Third Quarter 2022 NASDAQ: FRST Exhibit 99.2

This presentation and certain of our other filings with the Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. Such statements can generally be identified by such words as "may," "plan," "contemplate," "anticipate," "believe," "intend," "continue," "expect," "project," "predict," "estimate," "could," "should," "would," "will," and other similar words or expressions of the future or otherwise regarding the outlook for the Company’s future business and financial performance and/or the performance of the banking industry and economy in general. These forward-looking statements include, but are not limited to, our expectations regarding our future operating and financial performance, including our outlook and long-term goals for future growth and new offerings and services; our expectations regarding net interest margin; expectations on our growth strategy, expense management, capital management and future profitability; expectations on credit quality and performance; statements regarding the effects of the ongoing COVID-19 pandemic and related variants on our business and financial results and conditions; and the assumptions underlying our expectations. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of the Company to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. Factors that might cause such differences include, but are not limited to: the Company’s ability to implement its various strategic and growth initiatives, including its recently established Panacea Financial and Life Premium Finance Divisions, new digital bank and V1BE fulfillment service and recent acquisition of SeaTrust Mortgage Company; competitive pressures among financial institutions increasing significantly; changes in applicable laws, rules, or regulations, including changes to statutes, regulations or regulatory policies or practices; changes in management’s plans for the future; credit risk associated with our lending activities; changes in interest rates, inflation, loan demand, real estate values, or competition, as well as labor shortages and supply chain disruptions; changes in accounting principles, policies, or guidelines; adverse results from current or future litigation, regulatory examinations or other legal and/or regulatory actions, including as a result of the Company’s participation in and execution of government programs related to the COVID-19 pandemic; the ongoing impact of the COVID-19 pandemic on the Company’s assets, business, cash flows, financial condition, liquidity, prospects and results of operations; potential increases in the provision for credit losses; and other general competitive, economic, political, and market factors, including those affecting our business, operations, pricing, products, or services. Forward-looking statements speak only as of the date on which such statements are made. These forward-looking statements are based upon information presently known to the Company’s management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in the Company’s filings with the Securities and Exchange Commission, the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, under the captions “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors,” and in the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on these forward-looking statements. Forward-Looking Statements 2

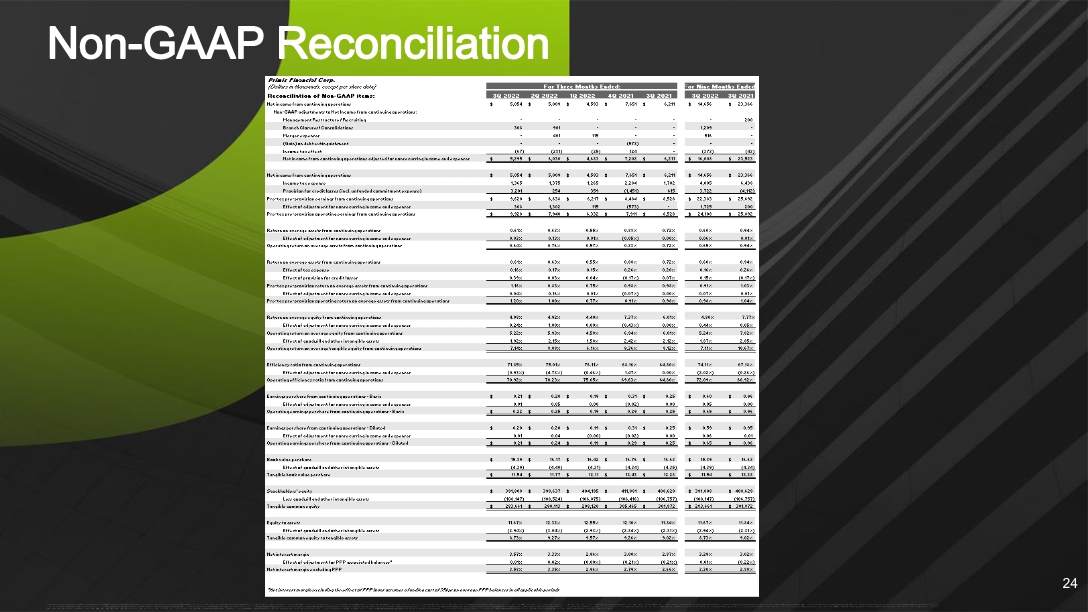

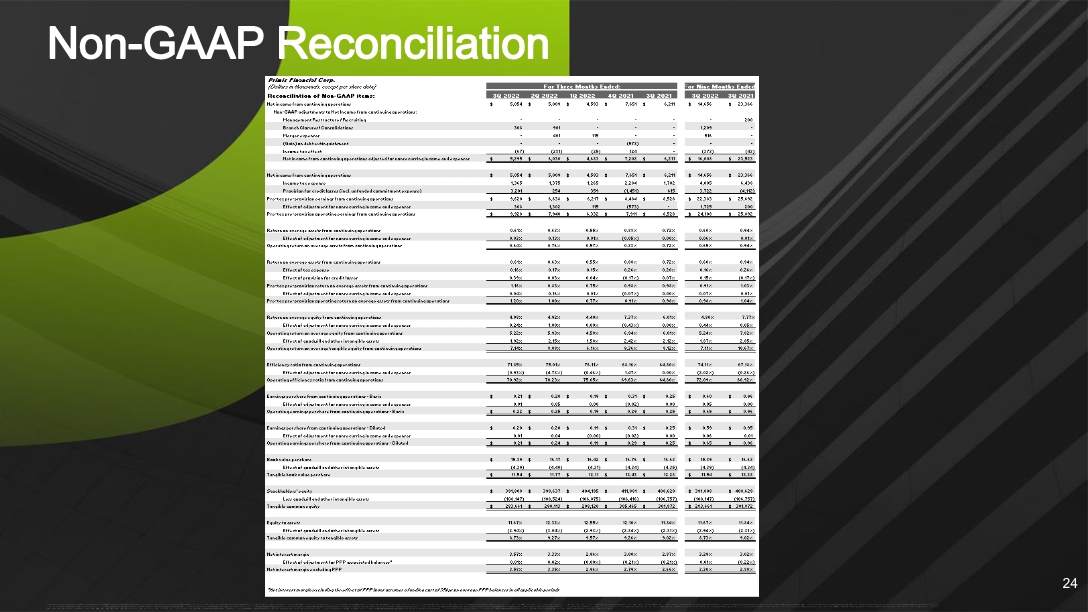

Statements included in this presentation include non-GAAP financial measures and should be read along with the accompanying tables. Primis uses non-GAAP financial measures to analyze its performance. The measures entitled pre-tax pre-provision operating earnings from continuing operations; pre-tax pre-provision operating return on average assets from continuing operations; operating earnings per share from continuing operations –diluted; tangible common equity; tangible common equity to tangible assets; tangible book value per share; and net interest margin excluding PPP loans are not measures recognized under GAAP and therefore are considered non-GAAP financial measures. A reconciliation of these non-GAAP financial measures to the most comparable GAAP measures is provided in the Reconciliation of Non-GAAP items table. Management believes that these non-GAAP financial measures provide additional useful information about Primis that allows management and investors to evaluate the ongoing operating results, financial strength and performance of Primis and provide meaningful comparison to its peers. Non-GAAP financial measures should not be considered as an alternative to any measure of performance or financial condition as promulgated under GAAP, and investors should consider Primis’s performance and financial condition as reported under GAAP and all other relevant information when assessing the performance or financial condition of Primis. Non-GAAP financial measures are not standardized and, therefore, it may not be possible to compare these measures with other companies that present measures having the same or similar names. Non-GAAP financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the results or financial condition as reported under GAAP. Non-GAAP Measure 3

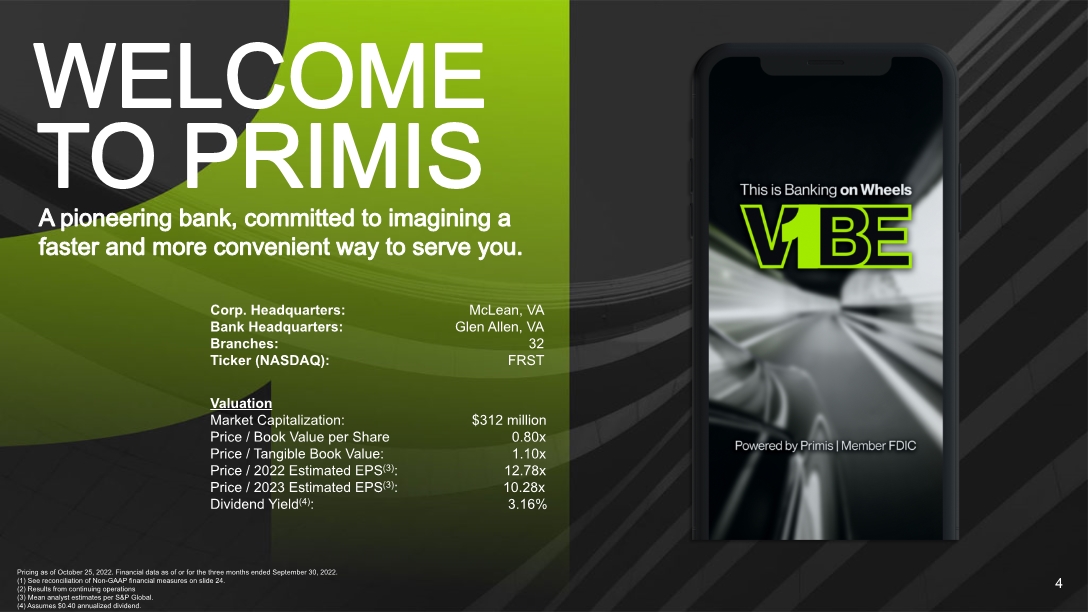

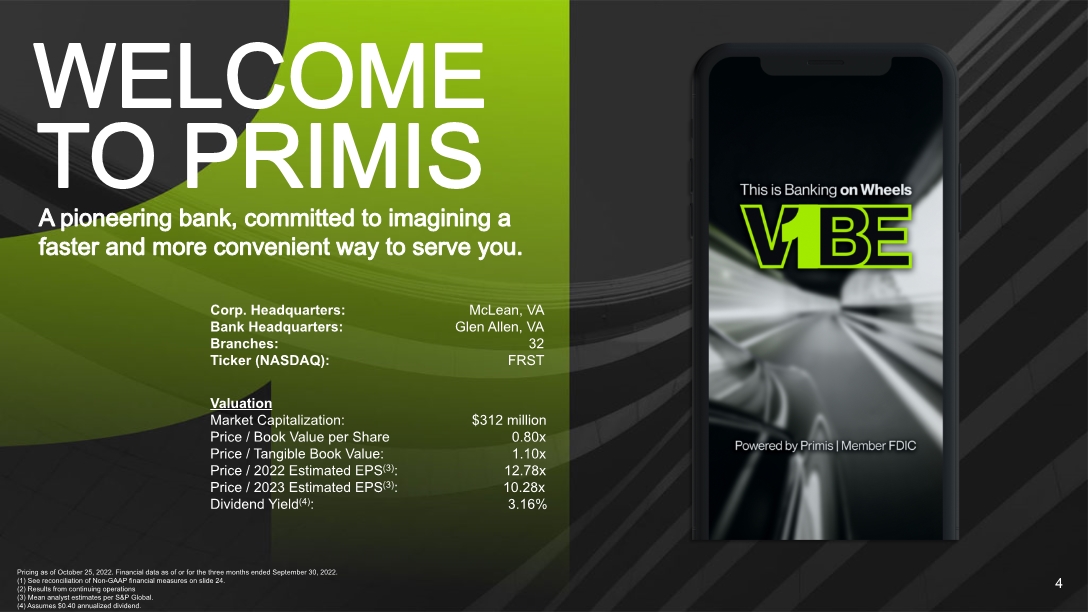

A pioneering bank, committed to imagining a faster and more convenient way to serve you. WELCOME TO PRIMIS Corp. Headquarters: McLean, VA Bank Headquarters: Glen Allen, VA Branches: 32 Ticker (NASDAQ): FRST Valuation Market Capitalization: $312 million Price / Book Value per Share 0.80x Price / Tangible Book Value: 1.10x Price / 2022 Estimated EPS(3): 12.78x Price / 2023 Estimated EPS(3): 10.28x Dividend Yield(4): 3.16% 4 Pricing as of October 25, 2022. Financial data as of or for the three months ended September 30, 2022. (1) See reconciliation of Non-GAAP financial measures on slide 24. (2) Results from continuing operations (3) Mean analyst estimates per S&P Global. (4) Assumes $0.40 annualized dividend.

