its direct, wholly-owned subsidiary Fiat Netherlands Holding N.V. (“Fiat Netherlands”).

Fiat S.p.A. is a corporation organized under the laws of the Republic of Italy. The Fiat Group performs automotive, manufacturing, and financial service activities through companies located in approximately 50 countries and is engaged in commercial activities with customers in approximately 190 countries. It also manufactures other products and systems, principally automotive-related components, metallurgical products and production systems. In addition, the Fiat Group is involved in certain other activities, including publishing, communications and service companies.

We calculate basic earnings per share based on the two-class method of computing earnings per share when participating securities are outstanding. The two-class method is an earnings allocation formula that determines earnings per share for common stock and participating securities based upon an allocation of earnings as if all of the earnings for the period had been distributed in accordance with participation rights on undistributed earnings. In 2005, we calculated basic earnings per share using the two-class method as CNH’s Series A Preference Shares

i

(“Series A Preferred Stock”) were outstanding. Subsequent to the conversion of the eight million shares of Series A Preferred Stock into CNH common shares on March 23, 2006, there have been no shares of Series A Preferred Stock outstanding.

In periods when the Series A Preferred Stock was outstanding, undistributed earnings, which represent net income attributable to CNH less dividends paid to common shareholders, were allocated to the Series A Preferred Stock based on the dividend yield of the common shares, which was impacted by the price of our common shares. For purposes of the basic earnings per share calculation, we used the average closing price of our common shares over the last thirty trading days of the period (“Average Stock Price”). As of December 31, 2005, the Average Stock Price was $17.47 per share. Had the Average Stock Price of the common shares been different, the calculation of the earnings allocated to Series A Preferred Stock may have changed. Additionally, the determination was impacted by the payment of dividends to common shareholders as the dividend paid is added to net income in the computation of basic earnings per share. Subsequent to the March 23, 2006 conversion of the Series A Preferred Stock, there has been no further impact on earnings per share.

Certain financial information contained or incorporated by reference in this prospectus has been presented by geographic area. We use the following designations: (1) North America; (2) Western Europe; (3) Latin America; and (4) Rest of World. As used in this prospectus, all references to “North America,” “Western Europe,” “Latin America” and “Rest of World” are defined as follows:

| | • | | North America — United States and Canada. |

| | • | | Western Europe — Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, The Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom. |

| | • | | Latin America — Mexico, Central and South America and the Caribbean Islands. |

| | • | | Rest of World — Those areas not included in North America, Western Europe and Latin America, as defined above. |

Certain industry and market share information contained or incorporated by reference in this prospectus has been presented on a worldwide basis which includes all countries, with the exception of India. In this prospectus, management estimates of market share information are generally based on retail unit data in North America, on registrations of equipment in most of Europe, Brazil, and various Rest of World markets and on retail and shipment unit data collected by a central information bureau appointed by equipment manufacturers’ associations including the Association of Equipment Manufacturers (“AEM”) in North America, the Committee for European Construction Equipment (“CECE”) in Europe, the Associação Nacional dos Fabricantes de Veículos Automotores (“ANFAVEA”) in Brazil, the Japan Construction Equipment Manufacturers’ Association (“CEMA”) and the Korea Construction Equipment Manufacturers’ Association (“KOCEMA”), as well as on other shipment data collected by an independent service bureau. Not all agricultural or construction equipment is registered, and registration data may thus underestimate, perhaps substantially, actual retail industry unit sales demand, particularly for local manufacturers in China, Southeast Asia, Eastern Europe, Russia, Turkey, Brazil and any country where local shipments are not reported. In addition, there may also be a period of time between the shipment, delivery, sale and/or registration of a unit, which must be estimated, in making any adjustments to the shipment, delivery, sale, or registration data to determine our estimates of retail unit data in any period.

The “Guarantor Entities” described in “Note 22: Supplemental Condensed Consolidating Financial Information” to our consolidated financial statements for the year ended December 31, 2009 are also the guarantors of the new notes. Accordingly, the supplemental condensed consolidating financial information contained in Note 22 should be deemed to relate to the new notes and related guarantees offered as well as the Senior Notes and guarantees described therein. See “Description of the Notes” and “Risk Factors — Risks Relating to the Notes — Your rights under the guarantees may be limited by laws in various jurisdictions, including fraudulent conveyance and insolvency laws.”

ii

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F-4 under the Securities Act of 1933, as amended (the “Securities Act”), relating to the exchange offer that includes important business and financial information about us that is not included in or delivered with this prospectus. This prospectus, which forms part of the registration statement, does not contain all of the information included in that registration statement. For further information about us and the new notes offered in this prospectus, you should refer to the registration statement and its exhibits. You may read and copy any document we file with the SEC at the SEC’s Public Reference Room, 450 Fifth Street, N.W., Washington, D.C. 20549. Copies of these reports, proxy statements and information may be obtained at prescribed rates from the Public Reference Section of the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. In addition, the SEC maintains a web site that contains reports, proxy statements and other information regarding registrants, such as us, that file electronically with the SEC. The address of this web site is http://www.sec.gov.

We also make available on our website, free of charge, our annual reports on Form 20-F and the text of our reports on Form 6-K, including any amendments to these reports, as well as certain other SEC filings, as soon as reasonably practicable after they are electronically filed with or furnished to the SEC. Our website address is http://www.cnh.com. The information contained on our website is not incorporated by reference in this document.

You can request a copy of the documents incorporated by reference in this prospectus and a copy of the indenture, registration rights agreement and other agreements referred to in this prospectus without charge upon written request by requesting them in writing at the following address:

CNH Investor Relations

6900 Veterans Boulevard

Burr Ridge, Illinois 60527 USA

In order to receive timely delivery of requested documents in advance of the expiration date of the exchange offer, you should make your request no later than May 6, 2010, which is five business days before you must make a decision regarding the exchange offer.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

CNH files annual reports and other information with the SEC. You may read and copy any document filed by CNH at the SEC’s public reference rooms referred to above. CNH’s SEC filings also are available at the SEC’s web site at http://www.sec.gov.

We incorporate by reference the documents listed below and any future filings made with the SEC by CNH Global under Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) until the exchange offer has been completed. We may incorporate by reference into this prospectus our reports on Form 6-K that we identify in the Form 6-K as being incorporated into this registration statement filed after the date of this prospectus and before the exchange offer has been completed.

| | • | | Annual Report on Form 20-F for the fiscal year ended December 31, 2009. |

| | • | | Current Reports on Form 6-K furnished on January 15, 2010, January 19, 2010, January 25, 2010, February 16, 2010, February 17, 2010, March 1, 2010, March 8, 2010, March 12, 2010, March 22, 2010, March 30, 2010, April 7, 2010 and April 13, 2010. |

The information incorporated by reference in this prospectus is considered to be part of this prospectus, and information that CNH files later with the SEC prior to the expiration of this exchange offer will automatically be updated and supersede this information.

iii

FORWARD-LOOKING STATEMENTS

This prospectus includes, and incorporates by reference, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact contained or incorporated by reference in this prospectus, including statements: regarding our competitive strengths; business strategy; future financial position, operating results or economic performance; budgets; projections with respect to revenue, income, earnings (or loss) per share, capital expenditures, dividends, capital structure or other financial items; costs; and plans and objectives of management regarding operations and products, are forward-looking statements. These statements may include terminology such as “may,” “will,” “expect,” “could,” “should,” “intend,” “estimate,” “anticipate,” “believe,” “outlook,” “continue,” “remain,” “on track,” “design,” “target,” “objective,” “goal,” or similar terminology.

