UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

ALON USA ENERGY, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | |

| þ | | No fee required. |

| | | | |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials: |

| | | | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | (1) | | Amount previously paid: |

| | | | |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | | | |

| | (4) | | Date Filed: |

| | | | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

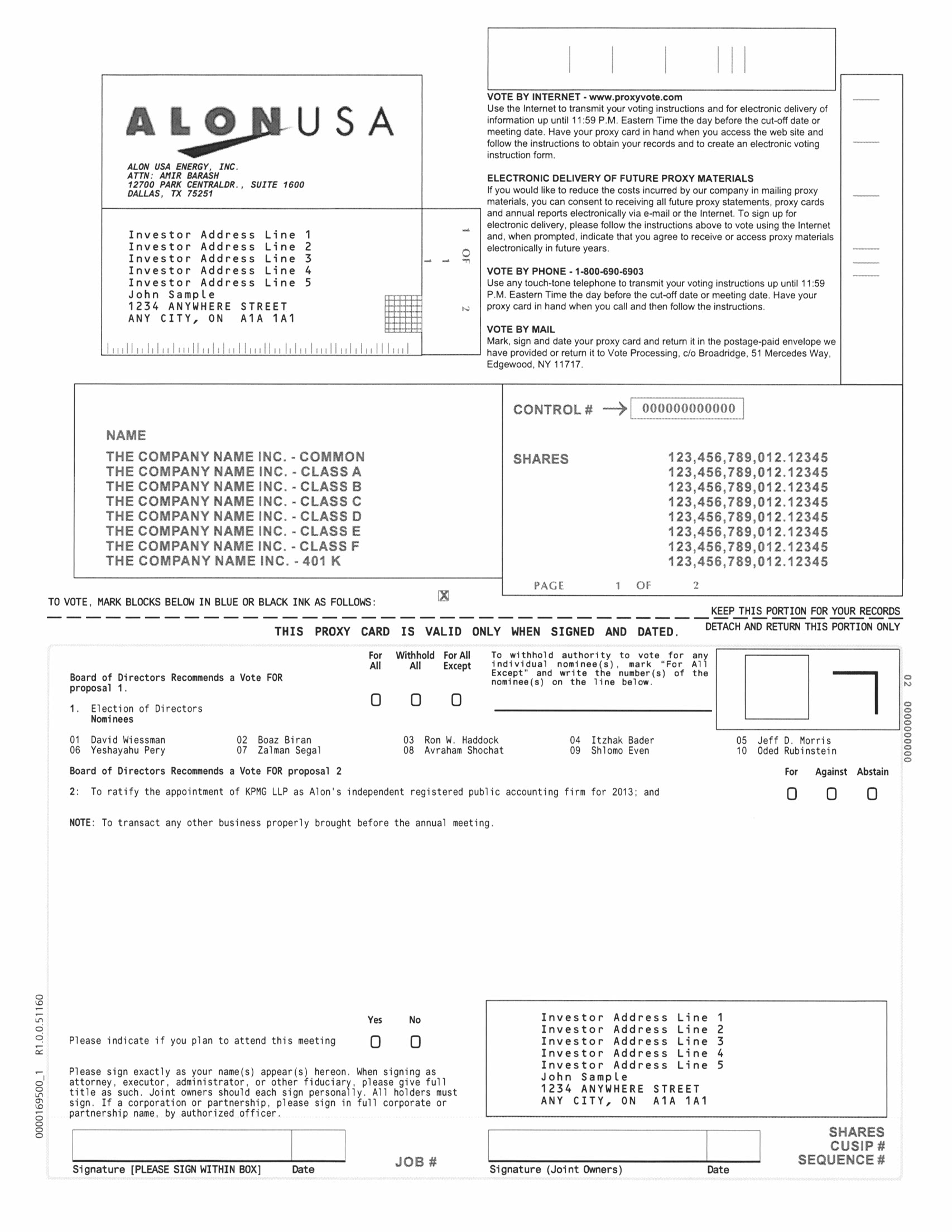

The Board of Directors has determined that the 2013 Annual Meeting of Stockholders of Alon USA Energy, Inc., or Alon, will be held on May 7, 2013 at 8:30 a.m., Dallas, Texas time, at The Frontiers of Flight Museum, 6911 Lemmon Avenue, Dallas, Texas 75209, for the following purposes:

| |

| (1) | To elect ten directors to serve until the 2014 annual meeting; |

| |

| (2) | To ratify the appointment of KPMG LLP as Alon's independent registered public accounting firm for 2013; and |

| |

| (3) | To transact any other business properly brought before the annual meeting. |

Information concerning the matters to be voted upon at the annual meeting is set forth in the accompanying Proxy Statement. Holders of record of Alon's common stock as of the close of business on March 15, 2013 are entitled to notice of, and to vote at, the annual meeting.

To make it easier for you to vote, Internet and telephone voting are available. The instructions on your proxy card describe how to use these services. If you prefer, you can vote by mail by completing your proxy card and returning it in the enclosed envelope. We urge you to vote your proxy promptly by Internet, telephone or mail, whether or not you plan to attend the annual meeting in person. If you do attend the annual meeting in person, you may withdraw your proxy and vote personally on all matters brought before the annual meeting.

Important Notice Regarding the Availability of Proxy Materials for the 2013 Annual Meeting of Stockholders to be held on May 7, 2013. Pursuant to Securities and Exchange Commission rules we have elected the “full set delivery” option of providing proxy materials to our stockholders whereby we are delivering to all stockholders paper copies of all of our proxy materials, including a proxy card, as well as providing access to our proxy materials on a publicly accessible website. Alon's Notice of Annual Meeting, Proxy Statement and Annual Report to Stockholders for the fiscal year ended December 31, 2012 are available on the Internet at www.proxyvote.com.

By order of the Board of Directors,

James Ranspot

Senior Vice President, General Counsel and Corporate Secretary

Alon USA Energy, Inc.

12700 Park Central Dr., Suite 1600

Dallas, Texas 75251

March 28, 2013

TABLE OF CONTENTS

|

| |

| | Page |

| GENERAL INFORMATION | |

| CORPORATE GOVERNANCE MATTERS | |

| The Board of Directors | |

| Independent Directors | |

| Committees of the Board | |

| Corporate Governance Guidelines, Code of Business Conduct and Ethics and Committee Charters | |

| Board Leadership Structure | |

| Board's Role in Risk Management | |

| Presiding Director | |

| Communication with Directors | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL HOLDERS AND MANAGEMENT | |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

| EXECUTIVE COMPENSATION | |

| Compensation Discussion and Analysis | |

| Introduction | |

| Objectives of Compensation Policies | |

| Compensation Program Elements | |

| Employment Agreements | |

| Methodology of Establishing Compensation Packages | |

| Chief Executive Officer Compensation | |

| Stock Ownership Policy | |

| Section 162(m) | |

| Summary Compensation Table | |

| Employment Agreements and Change of Control Arrangements | |

| Grants of Plan-Based Awards | |

| Outstanding Equity Awards at Fiscal Year-End 2012 | |

| Pension Benefits | |

| Compensation of Directors | |

| Compensation Committee Interlocks and Insider Participation | |

| 2012 EQUITY COMPENSATION PLAN INFORMATION | |

| COMPENSATION COMMITTEE REPORT | |

| AUDIT COMMITTEE REPORT | |

| INDEPENDENT PUBLIC ACCOUNTANTS | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | |

| Review, Approval or Ratification of Transactions with Related Persons | |

| Transactions with Management and Others | |

| PROPOSAL 1. ELECTION OF DIRECTORS | |

| PROPOSAL 2. RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| OTHER MATTERS | |

| INCORPORATION BY REFERENCE | |

| STOCKHOLDER PROPOSALS | |

| Stockholder Recommendations for Nomination of Directors | |

| Stockholder Proposals for Annual Meeting in 2014 | |

| APPENDIX A | |

ALON USA ENERGY, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 7, 2013

GENERAL INFORMATION

This Proxy Statement and the proxy card are being made available to stockholders beginning on or about March 28, 2013 in connection with the solicitation of proxies by the Board of Directors of Alon USA Energy, Inc., which we refer to as Alon or the Company, to be voted at the 2013 Annual Meeting of Stockholders of Alon to be held May 7, 2013 and at any postponement or adjournment thereof. The accompanying notice describes the time, place and purposes of the annual meeting.

Holders of record of Alon's common stock, $0.01 par value, at the close of business on March 15, 2013, the record date, are entitled to vote on the matters presented at the annual meeting. On the record date, there were 62,464,123 shares of common stock issued and outstanding and entitled to one vote per share. The common stock is the only outstanding class of voting securities of Alon.

