Searchable text section of graphics shown above

[GRAPHIC]

Federal Services Acquisition Corporation

Acquisition of

Advanced Technology Systems, Inc.

May 23, 2006

[LOGO]

Stockholders of Federal Services are urged to read the proxy statement regarding its proposed acquisition of ATS when it becomes available as it will contain important information regarding ATS and the transaction. Copies of the proxy statement and other relevant documents filed by Federal Services, which will contain information about Federal Services and ATS, will be available when filed and without charge at the U.S. Securities and Exchange Commission’s Internet site (http://www.sec.gov). The definitive proxy statement, when available, may also be obtained from Federal Services without charge by directing a request to Federal Services Acquisition Corporation, 900 Third Avenue, 33rd Floor, New York, New York 10022-4775.

Federal Services and its directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed acquisition of ATS. Information regarding Federal Services’ directors and executive officers is available in its Form 10-K for the year ended December 31, 2005, filed with the U.S. Securities and Exchange Commission. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement to be filed with the U.S. Securities and Exchange Commission when it becomes available.

2

Forward-Looking Statements

This slide presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, about Federal Services, ATS and their combined business after completion of the proposed acquisition. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are based upon the current beliefs and expectations of Federal Services’ and ATS’ management and are subject to risks and uncertainties which could cause actual results to differ from the forward-looking statements. The following factors, as well as other relevant risks detailed in Federal Services’ filings with the U.S. Securities and Exchange Commission, could cause actual results to differ from those set forth in the forward-looking statements:

• Federal Services being a development stage company with no operating history;

• Federal Services’ dependence on key personnel, some of whom may not remain with Federal Services following a business combination;

• risks that the acquisition of ATS or another business combination may not be completed due to failure of the conditions to closing being satisfied or other factors;

• Federal Services personnel allocating their time to other businesses and potentially having conflicts of interest with our business;

• Federal Services potentially being unable to obtain additional financing to complete a business combination;

• the ownership of Federal Services’ securities being concentrated; and

• risks associated with the federal services sector in general, and the defense and homeland security sectors in particular.

The information set forth herein should be read in light of such risks. Neither Federal Services nor ATS assumes any obligation to update the information contained in this slide presentation.

3

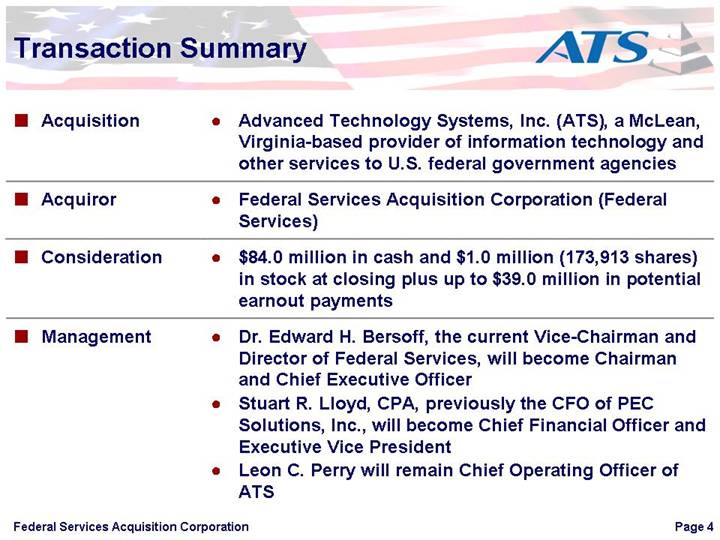

Transaction Summary

• | Acquisition | • | Advanced Technology Systems, Inc. (ATS), a McLean, Virginia-based provider of information technology and other services to U.S. federal government agencies |

| | | |

• | Acquiror | • | Federal Services Acquisition Corporation (Federal Services) |

| | | |

• | Consideration | • | $84.0 million in cash and $1.0 million (173,913 shares) in stock at closing plus up to $39.0 million in potential earnout payments |

