Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the year ended December 31, 2009

PATNI COMPUTER SYSTEMS LIMITED

Akruti Softech Park, MIDC Cross Road No 21,

Andheri (E), Mumbai - 400 093, India

(Exact name of registrant and address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file under assigned to the registrant in connection with Rule 12g3-2(b):

Table of Contents

This Form 6-K contains our Annual Report for the fiscal year ended December 31, 2009, the Notice of the Annual General Meeting of the Shareholders dated 28th April 2010, and the Form of Voting Card, each of which has been mailed to holders of our Equity Shares. Also included in this Form 6-K is the Depositary’s Notice of the Annual General Meeting of Shareholders and the Form of Proxy Card, each of which have been mailed to holders of American Depositary Shares. The information contained in this Form 6-K shall not be deemed “filed” for the purposes of section 18 of the Securities Exchange Act, 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing”.

Table of Contents

The theory of evolution has its parallels even in the corporate world. As was eminently relevant with the evolution of biological species, ‘survival of the fittest’ finds similar context in the world of business. Being fittest, after all, is about the ability to evolve and adapt to constantly changing stimuli.

We at Patni have always been cognizant of the fact that constantly changing markets merit a culture of organizational evolution. In the aftermath of an unprecedented meltdown, global and domestic markets as well as the competition landscape have undergone a sea change. We are focused on the fact that to grow in such a volatile environment, we need to undergo a DNA change; treasuring our legacy while excited about the future.

Accordingly, we have embarked on an evolutionary path to provoke change in our strategy, structure, systems, skills and culture.

Four critical vectors have been identified as the very vortices of this evolution...

Geographical expansion – venturing further afield into global markets.

Micro-vertical leadership – pursuing IP-led domain solution portfolio expansion.

Operational excellence – towards creating an agile, innovative and efficient organization, and...

‘Great-place-to-work’ practices – driven by the desire to be a great brand to work with.

In the process of evolution lies the potential for an infinite growth curve. In order to continue delivering value to every class of stakeholders, Patni is evolving like never before.

Table of Contents

Highlights of achievements: 2009

2009 was a year of great economic challenges, changes and new opportunities. Even as we waded through the difficult times, Patni found its path to success by aligning, accelerating and achieving a very creditable performance. We worked aggressively to realign our overall operations and leverage the changing times to build sustainable competitive advantage in our business.

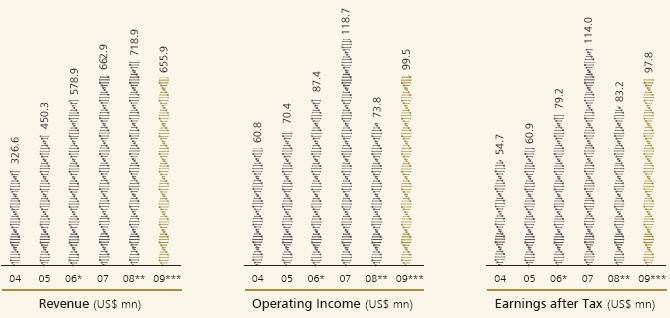

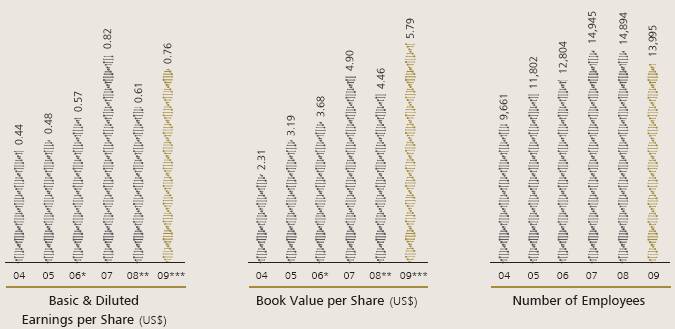

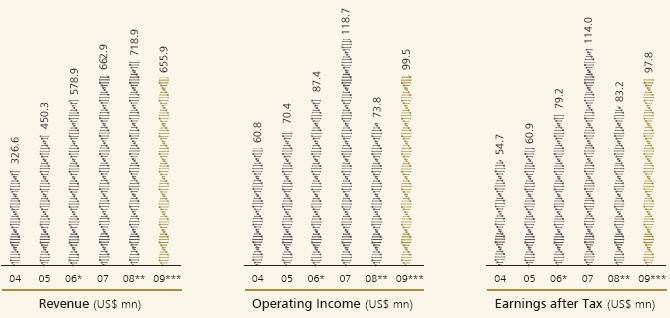

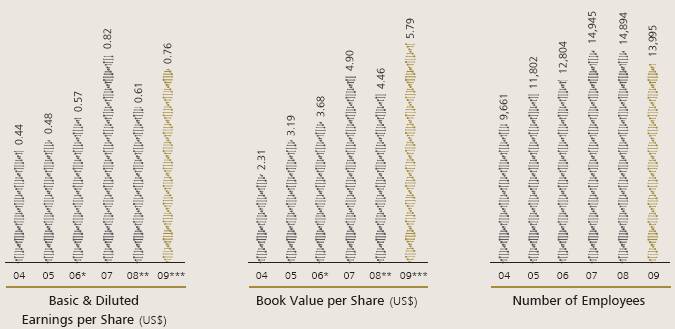

· Overall revenues for CY 2009 were at US$ 655.9 million, down 8.8% as compared to US$ 718.9 in CY 2008. Net income adjusted for extra ordinary items was at US$ 97.4 million for the year, higher by 17.0% against US$ 83.2 million for 2008.

· Acquired 56 new clients in the year, taking our total number of active clients to 272; during the year we rationalized our client portfolio to remain focused on growth and productivity. The number of $1 million client relationship remained unchanged at 92, despite the economic meltdown. Percentage of repeat business continued to be stable at 94.0% for CY 2009.

· Opened our new EMEA headquarters to drive growth for outsourced IT and BPO services. We also opened a new regional office and delivery center in Singapore which will serve as headquarters for our APAC operations.

· Launched a Cloud Acceleration Program (CAP) for our customers to ensure a smooth, rapid transition to the cloud while minimizing risk and keeping operating expenses in check.

· Became Co-development Partner & Preferred Implementer for Oracle’s Supplier Data Management solution.

· Our Inventory Liability and Risk Management solution was identified as a part of SAP’s ‘Best Run Now’ package solutions for the recessionary economy.

· Expanded our footprint to become a SAP Services Partner in Japan, offering our global experience in consulting and system integration in support of SAP solutions to Japanese enterprises.

· Chosen by Hitachi as a preferred partner outside Japan for providing application life-cycle services around its Job Management Partner 1 (JP1) suite – a next-generation business-level system management solution.

Awards and Recognitions

· Ranked 40th amongst the ‘top technology providers for financial institutions’ in the ‘FinTech 100 - 2009’ list.

· Listed in the ‘Global Services 100 – 2009’, instituted by Global Services and neoIT:

· Ranked 7th among ‘Top 10 best performing IT Infrastructure Service Providers’

· Ranked 8th among ‘Top 10 best performing IT Service Providers’.

· Named a ‘Niche Player’ in Gartner’s Magic Quadrant for CRM Service Providers, North America, 2009 Report.

· Named a ‘Challenger’ in Gartner’s Magic Quadrant for Help Desk Outsourcing, North America, 2009 Report.

· Listed among the Top 20 India-Centric BPO players in ‘Competitive Landscape: Business Process Outsourcing, India – 2009’, by Gartner.

· Listed in the ‘Black Book of Outsourcing – 2009’:

· Ranked # 1 ‘Life Sciences Information Technology Outsourcing’ Vendor

· Ranked # 1 ‘Product Development and Engineering Outsourcing’ Vendor

· Ranked # 2 ‘Property and Casualty: Automotive Insurance BPO’ Player

· Ranked # 4 ‘Health Insurance BPO’ Player

· Ranked # 8 HomeOwners BPO Player

· Listed among the Top 10 ‘End-to-end Insurance BPO/ITO Services Providers’

· Ranked among Top 15 ‘Best Managed Global Outsourcing Vendor of 2009’ in the Annual Client Experience Survey.

2

Table of Contents

Key performance indicators: 2004-09

* Excluding additional provision for prior years’ tax review by IRS and review by Department of Labor of Patni’s US operations; leading to an increase in gross profit and operating income by approximately US$ 7.0 million, and decrease in net income by US$ 19.9 million, as compared to the reported numbers.

