| | | | |

| | May 2, 2007 | | ATTORNEYS AT LAW ONE DETROIT CENTER 500 WOODWARD AVENUE, SUITE 2700 DETROIT, MI 48226-3489 313.234.7100 TEL 313.234.2800 FAX www.foley.com thartman@foley.com EMAIL CLIENT/MATTER NUMBER 071569-0103 |

Mail Stop 3720

Securities and Exchange Commission

100 F. Street, N.E.

Washington, DC 20549-9303

| | |

| Attention: | | Mr. John Zitko Ms. Kathryn Jacobson Mr. Dean Suehino |

| |

| | Re: Oakmont Acquisition Corp. Amendment No. 1 to Proxy Statement on Schedule 14A File No. 0-51423 |

Ladies and Gentlemen:

This letter is in response to your comment letter dated April 12, 2007. Your comments are reproduced below in bold italics, followed in each case by our response on behalf of our client, Oakmont Acquisition Corp.

To facilitate the staff’s review of the filing, we are furnishing to Mr. John Zitko under separate cover four copies of this letter and the blacklined printer’s proof of the amended proxy statement being filed contemporaneously herewith.

Preliminary Proxy Statement on Schedule 14A

| 1. | We note that Oakmont’s IPO prospectus and Certificate of Incorporation provide for mandatory liquidation of the company in the event that it does not consummate a business combination within 18 months from the date of consummation of its IPO (January 18, 2007), or within 24 months if a letter of intent, agreement in principle or definitive agreement was executed within the 18 month period. We further note the discussion beginning on page 32 of your proxy which indicates that Oakmont terminated the previously-proposed transaction with One Source on January 17, 2007 and entered into a letter of intent (“LOI”) with Brooke on the same day. |

However, we additionally note that:

| | • | | The termination of the One Source transaction was first disclosed on Form 8-K February 5, 2007 (approximately 13 business days after the termination); |

| | | | | | |

BOSTON BRUSSELS CHICAGO DETROIT JACKSONVILLE | | LOS ANGELES MADISON MILWAUKEE NEW YORK ORLANDO | | SACRAMENTO SAN DIEGO SAN DIEGO/DEL MAR SAN FRANCISCO SILICON VALLEY | | TALLAHASSEE TAMPA TOKYO WASHINGTON, D.C. |

Securities and Exchange Commission

May 2, 2007

Page 2

| | • | | The earliest disclosure in your filings with the Commission relating to the existence of any LOI occurred on march 13, 2007 (approximately 39 business days after the execution of such LOI is disclosed to have taken place); and |

| | • | | There were no filings otherwise made by Oakmont relating to the 18 months mandatory liquidation deadline, or the status of the One Source transaction, between November 14, 2006 and February 5, 2007. |

Please provide us with a detailed legal analysis with respect to the manner in which the disclosure of the execution of the LOI, which allowed Oakmont to avoid mandatory liquidation, and the termination of the One Source transaction was consistent with Items 1.01 and 1.02 of Form 8-K, as such Items would appear to require disclosure within four business days.

Additionally, please provide us with a copy of the dated and executed letter of intent.

Response: The Company issued a press release through PR Newswire on January 17, 2007 announcing the letter of intent signed with Brooke Credit Corporation and the termination of the pending One Source Equipment Rental, LLC transaction. A copy of that press release is attached as Annex A to this letter. The Company intended to file the press release as an exhibit to a Form 8-K announcing both events, but unfortunately that Form 8-K was not filed due to an administrative error. The Company did not learn of that omission until on or about February 5, 2007, and it immediately filed at that time a Form 8-K announcing the termination of the One Source transaction.

You will note that the press release attached as Annex A does not specifically identify Brooke Credit Corporation by name, instead referring to Brooke Credit as a “specialty finance company.” This is because the Letter of Intent dated January 17, 2007 specifically provides in Section 11 that the Company could not publicly disclose the identity or name of Brooke Credit or its parent in connection with the proposed transaction prior to the execution of the definitive agreement providing for the transaction. A copy of the Letter of Intent dated January 17, 2007 is attached as Annex B to this letter.

| 2. | We note that the number of shares and warrants currently held by your officers and directors has changed since your IPO. With a view towards disclosure, please advise us of each purchase and sale of common stock and warrants by such persons, including the date, time, volume, and manner in which each transaction was effected. |

There have been no purchases or sales of Oakmont common stock by our officers and directors since our IPO. The number of shares held by our officers and directors indicated on the “Principal Stockholders” table of the preliminary proxy statement filed March 14, 2007 was incorrect and inadvertently double-counted certain shares beneficially owned by both Mr. Skandalaris and Mr. Azar. In the course of reviewing this table in the preliminary prospectus, Oakmont has also identified a minor error on the Principal Stockholders table on page 33 of the final IPO prospectus resulting from inadvertent under-counting of certain shares beneficially owned by both Mr. Skandalaris and Mr. Azar that were contributed to QVM Oakmont Services LLC on July 7, 2005 (as reflected in footnote 3 to the table under “Certain Transactions” on page 35 of the IPO prospectus). The shares of common stock beneficially owned by Mr. Skandalaris, Mr. Azar and all the officers and directors of Oakmont as a group on the “Principal Stockholders” table of the preliminary proxy statement have been revised to correct these errors.

Securities and Exchange Commission

May 2, 2007

Page 3

| 3. | We note the various roles that Morgan Joseph, the underwriter of your IPO, has played throughout the history of the [sic] Oakmont. We also note your disclosure on pages 32, 33, and 67 that Morgan Joseph has, within the same time period, provided “financial advisory and investment banking services” to Brooke Credit and not only introduced Brooke Credit to Oakmont, but served as placement agent in Brooke Credit’s $45 million private placement in November 2006. We further note that Morgan Joseph received warrants for 100,446 shares of your target’s common stock representing 2% of the private placement offering. |

In all relevant locations throughout your proxy statement, disclose the full extent of conflicts presented by Morgan Joseph’s dual role in this proposed transaction, including a complete summary of the financial remuneration to be available to Morgan Joseph not only upon consummation of any transaction with Brooke Credit, but as a result of services provided to each Oakmont and Brooke Credit. Further, please revise the section entitled “Oakmont’s Board of Directors’ Reasons for the Approval of the Merger” on page 33 to discuss what consideration, if at all, the board gave to these conflicts.

Response: The Company has added a new section entitled “Interest of Morgan Joseph in the Merger” to explain the dual role of Morgan Joseph on behalf of each of Brooke Credit and Oakmont and the remuneration to be received by Morgan Joseph in connection with the merger.

The section entitled “Item 1: The Merger Proposal—Oakmont’s Board of Directors’ Reasons for the Approval of the Merger” has been revised to address the board’s awareness of Morgan Joseph’s dual role.

| 4. | We note your discussion of the reincorporation proposal on page seven, wherein you state that “Upon the reincorporation, the rights of Oakmont shareholders will cease being governed by Delaware law and will, instead, be governed by Kansas law.” We also note that you disclose the reincorporation will take placeprior to the consummation of the proposed acquisition of Brooke Credit and that the Articles of Incorporation of Oakmont Kansas, Inc. do not contain the investor protections currently included in Article Six of the Certificate of Incorporation of Oakmont Acquisition Corp. |

Article Six of the Certificate of Incorporation of Oakmont Acquisition Corp. states, in relevant part, that such provisions “may not be amended prior to the consummation of any Business Combination.”

Please include disclosure in your proxy statement with respect to whether such reincorporation is consistent with Oakmont’s current Certificate of Incorporation as well as the disclosure contained in Oakmont’s IPO prospectus. If it is not, please disclose the consequences to both Oakmont and its public shareholders that may result, including any potential liabilities.

Response: The parties have revised the structure of the Merger and have entered into an Amended and Restated Agreement and Plan of Merger, dated as of April 30, 2007 (the “Amended Merger Agreement”). The Amended Merger Agreement provides for the merger of Brooke Credit Corporation with and into the Company, with the Company surviving the merger. The Company believes this comment is no longer applicable given this revised structure.

Securities and Exchange Commission

May 2, 2007

Page 4

| 5. | Please provide us with a detailed legal analysis with respect to why your proposed issuance of common stock pursuant to the reincorporation proposal dies not require registration under the Securities Act of 1933. It does not appear that the exchange of shares in connection with the reincorporation would be within the change of domicile exception of Rule 145(a)(2), which requires that the “sole purpose of the transaction is to change an issuer’s domicile solely within the United States.” In this regard, we note several other objectives of the proposed reincorporation, including, but not limited to, an increase in the number of authorized shares in common stock and fulfillment of a condition to the merger agreement. |

Response: The parties have revised the structure of the Merger and have entered into an Amended and Restated Agreement and Plan of Merger, dated as of April 30, 2007 (the “Amended Merger Agreement”). The Amended Merger Agreement provides for the merger of Brooke Credit Corporation with and into the Company, with the Company surviving the merger. The Company believes this comment is no longer applicable given this revised structure.

| 6. | Please also advise us why your proposed issuance of common stock pursuant to the merger proposal does not require registration under the Securities Act of 1933, including, but not limited to, a listing of each person and entity that will receive shares pursuant to such merger. |

Response: The Company believes the issuance of its common stock to the holders of Brooke Credit common stock in connection with the closing of the merger will qualify as a private placement exempt from registration pursuant to Section 4(2) of the Securities Act of 1933. Brooke Corporation is currently the sole stockholder of Brooke Credit, and has already approved the Merger Agreement and the transactions provided for therein.

In addition to the Brooke Credit common stock owned by Brooke Corporation, Brooke Credit has issued warrants to purchase its common stock to Falcon Mezzanine Partners II, LP, FMP Co-investment, LLC and JZ Equity Partners PLC, the three institutional investors in Brooke Credit’s October 2007 private placement of its senior notes, as well as to Morgan Joseph, the placement agent in the senior note transaction. As of the date of this response, no warrants have been exercised. The Merger Agreement provides that the warrants will be assumed and be exercisable for shares of Oakmont common stock, as adjusted to reflect the exchange ratio. Also, Brooke Credit anticipates that its board of directors may approve the issuance of stock or options to the following members of Brooke Credit’s management team and board of directors prior to the closing of the merger: Branden Banks, Keith Bouchey, Barbara Davison, Anita Larson, Michael Lowry, Lindsay Olsen and Gage Zierlein. As of the date of this response, no such stock or options have been granted. Brooke Credit is not obligated to and may elect not to, grant such stock or options. If Brooke Credit issues such stock prior to the closing of the merger, such stockholders will receive Oakmont common stock pursuant to the merger. If Brooke Credit issues such options prior to the closing of the merger, the Merger Agreement provides that such options will be converted into options for shares of Oakmont common stock, as adjusted to reflect the exchange ratio.

| 7. | The disclosure throughout your proxy statement in many respects appear promotional, rather than factual, and should be revised to remove all promotional language, including terms used to describe Brooke Credit such as “premier,” “strong,” “excellent.” All speculative information should be clearly labeled as the opinion of management of the companyalong with disclosure of the reasonable basis for such opinions or beliefs. |

We note that such statements include, but are not limited to, the following:

| | • | | “Oakmont believes that the merger with Brooke Credit will provide Oakmont stockholders with an opportunity to participate in a company withsignificant growth potential in an attractive market.” (page two) |

| | • | | “Brooke Credithas built a unique business model in lending to issuance-related entities, which involve borrowers that have historically been under-served by traditional lenders. This unique business model includes a proprietary loan sourcing network, which providesa steady stream of high quality loan candidates, and a deep credit underwriting expertise withproven success. Brooke Credit’s business model also includes a proprietary collateral preservation platform, which features use of industry consultants and franchisors within the insurance and death care industries in monitoring and fixing distressed businesses, resulting inbetter control over credit quality . . . .” (pages eight and nine) |

| | • | | “Brooke Credithas evolved into the market leader of providing capital to small businesses in the insurance and death care industries. Because traditional or generalist lenders typically lack the underwriting expertise that is required to make loans |

Securities and Exchange Commission

May 2, 2007

Page 5

| | secured by insurance businesses or funeral homes, Brooke Credit faces limited competition. Brooke Credit’s management believes thatother specialty finance companies are at a disadvantage as they have yet to generate Brooke Credit’s level of origination volumes in its target markets and therefore currently lack the efficiencies to be competitive with Brooke Credit. In addition, Brooke Credit has established a strong brand name in its target market. . . .” (page nine) |

Response: The promotional language has been removed and/or labeled as the opinion of management along with the basis for such opinions or beliefs. Please see the sections entitled “Questions and Answers About the Proposals,” “Summary—Business Rationale for Merging with Brooke Credit Corporation,”“Item 1: The Merger Proposal—Oakmont’s Board of Directors’ Reasons for the Approval of the Merger” and“Information about Brooke Credit.”

