Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Quintana Maritime Limited

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

Table of Contents

Quintana Maritime Limited

Pandoras 13 & Kyprou Street

166 74 Glyfada

Athens, Greece

+30 210 898 6820

March 30, 2007

Dear Stockholder:

Quintana Maritime Limited’s Annual Meeting of Stockholders will be held on Friday, May 4, 2007 at 10:00 a.m. local time, in the Athena C room at the Arion Hotel at Astir Palace, Athens, Greece. You are cordially invited to attend. Your Annual Meeting materials, including the Annual Report, Notice of Annual Meeting, Proxy Statement and Proxy Card from Quintana Maritime Limited’s Board of Directors, are enclosed.

At this year’s Annual Meeting, the agenda includes the election of eight directors and the ratification of the appointment of our independent auditors. The Board recommends that you voteFORelection of the director nominees andFORratification of the appointment of independent auditors. Please refer to the enclosed notice of meeting and proxy statement for detailed information on each of the proposals to be considered at the Annual Meeting.

Your vote is important. We encourage you to sign and return your proxy card before the meeting so that your shares will be represented and voted even if you cannot attend the meeting.

Very truly yours,

CORBIN J. ROBERTSON, JR.

Chairman of the Board

Table of Contents

Quintana Maritime Limited

Pandoras 13 & Kyprou Street

166 74 Glyfada

Athens, Greece

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 4, 2007

To the Stockholders of

Quintana Maritime Limited:

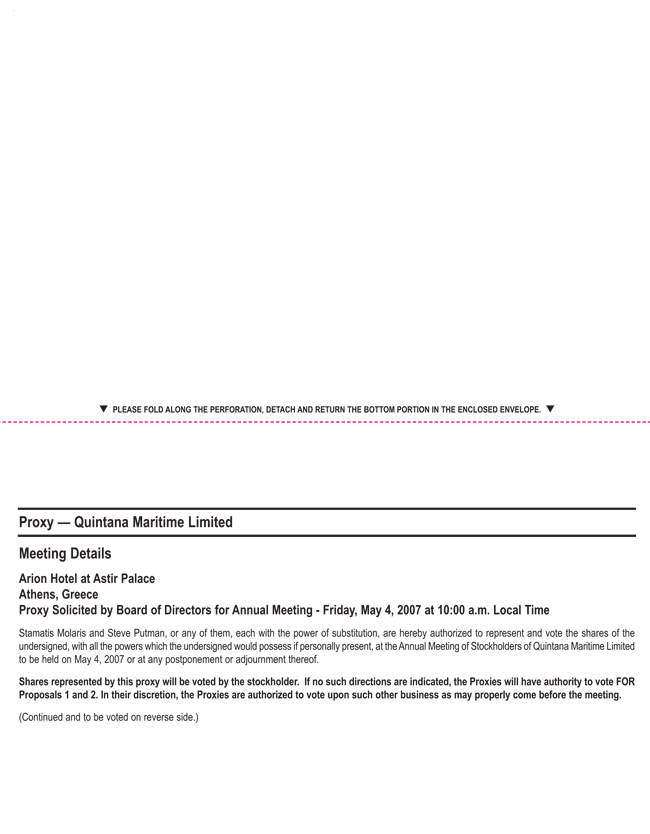

The 2007 Annual Meeting of Stockholders of Quintana Maritime Limited will be held in the Athena C room at the Arion Hotel in Astir Palace, 40 Apollonos str., 166 71 Vouliagmeni, Athens, Greece, on May 4, 2007 at 10:00 a.m., local time.

We are holding the Annual Meeting for the following purposes:

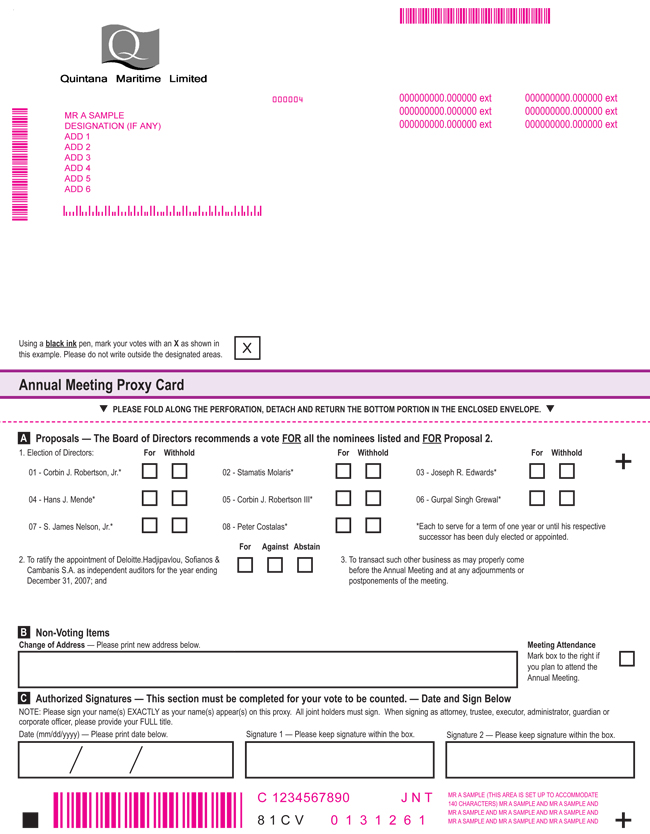

1. To elect eight directors, each to serve for a term of one year or until his respective successor has been duly elected or appointed;

2. To ratify the appointment of Deloitte.Hadjipavlou, Sofianos & Cambanis S.A. as independent auditors for the year ending December 31, 2007; and

3. To transact such other business as may properly come before the Annual Meeting and at any adjournments or postponements of the meeting.

The above matters are fully described in the attached proxy statement, which is part of this notice. We have not received notice of any other matters that may be properly presented at the Annual Meeting.

Only stockholders of record at the close of business on March 27, 2007 will be entitled to vote at the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at Quintana Maritime Limited’s offices, Pandoras 13 & Kyprou Street, 166 74 Glyfada, Athens, Greece for 10 days prior to the Annual Meeting. If you would like to review the stockholder list, please call Anna Mageropoulou at +30 210 898 6820 to schedule an appointment.

To ensure that your vote is recorded promptly, please vote as soon as possible by completing, signing and mailing the enclosed proxy card in the accompanying envelope.

By Order of the Board of Directors,

STEVE PUTMAN

Secretary

March 30, 2007

Table of Contents

QUINTANA MARITIME LIMITED

Pandoras 13 & Kyprou Street

166 74 Glyfada

Athens, Greece

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 4, 2007

This proxy statement and accompanying proxy card are being furnished to the stockholders of Quintana Maritime Limited (“Quintana”) in connection with the solicitation of proxies by and on behalf of Quintana’s Board of Directors (the “Board”). The proxies are to be voted at our 2007 Annual Meeting of Stockholders (the “Annual Meeting”) to be held in the Athena C room at the Arion Hotel in Astir Palace, 40 Apollonos str., 166 71 Vouliagmeni, Athens, Greece, at 10:00 a.m., local time, on Friday, May 4, 2007, and any adjournments or postponements thereof, for the purposes set forth in the accompanying notice. The Board is not aware of any other matters to be presented at the Annual Meeting. This proxy statement and the accompanying form of proxy were first mailed to stockholders on or about April 4, 2007.

As of March 27, 2007, the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were outstanding and entitled to vote 56,018,720 shares of the common stock of Quintana. Each share of common stock entitles the holder to one vote on each matter presented at the Annual Meeting. A majority of the outstanding shares present in person or by proxy will constitute a quorum for the Annual Meeting.

Proxies will be voted in accordance with the directions specified thereon and otherwise in accordance with the judgment of the persons designated as proxies. Any proxy on which no direction is specified will be votedFORthe election of the nominees to the Board named herein andFORthe ratification of the appointment of Deloitte.Hadjipavlou,Sofianos & Cambanis S.A. (“Deloitte”) as our independent auditors.

