UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

GENCO SHIPPING & TRADING LIMITED

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

In connection with its 2024 Annual Meeting of Shareholders, on May 2, 2024, Genco Shipping & Trading Limited issued an investor presentation and a press release. Copies of the materials can be found below:

Investor Presentation

GENCO SHIPPING & TRADING LIMITED CREATING VALUE FOR ALL GENCO SHAREHOLDERS May 2, 2024

2 “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995 This communication material contains certain forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements use words such as “expect,” “intend,” “plan,” “believe,” and other words and terms of similar meaning in connection with a discussion of potential future events, circumstances or future operating or financial performance. These forward-looking statements are based on management’s current expectations and observations. For a discussion of factors that could cause results to differ, please see the Company’s filings with the Securities and Exchange Commission, including, without limitation, the Company’s Annual Report on form 10-K for the year ended December 31, 2023, and the Company’s reports on Form 10-Q and Form 8-K subsequently filed with the SEC. We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additional Information and Where to Find It On April 16, 2024, Genco filed with the SEC a definitive proxy statement on Schedule 14A (the “Definitive Proxy Statement”), containing a form of WHITE proxy card, with respect to its solicitation of proxies for Genco’s 2024 Annual Meeting of Shareholders. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY GENCO AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. Investors and security holders may obtain copies of these documents and other documents filed with the SEC by Genco free of charge through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by Genco are also available free of charge by accessing Genco’s website at www.gencoshipping.com. Participants Genco, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the 2024 Annual Meeting of Shareholders, including John C. Wobensmith (Chief Executive Officer and President), Peter Allen (Chief Financial Officer), Joseph Adamo (Chief Accounting Officer), Jesper Christensen (Chief Commercial Officer), and Genco’s directors other than Mr. Wobensmith, namely James G. Dolphin, Paramita Das, Kathleen C. Haines, Basil G. Mavroleon, Karin Y. Orsel, and Arthur L. Regan. Investors and security holders may obtain more detailed information regarding the Company’s directors and executive officers, including a description of their direct or indirect interests, by security holdings or otherwise, under the captions “Management,” “Executive Compensation,” and “Security Ownership of Certain Beneficial Owners and Management” in Genco’s Definitive Proxy Statement. To the extent holdings of such participants in Genco’s securities changed since the amounts described in the Definitive Proxy Statement, such changes will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership on Form 4 filed with the SEC. These documents are available free of charge as described above.

Speakers 3 Paramita Das Independent Director Jim Dolphin Chairman & Independent Director Chairman of the Board since May 2021 Director since July 2014 John Wobensmith CEO & Director Kathleen C. Haines Independent Director CEO since March 2017 Director since May 2021 Chairwoman of the Audit Committee Member of the Compensation and ESG Committees Director since May 2017 Director since March 2024

Executive summary 4 Genco is poised to drive sustainable long-term value Genco Is Executing its Clear Strategy Designed to Drive Value Through Volatile Drybulk Cycles Genco Has Made Significant Progress on its Comprehensive Value Strategy, Outperforming the Market and Peers Genco Has a Highly Qualified and Engaged Board Overseeing Sustainable, Long-Term Value Creation Genco Has Industry-Leading Corporate Governance Standards George Economou’s Unclear Agenda for Genco & His Track Record The Board Has Concluded that Economou’s Suggestions Are NOT in the Best Interest of All Shareholders The Board Believes Pons is NOT Additive to Genco’s Board Vote FOR Genco’s Board of Directors Nominees

Table of contents 5 About Genco Shipping Is a Highly Cyclical Industry Genco’s Comprehensive Value Strategy Genco’s Strategy is Creating Value for Shareholders Genco’s Board Has Long Prioritized Strong Corporate Governance Practices Economou’s Unclear Agenda for Genco & His Track Record The Board Believes Pons Would Not Be Additive to Our Already Strong, Focused And Experienced Board Setting the Record Straight VOTE FOR GENCO Appendix

Genco Shipping & Trading overview 7 The largest U.S. based drybulk shipowner, with 43 modern, high-quality vessels(1) Headquartered in New York with global offices in Singapore and Copenhagen Transport both major (iron ore & coal) and minor (grains, cement, fertilizers, etc.) bulk across all key world-wide shipping routes Direct exposure to all drybulk trades transported across world-wide shipping routes Provides a full-service logistics solution to our customers Balanced risk return profile: low leverage (8% net LTV(2)) + high dividend payout Transparent US filer with no related party transactions Only US-based drybulk company listed in the US Rated #1 ESG shipping company globally(3) NYSE listed under ticker symbol GNK Reflects pro forma fleet based on the agreed sales of the Genco Claudius and Genco Maximus. Net LTV is based on VesselsValue.com estimates from April 2024 and cash and debt balances as of Dec 31, 2023. Based on the Webber Research 2023, 2022 and 2021 ESG scorecard. Webber Research ESG Scorecard ranks the public shipping universe on a number ofcorporate governance metrics , with the goal of identifying both high quality shipping platforms and points of conflict, was first published in 2016, and rebranded in 2019.

Global Seaborne Trade (% of 2023 total) Drybulk trade constitutes approximately half of all seaborne trade volume Commodity % of drybulk trade Primary use Iron ore 28% Steel production Met / thermal coal 24% Steel production + power generation Grain 10% Human consumption + feed livestock Minor bulks 38% Various uses, building products, raw materials, linked to global GDP growth Genco transported 27 million tons of drybulk commodities in 2023 8 We employ a diversified asset base consisting of large Capesize vessel and medium size Ultramax/Supramax vessels, enabling us to carry a wide range of cargoes worldwide GENCO’S COMMODITIES CARRIED

16 Vessels Higher industry beta leading to greater upside potential Focused on iron ore trade Driven by world-wide steel production More stable earnings Diverse trade routes Linked to global GDP Cargo arbitrage opportunities These two sectors provide complementary characteristics for Genco’s value strategy… Genco’s fleet composition 9 Our “Barbell” approach – Strategically combining upside potential of Capesize vessels with the more stable earnings stream of minor bulk vessels 27 Vessels Minor bulk Ultramax/Supramax Direct exposure to all drybulk commodities Scalable fleet Active approach to revenue generation High operating leverage Focused fleet on 2 main sectors Note: Reflects pro forma fleet based on the agreed sales of the Genco Claudius and Genco Maximus. Major bulk Capesize

Shipping Is a Highly Cyclical Industry 10

Active capital allocation management is critical in dynamic drybulk shipping markets 11 The drybulk sector is a cyclical sector prone to volatilityDemand growth provides long-term value-creation opportunity for companies that can navigate the volatility Capital intensive business that operates assets with a finite lifeFleet management requires significant investment by owners, typically financed with a combination of debt & equity Prudent stewardship required to navigate through the market cyclesOver the course of the last 20+ years, shipping markets have experienced major cyclical events with many companies enduring reorganizations Asset acquisition timing is critical to long-term sustainabilityHigh day rate and asset value volatility amplify the need for risk management and flexible capital allocation

The drybulk sector is a cyclical sector prone to volatility 12 Capital risk management is critical for sustainability and long-term profitability Drybulk index volatility the highest when compared to key commodity prices Monthly Volatility over the Last 10 Years Index Index An industry with rapid swings in earnings & values requires an efficient cost structure and highly-disciplined capital allocation Source: Clarksons Research Services Limited.

