AVEO Overview June 2016 Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this presentation are forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” “contemplate,” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements include, among others, statements about: AVEO’s plans to leverage biomarkers and pursue strategic partnerships for certain of its assets; AVEO’s goals and business strategy; the timing, design and results of preclinical and clinical trials; the timing and outcome of meetings with and applications to regulatory authorities by AVEO and its partners; the competitive landscape for AVEO’s therapeutic candidates; AVEO’s ability to demonstrate tivozanib’s safety and efficacy as a combination therapy and AVEO’s estimates for its cash runway. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements AVEO makes due to a number of important factors, including substantial risks and uncertainties relating to: AVEO’s ability to successfully implement its strategic plans; AVEO’s ability to successfully develop, test and gain regulatory approval of its product candidates, including its companion diagnostics; developments, expenses and outcomes related to AVEO’s ongoing shareholder litigation; AVEO’s ability to obtain necessary financing required to perform its clinical trials and achieve its other goals; AVEO’s ability to establish and maintain strategic partnerships; AVEO’s ability to obtain and maintain intellectual property rights; competition; AVEO’s dependence on its strategic partners and other third parties; adverse general economic and industry conditions; and those risk factors discussed in the “Risk Factors” and elsewhere in AVEO’s Annual Report on Form 10-K for the year ended December 31, 2015, and other periodic filings AVEO makes with the SEC. All forward-looking statements contained in this presentation speak only as of the date of this presentation, and AVEO undertakes no obligation to update any of these statements, except as required by law.

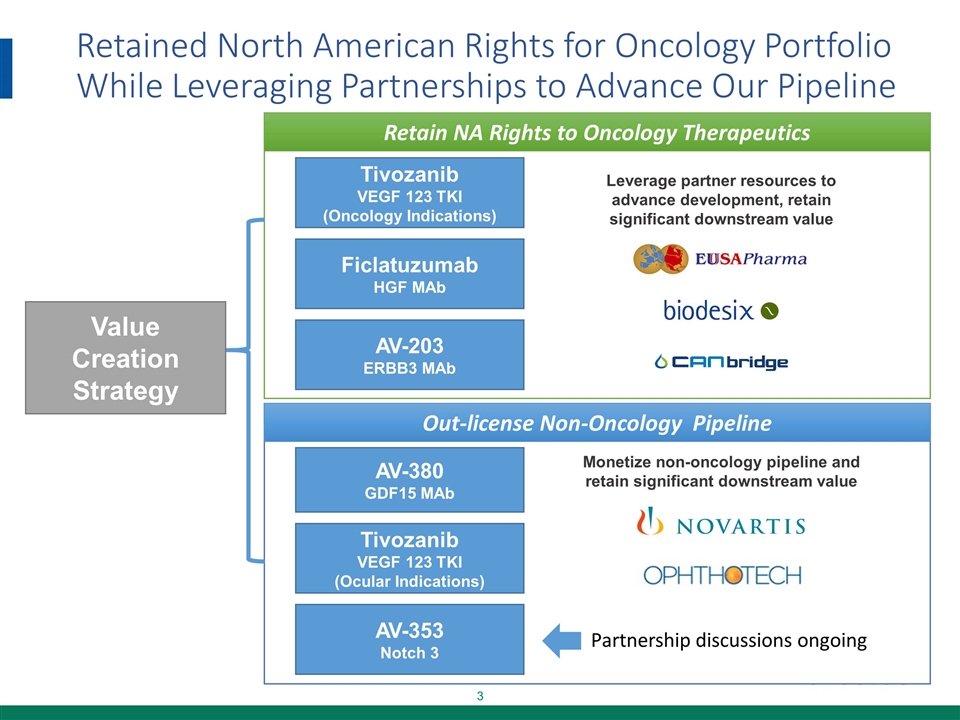

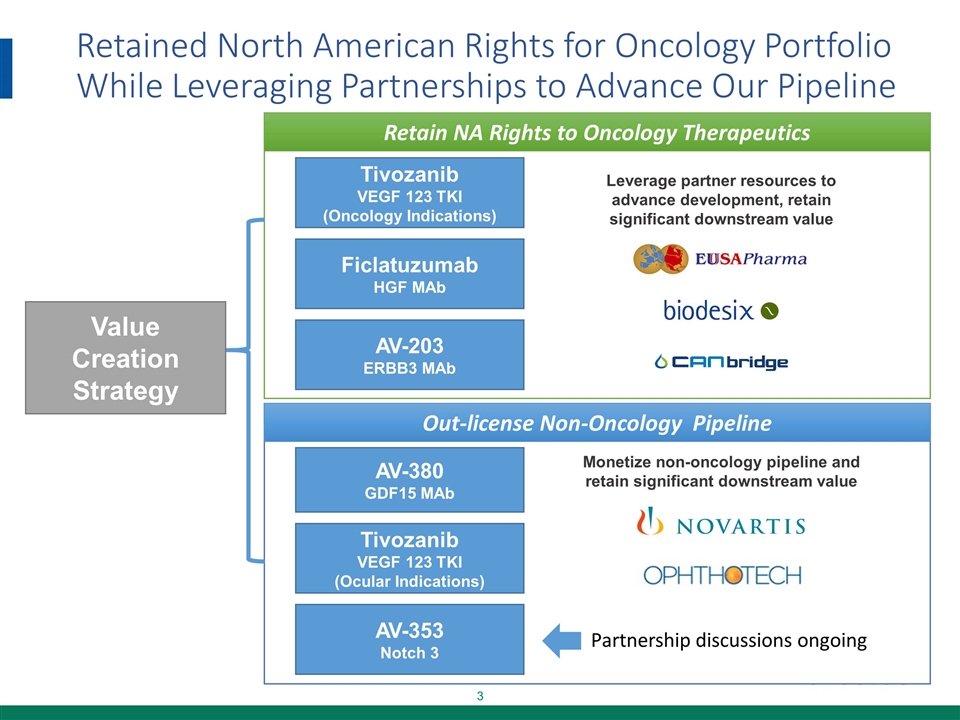

Retained North American Rights for Oncology Portfolio While Leveraging Partnerships to Advance Our Pipeline AV-380 GDF15 MAb Tivozanib VEGF 123 TKI (Oncology Indications) AV-203 ERBB3 MAb Ficlatuzumab HGF MAb Value Creation Strategy Leverage partner resources to advance development, retain significant downstream value Retain NA Rights to Oncology Therapeutics Out-license Non-Oncology Pipeline Tivozanib VEGF 123 TKI (Ocular Indications) Monetize non-oncology pipeline and retain significant downstream value AV-353 Notch 3 Partnership discussions ongoing

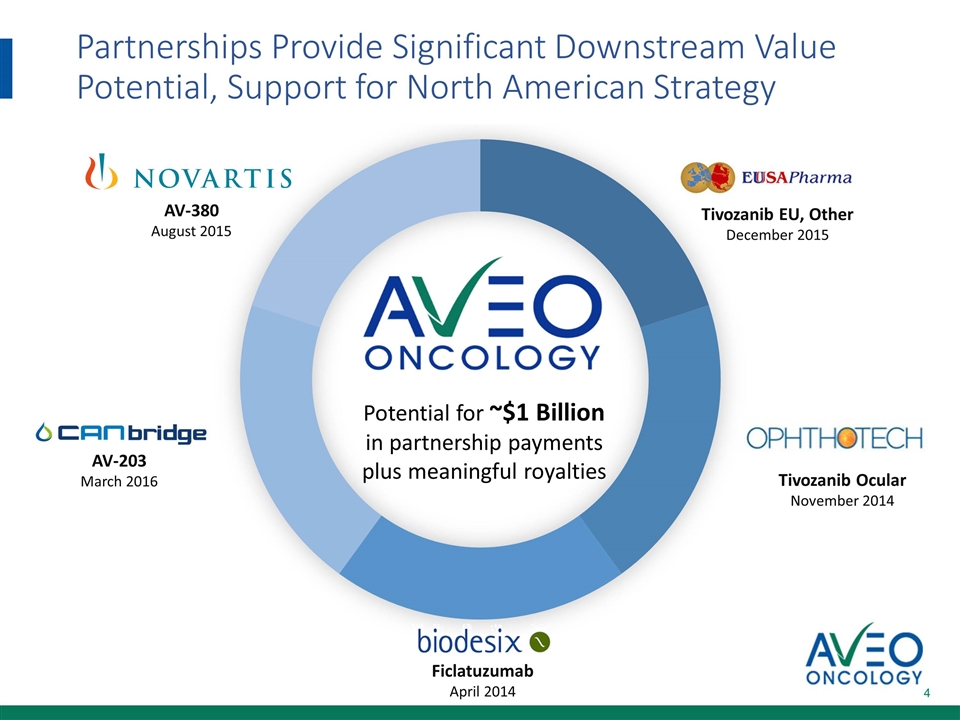

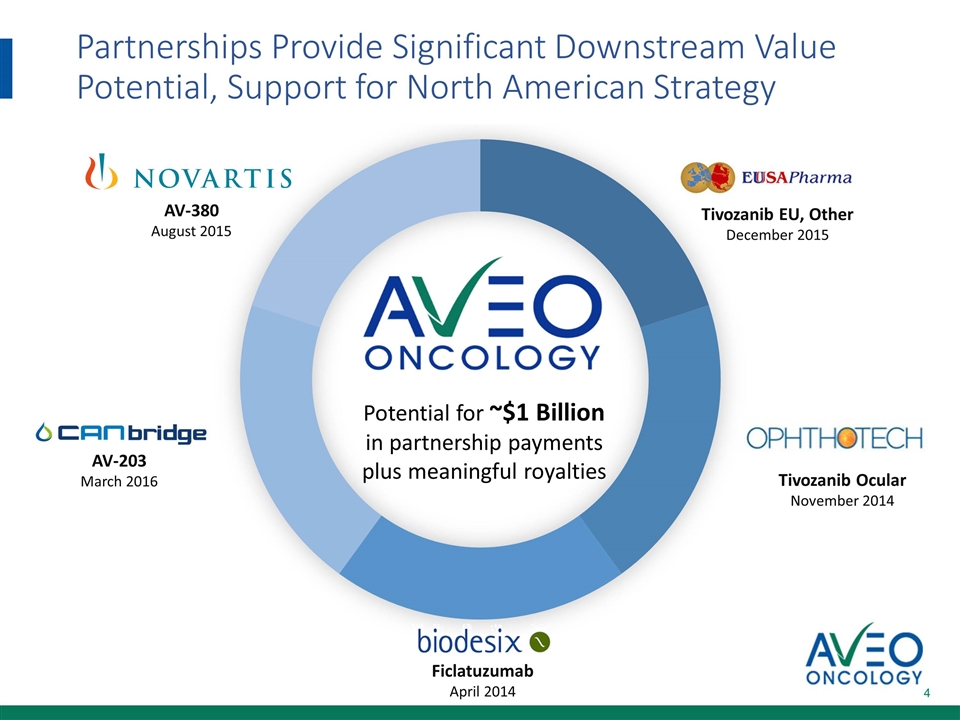

Partnerships Provide Significant Downstream Value Potential, Support for North American Strategy Tivozanib EU, Other December 2015 Tivozanib Ocular November 2014 AV-380 August 2015 Ficlatuzumab April 2014 Potential for ~$1 Billion in partnership payments plus meaningful royalties AV-203 March 2016

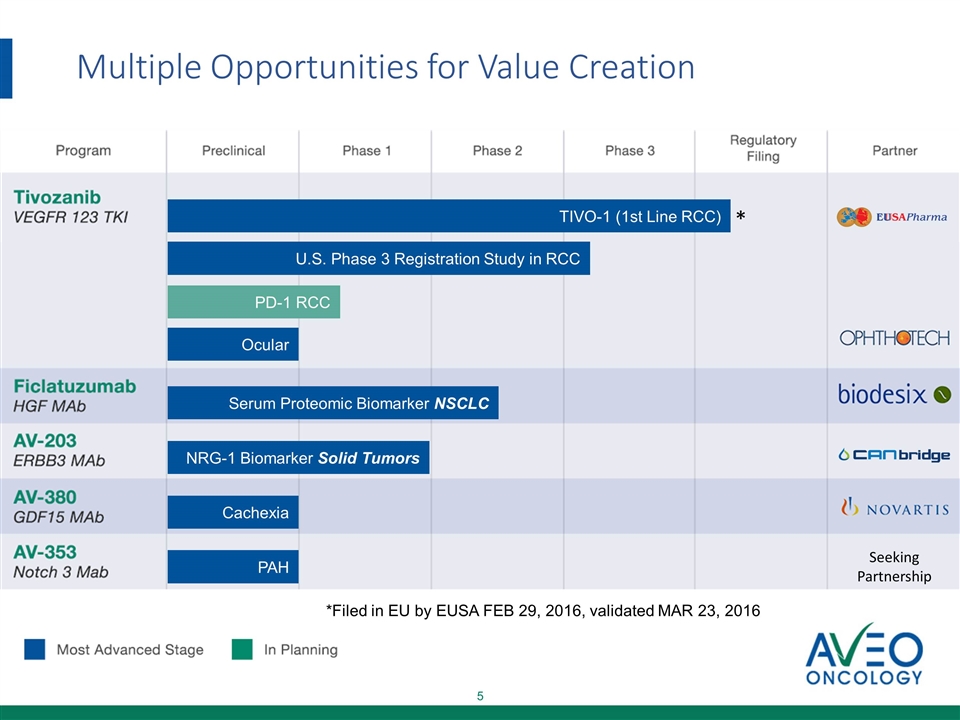

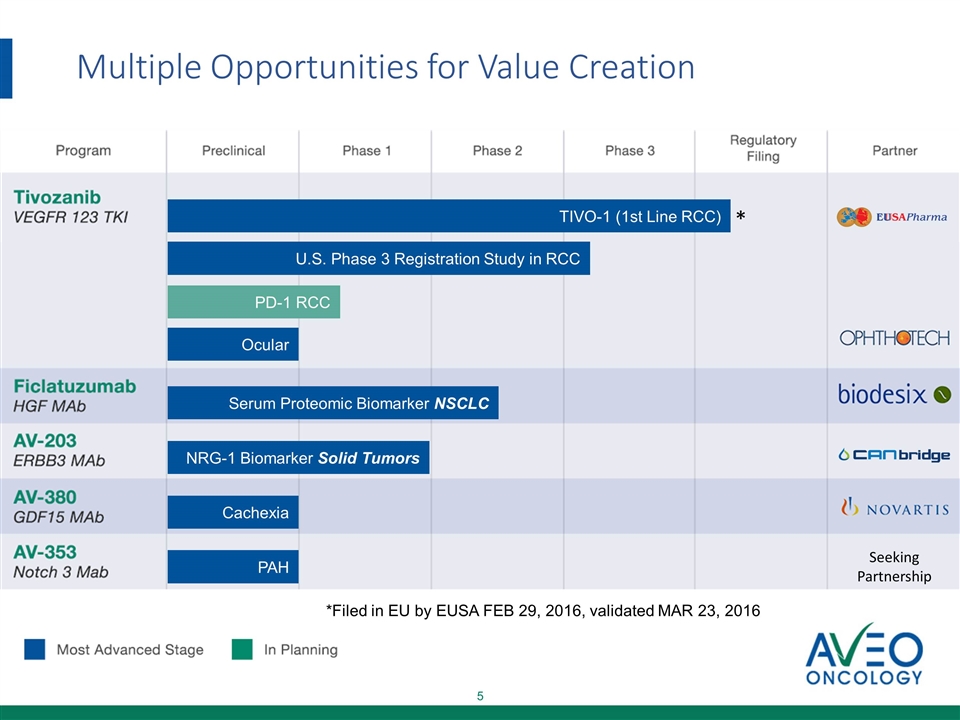

TIVO-1 (1st Line RCC) * Ocular Serum Proteomic Biomarker NSCLC NRG-1 Biomarker Solid Tumors Cachexia U.S. Phase 3 Registration Study in RCC PD-1 RCC PAH Multiple Opportunities for Value Creation *Filed in EU by EUSA FEB 29, 2016, validated MAR 23, 2016 Seeking Partnership