Our annual report to stockholders containing financial statements for the year ended December 31, 2006 accompanies this proxy statement. Stockholders are referred to the annual report for financial and other information about the activities of Quintana. The annual report is not incorporated by reference into this proxy statement and is not deemed to be a part hereof.

We sent you this proxy statement and the enclosed proxy card because our Board is soliciting your proxy to vote your shares at the Annual Meeting. As a stockholder, you are invited to attend the meeting and entitled to vote on the items of business described in this proxy statement.

Our Notice of Annual Meeting, proxy statement, and Annual Report are available on our Web site located atwww.quintanamaritime.com.

Table of Contents

i

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING

1. What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will vote upon several important matters. In addition, our management will report on our performance over the last fiscal year and, following the meeting, respond to questions from stockholders.

2. What is a proxy?

It is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. Stamatis Molaris, President, Chief Executive Officer and a Director of Quintana Maritime, and Steve Putman, Vice President, General Counsel and Secretary, have been designated as proxies for the 2007 Annual Meeting.

3. What is a proxy statement?

It is a document that the regulations of the Securities and Exchange Commission (“SEC”) require us to give you when we ask you to sign a proxy card designating Stamatis Molaris, our President and Chief Executive Officer, and Steve Putman, our Vice President, General Counsel & Secretary, each as proxies to vote on your behalf. The proxy statement includes information about the proposals to be considered at the Annual Meeting and other required disclosures including information about our Board and officers.

4. Who may attend the Annual Meeting?

The Board set March 27, 2007 as the record date for the Annual Meeting. All stockholders of record who owned shares of common stock at the close of business on March 27, 2007, or their duly appointed proxies, may attend and vote at the Annual Meeting or any adjournments or postponements thereof as well as our invited guests. Seating is limited and admission is on a first-come, first-served basis. Please note that if you hold shares in “street name” (that is, in a brokerage account or through a bank or other nominee), you will need to bring personal identification and a copy of a statement reflecting your share ownership as of March 27, 2007 and check in at the registration desk at the Annual Meeting.

5. Who can vote?

Each stockholder who owned common stock at the close of business on March 27, 2007 is entitled to one vote for each share of common stock held on all matters to be voted on. At the close of business on the record date, there were 56,018,720 shares of our common stock outstanding.

6. What am I voting on?

You will be voting on the following two items of business at the Annual Meeting:

| • | The election of eight directors to serve until the 2008 Annual Meeting or until their successors are elected and qualified; and |

| • | The ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2007. |

We are not aware of any other business to be conducted at the Annual Meeting, but we will also consider any other business that properly comes before the Annual Meeting.

1

Table of Contents

7. How many votes are required to hold the Annual Meeting?

The required quorum for the transaction of business at the Annual Meeting is a majority of shares of common stock issued and outstanding on the record date. Shares that are voted “FOR,” “AGAINST” or “ABSTAIN” with respect to a particular matter are treated as being present at the meeting for purposes of establishing a quorum and are also treated as shares entitled to vote at the Annual Meeting with respect to such matter.

| 8. | What is the difference between a stockholder of record and a stockholder who holds stock in street name? |

(a) If your shares are registered in your name, you are a stockholder of record.

(b) If your shares are registered in the name of your broker or bank, your shares are held in street name.

Most stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

| • | Stockholder of Record. If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the shareholder of record, and these proxy materials are being sent directly to you by us. As the stockholder of record, you have the right to grant your voting proxy directly to the proxyholders or to vote in person at the Annual Meeting. We have enclosed or sent a proxy card for you to use. |

| • | Street Name. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee, which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtained a signed proxy from the record holder giving you the right to vote the shares. Your broker or nominee has enclosed or provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares. |

9. What different methods can I use to vote?

(a) By Written Proxy: All stockholders of record as of March 27, 2007 can vote by written proxy card.

(b) In Person: All stockholders of record as of March 27, 2007 may vote in person at the Annual Meeting (unless they are street name holders without a legal proxy, as described in question 4).

In addition, street name holders may vote by telephone or over the Internet if their bank or broker makes those methods available, in which case the bank or broker will enclose the instructions with the proxy statement. The telephone and Internet voting procedures, including the use of control numbers, are designed to authenticate stockholders’ identities, to allow share owners to vote their shares and to confirm that their instructions have been properly recorded.

10. What is the record date and what does it mean?

The record date for the 2007 Annual Meeting is March 27, 2007. The record date is established by the Board as required by Marshall Islands law. Owners of record of our common stock at the close of business on the record date are entitled to:

(a) receive notice of the Annual Meeting, and

2

Table of Contents

(b) vote at the Annual Meeting and any adjournments or postponements of the meeting.

11. What is a quorum?

A “quorum” is a majority of the outstanding shares represented in person or by proxy and entitled to vote at the 2007 Annual Meeting. There must be a quorum for business to be conducted at the meeting. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

12. How can I revoke a proxy?

If you are a stockholder of record, you can revoke a proxy prior to the completion of voting at the Annual Meeting by giving written notice to the Secretary of Quintana, delivering a later-dated proxy or voting in person at the Annual Meeting. If you are a street name holder, you must follow the instructions on revocation of proxies, if any, provided by your bank or broker.

| 13. | What are my voting choices when voting for director nominees, and what vote is needed to elect Directors? |

In the vote on the election of eight director nominees to serve until next year’s Annual Meeting, you may vote for or withhold votes with respect to each nominee. The nominees receiving a plurality of votes of the shares entitled to vote at the Annual Meeting in person or by proxy will be elected as directors. Withholding votes as to a nominee has no effect on the election of directors. You may not cumulate your votes in the election of directors.

The Board recommends a vote “FOR” each of the nominees.

| 14. | What are my voting choices when voting on the ratification of the appointment of Deloitte as independent auditors, and what vote is needed to ratify their appointment? |

In the vote on the ratification of the appointment of Deloitte as independent auditors, you may:

(a) vote in favor of the ratification,

(b) vote against the ratification, or

(c) abstain from voting on the ratification.

The proposal to ratify the appointment of Deloitte as independent auditors will require approval by votes of a majority of the shares represented in person or by proxy and entitled to vote at the Annual Meeting.

The Board recommends a vote “FOR” the ratification of the appointment of Deloitte as Quintana’s independent auditors.

15. What if I don’t specify a choice for a matter when returning my proxy?

You should specify your choice for each matter on the enclosed proxy. If you sign and return your proxy but do not give specific instructions, your proxy will be voted FOR the election of all director nominees and FOR the proposal to ratify the appointment of Deloitte.

16. Will my shares be voted if I do not provide my proxy?

Your shares may be voted if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting instructions. Brokerage firms have the authority under NASDAQ rules to cast votes

3

Table of Contents

on certain “routine” matters if they do not receive instructions from their customers. The election of directors and the proposal to ratify the selection of Deloitte as our independent registered public accounting firm for fiscal 2007 are considered routine matters for which brokerage firms may vote unvoted shares. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is called a “broker non-vote.”

17. How are abstentions and broker non-votes counted?

Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. In the election of directors, which requires a plurality of votes, broker non-votes will have no effect. In the ratification of the appointment of our independent auditors, abstentions will have the same effect as a vote against ratification, and broker non-votes will not be counted for determining the number of shares represented at the meeting for purposes of the vote on the ratification.

18. What happens if additional proposals are presented at the Annual Meeting?

Other than the election of directors and the ratification of the appointment of the independent registered public accounting firm, we do not expect any matters to be presented for a vote at the Annual Meeting. If you grant a proxy, the persons named as proxyholders will have the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting. Under our Bylaws, the deadline for notifying us of any additional proposals to be presented at the Annual Meeting has passed and, accordingly, stockholders may not present proposals at the Annual Meeting.

19. Can I change my vote?

If you are stockholder of record, you may change your vote at any time before the polls close at the Annual Meeting. You may do this by:

| • | signing another proxy card with a later date and returning it to us prior to the Annual Meeting; |

| • | giving written notice to the Secretary of the Company by April 27, 2007; or |

| • | voting again at the meeting. |

Your attendance at the Annual Meeting will not have the effect of revoking a proxy unless you notify our Secretary in writing before the polls close that you wish to revoke a previous proxy. You may revoke your proxy at any time before the proxy has been voted at the Annual Meeting by taking one of the actions described above.