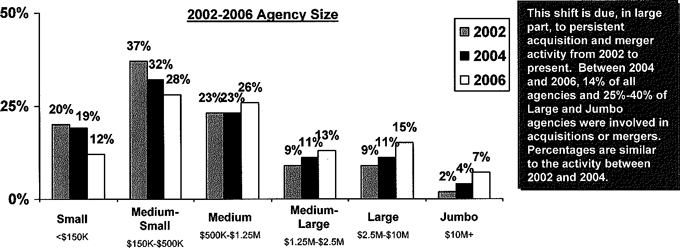

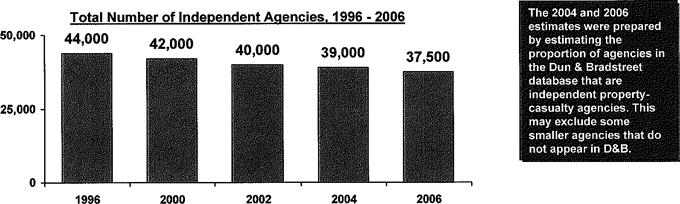

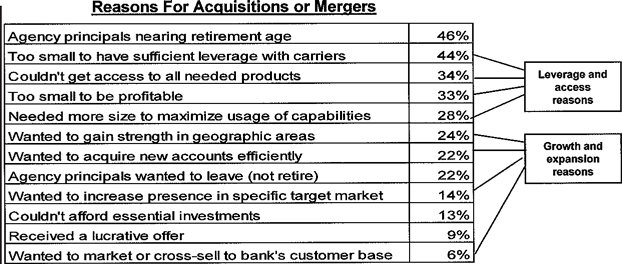

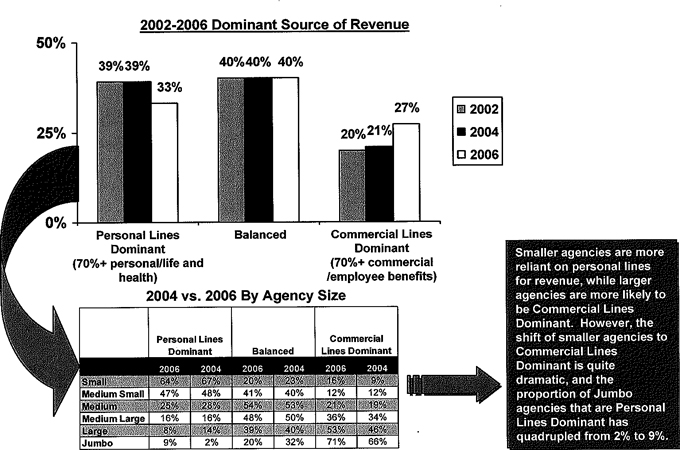

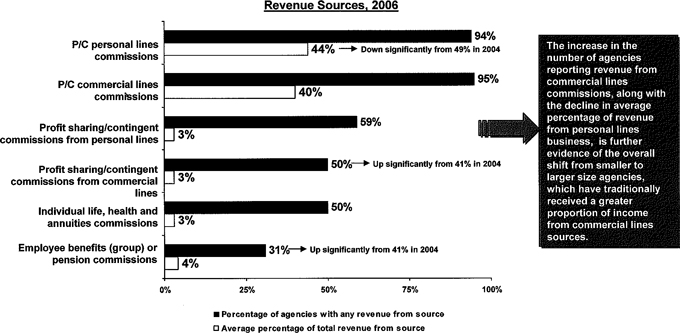

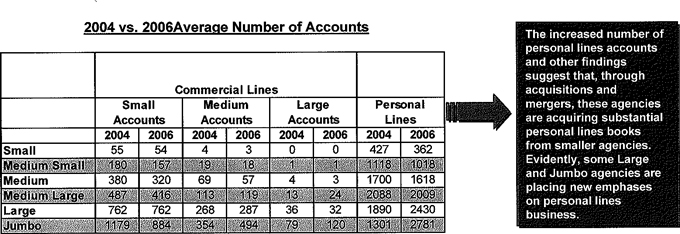

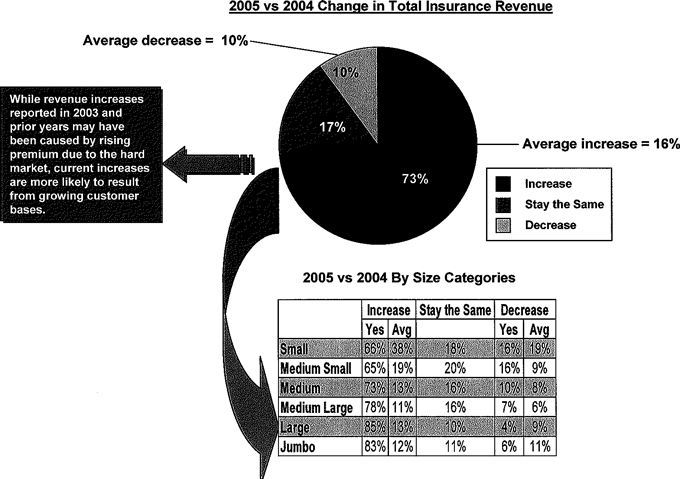

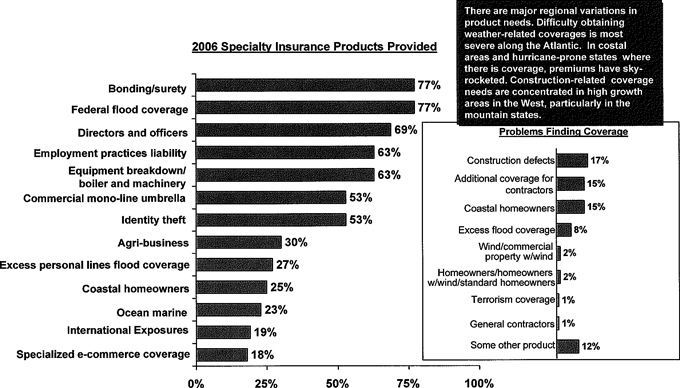

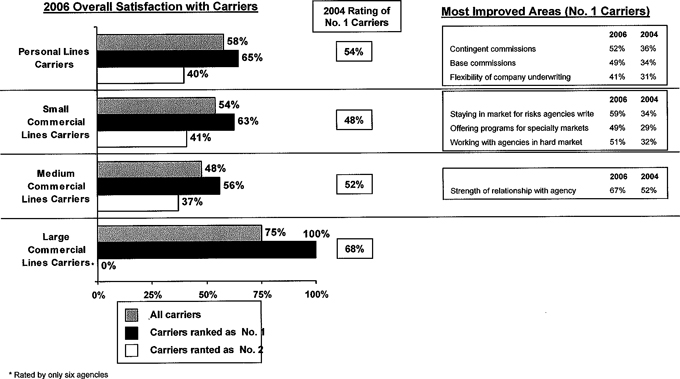

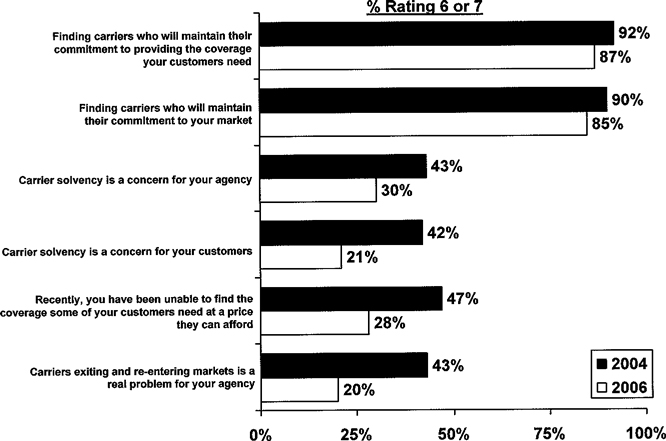

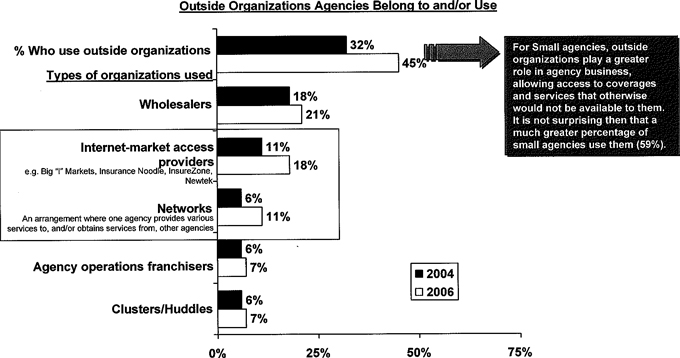

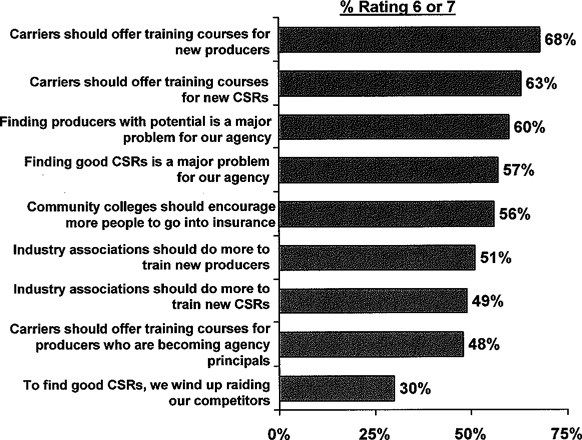

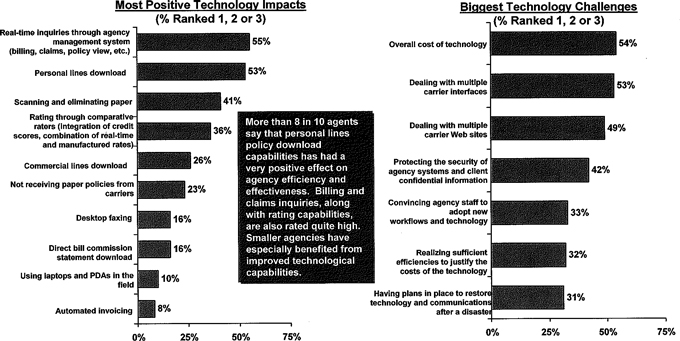

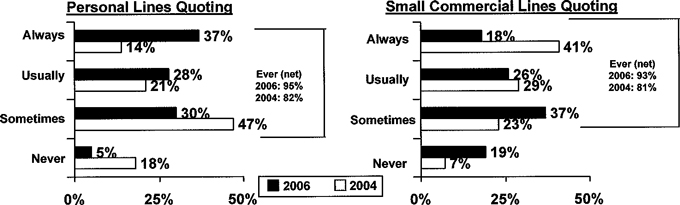

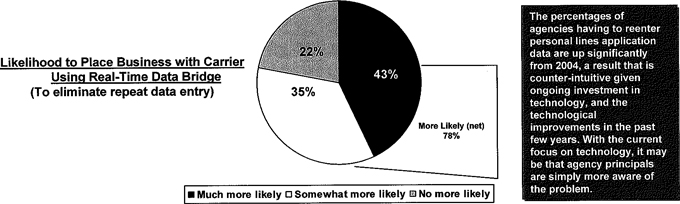

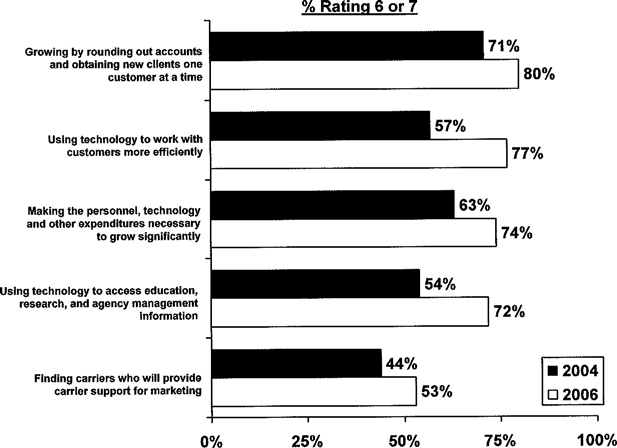

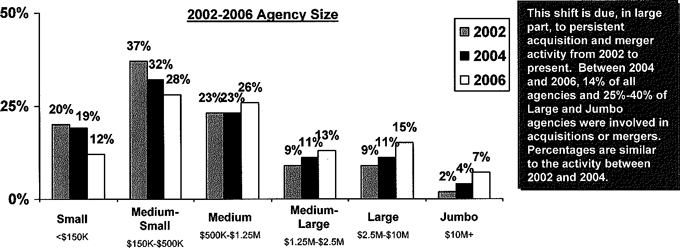

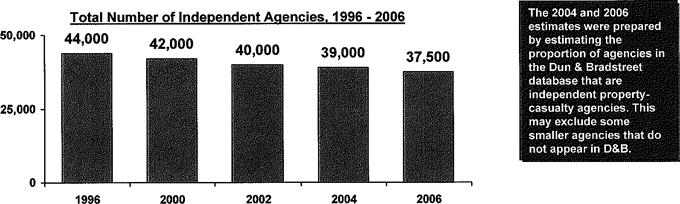

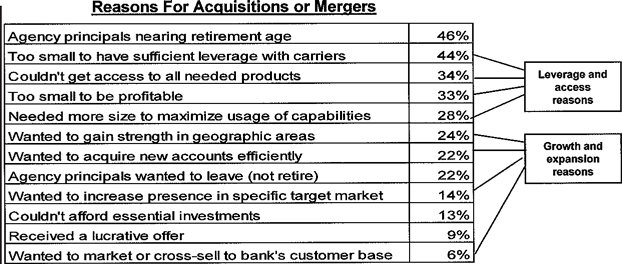

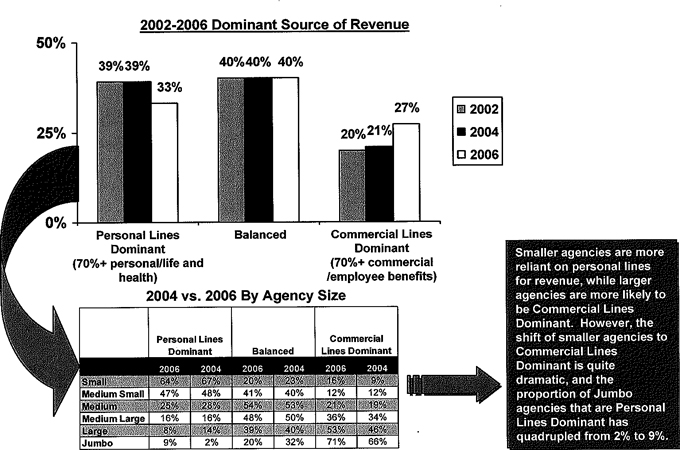

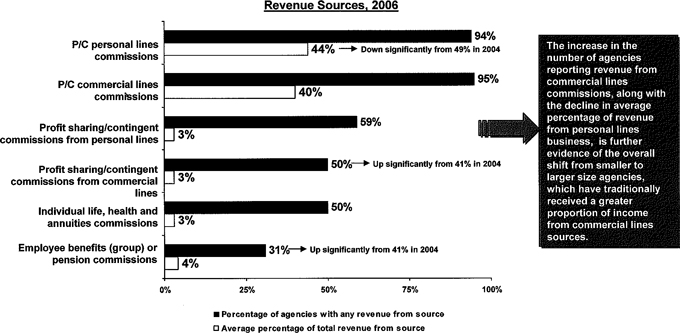

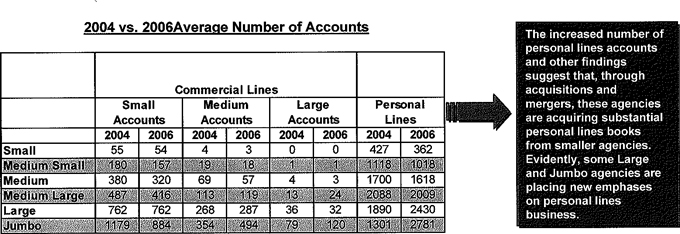

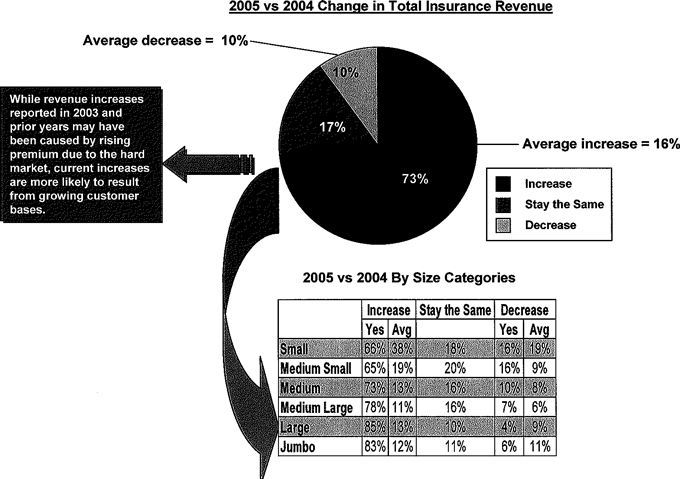

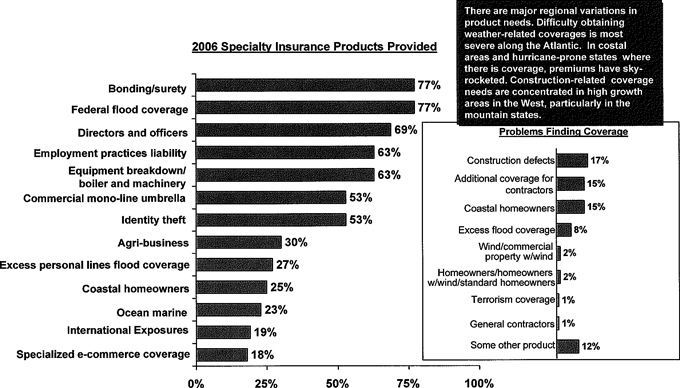

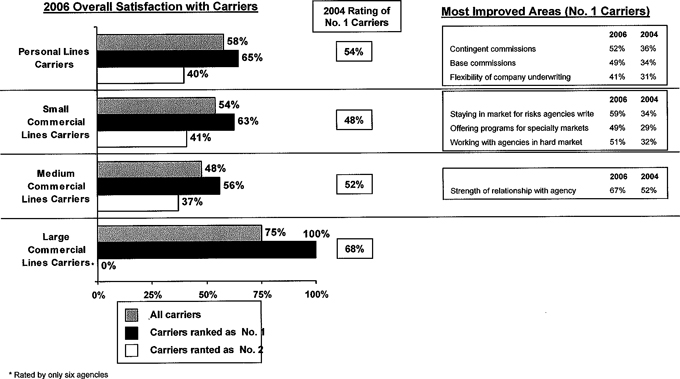

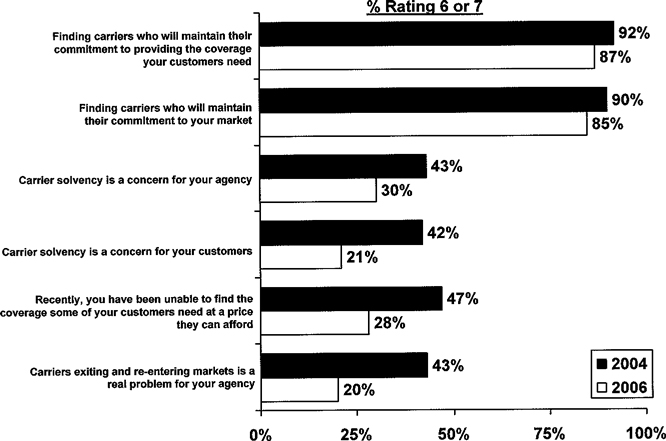

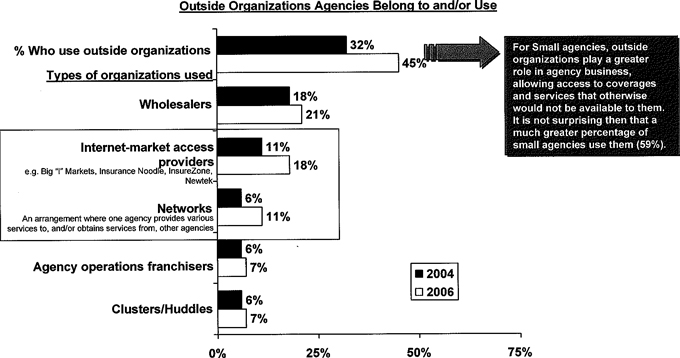

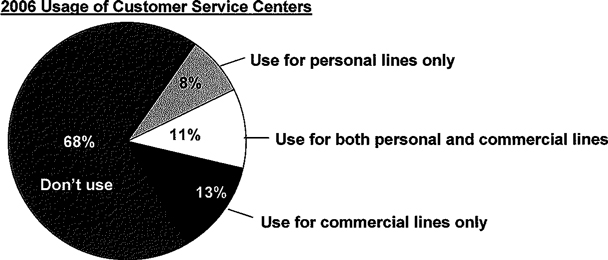

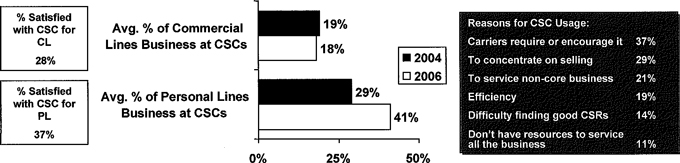

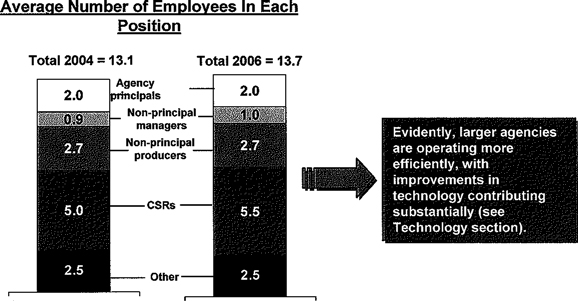

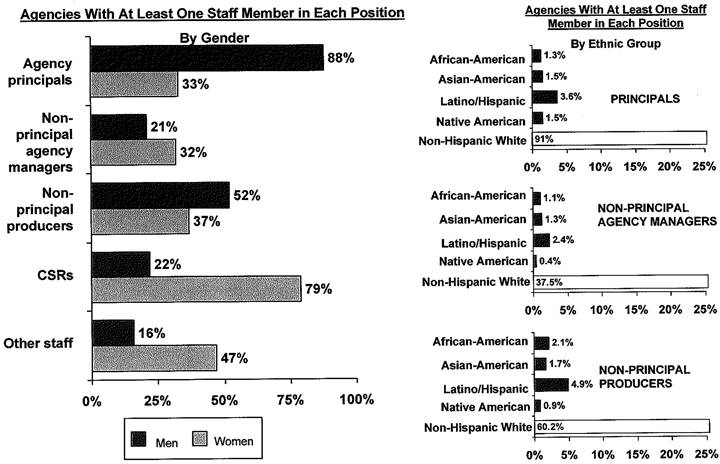

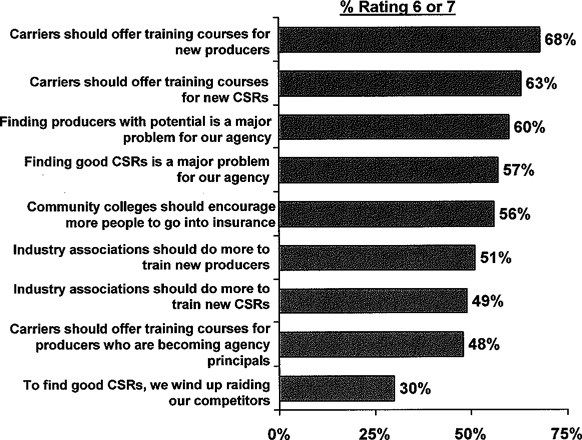

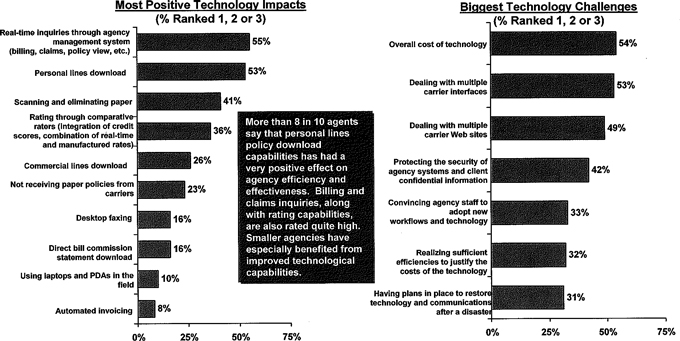

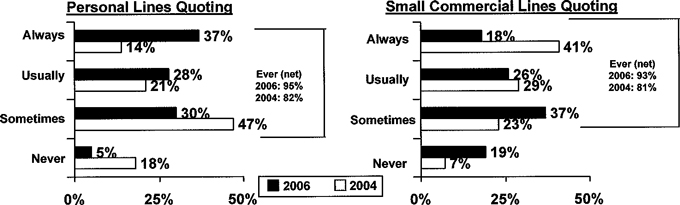

| 8. | We note the industry and market data cited throughout the document, such as the FutureOne 2006 Agency Universe Study mentioned on page nine. Please provide us with marked copies of any materials that support any third party statements, clearly cross-referencing each statement with the underlying factual support. |

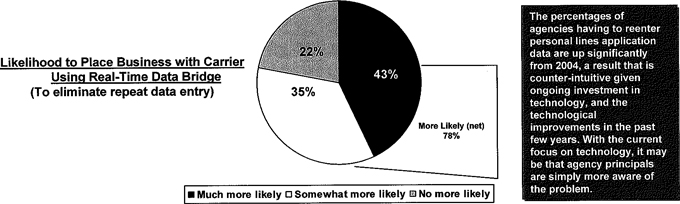

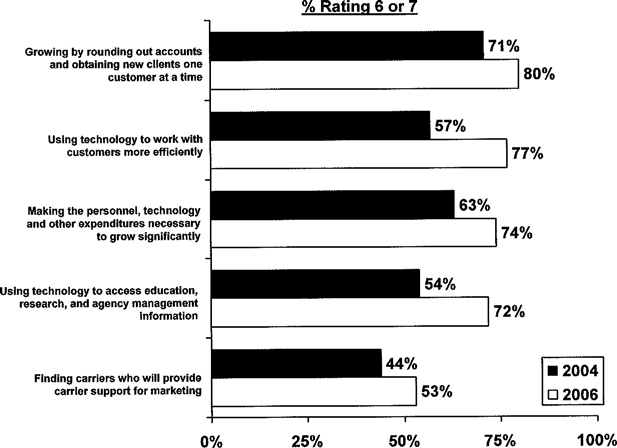

Responses: The Company has provided with this letter relevant portions of the FutureOne 2006 Agency Universe Study conducted by the Independent Insurance Agents and Brokers of America (Annex C to this letter), information from the U.S. Department of Labor, Bureau of Statistics (Annexes D and E to this letter), and statistics from the National Funeral Directors Association (Annex F to this letter).

| 9. | It appears you have not had a Chief Financial Officer since the March 31, 2006 resignation of Patrick Flynn. Please advise and amend your Form 8-K filed April 5, 2006 as necessary to meet the disclosure requirements contained in Item 5.02 of Form 8-K, or advise why revisions are not necessary. |

Response: The Company’s Form 8-K dated and filed on April 5, 2006 inadvertently failed to disclose Mr. Michael C. Azar’s assumption of the role of Principal Accounting Officer on April 1, 2006. The Company filed a Form 8-K/A on April 17, 2007 to amend the Form 8-K filed on April 5, 2006 providing such disclosure.

| 10. | In connection with the preceding comment, we note that in Oakmont’s Exchange Act reports filed since March 31 2006, its Item 307 disclosure refers to a Chief Financial Officer and the 302 and 906 Certifications attached to your Exchange Act filings also refer to a Principal Financial Officer. |