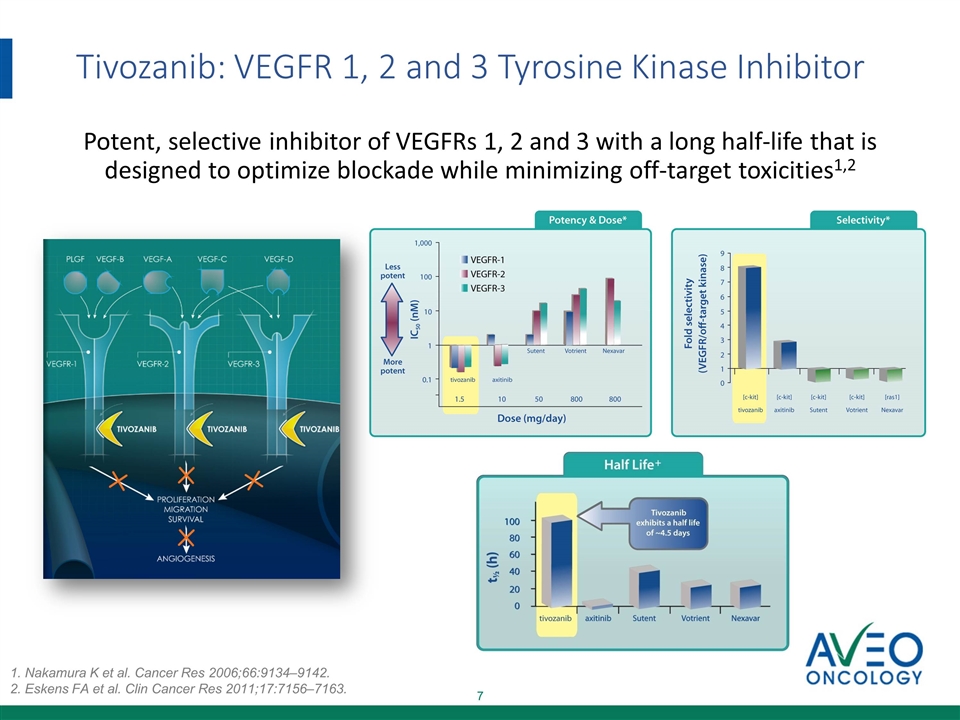

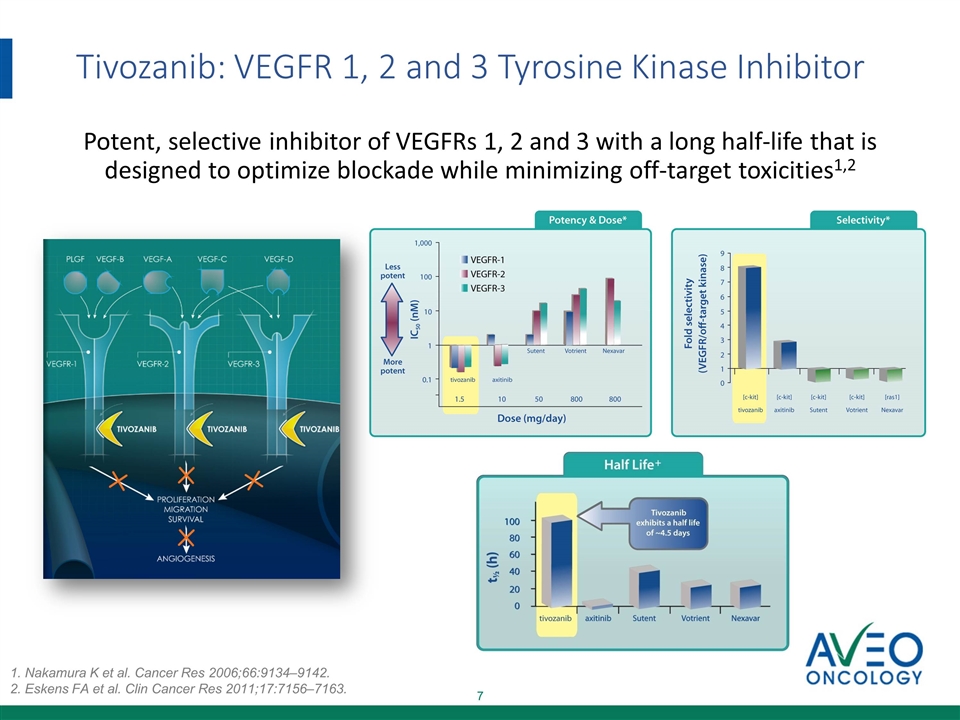

Tivozanib A potent, selective, long half-life inhibitor of vascular endothelial growth factor (VEGF) 1, 2 and 3 receptors

Tivozanib: VEGFR 1, 2 and 3 Tyrosine Kinase Inhibitor Potent, selective inhibitor of VEGFRs 1, 2 and 3 with a long half-life that is designed to optimize blockade while minimizing off-target toxicities1,2 1. Nakamura K et al. Cancer Res 2006;66:9134–9142. 2. Eskens FA et al. Clin Cancer Res 2011;17:7156–7163.

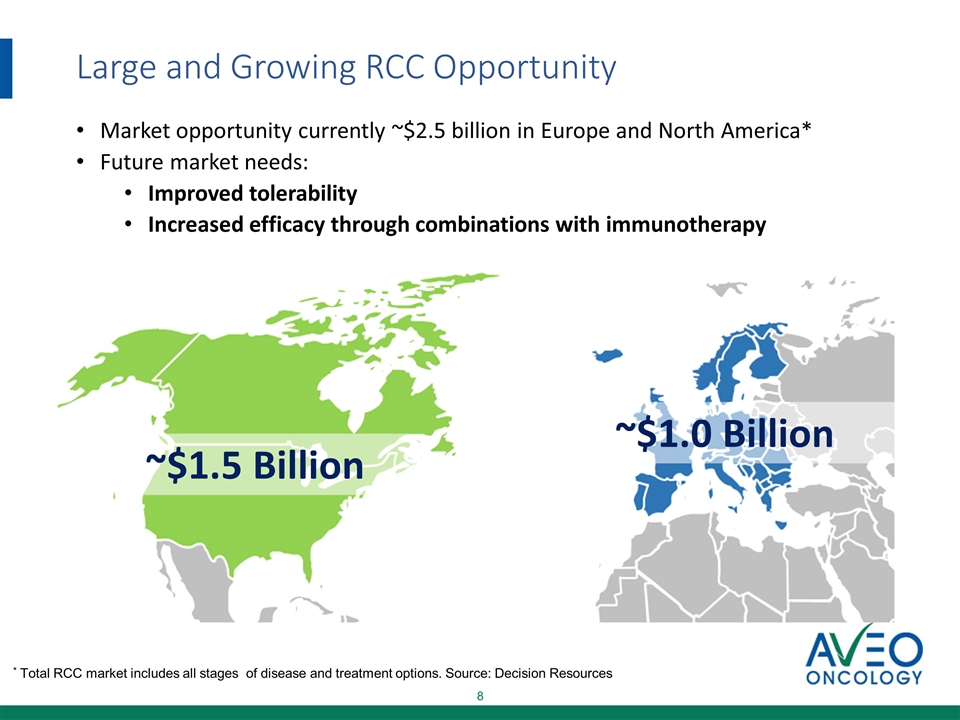

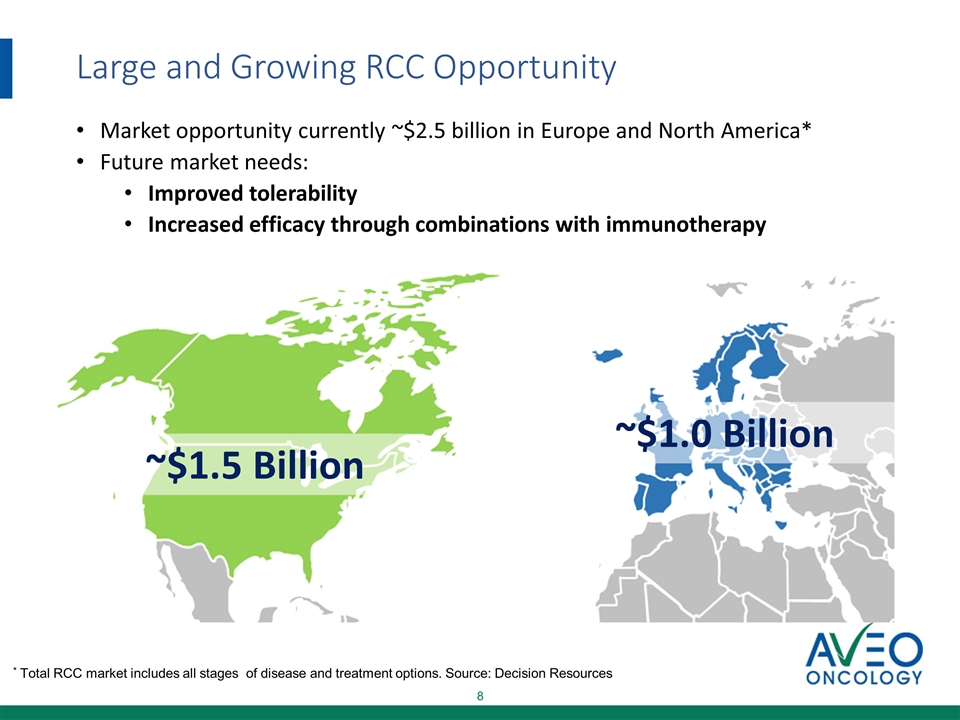

Large and Growing RCC Opportunity ~$1.5 Billion ~$1.0 Billion Market opportunity currently ~$2.5 billion in Europe and North America* Future market needs: Improved tolerability Increased efficacy through combinations with immunotherapy * Total RCC market includes all stages of disease and treatment options. Source: Decision Resources

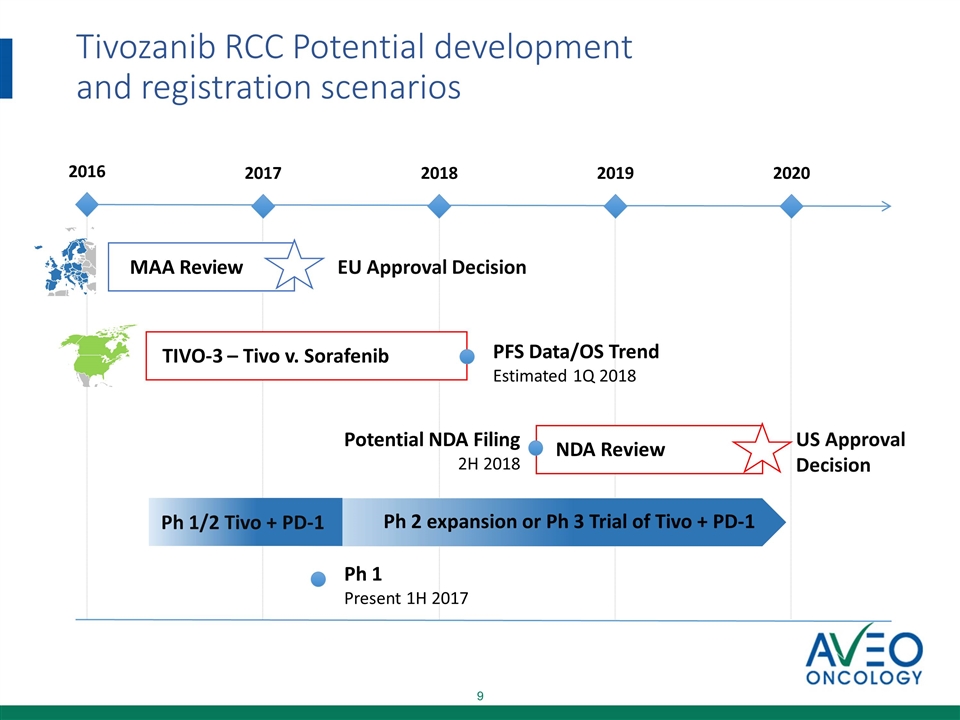

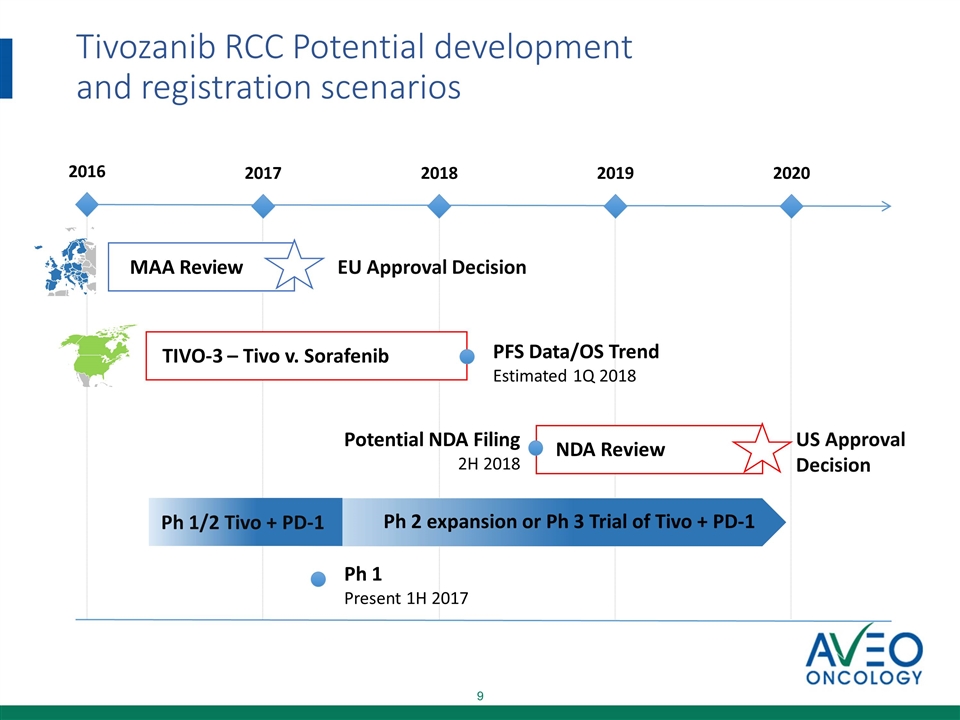

Tivozanib RCC Potential development and registration scenarios MAA Review TIVO-3 – Tivo v. Sorafenib US Approval Decision EU Approval Decision NDA Review 2016 2017 2018 2019 2020 Ph 2 expansion or Ph 3 Trial of Tivo + PD-1 Ph 1/2 Tivo + PD-1 Potential NDA Filing 2H 2018 PFS Data/OS Trend Estimated 1Q 2018 Ph 1 Present 1H 2017