If you are a street name holder, you must follow instructions provided by your broker or bank, if any, in order to change your vote.

20. What does it mean if I receive more than one proxy card?

It means that you have multiple accounts with brokers and/or our transfer agent, Computershare. Please vote all of these shares. We recommend that you contact your broker and/or Computershare to consolidate as many accounts as possible under the same name and address. Computershare can be contacted at (781) 575-3100 and via its website atwww.computershare.com.

21. What is “householding”?

Street-name stockholders may receive a single set of proxy materials and other stockholder communications to any household at which two or more stockholders reside. This process is called “householding.” This reduces

4

Table of Contents

duplicate mailings, saves printing and postage costs as well as natural resources. Proxy materials and other stockholder communications to you may be householded based on your prior express or implied consent. If your proxy materials are being householded and you wish to receive separate copies of the proxy statement and/or Annual Report, or if you are receiving multiple copies and would like to receive a single copy, or if you would like to opt out of this householding practice for future mailings, please submit your request to your broker.

5

Table of Contents

Security Ownership of Management

The following table sets forth the beneficial ownership, as of March 15, 2007, by each current director, each director nominee, each named executive officer listed in the summary compensation table on page 20, and all directors and executive officers as a group. Except as otherwise indicated, the persons listed below have sole voting and investment power over the shares beneficially held by them.

| Shares Beneficially Owned | |||||

Name(1) | Amount and Nature of Beneficial Ownership | Percent of Class(2) | |||

Corbin J. Robertson, Jr.(3) | 5,105,616 | 9.1 | % | ||

Hans J. Mende(4) | 2,393,283 | 4.3 | % | ||

Stamatis Molaris(5) | 612,648 | 1.1 | % | ||

Corbin J. Robertson III(6) | 516,834 | Less than 1 | % | ||

Joseph R. Edwards(7) | 25,500 | Less than 1 | % | ||

Gurpal Singh Grewal(8) | 25,500 | Less than 1 | % | ||

S. James Nelson(9) | 28,000 | Less than 1 | % | ||

Peter Costalas(10) | 22,500 | Less than 1 | % | ||

Paul J. Cornell(11) | 187,500 | Less than 1 | % | ||

Nikos Frantzeskakis(12) | 219,324 | Less than 1 | % | ||

Steve Putman(13) | 116,000 | Less than 1 | % | ||

All directors and executive officers as a group (12 persons) | 9,252,705 | 16.5 | % | ||

Security Ownership of Certain Beneficial Owners

The following table sets forth information about each person or group known to us as of March 27, 2007 who owns or has the right to acquire more than five percent of our common stock:

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class(1) | |||

Quintana Maritime Partners, L.P.(2) 601 Jefferson St., Suite 3600 Houston, Texas 77002 | 5,080,116 | 9.1 | % | ||

FR X Offshore, L.P.(7) One Lafayette Place Greenwich, Connecticut 06830 | 3,867,895 | 6.9 | % | ||

King Street Capital Management, L.L.C.(14) 65 E. 55th St. 30th Floor New York, New York 10022 | 4,055,015 | 7.2 | % |

| (1) | The address for each beneficial owner is c/o Quintana Maritime Limited, Pandoras 13 & Kyprou str., 166 74 Glyfada, Athens, Greece. |

| (2) | Based upon an aggregate of 56,018,720 shares outstanding, which includes 1,234,700 unvested restricted shares issued pursuant to our stock incentive plan. |

| (3) | The number of shares shown for Mr. Robertson includes 5,080,116 shares held by Quintana Maritime Partners, L.P., a limited partnership indirectly controlled by Mr. Robertson in his capacity as the sole stockholder of QMP Inc., the general partner of Quintana Maritime Partners, L.P. In addition, Mr. Robertson holds 25,500 shares of restricted stock that were granted to him during 2005 and 2006 for his service as a director. Mr. Robertson has dispositive power over 7,500 restricted shares that vested in February 2006 and February 2007. |

6

Table of Contents

| (4) | The number of shares shown for Mr. Mende includes 2,347,783 shares held by AMCI Acquisition II, LLC, a limited liability company indirectly controlled by Mr. Mende, and 25,500 shares of restricted stock granted to Mr. Mende during 2005 and 2006 for his service as a director. Mr. Mende has dispositive power over 7,500 restricted shares that vested in February 2006 and February 2007. |

| (5) | The number of shares shown for Mr. Molaris includes 82,648 shares held directly and 530,000 shares of restricted stock granted to him during 2005 and 2006 as part of his total compensation. Mr. Molaris has dispositive power over 88,000 restricted shares that vested in February 2006 and February 2007. |

| (6) | The number of shares shown for Mr. Robertson III includes 485,547 shares held directly, 7,000 shares held by Lion Fund LP, which is indirectly controlled by Mr. Robertson III, 24,287 shares held in accounts held for the benefit of other holders but managed by Mr. Robertson III, and 25,500 shares of restricted stock granted to Mr. Robertson III during 2005 and 2006 for his service as a director. Mr. Robertson III has dispositive power over 7,000 restricted shares that vested in February 2006. |

| (7) | The number of shares shown for Mr. Edwards consists of 25,500 shares of restricted stock granted to Mr. Edwards in 2005 and 2006 for his service as a director. The number of shares shown for FR X Offshore, L.P. (“Offshore LP”) consists of 3,842,395 shares directly owned by Offshore LP and the 25,500 shares of restricted stock granted to Mr. Edwards. FR X Offshore GP, L.P. (“Offshore GP”) is the general partner of Offshore LP and may be deemed to share beneficial ownership of the shares of Common Stock beneficially owned by Offshore LP. FR X Offshore GP Limited (“Offshore Ltd.”), as the general partner of Offshore GP, may also be deemed to share beneficial ownership of the shares of Common Stock beneficially owned by Offshore LP. Each of Offshore Ltd., Offshore GP, and Offshore LP are entitled to a portion of the profits from the sale of securities held by Mr. Edwards, and therefore they share beneficial ownership of the securities issued to Mr. Edwards. Mr. Edwards (who is an officer of Offshore Ltd.) shares dispositive power over 7,500 restricted shares that vested in February 2006 and February 2007. Other than the shares he holds directly, Mr. Edwards disclaims beneficial ownership of securities beneficially owned by Offshore Ltd., Offshore GP, and Offshore LP. The information in the table above is based on a Schedule 13D/A filed with the SEC on February 16, 2007. |

| (8) | The number of shares shown for Mr. Grewal includes 25,500 shares of restricted stock granted to Mr. Grewal during 2005 and 2006 for his service as a director. Mr. Grewal has dispositive power over 7,500 restricted shares that vested in February 2006 and February 2007. |

| (9) | The number of shares shown for Mr. Nelson includes 2,500 shares held directly and 25,500 shares of restricted stock granted to him during 2005 and 2006 for his service as a director. Mr. Nelson has dispositive power over 7,500 restricted shares that vested in February 2006 and February 2007. |

| (10) | The number of shares shown for Mr. Costalas includes 22,500 shares of restricted stock granted to Mr. Costalas during 2006 for his service as a director. Mr. Costalas has dispositive power over 4,500 restricted shares that vested in February 2007. |

| (11) | The number of shares shown for Mr. Cornell includes 187,500 shares of restricted stock granted to him during 2005 and 2006 as part of his total compensation. Mr. Cornell has dispositive power over 33,500 restricted shares that vested in February 2006 and February 2007. |

| (12) | The number of shares shown for Mr. Frantzeskakis includes 23,074 shares held directly, 187,500 shares of restricted stock granted to him during 2005 and 2006 as part of his total compensation, and 8,750 shares of restricted stock held by his wife, who is also an employee of the Company, as part of her total compensation. Mr. Frantzeskakis has dispositive power over 33,500 shares that vested in February 2006 and February 2007. |

| (13) | The number of shares shown for Mr. Putman includes 2,000 shares held directly and 114,000 shares of restricted stock granted to him during 2005 and 2006 as part of his total compensation. Mr. Frantzeskakis has dispositive power over 19,500 shares that vested in February 2006 and February 2007. |

| (14) | Based on Amendment No. 1 to Schedule 13G filed on February 14, 2007, King Street Capital Management, L.L.C. (“KSCM”) may potentially be deemed to beneficially own the indicated shares insofar as it has been delegated certain investment advisory responsibilities by King Street Advisors, L.L.C. (“KSA”) on behalf of King Street Capital, L.P. (“KSC”) and is also the Investment Manager of King Street Capital, Ltd. (“KSC Ltd.”). KSC directly owns 1,333,302 shares (including warrants exercisable for 400,757 shares of common stock), and KSC Ltd. directly owns 2,721,313 shares of common stock (including warrants exercisable for 826,471 shares of common stock). KSA is the general partner of KSC and may be deemed to have identical beneficial ownership as KSC. In addition, Messrs. O. Francis Biondi, Jr. and Brian J. Higgins may each potentially be deemed to have beneficial ownership of the indicated shares, insofar as each is a Managing Member of KSA and a Managing Principal of KSCM. |