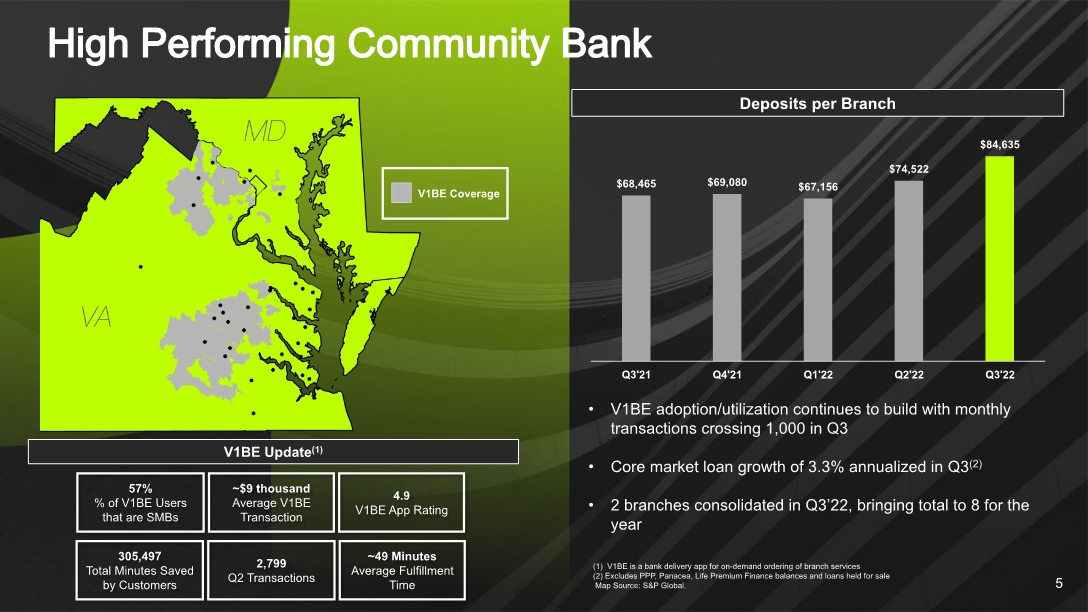

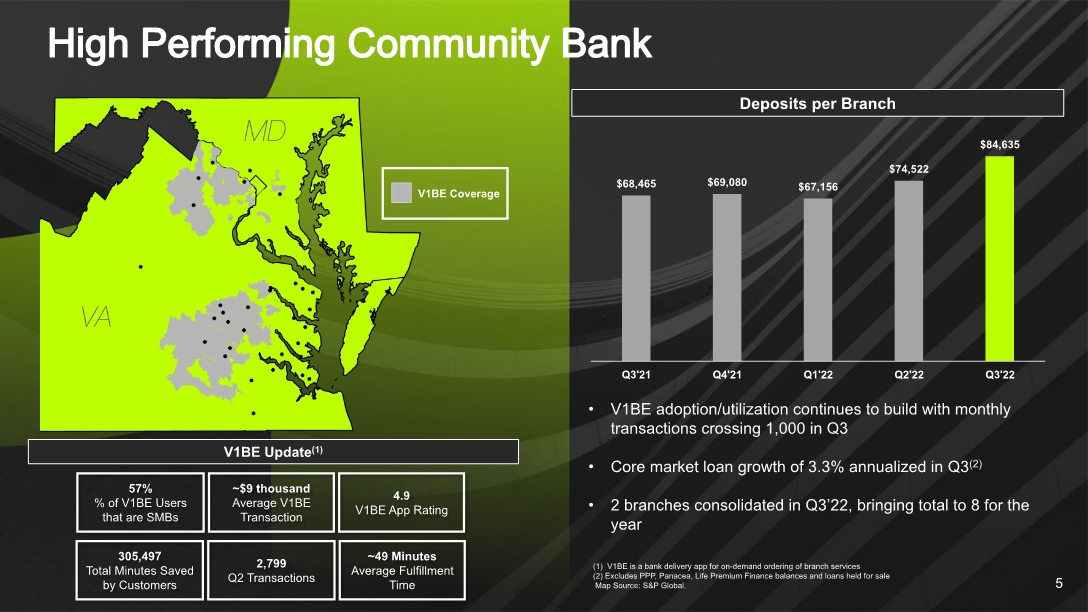

High Performing Community Bank 5 V1BE adoption/utilization continues to build with monthly transactions crossing 1,000 in Q3 Core market loan growth of 3.3% annualized in Q3(2) 2 branches consolidated in Q3’22, bringing total to 8 for the year Deposits per Branch (1) V1BE is a bank delivery app for on-demand ordering of branch services (2) Excludes PPP, Panacea, Life Premium Finance balances and loans held for sale Map Source: S&P Global. 4.9 V1BE App Rating ~$9 thousand Average V1BE Transaction 57% % of V1BE Users that are SMBs V1BE Update(1) V1BE Coverage ~49 Minutes Average Fulfillment Time 305,497 Total Minutes Saved by Customers 2,799 Q2 Transactions

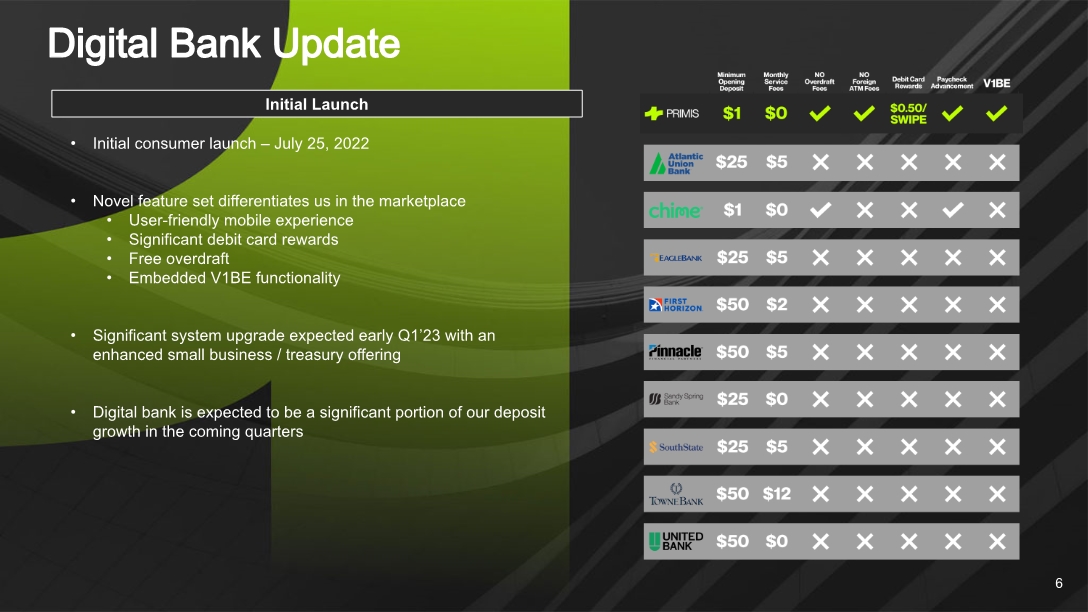

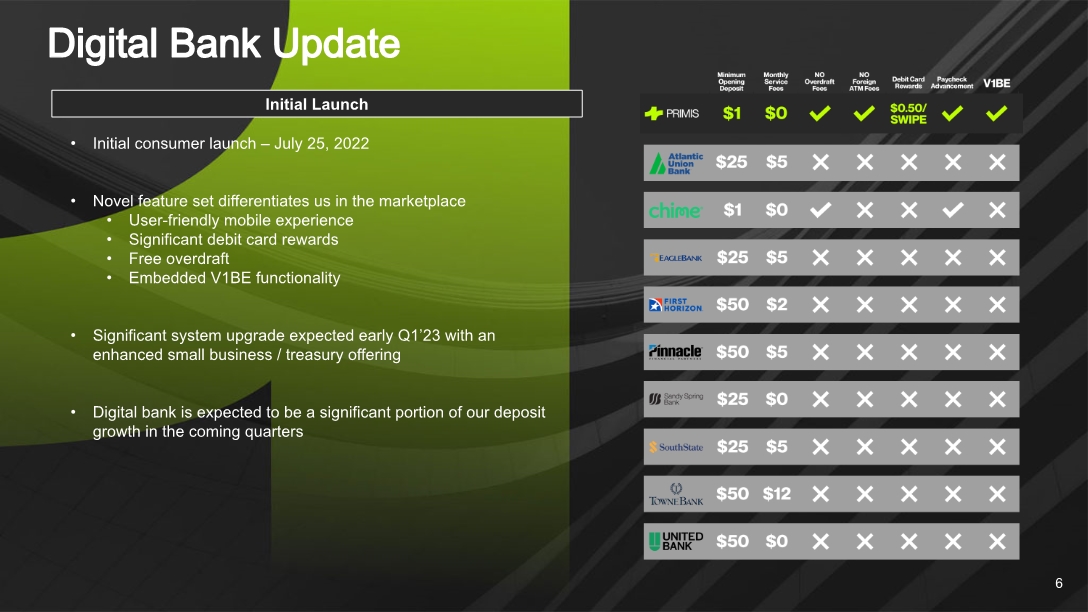

Digital Bank Update 6 Initial consumer launch – July 25, 2022 Novel feature set differentiates us in the marketplace User-friendly mobile experience Significant debit card rewards Free overdraft Embedded V1BE functionality Significant system upgrade expected early Q1’23 with an enhanced small business / treasury offering Digital bank is expected to be a significant portion of our deposit growth in the coming quarters Initial Launch

