Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For March 21, 2012

PATNI COMPUTER SYSTEMS LIMITED

Akruti Softech Park , MIDC Cross Road No 21,

Andheri (E) , Mumbai - 400 093, India

(Exact name of registrant and address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file under assigned to the registrant in connection with Rule 12g3-2(b):

Table of Contents

“This Form 6-K contains our Annual Report for the fiscal year ended December 31, 2011, the Notice of the Annual General Meeting of the Shareholders dated January 25, 2012, and the Form of Voting Card, each of which has been mailed to holders of our Equity Shares. Also included in this Form 6-K is the Depositary’s Notice of the Annual General Meeting of Shareholders and the Form of Proxy Card, each of which have been mailed to holders of American Depositary Shares. The information contained in this Form 6-K shall not be deemed “filed” for the purposes of section 18 of the Securities Exchange Act, 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing”.

Table of Contents

Integration Story

Integration Story

A journey of a thousand miles began in January 2011 with a single step — the Integration. A year later, we take pride in the effective manner in which we have achieved the smooth and seamless integration of iGATE and Patni.

The success of our integration can be attributed to our unique, top down approach. Instead of a process that identified and chose the best from both entities, we led the way by driving the integration under the banner of a futuristic vision and mission for the combined organization, which served as the motivational force.

Customer First

Customers and Markets (C&M) is the most important activity by which integration specialists assess an integration and transformation as either a ‘success’ or ‘failure’. As the leadership team initiated the integration exercise by defining the vision, mission, values and the strategic issues of running the combined entity, a special task force simultaneously managed the practical details of customer service, daily sales operations and pipeline protects.

Key resources from both sides were identified and paired for a two-in-a-box approach, working closely with the Executive Committee for quick escalation and decision-making. This method proved highly successful as the C&M team executed a comprehensive program that included customer communication, unified account governance, detailed market analysis and field sales support.

Customer communication and relationship management was an integration priority with a focus on account stability and growth, program follow-through and executive leadership outreach. As a best practice, we over communicated with all stakeholders to ensure transparency and gain trust.

Identifying performers and creating a strong combined sales force which is aligned to the value proposition of the new combine through a well-equipped knowledge portal was given prime importance. It helped provide dedicated, optimized support for better RFP responses, adding value to our customers and the sales process.

Uninterrupted Show

Another key imperative was to instill the 22,000+ delivery professionals with the vision of the new company while managing the ongoing business. It needed to be accomplished skillfully, ensuring that there was no disruption to existing customer delivery and, in fact, exceeding customer expectations.

We utilized a blueprint for driving the execution with seven key objectives, including building trust and relationship with customers, strengthening the partner ecosystem, developing iTOPS and outcome-based opportunities, investing in innovation and establishing common process norms for the combine.

The PMO team was diligent in ensuring that the 250+ actions identified were consistently acted upon, risks were monitored and mitigated, and the leadership governance was focused on key deliverables. The teamwork demonstrated for this high level of delivery excellence was a key success factor.

Money Matters

The integration of the finance operation was critical to all aspects of the business; namely, deal structures, investor relations, vendor management and employee welfare. The top priority for the team was to create an experience of ‘one organization’ for the critical stakeholders of the combine. This was achieved

1

Table of Contents

through a synchrony of global finance teams providing a non-disruptive experience where the participants felt little or no change during the transition. Throughout, we leveraged new talents, diversity, and domain experience, meeting statutory and other important milestones along the way. Even though the Patni acquisition was one of the largest leveraged buyout deals in the IT services sector, significant cost savings were achieved through derived synergies, streamlined processes and consolidations.

One-Tech Take

The IT group was keenly aware of the pivotal role it had to play to bring the two organizations together under common platforms and processes. IT systems were to be one of the first integration touch points that employees would have experienced. Their priorities included building a common IT backbone, installing a world-class telepresence system for internal communications, and improving the social networking and collaboration platforms.

To manage the combined business more effectively, PeopleSoft 9 was made the new choice, supported by business intelligence and master data management resources. This helped create a consolidated view of human resource and other systems. Investment in advanced tools and processes at this stage is envisaged to yield further efficiency and faster growth for the business.

New Brand Speak

The Brand team’s task was to translate the merits and value of the combined parts into a common brand. The new brand identity had to come alive through a multitude of touch points. Along with aiding recall, we needed to ensure that the equity of positive synergies is communicated to all stakeholders.

The biggest challenge was to communicate the meaning of the two forces coming together. We found our answer in the power of multiplication of the talent and opportunities, and not in mere addition of these attributes. We relentlessly used a plethora of communication channels to reach out with our messages to stakeholders across both companies.

One World

The success of any integration hinges on the effective integration of people, processes and culture. The top leadership team gave strategic weightage to this aspect of integration by dedicating ample time and resources to it.

iGATE Patni quickly integrated business units and sales teams through right role allocations, harmonizing 72 people practices and processes. The company also communicated the strategic intent and vision of the integration and its benefits to employees through many focused and large scale interactive forums. While ensuring that the people integration happened at a rapid pace, adequate care was also taken to ensure that ongoing operations were not hampered as a result.

A notable outcome of the cultural assimilation has been the emergence of a new-generation work culture in the form of openness and transparency coupled with an entrepreneurial style of leadership, which is non-hierarchical and rewards individual achievement and spontaneity. The new culture has helped to highlight the significance of innovation in day-to-day work and its impact in enriching the role of every employee in the company.

Miles to Go

The biggest reward for an achievement is the achievement itself! Today, even as we look back at the integration exercise, each employee of iGATE Patni stands proud to have been part of one of the historic initiatives of our career.

It is a journey that has just begun and as we reach our first station, we are pleased with what has been accomplished and look forward to the many exciting challenges ahead.

2

Table of Contents

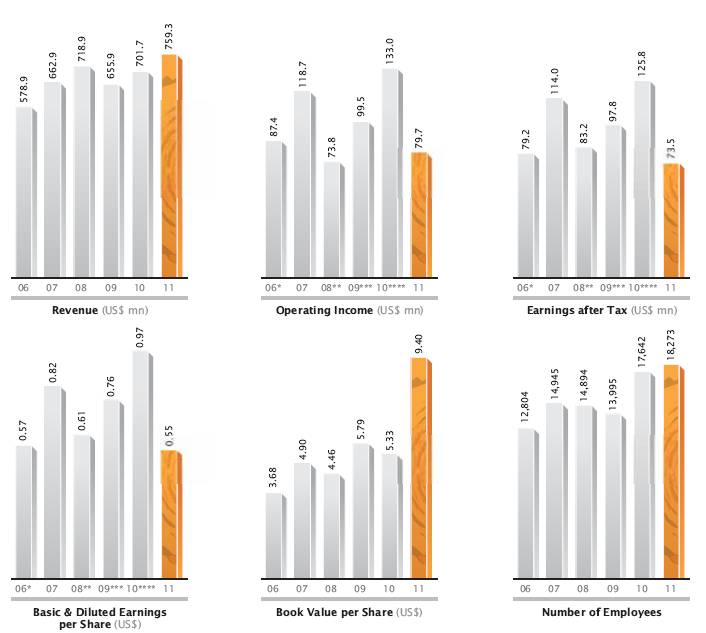

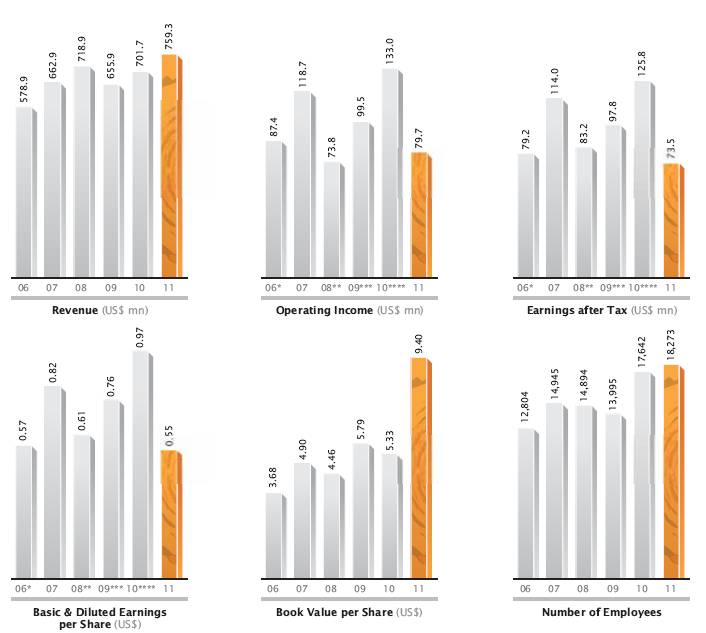

Key Performance Indicators: 2006-11

Key Performance Indicators: 2006-11

* | Excluding additional provision for prior years’ tax review by IRS and review by Department of Labor of Patni’s US operations; leading to an increase in gross profit and operating income by approximately US$ 7.0 million, and decrease in net income by US$ 19.9 million, as compared to the reported numbers. |

| |

** | Excluding reversal for prior years’ tax review by IRS of Patni US operations; leading to a decrease in gross profit and operating income by approx US$ 2.7 million, and decrease in net income by US$ 18.2 million, as compared to the reported numbers. |

| |

*** | Excluding reversal for prior years’ tax review by IRS of Patni US operations and reversal of tax positions for Patni India operations; leading to a decrease in gross profit and operating income by approx US$ 1.2 million, and a decrease in net income by US$ 22.01 million, as compared to the reported numbers. |

| |

**** | Excluding reversal for prior years’ tax position of Patni US operations leading to a decrease in net income by US$ 7.4 million, as compared to the reported numbers. |

