Exhibit 99.1

Duke Energy Indiana

Summary of Settlement in Federal Tax Act Proceeding

(Docket No. 45032 S2)

Background

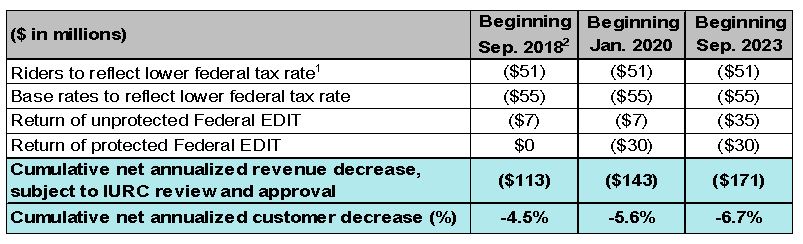

On June 27, 2018, Duke Energy Indiana (DEI), the Indiana Office of Utility Consumer Counselor, the Indiana Industrial Group and Nucor Steel – Indiana filed testimony consistent with their Stipulation and Settlement Agreement (Settlement Agreement) in the federal tax act proceeding with the Indiana Utility Regulatory Commission (IURC). The Settlement Agreement outlines how DEI will implement the impacts of the Tax Cuts and Jobs Act of 2017 (the Tax Act).

Major Components of the Settlement Agreement:

| |

| • | Riders to reflect the change in the statutory federal tax rate from 35% to 21% as they are filed in 2018 |

| |

| • | Base rates to reflect the change in the statutory federal tax rate from 35% to 21% upon IURC approval, but no later than September 1, 2018 |

| |

| • | DEI to continue to defer protected federal excess deferred income taxes (Federal EDIT) until January 1, 2020, at which time it will be returned to customers according to the Average Rate Assumption Method (ARAM) required by the Internal Revenue Service over approximately 26 years |

| |

| • | DEI to begin returning unprotected Federal EDIT upon IURC approval, but no later than September 1, 2018, over 10 years. In order to mitigate the negative impacts to cash flow and credit metrics, the Settlement Agreement allows DEI to return $7 million per year over the first five years, with a step up to $35 million per year in the following five years |

Additional Information:

| |

| • | The settlement is subject to the review and approval of the IURC. An evidentiary hearing is set for July 13, 2018 |

Estimated Annual Rate Impacts to Customer Bills

| |

| 1. | Riders are updated with the lower federal tax rate as they are filed. Estimated effective dates are between March and October 2018 |

| |

| 2. | Base rates to be updated upon IURC approval, but no later than September 1, 2018 |