UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

þ ANNUAL REPORT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

¨ TRANSITION REPORTPURSUANTTOSECTION13OR15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________to ___________.

Commission file number333-135946

HEMIS CORPORATION

(Exact name of registrant as specified in its charter) |

| Nevada | 20-2749916 |

| (State or Other Jurisdiction of Incorporation of Organization) | (I.R.S. Employer Identification No.) |

| |

Bettlistrasse 35

8600 Dübendorf, Switzerland

(Address of principal executive offices) |

(702) 387 2382

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act:NoneSecurities registered under Section 12(g) of the Exchange Act:None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant as required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yesþ No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

¨Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting companyþ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act)Noþ

Aggregate market value of the voting stock of the registrant held by non-affiliates of the registrant at June 29, 2007 (computed by reference to the price at which the common equity was last sold):$20,691,302

Aggregate market value of the voting stock of the registrant held by affiliates of the registrant at June 29, 2007 (computed by reference to the price at which the common equity was last sold of $0.47):$12,854,392

Number of common shares outstanding atMarch 27, 2008:76,363,372

Item 1. Description of Business

Cautionary Statement |

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology including, "could" "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" and the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this Annual Report.

Currency

All currency references in this Report are in US dollars unless otherwise noted.

Introduction

Hemis Corporation (“we”, “us”, “Hemis”) was incorporated as a Nevada company on February 9, 2005. Since our inception, we have been engaged in the acquisition, exploration and development of mineral properties. We carry out exploration activities in Mexico through our only wholly subsidiary, Hemis Gold SA de CV, which was incorporated in Mexico in May 2005.

Overview

We are engaged in the acquisition and exploration of mineral properties in Sonora, Mexico; British Columbia, Canada; and Alaska, U.S. Our plan of operations for the next twelve months beginning January 2008 is to conduct exploration of our mineral properties in Mexico, Canada and the U.S.

Until recently, we also had an option interest in a mineral concession in La Zacatecas, Mexico known as “Santa Rita”. However management has decided to allow our option interest to lapse by choosing not to fulfill certain option payments. Our management does not believe that this particular mineral concession holds as much potential as our other sites and has decided to concentrate our exploration efforts on our other mineral properties in Sonora, Mexico, British Columbia, Canada and Alaska, U.S.

We not yet earned any revenues and have had operational losses to date, as well as an accumulated deficit. From our inception on February 9, 2005 until December 31, 2007, we have incurred a total comprehensive loss of $(22,325,388).

We are an exploration stage company. Our most advanced projects are at the exploration stage and there is no assurance that any of our mining claims contain a commercially viable ore body. We plan to undertake further exploration of our properties. We anticipate that we will require additional financing in order to pursue full exploration of these claims. We do not have sufficient financing to undertake full exploration of our mineral claims at present and there is no assurance that we will be able to obtain the necessary financing.

1

There is no assurance that a commercially viable mineral deposit exists on any of our mineral properties. Further exploration beyond the scope of our planned exploration activities will be required before a final evaluation as to the economic and legal feasibility of mining of any of our properties is determined. There is no assurance that further exploration will result in a final evaluation that a commercially viable mineral deposit exists on any of our mineral properties.

Mineral Properties and Plan of Operations

We are engaged in the acquisition and exploration of mineral properties in Sonora, Mexico; British Columbia, Canada; and Alaska, U.S.A. We have acquired a percentage interest in two properties in Sonora, Mexico and hold options to acquire interests in two further mineral concessions on properties in Mexico. In addition, we hold the rights to acquire various offshore prospect permitting applications in Alaska, some of which have been granted. We also hold the rights to acquire interests in two mineral claims in Canada as described below:

| Name of Property | Location | Nature of Interest |

| El Tigre Property | Sonora, Mexico | 67.5% interest in mining rights |

| Porvenir Property | Sonora, Mexico | 67.5% interest in mining rights |

| La Centela Property | Sonora, Mexico | Option to acquire up to a 75% interest in mining rights |

| Anchor Point Gold Project | Alaska, US | Right to acquire various offshore prospecting permit applications and a non-exclusive license of geologic information |

| Wolfe Creek and Covenant Properties | British Columbia, Canada | Option to acquire 100% interest in mining rights of two properties |

Our interest in the El Tigre and Porvenir properties consists of an Option Agreement our wholly owned subsidiary, Hemis Gold S.A. de C.V. entered into with Loreto Careaga Galaz Widow Rascón and others on December 31, 2005. The agreement grants us an option to acquire a 67.5% interest in the El Tigre and Porvenir properties. On November 5, 2007, we entered into an agreement granting Monte Cristo Gold Corporation the option to purchase either 49% or 60% of our interest in these properties from us. Bruno Weiss, our Director and Chief Financial Officer is Chief Financial Officer of Monte Cristo. To exercise the 49% interest option, Monte Cristo must pay us two payments, the first in the amount of $100,000 within 5 business days following November 5, 2007, and the second of $1,900,000 on or before November 4, 2008. To exercise the 60% interest option, Monte Cristo must pay us the amounts specified to exercise the 49% option, as well as two additional payments of $500,000 by March 3, 2009 and $1 ,500,000 by November 3, 2009, respectively.

On September 7, 2006 we entered into an agreement with Electrum Capital, Inc. and Snra. Maria de Los Angeles Valverde Guzman whereby we acquired options to acquire up to 75% of the La Centela mineral claims. The La Centela mineral claims are located to the North, North East and West of the Porvenir claim.

2

On January 8, 2007 we entered into an agreement with Aspen Exploration Corporation pursuant to which Aspen assigned offshore prospecting permit applications in an area of the Cook Inlet, Alaska to us, together with a non-exclusive license of all of Aspen’s right, title and interests to all maps, aeromagnetic surveys and geologic information developed by Aspen in the Cook Inlet, Alaska, which we refer to as the “Anchor Point Gold Project”.

On November 16, 2007, we entered into an agreement which became effective on November 23, 2007 granting Condor Gold Corporation, the option to purchase either 49% or 60% of our interest in the Anchor Point Gold Project from us. Bruno Weiss, our Director and Chief Financial Officer, is a major shareholder and Chief Financial Officer of Condor Gold. Norman Meier, our President and Chief Executive Officer is a major shareholder of Condor Gold. To exercise the 49% interest option, Condor Gold must pay us two payments, the first in the amount of $100,000 within 5 business days following November 23, 2007, and the second of $1,900,000 on or before November 23, 2008. Condor Gold failed to make the initial $100,000 payment to maintain its option and therefore the option expired and the Option Agreement terminated as of November 22, 2007.

We have not acquired an interest in any physical property in the Cook Inlet, Alaska. Previously, Aspen have made two attempts to have the offshore prospecting permit applications granted, but both times, have been denied. We are in the process of applying to have the same applications granted. If we are successful in applying for them, we will have the right to exploit, mine and produce all minerals lying beneath the surface of the defined area. However, there is a risk that the State of Alaska will never accept these offshore prospecting permit applications in which case this asset will be of little value to us.

Our interest in the Wolfe Creek and Covenant mining concessions consists of an option agreement we signed with Stacs GmbH on March 13, 2007 whereby we have an option to acquire a 100% interest to mineral rights on two properties that we refer to as Wolfe Creek and Covenant, in British Columbia, Canada.