3

Table of Contents

Letter to the Shareholders

Letter to the Shareholders

Phaneesh Murthy

Chief Executive Officer & Managing Director

Dear Shareholders,

2011 has been an eventful and a milestone year for Patni. With a change in guard of the promoters on account of its acquisition by iGATE Corp and a successful integration thereafter with iGATE, opportunities for Patni’s growth have found new vistas with a potential to differentiate based on innovation-led forward looking business models.

Acquisition and Integration

With the acquisition of Patni, we were able to immediately allay uncertainties about the company that existed amongst employees, customers and investors. On the integration front, I am particularly pleased with the smoothness which the two companies came together. While both the organizations had their dissimilarities in terms of culture, business models and market approach, we used those as an advantage and ended up creating a whole new brand that best represents the synergistic merit of both. Brand iGATE Patni now engages with Global Fortune 1000 companies to partner with them and deliver core Business Outcomes. As a visible metric, Patni’s gross margins and Adjusted EBITDA have shored up significantly over the last two quarters of 2011 confirming our successful integration efforts. Furthermore, with the shareholder and stakeholder value thoroughly preserved, our integration exercise is now referred to as an exemplary program in the M&A space within and outside the industry.

Customers and Markets

I am delighted to say that we were able to efficiently protect and grow Patni’s revenues without losing any customer due to our integration. On the other hand, several existing customers of Patni have shown keen interest to add to the existing Time and Material based work and engage with us on high impact Business Outcomes. Our focus will be to engage with Global Fortune 1000 companies mainly in Banking, Insurance, Healthcare, Manufacturing and Retail verticals. Apart from these, we will also focus on Media, Entertainment, Leisure and Travel along with Communication and Utilities as other target industries. Product Engineering Services will continue to be a high impact focus area for us, while Europe, Middle and India will be among the geographies that we expect greater growth from.

Organizational Excellence

As one of the merits of the integration, we were able to implement best practices in Quality processes across the two organizations. Some of the improvement initiatives that were introduced in Patni include “Small Steps” - a Kaizen based initiative to drive small improvements at project level and “Giant Leap” - a program level initiative to focus on big improvements that bring in tangible benefits.

Confirming to our quality standards, Patni was re-assessed at Level 5 against CMMI Version 1.2. CMMI Maturity Level 5 is the highest rating an organization can achieve and is indicative of process implementation that improves quality and provides predictable process performance.

4

Table of Contents

Patni’s paper on ‘Achieving business excellence through high maturity practices’ got accepted to be presented in the International Software Engineering Conference.

Talent Capital

I have firmly articulated that one of the key assets that we have gained as a result of the acquisition is the talent capital in Patni. While we carried out our integration across phases in the year, we ensured that we initiated an Egalitarian work culture at Patni where employees are encouraged to disagree and innovate in their respective streams of expertise. As an organization, we have been cautious not to be paternalistic and have hence adopted an adult-to-adult engagement model with our employees. We have also initiated a focused ‘fun at work’ initiative across the organization with an intent of creating employee pods of common interests and talent beyond work, and in the process, make our workplaces more exciting to be in.

We have introduced a set of five values - Citizenship, Innovation, Respect, Passion and Excellence - that defines the approach we take as we continue to delight our customers and shareholders. We are glad that Patni’s employee attrition has decreased significantly to well under 20% confirming to our best-in-class people practices. Our employee engagement programs are now focused to distill our market value proposition and our newly crafted values to all employees.

Awards and Accolades

I am pleased that our integration efforts were well complemented with achievements that were duly recognized across several areas:

· | Patni was ranked the No. 1 Healthcare R&D Service Provider in Global R&D Service Providers Rating, by Zinnov Management Consulting. |

| |

· | Zinnov Management Consulting also ranked Patni in the Leadership Zone for Overall Leading R&D Service Providers, Automotive and Computer Peripherals & Storage in its Global R&D Service Providers Rating. |

| |

· | Everest Group named us as a “Major Contender” in Finance and Accounting in its FAO Research Report 2011. |

| |

· | CHCS Services Inc., a unit of Patni that offers health and life administration services, was honored with the “Case in Point Platinum Award” for overall case management excellence across the healthcare spectrum. |

| |

· | Patni was awarded the Advanced Solutions Partner status with TIA Technology, the Copenhagen-based world leader in integrated, leading-edge standard software solutions for the global insurance industry. |

New Vision and Outlook for the Future

To deliver increased value to our stakeholders, we have crafted a new vision “to change the rules of the game and deliver high-impact outcomes in a new technology enabled world.” We would now like to continue the good work beyond the integration and ensure that the company delivers increased value to all its stakeholders. We will continue to focus on outcomes based engagements and in the journey, earning respect as one of the top three employers in all the talent markets we operate.

With Patni’s scale of operations and micro-vertical focus meeting the innovative Business Outcomes-based positioning as the result of a successful integration, we now have the foundation to build a special and an exciting company that wins the admiration of peers and competition alike and that bodes for an exciting future.

/s/ Phaneesh Murthy | |

Phaneesh Murthy | |

23 Feb, 2012 | |

Mumbai | |

5

Table of Contents

Directors’ Report

Directors’ Report

To,

The Members,

PATNI COMPUTER SYSTEMS LIMITED

Your Directors have pleasure in presenting their Thirty fourth Annual Report together with Audited statements of Accounts for the year ended 31 December 2011.

Financial Results

| | 31 Dec 2011

( in million) in million) | | 31 Dec 2010

( in million) in million) | |

Sales | | 21,517 | | 18,913 | |

Resulting in Profit Before Tax | | 5,940 | | 7,155 | |

Profit After Tax | | 4,998 | | 6,551 | |

Profit available for appropriation after adding to it Previous Year’s Brought Forward | | 21,167 | | 26,441 | |

Appropriated as under: | | | | | |

Adjustment on account of employee benefits | | | | | |

Transfer to General Reserve | | — | | 655 | |

Final Proposed Dividend on Equity Shares @ Nil (Previous Year 150%) | | — | | 2 | |

Special Interim Dividend on Equity Shares @ Nil (Previous Year 3150%) | | — | | 8,244 | |

Corporate Tax on above Dividend | | — | | 1,370 | |

Balance Carried to Balance Sheet | | 21,167 | | 16,170 | |

Business Performance

The performance of your Company during the year under report has shown improvement over the previous year. Total revenue for the year ended 31 December 2011 amounted to  21,517 million as against

21,517 million as against  18,913 million for the corresponding period last year, registering a growth of about 14%. The Company has posted the Net Profits after tax to

18,913 million for the corresponding period last year, registering a growth of about 14%. The Company has posted the Net Profits after tax to  4,998 million as compared to

4,998 million as compared to  6,551 million for the corresponding period last year, registering a decline of about 24% for the year ended 31 December 2011. Even on consolidated basis, revenues were increased in the current year 2011 by 12% to

6,551 million for the corresponding period last year, registering a decline of about 24% for the year ended 31 December 2011. Even on consolidated basis, revenues were increased in the current year 2011 by 12% to  35,679 million from

35,679 million from  31,881 million in 2010.The net income decreased by 36%.

31,881 million in 2010.The net income decreased by 36%.

Dividend

With a view to conserve the resources for the proposed facility and infrastructure expansion, your Directors do not recommend any dividend for the year 2011.

Business Overview

Your Company is a worldwide outsourcing provider of integrated end-to-end offshore centric information technology (“IT”) and IT-enabled operations solutions and services. The Company delivers a comprehensive range of IT services through globally integrated onsite and offshore delivery locations primarily in India. Your Company offers its services to customers through industry focused practices, including insurance and healthcare (“IHC”), manufacturing, retail and logistics (“MRDL”), banking and financial services (“BFS”), communications and utilities (“CEU”), and media and entertainment (“MELT”) and through technology focused practices. IT services include application development, application maintenance and support, verification and validation, enterprise application solutions, business intelligence and data warehousing (“BI & DW”), packaged software implementation, infrastructure management services, quality assurance services and product engineering services. IT-enabled services include business process outsourcing (“BPO”), transaction processing services and customer interaction services (“CIS”).

