Exhibit 5.4

Case New Holland Inc.

CNH Global, N.V.

Tower B, 10th Floor

World Trade Center, Amsterdam Airport

Schiphol Boulevard 217

1118 BH Amsterdam

The Netherlands

Lugano/Zurich, 20 May 2011

Case New Holland Inc. Form F-4 Registration Statement – CNH International SA, Paradiso – Issuance of a guarantee in relation to 7 7/8% Senior Notes due 2017 in the Aggregate Principal Amount of USD 1’500’000’000 by Case New Holland Inc.

Ladies and Gentlemen,

This opinion is furnished to you in connection with the registration statement onForm F-4 (the “Registration Statement”) being filed by Case New Holland Inc., a Delaware corporation (the “Issuer”), CNH Global, N.V., a Netherlands public limited liability company (the “Parent”) and certain subsidiaries of the Parent named therein as guarantors (collectively with the Parent, the “Guarantors”), including CNH International SA, Paradiso, Switzerland (the “Company”) with the United States of America (the “United States” or “U.S.”) Securities and Exchange Commission (the “SEC”) under the United States Securities Act of 1933, as amended (the “Securities Act”), relating to the registration of USD 1’500’000’000 principal amount of the Issuer’s 7 7/8% senior notes due 2017 that have been registered under the Securities Act of 1933, as amended (the “New Notes”) which are to be offered in exchange for an equivalent principal amount of presently outstanding 7 7/8% senior notes due 2017 (the “Old Notes”) as more fully described in the Registration Statement. The Old Notes are and the New Notes will be guaranteed by the Guarantors, including the Company.

| | |

| Bär & Karrer 20 May 2011 | | 2 |

The Old Notes were and the New Notes will be issued under an indenture dated 28 June 2010 (the “Indenture”) by and among the Issuer, the Guarantors and Wells Fargo, N.A. as trustee.

Terms not otherwise defined herein shall have the same meaning as ascribed to them in the Indenture.

For the purpose of this opinion letter, we have exclusively relied on the following documents:

| | a) | a original excerpt from the Commercial Register of the Canton of Ticino relating to the Company dated 16 May 2011; |

| | b) | a original copy of the articles of association of the Company dated 16 May 2011 (the “Articles of Association”); |

| | c) | a pdf copy of (i) the Business Regulations of the Company dated 26 October 2007 and (ii) the Internal Regulations of the Company approved on 13 May 2008 (together the “Organisational Regulations”); |

| | d) | a original copy of the Company’s extraordinary shareholder’s meeting dated 14 June 2010 regardinginter alia the issuance of and the payment under the guarantee included in the Indenture; |

| | e) | a original copy of the circular resolution of the Company’s board of directors (the “Board of Directors”) of June 2010 regardinginter alia the issuance of and the payment under the guarantee included in the Indenture; |

| | f) | a copy of the Indenture; |

| | g) | a copy of the Registration Statement dated 6 April 2011; |

| | h) | a copy of the form of guarantee (the “Guarantee”, together with the Indenture and the Registration Statement, the “Documents”); |

For the purposes of this opinion we have not reviewed any documents other than those listed above and our opinion is confined to these documents, which we deem sufficient to form our opinion.

In rendering this opinion, we have assumed:

| | |

| Bär & Karrer 20 May 2011 | | 3 |

| | a) | the completeness and correctness of the representations and warranties made in the Documents (and in documents referred to therein) and information provided to us as to matters of fact; |

| | b) | that the choice by the parties to the Indenture of the laws of the State of New York to govern the Indenture, as expressed in Section 11.08 of the Indenture is recognised by the law of the state of New York as a valid choice of law; |

| | c) | the requisite capacity, power and authority to execute and perform the obligations arising from the Documents of the parties thereto other than the Company; |

| | d) | that the Indenture and the Registration Statement have been duly authorised, signed, executed and delivered by or on behalf of the parties thereto other than the Company; |

| | e) | that the Guarantee remains in force as of the date of this opinion and has not been amended, revoked or affected by any action subsequent to its execution, and that its terms reflect the true intent and the entire agreement of the parties thereto in respect of its subject-matter; |

| | f) | that the information contained in the excerpt from the Commercial Register of the Canton of Ticino referred to in Section I a) above is correct and up-to-date as of the date of this opinion, and the version of the Articles of Association referred to in Section I b) above is the version in force at the date of this opinion, in all respects relevant to our opinions; |