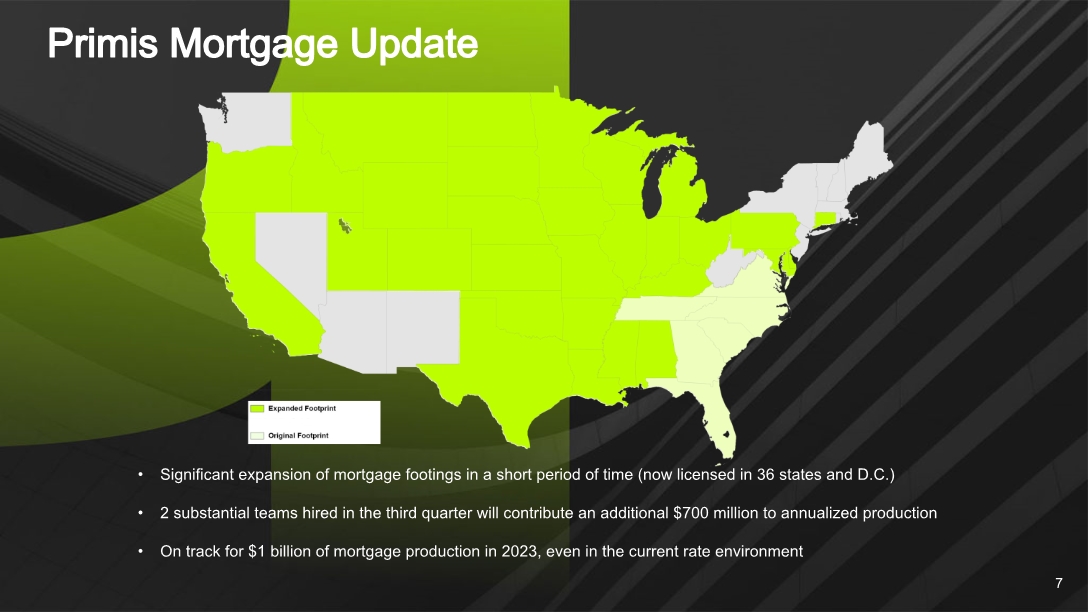

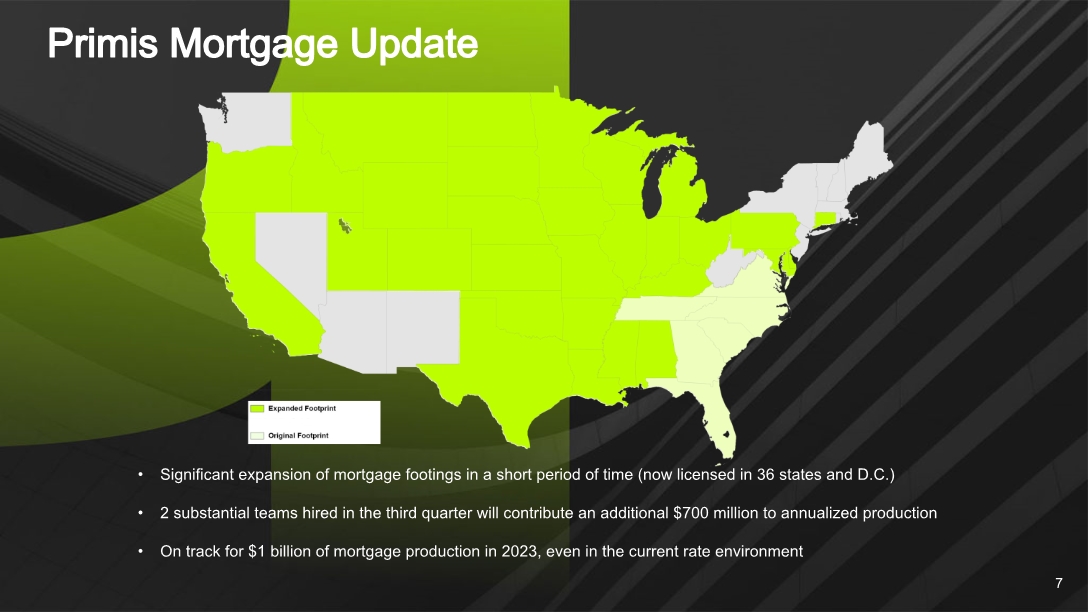

Primis Mortgage Update 7 Significant expansion of mortgage footings in a short period of time (now licensed in 36 states and D.C.) 2 substantial teams hired in the third quarter will contribute an additional $700 million to annualized production On track for $1 billion of mortgage production in 2023, even in the current rate environment

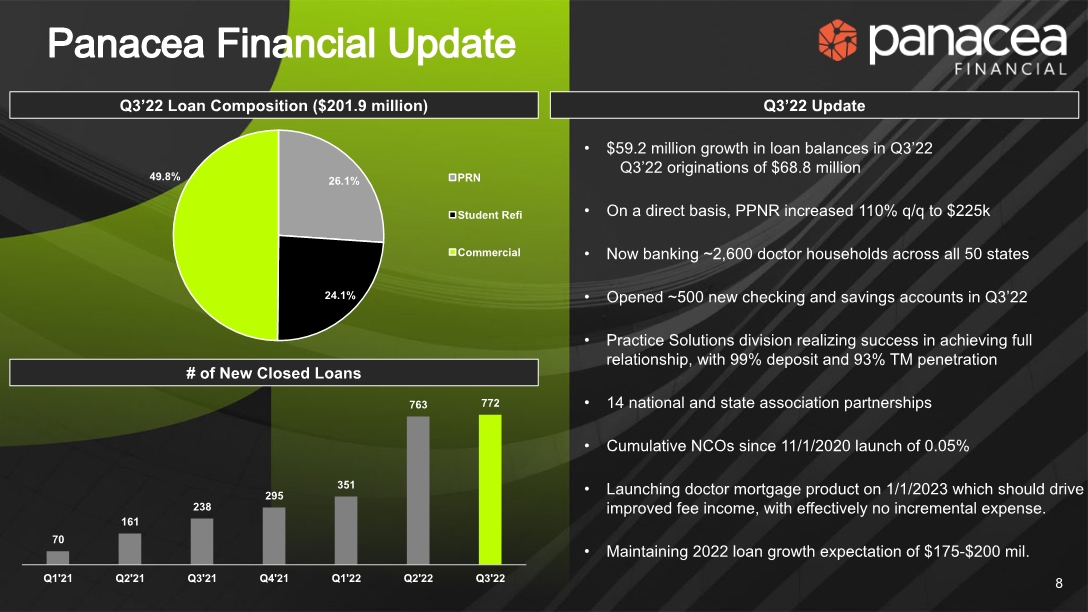

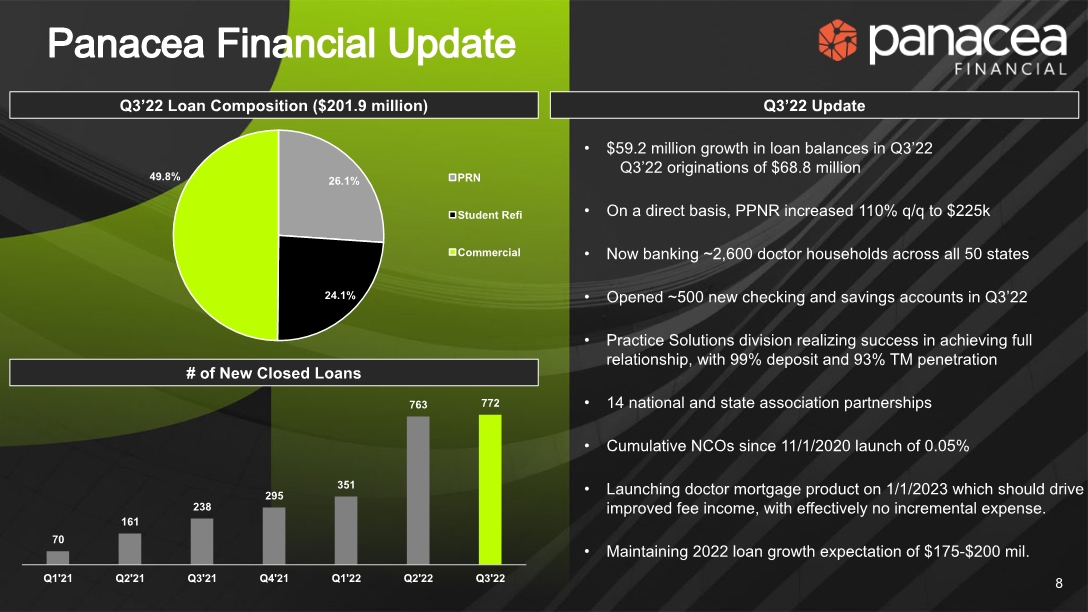

8 Panacea Financial Update Q3’22 Update Q3’22 Loan Composition ($201.9 million) # of New Closed Loans $59.2 million growth in loan balances in Q3’22 Q3’22 originations of $68.8 million On a direct basis, PPNR increased 110% q/q to $225k Now banking ~2,600 doctor households across all 50 states Opened ~500 new checking and savings accounts in Q3’22 Practice Solutions division realizing success in achieving full relationship, with 99% deposit and 93% TM penetration 14 national and state association partnerships Cumulative NCOs since 11/1/2020 launch of 0.05% Launching doctor mortgage product on 1/1/2023 which should drive improved fee income, with effectively no incremental expense. Maintaining 2022 loan growth expectation of $175-$200 mil.

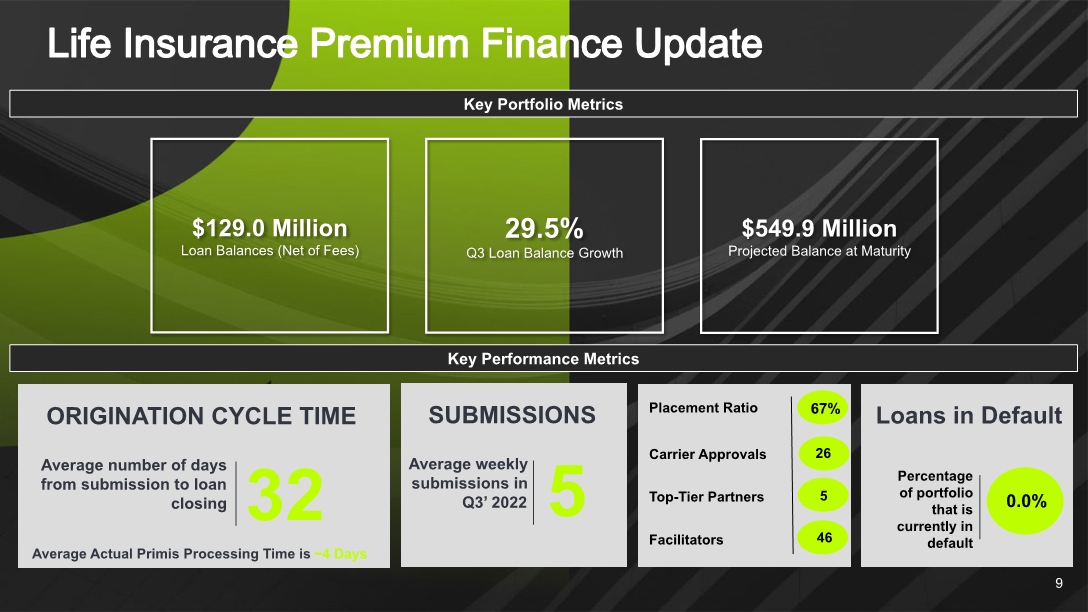

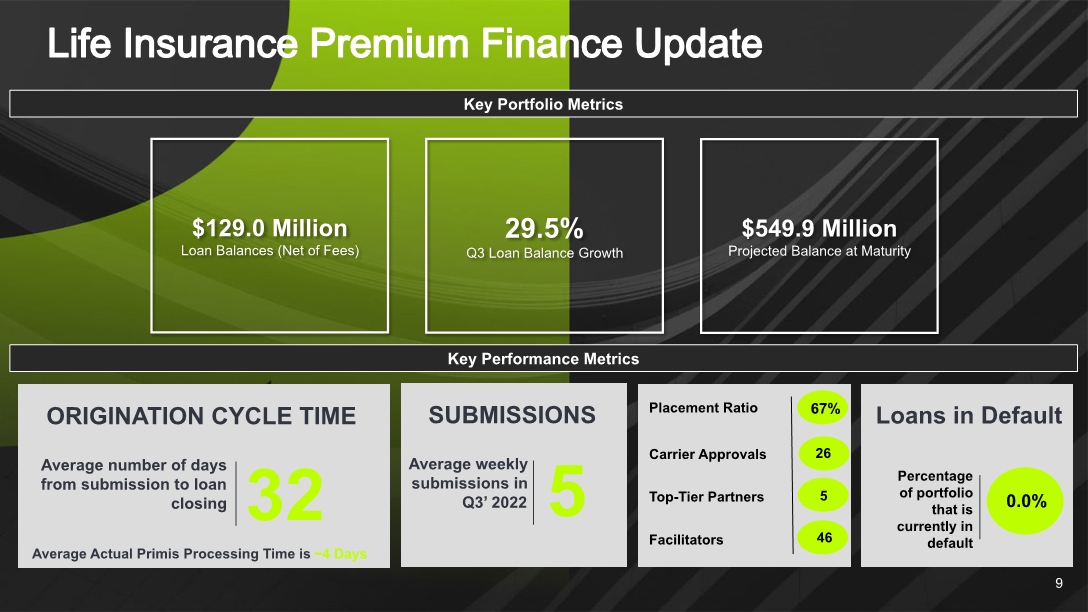

4 9 Life Insurance Premium Finance Update Key Portfolio Metrics Key Performance Metrics Average Actual Primis Processing Time is ~4 Days Placement Ratio Carrier Approvals Top-Tier Partners Facilitators 67% 26 46 5 Percentage of portfolio that is currently in default 0.0% Loans in Default

