- RBC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

RBC Bearings (RBC) PRE 14APreliminary proxy

Filed: 16 Jul 24, 5:18pm

| ☑ | | | Preliminary Proxy Statement |

| ☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | | | Definitive Proxy Statement |

| ☐ | | | Definitive Additional Materials |

| ☐ | | | Soliciting Material Pursuant to §240.14a-12 |

| RBC Bearings Incorporated |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| ☑ | | | No fee required. | |||

| ☐ | | | Fee paid previously with preliminary materials. | |||

| ☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. | |||

| | |  | | | 2024 Proxy Statement | | | 01 |

| 1. | election of three directors in Class II to serve a term of three years; |

| 2. | ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2025; |

| 3. | approval of an amendment to our certificate of incorporation eliminating personal liability of officers for monetary damages for breach of their fiduciary duty of care as officers; |

| 4. | approval, on a non-binding advisory basis, of the compensation of our named executive officers; and |

| 5. | any other matter that may properly come before the meeting or any adjournment or postponement thereof. |

| 02 | | |  | | | 2024 Proxy Statement | | |

| | |  | | | 2024 Proxy Statement | | | 03 |

| 04 | | |  | | | 2024 Proxy Statement | | |

| | |  | | | 2024 Proxy Statement | | | 05 |

| 06 | | |  | | | 2024 Proxy Statement | | |

| Business Highlights |

| Founder-Led Growth Company | ||||||

| RBC was built through a series of acquisitions led by CEO Dr. Michael J. Hartnett, culminating in 28 transactions over 34 years. The combination of organic and inorganic growth has resulted in double-digit through-cycle revenue growth coupled with healthy margin expansion and free cash flow generation. The Company has been publicly listed since 2005 and is now traded on the NYSE. | ||||||

$7.8 billion Market Capitalization (as of July 1, 2024) | | | 54 Facilities in 11 countries | | | >70% Estimated percentage of sales that are sole, single or primary sourced |

| Focus on Niche / Proprietary Products | | | Strategic Inventory | | | RBC Ops Management System | | | Manufacturing Leadership |

• Managing the Pareto: ~20% of products drive ~80% of revenue • Focus on highly specialized products, with ownership of IP, and product approvals • Estimated >70% sole, single or primary sourced products • High Aftermarket mix: ○ Stable, recurring revenue ○ Continually growing installed base | | | • Long shelf-life products with long-term supply agreements • Allows RBC to level-load production to optimize gross margin • Fast lead times and high on-time delivery rates drive strong customer relationships and opportunities for growth | | | • Monthly Ops meetings underpin a system of focus and accountability • Creates a systematic approach to monitoring: ○ Organic growth drivers ○ Margin performance ○ Strategic inventory levels ○ Staffing and human resources ○ Research and development • Drives CEO- and COO-level focus down to the division level, underpinning a culture of deep engagement | | | • High levels of automation • High levels of vertical integration • Low-cost country leadership • Long track record as exceptional operators • Long tenure of management creates a culture of continuous improvement |

| | |  | | | 2024 Proxy Statement | | | 07 |

| • | Net sales were $1,560.3 million, a 6.2% increase over fiscal 2023 |

| • | Gross margin was 43.0% compared to 41.2% for fiscal 2023 |

| • | Net income was $209.9 million, a 25.9% increase over fiscal 2023 |

| • | Adjusted EBITDA was $482.1 million, an 11.1% increase over fiscal 2023 and 104.7% of our plan for the year1 |

| • | Free cash flow conversion (i.e., (operating cash minus capital expenditures) divided by net income) of 115.1% |

| 1 | Adjusted EBITDA is a non-GAAP financial measure. See Appendix B to this proxy statement for a reconciliation of adjusted EBITDA to net income. |

| 08 | | |  | | | 2024 Proxy Statement | | |

| | |  | | | 2024 Proxy Statement | | | 09 |

| Proposals Submitted for Stockholder Vote |

| Richard R. Crowell | | | Mr. Crowell is a Managing Partner of Vance Street Capital LLC, a private equity investment firm, and serves as a director of Micronics, Inc. and Jet Parts Aviation, private companies in the businesses of filtration products, aerospace parts, precision manufacturing, engineered solutions, and related services. Mr. Crowell earned a Bachelor of Arts degree from the University of California, Santa Cruz and a Master of Business Administration degree from the University of California, Los Angeles’s Anderson School. See “Directors and Executive Officers” below. |

Director since 2002 Age: 69 Committees: Audit | | ||

Skills and Expertise Mr. Crowell brings broad business, financial and executive leadership experience to the Board developed through his leadership roles in private equity and investment banking. He has extensive experience with a number of precision manufacturing and aerospace companies. In addition, Mr. Crowell’s experience in private investment enables him to bring a valuable investor’s view to the Board and his relationships across the financial community strengthen the Company’s access to capital markets. His board memberships provide deep understanding of trends in the precision manufacturing and aerospace sectors, both of which present ongoing challenges and opportunities for the Company. | |||

| Dr. Amir Faghri | | | Dr. Faghri is Distinguished Professor Emeritus and Distinguished Dean Emeritus of Engineering at the University of Connecticut, and Distinguished Adjunct Professor at the University of California, Los Angeles. He received a Bachelor of Science degree with highest honors from Oregon State University and his Master of Science and Doctoral degrees in Mechanical Engineering from the University of California at Berkeley. See “Directors and Executive Officers” below. |

Director from 2004 to 2020 and rejoined in 2022 Age: 73 Committees: Compensation | | ||

Skills and Expertise Dr. Faghri’s extensive experience as a leader in the engineering profession—as an educator, scientist and administrator—along with his associations with U.S. companies and global academic institutions, provides the Company with valuable state-of-the-art resources in engineering, manufacturing and information technology, as well as unparalleled expertise in workforce development. | |||

| 10 | | |  | | | 2024 Proxy Statement | | |

| Dr. Steven H. Kaplan | | | Dr. Kaplan is President Emeritus of the University of New Haven. He received a Bachelor of Arts degree from the University of California, Los Angeles, and a Master of Arts and a Doctoral degree from Eberhard-Karls Universität in Germany. See “Directors and Executive Officers” below. |

Director since 2018 Age: 71 Committees: Compensation, Nominating and Governance | | ||

Skills and Expertise Dr. Kaplan’s extensive academic and chief executive experience provides the Company with a wealth of valuable information and a perspective that provides the Board a critical resource for management. His association with U.S. companies and global academia provides the Company with a valuable state of the art executive management resource. | |||

| | | The Board recommends a vote FOR the election to the Board of Directors of the nominees identified above. |

| | | The Board recommends a vote FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2024. |

| | |  | | | 2024 Proxy Statement | | | 11 |

| • | for breach of their duty of loyalty to the Company or our stockholders; |

| • | for acts or omission not in good faith or which involve intentional misconduct or a knowing violation of law; |

| • | in connection with any transaction from which they derived an improper personal benefit; or |

| • | in any action by or in the right of the Company. |

| | | The Board recommends a vote FOR the proposal to amend the Company’s certificate of incorporation to eliminate personal liability of officers for monetary damages for breach of their fiduciary duty of care as officers to the fullest extent permitted by the DGCL. |

| 12 | | |  | | | 2024 Proxy Statement | | |

| • | drive outstanding Company performance, |

| • | align CEO pay with Company performance, |

| • | ensure that no problematic pay practices exist (e.g., re-pricing or backdating of stock options, excessive perquisites, or tax gross-ups), and |

| • | reflect appropriate communication with and responsiveness to stockholders. |

| • | Equity-Based Compensation: The long-term equity incentive program for the CEO and COO, which each year awards shares of stock based on the Company’s performance in the prior fiscal year or prior three-fiscal-year period, was revised to (i) eliminate overlapping metrics between the one-year and three-year components, (ii) increase the weighting of the CEO’s three-year component, and (iii) use the Company’s total shareholder return (TSR) as a percentage of our peer group average as an additional metric for the three-year component. |

| • | Peer Group: The peer group in place as of the 2023 annual meeting was revised by replacing seven of the 16 companies in the group in order to better align RBC with its peers in light of our increasing revenue and profitability. See “Compensation Discussion and Analysis—Compensation Philosophy and Program—Maintaining a Compensation Peer Group” below. |

| | | The Board recommends a vote FOR the approval of the compensation of our named executive officers. |

| | |  | | | 2024 Proxy Statement | | | 13 |

| Board of Directors and Corporate Governance |

| 14 | | |  | | | 2024 Proxy Statement | | |

| • | calling the Company’s Ethics Hotline at 1-866-247-5449 (which is available 24 hours per day, 365 days per year) and leaving a recorded message, which is transcribed by a third-party service provider to insure the caller’s anonymity, or |

| • | sending a written communication marked “Private & Confidential” to the Audit Committee, RBC Bearings Incorporated, c/o the Secretary, 102 Willenbrock Road, Oxford, CT 06478. |

| Audit Committee | | | Responsible for • selecting our independent registered public accounting firm, • approving the overall scope of the audit and the associated fees, • assisting the Board in monitoring the integrity of our financial statements, the independent registered public accounting firm’s qualifications and independence, the performance of the independent registered public accounting firm and our internal audit function, and our compliance with legal and regulatory requirements, • annually reviewing the independent registered public accounting firm’s report describing the auditing firms’ internal quality-control procedures, and any material issues raised by the most recent internal quality-control review, or peer review, of the registered public accounting firm, • discussing the annual audited financial and quarterly statements with management and the independent registered public accounting firm, • discussing earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies, • discussing policies with respect to risk assessment and risk management, • meeting separately, periodically, with management and the independent registered public accounting firm, • reviewing with the independent registered public accounting firm any audit problems or difficulties and management’s response, • setting clear hiring policies for employees or former employees of the independent registered public accounting firm, • handling such other matters that are specifically delegated to the Audit Committee by the Board from time to time, and • reporting regularly to the full Board. |