On 12 May 2011, iGATE through its wholly owned subsidiaries acquired 82.4% of the outstanding shares of the Company. The acquisition by iGATE combined two highly recognized IT services and outsourcing companies with complementary industry verticals for the purpose of facilitating sustained long-term growth and to strengthen their competitive position as a top-tier company in the highly-fragmented global IT industry. iGATE’s strategy is to utilize your Company’s expanded pool of talent, diverse expertise across multiple verticals, higher level of strategic end-to-end service offerings and established management team to enable iGATE in offering differentiated solution sets in developing and maintaining long-term client relationships with a diversified client basis that spans different industry verticals.

8

Table of Contents

Post acquisition, the internal management of the consolidated entities — iGATE and Patni were restructured such that there were primarily two major segments in the consolidated company — (i) iGATE Corporation (and its subsidiaries other than Patni) and; (ii) Patni. The internal restructuring also included a restructuring of the Board of Directors of your Company.

Your Company offers services in an integrated manner to customers who belong to different industry verticals namely insurance and healthcare, manufacturing, retail and logistics, banking and financial services, communications and utilities, and media and entertainment. Your Company’s operations are located in twenty seven countries.

Through a blended strategy of “offerings tailored to customers’ and market needs” referred to as “outside-in approach” for problem-solving, experimenting and innovating business and technology platforms, your Company achieves results efficiently through rapid improvement and automation, resulting in reduced cycle times and costs over a period of time. Accountability for results towards aligned goals requires your Company to continuously measure its progress against the goals, thus enabling it to deliver significant benefits to its customers along with a lower risk profile.

Your Company has a track record of successfully developing and managing large, long-term client relationships with some of the world’s largest and best known companies. As of 31 December 2011, your Company’s customer base was 280 clients. Several of the Company’s key executives are located in its client geographies to better develop and maintain client relationships at senior levels. Repeat business accounted for 98.6%, 94.6% and 94.0% of your Company’s revenues in 2011, 2010 and 2009.

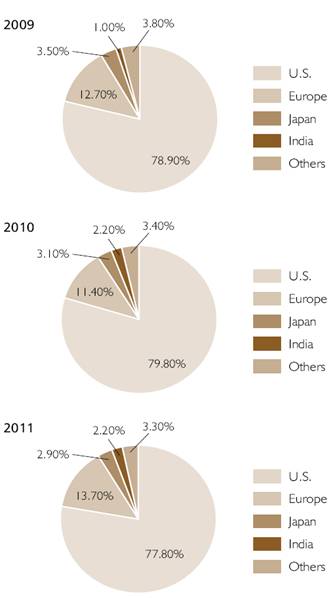

Your Company’s revenues have grown from $655.9 million in 2009 to $759.3 million in 2011, representing a CAGR of 7.6%. As of 31 December 2011, your Company’s total number of employees were around 18,000. Your Company has invested in new high-tech facilities, which it refers to as “knowledge parks”, designed for expanding our operations and training our employees. Your Company has 130 sales and marketing personnel supported by dedicated industry specialists in 25 sales offices around the globe, including North America, Europe, Japan and the rest of the Asia-Pacific region.

Global Delivery Model

Global demand for high quality, lower cost IT and IT-enabled services has created a significant opportunity for your Company, which it uses to successfully leverage the benefits of, and address the challenges in using, an offshore talent pool. Your Company’s effective use of offshore personnel offers a variety of benefits, including lower costs, faster delivery of new IT solutions and innovations in vertical solutions, processes and technologies.

Your Company has adopted a global delivery model for providing services to its clients. Your Company’s global delivery model includes on-site and offshore teams. Your Company has offshore development centers located in Bangalore, Hyderabad, Chennai, Noida, Mumbai, Pune and Gandhinagar in India and has global development centers located in Australia, Mexico, Canada, the United States, China, Singapore and India. The centers can deliver both onsite and offshore services, depending on client location and preferences.

IT services that your Company delivers using its offshore centers include software application development and maintenance, implementation and support of enterprise applications, package evaluation and implementation, re-engineering, data warehousing, business intelligence, analytics, data management and integration, software testing and IT infrastructure management services. Your Company believes that it delivers high quality solutions to its clients at substantial savings by using its global pool of highly talented people.

IT-enabled operations offshore outsourcing solutions and services that your Company offers include BPO, transaction processing services and call center services. BPO services are offered to clients that are looking to achieve converged IT and BPO solutions. The transaction processing services offered are focused on the mortgage banking, financial services, insurance and capital market industries, except for the delivery of finance and accounting functions such as accounts payable which can be performed for clients across all industries. The call center services are offered to clients in several industries and are not industry specific.

Industry Practices, Technology Practices and IT Services

Your Company offers its services to customers through industry practices in insurance and healthcare, manufacturing, retail and logistics, banking and financial services, communications and utilities, and media and entertainment. Your Company also has technology practices that offer services in product engineering and product design. Your Company’s industry practices and technology practices are complemented by its IT services, which it develops in response to client requirements and technology life cycles. The Company’s service lines include application development, application maintenance and support, verification and validation, enterprise application solutions, business intelligence and data warehousing, customer interaction services and BPO, infrastructure management services and quality assurance services.

Sales and Marketing

Your Company’s sales teams use a multi pronged approach to market our services. They target certain industries and service lines through focused sales executives, geographies through regional sales executives and large clients through dedicated account managers. Your Company has aligned a majority of its sales and marketing teams to focus on specific industries and geographies. In addition to its sales executives, Your Company has industry experts and solution architects who complement its sales efforts by providing specific industry and service line expertise.

Your Company’s senior management and dedicated account managers are actively involved in managing client relationships and business development through targeted interaction

9

Table of Contents

with multiple contacts throughout its clients’ organizations. Your Company aims to develop its client relationships into partnerships by working closely with its clients’ managers and senior executives to formulate and execute an offshore outsourcing strategy, implement engagement models that suit their particular challenges and explore new service lines.

Your Company undertakes detailed periodic reviews to identify existing and prospective clients that it believes can develop into large, strategic clients. Your Company intends to focus on adding more strategic accounts, which it defines as those who provide $5.0 million or more in annual revenues or those with whom it believes it has the potential to achieve such annual revenue amounts over a 24 to 30 month period. For each strategic client, a senior executive is identified and charged with managing the overall client relationship and leading periodic reviews with the client.

Your Company has 25 sales offices across North America, Europe, Japan and the rest of the Asia-Pacific region and 130 sales and marketing personnel who are supported by dedicated industry specialists. Your Company sets targets for its sales personnel at the beginning of each year, which are subject to periodic reviews. In addition to a base salary, the Company’s compensation package for sales personnel includes an incentive based compensation plan driven by achievement of the prescribed sales targets.

Human Resources

Your Company strongly believes that it ability to maintain and continue its growth depends to a large extent on its strength in attracting, developing, motivating and retaining the talent. Your Company operates in seven major cities in India, which enables it to recruit technology professionals from different parts of the country. The key elements of your Company’s human resource management strategy include Talent Acquisition, learning and development, rewards and retention.

None of your Company’s employees are represented by a union.

Your Company employed around 18,000, 17,600 and 14,000 employees as of 31 December 2011, 2010 and 2009, respectively. Out of 18,000 employees, around 17,000 were software professionals as of 31 December 2011. Of these software professionals, around 3,000 employees were categorized as onsite and 14,000 as offshore. The geographic breakdown for your Company’s employees as of 31 December 2011 was as follows:

Geography | | Number of Employees

(rounded off) | |

India | | 14,900 | |

North America | | 2,500 | |

Rest of the World | | 600 | |

Total | | 18,000 | |

Centers of Excellence

Your Company is developing internal “centers of excellence” to create expertise in emerging technologies. Your Company is working on centers of excellence that focus on next generation technologies which includes Web 2.0 and Web 3.0 specification, mobility solutions for ease of access to application, Anywhere secured access to data and in areas of Business Intelligence. Your Company partners with leading technology vendors such as Microsoft, HP, IBM and Oracle to implement these technologies.

Facility Expansion

A key component of your Company’s global delivery model is the telecommunication linkages between client sites and its sites and between its distributed sites in India. Your Company has designed a global network architecture which provides client connectivity, offshore development center connectivity and internet connectivity. This network provides seamless access and uses high availability networks and advanced routing protocols for redundancy and availability. Although your Company relies on third parties, such as telecommunications providers and internet service providers to provide such services, your Company ensures that it has multiple service providers using multiple routes and media to attain high levels of redundancy, availability and performance. Your Company has dedicated teams to monitor the operations of its network operations 24 hours a day and seven days a week. Your Company uses encryption techniques for confidentiality of data as required.