Third Quarter Results

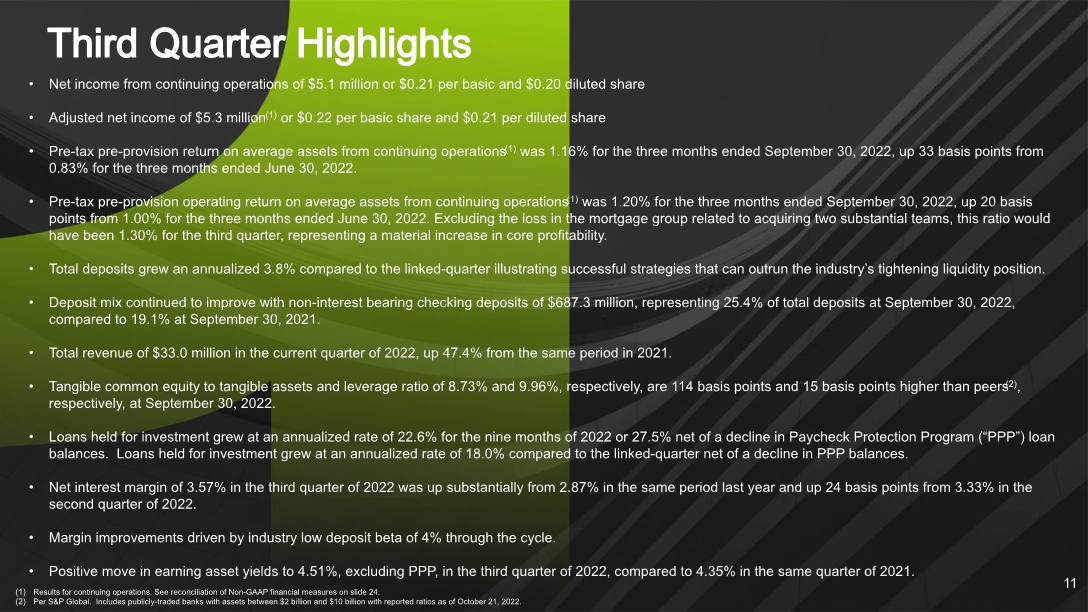

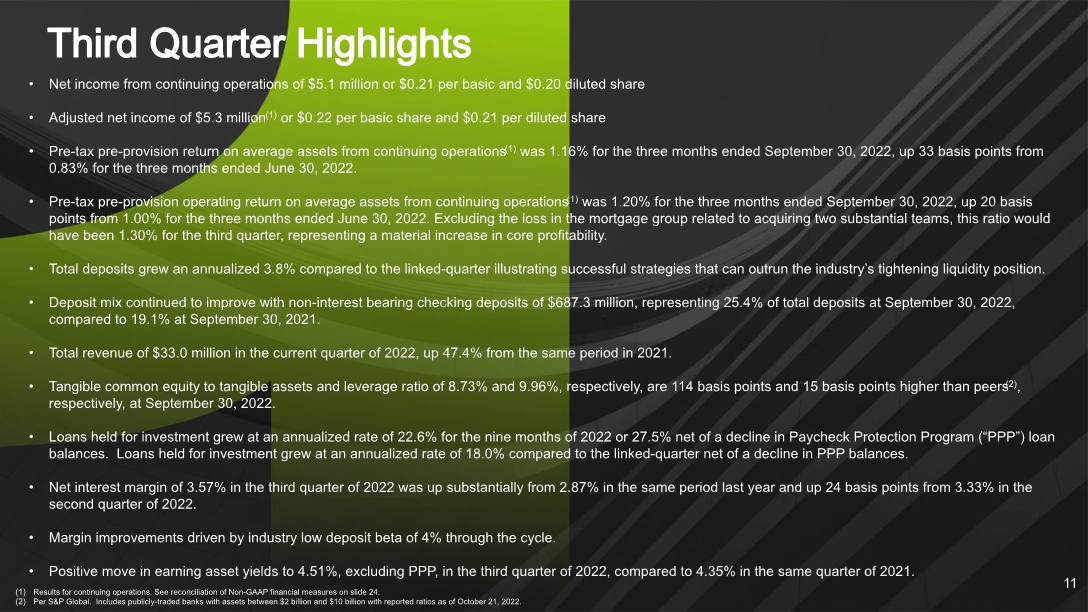

Net income from continuing operations of $5.1 million or $0.21 per basic and $0.20 diluted share Adjusted net income of $5.3 million(1) or $0.22 per basic share and $0.21 per diluted share Pre-tax pre-provision return on average assets from continuing operations(1) was 1.16% for the three months ended September 30, 2022, up 33 basis points from 0.83% for the three months ended June 30, 2022. Pre-tax pre-provision operating return on average assets from continuing operations(1) was 1.20% for the three months ended September 30, 2022, up 20 basis points from 1.00% for the three months ended June 30, 2022. Excluding the loss in the mortgage group related to acquiring two substantial teams, this ratio would have been 1.30% for the third quarter, representing a material increase in core profitability. Total deposits grew an annualized 3.8% compared to the linked-quarter illustrating successful strategies that can outrun the industry’s tightening liquidity position. Deposit mix continued to improve with non-interest bearing checking deposits of $687.3 million, representing 25.4% of total deposits at September 30, 2022, compared to 19.1% at September 30, 2021. Total revenue of $33.0 million in the current quarter of 2022, up 47.4% from the same period in 2021. Tangible common equity to tangible assets and leverage ratio of 8.73% and 9.96%, respectively, are 114 basis points and 15 basis points higher than peers(2), respectively, at September 30, 2022. Loans held for investment grew at an annualized rate of 22.6% for the nine months of 2022 or 27.5% net of a decline in Paycheck Protection Program (“PPP”) loan balances. Loans held for investment grew at an annualized rate of 18.0% compared to the linked-quarter net of a decline in PPP balances. Net interest margin of 3.57% in the third quarter of 2022 was up substantially from 2.87% in the same period last year and up 24 basis points from 3.33% in the second quarter of 2022. Margin improvements driven by industry low deposit beta of 4% through the cycle. Positive move in earning asset yields to 4.51%, excluding PPP, in the third quarter of 2022, compared to 4.35% in the same quarter of 2021. Results for continuing operations. See reconciliation of Non-GAAP financial measures on slide 24. Per S&P Global. Includes publicly-traded banks with assets between $2 billion and $10 billion with reported ratios as of October 21, 2022. Third Quarter Highlights 11

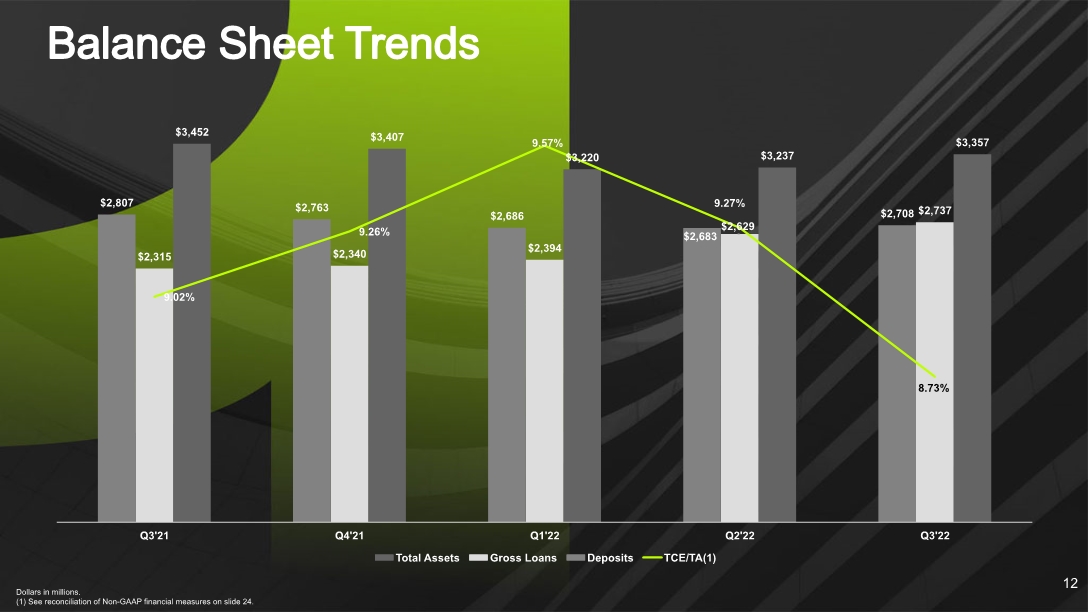

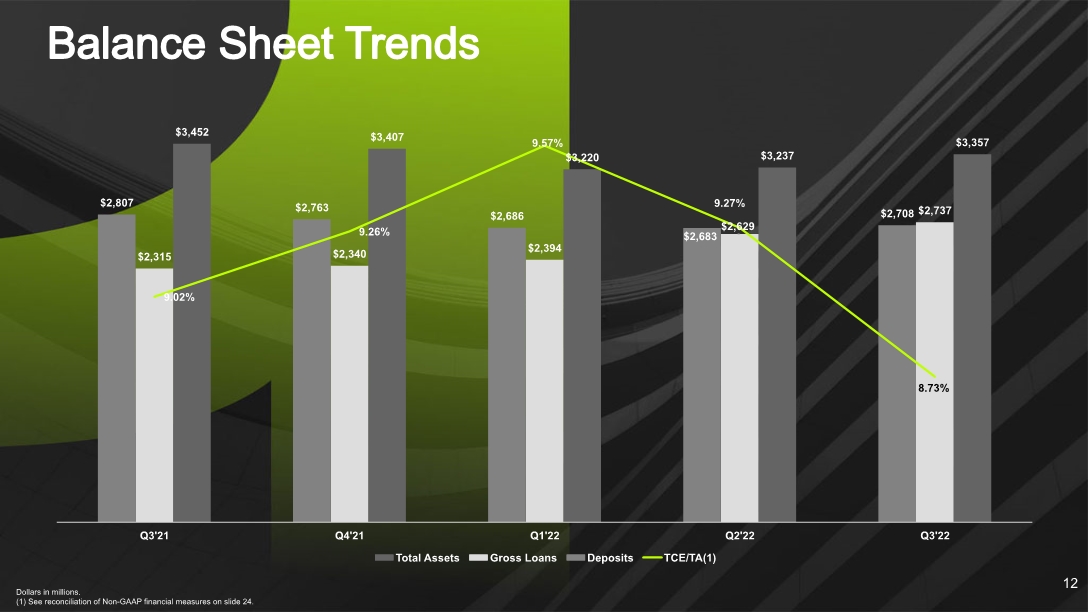

Dollars in millions. (1) See reconciliation of Non-GAAP financial measures on slide 24. Balance Sheet Trends 12

