UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of the earliest event reported) May 4, 2007

OAKMONT ACQUISITION CORP.

(Exact Name of Registrant as Specified in Its Charter)

| | | | |

| Delaware | | 000-51423 | | 20-2679740 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

33 Bloomfield Hills Pkwy., Ste. 240

Bloomfield Hills, MI 48304

| | |

| (Address of Principal Executive Offices) | | (Zip Code) |

(248) 220-2001

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure |

Commencing on or about May 17, 2007, Oakmont Acquisition Corp., (“Oakmont”) and Brooke Credit Corporation (“BCC”) intend to hold presentations for Oakmont’s stockholders regarding the proposed merger between Oakmont and BCC, as described in Oakmont’s Form 8-Ks filed on May 2, 2007 and May February 8, 2007. In connection with such presentations, the slide show presentation attached to this Current Report on Form 8-K as Exhibit 99.1 will be distributed to participants.

Oakmont, BCC and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies for the Oakmont special meeting of stockholders at which Oakmont’s stockholders will be asked to approve the transaction.

Stockholders of Oakmont and BCC and other interested persons are advised to read Oakmont’s amended preliminary proxy statement and, when available, Oakmont’s definitive proxy statement in connection with Oakmont’s solicitation of proxies for the special meeting at which Oakmont’s stockholders will be asked to approve the merger because these proxy statements contain important information. Such persons can also read Oakmont’s final prospectus, dated July 12, 2005, as well as periodic reports, for more information about Oakmont, its officers, directors, and their interests in the successful consummation of this business combination.

The definitive proxy statement will be mailed to Oakmont’s stockholders as of a record date to be established for voting at the special meeting. Stockholders will also be able to obtain a copy of the definitive proxy statement, the final prospectus and other periodic reports filed with the Securities and Exchange Commission, without charge, by visiting the Securities and Exchange Commission’s Internet site at (http;//www.sec.gov).

| Item 9.01 | Financial Statements and Exhibits. |

| | (d) | Exhibits. The following exhibit is being furnished herewith: |

| | |

| Exhibit 99.1 | | Slide Show Presentation |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned thereunder duly authorized.

| | |

| OAKMONT ACQUISITION CORP. |

| |

| By: | | /s/ Michael C. Azar |

| | Name: Michael C. Azar |

| | Title: President |

Date: May 4, 2007

Merger of Merger of and and May 2007 Exhibit 99.1 |

- 2 - Investor Presentation This presentation was filed with the Securities and Exchange Commission as part of the Form 8-K filed by Oakmont Acquisition Corp. (“Oakmont”) on M ay 4, 2007. Oakmont is holding presentations for its stockholders regarding the merger of Oakmont and Brooke Credit Corporation (“BCC”), as described in earlier Form 8-Ks filed by Oakmont which describe the merger in more detail. Morgan Joseph & Co. Inc. (“Morgan Joseph”), the managing underwriter of Oakmont’s initial public offering (“IPO”) consummated in July 2005, is assisting Oakmont in these efforts without charge, other than the reimbursement of out-of-pocket expenses, although Morgan Joseph has a financial interest in the successful consummation of the proposed merger with Brooke Credit. As a part of its underwriting compensation in Oakmont’s IPO Morgan Joseph received an option to purchase up to a total of 720,000 Oakmont units. If the merger with Brooke Credit is not consummated this option will have no further economic value. Morgan Joseph has also served as financial advisor to Brooke Credit in connection with the negotiation of the merger. In connection with such services, Morgan Joseph is entitled to receive additional cash compensation upon the closing of the merger equal to 5.0% of the amount of cash and cash held in trust funds on Oakmont’s balance sheet as of the closing date of the merger. Morgan Joseph will only receive this additional compensation from Brooke Credit if the merger is consummated. Finally, Morgan Joseph has provided investment banking and financial advisory services to Brooke Credit in the past, for which Morgan Joseph received customary compensation comprising a cash fee and warrants to purchase 100,446 shares of Brooke Credit common stock. Oakmont, BCC, their respective directors and executive officers and Morgan Joseph may be deemed to be participants in the solicitation of proxies for the Oakmont special meeting of stockholders at which stockholders will be asked to approve this transaction. Stockholders of Oakmont and BCC and other interested persons are advised to read Oakmont’s preliminary proxy statement and, when available, Oakmont’s definitive proxy statement in connection with Oakmont’s solicitation of proxies for the special meeting at which Oakmont’s stockholders will be asked to approve the merger because these proxy statements contain important information. Such persons can also read Oakmont’s final prospectus, dated July 12, 2005, as well as periodic reports, for more information about Oakmont, its officers and directors, and their interests in the successful consummation of this business combination. The definitive proxy statement will be mailed to Oakmont’s stockholders as of a record date to be established for voting at the special meeting. Oakmont’s stockholders will also be able to obtain a copy of the definitive proxy statement, the final prospectus and other periodic reports filed with the Securities and Exchange Commission, without charge, by visiting the Securities and Exchange Commission’s Internet site at (http://www.sec.gov). |