Our outlook is predominantly based on our interpretation of what we consider important economic assumptions and involves risks and uncertainties that could cause actual results to differ (possibly materially) from such forward-looking statements. Macro-economic factors including monetary policy, interest rates, currency exchange rates, inflation, deflation, credit availability and government intervention in an attempt to influence such factors can have a material impact on our customers and the demand for our goods. Crop production and commodity prices are strongly affected by weather and can fluctuate significantly. Housing starts and other construction activity are sensitive to, among other things, credit availability, interest rates and government spending. Some of the other significant factors which may affect our results include general economic and capital market conditions, the cyclical nature of our businesses, customer buying patterns and preferences, the impact of changes in geographical sales mix and product sales mix, foreign currency exchange rate movements, our hedging practices, investment returns, our and our customers’ access to credit, restrictive covenants in our debt agreements actions by rating agencies concerning the ratings on our debt and asset-backed securities and the credit ratings of Fiat S.p.A., risks related to our relationship with Fiat S.p.A., political uncertainty and civil unrest or war in various areas of the world, pricing, product initiatives and other actions taken by competitors, disruptions in production capacity, excess inventory levels, the effect of changes in laws and regulations (including those related to tax, healthcare, retiree benefits, government subsidies and international trade regulations), the results of legal proceedings, technological difficulties, results of our research and development activities, changes in environmental laws, employee and labor relations, pension and health care costs, relations with and the financial strength of dealers, the cost and availability of supplies, raw material costs and availability, energy prices, real estate values, animal diseases, crop pests, harvest yields, government farm programs (including those that may result from farm economic conditions in Brazil), consumer confidence, housing starts and construction activity, concerns related to modified organisms and fuel and fertilizer costs, and the growth of non-food uses for some crops (including ethanol and biodiesel production). Additionally, our achievement of the anticipated benefits of our margin improvement initiatives depends upon, among other things, industry volumes as well as our ability to effectively rationalize our operations and to execute our brand strategy. Further information concerning factors that could significantly affect expected results is included in CNH’s Form 20-F for the fiscal year ended December 31, 2009.

Furthermore, in light of recent difficult economic conditions, both globally and in the industries in which we operate, it is particularly difficult to forecast our results and any estimates or forecasts of particular periods that we provide are uncertain. We can give no assurance that the expectations reflected in our forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in these forward-looking statements. All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by the factors we disclose that could cause our actual results to differ materially from our expectations. We undertake no obligation to update or revise publicly any forward-looking statements.

iv

SUMMARY

This summary highlights information located elsewhere in this prospectus and in our Annual Report on Form 20-F for the year ended December 31, 2009 (our “Form 20-F”), which is incorporated by reference in this prospectus. It does not contain all the information that is important to you. You should read this summary together with the more detailed information and consolidated financial statements and notes appearing elsewhere in this prospectus or incorporated by reference in this prospectus. You should carefully consider, among other factors, the matters discussed under “Risk Factors” in this prospectus and in our Form 20-F. Unless the context otherwise requires, as used in this prospectus, (1) the terms “CNH,” “the company,” “we” and “our” refer to CNH Global N.V. and its consolidated subsidiaries, (2) the term “Case New Holland” refers to Case New Holland Inc., the issuer of the notes, and (3) the term “CNH Global” refers to CNH Global N.V. (excluding its consolidated subsidiaries), a Netherlands corporation that owns 100% of the capital stock of Case New Holland and is one of the guarantors of the notes.

Our Business

Overview

We are a global, full-line company in both the agricultural and construction equipment industries, with strong and often leading positions in many significant geographic and product categories in both agricultural and construction equipment. Our global scope and scale includes integrated engineering, manufacturing, marketing and distribution of equipment on five continents. We organize our operations into three business segments: agricultural equipment, construction equipment and financial services.

We market our products globally through our two highly recognized brand families, Case and New Holland. Case IH (along with Steyr in Europe) and New Holland make up our agricultural brand family. Case and New Holland Construction (along with Kobelco in North America) make up our construction equipment brand family. As of December 31, 2009, we were manufacturing our products in 38 facilities throughout the world and distributing our products in approximately 170 countries through a network of approximately 11,600 full-line dealers and distributors.

In agricultural equipment, we believe we are one of the leading global manufacturers of agricultural tractors and combines based on units sold, and we have leading positions in hay and forage equipment and specialty harvesting equipment. In construction equipment, we have a leading position in backhoe loaders and a strong position in skid steer loaders in North America and crawler excavators in Western Europe. In addition, each brand provides a complete range of replacement parts and services to support its equipment. For the year ended December 31, 2009, our sales of agricultural equipment represented 76% of our revenues, sales of construction equipment represented 15% of our revenues and Financial Services represented 9% of our revenues.

We believe that we are the most geographically diversified manufacturer and distributor of agricultural and construction equipment in the industry. For the year ended December 31, 2009, 41% of our net sales of equipment were generated in North America, 29% in Western Europe, 14% in Latin America and 16% in the Rest of World. Our worldwide manufacturing base includes facilities in Europe, Latin America, North America and Asia.

We offer a range of financial products and services to dealers and customers in North America, Australia, Brazil and Western Europe. The principal products offered are retail financing for the purchase or lease of new and used CNH equipment and wholesale financing to our dealers. Wholesale financing consists primarily of floor plan financing and allows dealers to purchase and maintain a representative inventory of products. Our retail financing products and services are intended to be competitive with those available from third parties. We offer

1

retail financing in North America, Brazil, Australia and Europe through wholly-owned subsidiaries and in Western Europe through our joint venture with BNP Paribas Lease Group (“BPLG”). As of December 31, 2009, Financial Services managed a portfolio of receivables of approximately $17.3 billion.

We have benefited in a variety of ways from our close relationship with the Fiat Group, which as of December 31, 2009, owns 89% of our common shares and is one of the largest industrial groups in the world, with major operations in auto and truck manufacturing, automotive components and other non-automotive sectors. We believe shared services provided by Fiat and its subsidiaries, such as purchasing, accounting, information technology, treasury and cash management, lower our administrative costs by leveraging Fiat’s economies of scale.

Corporate Structure and Ownership

The common shares of CNH Global are listed on the New York Stock Exchange under the symbol “CNH.”

Case New Holland is a Delaware corporation and a direct wholly owned subsidiary of CNH Global. Case New Holland, indirectly through its subsidiaries, owns substantially all of the U.S. assets of CNH as well as certain of its non-U.S. assets.