Meetings held in fiscal 2024: five Members: Michael J. Ambrose Richard R. Crowell Edward D. Stewart (Chair) Each member satisfies the financial literacy requirements of the NYSE and the SEC and the NYSE’s independence requirements for audit committee members. The Board has determined that Messers. Crowell and Stewart qualify as “audit committee financial experts” for SEC purposes. | |

| Compensation Committee | | | Responsible for • reviewing key employee compensation goals, policies, plans and programs, • reviewing and approving the compensation of our directors, chief executive officer and other executive officers, • reviewing and approving employment contracts and other similar arrangements between the Company and our executive officers, • reviewing and consulting with the Board on the selection of the chief executive officer and evaluation of such officer’s executive performance and other related matters, • administration of stock plans and other incentive compensation plans, • approving overall compensation policies for the Company, and • handling such other matters that are specifically delegated to the Compensation Committee by the Board from time to time. | |

Meetings held in fiscal 2024: six Members: Dolores J. Ennico (Chair) Dr. Amir Faghri Dr. Steven H. Kaplan Each member satisfies the NYSE’s independence requirements for compensation committee members. | | |

| | |  | | | 2024 Proxy Statement | | | 15 |

| Nominating and Governance Committee | | | Responsible for • evaluating the composition, size and governance of the Board and its committees and making recommendations regarding future planning and the appointment of directors to committees, • establishing a policy for considering stockholder nominees for election to the Board, • evaluating and recommending candidates for election to the Board, • overseeing the Board’s performance and self-evaluation process and developing continuing education programs for our directors, • reviewing our corporate governance principles and policies and providing recommendations to the Board regarding possible changes, and • reviewing and monitoring compliance with the Company’s Code of Business Conduct and Ethics and our Insider Trading Policy. |

Meetings held in fiscal 2024: two Members: Dolores J. Ennico Dr. Steven H. Kaplan Edward D. Stewart Each member satisfies the NYSE’s independence requirements for nominating and governance committee members. | |

| • | high-level leadership experience in business or administrative activities, and significant accomplishment, |

| • | breadth of knowledge about issues affecting the Company, |

| • | proven ability and willingness to contribute special competencies to Board activities, |

| • | personal integrity, |

| • | loyalty to the Company and concern for its success and welfare, |

| • | ability and willingness to apply sound and independent business judgment, |

| • | awareness of a director’s vital role in assuring the Company’s good corporate citizenship and corporate image, |

| • | no present conflicts of interest, |

| • | availability for meetings and consultation on Company matters, enthusiasm about the prospect of serving, |

| • | willingness to assume broad fiduciary responsibility, and |

| • | willingness to become a Company stockholder. |

| 16 | | |  | | | 2024 Proxy Statement | | |

| Experience, Qualifications, Skills or Diversity | | | Michael Hartnett | | | Michael Ambrose | | | Daniel Bergeron | | | Richard Crowell | | | Dolores Ennico | | | Amir Faghri | | | Steven Kaplan | | | Edward Stewart |

| Leadership Experience | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Industry Experience | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | ||

| Corporate Governance/Board Experience | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Financing/Accounting Experience | | | ✔ | | | | | ✔ | | | ✔ | | | | | | | | | ✔ | ||||

| Human Capital Management Experience | | | ✔ | | | | | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | |||

| Mergers and Acquisitions Experience | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | | | | | | | ✔ | |||

| International Experience | | | ✔ | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | |

| Risk Management Experience | | | | | ✔ | | | ✔ | | | | | ✔ | | | | | | | ✔ | ||||

| Academics & Research Experience | | | ✔ | | | | | | | | | | | ✔ | | | ✔ | | | |||||

| Technology & Cybersecurity Skills | | | ✔ | | | ✔ | | | | | | | | | ✔ | | | | | |||||

| Independence | | | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | ||

| Gender/Ethnic/Racial Diversity | | | | | | | | | | | ✔ | | | ✔ | | | |

| | |  | | | 2024 Proxy Statement | | | 17 |

| 18 | | |  | | | 2024 Proxy Statement | | |

| Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(1) | | | Total ($) |

| Michael H. Ambrose | | | 50,000 | | | 247,428 | | | 94,160 | | | 391,588 |

| Richard R. Crowell | | | 50,000 | | | 247,428 | | | 94,160 | | | 391,588 |

| Dolores J. Ennico | | | 55,000 | | | 247,428 | | | 94,160 | | | 396,588 |

| Dr. Amir Faghri | | | 50,000 | | | 247,428 | | | 94,160 | | | 391,588 |

| Dr. Steven H. Kaplan | | | 50,000 | | | 247,428 | | | 94,160 | | | 391,588 |

| Edward D. Stewart | | | 55,000 | | | 247,428 | | | 94,160 | | | 396,588 |

| (1) | The amounts represent the fair market value on the date of award of restricted shares and non-qualified stock options awarded during the fiscal year. The fair market value of restricted shares is calculated using the closing stock price on the date of award ($206.19) multiplied by the number of shares awarded (1,200). The fair market value of stock options is calculated using the Black-Scholes model, which determined a fair value of $94.16 per option for the 1,000 options awarded. As these represent values as of the date of award, they do not reflect the actual value that will be received at the time the restricted shares vest or the options are exercised, which value will depend on market conditions at that time. |

| | |  | | | 2024 Proxy Statement | | | 19 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS |

| PRINCIPAL STOCKHOLDERS |

| Name of Beneficial Owner | | | Amount and Nature of Beneficial Ownership(1)(2)(3) | | | Percent of Class(4) |

| Michael J. Hartnett | | | 419,575 | | | 1.4% |

| Michael H. Ambrose | | | 8,228 | | | * |

| Daniel A. Bergeron | | | 219,002 | | | * |

| Richard R. Crowell | | | 33,135 | | | * |

| Dolores J. Ennico | | | 7,578 | | | * |

| Dr. Amir Faghri | | | 3,978 | | | * |

| Dr. Steven H. Kaplan | | | 4,193 | | | * |

| Edward D. Stewart | | | 27,461 | | | * |

| John J. Feeney | | | 5,372 | | | * |

| Richard J. Edwards | | | 16,739 | | | * |

| Robert M. Sullivan | | | 32,382 | | | * |

| All directors and executive officers as a group (11 persons) | | | 777,643 | | | 2.6% |

| (1) | Each person in this table has sole voting and dispositive power with respect to their shares or shares such power with their spouse. None of these shares are held in margin accounts or pledged or otherwise available to a lender as security. |

| (2) | Includes the following restricted shares held as of July 1, 2024: Dr. Hartnett – 48,297; Mr. Ambrose – 1,978; Mr. Bergeron – 17,693; Mr. Crowell – 1,978; Ms. Ennico – 1,978; Dr. Faghri – 1,978; Dr. Kaplan – 1,978; Mr. Stewart – 1,978; Mr. Feeney – 1,880; Mr. Edwards – 3,550; Mr. Sullivan – 5,500; all directors and executive officers as a group – 88,788. |

| (3) | Includes the following unissued shares that are subject to stock options that are exercisable within 60 days of July 1, 2024: Dr. Hartnett – 126,536; Mr. Ambrose – 1,500; Mr. Bergeron – 107,594; Mr. Crowell – 1,400; Ms. Ennico – 1,200; Dr. Faghri – 600; Dr. Kaplan – 1,600; Mr. Stewart – 4,000; Mr. Feeney – 2,296; Mr. Edwards – 4,200; Mr. Sullivan – 22,200; all directors and executive officers as a group – 273,126. |

| (4) | Based on 29,221,224 shares of common stock outstanding as of July 1, 2024 plus the unissued option shares of each person referred to in footnote (3). |

| 20 | | |  | | | 2024 Proxy Statement | | |

| Name and Address of Beneficial Owner | | | Amount and Nature of Beneficial Ownership | | | Percent of Class(1) |

The Vanguard Group 100 Vanguard Blvd., Malvern, PA 19355 | | | 2,711,736(2) | | | 9.3% |

BlackRock Inc. 55 East 52nd Street, New York, NY 10055 | | | 2,607,586(3) | | | 8.9% |

Durable Capital Partners LP 5425 Wisconsin Avenue, Chevy Chase, MD 20815 | | | 2,416,738(4) | | | 8.3% |

T. Rowe Price Associates, Inc. 100 E. Pratt Street, Baltimore, MD 21202 | | | 2,077,450(5) | | | 7.1% |

Kayne Anderson Rudnick Investment Management LLC 1800 Avenue of the Stars, Los Angeles, CA 90067 | | | 1,931,657(6) | | | 6.6% |