Your Company’s principal executive offices are located at Mumbai, India. Your Company’s North American headquarters are located in Cambridge, Massachusetts. These facilities are used primarily for management functions and support functions such as sales, marketing and general administration.

Your Company has state-of-the-art facilities in nine locations in India where its technical staff is located and which serve as its primary delivery centers. Your Company also has imaging centers and distribution centers in the United States and in the United Kingdom for handling the digital processing of documents.

Your Company currently has capacity for approximately 17,000 professionals at these facilities. As of 31 December 2011, your Company had used approximately 83% of its existing office space in its operations.

Most of your Company’s global branch offices located outside of India are used for sales and marketing.

Your Company has 25 sales and marketing offices located in the U.S.A, Canada, India, Australia, China, Japan, Singapore, Malaysia, Germany, Mexico, Czech Republic, Indonesia, Sweden, Switzerland, Belgium, the Netherlands, the U.K, Finland, U.A.E., South Korea, South Africa, Turkey, Italy, Ireland and Romania.

10

Table of Contents

Your Company operates through its facilities located in various parts of India. In the recent past your Company has acquired facilities to support its growth. In keeping with its plans for expansion, your Company has constructed new facilities in India, which includes three knowledge parks in Chennai, Navi Mumbai and Noida. These knowledge parks have state-of-the-art infrastructure with extensive workspace and training facilities and a modular design for ease of segregation of dedicated projects with the ability to provide scale and service to clients from one location.

Your Company’s Noida Knowledge Park was awarded the prestigious LEED Platinum (Leadership in Energy and Environmental Design) rating jointly by the U.S Green Building Council and the Indian Green Building Council for the Company’s Green IT-BPO Centre. This makes your Company’s Knowledge Park the second largest Platinum rated building in the world, and the largest Platinum rated building outside the United States.

Phase I of the Navi Mumbai facility, with a capacity of 4,300 seats, is complete and occupied. Phase I of the Chennai facility, with a capacity of 1,200 seats, is complete and partially occupied. Construction of the Noida SEZ facility with capacity to accommodate 3,300 seats is completed and is partially occupied. The Navi Mumbai, Chennai and Noida facilities are expected to accommodate up to 14,000, 10,000 and 3,300 engineers, respectively when fully completed.

In continuation of its policy to have its own campus operations, your Company has acquired land in Pune, Hyderabad and Kolkata in addition to its campuses in Mumbai, Chennai and Noida. These facilities when fully built, are expected to have a seating capacity for approximately 25,000 professionals.

As of 31 December 2011, your Company had spent approximately $ 101.3 million on the knowledge parks.

Your Company announced a Capital outlay of $120 million over a period of three years, of which $102 million relates to building a residential training facility in Pune along with a 5,000 member capacity delivery center and campus expansion in Mumbai.

Quality and Project Management

While quality always has been an integral part of your Company’s operations, your Company became formally certified and assessed for quality models in 1995. Your Company started with ISO 9000-1994, underwent SEI-CMM level 4 and 5 assessments and as of today is ISO 9001-2000 certified and are assessed for P-CMM Level 3 and SEI-CMMi Level 5. In the last year, your Company also got reassessed for CMMI Level 5 against version 1.2. ISO 9001 is an international standard for quality management systems maintained by the International Organization for Standardization. The Capability Maturity Model (CMM) is a method for evaluating the quality of a company’s management and software engineering practices, with Level 5 being the highest attainable certification. The CMM was developed by the Software Engineering Institute (SEI) at Carnegie Mellon University. The Software Engineering Institute subsequently released a revised version known as the Capability Maturity Model Integration (CMMi). Your Company has been using the Six Sigma Program to implement process changes including the above. Your Company continuously strives to better its quality management system with the help of industry best practices and research findings. Your Company’s quality management system involves the review and continuous improvement of software development and related processes, testing of work products and regular internal and external quality audits. Your Company applies sophisticated project management and solution deployment methodologies that it has developed to help ensure timely, consistent and accurate delivery of IT solutions to its clients.

In 2011, your Company has received the following recognitions:

· iGATE Patni won the ‘Golden Peacock’ National Quality Award — 2011

· iGATE Patni’s IT and Business Enabling functions in Bangalore were successfully appraised and rated at People CMM® maturity level 5.

· iGATE Patni’s Employee Engagement initiative ‘Thank God It’s Monday’ entered the Limca Book of Records for running a corporate music show every Monday, for five consecutive years.

Patni ESOP 2003 (Revised 2009)

Your Company had introduced the Employees Stock Option Plan known as ‘Patni ESOP 2003’. The Plan is being administered by the Compensation and Remuneration Committee of Directors constituted as per SEBI Guidelines. The details of Options granted under the Plan are given in the Annexure to this Report.

Subsidiary Companies

The Company has wholly owned subsidiaries viz. Patni Americas, Inc., Patni Computer Systems (UK) Limited, Patni Computer Systems GmbH, PCS Computer Systems Mexico, SA de CV and Patni (Singapore) Pte. Ltd.

Patni Telecom Solutions, Inc. and CHCS Services Inc. are the subsidiaries of Patni Americas, Inc., one of the Company’s main subsidiaries.

Patni Telecom Solutions (P) Limited and Patni Telecom Solutions (UK) Limited are subsidiaries of Patni Telecom Solutions, Inc.

Patni Computer Systems (Czech) s.r.o. is the subsidiary of Patni Computer Systems (UK) Limited.

Patni Computer Systems Japan Inc, Patni Computer Systems (Suzhou) Co.Ltd., Patni Computer Systems (Dalian) Co, Ltd. and Patni Computer Systems Indonesia are owned through Patni (Singapore) Pte. Ltd., one of the Company’s main subsidiaries.

In view of the above and by virtue of Section 4 of the Companies Act, 1956 the Company has following subsidiaries (Collectively to be referred as “Subsidiary Companies”) i)

11

Table of Contents

Patni Americas, Inc.; ii) Patni Computer Systems (UK) Limited; iii) Patni Computer Systems GmbH; iv) PCS Computer Systems Mexico, SA de CV; v) Patni (Singapore) Pte. Ltd.; vi) Patni Telecom Solutions, Inc.; vii) CHCS Services Inc.; viii) Patni Telecom Solutions (P) Limited; ix) Patni Telecom Solutions (UK) Limited; x) Patni Computer Systems (Czech) s.r.o.; xi) Patni Computer Systems Japan Inc.; xii) Patni Computer Systems (Suzhou) Co., Ltd.; xiii) Patni Computer Systems (Dalian) Co., Ltd.; and xiv) Patni Computer Systems Indonesia.

The Company has been granted a general exemption for the year ended 31 December 2011 by the Ministry of Corporate Affairs from attaching to its Balance Sheet, the individual Annual Reports of each of its Subsidiary Companies. A statement containing brief financial details of the Company’s subsidiaries for the year ended 31 December 2011 is included in the Annual Report. The annual accounts of Subsidiary Companies and the related detailed information will be made available to any member of the Company / its Subsidiary Companies seeking such information at any point of time and are also available for inspection by any member of the Company / its Subsidiary Companies at the Registered Office of the Company.

Reconstitution of the Board

In accordance with the requirements of the Companies Act, 1956 and Articles of Association of the Company, Mr. Shashank Singh and Mr. Göran Lindahl are liable to retire and eligible for reappointment in the forthcoming Annual General Meeting.

Corporate Developments

Your Company had received a letter dated 11 November 2011 from Pan - Asia iGATE Solutions and iGATE Global Solutions Limited (Collectively “the Promoters”), expressing their intention to initiate the process to acquire the Shares held by the public shareholders of the Company by providing an exit opportunity in accordance with the Securities and Exchange Board of India (Delisting of Equity Shares) Regulations, 2009 (as amended) (“Delisting Regulations”), and all other applicable regulations in order to voluntarily delist the Company’s Shares from the Indian Stock Exchanges and the American Depository Shares (“ADSs”) from the New York Stock Exchange (“NYSE”) (“Delisting Proposal”).

On 16 November 2011, the Board of Directors of the Company had granted its approval to the said Delisting Proposal and sought the approval of the shareholders of the Company through postal ballot in terms of the Delisting Regulations after complying with the SEBI and the U.S. Securities Exchange Commission requirements, if any.