| | g) | the genuineness of all signatures on and the authenticity and completeness of all documents submitted to us whether as original or copy; |

| | h) | the due organisation, valid existence and good standing (if applicable) of each of the parties to the Indenture and the Registration Statement (other than the Company) under the laws of the jurisdiction of their incorporation; |

| | i) | that the Indenture and the Registration Statement constitute legal, valid, binding and enforceable obligations of the parties thereto under the laws applicable to each of them, other than the laws of Switzerland; |

| | j) | that all authorisations, approvals, consents, licenses, exemptions, registrations and other requirements, other than those required under the laws of Switzerland, for the legality, validity and enforceability of the Indenture and the Registration Statement have been duly obtained and are and will remain in full force and effect and that any related conditions to which the parties thereto are subject have been satisfied; |

| | |

| Bär & Karrer 20 May 2011 | | 4 |

| | k) | that none of the parties to the Indenture or the Registration Statement has passed a voluntary winding-up resolution, no petition has been presented or order made by a court for the winding-up, dissolution, bankruptcy or administration of any party, and that no receiver, trustee in bankruptcy, administrator or similar officer has been appointed in relation to any of the parties or any of their assets or revenues, it being noted that we are not aware of anything of the foregoing having occurred by the date of this Legal Opinion in respect of the Company; |

| | l) | that the Company was not and will not be, at the date of execution of the Guarantee, insolvent or over-indebted (in the sense of Article 725 of the Swiss Code of Obligations), and no insolvency or overindebtedness was or will be threatened or reasonably expected; |

| | m) | that all parties entered into the Indenture and file the Registration Statement forbona fide commercial reasons and at arm’s length terms, and the guarantees included in the Indenture and the Guarantee and given by the Company pursuant to the Indenture and the Guarantee may reasonably be regarded as being in the best interest of the Company; |

| | n) | that the resolutions referred to in Section I d) and e) and the Organisational Regulations are as of the date of this letter validly in force and effect in their version referred to in Section I. |

Based on the foregoing assumptions and subject to the qualifications set out under Section IV below, we are of the opinion that:

| | a) | the Company has been duly organised and is validly existing as a stock corporation (Aktiengesellschaft) under the laws of Switzerland, established with unlimited duration, having the capacity to sue or be sued in its own name, and having the power and authority to carry on business and to own property and assets in Switzerland and abroad in accordance with the Articles of Association; |

| | b) | the Company has the necessary corporate capacity and power to enter into, execute and deliver the Guarantee and to perform its obligations under the Guarantee; and |

| | c) | the execution, delivery and performance by the Company of the Indenture to which it is a party and the issuance of the guarantees thereunder (including the Guarantee) and compliance by the Company with the terms thereof and the consummation of the transactions thereby contemplated has not resulted and will not result (i) in any violation of the provisions of the Articles of Association or (ii) in the violation of any law or statute of any |

| | |

| Bär & Karrer 20 May 2011 | | 5 |

| | governmental or regulatory authority in Switzerland, except that limitations under Swiss corporate law limit the extent to which it may make payments under the guarantees included in the Indenture and the Guarantee and the extent to which it may perform its other liabilities for other parties under or in connection with the Indenture and the Guarantee (other than for obligations of wholly owned and controlled subsidiaries of the Company) (cf. in this context also Section IV e) below). |

The opinions set out in Section III above are subject to the following qualifications:

| | a) | we are members of the Zurich Bar and do not hold ourselves to be experts in any laws other than the laws of Switzerland. Accordingly, our opinion is confined to Swiss law. We have abstained from examining any issues of any other jurisdiction and therefore no opinion on matters other than Swiss law issues is to be inferred; |

| | b) | we have not been retained as tax counsel or accountants and, consequently, express no opinion on any tax or accounting matters; |

| | c) | we express no opinion on the commercial value of the guarantee obligations included in the Indenture or in the Guarantee or other obligations for liabilities of other parties created pursuant to the Indenture or the Guarantee, nor on the possibilities to actually recover proceeds when realising such security interests; |

| | d) | no opinion is rendered as to the validity, binding effect or enforceability as against the Company of its guarantee obligations under the Indenture and the Guarantee; |