| | | |

• | Management | • | Dr. Edward H. Bersoff, the current Vice-Chairman and Director of Federal Services, will become Chairman and Chief Executive Officer |

| | • | Stuart R. Lloyd, CPA, previously the CFO of PEC Solutions, Inc., will become Chief Financial Officer and Executive Vice President |

| | • | Leon C. Perry will remain Chief Operating Officer of ATS |

4

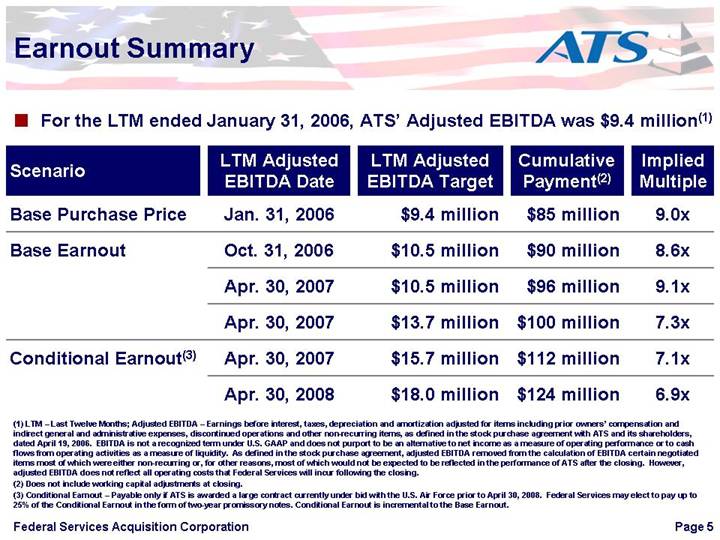

Earnout Summary

• For the LTM ended January 31, 2006, ATS’ Adjusted EBITDA was $9.4 million(1)

| | LTM Adjusted | | LTM Adjusted | | Cumulative | | Implied | |

Scenario | | EBITDA Date | | EBITDA Target | | Payment(2) | | Multiple | |

Base Purchase Price | | Jan. 31, 2006 | | $ | 9.4 million | | $ | 85 million | | 9.0 | x |

Base Earnout | | Oct. 31, 2006 | | $ | 10.5 million | | $ | 90 million | | 8.6 | x |

| | Apr. 30, 2007 | | $ | 10.5 million | | $ | 96 million | | 9.1 | x |

| | Apr. 30, 2007 | | $ | 13.7 million | | $ | 100 million | | 7.3 | x |

Conditional Earnout(3) | | Apr. 30, 2007 | | $ | 15.7 million | | $ | 112 million | | 7.1 | x |

| | Apr. 30, 2008 | | $ | 18.0 million | | $ | 124 million | | 6.9 | x |

(1) LTM – Last Twelve Months; Adjusted EBITDA – Earnings before interest, taxes, depreciation and amortization adjusted for items including prior owners’ compensation and indirect general and administrative expenses, discontinued operations and other non-recurring items, as defined in the stock purchase agreement with ATS and its shareholders, dated April 19, 2006. EBITDA is not a recognized term under U.S. GAAP and does not purport to be an alternative to net income as a measure of operating performance or to cash flows from operating activities as a measure of liquidity. As defined in the stock purchase agreement, adjusted EBITDA removed from the calculation of EBITDA certain negotiated items most of which were either non-recurring or, for other reasons, most of which would not be expected to be reflected in the performance of ATS after the closing. However, adjusted EBITDA does not reflect all operating costs that Federal Services will incur following the closing.

(2) Does not include working capital adjustments at closing.

(3) Conditional Earnout – Payable only if ATS is awarded a large contract currently under bid with the U.S. Air Force prior to April 30, 2008. Federal Services may elect to pay up to 25% of the Conditional Earnout in the form of two-year promissory notes. Conditional Earnout is incremental to the Base Earnout.