Your Company, vide Postal Ballot Notice dated 5 December 2011, had sought the consent of its Members to a delisting proposal received from the Promoters to voluntarily delist the equity shares of the Company from the Indian Stock Exchanges and ADSs from NYSE, USA. Special Resolution contained in the said Postal Ballot Notice was duly passed by the requisite majority as required under the Companies Act, 1956 and Delisting Regulations. The Promoters may make a public announcement of a Delisting offer in accordance with the Delisting Regulations within a period of one year from the date of the above-mentioned special resolution.

Corporate Governance

Your Company follows the principles of the effective corporate governance practices. The Clause 49 of the Listing Agreement deals with the Corporate Governance requirements with which every publicly listed Company is required to comply with. The Company has taken steps to comply with the requirements of revised Clause 49 of the Listing Agreement with the Stock Exchanges.

A separate section on Corporate Governance forming part of the Directors’ Report and certificate from the Company’s Auditors confirming the compliance of conditions on Corporate Governance as stipulated in Clause 49 of the Listing Agreement is included in the Annual Report.

Particulars of Employees

Particulars of employees as required under the provisions of Section 217 (2A) of the Companies Act, 1956 read with the Companies (Particulars of Employees) Rules, 1975, as amended, forms part of this Report. However, in pursuance of Section 219(1)(b)(iv) of the Companies Act, 1956, this Report is sent to all the Members of the Company excluding the aforesaid information and the said particulars are made available at the registered office of the Company. The members desirous of obtaining such particulars may write to the Company Secretary at the registered office of the Company.

Fixed Deposits

Your Company has not accepted any fixed deposits from the public. As such, no amount of principal or interest is outstanding as of the balance sheet date.

Auditors

M/s. S.R. Batliboi & Associates, Chartered Accountants, the present statutory auditors of the Company holds office until the conclusion of the ensuing Annual General Meeting. M/s. S.R. Batliboi & Associates, under Section 224(1) of the Companies Act, 1956, have furnished the certificate of their eligibility for appointment.

Directors’ Responsibility Statement

Pursuant to Section 217(2AA) of the Companies Act, 1956, the Directors, based on the representation received from the Operating Management, confirm that:-

(a) in the preparation of the annual accounts, the accounting standards have been followed and that there is no material departure;

12

Table of Contents

(b) they, in selection of accounting policies, have consulted the Statutory Auditors and have applied them consistently and made judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company as at 31 December 2011 and the Profit of the Company for the period 1 January 2011 to 31 December 2011;

(c) they have taken proper and sufficient care, to their best of knowledge and ability, for the maintenance of adequate accounting records in accordance with the provisions of the Companies Act, 1956 for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities; and

(d) they have prepared the annual accounts on a going concern basis.

Conservation of Energy, Technology Absorption and Foreign Exchange Earnings/Outgo:

A) Conservation of Energy

Your Company consumes electricity mainly for the operation of its computers. Though the consumption of electricity is negligible as compared to the total turnover of the Company, your Company has taken effective steps at every stage to reduce consumption of electricity.

B) Technology Absorption

This is not applicable to your Company as it has not purchased or acquired any Technology for development of software from any outside party.

C) Foreign Exchange Earnings/Outgo

| | 31 Dec 2011

( in million) in million) | |

Earnings in Foreign Currency on account of: | | | |

Export Sale | | 21,133 | |

Others | | 46 | |

Total Earnings | | 21,179 | |

Expenditure in Foreign Currency on account of: | | | |

Travelling Expenses | | 264 | |

Overseas Employment Expenses | | 4,381 | |

Professional Fees & Consultancy Charges | | 286 | |

Subscription & Registration Fees | | 5 | |

Other Matters | | 156 | |

Total Expenditure | | 5,092 | |

Net Earnings in Foreign Currency | | 16,087 | |

Acknowledgements

Your Directors wish to convey their appreciation to all the Company’s employees for their performance and continued support. The Directors would also like to thank all the shareholders, consultants, customers, vendors, bankers, service providers and governmental & statutory authorities for their continued support.

For and on behalf of the Board of Directors

| Jai S Pathak | Phaneesh Murthy |

| Chairman | CEO & MD |

Date: 25 January 2012

13

Table of Contents

Annexure to the Directors’ Report: Employee Stock Options Plan (‘ESOP’)

Information as on 31 December 2011

(Currency: in thousands of Indian Rupees except share data)

| | | | As of 31 December 2011 | |

(a) | | No. of options granted | | 15,759,482 | * |

(b) | | Pricing formula | | As per market price as defined in SEBI guidelines on ESOP or on face value of equity shares | |

(c) | | Options vested | | 2,170,621 | ** |

(d) | | Options exercised | | 8,302,666 | |

(e) | | The total number of shares arising as a result of exercise of option | | 8,302,666 | |

(f) | | Options lapsed | | 5,012,320 | *** |

(g) | | Variation of terms of options | | N/A | |

(h) | | Money realized by exercise of options; | | 1,284,262 | |

(i) | | Total number of options in force; | | 2,444,496 | |

(j) | | Employee wise details of options granted during the year to:- | | | |

| | (I) | senior managerial personnel during the year; | | NIL | |

| | (II) | any other employee who receives a grant in any one year of option amounting to 5% or more of option granted during that year. | | NIL | |

| | (III) | identified employees who were granted option, during any one year, equal to or exceeding 1% of the issued capital (excluding outstanding warrants and conversions) of the Company at the time of grant; | | NIL | |

(k) | | diluted Earnings Per Share (EPS) pursuant to issue of shares on exercise of option calculated in accordance with the Accounting Standard (AS) 20 ‘Earnings per Share’ | | 29.58 | |

(l) | | Impact of Employee Compensation cost calculated as difference between intrinsic value and fair market value in accordance with SEBI Guidelines on ESOP | | | |

| | Profit for the year after taxation as reported | | 4,014,571 | |

| | Add: Stock based employee compensation deteremined under the intrinsic value method | | 249,067 | |

| | Less: Stock based employee compensation deteremined under the fair value method | | 227,004 | |

| | Pro-forma profit | | 4,036,634 | |

| | Reported earnings per equity share of  2 each 2 each | | | |

| | - Basic | | 30.07 | |

| | - Diluted | | 29.58 | |

| | Pro-forma earnings per equity share of  2 each 2 each | | | |

| | - Basic | | 30.23 | |

| | - Diluted | | 29.75 | |

(m) | | Weighted-average exercise prices and weighted-average fair values of options, for options whose exercise price equals or is less than the market price of the stock **** | | | |

| | Weighted average exercise price - Equity | | 165.15 | |

| | Weighted average fair value - Equity | | 155.89 | |

| | Weighted average exercise price - ADR | | $ | 0.08 | |

| | Weighted average fair value - ADR | | $ | 18.27 | |

14

Table of Contents

(Currency: in thousands of Indian Rupees except share data)

| | | | As of 31 December 2011 | |

(n) | | The fair value of each stock option is estimated on the date of grant using the Black Scholes option pricing model with the following assumptions for Equity linked options which are in accordance with SEBI Guidelines on ESOP | | | |

| | Dividend yield | | 0.67 | % |

| | Weighted average dividend yield | | 0.67 | % |

| | Expected life | | 3.5 - 5.5 years | |

| | Risk free interest rates | | 8.29% - 8.37 | % |

| | Expected Volatility | | 38.47% - 39.13 | % |

| | Weighted Average Volatality | | 38.84 | % |

| | | | | |

| | The price of the underlying share in market at the time of option grant | | Grant Date | | Price ( ) ) | |

| | | | 29 June 2011 | | 329.55 | |

| | The fair value of each stock option is estimated on the date of grant using the Black Scholes option pricing model with the following assumptions for ADR linked options which are in accordance with SEBI Guidelines on ESOP | | | | | |

| | Dividend yield | | 0.68 | % | | |

| | Weighted average dividend yield | | 0.68 | % | | |

| | Expected life | | 3.5 - 5.5 years | | | |

| | Risk free interest rates | | 0.58% - 1.15 | % | | |

| | Expected Volatility | | 38.27% - 40.64 | % | | |

| | Weighted average volatility | | 39.71 | % | | |

| | | | | | | | | |

| | The price of the underlying ADR in market at the time of option grant | | Grant Date | | Price ($) | |

| | | | 19 October 2011 | | 13.49 | |

(o) | | Ratio of ADS to Equity Shares | | 1 ADR = 2 Shares | | | |

* | | Including options granted to employees, who have seperated. |

** | | Net of options lapsed. |

*** | | As per the plan, in the event of resignation from employment, the options lapse for individual employee. However, the said options are available to Company for reissue. |

**** | | For options outstanding. |

15

Table of Contents

Corporate Governance Report

Your Company has complied, in all material respects, with features of Corporate Governance Code as per Clause 49 of the Listing Agreement with the Stock Exchanges.