The requirements of Item 307 and Sections 302 and 906 mandate that such disclosure and certifications arise out of the CEO’s and CFO’s evaluations and conclusions. Please advise us of the location of any disclosure by Oakmont relating to any person assuming either the position or the duties of Chief Financial Officer or Principal Financial Officer after Mr. Flynn’s resignation on March 31, 2006. Also, advise how Oakmont meets the requirements of Item 307 and Sections 302 and 906, or file full amendments for all filings that do not meet such requirements.

Securities and Exchange Commission

May 2, 2007

Page 6

Response: As stated in response to comment no. 9 above, Mr. Michael C. Azar assumed the role of Principal Accounting Officer on April 1, 2006, although the Company’s Form 8-K dated and filed on April 5, 2006 inadvertently failed to disclose this fact. The Company also notes that Mr. Azar (i) was inadvertently referred to as the “Chief Financial Officer” in Item 8A of the Company’s Annual Report on Form 10-KSB/A for the fiscal year ended December 31, 2005 and its Annual Report on Form 10-KSB for the fiscal year ended December 31, 2006, and (ii) was inadvertently identified as the “Chief Accounting Officer” in the Section 906 certifications to the Company’s Quarterly Reports on Form 10-QSB for the quarterly periods ended March 31, 2006, June 30, 2006 and September 30, 2006.

Nevertheless, Item 9 of the Company’s Annual Report on Form 10-KSB/A for the fiscal year ended December 31, 2005 filed on April 4, 2006 and of the Company’s Annual Report on Form 10-KSB for the fiscal year ended December 31, 2006 correctly identified Mr. Azar as the Principal Accounting Officer. Mr. Azar participated in evaluations of the disclosure controls and procedures for all periodic reporting period subsequent to assuming the role of Principal Accounting Officer and executed the Section 301 and 906 certificates associated with the periodic reports filed for such periods. Therefore, the Company believes it fulfilled the requirements of Item 307 and Sections 302 and 906, as applicable, in such reports.

Questions and Answers, page 2

| 11. | We note the use of bold type and capital letters in this section. Using all capital letters impedes the readability of the text in the table of contents. Please revise text written in all capital letters here and throughout the document. |

Response: The Company has revised the proxy statement to address this comment. Please see the section entitled “Questions and Answers About the Proposals.”

| 12. | Disclose the dollar value of the consideration to be paid in the merger based on the closing price of your common stock on the date of the acquisition agreement and as of the most recent date practicable. Also disclose the total dollar value of the merger consideration assuming all earnout shares are issued. |