5

Why We Are Acquiring ATS

• ATS is a strong federal services platform

• Long-standing reputation for quality service and high retention rate

• Diverse client base – 26 civil and 6 defense agencies

• Current backlog exceeds $185 million

• Attractive pipeline from existing and follow-on contracts

• Opportunities exist to create additional stockholder value

• Organic growth and acquisitions

• Leveraging the platform

• We are acquiring ATS for a reasonable price

• High quality information technology (IT) platform

• Large and diverse revenue base

• Solid and growing core earnings

6

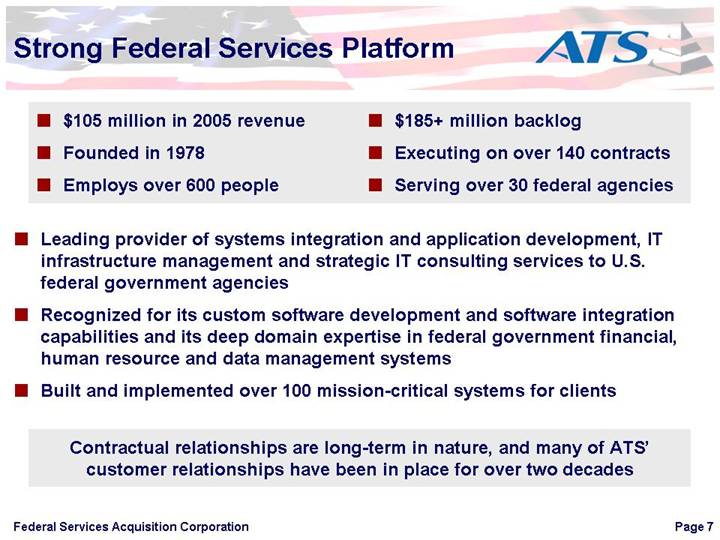

Strong Federal Services Platform

• $105 million in 2005 revenue

• Founded in 1978

• Employs over 600 people

• $185+ million backlog

• Executing on over 140 contracts

• Serving over 30 federal agencies

• Leading provider of systems integration and application development, IT infrastructure management and strategic IT consulting services to U.S. federal government agencies

• Recognized for its custom software development and software integration capabilities and its deep domain expertise in federal government financial, human resource and data management systems

• Built and implemented over 100 mission-critical systems for clients

Contractual relationships are long-term in nature, and many of ATS’

customer relationships have been in place for over two decades

7

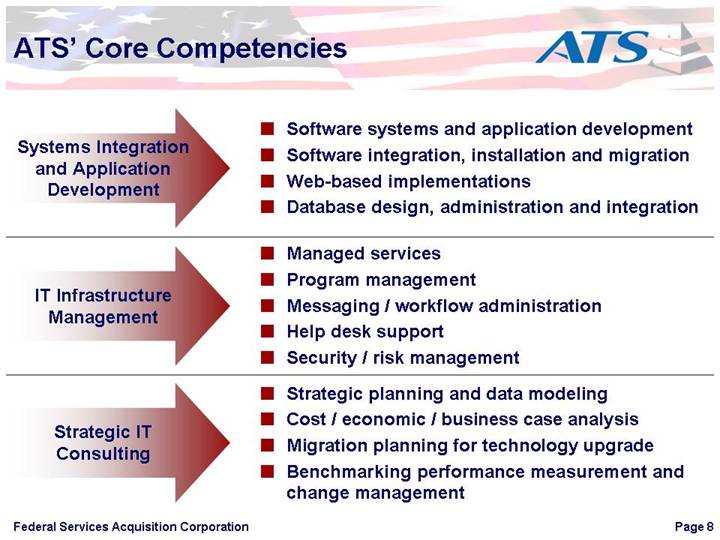

ATS’ Core Competencies

Systems Integration and Application Development | | • Software systems and application development |

| • Software integration, installation and migration |

| • Web-based implementations |

| • Database design, administration and integration |

| | |

IT Infrastructure Management | | • Managed services |

| • Program management |

| • Messaging / workflow administration |

| • Help desk support |

| • Security / risk management |

| | |

Strategic IT Consulting | | • Strategic planning and data modeling |

| • Cost / economic / business case analysis |

| • Migration planning for technology upgrade |

| • Benchmarking performance measurement and change management |

8

Established Client Relationships

[LOGO]