- 3 - Forward-Looking Statements This presentation may contain forward-looking statements about Oakmont Acquisition Corp. (“Oakmont”), Brooke Credit Corporation (“BCC”) and their combined business after completion of the merger. Forward-looking statements are statements that are not historical facts. Such forward-looking statements, based upon the current beliefs and expectations of Oakmont’s and BCC’s management, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: – A significant part of BCC’s business strategy involves originating new loans and our failure to grow may adversely affect BCC’s business, prospects, results of operations and financial condition. – BCC’s borrower’s financial performance (which may be affected by, among other conditions, a softening insurance market and rising interest rates) may adversely affect their ability to repay amounts due to BCC. – BCC’s financial condition could be adversely affected if BCC is unable to fund loans through sales to third parties. – BCC makes certain assumptions regarding the profitability of its securitizations, participations, warehouse lines and other funding vehicles which may not prove to be accurate. – The value of the collateral securing BCC’s loans to borrowers may be adversely affected by the borrowers’ actions. – Potential litigation and regulatory proceedings could materially adversely affect BCC’s financial condition. |

- 4 - Forward-Looking Statements – BCC is dependent on key personnel. – BCC may be required to repurchase loans sold with recourse or make payments on guarantees. – BCC may not be able to accurately report financial results or prevent fraud if BCC fails to maintain an effective system of internal controls over financial reporting. – Efforts to comply with the Sarbanes-Oxley Act will entail significant expenditures; non- compliance with the Sarbanes-Oxley Act may adversely affect BCC. – BCC may not be able to achieve the loan origination, loan pricing, operating expense, sources of funding, fee and other income levels that it has assumed. – BCC may not be able to secure the lines of credit and additional sources of funding necessary to accommodate BCC’s growth – Changes in economic, political and regulatory environments, governmental policies, laws and regulations, including changes in accounting policies and standards and taxation requirements (such as new tax laws and new or revised tax law interpretations) could materially adversely affect BCC’s operations and financial condition. Other relevant risks are described in the amended Preliminary Proxy Statement filed on May 2, 2007 by Oakmont with the SEC. The information set forth herein should be read in light of such risks. Neither Oakmont, nor BCC assumes any obligation to update the information contained in this presentation. As a “blank check” company, the safe harbor provided for in the Private Securities Litigation Reform Act of 1995 does not apply to Oakmont in connection with the proposed merger. |

- 5 - Table of Contents Executive Summary Why Specialty Finance and Why BCC? BCC Overview Transaction Summary Appendix |

- 7 - Executive Summary Oakmont and its merger with BCC Oakmont Acquisition Corp. (“Oakmont”) is a blank check company – In July 2005, Oakmont raised $51.5 million through its IPO (8.58 million units at $6.00 each) – Each unit consisted of one share of common stock and two warrants with an exercise price of $5.00 and an expiration date of 7/11/09 – As of December 31, 2006, approximately $48.9 million of the offering proceeds including interest are in a trust account On February 8, 2007, Oakmont entered into a definitive agreement to merge with Brooke Credit Corporation (“BCC”) in an all-stock transaction; the definitive agreement was amended as of April 30, 2007 BCC is a specialty finance company that makes senior secured loans to insurance-related businesses, such as retail insurance agencies, managing general agencies, and funeral homes (funeral homes that generate revenues derived from the sale of pre-need life insurance products) – BCC is a wholly-owned subsidiary of Brooke Corp., which is a publicly traded company listed on the NASDAQ under the ticker BXXX The merger is expected to close in the second quarter of calendar 2007 The combined entity will seek NASDAQ listing and plans to be publicly traded as Brooke Credit Corporation Brooke Corp. will be the majority shareholder (prior to the exercise of outstanding Oakmont warrants) Mr. Robert Skandalaris, Oakmont’s CEO, has agreed to use reasonable best efforts to purchase approximately 333,333 shares of Oakmont common stock in the open market, valued at approximately $1.9 million Mr. Mick Lowry , BCC’s CEO, indicated his intent to purchase at least 100,000 shares of Oakmont in the open market Significant earnout shares based on achieving 2007 and 2008 adjusted earnings of $15.0 million and $19.0 million, respectively (5,000,000 shares) |