Response: The Company has revised the proxy statement by adding a new question and answer line item that discloses the dollar value of the consideration to be paid based on the closing price of Oakmont’s common stock on the date of the Amended and Restated Plan of Merger, April 30, 2007, and the total dollar value of the merger consideration assuming all earnout shares are issued. Because of the recent date of the Amended and Restated Plan of Merger that was used as a basis to calculate the value of consideration, the Company does not feel it is necessary to include an additional value of consideration based on a subsequent date. Please see the section entitled “Questions and Answers About the Proposals.”

| 13. | Please clarify your use of the term “substantially identical terms” appearing in Q&A No. 1. As noted above, it would appear that the shareholder protections present in Oakmont’s current Certificate of Incorporation are not present in that of Oakmont Kansas. |

Securities and Exchange Commission

May 2, 2007

Page 7

Response: Due to the revised structure of the Merger referred to in the Company’s response to Comment No. 4 above, Q&A No. 1 has been substantially revised and the referenced term has been deleted, so the Company believes this comment is no longer applicable.

| 14. | Revise the Q&As on page 3 and the relevant disclosure throughout the proxy statement to clarify whether the proposals are cross-conditioned upon the approval of the others. For example, you state on page 3 that the merger proposal will not be approved if the reincorporation proposal is not also approved; however, it is unclear whether the reincorporation proposal can be approved without obtaining approval of the merger proposal. |

Response: The Company has revised the proxy statement to clarify that if the merger proposal is not approved, the merger will not be consummated notwithstanding an approval of the incentive plan proposal. We also revised the proxy statement to clarify that the approval of the incentive plan proposal is a condition to the consummation of the merger, although this condition could be waived by Brooke Corp. if the incentive plan proposal is not approved. Please see the sections entitled “Questions and Answers About the Proposals” and “Item 1: The Merger Proposal—The Merger Agreement; Conditions to Closing of the Merger.”

| 15. | You state in Q&A no. 6 that approval of the incentive plan proposal will require the affirmative vote of a majority of the outstanding shares of Oakmont’s common stock, yet the disclosure on page 48 indicates that approval of the plan requires the affirmative vote of a majority of the outstanding shares of Oakmont’s common stockpresent or represented at the meeting. Please revise to clarify the vote that is required for approval. |

Response: The approval of the incentive plan proposal will require the vote of the majority of the shares of Oakmont common stock present or represented at the meeting. Q&A no. 6 has been revised accordingly. Please see the sections entitled “Questions and Answers About the Proposals” and “Item 2: Approval of the 2007 Equity Incentive Plan of the Combined Company; Vote Required.”