9

Representative Federal IT Providers

• The following companies provide similar services to federal agency customers

[LOGO]

10

Solid Contract Base

• Derives approximately 75% of federal services contract revenue from prime contracts

• Large and increasing base of time and material (T&M) and firm fixed price contracts provides potential margin upside

Contract Types

[CHART]

11

Large, National Footprint

• Offices and customer co-locations in over 30 cities, military bases and client sites around the world

[GRAPHIC]

Note: Excludes customer locations in Toronto, Canada and Kingston, Jamaica

12

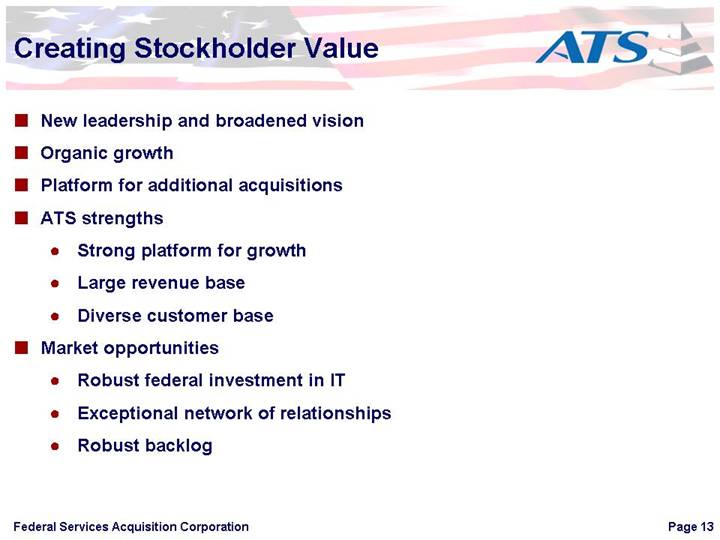

Creating Stockholder Value

• New leadership and broadened vision

• Organic growth

• Platform for additional acquisitions

• ATS strengths

• Strong platform for growth

• Large revenue base

• Diverse customer base

• Market opportunities

• Robust federal investment in IT

• Exceptional network of relationships

• Robust backlog

13

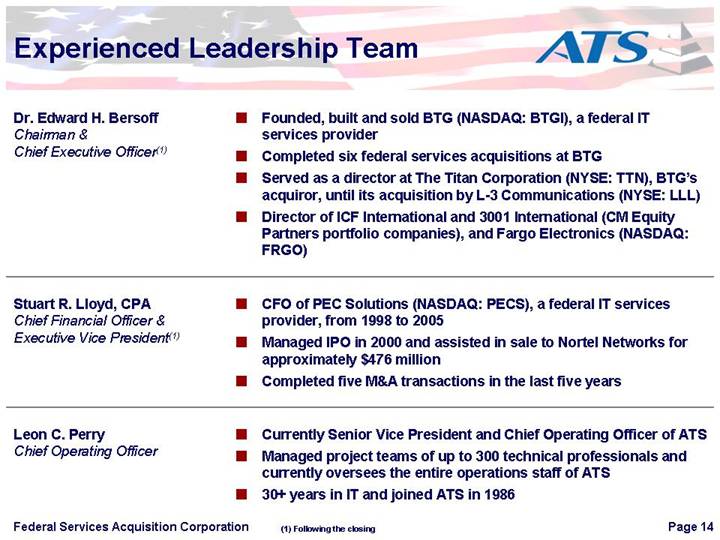

Experienced Leadership Team

Dr. Edward H. Bersoff | | • Founded, built and sold BTG (NASDAQ: BTGI), a federal IT services provider |

Chairman & | | • Completed six federal services acquisitions at BTG |

Chief Executive Officer(1) | | • Served as a director at The Titan Corporation (NYSE: TTN), BTG’s acquiror, until its acquisition by L-3 Communications (NYSE: LLL) |

| | • Director of ICF International and 3001 International (CM Equity Partners portfolio companies), and Fargo Electronics (NASDAQ: FRGO) |

| | |

Stuart R. Lloyd, CPA | | • CFO of PEC Solutions (NASDAQ: PECS), a federal IT services provider, from 1998 |