Wasatch Advisors LP 505 Wakara Way, Salt Lake City, UT 84108 | | | 1,759,189(7) | | | 6.0% |

| (1) | Based on 29,221,224 shares of common stock outstanding as of July 1, 2024. |

| (2) | A Form 13G/A filed February 13, 2024 indicates that it has (i) sole voting power over zero shares, (ii) shared voting power over 10,316 shares, (iii) sole dispositive power over 2,673,955 shares, and (iv) shared dispositive power over 37,781 shares. |

| (3) | A Form 13G/A filed January 25, 2024 indicates that it has (i) sole voting power over 2,548,596 shares, (ii) sole dispositive power over 2,607,586 shares, and (iii) shared voting and dispositive power over zero shares. |

| (4) | A Form 13G/A filed February 12, 2024 indicates that it has (i) sole voting and dispositive power over 2,416,738 shares, and (ii) shared voting and dispositive power over zero shares. |

| (5) | A Form 13G/A filed February 14, 2024 indicates that it has (i) sole voting power over 436,108 shares, (ii) sole dispositive power over 2,075,116 shares, and (iii) shared voting and dispositive power over zero shares. |

| (6) | A Form 13G/A filed February 13, 2024 indicates that it has (i) sole voting power over 1,339,739 shares, (ii) shared voting and dispositive power over 365,280 shares, and (iii) sole dispositive power over 1,566,377 shares. |

| (7) | A Form 13G filed February 9, 2024 indicates that it has (i) sole voting and dispositive power over 1,759,189 shares, and (ii) shared voting and dispositive power over zero shares. |

| | |  | | | 2024 Proxy Statement | | | 21 |

| Directors and Executive Officers |

| Dr. Michael J. Hartnett | | | Dr. Hartnett has been the Company’s President and Chief Executive Officer since 1992 and Chairman of the Board since 1993. Prior to that, Dr. Hartnett served as President and General Manager of our Industrial Tectonics Bearings Corporation, or ITB, subsidiary from 1990, following 18 years at The Torrington Company, one of the three largest bearings manufacturers in the U.S. While at The Torrington Company, Dr. Hartnett held the position of Vice President and General Manager of the Aerospace Business Unit and was, prior to that, Vice President of the Research and Development Division. Dr. Hartnett holds an undergraduate degree from the University of New Haven, a Master’s degree from Worcester Polytechnic Institute and a Doctoral degree in Applied Mechanics from the University of Connecticut. Dr. Hartnett has developed numerous patents, authored more than two dozen technical papers and is well known for his contributions to the field of tribology, the study of friction. Dr. Hartnett served as a director of ATC Technology Corporation, a publicly-owned third-party logistics and automotive aftermarket service provider, until 2010, and served as a director of Process Fab Inc., a private company in the business of precision manufacturing and related services, until 2014. Dr. Hartnett provides the Board with significant leadership and executive experience. His proven leadership capability and his strong knowledge of the complex financial and operational issues facing mid-sized companies provides the Board with a unique and necessary perspective. |

Chairman, President and CEO Joined RBC in 1992 Age: 79 | |

| Daniel A. Bergeron | | | Mr. Bergeron has been with the Company since 2003 when he joined us as Vice President, Finance and later that same year was appointed Chief Financial Officer. In 2017, he was additionally appointed Chief Operating Officer and in October 2020 he relinquished the position of Chief Financial Officer. From 2002 until 2003, he served as Vice President and Chief Financial Officer of Allied Healthcare International, Inc., a publicly-held provider of healthcare staffing services. Mr. Bergeron served as Vice President and Chief Financial Officer at Paragon Networks International, Inc., a telecommunications company, from 2000 to 2002. From 1998 to 2000, he served as Vice President and Chief Financial Officer of Tridex Corporation, a publicly-held software company. From 1987 to 1998, Mr. Bergeron held various financial reporting positions with Dorr-Oliver Inc., an international engineering and manufacturing company, including Vice President and Chief Financial Officer. Mr. Bergeron holds a Bachelor of Science degree in Finance from Northeastern University and a Master of Business Administration degree from the University of New Haven. Mr. Bergeron provides the Board with significant financial leadership and executive experience. His proven leadership capability and his strong knowledge of the complex financial and operational issues facing mid-sized companies provides the Board with a unique and necessary perspective. |

Vice President and COO Joined RBC in 2003 Age: 64 | |

| 22 | | |  | | | 2024 Proxy Statement | | |

| Michael H. Ambrose | | | Mr. Ambrose has been a director since 2019. Mr. Ambrose is currently Principal Partner of MH Ambrose Consulting, specializing in Aerospace and Digital Integration consulting. In this capacity, Mr. Ambrose consults with aerospace OEMs, manufacturing suppliers, and advisory boards for private digital solution providers. Additionally, Mr. Ambrose is recognized as a subject matter expert on digital integration. Since 2021, he has given over fifteen significant presentations on digital transformation, including for the World Affairs Council and a NATO summit in Brussels. Mr. Ambrose also currently serves as Chairman of the University of New Haven Board of Governors. In 2023, Mr. Ambrose completed a 39-year career with Sikorsky Aircraft, a Lockheed Martin Company, where he held executive leadership positions in complex aerospace design, manufacturing operations, and program management. He served as the Vice-President of Enterprise Business Transformation (2021-2023), Chief Engineer and Vice President of Engineering and Technology (2017-2021), Vice President of Aircraft Design and Manufacturing Engineering (2011-2017), Vice President of International Government Programs (2008-2011), and General Manager of Precision Machining Operations (2005-2008). Among his responsibilities and accomplishments at Sikorsky, he led organizations of over 3,500 engineers and separately 800 factory employees, was co-chair of the Sikorsky senior safety board with responsibility for air worthiness, and successfully implemented numerous lean and digital transformation projects. Mr. Ambrose holds a Mechanical Engineering Bachelor of Science degree from the University of New Haven and an Engineering Management Master of Science degree from the Massachusetts Institute of Technology. Mr. Ambrose’s diverse and extensive leadership experience in engineering, manufacturing, program management, international business, and digital integration provides the Board with unique and valuable resources pertaining to RBC’s business and understanding of RBC’s customers and industry trends. |

Director Joined RBC in 2019 Age: 62 | |

| Richard R. Crowell | | | Mr. Crowell has been a director since 2002. Mr. Crowell is a Managing Partner of Vance Street Capital LLC, a private equity investment firm he founded in 2007. Previously he was the President of Aurora Capital Group, a private equity investment firm he co-founded in 1991. Prior to establishing Aurora, Mr. Crowell was a Partner and President of Acadia Partners, a New York-based investment fund. From 1983 to 1987, he was a Managing Director, Corporate Finance for Drexel Burnham Lambert. He serves on the Board of Visitors of the University of California, Los Angeles Anderson School of Management. Mr. Crowell is a director of Micronics, Inc. and Jet Parts Aviation, all of which are private companies in the businesses of filtration products, aerospace parts, precision manufacturing, engineered solutions, and related services. Mr. Crowell earned a Bachelor of Arts degree from the University of California, Santa Cruz and a Master of Business Administration degree from UCLA’s Anderson School. His extensive financial experience qualifies him as an “audit committee financial expert.” Mr. Crowell brings broad business, financial and executive leadership experience to the Board developed through his leadership roles at Vance Street Capital LLC, Aurora Capital Group LLC, Acadia Partners and Drexel Burnham Lambert. He has extensive experience with a number of precision manufacturing and aerospace companies. In addition, Mr. Crowell’s experience in private investment enables him to bring a valuable investor’s view to the Board and his relationships across the financial community strengthen the Company’s access to capital markets. His board memberships provide deep understanding of trends in the precision manufacturing and aerospace sectors, both of which present ongoing challenges and opportunities for the Company. |

Director Joined RBC in 2002 Age: 69 | |

| | |  | | | 2024 Proxy Statement | | | 23 |

| Dolores J. Ennico | | | Ms. Ennico has been a director since 2020. She is currently the Principal of Canterbury Consulting, which provides strategic consulting services in various business initiatives. She was Chief Human Resources Officer of Olin Corporation from 2009 to 2018 and prior to that served Olin in a variety of capacities from 1974 including Vice President, Administration from 2004 to 2009, Director, Corporate Employee Relations from 2000 to 2004, and Director of Retail Marketing, Pool Chemicals from 1997 to 2000. Ms. Ennico is a member of the Board of Governors of the University of New Haven and a member of its Compensation Committee, is a member of the Advisory Council of Sacred Heart Academy in Hamden, Connecticut, and is a member of the Executive Committee of the Board of the Girl Scouts of Connecticut. She earned a Bachelor of Science degree in Microbiology and a Master of Science degree in Biochemistry from Southern Connecticut State University, and a Master of Business Administration degree from the University of New Haven. Ms. Ennico’s vast experience in human capital management, including executive compensation, and her C-suite experience with a Fortune 500 company are valuable resources for the Board. |

Director Joined RBC in 2020 Age: 71 | |

| Dr. Amir Faghri | | | Dr. Faghri was a director from 2004 to 2020 and then was reappointed a director in May 2022. He is currently Distinguished Professor Emeritus and Distinguished Dean Emeritus of Engineering at the University of Connecticut. He is also currently Distinguished Adjunct Professor at the University of California, Los Angeles. He was the Dean of the School of Engineering at the University of Connecticut from 1998 to 2006, and the Head of the Mechanical Engineering Department from 1994 to 1998. Dr. Faghri has authored five books and edited three volumes and authored more than 350 archival technical publications (including 230 journal papers), and holds nine U.S. patents. He has served as a consultant to several major research centers and corporations, including Los Alamos and Oak Ridge national laboratories, Exxon Mobil Corporation, and Intel Corporation. His technical productivity is further complemented by his service on the editorial boards of eight scientific journals. Dr. Faghri received a Bachelor of Science degree with highest honors from Oregon State University and his Master of Science and Doctoral degrees in Mechanical Engineering from the University of California, Berkeley. His extensive experience as a leader in the engineering profession—as an educator, scientist and administrator—along with his associations with U.S. companies and global academic institutions, provides the Company with valuable state-of-the-art resources in engineering, manufacturing and information technology, as well as unparalleled expertise in workforce development. |