- 8 - Why Specialty Finance and Why BCC? |

- 9 - Why Specialty Finance? Specialty Finance Companies offer growth potential with limited competition and lower marketing costs than traditional lenders – Small business lending comprises a significant portion of the specialty finance universe – Typically target traditionally underserved and niche growth industries – Marketing efforts tend to be more effective and cost efficient due to targeted focus on specific industries Investors benefit from lender specialization – As a result of lender specialization, specialty finance companies can better underwrite, measure, and control loan quality as compared to traditional or generalist lenders Specialty Finance Companies appeal to small business owners – Specialty finance companies create loan products more specific to a borrower’s business • Typically result in more flexible and accommodating capital for small business owners – The loan approval process is more friendly to the borrower, due to the lenders’ understanding of their borrowers’ businesses • Standardized underwriting, due diligence, and documentation that typically results from specialized lending Specialty Finance Companies benefit traditional lenders – Traditional or generalist lenders typically lack underwriting expertise in niche industries, which discourages them from loaning directly to these specialized borrowers – Traditional lenders tap niche industries by funding specialty finance companies or purchasing loans/asset- backed securities in which they benefit from the lender specialization of specialty finance companies – Relationships with traditional lenders strengthen funding capacity and promote continued growth for specialty finance companies |

- 10 - Why BCC? BCC is a leading provider of senior secured loans to insurance-related businesses, including funeral homes that sell pre-need life insurance, in the United States – December 31, 2006 book value of $64.4 million ($109 million pro forma¹) – Loan portfolio of $483.3 million as of December 31, 2006 – Achieved 74% annualized growth rate in loan portfolio during 2006 Has generated $672 million in new loans since 2001 To-date has closed six loan securitizations, resulting in approximately $188 million in asset-backed securities issued Has increased interest spreads as loan programs have evolved and seasoned Lending to “main street businesses,” a large, underserved market with financing needs – Established reputation within the insurance and death care industries – Primarily to provide senior secured acquisition financing backed by personal guarantees to the following borrowers: • Retail Insurance Agencies (Franchise) • Retail Insurance Agencies (Non-Franchise) • Managing General Insurance Agencies (“MGAs”) • Independent Funeral Home Owners 1 Assumes maximum shareholder approval Misc. Loans 1% MGA Loans 18% Funeral Home Loans 12% Retail Insurance Agencies (Non Franchise) 11% Retail Insurance Agencies (Franchise) 58% |

- 11 - 1 According to FutureOne 2006 Agency Universe Study conducted by Independent Insurance Agents and Brokers of America. 2 According to 2004 National Directory of Morticians. Why BCC? Unique business model with entrenched relationships – Proprietary loan sourcing network provides steady stream of high-quality loan candidates – Deep credit underwriting expertise with proven success – Payment lockbox arrangement helps ensure control of cash flow from retail agency borrowers – Proprietary loan funding network 150+ institutions strong – Proprietary collateral preservation platform, which features the use of licensed insurance professionals and funeral home directors in monitoring and fixing distressed businesses, results in better control over credit quality Impressive loan portfolio growth and financial results – Loan portfolio grew 74% to approximately $483 million during fiscal 2006 – Five year portfolio CAGR of 62% – As a result of lender specialization and unique collateral preservation platform, BCC is better able to monitor and control credit quality – For fiscal years ended 2004, 2005, and 2006, BCC generated $2.2, $6.1, and $7.0 million of net income, resulting in a three year earnings CAGR of 48% Attractive target markets with underserved need – Over 37,500 independent insurance agencies¹ and 21,000 independent funeral homes² in the U.S. – Aging insurance agency entrepreneurs nearing retirement seeking liquidity – Agencies have strong, predictable cash flow – Deconsolidation trend of smaller funeral homes from public company consolidators creates need for acquisition financing |