| | e) | our opinions expressed in Section III b) and c) are subject the qualification that Swiss corporate law sets mandatory limits as to the extent to which the Company may make payments under the guarantees included in the Indenture or under the Guarantee or under other obligations assumed for liabilities of parties to the Indenture not being wholly owned and controlled subsidiaries of the Company and, within such limitations, further corporate actions (including unanimous shareholders’ resolutions and board resolutions) may become necessary to make related payments; it is, however, (while the issue is not opinable) our best belief that the limitation language relating to Swiss law requirements in Section 10.03 (a)(6) of the Indenture and the Guarantee and also relating to other of its liabilities for the benefit of other companies of the group the Company belongs to, set appropriate limits for the amounts the Company may pay without violating mandatory Swiss corporate law (subject to related further corporate actions generally |

| | |

| Bär & Karrer 20 May 2011 | | 6 |

| | required for (interim) dividend distributions, including (special) auditors’ confirmations as to the amounts available for distribution and related unanimous shareholders’ resolutions and board resolutions); |

| | f) | no opinion in Section III b) is expressed in respect of any undertaking of the Company contained in the Indenture or the Guarantee to take or cause to be taken any corporate action, to the extent it would relate to the corporate actions necessary to make related payments as described in Section IV e) above; |

| | g) | our opinion is based solely on the documents referred to in Section I above and is confined to Swiss law as in force and interpreted at the date of this opinion; |

| | h) | our opinion is subject to the fact that the nature and enforcement of obligations may be affected by lapse of time, failure to take action or laws (including, without limitation, laws relating to bankruptcy, fraudulent transfer, insolvency, liquidation, receivership, moratorium, reorganisation and reconstruction) and defences generally relating to or affecting creditors’ rights including Swiss law principles on the abuse of rights (Rechtsmissbrauch as per Article 2 (2) of the Swiss Civil Code (“CC”)) or good faith (Treu und Glauben); |

| | i) | enforceability may be limited, as to the indemnification undertakings by the Company, if a court considers that the indemnified person or a person acting on its behalf has acted wilfully or by negligence; |

| | j) | in this opinion, Swiss legal concepts are expressed in English terms and not in their original Swiss terms. The concepts concerned may not be identical to the concepts described by the same English terms as they exist under the laws of other jurisdictions; |

| | k) | notwithstanding a valid choice of law by the parties to an agreement, a Swiss court will not apply a provision of foreign law if and to the extent that this would, in the court’s view, lead to a result violating Swiss public policy (ordre public). Moreover, a Swiss court will apply, notwithstanding a valid choice of law by the parties, any provisions of Swiss law (and, subject to further conditions, of another foreign law) which in the court’s view imperatively demand application in view of their specific purpose (lois d’application immédiate). In disputes of a commercial nature, a Swiss court may furthermore require a party invoking the applicability of foreign laws to prove their content; |

| | l) | under Swiss domestic laws there would also be limitations as to the validity, binding effect and/or enforceability of the following or as follows: |

| | |

| Bär & Karrer 20 May 2011 | | 7 |

| | i) | provisions allowing a party to proceed or determine in its “sole opinion” or “sole discretion” in matters affecting legitimate interests of other parties; |

| | ii) | provisions providing for a party’s determinations to be “conclusive” or “prima facie evidence”; |

| | iii) | provisions providing for delivery of communications or documents to be deemed although not received by (all of) the addressee(s) concerned; |

| | iv) | generally applicable concepts of Swiss contract law on impossibility and fraud or error which may invalidate duties to perform obligations; |

| | v) | a Swiss court may not consider to be bound by the severability/partial invalidity provisions contained in the Indenture (or referenced to be the Indenture); |

| | vi) | the concept of trust (entailing legal and beneficial ownership) as known in England or the United States is not known under Swiss law; the concept probably most closely resembling it under Swiss domestic law being the one of a fiduciary arrangement pursuant to which a fiduciary (instead of a trustee) becomes and is the legal owner of the assets and other rights transferred to it with the possibility of disposing of and/or enforcing such in its name, being subject to the contractual restrictions and other obligations as provided for in the related (fiduciary) documents; |

| | m) | for purposes of the enforcement of a claim for the payment of monies in forced collection and/or bankruptcy or similar proceedings in Switzerland, the amount claimed will have to be converted into Swiss Francs; |

| | n) | furthermore our opinion is generally subject to the following qualifications: |

| | i) | our opinions expressed in Section III above are subject to the effects of Swiss laws on forced debt collection and insolvency (including in respect of bankruptcy, moratoria, and composition proceedings, and including related provisions for the avoidance of transactions made to the detriment or preference of creditors) and of Swiss laws and rules of civil procedure (or, as the case may be, applicable arbitration rules), as applied to creditors and debtors and claimants and defendants generally and availability of certain remedies is at the discretion of a court in Switzerland and the commencement of court, insolvency or bankruptcy proceedings in Switzerland will be subject to the Swiss rules of civil, insolvency and bankruptcy procedure; |