The Company has also clarified that the vote required to adopt the merger proposal is by the majority vote of holders of the shares of common stock issued in Oakmont’s initial public offering present or represented at the meeting. Please see page of the proxy statement. Please see the sections entitled “Questions and Answers About the Proposals” and“Item 1: The Merger Proposal; Vote Required.”

| 16. | Please clarify in Q&A no. 19 the effect of broker non-votes for each proposal. Similarly revise the relevant disclosure appearing throughout the document, such as on page 24. |

Response: Under Delaware law, broker non-votes will be counted for the purpose of determining whether a quorum is present at the meeting. However, broker non-votes will not be counted as votes cast for any of the proposals. Therefore, unlike abstentions, broker non-votes do not have the effect of voting against the proposals. The Company has made revisions to the proxy statement to reflect this. Please see the sections entitled “Questions and Answers About the Proposals” and “Persons Making the Solicitation, Meeting, Voting Rights and Requirements—Terms of the Proxy.”

Securities and Exchange Commission

May 2, 2007

Page 8

Summary, page 7

| 17. | Please revise your summary so that it is presented in the form of a summary term sheet as required by Item 1001 of Regulation M-A. In doing so, ensure that you provide a summary of the material conditions to the closing of the merger as well the material interests that the members of Oakmont’s board of directors have in the merger. |

Response: The Company has added disclosure to address this comment. Please see the section entitled“Summary—The Merger Proposal.”

The Merger Proposal, page 8

The Parties, page 8

| 18. | Revise the last sentence of the paragraph describing Brooke Credit to clarify that the majority of its loans are extended to franchisees of your affiliate, Brooke Franchise. |

Response: The Company has revised the indicated disclosure to address this comment. Please see the section entitled“Summary—The Merger Proposal; The Parties.”

Business Rational for Merging with Brooke Credit Corporation, page 8

| 19. | In connection with the use of collateral preservation services and assistance with loss mitigation of distressed franchise loans, please include disclosure on page eight with respect to the number of loans for which Brooke has used such services and assistance, both in absolute and relative terms. |

Response: The Company has substantially revised the disclosure under “Business Rational for Merging with Brooke Credit Corporation” to more fully comply with the summary term sheet requirements per comment no. 17, and believes this comment no longer applies to the revised disclosure. Nevertheless, the Company has revised the similar disclosure in the section entitled “Information about Brooke Credit – Competitive Strengths.”

| 20. | We note the following disclosure on page nine and related disclosure on page 67: “Brooke Credit pioneered the first securitization of insurance agency loans in April 2003, which has resulted in six securitizations to-date with over $187.7 million in rated and un-rated asset-backed securities being issued. |

Please advise us whether registration statements were filed for such offerings and, if so, the respective file numbers. Also advise us of the nature of Brooke Capital’s role in these transactions and whether its activities fell within the definition of a “broker” or “dealer” under the Exchange Act.

Response: Brooke Credit has informed Oakmont that all six issuances of Brooke Credit’s asset-backed securities were privately placed pursuant to the exemption from registration provided by Regulation D under the Securities Act. With respect to each issuance of asset-backed securities, Brooke Credit is the seller and the subservicer. Although Brooke Credit Corporation employees helped place the asset backed securities, under Rule 3a4-1 they are “Associated Persons” of the issuer and therefore are not deemed to be brokers.

Securities and Exchange Commission

May 2, 2007

Page 9

The Merger, page 10

| 21. | Disclose the respective ownership percentages of the combined company’s outstanding common stock that the Oakmont shareholders and the Brooke Credit shareholders are expected to hold after the merger is completed, assuming both minimum and maximum approval by Oakmont shareholders. Also disclose these percentages assuming all earnout shares are issued. Similarly revise throughout the document. |

Response: The Company added a new section entitled “Item 1: The Merger Proposal—The Merger Agreement; Common Stock Ownership Following the Merger” to disclose (i) the respective ownership percentages of the combined company’s outstanding common stock that the Oakmont stockholders and Brooke Credit stockholders are expected to hold, assuming minimum and maximum approval, and (ii) such percentages assuming all earnout shares are issued. A summary of the aforementioned ownership percentages was also added under the section entitled, “Selected Historical Financial Information; Comparative Unaudited Historical and Pro Forma Per Share Data.”

Risk Factors, page 15

| 22. | Please revise your risk factor subheadings and discussions to concisely state the specific material risk each risk factor presents to your company or investors and the consequences should that risk materialize. We note that the vast majority of your subheadings are simply statements about the company or possibility of future events. See, for example, “We may be required to repurchase loans sold with recourse or make payments on guarantees” and “We are dependent on key personnel.” You should revise your subheadings and discussions so that they adequately describe the specific risk resulting from the stated fact. |

Response: The Company has revised the risk factors section to address this comment.

| 23. | Additionally, avoid the generic conclusion you make in many of your risk factors that the risk discussed would have an adverse impact on your business. Instead, replace this language with specific disclosure of how your business would be affected. |

Response: The Company has revised the risk factors section to address this comment.

| 24. | Please revise the risk factor entitled “We make certain assumptions regarding the profitability of our securitizations…” to explain how a material decrease in the value of the retained interest and/or servicing asset would impact your financial statements. |

Response: The Company has revised the risk factors section to address this comment.

Securities and Exchange Commission

May 2, 2007

Page 10

Principal Stockholders, page 25

| 25. | Identify the natural person(s) who exercise voting and/or investment control over the shares held by Azimuth Opportunity, Ltd, The Baupost Group, LLC, and Fir Tree, Inc., to the extent they are not widely held. |

Response: The Company has identified the natural persons who appear to exercise voting and/or investment control over the shares held by Azimuth Opportunities Ltd., The Baupost Group, LLC and Fir Tree, Inc. based on information that they have provided in Schedule 13G filings with the Commission. Please see the section entitled“Principal Stockholders.”

| 26. | Refer to footnote five to the beneficial ownership table. Advise us why you do not attribute beneficial ownership of the shares held by QVM Oakmont Services to Mr. Rooke as a result of his status as a current member. Also explain why you attribute only 340,000 held by QVM Oakmont Services to Mr. Skandalaris, whereas you attribute 360,000 shares held by QVM Oakmont Services to Mr. Azar. |

Response: Mr. Rooke maintains a non-managing role in QVM Oakmont Services, LLC and does not have the power to vote or dispose any of the Oakmont shares held by QVM Oakmont Services, LLC. Accordingly, Mr. Rooke is not deemed a “beneficial owner” of such shares as that term is defined under Rule 13d-3 of the Securities Exchange Act of 1934.

Footnote three was amended to fix an error in the number of shares attributable to Mr. Skandalaris. The correct number of Oakmont shares attributable to Mr. Skandalaris is 360,000. Please see the section entitled“Principal Stockholders.”

Reincorporation Merger, page 27

| 27. | Please disclose whether you presently have any plans, proposals or arrangements to issue any of the additional authorized shares of common stock remaining after the share issuances in the reincorporation merger and the merger with Brooke Credit. If so, please disclose by including materially complete descriptions of the future acquisitions, financing transactions or otherwise. If not, please state that you have no such plans, proposals, or arrangements, written or otherwise, at this time to issue any of the additional authorized shares. |

Response: Due to the revised structure of the Merger referred to in the Company’s response to Comment No. 4 above, the “Reincorporation Merger” section has been deleted so the Company believes this comment is no longer directly applicable. Nevertheless, the disclosure under the caption Comparison of the Oakmont Charter and Bylaws with the Restated Charter and Bylaws includes a statement that there are no current plans, proposals or arrangements to issue any of the additional authorized shares of common stock remaining after the share issuances to be made in connection with the Merger, other than those that will be made in connection with the surviving Company’s various warrant agreements and any awards granted under the 2007 Equity Incentive Plan.

Securities and Exchange Commission

May 2, 2007

Page 11

The Merger Proposal, page 32

| 28. | Please add a new section, immediately following “Interest of Oakmont’s Directors and officers in the Merger,” disclosing with specificity the interests of your IPO underwriter, Morgan Joseph, in the proposed merger. |

Response: The Company has added a new section entitled “Interest of Morgan Joseph in the Merger” to explain the dual role of Morgan Joseph on behalf of each of Brooke Credit and Oakmont and the remuneration to be received by Morgan Joseph in connection with the merger. References to the aforementioned section have also been added throughout the proxy statement.

The Merger, page 32

| 29. | We note your reference to “any other equity holders of Brooke Credit.” In this location, please affirmatively disclose the identify of all such parties, including those who will by operation of any relevant contractual terms be eligible to receive monies or shares as a result of the consummation of the proposed transaction. |

Response: The Company has revised the section entitled “Item 1: The Merger Proposal—The Merger” to address this comment.

Background of the Merger, page 32

| 30. | We note that Oakmont began searching for new acquisition opportunities after the receipt of comments on its proxy statement relating to the proposed acquisition with One Source. Disclose when Oakmont commenced its new search and describe the nature and extent of the search. Also disclose with specificity the reasons why Oakmont decided to pursue a transaction with Brooke Capital instead of any other entity (especially with respect to those 20 acquisition and merger opportunities which Oakmont had already identified and revised information), in light of the apparent fact that Brooke Credit was introduced by Morgan Joseph only two weeks before your mandatory 18 month dissolution date. Address why the board shifted from its original focus on acquiring “a manufacturing and distribution company in the industrial sector headquartered in North America,” as stated in your IPO prospectus, and instead developed an interest in Brooke Credit. Additionally, disclose in specific detail the impact that the impending dissolution date had on the decision to pursue the Brooke Capital transaction. |

Response: The Company has revised the section entitled “Item 1: The Merger Proposal—Background of the Merger” to add the disclosure specified in this comment.

| 31. | Discuss the reasons underlying the board’s decision to terminate the transaction with one Source. |

Response: The Company has revised the “Item 1: The Merger Proposal—Background of the Merger” section to add the disclosure specified in this comment.