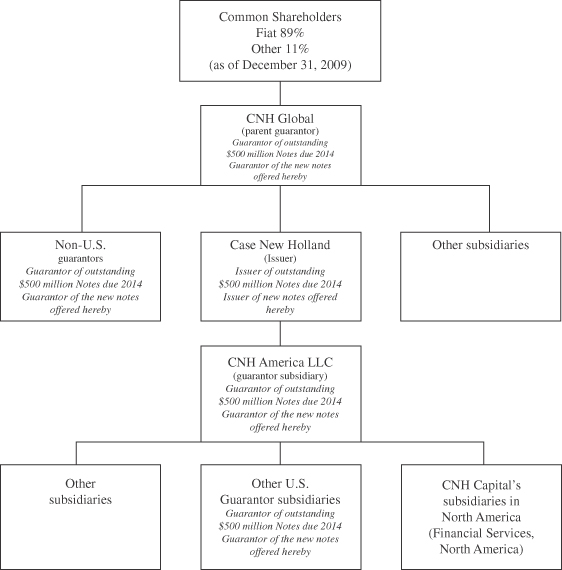

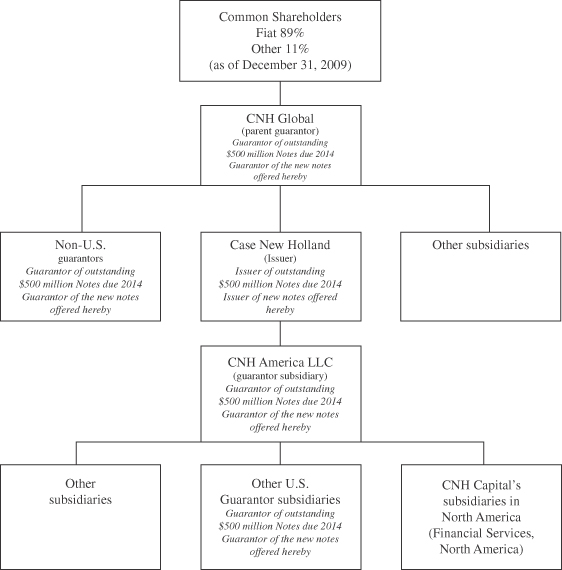

Case New Holland is the issuer of the notes offered hereby. The guarantors of the notes are:

(1) CNH Global;

(2) certain direct and indirect subsidiaries of Case New Holland that are organized in the United States; and

(3) certain direct and indirect subsidiaries of CNH Global organized outside the United States that are not also subsidiaries of Case New Holland.

For further information on the guarantors, see “Description of the notes — Guarantees.”

2

Set forth below is a simplified organizational chart showing the relationship among Case New Holland and the guarantors:

Corporate Information

CNH Global has its registered office in the World Trade Centre, Amsterdam Airport, Tower B, 10th Floor, Schiphol Boulevard 217, 1118 BH Amsterdam, The Netherlands (telephone number: + (31)-20-446-0429). It was incorporated under the laws of the Netherlands on August 30, 1996. Our agent for U.S. federal securities law purposes is Michael P. Going, 6900 Veterans Boulevard, Burr Ridge, Illinois 60527 (telephone number: +1-630-887-3766).

3

The Exchange Offer

For a more complete description of the terms of the exchange offer, see “The Exchange Offer.”

Old Notes | $1,000,000,000 aggregate principal amount of 7 3/4% Senior Notes due 2013 |

The old notes were issued in transactions exempt from registration under the Securities Act and are subject to transfer restrictions.

New Notes | $1,000,000,000 aggregate principal amount of 7 3/4% Senior Notes due 2013 |

The new notes have been registered under the Securities Act. The form and terms of the new notes and old notes are identical in all material respects (including principal amount, interest rate and maturity), except that the transfer restrictions of and registration rights provisions relating to the old notes do not apply to the new notes.

The Exchange Offer | We are offering to exchange up to $1,000,000,000 aggregate principal amount of our new 7 3/4% Senior Notes due 2013 for $1,000,000,000 aggregate principal amount of our currently outstanding 7 3/4% Senior Notes due 2013. |

See “The Exchange Offer.”

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on May 13, 2010, unless extended (the “expiration date”). |

Conditions of the Exchange Offer | Our obligation to consummate the exchange offer is not subject to any conditions, other than that the exchange offer does not violate any applicable law or SEC staff interpretation. See “The Exchange Offer — Conditions of the Exchange Offer.” We reserve the right to terminate or amend the exchange offer at any time prior to the expiration date if, among other things, there shall have been proposed, adopted or enacted any law, statute, rule, regulation or SEC staff interpretation which, in our judgment, could reasonably be expected to materially impair our ability to proceed with the exchange offer. |

Procedures for Tendering Old Notes | Brokers, dealers, commercial banks, trust companies and other nominees who hold old notes through The Depository Trust Company (“DTC”) may effect tenders by book-entry transfer in accordance with DTC’s Automated Tender Offer Program (“ATOP”). To tender old notes for exchange by book-entry transfer, an agent’s message (as defined under “The Exchange Offer — Procedures for Tendering”) or a completed and signed letter of transmittal (or facsimile thereof), with any required signature guarantees and any other required documentation, must be delivered to the exchange agent at the address set forth in this prospectus on or prior to the expiration date, and the old notes must be tendered in accordance with DTC’s ATOP procedures for transfer. |

4

To tender old notes for exchange by means other than book-entry transfer, you must complete, sign and date the letter of transmittal (or facsimile thereof) in accordance with the instructions contained in this prospectus and in the letter of transmittal and mail or otherwise deliver the letter of transmittal (or facsimile thereof), together with the old notes, any required signature guarantees and any other required documentation, to the exchange agent at the address set forth in this prospectus on or prior to the expiration date.

By tendering your old notes, you represent to us that:

| | • | | you are acquiring the new notes in the ordinary course of business; |

| | • | | you have no arrangement or understanding with any person to participate in a distribution of the old notes or the new notes; |

| | • | | you are not an “affiliate” of us (as defined under the Securities Act) or if you are an affiliate of us, that you will comply with the registration and prospectus delivery requirements of the Securities Act to the extent applicable; and |

| | • | | you are not engaged in, and do not intend to engage in, the distribution of the new notes. |

Each broker-dealer that receives new notes for its own account in exchange for old notes, where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such new notes.

See “The Exchange Offer — Procedures for Tendering” and “Plan of Distribution.”

