Excel Maritime Carriers Ltd. & Quintana Maritime Limited Investor Presentation January 29, 2008 Filed by Excel Maritime Carriers Ltd. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Quintana Maritime Limited Commission File No.: 000-51412 THE FOLLOWING ARE MATERIALS USED IN A PRESENTATION HELD ON JANUARY 29, 2008 FOR INVESTORS. |

1 Forward Looking Statements The information in this presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements relating to Excel Maritime Carriers Ltd., (“Excel”) planned acquisition of Quintana Maritime Limited (“Quintana”) and the expected terms and timing of the transaction, anticipated financial and operating results, the companies’ plans, objectives, expectations, intentions and cost savings. Words such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “will,” “should,” “may,” and other similar expressions are intended to identify forward-looking statements. Such statements are based upon the current beliefs and expectations of our management and involve a number of significant risks and uncertainties, many of which are difficult to predict and generally beyond the control of Excel and Quintana. Actual results may differ materially from the results anticipated in these forward-looking statements. The following factors, among others, could cause or contribute to such material differences: the ability to obtain the approval of the transaction by Quintana shareholders; the ability to obtain governmental approvals of the transaction or to satisfy other conditions to the transaction on the proposed terms and timeframe; the ability of Excel to obtain financing; the ability to realize the expected synergies resulting for the transaction in the amounts or in the timeframe anticipated; and the ability to integrate Quintana’s businesses into those of Excel in a timely and cost-efficient manner. Additional factors that could cause Excel’s and Quintana’s results to differ materially from those described in the forward-looking statements can be found in the 2006 Annual Report on Form 20-F of Excel and the 2006 Annual Report on Form 10-K of Quintana filed with the Securities and Exchange Commission and available at the Securities and Exchange Commission’s Internet site (http://www.sec.gov). This communication is being made in respect of the proposed merger transaction involving Excel and Quintana. In connection with the proposed merger transaction involving Excel and Quintana, Excel will file with the Securities and Exchange Commission a registration statement on Form F-4 containing a proxy statement/prospectus. The proposed merger transaction involving Excel and Quintana will be submitted to Quintana’s shareholders for their consideration. Shareholders are encouraged to read the proxy statement/prospectus regarding the proposed transaction when it becomes available because it will contain important information. Shareholders will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about Excel and Quintana without charge, at the Securities and Exchange Commission’s Internet site (http://www.sec.gov). Copies of the proxy statement/prospectus and the filings with the Securities and Exchange Commission that will be incorporated by reference in the proxy statement/prospectus can also be obtained, when available, without charge, by directing a request to Excel or to Quintana per the following contact information. To Excel: Investor relations/ Financial Media at Capital Link, Inc., 230 Park Avenue – Suite 1536, New York, NY 10160, USA, Attention: Nicolas Bornozis, (212) 661-7566, or to Quintana: Investor relations/ Financial Media at Capital Link, Inc., 230 Park Avenue – Suite 1536, New York, NY 10160, USA, Attention: Ramnique Grewal (212) 661-7566.. Excel, Quintana and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Excel’s directors and executive officers is available in Excel’s notice of annual meeting and proxy statement for its most recent annual meeting and Excel’s Annual Report on Form 20-F for the year ended December 31, 2006, which were filed with the Securities and Exchange Commission on September 14, 2007 and June 26, 2007, respectively, and information regarding Quintana’s directors and executive officers is available in Quintana’s proxy statement for its most recent annual meeting of shareholders and Quintana’s Annual Report on Form 10-K, which were filed with the Securities and Exchange Commission on April 2, 2007 and March 9, 2007, respectively. Other information regarding the participants in the solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the Securities and Exchange Commission when they become available. There shall not be any offer or sale of securities in any jurisdiction in which such offer or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. |

2 Paul Cornell, Chief Financial Officer Lefteris Papatrifon, Chief Financial Officer Gabriel Panayotides, Chairman Stamatis Molaris, CEO, President and Director Meeting Participants |