7

Table of Contents

PROPOSAL NO. 1

(Item 1 on the Proxy Card)

The size of our Board is currently set at eight, with all directors being elected each year to serve a one-year term. The Compensation, Nominating and Governance Committee, or the CNG Committee, of our Board has approved and recommended, and our Board has unanimously nominated, each of the nominees listed below to serve one-year terms expiring at our 2008 Annual Meeting or upon a successor being elected and qualified.

A plurality of the votes cast in person or by proxy by the holders of our common stock is required to elect each director. Accordingly, under Marshall Islands law, our Amended and Restated Articles of Incorporation and bylaws, withholding votes and broker non-votes (which occur if a broker or other nominee does not have discretionary authority and has not received instructions with respect to the particular item) are not counted and have no effect on the election of directors. Unless otherwise indicated on the proxy, the persons named as proxies in the enclosed proxy will voteFOR each of the nominees listed below. There were no third-party fees paid by the Company to assist in the process of identifying or evaluating candidates. Although the Company has no reason to believe that any of the nominees will be unable to serve if elected, should any of the nominees become unable to serve prior to the Annual Meeting, the proxies will be voted for the election of such other persons as may be nominated by the Board. Stockholders may not cumulate their votes in the election of directors.

It is our policy for directors to attend our annual meetings to provide an opportunity for stockholders to communicate directly with directors about issues affecting our company. At our 2006 Annual Meeting, all of our directors were in attendance.

The Board recommends a vote “FOR” the election to the Board of each of its nominees.

Information with respect to the directors nominated for election this year is presented below. There are no arrangements or understandings pursuant to which any director or nominee has been selected to serve.

Director Nominees

Corbin J. Robertson, Jr. 59 years old Director since January 2005 | Mr. Robertson has been the non-executive chairman of our Board since our formation in January 2005. Mr. Robertson has also served as Chief Executive Officer and the Chairman of the Board of Directors of GP Natural Resource Partners LLC, the general partner of Natural Resource Partners, L.P., a publicly held owner of coal reserves, since October 2002. In addition, Mr. Robertson has served in various executive capacities with affiliates of Natural Resource Partners, L.P. since 1978. He is a Principal in Quintana Energy Partners L.P., an energy-focused private-equity fund. He also serves as Chairman of the Cullen Trust for Higher Education and on the boards of directors of the American Petroleum Institute, the Baylor College of Medicine the National Petroleum Council, and the World Health and Golf Association. Mr. Robertson is the father of Corbin J. Robertson III, another member of our Board. | |

Stamatis Molaris 44 years old Director since June 2005 | Mr. Molaris has served as our Chief Executive Officer since February 2005, has served as our President since May 2005 and has been a member of our Board since June 2005. Prior to this, Mr. Molaris served as Chief Financial Officer and as a director of Stelmar Shipping Ltd., a tanker company. From August 1993 until January 2005. Prior to that, Mr. Molaris served as an audit manager for Arthur Andersen. | |

8

Table of Contents

Joseph R. Edwards 34 years old Director since April 2005 | Mr. Edwards has been a member of our Board since April 2005. Mr. Edwards is a Director of First Reserve Corporation, a private equity firm focusing on the energy industry, which he joined in March 1998. From July 1995 until March 1998, Mr. Edwards served as a member of the corporate finance team of Simmons & Company International, a Houston-based, energy-focused investment banking firm. Mr. Edwards currently serves as a director of T-3 Energy Services, Inc. (and as a member of its Compensation and Nominating Committees). | |

Hans J. Mende 63 years old Director since April 2005 | Mr. Mende has been a member of our Board since April 2005. Mr. Mende also serves as Chairman of the Board of Directors of Alpha Natural Resources, Inc. and is a director of Foundation Coal Holdings, Inc., both of which are coal companies. He is President and Chief Operating Officer of AMCI International, Inc., a mining and trading company, which is a position he has held since he co-founded AMCI in 1986. Prior to founding AMCI, Mr. Mende was employed by the Thyssen Group, one of the largest German multinational companies with interests in steel making and general heavy industrial production, in various senior executive positions. At the time of his departure from Thyssen Group, Mr. Mende was President of its international trading company. | |

Corbin J. Robertson III 36 years old Director since January 2005 | Mr. Robertson III has been a member of our board of directors since our formation in January 2005. Mr. Robertson is currently a Principal of Quintana Energy Partners L.P., an energy-focused private equity fund. Prior to joining Quintana Energy Partners, Mr. Robertson was a Managing Director of Spring Street Partners, a hedge fund focused on undervalued small cap securities, a position he has held since 2002. Prior to joining Spring Street, Mr. Robertson worked for three years as a Vice President of Sandefer Capital Partners LLC, a private investment partnership focused on energy related investments, and two years as a management consultant for Deloitte and Touche LLP. Mr. Robertson is also a member of the board of Gulf Atlantic Refining and Marketing L.P., an operator of a refinery and crude and refined products storage terminals and advisory director to Main Street Bank, a regional commercial bank. Mr. Robertson is the son of Corbin J. Robertson, Jr., the chairman of our Board. | |

Gurpal Singh Grewal 60 years old Director since June 2005 | Mr. Grewal has been a member of our Board since June 2005. Mr. Grewal currently serves as Director—Newbuildings for Shipmanagement Capital, a shipping company. From September 2005 to February 2006, he served as the Technical Manager of Marmaras Navigation Ltd., a shipping company. From June 1998 to September 2005, he served as Technical Director and the Principal Surveyor for Greece of Lloyd’s Register of Shipping and Industrial Services S.A. Prior thereto, he was employed by Lloyd’s Register of Shipping and Industrial Services S.A. since May 1997 as a Senior Ship and Engineer Surveyor in the Fleet Services Department. In addition, from 1996 to 1998, he was Assistant Chief Resident Superintended with JJMA, New York, where he supervised the newbuildings of product tankers in Spain. Prior to 1996, he served for 10 years as a Senior Engineer at Lloyd’s Register supervising the construction of newbuildings in a variety of shipyards. Mr. Grewal is a Chartered Engineer and has over 20-years’ experience in newbuildings of bulk carriers, tankers, LPG, and LNG vessels. | |

9

Table of Contents

S. James Nelson, Jr. 64 years old Director since August 2005 | Mr. Nelson has been a member of our Board since August 2005. In 2004, Mr. Nelson retired from Cal Dive International, Inc., a marine contractor and operator of offshore oil and gas properties and production facilities, where he was a founding shareholder, Chief Financial Officer, Vice Chairman and a Director. From 1985 to 1988, Mr. Nelson was the Senior Vice President and Chief Financial Officer of Diversified Energies, Inc., a NYSE-traded company, and from 1980 to 1985 was the Chief Financial Officer of Apache Corporation, an oil and gas exploration and production company. From 1966 to 1980, Mr. Nelson was employed with Arthur Andersen & Co where he became a partner in 1976. Mr. Nelson is also a Certified Public Accountant. Mr. Nelson currently serves on the boards of directors and audit committees of Oil States International, Inc., a diversified oilfield services company; Input/Output, a seismic services provider, and W&T Offshore Incorporated, an oil and natural gas exploration and production company. | |

