Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Related financial report

Williams Partners similar filings

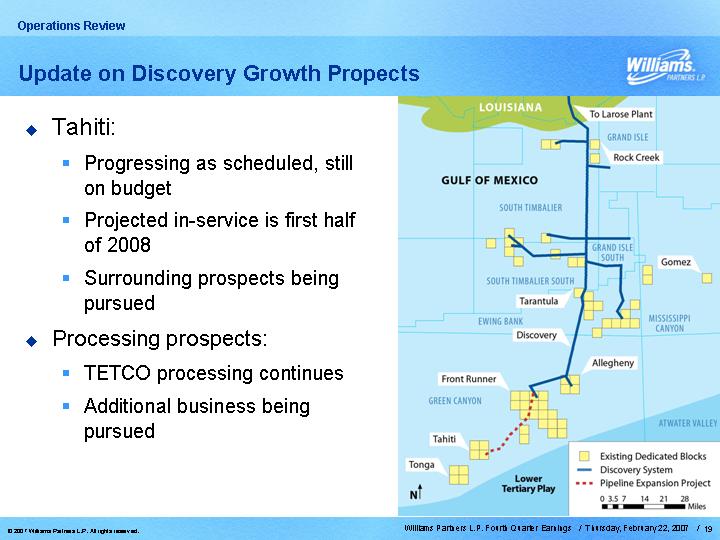

- 25 Jun 07 Williams Partners L.P. Agrees to Acquire Additional 20 Percent Interest in Discovery