** Excluding reversal for prior years’ tax review by IRS of Patni US operations; leading to a decrease in gross profit and operating income by approx US$ 2.7 million, and decrease in net income by US$ 18.2 million, as compared to the reported numbers.

*** Excluding reversal for prior years’ tax review by IRS of Patni US operations and reversal of tax positions for Patni India operations; leading to a decrease in gross profit and operating income by approx US$ 1.2 million, and a decrease in net income by US$ 22.01 million, as compared to the reported numbers.

3

Table of Contents

‘Evolution’ is essential to rise to greater heights. Preparing for the future, Patni is building on its legacy to ready itself for its next phase of growth.

Narendra K Patni, Chairman

4

Table of Contents

Letter to shareholders

CEO’s review

The year 2009 started amidst speculation and uncertainty precipitated by the economic downturn which engulfed every nation in the world. While the developments during the year demonstrated the resilience and maturity of the Indian IT-BPO industry, Patni saw opportunities to improve the Company’s overall competitive position. During the year, we focused on strategic initiatives towards achieving our long-term goal of creating an operationally efficient, global organization with a globally diversified customer portfolio, demonstrating adaptability to swiftly seize business growth opportunities and ensure sustained profitability.

Some key initiatives we undertook during the year:

· Towards evolving Patni to ride the next growth cycle, we thought it important for us to align ourselves to a shared vision and values. We also believed that this was vital to balance growth and business effectiveness for our stakeholders. This also set the basis for a new corporate strategy.

· Our corporate strategy was driven by four key vectors:

· Enhanced global presence

We structured the Company’s regional business into four key geographies, namely Americas, EMEA, APAC and SAARC. To tap the growing opportunity in Asia Pacific, we divided the region into APAC and SAARC. With this, we aim to maximize the opportunity through a concerted focus in the regions. The SAARC region will function independently with a growing focus on India. We are bullish about India’s growth and have plans to strengthen our India presence with a focus on the Telecom, Insurance, Manufacturing and e-Governance. During the year, we established our new EMEA regional headquarters in London and continue to invest in key talent in the region with increase focus in Continental Europe and MEA. This reinforced regional structure is foreseen to see the Company’s new vision through to fruition.

· Micro-verticals led growth

We dived deeper into our key accounts, addressing our portfolio gaps. We have decided to focus on rationalizing our portfolio and increasing our intensity at the sub-vertical level that will drive our customer and asset acquisition to deliver scale.

· Operational excellence

We also optimized our operational structures to deliver on our shareholder promise. The year 2009 was one of financial discipline, reduction in corporate overheads and organizational optimization.

· ‘Great-place-to-work’ practices

Having expanded our global footprint, we invested in numerous People Initiatives to become a ‘great-place-to-

5

Table of Contents

work’, with a focus on developing a winning culture and a confidence in our future.

· We made early investments with the right leadership changes in 2009, to set the pace for our 2010 growth. We put a new Executive Leadership Team in place to extend and enhance the management and to run critical positions. We announced key leadership appointments as part of a concerted effort to accelerate regional based growth. Confident of our long-term prospects, we invested in extending and deepening the senior management and overall talent pool of the Company.

· Having established our vision, mission and values and finalized our growth strategy, we re-aligned our organizational structure. Our new organization structure is aimed at achieving our business objectives and building an integrated and streamlined organization that will dynamically adapt to the evolving business realities. The new structure will help us execute our strategy faster with greater empowerment and frontline decision-making, agile and adaptive in a changing and challenging world.

We focused on creating an operationally efficient, global organization with a globally diversified customer portfolio, and an ability to swiftly seize business growth opportunities and ensure sustained profitability.

Industry Environment

To better appreciate our corporate strategy in the light of the IT-BPO industry environment, I would like to share with you some highlights from the NASSCOM Strategic Review 2010:

· Worldwide technology products and services spend were estimated to cross USD 1.5 trillion in 2009, declined by almost 3%; government and healthcare verticals continued to grow while BFSI and manufacturing declined.

· IT indices showing signs of recovery from the recessionary forces and stabilization started showing evidence from the latter part of 2009. However the timing and strength of the recovery varied across regions, with Asia leading the way, the US following and Europe lagging behind.

· Software and services export revenues for the Indian IT-BPO industry were estimated to grow over 5.5% from FY2009 to reach USD 49.7 billion in FY2010. The US continues to be a dominant market, but emerging markets grew three times higher.

· The IT-BPO sector generated direct employment for 2.3 million people, while indirect job creation estimated at approximately 8.3 million.

· The domestic IT-BPO market (including hardware) grew by nearly 8.5% driven by greater IT-BPO adoption and e-Governance initiatives. Outsourcing by India Inc. is on a growth path — Telecom and Retail sectors are high on outsourcing adoption.

· Engineering services (including embedded solutions) export revenues were estimated to touch USD 7.9 billion in FY2010 as investment in innovation, IP development and reverse innovation took centre stage.

· Among other services, Application Outsourcing and Infrastructure Outsourcing were the key growth drivers. Going forward, focus of the Indian IT-BPO industry will be on transformation and customer-centric solutions.

· India value proposition: Historical drivers are giving way to value creation, innovation, success to new markets and customers.

· India continues to retain its lead as an effective sourcing destination, based on its unique value proposition.

Corporate Performance

We are pleased with our 2009 execution as we march towards our 2011 goals. We contained the revenue decline to 8.8% and have managed our cost structure and risks well during the year which is reflected in our operating results. Net income adjusted for extra ordinary items was at US$ 97.4 million for the year, higher by 17.0% against US$ 83.2 million for 2008.

We have used the down-turn effectively to further enhance the strategic framework of our business. We will continue to rationalize our cost structures to neutralize the short-term cost pressures due to supply side inflation and forex changes. We have developed a strong growth pipeline for 2010 and this is further improving, with an increase in our ability to participate in large deals. I am optimistic about our prospects and our win ratio.

6

Table of Contents

We were ranked as ‘# 1 Green Innovative IT Vendor’ in the 2009 Black Book ‘Top Green Outsourcing Vendors’ Survey. We were also named the 2009 ‘IT Supplier of the Year’ by Weyerhaeuser – a leading provider of integrated forest products. With regard to ‘People’, we were ranked among the Top 20 in DQ-IDC’s ‘Best Employer Survey 2009’; also ranked as the 7th ‘Preferred Employer’; and among the Top 15 in the ‘BPO Employers Survey’. We were also listed as a winner of the ‘4th Employer Branding Awards 2009-10’ under the ‘Innovative retention strategy’ category.

We have developed a strong growth pipeline for 2010 and this is further improving, with an increase in our ability to participate in large deals.

Differentiation Reaps Rewards

During the year, our vertical and horizontal BUs continued to build solutions for differentiation, which resultantly reaped rewards.

Insurance BU achieved significant growth over 2008, retaining its distinction of being the ‘highest revenue and highest margin’ business in 2009. Our ability to help our customers derive significant business benefits through our services enabled us to deepen our strategic customer relationship and achieve significant growth over 2008. We continue to pursue our strategy of differentiation through micro-vertical focus. Deepening our capabilities in chosen sub-verticals has enabled us to introduce differentiated IT and BPO service offerings for Life, Health and P & C Insurers.

Financial Services (FS) BU, despite facing difficult times in the year 2009, succeeded in winning 11 new customers, including some leading names. We achieved this by leveraging our ability to provide differentiated services for Asset Management, Wealth Management and Benefits Administration. The focus on these chosen sub-verticals will enable us to drive growth in 2010.

Manufacturing, Retail and Distribution (MRD) BU retained all of its major customers with innovative structuring of deals and strong customer focus. The BU continued its focus on unique vertical and IT solutions during the year: We were registered as the first Indian IT vendor to be certified as a ‘SAP Application Maintenance Services Provider’; we built a complete offering in the Product Configuration System space, including a proprietary solution framework - for the ‘make-to-order’ industry; we also built a deal structuring framework within the product configurator offering for optimizing the ‘engineer-to-order’ process and got industry acceptance; we built a visualization dashboard for SKU rationalization process for the CPG industry; we collaborated with Oracle Corporation in developing an MDM product for supplier collaboration.

Communications, Media & Utilities (CMU) BU made breakthrough wins in the Saudi Arabian market through our consulting business and won additional contracts in the domestic Indian market. We also continued to consolidate our consulting, systems integration and offshore platform into a cohesive unit that is now able to seamlessly deliver services for clients across the industry’s value chain.