The holders of a majority of the outstanding shares of common stock on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business at the annual meeting. For purposes of determining whether a quorum exists, abstentions and broker non-votes will be included in determining the number of shares present or represented at the annual meeting. If the persons present or represented by proxy at the annual meeting constitute the holders of less than a majority of the outstanding shares of common stock as of the record date, the annual meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

A "broker non-vote" occurs when your broker submits a proxy card for your shares of common stock held in a fiduciary capacity (often referred to as being held in "street name"), but does not indicate a vote on a particular matter because the broker has not received voting instructions from you and does not have authority to vote on that matter without such instructions. Under the rules that govern brokers who are voting shares held in street name, brokers have the discretion to vote those shares on routine matters but not on non-routine matters. Routine matters include the ratification of the appointment of the independent registered public accountants. Non-routine matters include the election of directors and stockholder proposals. In order to obtain approval of the matters brought to a vote at the annual meeting, the following votes are required:

| |

| • | Election of Directors: A plurality of the votes cast is required for the election of directors. Only votes FOR or WITHHELD count. Broker non-votes are not counted for the election of directors. |

| |

| • | Other Proposals: Approval of the ratification of the appointment of independent auditors requires the favorable vote of a majority of votes cast. Only votes FOR or AGAINST this proposal are counted. Broker non-votes count as votes “FOR” the ratification of the appointment of independent auditors. |

Abstentions count for quorum purposes, but not for voting.

Shares will be voted as indicated by the stockholder by Internet or telephone or on the proxy card. A stockholder who has given a proxy may revoke it as to any proposal on which a vote has not already been taken by signing a proxy bearing a later date or by a written notice delivered to the Secretary of Alon USA Energy, Inc. in care of Broadridge Financial Solutions, Attention: Vote Processing, at 51 Mercedes Way, Edgewood, NY, 11717 or at the executive offices of Alon USA Energy, Inc., 12700 Park Central Dr., Suite 1600, Dallas, Texas 75251, at any time up to the meeting or any postponement or adjournment thereof, or by delivering it to the Chairman of the meeting.

If no instructions are indicated, such shares will be voted:

| |

| • | FOR the director nominees identified below; |

| |

| • | FOR the ratification of the appointment of KPMG LLP as Alon's independent registered public accounting firm for 2013; and |

| |

| • | In the discretion of the persons named on your proxy card for any other item that may be properly proposed at the annual meeting of stockholders, including a motion to adjourn or postpone the annual meeting. |

Alon pays for the cost of soliciting proxies for the annual meeting. In addition to the solicitation of proxies by mail, proxies may be solicited by email, telephone and otherwise by directors, officers or employees of Alon, none of whom will be specially compensated for such activities. Alon also intends to request that brokers, banks and other nominees solicit proxies from their principals and will reimburse such brokers, banks and other nominees for reasonable expenses incurred by them in connection with such activities.

CORPORATE GOVERNANCE MATTERS

The Board of Directors

At the date of this Proxy Statement, the Board of Directors, or the Board, consists of ten members. Ten director nominees have been nominated for election at the annual meeting to serve for a one-year term expiring at Alon's annual meeting of stockholders in 2014.

During 2012 the Board held seven meetings. Each director attended at least 75% of the total number of meetings of the Board and committees on which he served with the exception of Messrs. Pery and Biran. Two of our directors attended Alon's annual meeting of stockholders held in 2012. Under Alon's Corporate Governance Guidelines, each director is expected to devote the time necessary to appropriately discharge his or her responsibilities and to rigorously prepare for, and attend and participate in, Board meetings and meetings of Board committees on which he or she serves. Each director is expected to ensure that other commitments do not materially interfere with his or her service on the Board of Alon.

The age, principal occupation, board qualifications and certain other information for each director nominee are set forth below:

David Wiessman, 58, has served as Executive Chairman of the Board of Directors of Alon since July 2000 and served as President and Chief Executive Officer of Alon from its formation in 2000 until May 2005. Mr. Wiessman has over 25 years of oil industry and marketing experience. Since 1994, Mr. Wiessman has been Chief Executive Officer, President and a director of Alon Israel Oil Company, Ltd., or Alon Israel, Alon's parent company. In 1987, Mr. Wiessman became Chief Executive Officer of, and a stockholder in, Bielsol Investments (1987) Ltd., or Bielsol, which acquired a 50% interest in Alon Israel in 1992. In 1976, after serving in the Israeli Air Force, he became Chief Executive Officer of Bielsol Ltd., a privately-owned Israeli company that owns and operates gasoline stations and owns real estate in Israel. Since August 2012, Mr. Wiessman has been Executive Chairman of the Board of the general partner of Alon USA Partners, LP, which is listed on the NYSE. Mr. Wiessman has also been Executive Chairman of the Board of Directors of Alon Holdings Blue Square-Israel, Ltd., which is listed on the NYSE and the Tel Aviv Stock Exchange, or TASE, since 2003; Chairman of Blue Square Real Estate Ltd., which is listed on the TASE, since 2006; and Executive Chairman of the Board and President of Dor-Alon Energy Israel (1988) Ltd., which is listed on the TASE, since 2005, and all of which are subsidiaries of Alon Israel. Mr. Wiessman has also been Executive Chairman of the Board of Directors of Alon Refining Krotz Springs, Inc., or Krotz Springs, since 2008. Krotz Springs is a subsidiary of Alon through which Alon conducts its Louisiana refining business and which has publicly traded debt in the United States. The Board has concluded that Mr. Wiessman's vision, business expertise, industry experience, leadership skills and devotion to community service qualify him to serve as Executive Chairman of the Board.

Ron W. Haddock, 72, has served as a director of Alon since December 2000. From January 1989 to July 2000, Mr. Haddock served as Chief Executive Officer of Fina, Inc. Mr. Haddock has served as Chairman of the Board of AEI Services, LLC, an international power generation and distribution, and natural gas transmission distribution company since 2006 and its interim Chief Executive Officer since May 2011; and Safety-Kleen Systems, Inc., a waste management, oil recycling and refining company since 2003. Mr. Haddock also has served as a director of Trinity Industries, Inc., a diversified transportation, industrial and construction company since 2007; and Petron Corporation, an oil refining and marketing company since 2009. The Board has concluded that Mr. Haddock's extensive directorship experience, past executive positions within the refining industry, financial reporting background and expertise qualify him to serve as a member of the Board.

Jeff D. Morris, 61, has served Vice Chairman of the Board of Directors of Alon since May 2011 and a director since May 2005. Prior to this Mr. Morris served as our Chief Executive Officer from May 2005 to May 2011, our Chief Executive Officer of our operating subsidiaries from July 2000 to May 2011, our President from May 2005 until March 2010 and President of our operating subsidiaries from July 2000 until March 2010. Since August 2012, Mr. Morris has been Vice Chairman of the Board of the general partner of Alon USA Partners, LP, which is listed on the NYSE. Prior to joining Alon, he held various positions at Fina, Inc., where he began his career in 1974. Mr. Morris served as Vice President of Fina's SouthEastern Business Unit from 1998 to 2000 and as Vice President of its SouthWestern Business Unit from 1995 to 1998. In these capacities, he was responsible for both the Big Spring refinery and Fina's Port Arthur refinery and the crude oil gathering assets and marketing activities for both business units. Mr. Morris has also been a director of Krotz Springs since 2008. The Board has concluded that Mr. Morris' position as Chief Executive Officer of Alon, detailed knowledge of Alon's operations and assets, expertise in oil refining and marketing, devotion to community service and management skills qualify him to serve as a member of the Board.

Itzhak Bader, 66, has served as a director of Alon since August 2000. Mr. Bader has also served as Chairman of the Board of Directors of Alon Israel since 1993 and as a director of Alon Partners since November 2012. He is Chairman of Granot Cooperative Regional Organization Corporation, a purchasing organization of the Kibbutz movement, a position he has held since 1995. In addition, he is also Chairman of Gat Givat Haim Agricultural Cooperative for Conservation of Agricultural Production Ltd., an Israeli beverage producer, a position he has held since 1999. Mr. Bader has also been the Co-Chairman of Dor-Alon Energy in Israel (1988) Ltd. since 2005, a director of Alon Holdings Blue Square-Israel, Ltd. since 2003 and a director of Blue Square Real

Estate Ltd. since 2005, each a subsidiary of Alon Israel. The Board has concluded that Mr. Bader's experience gained while serving as a director on a number of companies' boards, including several chairman positions, qualifies him to serve as a member of the Board.