Director Joined RBC in 2004 and again in 2022 Age: 73 | |

| Dr. Steven H. Kaplan | | | Dr. Kaplan has been a director since 2018. He became President of the University of New Haven in 2004, leading the University through a period of remarkable growth and development, before becoming President Emeritus in 2023. In 2015, in recognition of his contributions to transforming the University, Dr. Kaplan was presented the Chief Executive Leadership Award by the Council for Advancement and Support of Education (CASE) District I. He also was named “Businessman of the Year” by Business New Haven magazine in 2008. Dr. Kaplan was awarded the 2011 William M. Burke Presidential Award for Experiential Education by the National Society for Experiential Education. Previously, Dr. Kaplan was chancellor and professor of English at the University of Virginia’s College at Wise. Dr. Kaplan began his teaching career in 1982 as an Instructor of English at the University of Maryland, European Division. From 1985 to 1989, he served as Visiting Lecturer in American Studies at Eberhard-Karls Universität, Tübingen, Germany, one of the oldest and most highly regarded universities in Europe. After completing his doctoral studies at Eberhard-Karls Universität, he returned to the U.S. to teach English at the University of Southern Colorado. Dr. Kaplan also served as Dean of Arts and Humanities at the State University of New York at Buffalo and as Dean of the College of Liberal Arts and Sciences at Butler University. In addition to earning his Ph.D. in Comparative Literature at Eberhard-Karls Universität, Dr. Kaplan holds a Master of Arts degree (with a concentration in philosophy, German and English) from Eberhard-Karls Universität and a Bachelor of Arts degree from the University of California, Los Angeles. This knowledge and chief executive experience allows Dr. Kaplan to provide the Company with a wealth of valuable international executive experience and a perspective that provides the Board a critical resource for management. His association with U.S. companies and global academia provides the Company with a valuable state of the art executive management resource. |

Director Joined RBC in 2018 Age: 71 | |

| 24 | | |  | | | 2024 Proxy Statement | | |

| Edward D. Stewart | | | Mr. Stewart has been a director since 2013. Mr. Stewart is the former Chairman of the Board of ATC Technology Corporation, a then-publicly-held third-party logistics services provider, and has served on other company boards and audit committees. Mr. Stewart has many years of financial and operational experience with General Electric Company including as Executive Vice President of GE Capital and Chief Financial Officer of a number of other GE businesses. Mr. Stewart formerly served as a member of the Board of Directors of Nordstrom fsb, a formerly wholly-owned subsidiary of Nordstrom, Inc., and a member of its Audit and Investment Committees. Mr. Stewart earned a Bachelor of Arts degree in Economics from Tufts University. His extensive financial experience qualifies him as an “audit committee financial expert.” In addition, his service as a director of other publicly-traded and private companies is a valuable resource to the Board. |

Director Joined RBC in 2013 Age: 81 | |

| Richard J. Edwards | | | Mr. Edwards has been with the Company since 1990 when he joined us as Manufacturing Manager for the Hartsville, South Carolina facility. After holding the positions of Plant Manager for the Hartsville Plant, and Director of Operations for the RBC Divisions, he was named Vice President and General Manager for the RBC Divisions in 1996. Prior to joining us, Mr. Edwards spent six years with The Torrington Company as Materials Manager, and later Plant Superintendent in the Tyger River plant. He holds a Bachelor of Science degree in Management from Arizona State University. |

Vice President and General Manager Joined RBC in 1990 Age: 68 | |

| John J. Feeney | | | Mr. Feeney joined RBC as Assistant General Counsel in 2014 and in October 2020 was appointed Vice President, General Counsel and Secretary. Prior to that he was Associate Counsel for Conair Corporation, a privately held consumer products company in Stamford Connecticut, from 2008 to 2014, and from 2005 to 2008 Mr. Feeney was Staff Counsel at Volt Information Sciences, Inc., a publicly-owned staffing company. From 2000 to 2005 he was with the New York City Law Department, where he focused on litigation. Mr. Feeney has a Bachelor of Arts degree in History from St. Joseph’s University, a Master of Arts degree from St. John’s University, and a Juris Doctor from SUNY Buffalo, School of Law. |

Vice President, General Counsel and Secretary Joined RBC in 2014 Age: 55 | |

| Robert M. Sullivan | | | Mr. Sullivan joined the Company in 2016 as Assistant Corporate Controller, in 2017 was appointed Corporate Controller, and then in October 2020 was appointed Vice President and Chief Financial Officer. From 2013 to 2016 he worked at Sikorsky Aircraft Corporation in business development, program finance and financial planning and analysis. From 2007 until 2013 he was employed by Ernst & Young LLP as an Audit Manager. Mr. Sullivan holds a Bachelor of Science degree in Accounting from Fairfield University, a Master of Science degree in Accounting and Taxation from the University of Hartford, and a Master of Business Administration degree from the University of Connecticut. He is a licensed certified public accountant. |

Vice President and CFO Joined RBC in 2016 Age: 40 | |

| | |  | | | 2024 Proxy Statement | | | 25 |

| Compensation Philosophy and Program |

| What We Do | | | What We Don’t Do |

• Annual say-on-pay vote • Performance-driven compensation philosophy • Balance compensation with both short- and long-term incentives using multiple performance measures • Set challenging quantitative performance measures • Rigorous stock ownership guidelines for executive officers • Retain independent compensation consultants as needed • Use an appropriate peer group selected based on a range of factors • Maintain a clawback policy on all incentive compensation • Use double-trigger provisions in the event of a change in control • Engage regularly with stockholders on executive compensation • Limited perquisites | | | • No executive officer employment agreements, other than for the CEO and COO • No guaranteed bonuses or salary increases • No re-pricing or backdating of options • No share recycling under long-term incentive plans • No excessive severance and/or change-in-control provisions • No tax “gross-ups” |

| 26 | | |  | | | 2024 Proxy Statement | | |

| • | Our motivation in selecting performance metrics is to choose the metric that most accurately captures our performance as a company and the value that we are generating for our stockholders. We strongly believe that adjusted EBITDA is that metric. |

| • | Adjusted EBITDA is the foundation on which all of our business units run. Over the years we have developed a strong focus and discipline around cash management and capital allocation from the top of the organization to the bottom. We continue to apply this focus in operating the Company today. |

| • | Adjusted EBITDA allows management, investors and others to evaluate and compare the Company’s core operating results, including return on capital and operating efficiencies, from period to period by removing the impact of the Company’s capital structure (interest expense from our outstanding debt), asset base (depreciation and amortization), tax consequences, other non-operating items, and share-based compensation. |

| • | Adjusted EBITDA is the measure that guides the Company, through managing cash flow, operating cost and efficiency, and capital allocation, during periods of economic downturn and inhibits the manipulation of operating performance through excessive leverage or capital expenditures, the impact of which are more problematic during periods of economic downturn. |

| • | Adjusted EBITDA is a key driver for debt covenants. |

| • | We use adjusted EBITDA for business planning purposes, to run the business, for capital allocation decisions, and to evaluate and price potential acquisitions. |

| • | In addition to its use by management, we also believe adjusted EBITDA is a measure widely used by securities analysts, investors, and others to evaluate the financial performance of the Company and other companies in our industry. |

| • | We view adjusted EBITDA as the most reliable bellwether of how well we are converting the Company’s revenue into value for our stockholders. |

| | |  | | | 2024 Proxy Statement | | | 27 |

| Position | | | Value of Stock |

| CEO | | | 6x base salary |

| All other executive officers | | | 3x base salary |

| Non-employee directors | | | 3x annual retainer fee |

| Compensation Committee | | | • Oversees the manner in which the Board discharges its responsibilities relating to the Company’s executive compensation program. • In consultation with the Board, the CEO and senior management, develops and approves the executive compensation philosophy. • Reviews and approves corporate goals and objectives related to the CEO and COO’s compensation and evaluates their performance. • Determines the CEO and COO’s compensation and reviews and approves the CEO’s recommendations regarding the compensation of the other executive officers. • Sole authority to retain executive compensation consultants engaged to provide advice to the Compensation Committee in connection with its responsibilities and to retain other professional advisors when necessary or appropriate. |

Dolores J. Ennico (Chair) Dr. Amir Faghri Dr. Steven J. Kaplan Each member satisfies the NYSE’s independence requirements. | |

| 28 | | |  | | | 2024 Proxy Statement | | |

| Outside Compensation Advisor | | | • Provides peer group compensation data. • Provides information regarding compensation best practices. • Assists with compensation program design. |

| As selected and retained by the Compensation Committee from time to time. | |

| Senior Management | | | • The CEO, who is in the best position to initially assess performance, makes recommendations to the Compensation Committee regarding compensation decisions regarding the executive officers other than the CEO and COO. • Senior management provides input and feedback to the Compensation Committee regarding the Compensation Committee’s compensation process and the compensation program design. • Senior management may be invited to attend Compensation Committee or Board meetings from time to time, or to contribute materials for such meetings. |

| CEO, COO, CFO, General Counsel | |

| • | The terms of the officer’s employment agreement in the case of the CEO and COO; |

| • | Peer group data; |

| • | The CEO’s salary recommendations in the case of officers other than the CEO; |

| • | Tenure |

| • | Performance in role; |

| • | Competitive positioning against market; |

| • | Value to the Company and future potential; |

| • | Scope of responsibility; and |

| • | Prior experience. |

| | |  | | | 2024 Proxy Statement | | | 29 |

| New Peer Group | | | ||||

| Added | | | Retained | | | Removed |

Carlisle Companies Dana Enerpac Tool Group Flowserve Gates Industrial Terex Textron | | | Barnes Group Curtiss-Wright Graco HEICO Hexcel ITT Regal Rexnord Timken Woodword | | | BWX Technologies Donaldson Franklin Electric Kratos Defense & Security Mercury Systems Moog Watts Water Technologies |

| | | Old Peer Group | ||||

| 30 | | |  | | | 2024 Proxy Statement | | |

| Stockholder Engagement and 2023 Say-on-Pay Results |

| • | the adoption of a new 3-year performance-based award, as well as the discontinuation of the use of stock options; and |

| • | the decision to base equity award values on a multiple of base salary rather than a fixed number of shares in order to enhance predictability and transparency. |