- 15 May 07 Entry into a Material Definitive Agreement

- 3 May 07 Williams Partners L.P. Reports First-Quarter 2007 Financial Results

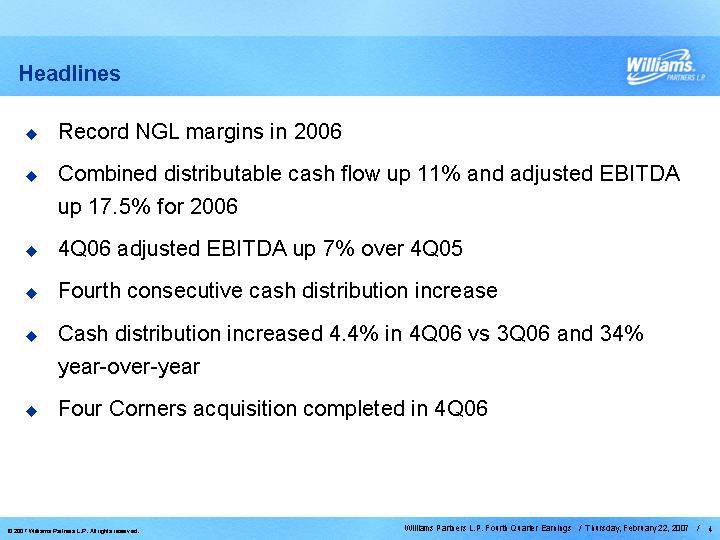

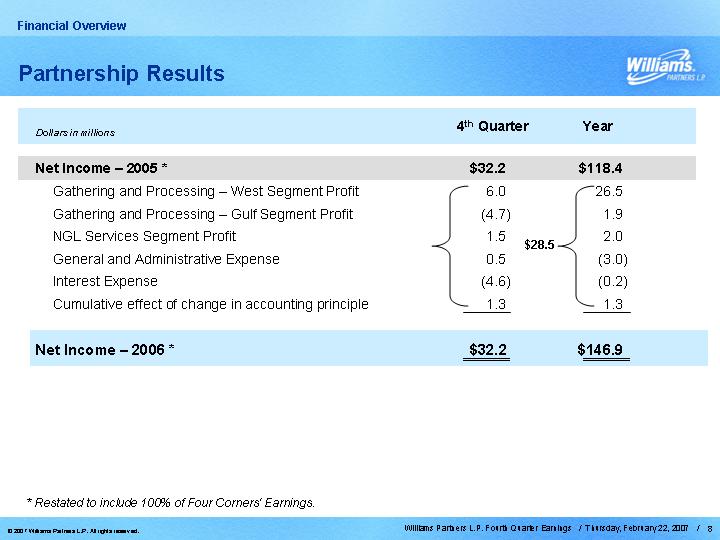

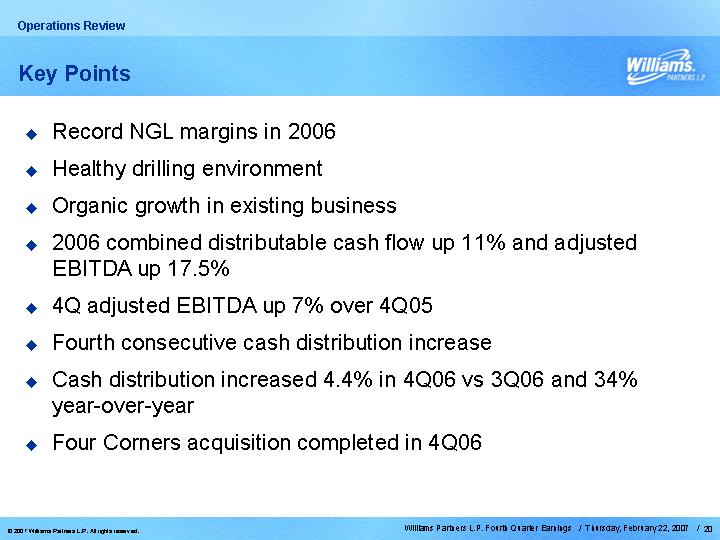

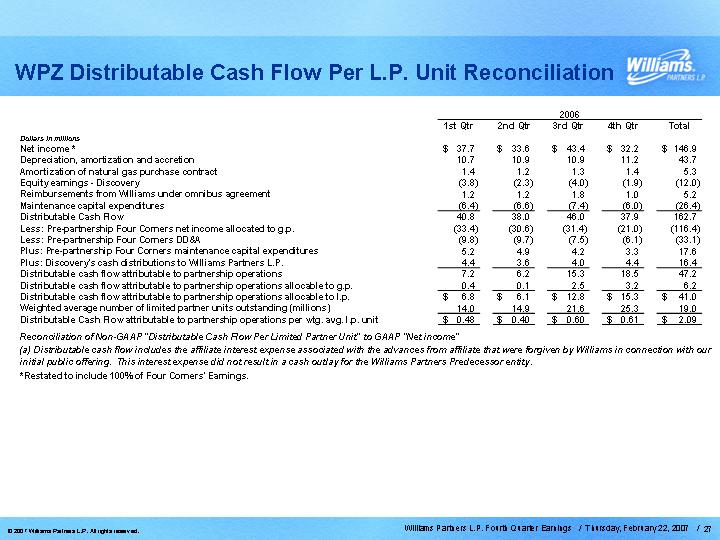

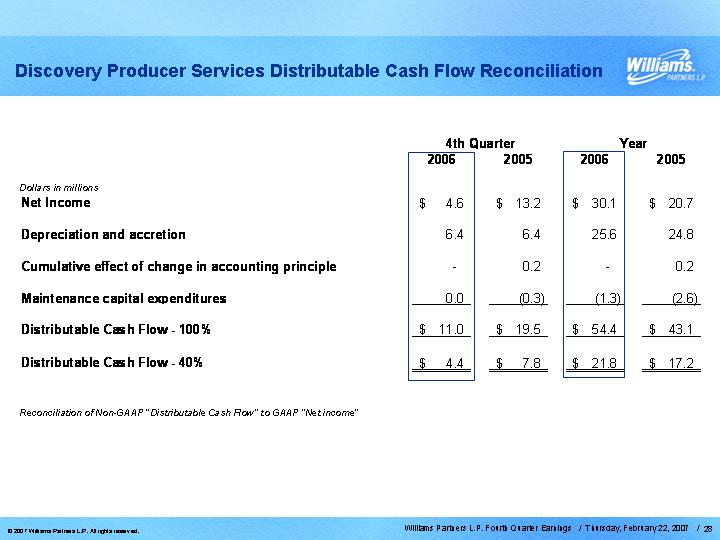

- 22 Feb 07 Williams Partners L.P. Reports Fourth-Quarter and Full-Year Financial Results

- 12 Jan 07 Report of Independent Registered Public Accounting Firm

- 12 Jan 07 Financial Statements and Exhibits

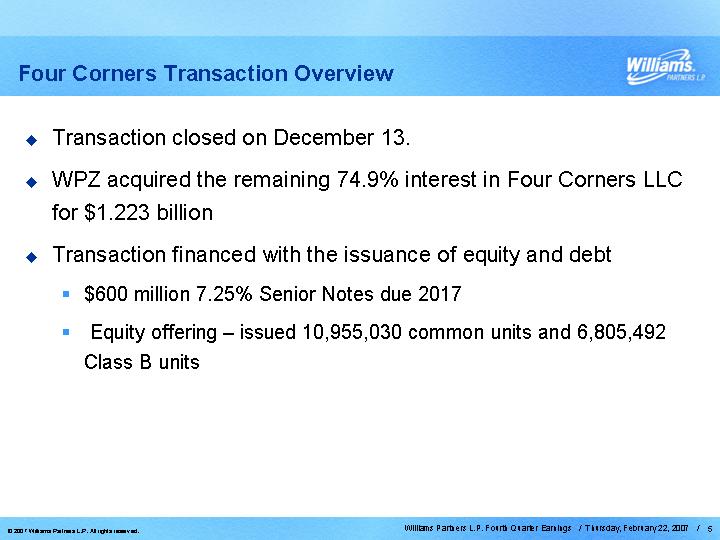

- 19 Dec 06 Williams Partners L.P. Completes Acquisition of Remaining Interest in Four Corners from Williams

Filing view

External links