| | | | |

| | May 29, 2007 | | ATTORNEYS AT LAW ONE DETROIT CENTER 500 WOODWARD AVENUE, SUITE 2700 DETROIT, MI 48226-3489 313.234.7100 TEL 313.234.2800 FAX www.foley.com thartman@foley.com EMAIL CLIENT/MATTER NUMBER 071569-0104 |

| | | | | | |

Mail Stop 3720 Securities and Exchange Commission 100 F. Street, N.E. Washington, DC 20549-9303 | | |

| | |

Attention: | | Mr. John Zitko Ms. Kathryn Jacobson Mr. Dean Suehiro | | |

| | | |

| | Re: | | Oakmont Acquisition Corp. Amendment No. 2 to Proxy Statement on Schedule 14A File No. 0-51423 | | |

Ladies and Gentlemen:

This letter is in response to your comment letter dated May 18, 2007. Your comments are reproduced below in bold italics, followed in each case by our response on behalf of our client, Oakmont Acquisition Corp.

To facilitate the staff’s review of the filing, we are furnishing to Mr. John Zitko under separate cover four copies of this letter and a blacklined version of the amended proxy statement being filed contemporaneously herewith, marked to show inserted text and deletions.

General

| 1. | We note your response to comment one from our letter of April 12, 2007, including the administrative error that resulting in the late filing of Form 8-K. Please include disclosure in the proxy statement that the company did not meet the requirements of Form 8-K as well as the ramifications for the company and its shareholders of such non-compliance. |

Response: The Company notes that Rule 13a-11(c) under the Securities Exchange Act, as amended (the “Exchange Act”), provides that no failure to file a report on Form 8-K that is required solely pursuant to Items 1.01 or 1.02 (among other items) of Form 8-K shall be deemed a violation of Section 10(b) of the Exchange Act and Rule 10b-5 promulgated thereunder. The Company further notes that in connection with the adoption of Regulation F-D the Commission has determined that public disclosure under Regulation F-D will include press releases distributed through a widely circulated news or wire service. See the second paragraph under Section II.B.4.b. of Release No. 33-7881, dated August 15, 2000. Finally, although the Company inadvertently failed to timely file a Form 8-K in connection with the termination of the One Source transaction and the execution of the Letter of Intent with Brooke Credit, it did issue a press release with respect to both matters through PR Newswire. The

| | | | | | | | |

BOSTON BRUSSELS CHICAGO DETROIT JACKSONVILLE | | LOS ANGELES MADISON MILWAUKEE NEW YORK ORLANDO | | SACRAMENTO SAN DIEGO SAN DIEGO/DEL MAR SAN FRANCISCO SILICON VALLEY | | TALLAHASSEE TAMPA TOKYO WASHINGTON, D.C. | | |

Securities and Exchange Commission

May 29, 2007

Page 2

Company also notes that there was no other separate disclosure obligation (other than its obligations under Form 8-K) with respect to these transactions. Therefore, the Company believes the only ramification of the failure to file the press release via Form 8-K is potential liability under Section 13(a) of the Exchange Act. While the Company does not minimize this potential liability, it also does not believe it justifies specific disclosure of the failure to file the Form 8-K in the proxy statement absent a specific requirement to do so under Schedule 14A or otherwise.

| 2. | While your response to comment two addresses purchases and sales of common stock, it does not appear to address purchases and sales of warrants. Accordingly, and again with a view towards disclosure, please advise us of each purchase and sale of Oakmont warrants by your officers and directors, including date, time, volume, and manner in which each transaction was effected. |

Response: No Oakmont directors of officers have sold warrants. Mr. Skandalaris and Mr. Azar are the only Oakmont directors or officers who have purchased warrants. The tables below set forth the date, volume, price and manner in which each transaction was effected:

| | | | | | | |

| Mr. Robert J. Skandalaris |

| | | |

Date | | Number of Warrants | | Price | | Manner |

8/23/2005 | | 125,300 | | $ | 0.37 | | Open Market |

8/24/2005 | | 230,552 | | $ | 0.39 | | Open Market |

8/25/2005 | | 72,048 | | $ | 0.43 | | Open Market |

8/26/2005 | | 65,783 | | $ | 0.42 | | Open Market |

8/29/2005 | | 3,126 | | $ | 0.42 | | Open Market |

10/3/2005 | | 89,110 | | $ | 0.49 | | Open Market |

10/4/2005 | | 104,580 | | $ | 0.498 | | Open Market |

10/6/2005 | | 169,500 | | $ | 0.489 | | Open Market |

10/7/2005 | | 31,500 | | $ | 0.50 | | Open Market |

10/11/2005 | | 630 | | $ | 0.48 | | Open Market |

10/17/2005 | | 125,500 | | $ | 0.456 | | Open Market |

10/18/2005 | | 130,500 | | $ | 0.499 | | Open Market |

3/15/2007 | | 3,133 | | $ | 0.52 | | Open Market |

3/16/2007 | | 6,300 | | $ | 0.53 | | Open Market |

3/19/2007 | | 8,771 | | $ | 0.54 | | Open Market |

|

| Mr. Michael C. Azar |

| | | |

Date | | Number of Warrants | | Price | | Manner |

8/23/2005 | | 74,700 | | $ | 0.37 | | Open Market |

8/24/2005 | | 137,448 | | $ | 0.39 | | Open Market |

8/25/2005 | | 42,953 | | $ | 0.43 | | Open Market |

8/26/2005 | | 39,218 | | $ | 0.42 | | Open Market |

8/29/2005 | | 1,874 | | $ | 0.42 | | Open Market |

10/3/2005 | | 43,890 | | $ | 0.49 | | Open Market |

10/4/2005 | | 61,420 | | $ | 0.498 | | Open Market |

10/11/2005 | | 370 | | $ | 0.48 | | Open Market |

10/18/2005 | | 20,000 | | $ | 0.499 | | Open Market |

3/15/2007 | | 1,867 | | $ | 0.52 | | Open Market |

3/16/2007 | | 3,700 | | $ | 0.53 | | Open Market |

3/19/2007 | | 5,229 | | $ | 0.54 | | Open Market |

Securities and Exchange Commission

May 29, 2007

Page 3

Additionally, we note that Mr. Skandalaris purchased 500,000 shares of Oakmont common stock on the open market on May 17, 2007. This purchase is reflected in the Principal Stockholders table and identified in the appropriate footnote for Mr. Skandalaris, and is also disclosed under the section entitled“Item 1: The Merger Proposal – Oakmont Common Stock Purchases.”

| 3. | We note your response to comment three and the added section entitled “Interest of Morgan Joseph in the Merger,” but we could not locate any additional disclosure relating to this issue in the section entitled “Oakmont’s Board of Directors’ Reasons for the Approval of the Merger.” Accordingly, we reissue our prior comment in part. |

Response: The Company has added the requested disclosure to the fourth paragraph under the section entitled“Oakmont’s Board of Directors Reasons for the Approval of the Merger.”

| 4. | We reissue prior comment seven, which was not limited to the examples specifically presented. The disclosure throughout your proxy statement continues to contain many promotional, rather than factual, statements that are either not clearly labeled as the opinion of management of the company or presented with disclosure of the reasonable basis for such opinions or beliefs (e.g., “attractive specialty finance company,” “attractive growth profiles,” and “Brooke Credit’s unique, diverse and mature funding platform.”). Please revise the proxy statement throughout to remove promotional statements. Again, this comment is not limited to the examples provided herein. |

Response: We have revised the proxy statement throughout to remove promotional statements or label them as the opinion of management with the reasonable basis for such opinions or beliefs.

| 5. | As requested in our prior comment eight, with your next response letter, please provide us withmarked copies of any materials that support any third party statements, clearly cross-referencing each third party statement contained in your proxy with the underlying factual support. |

Response: The Company has provided with this letter marked, cross-referenced portions of the FutureOne 2006 Agency Universe Study conducted by the Independent Insurance Agents and Brokers of America, previously included as Annex C to the Company’s prior response letter (pages A-1 and A-2 of Annex A to this letter), information from the U.S. Department of Labor, Bureau of Statistics, previously included as Annex E to the prior response letter (page A-3 of Annex A to this letter), and statistics from the National Funeral Directors Association, previously included as Annex F to the prior response letter (page A-4 of Annex A to this letter). Each of these third party statements are disclosed under the section entitled“Information About Brooke Credit – Competitive Strengths – Target Markets” of the proxy statement.