Our plan of operations is to carry out exploration of our mineral properties in Sonora, Mexico and British Columbia, Canada and to get approval for the offshore prospecting permit applications in Alaska. We intend to primarily explore for gold and molybdenum, but if we discover that any of our mineral properties hold potential for other minerals that our management determines are worth exploring further, then we will explore for those other minerals. Our specific exploration plan for each of our mineral properties, together with information regarding the location and access, history of operations, present condition and geology of each of our properties, is presented in the section of this annual report entitled “Description of Properties.” All of our exploration programs are preliminary in nature in that their completion will not result in a determination that any of our properties contains commercially exploitable quantities of mineralization. Our management estimates that if the min eral properties on which we have options do have commercially exploitable quantities of mineralization, it will cost us approximately $5,000,000 in exploration expenses and take us until summer of 2009 to make such a determination.

Our exploration programs will be directed by our management and will be supervised by Dr. Doug Oliver, our Vice President Operations. We will engage contractors to carry out our exploration programs under Dr. Oliver’s supervision. Contractors that we plan to engage include project geologists, geochemical sampling crews and drilling companies, each according the specific exploration program on each property. Our budgets for our exploration programs are set forth in the section of this annual report entitled “Description of Properties.” We plan to solicit bids from drilling companies prior to selecting any drilling company to complete a drilling program. We anticipate paying normal industry rates for core drilling.

3

We plan to complete our exploration programs within the periods specified in the section of this annual report entitled “Description of Properties.” Key factors that could delay completion of our exploration programs beyond the projected timeframes include the following.

| (a) | Poor availability of drill rigs due to high demand in Mexico and Canada; |

| |

| (b) | Delays in obtaining permission from private owners of land adjacent to our properties; |

| |

| (c) | Our inability to identify a joint venture partner and conclude a joint venture agreement where we anticipate a joint venture will be required due to the high costs of a drilling program; |

| |

| (d) | Adverse weather; and |

| |

| (e) | Our inability to obtain sufficient funding. |

| |

Key factors that could cause our exploration costs to be greater than anticipated include the following:

| (a) | adverse drilling conditions, including caving ground, lost circulation, the presence of artesian water, stuck drill steel and adverse weather precluding drill site access; |

| |

| (b) | increased costs for contract geologists and geochemical sampling crews due to increased demand in Mexico and Canada; and |

| |

| (c) | increased drill rig and crew rental costs due to high demand in Mexico and Canada. |

| |

Our Board of Directors will make determinations as to whether to proceed with the additional exploration of our mineral properties based on the results of the preliminary exploration that we undertake. In completing these determinations, we will make an assessment as to whether the results of the preliminary exploration are sufficiently positive to enable us to achieve the financing that would be necessary for us to proceed with more advanced exploration.

We plan to continue exploration of our mineral claims for so long as the results of the geological exploration that we complete indicate that further exploration of our mineral claims is recommended and we are able to obtain the additional financing necessary to enable us to continue exploration. All exploration activities on our mineral claims are presently preliminary exploration activities. Advanced exploration activities, including the completion of comprehensive drilling programs, will be necessary before we are able to complete any feasibility studies on any of our mineral properties. If our exploration activities result in an indication that our mineral claims contain potentially commercial exploitable quantities of gold, then we would attempt to complete feasibility studies on our property to assess whether commercial exploitation of the property would be commercially feasible. There is no assurance that commercial exploitation of our mineral claims would be commercially feasible even i f our initial exploration programs show evidence of gold mineralization.

If we determine not to proceed with further exploration of any of our mineral claims due to results from geological exploration that indicate that further exploration is not recommended, we will attempt to acquire additional interests in new mineral resource properties. There is no assurance that we would be able to acquire an interest in a new property that merits further exploration. If we were to acquire an interest in a new property, then our plan would be to conduct resource exploration of the new property. In any event, we anticipate that our acquisition of a new property and any exploration activities that we would undertake will be subject to our achieving additional financing, of which there is no assurance.

4

Competition

We are a new and unestablished mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties.

We also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral exploration companies. The presence of competing junior mineral exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors.

We also compete with other junior and senior mineral companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

Government Regulations

Mexico

Our current and future exploration and development activities, as well as our future mining and processing operations, are subject to various federal, state and local laws and regulations in the countries in which we conduct our activities. These laws and regulations govern the protection of the environment, prospecting, development, production, taxes, labor standards, occupational health, mine safety, toxic substances and other matters. We expect to be able to comply with those laws and do not believe that compliance will have a material adverse effect on our competitive position. We have obtained, and intend to obtain all licenses and permits required by all applicable regulatory agencies in connection with our exploration activities and any mining operations we carry out. We intend to maintain standards of environmental compliance consistent with regulatory requirements. We have obtained, and will obtain at the appropriate time, environmental permits, licenses or approvals required for our o perations. We are not aware of any material violations of environmental permits, licenses or approvals issued with respect to our operations.

Mining law in Mexico applies to exploration and exploitation of natural resources deposits. In connection with mining and exploration activities in the El Tigre, Porvenir and La Centela properties, we are subject to extensive Mexican federal, state and local laws and regulations governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species.

5

Before we can commence a full drilling program in Mexico, we will have to submit an environmental impact statement for authorization (a “Statement”). Exploration activities such as mapping and sampling do not require the preparation of a Statement. We have received all necessary permits to conduct our initial exploration activities on El Tigre, Porvenir, and La Centela. Before we can begin a drilling program on any of the properties, we will have to prepare a Statement which will describe the anticipated environmental impact of our planned drilling program, as well as outlining our planned actions to minimize any potential environmental damage. Studies required to support the environmental impact statement include a detailed analysis of these areas, among others: soil, water, vegetation, wildlife, cultural resources and socio-economic impacts. In reviewing the Statement, the Mexican authority looks at potential impact on the local Mexican environment, as well as reviewing for local co ncerns such as proximity to water supplies or potential interference with local farms. The Mexican authority has ten days to respond after we file a Statement, and if they do not respond, authorization is deemed to have been granted. If the Mexican government does respond, then the time within which authorization will be granted can be increased to six to twelve months or longer. It is also possible that no authorization will be granted if the Mexican government is not satisfied that appropriate measure will be taken to protect the environment.

For our exploration activities, we will be subject to the following Mexican government requirements:

| within 90 days after commencement of labor, we must file a report with the Mexico Mining Registry; |

| |

| Payment of Mining taxes in January and July of each year; |

| |

| Comply with Official Mexican Standards pertaining to safety by submitting receipts showing the purchase of equipment used for workplace safety; |

| |

| Compliance with general Mexican environmental laws which prohibit the following: |

| |

| | o | Releasing pollutants into the atmosphere, causing damage to natural resources; |

| |

| | o | Destroying or cutting trees without authorization; and |

| |

| | o | Causing forest or jungle fires. |

| |

If we commence mining development or production activities, we must also comply with the following Mexican environmental laws and standards:

Authorization of environmental impact statements;

Under the Mexican hazardous waste regulations, materials left over after the removal of minerals are defined as hazardous wastes. These wastes must be stored and deposited in areas at least 25 kilometers away from urban centers; and

The use of national waters in mining activities requires a concession or assignment from the National Water Commission. Wastewater resulting from mining activities requires a wastewater discharge permit.

British Columbia, Canada

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Canada generally, and in the province of British Columbia, specifically. Under these laws, prior to production, we have the right to explore the property, subject only to a notice of work which may entail posting a bond if we significantly disturb the property surface. This would first occur during the drilling phase of exploration.

6

We will have to sustain the cost of reclamation and environmental mediation for all exploration and development work undertaken. Our first phase of exploration, which will consist of mapping, re-sampling, relocation, geological, geochemical and geophysical surveys, and trenching, will not require any reclamation and environmental mediation work because there will not be significant physical disturbance to the land. Subsequent drilling will require some remediation work. We will need to raise additional funds to finance any drilling programs, including remediation costs.