Boaz Biran, 49, has served as director of Alon since May 2002. Mr. Biran has been a director of Bielsol since 1998 and served as Chairman of the Board of Directors of Rosebud Real Estate Ltd., an investment company in Israel listed on the TASE, since November 2003 and as a director of Alon Partners since November 2012. Mr. Biran was also a partner in Shraga F. Biran & Co., a law firm in Israel, from 1999 to 2008. The Board has concluded that Mr. Biran's broad business background and experience, legal expertise and directorship experience qualify him to serve as a member of the Board.

Shlomo Even, 56, has served as a director since November 2009. Mr. Even has been a certified public accountant and partner of the certified public accounting firm of Tiroshi Even since 1986. Mr. Even has also been a director of Alon Israel since 2002 (and previously from 1994 to 1999), Dor-Alon Energy in Israel (1988) Ltd. since September 1999, Alon Holdings Blue Square-Israel Ltd. since July 2003, Rosebud Real Estate Ltd. since July 2000, and Alon Natural Gas Ltd., which is listed on the TASE, since November 2009. Shlomo Even is the brother of Shai Even, our Senior Vice President and Chief Financial Officer. The Board has concluded that Mr. Even's public accounting experience, knowledge of corporate financial reporting and directorship experience qualify him to serve as a member of the Board.

Yeshayahu Pery, 79, has served as a director of Alon since August 2003. Mr. Pery has also served as a director of Alon Israel from 1997 until 2010. He is Chairman of MIGAL INC., a technology institute in the biotechnology field, a position he has held since 1998. From 1997 until 2004, Mr. Pery served as Chairman and Chief Executive Officer of Galilee Cooperative Organization, a purchasing and finance organization of the Kibbutz movement. In addition, Mr. Pery served as Chairman of Agricultural Insurance Association and the Atudot pension fund between 1995 and 2004. The Board has concluded that Mr. Pery's experience gained while serving as a director on a number of companies' boards, including several chairman positions, qualifies him to serve as a member of the Board.

Zalman Segal, 76, has served as a director of Alon since July 2005. Mr. Segal is a director of Union Bank Israel, an Israeli bank listed on the TASE, a position he has held since February 2010. Mr. Segal has also served as Chairman of the board of directors of Bank Leumi Romania, a financial services company, from August 2006 through August 2008. Mr. Segal served from 1989 through 2006 as Vice Chairman of the Board of directors of Bank Leumi USA and its subsidiary, Leumi Investment Services. Mr. Segal served from 1989 through 2005 as Chief Executive Officer and as director of Bank Leumi USA, where he was responsible for the commercial banking business of Bank Leumi USA in the Western Hemisphere. The Board has concluded that Mr. Segal's extensive financial education and expertise, including his PhD in banking and marketing from New York University, combined with his management and directorship experiences in financial and banking companies, qualify him to serve as a member of the Board.

Avraham Shochat, 76, has served as a director of Alon since October 2005. From 1988 to January 2006 he served as a member of the Israeli Parliament, where he chaired or was a member of various committees including economics, finance, defense, foreign affairs and education. From 1992 to 1996 and 1999 to 2001, Mr. Shochat served as Israel's Minister of Finance and from October 2000 to March 2001 as the country's Minister of Infrastructure. Mr. Shochat has also been a director of Israel Chemicals Ltd., a company engaged in the development, manufacture and marketing of fertilizers and industrial and performance products and which is listed on the TASE, since 2006; Bank Mizrahi Tefahot Ltd., Israel's fourth largest bank and which is listed on the TASE, since 2006; and Direct Insurance Financial Investments Ltd., an insurance company and which listed on the TASE, since 2006. The Board has concluded that Mr. Shochat's financial education and expertise, directorship experience and unique leadership and executive experience as Israel's Minister of Finance and Minister of Infrastructure qualify him to serve as member of the Board.

Oded Rubinstein, 52, has served as a director of Alon since August 2012. Mr. Rubinstein has been Managing Director of Mishkey Hanegev Agricultural Cooperative Ltd. since July 2007. Mr. Rubinstein has been Director of Dor Alon Energy In Israel (1988) Ltd. since March 23, 2008. Mr. Rubinstein currently serves as a director in Alon Israel Oil Company Ltd., Dor Alon Fuel Stations Operation Ltd., Dor Alon Gas Technologies Ltd., Hanegev Cooperative Society for Transportation Ltd., Hanagev Central Mechanical Services Ltd., Mishkey Hanegev Central Agricultural Cooperative Society Ltd., Ambar Central Feed Mill Agricultural Cooperative Society Ltd., Mishkey Dan Rechesch Mishkey Hadarom Vehanegev, D.N.H. Financing Services, D.N.H. Esco Ltd., Seed Growers Co. Ltd., The Financial Cooperative Organizations Union - Agricultural Cooperative Society Ltd., Fuel Holdings Ltd., Shovre Bar Feed Import - Agricultural Cooperative Society Ltd., Hazera (1939) Ltd. (as an alternate director), Zirei Eichut - Agricultural Cooperative Society, Tnuva Holdings, TAMAT - Agricultural Cooperative Society Ltd., Shdamot Mishkey Hanegev Ltd., D.N.H. Bar Ltd., BRIT - Pikvah 2000 Cooperative Ltd., K.M.A. Ltd. and the Israel Poultry Council.

Independent Directors

The Board has determined that Alon is a "controlled company" for the purposes of Section 303A of the NYSE Listed Company Manual because more than 50% of the voting power for the election of directors of Alon is held by Alon Israel. As such, Alon relies on exemptions from the provisions of Section 303A that would otherwise require it, among other things, to have a board of directors composed of a majority of independent directors.

Under the NYSE's listing standards, a director will not be deemed independent unless the Board affirmatively determines that the director has no material relationship with Alon. Based upon information requested from and provided by each director concerning their background, employment and affiliations, including commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, the Board has determined that each of Messrs. Segal, Haddock and Shochat has no material relationship with Alon, either directly or as a partner, stockholder or officer of an organization that has a relationship with Alon, and is therefore independent of Alon and its management under the NYSE's listing standards.

Committees of the Board

The Board has a standing Audit Committee and Compensation Committee. Currently, Messrs. Segal, Haddock and Shochat serve on the Audit Committee, and Messrs. Wiessman and Bader serve on the Compensation Committee. As a controlled company, Alon relies on exemptions from the provisions of Section 303A of the NYSE Listed Company Manual that would otherwise require it, among other things, to have a Compensation Committee composed of independent directors and to have a Nominating and Corporate Governance Committee.

As a controlled company, the Board does not believe that it is necessary to have a Nominating and Corporate Governance Committee or a committee performing the functions thereof, and does not have such a committee or charter. The entire Board (including Messrs. Wiessman, Bader, Biran, Even, Grinshpon, Morris and Pery, Alon's non-independent directors) participates in the nomination of director candidates. The Board identifies individuals qualified to become Board members in accordance with Alon's Corporate Governance Guidelines. In identifying candidates, the Board considers such factors as it deems appropriate, including the individual's education, experience, reputation, judgment, skill, integrity, industry knowledge, the degree to which the individual's qualities and attributes complement those of other Board members, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board. Although Alon does not have a defined diversity policy, when considering such factors the Board tries to identify candidates that will create a balanced and diverse leadership group with a variety of opinions, perspectives and backgrounds in the context of the requirements of the Board at that point in time.

Audit Committee. The purposes of the Audit Committee are to assist the Board in its oversight of (i) the integrity of Alon's financial statements, (ii) Alon's compliance with legal and regulatory requirements, (iii) the independent auditor's qualifications and independence, and (iv) the performance of Alon's internal audit function, as well as to prepare an audit committee report for inclusion in Alon's annual proxy statement. The Audit Committee met six times during 2012. The Audit Committee Charter, which, among other things, sets forth the Audit Committee's responsibilities, is available in the "Corporate Governance" section of the "Investor Center" section of Alon's website (www.alonusa.com).

The Audit Committee consists of Messrs. Segal, Haddock and Shochat. The Board has determined that (i) each of Messrs. Segal, Haddock and Shochat meets the audit committee independence criteria specified in the rules promulgated by the Securities and Exchange Commission, or SEC, and the NYSE's listing standards, (ii) each of Messrs. Segal, Haddock and Shochat has a basic understanding of finance and accounting and is able to read and understand fundamental financial statements, (iii) each of Messrs. Segal, Haddock and Shochat has accounting or related financial management expertise, and (iv) Mr. Segal, the Chairman of the Audit Committee, is an "audit committee financial expert" within the meaning of Item 407(d) of Regulation S-K.