Special Procedures for Beneficial Owners | If you are a beneficial owner whose old notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender, you should contact the registered holder promptly and instruct the registered holder to tender on your behalf. See “The Exchange Offer — Procedures for Tendering.” |

Guaranteed Delivery Procedures | If you wish to tender your old notes in the exchange offer but your old notes are not immediately available for delivery or other documentation cannot be completed by the expiration date, or the procedures for book-entry transfer cannot be completed on a timely basis, you may still tender your old notes by completing, signing and delivering the letter of transmittal or, in the case of a book-entry transfer, an agent’s message, with any required signature guarantees and any other documents required by the letter of transmittal, to the exchange agent prior to the expiration date and tendering your old notes according to the guaranteed delivery procedures set forth in “The Exchange Offer — Guaranteed Delivery Procedures.” |

5

Withdrawal Rights | You may withdraw your tender of old notes at any time prior to 5:00 p.m., New York City time, on the expiration date. See “The Exchange Offer — Withdrawal of Tenders.” |

Acceptance of Old Notes and Delivery of New Notes | We will accept for exchange any and all old notes that are properly tendered to the exchange agent prior to 5:00 p.m., New York City time, on the expiration date. The new notes issued pursuant to the exchange offer will be delivered promptly following the expiration date. See “The Exchange Offer — Terms of the Exchange Offer.” |

Exchange Agent | The Bank of New York Mellon Trust Company, N.A. is serving as the exchange agent in connection with the exchange offer. See “The Exchange Offer — Exchange Agent.” |

United States Federal Income Tax Consequences | The exchange of old notes for new notes will not be a taxable event for U.S. federal income tax purposes. You will not recognize any taxable gain or loss as a result of exchanging old notes for new notes and you will have the same tax basis and holding period in the new notes as you had in the old notes immediately before the exchange. See “Certain U.S. Federal Income Tax Considerations.” |

Consequences of Failure to Exchange the Old Notes | Any old notes that are not tendered or that are tendered but not accepted will remain subject to the restrictions on transfer. Because the old notes have not been registered under the Securities Act, they bear a legend restricting their transfer absent registration or the availability of a specific exemption from registration. Upon the completion of the exchange offer, we will have no further obligations to provide for registration of the old notes under the Securities Act. You do not have any appraisal or dissenters’ rights under the indenture governing the notes in connection with the exchange offer. See “The Exchange Offer — Consequences of Failure to Exchange.” |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the new notes pursuant to the exchange offer. |

6

The New Notes

The summary below describes the principal terms of the new notes. Some of the terms and conditions described below are subject to important limitations and exceptions. You should carefully read the “Description of Notes” section of this prospectus for a more detailed description of the new notes.

Issuer | Case New Holland Inc., a Delaware corporation. |

Notes Offered | $1,000,000,000 principal amount of 7 3/4% Senior Notes due 2013 (the “notes”). |

Maturity Date | September 1, 2013. |

Interest | The notes will bear interest at a rate of 7 3/4% per annum. |

Interest Payment Dates | March 1 and September 1, beginning September 1, 2010. |

Original Issue Discount | The notes will be issued with original issue discount for United States federal income tax purposes. United States Holders (as defined in “Certain U.S. Federal Income Tax Consequences”) will be required to include amounts representing original issue discount in gross income as ordinary income on a constant yield basis for United States federal income tax purposes in advance of the receipt of cash payments to which such income is attributable (regardless of whether such holder is on the cash or accrual method of tax accounting). See “Certain U.S. Federal Income Tax Consequences.” |

Denominations | Each note will have a minimum denomination of $2,000 and will be offered only in increments of $1,000. |

Guarantors | CNH Global and certain of its direct and indirect subsidiaries, including certain of Case New Holland’s direct and indirect subsidiaries, will guarantee the notes. |

Ranking | The notes and the guarantees will be Case New Holland’s and the guarantors’ senior unsecured obligations and will rank: |

| | • | | equally with any of Case New Holland’s and the guarantors’ existing and future senior unsecured debt, including $500 million aggregate principal amount of Case New Holland’s 7.125% notes due 2014 and any guarantees thereof by the guarantors and $250 million aggregate principal amount of CNH America LLC’s, a subsidiary of Case New Holland and a guarantor of the notes, 7.25% Senior Notes due 2016 and any guarantees thereof by the guarantors; |

| | • | | effectively junior to all of Case New Holland’s and the guarantors’ existing and future secured indebtedness to the extent of the value of the collateral securing such indebtedness; and |

| | • | | senior to any of Case New Holland’s or the guarantors’ existing and future subordinated indebtedness, if any. |

7

As of December 31, 2009, Case New Holland and the guarantors had approximately zero and $1 million, respectively, of secured debt outstanding.

The notes will also be effectively subordinated to all obligations of each of CNH Global’s direct and indirect subsidiaries (including certain of Case New Holland’s direct and indirect subsidiaries) that are not guarantors. As of December 31, 2009, such non-guarantor subsidiaries had $5.6 billion of outstanding debt, $651 million of which is debt of Equipment Operations which does not include $2.4 billion that Financial Services subsidiaries owed to Equipment Operations subsidiaries.

Optional Redemption | The notes will be redeemable, in whole or in part, at any time at a price equal to 100% of the principal amount thereof, plus accrued and unpaid interest, if any, plus the applicable “make whole” premium set forth in this prospectus. |

Change of Control Triggering Event | Upon a change of control triggering event, if we do not redeem the notes, each holder of notes will be entitled to require us to purchase all or a portion of its notes at a purchase price equal to 101% of the principal amount thereof, plus accrued and unpaid interest. Our ability to purchase the notes upon a change of control triggering event will be limited by the terms of our other debt agreements. We cannot assure you that we will have the financial resources to purchase the notes in such circumstances. See “Description of the Notes — Repurchase at the Option of Holders Upon A Change of Control Triggering Event.” |

Certain Covenants | We will issue the notes under an indenture, dated as of August 17, 2009. The indenture, among other things, limits: |

| | • | | CNH Global’s ability and the ability of its restricted subsidiaries to incur secured funded debt or enter into certain sale leaseback transactions; |

| | • | | the ability of CNH Global’s non-guarantor restricted subsidiaries other than Case New Holland to incur additional funded debt; and |

| | • | | CNH Global and Case New Holland’s ability and the ability of the subsidiary guarantors to consolidate, merge, convey, transfer or lease our properties and assets substantially as an entirety. |

These covenants are subject to important exceptions. For more detail, see “Description of the Notes — Certain Covenants” in this prospectus.

Listing | We do not intend to list the notes on any securities exchange. |

8

Risk Factors

Investing in the notes involves substantial risks. You should carefully consider the risk factors set forth under the caption “Risk Factors” and the other information included in this prospectus prior to making an investment in the notes. See “Risk Factors” beginning on page 12.

9

CAPITALIZATION

The following table presents our cash, cash equivalents and deposits in Fiat affiliates cash management pools plus consolidated capitalization as of December 31, 2009.

You should read this table in conjunction with the information contained our consolidated financial statements and related notes in our Form 20-F for our fiscal year ended December 31, 2009, which are incorporated by reference into this prospectus.

The capitalization table below is not necessarily indicative of our future capitalization or financial condition.

| | | |

| | | As of December 31,

2009 |

| | | Actual |

| | | (Dollars in

millions) |

Cash, cash equivalents and deposits in Fiat affiliates cash management pools | | $ | 3,514 |

| | | |

Debt included in current liabilities | | | |

Short-term debt | | $ | 1,972 |

Current maturities of long-term debt | | | 2,386 |

Debt included in long-term liabilities | | | |

Long-term debt, excluding current maturities | | | 5,050 |

| | | |

Total debt | | | 9,408 |

Total equity | | | 6,810 |

| | | |

Total capitalization | | $ | 12,704 |

| | | |

10

SUMMARY FINANCIAL DATA

The following table presents summary consolidated financial data as of and for each of the fiscal years in the five-year period ended December 31, 2009. The statement of operations data for each of the fiscal years in the three-year period ended December 31, 2009 and the balance sheet data as of December 31, 2008 and 2009 have been derived from the audited consolidated financial statements included in our Form 20-F filed with the SEC on February 25, 2010, which is incorporated herein by reference. The statement of operations data for the fiscal years ended December 31, 2005 and 2006 and the balance sheet data as of December 31, 2005, 2006 and 2007 have been derived from audited consolidated financial statements that are not included in this prospectus. You should read the following table in conjunction with our audited consolidated financial statements and related notes in our Form 20-F.