3 TRANSFORMATIONAL COMBINATION |

4 Our Vision for the Combination of Two World Class Shipping Companies Transaction will create one of the world’s largest dry bulk owners and operators by dwt – 3.7 million on the water, 1.4 million from newbuilds 47 operated vessels on the water 8 newbuilds to be operated with delivery 2008 to 2010 Ability to offer full spectrum of dry bulk vessels to customer base |

5 Leadership of the New Excel Gabriel Panayotides will remain as Chairman Stamatis Molaris to serve as CEO of the combined entity – CEO and Director of Quintana since its inception – Chief Financial Officer and a Director of Stelmar Shipping Ltd. 1993 to 2005 Lefteris Papatrifon to serve as CFO of the combined entity – Chief Financial Officer of Excel since January 1, 2005 Additions to the Board of Directors – Stamatis Molaris, Hans Mende, Corbin Robertson III, and Paul Cornell from Quintana will be joining Excel’s board |

6 Strategic Merits of the Combined Company Forms an industry leader - the largest dry bulk company by owned and operated vessel deadweight tonnage publicly listed in the U.S. Strong cash flow visibility, with charter coverage to protect from near term market volatility Modern, diverse fleet with a full spectrum of vessel sizes to service customers Enhanced growth prospects from existing newbuilding program Significant synergies from fleet combination Long-term relationships with broad, investment grade customer base Experienced management team with proven track record to lead the combined company |

7 CHIEF FINANCIAL OFFICERS Lefteris Papatrifon, Excel Maritime Carriers Ltd., Paul Cornell, Quintana Maritime Limited |

8 Compelling Offer to Quintana Shareholders Cash Portion: $13.00 per share in cash Stock Portion: $13.48 per share (Based on Excel’s closing price as of January 28 th ), reduced by Quintana dividends paid prior to closing – 0.4084 in Excel shares for every share of Quintana with maximum total value of $31.38 reduced by Quintana dividends paid prior to closing – If average closing price of Excel for 15 trading day period prior to merger date exceeds $45.00 per share, this exchange ratio will be adjusted so that the stock portion value is $18.38 per share Compelling value to Quintana shareholders: – As of market close on January 28 th , offer value of $26.48 less Quintana dividends paid prior to closing – 57% premium to yesterday’s closing Quintana price – 34% premium to 30-day average of Quintana price Meaningful pro forma economic ownership of the new Excel: 55% of Class A shares Key Conditions: Quintana shareholder vote, Excel’s receipt of financing, and customary government and regulatory approvals Timing: Targeting completion Q2 2008 Quintana Shareholders Receive a Combination of Cash and Class A Stock – Certainty of Value with Equity Upside |

9 Funding and Pro Forma Capitalization (1) Does not include newbuildings. (2) Based on the average of 2 independent fleet valuation reports $1.4 billion in newly committed secured loans Approximately $350 million of available cash $225 million in debt rolling with the transaction ~$100 million in available cash $1,625 million in pro forma debt ~$3,600 million in combined owned fleet market value (1) (2) 45% pro forma debt to combined owned fleet market value (1) shares outstanding Financing the Transaction Pro Forma Capitalization |