The Product Engineering Services (PES) BU did well in sustaining its business in 2009, and more than 95% of its revenues came from repeat business from its customers cutting across diverse industries. The SBU now nurtures more than 100 customer relationships with the world’s leading R&D and Technology enterprises and OEMs. PES continues to maintain its industry leadership position in the Medical, Storage, and Automation domains. It has also built a strong presence in the Enterprise platform, Automotive and Consumer Electronics domain over the years. Some of the emerging growth areas for PES include Railway Engineering, Virtualization and Gaming.

Life Sciences BU. Our thought leadership and expansion of client base helped us to be ranked the ‘# 1 Life Sciences Information Technology Outsourcing Vendor’ by the Black Book of Outsourcing. Growth in 2009 came from the expansion of our project portfolio with the top ten life sciences clients. Also, a strong foundation for future growth was laid with the acquisition of new clients across industry segments. We advanced our relationships through a range of services provided during the year. Additionally, we advanced our SAP portfolio of Life Sciences-specific offerings, and accelerated our relationship with Oracle with a focus on clinical and safety areas.

Our Strategic Outsourcing Group launched two consulting led programs – ACT!Now for cost transformation and iGSS for integrated support services. These programs saw

7

Table of Contents

significant customer successes coming from the Asia Pacific and North American Geographies.

Enterprise Application Services (EAS) BU has taken significant strides towards making a mark as a solution provider. Besides traditionally strong areas of Supply Chain Planning and Manufacturing, we have now come up with unique offerings jointly with SAP and Oracle in the Compliances – Corrective Action Preventive Action (iCAPA) domain for Life Sciences vertical, Inventory Risk Liability (IRL) for Hi-tech vertical and Procurement solution for Hospitality industry (PROMPT). EAS has also worked with Oracle on Automated Testing Suite (ATS) end-to-end testing tool and jointly build technical frameworks for integrating ATS with Oracle User Productivity Kit (UPK)/Tutor products.

Customer Dynamics & Intelligence BU’s strategy of providing integrated services and solutions across Business Intelligence and CRM on a strong EAI platform continued to see a differentiated value proposition. Our investments and expansion of our solutions assets created more value-added services options for our customers. Most notable were: Business Intelligence SaaS applications deployed on the Amazon cloud; and Mobile CRM solutions based on Salesforce.com, Chordiant and Siebel.

CIS & BPO BU added several marquee names to its growing clientele. We grew our business in Europe by 20% with a focus on Telecom, Helpdesk and Customer services. The BU scaled up its insurance, asset administration, retirements, F&A, Life Sciences and integrated help desk practices and also launched new service offerings in the areas of Insurance (Claims as a ServiceTM), asset administration (Hosted Reconciliations, Reference Data Management), iGSS (Integrated Global Support Services) and ITIL Consulting. The CIS & BPO BU received several recognitions during the year.

Infrastructure Management Services (IMS) BU saw significant growth in Data Center operations as well as Database and Web-Operations Productized Services during the year. We rolled out various service and delivery models to supplement the BU’s RIMO++ and ADM++ offerings, in response to the dynamic market conditions. Managed Services, Shared Services, and Output/Outcome were some of the models used to transition the customer operation risks to Patni. The BU received noteworthy recognitions and accolades during the year.

Verification & Validation (V&V) BU – our independent testing practice continued to maintain its high growth trajectory and grew by around 35% in 2009, with over 60% growth in its million dollar clients. A significant portion of the increased revenue in testing came from the Insurance and Finance sector. In addition, solution building in test automation, alliance partnerships in new testing products, and capability into non-functional areas of testing, such as Application Security testing, Data Warehouse testing, and Performance testing catalyzed growth for V&V. ‘Framework for Accelerated Automation Solution for Testing (FAAST)’ was upgraded to its next version and rolled out to its existing and new clients.

The Microsoft CoE built innovative solutions to help customers migrate their Lotus Notes application portfolio to SharePoint. The CoE successfully conducted pilots on Microsoft’s Azure platform and hosted applications in Cloud.

The IT Governance CoE launched innovative solutions specifically ‘e-mail plug in on Blackberry for CA-Clarity suite’ and ‘Calendar synchronization with Outlook for CA-Clarity suite’.

The Business Process Management (BPM) CoE grew its footprint by launching a service offering in Open source BPM platforms.

Regional Performance

Our focus on geographical diversification continued with the setting up of a new office and delivery center in Singapore. Our Mexico delivery center went operational in early 2009. We also opened an entity in Switzerland. While 2009 was the year of unprecedented meltdown, we were able to arrest our revenue downfall from Q2 onwards and expect that such a diversification will yield significant positive results in 2010.

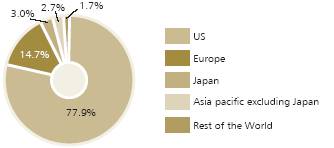

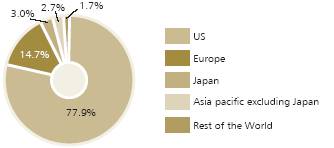

The US region continued to be the biggest market with an 80.1% contribution to the total revenues in 2009.

EMEA region’s contribution was 14.2% in 2009.

The Asia Pacific region contributed 5.7% which was 10 basis points more than 2008.

8

Table of Contents

Infrastructure

In 2009, we decided to increase our regional presence in the regions we conduct our business, and build more employee friendly facilities globally. In this direction, we firstly shutdown many of our older facilities in Noida, Mumbai, Pune and Hyderabad and co-located our employees in newer, upgraded facilities in India. We also opened a delivery center in London, UK where we have been active for over a decade. With focus on growth in the Asia-Pacific region, we inaugurated a new sales office and delivery center in Singapore that will serve as a headquarters for the region.

People Initiatives

In view of the Company being poised for growth and positioned well to reap new opportunities, significant focus was given to people practices during the year.

Our global headcount stood at 13,995 at the close of 2009. We added 18 senior management personnel at the Vice-President level and above, during the year. A continuous thrust on improvement through focussed interventions resulted in a significant dip in the Company’s attrition figures from 20% (at the end of 2008) to 13.7% (at the end of 2009).

The Patni Academy for Competency Enhancement (PACE) and Learning & Development delivered technical, functional & behavioral training of close to 58,112 person days in 2009. The Faculty Development Programs as a part of the PLEdge initiative (Patni’s Industry-Academia collaboration) were attended by 50+ faculty members from colleges in and around Mumbai. Totally, 82 employees completed their Master’s degree through Patni–BITS collaborative program specializing in Software Engineering and Embedded Systems.

Through the newly launched ‘Patni Leadership Academy’, over 150 persons successfully completed a customized executive education program or an Executive MBA program from IIM-Ahmedabad and IIM- Kozhikode, respectively. Three senior leaders went through the Advanced Management Program of Harvard Business School.

As part of our Global Resources in Technology (GRiT) initiative, more than 2500 GRiT employees successfully completed one or more of the certifications which included external certifications from vendors such as Microsoft, Sun, Oracle.

As the global economies stabilize, we are well prepared and poised for growth.

The Road Ahead

Induced with a new vigor as a result of the numerous organizational initiatives, we feel confident of demonstrating our momentum to execute going forward, and regaining our rightful place in the Indian IT industry. As the global economies stabilize, we are well prepared and poised for growth. While the market is still thwart with risks of double dip recession, we are positioned well to reap the opportunities given our impressive pipeline.

We are now looking at 2010 and beyond with renewed optimism. We believe that walking slower doesn’t make the distance shorter. We will focus on accelerating our pace, aligning ourselves to the operating and strategic priorities; this will ensure that our achievements will happen sooner than we envision. Also, we have sound financial and management scale to grow our business faster through acquisitions.

In the coming year, our focus is going to be on working together in a more unified way to accelerate growth and create stakeholder value by winning in the market place.

I thank you for your trust and confidence placed in us throughout the year. I firmly believe that we as a company cherish our legacy while being excited about our future.

Regards,

Jeya Kumar

5 May 2010

Mumbai

9

Table of Contents

Evolving

like never before

The economic downturn triggered a never before seen sense of urgency. Most organizations carefully monitored themselves for signs of financial failures, evaluated the effectiveness of strategies, and also revisited their objectives. Consequently, they either ratified their game plan or sought change of course. Like the others, we too felt that the global economic crisis provided us with a once-in-a-lifetime opportunity to dispassionately examine ‘who we are as an organization’, ‘how we want to operate’ and ‘what is our performance vis-à-vis industry standards’. The economic shock and uncertainty in the demand for IT services sounded a clarion call for action. We decided to do more than attempting to eke out a survival strategy. It was an opportune moment to initiate some transformational initiatives that would lead to organizational renaissance. However, the magnitude of transformation that we contemplated required fundamental changes in the company’s structure, management processes and people-mindset. But there was a strong sense of shared commitment at the top. We were ready to embark on a journey never ventured before.