- 12 - Why BCC? Pioneer in their industry with limited competition – Intangible nature of the asset collateral deters most traditional banks and lending institutions because they lack underwriting expertise to effectively measure and control credit quality – SBA lenders offer similar loans but at less favorable terms and can be an administrative burden for small insurance businesses – Potential competitors have fewer sourcing relationships and funding outlets, putting them at a disadvantage Proprietary relationships with diversified loan funding sources – Loan participations and asset-backed securities sold to nationwide network of over 150 banks – Pioneered securitization program of insurance agency loans; subsequently closed six securitizations with asset-backed securities issued of approximately $188 million – Five lines of credit with total availability of $100 million provides immediate source of loan funding Well-positioned to be a public company – Led by experienced management team that has been instrumental in BCC’s growth since inception – Public parent has required diligent fiscal and operational discipline; BCC is currently in testing phase of SOX 404 – Mature securitization model and relationship within over 150 funding partners, resulting in increased due diligence and increased underwriting and loan servicing discipline – Management has created an entrepreneurial firm with the systems and transparency of a public company |

- 14 - BCC has well-developed processes to measure loan quality through extensive credit analysis, background checks, in-person interviews, and third-party diligence BCC has deep expertise in underwriting loans to a demographic with intangible business assets The underwriting process measures human capital, which BCC believes is the key to creating business value in this sector, by use of personality and skills testing BCC has two types of ongoing loan servicing: Standard and Special – Standard loan servicing includes boarding loans, collecting and processing loan payments; performed primarily by third-party firms such as Bank of NY or Textron Financial – Special loan servicing features close monitoring and ranking of loan performance and utilization of collateral preservation and loss mitigation activities to preserve underperforming loans BCC Overview What BCC Does BCC currently lends to four basic types of borrowers: Historically these groups have been underserved by traditional lenders – Managing general agencies (MGAs) – Independent funeral home owners – Retail insurance agencies (Franchise) – Retail insurance agencies (Non-Franchise) BCC receives a steady stream of loan referrals from three primary sources: – Proprietary Loan Sourcing Network offers high-quality loan referrals – Brooke Franchise, affiliate company of BCC, that is a nationwide franchisor of property and casualty (P&C) insurance agencies – Internal loan-sourcing professionals generate loans through well-planned marketing efforts TARGET DEMOGRAPHICS LOAN SOURCING LOAN UNDERWRITING ONGOING LOAN SERVICING |

- 15 - BCC Overview Loan Summary 10 years 15 years 12 years 15 years Maximum Maturity $5.0 million $747,000 $594,000 $290,000 Average Loan Size 18 50 85 590 Number of Obligors 18 75 91 962 Number of Loans $89.5 million $56.0 million $54.0 million $279.0 million Loan Amount MGA Loans Funeral Home Loans Retail Agency Loans (Non- Franchise) Retail Agency Loans (Franchise) |

- 16 - Company maintains five lines of credit for on-balance sheet funding Bank lines used for immediate on-balance sheet funding needs Cumulative availability of $100 million Cost of funds is expected to continue to improve as the loan portfolio seasons BCC pioneered the securitization of insurance agency loans Completed six securitizations to date and issued approximately $188 million in asset-backed securities Most profitable off-balance sheet loan funding method Non-recourse sale of loan participation interests in loans BCC is responsible for ongoing servicing but transfers credit risk off-balance sheet to loan participants Used as a seasoning platform for new loan types BCC Overview Loan Funding Loan Participations Loan Securitizations Warehouse Lines On-Balance Sheet Funding Methods Off-Balance Sheet Funding Methods Participations Securitizations On-Balance Sheet 12/31/2005 34% 51% 15% 12/31/2004 47% 29% 24% 12/31/2006 31% 35% 34% |