Peter Costalas 56 years old Director since May 2006 | Mr. Costalas has been a member of our Board since May 2006. Mr. Costalas has over 38 years of experience in the shipping industry. Since June 2004, Mr. Costalas has served as the Managing Director of Euroceanica (UK) Ltd., a private shipowning company specializing in dry-bulk carriers and chemical tankers that is based in London. He has served as a director of Euroceanica since September 2001. From January 2001 to August 2001, Mr. Costalas served as the Chief Executive Officer of Osprey Maritime Limited, which was at the time a Singapore-listed shipping company concentrating on liquefied natural gas, crude oil, and product tankers. From 1997 until his appointment as Chief Executive Officer of Osprey, Mr. Costalas served as its Chief Commercial Officer. During the same period, he helped form the Tankers International VLCC pool and the International Product Tanker pools. Before joining Osprey, Mr. Costalas served as the Commercial Director of Exmar NV, a Belgian-listed diversified shipping company, among other positions in the shipping industry. Mr. Costalas currently serves as a director of Euroceanica (UK) Limited, Integra Holdings Pte Ltd, a global petrochemical trading company, and Bancosta sam, a subsidiary of an Italian-based shipbroker. | |

10

Table of Contents

ADDITIONAL INFORMATION REGARDING

THE BOARD OF DIRECTORS

Board Independence

Our Board has determined that all existing members of our Board other than Mr. Molaris are “independent” directors under the NASDAQ Global Market corporate-governance rules. The Board has determined that each of the members of the CNG Committee qualifies as independent under applicable NASDAQ rules. In addition, all current members of the Audit Committee qualify as “independent” under Rule 10A-3 promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”).

Board Meetings and Committees

The Board and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. Board agendas include regularly scheduled executive sessions for the non-management directors to meet without management or the other directors present. Our Board met in person four times in 2006 and held eight telephonic meetings. The non-management directors met in executive session at the conclusion of two of the in-person meetings. In 2006, each Board member other than Mr. Grewal attended in person or by proxy at least 75% of the total number of meetings of the Board and any committees on which he served. Mr. Grewal was unable to attend a number of Board and Audit Committee meetings due to unavoidable travel in connection with work obligations. Our directors are expected to attend all meetings of the Board and of the committees of which they are members.

The Board currently has, and appoints the members of, three standing committees: the Audit Committee, the CNG Committee and the Conflicts Committee. The Board established the Audit and CNG Committee in July 2005 and the Conflicts Committee in December 2006. The Audit and CNG Committees have written charters approved by the Board. The Conflicts Committee does not yet have a charter but instead operates pursuant to a mandate adopted by the Board. These charters are available on our website atwww.quintanamaritime.com. We will also furnish, free of charge, copies of any charter to any person who requests them. Requests for copies should be directed to Mr. Steve Putman, 601 Jefferson St., Suite 3600, Houston, Texas 77002.

The members of the committees as of March 31, 2007 are identified in the following table:

Director | Audit | CNG | Conflicts | |||

Corbin J. Robertson, Jr. | Chair | |||||

Joseph R. Edwards | X | |||||

S. James Nelson, Jr. | Chair | X | Chair | |||

Gurpal Singh Grewal | X | X | ||||

Peter Costalas | X | X |

Audit Committee. The Audit Committee has been established to assist the Board in fulfilling its responsibility to (i) oversee the quality and integrity of the financial statements and other financial information Quintana provides to any governmental body or the public; (ii) oversee Quintana’s compliance with legal and regulatory requirements; (iii) oversee the independent external auditor’s qualifications and independence; (iv) oversee the performance of Quintana’s internal audit function and the auditors; (v) oversee Quintana’s systems of internal controls regarding finance, accounting, legal compliance and ethics that Quintana’s management and the Board have established; (vi) facilitate an open avenue of communication among the auditors, financial and senior management, the internal auditing department, and the Board, with the auditors being accountable to the Audit Committee; and (vii) perform such other duties as are directed by the Board. The Audit Committee has sole responsibility for the retention and termination of the independent auditors. The Board has determined that Mr. Nelson, the Chairman of the Audit Committee, and Mr. Costalas qualify as “audit committee financial experts,” as defined by NASDAQ listing standards and SEC regulations. The charter of the Audit Committee limits the ability of members of the Audit Committee to serve on the audit committees of more than two other public companies. Mr. Nelson serves as the Chairman of the audit committees of three other public companies. Quintana’s Board waived this restriction with respect to Mr. Nelson in light of the fact that

11

Table of Contents

Mr. Nelson devotes full time to making his capacity as a financial expert available to public companies, and the Board determined that Mr. Nelson’s simultaneous service would not impair his ability to effectively serve on Quintana’s Audit Committee. For additional information regarding Messrs. Nelson, Costalas, and Grewal, please see the biographical information beginning on page 8. The Audit Committee held four in-person meetings and nine telephonic meetings in 2006. The report of the Audit Committee begins on page 32.

Compensation, Nominating and Governance Committee. The duties of the CNG Committee are to (i) review, evaluate, and approve Quintana’s agreements, plans, policies and programs utilized to compensate the officers, directors, and when applicable, employees, consultants, contractors, agents or other providers of services to or for the benefit of Quintana or its affiliates; (ii) otherwise discharge the Board’s responsibilities relating to compensation of Quintana’s officers and directors; (iii) assist the Board by identifying individuals qualified to become board members and to recommend that the Board select the director nominees for election at the annual meetings of stockholders or for appointment to fill vacancies; (iv) recommend to the Board director nominees for each committee of the Board; (v) advise the Board about appropriate composition of the Board and its committees; (vi) advise and recommend to the Board appropriate corporate governance practices and to assist the Board in implementing those practices; (vii) lead the Board in its annual review of the performance of the Board and its committees; and (viii) perform such other functions as the Board may assign to the Committee from time to time.

The CNG Committee identifies director candidates through a variety of means, including recommendations from other Board members and management. From time to time, the CNG Committee may use third-party search consultants to identify director candidates. The CNG Committee will consider all stockholder recommendations for candidates for the Board, which should be sent to the CNG Committee, c/o Steve Putman, Secretary, Quintana Maritime Limited, 601 Jefferson St., Suite 3600, Houston, Texas 77002, and should include the recommended candidate’s name, biographical data and qualifications. The CNG Committee’s minimum qualifications and specific qualities and skills required for directors are set forth in Section I of Quintana’s Corporate Governance Guidelines, which can be viewed on our website atwww.quintanamaritime.com. These considerations include the potential director’s independence, background, experience, judgment, diversity, age, and skill in the context of the needs of the Board.

The CNG Committee screens all potential candidates in the same manner regardless of the source of the recommendation. The CNG Committee’s review is based on any written materials provided with respect to the potential candidate. The CNG Committee determines whether the candidate meets Quintana’s minimum qualifications and specific qualities and skills for directors and whether requesting additional information or an interview is appropriate. The members of the CNG Committee are Corbin J. Robertson, Jr. (Chair), S. James Nelson, Jr., and Joseph R. Edwards. The CNG Committee held four in-person meetings in 2006 and one telephonic meeting in 2006. The report of the CNG Committee begins on page 28.

Conflicts Committee. The primary powers and duties of the Conflicts Committee are to (i) review any proposed transactions that may appear to present conflicts of interest with respect to any director or executive officer, including those within the purview of Section 58 of the Business Corporations Act of the Marshall Islands (including any interpretations that may be imputed to Section 58 by virtue of its similarity to Section 144 of the Delaware General Corporation Law); (ii) retain any advisors necessary to review such transactions, including financial, accounting, and legal advisors; (iii) make final determinations as to the propriety of any such transactions, including the form, term, and provisions of the agreements, documents, and instruments executed on behalf of or otherwise affecting the Company in connection with any such transactions; and (iv) exercise any other powers necessary to arbitrate any conflicts of interest that may arise. Messrs. Nelson, Costalas and Grewal serve on the Conflicts Committee, with Mr. Nelson acting as Chair. The Conflicts Committee was formed in late 2006 and, as a result, the committee did not have any in-person or telephonic meetings until 2007.