As the global fiscal crisis stared in the face, we strengthened our resolve to further improve our business resiliency.

To succeed in this endeavor, we had to build a sense of urgency among the employees about the evolution of our organization at a speed and scale that was never witnessed before. The transformation journey began in February 2009, when the executive leadership team communicated company’s transformation agenda, strategic business priorities, vision and values in a consistent manner to employees across all geographical regions. Our strategy was centered around four themes: (1) Global presence (2) Micro-vertical specialization (3) Operational excellence (4) ‘Great-place-to-work’ practices. The overwhelming response boosted our confidence and strengthened our resolve to overcome the impending challenges and move forward. In the last one year we have successfully kick-started the process of evolution and started experiencing the difference. Here are some of the outcomes resulting from the implementation of the strategic agenda.

The magnitude of transformation that we contemplated required fundamental changes in the company’s structure, management processes and people’s mindsets.

10

Table of Contents

It was important that we had a business infrastructure that helped us better manage the interdependencies across economies and businesses.

Global Presence

We are a global player operating in an integrated, global business environment. It was important that we had a business infrastructure that helped us better manage the interdependencies across economies and businesses. There was an urgency for us to have a four-tier global delivery architecture that was multi-cultural, multi-lingual, and multi-regional and encompasses the right mix of onshore, offshore, and near-shore delivery services. Soon, we announced our strategy to augment the ‘follow-the-sun’ model aimed at serving regional markets. We opened our first near-shore center in Queretaro, to augment our global delivery capabilities and serve the North American and Latin American markets. We also opened an onshore delivery center at El Paso in the Texas region to service the North American customers.

Revenue risk diversification is another facet of our geographical expansion. As the economy plunged into deep recession in the early 2009, leading to a sharp decline in IT spending across the US and Europe, we focused our sales efforts on APAC and other emerging markets, where the impact was comparatively less severe. The investments in the new APAC regional headquarters helped us improve our coverage of all the important markets in the region. Our focus in India is more than ever before. We have the entire wherewithal to capitalize on the opportunity that looms on the horizon due to the surge in public sector and government spending on IT initiatives. The traction in new markets like Turkey and South Africa in EMEA had put us in a safer situation to arrest revenue shortfall.

As we strived to augment our global presence, we also ensured that we remain focused on our objective of being a customer-centric organization. We identified US, EMEA, APAC and SAARC as our focus regions and appointed regional heads who are accountable to build and support strong relationships with customers and prospects in their respective markets and propel growth.

11

Table of Contents

Micro-vertical specialization is a sure-fire way to climb up the business value trajectory and pursue a non-linear model of growth.

Micro-vertical Specialization

The shift in buying preferences have changed the face of service delivery. Clients no longer buy commoditized services. Vertical domain expertise is also not a strong differentiator. The focus is narrower than ever before as clients increasingly seek business process-related solutions that can create a business impact.

Keeping in tune with the trend, we leveraged micro-vertical specialization to offer standard solutions that are not only cost-effective but also faster to implement and easy to operate. Drawing upon our understanding of the unique requirements in every industry, we delivered pre-configured industry capabilities or worked with our partners to develop solutions that addressed such opportunities. Some of our process-based solutions included (a) PROMPT – an e-procurement solution for hospitality industry, (b) iCAPA – an incident and complaint management solution for life sciences, (c) atoms – pre-packaged processes for telecom operators and (d) Inventory liability and risk management dashboard – a reporting and analytics solutions for the hi-tech industry.

Buoyed by the success of the micro-verticalisation strategy in a few select areas, we have made investments to create intellectual property driven solutions in Underwriting, Policy Administration, Claims Management, Asset Management, Benefits Administration and Retail & Commercial Banking. We are convinced that micro-vertical specialization is a sure-fire way to climb up the business value trajectory and pursue a non-linear model of growth.

12

Table of Contents

We induced efficiency in our business operations as we digitized most of the core processes as a part of the ‘iChange’ initiative.

Operational Excellence

As the shadow of the global financial slowdown loomed large, we responded with a sense of immediacy to assess our company’s competitive position. We pulled all the levers that drove operational efficiencies. We introduced flexibility in our cost structures to absorb margin erosion caused by depressed economic environment and sluggish demand. We scrutinized costs, assets and investments and embarked on a sustainable cost management program. Consolidation of our delivery capabilities gave a boost to our utilization as well as customer satisfaction levels. The cost efficiencies yielded favorable financial results. Our bench utilization was at an all time high and our EBITDA margin (ex-FX) touched a four-year high.

Efficiently managing daily operations during a downturn can help the company stay afloat, but does not fuel growth. Hence, we continued to make market sensitive investments to energize marketing and sales. We induced efficiency in our business operations as we digitized most of the core processes as a part of the ‘iChange’ initiative. We sharpened our focus on automating our service delivery and leveraging reusable assets, frameworks and tools (RAFT). Our delivery teams developed both technology and industry specific solution accelerators and frameworks aimed at accelerating time-to-deliver and reducing effort intensity.

Recession also provoked changes in client engagement models, which in turn had an impact on the service delivery. Thanks to the robust Patni PLUSTM suite of delivery methodologies and good project management practices, we could transform the terms of revenue engagement from a T&M model to emerging pricing models which are based on delivery of output and business outcome.

13

Table of Contents

By creating a genuinely appealing workplace that is supportive, efficient and committed to excellence, our existing and potential employees will strongly identify Patni as a great place to work.

‘Great-Place-to-Work’ Practices

During difficult economic situations, it was important for us to stay focused on employees and keep the business moving forward. We did what was very obvious to do i.e. improve cost competitiveness, boost employee engagement and demonstrate compliance through corporate governance. However, we did not stop here in our journey towards workplace transformation.

We firmly believe that fostering an exceptional work environment is a business imperative. By creating a genuinely appealing workplace that is supportive, efficient and committed to excellence, our existing and potential employees will strongly identify Patni as a great place to work. We are adopting good workplace practices to help employees develop a sense of professional identification and a deeper connection with the organization.

In 2009, our executive leadership reviewed and reflected on what is really important to us in an enduring way. They reached a common understanding about the inherent beliefs in the organization and distilled its essence into a new set of core values. The new values emanate from previous Patni values, reflecting the evolution of our business. They portray who we are, the way we work, and what we aspire to achieve. In the last one year, we have diligently worked to weave our core values into the fabric of everything we do to positively impact those who seek our services. We will continue to operate with allegiance to the following core values: Passion, Honesty & Integrity, Operational Excellence, Innovation, Accountability, and Customer Centricity.

In line with our values, we have redesigned most of our processes and systems pertaining to recruitment, talent

14

Table of Contents

management, talent retention, competence development, leadership pipeline creation and succession planning. The new systems are designed to invigorate behaviors associated with our values. There was a renewed focus on influencing and inspiring engagement by formulating a ‘people’ strategy that drives accountability, boosts productivity and performance, fosters collaboration, and creates growth opportunities for leaders, managers, and frontline employees.

As we evolve into a global organization, we are doing more than just expanding the geographical footprint. We are consciously building a culture, which welcomes diversity and inclusivity. The organization is committed to advance the diversity agenda in a sustained and proactive manner by recruiting and employing a workforce representing different nationalities, cultures, genders, employment histories, and levels of physical ability. We are optimistic that in the coming years as the demographics of Patni become comparable with the best in our peer groups, we will transform into an organization, which would be known for innovation, openness, good governance, high performance and work ethics, greater degree of specialization, and collaborative work culture.

The Way Forward

The evolution is far from over. We will build on our early accomplishments and keep the momentum going. There’s nothing that we can’t do if we put our minds and energy to it. There are three good reasons to be optimistic about our company: our business fundamentals are strong, we are focused and moving in the right direction, and our people are at par with the best in the industry.