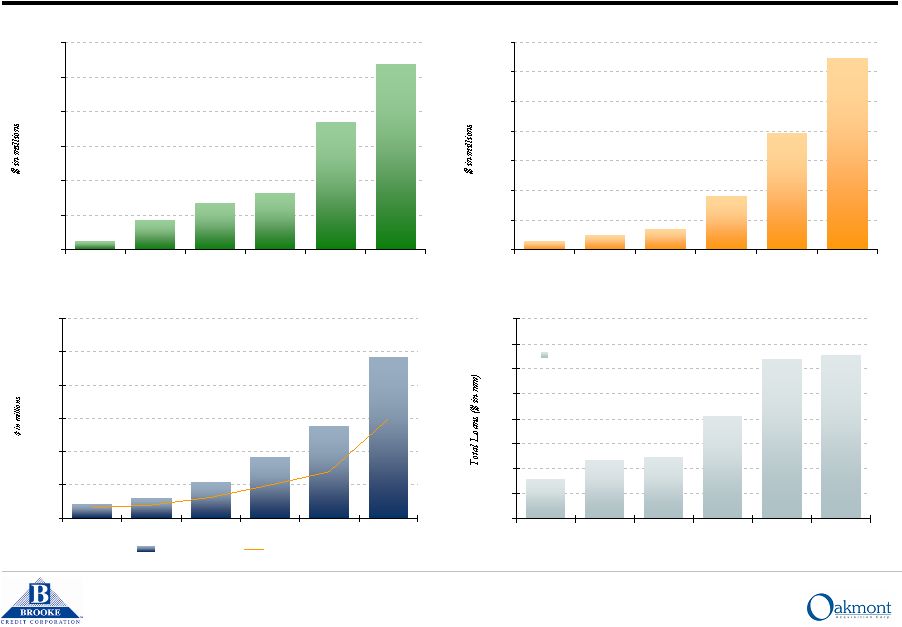

- 17 - BCC Overview Historical Operating Results Revenues Loan Portfolio Growth Book Value Increasing Size of Securitizations $43 $60 $108 $183 $277 $483 $- $100 $200 $300 $400 $500 $600 2001 2002 2003 2004 2005 2006 Aggregate Balance New Originations $16 $24 $25 $41 $64 $65 $0 $10 $20 $30 $40 $50 $60 $70 $80 Apr 2003 Nov 2003 Jun 2004 Mar 2005 Dec 2005 Jul 2006 Securitization Date Total Loans $1.3 $4.3 $6.7 $8.3 $18.4 $26.8 $- $5 $10 $15 $20 $25 $30 2001 2002 2003 2004 2005 2006 $2.9 $5.0 $7.3 $18.2 $39.2 $64.4 $- $10 $20 $30 $40 $50 $60 $70 2001 2002 2003 2004 2005 2006 |

- 18 - BCC intends to implement the following initiatives to facilitate high growth Enhance Marketing Effort – Continue expanding its relationships with consultants, consolidators, and franchisors to discover new leads – Increase direct marketing efforts to banks and business owners Further Streamline Underwriting – Increase the efficiency of the underwriting process by expanding personnel resources, enhancing risk profiling measures, and continuing emphasis on senior management’s oversight to ensure future credit quality Further Streamline Special Loan Servicing Activities – Continue the raising of the reporting requirements, expand and develop special loan servicing personnel, and continue emphasis on oversight by senior staff on loss mitigation activities Formalize new collateral preservation services agreements – Increasing relationships with collateral preservation agents will assist in portfolio growth and provide expertise in possible additional vertical markets. Enhance Loan Funding – Through several courses of action, BCC intends to continue to negotiate increasingly favorable pricing spreads and increase its network of bank relationships to enhance the cost and efficiency of its loan funding activities BCC Overview Growth Strategy |

- 19 - BCC Overview BCC’s Historical Income Statement ($ in thousands) 2004 2005 2006 OPERATING REVENUES: Interest Income, net 5,739 $ 10,674 $ 19,147 $ Gain on Sale of Notes Receivable 2,448 7,459 7,409 Other Income 64 316 224 Total Operating Revenues 8,251 18,449 26,780 OPERATING EXPENSES: Other Operating Interest Expense 717 1,920 3,125 Payroll Expense 1,441 1,483 1,596 Amortization 973 1,120 876 Other Operating Expense 1,121 2,802 5,999 Total Operating Expenses 4,252 7,325 11,596 Income from Operations 3,999 11,124 15,184 Interest Expense 648 1,288 3,919 Income Before Taxes 3,351 9,836 11,265 Provision for Income Taxes 1,139 3,738 4,281 Net Income 2,212 $ 6,098 $ 6,984 $ |