Tivozanib RCC Front-line Setting

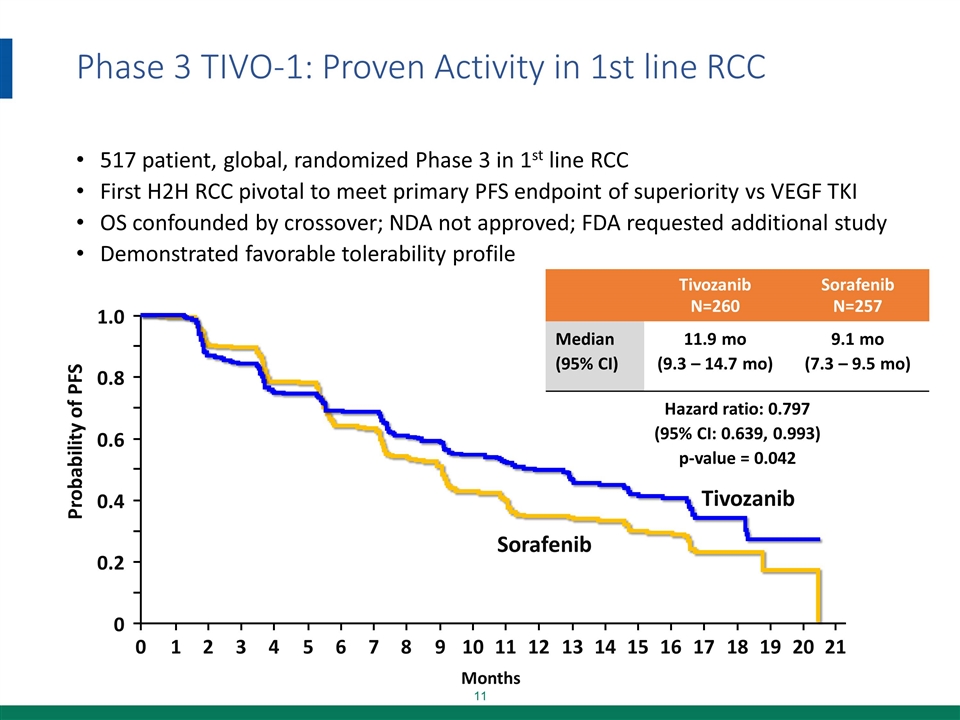

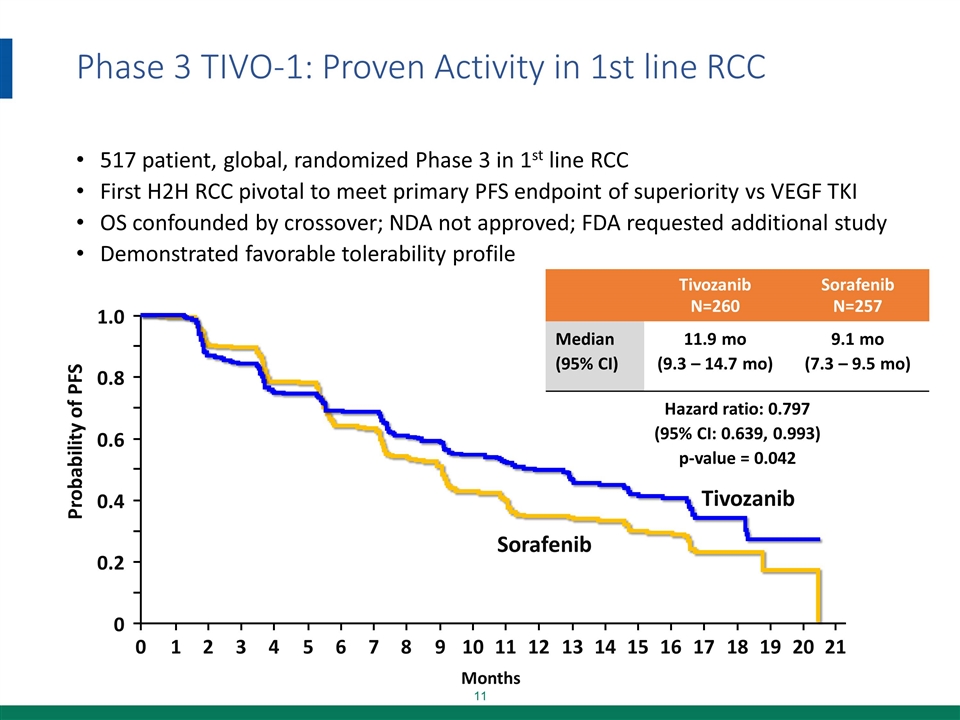

Phase 3 TIVO-1: Proven Activity in 1st line RCC 517 patient, global, randomized Phase 3 in 1st line RCC First H2H RCC pivotal to meet primary PFS endpoint of superiority vs VEGF TKI OS confounded by crossover; NDA not approved; FDA requested additional study Demonstrated favorable tolerability profile Months Probability of PFS 0 Sorafenib 1.0 0.8 0.6 0.4 0.2 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Tivozanib Tivozanib N=260 Sorafenib N=257 Median (95% CI) 11.9 mo (9.3 – 14.7 mo) 9.1 mo (7.3 – 9.5 mo) Hazard ratio: 0.797 (95% CI: 0.639, 0.993) p-value = 0.042

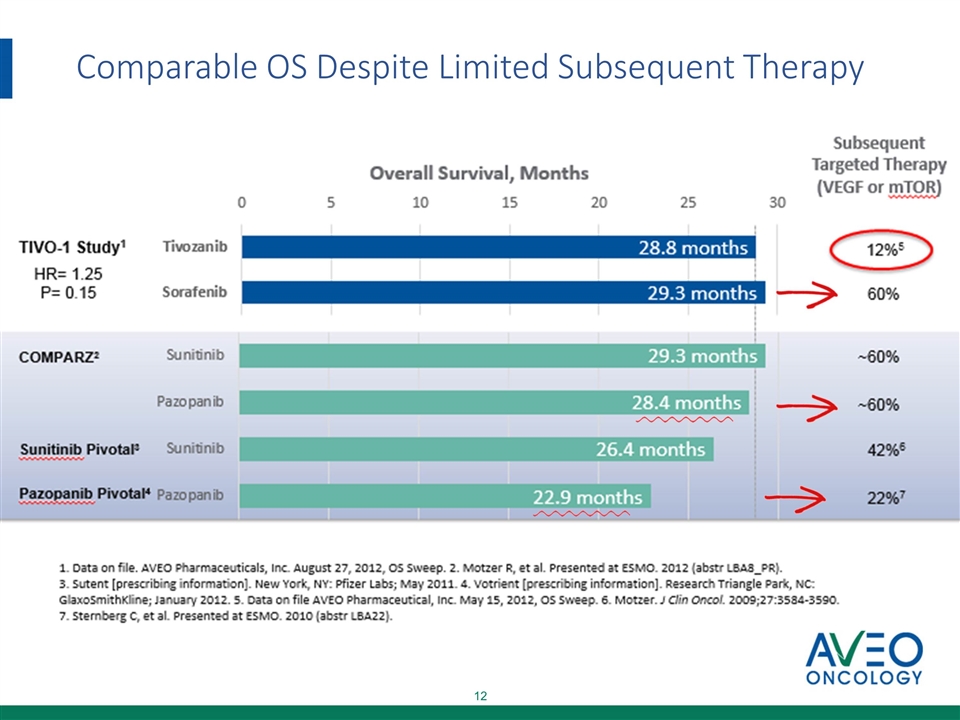

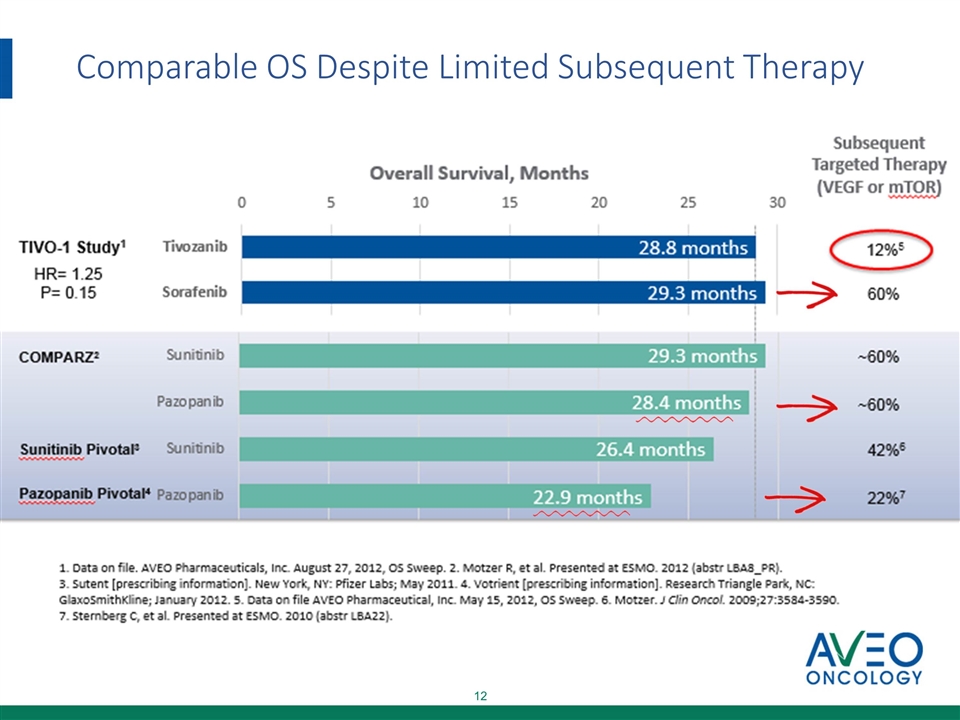

Comparable OS Despite Limited Subsequent Therapy

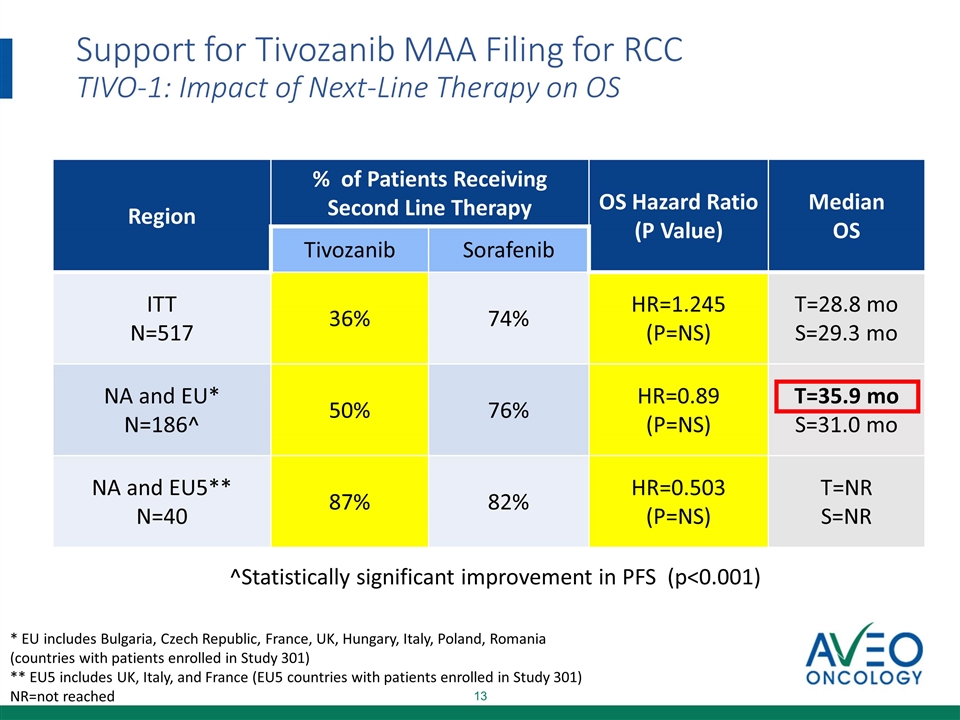

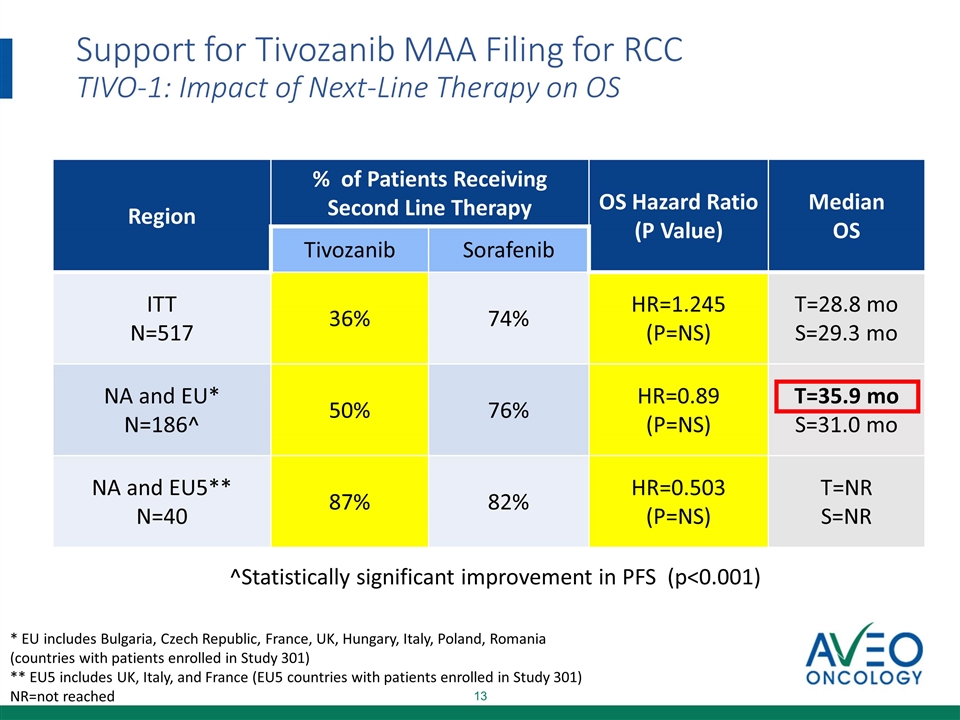

Support for Tivozanib MAA Filing for RCC TIVO-1: Impact of Next-Line Therapy on OS * EU includes Bulgaria, Czech Republic, France, UK, Hungary, Italy, Poland, Romania (countries with patients enrolled in Study 301) ** EU5 includes UK, Italy, and France (EU5 countries with patients enrolled in Study 301) NR=not reached ^Statistically significant improvement in PFS (p<0.001) Region % of Patients Receiving Second Line Therapy OS Hazard Ratio (P Value) Median OS Tivozanib Sorafenib ITT N=517 36% 74% HR=1.245 (P=NS) T=28.8 mo S=29.3 mo NA and EU* N=186^ 50% 76% HR=0.89 (P=NS) T=35.9 mo S=31.0 mo NA and EU5** N=40 87% 82% HR=0.503 (P=NS) T=NR S=NR