Stockholder Feedback Regarding Equity Comp Program | | | RBC Response |

• Overlapping metrics should be avoided. • Three-year component should be more heavily weighted. • Third metric should be added to the program. | | | • ROIC has been removed as a one-year metric and adjusted EBITDA has been removed as a three-year metric. • The one-year and three-year components of the CEO’s program are now weighted 60/40 at target performance level. • TSR relative to our peer group has been added as a second metric for the three-year component. |

| Compensation Committee Report on Executive Compensation |

| | |  | | | 2024 Proxy Statement | | | 31 |

| Executive Compensation |

| Compensation Program Components and Pay Outcomes for Fiscal 2024 |

| Name | | | Position |

| Dr. Michael J. Hartnett | | | Chairman, President and Chief Executive Officer(1) |

| Daniel A. Bergeron | | | Director, Vice President and Chief Operating Officer(2) |

| Patrick S. Bannon | | | Vice President and General Manager, retired(3) |

| Richard J. Edwards | | | Vice President and General Manager(2) |

| John J. Feeney | | | Vice President, General Counsel and Secretary(2) |

| Robert M. Sullivan | | | Vice President and Chief Financial Officer(4) |

| (1) | Our principal executive officer. |

| (2) | One of our three most highly compensated executive officers for fiscal 2024 other than our principal executive and financial officers. |

| (3) | Mr. Bannon retired as an officer of the Company at the end of the third quarter of fiscal 2024. He continued to serve the Company in a consulting role until the end of the first quarter of fiscal 2025. His compensation information is provided in this proxy statement pursuant to Item 402(a)(3)(iv) of Regulation S-K. |

| (4) | Our principal financial officer. |

| 32 | | |  | | | 2024 Proxy Statement | | |

| | | Fiscal 2024 Base Salary | | | Fiscal 2025 Base Salary | | | Percent Increase | |

| Dr. Michael J. Hartnett | | | $ 997,500 | | | $ 1,500,000(1) | | | 50.4% |

| Daniel A. Bergeron | | | 640,500 | | | 672,525(2) | | | 5.0% |

| Patrick S. Bannon | | | 293,604 | | | NA | | | NA |

| Richard J. Edwards | | | 373,118 | | | 384,312(2) | | | 3.0% |

| John J. Feeney | | | 282,730 | | | 292,625(2) | | | 3.5% |

| Robert M. Sullivan | | | 243,800 | | | 258,428(2) | | | 6.0% |

| (1) | Increase effective from March 31, 2024. |

| (2) | Increase effective from June 1, 2024. |

| | | CEO and COO Annual Bonus | ||||

| Percentage of Adjusted EBITDA to Plan | | | CEO Bonus as a Multiple of Base Salary | | | COO Bonus as a Multiple of Base Salary |

| Less than 80.0% | | | 0.0x | | | 0.0x |

| 80.0% to 89.9% | | | 0.75x | | | 0.45x |

| 90.0% to 99.9% | | | 1.0x | | | 0.6x |

| 100.0% to 109.9% | | | 1.5x | | | 0.9x |

| 110.0% to 119.9% | | | 2.0x | | | 1.2x |

| 120.0% or higher | | | 2.5x | | | 1.5x |

| 1. | Divisional sales plus depreciation minus total factory costs for the fiscal year. This component is targeted at 50% of the total annual performance incentive (or 30% of the executive’s fiscal year-end base salary), subject to adjustment based on level of achievement as noted below |

Percentage of Achievement of Target Goal | | | Amount of Bonus as Percentage of Target |

| Less than 80.1% | | | No bonus |

| 80.1% to 99.9% | | | Pro rata portion of 100% |

| 100.0% | | | 100% |

| 100.1% to 119.9% | | | Pro rata portion of 200% |

| 120.0% or higher | | | 200% |

| 2. | Divisional revenue growth relative to U.S. gross domestic product. This component is equal to 25% of the total target annual performance incentive (or 15% of the executive’s fiscal |

| | |  | | | 2024 Proxy Statement | | | 33 |

| 3. | Non-financial and qualitative performance goals. This component is equal to 25% of the total target annual performance incentive (or 15% of the executive’s fiscal year-end base salary). The CEO reviews non-financial performance in areas critical to the long-term success of the business. |

| | | Performance Bonus | | | Discretionary Bonus | | | Total Bonus | | | Bonus as a Percentage of Base Salary | |

| Dr. Michael J. Hartnett | | | $1,496,250 | | | NA | | | $1,496,250 | | | 150.0% |

| Daniel A. Bergeron | | | 576,450 | | | NA | | | 576,450 | | | 90.0% |

Patrick S. Bannon(1) | | | - | | | - | | | - | | | - |

| Richard J. Edwards | | | 296,629(2) | | | - | | | 296,629 | | | 88.3% |

| John J. Feeney | | | NA | | | $65,000 | | | 65,000 | | | 23.0% |

| Robert M. Sullivan | | | NA | | | 150,000 | | | 150,000 | | | 61.5% |

| (1) | Because Mr. Bannon retired prior to the completion of fiscal 2024, he did not receive a performance bonus for the year. |

| (2) | Based on achievement of the following performance to target goal under his performance bonus plan: 113.1% of part 1; 100.0% of part 2; 100.0% of part 3. |

| 34 | | |  | | | 2024 Proxy Statement | | |

| | | CEO and COO One-Year Adjusted EBITDA-Based Awards | ||||

| Percentage of Adjusted EBITDA to Plan | | | CEO Award Value as a Multiple of Base Salary | | | COO Award Value as a Multiple of Base Salary |

| Less than 75.0% | | | 0.0x | | | 0.0x |

| 75.0% to 84.9% | | | 2.8x | | | 1.45x |

| 85.0% to 94.9% | | | 3.5x | | | 1.9x |

| 95.0% to 104.9% (target) | | | 4.5x | | | 2.6x |

| 105.0% to 114.9% | | | 5.25x | | | 3.05x |

| Over 114.9% | | | 6.65x | | | 4.85x |

| | | CEO and COO Three-Year Adjusted EBITDA-Based Awards(1) | ||||

| Percentage of adjusted EBITDA to Plan | | | CEO Award Value as a Multiple of Base Salary | | | COO Award Value as a Multiple of Base Salary |

| Less than 75.0% | | | 0.0x | | | 0.0x |

| 75.0% to 84.9% | | | 0.6x | | | 0.3x |

| 85.0% to 94.9% | | | 0.9x | | | 0.6x |

| 95.0% to 104.9% (target) | | | 1.2x | | | 0.8x |

| 105.0% to 114.9% | | | 1.65x | | | 1.0x |

| Over 114.9% | | | 2.25x | | | 1.25x |

| (1) | For three-year periods ending with fiscal 2025 and fiscal 2026. |

| | | CEO and COO Three-Year ROIC-Based Awards(1) | |||||||

| | | ROIC as % of Plan(2) | | | CEO Award Value as a Multiple of Base Salary(2) | | | COO Award Value as a Multiple of Base Salary(2) | |

| Threshold | | | -0.75% | | | 0.3x | | | 0.2x |

| Target | | | 0.00% | | | 0.6x | | | 0.3x |

| Maximum | | | +0.75% | | | 1.2x | | | 0.7x |

| (1) | For three-year periods ending with fiscal 2025 and fiscal 2026. |

| (2) | In between is straight line. |

| | |  | | | 2024 Proxy Statement | | | 35 |

| | | CEO and COO TSR-Based Awards(1) | ||||

| Trailing Five-Year TSR as a Percentage of Peer Group Average | | | CEO Award Value as a Multiple of Base Salary | | | COO Award Value as a Multiple of Base Salary |

| Less than 75.0% | | | 0.0x | | | 0.0x |

| 75.0% to 84.9% | | | 0.5x | | | 0.25x |

| 85.0% to 94.9% | | | 0.75x | | | 0.5x |

| 95.0% to 104.9% | | | 1.0x | | | 0.65x |

| 105.0% to 114.9% | | | 1.25x | | | 0.75x |

| Over 114.9% | | | 1.5x | | | 0.85x |

| (1) | For three-year periods ending with fiscal 2027 and thereafter. |

| | | CEO and COO Three-Year ROIC-Based Awards(1) | |||||||

| | | ROIC as % of Plan(2) | | | CEO Award Value as a Multiple of Base Salary(2) | | | COO Award Value as a Multiple of Base Salary(2) | |

| Threshold | | | -0.75% | | | 1.0x | | | 0.4x |

| Target | | | 0.00% | | | 2.0x | | | 0.6x |

| Maximum | | | +0.75% | | | 4.0x | | | 1.75x |

| (1) | For three-year periods ending with fiscal 2027 and thereafter. |

| (2) | In between is straight line. |

| • | Assessments by the CEO and the Compensation Committee of the achievement of applicable performance metrics; |

| • | The perceived incentive that any award would provide to generate long-term stockholder value; and |

| • | The contribution of the individual. |

| 36 | | |  | | | 2024 Proxy Statement | | |

| | | Restricted Stock Fair Value(1) | | | Stock Options Fair Value(1) | |

| Dr. Michael J. Hartnett | | | $5,027,356 | | | NA |

| Daniel A. Bergeron | | | 1,972,638 | | | NA |

| Patrick S. Bannon | | | - | | | - |

| Richard J. Edwards | | | 219,638 | | | 271,039 |

| John J. Feeney | | | 146,425 | | | 135,520 |

| Robert M. Sullivan | | | 292,850 | | | 271,039 |

| (1) | The amounts represent the fair market value of the award on the award date. The fair market value of restricted shares is calculated using the closing stock price on the award date ($292.85) multiplied by the number of shares. The fair market value of stock options is calculated using the Black-Scholes model, which determined a fair value of $135.52 per option. As these represent values as of the award date, they do not reflect the actual value that will be received at the time the restricted shares vest or the options are exercised, which value will depend on market conditions at that time. |

| Benefits and Perquisites |

| | |  | | | 2024 Proxy Statement | | | 37 |

| Employment Agreements and Change-in-Control and Severance Arrangements |

| 38 | | |  | | | 2024 Proxy Statement | | |

| | | Michael J. Hartnett | | | Daniel A. Bergeron | | | Richard J. Edwards | | | Patrick S. Bannon | | | John J. Feeney | | | Robert M. Sullivan | |