Prior period amounts have been restated to reflect the required January 1, 2009, adoption of new accounting guidance with regards to the presentation and disclosure of noncontrolling interests in consolidated financial statements. As a result, net income (loss) is attributed between CNH and the noncontrolling interests in partially owned subsidiaries. In addition, net income (loss) attributable to noncontrolling interests has been reclassified and renamed from minority interest to a new line below net income (loss). Additionally, prior period balances of accumulated undistributed earnings relating to noncontrolling interests in partially owned subsidiaries are now classified as a component of equity, instead of as a minority interest liability.

| | | | | | | | | | | | | | | | |

| | | For the Years Ended December 31, |

| | 2009 | | | 2008 | | 2007 | | 2006 | | 2005 |

| | (in millions, except per share data) |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | |

Net sales | | $ | 12,783 | | | $ | 17,366 | | $ | 14,971 | | $ | 12,115 | | $ | 11,806 |

Finance and interest income | | | 977 | | | | 1,110 | | | 993 | | | 883 | | | 769 |

| | | | | | | | | | | | | | | | |

Total revenues | | $ | 13,760 | | | $ | 18,476 | | $ | 15,964 | | $ | 12,998 | | $ | 12,575 |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (222 | ) | | $ | 824 | | $ | 574 | | $ | 308 | | $ | 189 |

| | | | | | | | | | | | | | | | |

Net income (loss) attributable to CNH Global N.V. | | $ | (190 | ) | | $ | 825 | | $ | 559 | | $ | 292 | | $ | 163 |

| | | | | | | | | | | | | | | | |

Earnings (loss) per share attributable to CNH Global N.V. common shareholders: | | | | | | | | | | | | | | | | |

Basic earnings (loss) per share | | $ | (0.80 | ) | | $ | 3.48 | | $ | 2.36 | | $ | 1.37 | | $ | 0.77 |

| | | | | | | | | | | | | | | | |

Diluted earnings (loss) per share | | $ | (0.80 | ) | | $ | 3.47 | | $ | 2.36 | | $ | 1.23 | | $ | 0.70 |

| | | | | | | | | | | | | | | | |

Cash dividends declared per common share | | $ | — | | | $ | 0.50 | | $ | 0.25 | | $ | 0.25 | | $ | 0.25 |

| | | | | | | | | | | | | | | | |

| |

| | | As of December 31, |

| | 2009 | | | 2008 | | 2007 | | 2006 | | 2005 |

| | (in millions) |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | |

Total assets | | $ | 23,208 | | | $ | 25,459 | | $ | 23,745 | | $ | 18,274 | | $ | 17,318 |

| | | | | | | | | | | | | | | | |

Short-term debt | | $ | 1,972 | | | $ | 3,480 | | $ | 4,269 | | $ | 1,270 | | $ | 1,522 |

| | | | | | | | | | | | | | | | |

Long-term debt, including current maturities | | $ | 7,436 | | | $ | 7,877 | | $ | 5,367 | | $ | 5,132 | | $ | 4,765 |

| | | | | | | | | | | | | | | | |

Common shares at €2.25 par value | | $ | 595 | | | $ | 595 | | $ | 595 | | $ | 592 | | $ | 315 |

| | | | | | | | | | | | | | | | |

Common shares outstanding | | | 237 | | | | 237 | | | 237 | | | 236 | | | 135 |

| | | | | | | | | | | | | | | | |

Equity | | $ | 6,810 | | | $ | 6,575 | | $ | 6,419 | | $ | 5,229 | | $ | 5,143 |

| | | | | | | | | | | | | | | | |

11

RISK FACTORS

Before participating in the exchange offer and investing in the new notes, you should consider carefully the following factors, the risk factors contained in our Form 20-F and the information contained in the rest of this prospectus and the documents incorporated by reference in this prospectus.

Risks Related to Our Business, Strategy and Operations

Current conditions in the global economy and the major industries we serve have adversely affected our business. The business and operating results of our Equipment Operations have been, and will continue to be, adversely affected by worldwide economic conditions. Current financial conditions and, in particular, conditions in the construction industry, continue to place significant economic pressures on our existing and potential customers, including our dealer network. As a result, some customers may delay or cancel plans to purchase our products and services and may not be able to fulfill their obligations to us in a timely fashion. Further, our suppliers may be experiencing similar conditions, which may adversely affect their ability to fulfill their obligations to us, which could result in product delays, increased accounts receivable, defaults and inventory challenges. The full impact of stimulus programs by the United States and other governments remains uncertain, as does their willingness to extend existing programs or adopt additional programs. If there is significant further deterioration in the global economy, the demand for our products and services would likely decrease, and our results of operations, financial position and cash flows could be materially and adversely affected.

In addition, a decline in equity market values could cause many companies, including us, to carefully evaluate whether certain intangible assets, such as goodwill, have become impaired. The factors that we evaluate to determine whether an impairment charge is necessary requires management judgment and estimates. The estimates are impacted by a number of factors, including, but not limited to, worldwide economic factors, technological changes and the achievement of the anticipated benefits of our profit improvement initiatives. Any of these factors, or other unexpected factors, may cause us to re-evaluate whether we need to record an impairment charge. In the event we are required to record an impairment charge to certain intangible assets, it could have an adverse impact on our equity position and statement of operations.

We are exposed to political, economic and other risks from operating a global business. Our global business is also subject to the political, economic and other risks that are inherent in operating in numerous countries. Some of those risks include:

| | • | | changes in laws, regulations and policies that affect: |

| | • | | import and export duties and quotas, |

| | • | | interest rates and the availability of credit to our dealers and customers, |

| | • | | property and contract rights, and |

| | • | | regulations from changing world organization initiatives and agreements; |

| | • | | changes in the dynamics of our competitors and the industries in which we operate; |

| | • | | varying and unpredictable customer needs and desires; |

| | • | | war, civil unrest, and terrorism. |

12

Financial Services borrows through a subsidized long-term program of a Brazilian development agency, Banco Nacional de Desenvolvimento e Social (“BNDES”), and this program provides subsidized funding to financial institutions to be loaned to farmers to support the purchase of machinery in accordance with the provisions of the program. The Brazilian government provided debt relief, which included deferral of payments and extensions of maturities, to certain qualifying farmers and borrowers under this program in 2005, 2006, 2007 and 2008.

In 2009, no mass debt relief program was initiated. In most instances, the 2009 payments were due as scheduled or as renegotiated, where applicable. At December 31, 2009 and 2008, the amount of non-performing retail receivables included in this program, including the off-book guaranteed portfolio, was $633 million and $51 million, respectively. Total receivables greater than 60 days or more past due were $651 million and $63 million, respectively. We continue to aggressively pursue collections of these receivables. At December 31, 2009 and 2008, we had $172 million and $98 million in allowance for credit losses related to this portfolio, respectively.