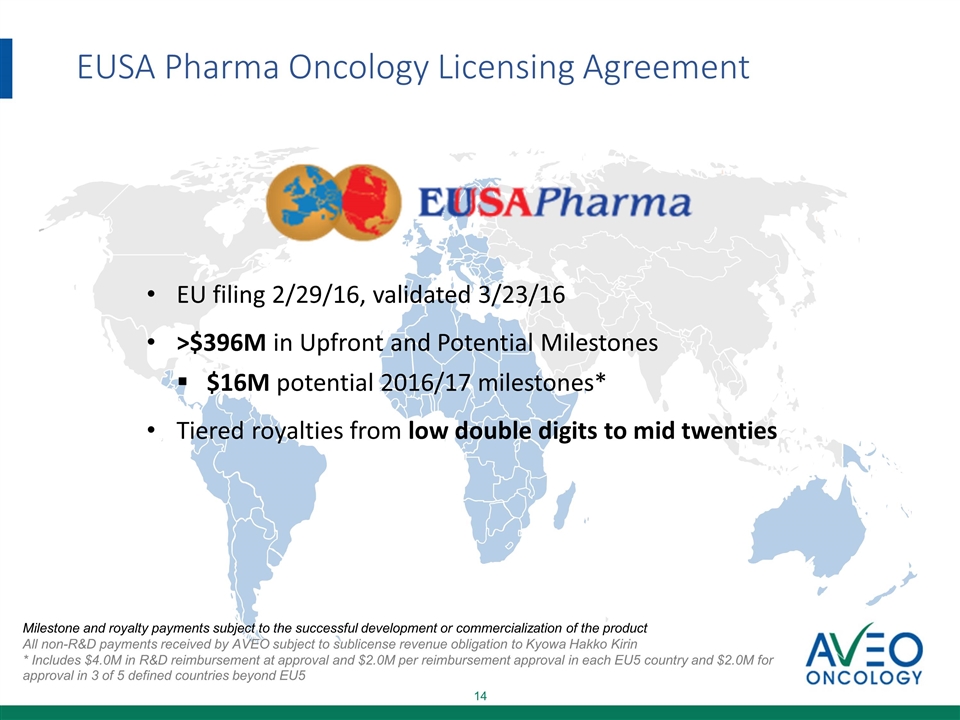

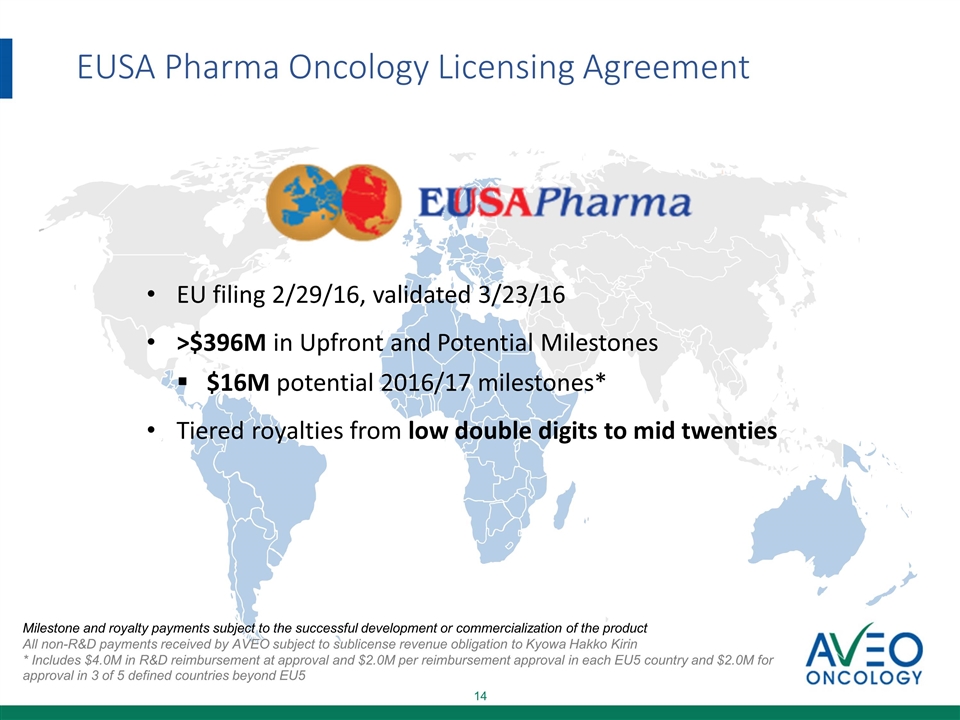

EUSA Pharma Oncology Licensing Agreement EU filing 2/29/16, validated 3/23/16 >$396M in Upfront and Potential Milestones $16M potential 2016/17 milestones* Tiered royalties from low double digits to mid twenties Milestone and royalty payments subject to the successful development or commercialization of the product All non-R&D payments received by AVEO subject to sublicense revenue obligation to Kyowa Hakko Kirin * Includes $4.0M in R&D reimbursement at approval and $2.0M per reimbursement approval in each EU5 country and $2.0M for approval in 3 of 5 defined countries beyond EU5

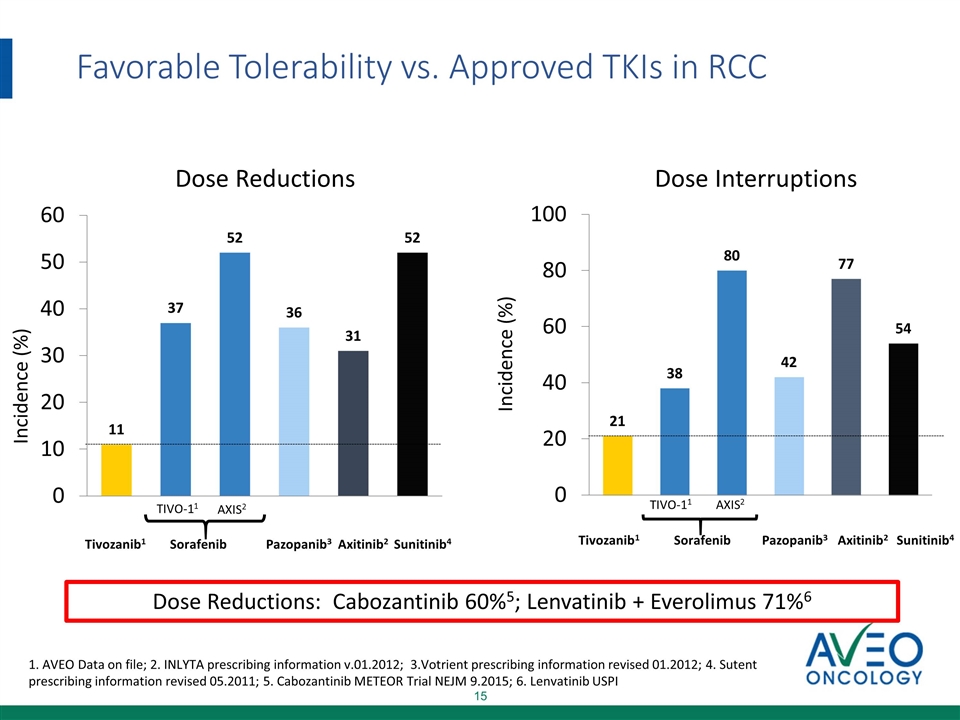

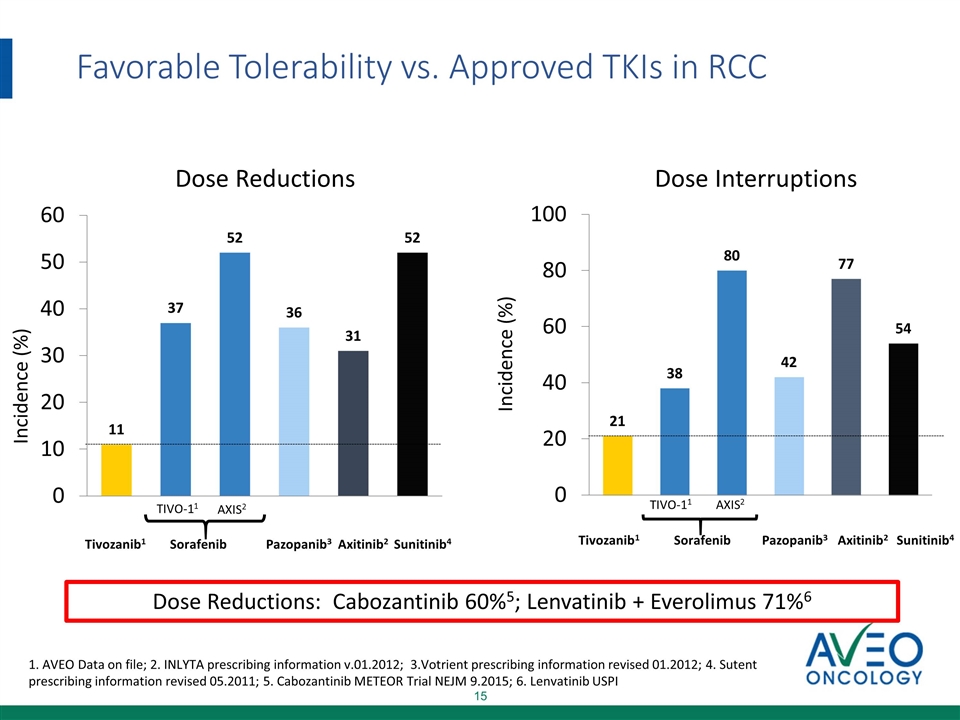

Favorable Tolerability vs. Approved TKIs in RCC 1. AVEO Data on file; 2. INLYTA prescribing information v.01.2012; 3.Votrient prescribing information revised 01.2012; 4. Sutent prescribing information revised 05.2011; 5. Cabozantinib METEOR Trial NEJM 9.2015; 6. Lenvatinib USPI Dose Reductions: Cabozantinib 60%5; Lenvatinib + Everolimus 71%6 Incidence (%) Incidence (%) Tivozanib1 Sorafenib Pazopanib3 Axitinib2 TIVO-11 AXIS2 Sunitinib4 Dose Reductions Dose Interruptions Tivozanib1 Sorafenib Pazopanib3 Axitinib2 TIVO-11 AXIS2 Sunitinib4