Compensation Committee. The purpose of the Compensation Committee is to establish and administer Alon's policies, programs and procedures for determining compensation for Alon's executive officers and Board members. The Compensation Committee reviews and reports to the Board on matters related to compensation strategies, policies and programs, including management development, incentive compensation and employee benefit programs. For further information regarding the Compensation Committee's processes and procedures for consideration of executive compensation, see "Compensation Discussion and Analysis" below.

The Compensation Committee consists of Messrs. Wiessman and Bader. The Compensation Committee met twice during 2012. The Compensation Committee Charter, which, among other things, sets forth Compensation Committee's responsibilities, is available in the "Corporate Governance" section of the "Investor Center" section of Alon's website (www.alonusa.com).

Corporate Governance Guidelines, Code of Business Conduct and Ethics and Committee Charters

The full texts of Alon's Corporate Governance Guidelines and Code of Business Conduct and Ethics, as well as the charters for the Audit Committee and Compensation Committee, are available in the "Corporate Governance" section of the "Investor Center" section of Alon's website (www.alonusa.com). Alon intends to post any amendment to or waiver of its Code of Business Conduct and Ethics (to the extent such waiver is applicable to its directors or executive officers) at this location on its website within four days of such amendment or waiver.

Board Leadership Structure

At this time the Board has elected to separate the Chief Executive Officer and Chairman of the Board positions of Alon. While the Board recognizes that these positions have overlapping roles and duties, the Board believes that given the distinctive talents, expertise and experience of Messrs. Eisman and Wiessman, it is advantageous to separate the positions and utilize each in different roles. The Board believes that Mr. Eisman's expertise in the refining and marketing industry and management experience are best utilized in allowing him to focus on strategic and operational decisions affecting Alon's refining and marketing business as our Chief Executive Officer. Given Mr. Wiessman's experience in energy, marketing and financial markets and in leading other companies' boards of directors, the Board believes he best serves Alon in a role that allows him to lead the Board and represent stockholder interests as our Chairman of the Board.

Board's Role in Risk Management

The Board, through the Audit Committee, conducts periodic assessments of the risks facing Alon. As a result of these assessments, the Board determines the appropriate course of action to be taken to mitigate perceived risks. In response to Alon's exposure to commodity price risk resulting from its significant inventory holdings, the Board established a Risk Management Committee comprised of senior management to oversee inventory risk management and trading activities. The Risk Management Committee acts pursuant to procedures established in Alon's Risk Management Policy, which was approved by the Board. The Risk Management Committee reports quarterly to the Audit Committee regarding risk management positions, including hedging or other risk mitigation steps that have been taken, and our Chairman of the Board is advised prior to any new material hedging position being established.

The Board, through the Compensation Committee, considers, in establishing and reviewing Alon's executive compensation program, whether the program encourages unnecessary or excessive risk taking. The Compensation Committee, in reviewing the current executive compensation program, analyzed Alon's short- and long-term compensation programs, including the key components of each program, the performance factors for each program, the target awards of each program and the administrative oversight of each program. Based on the foregoing review, the Compensation Committee believes that Alon's executive compensation program does not encourage unnecessary or excessive risk taking.

Base salaries are fixed in amount and thus do not encourage risk taking. While a portion of the annual cash bonuses paid to the executives focuses on individual performance and contributions and on the financial performance of Alon's refineries, and such bonus system may encourage the taking of short-term risks, the Compensation Committee believes that the bonus program appropriately balances risk and the desire to focus employees on specific short-term goals important to Alon's success, and that it does not encourage unnecessary or excessive risk taking. Furthermore, a significant portion of the annual cash bonuses paid to our executives focuses on the safety and environmental objectives of our refineries, which does not encourage risk taking. The executive officers also receive long-term equity awards that are designed to align executive and stockholder long-term interests by creating a strong and direct link between executive compensation and stockholder return. The Compensation Committee believes that these awards do not encourage unnecessary or excessive risk taking since the ultimate value of the awards is tied to the Company's stock price, and since awards are staggered and subject to long-term vesting schedules to help ensure that executives have significant value tied to long-term stock price performance.

Based on the foregoing, the Compensation Committee concluded that Alon's executive compensation program is not reasonably likely to have a material adverse effect on Alon.

Presiding Director

The NYSE's listing standards require Alon's non-management directors to meet at regularly scheduled executive sessions without management. Alon's non-management directors met four times in such executive sessions in 2012. Mr. Pery presided over each such session.

Communication with Directors

Any stockholder or other interested party who wishes to communicate directly with the Board or any committee thereof, or any member or group of members of the Board or any committee thereof, may do so by writing to the Board or the applicable committee thereof (or one or more named individuals) in care of the Secretary of Alon USA Energy, Inc., 12700 Park Central Dr., Suite 1600, Dallas, Texas 75251. All communications received will be collected by the Secretary of Alon and forwarded to the appropriate director or directors.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL HOLDERS AND MANAGEMENT

The following table presents information regarding the number of shares of Alon common stock beneficially owned as of March 5, 2013 by each of Alon's directors, each executive officer of Alon named in the Summary Compensation Table, and all directors and executive officers of Alon as a group. In addition, the table presents information about each person known by Alon to beneficially own 5% or more of Alon's outstanding common stock. Unless otherwise indicated by footnote, the beneficial owner exercises sole voting and investment power over the shares. Additionally, unless otherwise indicated by footnote, the percentage of outstanding shares is calculated on the basis of 62,464,423 shares of Alon common stock outstanding as of March 5, 2013.

|

| | | | | |

| | | Beneficial Share Ownership |

| Directors, Executive Officers and 5% Stockholders | | Number of Shares | | Percent of Outstanding Shares |

| Directors and Executive Officers: | | | | |

| David Wiessman | | 3,069,541 |

| | 4.91% |

| Itzhak Bader | | — |

| | — |

| Boaz Biran | | — |

| | — |

| Shlomo Even | | — |

| | — |

| Ron W. Haddock | | 27,375 |

| | * |

| Jeff D. Morris (1) | | 100 |

| | * |

| Yeshayahu Pery | | — |

| | — |

| Zalman Segal | | 14,875 |

| | * |

| Avraham Shochat (2) | | 13,488 |

| | * |

| Oded Rubinstein | | — |

| | — |

| Shai Even (3) | | 93,178 |

| | * |

| Paul Eisman (3) | | 4,383 |

| | * |

| Alan Moret (3) | | 79,462 |

| | * |

| Michael Oster (3) | | 60,811 |

| | * |

| Kyle McKeen (3) | | 32,420 |

| | * |

| All directors and executive officers as a group (15 persons) (1)(2)(3) | | 3,395,633 |

| | 5.44% |

| 5% or more Stockholders: | | | | |

| Alon Israel Oil Company, Ltd. (4)(5) | | 41,062,879 |

| | 60.69% |

___________

* Indicates less than 1%

| |

| (1) | Jeff D. Morris (the Vice Chairman of the Board of Directors of Alon), Claire A. Hart (an executive officer of Alon) and Joseph A. Concienne, III (a former officer of Alon) each own shares of non-voting stock of Alon Assets, Inc., or Alon Assets. Alon Assets is a subsidiary of Alon through which Alon conducts substantially all of its business. As of March 1, 2013, there were 295,176.86 shares of capital stock of Alon Assets outstanding. Messrs. Morris, Hart and Concienne each own shares of non-voting stock of Alon Assets as set forth in the following table: |

|

| | | | | | |

| | | Alon Assets |

| Name of Beneficial Owner | | Non-voting Common Stock | | Percent of All Common Stock |

| Jeff D. Morris | | 11,195.6 |

| | 3.78 | % |

| Claire A. Hart | | 2,591.4 |

| | 0.88 | % |

| Joseph A. Concienne | | 673.1 |

| | 0.23 | % |

| Total | | 14,460.10 |

| | 4.89 | % |

| |

| (2) | Shares of Alon common stock are held in trust by Sian Holdings Enterprises LTD., which is an entity controlled by Mr. Shochat. |

| |

| (3) | Pursuant to the Alon USA Energy, Inc. Amended and Restated 2005 Incentive Compensation Plan, or the 2005 Incentive Compensation Plan, on March 7, 2007 Alon made grants of Stock Appreciation Rights (SARs) to certain officers at a grant price of $28.46 per share. On January 25, 2010, Alon amended the March 7, 2007 SARs grants to extend the exercise period. The SARs granted on March 7, 2007 vest as follows: 50% on March 7, 2009, 25% on March 7, 2010 and 25% on March 7, 2011 and are exercisable (as amended) during the 3-year period following the date of vesting. |

Pursuant to the 2005 Incentive Compensation Plan, on January 25, 2010 Alon made grants of SARs to certain officers at a grant price of $16.00 per share. The SARs granted on January 25, 2010 vest as follows: 50% on December 10, 2011, 25% on December 10, 2012 and 25% on December 10, 2013 and are exercisable during the 365-day period following the date of vesting.