Communications from Stockholders to the Board

The Board is receptive to direct communication with stockholders and recommends that stockholders initiate any communications with the Board in writing and send them in care of our presiding director.

12

Table of Contents

Stockholders can send communications by e-mail to board@quintanamaritime.com or by mail to Board of Directors, Quintana Maritime Limited, c/o Presiding Director, 601 Jefferson Street, Suite 3600, Houston, Texas 77002. This centralized process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The name of any specific intended Board recipient should be noted in the communication. Communications to the Board must include the number of shares owned by the stockholder as well as the stockholder’s name, address, telephone number and email address, if any. The Company will, prior to forwarding any correspondence, review such correspondence and, pursuant to Board policy, not forward certain items if they are deemed of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration. In such cases, these items may be forwarded elsewhere in Quintana for review and possible response.

CNG Committee Interlocks and Insider Participation

None of the members of the CNG Committee has at any time been an officer or employee of the Company and none of these directors serves as a member of the board of directors or CNG Committee of any entity that has one or more executive officers serving as a member of the Company's board or CNG Committee.

Corporate Governance

The Board has adopted Corporate Governance Guidelines, and the Board’s CNG Committee is responsible for implementing the guidelines and making recommendations to the Board concerning corporate governance matters. The guidelines can be viewed on our website atwww.quintanamaritime.com. Among other matters, the guidelines include the following:

| • | Membership on the Board will be made up of a majority of independent directors who, at a minimum, meet the criteria for independence required by the NASDAQ Global Market. |

| • | At least two of each year’s regularly scheduled Board meetings will include an executive session of the independent directors. |

| • | The Board and its committees each conduct an annual self-evaluation. |

| • | The Board and the CNG Committee conduct an annual evaluation of management. |

| • | Directors are not permitted to serve as a director for more than three other public companies. |

| • | Directors are expected to attend all meetings of the Board and of the committees of which they are members. |

| • | To effectively discharge its oversight duties, the Board has direct access to management. |

Code of Ethics

The Board has adopted a Code of Business Conduct and Ethics. The Board requires all its employees to adhere to this code of ethics. Among other matters, this code of ethics is designed to promote:

| • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| • | avoidance of conflicts of interest; |

| • | compliance with applicable governmental laws, rules and regulations; |

| • | acting in good faith, responsibly, and with due care and diligence; |

| • | the prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

| • | accountability for adherence to the code. |

You can view the Code of Business Conduct and Ethics on our website atwww.quintanamaritime.com.

13

Table of Contents

Legal Proceedings Relating to Mr. Molaris

A private individual has filed a complaint with the public prosecutor for the Athens Magistrates Court against Mr. Molaris and four others relating to allegations that, while Mr. Molaris was employed by Stelmar Shipping Ltd., they conspired to defraud the individual of a brokerage fee of €1.2 million purportedly owed by a shipyard in connection with the repair of a vessel of Stelmar. Mr. Molaris believes the complaint is without merit and is vigorously contesting these allegations. The prosecutor has referred the matter to a Greek judge for further investigation. The judge will determine whether the claim has sufficient merit to forward the matter on to a court for adjudication. We have been advised that an independent committee of the board of directors of Stelmar has conducted an inquiry into these allegations and found no evidence to support them.

As publicly disclosed by Stelmar Shipping Ltd., on November 10, 2003 Mr. Molaris, who then was the chief financial officer of Stelmar, took a non-interest bearing advance from Stelmar in the amount of $125,000, in apparent violation of applicable U.S. law prohibiting loans by public companies to their directors and executive officers. This transaction was reflected as an advance in Stelmar’s 2003 year-end financial statements and was repaid on February 10, 2004. The board of directors of Stelmar imposed a fine on Mr. Molaris in the amount of $30,000, which Mr. Molaris paid to Stelmar. The Enforcement Division of the SEC conducted an inquiry into this matter, and, on December 1, 2005, the SEC entered an order relating to these alleged violations of Section 13(k) of the Securities Exchange Act of 1934. Without admitting or denying the findings in the order, Mr. Molaris agreed to cease and desist from causing any violations and any future violations of Section 13(k) of the Exchange Act. The SEC did not impose any monetary sanctions on Mr. Molaris.

14

Table of Contents

Compensation Discussion and Analysis

Overview

Most of our operational staff are located in Athens, Greece and are compensated directly by Quintana. Our chief executive officer and chief commercial officer are headquartered in Athens. The Company pays part of their salaries directly and pays the balance of their salary, related to work performed or relating to activities outside of Greece, indirectly under a consulting arrangement with Shipmanagement Consultants Inc., a Marshall Islands company. Regardless of the form of the payment, all amounts paid to these officers are considered salary and included as such on the Summary Compensation Table and in the related discussion below. Although our chief financial officer and general counsel devote all their time to Quintana, they are directly employed by Quintana Minerals Corporation, an affiliate, which is reimbursed by Quintana for the salary and bonuses that Quintana pays to those officers. Reimbursement is governed by the Services Agreement between Quintana and Quintana Minerals Corporation dated as of October 31, 2005. This arrangement was put in place to ease the administrative burden of the Company, which is currently not a U.S. taxpayer, with respect required U.S. tax withholding and reporting with respect to its U.S.-based employees. As with the other relevant executive officers, all amounts paid to Messrs. Cornell and Putman are included as salary or bonus, as appropriate on the Summary Compensation Table and in the related discussion below. Both the agreement with Shipmanagement Consultants Inc. and the Services Agreement with Quintana Minerals Corporation are filed or incorporated by reference as exhibits to our Annual Report on Form 10-K for the year ended December 31, 2006.

Executive Officer Compensation Strategy and Philosophy

Our primary business goal is to generate cash flows at levels that cover our operating costs, maintain our scheduled debt repayment, permit growth, as well as sustain or increase our dividend guidance. Under our current dividend policy, we expect to pay out minimum dividends of approximately $0.96 per common share in 2007.

Our executive officer compensation strategy has been designed to motivate and retain our executive officers and to align their interests with those of our shareholders. Our primary objective in determining the compensation of our executive officers is to encourage them to build the Company in a way that will achieve our business goals. In determining our executives’ success in achieving those goals, we look at specified performance criteria and financial targets. In order to arrive at the appropriate criteria, we examined various operating and financial data and determined that the factors listed below best reflected the effectiveness of management without making them responsible for factors beyond their control. While we do not use a predetermined formula to directly tie executive compensation to these criteria and targets, we find these measures helpful in our annual review of executive compensation. The primary performance criteria and financial targets we review are:

| • | average operating expenses per ship per day; |

| • | overall fleet utilization; |

| • | average overhead burden per ship per day (excluding corporate expenses and amortization of restricted stock); |

| • | unplanned incidents; |

| • | drydocking budget performance; |

| • | net revenue; and |

| • | Adjusted EBITDA. |

15

Table of Contents

Adjusted EBITDA represents net income plus interest and finance costs plus depreciation and amortization and income taxes, if any, plus deferred stock-based compensation, and amortization of time charter fair value and unrealized loss on swap transaction, which are non-cash items.

Summary of Executive Compensation.Our compensation for executive officers consists of four primary components:

| • | base salaries; |

| • | annual cash bonuses; |

| • | long-term equity incentive compensation; and |

| • | dividends paid on unvested restricted stock. |

In determining total compensation for executives, it is our policy to strongly weight total compensation in favor of long-term equity incentive compensation in order to achieve optimal alignment between our shareholders and our executive officers. The specific benefits of long-term equity incentive compensation are described below in “Long-Term Equity Compensation.” Quintana did not engage in any benchmarking in 2006.