| Severance Payment | | | 6,234,375 | | | 3,042,373 | | | 895,483 | | | NA | | | NA | | | NA |

| Bonus | | | 2,493,750 | | | 960,750 | | | 335,806 | | | NA | | | NA | | | NA |

| Other Payments | | | 43,328 | | | 52,351 | | | 17,765 | | | NA | | | NA | | | NA |

| Vested Stock Options | | | 8,298,961 | | | 3,482,754 | | | 836,110 | | | NA | | | NA | | | NA |

| Vested Restricted Stock | | | 18,668,208 | | | 7,226,456 | | | 1,135,470 | | | NA | | | 481,223 | | | 1,730,240 |

| Total | | | 35,738,622 | | | 14,764,684 | | | 3,220,634 | | | NA | | | 481,223 | | | 1,730,240 |

| | | Michael J. Hartnett | | | Daniel A. Bergeron | |

Death or Disability/Termination Without Cause(1)(2) | | | | | ||

| Base Salary | | | 997,500 | | | 640,500 |

| Bonus | | | 2,493,750 | | | 960,750 |

| Other Payments | | | 567,808 | | | 93,310 |

| Vested Stock Options | | | 8,298,961 | | | 3,482,754 |

| Vested Restricted Stock | | | 18,668,208 | | | 7,226,456 |

| Long-Term Stock Award | | | 1,795,500 | | | NA |

| Total | | | 32,821,727 | | | 12,403,770 |

Termination With Cause/Voluntary Resignation(3) | | | | | ||

| Base Salary | | | 498,750 | | | NA |

| Other Payments | | | 447,920 | | | NA |

| Total | | | 946,670 | | | NA |

| (1) | The employment agreement provides that if his employment ends due to his death, disability or termination by the Company without cause, he will (i) receive (x) a lump-sum payment equal to his then-base salary for the period from the termination date through the end of the term of the employment agreement and (y) his annual performance bonus at the maximum base salary multiple prorated for the portion of the fiscal year prior to the termination date, and (ii) be entitled to the continuation of certain benefits until the end of the term of the employment agreement or for 12 months, whichever is longer. For purposes of the foregoing, the end of the term of the employment agreement will be March 31, 2026 unless the agreement is automatically renewed, in which case the end of the term will be the end of the then-current 12-month renewal period. |

| (2) | The employment agreement also provides that if his employment ends due to his death, disability, termination by the Company without cause, or the Company giving him notice of nonrenewal prior to March 31, 2026 or the end of any subsequent renewal period, all his restricted stock and unvested stock options will vest. Dr. Hartnett’s agreement also provides that he will receive an award of a prorated portion of the shares that would be issuable under the three-year component of his equity incentive program for any three-year performance periods that are then open (at the base salary multiple for the plan target goals). Starting with fiscal 2025, this benefit will also include a prorated portion of the shares that would be issuable under the one-year component of his equity incentive program, and this benefit will also be provided to Mr. Bergeron. |

| (3) | Dr. Hartnett’s employment agreement provides that if he is terminated for cause or he voluntarily resigns, he will be entitled to his base salary and continuation of certain benefits set forth in his employment agreement for six months following the date of his termination. |

| | |  | | | 2024 Proxy Statement | | | 39 |

| Compensation Tables |

Name and Principal Position | | | Fiscal Year | | | Salary ($)(1) | | | Bonus ($)(2) | | | Stock Awards ($)(3) | | | Option Awards ($)(3) | | | Non-Equity Incentive Plan Compensation ($)(4) | | | All Other Compensation ($) | | | Total ($) |

Michael J. Hartnett Chairman, President and CEO | | | 2024 | | | 997,500 | | | NA | | | 6,317,484 | | | NA | | | 1,496,250 | | | 166,342(5) | | | 8,977,576 |

| | 2023 | | | 950,000 | | | NA | | | 5,984,946 | | | NA | | | 1,425,000 | | | 90,271 | | | 8,450,217 | ||

| | 2022 | | | 900,000 | | | NA | | | 10,364,286 | | | 5,820,840 | | | 2,250,000 | | | 69,237 | | | 19,404,363 | ||

| | 2021 | | | 631,937 | | | NA | | | 3,725,036 | | | 2,900,431 | | | 1,550,040 | | | 87,557 | | | 8,895,001 | ||

Daniel A. Bergeron Vice President and COO | | | 2024 | | | 640,500 | | | NA | | | 2,104,431 | | | NA | | | 576,450 | | | 32,461(6) | | | 3,353,842 |

| | 2023 | | | 610,000 | | | NA | | | 2,344,192 | | | NA | | | 549,000 | | | 37,401 | | | 3,540,593 | ||

| | 2022 | | | 574,219 | | | NA | | | 4,979,000 | | | 2,680,650 | | | 868,220 | | | 28,680 | | | 9,130,769 | ||

| | 2021 | | | 449,479 | | | NA | | | 1,769,128 | | | 1,021,593 | | | 661,500 | | | 35,138 | | | 3,936,838 | ||

Patrick S. Bannon Vice President and General Manager, retired | | | 2024 | | | 196,434 | | | - | | | 199,510 | | | 181,380 | | | - | | | 8,065 | | | 585,389 |

| | 2023 | | | 286,443 | | | - | | | 199,100 | | | 172,896 | | | 150,000 | | | 9,820 | | | 818,259 | ||

| | 2022 | | | 272,575 | | | 58,285 | | | 398,320 | | | 382,950 | | | 41,715 | | | 5,448 | | | 1,159,293 | ||

| | 2021 | | | 239,885 | | | 24,450 | | | 687,200 | | | 738,750 | | | 125,550 | | | 8,846 | | | 1,824,681 | ||

Richard J. Edwards Vice President and General Manager | | | 2024 | | | 373,118 | | | - | | | 199,510 | | | 181,380 | | | 296,629 | | | 27,844(7) | | | 1,078,481 |

| | 2023 | | | 362,250 | | | - | | | 398,200 | | | 345,793 | | | 235,463 | | | 23,302 | | | 1,365,008 | ||

| | 2022 | | | 343,375 | | | - | | | 398,320 | | | 382,950 | | | 310,545 | | | 23,371 | | | 1,458,561 | ||

| | 2021 | | | 273,153 | | | 29,400 | | | - | | | - | | | 120,600 | | | 22,991 | | | 446,144 | ||

John J. Feeney Vice President, General Counsel and Secretary | | | 2024 | | | 282,730 | | | 65,000 | | | 99,755 | | | 90,690 | | | NA | | | 10,120 | | | 548,295 |

| | 2023 | | | 275,834 | | | 55,167 | | | 199,100 | | | 172,900 | | | NA | | | 9,821 | | | 712,822 | ||

| | 2022 | | | 266,500 | | | 160,680 | | | 99,580 | | | 153,180 | | | NA | | | 5,460 | | | 685,400 | ||

| | 2021 | | | 205,579 | | | 104,000 | | | 81,711 | | | 19,130 | | | NA | | | 4,151 | | | 414,571 | ||

Robert M. Sullivan Vice President and CFO | | | 2024 | | | 243,800 | | | 150,000 | | | 598,530 | | | 453,450 | | | NA | | | 10,059 | | | 1,455,839 |

| | 2023 | | | 230,000 | | | 138,000 | | | 398,200 | | | 345,793 | | | NA | | | 9,090 | | | 1,121,083 | ||

| | 2022 | | | 205,000 | | | 206,000 | | | 199,160 | | | 382,950 | | | NA | | | 5,392 | | | 998,502 | ||

| | 2021 | | | 148,672 | | | 100,000 | | | 343,600 | | | 492,500 | | | NA | | | 4,768 | | | 1,089,540 |

| (1) | Includes amounts deferred by the officer pursuant to the 401(k) plan and SERP. |

| (2) | Consists of discretionary bonuses for the fiscal year and paid in the following fiscal year. Performance bonuses paid under the annual incentive plan are included in the “Non-Equity Incentive Plan Compensation” column. |

| (3) | Represents the fair market value on the date of award of restricted shares and non-qualified stock options awarded during the fiscal year based on performance in the prior fiscal year. |

| (4) | Consist of annual cash bonuses earned under the annual incentive plan for performance in the fiscal year and paid in the following fiscal year. See “Compensation Program Components and Pay Outcomes for Fiscal 2024—Annual Incentive Compensation Plan” above. |

| (5) | Consists of (i) $148,000 for reimbursement of personal expenses, (including aircraft use for personal travel), (ii) $10,256 of Company contributions to his 401(k) account, (iii) $6,909 for reimbursement of healthcare expenses, and (iv) $1,176 for a Company-owned vehicle. |

| (6) | Consists of (i) $10,129 of Company contributions to his 401(k) account, (ii) $12,000 for a vehicle allowance, (iii) $9,844 for reimbursement of healthcare expenses, and (iv) $488 for taxable costs of group-term life insurance. |

| (7) | Consists of (i) $12,000 for a vehicle allowance, (ii) $9,982 of Company contributions to his 401(k) account, and (iii) $5,862 for taxable costs of group-term life insurance. |

| 40 | | |  | | | 2024 Proxy Statement | | |

| Name | | | Award Date | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | | | All Other Stock Awards: Number of Shares of Stock or Units (#) | | | All Other Option Awards: Number of Securities Underlying Options (#) | | | Exercise or Base Price of Option Awards ($/Sh) | | | Award Date Fair Value of Stock and Stock Option Awards ($)(2) | ||||||

| | Threshold ($) | | | Target ($) | | | Maximum ($) | | ||||||||||||||||

| Michael J. Hartnett | | | | | 748,125(3) | | | 1,496,250(4) | | | 2,493,750(5) | | | | | | | | | |||||

| | | 6/1/23 | | | | | | | | | 31,665 | | | - | | | - | | | 6,317,484 | ||||

| Daniel A Bergeron | | | | | 288,225(6) | | | 576,450(7) | | | 960,750(8) | | | | | | | | | |||||