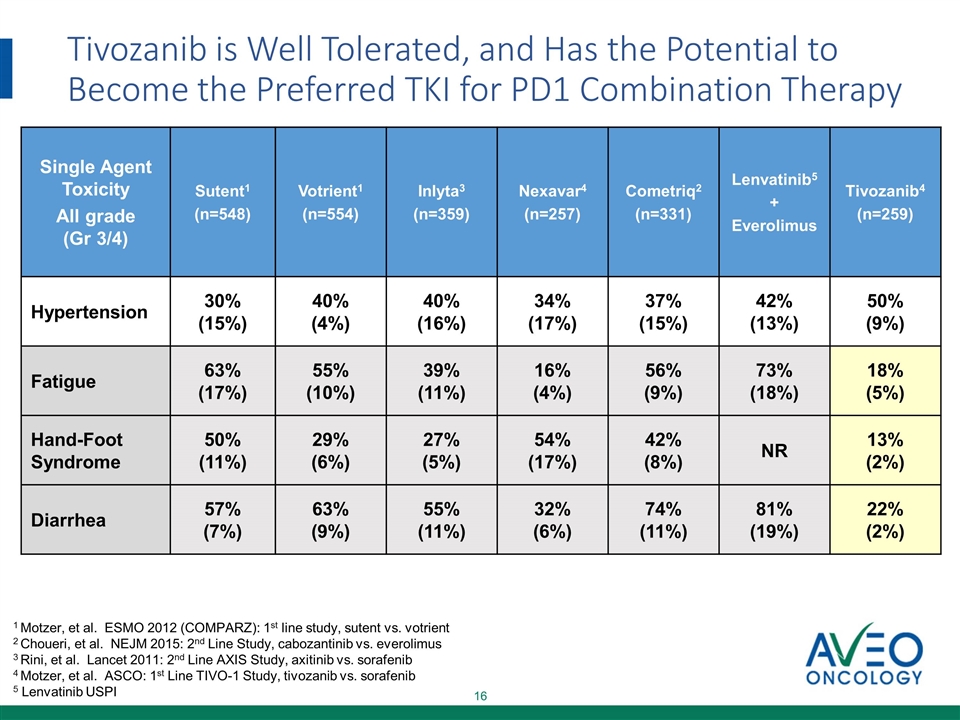

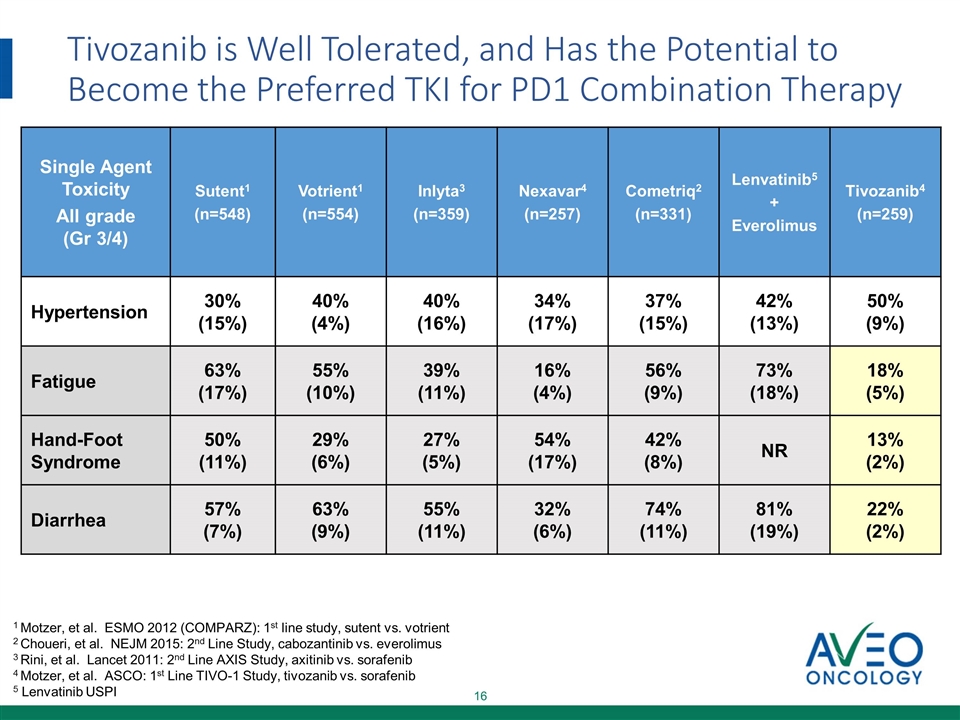

Tivozanib is Well Tolerated, and Has the Potential to Become the Preferred TKI for PD1 Combination Therapy Single Agent Toxicity All grade (Gr 3/4) Sutent1 (n=548) Votrient1 (n=554) Inlyta3 (n=359) Nexavar4 (n=257) Cometriq2 (n=331) Lenvatinib5 + Everolimus Tivozanib4 (n=259) Hypertension 30% (15%) 40% (4%) 40% (16%) 34% (17%) 37% (15%) 42% (13%) 50% (9%) Fatigue 63% (17%) 55% (10%) 39% (11%) 16% (4%) 56% (9%) 73% (18%) 18% (5%) Hand-Foot Syndrome 50% (11%) 29% (6%) 27% (5%) 54% (17%) 42% (8%) NR 13% (2%) Diarrhea 57% (7%) 63% (9%) 55% (11%) 32% (6%) 74% (11%) 81% (19%) 22% (2%) 1 Motzer, et al. ESMO 2012 (COMPARZ): 1st line study, sutent vs. votrient 2 Choueri, et al. NEJM 2015: 2nd Line Study, cabozantinib vs. everolimus 3 Rini, et al. Lancet 2011: 2nd Line AXIS Study, axitinib vs. sorafenib 4 Motzer, et al. ASCO: 1st Line TIVO-1 Study, tivozanib vs. sorafenib 5 Lenvatinib USPI

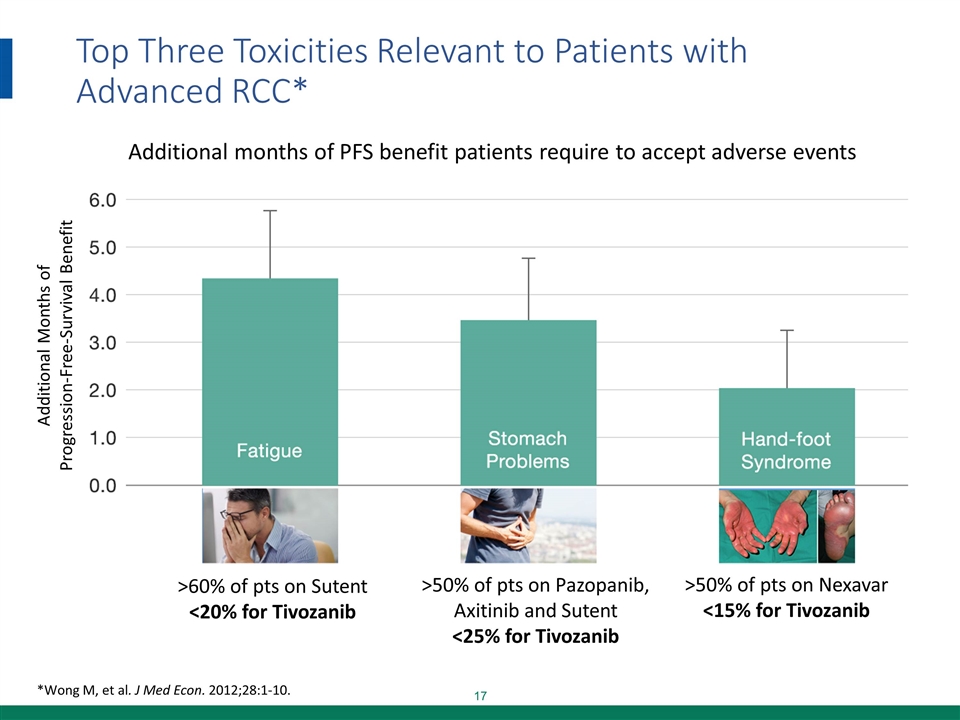

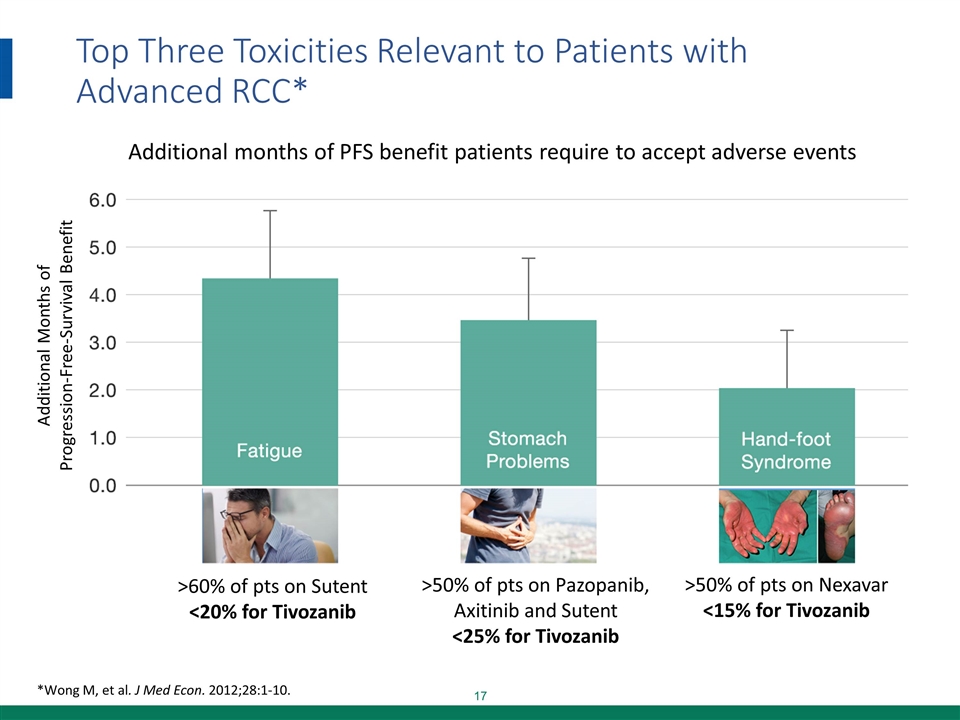

Top Three Toxicities Relevant to Patients with Advanced RCC* *Wong M, et al. J Med Econ. 2012;28:1-10. Additional months of PFS benefit patients require to accept adverse events >50% of pts on Nexavar <15% for Tivozanib >60% of pts on Sutent <20% for Tivozanib >50% of pts on Pazopanib, Axitinib and Sutent <25% for Tivozanib Additional Months of Progression-Free-Survival Benefit

Tivozanib North American Registration Strategy

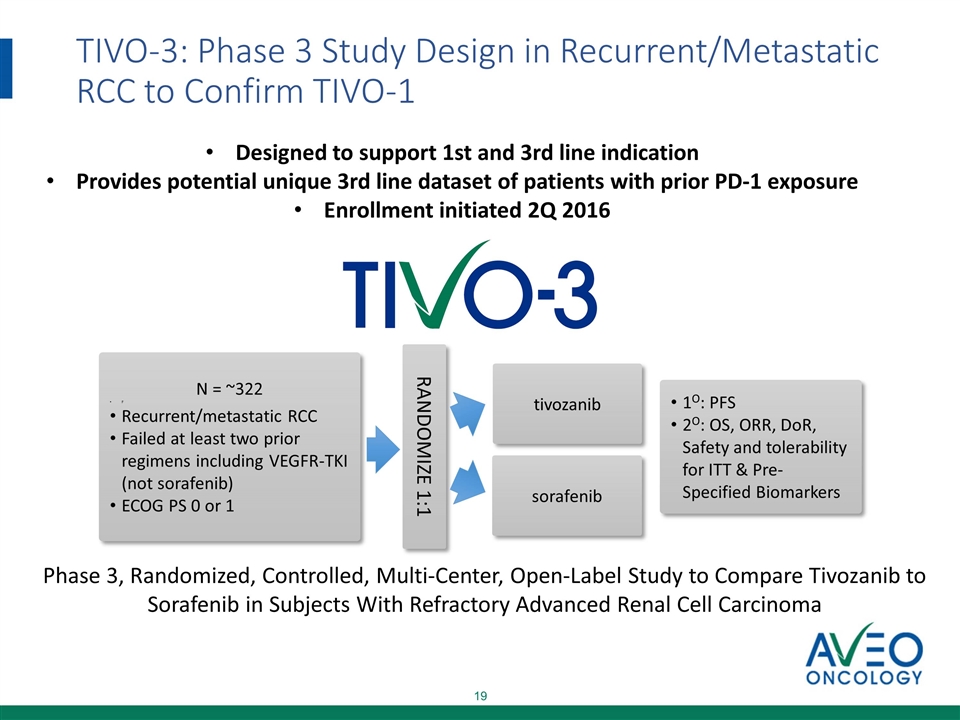

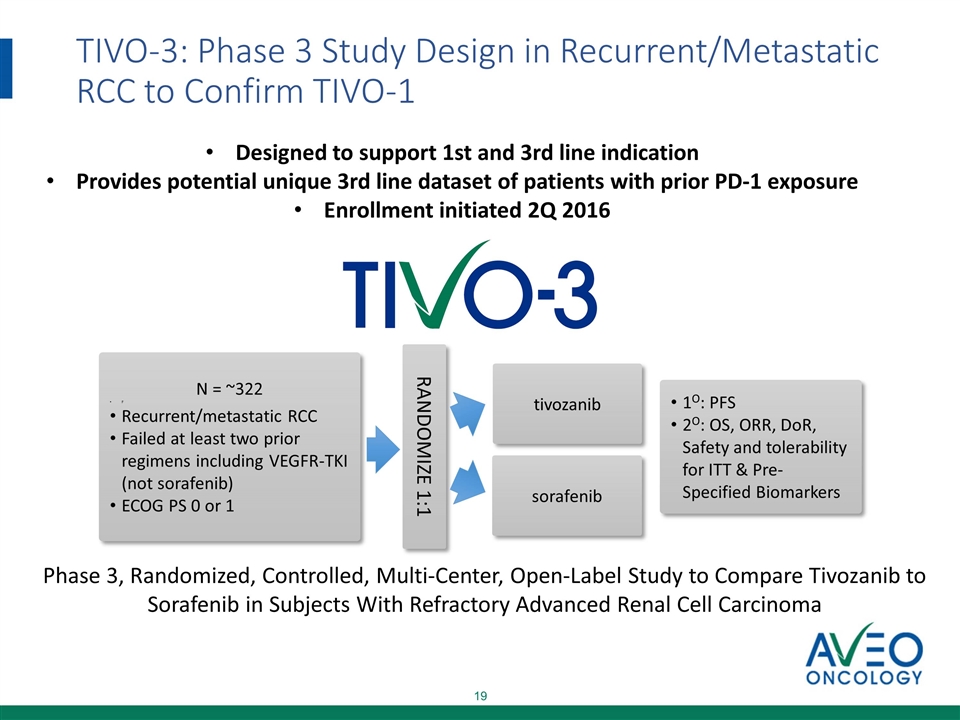

TIVO-3: Phase 3 Study Design in Recurrent/Metastatic RCC to Confirm TIVO-1 N = ~322 F Recurrent/metastatic RCC Failed at least two prior regimens including VEGFR-TKI (not sorafenib) ECOG PS 0 or 1 RANDOMIZE 1:1 tivozanib sorafenib 1O: PFS 2O: OS, ORR, DoR, Safety and tolerability for ITT & Pre-Specified Biomarkers Phase 3, Randomized, Controlled, Multi-Center, Open-Label Study to Compare Tivozanib to Sorafenib in Subjects With Refractory Advanced Renal Cell Carcinoma Designed to support 1st and 3rd line indication Provides potential unique 3rd line dataset of patients with prior PD-1 exposure Enrollment initiated 2Q 2016