Chief Financial Officer & | | to 2005 |

Executive Vice President(1) | | • Managed IPO in 2000 and assisted in sale to Nortel Networks for approximately $476 |

| | million |

| | • Completed five M&A transactions in the last five years |

| | |

Leon C. Perry | | • Currently Senior Vice President and Chief Operating Officer of ATS |

Chief Operating Officer | | • Managed project teams of up to 300 technical professionals and currently oversees the entire operations staff of ATS |

| | • 30+ years in IT and joined ATS in 1986 |

(1) Following the closing

14

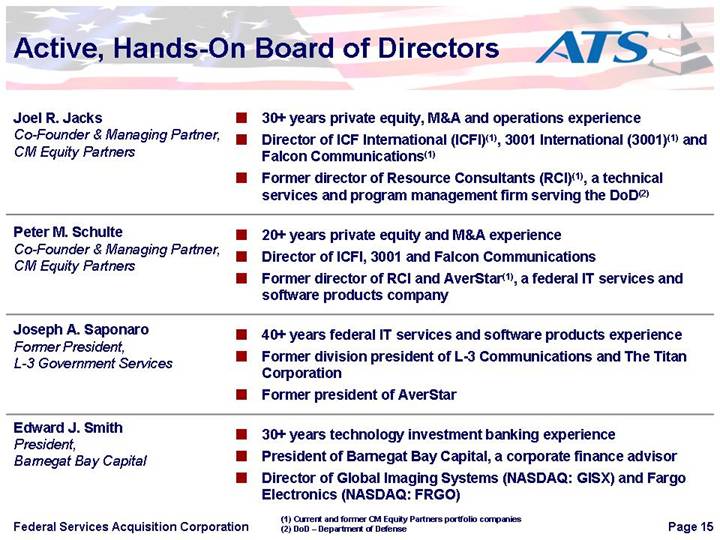

Active, Hands-On Board of Directors

Joel R. Jacks | | • 30+ years private equity, M&A and operations experience |

Co-Founder & Managing Partner, | | • Director of ICF International (ICFI)(1), 3001 International (3001)(1) and |

CM Equity Partners | | Falcon Communications(1) |

| | • Former director of Resource Consultants (RCI)(1), a technical services and program management firm serving the DoD(2) |

| | |

Peter M. Schulte | | • 20+ years private equity and M&A experience |

Co-Founder & Managing Partner, | | • Director of ICFI, 3001 and Falcon Communications |

CM Equity Partners | | • Former director of RCI and AverStar(1), a federal IT services and software products company |

| | |

Joseph A. Saponaro | | • 40+ years federal IT services and software products experience |

Former President, | | • Former division president of L-3 Communications and The Titan Corporation |

L-3 Government Services | | • Former president of AverStar |

| | |

Edward J. Smith | | |

President, | | • 30+ years technology investment banking experience |

Barnegat Bay Capital | | • President of Barnegat Bay Capital, a corporate finance advisor |

| | • Director of Global Imaging Systems (NASDAQ: GISX) and Fargo Electronics (NASDAQ: FRGO) |