10 Quintana Maritime Limited Chief Executive Officer Stamatis Molaris |

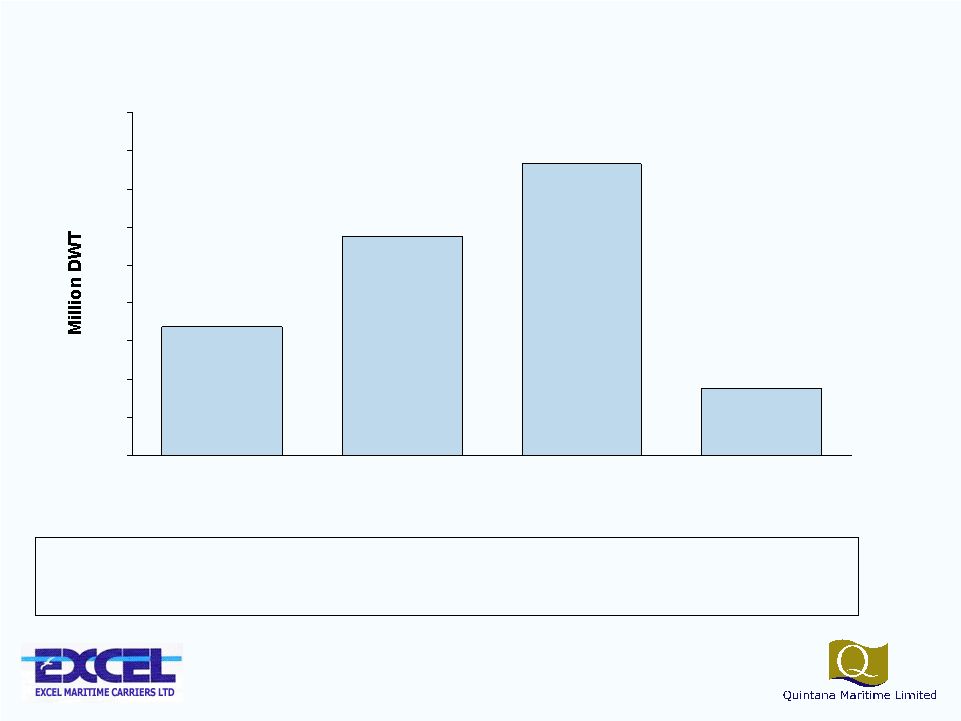

11 0.7 0.7 0.9 1.8 1.9 2.9 3.1 3.7 11 Ships 9 Ships 18 Ships 18 Ships 28 Ships 36 Ships 38 Ships 47 Ships 0.0 1.5 3.0 4.5 Paragon Ocean Freight Eagle Diana Genco DryShips Navios New Excel Shipping Largest Dry Bulk The We Will Be Company Listed in US by Operated DWT Note: The number of vessels includes both owned and chartered-in vessels, but not Newbuildings. (1) Fleet includes dry bulk vessels only. (2) Fleet does not include the capesize Netadola which was sold in December 2007. (1) (2) Clear Market Leadership |

12 Vessel Average Age 5.5 Years 1.5 Years 10.6 Years 14.7 Years 0.7 1.2 1.5 0.4 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 Capesize Kamsarmax Panamax Supramax / Handymax Our Combined Current Fleet 4 Ships 14 Ships 21 Ships 8 Ships Note: Newbuildings are not included. Panamax segment includes 7 vessels sold and leased back. |

13 Our Combined Capesize Newbuilding Program Iron Endurance Capesize 180,000 Dec-08 Imabari 100.0% Christine Capesize 180,000 Mar-10 Imabari 42.8% Hope Capesize 181,000 Nov-10 STX 50.0% Lillie Capesize 181,000 Dec-10 STX 50.0% Fritz Capesize 180,000 May-10 KSC 50.0% Benthe Capesize 180,000 Jun-10 KSC 50.0% Gayle Frances Capesize 180,000 Jul-10 KSC 50.0% Iron Lena Capesize 180,000 Aug-10 KSC 50.0% Yard Built % Ownership TOTAL 8 Vessels 1,442,000 FLEET TO BE DELIVERED Type DWT Estimated Delivery |