We believe this series of debt relief actions has impacted customer behavior and payment patterns. The impact of any future changes to the program could further impact our ability to collect amounts owed.

The costs of compliance or other liabilities arising from or relating to such laws, regulations, and risks could adversely affect our financial condition and results of operations.

Currently, our ability to grow our businesses depends to an increasing degree on our ability to increase market share and operate profitably in emerging market countries, such as Brazil, Russia, India and China. Some of these emerging market countries may be subject to a greater degree of economic and political volatility which could adversely affect our financial condition and results of operations.

Our financial performance is subject to currency exchange rate fluctuations and interest rate changes. We conduct operations in many areas of the world involving transactions denominated in a variety of currencies other than the U.S. dollar. To prepare our consolidated financial statements, we must translate those assets, liabilities, expenses and revenues into U.S. dollars at the applicable exchange rates. As a result, increases and decreases in the value of the U.S dollar relative to other currencies will affect the amount of these items in our consolidated financial statements, even if their value has not changed in their original currency (currency translation). We do not hedge currency translation risk. In addition, we are subject to daily variations in currency values as we make payments in or convert monies received from different currencies (currency transaction). Accordingly, a substantial increase or decrease in the value of the U.S. dollar relative to other currencies could substantially affect our operating results.

Changes in interest rates affect our results of operations by, among other things, increasing or decreasing our borrowing costs and finance income. In addition, an increase in interest rates will, among other things, increase our customers’ costs of financing equipment purchases which could reduce our sales of equipment. A decline in equipment sales or an increase in our funding costs would have an adverse effect on our financial condition and results of operations.

We attempt to mitigate our currency transaction risk and the impact of interest rate changes through the use of financial hedging instruments. We have historically entered into, and expect to continue to enter into, hedging arrangements with respect to currency transaction risk, a substantial portion of which are with counterparties that are treasury subsidiaries of Fiat S.p.A. As with all hedging instruments, there are risks associated with the use of foreign currency forward exchange contracts, as well as interest rate swap agreements and other risk management contracts. While the use of such hedging instruments provides us with protection from certain fluctuations in currency exchange and interest rates, we potentially forgo the benefits that might result from favorable fluctuations in currency exchange and interest rates. In addition, any default by the counterparties to these transactions could adversely affect our financial condition and results of operations. These financial hedging

13

transactions may not provide adequate protection against future currency exchange rate or interest rate fluctuations and, consequently, such fluctuations could adversely affect our financial condition and results of operations.

See “Item 11. Quantitative and Qualitative Disclosures about Market Risk” in our Form 20-F filed with the SEC on February 25, 2010.

Risks related to our pension plans and other postretirement obligations could impact our profitability. At December 31, 2009, our pension plans had an underfunded status of $848 million and our postretirement benefit plans had an underfunded status of $1,086 million. Benefit obligations for pension plans that we do not currently fund were $481 million at that date. The funded status of our pension and postretirement benefit plans is subject to many factors, such as actual experience and updates to actuarial assumptions used to measure the obligations. Actual developments, such as a significant change in the return on investment of the plan assets or a change in the portfolio mix of plan assets, may result in corresponding increases or decreases in the valuation of plan assets, particularly with respect to equity securities. Moreover, changes in interest rates may result in increases or decreases in the valuation of plan assets consisting of debt securities. Differences between actuarial projections and actual experience, such as a difference between expected and actual participant mortality rates, retirement rates or health care costs, may result in significant increases or decreases in the valuation of pension or postretirement obligations. Changes in actuarial assumptions, such as discount rates or rates of increase in future compensation, may also result in significant changes to the funded status of our pension and postretirement benefit plans. A change in funded status and/or a change in actuarial assumptions can result in higher or lower net periodic pension costs in the following year. See also “Item 5. Operating and Financial Review and Prospects — A. Operating Results — Application of Critical Accounting Estimates” and “— Defined Benefit Pension and Other Postretirement Benefits,” as well as “Note 12: Employee Benefit Plans and Postretirement Benefits” of our consolidated financial statements for the year ended December 31, 2009 included in our Form 20-F filed with the SEC on February 25, 2010, for additional information on pension and postretirement benefit accounting.

Significant legislative initiatives related to healthcare benefits, including related corporate tax treatment, are under consideration in the U.S. Congress. Although the final outcome of such legislation and its impact upon us remain uncertain, legislative versions under consideration have the potential to impose significant costs upon our current employee and retiree healthcare obligations, potentially adversely affecting our operating results.

We depend on key suppliers for certain raw materials and components. We purchase raw materials, parts and components from third-party suppliers. We rely upon single suppliers for certain parts and components, primarily those that require joint development between us and our suppliers. Current financial conditions could cause some of our suppliers to continue to face severe financial hardship and disrupt our access to critical parts, components and supplies which could have a negative impact on our costs of production, our ability to fulfill orders and on the profitability of our business.

Changes in the price of certain parts or commodities could adversely affect our operating results. A significant change in the demand for, or supply or price of, any part, component or commodity could adversely affect our profitability or our ability to obtain and fulfill orders. Increases in the prices of raw materials could adversely affect our operating results. Changes in the price or availability of raw materials, which are more likely to occur during times of economic volatility, could have a negative impact on our manufacturing costs which could reduce the profitability of our businesses. In addition, increases in the costs of steel, rubber, oil and related petroleum-based products would adversely affect our profitability unless we raise equipment and parts prices to recover any such material or component cost increases. However, we may be unable to raise prices due to market conditions. Our ability to realize the benefit of declining commodity prices may be delayed by the need to reduce existing whole goods inventories which were manufactured during a period of higher commodity prices.

Labor laws and labor unions, which represent most of our production and maintenance employees, could impact our ability to maximize the efficiency of our operations. We are subject to various local labor laws in the countries in which we operate. For instance, in Europe, our employees are covered by various worker

14

protection laws which afford employees, through local and central works councils, rights of information and consultation with respect to specific matters involving their employers’ business and operations, including the downsizing or closure of facilities and employment terminations. Labor agreements covering employees in certain European countries generally expire annually. The European worker protection laws and the collective bargaining agreements to which we are subject could impair our flexibility in streamlining existing manufacturing facilities and in restructuring our business.

Overall, labor unions represent most of our production and maintenance employees. Although we believe our relations with our employees and our unions are generally positive, current or future issues with labor unions might not be resolved favorably, and we may experience a work interruption or stoppage which could adversely affect our financial condition and results of operations.

Risks Particular to the Industries in Which We Operate

Government action and changes in government policy can impact our sales and restrict our operating flexibility. Our businesses are exposed to a variety of risks and uncertainties related to the action or inaction of governmental bodies.

Government policies can affect the market for our agricultural equipment by influencing interest rates and regulating economic activity. For example, governments may regulate the levels of acreage planted through direct subsidies affecting specific commodity prices or through payments made directly to farmers. The existence of a high level of subsidies may reduce the effects of cyclicality in the equipment business. Other changes in government regulations, policies and initiatives could reduce demand for equipment and reduce our net sales.