| | | 6/1/23 | | | | | | | | | 10,548 | | | - | | | - | | | 2,104,431 | ||||

| Patrick S. Bannon | | | | | NA | | | NA | | | NA | | | | | | | | | |||||

| | | 6/1/23 | | | | | | | | | 1,000 | | | 2,000 | | | 199.51 | | | 380,890 | ||||

| Richard J. Edwards | | | | | 55,968(9) | | | 223,871(10) | | | 335,806(11) | | | | | | | | | |||||

| | | 6/1/23 | | | | | | | | | 1,000 | | | 2,000 | | | 199.51 | | | 380,890 | ||||

| John J. Feeney | | | | | NA | | | NA | | | NA | | | | | | | | | |||||

| | | 6/1/23 | | | | | | | | | 500 | | | 1,000 | | | 199.51 | | | 190,240 | ||||

| Robert M. Sullivan | | | | | NA | | | NA | | | NA | | | | | | | | | |||||

| | | 6/1/23 | | | | | | | | | 3,000 | | | 5,000 | | | 199.51 | | | 1,051,980 | ||||

| (1) | See “Compensation Program Components and Pay Outcomes for Fiscal 2024—Annual Performance Bonuses” above for a description of the annual performance plans for the NEOs. |

| (2) | The Award Date Fair Value of restricted stock awards is based on the $199.51 closing price of our common stock on the award date. |

| (3) | Equals 75% of base salary if adjusted EBITDA performance is 80% of plan. |

| (4) | Equals 150% of base salary if adjusted EBITDA performance is 100% of plan. |

| (5) | Equals 250% of base salary if adjusted EBITDA performance is 120% of plan. For fiscal 2024, adjusted EBITDA performance was 107.9% of plan. |

| (6) | Equals 45% of base salary if adjusted EBITDA performance is 80% of plan. |

| (7) | Equals 90% of base salary if adjusted EBITDA performance is 100% of plan. |

| (8) | Equals 150% of base salary if adjusted EBITDA performance is 120% of plan. For fiscal 2024, adjusted EBITDA performance was 107.9% of plan. |

| (9) | Equals 15% of base salary if the metrics for parts 1, 2 and 3 of the bonus are (i) less than 80% of plan, (ii) less than 100% of plan, and (iii) 100% of plan, respectively. |

| (10) | Equals 60% of base salary if the metric for part 1 of the bonus is 100% of plan. |

| (11) | Equals 90% of base salary if the metric for part 1 of the bonus is 120% of plan. |

| | |  | | | 2024 Proxy Statement | | | 41 |

| | | Option Awards | | | Stock Awards | ||||||||||||||||

| Name | | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($)(1) |

| Michael J. Hartnett | | | 30,400 | | | 15,200(2) | | | - | | | 143.92 | | | 6/3/26 | | | 17,347(2) | | | 4,689,761 |

| | 23,557 | | | 23,557(3) | | | - | | | 137.44 | | | 6/2/27 | | | 20,040(3) | | | 5,417,814 | ||

| | 30,400 | | | 45,600(4) | | | - | | | 199.16 | | | 6/3/28 | | | 31,665(4) | | | 8,560,633 | ||

| Daniel A. Bergeron | | | 35,000 | | | - | | | - | | | 132.12 | | | 6/7/25 | | | 8,333(2) | | | 2,252,827 |

| | 28,000 | | | 7,000(2) | | | - | | | 143.92 | | | 6/3/26 | | | 7,849(3) | | | 2,121,977 | ||

| | 12,446 | | | 8,297(3) | | | - | | | 137.44 | | | 6/2/27 | | | 10,548(4) | | | 2,851,652 | ||

| | 14,000 | | | 21,000(4) | | | - | | | 199.16 | | | 6/3/28 | | | - | | | - | ||

| Patrick S. Bannon | | | - | | | 3,000(2) | | | | | 143.92 | | | 9/30/24 | | | 2,600(2) | | | 702,910 | |

| | - | | | 3,000(2) | | | | | 137.44 | | | 9/30/24 | | | - | | | - | |||

| | 2,000 | | | 1,000(2) | | | - | | | 199.16 | | | 9/30/24 | | | - | | | - | ||

| | 400 | | | 400(2) | | | - | | | 199.10 | | | 9/30/24 | | | - | | | - | ||

| | - | | | 400(2) | | | - | | | 199.51 | | | 9/30/24 | | | - | | | - | ||

| Richard J. Edwards | | | - | | | 2,000(2) | | | - | | | 143.92 | | | 6/3/26 | | | 400(2) | | | 108,140 |

| | - | | | 3,000(4) | | | - | | | 199.16 | | | 6/3/28 | | | 1,200(4) | | | 324,420 | ||

| | - | | | 3,200(5) | | | - | | | 199.10 | | | 6/3/29 | | | 1,600(5) | | | 432,560 | ||

| | - | | | 2,000(6) | | | - | | | 199.51 | | | 6/1/30 | | | 1,000(6) | | | 270,350 | ||

| John J. Feeney | | | 40 | | | - | | | - | | | 135.53 | | | 12/15/25 | | | 180(7) | | | 48,663 |

| | 56 | | | 112(7) | | | - | | | 181.58 | | | 2/8/28 | | | 300(4) | | | 81,105 | ||

| | 800 | | | 1,200(4) | | | - | | | 199.16 | | | 6/3/28 | | | 800(5) | | | 216,280 | ||

| | 400 | | | 1,600(5) | | | | | 199.10 | | | 6/3/29 | | | 500(6) | | | 135,175 | |||

| | - | | | 1,0006) | | | - | | | 199.51 | | | 6/1/30 | | | - | | | - | ||

| Robert M. Sullivan | | | 3,000 | | | - | | | - | | | 132.12 | | | 6/7/25 | | | 200(2) | | | 54,070 |

| | 4,200 | | | 1,400(2) | | | - | | | 143.92 | | | 6/3/26 | | | 1,000(3) | | | 270,350 | ||

| | 6,000 | | | 4,000(3) | | | - | | | 137.44 | | | 6/2/27 | | | 600(4) | | | 162,210 | ||

| | 2,000 | | | 3,000(4) | | | - | | | 199.16 | | | 6/3/28 | | | 1,600(5) | | | 432,560 | ||

| | 800 | | | 3,200(5) | | | - | | | 199.10 | | | 6/3/29 | | | 3,000(6) | | | 811,050 | ||

| | - | | | 5,000(6) | | | - | | | 199.51 | | | 6/1/30 | | | - | | | - | ||

| (1) | These amounts are based on $270.35, the closing price of our common stock on March 28, 2024, the last business day of fiscal 2024. |

| (2) | Vest in June 2024. For Mr. Bannon, excludes options and shares that were scheduled to vest at subsequent dates but expired when he ceased to provide services to the Company at the end of the first quarter of fiscal 2025. |

| (3) | Vest in one-half increments in June 2024 and June 2025. |

| (4) | Vest in one-third increments in June 2024, June 2025 and June 2026. |

| (5) | Vest in one-fourth increments in June 2024, June 2025, June 2026 and June 2027. |

| (6) | Vest in one-fifth increments in June 2024, June 2025, June 2026, June 2027 and June 2028. |

| (7) | Vest in one-half increments in February 2025 and February 2026. |

| 42 | | |  | | | 2024 Proxy Statement | | |

| | | Option Awards | | | Stock Awards | |||||||

| Name | | | Number of Shares Acquired on Exercise (#) | | | Value Realized on Exercise ($)(1) | | | Number of Shares Acquired on Vesting (#) | | | Value Realized on Vesting ($)(2) |

| Michael J. Hartnett | | | 71,896 | | | 10,367,777 | | | 36,400 | | | 7,501,890 |

| Daniel A. Bergeron | | | 30,000 | | | 5,027,313 | | | 16,550 | | | 3,409,279 |

| Patrick S. Bannon | | | 27,000 | | | 3,225,160 | | | 3,600 | | | 745,852 |

| Richard J. Edwards | | | 5,800 | | | 479,405 | | | 1,800 | | | 377,790 |

| John J. Feeney | | | 302 | | | 27,351 | | | 450 | | | 103,584 |

| Robert M Sullivan | | | 800 | | | 123,888 | | | 1,400 | | | 287,682 |

| (1) | Based on the closing price of our common stock on the date of exercise. |

| (2) | Based on the closing price of our common stock on the date of vesting. |

| Name | | | Executive Contributions in Last Fiscal Year ($)(1) | | | Registrant Contributions in Last Fiscal Year ($)(2) | | | Aggregate Earnings in Last Fiscal Year ($)(3) | | | Aggregate Withdrawals/ Distributions ($) | | | Aggregate Balance at Last Fiscal Year End ($) |

| Michael J. Hartnett | | | - | | | - | | | 115,222 | | | - | | | 968,084 |

| Daniel A. Bergeron | | | - | | | - | | | 357,217 | | | - | | | 2,005,939 |

| Patrick S. Bannon | | | 52,981 | | | - | | | 49,593 | | | - | | | 678,170 |

| Richard J. Edwards | | | 29,968 | | | - | | | 54,982 | | | - | | | 542,945 |

| John J. Feeney | | | 22,699 | | | - | | | 46,519 | | | - | | | 284,395 |

| Robert M. Sullivan | | | 15,927 | | | - | | | 45,823 | | | - | | | 217,836 |

| (1) | These amounts are included in the “Salary” column in the Summary Compensation table. |

| (2) | These amounts are included in the “All Other Compensation” column in the Summary Compensation table. |

| (3) | Appreciation (depreciation) and earnings (loss) on the NEO’s account under the SERP. |