Volatility in the drybulk market is driven by vessel supply and commodity demand 13 A long-term value-creation opportunity for companies that can navigate a volatile and cyclical market environment Historically, periods with strong earnings have been followed by periods of vessel ordering as owners reinvest earnings into assets Increases in vessel supply led to weaker earning environments In 2021, orderbook was at its lowest levels in the last 20 years supporting a healthy earnings environment, however since then, it has increased by ~2% OB/fleet ratio $/day Source: Clarksons Research Services Limited. Vessel supply plays a critical role in the development of shipping cycles Despite volatility, a long history of consistent growth in drybulk trade Financial Crisis COVID-19 Since 1990, there have been only two periods in which drybulk trade has contracted, both due to macroeconomic shocks Growth in drybulk trade has remained largely consistent in the past several decades, with few contractions driven by larger macroeconomic events Drybulk demand in recent years has been heavily influenced by growth in China Indicates periods of drybulk market contraction Strong demand over the last 20 years driven by China’s economic growth, leading to an oversupply of vessels in the early 2010s and follow on decline in freight rates which the drybulk sector has been recovering from in recent years Overbuilding of vessels results in prolonged market downturns while demand growth has proven to be relatively consistent

Genco’s Comprehensive Value Strategy 14

Comprehensive Value Strategy 15 Positioning Genco to generate returns through volatile drybulk market cycles Implemented strategy in 2021 following thorough Board and management review and discussion process Executing across three key pillars: compelling dividends, reducing debt, and investing in the fleet to drive growth

Implementing a strategy to create value through cycles 16 Genco implemented the Comprehensive Value Strategy in 2021 Strategy developed by Board and management team through a comprehensive review and open debate As part of the discussion, the Board and management team considered a range of options and factors including: The Company’s historic performance The market environment Peer benchmarking performance Capital allocation priorities – repurchases vs. dividends Rejuvenating the Company’s asset base Driving down cash flow breakeven levels through debt repayment Seeking to optimize debt levels Resulted in a clear strategy that creates a low leverage, high dividend payout model that provides flexibility; optionality to pursue growth opportunities; and ability to maintain significant returns to shareholders through volatile market cycles.

Genco’s strategy is driven by a desire to deliver value to its shareholders through sustained dividends – but this is only possible with low to no debt 17 Industry leading breakeven costs covered in nearly every rate environment over the last 2 decades Every $1,000 increase in TCE(1) equates to ~$15m of incremental annualized EBITDA on our pro forma 43-vessel fleet $15m Significant Operating Leverage Cash flowbreakeven rate % of the periods in which rates are above breakeven levels ~$15k ~50% ~$10k ~80% ~$9k ~90% $ / day Current rates create a comfortable margin above Genco’s 2024 CF breakeven rate Of the 96 quarters from 2000 to 2023, a dividend could be paid in 85 of those quarters or ~90% with the cash flow breakeven rate ex-debt service (no div in 11 quarters or ~10% of the time) Under a fully drawn revolving credit facility, with higher leverage, only ~50% of the time a dividend could be paid Cash flow breakeven rate prior to debt service is covered in nearly every rate environment over the last two decades, highlighting the importance of continued debt repayments We believe this is a prudent approach to balance sheet management during volatile market periods Assumptions: Illustrative fleet-wide time charter rate is based on the quarterly averages of the Baltic Capesize Index and Baltic Supramax Index since 2000 weighted based on Genco’s pro forma fleet composition of 43 vessels. An assumed scrubber premium is included together with a target minor bulk outperformance figure. Cash flow breakeven rate is based on our Q1 2024 expense budget. Under its existing credit facility, Genco has no mandatory debt amortization until 2028, when this credit facility matures. TCE rate is a common shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charterhire rates for vessels on voyage charters are generally not expressed in per-day amounts, while charterhire rates for vessels on time charters generally are expressed in such amounts. We believe the non-GAAP measure presented provides investors with a means of better evaluating and understanding the Company’s operating performance.

WELL-BALANCED CAPITAL ALLOCATION ACROSS 3 PILLARSOF DIVIDENDS, DELEVERAGING AND GROWTH Continued progress over the last 3 years executing on our value strategy 18 Successful progression of the value strategy allowed Genco to shift focus from repaying debt to paying dividends What we said April 2021… What we did ~3 years later… TransformGenco into a low leverage,high dividend yield company Paid$170m in dividendssince 2021 Maintainsignificant flexibilityto grow the fleet Paid down$249m of debt Targetpaying a quarterly dividendbased on cash flows less avoluntary quarterly reserve Invested$236m in highspecification vessels 38% 36% Debt paydowns Dividends paid Fleet growth

Our comprehensive value strategy is enabling Genco to allocate capital more towards dividend payouts over the years 19 Prioritizing debt repayments at the onset of the strong drybulk market and as the value strategy was being implemented Increased focus on dividends while continuing to voluntarily pay down debt. First full value strategy dividend payment made in Q1-22 Continued emphasis on dividends, drawing upon the flexibility within the dividend calculation to supplement quarterly dividends in Q1-Q3. Debt paydowns are pro forma for agreed upon vessel sales that occurred in Q1 and Q2-24 We define TCE rates as our voyage revenues less voyage expenses, charter-hire expenses, and realized gains or losses on fuel hedges divided by the number of the available days of our owned fleet during the period. TCE rate is a common shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charterhire rates for vessels on voyage charters are generally not expressed in per-day amounts, while charterhire rates for vessels on time charters generally are expressed in such amounts. We believe the non-GAAP financial measure presented provides investors with a means of better evaluating and understanding the Company’s operating performance. Please see the appendix for a reconciliation.

Capesize sale & purchase activity:Modernizing the fleet + increasing earnings capacity ~$10m OR~$0.24/sh Drydocking capex savings due to well-timed fleet renewal Executed the next leg of our fleet renewal strategy 20 Bought: 2016-built high specification vessels Selling: 2009-2010 built vessels due for 3rd special survey UPGRADING THE FLEET WITH MODERN CAPESIZE PURCHASES # of vessels

Asset values rising due to firm freight rates and supported by limited supply and strong newbuild prices SIGNIFICANToperating leverage COUNTERCYCLICALOPPORTUNITIESto buy vessels from a position of strength ENHANCES POSITION in up or down markets Financial flexibility in various market conditions 21 As a result of its strategy, Genco is moving forward with flexibility to capture growth opportunities As a result of the Comprehensive Value Strategy, Genco is moving forward with flexibility to capture growth opportunities Source: Clarksons Research Services Limited.

Genco’s Strategy is Creating Value for Shareholders 22

We believe our comprehensive Value Strategy is working 23 Genco is performing well and capturing opportunities As evidenced by our recent quarterly results Strong TSR performance over short, medium and long-term Combination of share price performance and high distributions drives Genco’s outperformance vs. core peers Genco’s P/NAV valuation above U.S.-listed peer group average Significant improvement in trading levels supported by shareholder-friendly capital allocation policy