14 Greater Ability to Serve Our Blue Chip List of Customers |

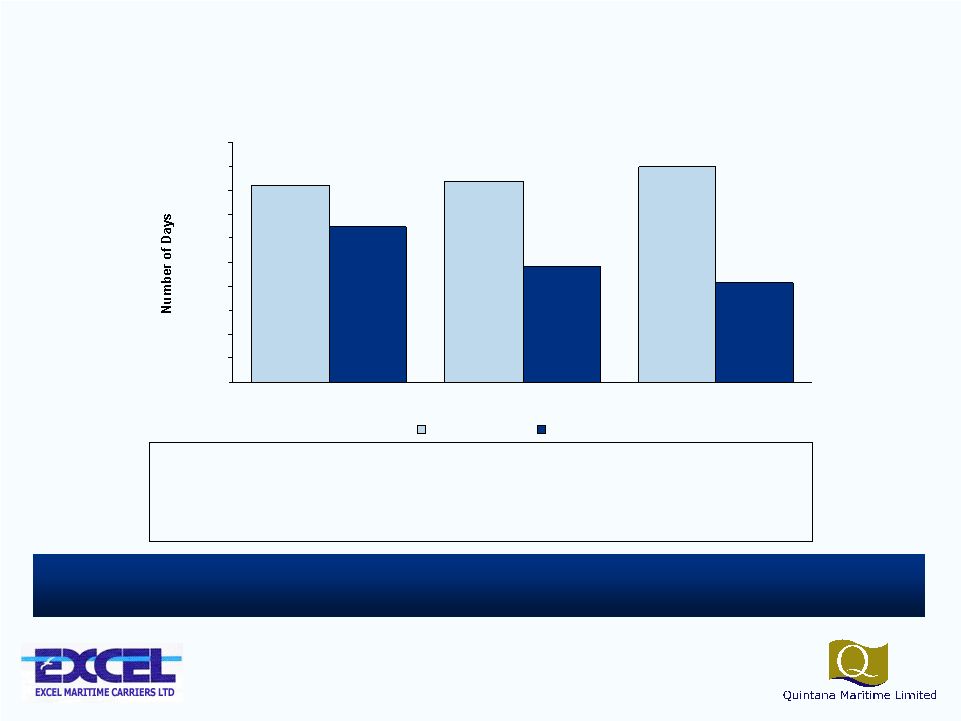

15 Significant Contract Coverage with Upside Potential Note: Expected pro forma charter coverage. Charter fixed days over total operating days. Includes Capesize vessels to be delivered in years 2008-2010. ~$800 million in fixed revenues insulates Company from Near Term Volatility while Retaining Upside Potential Fixed charter coverage 78% 57% 46% Net Combined Fixed Revenue (USD millions) $367 $247 $194 16,476 16,780 17,928 12,930 9,640 8,276 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 2008 2009 2010 Operating Days Fixed Days |