If we enter into production, the cost of complying with permit and regulatory environment laws will be greater than in the exploration phases because the impact on the project area is greater. Permits and regulations will control all aspects of any production programs if the project continues to that stage because of the potential impact on the environment. Examples of regulatory requirements include:

Water discharge will have to meet water standards;

Dust generation will have to be minimal or otherwise re-mediated;

Dumping of material on the surface will have to be re-contoured and re-vegetated;

An assessment of all material to be left on the surface will need to be environmentally benign;

Ground water will have to be monitored for any potential contaminants;

The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and

There will have to be an impact report of the work on the local fauna and flora.

The Canadian Environmental Assessment Act (CEAA), which came into force in January 1995, governs environmental assessment at the federal level. The Canadian Environmental Assessment Agency is in charge of administering the environmental assessment process. The CEAA requires an environmental assessment where a federal authority supports a private or public sector project in one or more of four ways:

by being the proponent of the project,

by providing money for the project,

by providing land for the project, or

by issuing some form of regulatory approval for the project.

In Canada, mineral title belongs to the provincial Crown. Mining is generally regulated by the provinces. Provincial mining legislation, policies, and codes of practice, usually have specific requirements for the control of mining wastes. Provinces also use different procedures to regulate mining activity. We will be required to comply with all regulations defined in the Mineral Tenure Act for the Province of British Columbia. In British Columbia, the proponent must submit a permit application for all mechanized surface exploration. The application includes information about the mineral title, the operator, the program of work, and the proposed reclamation plan. For minimal surface disturbance in a non-sensitive area, a letter permit is issued by a district inspector of the

7

Ministry of Energy and Mines and Petroleum Resources. If a mechanized work program is contemplated, the district inspector follows a consultation procedure with other government agencies, following which a permit will be issued. For exploration in highly sensitive areas, further referrals will be made by the Ministry to, for example, the inter-agency management committee, other government agencies, and/or public stakeholder groups. We are also subject to safety policies of the Canadian Workers Compensation Board that regulates the protection of the health and safety of workers.

In addition to the foregoing, in the future, our Canadian operations may be affected from time to time by political developments in Canada and by Canadian Federal, provincial and local laws and regulations, such as restrictions on mining production and exploration, price controls, tax increases, expropriation of property, modification or cancellation of contract rights, and environmental protection controls.

During the initial phases of exploration, there will be no significant costs of compliance with government regulations. However, while it is difficult to know exactly how much these costs will be until we have a better indication of the size and tenor of any production operation, we would expect that they could be high in the production operation.

We are in compliance with the Canadian Mining Regulations and will continue to comply with them in the future. We currently have no funds set aside to comply with environmental laws concerning our exploration program.

Alaska

Companies which are incorporated under the laws of the United States, must be qualified under Alaska Statute 38.05.190 to acquire mineral rights on state-owned land in the State of Alaska. This includes acquiring mineral rights or acquiring mineral rights through transfer of ownership. To be qualified, the company needs an active “Certification” as a corporation in good standing in Alaska. What this means is corporations locating mineral properties must be qualified prior to locating locations under state mining law, otherwise the locations will not be valid. We obtained our certification on December 19, 2006.

If we are successful in getting approval for the offshore prospecting permit applications which relate to the Anchor Point Gold Project, and if we decide to explore and develop this area, we will be subject to all the various state and local laws and regulations in Alaska which govern the protection of the environment, prospecting, development, production, taxes, labor standards, occupational health, mine safety, toxic substances and other matters. In particular, there are a number of sensitive environmental issues associated with the Cook Inlet, for example, regarding the Endangered Species Act, Marine Mammal Protection Act, and the Clean Water Act. The regulatory impact to us in this development phase will be onerous and we will have ongoing compliance obligations, however, we do not anticipate this will cause us problems.

However, before any development work can be started, we are obliged to submit a plan of operation to the mining department of the State of Alaska. We are in the process of pre-applying for this at the moment. The reason for submitting the plan of operation is because we will be carrying out development work in the three miles radius off the Alaskan coast, which are Alaskan state waters. If our development program takes the operation further off shore, we will be in federal waters and subject to further regulations and different agencies. It is impossible to tell at this stage whether our development program will take us into federal waters. It can take anything between 18 months and three years for the plan of operation to be approved by the State of Alaska. During this time we can continue to explore and do sampling work but we are unable to mine.

8

Intellectual Property

We have not filed for any protection of our trademark. We own the copyright in our website www.hemiscorporation.com.

Research and Development

Apart from exploration expenses incurred, we have not spent any amounts on research and development activities since our inception. Our planned expenditures on our exploration programs are summarized under the section of this annual report entitled “Description of Properties.”

Employees and Consultants

As of March 31, 2008, our Chief Executive Officer our Chief Financial Officer work as full time consultants, each contributing approximately 40% of their time to Hemis. We also engage independent contractors in the areas of marketing, accounting, bookkeeping, business and financial consulting and legal services.

On May 15, 2005 we entered into a consulting agreement with Charles Reed, whereby Mr. Reed agreed to act as our Chief Geologist from May 15, 2005 until the agreement is terminated on 14 days notice by either party. As remuneration we agreed to issue Mr. Reed 100,000 common shares as compensation to December 31, 2007 and after that 50,000 common shares per year, payable on a pro rated basis at the end of each of our fiscal quarters.

On May 22, 2005 we entered into a consulting agreement with Craig Schneider wherein Mr. Schneider agreed to act as an advisory board member, to provide us with consulting services, to assist us in finding mining properties, assist us with geological matters and introduce our management to persons and businesses involved in mining in Mexico. As compensation we issued Mr. Schneider a one time payment of 50,000 common shares. The agreement terminates on May 21, 2007, or on 14 days notice by either party.

On May 22, 2005 we entered into a consulting agreement with Chris Bogart wherein Mr. Bogart agreed to act as an advisory board member, to provide us with consulting services to assist us in finding mining properties, assist us with geological matters and introduce our management to persons and businesses involved in mining in Mexico. As compensation we issued Mr. Schneider a one time payment of 50,000 common shares. The agreement terminates on May 21, 2007 or on 14 days notice by either party.

On November 9, 2005, we entered into a consulting agreement with Hudson Capital Corporation whereby Hudson Capital agreed to assist us in creating our website, producing marketing material, presenting exchange listing efforts, providing business consulting and strategic planning advice and increasing our profile within the brokerage community. The agreement was extended on a month to month basis. We agreed to pay Hudson Capital up to 900,000 common shares upon the occurrence of various corporate milestones and objectives. On November 9, 2006, we amended the agreement to allow Hemis sole discretion in awarding bonus shares to Hudson Capital and we issued 900,000 shares on November 14, 2006 as a bonus to Hudson Capital. The bonus was awarded in part as compensation to Hudson Capital to agree to remove the specific targets and entitlements to stock bonuses based on corporate milestones as set out in the original agreement and also to compensate Hudson Capital for certain services it provided in Oc tober and November 2006, including introduction to German newsletter writers, research analysts and corporate communications consultants.

9

On January 5, 2006 we entered into a consulting agreement with Douglas Oliver whereby he agreed to provide geologist consulting services and also to act as a Director on our Board of Directors. This agreement has been superseded by an agreement dated January 1, 2007 pursuant to which Dr. Oliver was appointed as Vice President Operations and Geologist for the Company and receives fixed remuneration at the rate of $10,000 per month commencing January 1, 2007. However, by verbal agreement with Dr. Oliver we only paid him $6,000 per month from January to November 2007. Dr. Oliver resigned as a director of us on September 14, 2007, but he continues as our Vice President Operations and Geologist.