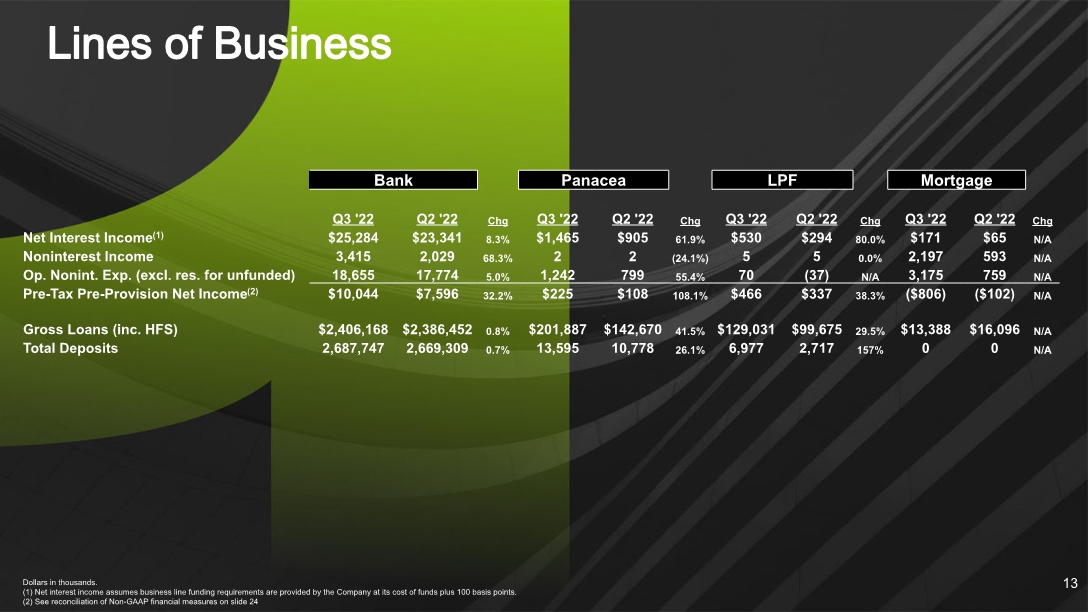

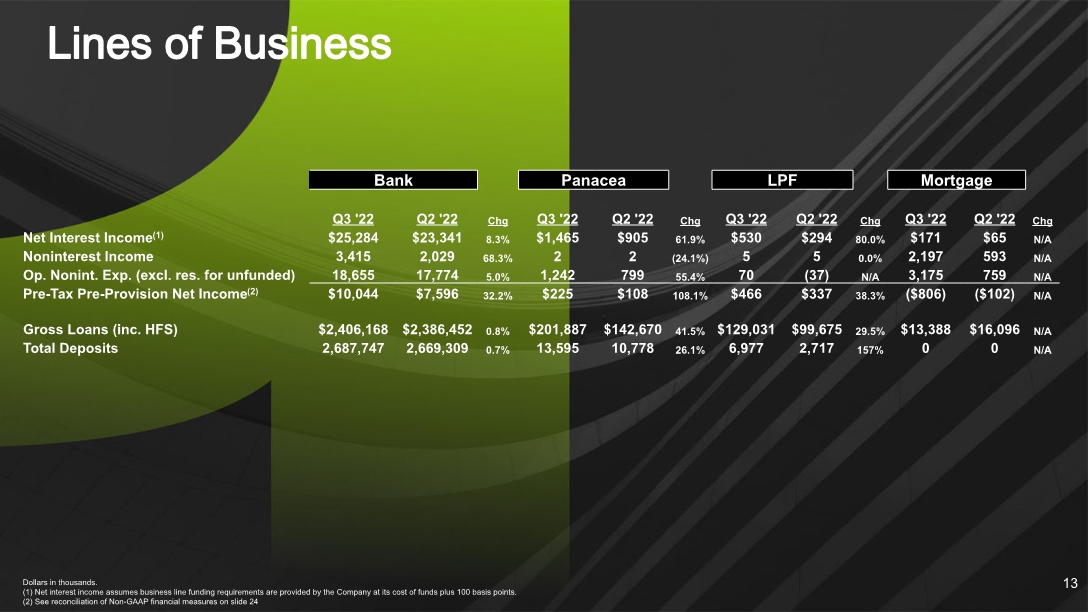

Lines of Business Dollars in thousands. (1) Net interest income assumes business line funding requirements are provided by the Company at its cost of funds plus 100 basis points. (2) See reconciliation of Non-GAAP financial measures on slide 24 13

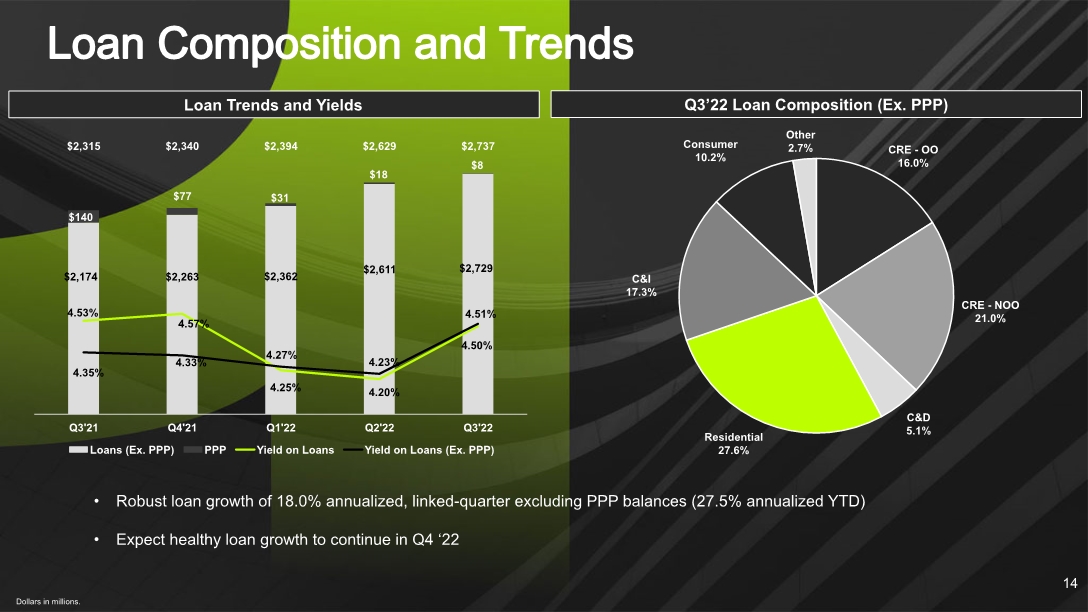

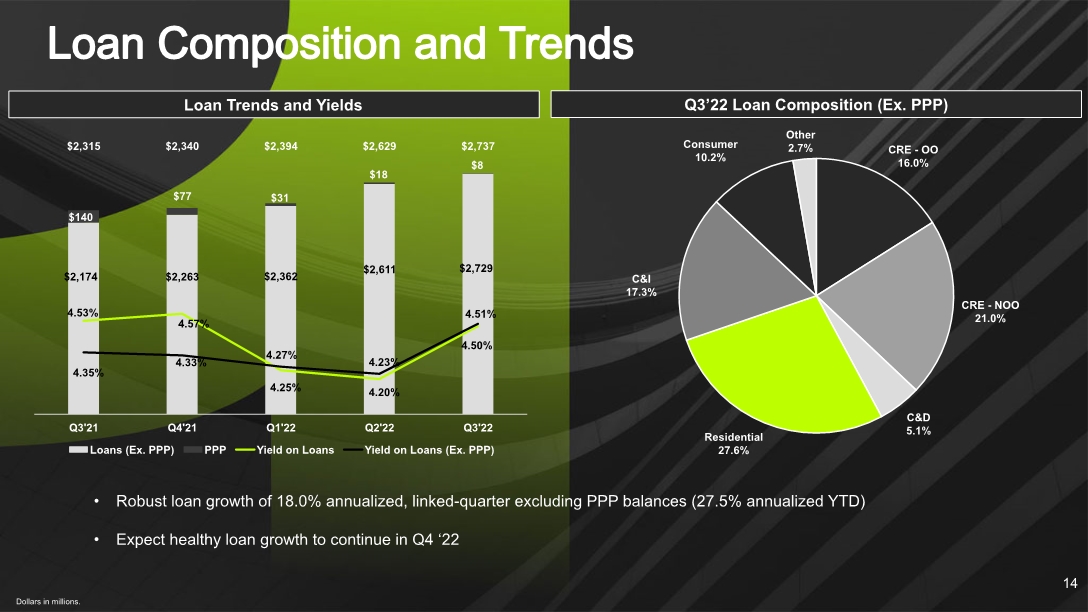

Dollars in millions. Loan Composition and Trends 14 Loan Trends and Yields Q3’22 Loan Composition (Ex. PPP) Robust loan growth of 18.0% annualized, linked-quarter excluding PPP balances (27.5% annualized YTD) Expect healthy loan growth to continue in Q4 ‘22

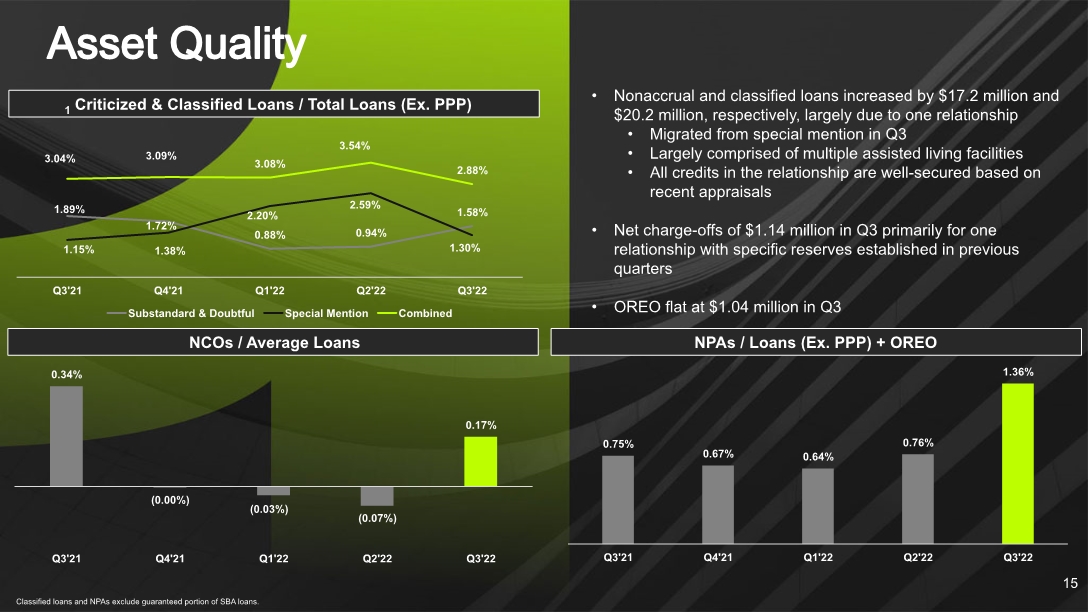

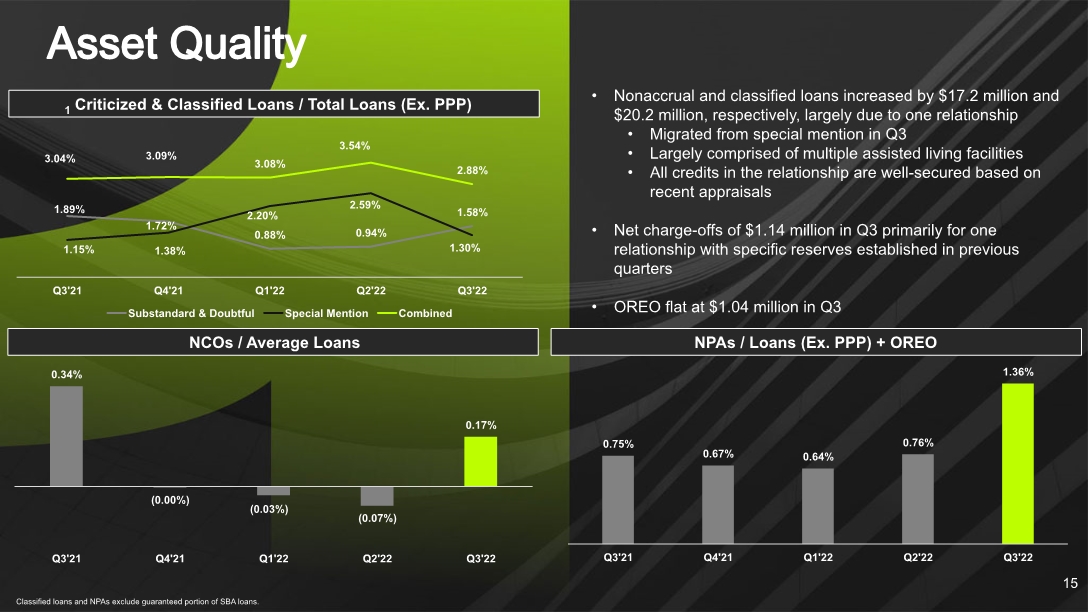

Classified loans and NPAs exclude guaranteed portion of SBA loans. Asset Quality 15 NPAs / Loans (Ex. PPP) + OREO NCOs / Average Loans Criticized & Classified Loans / Total Loans (Ex. PPP) Nonaccrual and classified loans increased by $17.2 million and $20.2 million, respectively, largely due to one relationship Migrated from special mention in Q3 Largely comprised of multiple assisted living facilities All credits in the relationship are well-secured based on recent appraisals Net charge-offs of $1.14 million in Q3 primarily for one relationship with specific reserves established in previous quarters OREO flat at $1.04 million in Q3