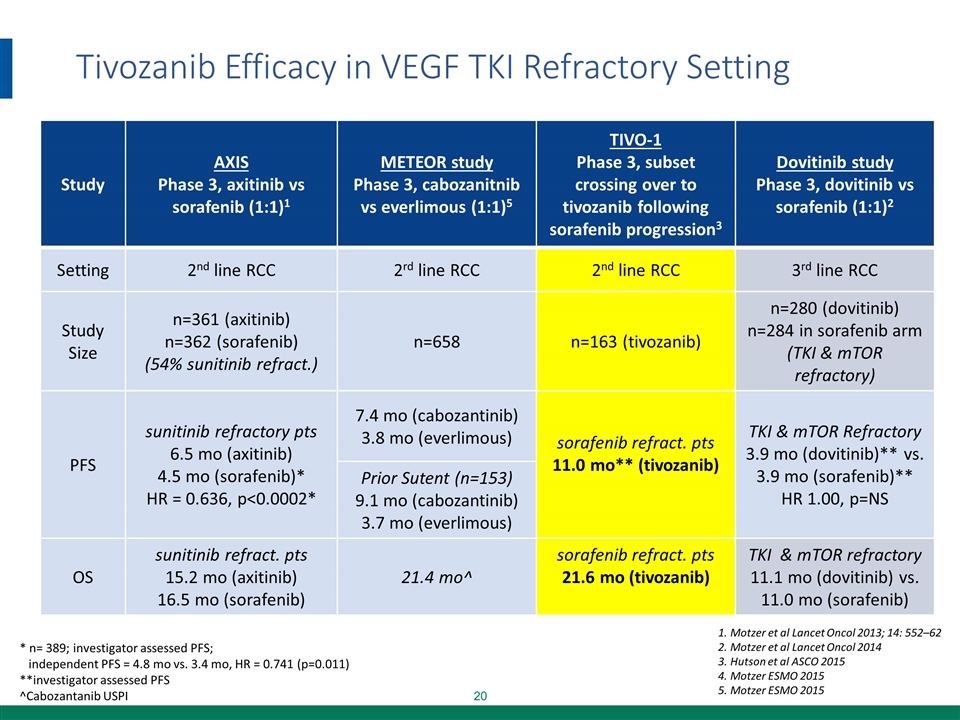

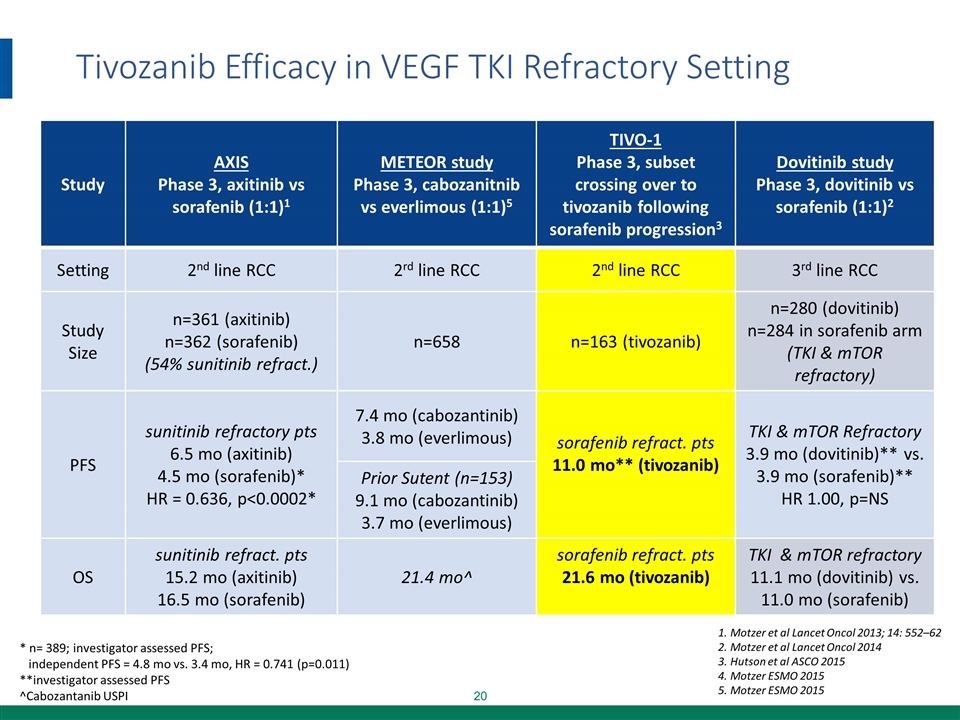

Tivozanib Efficacy in VEGF TKI Refractory Setting * n= 389; investigator assessed PFS; independent PFS = 4.8 mo vs. 3.4 mo, HR = 0.741 (p=0.011) **investigator assessed PFS ^Cabozantanib USPI Motzer et al Lancet Oncol 2013; 14: 552–62 Motzer et al Lancet Oncol 2014 Hutson et al ASCO 2015 Motzer ESMO 2015 Motzer ESMO 2015 Study AXIS Phase 3, axitinib vs sorafenib (1:1)1 METEOR study Phase 3, cabozanitnib vs everlimous (1:1)5 TIVO-1 Phase 3, subset crossing over to tivozanib following sorafenib progression3 Dovitinib study Phase 3, dovitinib vs sorafenib (1:1)2 Setting 2nd line RCC 2rd line RCC 2nd line RCC 3rd line RCC Study Size n=361 (axitinib) n=362 (sorafenib) (54% sunitinib refract.) n=658 n=163 (tivozanib) n=280 (dovitinib) n=284 in sorafenib arm (TKI & mTOR refractory) PFS sunitinib refractory pts 6.5 mo (axitinib) 4.5 mo (sorafenib)* HR = 0.636, p<0.0002* 7.4 mo (cabozantinib) 3.8 mo (everlimous) sorafenib refract. pts 11.0 mo** (tivozanib) TKI & mTOR Refractory 3.9 mo (dovitinib)** vs. 3.9 mo (sorafenib)** HR 1.00, p=NS Prior Sutent (n=153) 9.1 mo (cabozantinib) 3.7 mo (everlimous) OS sunitinib refract. pts 15.2 mo (axitinib) 16.5 mo (sorafenib) 21.4 mo^ sorafenib refract. pts 21.6 mo (tivozanib) TKI & mTOR refractory 11.1 mo (dovitinib) vs. 11.0 mo (sorafenib)

Tivozanib PD-1 Combination Setting

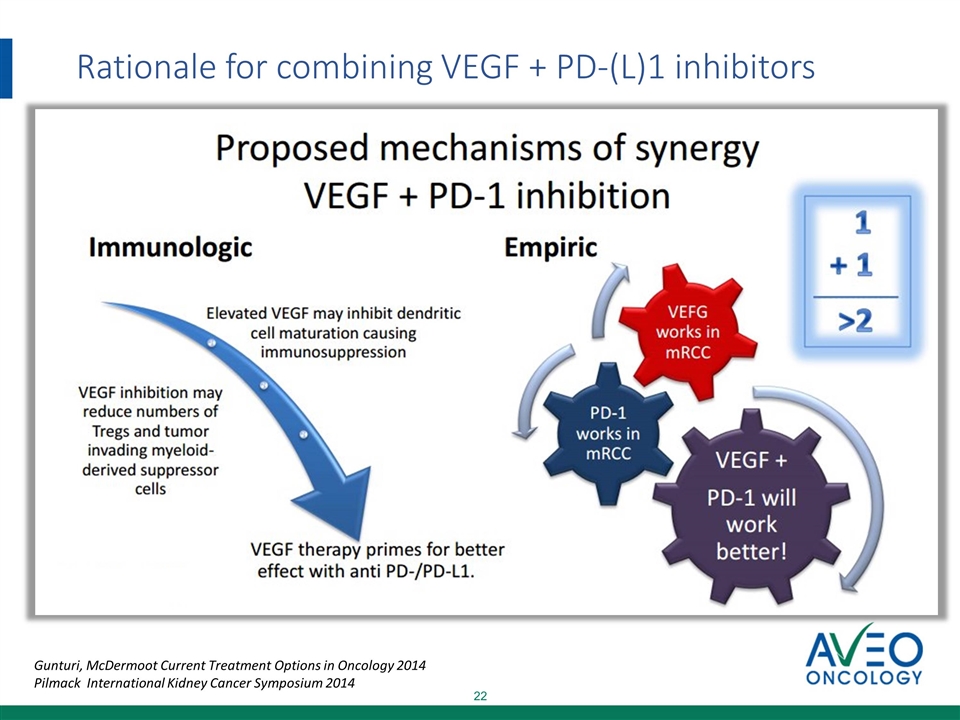

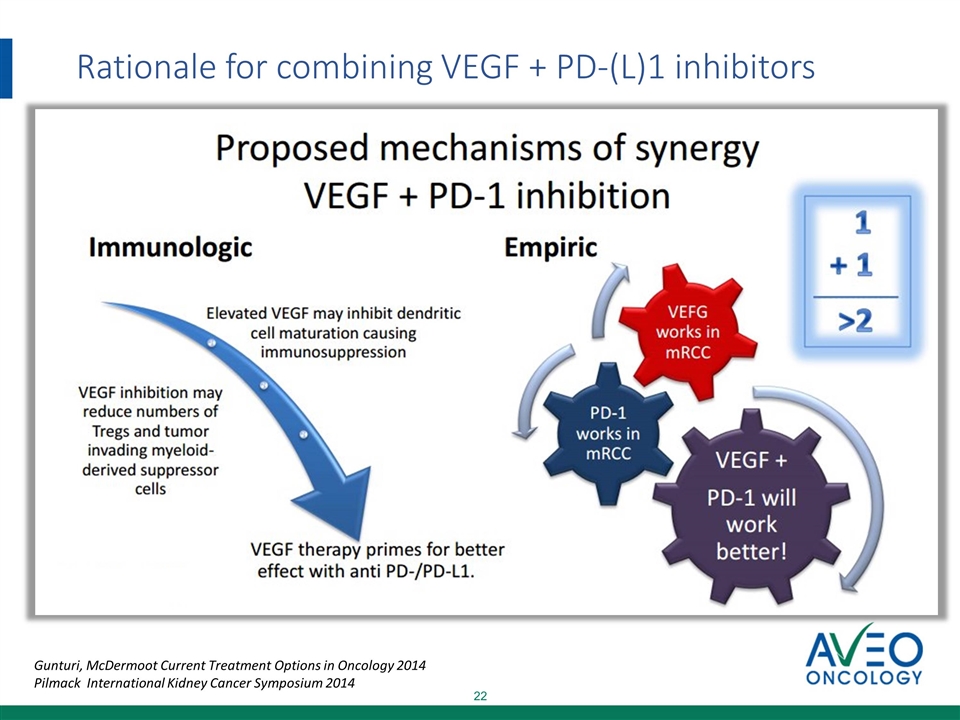

Rationale for combining VEGF + PD-(L)1 inhibitors Gunturi, McDermoot Current Treatment Options in Oncology 2014 Pilmack International Kidney Cancer Symposium 2014

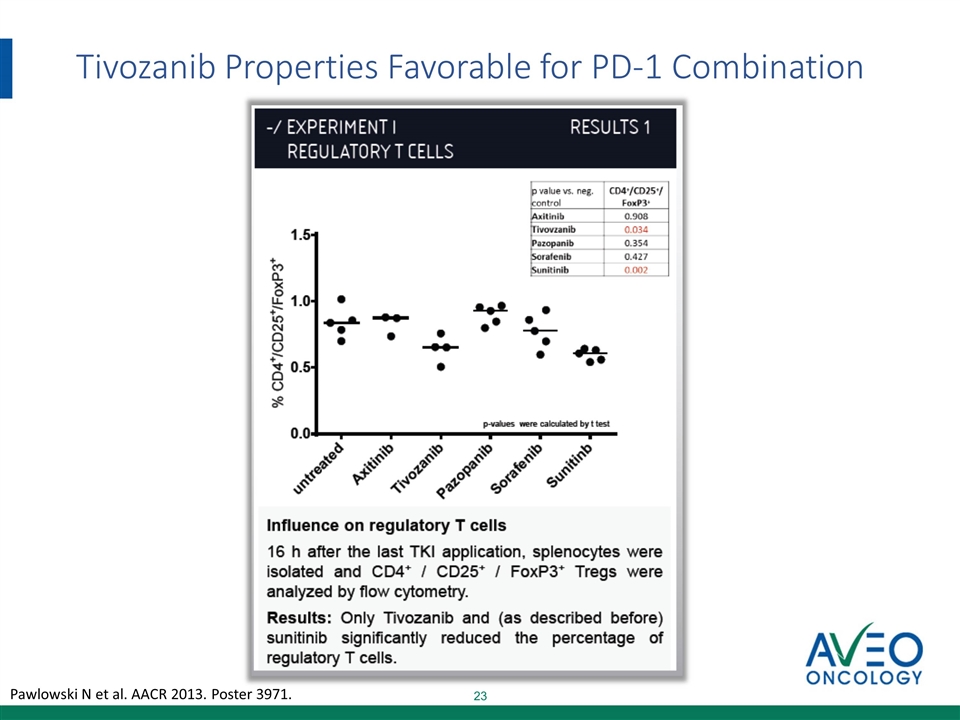

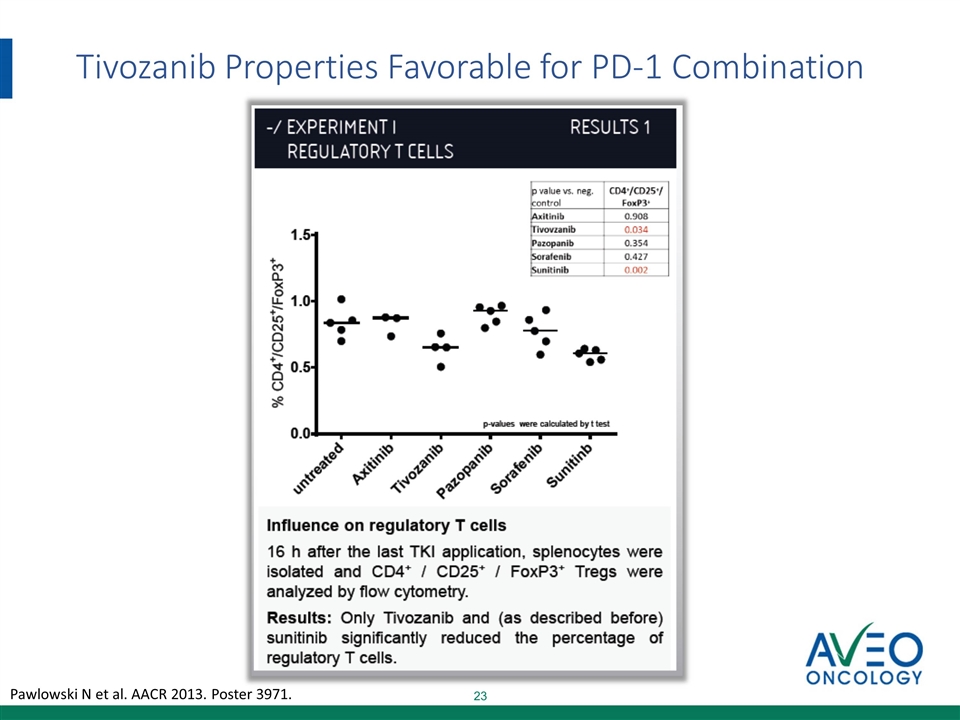

Tivozanib Properties Favorable for PD-1 Combination Pawlowski N et al. AACR 2013. Poster 3971.