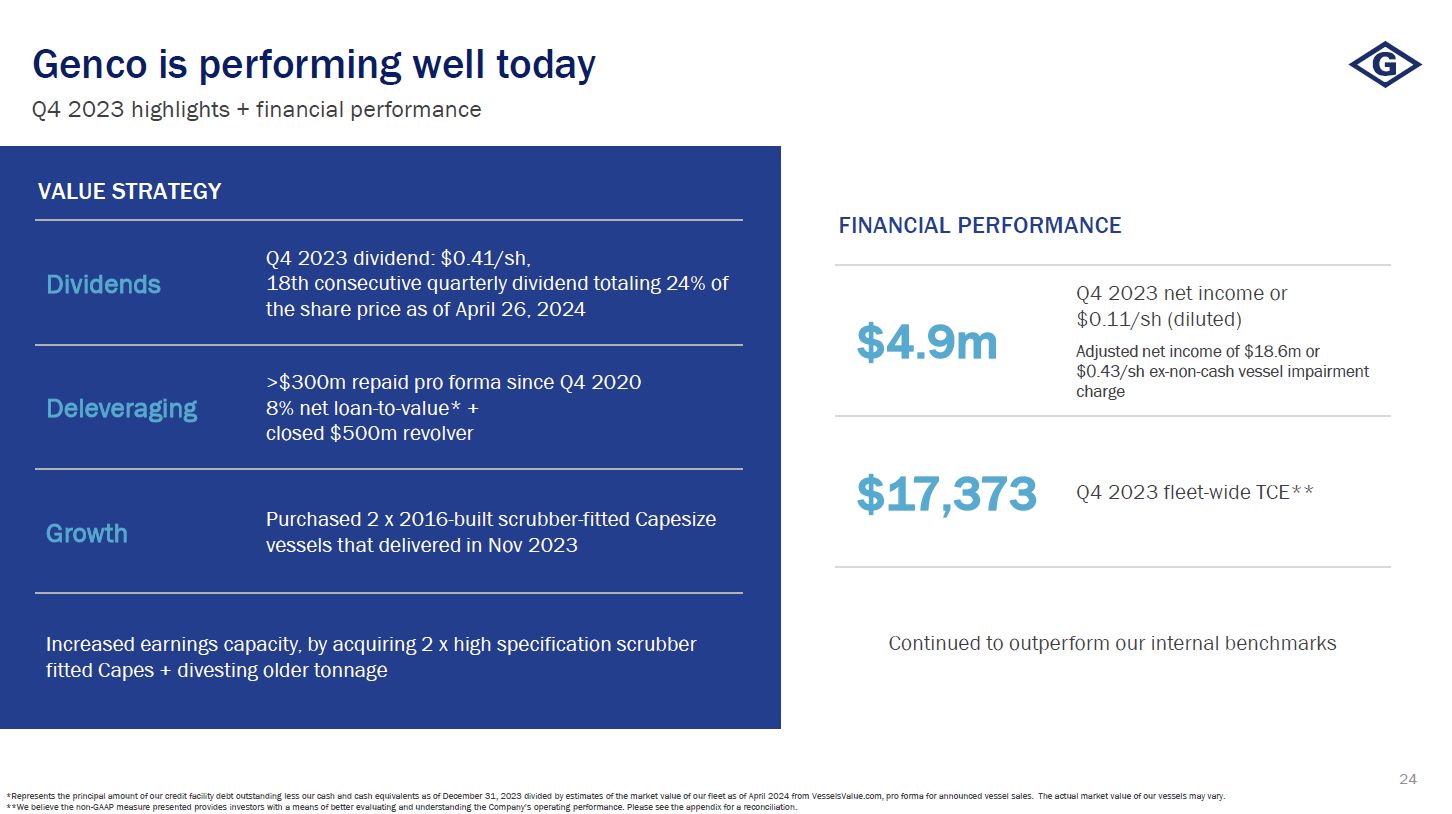

Genco is performing well today 24 Q4 2023 highlights + financial performance FINANCIAL PERFORMANCE VALUE STRATEGY Dividends Q4 2023 dividend: $0.41/sh,18th consecutive quarterly dividend totaling 24% ofthe share price as of April 26, 2024 Deleveraging >$300m repaid pro forma since Q4 2020 8% net loan-to-value* +closed $500m revolver Growth Purchased 2 x 2016-built scrubber-fitted Capesize vessels that delivered in Nov 2023 Increased earnings capacity, by acquiring 2 x high specification scrubber fitted Capes + divesting older tonnage $4.9m Q4 2023 net income or $0.11/sh (diluted) Adjusted net income of $18.6m or $0.43/sh ex-non-cash vessel impairment charge $17,373 Q4 2023 fleet-wide TCE** Continued to outperform our internal benchmarks *Represents the principal amount of our credit facility debt outstanding less our cash and cash equivalents as of December 31, 2023 divided by estimates of the market value of our fleet as of April 2024 from VesselsValue.com, pro forma for announced vessel sales. The actual market value of our vessels may vary. **We believe the non-GAAP measure presented provides investors with a means of better evaluating and understanding the Company’s operating performance. Please see the appendix for a reconciliation.

Genco has outperformed its peers and the market 25 Source: FactSet as of 4/30/2024. Proxy performance peers consist of Eagle Bulk Shipping Inc., Star Bulk Carriers Corp., Diana Shipping Inc., Golden Ocean Group Limited, Safe Bulkers, Inc., Pacific Basin Shipping Limited, Pangaea Logistics Solutions Ltd., Belships ASA, Seanergy Maritime Holdings Corp., Taylor Maritime Investments Limited, 2020 Bulkers Ltd. and Thoresen Thai Agencies Plc. 1) Jim Dolphin was appointed Chairman effective on May 13, 2021. Relative TSR Since Jim Dolphin Became Chairman(1) GNK 78.4% Proxy Peers 70.0% S&P500 28.2% 5-Year Relative TSR GNK 195.4% Proxy Peers 166.7% S&P500 85.8% 1-Year Relative TSR GNK 45.9% Proxy Peers 30.0% S&P500 22.7% 3-Year Relative TSR GNK 78.7% Proxy Peers 71.4% S&P500 26.2% 2/22/2024 GNK Q4’23 earnings release 2/22/2024 GNK Q4’23 earnings release 2/22/2024 GNK Q4’23 earnings release 2/22/2024 GNK Q4’23 earnings release

Genco’s P/NAV valuation above U.S.-listed peer group average 26 Many shipping companies trade at a discount to NAV Genco is relentlessly focused on executing our Comprehensive Value Strategy, which we believe will mitigate the discount in the eyes of investors given that Genco has outperformed its peers and the market in historical 1, 3 and 5 year TSRs NAV is a backward-looking metric. Given the volatility of asset values, we believe that NAV metrics should be evaluated alongside cash flow and dividend yield to adequately measure company performance CURRENT SHARE PRICE / NAV(1) Source: Company filings, VesselsValue and market data as of 4/30/2024. Note: U.S. listed peer group consists of Diana Shipping Inc., Golden Ocean Group Limited, Safe Bulkers, Inc., and Star Bulk Carriers Corp. NAV is calculated as the aggregate value of owned ships including newbuild vessels, cash, net working capital, charter adjusted value, less debt outstanding and remaining capital expenditure on newbuild assets.

Genco’s Board Has Long Prioritized Strong Corporate Governance Practices 27

Genco’s board has long prioritized strong corporate governance practices 28 Genco has a strong and highly qualified board Directors bring significant experience, skills and diversity that is relevant to Genco’s business and to create shareholder value Genco’s Board has been open-minded and responsive Continued to make corporate governance enhancements to investor and ISS feedback Genco is the shipping industry leader in ESG Ranked #1 in the Webber Research ESG Scorecard for 3 consecutive years

Genco has a strong, independent and experienced Board 29 Genco prioritizes a Board filled with new perspectives and diverse backgrounds, as demonstrated through its thorough search process which resulted in the appointment of Independent Director Paramita Das Each director is highly qualified, active and engaged Genco added one new director, Ms. Das, in March 2024 following a comprehensive search Drybulk Commodities Relationships Capital Markets Commercial / Chartering Executive Mgmt. Operations / Technical Accounting & Finance Risk Mgmt. Strategy Public / Investor Relations ESG James Dolphin Paramita Das Basil Mavroleon Kathleen Haines Karin Orsel Arthur Regan John Wobensmith Shipping-Related Experience Other Business-Related Experience

Genco has a strong, independent and experienced Board (con’t) 30 Ms. Das’ appointment follows a comprehensive search process with the assistance of a leading executive search firm that began months before Economou took a stake, from a pool of more than 20 candidates Paramita Das Independent Director Director since 2024 Jim Dolphin Chairman Director since 2014 Significant global leadership experience Global head of marketing, development and ESG at Rio Tinto Deep understanding of the commodities market and Genco’s customer base Served as Chief Strategy Officer at Consortium of Sumitomo Corporation, Itochu Corporation and UACJ Currently serves on the Board of Coeur Mining, Inc. Managing Director and President of AMA Capital, since 2001 Instrumental in developing and refining the Company’s Comprehensive Value Strategy Strong understanding of cyclical businesses Has conducted rigorous reviews of capital spending given his experience in shipping and the oil and gas industries Served companies including BHP, BP, Union Pacific Railroad and the Panama Canal Commission Genco Board Highlights Balanced Board with wide-ranging skillsets and essential expertise relevant to Genco Diverse Board with gender and racial diversity 3 of 7 directors are female (43%) 1 ethnically diverse director We expect all directors other than our CEO will be independent as of this year’s annual meeting Established an ESG committee