A report on the implementation of the Corporate Governance Code of the Listing Agreement by the Company is furnished below.

Philosophy on Corporate Governance

A good corporate governance process aims to achieve balance between shareholders’ interest and corporate goals by providing long-term vision of its business and establishing systems that help the Board in understanding and monitoring risk at every stage of the corporate evolution process to enhance the trust and confidence of the stakeholder without compromising with laws and regulations.

The Company’s philosophy on corporate governance encompasses achieving balance between individual interests and corporate goals through the efficient conduct of its business and meeting its stakeholder obligations in a manner that is guided by transparency, accountability and integrity. Accountability improves decision-making and transparency helps to explain the rationale behind decisions and to build stakeholder confidence.

At Patni Computer Systems Limited, we strive towards excellence through adoption of best governance and disclosure practices.

A. Board of Directors

1. Composition of directors

The Board of Directors of the Company (“the Board”) has an optimum combination of executive and non-executive directors, which is in conformity with the requirements of Clause 49 of the Listing Agreement with the Stock Exchanges (“Listing Agreement”) in this regard. The Chairman of the Board is a Non-executive Independent Director. In order to ensure the independence of the Board, 50% of the Board is comprised of Independent Directors.

The relevant details in respect of the composition of the Board are furnished below.

Name of the director | | Position/Category | | Number of directorships in other companies* | |

Mr. Jai S Pathak | | Chairman (Independent Director) | | 2 | |

Mr. Phaneesh Murthy | | Chief Executive Officer & Managing Director | | 7 | |

Mr. Göran Lindahl | | Non-executive Director | | 5 | |

Mr. Shashank Singh | | Non-executive Director | | 1 | |

Mr. Arun Duggal | | Independent Director | | 12 | |

Mr. Vimal Bhandari | | Independent Director | | 8 | |

* This includes directorships held in public limited companies, foreign companies and subsidiaries of public limited companies but excludes directorships held in private limited companies.

Changes in composition of the Board during the year ended 31 December 2011

· Pan-Asia iGATE Solutions and iGATE Global Solutions Limited (jointly referred to as the “Acquirers”), alongwith iGATE Corporation as the person acting in concert (“PAC”), acquired 63% of the then equity share capital of the Company from Mr. Narendra K Patni, Mr. Gajendra K Patni and Mr. Ashok K Patni along with their respective relatives (the “Previous Promoter Group”) and M/s. General Atlantic Mauritius Limited (“PE Investor”) and further 20% from public shareholders of the Company by way of mandatory tender offer in accordance with Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 1997 at a price of  503.50 per share (collectively referred as “Acquisition Transaction”). Pursuant to the said Acquisition Transaction, Mr. Phaneesh Murthy was appointed as a Director (not liable to retire by rotation) and Mr. Shashank Singh was appointed as Director (liable to retire by rotation) w.e.f. 8 February 2011.

503.50 per share (collectively referred as “Acquisition Transaction”). Pursuant to the said Acquisition Transaction, Mr. Phaneesh Murthy was appointed as a Director (not liable to retire by rotation) and Mr. Shashank Singh was appointed as Director (liable to retire by rotation) w.e.f. 8 February 2011.

· Mr. Jai S Pathak and Mr. Göran Lindahl were appointed as Directors (liable to retire by rotation) w.e.f. 12 May 2011.

· Mr. Gajendra K Patni and Mr. William O Grabe resigned as Directors of the Company w.e.f. 8 February 2011. While, Mr. Narendra K Patni, Mr. Ashok K Patni, Mr. Pradip Shah, Mr. Ramesh Venkateswaran, Mr. Louis Theodoor van den Boog, Dr. Michael A Cusumano, Mr. Pradip Baijal and Mr. Jeya Kumar also resigned as Directors w.e.f. 12 May 2011.

· Mr. Arun Duggal and Mr. Vimal Bhandari were subsequently re-appointed as Directors (liable to retire by rotation) at the Annual General Meeting held on 29 June 2011.

16

Table of Contents

2. Number of Board Committees of the Company and of other companies on which directors are Member or Chairman.

| | | | | | Number of board | | Number of board | |

| | Number of board | | Number of board | | committees of other | | committees of other | |

| | committees on | | committees on | | companies on which | | companies on which | |

Name of the director | | which Chairman | | which Member | | Chairman | | Member | |

Mr. Jai S Pathak* | | — | | 2 | | — | | 1 | |

Mr. Phaneesh Murthy | | — | | — | | — | | 1 | |

Mr. Göran Lindahl | | — | | — | | — | | — | |

Mr. Shashank Singh** | | 1 | | — | | — | | — | |

Mr. Arun Duggal# | | 1 | | — | | 1 | | 2 | |

Mr. Vimal Bhandari# | | — | | 2 | | 3 | | 2 | |

Mr. Narendra K Patni@ | | — | | — | | NA | | NA | |

Mr. Jeya Kumar@ | | — | | — | | NA | | NA | |

Mr. Ashok K Patni@ | | — | | — | | NA | | NA | |

Mr. Louis Theodoor van den Boog@ | | — | | 1 | | NA | | NA | |

Mr. Pradip Shah@ | | 1 | | — | | NA | | NA | |

Mr. Ramesh Venkateswaran@ | | — | | — | | NA | | NA | |

Dr. Michael A Cusumano@ | | — | | — | | NA | | NA | |

Mr. Pradip Baijal@ | | 1 | | — | | NA | | NA | |

Mr. Gajendra K Patni@ | | — | | — | | NA | | NA | |

Mr. William O Grabe@ | | — | | 1 | | NA | | NA | |

NA — Not Applicable

@ Resigned during the year.

* Mr. Jai S Pathak was inducted as a Member of Audit Committee and Shareholders’/Investors’ Grievance Committee w.e.f. 12 May 2011.

** Mr. Shashank Singh was inducted as the Chairman of the Shareholders’/Investors’ Grievance Committee Meeting w.e.f.12 May 2011.

* Mr. Arun Duggal was inducted as the Chairman of the Audit Committee and Mr. Vimal Bhandari was inducted as a member of the Shareholders’/Investors’ Grievance Committee w.e.f. 12 May 2011.

Note: (As required under the Listing Agreement)

1. For the purpose of considering the limit of the committees on which a director can serve, all public limited companies, whether listed or not, have been included and all other companies including private limited companies, foreign companies and companies under Section 25 of the Companies Act have been excluded.

2. For the purpose of considering the limit on memberships of the committees, the Audit Committee and the Shareholders’/ Investors’ grievance committee alone are considered.

3. Number of board meetings held and the dates on which such meetings were held:

Nine board meetings were held during the year ended 31 December 2011 with a time gap of not more than four months between any two meetings and the required information as stipulated under Clause 49 of the Listing Agreement was made available to the members of the Board. The dates of such board meetings were 3 January 2011, 10 January 2011, 8-9 February 2011, 26-27 April 2011, 12 May 2011, 29 June 2011, 25 July 2011, 18 October 2011 and 16 November 2011.

17

Table of Contents

4. Attendance of each present director at the board meetings and the last AGM

Name of the director | | Total board meetings

held during tenure | | Attended in

person | | Attended through

video/tele conference | | Annual general meeting

on 29 June 2011 | |

Mr. Jai S Pathak | | 5 | | 4 | | 1 | | Ö | |

Mr. Phaneesh Murthy | | 7 | | 5 | | 2 | | Ö | |

Mr. Göran Lindahl | | 5 | | 3 | | — | | Ö | |

Mr. Shashank Singh | | 7 | | 7 | | — | | Ö | |

Mr. Arun Duggal | | 9 | | 9 | | — | | Ö | |

Mr. Vimal Bhandari | | 9 | | 9 | | — | | Ö | |

Mr. Pradip Shah@ | | 5 | | 4 | | — | | NA | |

Mr. Narendra K Patni@ | | 5 | | 5 | | — | | NA | |

Mr. Jeya Kumar@ | | 5 | | 5 | | — | | NA | |

Mr. Ashok K Patni@ | | 5 | | 5 | | — | | NA | |

Mr. Ramesh Venkateswaran@ | | 5 | | 3 | | — | | NA | |

Mr. Pradip Baijal@ | | 5 | | 3 | | — | | NA | |

Mr. Gajendra K Patni@ | | 3 | | 2 | | — | | NA | |

Mr. William O Grabe@ | | 3 | | 0 | | — | | NA | |

Mr. Louis Theodoor van den Boog@ | | 5 | | 3 | | — | | NA | |

Dr. Michael A Cusumano@ | | 5 | | 1 | | — | | NA | |

Mr. Abhay Havaldar@ (Alternate Director to Mr. William O Grabe) | | 3 | | 2 | | — | | NA | |

NA — Not Applicable

@ Resigned during the year.