On August 20, 2006 we entered into a Director Agreement with Richard Hamelin, whereby he agreed to act as a Director on our Board of Directors. Under the agreement, Mr. Hamelin is to receive no compensation but he is reimbursed for all expenses reasonably incurred in the proper performance of his obligations as a Director.

On August 25, 2006 we entered into a consulting agreement with Michael Forster whereby Mr. Forster agreed to assist us in introducing us to his contacts at Safeport Gold Fund in Liechtenstein with a view to Safeport potentially investing in us, introduce us to accredited investors in Switzerland and Europe, organize at least three presentations for potential investors in us, assist our CEO in identifying strategic alliances in Europe for us, and introduce us to market participants, investment professionals and financial institutions in Switzerland and Europe. In consideration for the provision of such consulting services, we paid Mr. Forster a flat fee of $755,000 which was payable by the issuance of 1,000,000 shares of our common stock, each share with a deemed price of $0.75. The agreement terminated on December 31, 2007.

On September 1, 2006 we entered into an advisory board agreement with George Eliopulos, a geologist, whereby Mr. Eliopulos agrees to act as an advisory board member, to provide us with consulting services, to assist us in finding mining properties, assist us with geological matters and introduce our management to persons and businesses involved in mining around the world and specifically in the USA. As compensation we issued Mr. Eliopulos a payment of 20,000 common shares of Hemis, and have agreed to issue Mr. Eliopulos another 20,000 common shares of Hemis on September 1, 2007. In addition, Mr. Eliopulos receives a daily rate of $500 for geological consulting services. The agreement terminates on September 1, 2008, or on 14 days notice by either party.

On September 15, 2006 we entered into a consulting agreement with Sedona AG, whereby Sedona AG agreed to assist us in raising capital in Switzerland, use its legal status to promote the sale of shares in Switzerland, and provide due diligence services to us to ensure that any potential investment in us complies with all laws and regulations of Switzerland, including money laundering provisions. In consideration for the provision of such consulting services, we paid Sedona AG a flat fee of $375,000 which was payable by the issuance of 500,000 shares of our common stock, each share with a deemed price of $0.75. The agreement terminated on September 30, 2007.

On October 1, 2006 we entered into an advisory board agreement with Casey Danielson, a geologist, whereby Mr. Danielson agreed to act as an advisory board member, to provide us with consulting services, to assist us in finding mining properties, assist us with geological matters and introduce our management to persons and businesses involved in mining around the world. As compensation we agreed to issue Mr. Danielson a one time payment of 20,000 common shares by March 1, 2007. The agreement terminates on October 1, 2008, or on 14 days notice by either party. As of December 31, 2007 the shares had not yet been issued.

10

On February 28, 2007 we entered into a consulting agreement with Dorado Inc. for the provision of human resources services including developing recruitment policies to attract new personnel for executive, administrative, operational and supervisory roles; implementing policies in accordance with the government employment standards of the countries in which we conduct our operations. Dorado’s obligations were to assist us in identifying at least 12 potential mining projects, conduct due diligence on these identified projects, negotiate mining options, rights or leases for any projects we wish to pursue, and introduce us to potential geologists and other advisors and consultants that we may retain in the future to assist us with our mining operations. We paid Dorado a flat fee of $1,500,000 which was paid by the issuance of 1,363,638 shares of our common stock on March 9, 2007, with each share having a fair market value of $1.10 per share. The agreement has a term of one year and terminated on February 28, 2008.

On March 1, 2007, we entered into a consulting agreement with Battle X Inc. for the provision of managerial consulting services, including analyzing our corporate goals and objectives; assessing our current corporate structure; developing a plan to optimize our corporate structure based on our goals and objectives; and developing a strategic plan after we have optimized our corporate structure. Battle X was obligated to introduce our management to persons and businesses involved in mining around the world and specifically in the USA, Germany, Switzerland and Austria. As compensation, we issued Battle X 2,000,000 shares of our common stock on March 9, 2007. Each share had a fair market value of $1.10 per share, with total compensation valued at $2,200,000. The agreement had a term of March 1, 2007 to December 31, 2007.

On March 9, 2007 we entered into a consulting agreement with Westgate Corporation, a company wholly owned by Gerardino Mastrandrea, pursuant to which Mr. Mastrandrea shall assist us in negotiating mining options, rights or leases with owners or principals of mineral properties and to assist us in carrying out due diligence of such properties. In consideration for the consulting services, we paid Westgate Corporation a flat fee for one year of service in advance on March 9, 2007 with the issuance of 1,700,000 common shares, at a fair market value of $1.10 per share, the closing price of our shares on the date of issuance, for $1,870,000 of consulting services.

On March 13, 2007 we entered into a consulting agreement with Dr. Fuat Cirit pursuant to which Dr. Cirit has agreed to oversee and conduct exploration activities on the Wolfe Creek and Covenant properties, and advise us on future strategies regarding these properties. In consideration for the consulting services, we paid Stacs GmbH, a company controlled by Dr. Cirit, a flat fee for two years of service in advance with the issuance of an aggregate of 3,000,000 shares of our common stock. The agreement terminates on March 13, 2009.

On April 10, 2007, we entered into a consulting agreement with Swissalis AG pursuant to which Rene Ghalinger, the principal of Swissalis, agreed to introduce us to Austrian and German based resource investment companies for potential joint venture projects. In consideration for the consulting services, we have agreed to pay Swissalis AG a flat fee with the issuance of 500,000 common shares.

11

On July 24, 2007 we entered into a services agreement with Mineralogics Corporation pursuant to which Mineralogics provides us with exploration office facilities, oversees our mineral property acquisition and development activities and provides us with administrative services. In exchange for these services we agreed to pay Mineralogics a monthly service fee of $7,500. Pursuant to the agreement, fees of $7,500 per month were accrued for October, November and December, 2007. On February 1, 2008, Mineralogics exercised their right to give notice to terminate the agreement and the agreement terminated on March 1, 2008. As of December 31, 2007, we owed Mineralogics $22,500 for services pursuant to the agreement. Norman Meier, our President and Chief Executive Officer, was a director of Mineralogics and owned Mineralogics until February 8, 2008. Since February 8, 2008 Doug Oliver, our Vice President Operations, has been a director and the President of Mineralogics.

Conflicts

Dr. Meier, Mr. Weiss, and Dr. Oliver also serve as directors and/or officers for Tecton Corporation, a public company, as well as various private mining companies in Switzerland and in the United States.

These companies are mining companies all have a different geographical focus and explore for different types of minerals. In this way we do not envisage any conflicts of interest arising between us and Tecton or any of these private entities. We do not have any formal agreements with any of these companies with respect to conflicts of interests, nor do we have any written procedures in place to address conflicts of interest that may arise between our business and the future business activities of our directors.

Item 2. Description of Property.

Our principal executive offices are located at Bettlistrasse 35, 8600 Dübendorf, Switzerland. We pay a Swiss administration company a monthly administrative fee which includes rent for these premises.

Our mineral properties are described below.

El Tigre Property, Porvenir Property and La Centela Property

1. Location and Access

The El Tigre property, the Porvenir property and the La Centela property are located very close to each other, in western Mexico in the south-eastern Sonora in the mountains. The nearest river is Sahuaripa River. The La Centela Property is divided into six concessions which surround the El Tigre and Porvenir properties.