(1) Current and former CM Equity Partners portfolio companies

(2) DoD – Department of Defense

15

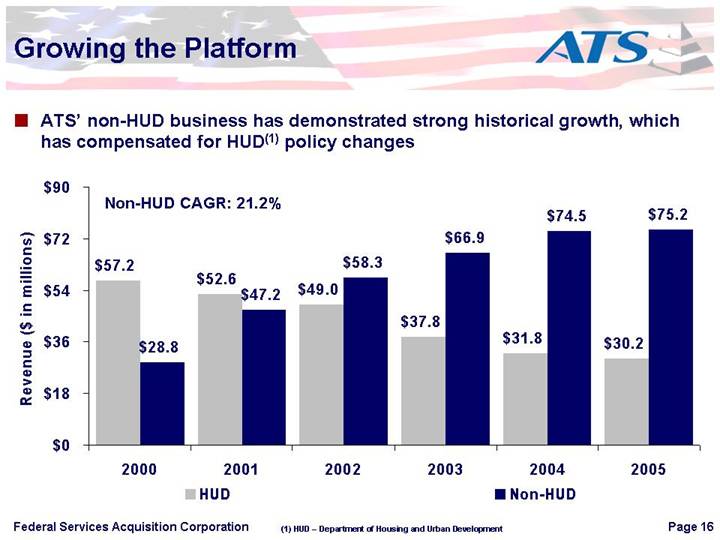

Growing the Platform

• ATS’ non-HUD business has demonstrated strong historical growth, which has compensated for HUD(1) policy changes

[CHART]

(1) HUD – Department of Housing and Urban Development

16

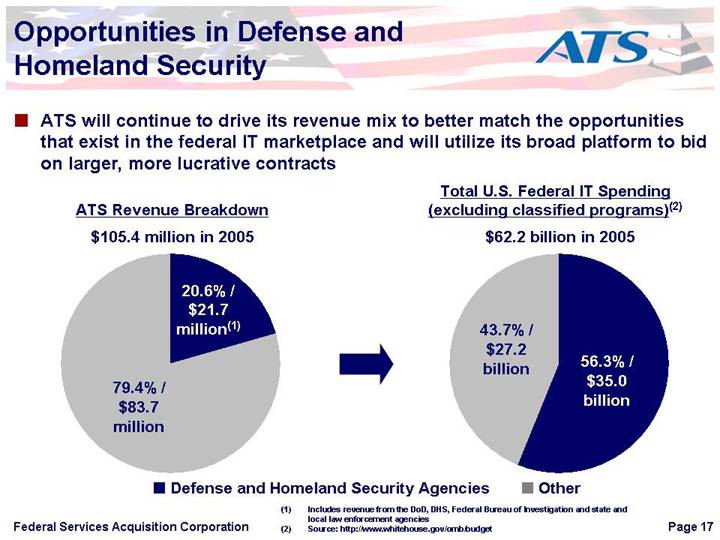

Opportunities in Defense and Homeland Security

• ATS will continue to drive its revenue mix to better match the opportunities that exist in the federal IT marketplace and will utilize its broad platform to bid on larger, more lucrative contracts

ATS Revenue Breakdown

$105.4 million in 2005

| | Total U.S. Federal IT Spending

(excluding classified programs)(2)

$62.2 billion in 2005 |

| | |

[CHART] | [GRAPHIC] | [CHART] |

(1) Includes revenue from the DoD, DHS, Federal Bureau of Investigation and state and local law enforcement agencies