Review of Executive-Officer Performance.The CNG Committee meets at least annually to review the performance of the executive officers. During its review, the CNG Committee takes into account the scope of responsibilities and experience of these officers as well as significant individual and company accomplishments over the preceding year, and determines what it believes to be competitive levels of total compensation. Based on its review, the CNG Committee makes recommendations to the full Board with respect to the salaries, annual cash bonuses, and long-term equity compensation (in the form of restricted stock awards) for each of the executive officers. We believe our compensation program aligns the interests of our executive officers with those of our shareholders and appropriately rewards the officers for achieving the goals of the Company: prudent growth, generation of stable and predictable cash flows, dividend growth, and increased market valuation.

Role of Compensation Experts

In early 2005, prior to the Company’s initial public offering, we engaged a consultant to review executive-officer and director compensation. Prior to the CNG Committee meeting in December 2005, the CNG Committee requested that the consultant update the information. The CNG Committee considered the advice of the consultant as only one factor among the other items discussed in this compensation discussion and analysis. For a more detailed description of the CNG Committee and its responsibilities, please see “Additional Information Regarding the Board of Directors” in this proxy statement.

Role of Our Executive Officers in the Compensation Process

Mr. Molaris was actively involved in providing recommendations to the CNG Committee in its evaluation of the 2006 compensation programs for our executive officers. Mr. Molaris, with the consultation of Mr. Robertson (the chairman of the CNG Committee), provided the full CNG Committee with recommendations for the executive officers. Mr. Molaris has been involved in the shipping industry for a number of years and, prior to joining Quintana, served as the Chief Financial Officer of a shipping company. Mr. Robertson has served as the Chairman and Chief Executive Officer of a publicly traded company since 2005, has served as a director of several organizations, and has served in the chief executive capacity of private companies for approximately 30 years. In these capacities, Mr. Molaris and Mr. Robertson have had significant experience in setting appropriate levels of compensation. Based on that experience, Mr. Molaris and Mr. Robertson determined the appropriate amounts for each employee and considered each of the factors described elsewhere in this compensation

16

Table of Contents

discussion and analysis. Mr. Molaris attended the CNG Committee meetings at which the committee deliberated and approved the compensation, but was excused from the meetings when the CNG Committee discussed his compensation. No other named executive officer assumed an active role in the evaluation or design of the 2006 executive officer compensation programs.

Components of Compensation

Base Salaries

The base salaries of our named executive officers are reviewed on an annual basis as well as at the time of a promotion or other material change in responsibilities. Adjustments in base salary are based on an evaluation of individual performance, the Company’s overall performance during the fiscal year, and the individual’s contribution to our overall performance. In determining salaries for 2006, our determination of salaries was based on limited operating experience. Consequently, we took into account the suggestions of compensation experts, as described above, to set salaries for 2006. These determinations were made consistent with our policy of weighting total compensation heavily in favor of long-term equity compensation. In 2006, we increased the salary of our executive officers for 2007. These increases were calculated to reward our executive officers for their accomplishments during 2006, which included significant growth as well as turning in a solid year of efficient operations. Among the primary accomplishments during 2006 were:

| • | Nearly tripling the size of the Company’s fleet, from 10 vessels to 28 vessels; |

| • | Achieving fleet utilization of 98%; and |

| • | Increasing dividends over 14% to $0.96 per share. |

Annual Cash Bonuses

Each executive officer received a discretionary cash bonus award approved in December by the CNG Committee based on the same criteria used to evaluate the annual base salaries. The bonuses paid under this program in 2007 and 2006 with respect to fiscal years 2006 and 2005, respectively, are disclosed in the Summary Compensation Table under the Bonus column. In line with our philosophy of primarily using the long-term compensation to motivate and retain our executive officers, on average these bonuses only represented approximately 65% of the annual salaries paid to the named executive officers, with the actual percentage varying by officer. On an aggregate basis, salary and bonus paid to the named executive officers represented approximately 14.5% of annual total compensation in 2006. As with the base salaries, the CNG Committee reviews individual and Company achievements, as well as the performance criteria and financial targets listed above in setting bonuses. With respect to determining bonuses vis-à-vis salaries, the CNG Committee weighs the Company’s cash flows, as determined by reference to the Adjusted EBITDA measure described above, more heavily in bonus determination.

Long-Term Incentive Compensation

At the time of our initial public offering, we adopted the Quintana Maritime Limited 2005 Stock Incentive Plan for our directors, consultants, and all the employees who perform services for the company, including the executive officers. We consider long-term equity-based incentive compensation to be the most important element of our compensation program for executive officers because we believe that these awards keep our officers focused on the growth of the company, as well as dividend growth and its impact on our share price, over an extended time horizon. In addition, the vesting schedule of these awards, which currently extends until 2011, helps us retain not only our executive officers but all of our employees: because unvested restricted shares are forfeited upon an employee’s departure from the Company, both our executive officers and employees are encouraged to continue employment at Quintana.

17

Table of Contents

When we completed our initial public offering in 2005, we granted each executive officer long-term incentive compensation that vested over a four-year period, from 2006 to 2009 (the “IPO Award”). In May 2006, we granted long-term executive compensation that vested in 2010 (the “May 2006 Award”), which was granted in order to extend the overall vesting horizon of the awards and to accommodate a newly elected director. In December 2006, we granted long-term compensation that vested over a four-year period, from 2007 to 2011 (the “December 2006 Award”). A portion of the initial award has vested in 2006 and 2007, but a substantial portion of the IPO Award will vest in 2009, the entirety of the May 2006 Award will vest in 2010, and a substantial portion of the December 2006 Award will vest in 2011. The amounts disclosed in the Restricted Stock Awards column in the Summary Compensation Table represent the expense incurred by the company in 2006 with respect to awards granted in 2005 and 2006. The size and value of the awards that the CNG Committee approved in 2006 reflect:

| • | the company’s success in more than doubling the size of its fleet; |

| • | the increase of our minimum annualized dividend guidance by over 14%; |

| • | the dilution in executives’ existing awards caused by the issuance of approximately 25 million shares of common stock in August 2006; and |

| • | the desire of the CNG Committee to motivate the executive officers to continue the growth over the long term. |

Our policy is to grant restricted stock awards at a meeting at the end of each fiscal year. In addition, we will consider significant corporate events, such as large acquisitions, in granting additional awards.

As stated above in the Compensation Discussion and Analysis, we have no outstanding option grants and do not intend to grant any options in the future.

Perquisites and Other Personal Benefits

Both we and Quintana Minerals Corporation maintain employee benefit plans that provide our executive officers and other employees with the opportunity to enroll in health, dental and life insurance plans. Each of these benefit plans require the employee to pay a portion of the premium, with the Company paying the remainder. These benefits are offered on the same basis to all employees of Quintana and Quintana Minerals Corporation. To the extent these costs are paid by Quintana Minerals Corporation, we reimburse it for those costs.

Quintana Minerals Corporation also maintains 401(k) and defined contribution retirement plans. Quintana Minerals Corporation matches the employee contributions under the 401(k) plan at a level of 100% of the first 3% of the contribution and 50% of the next 3% of the contribution. In addition, Quintana Minerals Corporation contributes 1/12 of each employee’s base compensation to the defined contribution retirement plan on an annual basis. Mr. Cornell also receives an automobile allowance. As with the other contributions, any amounts contributed by Quintana Minerals are reimbursed by us. Neither Quintana nor Quintana Minerals Corporation maintains a pension plan or a defined benefit retirement plan.

Under Greek law, Quintana may be required to pay, in certain circumstances, legally mandated compensation to its Greek employees on their retirement or dismissal. The compensation paid is a function of, among other factors, an employee’s length of service, his salary payable at the time of retirement or dismissal, and the manner of termination. If the employee is not given adequate notice (the adequacy of which is similarly calculated based on length of service and salary), Quintana is required to pay an amount based on the factors previously listed, subject to a maximum of 24 months’ salary. If adequate notice is given or if the employee retires, Quintana will pay the terminated employee approximately 40% of that amount. An actuarial valuation is used to determine the present value of accrued benefits under this law. As of December 31, 2006, Quintana had accrued $30,610 relating to potential obligations under this law.

18

Table of Contents

In addition, executive officers and other grantees of restricted stock awards receive dividends paid on both vested and unvested restricted stock. We believe that this cash component of compensation further ties our executives’ interests to those of our shareholders. The CNG Committee takes into consideration the amount of cash dividends each executive officer is expected to receive in the following year when it determines base salaries.

