Certain clearing fees are based on the number of trades executed by the Advisors for the Partnership/Funds. Accordingly, they must be compared in relation to the number of trades executed during the period. Clearing fees related to direct investments for the three and twelve months ended December 31, 2019 increased by $118,694 and $640,775, respectively, as compared to the corresponding periods in 2018. The increase in these clearing fees was primarily due to an increase in the number of direct trades made by the Partnership during the three and twelve months ended December 31, 2019 as compared to the corresponding periods in 2018.

Ongoing selling agent fees are calculated as a percentage of the Partnership’s adjusted net asset value of Class A Redeemable Units and Class D Redeemable Units as of the end of each month and are affected by trading performance, subscriptions and redemptions. Accordingly, they must be analyzed in relation to the fluctuations in the monthly net asset values. Ongoing selling agent fees for the three and twelve months ended December 31, 2019 increased by $163,846 and $750,496, respectively, as compared to the corresponding periods in 2018. This increase was due to higher average net assets attributable to Class A Redeemable Units and Class D Redeemable Units during the three and twelve months ended December 31, 2019 as compared to the corresponding periods in 2018.

Management fees are calculated as a percentage of the Partnership’s net assets per Class as of the end of each month and are affected by trading performance, subscriptions and redemptions. Accordingly, they must be analyzed in relation to the fluctuations in the monthly net asset values. Management fees for the three and twelve months ended December 31, 2019 increased by $109,559 and $524,377, respectively, as compared to the corresponding periods in 2018. This increase was due to higher average net assets per Class during the three and twelve months ended December 31, 2019 as compared to the corresponding periods in 2018.

General Partner fees are calculated as a percentage of the Partnership’s adjusted net assets per Class as of the end of each month and are affected by trading performance, subscriptions and redemptions. Accordingly, they must be analyzed in relation to the fluctuations in the monthly net asset values. General Partner fees for the three and twelve months ended December 31, 2019 increased by $21,965 and $121,356, respectively, as compared to the corresponding periods in 2018. This increase was due to higher average net assets per Class during the three and twelve months ended December 31, 2019 as compared to the corresponding periods in 2018.

Incentive fees are based on the Net Trading Profits (as defined in the respective management agreements between the Partnership, the General Partner and each Advisor) generated by each Advisor at the end of each quarter, half year or year, as applicable. Trading performance for the three and twelve months ended December 31, 2019 resulted in incentive fees of $738,566 and $1,057,828, respectively. Trading performance for the three and twelve months ended December 31, 2018 resulted in incentive fees of $372,041 and $1,017,644, respectively. To the extent an Advisor incurs a loss for the Partnership, the Advisor will not be paid incentive fees until such Advisor recovers any net loss incurred and earns additional new trading profits for the Partnership.

The Partnership pays professional fees, which generally include professional fees made up of legal and accounting expenses, as well as certain offering costs and filing, administrative, reporting and data processing fees. Professional fees for the years ended December 31, 2019 and 2018 were $394,964 and $351,346, respectively.

In the General Partner’s opinion, the Partnership’s Advisors continue to employ trading methods consistent with the objectives of the Partnership/Funds and expectations of the Advisors’ respective programs. The General Partner monitors the Advisors’ performance on a daily, weekly, monthly and annual basis to assure these objectives are met.

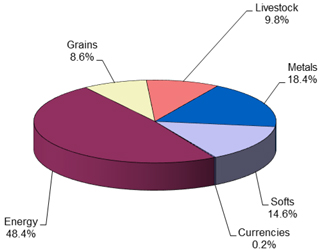

Commodity markets are highly volatile. Broad price fluctuations and rapid inflation increase not only the risks involved in commodity trading, but also the possibility of profit. The profitability of the Partnership/Funds depends on the existence of major price trends and the ability of the Advisors to correctly identify those price trends. Price trends are influenced by, among other factors, changing supply and demand relationships, weather, governmental, agricultural, commercial and trade programs and policies, national and international political and economic events and changes in interest rates. To the extent that market trends exist and the Advisors are able to identify them, the Partnership/Funds expect to increase capital through operations.

In allocating substantially all of the assets of the Partnership among the Advisors, the General Partner considers, among other factors, each Advisor’s past performance, trading style, volatility of markets traded and fee requirements. The General Partner may modify or terminate the allocation of assets to the Advisors and allocate assets to additional advisors at any time. Each Advisor’s percentage allocation and trading program is described in the “Overview” section of this Item 7.

(d)Off-balance Sheet Arrangements. None.

(e)Contractual Obligations. None.

(f)Operational Risk.

31