15

Table of Contents

Directors’ Report

To,

The Members,

PATNI COMPUTER SYSTEMS LIMITED

Your Directors have pleasure in presenting their Thirty Second Annual Report together with Audited statements of Accounts for the year ended 31 December 2009:

Financial Results:

| | 31 December 2009 | | 31 December 2008 | |

| | (Rs. in million) | | (Rs. in million) | |

Sales | | 17,349 | | 15,410 | |

Resulting in Profit Before Tax | | 5,818 | | 4,133 | |

Profit After Tax | | 5,427 | | 3,891 | |

Profit available for appropriation after adding to it Previous Year’s Brought Forward | | 20,886 | | 16,298 | |

Appropriated as under: | | | | | |

Adjustment on account of employee benefits | | — | | — | |

Transfer to General Reserve | | 543 | | 389 | |

Final Proposed Dividend on Equity Shares @ 150% (Previous Year 150 %) | | 387 | | 384 | |

Corporate Tax on above Dividend | | 66 | | 65 | |

Balance Carried to Balance Sheet | | 19,890 | | 15,459 | |

16

Table of Contents

Executive Leadership Team

(Left to Right)

Naresh Lakhanpal EVP, President – Patni Americas; Deepak Khosla SVP, President – SAARC; Derek Kemp EVP, President – EMEA; Satish Joshi EVP, Global Head –Technology & Innovation; Mohan Hastak SVP, Global Head – AD & AM; Ajay Chamania EVP, Global Head – Product Engineering Services; Rajesh Padmanabhan EVP, Global Head – Human Resources; Jeya Kumar Chief Executive Officer; Anil Gupta EVP, Global Head - Business Operations; Surjeet Singh Chief Financial Officer; Sanjiv Kapur SVP, Global Head - BPO & CIS; Sunil Chitale EVP, Global Head – ES & SI; Niket Ghate SVP, General Counsel; Vijay Khare EVP, Global Head – Industry Verticals; V. Mathivanan EVP, President – APAC.

Table of Contents

Board of Directors

|

|

|

|

| | | |

Narendra K Patni Chairman | Jeya Kumar

Chief Executive Officer | Gajendra K Patni Non-Executive Director | Ashok K Patni

Non-Executive Director |

| | | |

|

|

|

|

| | | |

William O Grabe Non-Executive Director | Louis Theodoor van den Boog

Non-Executive Director | Arun Duggal Independent Director | Pradip Shah Independent Director |

| | | |

|

|

|

|

| | | |

Ramesh Venkateswaran Independent Director | Michael A Cusumano Independent Director | Pradip Baijal Independent Director | Vimal Bhandari Independent Director |

| | | |

| | | |

| | | |

Abhay Havaldar Alternate Director to

William O Grabe | | | |

Table of Contents

Business Performance

The performance of your Company during the year under report has shown improvement over the previous year. Total revenue for the year ended 31 December 2009 amounted to Rs. 17,349 million as against Rs. 15,410 million for the corresponding period last year, registering a growth of about 13%. The Company has posted the Net Profits after tax to Rs. 5,427 million as compared to Rs. 3,891 million for the corresponding period last year, registering a growth of about 39% for the year ended 31 December 2009. Even on consolidated basis, revenues were increased in the current year 2009 by 0.92% to Rs. 31,461 million from Rs. 31,173 million in 2008.The net income increased by 34%.

Dividend

Your Directors are pleased to recommend the payment of dividend for the year ended 31 December 2009 at Rs.3/- (Rupees Three only) per share (150 percent) on face value of Rs.2/- [Previous year Rs.3/- per share (150 percent)], subject to approval of Members at the ensuing Annual General Meeting.

Economic Scenario and Outlook

The year 2009 began amid great uncertainty with regard to the likely impact of the global financial crisis, which has initially erupted in the second half of 2008. Governments around the world acted quickly and decisively, and in a coordinated manner, which helped in preventing the situation slipping into a full scale depression. Nevertheless, recession on a global scale was, inevitable to some extent and the only question was, and still is to some extent, how deep the recession would be and how long it would last. Most of the economies are showing sig of improvement but it is still a long way to go. Emerging markets in general and India in particular, are leading the way on the road to recovery, with strong growth rates based on robust economic fundamentals. Despite of inflationary pressures gradually building, a steady monetary policy course has been maintained, with a focus on supporting growth recovery.

Nasscom Strategic Review 2010 states that the year 2009 ushered turbulence, with countries around the world plunging into the recession. The housing bubble burst, followed by the financial crisis creating a domino effect that, but, brought the world to a standstill. While robust fundamentals ensured that the recession impact on India was relatively moderate, in an increasingly globalised environment, it could not escape declining GDP growth, rising unemployment and weakened consumer demand. However, prompt action by governments across the world and stimulus packages helped to contain this downfall and make way for revival by the end of 2009.

The industry is estimated to aggregate revenues of $73.1 billion in FY2010, with the IT software and services industry accounting for $63.7billion of revenues. During this period, direct employment is expected to reach nearly 2.3 million, an addition of 90,000 employees, while indirect job creation is estimated at 8.2 million. As a proportion of national GDP, the sector revenues have grown from 1.2% in FY1998 to an estimated 6.1% in FY2010. Its share of total Indian exports (merchandise plus services) increased from less than 4 % in FY1998 to almost 26% in FY2010.

Export revenues are estimated to gross $ 50.1 billion in FY2010, growing by 5.4%over FY2009, and contributing 69% of the total ITBPO revenues. Software and services exports (including BPO) are expected to account for over 99% of total exports, employing around 1.8 million employees.

The industry’s vertical market mix is well balanced across several mature and emerging sectors. 2009 saw increased adoption of outsourcing from not only our biggest segment i.e., the Banking, Financial Services and Insurance (BFSI), but also new emerging verticals of retail healthcare and utilities.

According to the report, the beginning of the new decade heralds the slow, but steady end of the worst recession in the past 60 years.

Global GDP, after declining by 1.1%in 2009, is expected to increase by 3.1%in 2010,and 4.2% in 2011,with developing economies growing thrice as fast as the developed economies. Improving economic conditions signifying return of consumer confidence and renewal of business growth, is expected to drive IT spending going forward. IT services is expected to grow by 2.4% in 2010, and 4.2% in 2011 as companies coming out of recession harness the need for information technology to create competitive advantage.

17

Table of Contents

Organizations now recognize IT’s contribution to economic performance extending beyond managing expenditures. They expect IT to play a role in reducing enterprise costs, not merely with cost cutting but by changing business processes, workforce practices and information use. Movement toward SaaS and cloud computing, shared services, and more selective outsourcing will take firmer shape as near-term priorities to address constrained IT budgets.

Government IT spending continues to rise across the world, focusing on infrastructure, and security. Other areas of spending include BPM, data management, on demand ERP, virtualization, and efforts to increase and deliver enterprise managed services on IP networks. Business process outsourcing spending in 2010 is expected to be increasingly driven by F&A segment and procurement, followed by HR outsourcing. Providers will increase their focus on developing platform BPO solutions across verticals and services.

Growth in outsourcing is expected to supersede overall IT spend reaffirming its potential to not only support short term, tactical goals of cost savings, but also long term advantages of increased competitiveness, efficiencies and access to emerging markets. Within outsourcing, off shoring will see increased acceptance as off shore based providers grow and traditional service providers ramp up off shore delivery capabilities. India’s technology and business services industry has flourished in the last decade. A bright future lies ahead and the industry has much to look forward to, with the potential to quadruple its revenues over the next decade. Several macroeconomic and social trends will support the rise of the IT-BPO sector in the future, in core and emerging markets.

Business Overview

Your Company is a leading Indian provider of information technology services. The Company delivers a comprehensive range of IT services through globally integrated onsite and offshore delivery locations primarily in India, which the Company calls its global delivery model. Your Company offers its services to customers through industry-focused practices, including insurance, manufacturing, retail and distribution, financial services and communications, media and utilities, and through technology-focused practices. Within these practices, its service lines include application development, application maintenance and support, packaged software implementation, infrastructure management services, product engineering services, business process outsourcing and quality assurance services.

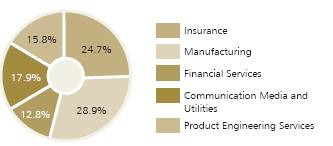

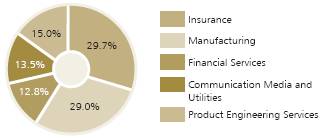

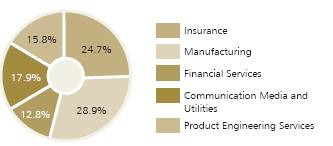

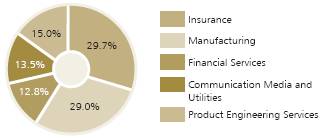

Your Company has in-depth knowledge in its industry and technology practices. Insurance, manufacturing, retail and distribution, communications, media and utilities and financial services accounted for 24.7%, 29.0%, 17.9% and 12.8% in 2008, respectively and 29.7%, 29.0%, 13.5%, and 12.8% in 2009, respectively. The Company’s technology practices offer research, design and development services for product engineering. Through its dedicated sales and management teams in each of its industry and technology practices, your Company believes it is able to provide better client service, effectively cross-sell services to its existing clients and develop new client relationships.