12

A diagram of the El Tigre, Porvenir and La Centela properties is presented below:

The area where the El Tigre, Porvenir and La Centela properties are located is 1600 meters above sea level and is located on a hill. They are approximately 250 km east of Hermosillo, the capital of Sonora. The properties are accessible by paved road from Hermosillo to within about 15 km of the properties. A well maintained dirt road comprises the next 8 km with a four-wheel drive trail providing the final 7 km of access to the properties. We have re-constructed and improved this four-wheel drive trail and several other vehicular trails that lead to some of the abandoned mine workings. Valle de Tacupero is the nearest village to the property and is located on the paved road. The closest available lodging is in the village of Bamori, which is 10 km to the north of Valle de Tacupero. Fuel and services are available in Sahuaripa, which is another 20 km north of Bamori.

13

Maps showing the location and access to the El Tigre Property and the Porvenir Property are presented below.

2. Ownership Interest

El Tigre and Porvenir |

The El Tigre claim property has an area of 30 hectares and the Porvenir claim property has an area of 83 hectares. The La Centela claim property consists of six concessions with a total area of 572 hectares.

On December 31, 2005, our wholly owned Mexican subsidiary, Hemis Gold S.A. do C.V., entered into an option agreement with Jose Quiros Soto, Loreto Careaga Galaz, Viuda de Rascon and Rosa Maria Burgos Robles to acquire a 67.5% interest in the El Tigre and Porvenir properties. We have exercised our option and acquired a 67.5% interest in the El Tigre concession and the Porvenir concession mineral claims.

In Fiscal 2007, we incurred $1,179,888 of exploration expenditures pursuant to the option agreement, while in fiscal 2006, we incurred exploration expenditures of $140,227. We are actively pursuing additional mineral concessions within this project area.

15

On November 5, 2007, we entered into an option agreement with Monte Cristo Gold Corporation granting Monte Cristo Gold the option to acquire a 49% or a 60% undivided interest in our right to explore and exploit the El Tigre and Porvenir concession mineral claims. Bruno Weiss, our Director and Chief Financial Officer is Chief Financial Officer of Monte Cristo. In order to maintain the option, Monte Cristo Gold paid us an initial amount of $100,000 and must pay us a further $1,900,000 by November 4, 2008. Monte Cristo may also elect to increase its interest under the option to 60% by paying us $500,000 by March 3, 2009 and $1,500,000 by November 3, 2009. If the option is exercised, regardless of the interest, we have agreed to enter into a joint venture agreement governing how the property is to be exploited and managed, with all costs and revenues to be split proportionate to the parties’ respective interests.

The property owner Federico Valenzuela controls surface rights to the El Tigre and Porvenir properties. We have negotiated an agreement with the property owner that allows us access during exploration and mining.

La Centela

On September 12, 2006 we entered into a binding letter of intent agreement with Electrum Capital, Inc. and Snra. Maria de Los Angeles Valverde Guzman (the "Optionors") whereby we obtained options to acquire up to 75% of the La Centela mineral claims. The La Centela mineral claims are located to the North, North East and West of the Porvenir claim. On October 5, 2006 the parties entered into an addendum to change the commencement date of the agreement to October 6, 2006. The agreement required that $25,000 be paid on the commencement date and that 25,000 common shares be issued within 10 days of the commencement date. We have already paid the $25,000 and issued the 25,000 shares. The agreement contemplates that a long form agreement will be entered into between the parties, although there is no deadline for entering into such an agreement,

The La Centela option agreement consists of two parts; an option to acquire the first 70% of the mining rights and an option for a further 5% of the mining rights. To acquire the first 70% of the mining rights we must pay $500,000 and issue 500,000 of our common shares to the mineral rights owner, spend at least $2,000,000 in exploration expenses and make a final share payment of 1 share for every ounce of gold we identify, if we identify any gold, to a maximum of 10,000,000 shares. If we exercise our option to acquire the first 70% of the mineral rights, we may then acquire a further 5% of the total claim by making a cash payment of $1,000,000.

To exercise the first 70% of the mining rights, we must deliver the following stock and payments to the mining concession owners, and we are required to make the following minimum exploration expenditures within the periods described:

| Period | Share to be Issued | Cash Payments | Exploration |

| Paid & Issued (due October 14, 2006) | 25,000 common shares | | |

| Paid & Issued (due October 5, 2007) | 50,000 common shares | $50,000 | $200,000 |

| October 6, 2007 – October 5, 2008 | 75,000 common shares | $75,000 | $200,000 |

| October 6, 2008 – October 5, 2009 | 100,000 common shares | $100,000 | $200,000 |

| October 6, 2009 – October 5, 2010 | 250,000 common shares | $250,000 | $1,400,000 |

16

Further, if, at the time we have completed all of the payments, issuances and expenditures as described in the table above, we have identified a gold deposit, then we must issue one common shares for every once of gold we estimate that we have identified, up to a maximum of 10,000,000 shares.

If we exercise our option and acquire a majority interest in the La Centela mining concession, and if we decide to proceed with mining the property, the Optionors shall be required to contribute to expenses of the mining, in proportion to their ownership interest. A failure to contribute proportionately to the expenses will result in conversion of the Optionors' interest to a 3% net smelter return. The 3% net smelter return would entitle the Optionors to 3% of revenues we receive from sales of minerals we have mined in the property.

3. History of Operations

The El Tigre, Porvenir and La Centela properties were mined by Spanish and Mexican miners before the Mexican Revolution which took place from 1910 to 1930. These areas have been mined for several hundred years. In the El Tigre Property there are several large pits which range in size up to approximately 15 meters wide, 25 meters long and at least 20 meters deep. They appear to have been previously mined by hand. There are no records indicating the amount of gold produced from these workings. The area has never been processed with professional machines.

4. Present Condition of the Property and Current State of Exploration

El Tigre Property

We have recently finalized the initial exploration phase on the El Tigre concession. The initial exploration work has yielded positive indications.

Over 173 samples were collected in sections of the concession that are far from any of the known prospect pits and analyzed by ALS Chemex in Hermosillo, Mexico. We conducted the sampling to identify areas of precious metal mineralization both on and off the claim block. Most of the samples had detectable gold in the geochemically anomalous range.

As a result of this sampling, five main target areas have been identified on the property; two areas around the El Tigre monument; one area with breccia evident at surface, situated east of El Tigre with a few historic pits; and two large historic workings on the same breccia zone which were discovered at a distance of 500m along the Eastern High Ridge, which is a section further east than El Tigre East and along the roadway near the our La Centela claim

We have one geologic report on the El Tigre Property that was written by Doug Oliver, Ph. D., our Vice President Operations, geologist and a former director of us. The report was prepared in May 2006 and reviews the potential for mineral deposits in the El Tigre Property.

17

In his discussion of the results of the rock samples from El Tigre, Dr. Oliver states that because of the highly oxidized state of the rocks at El Tigre, any bulk-tonnage gold deposit discovered there would be an excellent candidate for low cost heap leach extraction methods.

The heap leach process is a process of extracting gold by placing ore on an impermeable pad and applying a diluted cyanide solution that dissolves a portion of the contained gold, which is then recovered in metallurgical processes. Some governmental bodies, including the State of Montana, have banned the use of this method because of environmental concerns. Neither Mexico, nor the State of Sonora in Mexico have banned the use of this method and our management is not aware that any government body in Mexico is considering banning this method.

The chief environmental consequence of the heap leach process is the accidental release of cyanide from the site. This can happen either as a result of a tailings dam failure or during overflow of the pregnant solution pond during intense rainfall. According to our geologist, Dr. Oliver, Hemis can prevent both of these situations by designing the processing facility to prevent the possibility of either of these happening in even worst-case scenarios. The tailings pond should be professionally designed and constructed with quality assurance personnel monitoring the process at all stages. The pregnant pond should be designed to retain the water from a 100-year flood. In professionally designed and operated mines there should not be a significant risk of accidental release of cyanide. The costs of building and operating a professionally designed mine is an integral part of mine construction and we do not anticipate it would add any unusual or significant expense to our cost of operations, should w e decide to use the heap leach process on a gold deposit if we find one.

