Incentive fees are based on the Net Trading Profits (as defined in the respective management agreements between the Partnership, the General Partner and each Advisor) generated by each Advisor at the end of each quarter, half year or year, as applicable. Trading performance for the three months ended December 31, 2023 resulted in a reversal of incentive fees of $414,312. Trading performance for the twelve months ended December 31, 2023 resulted in incentive fees of $513,461. Trading performance for the three and twelve months ended December 31, 2022 resulted in incentive fees of $917,729 and $6,568,293, respectively. To the extent an Advisor incurs a loss for the Partnership, the Advisor will not be paid incentive fees until such Advisor recovers any net loss incurred and earns additional new trading profits for the Partnership.

The Partnership pays professional fees, which generally include professional fees made up of legal and accounting expenses, as well as certain offering costs and filing, administrative, reporting and data processing fees. Professional fees for the years ended December 31, 2023 and 2022 were $450,270 and $471,475, respectively.

In the General Partner’s/Trading Manager’s opinion, the Partnership’s Advisors continue to employ trading methods consistent with the objectives of the Partnership/Funds and expectations of the Advisors’ respective programs. The General Partner/Trading Manager monitors the Advisors’ performance on a daily, weekly, monthly and annual basis to assure that these objectives are met.

Commodity markets are highly volatile. Broad price fluctuations and rapid inflation increase not only the risks involved in commodity trading, but also the possibility of profit. The profitability of the Partnership/Funds depends on the existence of major price trends and the ability of the Advisors to correctly identify those price trends. Price trends are influenced by, among other factors, changing supply and demand relationships, weather, governmental, agricultural, commercial and trade programs and policies, national and international political and economic events, changes in interest rates, pandemics, epidemics and other public health crises. To the extent that market trends exist and the Advisors are able to identify them, the Partnership/Funds expect to increase capital through operations.

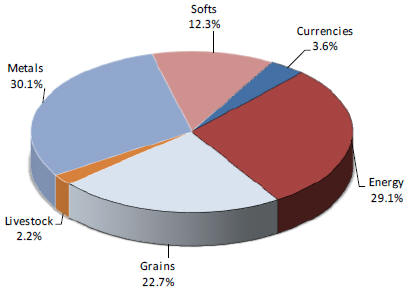

In allocating substantially all of the assets of the Partnership among the Advisors, the General Partner considers, among other factors, each Advisor’s past performance, trading style, volatility of markets traded and fee requirements. The General Partner may modify or terminate the allocation of assets to the Advisors and allocate assets to additional advisors at any time. Each Advisor’s percentage allocation and trading program is described in the “Overview” section of this Item 7.

(d) Off-balance Sheet Arrangements. None.

(e) Contractual Obligations. None.

(f) Operational Risk.

The Partnership, directly or indirectly through its investment in the Funds, is directly exposed to market risk and credit risk, which arise in the normal course of its business activities. Slightly less direct, but of critical importance, are risks pertaining to operational and back office support. This is particularly the case in a rapidly changing and increasingly global environment with increasing transaction volumes and an expansion in the number and complexity of products in the marketplace.

Such risks include:

Operational/Settlement Risk — the risk of financial and opportunity loss and legal liability attributable to operational problems, such as inaccurate pricing of transactions, untimely trade execution, clearance and/or settlement, or the inability to process large volumes of transactions. The Partnership/Funds are subject to increased risks with respect to their trading activities in emerging market instruments, where clearance, settlement, and custodial risks are often greater than in more established markets.

Technological Risk — the risk of loss attributable to technological limitations or hardware failure that constrain the Partnership’s/Funds’ ability to gather, process, and communicate information efficiently and securely, without interruption, to customers, and in the markets where the Partnership and the Funds participate. Additionally, the General Partner’s computer systems may be vulnerable to unauthorized access, mishandling or misuse, computer viruses or malware, cyber attacks and other events that could have a security impact on such systems. If one or more of such events occur, this potentially could jeopardize a limited partner’s personal, confidential, proprietary or other information processed and stored in, and transmitted through, the General Partner’s computer systems, and adversely affect the Partnership’s business, financial condition or results of operations.

Legal/Documentation Risk — the risk of loss attributable to deficiencies in the documentation of transactions (such as trade confirmations) and customer relationships (such as master netting agreements) or errors that result in noncompliance with applicable legal and regulatory requirements.

31