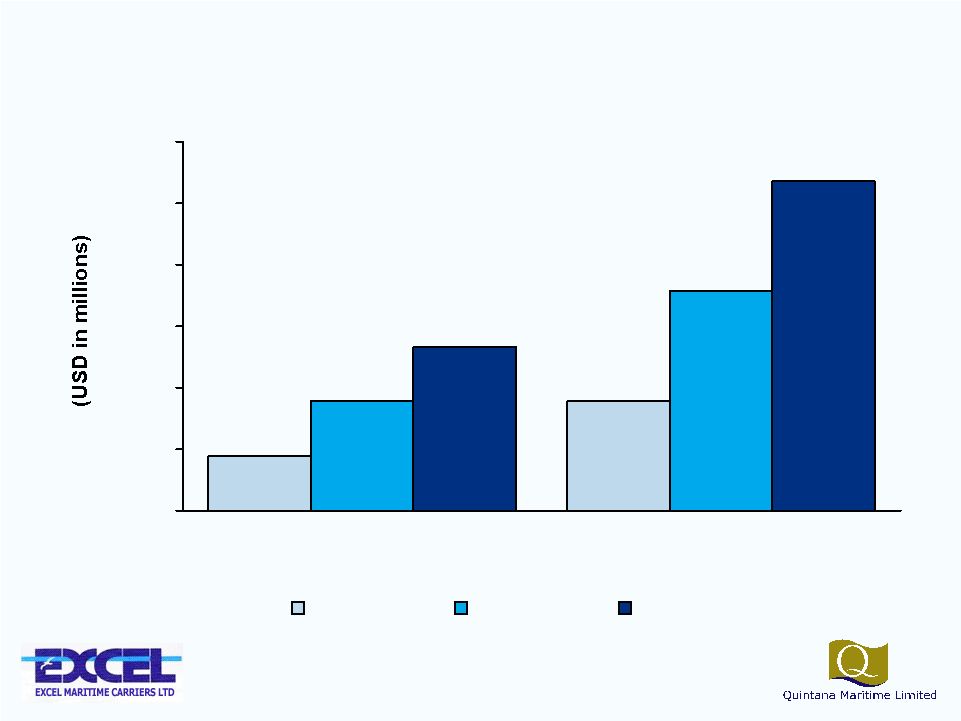

16 Forecast Contracted Revenue Coverage of Fixed Charges 2009 2008 Contracted Revenue Coverage of Fixed Charges 0.83x 1.54x $0 $100 $200 $300 $400 $367 $239 $0 $100 $200 $300 $400 $247 $298 Contracted revenue Principal Net interest Dry docking costs |

17 Upside Potential From Current Unfixed Combined Fleet $89 $179 $177 $357 $266 $536 $ $100 $200 $300 $400 $500 $600 2008 2009 $25,000 $50,000 $75,000 Average Daily Rate for Unfixed Vessels: |

18 Attractive, Attainable Synergies Enhanced technical and operational management capability Improved purchasing and placing power “Best of Breed” approach to cost discipline and training and motivating crews Enhanced fleet utilization - fewer breakdown and dry docking days Dry docking cost savings Improved daily operating expenses Lower general and administrative expenses through elimination of redundancies We anticipate total savings of $15m to $20m annually |

19 Strategic Merits of the Combined Company Forms an industry leader - the largest dry bulk company by owned and operated vessel deadweight tonnage publicly listed in the U.S. Strong cash flow visibility, with charter coverage to protect from near term market volatility Modern, diverse fleet with a full spectrum of vessel sizes to service customers Enhanced growth prospects from existing newbuilding program Significant synergies from fleet combination Long-term relationships with broad, investment grade customer base Experienced management team with proven track record to lead the combined company |

20 Q&A |

21 APPENDIX |

22 Appendix - Combined Fleet Profile Total of 55 vessels, an average age for the operating fleet of 8.1 years and 5.2 million DWT, including the newbuildings. Time Charter Vessel Vessel Type Ownership Age DWT Expiration Deployment Iron Beauty Capesize Owned 6.4 Yrs 165,500 Jun-10 Period Kirmar Capesize Owned 6.2 Yrs 165,500 Apr-08 Period Iron Miner Capesize Owned 0.8 Yrs 177,000 Apr-12 Period L Beilun Capesize Owned 8.7 Yrs 170,162 Jun-10 Period Iron Endurance (1) Capesize Owned -- 180,000 Dec-15 Period Christine (1) Capesize Joint Venture -- 180,000 Feb-16 Period Hope (1) Capesize Joint Venture -- 181,000 -- Spot Lillie (1) Capesize Joint Venture -- 181,000 Jun-15 Period Fritz (1) Capesize Joint Venture -- 180,000 Nov-15 Period Benthe (1) Capesize Joint Venture -- 180,000 -- Spot Gayle Frances (1) Capesize Joint Venture -- 180,000 Jan-14 Period Iron Lena (1) Capesize Joint Venture -- 180,000 Feb-15 Period Iron Bradyn Kamsarmax Owned 2.9 Yrs 82,769 Dec-10 Period Iron Fuzeyya Kamsarmax Owned 1.9 Yrs 82,209 Dec-10 Period Iron Kalypso Kamsarmax Owned 1.9 Yrs 82,224 Dec-10 Period Ore Hansa Kamsarmax Owned 1.8 Yrs 82,229 Dec-10 Period Santa Barbara Kamsarmax Owned 1.8 Yrs 82,266 Dec-10 Period Iron Bill Kamsarmax Owned 1.6 Yrs 82,000 Dec-10 Period Iron Vassilis Kamsarmax Owned 1.5 Yrs 82,000 Dec-10 Period Iron Anne Kamsarmax Owned 1.3 Yrs 82,000 Dec-10 Period Coal Gypsy Kamsarmax Owned 1.2 Yrs 82,300 Dec-10 Period Pascha Kamsarmax Owned 1.1 Yrs 82,300 Dec-10 Period Coal Hunter Kamsarmax Owned 1.0 Yrs 82,300 Dec-10 Period Iron Lindrew Kamsarmax Owned 0.9 Yrs 82,300 Dec-10 Period Iron Brooke Kamsarmax Owned 0.8 Yrs 82,300 Dec-10 Period Iron Manolis Kamsarmax Owned 0.7 Yrs 82,300 Dec-10 Period (1) Newbuildings delivery between 2008 and 2010. |