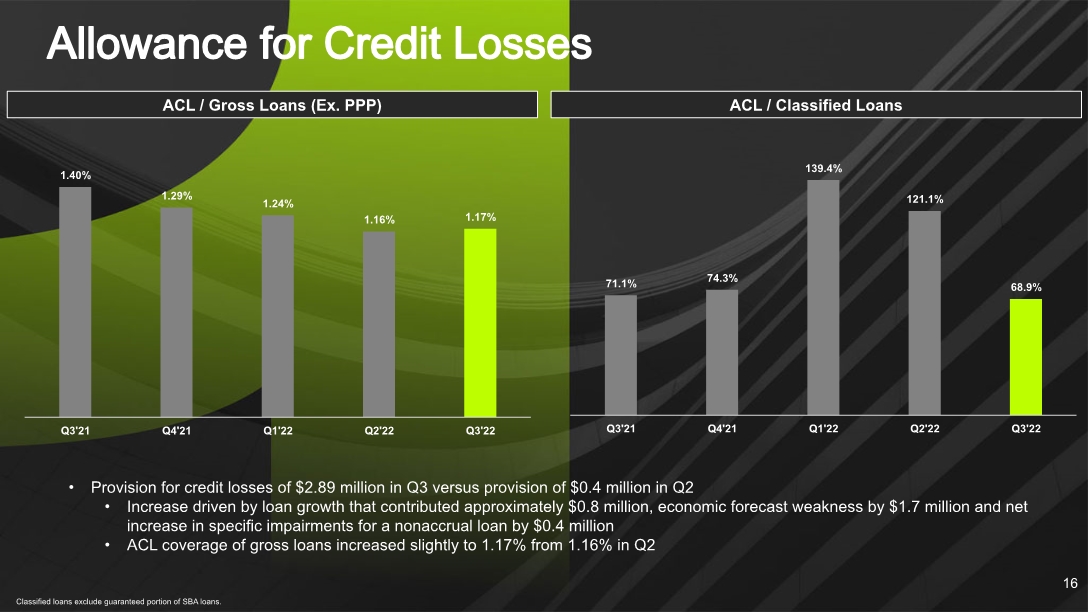

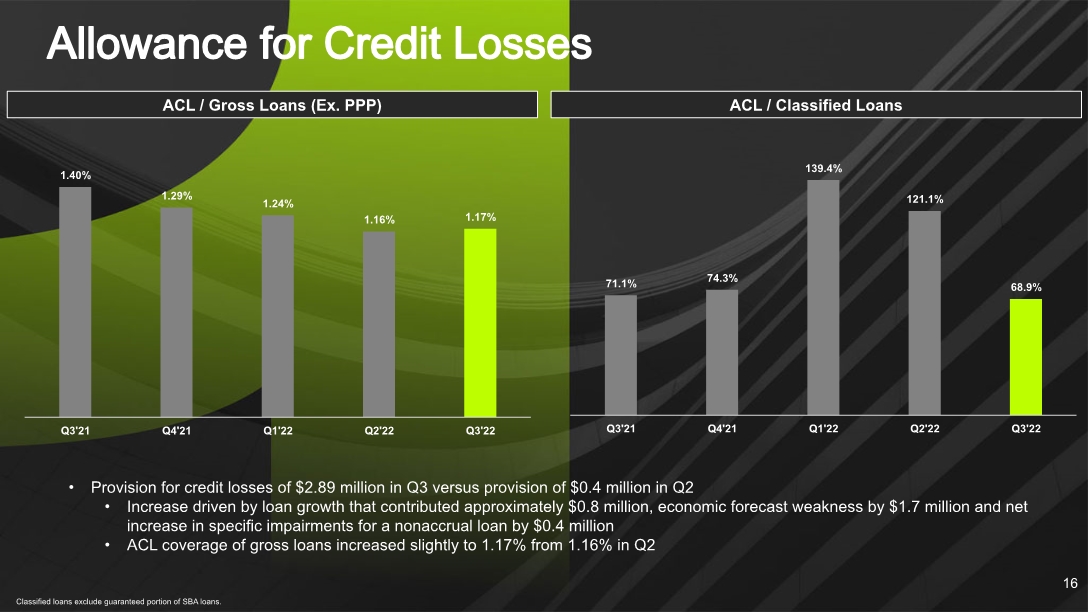

Classified loans exclude guaranteed portion of SBA loans. Allowance for Credit Losses 16 ACL / Gross Loans (Ex. PPP) ACL / Classified Loans Provision for credit losses of $2.89 million in Q3 versus provision of $0.4 million in Q2 Increase driven by loan growth that contributed approximately $0.8 million, economic forecast weakness by $1.7 million and net increase in specific impairments for a nonaccrual loan by $0.4 million ACL coverage of gross loans increased slightly to 1.17% from 1.16% in Q2

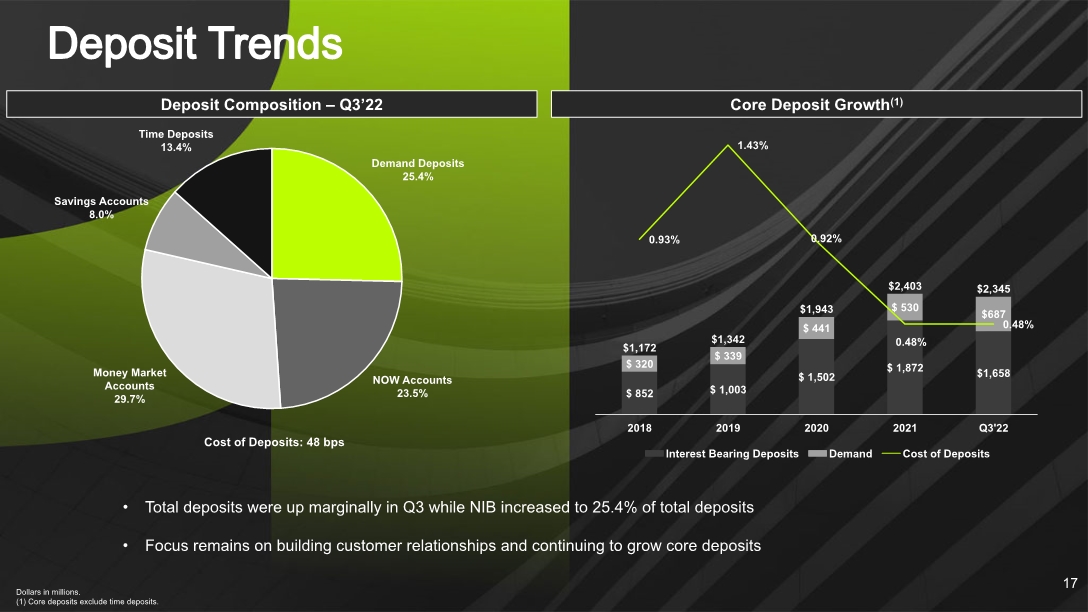

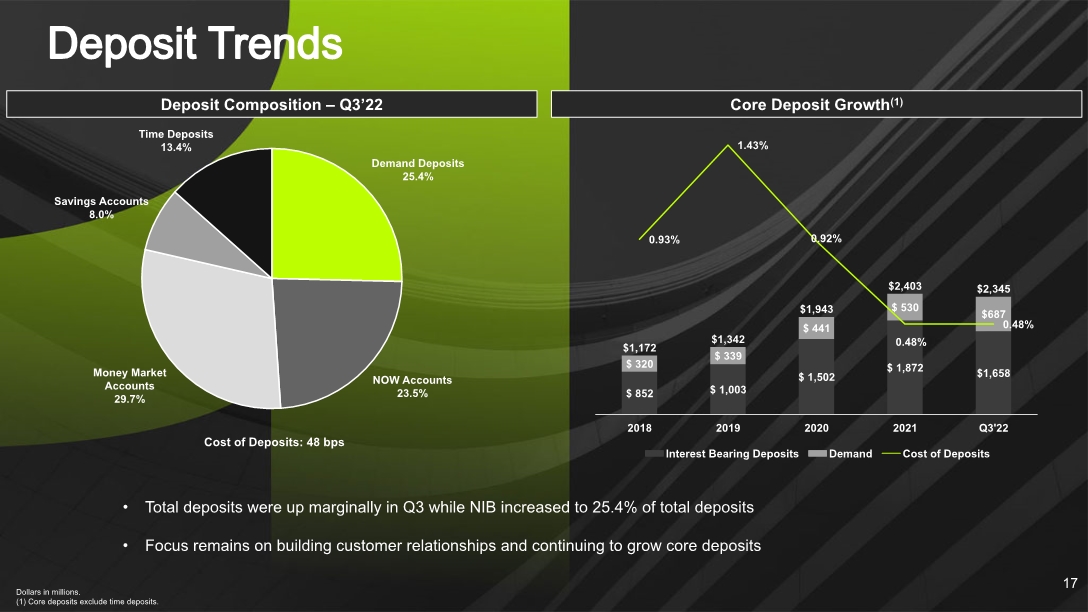

Dollars in millions. (1) Core deposits exclude time deposits. Deposit Trends 17 Deposit Composition – Q3’22 Core Deposit Growth(1) Total deposits were up marginally in Q3 while NIB increased to 25.4% of total deposits Focus remains on building customer relationships and continuing to grow core deposits Cost of Deposits: 48 bps