Securities and Exchange Commission

May 29, 2007

Page 4

| 6. | Your response to comment ten notes that Mr. Azar participated in the evaluation of the disclosure controls and procedures and executed certifications in his role as Principal Accounting Officer. However, the requirements of Item 307 of Regulation S-K and Sections 302 and 906 direct that such disclosure and certifications arise out of the CEO’s andCFO’s evaluations and conclusions. Accordingly, we reissue our prior comment. Please advise how Oakmont meets the requirements of Item 307 and Sections 302 and 906, or file full amendments for all filings that do not meet such requirements. |

Response: The Company notes that both Item 307 of Regulation S-B and Section 302 of the Sarbanes-Oxley Act provide that the required certifications are to be made by the “principal executive and principal financial officers,or persons performing similar functions.” (emphasis added). The Company further notes that Section 906 of the Sarbanes-Oxley Act provides that the required certifications are to be made by the “chief executive officer and chief financial officer (or equivalent thereof)” (emphasis added). Mr. Azar, as Principal Accounting Officer, performs the function of, and is the equivalent of, a principal financial officer or chief financial officer for Oakmont. Therefore, the Company believes it has met the requirements of Item 307 and Sections 302 and 906.

Questions and Answers, page 1

| 7. | Your revised disclosure indicates that approval of the merger proposal will require the affirmative vote of holders of a majority of the shares “present or represented at the meeting.” Please advise us whether this standard is consistent with the disclosure in your IPO prospectus indicating that ‘[w]e will proceed with a business combination only if a majority of the shares of common stock voted by the public stockholders are voted in favor of the business combination.” Advise us why the language differs in the two documents. |

Response: We believe that the standard is equivalent with the statement in the IPO prospectus. However, for consistency and to avoid possible confusion, we have revised the proxy statement with wording that is virtually identical to the wording in the IPO prospectus.

| 8. | Clarify here and on the proxy card whether the incentive plan proposal is conditioned upon approval of the merger proposal. See prior comment 14. |

Response: We have clarified in this section and on the proxy card that the incentive plan proposal is conditioned upon approval of the merger proposal.

| 9. | As required in prior comment 12, disclose the dollar value of the consideration to be paid in the merger based on the closing price of Oakmont’s common stock as of the latest date practical prior to mailing the definitive proxy materials in addition to the price on April 30, 2007. for now, you may insert a placeholder for this information. Also disclose the dollar value of the 2.4 million shares that will be issued or reserved for issuance in connection with warrants and stock and options to be granted under the equity incentive plan. In addition, disclose the aggregate value of the consideration assuming the issuance of all shares. |

Response: The Company has added the requested disclosure to the answer to the ninth question under the section entitled“Questions and Answers About the Proposals.”

Securities and Exchange Commission

May29, 2007

Page 5

Summary, page 5

Business Rational for Merging with Brooke Credit Corporation, page 6

| 10. | Please provide disclosure in both your summary and business sections that supports your view that the “unique collateral preservation platform” is an appealing aspect of acquiring Brooke Credit. We note that it is a different entity, Brooke Franchise, that provides such services and that you additionally state elsewhere in your proxy that you cannot assure that Brooke Franchise will be able to continue to provide effective collateral preservation services. |

Response: The Company has revised the section entitled “Summary - Business Rationale for Merging with Brooke Credit Corporation” of the proxy statement to clarify the appeal of Brooke Credit’s collateral preservation platform. Although the Company believes Brooke Credit’s collateral preservation platform to be “unique,” the Company has deleted the word to avoid having to include lengthy disclosure detailing the unique nature of the platform. Additional disclosure is also set forth in the section entitled “Information About Brooke Credit - Competitive Strengths- Brooke Credit’s Business Model.”

As disclosed in the risk factors, there is no guaranty that Brooke Credit’s affiliates will be willing or able to continue to provide such services indefinitely and there is a risk that its affiliates may discontinue providing such services. However, Brooke Credit believes it would be able to effectively utilize backup providers or contract with other collateral services providers to provide the services.

Risk Factors, page 13

| 11. | We note your disclosure on page 14 that “As of December 31, 2006, we had loan balances of $483.3 million, of which over 80% was funded through money obtained from unaffiliated third parties.” However, we also note the statement contained in your response letter under Annex H, Schedule 2.7(e) that suggests the aggregate principal balance was $497.69 million, with $483.28 million being related party loans. Please supply us with a copy of Schedule 2.7(e) and advise as to the apparent inconsistency. |

Response: The percentage referenced above in the risk factors pertains to loan funding and that 80% of the Brooke Credit’s loan balances were funded by sales of loans to unaffiliated parties. Annex H refers to loans originated by Brooke Credit to affiliated parties and discloses that out of total loan balances of $497.69 million, $483.28 million were originated to unaffiliated borrowers. Annex H with respect to Schedule 2.7(e) has been revised to clarify that the reference to loan balances of $497.69 million includes related party and unaffiliated loan balances and that the reference to loan balances of $483.28 million is net of loans originated to related parties. A copy of Schedule 2.7(e) is attached as Annex B to this letter.

The Merger Proposal, page 26

| 12. | Please include all financial projections exchanged between Brooke Capital and Oakmont as disclosure in this section of the proxy statement as opposed to Annex F. Also, as requested previously in prior comment 37, disclose thebases for and the nature of the material assumptions underlying the projections instead of simply listing the assumptions. |

Response: The Company has removed Annex F and added the financial projections contained therein under a new section entitled,“Item 1: The Merger Proposal – Brooke CreditProjections.” The Company notes your request for

Securities and Exchange Commission

May 29, 2007

Page 6

additional disclosure regarding the bases for and the nature of the material assumptions underlying the financial projections, but believes that additional disclosure is not required or applicable. The Company understands that the Brooke Credit financial projections used by the Company’s board in connection with its evaluation of the proposed merger are appropriate disclosure in order to provide the Company’s stockholders an opportunity to review the material information used by the board, and has provided those projections in the proxy statement in the same form provided to the board. The board did not receiveany additional information regarding the assumptions Brooke made in preparing these projections, and the Company believes it is neither required nor appropriate to provide information in the proxy statement beyond that provided to the board.

The merger, page 26

| 13. | We note your revisions in response to prior comment 29, but the disclosure does not rule out any additional recipients. Please affirmatively disclose the identify ofall such parties, including those who will by operation of any relevant contractual terms be eligible to receive monies or shares as a result of the consummation of the proposed transaction. In addition, please provide us with a copy of Schedule 2.3, the Brooke Credit stockholder list, for our review. |

Response: There are no other recipients other than those disclosed in the proxy statement under the referenced section who will receive monies or shares as a result of the consummation of the transaction, including those who will by operation of any relevant contractual terms be eligible to receive monies or shares as a result of the consummation of the proposed transaction. The Brooke Credit stockholder list is attached to this letter as Annex C.

Background of the Merger, page 26

| 14. | You state on page 26 that “[t]he terms of the Merger Agreement are the result of arm’s-length negotiations between representatives of Oakmont, Brooke Corp. and Brooke Credit.” In this location, please clarify the basis for your use of the term “arm’s length” in light of, but not limited to, your disclosure of Morgan Joseph’s role in the transaction, including: |

| | • | | Being retained in January 2007 as Brooke Credit’s exclusive financial advisor in connection with a potential transaction with Oakmont, a result of which Brooke Credit will pay Morgan Joseph a cash fee equal to 5.0% of the amount of cash held in Oakmont’s trust fund as of the closing date of the merger; |

| | • | | Underwriting Oakmont’s IPO, as a result of which it received consideration contingent upon the successful consummation of a transaction; and |

| | • | | Providing “investment banking and financial advisory services to Brooke Credit in the past.” |

Response: The Company has added the requested disclosure in the first paragraph under the section entitled“Background of the Merger.”