Pursuant to the 2005 Incentive Compensation Plan, on March 1, 2010 Alon made grants of SARs to Paul Eisman. Of these SARs granted, 50% had a grant price of $10.00 per share and 50% had a grant price of $16.00 per share. The SARs granted on March 1, 2010 vest as follows: 50% on March 1, 2012, 25% on March 1, 2013 and 25% on March 1, 2014.

When exercised, the SARs are convertible into shares of Alon common stock, the number of which will be determined at the time of exercise by calculating the difference between the closing price of Alon common stock on the exercise date and the grant price of the SARs (the "Spread"), multiplying the Spread by the number of SARs being exercised and then dividing the product by the closing price of Alon common stock on the exercise date. In no event may a SAR be exercised if the Spread is not a positive number. On March 5, 2013, the reported closing price for Alon common stock on the NYSE was $19.62, and, as a result, a total of 4,455 shares are reflected in this table in respect of the SARs.

| |

| (4) | Includes (a) 35,869,929 shares of Alon common stock held directly by Alon Israel, and (b) 5,192,950 shares of Alon common stock underlying 3,500,000 shares of Alon's 8.50% Series A Convertible Preferred Stock (assuming conversion of all the shares of preferred stock held by Alon Israel but not including conversion by other Series A Preferred Stock holders). |

The address of Alon Israel and Tabris is Europark (France Building), Kibbutz Yakum 60972, Israel.

As of March 5, 2013, Alon Israel had 6,046,872 ordinary shares outstanding (excluding non-voting treasury shares), which were owned of record as follows:

|

| | | | | | |

| Record Holder (c) | | Number of Shares | | Percent of Outstanding Shares |

| Bielsol Investments (1987) Ltd. (a) | | 3,131,375 |

| | 51.79 | % |

| Several Purchase Organizations of the Kibbutz Movement (b) | | 2,915,497 |

| | 48.21 | % |

| Total | | 6,046,872 |

| | 100.00 | % |

___________

| |

| (a) | Bielsol is beneficially owned (i) 80.0% by Shebug Ltd., an Israeli limited liability company that is wholly owned by the family of Shraga Biran (where all voting rights have been granted to Shraga Biran), the father of Boaz Biran, one of Alon's directors, and (ii) 20.0% by David Wiessman, the Executive Chairman of the Board. The address of Bielsol is 1 Denmark St., Petach-Tivka, Israel. |

| |

| (b) | The Kibbutz Movement is a combination of approximately 270 economic cooperatives, or purchase organizations, engaged in agriculture, industry and commerce in Israel. The shares of Alon Israel shown in the table above as owned by several purchase organizations of the Kibbutz Movement are owned of record |

by nine such purchase organizations. Each of the purchase organizations that owns of record 5% or more of the outstanding shares of Alon Israel is shown on the following table:

|

| | | | | | |

| Purchase Organization | | Number of Shares | | Percent of Outstanding Shares |

| Aloney Granot Regional Cooperative Organization and Central Agricultural Cooperative Ltd. (i) | | 505,172 |

| | 8.35 | % |

| Mishkey Jordan Valley Central Agricultural Cooperative Ltd. | | 489,012 |

| | 8.09 | % |

| Mishkey Hanegev Agricultural Cooperative Ltd. (ii) | | 551,209 |

| | 9.12 | % |

| Holdings of Mishkey Darom Central Agricultural Cooperative Ltd. | | 479,734 |

| | 7.93 | % |

| Mishkey Upper Galilee Central Agricultural Cooperative Ltd. | | 391,005 |

| | 6.47 | % |

| Alonit - Agricultural Cooperative Ltd. | | 405,394 |

| | 6.70 | % |

| |

| (i) | Itzhak Bader, one of Alon's directors, is Chairman of Aloney Granot Regional Cooperative Organization and Central Agricultural Cooperative Ltd. The purchase organizations of the Kibbutz Movement have granted a holding company, or the Holding Company, an irrevocable power of attorney to vote all of the shares of Alon Israel held by such purchase organizations. The Holding Company is an Israeli limited liability company that is owned by nine organizations of the Kibbutz Movement, some of which are also stockholders of Alon Israel. Mr. Bader is Chairman of the Holding Company. |

| |

| (ii) | Oded Rubinstein, one of Alon's directors, is the Managing Director of Mishkey Hanegev Agricultural Cooperative Ltd. |

| |

| (c) | Bielsol, the purchase organizations of the Kibbutz Movement and the Holding Company are parties to a shareholders agreement. Under that agreement: |

| |

| • | Certain major decisions made by Alon Israel require the approval of more than 75% of the voting interests in Alon Israel or of more than 75% of the board of directors of Alon Israel, as applicable. The provisions of the shareholders agreement relating to approval of major transactions involving Alon Israel also apply to approval of major transactions involving significant subsidiaries of Alon Israel, including Alon. |

| |

| • | The number of directors of Alon Israel must be between three and 12. The provision under the agreement currently allows Bielsol to elect six directors and the purchase organizations of the Kibbutz Movement to elect five directors. |

| |

| • | There are various rights of first refusal among the shareholders who are party to the agreement. |

| |

| (5) | Alon Israel has caused, or has agreed to cause, up to $15.0 million of letters of credit to be issued for the benefit of Krotz Springs. Alon Israel has the option to withdraw the $15.0 million of letters of credit and acquire shares of preferred stock of Alon Refining Louisiana, Inc. ("Alon Louisiana"), a subsidiary of Alon, in an amount equal to such withdrawn letters of credit. The shares of Alon Louisiana's preferred stock acquired upon withdrawal of the $15.0 million of letters of credit are exchangeable under certain circumstances for shares of Alon common stock. Additionally, Alon has an option to issue shares of Alon common stock to Alon Israel in satisfaction of the payment obligations under promissory notes to be issued by a subsidiary of Alon in the event of a draw of any of the $15.0 million of letters of credit. For more information, see "Certain Relationships and Related Party Transactions-Transactions with Management and Others- Transactions with Alon Israel-L/Cs." |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and regulations of the SEC thereunder require Alon's executive officers and directors and persons who own more than ten percent of Alon's common stock, as well as certain affiliates of such persons, to file initial reports of ownership and changes in ownership with the SEC. Executive officers, directors and persons owning more than ten percent of Alon's common stock are required by SEC regulations to furnish Alon with copies of all Section 16(a) reports they file. Based solely on its review of the copies of such reports received by it and written representations that no other reports were required for those persons, Alon believes that, during the year ended December 31, 2012 all filing requirements applicable to its executive officers, directors and owners of more than ten percent of Alon's common stock were satisfied other than two Form 4s not filed on a timely basis, which were ultimately filed on October 15, 2012, reporting the transactions effected by the agreements dated June 20, 2012 between Alon and Jeff Morris, a former officer and current director of Alon, and Alon and Claire Hart, an executive officer of Alon, pursuant to which Alon agreed to exchange shares of non-voting

stock of two of its subsidiaries held by Messrs. Morris and Hart for shares of the Alon's common stock. Pursuant to powers of attorney in favor of Alon, Section 16(a) reports for Messrs. Morris and Hart are prepared and filed by Alon, but these filings were late due to a clerical oversight.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Introduction

The Compensation Discussion and Analysis provides a description of the objectives of Alon's executive compensation policies, a description of the Compensation Committee and a discussion of the material elements of the compensation of each of the executive officers listed below, who are referred to as Alon's named executive officers:

|

| | |

| Name | | Title |

| Paul Eisman | | President and Chief Executive Officer |

| Shai Even | | Senior Vice President and Chief Financial Officer |

| Alan Moret | | Senior Vice President of Supply |

| Michael Oster | | Senior Vice President of Mergers and Acquisitions |

| Kyle McKeen | | Chief Executive Officer of Alon Brands, Inc. |

| | | |

Objectives of Compensation Policies

The objectives of Alon's compensation policies are to attract, motivate and retain qualified management and personnel who are highly talented while ensuring that executive officers and other employees are compensated in a manner that advances both the short and long-term interests of stockholders. In pursuing these objectives, the Compensation Committee believes that compensation should reward executive officers and other employees for both their personal performance and Alon's performance. In determining compensation levels for Alon's executive officers, the Compensation Committee considers the scope of an individual's responsibilities, external competitiveness of total compensation, an individual's performance, prior experience and current and prior compensation, the performance of Alon and the attainment of financial and strategic objectives.