In addition, international and multilateral institutions, such as the World Trade Organization, can affect the market for agricultural equipment through initiatives for changes in governmental policies and practices regarding agricultural subsidies, tariffs and the production of genetically modified crops. In particular, the outcome of the global negotiations under the auspices of the World Trade Organization could have a material effect on the international flow of agricultural commodities and could cause severe dislocations within the farming industry as farmers shift production to take advantage of new programs. With uncertainty created by policy changes and reforms, farmers could delay purchasing agricultural equipment, causing a decline in industry unit volumes and our net sales.

The worldwide financial and credit crisis dramatically affected, among other things, the availability and cost of credit. The full impact of actions by various central banks and other governmental entities to restore liquidity, increase the availability of credit and stimulate job growth continues to be uncertain. Although credit conditions generally improved in 2009 from 2008, enabling many government programs to expire, pressures on liquidity and the availability of credit could have an adverse impact on our customers and suppliers as well as our financial condition and results of operations. In addition, some of our competitors may be eligible for government programs for which we are ineligible, which would put us at a competitive disadvantage. Governmental action may have the effect of impacting market forces and consumer demand in unanticipated ways.

Government policies on issues like taxes and spending can have a material effect on our sales and business results. For example, increased government spending on roads, utilities and other construction projects and requirements with respect to biofuel additives to gasoline can have a positive effect on sales, while tax laws and regulations may affect depreciation schedules and the net income earned by our customers. These factors may influence customer decisions with respect to whether and when to buy equipment. Developments which are more unfavorable than anticipated, such as decisions to reduce public spending, could have an adverse effect on our financial condition and results of operations.

See also “Item 4. Information on the Company — B. Industry Overview-Biofuels Impact on Agriculture, Light Construction Equipment, and D. Property, Plant and Equipment — Environmental Matters” in our Form 20-F filed with the SEC on February 25, 2010.

15

Reduced demand for equipment would reduce our sales and profitability. Some factors affecting demand for equipment, which could materially impact our operating results, include:

| | • | | general economic conditions; |

| | • | | commodity prices and stock levels; |

| | • | | net farm income levels; |

| | • | | availability of credit; |

| | • | | developments in biofuels; |

| | • | | infrastructure spending rates; |

| | • | | commercial construction. |

As such factors increase or decrease around the world, demand for our products may be significantly impacted in a relatively short timeframe. Negative economic conditions or a negative outlook for any of these factors can dampen demand for farm and/or construction equipment. Rapid declines in demand can result in, among other things, an oversupply of equipment, a decline in prices, the need for additional promotional programs, and a decrease in factory utilization, all of which would adversely affect our financial condition and results of operations.

Positive economic conditions or positive outlooks for any of these factors can increase demand for farm and/or construction equipment. Rapid increases in demand can result in, among other things, an undersupply of equipment, increases in prices of our equipment, increases in our costs for materials and components, and increases in factory utilization demands (that either may not be possible due to production or other constraints, affecting either us or our suppliers, or may not be sustainable for long periods of time without additional, potentially significant, capital expenditures or inefficiency costs). Producing our products is a capital intensive activity and can require significant amounts of time and capital investment to materially adjust production capacity and efficiency. Accordingly, we may not be able to quickly accommodate large changes in demand which could impede our ability to operate efficiently. See also “Item 4. Information on the Company — B. Business Overview — Industry Overview” in our Form 20-F filed with the SEC on February 25, 2010.

The agricultural and construction equipment industries are highly cyclical. The nature of the agricultural and construction equipment industries is such that changes in demand can occur suddenly, resulting in imbalances in inventories, production capacity and prices for new and used equipment. Downturns may be prolonged and may result in significant losses during affected periods. Equipment manufacturers, including us, have responded to downturns in the past by reducing production levels and discounting product prices. These actions have resulted in restructuring charges and lower earnings for us in past affected periods. In response to the current decline in sales (particularly in the construction equipment industry), we may continue to under-produce relative to retail demand the amount of equipment we manufacture in the first half of 2010. In the event of further downturns in the future, we may need to undertake similar or additional actions. Upturns also may be prolonged and result in lower than expected improvements in results as we and our suppliers invest to increase production capacities and efficiencies.

16

Risks Related to Financial Services.

Credit Risk. Fundamental to any organization that extends credit is the risk associated with its customers. The creditworthiness of each customer, and the rates of delinquencies, repossessions and net losses relating to customer loans is impacted by many factors including:

| | • | | relevant industry and general economic conditions; |

| | • | | the availability of capital; |

| | • | | changes in interest rates; |

| | • | | the experience and skills of the customer’s management team; |

| | • | | the value of the collateral securing the extension of credit. |

A deterioration of our asset quality, an increase in delinquencies or a reduction in collateral recovery rates could have an adverse impact on the performance of Financial Services. These risks become more acute in any economic slowdown or recession due to decreased demand for (or the availability of) credit, declining asset values, changes in government subsidies, reductions in collateral to loan balance ratios, and an increase in delinquencies, foreclosures and losses. Our servicing and litigation costs may also increase. In addition, governments may pass laws or implement regulations that modify rights and obligations under existing agreements or which prohibit or limit the exercise of contractual rights.

When loans become delinquent and Financial Services forecloses on collateral securing the repayment of the loan, its ability to sell the collateral to recover or mitigate losses is subject to the market value of such collateral. Those values are affected by levels of new and used inventory of agricultural and construction equipment on the market. They are also dependent upon the strength or weakness of market demand for new and used agricultural and construction equipment, which is affected by the strength of the general economy. In addition, repossessed collateral may be in poor condition, which would reduce its value. Finally, relative pricing of used equipment, compared with new equipment, can affect levels of market demand and the resale of the repossessed equipment. An industry wide decrease in demand for agricultural or construction equipment could result in lower resale values for repossessed equipment which could increase losses on loans and leases, adversely affecting our financial condition and results of operations. See also “Item 3D. Risk Factors — Risks Related to Our Indebtedness — Access to funding at competitive rates is essential to our Financial Services business” in our Form 20-F filed with the SEC on February 25, 2010.

Funding Risk. Financial Services has traditionally relied upon the asset-backed securitization (“ABS”) market as a primary source of funding for its operations in North America and Australia. The recent worldwide financial and credit crisis had a material impact on the ABS market. While Financial Services has been able to access funding through the ABS market and alternative sources, some of our securitizations in 2009 were completed under the U.S. Federal Reserve Term Asset-Backed Securities Loan Facility (“TALF”), which is not expected to be available in the future. In 2009, we did see a return of liquidity to the ABS market at spreads that have improved throughout the year, but which are still higher than historical averages. However, if economic conditions worsen, Financial Services could have materially higher funding costs or may have to limit its product offerings, which could negatively impact our financial results. As Financial Services finances a significant portion of our sales of equipment, to the extent that Financial Services is unable to access funding on acceptable terms our sales of equipment could be negatively impacted.

17

To maintain competitiveness in the capital markets and to promote efficient use of funding sources, we have in the past provided additional reserve support to previously issued ABS transactions and may continue to do so from time to time. Such support may be required to maintain credit ratings assigned to the transactions if loss experiences are higher than anticipated due to adverse economic conditions. The need to provide additional reserve support could have an adverse effect on our financial condition, results of operations and liquidity.