Securities and Exchange Commission

May 29, 2007

Page 7

| 15. | We note your disclosure on page 28 that Mr. Skandalaris was informed of the Brooke Credit opportunity in January 2007. Please clarify what the “opportunity” was and provide disclosure with respect to how and when Brooke Credit decided to offer such opportunity. |

Response: The Company has added disclosure to the twelfth paragraph under the section entitled“Background of the Merger” in response to this comment.

| 16. | It remains unclear how the parties initially determined that the merger consideration would consist of 17.4 million shares of Oakmont common stock and ultimately 17.5 million shares. Please revise to provide greater insight into how the number of shares was determined, including the relationship between that figure and the ratio of the stockholder’s equity of each company. |

Response: The Company has added additional disclosure to the eighteenth paragraph under the section entitled“Background of the Merger” in response to this comment.

Oakmont’s Board of Directors’ Reasons for the Approval of the Merger, page 29

| 17. | We note your responses to comments 36, 37 and 41 and that you have removed any reference to a valuation analysis because “Oakmont did not perform such an analysis and the previous reference was in error.” Pleaser revise your proxy statement to include this statement in this section and under “Satisfaction of the 80% Test.” Address what consideration the board gave to performing a valuation analysis (or retain an advisor to perform such an analysis) and why it declined to do so. |

Response: The Company has revised the second paragraph under the section entitled“Oakmont’s Board of Directors’ Reasons for the Approval of the Merger” to disclose that the board did not perform a formal valuation analysis with respect to Brooke Credit, and that the board did not consider engaging an advisor to perform such a formal valuation analysis.

| 18. | In connection with the preceding comment, please disclose how such failure to perform a valuation analysis is consistent with the disclosure contained in Oakmont’s IPO prospectus. For instance, the prospectus provides that “[t]he fair market value of such business will be determined by our board of directors based upon standards generally accepted by the financial community, such as actual and potential sales, earnings and cash flow and book value. If our board is not able to independently determine that the target business has a sufficient fair market value, we will obtain an opinion from an unaffiliated, independent investment banking firm which is a member of the National Association of Securities Dealers, Inc. with respect to the satisfaction of such criteria.” If you conclude that it is not consistent, please disclose any possible ramifications to Oakmont and its shareholders that result. |

Response: The Company believes the board’s determination to not perform a formal valuation analysis is consistent with the disclosure in the IPO prospectus. First, the Company notes that the language from the IPO prospectus quoted in this comment relates to the board’s determination as to whether the 80% test has been satisfied (see the IPO prospectus at pages 23-24 under the caption“Fair Market Value of Target Business”), not the board’s determination to approve the merger. But even if this

Securities and Exchange Commission

May 29, 2007

Page 8

disclosure does apply to the board’s determination to approve the merger and at any rate with respect to the board’s determination that the 80% test has been satisfied, the Company notes that the disclosure basically says the board will engage a financial advisor only if the board is not able to determine the fair market value itself. The directors determined that the consideration was fair and reasonable and the proposed merger was in the best interests of Oakmont’s stockholders, and that the 80% test was satisfied, without a formal valuation analysis, basing these determinations on their individual and collective experience in buying and selling businesses.

The Company is not aware of any disclosure in the IPO prospectus or any agreement, rule or regulation binding upon the Company or its directors requiring the engagement of a financial advisor or the performance of a formal valuation analysis.

| 19. | Expand the first paragraph at the top of page 30 to explain how the board reached a conclusion that the consideration to be paid was “fair and reasonable.” Describe in detail the analyses the board performed, if any, and how it utilized the information obtained from Brooke Credit’s management presentation, the confidential information memorandum and other sources. |

Response: The Company has revised the indicated paragraph in response to this comment.

| 20. | As requested in prior comment 39, revise this section to address what consideration the board gave to the company’s potential loss of leverage in negotiating the terms of an acquisition since Brooke Credit and its affiliates knew that it had a firm deadline for completing the acquisition. |

Response: The Company has further revised the disclosure added as the fourth paragraph under the section entitled“Oakmont’s Board of Directors’ Reasons for the Approval of the Merger” to address this comment.

Satisfaction of the 80% Test, page 31

| 21. | Discuss why the board deemed it appropriate to rely upon the value of the consideration to be paid in the merger in evaluating whether Brooke Credit satisfies the 80% test. In this regard, it appears that Oakmont could offer to issue a certain number of shares to ensure that any potential target would meet the 80% test. |

Response: The board considered, but did not rely exclusively upon, the valuation of the consideration paid in evaluating whether the transaction with Brooke Credit satisfied the 80% test. The Board deemed this reliance appropriate because the board believed the value of the merger consideration was reached through an arm’s-length negotiating process with Brooke Corporation, a sophisticated public company with experienced legal and financial advisors. Furthermore, Oakmont made the first offer in the negotiation of the letter of intent as to value, and as disclosed in the proxy statement, it based that valuation on the combined stockholders’ equity of the two companies, an amount that is not dependent upon the number of shares issued (for instance, as more shares are issued, the value per share declines and the stockholders’ equity remains constant). Brooke basically accepted this valuation for the closing payment, with the additional consideration only payable in the future if the financial milestones are met. The fact that Brooke basically accepted this valuation is a strong indication of its reliability. The Company is not aware that Brooke was under any immediate pressure to sell any portion of its Brooke Credit equity or otherwise have any reason to accept a valuation that was not reflective of Brooke Credit’s fair market value.

Securities and Exchange Commission

May 29, 2007

Page 9

| 22. | Provide an enhanced description of how the board specifically analyzed Brooke Credit’s projections and other financial data to assess its fair market value. See prior comment 41. |

Response: The Company has added additional disclosure to the third paragraph under the section entitled“Satisfaction of 80% Test” in response to this comment.

Interest of Morgan Joseph in the Merger, page 32

| 23. | Please specifically disclose all “investment banking and financial advisory services [provided] to Brooke Credit in the past” as we note your disclosure uses the word “including” with respect to Morgan Joseph’s activities as placement agent. Additionally, please provide more detail with respect to that engagement and the “customary compensation” provided to Morgan Joseph including, but not limited to, the exact amounts already paid and any amounts that may be due in the future. Please clarify how any change of control of Brooke Credit could affect amounts payable to Morgan Joseph. |

Response: The section entitled “Item 1: The Merger Proposal—Interest of Morgan Joseph in the Merger” has been revised to more specifically identify the compensation and services provided to Brooke Credit by Morgan Joseph and to clarify that amounts paid to Morgan Joseph would not be affected by a change of control of Brooke Credit.

Anticipated Accounting Treatment, page 33

| 24. | Please refer to prior comment 43. Please tell us in more detail how you considered each of the paragraphs 17(a)-(e) of SFAS 141 in concluding that the shareholders of Brooke Corporation and Brooke Credit Corporation have control of the combined company after the merger. In your response, tell us in more detail how you considered the warrants in arriving at your conclusion. |

Response: Paragraph 17 of SFAS 141 provides that the following facts and circumstances should be considered:

(a)The relative voting rights in the combined entity after the combination. Brooke Corporation will receive the larger portion of the voting rights. Although there is a significant number of warrants outstanding that may dilute Brooke Corporation’s interest at some point in the future, the warrants (i) have no voting rights prior to exercise; (ii) may never be exercised; and (iii) if exercised, based upon current warrant and stock holdings, would result in Brooke Corporation still holding the largest block of voting securities, although less than 50%.

(b)The existence of a large minority voting interest with no other significant holders. Brooke Corporation will have a majority voting interest in the combined company. At closing, there will be no other owner or group of owners holding a large minority voting interest.

(c)Ability to elect or appoint a voting majority of the board. Post closing until such time additional voting shares are issued, Brooke Corporation as the majority shareholder will have the power to elect or appoint a voting majority of the board of the

Securities and Exchange Commission

May 29, 2007

Page 10

combined company. There are no extraordinary voting rights or powers of minority holders to elect a majority of the board of directors of the combined company or otherwise control the direction of the combined company.

(d)The composition of the senior management of the combined entity. The chairman of the board, the chief executive officer and president, and all other management are current members of Brooke Credit’s management team.

(e)The terms of the exchange of equity securities. All things being equal, the acquiring entity is the combining entity that pays a premium over the market value of the equity securities of the combining entity. The merger is an all stock transaction with the fair market value of the consideration equal to the per share closing price reported on the OTC Bulletin Board on the closing date of the merger with no premium or discount.