| | |  | | | 2024 Proxy Statement | | | 43 |

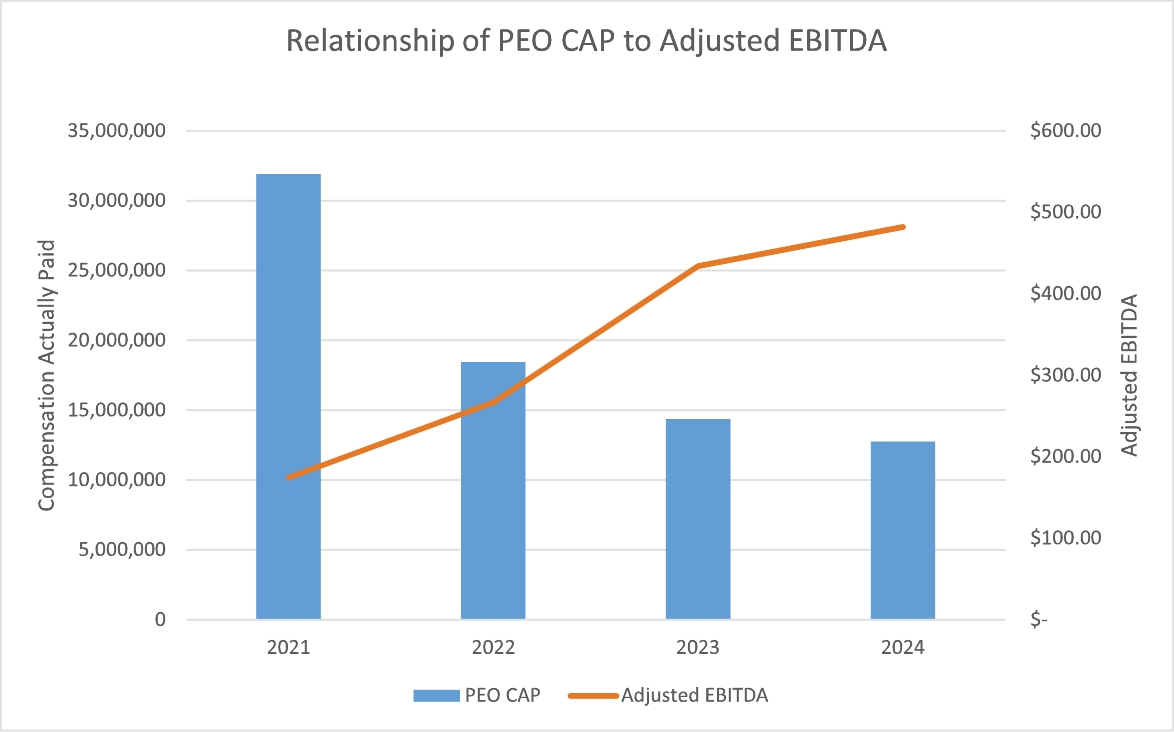

| Pay Versus Performance |

| • | The information in columns (b) and (d) comes directly from the Summary Compensation table (SCT) in this proxy statement, without adjustment. |

| • | As required by the PVP regulations, we describe the information in columns (c) and (e) as “compensation actually paid” (CAP) to the applicable NEOs, but these CAP amounts do not necessarily reflect compensation that our NEOs actually earned for their service in the Covered Years. Instead, CAP is a calculation involving a combination of realized pay (for cash amounts and some equity award amounts) and realizable or accrued pay (primarily for pension benefits and other equity awards). |

| • | The PVP regulations require that we choose a peer group or index for purposes of TSR comparisons, and we have chosen the S&P 400 Industrials Sector (the “PVP Peer Index”) for this purpose. |

| • | As required by the PVP regulations, we provide information about our cumulative TSR, cumulative PVP Peer Index TSR and U.S. GAAP net income results (the “External Measures”) during the Covered Years in the PVP table, but we did not actually base any compensation decisions for the NEOs on, or link any NEO pay to, the External Measures. |

| 44 | | |  | | | 2024 Proxy Statement | | |

| | | | | | | | | | | Value of initial fixed $100 Investment based on: | | | | | ||||||||||

Fiscal Year (a) | | | Summary Compensation Table “SCT” Total for PEO (b) | | | Compensation Actually Paid to PEO (c)(2) | | | Average Summary Compensation Table Total for non-PEO NEOs (d) | | | Average Compensation Actually Paid to non-PEO NEOs (e)(2) | | | Total Shareholder Return (f)(3) | | | PVP Peer Index Total Shareholder Return (g)(3) | | | Net Income (h)(4) | | | Adjusted EBITDA (i)(5) |

| 2024 | | | $8,977,576 | | | $12,753,252 | | | $1,404,369 | | | $1,634,542 | | | $245.8 | | | $283.9 | | | $209.9 | | | $482.1 |

| 2023 | | | $8,450,217 | | | $14,352,594 | | | $1,511,553 | | | $2,480,850 | | | $211.6 | | | $209.7 | | | $166.7 | | | $433.9 |

| 2022 | | | $19,404,363 | | | $18,435,256 | | | $2,686,505 | | | $2,511,344 | | | $177.8 | | | $201.6 | | | $54.7 | | | $266.5 |

| 2021 | | | $8,895,001 | | | $31,906,739 | | | $1,542,355 | | | $5,036,399 | | | $180.1 | | | $195.7 | | | $90.1 | | | $174.3 |

| (1) | Dr. Michal J. Hartnett was out principal executive officer (PEO) for each of the Covered Years. In this disclosure, we refer to our NEOs other than Dr. Hartnett as our “other NEOs.” Daniel A. Bergeron, Patrick S. Bannon, Richard J. Edwards, John J. Feeney and Robert M. Sullivan were our other NEOs for each of the Covered Years. |

| (2) | For each Covered Year, in determining the CAP for our PEO and the average CAP for our other NEOs, we deducted or added back the following amounts from or to the total amounts of compensation reported in column (b) and column (d) for such Covered Year: |

| Item and Value Added (or Deducted) | | | 2024 | | | 2023 | | | 2022 | | | 2021 |

| For Dr. Hartnett: | | | | | | | | | ||||

| - change in actuarial present value of pension benefits, as reported in SCT for Covered Year | | | - | | | - | | | - | | | - |

| + service cost of pension benefits, as calculated for Covered Year | | | - | | | - | | | - | | | - |

| + prior service cost of pension benefits, as calculated for Covered Year | | | - | | | - | | | - | | | - |

| - SCT “Stock Awards” column value | | | (6,317,484) | | | (5,984,946) | | | (10,364,286) | | | (3,725,036) |

| - SCT “Option Awards” column value | | | - | | | - | | | (5,820,840) | | | (2,900,431) |

| +/- adjusted amount for applicable stock/option awards, as calculated for Covered Year | | | 10,093,160 | | | 11,887,323 | | | 15,216,019 | | | 29,637,205 |

| + the Covered Year-end fair value of equity awarded in (and still outstanding as of the end of) the Covered Year | | | 8,560,633 | | | 6,995,864 | | | 16,179,662 | | | 11,090,134 |

| +/- the change in fair value of equity awarded in prior Covered Years (and still outstanding as of the end of the Covered Year) | | | 3,925,511 | | | 4,844,811 | | | (827,571) | | | 15,484,735 |

| + the vesting date fair value of equity awarded and vested in the Covered Year | | | - | | | - | | | - | | | - |

| +/- the change in fair value of equity awarded in prior Covered Years that vested in the Covered Year | | | (2,392,984) | | | 46,648 | | | (136,072) | | | 3,062,336 |

| - prior the Covered Year-end fair value of equity awarded in prior Covered Years that were forfeited in the Covered Year | | | - | | | - | | | - | | | - |

| + dividends/earnings paid or accrued on equity awarded during or for the Covered Year (if not otherwise included in CAP) | | | - | | | - | | | - | | | - |

| Total Added (or Deducted): | | | 3,775,676 | | | 5,902,377 | | | (969,107) | | | 23,011,738 |

| For the Other NEOs (on Average): | | | | | | | | | ||||

| - change in actuarial present value of pension benefits, as reported in SCT for Covered Year | | | - | | | - | | | - | | | - |

| + service cost of pension benefits, as calculated for Covered Year | | | - | | | - | | | - | | | - |

| + prior service cost of pension benefits, as calculated for Covered Year | | | - | | | - | | | - | | | - |

| - SCT “Stock Awards” column value | | | (640,347) | | | (707,758) | | | (1,214,876) | | | (576,328) |

| - SCT “Option Awards” column value | | | (181,380) | | | (207,476) | | | (796,536) | | | (454,395) |

| +/- adjusted amount for applicable stock/option awards, as calculated for Covered Year | | | 1,051,901 | | | 1,884,532 | | | 1,836,251 | | | 4,524,766 |

| + the Covered Year-end fair value of equity awarded in (and still outstanding as of the end of) the Covered Year | | | 1,156,295 | | | 1,095,605 | | | 2,014,351 | | | 1,647,593 |

| | |  | | | 2024 Proxy Statement | | | 45 |

| Item and Value Added (or Deducted) | | | 2024 | | | 2023 | | | 2022 | | | 2021 |

| +/- the change in fair value of equity awarded in prior Covered Years (and still outstanding as of the end of the Covered Year) | | | 395,102 | | | 739,047 | | | (137,485) | | | 2,408,529 |

| + the vesting date fair value of equity awarded and vested in the Covered Year | | | - | | | - | | | - | | | - |

| +/- the change in fair value of equity awarded in prior Covered Years that vested in the Covered Year | | | (499,496) | | | 49,881 | | | (40,615) | | | 468,644 |

| - prior the Covered Year-end fair value of equity awarded in prior Covered Years that was forfeited in the Covered Year | | | - | | | - | | | - | | | - |

| + dividends/earnings paid or accrued on equity awarded during or for the Covered Year (if not otherwise included in CAP) | | | - | | | - | | | - | | | - |

| Total Added (or Deducted): | | | 230,173 | | | 969,297 | | | (175,161) | | | 3,494,044 |