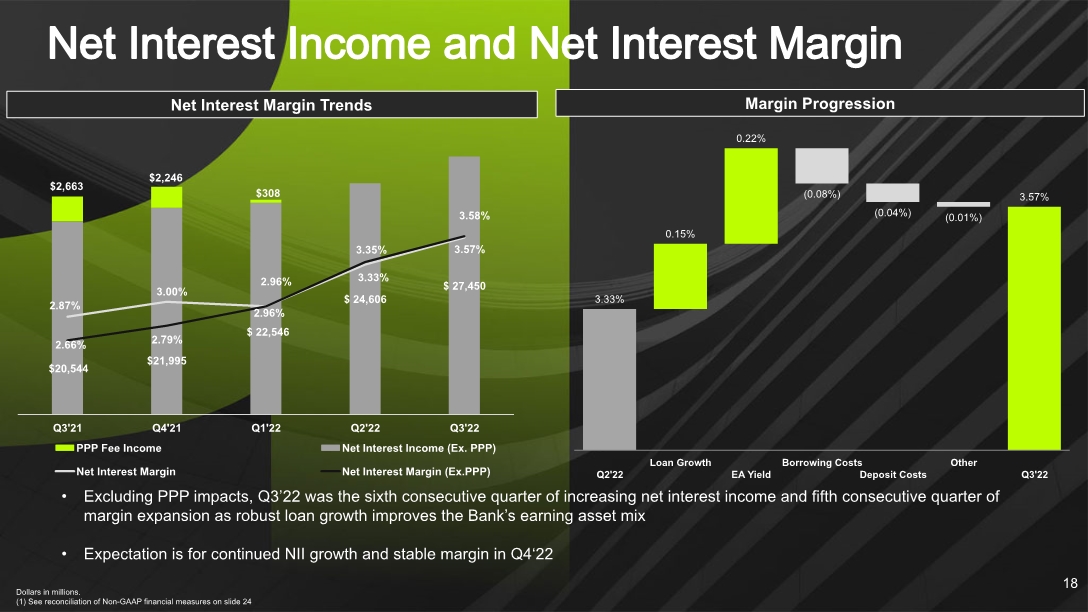

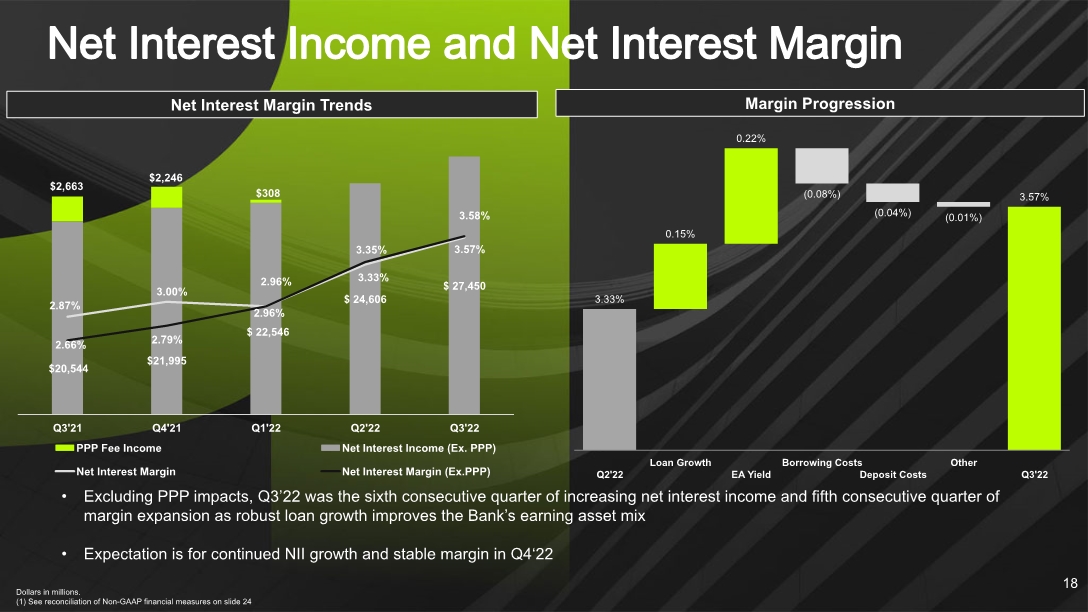

Margin Progression Dollars in millions. (1) See reconciliation of Non-GAAP financial measures on slide 24 Net Interest Income and Net Interest Margin 18 Excluding PPP impacts, Q3’22 was the sixth consecutive quarter of increasing net interest income and fifth consecutive quarter of margin expansion as robust loan growth improves the Bank’s earning asset mix Expectation is for continued NII growth and stable margin in Q4‘22 Net Interest Margin Trends

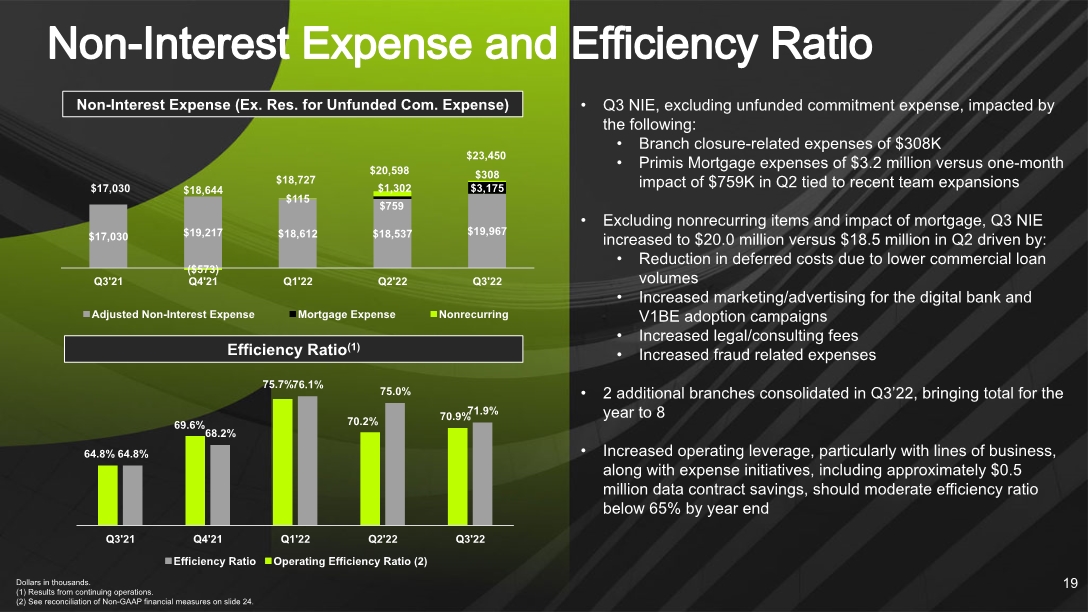

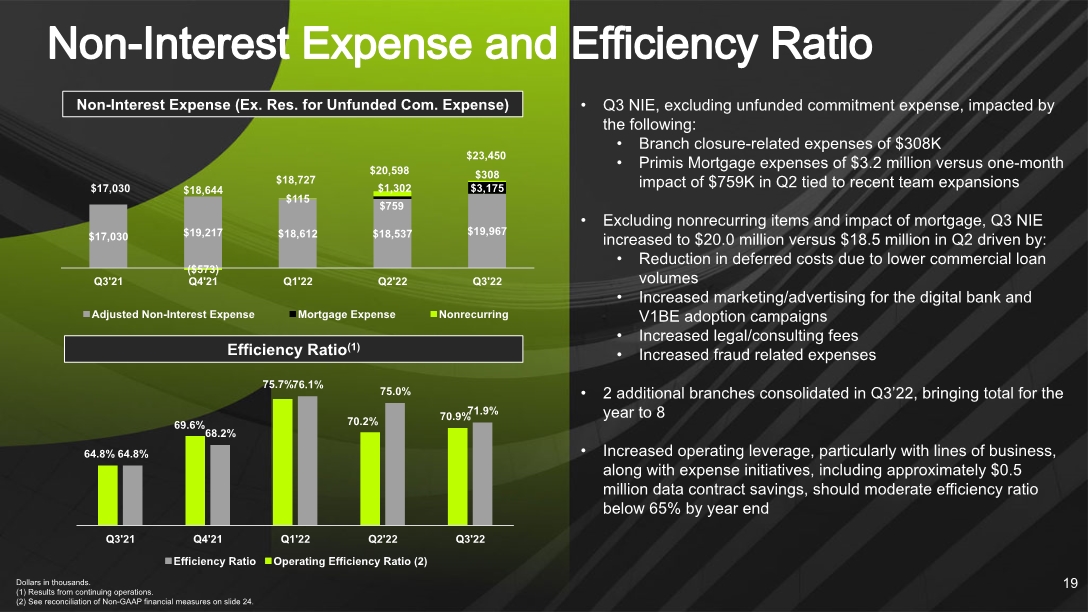

Q3 NIE, excluding unfunded commitment expense, impacted by the following: Branch closure-related expenses of $308K Primis Mortgage expenses of $3.2 million versus one-month impact of $759K in Q2 tied to recent team expansions Excluding nonrecurring items and impact of mortgage, Q3 NIE increased to $20.0 million versus $18.5 million in Q2 driven by: Reduction in deferred costs due to lower commercial loan volumes Increased marketing/advertising for the digital bank and V1BE adoption campaigns Increased legal/consulting fees Increased fraud related expenses 2 additional branches consolidated in Q3’22, bringing total for the year to 8 Increased operating leverage, particularly with lines of business, along with expense initiatives, including approximately $0.5 million data contract savings, should moderate efficiency ratio below 65% by year end Efficiency Ratio(1) Dollars in thousands. (1) Results from continuing operations. (2) See reconciliation of Non-GAAP financial measures on slide 24. Non-Interest Expense and Efficiency Ratio 19 Non-Interest Expense (Ex. Res. for Unfunded Com. Expense)

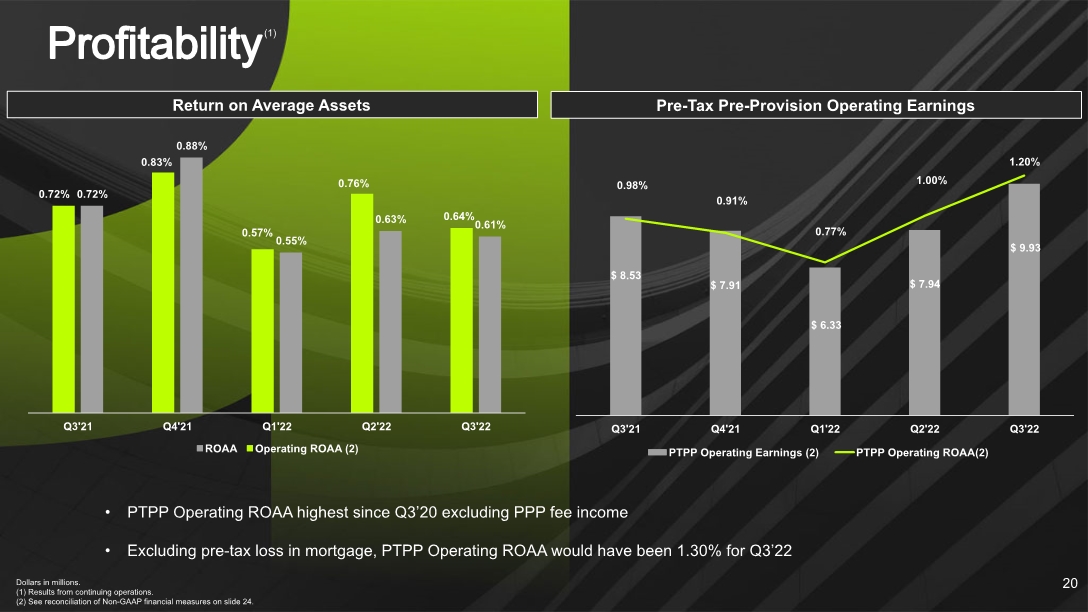

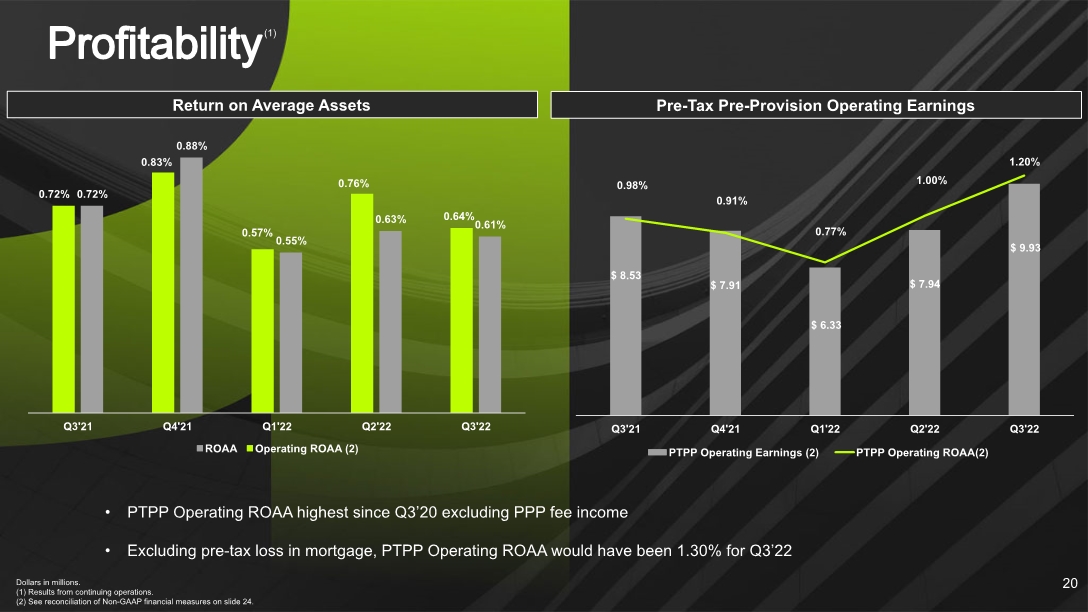

Dollars in millions. (1) Results from continuing operations. (2) See reconciliation of Non-GAAP financial measures on slide 24. Profitability 20 Return on Average Assets Pre-Tax Pre-Provision Operating Earnings (1) PTPP Operating ROAA highest since Q3’20 excluding PPP fee income Excluding pre-tax loss in mortgage, PTPP Operating ROAA would have been 1.30% for Q3’22