Comparison of the Oakmont Charter and Bylaws with the Restated Charter and Bylaws, page 34

| 25. | Please tell us in your response letter what consideration you have given to reflecting material provisions in the Restated Charter and Restated Bylaws that will be new to Oakmont stockholders, particularly the new provision relating to an increase in the number of authorized shares, as separate proposals for separate consideration by your stockholders. See Rule 14a-4(a)(3) and the September 2004 Interim Supplement to the Manual of Publicly Available Telephone Interpretations available on our website. |

Response: The Company has added two new proposals to the proxy statement to address certain material changes that will be included in the Restated Charter and Restated Bylaws.

The first proposal seeks stockholder approval to amend Oakmont’s Certificate of Incorporation to include an increase in Oakmont’s capital stock. Please see the new section entitled “Item 3: Amendment to Certificate of Incorporation” added to the proxy.

The second proposal seeks stockholder approval to declassify the Oakmont board of directors and provide for the annual election of all of our directors. Please see the new section entitled “Item 4: Amendment to Bylaws” added to the proxy.

While the Company plans to include other changes in the Restated Charter and Restated Bylaws, as previously disclosed under the section entitled “Item 1: The Merger Proposal – Comparison of the Oakmont Charter and Bylaws with the Restated Charter and Bylaws,” the Company has concluded that the increase in capital stock as reflected in the Restated Charter and the declassification of the board of directors as reflected in the Restated Bylaws are the only material changes requiring stockholder approval based on the guidance provided under Rule 14a-4(a)(3) and the September 2004 Interim Supplement to the Manual of Publicly Available Telephone Interpretations.

Common Stock Ownership Following the Merger, page 42

| 26. | It appears that you have reversed the number of shares to be held by Oakmont stockholders assuming either minimum or maximum conversion. Why will Oakmont stockholders hold a smaller number of shares of the combined company’s common stock assuming none of the stockholders exercise conversion rights, as your disclosure suggests? Please revise accordingly or advise us. |

Response: The Company has revised the section entitled “Item 1: The Merger Proposal – Common Stock Ownership Following the Merger” to address this comment.

Securities and Exchange Commission

May 29, 2007

Page 11

Potential Oakmont Common Stock Purchases, page 43

| 27. | Please disclose if Mr. Skandalaris will vote any shares acquired by him in the same manner as he is required to vote his founder’s shares and, if not, why not, in light of the potential for conflicts of interest. Similarly disclose if Mr. Lowry will vote any shares acquired by him in the same manner as the founders of Oakmont are required to vote their founder’s shares and, if not, why not, in light of the potential for conflicts of interest. |

Response: The Company has revised the disclosure in both paragraphs under the section entitled“Potential Oakmont Common Stock Purchases” to provide the requested disclosure.

| 28. | In your response letter, please provide confirmation that you will update the disclosure in the proxy materials to reflect any purchases of shares of Oakmont common stock by Messrs. Skandalaris and Lowry. |

Response: The Company will update the disclosure under the section entitled“Potential Oakmont Common Stock Purchases” to reflect any shares of Oakmont common stock actually purchased by Mr. Lowry and any additional purchases that may be made by Mr. Skandalaris up to the date of the definitive proxy statement mailed to Oakmont Stockholders.

Sourcing, page 50 and

Collateral Preservation Services, page 50

| 29. | We note your revisions in response to comment 50; however, it does not appear that you have addressed the generation of referrals, nor does it appear that you have provided clarification of all of the specialized terms in this section as your response indicates. Please continue to revise these sections accordingly. |

Response: The Company has revised and expanded the discussion of referrals in the section entitled “Information About Brooke Credit—Sourcing.” A discussion of referrals is also set forth in the first paragraph of the section entitled “Collateral Preservation Services.” Instead of adding disclosure to further explain the “proprietary” nature of its loan sourcing network, collateral preservation platform and nationwide network of over 150 banks, the Company has deleted “proprietary” from the section entitled “Information About Brooke Credit—Competitive Strengths” and other sections.

Securities and Exchange Commission

May29, 2007

Page 12

| 30. | Please clarify your use of the term “long-term monetary incentive” on page 50. We further note the discussion of Brooke Capital’s transactions with related parties in notes seven and eight of the financial statements, beginning on page F-23. |

Response: Disclosure has been added to the section entitled “Information About Brooke Credit—Collateral Preservation Services” to clarify the term “long-term monetary incentive.” Consistent with note eight of the financial statements, the disclosure now refers to the “long-term monetary incentive” as an “ongoing fee.”

Brooke Credit’s Management’s Discussion and Analysis, page 54

| 31. | Your response to comment 51 states that you have revised the MD&A, but it is not apparent that any changes were made to this section in response to our comment other than the discussion on page 60 of the rates of increases in revenues and income before taxes as compared to the growth in Brooke Credit’s portfolio balances in 2006. Please continue to revise in accordance with our prior comment. |

Response: The Company has revised the proxy to add the requested disclosure in the MD&A.

Results of Operations, page 56

| 32. | Please refer to prior comment 52. As previously requested, revise the basic net income per share to $1.25 consistent with the disclosure on page FS-4. |

Response: The Company has revised the basic and diluted income per share to be $1.25. Please see the section entitled “Brooke Credit’s Management’s Discussions and Analysis of Financial Condition and results of Operations – Results of Operations.”

Gain on Sales of Notes Receivable, page 57

| 33. | We note that you discuss the two components of the gain on the sales of notes receivable. For clarification, please revise to discuss all components related to the determination of the gain on the sales of notes receivable. |

Response: The Company has revised the disclosure to clarify that there are only two components of the gain on sales of notes receivable. Please see the section entitled “Brooke Credit’s Management’s Discussions and Analysis of Financial Condition and results of Operations – Results of Operations, Gain on Sales of Notes Receivable.”

Securities and Exchange Commission

May 29, 2007

Page 13

Bank Lines of Credit, page 72

| 34. | Please refer to prior comment 56. We are unable to locate the added disclosure in footnote 3. Please revise or advise. |

Response: The Company added disclosures responsive to prior comment 56 to the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources; Bank Lines of Credit,” but mistakenly referred to the disclosures as being added to footnote 3. The Company agrees with the Staff that it is appropriate to add the disclosure to the Notes to Consolidated Financial Statements. Therefore, please see the disclosure found in “Notes to Consolidated Financial Statements—Footnote 3, Bank Loans and Other Long-Term Obligations.”

Capital Commitments, page 74

| 35. | We note your response to prior comment 58 and your statement that you are “in compliance with your material debt covenants.” Please revise to state, if true, that you are in compliance with all your debt covenants. To the extent that you are not, please identify the exceptions, and why you concluded that the covenants are not material and will not otherwise require disclosure or reclassifications in the financial statements. It appears that a significant portion of your liens of credit due in 2009 and 2013 are presented as a component of short-term debt per page FS-20. |

Response: Brooke Credit has informed the Company that it is aware of no covenants with which Brooke Credit is not in compliance. Therefore, the disclosure in the section entitled “Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations – Capital Commitments” has been amended to delete the term “material.” Even though Brooke Credit’s warehouse lines of credit have terms of more than one year, historically every six to nine months Brooke Credit has sold loans funded through these warehouse lines to investors in connection with off balance sheet transactions, and therefore, a significant portion of the lines have been paid in less than one year. Accordingly, Brooke Credit has classified a significant portion of the debt associated with its warehouse lines of credit as short term debt.

| 36. | You indicate that the merger will require the consent of Brooke Credit’s note holders and lenders. Please clarify how the terms of the proposed merger contemplate the potential payment obligations raised by the default provisions you have described. For instance, what condition(s) contained in the merger agreement will be triggered in the event Brooke Credit is unable to obtain the required consents? |

Response: The Company has revised the disclosure in the last paragraph under the section entitled“Brooke Credit’s Management’s Discussion and Analysis of Financial Condition and Results of Operations – Capital Commitments” to provide the requested disclosure.

Unaudited Pro forma Condensed Consolidated Statements of Operations, page 96

| 37. | Please refer to page 42. Please give effect to the servicing agreement with Brooke Corp. |

Response: The effect of the servicing agreement with Brooke Corporation is reflected in the pro forma Condensed Consolidated Statements of Operations as other operating expenses.