5. Compensation to Directors

Details of compensation paid to Directors for the year ended 31 December 2011 are as below:

(Amounts in  )

)

Director | | Relationship with other

directors | | Business

relationship

with the

Company | | Loans &

advances

from the

Company | | Sitting

Fees* | | Remuneration* | | Commission* | |

Mr. Jai S Pathak | | No | | None | | — | | 200,000 | | — | | 2,151,434 | |

Mr. Phaneesh Murthy | | No | | None | | — | | — | | — | | — | |

Mr. Göran Lindahl | | No | | None | | — | | — | | — | | — | |

Mr. Shashank Singh | | No | | None | | — | | — | | — | | — | |

Mr. Arun Duggal | | No | | None | | — | | 260,000 | | — | | 2,499,841 | |

Mr. Vimal Bhandari | | No | | None | | — | | 300,000 | | — | | 2,499,841 | |

Mr. Narendra K Patni@ | | Brother of Mr. Gajendra K Patni and Mr. Ashok K Patni | | Erstwhile Promoter | | — | | — | | Refer note 3 | | — | |

Mr. Jeya Kumar@ | | No | | None | | — | | — | | 162,707,037 | | — | |

Mr. Gajendra K Patni@ | | Brother of Mr. Narendra K Patni and Mr. Ashok K Patni | | Erstwhile Promoter | | — | | 40,000 | | | | — | |

Mr. Ashok K Patni@ | | Brother of Mr. Gajendra K Patni and Mr. Narendra K Patni | | Erstwhile Promoter | | — | | 60,000 | | 8,691,359 | # | — | |

Mr. William O Grabe@ | | No | | Erstwhile | | — | | — | | — | | — | |

| | | | Nominee of | | | | | | | | | |

| | | | strategic investor | | | | | | | | | |

Mr. Louis Theodoor van | | No | | None | | — | | 60,000 | | — | | 655,329 | |

den Boog@ | | | | | | | | | | | | | |

Mr. Pradip Shah@ | | No | | None | | — | | 80,000 | | — | | 655,329 | |

Mr. Ramesh | | No | | None | | — | | 40,000 | | — | | 655,329 | |

Venkateswaran@ | | | | | | | | | | | | | |

Dr. Michael A Cusumano@ | | No | | None | | — | | 40,000 | | — | | 655,329 | |

Mr. Pradip Baijal@ | | No | | None | | — | | 20,000 | | — | | 655,329 | |

* Gross amounts subjected to applicable TDS.

# Pension and Medical Liability.

@Resigned during the year.

18

Table of Contents

Notes:

1. Payment to Non-executive Directors:

The Company paid commission to its Independent Directors as approved by the Board within the limits approved by the Members of the Company. The amount of such commission, taken together for all Non-executive Directors, did not exceed 1% of the net profits of the Company in the financial year. The Independent Directors were also paid a sitting fee of  20,000 per meeting, being the maximum amount permissible under the present regulations, for attending the Board/Committee meetings.

20,000 per meeting, being the maximum amount permissible under the present regulations, for attending the Board/Committee meetings.

The Board of Directors, at its meeting held on 12 May 2011, has revised the compensation payable to the Independent Directors, as given below:

· Base Compensation to each Independent Director: $ 50,000 p.a.

· Chairman of the Board of Directors: $ 10,000 p.a.

· Chairman of each of the other Committees of Directors: $ 10,000 p.a.

· The Compensation will be in the form of Commission as permitted under the provisions of the Companies Act, 1956.

· Commission will be paid on quarterly basis in equal installments.

· Overall Commission not to exceed 1% of the net profit of the Company.

·  20,000 as sitting fees for the meetings attended.

20,000 as sitting fees for the meetings attended.

In addition to the above, the Independent Directors are also eligible for stock option grants under Company’s Stock Option Plan i.e. Patni ESOP 2003 (Revised 2009).

Before the acquisition transaction, the Company had paid commission to its Independent Directors as approved by the previous Board within the limits approved by the Members of the Company. The Independent Directors were also paid a sitting fee of  20,000 per meeting, being the maximum amount permissible under the present regulations, for attending the Board/Committee meetings. In addition to above mentioned commission, the following were entitled to a one-time annual commission as under for the period starting from 1 January 2011 till 11 May 2011.

20,000 per meeting, being the maximum amount permissible under the present regulations, for attending the Board/Committee meetings. In addition to above mentioned commission, the following were entitled to a one-time annual commission as under for the period starting from 1 January 2011 till 11 May 2011.

· The Chairman of the Audit Committee: $ 10,000 p.a.

· Members of the Audit Committee: $ 5,000 p.a.

· The Chairman of Compensation & Remuneration Committee: $ 5,000 p.a.

· The Chairman of Shareholders’/Investors’ Grievance Committee: $ 5,000 p.a.

2. Payment to Managing Director and former Manager:

During the year, Mr. Phaneesh Murthy was appointed as a Managing Director with the designation of ‘Chief Executive Officer & Managing Director’ w.e.f. 12 May 2011 for the period of five years pursuant to the provisions of the Companies Act, 1956. He is also the President and Chief Executive Officer of iGATE Corporation, the holding company of the Company. He does not draw any remuneration from the Company and the Company provides him all the necessary infrastructural facilities to function as a Chief Executive Officer and Managing Director of the Company.

Mr. Jeya Kumar ceased to be the Manager designated as Chief Executive Officer of the Company w.e.f. 12 May 2011 and accordingly during the year, the Company had paid remuneration/compensation to Mr. Jeya Kumar within the limits envisaged under the applicable provisions of the Companies Act, 1956. The remuneration paid was approved by the Board within the limits approved by the Members of the Company.

The breakups of compensation/remuneration paid to them are as under:

(Amounts in  )

)

| | Fixed Components | | Variable Components | | | |

| | Salary, Allowances & | | | | | | Performance Linked | | | |

| | Perquisites | | PF contribution | | Pension | | Incentive | | Total | |

Mr. Phaneesh Murthy | | — | | — | | — | | — | | — | |

Mr. Jeya Kumar*

(in capacity of Manager) | | 145,985,157 | | 1,101,704 | | — | | 15,620,176 | | 162,707,037 | * |

*Mr. Jeya Kumar ceased to be the Manager designated as CEO of the Company w.e.f. 12 May 2011. This includes the severance payment of  81,940,905/- made to him during the year.

81,940,905/- made to him during the year.

19

Table of Contents

3. Compensation to Mr. Narendra K Patni: This includes the severance payment of  152,928,697/- which was paid by Patni Americas Inc., a wholly owned subsidiary of the Company. The Compensation is as described in the financial statements of the Company and its Subsidiaries. However, he ceased to be the Chairman and the Director of the Company w.e.f. 12 May 2011.

152,928,697/- which was paid by Patni Americas Inc., a wholly owned subsidiary of the Company. The Compensation is as described in the financial statements of the Company and its Subsidiaries. However, he ceased to be the Chairman and the Director of the Company w.e.f. 12 May 2011.

Shareholding of present Non-executive Directors’ in the Company for the year ended 31 December 2011

Name of Non-executive Director | | No. of Equity Shares held as of 31 December 2011 |

Mr. Jai S Pathak | | Nil |

Mr. Arun Duggal | | 4,550 |

Mr. Vimal Bhandari | | 2,600 |

Mr. Göran Lindahl | | Nil |

Mr. Shashank Singh | | Nil |

Stock Options Grant

Name | | Exercise Price Per Share | | Number of Options Granted | | Expiration Date | |

Mr. A Duggal | |  254/381/458/455/471/2/2 254/381/458/455/471/2/2

| | 20,000/5,000/5,000/5,000/5,000/4,550/4,000 | (1) | 2010/2011/2012/2013/2016/2016/2017 | (1) |