Repurchase Risk. In connection with our ABS transactions, we make customary representations and warranties regarding the assets being securitized. While no recourse provisions exist that allow holders of asset-backed securities issued by our qualifying special purpose entities (“QSPE”) to put those securities back to us, a breach of these representations and warranties could give rise to an obligation to repurchase receivables from the QSPEs. We have not been requested to repurchase asset-backed securities due to a breach of representations or warranties, but any future repurchases could have an adverse effect on our financial condition, results of operations and liquidity.

Regulatory Risk. The operations of Financial Services are subject, in certain instances, to supervision and regulation by various governmental authorities. These operations are subject to various laws and judicial and administrative decisions and interpretations imposing requirements and restrictions, which among other things:

| | • | | regulate credit granting activities, including establishing licensing requirements; |

| | • | | establish maximum interest rates, finance and other charges; |

| | • | | regulate customers’ insurance coverage; |

| | • | | require disclosure to customers; |

| | • | | govern secured transactions; |

| | • | | set collection, foreclosure, repossession and claims handling procedures and other trade practices; |

| | • | | prohibit discrimination in the extension of credit and administration of loans; and |

| | • | | regulate the use and reporting of information related to a borrower. |

To the extent that applicable laws are amended or construed differently, new laws are adopted to expand the scope of regulation imposed upon Financial Services, or applicable laws prohibit interest rates we charge from rising to a level commensurate with risk and market conditions, such events could adversely affect our Financial Services business and our financial condition and results of operations.

Financial Services conducts business in parts of Europe and Brazil through two wholly-owned licensed banks. The activities of these entities are also governed by international, federal and local banking laws, and our banks are subject to examination by banking regulators. These banking entities are also required to comply with various financial requirements (such as minimum capital requirements). Compliance with such banking regulations could increase our operating costs which would have an adverse effect on our financial condition and results of operations. In addition, government regulators may implement laws which negatively impact our contractual rights, which may increase our financial risk of doing business in such countries.

Market Risk. We hold substantial retained interests in securitization transactions, which we refer to collectively as retained interests. We carry these retained interests at estimated fair value, which we determine by discounting the projected cash flows over the expected life of the assets sold in connection with such transactions using prepayment, default, loss and interest rate assumptions. We are required to recognize declines in the value of our retained interests, and resulting charges to income or equity, when their fair value is less than carrying

18

value. The portion of the decline, from discount rates exceeding those in the initial deal, are charged to equity. All other credit related declines are charged to income. Assumptions used to determine fair values of retained interests are based on internal evaluations and, although we believe our methodology is reasonable, actual results may differ from our expectations. Our current estimated valuation of retained interests may change in future periods, and we may incur additional impairment charges as a result. Beginning January 1, 2010, the Company adopted the new accounting guidance relating to variable interest entities. The retained interest, included in the December 31, 2009 balance sheet, will generally be reclassified to receivables for the transactions that are consolidated upon adoption of this guidance.

See also “Item 3D. Risk Factors — Risks Related to Our Indebtedness — Access to funding at competitive rates is essential to our Financial Services business” in our Form 20-F filed with the SEC on February 25, 2010.

The agricultural equipment industry is highly seasonal which causes our results of operations and levels of working capital to fluctuate. The agricultural equipment business is highly seasonal as farmers traditionally purchase agricultural equipment in the spring and fall in connection with the main planting and harvesting seasons. Our net sales and results of operations have historically been the highest in the second quarter, reflecting the spring selling season in the Northern Hemisphere, and lowest in the third quarter, when many of our production facilities experience summer shut-down periods, especially in Europe. Seasonal conditions also affect our construction equipment business, but to a lesser extent than our agricultural equipment business. Our production levels are based upon estimated retail demand. These estimates take into account the timing of dealer shipments, which occur in advance of retail demand, dealer inventory levels, the need to retool manufacturing facilities to produce new or different models and the efficient use of manpower and facilities. However, because we spread our production and wholesale shipments throughout the year, wholesale sales of agricultural equipment products in any given period may not necessarily reflect the timing of dealer orders and retail demand in that period.

Estimated retail demand may exceed or be exceeded by actual production capacity in any given calendar quarter because we spread production throughout the year. If retail demand is expected to exceed production capacity for a quarter, then we may schedule higher production in anticipation of the expected retail demand. Often, we anticipate that spring selling season demand may exceed production capacity in that period and schedule higher production, and anticipate higher inventories and wholesale shipments to dealers in the first quarter of the year. Thus, our working capital and dealer inventories are generally at their highest levels during the February to May period and decline to the end of the year as both company and dealers’ inventories are typically reduced.

As economic, geopolitical, weather and other conditions change during the year and as actual industry demand might differ from expectations, sudden or significant declines in industry demand could adversely affect our working capital and debt levels, financial condition or results of operations. In addition, to the extent our production levels (and timing) do not correspond to retail demand, we may have too much or too little inventory, which could have an adverse effect on our financial condition and results of operations.

Weather, climate change, and natural disasters can impact our operations and our sales. Poor or unusual weather conditions, particularly in the spring, can significantly affect purchasing decisions of our customers. Sales in the important spring selling season can have a material impact on our financial results. In addition, growing public concerns over the effects of climate change have resulted in international and national initiatives to control the emissions of greenhouse gasses (“GHG”) and additional proposed laws and regulations designed to further reduce emissions of carbon dioxide and other GHGs which contribute to “global warming”. For example, the U.S. Environmental Protection Agency (“EPA”) has proposed a mandatory carbon emissions reporting system for certain facilities and has made an endangerment finding with respect to GHG emissions under the U.S. Clean Air Act which could lead to increased regulation of GHG emissions in the U.S. In addition, legislation under consideration in the U.S. Congress could result in the institution of a carbon tax or a cap and trade program for carbon dioxide and other GHG emissions in the U.S. Depending upon the nature, extent, and

19

timing of such potential laws and regulations, we could experience increased costs of compliance, which could negatively impact our results of operations. In addition, it is unclear how climate change may impact our suppliers and customers (particularly with respect to agricultural equipment) and their businesses and the resulting potential impact to our businesses. In addition, natural disasters such as tornadoes, hurricanes, earthquakes, floods, droughts and other forms of severe weather in a country in which we produce or sell equipment could have an adverse effect on our customers, our sales, or our property, plant and equipment.

Competitive activity or failure by us to respond to actions by our competitors could adversely affect our results of operations. We operate in a highly competitive environment with global, regional and local competitors of differing strengths in various markets throughout the world. Our equipment businesses compete primarily on the basis of product features and performance, customer service, quality, price and anticipated resale value, and our products may not be able to compete successfully with those offered by our competitors. Aggressive pricing or other strategies pursued by competitors, unanticipated product improvements or difficulties, manufacturing difficulties, our failure to price our products competitively or an unexpected buildup in competitors’ new machine or dealer-owned rental fleets, leading to severe downward pressure on machine rental rates and/or used equipment prices, could result in a loss of customers, a decrease in our revenues and a decline in our share of industry sales.