Your Company has a track record of successfully developing and managing large, long-term client relationships with some of the world’s largest and best known companies. Your Company’s customer base has increased from 199 clients as of December 31, 2005 to 272 clients as of December 31, 2009. Several of Company’s key executives are located in its client geographies to better develop and maintain client relationships at senior levels. Repeat business accounted for 93.0% and 94.0% of its revenues in 2008 and 2009.

Delivery Model

Your Company addresses its clients’ needs with its global delivery model, through which it allocates resources in a cost-efficient manner using a combination of onsite client locations in North America, Europe and Asia and offshore locations in India. Your Company believes an integral part of its delivery is its industry knowledge, which your Company refers to as its domain expertise.

Your Company refers to its own industry experts, business analysts and solutions architects who are located primarily onsite with the client as its “domain wedge”. These experts are supported by additional personnel who provide technical services onsite on a temporary basis, and by its trained professionals located normally at one or more of our nine offshore centers in India. Typically, at the initial stage of a project, your Company provides services through its onsite industry and technology experts and its transient onsite delivery personnel.

By applying its domain wedge approach, your Company delivers solutions that can be structured to scale to suit its clients’ needs. In certain cases your Company provides dedicated offshore development centers, set up for a particular client. Through these offshore development centers

18

Table of Contents

your Company integrates its clients’ processes and methodologies and believe it is better positioned to provide comprehensive and long-term support. Your Company maximizes the cost efficiency of its service offerings by increasing the offshore portion of the work as the client relationship matures. To complement its domain wedge, your Company has aligned a majority of its sales and marketing teams to focus on specific industry sectors.

Industry Practices, Technology Practices and Service Lines

Your Company offers its services to customers through industry practices in insurance, manufacturing, retail and distribution, financial services and communications, media and utilities, as well as in other industries. Your Company also has technology practices that offer services in product engineering and for Independent Software Vendors, or ISVs. The Company’s industry practices and technology practices are complemented by its service lines, which your Company develops in response to client requirements and technology life cycles. The Company’s service lines include application development, application maintenance and support, packaged software implementation, infrastructure management services, product engineering, business process outsourcing and quality assurance services.

Customer Relationships

Your Company has always demonstrated the ability to build and manage relationships with some of the world’s largest and best known companies. Our strategy to diversify our revenue profile is on course.

Your Company’s active client base is at 272 as of 31 December 2009 as compared to 331 as of 31 December 2008. In addition, the total number of clients that individually accounted for over $ 1.0 million in annual revenues continued to be 92 as of 31 December 2009 and as of 31 December 2008.

During 2009, your Company’s revenues from T&M projects decreased by 7.3% over revenues in 2008, while revenues from fixed price contracts increased by 12.8% over the same period. T&M projects accounted for 59.4% of the Company’s revenues in 2009, compared to 64.0% in 2008 and 62.2% of its new business was billed on a T&M basis.

Your Company’s client concentration, as measured by the proportion of revenue generated from its top ten clients, increased to 49.7% in 2009 from 45.6% in 2008. The Company’s largest client contributed 11.9% of our revenues in 2009, compared to 10.7% in 2008. During 2009, clients in the insurance, manufacturing, retail and distribution, financial services and product engineering services industries continued to contribute a large proportion of the Company’s revenues. Revenues from clients in these industries contributed 29.7%, 29.0%, 12.8% and 15% to overall revenues respectively in 2009 as compared to 24.7%, 28.9%, 12.8% and 15.7% respectively in 2008. Your Company’s clients in the communications, media and utilities industry contributed to 13.5% of its revenues in 2009 as compared to 17.9% in 2008.

During 2009, your Company continued to derive a significant proportion of its revenues from clients located in the United States. In 2009 and 2008, your Company derived 78.9% and 75.9% of its revenues from clients located in the United States.

Sales and Marketing

Your Company’s sales teams use a multi-pronged approach to market its services. They target certain industries and service lines through focused sales executives, geographies through regional sales executives and large clients through dedicated account managers. The Company has aligned a majority of its sales and marketing teams to focus on specific industries and geographies. In addition to its sales executives, your Company has industry experts and solution architects who complement its sales efforts by providing specific industry and service line expertise. Your Company’s sales efforts are also supported by its marketing professionals, who assist in brand-building and tracking the Company’s expertise.

Your Company’s senior management and dedicated account managers are actively involved in managing client relationships and business development through targeted interaction with multiple contacts throughout Company’s clients’ organizations. Your Company aims to develop its client relationships into partnerships by working closely with its clients’ managers and senior executives to formulate and execute an offshore outsourcing strategy, implement engagement models that suit their particular challenges and explore new service lines.

Your Company has 28 sales offices across North America, Europe, Japan and the rest of the Asia-Pacific region and 235 sales and marketing personnel who are supported by

19

Table of Contents

dedicated industry specialists. Your Company sets targets for its sales personnel at the beginning of each year, which are subject to periodic reviews. In addition to a base salary, the Company’s compensation package for sales personnel includes an incentive-based compensation plan driven by achievement of the prescribed sales targets. Your Company’s sales and marketing professionals help promote the “Patni” brand through targeted analyst outreach programs, trade shows, white papers, sponsorships, workshops, road shows, speaking engagements and global public relations management. Your Company believes that a stronger brand will facilitate the Company’s ability to gain new clients and to attract and retain talented professionals.

Personnel & Performance

Your Company strongly believes that its ability to maintain and continue its growth depends to a large extent on its strength in attracting, developing, motivating and retaining the talent. The Company operates in seven major cities in India, which enables the Company to recruit technology professionals from different parts of the country. The key elements of the Company’s human resource management strategy include recruitment, learning and development, compensation and retention.

Your Company has established a work ethic based on values that transcend across its global operations. The culture is oriented to high growth and performance that allows the Company to attract, motivate and retain high quality talent worldwide. Abilities are recognized with rewards for high performance.

Your Company uses its competitive recruitment program to select talent from India’s premier engineering institutions. An adaptive business model and mature management structure allow aggressive scalability without compromising on flexibility, responsiveness and reliability of services.

Your Company employed 13,995 employees as of 31 December 2009. Out of 13,995 employees, 11,102 were software professionals. Of these software professionals, 2,372 employees were categorized as onsite and 8,730 as offshore.

The Company’s software employees are highly-skilled and have diverse educational backgrounds. As of 31 December 2009, graduate engineers comprised 67.03%, post graduate engineers comprised 4.67%, employees with master’s degrees in computer applications or computer management comprised 12.73% and employees with masters in business administration and equivalent qualifications comprised 3.80% of its software professionals. Other degrees comprised 11.77% of its software professionals.

Your Company believes that it has a balanced mix of experience with approximately 28.6%, 33% and 38.4% of its software professionals with work experience of less than 3 years, 3 to 6 years and over 6 years, respectively, as of 31 December 2009.

Facility Expansion

In keeping with its plans for expansion, your Company has constructed new facilities in India, which includes three knowledge parks in Chennai, Navi Mumbai and Noida. These knowledge parks have state-of-the-art infrastructure with extensive workspace and training facilities and a modular design for ease of segregation of dedicated projects with ability to provide scale and service to clients from one location.

The Navi Mumbai, and the Chennai facilities are expected to accommodate up to 14,000 and 10,000 engineers, respectively, when fully completed. The Company estimates that it may spend an aggregate of approximately $ 140 million to complete these two projects. Phase I of the Navi Mumbai facility, having a capacity of 4,300 seats, is complete and occupied. Phase I of the Chennai facility, having a capacity of 1,200 seats, is complete and partially occupied. Construction of the Noida SEZ facility is completed with capacity to accommodate 3,200 Seats and is partially occupied. As of 31 December 2009, we had spent approximately $101.3 million on the knowledge parks. The estimated amounts (net of advances) remaining to be executed on contracts in relation to capital expenditure for the construction of various facilities, aggregated approximately to $55.6 million as of 31 December 2009 which will be executed over 3 years. Your Company anticipates that expenditures for its expansion plans will total approximately $20 to $25 million in 2010. In continuation of Company’s policy to have its own campus operations, your Company has acquired land in Pune, Hyderabad and Kolkata in addition to its campuses in Mumbai, Chennai and Noida. These facilities when fully built are expected to have a seating capacity for approximately 25,000 professionals.