Mr. V Bhandari | |  471/2/2 471/2/2

| | 20,000/2,600/4,000 | (2) | 2016/2016/2017 | (2) |

Mr. Jai S Pathak | |  2 2

| | 4,000 | (3) | 2017 | (3) |

Dr. M Cusumano* | |  254/381/458/455/$20.78/ 254/381/458/455/$20.78/  4 4

| | 20,000/5,000/5,000/5,000/2,500#/2,275# | (4) | 2011 | (4) |

Mr. P Shah* | |  254/381/458/455/471/2 254/381/458/455/471/2

| | 20,000/5,000/5,000/5,000/5,000/1,950 | (4) | 2011 | (4) |

Mr. L van den Boog* | |  381/458/455/2/4 381/458/455/2/4

| | 20,000/5,000/5,000/96,000/1,950# | (4) | 2011 | (4) |

Mr. R Venkateswaran* | |  254/381/458/455/471/2 254/381/458/455/471/2

| | 20,000/5,000/5,000/5,000/5,000/2,600 | (4) | 2011 | (4) |

Mr. P Baijal* | |  471/2 471/2

| | 20,000/2,600 | (4) | 2011 | (4) |

Mr. J Kumar* | |  106/2/2 106/2/2

| | 1,500,000/350,000/240,500 | (5) | — | (5) |

#ADR linked Options

*Former Directors

(1) In respect of the first grant, options will vest in four equal installments, i.e. 25% each year and expiry date in respect of said grant will be from 2010 to 2013. Please note that the first & second vesting i.e. 25% of said grant has already expired in July 2010 & 2011 respectively. In respect of the second grant, options will vest in four equal installments, i.e. 25% each year and expiry date in respect of said grant will be from 2011 to 2014. Please note that the first vesting i.e. 25% of said grant has already expired in April 2011. In respect of third, fourth and fifth grants, options will vest in four equal installments, i.e. 25% each year and expiry date in respect of said three grants will be from 2012 to 2015, 2013 to 2016, and 2016 to 2019 respectively. In respect of the sixth grant, the options will vest in full at the end of first year and will expire in 2016 and in respect of the last grant, the options will vest in three installments, i.e. 30%, 30% and 40% each year, and expiry date in respect of the said grant will be from 2017 to 2019.

(2) In respect of the first grant, options will vest in four equal installments, i.e. 25% each year, and expiry date in respect of said grant will be from 2016 to 2019. In respect of the second grant, the options will vest in full at the end of first year and it will expire in 2016 and in respect of the last grant, the options will vest in three installments, i.e. 30%, 30% and 40% each year, and expiry date in respect of the said grant will be from 2017 to 2019.

(3) The options will vest in three installments, i.e. 30%, 30% and 40% each year, and expiry date in respect of the said grant will be from 2017 to 2019.

(4) Ceased to be the Director of the Company w.e.f. 12 May 2011(“Effective Date”) and by virtue of the resignation, all unvested options as on date of resignation lapsed and all vested options expired in 2011 in pursuance to the Patni ESOP Plan (Revised 2009).

(5) Ceased to be the Manager designated as Chief Executive Officer & Director of the Company w.e.f. 12 May 2011 and he has exercised all his vested options.

Code of Conduct:

Pursuant to the requirements of the Clause 49 of the Listing Agreement, the Board has adopted Code of Business Conduct and Ethics for the executive directors, whole time directors, officers and employees of the Company as well as the separate Code of Business Conduct and Ethics for Non-executive Directors of the Company. The said Code has been posted on website of the Company.

All the Board Members and senior management personnel have affirmed compliance with the Code for the year 2011 and a declaration to this effect signed by the Chief Executive Officer and Managing Director of the Company is provided at the end of this report.

20

Table of Contents

Tenure:

As per the provisions of the Companies Act, 1956 and the Articles of Association of the Company, two third of the total directors of the Company retire by rotation. Out of this two third, one third will be retiring at every Annual General Meeting. Accordingly, the tenure of each director is two years but they are eligible for re-appointment.

Mr. Phaneesh Murthy was appointed as a Director of the Company w.e.f. 8 February 2011 pursuant to Acquisition Transaction as mentioned earlier. He was further appointed as a Managing Director with the designation of ‘Chief Executive Officer & Managing Director’ w.e.f. 12 May 2011 for the period of five years pursuant to the provisions of the Companies Act, 1956 which was further approved at the Annual General Meeting held on 29 June 2011. His appointment as a Director is not liable to retire by rotation.

B. Audit Committee

1. Brief description of terms of reference

The Audit Committee was initially set up on 19 December 2001 and reconstituted on 12 November 2003 in line with then corporate governance norms. Subsequently, the Audit Committee was further reconstituted on 30 March 2005, 29 April 2008, 10 February 2010 and recently on 12 May 2011. The Audit Committee has three non-executive members, all being independent. The Chairman of the Committee is an independent director. All members of the Audit Committee are financially literate and they have accounting or related financial management expertise.

Existing Charter of the Audit Committee, including terms of reference, is as under:

I. Purpose

The primary purpose of the Audit Committee is to assist the Board of Directors (the “Board”) of Patni Computer Systems Limited, (the “Company”), in fulfilling its oversight responsibilities with respect to (a) the accounting and financial reporting processes of the Company, including the integrity of the audited financial statements and other financial information provided by the Company to its stockholders, the public, any stock exchange and others, (b) the Company’s compliance with legal and regulatory requirements, (c) the Company’s independent auditors’ qualifications and independence, (d) the audit of the Company’s financial statements and the performance of the Company’s internal audit function and its independent auditors.

II. Organization

The Audit Committee shall have minimum of three Directors as its Members. All Members of the Audit Committee shall be Independent Directors and shall be financially literate and at least one member shall have accounting or related financial management expertise. The Board shall appoint a Chairperson of the Audit Committee and in the absence of such person, the members of the Audit Committee shall appoint one of their members present as the Chairman by a vote of the majority of the full Audit Committee. The Chairman of the Audit Committee shall be present at the Annual General Meeting of the Company to answer shareholder’s queries.

The Audit Committee may invite such of the executives, as it consider appropriate (and Particularly the CFO) to be present at the meetings of the committee, but on occasions it may also meet without the presence of any executives of the Company. The CFO, head of Internal Audit and representative of the Statutory Auditor may be present as invitees for the meetings of the Audit Committee.

III. Meetings

The Audit Committee should meet at least four times in a year and not more than four months shall elapse between two meetings. The Quorum shall be either two members or one third of the members of the Audit Committee whichever is greater.

IV. Authority and Responsibilities

Subject to and in accordance with Clause 49 of the listing agreement

Description | | Period |

A. | With Respect to the Management | | |

| 1. | | Review the annual financial statements before submission to the board for approval. | | Annually |

| 2 | | Review the quarterly financial statements before submission to the board for approval. | | Quarterly |

| 3 | | Review and discuss the major issues w.r.t. accounting principles and financial statement presentations and changes in accounting principles and policies. | | As appropriate |

| 4 | | Review disagreements or audit problems, if any, for preparation of financial statements etc. | | As appropriate |

| 5 | | Review Company’s legal Compliance Report and any matters which could impact Company’s financial statements. | | As appropriate |

21

Table of Contents

Description | | Period |

| 6 | | Review the Company’s Earnings press releases and other information provided to analysts and rating agencies. | | As appropriate |

| 7 | | Review and discuss w.r.t. off-balance sheet transaction, arrangements, obligations etc. | | As appropriate |

| 8 | | Review steps to monitor, control and manage major financial risk and corrective measures. | | As appropriate |

| | | | | |

B. | With Respect to the Independent Auditors | | |

| 1. | | Appointment, compensation and oversight of the work of Independent Auditors. | | As appropriate |

| 2. | | Evaluate Performances of Independent Auditors including lead audit partner. | | Annually |

| 3. | | Ensure objectivity & independence of Independent Auditors, and receive a statement of Independence from them. | | Annually |

| 4. | | Review Appropriate Internal Quality Control procedures of Independent Auditors. | | Annually |

| 5. | | Confirm Rotation requirement of Partners & Independent Auditors and hiring of former employees of Independent Auditors. | | As appropriate |

| 6. | | Review of any report submitted by Independent Auditors. | | As appropriate |

| 7. | | Before commencement of Statutory Audit, review the scope & plan of work of Independent Auditors. | | Annually |

| 8. | | Post audit discussion with Independent Auditors to ascertain areas of concern. | | Annually |

| 9. | | Review Alternative Accounting treatments of Financial information reported in US GAAP and treatment advised by Independent Auditors. | | As appropriate |

| 10. | | Ensuring the quality and appropriateness of the Company’s accounting and financial disclosures. | | As appropriate |

| | | | | |

C. | With Respect to the Internal Auditors | | |

| 1. | | Appointment of Head of Internal Audit and review of scope of work and his responsibilities. | | Annually |

| 2. | | Review the scope & plan of work of Internal Audit Group including staffing & budget. | | At least Annually |

| 3. | | Evaluate Performance of Internal Audit Group. | | At least Annually |

| 4. | | In discussion with internal auditors Review of the adequacy of Company’s internal controls. | | As appropriate |

| 5. | | Review the process of complaints regarding internal accounting controls and auditing matters. | | As appropriate |

| 6. | | Review effectiveness of the Company’s internal control over financial reporting. | | Annually |

| 7. | | Review Management certification and disclosures. | | Annually |

| 8. | | Review on the issues raised in management letters and corrective steps. | | As appropriate |

| 9. | | Review on significant findings of the Internal Audit Group. | | As appropriate |

| | | | | |

D. | Other | | |