| | |

| Bär & Karrer 20 May 2011 | | 8 |

| | ii) | an obligation to pay an amount may be unenforceable, if the amount is held to constitute a penalty (such as exemplary or punitive damages); |

| | iii) | no opinion is expressed as to the accuracy of the representations and warranties set out in the Indenture (or in documents referred to by the Indenture) or the factual background assumed therein; |

| | iv) | in making references to the terms of the Indenture (or documents referred to therein), no opinion is expressed as to whether and to what extent these leave room for interpretation which may, as the case may be, become a matter of the discretion of the courts; |

| | v) | court proceedings may be stayed if the subject of the proceedings is concurrently before another court, and damages awarded by courts may be awarded depending upon the degree of fault of the party; |

| | vi) | the enforceability of a foreign judgment (if any) rendered against the Company is subject to the limitations set forth in the Lugano Convention on Jurisdiction and Enforcement of Judgments in Civil and Commercial Matters of 16 September 1988, as amended, such treaties to which Switzerland is bound, and the Swiss Federal Act on Private International Law of 18 December 1987, as amended. In particular and without limitation to the foregoing, a judgment rendered by a foreign court may only be enforced in Switzerland if (x) the foreign court has jurisdiction, (y) the judgment of such foreign court has become final and non appealable and does not contravene Swiss public policy and (z) the court procedures and the service of documents leading to the judgment followed the principles of due process of law. In particular, a judgement by the courts of the State of New York would only be recognised in Swiss courts, if the consent to service of process to the agent specified in Section 11.12 of the Indenture had not been withdrawn by the Company prior to the service of the relevant document to the agent; and |

| | vii) | the legality, validity, binding nature and enforceability of obligations (including judgment obligations) under Swiss law or in Switzerland may be or become affected by rules enacted under the Swiss Federal Act on Enforcement of International Sanctions. |

We are aware that we are referred to under the heading “Legal Matters” in the Registration Statement. We hereby consent to the references to us in such section and the filing of this opinion letter as an exhibit to the Registration Statement without thereby implying or admitting that we are “experts” within the meaning of the Securities Act or the rules and regulations of the Commission issued thereunder, with respect to any part of the Registration Statement, including this exhibit.

| | |

| Bär & Karrer 20 May 2011 | | 9 |

Also, in giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act.

This opinion is strictly limited to the matter stated in it and does not apply by implication to any other matters. We do not assume any obligation to inform you of any facts or circumstances occurring or coming to our attention subsequently to the date of this letter and which might have an impact on any matters addressed in our opinions given herein.

This opinion letter and the obligations resulting from it are governed by and shall be interpreted in accordance with the substantive provisions of Swiss law, the ordinary courts in Zurich (Switzerland) having exclusive jurisdiction.

Yours sincerely,

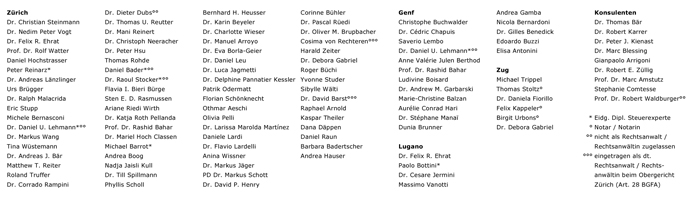

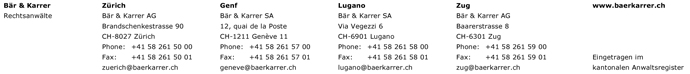

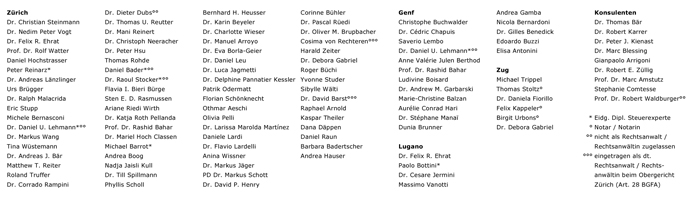

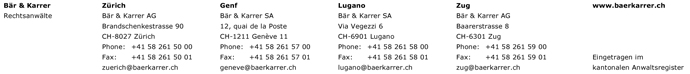

Bär & Karrer AG