Porvenir Property

As of March 31, 2008, the only work that has been done on the Porvenir Property is some geochemical sampling. The owner of the property, Jose Quiroz, has promised to come out to the property and show us where he thinks the higher grade breccias are.

La Centela Property

We have conducted some preliminary sampling and mapping on the La Centela property, and have constructed two drill pads, one on a gold-bearing breccia zone and a second to test the deep molybdenum target. We are also constructing an exploration camp near the ranch house for the drill crew and geologists.

Our plan of exploration for the joint El Tigre Gold Project (the joint El Tigre, Porvenir and La Centela Claims) is as follows:

18

Description of Phase of Exploration Commence core drilling | Description of Exploration Work Required We plan to commence core drilling at the end of April 2008 using Cabo Drilling. Initial drilling will be on three of the five known gold- bearing breccia zones. We are planning on eight holes averaging 200 meters each. Estimated time of completion is two months. Projected cost for this phase is $240,000. |

Test Hole | Drilling will then shift to an initial deep hole on the El Aliso Moly target. This will be a single test hole of approximately 1,000 meters. This hole will give us time to get assays and evaluate the initial round of drilling at El Tigre. The time to drill this hole is estimated at approximately two months. Projected cost for this phase is $185,000. |

Follow up drilling | A round of follow-up drilling will take place to further test and expand results from the first round of drilling at El Tigre. Target selection will be based on either favorable results from the first round, untested breccia zones, and/or target areas found in ongoing sampling and mapping. This second round of drilling is currently scheduled at five holes averaging 250 meters each but may be expanded depending on results from the first round. Estimated time of completion is approximately six weeks. Projected cost for this phase is $180,000. |

On-going sampling and mapping | We are also currently engaged in on-going sampling and mapping at El Tigre. The goal is to generate more targets while we are drilling so as to sustain the project. Projected cost for continued exploration is $30,000. |

There are several key factors that can delay completion of the exploration program:

Factors that could cause exploration costs to be greater than anticipated are largely from drilling conditions to include the following:

Caving ground;

Lost circulation;

Artesian water; and

Stuck drill steel.

All work on the El Tigre, Porvenir and La Centela properties will be conducted on our behalf by contractors who will include Dr. Doug Oliver, our Vice President Operations and geologist, and a drilling company. Dr. Oliver was paid approximately $6,000 per month plus travel expenses from January 2007 until November 2007. He stopped receiving a salary after that as he was providing less hours of services to us. We have been soliciting bids from various drilling companies and we do not yet have any written commitments from a drilling company to provide us with drilling services. Normal industry rates are expected for core drilling. The program will be supervised by our Vice President Operations, Dr. Oliver.

19

5. Geology

The El Tigre concession contains 30 hectares (0.3 sq. km) and the Porvenir property contains 83 hectares (0.83 sq. km). The La Centela property contains 572 hectares (5.72 sq. km). Exposed bedrock comprises about 20% of the El Tigre, Porvenir and La Centela properties and consists of intrusive and extrusive igneous rocks. Contacts between these various lithologies have not been observed thus far, nor have any geologic structures.

The intrusive rocks are primarily granitic in composition. Large intrusive bodies are exposed to the south and west of the project area. These larger bodies are the coarsest grained rocks in the project area and show the least amount of fracturing or alteration. Small intrusive bodes are widespread across the project and are finer in grain size. Some of these bodies appear to be intrusive into the surrounding volcanic rocks.

Ryolite is the most abundant rock type in the project area. It commonly contains small phenocrysts of quartz and/or orthoclase and is very light in color. Breccias consisting of angular clasts surrounded by fine-grained matrix are widespread across the project area. They are most commonly developed in the rhyolite volcanic rocks and may also occur in andesites. Mega-breccias and breccias containing rounded or zoned clasts are in the area. The breccias often occur in linear zones but also cover broad areas.

The rocks on the El Tigre, Porvenir and La Centela properties are comprised of rhyolite, breccias, granite, quartz monzonite and andesite. Surrounding areas show evidence of quartz veins, breccia dikes and breccia zones, which stretch over a large area and extend to the southeast.

On the El Tigre, Porvenir and La Centela properties there are lots of pits, burrows and holes, some from which gold appears to have been previously extracted.

Anchor Point Gold Project

1. Location and Access

We have five exploration project locations in Alaska, which are collectively known as The Anchor Point Gold Project. They are located near shore on the west side of the lower Cook Inlet adjacent to and north of Anchor point. The project locations are all located within a 45 square mile area of marine waters with the following boundaries: beginning at the city of Anchorage, Alaska, a line running due west from Anchorage to the western shore of Cook Inlet, and extending south to a line running due west from the village of Seldovia on the east side of Cook Inlet to the western shore of Cook Inlet. The nearest onshore access infrastructure is a boat launch area (Anchor Point Boat Launch) located on the shoreline at the confluence of the Anchor River and Cook Inlet waters. The boat launch is approximately 1.5 miles west of the city of Anchor Point connected by 1.5 miles of paved road. The project locations vary in distance from one mile to eight miles offshore from the Boat launch. Anchor Point is a city of approximately 1800 population and is located 16 miles north of the city of Homer Alaska and 24 miles south of Ninilchik Alaska connected by the Sterling Highway. The Sterling Highway is a two lane paved highway with year-round access to the State-wide highway system. Access to the project sites will be by marine vessel from Anchor Point and Homer. Fuel, services, and lodging are located in Homer and Anchor Point. The nearest hospital and commercial airport is located in Homer.

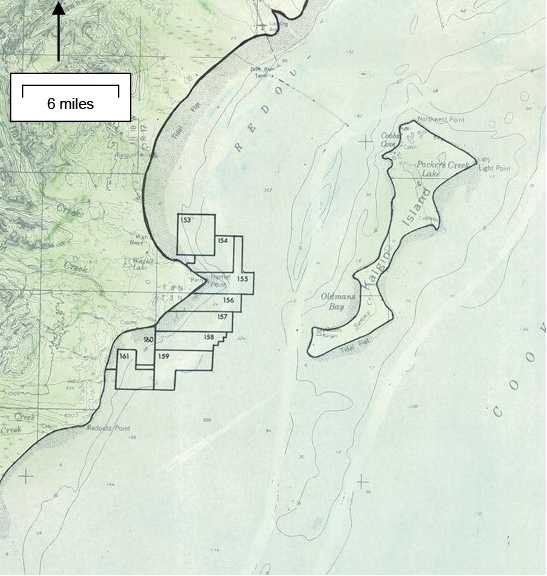

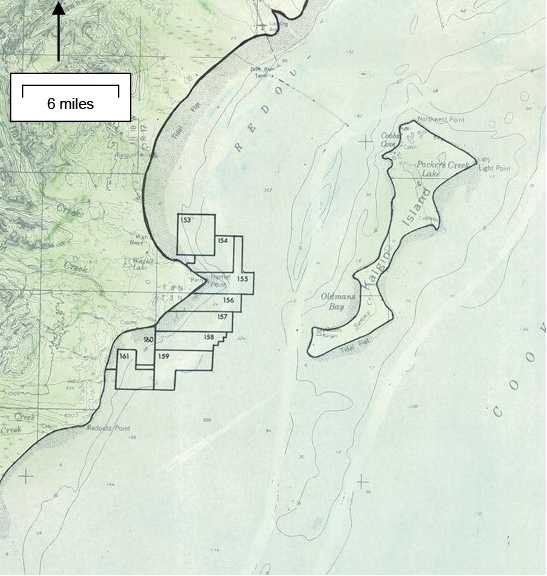

The maps below show the location of the Anchor Point Gold Project and also the location of offshore prospecting permit applications 153-161 and 194-222 that we are applying for.