Securities and Exchange Commission

May 29, 2007

Page 14

Consolidated Statements of Operations, Page FS-4

| 38. | Please refer to prior comment 62. As previously requested, disclose the weighted-average shares used to calculate your net income per share. We note your disclosure in Note 1(q) on page FS-12. |

Response: The Company has disclosed the weighted average shares used to calculate net income per share. Please see the disclosure found in Brooke Credit’s “Consolidated Statements of Operations.”

1(a). Organization, page FS-7

| 39. | Please refer to prior comment 64. Based on your conclusion that the Brooke Credit Funding LLC and Brooke Warehouse Funding LLC are not qualifying SPEs, please tell us in more detail why your accounting is appropriate under paragraph 9 of SFAS 140. |

Response: As of year end 2006, neither Brooke Credit Funding LLC nor Brooke Warehouse Funding LLC was a qualifying SPE because neither was demonstrably distinct from the transferor under SFAS 140 paragraphs 35 and 26. Accounting with respect to these two SPEs was appropriate under paragraph 9 of SFAS 140 because Brooke Credit had not surrendered control over the assets. The transferor has “surrendered control” over transferred assets if and only if all of the following conditions are met:

(a)Assets isolated from the transferor beyond the reach of the transferor and its creditors. Because Brooke Credit received a substantive non-consolidation opinion in connection with the transfer of assets to these two SPEs, Brooke Credit believes the SPEs met this prong of the “surrender of control” test.

(b)Transferee or beneficial interest holder has the right to pledge or exchange the assets. The credit facility lender has the ability to pledge or exchange its beneficial interest and therefore Brooke Credit believes the SPEs met this prong of the “surrender of control” test.

(c)Transferor does not maintain effective control over the transferred assets. As of the end of 2006, Brooke Credit had the ability to unilaterally cause the SPEs to return specific assets other than through a clean-up call. Specifically, the agreements executed by the SPEs allowed them to unilaterally obtain a release of collateral to sell loans on a whole loan basis. Therefore, Brooke Credit had not “surrendered control” and therefore accounting for the transfer of financial assets as a sale was inappropriate.

Securities and Exchange Commission

May 29, 2007

Page 15

| 40. | Please tell us in detail why the accounting for the sale of the March 2007 facility is appropriate under paragraph 9 of SFAS 140. Since you consolidate Brooke Warehouse Funding, LLC, tell us how this sale is reflected in your financial statements. |

Response: During the first quarter of 2007, Brooke Credit amended and restated its Brooke Warehouse Funding LLC credit facility. In connection with this amendment and restatement, significant changes were made to the structure and the terms of the facility which qualify it for sale treatment under SFAS 140. As a part of the amendment and restatement, Brooke Warehouse Funding organized a wholly-owned SPE subsidiary, Brooke Acceptance Company 2007-1 LLC (BAC 2007-1). Brooke Credit has reasonably determined that BAC 2007-1 is a qualifying SPE and that the conditions set forth in paragraphs 9 and 35 of SFAS 140 have been met. SFAS 140, paragraph 35, notes that a qualifying SPE must meet all of the following conditions:

a.The SPE must be distinct from the transferor. In connection with the amendment and restatement, Brooke Credit obtained a substantive non-consolidation opinion by qualified counsel. Although this substantive non-consolidation opinion is intended to address bankruptcy-remoteness issues, to render an opinion the law firm opining had to reach the reasonable conclusion that Brooke Warehouse Funding and BAC 2007-1 will be treated as separate and distinct entities and that a bankruptcy court (in the unlikely event it were called upon to decide) would not consolidate Brooke Warehouse Funding’s or BAC 2007-1’s assets with another Brooke entity. Furthermore, Brooke Warehouse Funding’s and BAC 2007-1’s Limited Liability Company Agreements (the “Operating Agreements”) and the Receivables Financing Agreement for the facility to which Brooke Warehouse Funding and BAC 2007-1 are a party specifically require that separateness of Brooke Warehouse Funding and BAC 2007-1 be maintained and outlines a number of specific steps that Brooke Warehouse Funding and BAC 2007-1 must take (or not take, as the case may be) to help maintain separateness. Although Brooke Credit, as seller, has the obligation to repurchase loans from Brooke Warehouse Funding, such obligations are limited only to instances where there is a breach of warranty with respect to the loans as of the transaction closing date. The beneficial owner of BAC 2007-1, the holder of the note, is an unaffiliated lender.

b.The SPE’s activities must be significantly limited, etc. The Operating Agreements of Brooke Warehouse Funding and BAC 2007-1 specifically set forth their limited purposes and significantly limit their activities. Brooke Warehouse Funding and BAC 2007-1 can only perform those activities set forth in the Operating Agreements and the transaction documents to which they are a party. Pursuant to the Receivables Financing Agreement, the Operating Agreements cannot be amended without the consent of the lender, which is not affiliated with Brooke Credit.

c.SPEs may hold only financial instruments, derivative financial instruments, financial assets, servicing rights, and cash. BAC 2007-1 holds participation interests in loans sold to Brooke Warehouse Funding LLC, and BAC 2007-1 holds these participation interests passively. BAC 2007-1’s and Brooke Warehouse Funding’s investments are strictly limited by the transaction documents to financial assets, servicing rights, cash collected in connection with the loans (which can be invested in eligible investments which are relatively risk free instruments), and temporary holding of collateral upon foreclosure or liquidation of loans. Pursuant to the Operating Agreements, BAC 2007-1 and Brooke Warehouse Funding are not allowed to incur, create or assume any indebtedness other than the indebtedness contemplated in the transaction documents. Furthermore, BAC 2007-1 and Brooke Warehouse Funding are not allowed to own or acquire any stock or securities other than as specifically allowed under the transaction documents.

d.Disposition of non cash financial assets. BAC 2007-1 is restricted by the Participation Agreement from selling, transferring or otherwise disposing of any of its assets.

Securities and Exchange Commission

May 29, 2007

Page 16

In accordance with SFAS 140 paragraph 9, Brooke Credit has “surrendered control” over transferred assets:

(a)Assets isolated from the transferor beyond the reach of the transferor and its creditors. Brooke Credit received a true sale opinion that in a bankruptcy case in which Brooke Credit is the debtor, a federal bankruptcy court, in a properly argued and presented case with a properly reasoned judicial decision would not hold that the loans and payments there under and proceeds thereof are (i) property of the estate of Brooke Credit under the bankruptcy code or (ii) subject to the automatic stay based on the theory that the transfer of the loans by Brooke Credit to Brooke Warehouse Funding did not constitute a true sale. It received a substantive non-consolidation opinion that addresses bankruptcy-remoteness issues. The law firm opining reached the reasonable conclusion that Brooke Warehouse Funding and BAC 2007-1 would be treated as separate and distinct entities and that a bankruptcy court (in the unlikely event it were called upon to decide) would not consolidate their assets with another Brooke entity. Brooke Credit has reasonably determined that this prong of the “surrender of control” test has been met.

(b)Transferee or beneficial interest holder has the right to pledge or exchange the assets. The credit facility lender has the ability to pledge or exchange its beneficial interest and therefore Brooke Credit has concluded that Brooke Warehouse Funding and BAC 2007-1 meet this prong of the “surrender of control” test.