Securities and Exchange Commission

May 2, 2007

Page 12

| 32. | Please provide more insight into the reasons for and negotiations behind the parties’ decisions regarding the ultimate amount and form of merger consideration and the provisions of the merger agreement providing for performance payments. Also explain how the parties determined the specific financial benchmarks and the number of additional shares payable if Brooke Capital attains them. Similarly summarize any negotiations regarding the proposed equity split of the combined company. |

Response: The Company has revised the “Item 1: The Merger Proposal—Background of the Merger” section to add the disclosure specified in this comment.

| 33. | It appears that the $105 million payable as set forth in the letter of intent assumes a sale price of $6.00 per Oakmont share rather than the $5.57 sale price on January 17, 2007. Please revise accordingly. |

Response: The Company has revised the “Item 1: The Merger Proposal—Background of the Merger” section to add the disclosure specified in this comment.

| 34. | Expand the eighth paragraph on page 33 to describe the “various aspects of the proposed acquisition” that were the subject of “additional discussions and negotiations” as well as the specific terms and conditions that the parties contained to negotiate. Describe the material issues negotiated during this time period, including how the parties ultimately resolved those issues. |

Response: The Company has revised the “Item 1: The Merger Proposal—Background of the Merger” section to add the disclosure specified in this comment.

| 35. | Disclose the date on which the board approved the transaction and indicate whether this approval was unanimous. |

Response: The Company has added disclosure in the “Item 1: The Merger Proposal—Background of the Merger” section to clarify that the board unanimously approved the merger on February 5, 2007.

Oakmont’s Board of Directors’ Reasons for the Approval of the Merger, page 33

| 36. | We note from page 33 that “Oakmont conducted a due diligence review of Brooke Credit that included an industry analysis, a description of its existing business model, a valuation analysis and financial projections in order to enable the board of directors to ascertain the reasonableness of this range of consideration.” Please revise to include a reasonably thorough description of these efforts and analyses, including all calculations performed as part of the valuation analysis. Also specify the “range” of consideration that the board evaluated. |

Response: The Company has revised the section “Item 1: The Merger Proposal—Oakmont’s Board of Directors’ Reasons for the Approval of the Merger” to remove any reference to a valuation analysis (Oakmont did not perform such an analysis and the previous reference was in error) and to add the other disclosure specified in this comment.

| 37. | Disclose all financial projections exchanged between Brooke Capital and Oakmont, or advise us why they are not material. Also disclose the bases for and the nature of the material assumptions underlying the projections. |

Response: The financial projections provided to Oakmont by Brooke Credit, including the material assumptions underlying the projections, have been added as Annex F to the proxy statement.

Securities and Exchange Commission

May 2, 2007

Page 13

| 38. | Please expand the factors that you list as considered by the board in making its recommendation. Vague statements of topics, such as “[t]he strength of Brooke Credit’s funding network: and “[t]he terms of the merger and the additional agreements…” are not sufficient. You will need to provide a reasonable basis for the listed beliefs and explain how each factor supports or does not support the decision to approve the merger. For example, provide the basis for the belief that “Brooke Credit’s growth has been capital constrained.” |

Response: The description of the factors considered by the board have been expanded in response to this comment.

| 39. | Please disclose what, if any, adverse factors the board considered regarding the merger. By way of example only, this might include the fact that Oakmont was fast approaching the mandatory 18 month dissolution date when it determined to explore the Brooke Credit opportunity, the potential loss of leverage in negotiating the terms of an acquisition since Brooke Credit and its affiliates knew that the company had a firm deadline for completing the acquisition, etc. |

Response: The above factors considered by the board have been added in response to this comment.

| 40. | Please revise the last paragraph of this section to delete the assertion that the merger will provide Oakmont stockholders with “a resulting increase in stockholder value.” See the Instruction to Rule 14a-9, which proscribes “predictions as to specific future market values.” |

Response: The Company has deleted the referenced assertion.

Satisfaction of the 80% Test, page 34

| 41. | Revise this section to clearly explain the basis for the board’s determination that the 80% test has been met, aside from the value you assign to the consideration to be paid in stock based upon market price on February 8, 2007. In other words, clarify how the board members used their “financial skills and background” and the “financial analysis…generally used to approve the transaction” in order to arrive at its determination that the 80% test was met. To the extent the board conducted its own financial and valuation and analyses, revise to include a reasonably thorough description of those analyses. Also quantify 80% of Oakmont’s net assets as of the most recent date practicable. |

Response: The Company has revised the section “Item 1: the Merger Proposal—Satisfaction of 80% Test” to add the disclosure specified in this comment.

| 42. | Regarding your statement that the board determined that the consideration being paid was fair to and in the best interests of Oakmont, please address the following: |

| | • | | Clarify how you determined the value of the consideration to be $90.8 million. It appears that you utilized a per share price of $5.57 rather than $5.56 to arrive at $90.8 million. |

Securities and Exchange Commission

May 2, 2007

Page 14

| | • | | Indicate whether the board evaluated the fairness of the consideration while taking into account the value of the 1.2 million shares to be issued on connection with the assumption of warrants. Disclose the dollar value of these shares. |

| | • | | Include disclosure of the value of the total maximum consideration, taking into account the value of the 1.2 million warrant shares and the 5 million earnout shares. Indicate whether the board evaluated the fairness of the consideration while considering the value of the total maximum consideration payable. |

Response: The Company has revised the “Item 1: the Merger Proposal—Satisfaction of 80% Test” section in response to the first bullet point of this comment. The Company has also deleted the reference to the board’s determination that the merger consideration was fair from the “Item 1: the Merger Proposal—Satisfaction of 80% Test” section because it is duplicative of the revised disclosure in the “Item 1: the Merger Proposal—Oakmont’s Board of Directors’ Reasons for the Approval of the Merger” section. Nevertheless, we revised the disclosure in the “Item 1: the Merger Proposal—Oakmont’s Board of Directors’ Reasons for the Approval of the Merger” section to address the issues raised in the second and third bullet points of this comment to clarify that the board considered all of the consideration potentially issuable to the Brooke Credit equity holders.

Anticipated Accounting Treatment, page 36

| 43. | Please refer to pages 83 and F-37. We understand that the Oakmont IPO warrants become exercisable at the closing of this merger. Without considering the contingently issuable shares related to the merger but considering the Oakmont IPO and the Brooke Credit outstanding warrants, it appears that the shareholders of Oakmont Acquisition Corporation will own 63.9% of the combined company. Please tell us how you considered these warrants in concluding that the shareholders of Brooke Corporation and Brooke Credit corporation have control of the combined company after the merger. Include in your response references to the appropriate accounting literature. |

Response: Rule 12b-2 promulgated under the Securities Exchange Act of 1934 and Rule 404 promulgated under the Securities Act of 1933 define control as the “possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a person, whether through the ownership of voting securities, by contract, or otherwise. Accounting Research Bulletin No. 51,“Consolidated Financial Statements (ARB No. 51)” provides that the usual condition for control is ownership of a majority voting interest, and therefore, as a general rule, ownership by one company, directly or indirectly, of over fifty percent of the outstanding voting shares of another company is a condition pointing toward control. SFAS 94,“Consolidation of all Majority-Owned Subsidiaries,” which amends ARB No. 51, requires the consolidation of all majority-owned subsidiaries unless control is temporary or does not rest with the majority owner. Upon the closing of the merger, Brooke Corporation will hold more than 50% of the issued and outstanding voting stock of Brooke Credit. Although there is a significant number of warrants outstanding that can be converted into voting common shares on or after the date the merger closes, until the Oakmont warrant holders convert their warrants to common stock, they have no voting rights.

Securities and Exchange Commission

May 2, 2007

Page 15

The FASB Board agreed at its meeting on April 5, 2006 that control over an entity is based on an assessment of all the present facts and circumstances and that the concept of control does not exclude situations in which control exists but it might be temporary. Specifically, the minutes of this meeting, under Matters Discussed and Decisions Reached No. 24, note that a “present ability” is required for control and that an entity with current ownership of a majority of an entity’s voting stock would have control over that entity even though another investor had a warrant to obtain a majority of such entity’s voting stock. The Board also agreed that control cannot be shared, that is, control involves one entity (not multiple entities) having control over another entity.

The Merger Agreement, page 37

General Structure of Merger, page 37

| 44. | We note the disclosure relating to the earnout provisions set forth in the merger agreement. Please explain how “adjusted earnings” are calculated, ensuring that you provide clear descriptions of the nature of the adjustments. Also disclose what Brooke Credit’s adjusted earnings (calculated in the same manner to be used for the earnout consideration) were for the last three years. |

Response: The Company has added disclosure to explain how “adjusted earnings” are calculated and has provided disclosure which shows what Company’s adjusted earnings were for the last three years. Please see the section entitled “Item 1: The Merger Proposal—the Merger Agreement; General; Structure of the Merger.”

Conditions to Closing of the Merger, page 40

| 45. | We note that one of the conditions is that Mr. Skandalaris will use his reasonable best efforts to acquire up to 333,333 shares of Oakmont stock through open market purchases. In an appropriate location in the proxy statement, disclose that Mr. Lowry intends to purchase at least 100,000 shares of Oakmont in the open market, as mentioned on page seven of the Investor Presentation materials filed on Form 8-K on March 14, 2007. Also clarify the time period during which Messrs. Skandalaris and Lowry are to purchase such shares and the purpose of such purchases. In addition, please advise us how such purchases will be made in compliance with Rule 102 of Regulation M. |

Response: The Company has added disclosure regarding Mr. Lowry’s intention to purchase up to 100,000 shares and the anticipated timing of Messrs. Skandalaris’ and Lowry’s purchases under the new section entitled “Item 1- The Merger Proposal - Potential Oakmont Common Stock Purchases.” Mr. Skandalaris and Mr. Lowry have not yet purchased any of the indicated shares. They intend to do so after the filing of the amended preliminary proxy statement and before the day the final proxy statement is first disseminated to Oakmont security holders. Since these purchases will occur outside the applicable restricted period under Rule 100 of Regulation M, they may be made in compliance with Rule 102 of Regulation M.

Securities and Exchange Commission

May 2, 2007

Page 16

| 46. | Please revise to summarize the material terms of the tax allocation agreement, if finalized. Also expand the description of the shared services agreement to explain how the $2.3 million fee for 2007 was determined, particularly in light of the fact that Brooke Credit paid $1.8 million for these shared services in 2006 and 2005. Further, please provide us with copies of the shared services agreement and the tax allocation agreement to facilitate our review. |

Response: The tax allocation agreement to be entered into between Brooke Corp. and Brooke Credit has not been entered into as of the date of this response. A summary of that agreement will be included in the preliminary proxy statement, and a copy will be supplementally provided to the staff at the SEC, after it has been entered into.

The description of the shared services agreement in the section entitled “Item 1: The Merger Proposal – Shared Services Agreement” describing the reasons for the increase in the 2007 fee has been revised. A copy of the shared services agreement is attached as Annex G to this letter.