Genco is the shipping industry leader in ESG 31 Implementing well-planned and well-executed corporate governance and sustainability initiatives, in responsive to shareholders and ISS feedback Further strengthened corporate governance based on shareholder engagement + in response to ISS recommendations Adopted policy prohibiting hedging and pledging of shares Implemented Human Rights and Safety & Occupational Health Policies Published an annual Sustainability Report Increased disclosure around: Environmental initiatives Cybersecurity Board responsibilities Human rights Safety & Occupational Health Ranked #1, out of 64 public shipping companies, in the annual Webber Research ESG Scorecard three years in a row(1) The only drybulk company listed in the US, committed to full transparency and best-in-class governance practices All of Genco’s close shipping peers are currently not subject to the SEC reporting requirements for U.S.-based companies and provide limited information on their executive compensation and governance profile Refined our compensation plan so compensation for the Genco Board and management team is more closely tied to the Company’s performance Adopted stock ownership guidelines for executives and directors Genco’s Board and management team have established a record of leadership across our industry based on our performance and our corporate governance Based on the Webber Research 2023, 2022 and 2021 ESG scorecard. Webber Research ESG Scorecard ranks the public shipping universe on a number of corporate governance metrics , with the goal of identifying both high quality shipping platforms and points of conflict, was first published in 2016, and rebranded in 2019.

Economou’s Unclear Agenda for Genco & His Track Record 32

Economou’s track record and unclear agenda 33 The board has evaluated and believes Economou’s suggestions do not create value We believe Economou’s agenda is NOT in the best interest of our shareholders We believe Genco shareholders should be concerned with Economou’s record Genco has tried to engage with Economou, his ideas and his nominees since day one

We believe Economou demonstrated NO willingness for meaningful engagement 34 He did not begin interacting with Genco through any constructive dialogue regarding any proposal(1) Instead, he first requested a director questionnaire through counsel without revealing his identity, only revealed himself through publicly filing a Schedule 13D, and submitted a board nomination notice(1) He later proposed that Genco initiate a stock buyback program without providing any supportive analysis of his own despite repeated requests from us(1) We discussed with him our buyback analysis and strategic priorities, and he then quickly flip-flopped to a tender offer at a premium(1) He indicated he’s a seller at 100% NAV(2) and later sold shares after our stock reached $21(3) Genco Board and management sought to engage constructively and gave his suggestions full consideration with assistance from an external financial advisor See Economou’s definitive proxy statement, pp. 8-10, at https://www.sec.gov/Archives/edgar/data/1326200/000110465924048392/tm2412105d1_defc14a.htm. Per a discussion between Economou and members of our board. See Economou’s definitive proxy statement, p. A-3, at https://www.sec.gov/Archives/edgar/data/1326200/000110465924048392/tm2412105d1_defc14a.htm.

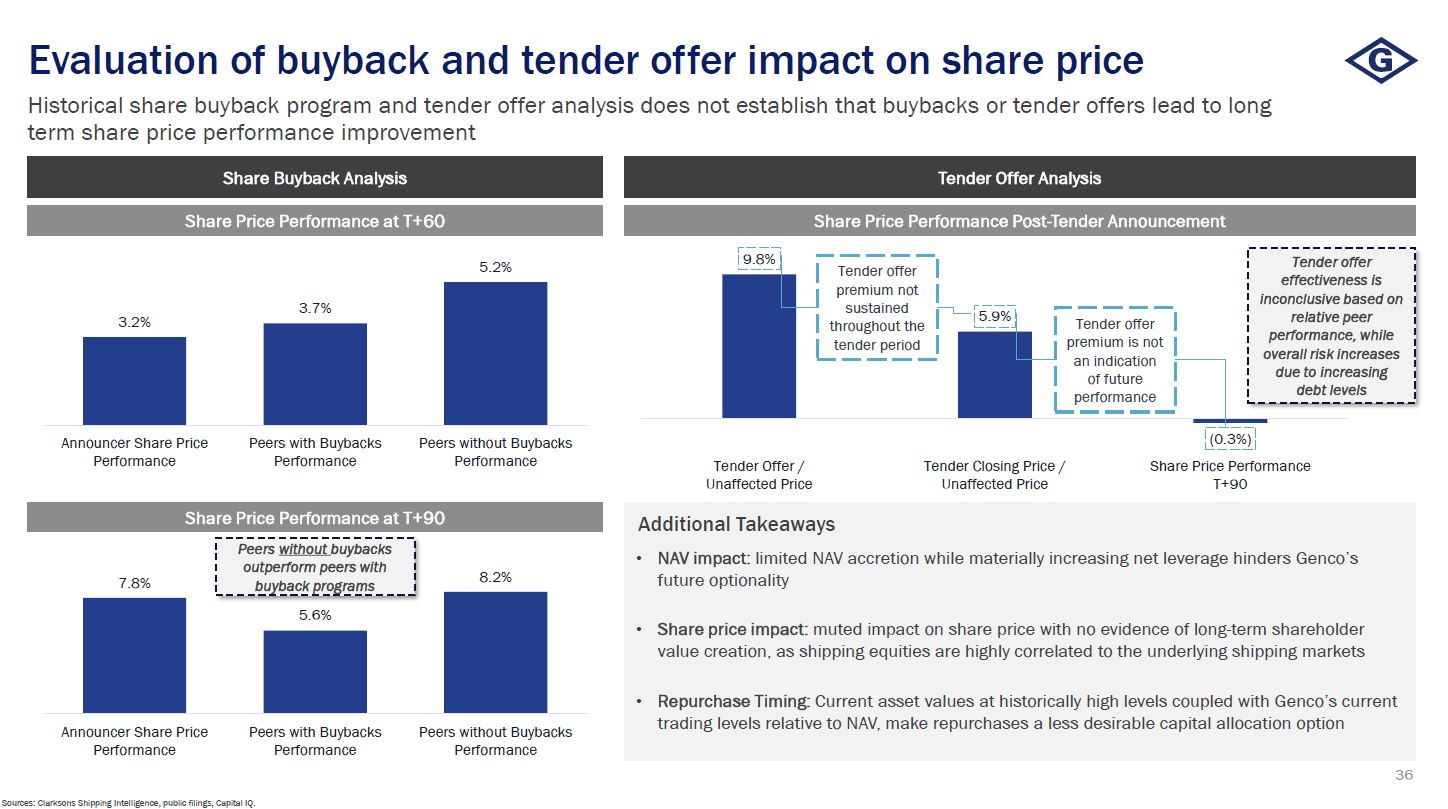

Genco evaluated Economou’s suggestions and concluded they are not in the best interest of shareholders 35 The Board and management team with an external financial advisor reviewed Economou’s suggestions to repurchase shares, sell vessels and pursue a $100 million tender offer at a significant premium The comprehensive review included an analysis of 52 buyback programs among the U.S-listed peers and 133 buyback executions separately over the last eight years Share price of shipping peers without buyback programs outperformed the announcer of a buyback program at T+60 and T+90 from announcement Overall, buyback programs do not appear to have a conclusive or material impact on future share price performance, as shipping equities are strongly correlated to the underlying shipping market data drivers The review also included an analysis of 17 tender offer transactions since 2017 which indicate a median tender offer to an unaffected price premium of ~9.8% The proposed tender is at a ~12% premium to Genco’s share price at the time of the proposal, ~1.2x the premium offered in other shipping tender offer precedents The Board concluded that pursuing a share repurchase or a tender offer is not in best interest of shareholders. The analysis showed that purchasing new vessels for fleet optimization can create more long-term value for shareholders than a self-tender offer Day Rate Performance at T+30 Price Performance at T+30 66% of observations Share Price vs. Day Rate Performance at T+30 from Buyback Announcement