(c)Transferor does not maintain effective control over the transferred assets. Under the facilities amended structure and terms, Brooke Credit has no ability to unilaterally cause Brooke Warehouse Funding and BAC 2007-1 to return assets. Therefore, the transferor has “surrendered control” and accounting for the transfer of financial assets as a sale is appropriate.

| 41. | In concluding that Brooke Capital Company LLC, Brooke Securitization Company V, LLC and Brooke Securitization Company 2006-I, LLC are qualifying SPEs, please tell us your consideration of the conditions required for qualifying SPEs in paragraph 35 of SFAS 140 and your conclusion as to whether all of them have been met. |

Response: Brooke Credit has concluded that these SPE’s are qualifying SPE’s based upon an analysis of paragraph 35 of SFAS 140 and a determination that all conditions in paragraph 35 have been met:

a.The securitization SPEs must be distinct from the transferor. In connection with the securitization transactions for which these SPEs are used, Brooke Credit has obtained substantive non-consolidation opinions by qualified counsel. Although these substantive non-consolidation opinions are intended to address bankruptcy-remoteness issues, to render such an opinion the law firm opining must reach the reasonable conclusion that the SPE will be treated as a separate and distinct entity and that a bankruptcy court (in the unlikely event it were called upon to decide) would not consolidate the SPE’s assets with another Brooke entity. Furthermore, Brooke Credit’s SPE’s Limited Liability Company Agreements (the “Operating Agreements”) and the Indentures for the securitizations to which Brooke Credit’s SPEs are a party specifically require that separate corporate existence of the SPE be maintained and outline a number of specific steps that the SPEs must take (or not take, as the case may

Securities and Exchange Commission

May 29, 2007

Page 17

be) to help maintain corporate separateness. Although Brooke Credit has the obligation to repurchase loans from the qualifying SPEs, such obligations are limited only to instances where there was a breach of warranty with respect to the loans as of the transaction closing date. The beneficial owners of these SPEs, the holders of the asset-backed securities, are all unaffiliated investors except in the case of one of Brooke Credit’s securitization transactions in connection with which Brooke Credit holds a subordinate note.

b.The securitization SPEs activities must be significantly limited. The Operating Agreements of Brooke Credit’s SPE’s specifically set forth their limited purposes and significantly limit their activities. Brooke Credit SPEs can only perform those activities set forth in the Operating Agreements and the Indentures for the transactions to which the SPEs are a party. Pursuant to the Indenture, the Operating Agreements cannot be amended without the consent of the beneficial holders, which are not affiliated with the Brooke Credit.

c.The securitization SPEs may hold only financial instruments, derivative financial instruments, financial assets, servicing rights, and cash. Brooke Credit’s SPEs hold loans and do so passively. The SPEs’ investments are strictly limited by the transaction documents to financial assets (the loans and rights related thereto), servicing rights, cash collected in connection with the loans (which can be invested in eligible investments which are relatively risk free instruments), and temporary holding of collateral upon foreclosure or liquidation of loans. Pursuant to the Operating Agreements, the SPEs are not allowed to incur, create or assume any indebtedness other than the indebtedness contemplated in the transaction documents. Furthermore, the SPEs are not allowed to own or acquire any stock or securities other than as specifically allowed under the transaction documents.

d.Disposition of non cash financial assets. Brooke Credit’s SPEs are restricted by the Indentures from selling, transferring or otherwise disposing of any of its assets unless specifically authorized by the Trustee in accordance with the terms of the Indentures.

| 42. | Please tell us the credit rating of any of your rated asset-backed securities issued in connection with off-balance sheet loan securitizations. Addressing the sufficiency of your credit enhancement from the junior interest (i.e., over-collateralization) and your credit rating, tell us your consideration of your continuing involvement in the assets sold and how you concluded that a sale has occurred under paragraphs 80-84 of SFAS 140. |

Response: The asset-backed securities sold in connection with five of Brooke Credit’s securitizations have been rated “A” by S&P. The asset-backed securities sold in connection with the sixth securitization were sold to a single qualified institutional buyer on an unrated basis. SFAS 140 paragraph 9(a) requires the transferred assets to be isolated from the transferor in order for sale treatment to apply. SFAS 140 paragraphs 80-84 provide guidance with respect to the isolation of transferred assets in securitizations. Brooke Credit considered paragraph 82 in its analysis because its six securitizations have all been “single step” securitizations. Brooke Credit transferred assets to an SPE in exchange for cash and a beneficial interest in the SPE. This beneficial interest retained by Brooke Credit represents a junior interest to be reduced by any credit losses on the financial assets in the SPE. Paragraph 82 notes that “single step” securitizations should be analyzed to ensure sufficient isolation of assets

Securities and Exchange Commission

May 29, 2007

Page 18

because the nature of the continuing involvement of the transferor may make it difficult to obtain reasonable assurance that the transfer would be found to be a true sale at law that places the assets beyond the reach of the transferor and its creditors in US bankruptcy. Because Brooke Credit retains an interest in the SPE, paragraph 113 of SFAS 140 must also be analyzed for guidance on the transfer of receivables with limited recourse. Brooke Credit has determined that the transferred assets are sufficiently isolated for sale treatment, but because Brooke Credit retains an over-collateralization interest in the loans sold to securitization SPEs, the fair value of its retained interest should be recorded as “securities” on Brooke Credit’s balance sheet.

As stated in paragraph 113, the isolation analysis of paragraph 9 may vary by jurisdiction. For this reason, as paragraph 152 suggests is often the case, the rating agency and investors required that Brooke Credit obtain a true sale and substantive non-consolidation opinion by qualified counsel licensed to practice law in the state of Brooke Credit’s incorporation. The true sale opinion provides an opinion that in a bankruptcy case in which Brooke Credit is the debtor, a federal bankruptcy court, in a properly argued and presented case with a properly reasoned judicial decision would not hold that the loans and payments there under and proceeds thereof are (i) property of the estate of Brooke Credit under the bankruptcy code or (ii) subject to the automatic stay based on the theory that the transfer of the loans by Brooke Credit to the SPE issuer did not constitute a true sale. The substantive non-consolidation opinion is also intended to address bankruptcy-remoteness issues. The law firm opining reached the reasonable conclusion that the SPE would be treated as a separate and distinct entity and that a bankruptcy court (in the unlikely event it were called upon to decide) would not consolidate the SPE’s assets with another Brooke entity.

1(f). Allowance for Doubtful Accounts, page FS-8

| 43. | Please refer to prior comment 65. Please mark the appropriate pages of the consolidated financial statements as “restated” and add a note indicating the nature of the restatement. Please ask your auditors to reissue their report. |

Response: The appropriate pages of the consolidated financial statements are now marked as “restated” and new Note 15 indicates the nature of the restatement. Brooke Credit’s auditors have reissued their report.

1(n). Revenue Recognition, page FS-11

1(n). Loan origination fees

| 44. | Please refer to prior comment 67. It does not appear that your accounting for loan origination fees and costs complies with paragraph 5 of SFAS 91. Please revise or advise. |

Response: Brooke Credit has informed the Company that its accounting for loan origination fees is appropriate. SFAS 91, paragraph 5, provides that loan origination fees and related direct loan origination costs for a given loan shall be offset and only the net amount shall be deferred and recognized over the life of the loan as an adjustment to yield. The amount of Brooke Credit’s loan origination fees has been established primarily to offset direct loan origination costs. Therefore, loan origination fees closely approximate actual direct loan origination costs. To the extent loan origination fees exceed direct loan origination costs or such costs exceed the fees, the difference is immaterial. Paragraph 21 of SFAS 91 provides that if the loan is held for resale, loan origination fees and the direct loan origination costs as specified in SFAS 91 shall be deferred until the related loan is sold. It is Brooke Credit’s practice to sell its loans soon after origination, frequently this sale occurs the

Securities and Exchange Commission

May 29, 2007

Page 19

same day of origination. Therefore, even immaterial mismatches between origination fees and direct loan origination costs are rectified upon loan sale.

2. Notes and Interest Receivable, Net, page FS-16

| 45. | We note your response to prior comment 69 and your revised disclosures. We note your disclosure on page 87, stating that you “expect increased levels of delinquencies, defaults and credit losses as the full impact of these market conditions are felt by Brooke’s credit borrowers.” Please tell us how you considered these factors in determining the key economic assumptions used in measuring the fair value of your retained interests and servicing assets. We note that your discount rate increased from 8.5% to 11% and all other assumptions remained the same. Also, tell us in more detail the factors you considered in concluding that the current prepayment rate of 15% is cyclical and the prepayment assumption of 8% to 10% is the appropriate average rate over the life of your portfolio. |

Response: Assumptions regarding discount rate, prepayment rate and credit loss rate are made based on historical comparisons, management’s experience and the trend in actual and forecasted portfolio prepayments, portfolio credit losses, risk-free interest rates and market interest rates. Brooke Credit regularly analyses the accuracy of its assumptions of prepayment speeds, credit losses and discount rate and makes change when necessary. The following outlines the basis for these assumptions and historical trends underlying each of these assumptions.