Termination, page 41

| 47. | Your disclosure here suggests that various material conditions to the merger, other than the 20% conversion condition, may be waived by either Oakmont or Brooke. Disclosure whether it is the intent of Oakmont’s board to resolicit shareholder approval of the merger if either party waives a material condition. We believe that resolicitation is generally required when companies waive material conditions to a merger and such changes in the terms of the merger render the disclosure that you previously provided to shareholders materially misleading. |

Response: The Company has added disclosure to clarify that to the extent a waiver by either Brooke Corp. or Oakmont results in a wavier of a material term of the Merger Agreement, or any material terms of the Merger Agreement change as a result of a waiver, Oakmont’s board of directors will resolicit shareholder approval for the merger. Please see the section entitled“Item 1: the Merger Proposal—The Merger Agreement; General; Structure of the Merger; Termination.”

Information About Brooke Credit, page 49

| 48. | Please include the website address of Brooke Credit. |

Response: The Company has added disclosure to identify the website address of Brooke Credit. Please see the section entitled“Information about Brooke Credit; History.”

Lending Programs, page 49

| 49. | For each one of the categories discussed please explain why such small “main street businesses” would need loans in order to operate. In light of Brooke Corporation’s proposed ownership interest in the combined company and the relative proportion of revenues generated by loans to Brooke Franchisees, discuss the terms of all types of agreements with these categories of customers in which any entity related to Brooke Corporation has a financial interest. |

Response: Disclosure has been added to the description of Retail Insurance agents and agencies that are franchisees of Brooke Franchise to clarify that Brooke Credit’s loans are needed to finance acquisitions of other agencies. The description of the other lending programs already identify that the primary need for loans is to finance acquisitions. Disclosure has also been added regarding the various agreements in place between Brooke franchisees and the various Brooke affiliates.

Securities and Exchange Commission

May 2, 2007

Page 17

Sourcing, page 50 and

Collateral Preservation Services, page 50

| 50. | We note the disclosure regarding the generation of referrals from Brooke Credit’s proprietary loan sourcing network and the provision of collateral preservation and loss mitigation services by participants in Brooke Credit’s sourcing network. Please revise to include substantial detail regarding this aspect of Brooke’s business, including the payment structure of these transactions, and provide examples as necessary. Disclose the amount and percentage of revenues to date that are attributed to this aspect of your business. Also clarify in detail your use of the following terms found throughout your proxy statement, all relating to Brooke’s business model: “proprietary loan sourcing network,” “proprietary collateral preservation platform,” “proprietary nationwide network of over 150 banks,” and “funding sources and proprietary funding network.” |

Response: The Company has revised the proxy statement in response to these comments. Please see the section entitled “Information about Brooke Credit—Collateral Preservation Services.”

Brooke Credit’s Management’s Discussion and Analysis, page 54

| 51. | The Commission’s Interpretive Release No. 33-8350, “Commission Guidance Regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations,” located on our website at http://www.sec.gov/rules/interp/33-8350.htm, suggests that companies identify and disclose known trends, events, demands, commitments and uncertainties that are reasonably likely to have a material effect on financial condition or operating performance. |

Please consider expanding your discussion of any known trends or uncertainties that could materially affect Brooke Credit’s results of operations in the future, including any trends management considers meaningful for investors in understanding the combined company’s prospects after the merger. For example, address the reasons why Brooke Credit’s net earnings grew by only an increase of 15% in FY2006 (a significant reduction from the comparable figure for FY 2005) while its loan portfolio grew 74% and revenues grew by 46% during the same period, and whether you expect this trend to continue. As another example, address what changes you expect as a result of becoming a public company. In this regard, we note your disclosure under the risk factor “Efforts to comply with the Sarbanes-Oxley Act will involve significant expenditures…” beginning on page 20.

Response: The Company has revised the proxy statement in response to these comments. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Securities and Exchange Commission

May 2, 2007

Page 18

Results of Operations, page 55

| 52. | It appears to us that the basic and diluted net income per share should be $1.25 per page F-4. Please revise or advise. |

Response: The Company has revised the basic and diluted income per share to be $1.25. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations.”

Liquidity and Capital Resources, page 66

Loan Participations, page 67

| 53. | Please disclose what the “excess concentration restrictions” are that prohibit you from selling these loans to your warehouse entities. |

Response: The Company has revised the proxy statement to clarify what the excess concentration restrictions are. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

Bank Debt, page 67

| 54. | Please define “subordinate securities.” Also, discuss the reasons for investing in these securities and discuss any risks associated with them. |

Response: The Company has revised the proxy statement to define the subordinate securities and to discuss the reasons for investing in them and the risks associated with them. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources; Bank Debt.”

Bank Lines of Credit, page 67

| 55. | Please tell us how the funding of over-collateralization is presented in your Statements of Cash Flows and the basis for the presentation. |

Response: The funding of the over-collateralization is presented in the Statements of Cash Flows. For example, when notes receivable are removed from an on balance sheet warehouse facility and are funded through the issuance of asset-backed securities or other off balance sheet funding vehicle, a decrease is reflected inAccounts and notes receivableequal to the principal balance and accrued interest of the notes sold to the special purpose entity or other third party, a decrease is reflected inOther liabilities in an amount equal to the purchase price paid to the on balance sheet warehouse provider. The over-collateralization is depicted as aCash payment for securities.

| 56. | Please provide the disclosures under paragraph 17(a)(2) of SFAS 140 in a note to your financial statements or tell us why the disclosures are not required. |

Response: The Company has added disclosure to the financial statements in the proxy statement to address this comment. Please see Brooke Credit’s “Notes to Consolidated Financial Statements – Footnote 3, Bank Loans and Other Long-Term Obligations.”

Securities and Exchange Commission

May 2, 2007

Page 19

| 57. | Refer to the first paragraph on page 68. Disclose, if true, that your existing cash, cash equivalents and funds generated from operating, investing and financing activities will be sufficient to satisfy your financial needs for the next twelve months. Also revise to indicate whether management’s belief that the company will have sufficient funds to satisfy its financial needs also assumes the closing of the merger with Oakmont and the resulting increase in equity capital. |

Response: The Company has revised the proxy statement in response to this comment. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources; Bank Lines of Credit.”

Capital Commitments, page 68

| 58. | Please disclose, if true, that you are in compliance with all your debt covenants as of each balance sheet date. |

Response: Brooke Credit is in compliance with all material debt covenants. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations—Capital Commitments.”

| 59. | Please describe briefly the events that constitute events of default under the notes placed in November 2006, the company’s bank loans and other long-term obligations and disclose the consequences of default. Also clarify whether the restrictions contained in these agreements will be triggered by the merger with Oakmont. |

Response: The Company has revised the proxy statement to address this comment. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition – Capital Commitments.”

Executive Compensation, page 84

| 60. | Please revise to include the executive compensation disclosure required by Item 402 of Regulation S-K since Oakmont is seeking approval of the 2007 equity incentive plan. See Item 8(b) to Schedule 14A. |

Response: The Company has added disclosure under the section entitled, “Certain Information Regarding Oakmont, its Common Stock and Other Securities” to address Oakmont’s executive compensation.

Description of Oakmont Common Stock and Other Securities, page 87

| 61. | Revise the fourth paragraph under “Common Stock” to disclose whether or not there will be any deductions from the trust account prior to or in connection with a dissolution and distribution, and if so, specify the types and, if possible, the amounts involved. |

Response: The indicated paragraph has been revised to add the specified disclosure. Please see the section entitled “Description of Oakmont Common Stock and Other Securities—Common Stock.”

Securities and Exchange Commission

May 2, 2007

Page 20

Brooke Credit Corporation Financial Statements

Consolidated Statements of Operations, page F-4

| 62. | Please disclose the weighted-average shares used to calculate your net income per share. |

Response: Please see the weighted-average shares disclosure found in Brooke Credit’s Audited Financial Statements under the section entitled “Notes to Consolidated Financial Statements—Footnote 1(q)”.

Consolidated Statements of Cash Flows, page F-6

| 63. | Please provide a separate non-cash charge caption for all impairment losses, including an impairment loss attributable to your securitized pools of loans (i.e., the $329,000 impairment included in other income). |

Response: The Company has added disclosure to financial statements in the proxy statement to address this comment. Please see “Brooke Credit’s Consolidated Statements of Cash Flows.”

1. Summary of Significant Accounting Policies, page F-7

(a). Organization, page F-7

| 64. | Please tell us your basis for consolidating Brooke Credit Funding LLC and Brooke Warehouse Funding LLC, which you referred to as bankruptcy-remote special purpose entities. Please tell us why you do not consider them to be qualifying special purpose entities. It is unclear to us why you refer to the purchase of your loans by theseconsolidated entities as a “true sale.” Please provide us your definition of a true sale and how your accounting complies with SFAS 140. |

Response: Brooke Credit’s management has reached the reasonable conclusion that Brooke Credit Funding LLC and Brooke Warehouse Funding LLC are bankruptcy remote based upon its factual analysis and supporting substantive non-consolidation opinions that Brooke Credit Funding LLC and Brooke Warehouse Funding LLC will be treated as separate and distinct entities, and that a bankruptcy court (in the unlikely event it were called upon to decide) would not consolidate their assets with another Brooke entity. Furthermore, the limited liability company agreements and the indentures for the transaction documents to which these special purpose entities (SPEs) are a party specifically require that separate corporate existence of each of these SPEs be maintained and outline a number of specific steps that the SPEs must take (or not take) as the case may be to help maintain corporate separateness. In addition, Brooke Credit’s management reached the reasonable conclusion based upon its analysis of the facts and supporting true sale legal opinions that the transactions during 2006 between Brooke Credit and these SPEs were true sales. For example, the transaction document between Brooke Credit and Brooke Credit Funding LLC specifically provides that Brooke Credit and Brooke Credit Funding LLC will treat Brooke Credit Funding LLC’s purchase of assets as a sale on all relevant books, records, tax returns, financial statements, and other applicable documents. However, the agreement further provides that nothing shall prevent Brooke Credit Funding LLC from being included in the consolidated financial statements of Brooke Credit.

Securities and Exchange Commission

May 2, 2007

Page 21

Despite the above conclusions, Brooke Credit’s management believes that neither Brooke Warehouse Funding LLC nor Brooke Credit Funding LLC was a Qualifying Special Purpose Entity (QSPE) during 2006. SFAS 140, paragraph 35, notes that, among other characteristics, a QSPE must be demonstrably distinct from the transferor. SFAS 140 paragraph 36 provides that a QSPE is demonstrably distinct for the purposes of SFAS 140 only if it cannot be unilaterally dissolved by any transferor, its affiliates, or its agents. An ability to unilaterally dissolve an SPE can take many forms, including the right to call all the assets transferred to the SPE or a right to call or a prepayment privilege on the beneficial interests held by other parties. Under the transaction documents governing these two SPEs during 2006, Brooke Credit’s management concluded that these two SPEs were not demonstrably distinct. For example, the agreements executed by Brooke Credit Funding LLC and Brooke Warehouse Funding LLC allow them to unilaterally obtain a release of collateral to sell loans on a whole loan basis.