Evaluation of buyback and tender offer impact on share price Historical share buyback program and tender offer analysis does not establish that buybacks or tender offers lead to long term share price performance improvement Share Price Performance Post-Tender Announcement Tender offer premium not sustained throughout the tender period Tender offer premium is not an indication of future performance Sources: Clarksons Shipping Intelligence, public filings, Capital IQ. Tender Offer Analysis Share Buyback Analysis Share Price Performance at T+60 Share Price Performance at T+90 NAV impact: limited NAV accretion while materially increasing net leverage hinders Genco’s future optionality Share price impact: muted impact on share price with no evidence of long-term shareholder value creation, as shipping equities are highly correlated to the underlying shipping markets Repurchase Timing: Current asset values at historically high levels coupled with Genco’s current trading levels relative to NAV, make repurchases a less desirable capital allocation option Additional Takeaways Tender offer effectiveness is inconclusive based on relative peer performance, while overall risk increases due to increasing debt levels Peers without buybacks outperform peers with buyback programs 36

We believe Economou’s proposal can materially hinder Genco’s value proposition 37 Units Genco Status Quo Genco Post Economou’s $100m Tender Offer at $23/share Genco Post $100m Share Buyback Program at $21/share Significantly increases Genco’s net debt Net Debt(1) $m $87 $187 $187 Net Loan-to-Value(1) % 8% 17% 17% Reduces Genco’s market capitalization and trading float Market Capitalization(2) $m $941 $848 $839 Trading float change % - (10%) (11%) Reduces available liquidity for opportunistic fleet growth Undrawn Revolver(3) $m $300 $200 $200 Incremental cash flow breakeven Cash breakeven(4) $/day $- $500 $500 Sources: FactSet, VesselsValue. Net LTV is based on VesselsValue.com estimates from April 2024 and cash and debt balances as of Dec 31, 2023. Market capitalization based on 44.1m shares in Status Quo. Tender scenario assumes retirement of ~4.4m shares based on $100m tender at $23.00/share. Buyback scenario assumes retirement of ~4.4m shares based on $100m of share buybacks at $21.00/share. Available liquidity based on $200m debt outstanding and total revolver capacity of $500m. Represents increase in cash breakeven per day resulting from additional debt compared to status quo.

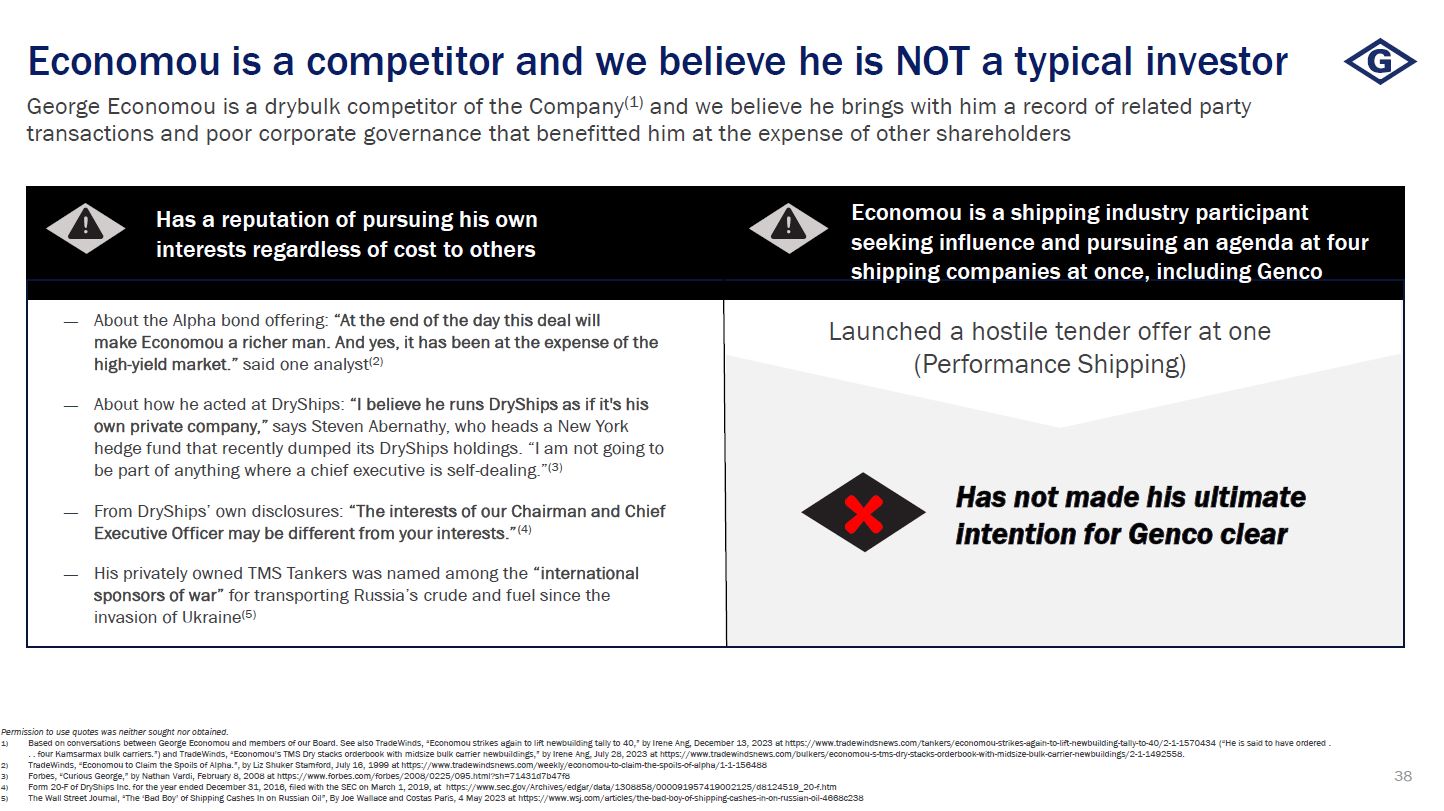

Economou is a competitor and we believe he is NOT a typical investor 38 George Economou is a drybulk competitor of the Company(1) and we believe he brings with him a record of related party transactions and poor corporate governance that benefitted him at the expense of other shareholders About the Alpha bond offering: “At the end of the day this deal will make Economou a richer man. And yes, it has been at the expense of the high-yield market.” said one analyst(2) About how he acted at DryShips: “I believe he runs DryShips as if it’s his own private company,” says Steven Abernathy, who heads a New York hedge fund that recently dumped its DryShips holdings. “I am not going to be part of anything where a chief executive is self-dealing.”(3) From DryShips’ own disclosures: “The interests of our Chairman and Chief Executive Officer may be different from your interests.”(4) His privately owned TMS Tankers was named among the “international sponsors of war” for transporting Russia’s crude and fuel since the invasion of Ukraine(5) Has not made his ultimate intention for Genco clear Launched a hostile tender offer at one (Performance Shipping) Has a reputation of pursuing his own interests regardless of cost to others Economou is a shipping industry participant seeking influence and pursuing an agenda at four shipping companies at once, including Genco Permission to use quotes was neither sought nor obtained. Based on conversations between George Economou and members of our Board. See also TradeWinds, “Economou strikes again to lift newbuilding tally to 40,” by Irene Ang, December 13, 2023 at https://www.tradewindsnews.com/tankers/economou-strikes-again-to-lift-newbuilding-tally-to-40/2-1-1570434 (“He is said to have ordered . . . four Kamsarmax bulk carriers.”) and TradeWinds, “Economou’s TMS Dry stacks orderbook with midsize bulk carrier newbuildings,” by Irene Ang, July 28, 2023 at https://www.tradewindsnews.com/bulkers/economou-s-tms-dry-stacks-orderbook-with-midsize-bulk-carrier-newbuildings/2-1-1492558. TradeWinds, “Economou to Claim the Spoils of Alpha.”, by Liz Shuker Stamford, July 16, 1999 at https://www.tradewindsnews.com/weekly/economou-to-claim-the-spoils-of-alpha/1-1-156488 Forbes, “Curious George,” by Nathan Vardi, February 8, 2008 at https://www.forbes.com/forbes/2008/0225/095.html?sh=71431d7b47f8 Form 20-F of DryShips Inc. for the year ended December 31, 2016, filed with the SEC on March 1, 2019, at https://www.sec.gov/Archives/edgar/data/1308858/000091957419002125/d8124519_20-f.htm The Wall Street Journal, “The ‘Bad Boy’ of Shipping Cashes In on Russian Oil”, By Joe Wallace and Costas Paris, 4 May 2023 at https://www.wsj.com/articles/the-bad-boy-of-shipping-cashes-in-on-russian-oil-4668c238