Prepayment Rate:Brooke Credit’s management based its initial estimate regarding prepayment rates based on its experience in small business lending. The prepayment rates of 8% and 10% represent average annual prepayment rates during the life of an originated loan portfolio, which takes into account expected increases and decreases in prepayment rates or cycles during the life of a portfolio. Prepayment rates are likely to be higher during increasing interest rate environments and a softening insurance market place, both of which are occurring in today’s market. If management believes that increases are not directly associated with a cycle within the portfolio and is rather a trend which is likely to be prevalent for most of the portfolio term, then a change to the prepayment assumption will be made. Prepayment rates are likely to be less during decreasing interest rate environments and a hardening insurance market place. To evidence changes in actual prepayment rates that occur on an annual basis, following are annualized prepayment rates during the past five years within Brooke Credit’s portfolio which represents an average annual prepayment rate of approximately 9.04%:

| | • | | 12 months ended December 31, 2006 – 15.6% prepayment rate |

| | • | | 12 months ended December 31, 2005 – 15.2% prepayment rate |

| | • | | 12 months ended December 31, 2004 – 4.6% prepayment rate |

| | • | | 12 months ended December 31, 2003 – 7.1% prepayment rate |

| | • | | 12 months ended December 31, 2002 – 2.7% prepayment rate |

Although Brooke Credit has experienced increased prepayment rates in its portfolio during 2006 and 2005, it believes that these increased prepayments result from the impact of the increased interest rate environment and softening insurance market and that during the remaining life of the portfolio there is likely to be periods of hard market cycles and decreasing or stable interest rate cycles.

Credit Loss Rate: Brooke Credit’s management based its initial estimate regarding credit loss rates based on its experience in small business lending. The credit loss rates of 0.21% and 0.50% represent average annual credit loss rates during the life of an originated loan portfolio, which takes into account expected increases and decreases in credit losses or cycles during the life of a portfolio. Credit losses are likely to be higher during increasing interest rate environments and a softening insurance market place, both of which are occurring in today’s market. Credit losses are likely to be less during decreasing interest rate environments and a hardening insurance market place. If Brooke Credit’s management believes that increases are not directly associated with a cycle within the portfolio and are rather a trend which is likely to be prevalent for most of the portfolio term, then a change to the credit loss assumption will be made. During the last five years, Brooke Credit has experiencedlife-to-date actual credit losses of $1,196,000 (includes on and off-balance sheet loans) and total originations in excess of $600,000,000, which represents alife-to-date credit loss ratio of approximately 0.19%.

Discount Rate: Brooke Credit’s management based its initial estimate regarding discount rate, using a range of the risk free rate as a starting point for this assumption. The difference between the risk free rate range and the discount rate assumption represents characteristics in regards to the loan types being originated by Brooke Credit, such as loan terms, interest rate type, underwriting metrics, collateral support, etc. During the fourth quarter of 2005, Brooke Credit voluntarily increased its discount rate because the then current risk free rate increased beyond the range initially established by Brooke Credit’s management, as a result of the increasing interest rate environment.

| 46. | Please revise the last sentence in the sixth paragraph to state, if true, that “gains or losses on sales of the notes receivable are determined based on the previous carrying amount of the financial assets involved in the transfer, allocated between the assets sold, the retained interest and the servicing assets based on their fair value at the date of the transfer,and the proceeds received.” |

Response: The Company has revised the disclosure to add the requested information.

| 47. | Please provide the tabular disclosures required in paragraph 17(f) and (h) of SFAS 140 or tell us why the disclosures are not required. |

Response: Brooke Credit has reviewed the requirements of SFAS 140 paragraphs 17(f) and (g) and believes that the disclosure required by these paragraphs is set forth in the“Notes to Consolidated Financial Statements—Footnote 2, Notes Receivable.” Brooke Credit believes much of the disclosure found in these paragraphs is best suited for narrative disclosure, and therefore, because tabular disclosure of the required information does not appear to be mandated, Brooke Credit has not added tabular disclosure to Footnote 2.

Updating

| 48. | Please update the financial statements and applicable sections under Rule 3-12 of Regulation S-X. |

Response: The Company has revised the proxy to update the financial statements and applicable sections under Rule 3-12 of Regulation S-X.

Securities and Exchange Commission

May 29, 2007

Page 20

Annex F

| 49. | We note the statements contained in Annex F that “Brooke Credit’s management prepared the projected financial information set forth [in Annex F] . . . for a confidential information memorandum provided to Oakmont in connection with their discussions of a possible transaction” and that such projections were prepared in July 2006. Please clarify the details and timing of the preparation of the confidential memorandum in light of your background section disclosure that Morgan Joseph informed Mr. Skandalaris of the Brooke Credit opportunity in early January 2007. |

Response: The Company has removed Annex F and added the financial projections contained therein under a new section entitled, “Item 1: The Merger Proposal – Brooke Credit Corporation Projections.” Under this section, the Company has revised statements made in the previous Annex F to clarify that the projections prepared in July 2006, although included in the confidential information memorandum provided to Oakmont, were prepared in connection with Brooke Credit’s private placement of debt which was unrelated to the Oakmont discussions.

|

| Very truly yours, |

|

| Thomas E. Hartman |

TEH:sdb

| | |

| cc: | | Robert J. Skandalaris |

| | Michael Azar |

ANNEX A

Top 10 Findings

The story of the agency universe between 2004 and 2006 is one of continuing consolidation, changing roles for smaller agencies and some very large agencies, and improved relations between agencies and their carriers.

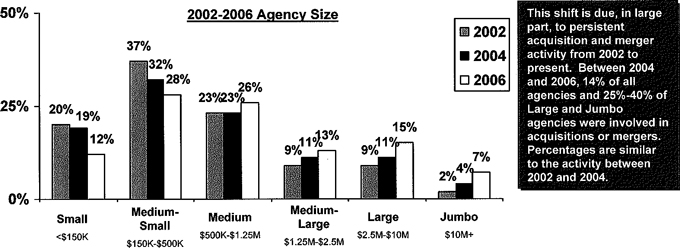

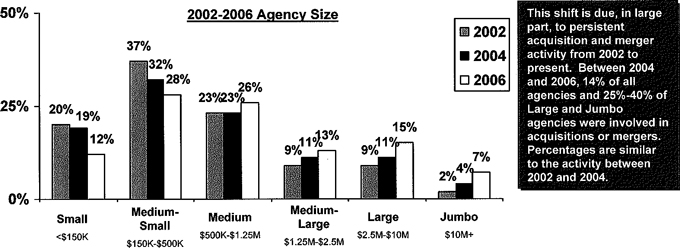

| 1. | Fewer and Larger.The estimated number of independent property-casualty insurance agencies in 2006 is 37,500, down by 4% from 39,000 in 2004. Ten years ago there were 44,500 independent agencies. The methods that have been used to estimate the number of agencies may exclude some small agencies, but the trend is clear-cut. |

| 2. | Survival of the Largest.Through acquisitions (and a few mergers) agencies are getting larger. In many cases, as agency principals near retirement age, agencies are sold. In almost half the acquisitions, lack of access to products and services or having little leverage with carriers is a factor in the decision to sell the agency. |

| 3. | Commercial Lines More Important.The proportion of agencies that are commercial lines dominant, deriving 70% or more of their revenue from commercial lines, has increased significantly, from 21% in 2004 to 27% in 2006. The shift toward commercial lines dominance has occurred in every size category except Medium Small agencies, with insurance revenues of $150,000 to just under $500,000. |

| 4. | A Few Jumbo Agencies Focusing on Personal Lines.Historically, Jumbo agencies with $10,000,000 or more in insurance revenue have focused on commercial lines. Most still do, but a few Jumbo agencies are building or buying enough personal lines business to be Personal Lines Dominant. They amount to 9% of Jumbo agencies in 2006, compared to only 2% in 2004. |

A - 1

The Agency System

Consolidation: The trend continues

The average agency size (determined by insurance revenue) has shifted from Small and Medium-Small agencies to Medium, Large and Jumbo agencies.