- 20 - BCC Overview BCC’s Historical Balance Sheet ($ in thousands) 2004 2005 2006 ASSETS: Cash 5,697 $ 2,855 $ 4,358 $ Restricted Cash - - 564 Notes & Interest Receivable, net 49,360 43,221 169,186 Other Receivables 48 591 496 Securities 17,115 44,681 50,320 Interest-Only Strip Receivable 2,509 1,434 4,511 Total Current Assets 74,729 92,782 229,435 Deferred Charges 650 779 5,691 Servicing Asset 2,948 2,726 4,564 Receivable from Parent - - 13,501 Prepaid Expenses and Other Assets 495 342 1,037 Total Assets 78,822 $ 96,629 $ 254,228 $ LIABILITIES AND STOCKHOLDERS' EQUITY: Accounts Payable 237 $ 298 $ 2,751 $ Interest Payable 645 664 1,457 Income Tax Payable to Parent 1,139 3,738 782 Current Deferred Income Tax Payable - - 1,196 Payable to Parent 16,532 12,978 - Payable Under Participation Agreement 2,452 10,857 33,479 Short-Term Debt 27,097 8,787 96,644 Current Maturities of Long-Term Debt 765 3,485 16 Total Current Liabilities 48,867 40,807 136,325 Long-Term Deferred Income Tax Payable 259 247 7,685 Servicing Liability 124 115 74 Long-Term Debt less Current Maturities 11,421 16,230 42,894 Warrant Obligation - - 2,821 Total Liabilities 60,671 $ 57,399 $ 189,799 $ Common Stock 65 $ 65 $ 57 $ Treasury Stock (15) (15) - Additional Paid-In Capital 10,641 25,641 43,134 Additional Paid-In Capital - Warrants - - 900 Retained Earnings 6,958 13,056 20,040 Accumulated Other Comprehensive Income 502 483 298 Total Stockholders' Equity 18,151 39,230 64,429 Total Liabilities and Stockholders' Equity 78,822 $ 96,629 $ 254,228 $ |

- 21 - BCC Overview Other Considerations Experienced management team with proven ability to deliver results Strong earnings visibility resulting from seasoned loans Ability to grow portfolio via other insurance related verticals Already on path for Sarbanes-Oxley compliance with minimal incremental new expenses; BCC has been subject to Sarbanes-Oxley compliance requirements as a consolidated subsidiary of Brooke Corporation and is currently testing its Sarbanes-Oxley Act Section 404 compliance Post Merger Considerations: Equity capital will be used to fund the continued growth of the portfolio Institutional familiarity due to status as subsidiary of a public company |

- 23 - Transaction Summary Oakmont entered a definitive agreement providing for the merger of BCC and Oakmont, with Oakmont surviving the merger and changing its name to Brooke Credit Corporation Under the terms of the Plan of Merger, the total consideration paid to the equity holders of BCC by Oakmont consists of: – 17,455,090 newly issued shares of Oakmont stock at closing – 5,000,000 Earnout Shares as follows: • 4,000,000 shares to be issued post-merger upon BCC achieving 2007 adjusted earnings of at least $15.0 million • 1,000,000 shares to be issued post-merger upon BCC achieving 2008 adjusted earnings of at least $19.0 million Combined entity expects to seek a NASDAQ listing upon closing Brooke Corp. will be the majority shareholder of the combined entity (prior to the exercise of outstanding Oakmont warrants) |