ALPHA SHIPPING PLC We believe Economou’s track record shows related party transactions, sharp declines in investor value, and a disregard of good governance 39 VALUE OF A $100 INVESTMENT IN ALPHA SHIPPING Decrease of 63% in <1 year Lost Bondholder Value A month after Economou established Alpha Shipping in 1998, as the holding company for DryTank, Economou’s first shipping company, Alpha Shipping issued $175 million of bonds.(1) Within months, the bonds were downgraded, and the company defaulted on an $8.4 million interest payment. In a restructuring a year later, bondholders would receive equity in a new company in exchange for their bonds, and Economou obtained the exclusive right to buy back Alpha Shipping’s 26-ship fleet for $64.75 million (37% of the principal amount of the bonds) which would be returned to the new company’s investors. Industry sources said Economou could sell the fleet at a profit.(2) Lloyd’s List, “Collision of Interests,” December 15, 2008 at https://lloydslist.com/LL086367/Collision-of-interests Forbes, “Curious George,” by Nathan Vardi, February 8, 2008 at https://www.forbes.com/forbes/2008/0225/095.html?sh=65d571147f86, and Lloyd’s List, “Collision of Interests,” 15 December 2008 at https://lloydslist.com/LL086367/Collision-of-interests, and TradeWinds, “Economou to Claim the Spoils of Alpha” by Liz Shuker Stamford, 16 July 1999 at https://www.tradewindsnews.com/weekly/economou-to-claim-the-spoils-of-alpha/1-1-156488.