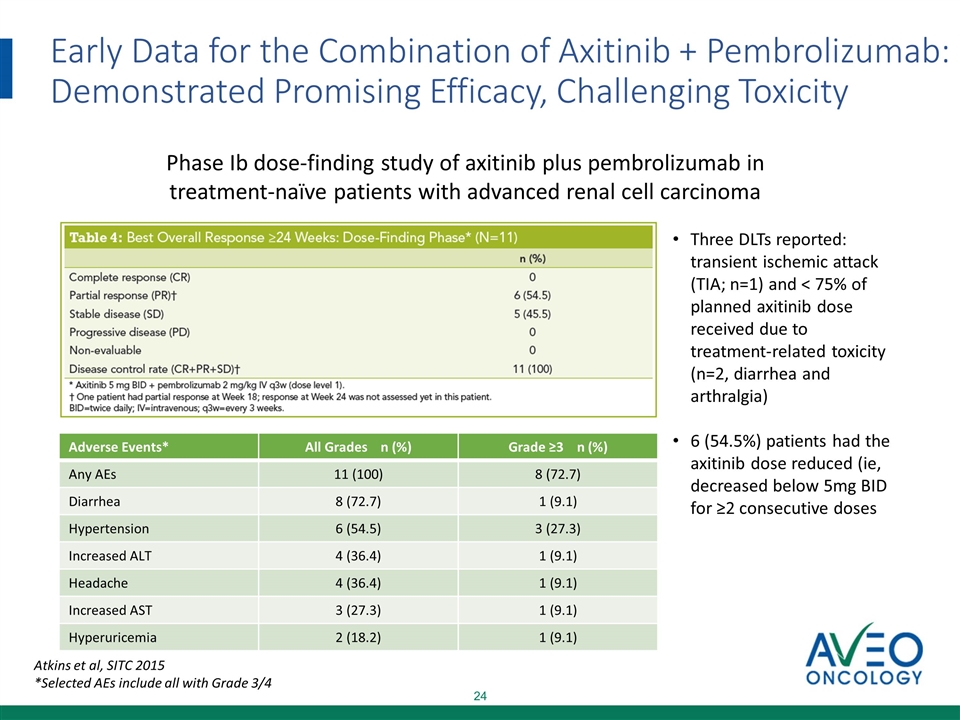

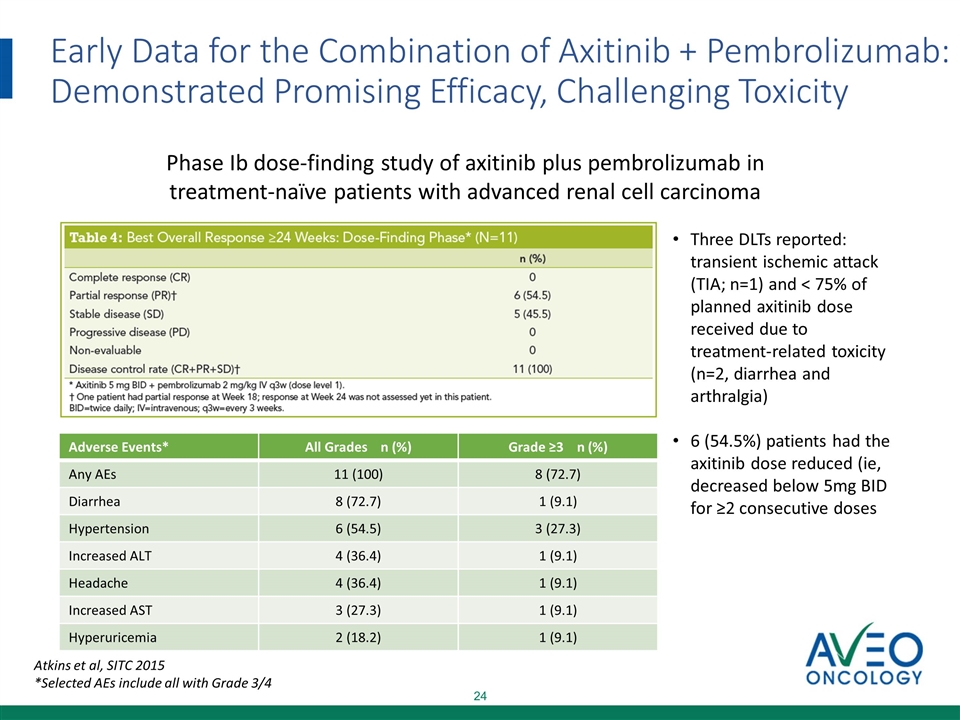

Early Data for the Combination of Axitinib + Pembrolizumab: Demonstrated Promising Efficacy, Challenging Toxicity Atkins et al, SITC 2015 *Selected AEs include all with Grade 3/4 Three DLTs reported: transient ischemic attack (TIA; n=1) and < 75% of planned axitinib dose received due to treatment-related toxicity (n=2, diarrhea and arthralgia) 6 (54.5%) patients had the axitinib dose reduced (ie, decreased below 5mg BID for ≥2 consecutive doses Phase Ib dose-finding study of axitinib plus pembrolizumab in treatment-naïve patients with advanced renal cell carcinoma Adverse Events* All Grades n (%) Grade ≥3 n (%) Any AEs 11 (100) 8 (72.7) Diarrhea 8 (72.7) 1 (9.1) Hypertension 6 (54.5) 3 (27.3) Increased ALT 4 (36.4) 1 (9.1) Headache 4 (36.4) 1 (9.1) Increased AST 3 (27.3) 1 (9.1) Hyperuricemia 2 (18.2) 1 (9.1)

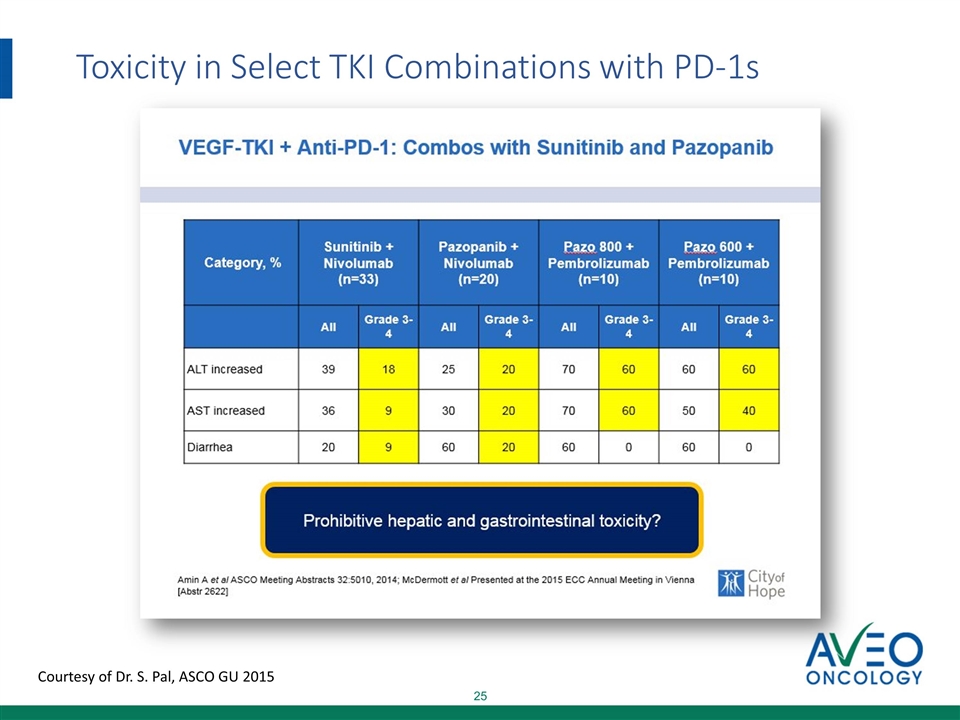

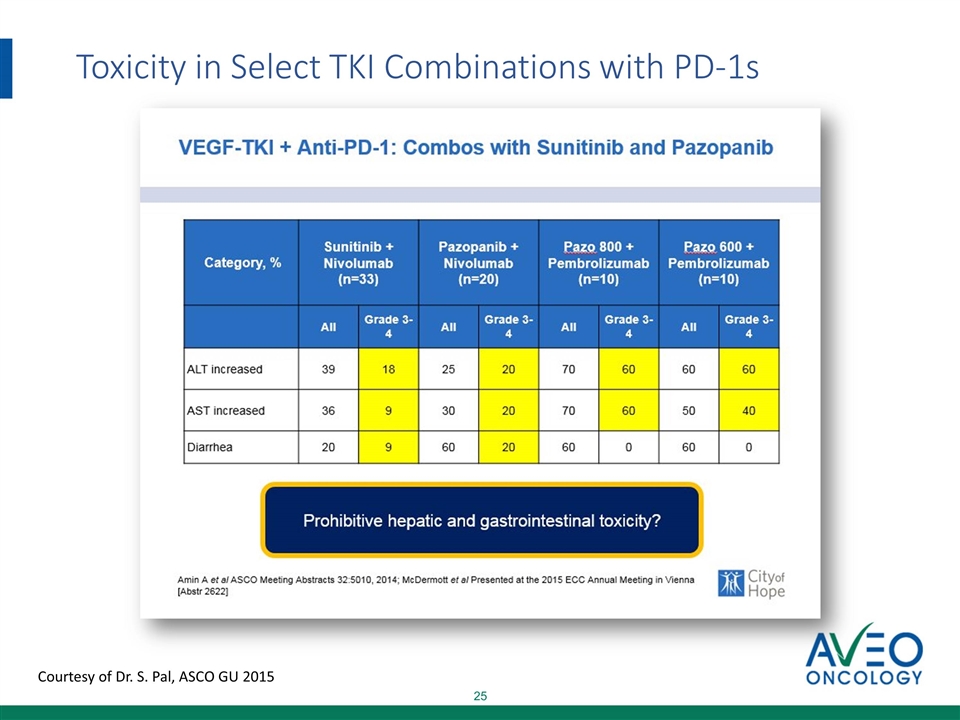

Toxicity in Select TKI Combinations with PD-1s Courtesy of Dr. S. Pal, ASCO GU 2015

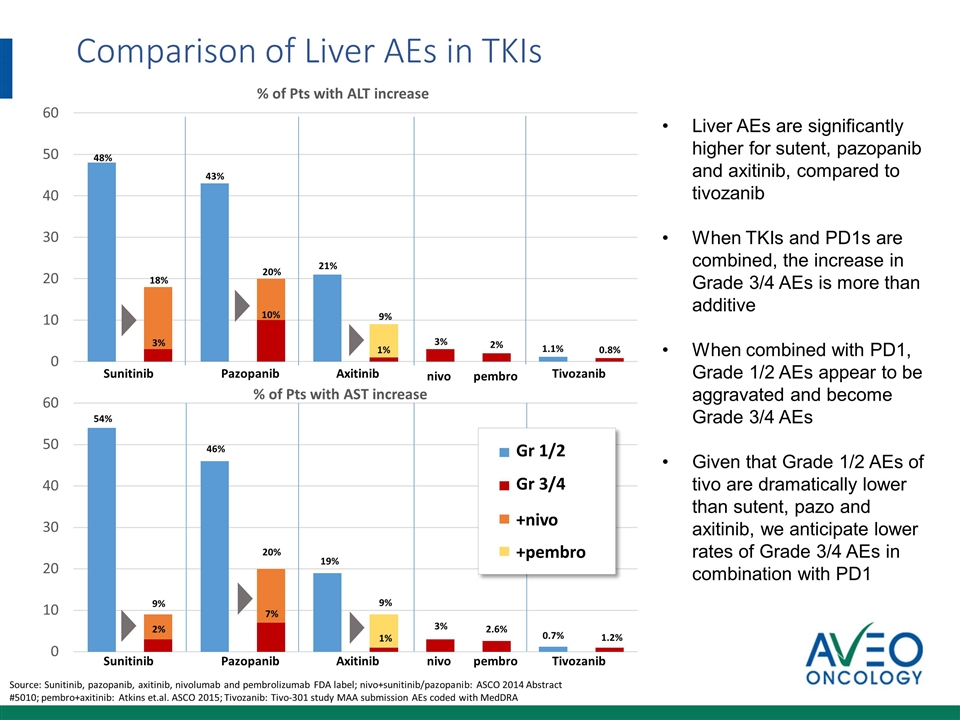

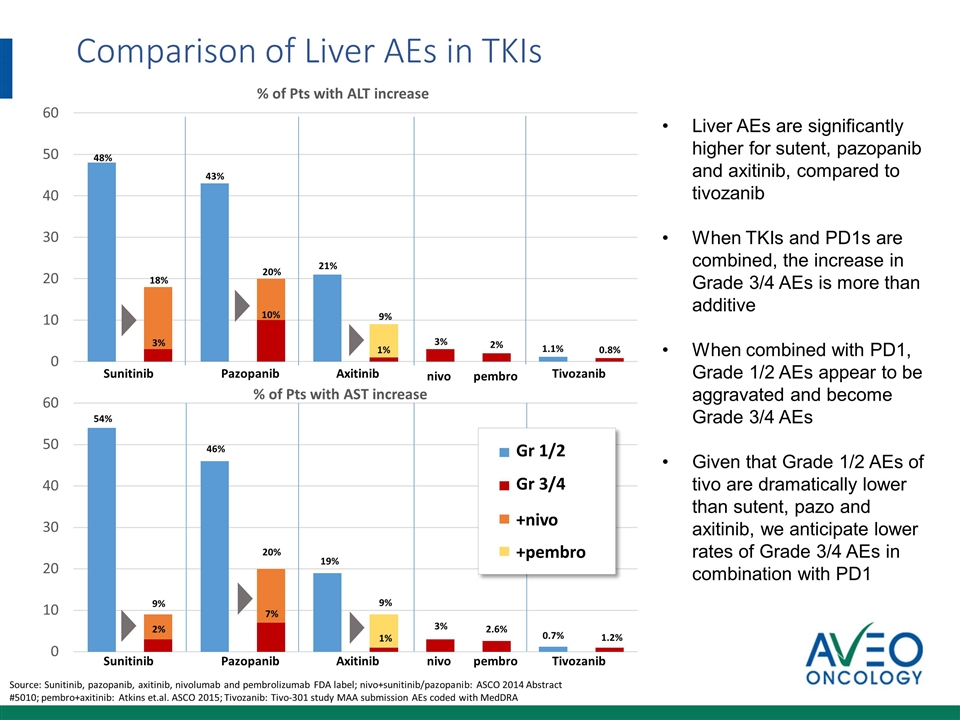

Axitinib Tivozanib Axitinib Tivozanib Comparison of Liver AEs in TKIs Liver AEs are significantly higher for sutent, pazopanib and axitinib, compared to tivozanib When TKIs and PD1s are combined, the increase in Grade 3/4 AEs is more than additive When combined with PD1, Grade 1/2 AEs appear to be aggravated and become Grade 3/4 AEs Given that Grade 1/2 AEs of tivo are dramatically lower than sutent, pazo and axitinib, we anticipate lower rates of Grade 3/4 AEs in combination with PD1 Sunitinib Pazopanib nivo 48% 18% 3% 43% 20% 10% 21% 9% 1% 1.1% 0.8% 54% 9% 2% 46% 20% 7% 19% 9% 1% 0.7% 1.2% Sunitinib Pazopanib pembro nivo pembro +nivo +pembro Gr 1/2 3% 2% Gr 3/4 3% 2.6% Source: Sunitinib, pazopanib, axitinib, nivolumab and pembrolizumab FDA label; nivo+sunitinib/pazopanib: ASCO 2014 Abstract #5010; pembro+axitinib: Atkins et.al. ASCO 2015; Tivozanib: Tivo-301 study MAA submission AEs coded with MedDRA