20

Table of Contents

For the Chennai facility, your Company has acquired 18.75 acres of land near Chennai for a lease term of 99 years to establish a project in connection with software development and support services. Further, for the Mumbai facility the Company has been granted licenses to construct facilities over 50 acres of land in a phased manner in Navi Mumbai.

Corporate Developments & Accolades

Your Company became the first Indian company to receive global certification by SAP for its Application Management Services. With this competitive edge, we are uniquely placed to jointly partner with SAP to take this offering to their large customer base.

Your Company was ranked among the ‘Top 10 Best Performers in IT Services and IT Infrastructure Services’, in a survey conducted by Global Services and neoIT. It was also featured in the prestigious list of Top 100 innovative service providers of the year.

Your Company was named a ‘Challenger’ in Gartner’s Magic Quadrant for Help Desk Outsourcing, North America, 2009 Report.

Your Company was ranked as the No. 1 ‘Green Innovative Information Technology Vendor’ by the prestigious 2009 Black Book Top Green Outsourcing Vendors Survey.

Your Company was named ‘IT Supplier of the Year’ by Weyerhaeuser, a leading provider of integrated forest products.

Your Company was ranked #7 Preferred Employer in DQ-IDC’s Best Employer Survey 2009.

Your Company was conferred the #7 ‘Preferred Employer’ rank in DQ-IDC’s Best Employer Survey 2009 based on an industry-wide employee satisfaction survey. The Company was also ranked #16 ‘Best IT Employer’ after a comprehensive analysis of HR policies across the industry. This rank is significant as it indicates a jump of 13 places from last year for the Company.

The Company also received some other key recognitions during the year:

Listed in the ‘Black Book of Outsourcing – 2009’:

Ranked # 1 ‘Life Sciences Information Technology Outsourcing’ Vendor

Ranked # 1 ‘Product Development and Engineering Outsourcing’ Vendor

Ranked # 2 ‘Property and Casualty: Automotive Insurance BPO’ Player

Ranked # 4 ‘Health Insurance BPO’ Player

Ranked # 8 ‘HomeOwners BPO’ Player

Listed among the Top 10 ‘End-to-end Insurance BPO/ITO Services Providers’

Ranked among Top 15 ‘Best Managed Global Outsourcing Vendor of 2009’ in the Annual Client Experience Survey.

Listed in the ‘Global Services 100 – 2009’, instituted by Global Services and neoIT:

Ranked 7th among ‘Top 10 best performing IT Infrastructure Service Providers’

Ranked 8th among ‘Top 10 best performing IT Service Providers’.

Listed among the Top 20 India-Centric BPO players in Competitive Landscape: Business Process Outsourcing, India-2009, by Gartner.

Named a ‘Niche Player’ in Gartner’s Magic Quadrant for CRM Service Providers, North America, 2009 Report.

Ranked 40th amongst the ‘top technology providers for financial institutions’ in the ‘FinTech 100 - 2009’ list.

Listed as a regional level award winner at the ‘4th Employer Branding Awards 2009-10’ under the ‘Innovative retention strategy’ and ‘Excellence in training’ categories.

Patni ESOP 2003 (Revised 2009)

Your Company had introduced the Employees Stock Option Plan known as ‘Patni ESOP 2003’. The Plan is being administered by the Compensation and Remuneration Committee of Directors constituted as per SEBI Guidelines. The details of Options granted under the Plan are given in the Annexure to this Report.

Subsidiary Companies

The Company has wholly owned subsidiaries viz. Patni Americas, Inc., Patni Computer Systems (UK) Limited, Patni Computer Systems GmbH, PCS Computer Systems Mexico, SA de CV and Patni Computer Systems Brasil LTDA.

During the year, the Company set up the wholly owned subsidiary in Singapore viz. Patni (Singapore) Pte. Ltd.,

21

Table of Contents

Patni Telecom Solutions, Inc. and Patni Life Sciences Inc. are the subsidiaries of Patni Americas, Inc., Company’s one of the main subsidiaries.

Patni Telecom Solutions (P) Limited and Patni Telecom Solutions (UK) Limited are subsidiaries of Patni Telecom Solutions, Inc.

Patni Computer Systems (Czech) s.r.o. is the subsidiary of Patni Computer Systems (UK) Limited.

In view of the above and by virtue of Section 4 of the Companies Act, 1956 the Company has following eleven subsidiaries (Collectively to be referred as “Subsidiary Companies”) i) Patni Americas, Inc.; ii) Patni Computer Systems (UK) Limited; iii) PCS Computer Systems Mexico, SA de CV; iv) Patni Computer Systems GmbH; v) Patni Computer Systems Brasil LTDA; vi) Patni (Singapore) Pte. Ltd.; vii) Patni Telecom Solutions, Inc.; viii) Patni Telecom Solutions (UK) Limited; ix) Patni Telecom Solutions (P) Limited; x) Patni Life Sciences, Inc.; and xi) Patni Computer Systems (Czech) s.r.o.

The Company has been granted exemption for the year ended 31 December 2009 by the Ministry of Corporate Affairs vide its letter dated 5 January 2010 from attaching to its Balance Sheet, the individual Annual Reports of each of its Subsidiary Companies. As per the terms of the said letter, a statement containing brief financial details of the Company’s subsidiaries for the year ended 31 December 2009 is included in the Annual Report. The annual accounts of Subsidiary Companies and the related detailed information will be made available to any member of the Company / its Subsidiary Companies seeking such information at any point of time and are also available for inspection by any member of the Company / its Subsidiary Companies at the Registered Office of the Company. The annual accounts of the said Subsidiary Companies will also be available for inspection, as above, at the registered offices of the respective Subsidiary Companies.

Directors

In accordance with the requirements of the Companies Act, 1956 and Articles of Association of the Company, Mr. Ramesh Venkateswaran, Dr. Michael A Cusumano and Mr. Louis Theodoor van den Boog are liable to retire and eligible for reappointment in the forthcoming Annual General Meeting.

Mr. Vimal Bhandari was appointed as an Additional Director of the Company w.e.f. 15 January 2010. Pursuant to provisions of Section 260 of the Companies Act, 1956, he shall hold his office till the ensuing Annual General Meeting of the Company. In view of the same, it is proposed to appoint him as a director of the Company in the forthcoming Annual General Meeting.

Corporate Governance

Your Company follows the principles of the effective corporate governance practices. The Clause 49 of the Listing Agreement deals with the Corporate Governance requirements which every publicly listed Company is required to comply with. The Company has taken steps to comply with the requirements of revised Clause 49 of the Listing Agreement with the Stock Exchanges.

A separate section on Corporate Governance forming part of the Directors’ Report and certificate from the Company’s Auditors confirming the compliance of conditions on Corporate Governance as stipulated in Clause 49 of the Listing Agreement is included in the Annual Report.

Particulars of Employees

Particulars of employees as required under the provisions of Section 217 (2A) of the Companies Act, 1956 read with the Companies (Particulars of Employees) Rules, 1975, as amended, forms part of this Report. However, in pursuance of Section 219(1)(b)(iv) of the Companies Act, 1956, this Report is sent to all the Members of the Company excluding the aforesaid information and the said particulars are made available at the registered office of the Company. The members desirous of obtaining such particulars may write to the Company Secretary at the registered office of the Company.

Fixed Deposits

Your Company has not accepted any fixed deposits from the Public. As such, no amount of principal or interest is outstanding as of the balance sheet date.

Auditors

M/s B S R & Co., Chartered Accountants, the present statutory auditors of the Company hold office until the conclusion of the ensuing Annual General Meeting. It is proposed to

22

Table of Contents

reappoint them as the statutory auditors of the Company until the conclusion of the next Annual General Meeting. M/s B S R & Co., have, under section 224(1) of the Companies Act, 1956, furnished the certificate of their eligibility for reappointment.

Directors’ Responsibility Statement

Pursuant to Section 217(2AA) of the Companies Act, 1956, the Directors, based on the representation received from the Operating Management, confirm that:-

(a) in the preparation of the annual accounts, the applicable accounting standards have been followed and that there are no material departure;

(b) they, in selection of accounting policies, have consulted the Statutory Auditors and have applied them consistently and made judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company as at 31 December 2009 and the profit of the Company for the period 1 January 2009 to 31 December 2009;

(c) they have taken proper and sufficient care, to their best of knowledge and ability, for the maintenance of adequate accounting records in accordance with the provisions of the Companies Act, 1956 for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities;

(d) they have prepared the annual accounts on a going concern basis.