Alon's management provides compensation recommendations to the Compensation Committee; however, the final determination of a compensation package for the named executive officers is made solely by the Compensation Committee. Alon does not currently engage any consultants relating to executive and/or director compensation practices. The Compensation Committee may consider the compensation practices of other companies when making a determination; however, Alon does not benchmark its compensation packages to any particular company or group of companies.

Compensation Program Elements

Alon compensates its employees and named executive officers through a combination of base salary, annual bonuses and awards granted pursuant to the 2005 Incentive Compensation Plan. The Compensation Committee considers each element of Alon's overall compensation program applicable to an employee or named executive officer when making any decision affecting that employee's or named executive officer's compensation. The particular elements of Alon's compensation program are explained below.

Base Salaries. Base salary levels are designed to attract and retain highly qualified individuals. Each executive officer is eligible to participate with Alon's other employees in an annual program for merit increases to the executive's base salary. Pursuant to this program, each officer's performance is evaluated annually utilizing a number of factors divided into three categories: (i) individual performance objectives and results, (ii) competencies in core skills and knowledge, and (iii) professional development. Each executive officer reviews his evaluation with Mr. Eisman and individualized performance objectives for the following year are established. Based on the results of these evaluations, each executive officer receives an overall score that is considered by the Compensation Committee when determining any increase in base compensation. The precise amount of any increase in base compensation varies based on the executive's current level of compensation when compared to others in the Company at the same pay grade and the results of the annual evaluation. The Compensation Committee may also consider available information on prevailing compensation levels for executive-level employees at comparable companies in Alon's industry.

The 2012 salaries of the named executive officers of Alon are included in "Executive Compensation - Summary Compensation Table 2012."

During 2012 Messrs. Eisman, Even, Moret, Oster and McKeen received a base salary increase as a result of annual review process. Mr. Wiessman's salary increases are set forth in his Executive Employment Agreement. Base salaries for Alon's named executive officers in 2012 and the amount of base salary increase (decrease) from 2011 were as follows:

|

| | | | | | | | | | | |

| Name | | Amount of Base Salary Increase from 2011 | | | 2012 Base Salary |

| Paul Eisman | | $ | 12,200 |

| | | | $ | 420,200 |

| |

| Shai Even | | 9,200 | | | | | 315,200 | | |

| Alan Moret | | 9,700 | | | | | 334,200 | | |

| Michael Oster | | 7,800 | | | | | 267,900 | | |

| Kyle McKeen | | 9,200 | | | | | 315,200 | | |

| | | | | | | | |

Annual Bonuses. Executive officers and key employees may be awarded bonuses outside the plans described herein based on individual performance and contributions.

Bonus Plans. The Board has approved three annual bonus plans pursuant to the 2005 Incentive Compensation Plan (collectively, the "Bonus Plans"). Annual cash bonuses under the Bonus Plans are distributed to eligible employees each year based on the previous year's performance. Bonuses were paid to certain eligible employees in the second quarter of 2012 based on performance during Alon's 2011 fiscal year and if bonuses are payable based on performance during Alon's 2012 fiscal year, we expect such bonuses to be paid in the second or third quarter of 2013. Each of the Bonus Plans contains the same plan elements, which are described below. Participation in the Bonus Plans is based on the location of each employee as follows: (i) Alon's refining and marketing employees and Big Spring refinery employees are eligible to participate in one plan based primarily on the performance of Alon's Big Spring refinery, (ii) the employees of Alon's Paramount Petroleum Corporation subsidiary are eligible to participate in a second plan based primarily on the performance of Alon's California refineries, and (iii) the employees at the Krotz Springs refinery are eligible to participate in the third plan based primarily on the performance of Alon's Krotz Springs refinery. The bonus potential for Alon's named executive officers is based 33.3% on the bonus plan for employees of Alon's Big Spring refinery, 33.3% on the bonus plan for employees of the California refineries and 33.3% on the bonus plan for employees of the Krotz Springs refineries. Under each of the Bonus Plans, bonus payments are based 37.5% on meeting or exceeding target reliability measures, 37.5% on meeting or exceeding target free cash flow measures and 25% on meeting or exceeding target safety and environmental objectives. The bonus pool available under each Bonus Plan is limited to 20% of the aggregate direct salary expenses of the employees eligible to participate in such plan for the applicable year. The bonus potential for Alon's named executive officers ranges from 65% to 100% of the respective executive officer's base salary, as established in each executive officer's employment agreement or by the Compensation Committee.

The Compensation Committee believes that the Bonus Plans provide motivation for the eligible employees to attain Alon's financial objectives as well as refinery reliability and environmental and safety objectives, which have been designed to benefit Alon in both the long- and short-term.

In addition to cash bonuses paid under the Bonus Plans, the Compensation Committee awards cash bonuses from time to time to recognize exemplary results achieved by employees and named executive officers. The amount of any such cash bonus is determined based on the recipient's pay grade, contribution to the project or result and the benefit to Alon from the recipient's efforts.

2005 Incentive Compensation Plan. In July 2005 the Board approved the Alon USA Energy, Inc. 2005 Incentive Compensation Plan, and the stockholders approved such plan at Alon's 2006 annual meeting of stockholders. In 2010 the Board approved an amendment and restatement to such plan and the stockholders approved such amendment and restatement at Alon's 2010 annual meeting of stockholders. In 2012 the Board approved a further amendment to such plan and this amendment was approved by the stockholders at Alon's 2012 annual meeting of stockholders. Alon refers to such plan, as so amended, as the Alon USA Energy, Inc. Amended and Restated 2005 Incentive Compensation Plan, or the 2005 Incentive Compensation Plan. The 2005 Incentive Compensation Plan is a component of Alon's overall executive incentive compensation program. The 2005 Incentive Compensation Plan permits the granting of awards in the form of options to purchase common stock, stock appreciation rights, restricted shares of common stock, restricted stock units, performance shares, performance units and senior executive plan bonuses to Alon's directors, officers and key employees. The Compensation Committee believes that the award of equity-based compensation pursuant to the 2005 Incentive Compensation Plan aligns executive and stockholder long-term interests by creating a strong and direct link between executive compensation and stockholder return.

The Compensation Committee also utilizes equity-based compensation with multi-year vesting periods for purposes of executive officer retention. The specific amount of equity-based grants is determined by the Compensation Committee primarily

by reference to an employee's level of authority within Alon. Typically, all executive officers of the same level receive awards that are comparable in amount. The grant of restricted shares of common stock and similar equity-based awards also allows Alon's directors, officers and key employees to develop and maintain a long-term ownership position in Alon. The 2005 Incentive Compensation Plan is currently administered, in the case of awards to participants subject to Section 16 of the Exchange Act, by the Board and, in all other cases, by the Compensation Committee. Subject to the terms of the 2005 Incentive Compensation Plan, the Compensation Committee and the Board have the full authority to select participants to receive awards, determine the types of awards and terms and conditions of awards, and interpret provisions of the 2005 Incentive Compensation Plan. Awards may be made under the 2005 Incentive Compensation Plan to eligible directors, officers and employees of Alon and its subsidiaries, provided that awards qualifying as incentive stock options, as defined under the Internal Revenue Code of 1986, as amended, or the Code, may be granted only to employees.

Perquisites. During 2012 Messrs. Even and Oster received vehicle allowances and reimbursement for a de minimis amount of health club costs. Alon's use of perquisites as an element of compensation is limited in scope and amount. Alon does not view perquisites as a significant element of compensation but does believe that in certain circumstances they can be used in conjunction with base salary to attract, motivate and retain qualified management and personnel in a competitive environment.

Retirement Benefits. Retirement benefits to Alon's senior management, including Alon's named executive officers, are currently provided through one of Alon's 401(k) plans and one of Alon USA's pension plans, each of which are available to most Alon employees, and the Alon USA Energy, Inc. Benefits Restoration Plan, or Benefits Restoration Plan, which provides additional pension benefits to Alon's highly compensated employees. Non-represented employees, including senior management, are eligible to receive company matching of employee contributions into the 401(k) plan in which they participate of up to 4.5% of the employee's base salary. Alon's pension plans and the Benefits Restoration Plan are discussed more fully below in the "2012 Pension Benefits" table included in this Proxy Statement.

Employment Agreements

As discussed more fully below in "Employment Agreements and Change of Control Arrangements," Alon has entered into employment agreements with Messrs. Eisman, Even, Moret, Oster and McKeen. Alon's decision to enter into employment agreements and the terms of those agreements were based on the facts and circumstances at the time and an analysis of competitive market practices.

Methodology of Establishing Compensation Packages

The Compensation Committee does not adhere to any specified formula for determining the apportionment of executive compensation between cash and non-cash awards. The Compensation Committee attempts to design each compensation package to provide incentive to achieve Alon's performance objectives, appropriately compensate individuals for their experience and contributions and secure the retention of qualified employees. This is accomplished through a combination of the compensation program elements and, in certain instances, through specific incentives not generally available to all Alon employees.

