Searchable text section of graphics shown above

[GRAPHIC]

Federal Services Acquisition Corporation

to Acquire

Advanced Technology Systems, Inc.

April 20, 2006

[LOGO]

Stockholders of Federal Services are urged to read the proxy statement regarding its proposed acquisition of ATS when it becomes available as it will contain important information regarding ATS and the transaction. Copies of the proxy statement and other relevant documents filed by Federal Services, which will contain information about Federal Services and ATS, will be available when filed and without charge at the U.S. Securities and Exchange Commission’s Internet site (http://www.sec.gov). The definitive proxy statement, when available, may also be obtained from Federal Services without charge by directing a request to Federal Services Acquisition Corporation, 900 Third Avenue, 33rd Floor, New York, New York 10022-4775.

Federal Services and its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed acquisition of ATS. Information regarding Federal Services’ directors and executive officers is available in its Form 10-K for the year ended December 31, 2005, filed with the U.S. Securities and Exchange Commission. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement to be filed with the U.S. Securities and Exchange Commission when it becomes available.

2

Forward-Looking Statements

This slide presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, about Federal Services, ATS and their combined business after completion of the proposed acquisition. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are based upon the current beliefs and expectations of Federal Services’ and ATS’ management and are subject to risks and uncertainties which could cause actual results to differ from the forward-looking statements. The following factors, as well as other relevant risks detailed in Federal Services’ filings with the U.S. Securities and Exchange Commission, could cause actual results to differ from those set forth in the forward-looking statements:

• Federal Services being a development stage company with no operating history;

• Federal Services’ dependence on key personnel, some of whom may not remain with Federal Services following a business combination;

• risks that the acquisition of ATS or another business combination may not be completed due to failure of the conditions to closing being satisfied or other factors;

• Federal Services personnel allocating their time to other businesses and potentially having conflicts of interest with our business;

• Federal Services potentially being unable to obtain additional financing to complete a business combination;

• the ownership of Federal Services’ securities being concentrated; and

• risks associated with the federal services sector in general and the defense and homeland security sectors in particular.

The information set forth herein should be read in light of such risks. Neither Federal Services nor ATS assumes any obligation to update the information contained in this slide presentation.

3

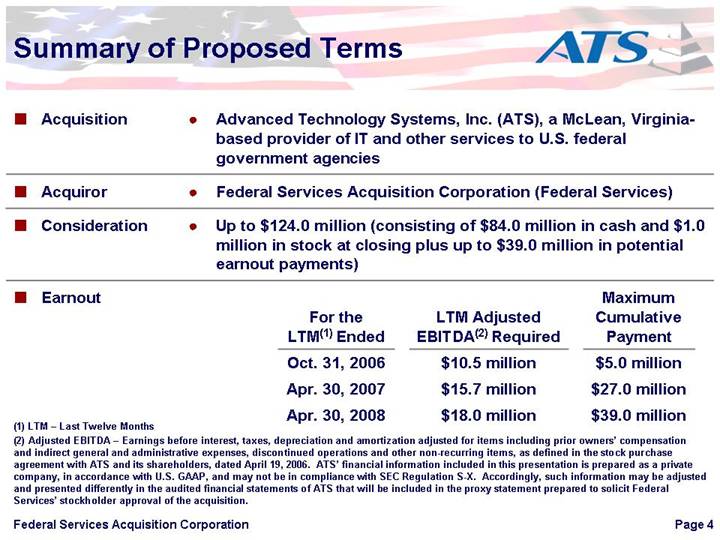

Summary of Proposed Terms

• Acquisition | | • | Advanced Technology Systems, Inc. (ATS), a McLean, Virginia-based provider of IT and other services to U.S. federal government agencies |

| | | |

• Acquiror | | • | Federal Services Acquisition Corporation (Federal Services) |

| | | |

• Consideration | | • | Up to $124.0 million (consisting of $84.0 million in cash and $1.0 million in stock at closing plus up to $39.0 million in potential earnout payments) |

| | | |

• Earnout | | | |

For the

LTM(1) Ended | | LTM Adjusted

EBITDA(2) Required | | Maximum

Cumulative

Payment | |

Oct. 31, 2006 | | $ | 10.5 million | | $ | 5.0 million | |

Apr. 30, 2007 | | $ | 15.7 million | | $ | 27.0 million | |

Apr. 30, 2008 | | $ | 18.0 million | | $ | 39.0 million | |

(1) LTM – Last Twelve Months

(2) Adjusted EBITDA – Earnings before interest, taxes, depreciation and amortization adjusted for items including prior owners’ compensation and indirect general and administrative expenses, discontinued operations and other non-recurring items, as defined in the stock purchase agreement with ATS and its shareholders, dated April 19, 2006. ATS’ financial information included in this presentation is prepared as a private company, in accordance with U.S. GAAP, and may not be in compliance with SEC Regulation S-X. Accordingly, such information may be adjusted and presented differently in the audited financial statements of ATS that will be included in the proxy statement prepared to solicit Federal Services’ stockholder approval of the acquisition.

4

Why We Are Acquiring ATS

• ATS is a strong federal services platform

• Long-standing reputation for quality service and high retention rate

• Diverse client base – 26 civil and 6 defense agencies

• Current backlog exceeds $185 million

• Attractive pipeline from existing and follow-on contracts

• We are acquiring ATS for a fair price

• High quality information technology (IT) platform

• Large and diverse revenue base

• Solid and growing core earnings

• Opportunities exist to create additional shareholder value

• Organic growth and acquisitions

• Leveraging the platform

5

ATS’ Core Competencies

Systems Integration and Application Development

• Software systems and application development

• Software integration, installation and migration

• Web-based implementations

• Database design, administration and integration

IT Infrastructure Management

• Managed services

• Program management

• Messaging / workflow administration

• Help desk support

• Security / risk management

Strategic IT Consulting

• Strategic planning and data modeling

• Cost / economic / business case analysis

• Migration planning for technology upgrade

• Benchmarking performance measurement and change management

6

Key Operating Issues ($ in millions)

• Revenue Transition and Growth Opportunities

• ATS successfully transitioned over the past five years to a broad customer base from a reliance on HUD(1)

• Over the past five years, ATS has grown new customer revenue rapidly, maintaining its revenue base

• Significant opportunities to expand in Departments of Defense and Homeland Security and other federal markets

• Cost Structure

• Private-company ownership environment

• Consolidated business operations prior to transaction closing

• Opportunities for enhanced profitability

FYE Oct. 31, 2005

Reported Revenue(2) | | $ | 107.2 | |

Reported Income from Continuing Operations(2) | | $ | 0.0 | (3) |

Adjusted EBITDA(4) | | $ | 8.7 | |

(1) HUD – Department of Housing and Urban Development

(2) Reflects audited financial results

(3) Reflects $23 thousand

(4) As defined on Page 4

7

Robust Federal Investment in IT

• Federal government demand for outsourced IT services remains high and is expected to continue

Total U.S. Federal IT Spending (excluding classified programs)

$57.1 billion in 2003 (Actual)

[CHART]

$63.8 billion in 2007 (Estimated)

[CHART]

Source: http://www.whitehouse.gov/omb/budget

8

Creating Shareholder Value

New Leadership and Broadened Vision Advanced Technology Systems, Inc. Organic Growth and Acquisitions

ATS Strengths | | Market Opportunities |

| | | | |

• | Strong Platform for Growth | | • | Robust Federal Investment in IT |

• | Large Revenue Base | | • | Exceptional Network of Relationships |

• | Diverse Customer Base | | • | Robust Backlog |

9