(2) Source: http://www.whitehouse.gov/omb/budget

17

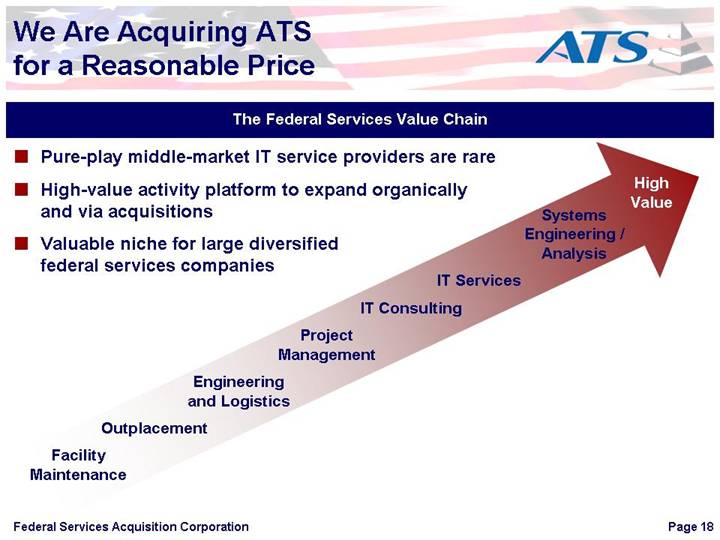

We Are Acquiring ATS for a Reasonable Price

The Federal Services Value Chain

• Pure-play middle-market IT service providers are rare

• High-value activity platform to expand organically and via acquisitions

• Valuable niche for large diversified federal services companies

| | | | | | | | | | | | | | High

Value | |

| | | | | | | | | | | | Systems Engineering / Analysis | | | |

| | | | | | | | | | IT Services | | | | | |

| | | | | | | | IT Consulting | | | | | | | |

| | | | | | Project Management | | | | | | | | | |

| | | | Engineering and Logistics | | | | | | | | | | | |

| | Outplacement | | | | | | | | | | | | | |

Facility Maintenance | | | | | | | | | | | | | | | |

18

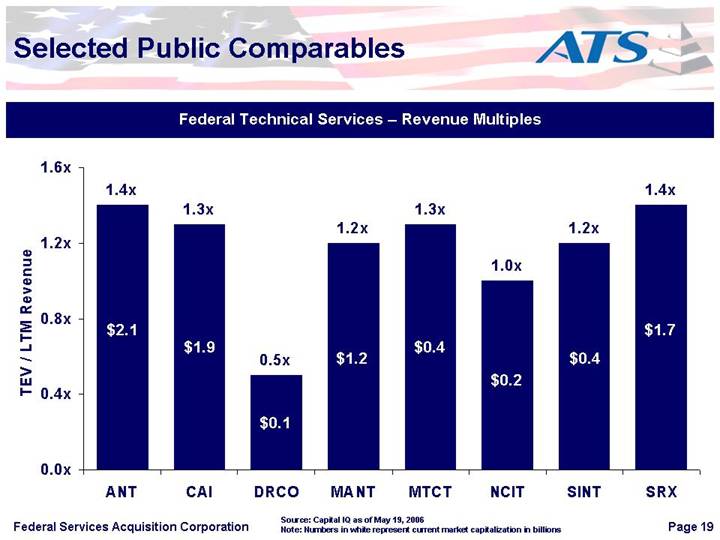

Selected Public Comparables

Federal Technical Services – Revenue Multiples

[CHART]

Source: Capital IQ as of May 19, 2006

Note: Numbers in white represent current market capitalization in billions

19

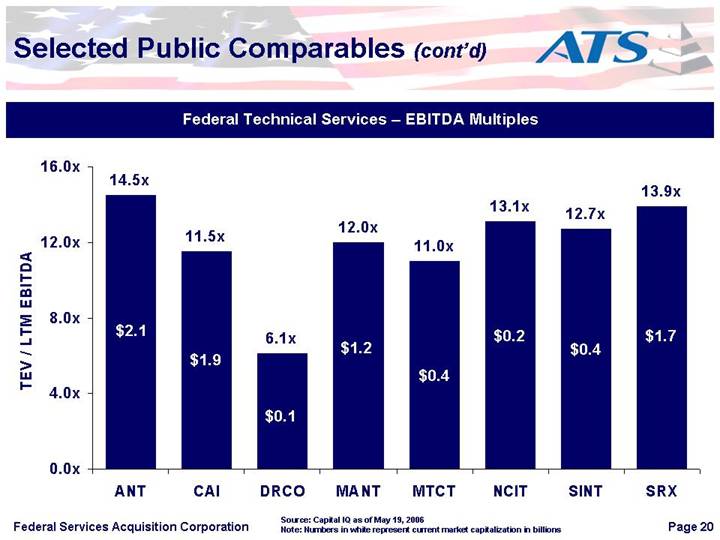

Federal Technical Services – EBITDA Multiples

[CHART]