Chief Executive Officer Compensation

The annual compensation of Alon's Chief Executive Officer, Paul Eisman, is determined by the Compensation Committee based on the compensation principles and programs described above. All cash compensation paid, and equity-based awards granted, to Mr. Eisman in 2012 is reflected in the "Summary Compensation Table" set forth in this Proxy Statement.

Stock Ownership Policy

Alon does not require its directors or executive officers to own shares of Alon stock.

Section 162(m)

Under Section 162(m) of the Code, compensation paid to the Chief Executive Officer or any of the other four most highly compensated individuals in excess of $1,000,000 may not be deducted by Alon in determining its taxable income. This deduction limitation does not apply to certain "performance based" compensation. The Board does not currently intend to award levels of non-performance based compensation that would exceed $1,000,000; however, it may do so in the future if it determines that such compensation is in the best interest of Alon and its stockholders.

Summary Compensation Table

The following table provides a summary of the compensation awarded to, earned by or paid to (i) Mr. Eisman, Alon's principal executive officer (PEO) in 2012, (ii) Mr. Even, Alon's principal financial officer (PFO) in 2012, and (iii) Messrs. Moret, Oster and McKeen, Alon's three other most highly compensated executive officers in 2012. Alon refers to these five individuals as its named executive officers.

2012 SUMMARY COMPENSATION TABLE

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) (1) | | Stock Awards ($) (2) | | Option Awards($) (3) | | Non-Equity Incentive Plan Compensation ($) (4) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) (5) | | All Other Compensation ($) | Total ($) |

| Paul Eisman Chief Executive Officer (PEO) |

| 2012 | | $ | 415,695 |

| | | $ | 200,000 | | | $ | — |

| | | $ | — |

| | | $ | — |

| | | $ | 44,349 |

| | | $ | 39,900 |

| | (6) | $ | 699,944 |

| * |

| | 2011 | | 405,077 | | | | — | | | | 5,735,000 | | | | — | | | | 182,285 | | | | 130,618 | | | | 19,547 | | | | 6,472,527 | | |

| | | 2010 | | 323,077 | | | | — | | | | — | | | | 29,720 | | | | 80,769 | | | | — | | | | 10,000 | | | | 443,566 | | |

Shai Even Senior Vice President and Chief Financial Officer (PFO) | | 2012 | �� | 311,803 | | | | 240,000 | | | | 438,500 | | | | — | | | | — | | | | 105,958 | | | | 8,513 | | | (7) | 1,104,774 | | |

| | 2011 | | 303,808 | | | | 376,000 | | | | 573,500 | | | | — | | | | 136,713 | | | | 98,026 | | | | 2,124 | | | | 1,490,171 | | |

| | 2010 | | 281,100 | | | | 175,000 | | | | — | | | | 14,541 | | | | 70,275 | | | | 40,210 | | | | 650 | | | | 581,776 | | |

Alan Moret Senior Vice President of Supply | | 2012 | | 324,378 | | | | 170,000 | | | | 350,800 | | | | — | | | | — | | | | — | | | | 7,500 | | | (8) | 852,678 | | |

| | 2011 | | 322,285 | | | | 240,000 | | | | 458,800 | | | | — | | | | 155,980 | | | | 6,759 | | | | 39,038 | | | | 1,222,862 | | |

| | 2010 | | 330,337 | | | | 100,000 | | | | — | | | | 14,541 | | | | 82,584 | | | | | — | | 39,170 | | | | 566,632 | | |

Kyle McKeen President and CEO Alon Brands (9) | | 2012 | | 311,803 | | | | — | | | | 578,738 | | | | — | | | | — | | | | 83,734 | | | | 7,600 | | | (10 | ) | 981,875 | | |

Michael Oster Senior Vice President of Mergers and Acquisitions | | 2012 | | 265,020 | | | | 207,000 | | | | 350,800 | | | | | | | | | | 84,192 | | | | 11,058 | | | (11) | 918,070 | | |

| | 2011 | | 258,237 | | | | 272,000 | | | | 458,800 | | | | | | | 116,206 | | | | 73,323 | | | | 2,528 | | | | 1,181,094 | | |

| | | 2010 | | 235,962 | | | | 167,000 | | | | — | | | | 7,270 | | | | 58,990 | | | | 27,765 | | | | 1,820 | | | | 498,807 | | |

___________

| |

| * | As described more fully in Note 2 below, during 2011 Alon made a grant of 500,000 restricted stock units (RSUs) to Mr. Eisman which vest over a four-year period. In accordance with SEC requirements, the grant date fair value of all 500,000 RSUs is reflected in the year 2011 rather than over the period of vesting. Had Mr. Eisman's grant been divided into four equal grants of 125,000 RSUs per year, the grant date fair value for 2012 would have been $1,096,250 and Mr. Eisman's total compensation for 2012 for purposes of the Summary Compensation Table would have been $1,796,194. |

| |

| (1) | This column reflects performance based bonuses awarded to the named executive officers for the fiscal year in which such amounts are earned, regardless of when paid. |

| |

| (2) | This column reflects the value of the awards based on aggregate grant date fair value determined in accordance with Financial Accounting Standards Board, Accounting Standard Codification 718, Stock Compensation, and does not reflect amounts the named executive officer has actually realized during the fiscal year. |

Pursuant to the 2005 Incentive Compensation Plan, on May 5, 2011 Alon made a grant of 500,000 RSUs to Mr. Eisman. Each RSU represents the right to receive one share of Alon common stock upon vesting. All 500,000 RSUs vest on March 1, 2015. The RSUs are subject to a restriction on transfer and Mr. Eisman is not entitled to receive dividends on, or vote, the RSUs. Mr. Eisman is entitled to receive, whenever a cash dividend is paid on shares of Alon common stock, an amount of cash equal to the product of the per-share amount of the dividend paid and the Dividend Share Amount (an amount set forth in the award agreement that increases each year). This payment for the fiscal year 2012 totaled $32,000 and is included in the "All Other Compensation" column of this table for Mr. Eisman.

Pursuant to the 2005 Incentive Compensation Plan, on May 10, 2012 Alon made grants of (a) 50,000 shares of restricted stock to Mr. Even and (b) 40,000 shares of restricted stock to each of Messrs. Moret and Oster. The restricted stock is subject to a restriction on transfer and the holders are not entitled to receive dividends on, or vote, the restricted stock until the shares vest. The shares of restricted stock granted on May 10, 2012 will vest 50% on May 10, 2013 and 50% on May 10, 2016.

Pursuant to the 2005 Incentive Compensation Plan, on August 27, 2012 Alon made grants of 20,625 shares of unrestricted stock and 20,625 shares of restricted stock to Mr. McKeen. The shares of restricted stock are subject

to a restriction on transfer and Mr. McKeen is not entitled to receive dividends on, or vote, the shares of restricted stock until they vest. The shares of restricted stock granted on August 27, 2012 vest on August 27, 2013.

| |

| (3) | This column reflects the value of the awards based on aggregate grant date fair value determined in accordance with Financial Accounting Standards Board, Accounting Standard Codification 718, Stock Compensation, and does not reflect amounts the named executive officer has actually realized during the fiscal year. |

Pursuant to the 2005 Incentive Compensation Plan, on January 25, 2010 Alon made grants of (a) 10,000 Stock Appreciation Rights (SARs) to each of Messrs. Even and Moret and (b) 5,000 SARs to Mr. Oster. The January 25, 2010 SARs have a grant price of $16.00 per share and vest as follows: 50% on December 10, 2011, 25% on December 10, 2012 and 25% on December 10, 2013 and are exercisable during the 365-day period following the date of vesting. When exercised, SARs are convertible into shares of Alon common stock, the number of which will be determined at the time of exercise by calculating the difference between the closing price of Alon common stock on the exercise date and the grant price of the SARs (the "Spread"), multiplying the Spread by the number of SARs being exercised and then dividing the product by the closing price of Alon common stock on the exercise date.