20

22

2. Ownership Interest

On January 8, 2007 we entered into an agreement with Aspen Exploration Corporation pursuant to which Aspen assigned us State of Alaska offshore prospecting permit applications153–161, and 194-222 as shown on the maps above, together with a non-exclusive license of all of Aspen’s right, title and interests to all maps, aeromagnetic surveys and geologic information developed by Aspen in the Cook Inlet, Alaska.

We have not acquired an interest in any physical property in the Cook Inlet, Alaska. The offshore prospecting permit applications have been denied for several years, but if we are successful in reapplying for them, we will have the right to exploit, mine and produce all minerals lying beneath the surface of the permitted area. However, there is a risk that the State of Alaska will never accept these offshore prospecting permit applications in which case this asset will be of little value to us.

Under the terms of the agreement with Aspen, Hemis shall own and operate all such interests within the area of interest (other than oil and gas rights and interests), either acquired or proposed to be acquired by Aspen or us, during the next 30 years; and Aspen will have a right to receive a 5% gross royalty on all ores, minerals and mineral resources produced from the offshore prospecting permit applications within the above described area of interest.

In order to maintain the rights to the offshore prospecting permit applications together with the non-exclusive license, we have agreed to pay Aspen $50,000 on signing the agreement, and an annual payment of $50,000 thereafter, beginning in September 2007. If we fail to make the payments, we will have been deemed to have withdrawn from the agreement with Aspen and the agreement will be terminated. We made a payment of $50,000 on September 5, 2007.

Additionally we have granted Aspen a 5% gross royalty in any ores, minerals, and mineral resources produced from the offshore prospecting permit applications, including all offshore prospecting permit applications acquired by us in the area of interest in the Cook Inlet, Alaska during the 30 year term of the agreement. In particular, the 5% royalty on all placer gold produced shall be paid in kind. Royalty for minerals other than placer gold shall be 5% of the gross revenue received by or on behalf of us from the sale or other dispositions of the ores, minerals, and mineral resources.

During the period ended December 31, 2007, we incurred exploration expenditures of $795,532 in relation to the Anchor Point Gold Project.

On November 16, 2007 we entered into an option agreement with Condor Gold Corporation which became effective on November 23, 2007 whereby we granted to Condor Gold the option to acquire a 49% or a 60% undivided interest in our rights to explore and exploit certain offshore gold permits located in the Anchor Point Project. Bruno Weiss, our Director and Chief Financial Officer is Chief Financial Officer of Condor Gold. Pursuant to the option agreement Condor Gold may acquire a 49% percent interest in our rights to the property by paying $100,000 to us within 5 business days following the effective date of November 23, 2007, and $1,900,000 within 12 months following the effective date. Additionally, Condor Gold may increase its interest to 60% by paying to the Company $500,000 within 18 months following the effective date and $1,500,000 within 24 months following the effective date. If Condor Gold exercises its option to acquire the 49% interest, the parties have agreed to enter into a joint- venture agreement regarding the exploitation and management of the property whereby all costs and revenues regarding the property will be divided in proportion to the respective interest of the parties. If Condor Gold exercises its option to increase its interest to 60%, the allocation of costs and revenues pursuant to the joint venture agreement will be modified accordingly. The option agreement does not grant to Condor Gold any right to hold title to the property. Condor Gold may terminate the option agreement at any time by giving written notice to us. The option agreement will terminate automatically if Condor Gold fails to make any payments necessary for it to acquire a 49% interest in the Property. As of December 31, 2007, we have not received any proceeds pursuant to the option agreement. Condor Gold failed to make the initial $100,000 payment to maintain its option and therefore the option expired and the Option Agreement terminated as of November 22, 2007.

23

3. History of Operations / Plan of Operations

Other than sporadic small-scale beach mining over the last century, there has been no mining in Cook Inlet.

As at March 30, 2008, none of the offshore prospecting permit applications have been approved. Until approval is obtained, we are involved in determining where the sampling program is to take place. We anticipate that if we are successful in obtaining the permits, the initial sampling program will start in May 2008 and last 30 days.

We will persist in obtaining approval of the offshore prospecting permits and if we are successful, we have agreed the following plan of operation, which we shall use as our basis for exploration, development and mining of all ores, minerals, and mineral resources in the area:

In the first year, we will acquire additional aeromagnetic data in the area of interest in the Cook Inlet, Alaska, and apply for additional state of Alaska offshore prospecting permits or federal offshore exploration and mining rights.

In the second and subsequent years, we will obtain permits and conduct exploration of the area.

Once feasibility is demonstrated, we will acquire the equipment needed to economically produce any identified deposits.

Thereafter, we will pursue the commencement of commercial production of any mining deposits that have a market value.

4. Present Condition of the Property and Current State of Exploration

Cook Inlet is famous for its extremely high tides (the second highest in the world after the Bay of Fundy). It is proposed that the back and forth tidal action has served to concentrate heavy minerals along the beach including gold. Unspecified quantities of gold have been found along the active beach in several places along Cook Inlet, particularly along the eastern shoreline. The gold occurs with another heavy mineral called magnetite which is a magnetic iron oxide. Aeromag surveys show pronounced magnetic anomalies along the active beach as would be expected due to the magnetite sand. However, there are other off-shore magnetic anomalies that parallel the beach. These are interpreted to represent ancestral beaches during low stands of sea-level during the ice age. These off-shore aeromag anomalies are the targets of the current exploration. There has never been any testing to determine if gold is present in the off-shore anomalies.

24

5. Geology

The surficial geology of the Anchor Point area is roughly divided into two parts by the lower Anchor River. North of the river, Kenai lowland is underlain by undifferentiated till of the pre-late Wisconsin (pre-Naptowne) glaciation and complex glaciolacustrine deposits related to the early (Moosehorn) stade of the late Wisconsin (Naptowne) glaciation. In the vicinity of the settlement of Anchor River, study of the logs of water wells allowed separation of a dominantly glaciolacustrine deposit that is apparently related to the Moosehorn stade of the Naptowne glaciation. This terrain is transected by a complex system of abandoned meltwater channels. Alluvium of fluvial terraces was deposited by modern streams as they incised their channels. Paludal deposits, primarily peat, form broad, generally treeless blankets and channel and basin fills. Undifferentiated colluvium forms aprons and fans on steep river and inlet bluffs; debris-flow deposits and mixed colluvium and alluvium occupy erosion gullie s. South of Anchor River, the surficial geology is dominantly till with associated coarse-grained ice-stagnation deposits comprising a kettle-rich moraine built during the Moosehorn stade of the Naptowne glaciation. Most of the kettles are occupied by small lakes or contain organic paludal sediments. A rotational slump scallops the steep, rapidly eroding sea cliff just north of the mouth of Traverse Creek in the southwestern corner of the study area. The beach area along Anchor Point and Laida Spit contain wedge and blanket-shaped deposits of medium to coarse sand with local lags of cobbles deposited by the action of waves and longshore currents.

Wolfe Creek and Covenant Properties

1. Location and Access

Wolfe Creek |

We have options to acquire two placer claims in British Columbia, Canada; claim 524570 covering 80 acres; and claim 545941 covering 40 acres, and a mineral claim 548020 covering 370 acres as outlined below in bold.