Source: Capital IQ as of May 19, 2006

Note: Numbers in white represent current market capitalization in billions

20

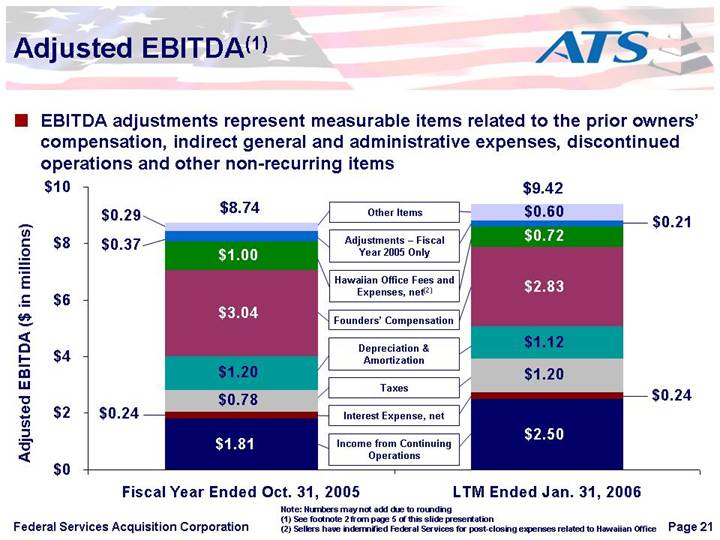

Adjusted EBITDA(1)

• EBITDA adjustments represent measurable items related to the prior owners’ compensation, indirect general and administrative expenses, discontinued operations and other non-recurring items

[CHART]

Note: Numbers may not add due to rounding

(1) See footnote 2 from page 5 of this slide presentation

(2) Sellers have indemnified Federal Services for post-closing expenses related to Hawaiian Office

21

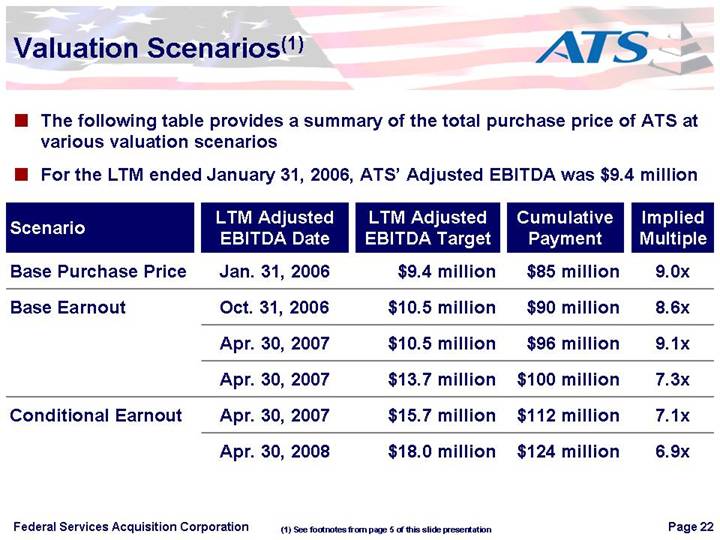

Valuation Scenarios(1)

• The following table provides a summary of the total purchase price of ATS at various valuation scenarios

• For the LTM ended January 31, 2006, ATS’ Adjusted EBITDA was $9.4 million

| | LTM Adjusted | | LTM Adjusted | | Cumulative | | Implied | |

Scenario | | EBITDA Date | | EBITDA Target | | Payment | | Multiple | |

Base Purchase Price | | Jan. 31, 2006 | | $ | 9.4 million | | $ | 85 million | | 9.0 | x |

Base Earnout | | Oct. 31, 2006 | | $ | 10.5 million | | $ | 90 million | | 8.6 | x |

| | Apr. 30, 2007 | | $ | 10.5 million | | $ | 96 million | | 9.1 | x |

| | Apr. 30, 2007 | | $ | 13.7 million | | $ | 100 million | | 7.3 | x |

Conditional Earnout | | Apr. 30, 2007 | | $ | 15.7 million | | $ | 112 million | | 7.1 | x |

| | Apr. 30, 2008 | | $ | 18.0 million | | $ | 124 million | | 6.9 | x |

(1) See footnotes from page 5 of this slide presentation

22