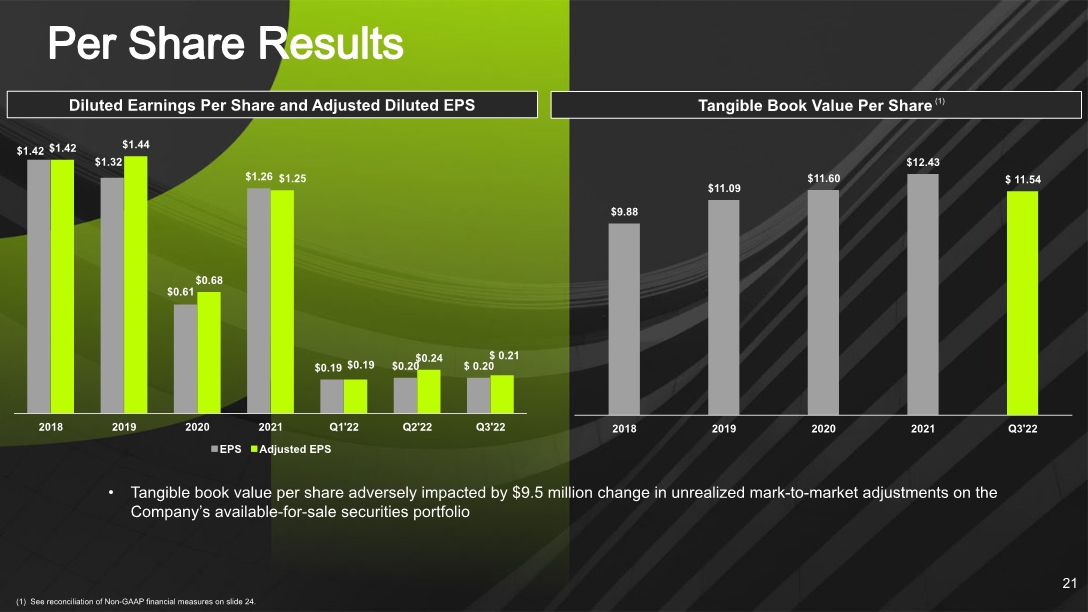

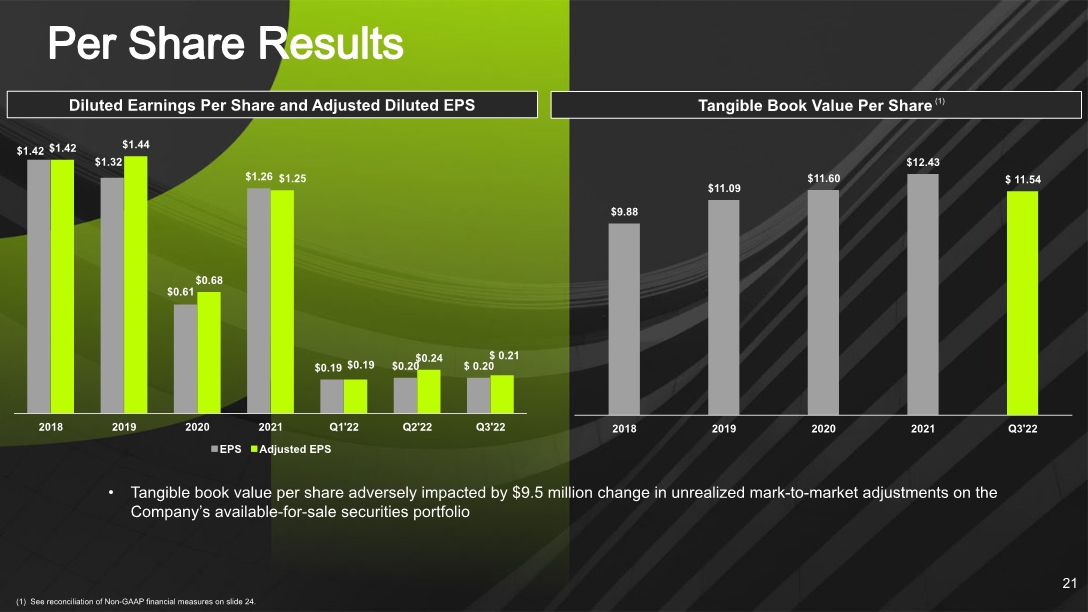

Tangible Book Value Per Share Diluted Earnings Per Share and Adjusted Diluted EPS (1) See reconciliation of Non-GAAP financial measures on slide 24. Per Share Results 21 (1) Tangible book value per share adversely impacted by $9.5 million change in unrealized mark-to-market adjustments on the Company’s available-for-sale securities portfolio

Talented management team and board committed to building long-term shareholder value Attractive multi-pronged strategy for growth beginning to pay dividends Aggressive and early use of technology positioning the bank for superior performance as the industry evolves Significant valuation upside as strategic investments mature Summary 22

Appendix 23

Non-GAAP Reconciliation 24 Primis Financial Corp. (Dollars in thousands, except per share data) For Three Months Ended: For Nine Months Ended: Reconciliation of Non-GAAP items: 3Q 2022 2Q 2022 1Q 2022 4Q 2021 3Q 2021 3Q 2022 3Q 2021 Net income from continuing operations $ 5,054 $ 5,009 $ 4,593 $ 7,651 $ 6,211 $ 14,656 $ 23,366 Non-GAAP adjustments to Net Income from continuing operations: Management Restructure / Recruiting - - - - - - 200 Branch Closures/ Consolidations 308 901 - - - 1,209 - Merger expenses - 401 115 - - 516 - (Gain) on debt extinguishment - - - (573) - - - Income tax effect (67) (281) (25) 124 - (373) (43) Net income from continuing operations adjusted for nonrecurring income and expenses $ 5,295 $ 6,030 $ 4,683 $ 7,202 $ 6,211 $ 16,008 $ 23,523 Net income from continuing operations $ 5,054 $ 5,009 $ 4,593 $ 7,651 $ 6,211 $ 14,656 $ 23,366 Income tax expense 1,365 1,375 1,265 2,284 1,702 4,005 6,438 Provision for credit losses (incl. unfunded commitment expense) 3,201 254 359 (1,451) 615 3,722 (4,112) Pre-tax pre-provision earnings from continuing operations $ 9,620 $ 6,638 $ 6,217 $ 8,484 $ 8,528 $ 22,383 $ 25,692 Effect of adjustment for nonrecurring income and expenses 308 1,302 115 (573) - 1,725 200 Pre-tax pre-provision operating earnings from continuing operations $ 9,928 $ 7,940 $ 6,332 $ 7,911 $ 8,528 $ 24,108 $ 25,892 Return on average assets from continuing operations 0.61% 0.63% 0.55% 0.88% 0.72% 0.60% 0.94% Effect of adjustment for nonrecurring income and expenses 0.03% 0.13% 0.01% (0.05%) 0.00% 0.06% 0.01% Operating return on average assets from continuing operations 0.64% 0.76% 0.57% 0.83% 0.72% 0.65% 0.94% Return on average assets from continuing operations 0.61% 0.63% 0.55% 0.88% 0.72% 0.60% 0.94% Effect of tax expense 0.16% 0.17% 0.15% 0.26% 0.20% 0.16% 0.26% Effect of provision for credit losses 0.39% 0.03% 0.04% (0.17%) 0.07% 0.15% (0.17%) Pre-tax pre-provision return on average assets from continuing operations 1.16% 0.83% 0.75% 0.98% 0.98% 0.91% 1.03% Effect of adjustment for nonrecurring income and expenses 0.04% 0.16% 0.01% (0.07%) 0.00% 0.07% 0.01% Pre-tax pre-provision operating return on average assets from continuing operations 1.20% 1.00% 0.77% 0.91% 0.98% 0.98% 1.04% Return on average equity from continuing operations 4.98% 4.92% 4.49% 7.37% 6.01% 4.80% 7.77% Effect of adjustment for nonrecurring income and expenses 0.24% 1.00% 0.09% (0.43%) 0.00% 0.44% 0.05% Operating return on average equity from continuing operations 5.22% 5.93% 4.58% 6.94% 6.01% 5.24% 7.82% Effect of goodwill and other intangible assets 1.92% 2.15% 1.58% 2.42% 2.12% 1.87% 2.85% Operating return on average tangible equity from continuing operations 7.14% 8.08% 6.16% 9.36% 8.12% 7.11% 10.67% Efficiency ratio from continuing operations 71.85% 75.01% 76.11% 68.16% 64.80% 74.11% 67.18% Effect of adjustment for nonrecurring income and expenses (0.93%) (4.78%) (0.46%) 1.47% 0.00% (2.02%) (0.26%) Operating efficiency ratio from continuing operations 70.92% 70.23% 75.65% 69.63% 64.80% 72.09% 66.92% Earnings per share from continuing operations - Basic $ 0.21 $ 0.20 $ 0.19 $ 0.31 $ 0.25 $ 0.60 $ 0.96 Effect of adjustment for nonrecurring income and expenses 0.01 0.05 0.00 (0.02) 0.00 0.05 0.00 Operating earnings per share from continuing operations - Basic $ 0.22 $ 0.25 $ 0.19 $ 0.29 $ 0.25 $ 0.65 $ 0.96 Earnings per share from continuing operations - Diluted $ 0.20 $ 0.20 $ 0.19 $ 0.31 $ 0.25 $ 0.59 $ 0.95 Effect of adjustment for nonrecurring income and expenses 0.01 0.04 (0.00) (0.02) 0.00 0.06 0.01 Operating earnings per share from continuing operations - Diluted $ 0.21 $ 0.24 $ 0.19 $ 0.29 $ 0.25 $ 0.65 $ 0.96 Book value per share $ 15.89 $ 16.17 $ 16.42 $ 16.76 $ 16.63 $ 15.89 $ 16.63 Effect of goodwill and other intangible assets (4.39) (4.40) (4.31) (4.34) (4.35) (4.39) (4.34) Tangible book value per share $ 11.54 $ 11.77 $ 12.11 $ 12.43 $ 12.28 $ 11.54 $ 12.28 Stockholders' equity $ 391,808 $ 398,637 $ 404,195 $ 411,881 $ 408,629 $ 391,808 $ 408,629 Less goodwill and other intangible assets (108,147) (108,524) (106,075) (106,416) (106,757) (108,147) (106,757) Tangible common equity $ 283,661 $ 290,113 $ 298,120 $ 305,465 $ 301,872 $ 283,661 $ 301,872 Equity to assets 11.67% 12.32% 12.55% 12.10% 11.84% 11.67% 11.84% Effect of goodwill and other intangible assets (2.94%) (3.04%) (2.98%) (2.84%) (2.81%) (2.94%) (2.81%) Tangible common equity to tangible assets 8.73% 9.27% 9.57% 9.26% 9.02% 8.73% 9.02% Net interest margin 3.57% 3.33% 2.96% 3.00% 2.87% 3.29% 3.02% Effect of adjustment for PPP associated balances* 0.01% 0.02% (0.00%) (0.21%) (0.21%) 0.01% (0.22%) Net interest margin excluding PPP 3.58% 3.35% 2.96% 2.79% 2.66% 3.30% 2.80% *Net interest margin excluding the effect of PPP loans assumes a funding cost of 35 bps on average PPP balances in all applicable periods.