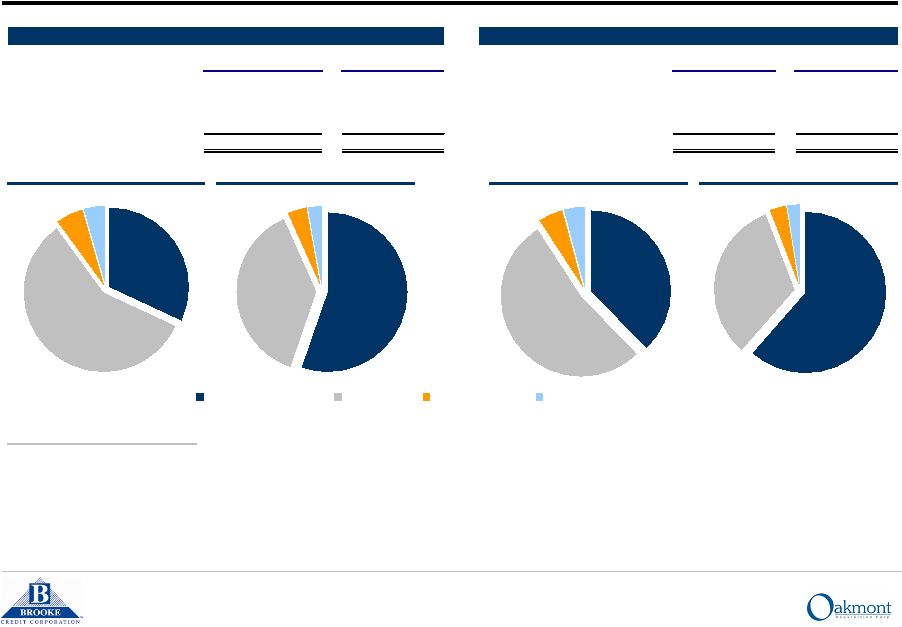

- 24 - Transaction Summary Pro Forma Ownership Proforma Ownership (Assuming Earnout) 1,5 Proforma Ownership (Assuming NO Earnout) 2,5 (thousands) Basic³ Diluted 4 Basic³ Diluted 4 Oakmont Stockholders 10,575 32.0% 27,725 55.3% Oakmont Stockholders 10,575 37.7% 27,725 61.4% Brooke Corp. 19,124 57.9% 19,124 38.1% Brooke Corp. 14,865 53.0% 14,865 32.9% BCC Management 1,875 5.7% 1,875 3.7% BCC Management 1,458 5.2% 1,458 3.2% Other Existing BCC Equityholders 1,456 4.4% 1,456 2.9% Other Existing BCC Equityholders 1,132 4.1% 1,132 2.5% Total 33,030 100.0% 50,181 100.0% Total 28,030 100.0% 45,181 100.0% Basic Diluted Basic Diluted 32.0% 4.4% 5.7% 57.9% Oakmont Stockholders Brooke Corp. BCC Management Other Existing BCC Equityholders 38.1% 3.7% 2.9% 55.3% 37.7% 4.1% 5.2% 53.0% 61.4% 2.5% 3.2% 32.9% Notes: 1 Earnout consists of 4,000,000 shares to be issued upon BCC achieving 2007 adjusted earnings of at least $15.0 million, and 1,000,000 shares to be issued upon BCC achieving 2008 adjusted earnings of at least $19.0 million. 2 Assumes that none of the 5,000,000 potential earnout shares are issued. 3 Assumes no Oakmont warrants exercised. 4 Assumes the exercise of outstanding Oakmont warrants 5 Assumes no redemptions and no exercise of Underwriters’ Purchase Option (UPO). Assuming a cashless exercise of the UPO, UPO would result in the issuance of no new shares at a stock price of $6.30 per share or less, and approximately 559,000 shares at a stock price of $8.50 per share. |

- 26 - Key Executives – BCC Anita Larson – Chairman of the Board, Director – Joined Brooke Corp. in 1999 – Chairman / Director of BCC since April 2006 – President / COO of Brooke Corp. since January 2005 – Prior Experience: The Equitable Life Assurance Society of the United States; First Security Benefit Life Insurance and Annuity Company Mick Lowry – President, CEO and Director – Joined BCC in 1998 – Served in current capacity since 2003 – Prior Experience: Sunflower Bank in Salina, Kansas Leland Orr, CPA – Interim Chief Financial Officer – CFO of Brooke Corp. since 1995 – Director and Treasurer of Brooke Corp. since 1986 – Member of Audit and Executive Committees of Brooke Corp. – Prior Experience: Brooke State Bank; Kennedy, McKee & Company |

- 27 - Key Executives – Oakmont Robert J. Skandalaris – Chairman and Chief Executive Officer – Managing Director and Principal of Quantum Value Management, LLC – Founder and current Chairman of Noble International Ltd., a full-service provider of tailored laser welded blanks and tubes for the automotive industry – Prior to founding Noble in 1993, Mr. Skandalaris was Vice Chairman and a shareholder of The Oxford Investment Group, Inc., a Michigan-based merchant banking firm, and served as Chairman and Chief Executive Officer of Acorn Asset Management, a privately held investment advisory firm – Began his career as a CPA with the national accounting firm of Touche Ross & Co. – Mr. Skandalaris holds a B.A. from Michigan State University and a M.S.A. from Eastern Michigan University Michael C. Azar – President, Principal Accounting Officer, Secretary, and Director – Managing Director and Principal of Quantum Value Management, LLC – Served as Vice President and Secretary for Noble International, Ltd. since 1996, and as General Counsel from 1996 to 2006 – He also served as a member of Noble’s Board of Directors from December 1996 until November 1997 – Executive officer of Veri-Tek International, Corp., a publicly traded equipment manufacturer – Prior to joining Noble, Mr. Azar was employed as General Counsel to River Capital, Inc., an investment banking firm – Mr. Azar holds a B.A. from Kalamazoo College and a J.D. from the University of Detroit |