Share Ownership Requirements

We do not have any policy or guidelines that require specified ownership of our common stock by our directors or executive officers or share retention guidelines applicable to equity-based awards granted to directors or executive officers. As of December 31, 2006, our named executive officers held 973,000 shares of unvested restricted stock awarded as compensation and 46,000 shares of common stock.

Securities Trading Policy

Our insider trading policy states that executive officers and directors may not purchase or sell puts or calls to sell or buy our shares, engage in short sales with respect to our shares, or buy our securities on margin.

U.S. Tax Implications of Executive Compensation

Because we are a foreign corporation and are currently not a U.S. taxpayer, Section 162(m) of the Internal Revenue Code does not apply to compensation paid to our named executive officers and accordingly, the CNG Committee did not consider the impact of U.S. taxation on individual executives in determining compensation levels in 2006.

Accounting Implications of Executive Compensation

On July 1, 2005, we adopted Statement of Financial Accounting Standards No. 123 (revised 2004) (“SFAS No. 123(R)”) “Share-Based Payment.” SFAS No. 123(R) requires all share-based payments to employees, including grants of employee stock options, to be recognized in the income statement based on their fair values.

In 2006, we issued restricted stock under our 2005 Stock Incentive Plan. Restricted stock is issued on the grant date and is subject to forfeiture under certain circumstances. All restricted stock currently outstanding is subject to forfeiture only if employment is not continued through the vesting date. We pay dividends on all restricted stock, regardless of whether it has vested.

We have selected the straight-line method under SFAS No. 123(R) to account for the restricted stock awards, which treats such awards as a single award and results in recognition of the cost ratably over the entire vesting period. We consider each restricted stock award to be a single award and not multiple awards. Additionally, the “front-loaded” recognition of compensation cost that results from the accelerated method implies that the related employee services become less valuable as time passes, which management does not believe to be the case. The fair market value of the restricted stock is fixed as of the grant date as the average of the high and low trading prices of our common stock on the grant date.

We do not currently record an estimate of forfeitures of restricted stock, as we believe that any such amount would be immaterial. We continue to believe that restricted stock is an essential component of our compensation strategy, and we intend to continue to offer these awards in the future.

SFAS No. 123(R) was adopted shortly after we began operations and therefore had no effect on our compensation decisions.

19

Table of Contents

Summary Compensation Table

The following table sets forth the compensation paid to Messrs. Molaris and Frantzeskakis, directly or indirectly through Shipmanagement Consultants Inc. for 2006 and 2005, as well as amounts reimbursed to Quintana Minerals for compensation expense in 2006 and 2005 for Messrs. Cornell, Putman, and Kahil.

Name and Principal | Year | Salary(1) | Bonus(1)(2) | Stock Awards(3) | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Non-Qualified Deferred Compensation Earnings | All Other | Total | |||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||

Stamatis Molaris(5) CEO and President | 2006

2005 | 265,000

187,415 | 275,000

155,000 | 4,402,300

1,146,200 | —

— | —

— | —

— | 155,400

13,750 | 5,097,700

1,502,365 | |||||||||

Nikos Frantzeskakis Chief Commercial Officer | 2006

2005 | 245,000

164,375 | 140,000

60,000 | 1,353,938

573,100 | —

— | —

— | —

— | 72,975

6,875 | 1,811,913

804,350 | |||||||||

Paul J. Cornell Chief Financial Officer | 2006

2005 | 170,000

151,388 | 110,000

110,000 | 1,353,938

573,100 | —

— | —

— | —

— | 100,792

19,213 | 1,734,730

853,701 | |||||||||

Steve Putman(6) Vice President, General Counsel and Secretary | 2006

2005 | 155,000

51,667 | 50,000

11,000 | 787,540

375,120 | —

— | —

— | —

— | 64,285

4,500 | 1,056,825

442,287 | |||||||||

| (1) | Salaries and bonuses paid to Messrs. Molaris and Frantzeskakis are paid in Euros, although their salaries are determined in dollars. Every pay period, the prevailing exchange rate is used to convert the payment for that period from dollars to Euros. |

| (2) | Bonuses are listed in the years to which they relate, even though they are paid in subsequent years. E.g., bonuses listed for 2006 relate to services performed in 2006 but were paid in 2007. |

| (3) | Amounts represent the fair market value of the restricted stock awards granted in 2005 and 2006 at the relevant grant dates calculated in accordance with FAS 123(R). For a description of the assumptions made in the FAS 123(R) calculation, please see Note 14 in Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2006. |

| (4) | Includes cash dividends received by named executive officers on restricted stock awards during the period. Also includes 401(k) matching and retirement contributions, as applicable, allocated to Quintana by Quintana Minerals Corporation with respect to Messrs. Cornell and Putman. |

| (5) | Mr. Molaris did not receive any compensation for his service as a director. |

| (6) | Mr. Putman joined Quintana in September 2005. |

Grants of Plan-Based Awards in 2006

Named Executive Officer | Grant Date | Approval Date | All Other Stock Awards: Number of Shares of Stock (#) | Grant Date Fair ($) | ||||

Stamatis Molaris | 5/15/06 12/18/06 | 5/11/2006 12/15/2006 | 100,000 320,000 | 805,500 3,596,800 | ||||

Nikos Frantzeskakis | 5/15/06 12/18/06 | 5/11/2006 12/15/2006 | 42,500 90,000 | 342,338 1,011,600 | ||||

Paul J. Cornell | 5/15/06 12/18/06 | 5/11/2006 12/15/2006 | 42,500 90,000 | 342,338 1,011,600 | ||||

Steve Putman | 5/15/06 12/18/06 | 5/11/2006 12/15/2006 | 28,000 50,000 | 225,540 562,000 |

| (1) | Amounts represent the fair market value of the restricted stock awards granted at the relevant grant dates calculated in accordance with FAS 123(R). For a description of the assumptions made in the FAS 123(R) calculation, please see Note 14 in Notes to Consolidated Financial Statements in our Annual Report on Form 10-K for the year ended December 31, 2006. |

20

Table of Contents

None of our executive officers has an employment agreement, and the salary, bonus, and restricted stock awards noted above are approved by the CNG Committee at its sole discretion. Please see our disclosure in the Compensation Discussion and Analysis section of this proxy statement for a description of the factors that the CNG Committee considers in determining the amount of each component of the compensation. No consideration was paid in connection with any plan-based awards.

Subject to the rules of the NASDAQ Global Market, the Board and the CNG Committee have the right to alter or amend the Long-Term Incentive Plan or any part of the Long-Term Incentive Plan from time to time. Except upon the occurrence of unusual or nonrecurring events, no change in any outstanding grant may be made that would materially reduce any award to a participant without the consent of the participant.

The CNG Committee may make grants under the Long-Term Incentive Plan to employees and directors containing such terms as it determines, including the vesting period. Outstanding grants vest upon a change in control of Quintana. If a grantee's employment or membership on the Board terminates for any reason, outstanding grants will be automatically forfeited unless and to the extent that the CNG Committee provides otherwise.

As stated above in the Compensation Discussion and Analysis, we have no outstanding option grants and do not intend to grant any options in the future.

In the above table, the shares awarded on May 15, 2006 vest on February 15, 2010, and the shares awarded on December 18, 2006 vest as follows:

Vesting Year | Percentage of Award Vesting | |

2007 | 15.0% | |

2008 | 17.5% | |

2009 | 20.0% | |

2010 | 22.5% | |

2011 | 25.0% |

Outstanding Awards at December 31, 2006

The table below shows the total number of outstanding shares of restricted stock held by each named executive officer at December 31, 2006. The restricted stock shown below has been awarded over the last two years, and the final component will vest in 2011.

Named Executive Officer | Shares of Restricted (#) | Market Value ($) | |||

Stamatis Molaris(2) | 510,000 | $ | 5,615,500 | ||

Nikos Frantzeskakis(3) | 177,500 | $ | 1,954,275 | ||

Paul J. Cornell(4) | 177,500 | $ | 1,954,275 | ||