| |

| (4) | The amounts shown under Non-Equity Incentive Plan Compensation reflect earnings by the named executive officers under Alon's Bonus Plans for the fiscal year in which such amounts are earned, regardless of when paid. Bonuses under Alon's Bonus Plans are generally paid during the second quarter of the fiscal year following the end of the fiscal year in which they are earned. Bonuses were paid under Alon's Bonus Plans during the second quarter of 2012 as a result of performance in 2011, and also during the second quarter of 2011 as a result of performance 2010. The amount of bonuses to be paid under Alon's Bonus Plans to the named executive officers as a result of Alon's performance in 2012, if any, cannot presently be determined. It is estimated that such determination will be made in the second or third quarter of 2013, at which time the bonus amounts, if any, will be disclosed by Alon in a Current Report on Form 8-K. |

| |

| (5) | Reflects the aggregate change in actuarial present value of the named executive officer's accumulated benefit under the Alon USA GP, LLC Pension Plan and Benefits Restoration Plan calculated by (a) assuming mortality according to 2012 IRS Prescribed Mortality-Static Non-annuitant, male and female and (b) applying a discount rate of 4% per annum to determine the actuarial present value of the accumulated benefit at December 31, 2012, of 4.75% per annum to determine the actuarial present value of the accumulated benefit at December 31, 2011, and of 5.75% per annum to determine the actuarial present value of the accumulated benefit at December 31, 2010. |

| |

| (6) | Reflects $7,500 of 401(k) matching contribution, $350 in health club cost reimbursement, $50 in miscellaneous fringe gifts and $32,000 in payments made pursuant to Mr. Eisman's Restricted Stock Award Agreement. |

| |

| (7) | Reflects $7,500 of 401(k) matching contribution, $615 of a vehicle allowance, $50 in miscellaneous fringe gifts and $348 in health club cost reimbursement. |

| |

| (8) | Reflects $7,500 of 401(k) matching contribution. |

| |

| (9) | Mr. McKeen became a named executive officer in 2012. |

| |

| (10) | Reflects $7,500 of 401(k) matching contribution and $100 in miscellaneous fringe gifts. |

| |

| (11) | Reflects $7,500 of 401(k) matching contribution and $3,558 of a vehicle allowance. |

Employment Agreements and Change of Control Arrangements

Paul Eisman. Alon is a party to a Management Employment Agreement with Paul Eisman, the initial term of which is through March 1, 2015, and the term of which automatically renews for one-year terms unless terminated by either party. Mr. Eisman currently receives a base salary of $420,200 per year and is eligible for annual merit increases. Under his employment agreement, Mr. Eisman is entitled to participate in Alon's annual cash bonus plans, pension plan and benefits restoration plan. Additionally, Alon is required to provide Mr. Eisman with additional benefits to the extent such benefits are made available to other employees, including disability, hospitalization, medical and retiree health benefits and life insurance. Mr. Eisman is subject to a covenant not to compete during the term of his employment. In the event that Mr. Eisman is terminated without Cause (as defined in the agreement) or resigns upon at least 30 days' prior written notice for Good Reason (as defined in the agreement), he will be entitled to receive his base salary through the termination date, the prorated share of his annual bonus and a severance payment equal to nine months' base salary. This agreement also prohibits Mr. Eisman from disclosing Alon's proprietary information received through his employment.

Shai Even. Alon is a party to an Executive Employment Agreement with Shai Even, the initial term of which was through August 1, 2006, and the term of which automatically renews for one-year terms unless terminated by either party. Mr. Even currently receives a base salary of $315,200 per year and is eligible for annual merit increases. Under his employment agreement, Mr. Even is entitled to participate in Alon's annual cash bonus plans, pension plan and benefits restoration plan. Additionally, Alon is required to provide Mr. Even with additional benefits to the extent such benefits are made available to other employees, including disability, hospitalization, medical and retiree health benefits and life insurance. Mr. Even is subject to a covenant not to compete during the term of his employment. In the event that Mr. Even is terminated without Cause (as defined in the agreement) or resigns

upon at least 30 days' prior written notice for Good Reason (as defined in the agreement), he will be entitled to receive his base salary through the termination date, the prorated share of his annual bonus and a severance payment equal to nine months' base salary. This agreement also prohibits Mr. Even from disclosing Alon's proprietary information received through his employment.

Alan Moret. Alon is party to an Employment Agreement with Alan Moret, the initial term of which was through November 2005, and the term of which automatically renews for one-year terms unless terminated by either party. Mr. Moret currently receives a base salary of $334,200 per year and is eligible for annual merit increases. Under his employment agreement, Mr. Moret is entitled to participate in Alon's annual cash bonus plans and a 401(k) plan with matching contribution from Alon of up to 6% of Mr. Moret's base salary. Additionally, Alon is required to provide Mr. Moret with additional benefits to the extent such benefits are made available to other employees, including disability, hospitalization, medical and retiree health benefits and life insurance. In the event that (i) Mr. Moret is terminated without Cause (as defined in the agreement), (ii) Alon does not elect to extend the employment term (as defined in the agreement) or (iii) Mr. Moret resigns upon at least 90 days' prior written notice for Good Reason (as defined in the agreement), he will be entitled to receive any earned but unpaid annual bonus as of the date of termination for the previous year and a severance payment equal to four years' base salary, provide that, he will receive an additional years' base salary if Alon terminates his employment prior to the then effective employment term. In the event that Mr. Moret's employment is terminated due to death or disability (as defined in the agreement), he will be entitled to receive any earned but unpaid annual bonus as of the date of termination for the previous year, the prorated share of his annual bonus for the current year and a severance payment equal to four years' base salary. This agreement also prohibits Mr. Moret from disclosing Alon's proprietary information received through his employment.

Michael Oster. Alon is party to a Management Employment Agreement with Michael Oster, the initial term of which was through January 1, 2006, and the term of which automatically renews for one-year terms unless terminated by either party. Mr. Oster currently receives a base salary of $267,900 per year and is eligible for annual merit increases. Under his employment agreement, Mr. Oster is entitled to participate in Alon's annual cash bonus plans, pension plan and benefits restoration plan. Additionally, Alon is required to provide Mr. Oster with additional benefits to the extent such benefits are made available to other employees, including disability, hospitalization, medical and retiree health benefits and life insurance. Mr. Oster is subject to a covenant not to compete during the term of his employment. In the event that Mr. Oster is terminated without Cause (as defined in the agreement) or resigns upon at least 30 days' prior written notice for Good Reason (as defined in the agreement), he will be entitled to receive his base salary through the termination date, the prorated share of his annual bonus and a severance payment equal to nine months' base salary. This agreement also prohibits Mr. Oster from disclosing Alon's proprietary information received through his employment.

Kyle McKeen. Alon is a party to an Executive Employment Agreement with Kyle McKeen, the initial term of which is through May 1, 2013, and the term of which automatically renews for one-year terms unless terminated by either party. Mr. McKeen currently receives a base salary of $315,200 per year and is eligible for annual merit increases. Under his employment agreement, Mr. McKeen is entitled to participate in Alon's annual cash bonus plans, pension plan and benefits restoration plan. Additionally, Alon is required to provide Mr. McKeen with additional benefits to the extent such benefits are made available to other employees, including disability, hospitalization, medical and retiree health benefits and life insurance. Mr. McKeen is subject to a covenant not to compete during the term of his employment. In the event that Mr. McKeen is terminated without Cause (as defined in the agreement) or resigns upon at least 30 days' prior written notice for Good Reason (as defined in the agreement), he will be entitled to receive his base salary through the termination date, the prorated share of his annual bonus and a severance payment equal to twelve months' base salary. This agreement also prohibits Mr. McKeen from disclosing Alon's proprietary information received through his employment.

The following table sets forth the payments that each of the named executive officers could receive upon the occurrence of any of the events described below. The payments set forth in the table are based on the assumption that the event occurred on December 31, 2012, Alon's last business day in 2012. The amounts shown in the table do not include payments and benefits, such as accrued salary, accrued vacation and insurance and pension benefits, to the extent that they are provided on a non-discriminatory basis to salaried employees generally upon termination of employment.

|

| | | | | | | | | | | | | | | | | | | |

| Name | | Event | | Cash Severance ($) | | SARs ($) | | | Total ($) |

| Paul Eisman | | Death or Disability | | $ | — |

| | | | $ | 101,800 |

| | (7) | | $ | 101,800 |

| |

| | Termination, Resignation or Change of Control | | 315,150 | | | (1) | | — | | | | | 315,150 | | |

| Shai Even | | Death or Disability | | — | | | | | 20,900 | | | (7) | | 20,900 | | |

| | Termination, Resignation or Change of Control | | 236,400 | | | (2) | | — | | | | | 236,400 | | |

| Alan Moret | | Death or Disability | | 1,336,900 | | | (3) | | 20,900 | | | (7) | | 1,357,800 | | |

| | Termination, Resignation or Change of Control | | 1,336,900 | | | (4) | | — | | | | | 1,336,900 | | |

| Michael Oster | | Death or Disability | | — | | | | | 20,900 | | | (7) | | 20,900 | | |

| | Termination, Resignation or Change of Control | | 200,925 | | | (5) | | — | | | | | 200,925 | | |