Claim 524570

25

Note that in Claim 524570, there is an overlapping of a claim staked under the previous mineral titles system, now deemed a “legacy claim” and shown on the east border of the highlighted claim above. It occupies approximately 10% of the available area on this claim. The partially overlying claim has priority over that 10% unless it expires. If it does expire the ground that was previously covered by it will automatically accrue into our claim.

These claims are located 3km (1.8 miles) north of the town of Sooke, which is 20 minutes west of Victoria, directly adjacent to Leechtown, a historic gold mining town. Access is possible by car to the Sooke potholes provincial park, from where it is necessary to continue on foot for approximately one hour using the Galloping Goose trail which runs parallel to the Sooke River, in a northerly direction for 4km to where the Leech River and Old Wolfe creek join. At this juncture, one can follow the mostly dry creek bed west approximately 900 metres (approximately half a mile) to the claims’ boundaries. Temperate island climate provides year round access. The claims are located at latitude 48°29'26" longitude 123°41'59".

The claims cover 800 metres (approximately half a mile) of available creek frontage and continuous dry creek channel per side. Semi tropical vegetation is moderately dense in places. Gravels from sand to large amounts of much coarser ungraded rocks and boulders are encountered throughout.

28

Covenant

The Covenant claim consists of placer claim 534244 covering 158.56 acres. The property binds both sides of a heavily pronounced bend on the Jordan River, 28km west of Sooke. It can be accessed by the logging road north of the West Coast Highway or, from the logging road that runs east-west on the south side of Loss Creek. The coordinates of the claims are latitude 48°32'6" and longitude 123°56'43".

A 4 wheel drive vehicle is recommended because the roads are all gravel. There are a couple of options if traveling to these claims by road:

| 1. | From Otter Point Road in Sooke, B.C. which is about 30 km (18 miles) east of Jordan River; and |

| 2. | From Forbay Road in Jordan River about 1 km east of the Jordan River bridge. |

| |

| 2. | Ownership Interest |

| |

On March 13, 2007 we entered into an option agreement with Stacs GmbH whereby we acquired an option to purchase a 100% mining rights to the Wolfe Creek and Covenant mineral concessions, subject to a 3% royalty. In order to exercise this option we must spend $1,000,000 in exploration expenses by March 13, 2010.

In addition to making the above payment, we are required to pay an ongoing royalty of 3% to Stacs GmbH on any minerals recovered.

As of December 31, 2007, we have not incurred any expenditure on this property.

3. History of Operations/ Plan of Operations

There is a lot of history surrounding gold exploration in the streams on the south west coast of Vancouver Island, especially in those originating from a geological formation known as the Leech River Formation, so named since it is the geological source of placer gold found in the Leech River, which was named after Lieutenant Peter Leech who discovered gold in its upper reaches on July 14th, 1864. The geological survey of Canada and the UBC Lithoprobe project have both confirmed that the deposits within the Leech River formation are due to the melting of the Juan de Fuca subducting plate underneath Vancouver Island, where intrusive materials tend to work their way up to the surface of the island. The rivers and streams in the area have been sporadically worked since the mid 1800’s, and the rivers in the region continue to yield high quality deposits even today (source:http://www.gis.unbc.ca/courses/geog432/projects/2002/milok000/index.htm).

Over the next 36 months, we plan to spend approximately $1,000,000 on mapping, re-sampling, relocation, geological, geochemical and geophysical surveys, and trenching. Subsequent drilling will require some remediation work. We are still in the early stages of developing our full exploration plan on this property, and we don’t anticipate that we will begin exploration of this property for another six months. We plan on spending approximately $500,000 over the next 12 months in exploration of the Wolfe Creek and Covenant claims.

29

4. Present Condition of the Property and Current State of Exploration

Wolfe Creek

Limited exploration of the Wolfe Creek property was carried out by using gold panning techniques. The make and model of goldpan used for sampling was a 15” Garret Super Sluice green plastic goldpan which features two 1/2"-deep riffles. This model was selected due to its light carry weight resultant in a quicker recovery time in precious metals versus using heavier metal versions. The green color was chosen based on preference. Coarse gravels were encountered throughout and therefore a great deal of time was spent preparing pans and sifting 25kg dry gravel per pan before washing. A total of three pans were reduced to observe colors. Pans were removed from a large ungraded dry pile on the north creek bed on the inside contour of a 45 degree bend, approx 20m inside the West border of the claim. A large tractor tire was 15 meters west of the hole. In this case, concentrates of each pan were black magnetite sand with the smallest visible particles of gold, known as “colors”. Our prosp ecting technique consisted of measuring the visible “colors” per pan.

Covenant

We have not yet performed evaluation work on this property, other than verifying access last year. We plan to start exploration work on this property within the next 6 months.

5. Geology

Regional Geology:South-West Vancouver Island, where the claims are located, is principally comprised of Wrangellia to the east and Pacific terrain to the west and southwest divided by Leech River fault thrusts. The Island’s southern shores edge out into Sooke formation sandstone and conglomerate.

Local Geology:Old Wolf Creek flows west (directly) along the Leech River fault which separates jurassic to cretaceous Leech River complex (formation) slates and schists on the north, from tertiary metchosin volcanics on the south. The metasediments strike nearly west and dip steeply northeast. The topography shows the stream to have cut down through the bedrock leaving a series of gravel covered benches. Placer gold, found in the gravel, is believed to have been derived from small, but numerous, gold-bearing quartz stringers hosted by the Leech River rocks.

Glossary of Technical Terms

30

Term Andesite Alluvium Bedrock Breccia | Definition a fine-grained igneous rock. soil or sediments deposited by a river or other running water solid rock present beneath any soil, sediment or other surface cover. a rock formed from fragments of pre-existing rock in which the gravel-sized particles are angular in shape and make up an appreciable volume of the rock. |

Breccia pipes | a circular, chimney-like mass of highly fragmented rock resulting from the subsidence of large rock segments into a void created by solution activity in a lower formation. |

Clasts | an individual constituent, grain, or fragment of sediment or rock, produced by mechanical or chemical disintegration of a larger rock mass. |

Colluvium Extrusive Geologic mapping | rock and soil accumulated at the foot of a slope from gravitational forces igneous rocks that crystallize at Earth's surface. the process of mapping geologic formations, associated rock characteristics and structural features. |

Geophysical Glaciolacustrine | the study of the earth by quantitative physical methods. pertaining to, or characterized by,glacialandlacustrineprocesses or conditions. The term is applied especially to deposits made in lakes. |

Granitic | a common, coarse-grained, light-colored, hard igneous rock consisting chiefly of quartz, orthoclase or microcline |

Lost circulation Magnetite | the loss of drilling fluids through open faults, fractures, and/or permeable rock. is a mineral, from the iron oxide family. It is the most magnetic of all the naturally occurring minerals on earth |

Molybdenum | A hard, silvery-white metallic element used to toughen alloy steels and soften tungsten alloy. An essential trace element in plant nutrition, it is used in fertilizers, dyes, enamels, and reagents. |

Moraine | is the term used to describe rock that is moved by a glacier as it traverses a continent |

Paludal Phenocryst | pertaining to a depositional environment or organisms from a marsh a crystal that is significantly larger than the crystals surrounding it. Phenocrysts form during an early phase in the cooling of magma, and are crystals of minerals that crystallize at higher temperatures than the groundmass. |

Pluton

Porphyry | an igneous intrusion.

Rock containing relatively large conspicuous crystals, especially feldspar, in a fine-grained igneous matrix. |

Quartz Monzonite | a rock enriched in lighter elements formed when molten rock (magma) cools and solidifies. |