Conservation Of Energy, Technology Absorption And Foreign Exchange Earnings/ Outgo:

A) Conservation of Energy

Your Company consumes electricity mainly for the operation of its computers. Though the consumption of electricity is negligible as compared to the total turnover of the Company, your Company has taken effective steps at every stage to reduce consumption of electricity.

B) Technology Absorption

This is not applicable to your Company as it has not purchased or acquired any Technology for development of software from any outside party.

C) Foreign Exchange Earnings/Outgo

Earnings in Foreign Currency | | 31 December 2009 | |

on account of: | | (Rs. in million) | |

Export Sale | | 17,395 | |

Others | | 62 | |

Total Earnings | | 17,457 | |

Expenditure in Foreign Currency | | 31 December 2009 | |

on account of: | | (Rs. in million) | |

Traveling Expenses | | 104 | |

Overseas Employment Expenses | | 2,224 | |

Professional Fees & Consultancy Charges | | 435 | |

Subscription & Registration Fees | | 4 | |

Other Matters | | 273 | |

Total Expenditure | | 3,040 | |

Net Earnings in Foreign Currency | | 14,417 | |

Acknowledgements

Your Directors wish to convey their appreciation to all the Company’s employees for their performance and continued support. The Directors would also like to thank all the shareholders, consultants, customers, vendors, bankers, service providers and governmental & statutory authorities for their continued support.

For and on behalf of the Board of Directors

Narendra K. Patni | Jeya Kumar |

Chairman | Chief Executive Officer |

Date: 29 April 2010

23

Table of Contents

Annexure to the Directors’ Report - Employee Stock Options Plan (‘ESOP’)

Information as on 31 December 2009

(Currency: in thousands of Indian Rupees except share data)

| | | | As of December 31, 2009 | |

(a) | | No. of options granted | | 14,635,292 | * |

(b) | | Pricing formula | | As per market price as defined in SEBI guidelines on ESOP or on face value of equity shares | |

(c) | | Options vested | | 3,069,095 | ** |

(d) | | Options exercised | | 2,973,145 | |

(e) | | The total number of shares arising as a result of exercise of option | | 2,973,145 | |

(f) | | Options lapsed | | 3,277,570 | *** |

(g) | | Variation of terms of options | | N/A | |

(h) | | Money realized by exercise of options; | | 582,630 | |

(i) | | Total number of options in force; | | 8,384,577 | |

(j) | | Employee wise details of options granted to;- | | | |

| | (I) senior managerial personnel during the year; | | Refer Table 1 | |

| | (II) any other employee who receives a grant in any one year of option amounting to 5% or more of option granted during that year. | | Refer Table 2 | |

| | (III) identified employees who were granted option, during any one year, equal to or exceeding 1% of the issued capital (excluding outstanding warrants and conversions) of the company at the time of grant; | | Refer Table 2 | |

Table 1

| Employee Name | | Equity Options Granted | |

| Jeya Kumar | | 1,850,000 | |

| Surjeet Singh | | 63,640 | |

| Ajay Chamania | | 21,710 | |

| Sunil Chitale | | 26,020 | |

| Vijay Khare | | 42,860 | |

| Satish Joshi | | 53,360 | |

| Manish Soman | | 50,000 | |

| Employee Name | | ADR Options Granted | |

| Brian Stones | | 9,250 | |

| V Mathivanan | | 50,000 | |

| Naresh Lakhanpal | | 50,000 | |

| Derek Kemp | | 20,000 | |

Table 2

| Employee Name | | Equity Options Granted | |

| Jeya Kumar | | 1,850,000 | |

(k) | | Diluted Earnings Per Share (EPS) pursuant to issue of shares on exercise of option calculated in accordance with the Accounting Standard (AS) 20 ‘Earnings per Share’ | | 41.47 | |

24

Table of Contents

| | | | As of December 31, 2009 | |

(i) | | Impact of Employee Compensation cost calculated as difference between intrinsic value and fair market value in accordance with SEBI Guidelines on ESOP | | | |

| | Profit for the year after taxation as reported | | 5,427,316 | |

| | Add Stock based employee compensation determined under the intrinsic value method | | 118,560 | |

| | Less Stock based employee compensation determined under the fair value method | | 173,614 | |

| | Pro-forma profit | | 5,372,262 | |

| | Reported earnings per equity share of Rs. 2 each | | | |

| | - Basic | | 42.32 | |

| | - Diluted | | 41.47 | |

| | Pro-forma earnings per equity share of Rs. 2 each | | | |

| | - Basic | | 41.89 | |

| | - Diluted | | 41.05 | |

(m) | | Weighted-average exercise prices and weighted-average fair values of options, for options whose exercise price equals or is less than the market price of the stock **** | | | |

| | Weighted average exercise price | - | Equity | | Rs. 202.59 | |

| | Weighted average fair value | - | Equity | | Rs. 124.96 | |

| | Weighted average exercise price | - | ADR | | | $12.36 | |

| | Weighted average fair value | - | ADR | | | $8.11 | |

(n) | | The fair value of each stock option is estimated on the date of grant using the Black Scholes option pricing model with the following assumptions for Equity linked options which are in accordance with SEBI Guidelines on ESOP | | | |

| | Dividend yield | | 1.37% - 1.78% | |

| | Weighted average dividend yield | | 1.53% | |

| | Expected life | | 3.5 - 6.5 years | |

| | Risk free interest rates | | 5.94% - 7.21% | |

| | Expected volatility | | 37.01% - 44.16% | |

| | Weighted Average Volatality | | 39.42% | |

| The price of the underlying share in market at the time of option grant |

| | Grant Date | | Price (Rs.) | |

| | March 10, 2009 | | 106 | |

| | July 6, 2009 | | 256 | |

| | August 26, 2009 | | 451 | |

| The fair value of each stock option is estimated on the date of grant using the Black Scholes option pricing model with the following assumptions for ADR linked options which are in accordance with SEBI Guidelines on ESOP | | | | |

| Dividend yield | | | 1.18%- 1.64% | |

| Weighted average dividend yield | | | 1.61% | |

| Expected life | | | 1.0 - 6.5 years | |

| Risk free interest rates | | | 0.52% - 2.96% | |

| Expected volatility | | | 42.41% - 50.79% | |

| Weighted average volatility | | | 46.65% | |

| The price of the underlying ADR in market at the time of option grant |

| | Grant Date | | Price | | |

| | January 8, 2009 | | $ | 5.50 | | |

| | July 6, 2009 | | $ | 10.59 | | |

| | August 26, 2009 | | $ | 18.40 | | |

| | November 3, 2009 | | $ | 19.35 | | |

(o) | Ratio of ADS to Equity Shares | 1 ADR = 2 Shares | | |

* Including options granted to employees, who have then seperated.

· ** Net of options lapsed.

· *** As per the plan, in the event of resignation from employment, the options lapse for individual employee. However, the said options are available to Company for reissue.

· **** For options outstanding.

25

Table of Contents

Disclosures required under Clause 12.2 of SEBI ESOP Guidelines

(Currency: in thousands of Indian Rupees except share data)

| | | | As of December 31, 2009 | |

(a) | | No. of options granted | | 2,743,400 | |

(b) | | Pricing formula | | The Company was not publicly listed as on the date of grant of stock options. The stock options were granted at the Fair Market Value as determined by an independent agency. | |

(c) | | Options vested | | 2,163,479 | ** |

(d) | | Options exercised | | 1,885,804 | |

(e) | | The total number of shares arising as a result of exercise of option | | 1,885,804 | |

(f) | | Options lapsed | | 579,921 | |

(g) | | Variation of terms of options | | N/A | |

(h) | | Money realized by exercise of options; | | 272,197 | |

(i) | | Total number of options in force; | | 277,675 | |

(j) | | Employee wise details of options granted to;- | | | |

| | (I) senior managerial personnel; | | Refer Table 1 | |

| | (II) any other employee who receives a grant in any one year of option amounting to 5% or more of option granted during that year. | | Nil | |

| | (III) identified employees who were granted option, during any one year, equal to or exceeding 1% of the issued capital (excluding outstanding warrants and conversions) of the company at the time of grant; | | Nil | |

Table 1

Employee Name | | Options Granted | |

Satish M. Joshi | | 62,000 | |

Deepak Sogani | | 52,600 | |

Sunil Chitale | | 37,200 | |

Milind S. Padalkar | | 31,700 | |

Nand Kumar S. Pradhan | | 18,000 | |

Milind Jadhav | | 19,000 | |