23 Appendix - Combined Fleet Profile Time Charter Vessel Vessel Type Ownership Age DWT Expiration Deployment Coal Pride Panamax Owned 8.1 Yrs 72,600 Jun-10 Period Grain Express Panamax Owned 3.7 Yrs 76,466 Dec-10 Period Iron Knight Panamax Owned 3.5 Yrs 76,429 Dec-10 Period Grain Harvester Panamax Owned 3.4 Yrs 76,417 Dec-10 Period Fortezza Panamax Owned 14.5 Yrs 69,634 Feb-08 Short Period Rodon Panamax Owned 14.5 Yrs 73,670 Oct-08 Period Angela Star Panamax Owned 9.5 Yrs 73,798 Nov-08 Period Happy Day Panamax Owned 10.5 Yrs 71,694 Dec-08 Period Renuar Panamax Owned 14.5 Yrs 70,128 Mar-09 Period Isminaki Panamax Owned 9.5 Yrs 74,577 Sep-09 Period Powerful Panamax Owned 13.5 Yrs 70,083 Jun-09 Period First Endeavour Panamax Owned 13.5 Yrs 69,111 May-09 Period Elinakos Panamax Owned 10.5 Yrs 73,751 Sep-09 Period Birthday Panamax Owned 14.5 Yrs 71,504 Feb-08 Spot Fearless 1 Panamax Leased 10.7 Yrs 73,427 Jun-08 Period King Coal Panamax Leased 11.0 Yrs 72,873 May-08 Period Coal Age Panamax Leased 10.5 Yrs 72,861 Dec-08 Period Iron Man Panamax Leased 10.5 Yrs 72,861 Aug-10 Period Linda Leah Panamax Leased 10.9 Yrs 73,390 Oct-09 Period Barbara Panamax Leased 10.7 Yrs 73,390 Jun-08 Period Coal Glory Panamax Leased 12.8 Yrs 73,670 Aug-08 Period July M Supramax Owned 2.5 Yrs 55,567 Jan-08 Spot Mairouli Supramax Owned 2.5 Yrs 53,206 Feb-08 Spot Lady Handymax Owned 22.5 Yrs 41,090 Jan-08 Short Period Emerald Handymax Owned 9.5 Yrs 45,588 Feb-08 Short Period Marybelle Handymax Owned 20.5 Yrs 42,552 Apr-08 Short Period Princess I Handymax Owned 13.5 Yrs 38,858 Jul-09 Period Attractive Handymax Owned 22.5 Yrs 41,524 -- Under Dry Dock Swift Handymax Owned 23.5 Yrs 37,687 Feb-08 Spot Total of 55 vessels, an average age for the operating fleet of 8.1 years and 5.2 million DWT, including the newbuildings. |

24 Contacts Investor Relations –Quintana Maritime Ramnique Grewal Vice President – Capital Link Inc. Tel No: 212-661-7566 E-mail: rgrewal@capitallink.com Investor Relations – Excel Maritime Nicolas Bornozis President – Capital Link Inc. Tel No: 212-661-7566 E-mail: nbornozis@capitallink.com Company Contacts –Quintana Maritime Paul Cornell Chief Financial Officer Tel No: 713-751-7525 E-mail: pcornell@quintanamaritime.com Company Contacts – Excel Maritime Lefteris Papatrifon Chief Financial Officer Tel No: +30 210 6209 520 E-mail: info@excelmaritime.com |