Robust Pipeline Development Funded by Partnerships

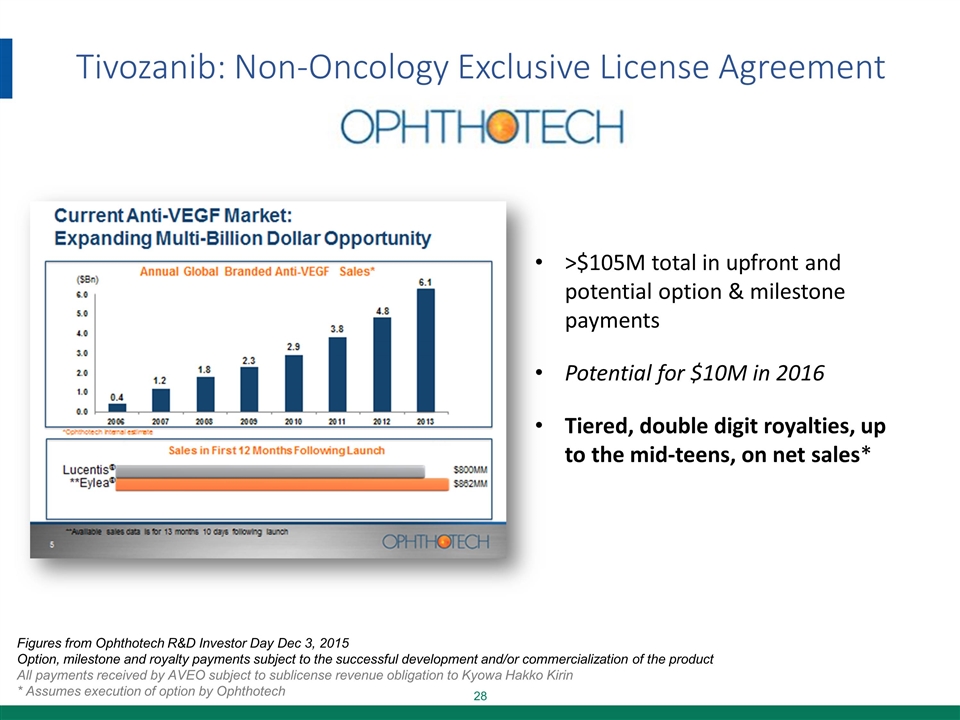

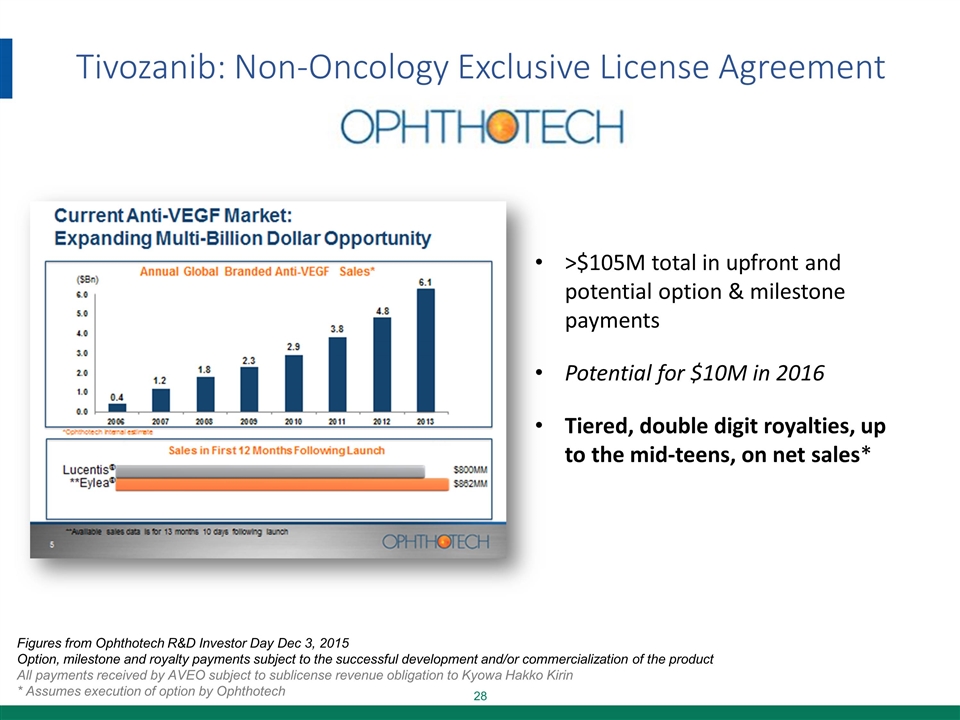

Tivozanib: Non-Oncology Exclusive License Agreement >$105M total in upfront and potential option & milestone payments Potential for $10M in 2016 Tiered, double digit royalties, up to the mid-teens, on net sales* Figures from Ophthotech R&D Investor Day Dec 3, 2015 Option, milestone and royalty payments subject to the successful development and/or commercialization of the product All payments received by AVEO subject to sublicense revenue obligation to Kyowa Hakko Kirin * Assumes execution of option by Ophthotech

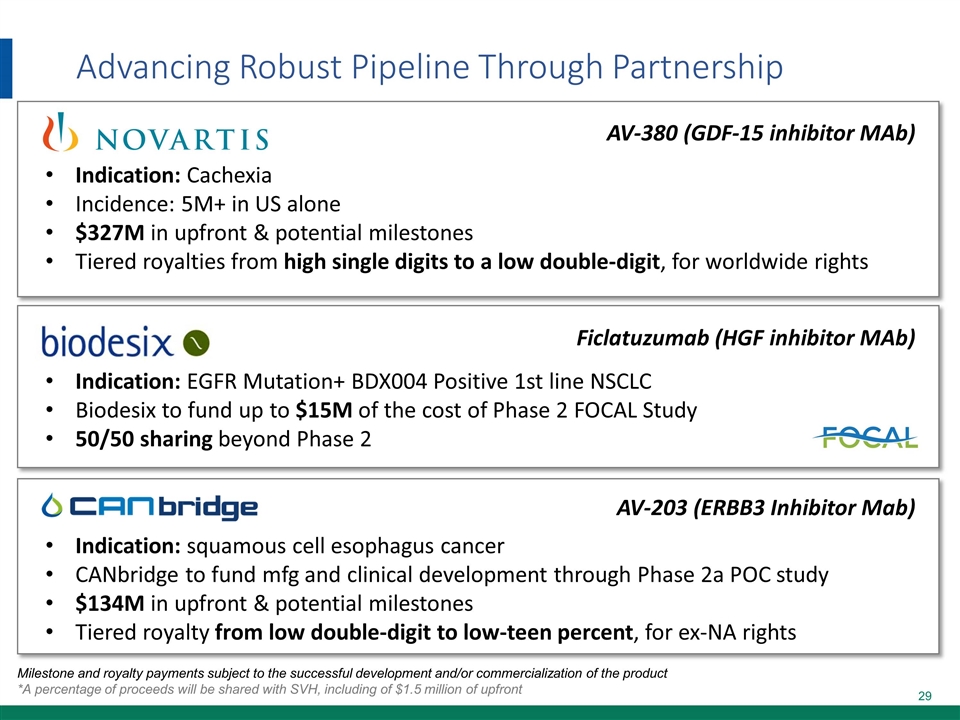

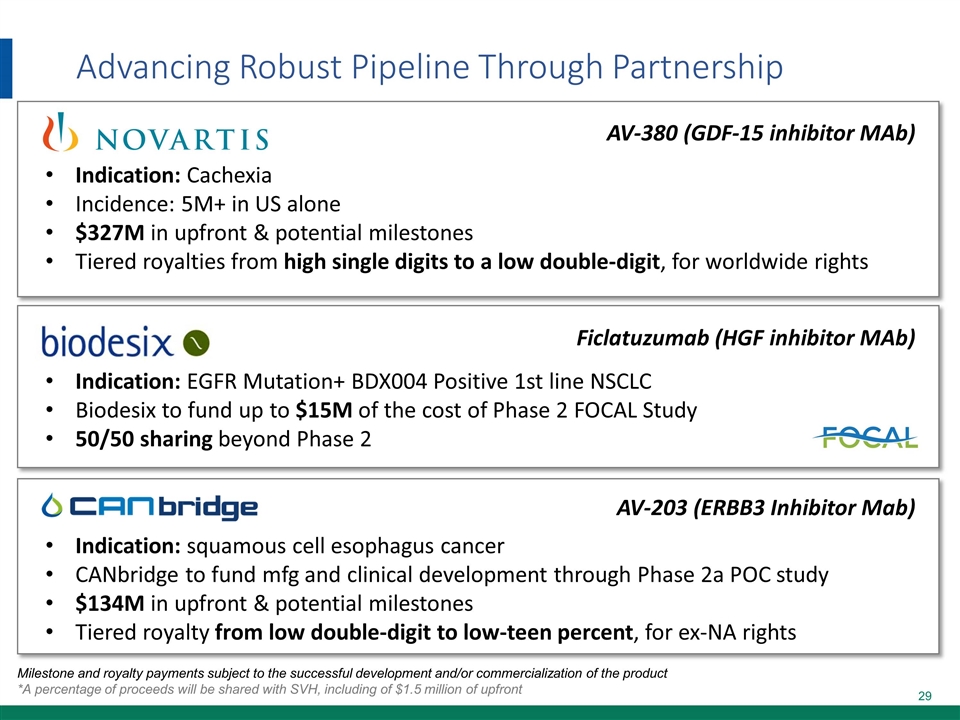

Advancing Robust Pipeline Through Partnership Milestone and royalty payments subject to the successful development and/or commercialization of the product *A percentage of proceeds will be shared with SVH, including of $1.5 million of upfront AV-380 (GDF-15 inhibitor MAb) Indication: Cachexia Incidence: 5M+ in US alone $327M in upfront & potential milestones Tiered royalties from high single digits to a low double-digit, for worldwide rights Ficlatuzumab (HGF inhibitor MAb) Indication: EGFR Mutation+ BDX004 Positive 1st line NSCLC Biodesix to fund up to $15M of the cost of Phase 2 FOCAL Study 50/50 sharing beyond Phase 2 AV-203 (ERBB3 Inhibitor Mab) Indication: squamous cell esophagus cancer CANbridge to fund mfg and clinical development through Phase 2a POC study $134M in upfront & potential milestones Tiered royalty from low double-digit to low-teen percent, for ex-NA rights

AV-353: 1st-in-class opportunity to address major unmet need in Pulmonary arterial hypertension (PAH) as first drug with disease modifying properties Binding specificity to Notch 3 reduces risks of pan-Notch toxicities that have hampered competitors Large Market Opportunity 2014 sales of $3.45B à 2024 sales of $4.75B Significant development opportunity with big market in additional oncology indications AV-353 Notch 3 Mab: First-in-Class Opportunity in Pulmonary Arterial Hypertension Pathophysiology of PAH AVEO owns worldwide rights to AV-353 and is actively seeking partners to help realize the full potential of the asset

Financials & Summary

Financial Highlights Cash and anticipated operational milestones to fully fund North American tivozanib development strategy to topline data $24M in cash and investments as of 1Q 2016 $17M equity financing completed 2Q 2016 Amended debt agreement for additional $5M, access to another $5M tranche and deferred repayment of principal for existing debt >$35M in potential payments through mid-2017 including: ~$10M in operational, not clinical milestones (IND filings, tech transfer) Streamlined operations with a headcount of ~20 Shares outstanding as of 5/5/16: ~58.2M† *As of year end financial results; Does not include potential development expense or receipt of milestone payments associated with partnerships † Excludes 5/13/2016 equity financing

Significant Progress During 2015 and 2016 Tivozanib Initiation of 3rd line confirmatory RCC Phase 3 study Filing and acceptance of filings in EU Partnership in EU ASCO presentation of refractory RCC data Presentation of encouraging CRC data Pipeline AV-380 partnership and option exercise AV-203 partnership AV-353 patent applications Corporate Streamlined operations – facilities & staffing Strengthened balance sheet Clinical / Regulatory Partnership Data

Potential Corporate Milestones Tivozanib Regulatory decision in EU (1Q17) Other geographic partnerships Initiation of PD1 combination study Proof of concept in AMD and option exercise (2016/17) TIVO-3 PFS data/OS trend (1Q18) Potential NDA submission (2H18) Pipeline (2016/17) Partnership for AV-353 Development Milestones for AV-380 Manufacturing transfer and re-initiation of AV-203 clinical dev. Data readout of FOCAL (ficlatuzumab) study

AVEO Oncology Highlights Retained significant North American (N.A.) rights for all oncology therapeutic assets Executing on potential N.A. registration strategies for Tivozanib Enrolling Ph 3 refractory RCC study (TIVO-3) to support 1st & 3rd line indications Anticipated PD1 combination study in RCC Advancing portfolio for value creation through partnerships Tivozanib: Partnership led regulatory review in EU for 1st line RCC; Partner-funded development and commercialization for Ocular indications Ficlatuzumab: Partner-funded Ph 2 study (FOCAL) in NSCLC enrolling AV-203: Partner-funded development through POC studies ongoing AV-380: Partner-funded development for cachexia ongoing AV-353: Seeking partner for PAH development Cash and anticipated milestones to fully fund N.A. tivozanib development strategy Lean organization, experienced management team and Board

AVEO Overview June 2016