Since 1996, the number of independent agencies has decreased by about 15%.Currently, a conservative estimate of the total number of independent property-casualty agencies is 37,500.

A - 2

Employers also are placing greater emphasis on continuing professional education as the diversity of financial products sold by insurance agents increases. It is important for insurance agents to keep up to date on issues concerning clients. Changes in tax laws, government benefits programs, and other State and Federal regulations can affect the insurance needs of clients and the way in which agents conduct business. Agents can enhance their selling skills and broaden their knowledge of insurance and other financial services by taking courses at colleges and universities and by attending institutes, conferences, and seminars sponsored by insurance organizations. Most State licensing authorities also have mandatory continuing education requirements focusing on insurance laws, consumer protection, and the technical details of various insurance policies.

As the demand for financial products and financial planning increases, many insurance agents are choosing to gain the proper licensing and certification to sell securities and other financial products. Doing so, however, requires substantial study and passing an additional examination-either the Series 6 or Series 7 licensing exam, both of which are administered by the National Association of Securities Dealers (NASD). The Series 6 exam is for individuals who wish to sell only mutual funds and variable annuities, whereas the Series 7 exam is the main NASD series license that qualifies agents as general securities sales representatives. In addition, to further demonstrate competency in the area of financial planning, many agents find it worthwhile to earn the certified financial planner or chartered financial consultant designation. The Certified Financial Planner credential issued by the Certified Financial Planner Board of Standards, requires relevant experience, completion of education requirements, passing a comprehensive examination, and adherence to an enforceable code of ethics. The CFP exams test the candidate’s knowledge of the financial planning process, insurance and risk management, employee benefits planning, taxes and retirement planning, and investment and estate planning. The Chartered Financial Consultant (ChFC) designation, issued by the American College in Bryn Mawr, Pennsylvania, which requires experience and the completion of an eight-course program of study. The CFP and ChFC designation and other professional designations have continuing education requirements.

Insurance sales agents should be flexible, enthusiastic, confident, disciplined, hard working, and willing to solve problems. They should communicate effectively and inspire customer confidence. Because they usually work without supervision, sales agents must be able to plan their time well and have the initiative to locate new clients.

An insurance sales agent who shows ability and leadership may become a sales manager in a local office. A few advance to agency superintendent or executive positions. However, many who have built up a good clientele prefer to remain in sales work. Some—particularly in the property and casualty field—establish their own independent agencies or brokerage firms.

| | | | |

| EMPLOYMENT | | [About this section] | |  |

Insurance sales agents held about 400,000 jobs in 2004. Most insurance sales agents employed in wage and salary positions work for insurance agencies and brokerages. A decreasing number work directly for insurance carriers. Although most insurance agents

A - 3

| | |

National Funeral Director Association - NFDA Fact Sheets | | |

Back to Top

What are some basic funeral service facts?

The following points demonstrate current funeral service facts:

| | • | | There are about 21,528 funeral homes in the United States. According to the 1997 U.S. Census of Service Industries, 16,031 have payrolls beyond their owners. |

| | • | | These funeral homes employ 103,258 individuals and generate about $11 billion in revenue, creating a significant economic impact in America’s cities, towns and villages; 68,258 are non-licensed funeral service and crematory personnel; 35,000 are licensed funeral professionals and eligible for NFDA membership. |

| | • | | Eighty-nine percent or 19,160 of these funeral homes are owned by individuals, families or closely held private corporations and average 66 years in business. |

| | • | | Eleven percent, or approximately 2,368 of these funeral homes, are owned by one of five publicly traded stock corporations. |

| | • | | The average NFDA funeral home handles 182 calls per year: Some handle fewer than 50 calls per year and are often run by husband and wife; others handle hundreds of calls and may be owned by small companies or large corporations. |

| | • | | The average NFDA funeral home has three full-time and three part-time employees. |

| | • | | The average cost of a funeral, as of July 2004, is $6,500. That cost includes an outer burial container, but does not include cemetery costs. |

Back to Top

What are some of the trends in funeral service?

The following points highlight several of the current trends in funeral service, particularly those which impact the consumer:

| | • | | An increase in funeral home “aftercare” services, including support groups, remembrance services, community referrals and libraries. |

| | • | | An increase in preplanning and prepayment of funerals. |

| | • | | Increased government regulation, particularly in areas of occupational safety and health, often requiring the hiring of additional personnel in order to comply with the new regulations. |

| | • | | More personalized service to accomodate the differing ideas of what is a traditional funeral and desires for various methods of disposition. Recent immigration trends mean funeral directors now serve people with differing funeral customs from all parts of the globe. |

| | • | | An increase in the number of women and minorities entering the funeral service profession. For example, approximately one-third of current mortuary science enrollees are women. |

| | • | | In many states, an increase in the educational requirements both to enter the profession and to retain a license. |

Back to Top

How does NFDA help its members serve consumers better?

A - 4

ANNEX B

MERGER AGREEMENT SCHEDULES

FOR OAKMONT KANSAS, INC. AND BROOKE CREDIT CORPORATION

| | |

| Section | | Description |

| |

Brooke Schedules | | |

| |

2.1.(d) | | Subsidiaries of Brooke Credit • 8 Delaware LLCs • 1 Canadian Corporation |

| |

2.3 | | Brooke Credit Stockholder List • All stock is owned by Brooke Corporation, Incentive Compensation Plan, Falcon Mezzanine Partners II LP, FMP II Co-Investment LLC, JZ Equity Partners PLC; and Morgan Joseph & Company, Inc. (Warrants) |

| |

2.4 | | Necessary Consents • Consents required from Falcon/Jordan, DZ Bank, Enterprise Bank, Great American, Fifth Third USA and Fifth Third (Canada). |

| |

2.6(e) | | Tax Matters • Service and Tax Allocation Agreement between Brooke Corporation and Brooke Credit Corporation as of January 1, 2007. |

| |

2.7(c) | | Loans • Model loan agreements |

| |

2.7(d) | | Past Due Loans • Schedule of past due loans as of December 31, 2006. Aggregate principal past due $2.82 million. |

| |

2.7(e) | | Principal Balance of Loans • Schedule of loans as of December 31, 2006. Aggregate principal balance $497.69 million, less related-party loan balances, such aggregate is $483.28 million. 986 franchise loans and 170 non-franchise loans. |

| |

2.8 | | Absence of Changes • Schedule of compensation for 2006-2007. • Planned Distributions—Brooke Corporation and management incentive plan • Borrowing in the ordinary course of business to fund its lending activities. |

| |

2.9 | | Absence of Undisclosed Liabilities • Warrants held by Falcon Mezzanine Partners II LP, FMP II Co-Investment LLC, JZ Equity Partners PLC will preclude equity treatment if not extinguished prior to closing. • Company paid parent under the tax sharing arrangement in effect in 2006 which were not yet due. • Borrowing from Falcon Mezzanine Partners and Jordan/Zalanick Advisers in the amount of $45 million. |

B - 1

ANNEX C

Schedule 2.3

Capitalization. The following contains a correct and complete list of each stockholder of the Company and the number of shares held by each. Except as set forth below, there are no outstanding subscription, option, warrant, call rights, preemptive rights or other agreements or commitments obligating the Company to issue, sell, deliver or transfer (including any rights of conversion or exchange under any outstanding security or other instrument) any economic, voting, ownership or any other type of interest or security in the Company.

| | | | | |

| | | # of Shares

or warrants | | Resulting %

Ownership | |

Brooke Corporation* | | 5,761,523 | | 85.17 | % |

Incentive compensation plan** | | 565,000 | | 8.35 | % |

Falcon Mezzanine Partners II, L.P. | | 186,514 | | 2.76 | % |

FMP II Co-Investment, LLC | | 1,409 | | 0.02 | % |

JZ Equity Partners PLC | | 150,339 | | 2.22 | % |

Morgan Joseph & Company, Inc. Warrants | | 100,446 | | 1.48 | % |

| | | | | |

| | 6,765,231 | | 100 | % |

| | | | | |

| * | Includes 111,523 shares that will be issued pre-closing. |

| ** | To be issued prior to closing, subject to board approval. |

The Company has 51,000,000 authorized shares

| • | | 1,000,000 undesignated preferred shares |

| • | | 50,000,000 common shares |

C-1