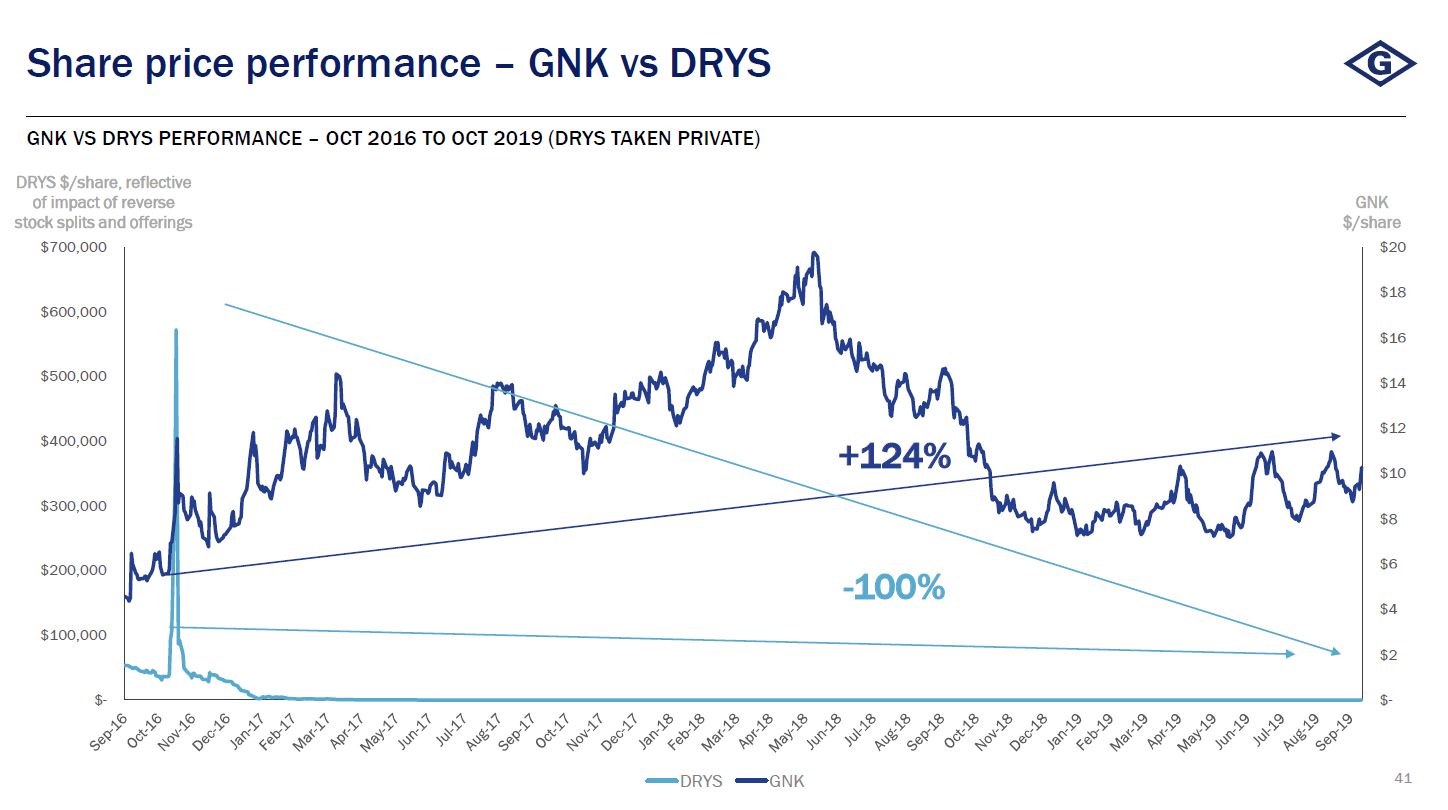

DRYSHIPS INC. IPO in 2005, taken private by Economou in 2019 We believe Economou’s track record shows related party transactions, sharp declines in investor value, and a disregard of good governance (cont’d) 40 Economou took his ownership stake in DryShips from 0.01% in March 2017 to 83% of the stock less than two years later through large-scale, highly dilutive equity offerings and related party transactions that resulted in a complete washout of shareholder value and gave control of DryShips to Economou without other shareholders receiving any control premium. (1) Taking Control of DryShips Without Paying a Premium Related Party Transactions Taking DryShips Private at a Discount In 2019, Economou took DryShips private at a share price that was approximately 21% below net asset value calculated by DryShips’ financial advisor.(9) While Economou was its CEO, DryShips purchased nine Capesize vessels from Economou-affiliated private entities and third party sellers for $1.17 billion, near all-time high asset value levels in October 2008.(2) This occurred after the onset of the global financial crisis of 2007-2008 and an approximately 60% decline in Capesize freight rates in September 2008.(3) Subsequently, the transaction was canceled for consideration of DryShips’ warrants issued to the Economou-affiliated entities and DryShips’ shares issued to the third party sellers, diluting shareholders.(4) In 2015, DryShips initiated a spin-off of Tankships Investment Holdings into a separate company. According to the prospectus, Tankships would pay fees to two other Economou entities.(5) DryShips ultimately abandoned that plan, instead selling ships directly to Economou himself.(6) DryShips also entered into management agreements with Economou-controlled entities, Cardiff Marine and later TMS Bulkers(7) that included substantial fees, payments for monitoring controls, financing and advisory commissions, and discretionary performance payments. DryShips’ financial advisor noted that “costs in the agreements are higher than other drybulk public companies with a potential NPV impact of $0.58 to $0.88 per share.” The termination fee alone represented a reduction of approximately 9% in the net asset value of the company as calculated by its financial advisor at the time.(8) Form 20-F of DryShips Inc. for the year ended December 31, 2016, p. 128, filed with the SEC on March 13, 2027 at https://www.sec.gov/Archives/edgar/data/1308858/000091957417002663/d7424585_20-f.htm, (reporting Economou’s 0.01% beneficial ownership of DryShips); Schedule 13D of SPII Holdings Inc., Sierra Investments Inc., Mountain Investments Inc., and George Economou filed with the SEC on September 5, 2017 at https://www.sec.gov/Archives/edgar/data/1308858/000091957417006592/d7628587_13-d.htm (reporting Economou’s 53.5% beneficial ownership of Dryships after a private placement; Amendment No. 1 to Schedule 13D of SPII Holdings Inc., Sierra Investments Inc., Mountain Investments Inc., and George Economou filed with the SEC on October 6, 2017 at https://www.sec.gov/Archives/edgar/data/1308858/000091957417007140/d7674066_13d-a.htm (reporting Economou’s 69.5% ownership following a rights offering). Form 6-K filed by DryShips, Inc. on October 6, 2008 at https://www.sec.gov/Archives/edgar/data/1308858/000131786108000342/f100608adrys6k.htm. Based on data from Clarksons Research Services Limited. Form 20-F of Dryships Inc. for the year ended December 31, 2008, p. 47, at https://www.sec.gov/Archives/edgar/data/1308858/000119312509066364/d20f.htm. Form F-1 Registration Statement of Tankships Investment Holdings Inc., p. 37, at https://www.sec.gov/Archives/edgar/data/1627482/000119312515016272/d836806df1.htm. TradeWinds, “George Economou in league of his own,” by Gillian Whittaker Athens, November 5, 2015 at https://www.tradewindsnews.com/weekly/george-economou-in-league-of-his-own/1-1-376048 , and TradeWinds, “Economou buys from DryShips,” by Eric Martin, 30 March 2015 at https://www.tradewindsnews.com/tankers/economou-buys-from-dryships/1-1-357081 and “Dryships Announces Agreements to Sell Its Tanker Fleet,” issued by DryShips, Inc. on March 30, 2015 at https://www.globenewswire.com/news-release/2015/03/30/1257863/0/en/DryShips-Inc-Announces-Agreements-to-Sell-Its-Tanker-Fleet.html. https://www.sec.gov/Archives/edgar/data/1308858/000091957416014489/R10.htm Form 20-F of DryShips, Inc. for the year ended December 31, 2012, filed with the SEC on March 22, 2013 at https://www.sec.gov/Archives/edgar/data/1308858/000091957413002527/d1368326_20-f.htm. Presentation materials prepared by Evercore Group L.L.C., dated August 18, 2019, for the Special Committee of the Board of Directors of DryShips Inc., pp. 7 and 35, at https://www.sec.gov/Archives/edgar/data/1308858/000114420419043847/tv528973_exc6.htm. Presentation materials prepared by Evercore Group L.L.C., dated August 18, 2019, for the Special Committee of the Board of Directors of DryShips Inc. p. 35 at https://www.sec.gov/Archives/edgar/data/1308858/000114420419043847/tv528973_exc6.htm.

Share price performance – GNK vs DRYS 41 +124% -100% DRYS $/share, reflective of impact of reverse stock splits and offerings GNK $/share GNK VS DRYS PERFORMANCE – OCT 2016 TO OCT 2019 (DRYS TAKEN PRIVATE)