Please note that in March 2007, Brooke Credit initiated a $150,000,000 facility to sell, on a revolving basis, a pool of its loans, while retaining residuals assets such as interest-only strip receivables and a subordinated over-collateralization interest in the receivables. The eligible receivables were sold to Brooke Warehouse Funding, LLC without legal recourse to Brooke Credit. Brooke Warehouse Funding, LLC then entered into a participation agreement with Brooke Acceptance Company 2007-1, LLC to sell an undivided senior participation interest in all of the assets of Brooke Warehouse Funding, LLC. Brooke Acceptance Company 2007-1, LLC entered into an amended and restated receivables financing agreement with Fifth Third Bank which extended a credit facility to Brooke Acceptance Company 2007-1 LLC to provide funds to acquire such participation interests with a facility line of credit of $150,000,000. The facility qualifies for sale treatment under SFAS 140. Accordingly, accounts receivable balances were removed from the consolidated balance sheet at March 31, 2007, with those funds being used to reduce outstanding debt on the Fifth Third line of credit that was previously utilized.

This transaction and its impact on Brooke Credit’s financial statements will be appropriately reflected in the first quarter 2007 financial information that the Company expects to include in a future amendment to the preliminary proxy statement.

(f). Allowance for Doubtful Accounts, page F-8

| 65. | Please refer to your disclosure herein of our credit loss exposing to, among others, “off-balance sheet loans sold with recourse” and the related risks as addressed on page 70. It is unclear to us if you surrendered control over the loans that you sold with recourse. Please advise. Refer to paragraph 9(c) of SFAS 140. |

Response: As of December 31, 2006 and December 31, 2005, respectively, Brooke Credit had an approximate total of $2,247,000 and $3,807,000 in off-balance sheet loans sold with recourse. The Company has increased “Notes & interest receivable, net” and “Payable under participation agreements” in Brooke Credit’s Consolidated Balance Sheets by such amounts. In addition, corresponding changes have been made throughout the proxy.

Securities and Exchange Commission

May 2, 2007

Page 22

(l). Warrant Obligation, page F-11

| 66. | We note that you referred to a third party valuation expert to determine the fair value of your warrants. While you are not required to make reference to a third party valuation expert, when you do you should disclose the name of the expert. If you decide to delete your reference to the expert, please revise the disclosures to explain the theoretical models and assumptions used by you to determine the valuation. We also note your reference to the expert on page F-27. |

Response: The Company has added disclosure to the proxy statement to address this comment. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies; Warrants.” See also Brooke Credit’s Audited Financial Statements under the section entitled “Notes to Consolidated Financial Statements—Footnote 1(l), Warrant obligation and Footnote 11, Significant Event.”

(n). Loan origination fees, page F-11

| 67. | Please disclose how you account for loan origination fees in excess of the loan origination expenses and loan origination expenses in excess of the loan origination fees. |

Response: Currently, loan origination fees charged to Brooke Credit’s borrowers are entirely offset against loan origination expenses incurred during the underwriting and placement of loans and are, therefore, not recorded by Brooke Credit as revenues. However, since it is Brooke Credit’s practice to sell its loans soon after origination, in the future if loan origination fees exceed direct loan origination expenses, the excess will be reported as income. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies; Loan origination fees.” See also, the Brooke Credit Audited Financial Statements under the section entitled “Notes to Consolidated Financial Statements - Footnote 1(n).”

(p). Income Taxes, page F-12

| 68. | We note that “the company did not record deferred taxes on those items with temporary differences between financial reporting amounts and the tax basis. Rather, the Parent Company recognized the resulting deferred tax liabilities.” Please tell us why this complies with paragraph 40 of SFAS 109 and SAB Topic. 1.B.1. |

Response: Pursuant to a tax allocation agreement, in 2005 and 2004, Brooke Credit paid tax amounts to Brooke Corporation based upon pretax income including those amounts that are deferrable for tax purposes. That agreement was revised during 2006 and the amounts that are deferred for tax purposes are no longer paid to Brooke Corporation but are instead deferred on Brooke Credit’s balance sheet as deferred income tax payables. Brooke Credit recorded amounts due to taxing authorities in future years for those amounts previously paid to Brooke Corporation; a corresponding receivable from Brooke Corporation is recorded. As noted in the management discussion and analysis, as a result, a significant deferred tax liability was recorded during 2006 for these amounts. Please see the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations – Results of Operation; Income Taxes.”

Securities and Exchange Commission

May 2, 2007

Page 23

2. Notes and Interest Receivable, Net, page F-16

| 69. | Per your sensitivity analyses on pages F-17 and F-18, you would have recognized an impairment of $501,000 or $981,000 assuming your prepayment rates increased 10% of 20%, respectively. Please tell us how you determined the impairment loss of $329,000, considering that your 2006 actual prepayment rate on your loan portfolio was 15.6%. This rate is a 56% increase from your assumed prepayment rates of 8% and 10%. Also, tell us and disclose why your assumed prepayment rates continue to be appropriate considering the 2006 actual prepayment rate on your loan portfolio. |

Response: The prepayment assumption of 8% to 10% determined by Brooke Credit’s management is an average rate over the life of our portfolio. Brooke Credit’s management believes that during the remaining term of this portfolio, several cycles are likely to occur which could increase or decrease actual prepayment rates; however, Brooke Credit’s management continues to believe the average rate assumption used by Brooke Credit’s management is appropriate. Please see Brooke Credit’s Audited Financial Statements under the section entitled “Notes to Consolidated Financial Statements—Footnote 2, Notes and Interest Receivable, Net.”

Annex A – Agreement and Plan Merger

| 70. | Please provide us with a list briefly identifying the contents of all omitted schedules, including the Disclosure Schedule, or similar supplements to the merger agreement. |

Response: Please see the list of contents of all schedules to the merger agreement, attached as Annex H to this letter.

Form of Proxy Card

| 71. | Revise the proxy card to briefly indicate which proposals are conditioned on the approval of others. See Rule 14a-4(a). |

Response: The Company has revised the disclosure in the proxy card to address this comment.

| 72. | Disclose whether Oakmont may adjourn or postpone the meeting for the purpose of soliciting additional proxies. |

In this regard, please note the staff’s view that a postponement or adjournment to permit further solicitation of proxies does not constitute a matter “incident to the conduct of the meetings,” as described in Rule 14a-4(c)(7). Accordingly, we consider the use of discretionary voting authority to postpone or adjourn the meeting to solicit additional proxies to be a substantive proposal for which proxies must be independently solicited. If you wish to obtain authority to adjourn the meeting to solicit additional proxies for the merger, please provide another voting box on the proxy card so that shareholders may decide whether to grant a proxy to vote in favor of postponement or adjournment specifically for this purpose.

Response: We note and are aware of the staff’s view on stockholder votes to adjourn a meeting and the application of Rule 14a-4(c)(7). Oakmont will not use discretionary voting authority to postpone or adjourn the meeting to solicit additional proxies. Nevertheless, Oakmont’s by-laws permit any meeting of its stockholders to be adjourned for such periods as any presiding officer at the meeting shall direct without a stockholder vote and therefore without exercising discretionary voting authority.

Securities and Exchange Commission

May 2, 2007

Page 24

Form 8-K filed March 14, 2007

| 73. | We note your reference to the safe harbor for forward-looking statements “within the meaning of the Private Securities Litigation Reform Act of 1995” on page two of the Investor Presentation materials. As a blank check company, the safe harbor provisions do not apply to you. See Section 21E(b)(1)(B) of the Securities Exchange Act. In future soliciting materials, please refrain from referring to the safe harbor or make clear that the safe harbor does not apply to you. We also note that you refer to the safe harbor contained in your periodic reports that discuss forward-looking statements and ask that you avoid doing so in your future filings. |

Response: Oakmont acknowledges the comment and will not include any reference to the safe harbor provided for under the Private Securities Litigation Reform Act of 1995 in connection with any offering of securities while it remains a blank check company.

Nevertheless, Oakmont may utilize a forward-looking statement disclaimer in connection with its soliciting materials in order to obtain maximum protection under and ensure the applicability of the “bespeaks caution” doctrine and any other judicial doctrine that may apply. In such instances, Oakmont will make clear that the safe harbor does not apply to Oakmont.

Finally, Oakmont notes that the exclusion of Section 21E(b)(1)(B) of the Securities Exchange Act only applies to forward looking statements made in connection with an offering of securities by the blank check company. Oakmont does not believe its periodic reports are “made in connection with an offering of securities” and therefore believes Section 21E of the Securities Exchange Act, and the safe harbor provided therein, applies to forward looking statements that may be made in such filings. In taking this position, Oakmont notes that Oakmont is not incorporating any of its periodic reports into the proxy statement.

| 74. | We note the assertion contained on page one of the Investor Presentation materials that Morgan Joseph is assisting Oakmont in holding stockholder presentations “without charge.” In future soliciting materials, please ensure to balance such statements with disclosure relating to Morgan Joseph’s financial interest in the transaction, as commented upon above. |

Response: Oakmont acknowledges the comment and will ensure disclosure of Morgan Joseph’s financial interest in the transaction is included in any future soliciting material.

| 75. | We note the statements on page seven of the Investor Presentation materials that BCC is “already on path for Sarbanes-Oxley compliance.” Provide the basis for such statements in future soliciting materials. |

Response: Oakmont acknowledges the comment and will include the basis for this statement in any future soliciting material.

Securities and Exchange Commission

May 2, 2007

Page 25

|

| Very truly yours, |

|

| Thomas E. Hartman |

TEH:sdb

Michael Azar

ANNEX A

For Immediate Release

OAKMONT ACQUISITION CORP. SIGNS LETTER OF INTENT TO ACQUIRE

SPECIALTY FINANCE COMPANY

BLOOMFIELD HILLS, MI – January 17, 2007– Oakmont Acquisition Corp. (“Oakmont” or the “Company”) (OTC Bulletin Board: OMAC.OB) announced today that it has entered into a letter of intent to acquire all of the stock of a specialty finance company, a subsidiary of a publicly traded company, that lends primarily to small businesses.

Pursuant to the terms of the letter of intent, Oakmont will acquire all of the stock of the selling shareholder (the “Seller”) for approximately $105 million, plus up to an additional $30 million should the acquired entity achieve certain financial goals over the next two years. The consideration received by Seller will be paid through issuance of approximately 17.5 million shares of Oakmont common stock at closing, an additional 4 million shares should the acquired business achieve net income (based upon a pre-acquisition financial structure) of $15.0 million in 2007 and an additional 1.0 million shares should the acquired business achieve net income of $19.0 million from the same computation in 2008. In addition, Robert Skandalaris, Oakmont’s Chief Executive Officer has agreed to acquire additional shares of Oakmont with a value of up to $2.0 million, through open market purchases prior to the closing of the transaction. Oakmont management and the Seller have further agreed to lock up certain of their shares for two years following the closing of the transaction.

The letter of intent is subject to the negotiation of a definitive acquisition agreement, Oakmont’s satisfactory completion of due diligence with respect to the acquired business and other conditions typically seen in letters of intent related to the acquisition of a business. Oakmont anticipates that a definitive agreement will be signed on or before February 5, 2007 and that the transaction will close on or before May 31, 2007.