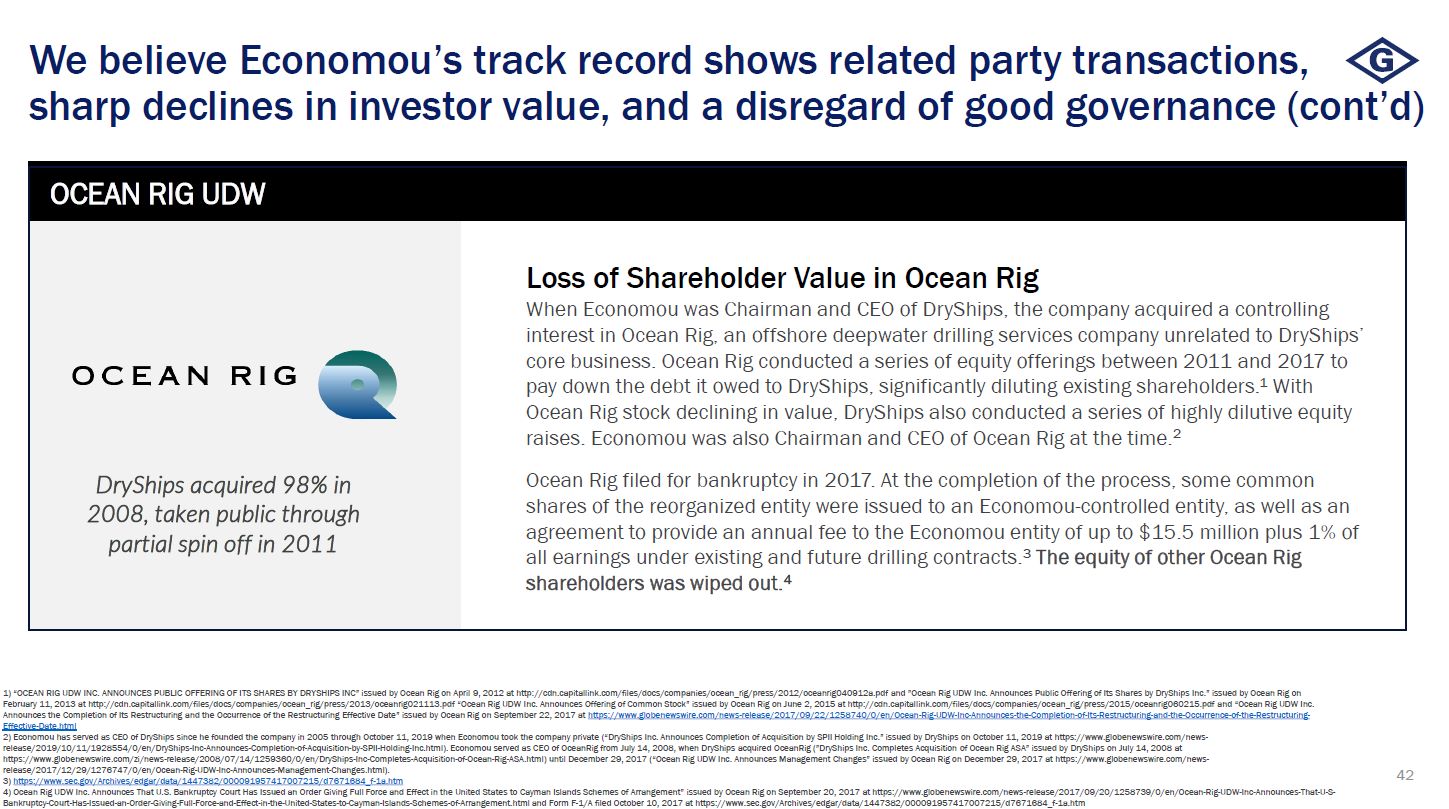

OCEAN RIG UDW DryShips acquired 98% in 2008, taken public through partial spin off in 2011 Loss of Shareholder Value in Ocean Rig When Economou was Chairman and CEO of DryShips, the company acquired a controlling interest in Ocean Rig, an offshore deepwater drilling services company unrelated to DryShips’ core business. Ocean Rig conducted a series of equity offerings between 2011 and 2017 to pay down the debt it owed to DryShips, significantly diluting existing shareholders.1 With Ocean Rig stock declining in value, DryShips also conducted a series of highly dilutive equity raises. Economou was also Chairman and CEO of Ocean Rig at the time.2 Ocean Rig filed for bankruptcy in 2017. At the completion of the process, some common shares of the reorganized entity were issued to an Economou-controlled entity, as well as an agreement to provide an annual fee to the Economou entity of up to $15.5 million plus 1% of all earnings under existing and future drilling contracts.3 The equity of other Ocean Rig shareholders was wiped out.4 We believe Economou’s track record shows related party transactions, sharp declines in investor value, and a disregard of good governance (cont’d) 42 1) “OCEAN RIG UDW INC. ANNOUNCES PUBLIC OFFERING OF ITS SHARES BY DRYSHIPS INC” issued by Ocean Rig on April 9, 2012 at http://cdn.capitallink.com/files/docs/companies/ocean_rig/press/2012/oceanrig040912a.pdf and ”Ocean Rig UDW Inc. Announces Public Offering of Its Shares by DryShips Inc.” issued by Ocean Rig on February 11, 2013 at http://cdn.capitallink.com/files/docs/companies/ocean_rig/press/2013/oceanrig021113.pdf “Ocean Rig UDW Inc. Announces Offering of Common Stock” issued by Ocean Rig on June 2, 2015 at http://cdn.capitallink.com/files/docs/companies/ocean_rig/press/2015/oceanrig060215.pdf and “Ocean Rig UDW Inc. Announces the Completion of Its Restructuring and the Occurrence of the Restructuring Effective Date” issued by Ocean Rig on September 22, 2017 at https://www.globenewswire.com/news-release/2017/09/22/1258740/0/en/Ocean-Rig-UDW-Inc-Announces-the-Completion-of-Its-Restructuring-and-the-Occurrence-of-the-Restructuring-Effective-Date.html 2) Economou has served as CEO of DryShips since he founded the company in 2005 through October 11, 2019 when Economou took the company private (“DryShips Inc. Announces Completion of Acquisition by SPII Holding Inc.” issued by DryShips on October 11, 2019 at https://www.globenewswire.com/news-release/2019/10/11/1928554/0/en/DryShips-Inc-Announces-Completion-of-Acquisition-by-SPII-Holding-Inc.html). Economou served as CEO of OceanRig from July 14, 2008, when DryShips acquired OceanRig (”DryShips Inc. Completes Acquisition of Ocean Rig ASA” issued by DryShips on July 14, 2008 at https://www.globenewswire.com/zi/news-release/2008/07/14/1259360/0/en/DryShips-Inc-Completes-Acquisition-of-Ocean-Rig-ASA.html) until December 29, 2017 (“Ocean Rig UDW Inc. Announces Management Changes” issued by Ocean Rig on December 29, 2017 at https://www.globenewswire.com/news-release/2017/12/29/1276747/0/en/Ocean-Rig-UDW-Inc-Announces-Management-Changes.html). 3) https://www.sec.gov/Archives/edgar/data/1447382/000091957417007215/d7671684_f-1a.htm 4) Ocean Rig UDW Inc. Announces That U.S. Bankruptcy Court Has Issued an Order Giving Full Force and Effect in the United States to Cayman Islands Schemes of Arrangement” issued by Ocean Rig on September 20, 2017 at https://www.globenewswire.com/news-release/2017/09/20/1258739/0/en/Ocean-Rig-UDW-Inc-Announces-That-U-S-Bankruptcy-Court-Has-Issued-an-Order-Giving-Full-Force-and-Effect-in-the-United-States-to-Cayman-Islands-Schemes-of-Arrangement.html and Form F-1/A filed October 10, 2017 at https://www.sec.gov/Archives/edgar/data/1447382/000091957417007215/d7671684_f-1a.htm

Example of related party transaction at the expense of shareholders 43 Siphoning millions of dollars from the public vehicle of DryShips to Economou controlled private entities through the following related party arrangements Key Terms from DryShips Management Agreement with TMS Bulkers and TMS Offshore Services, Economou’s private entities, dated as of December 9, 2016(1) Key Terms Management Fees Base fee: $1m per month For up to 20 vessels or $1,643 per day, decreasing to $1,500 per day thereafter Financial advisor to the special committee noted that costs in the agreements are higher than other drybulk public companies during the take private transaction Commissions on charter hire 1.25% Sale & Purchase Fee 1% of the purchase price, incremental to standard broker commissions Financial & advisory commission 0.5% 2016 performance fee $6m One-time set up fee for executing the agreement $2m Discretionary performance fee Up to $20m in cash or stock Termination fee $50m At the time of the take private transaction, the advisor to the special committee estimated that terminating the agreement would create a cost of $0.58/share, or a ~9% impact to NAV(2) Termination payment on change of control Payment is not less than the fees for a period of 36 months and not more than a period of 48 months Duration 10 years 1) Form 20-F of DryShips, Inc. for the year ended December 31, 2012, filed with the SEC on March 22, 2013 at https://www.sec.gov/Archives/edgar/data/1308858/000091957413002527/d1368326_20-f.htm 2) Presentation materials prepared by Evercore Group L.L.C., dated August 18, 2019, for the Special Committee of the Board of Directors of DryShips Inc., pp. 7 and 35, at https://www.sec.gov/Archives/edgar/data/1308858/000114420419043847/tv528973_exc6.htm

The Board Believes Pons Would Not Be Additive to Our Already Strong, Focused And Experienced Board 44

Board concluded Pons is not additive to Genco Board 45 See facts on the following slides that support the view of Genco’s Board We believe Pons has shown poor judgment in his associations We believe Pons’ history on boards is one of related party transactions and missteps Companies underperformed during Pons’ tenure We believe Pons does not have experience in industries relevant to Genco’s business

We believe Pons is not additive to Genco’s board 46 Pons has mainly served on the boards of micro or nano-cap companies in the technology sector Most companies whose boards Pons has served on declined in value or underperformed the S&P 500 during his tenure Pons has no experience at companies in: Shipping Commodities Cyclical businesses Any industries relevant to Genco’s business The Genco Board unanimously concluded that Pons would not be additive to our already strong, focused and experienced Board

We believe Pons has demonstrated poor judgement in his associations 47 GARY SINGER Charged with racketeering, conspiracy, money laundering, and fraud related to insider trading in junk bonds in 1992(1) Convicted on 21 felony counts; sentenced to 28 months in prison(2) Permanently banned by the SEC from acting as an officer or director of a public company(3) Gary Singer’s wife and son have since represented the Singer family in their investments MURCHINSON AND BISTRICER The SEC brought charges against Murchinson and Bistricer in 2021 over violations of short sale regulations(4) Settled agreeing to disgorge $7m and pay $875K in civil penalties Bistricer is currently a defendant in a pending Ontario Securities Commission (“OSC”) proceeding involving what the OSC has alleged to be an “illegal and abusive short selling scheme,” where the OSC asked the court to: (5) Have Bistricer immediately resign from any director or officer positions Prohibit him from any future such appointments Permanently ban him from acting as investment fund manager Terminate his Ontario securities law registration Cease his trading in any securities or derivatives Permanently ban him from acquiring any securities In his interview with Genco’s Nom. & Gov. committee, Pons stated that “George’s partner” Bistricer had introduced him to Economou Part of a dissident slate put forth by Murchinson in an unsuccessful proxy fight in 2023 Most of the Boards that Pons served on were at companies in which the family of Gary Singer invested, and he served as the Singers’ designee on multiple occasions See Reference A on slide 71 for list of sources.

We believe Pons’ history on boards is one of related party transactions and missteps 48 Related Party transactions (Arbinet Corporation, Concurrent Computer(1)) Transactions benefiting Singers while serving as their board designee or otherwise when they held substantial stock Companies delisted or sold substantial assets (SmartServ Online, LiveWire Mobile, Primus Telecommunications Group, Concurrent Computer(1)) Failed to consummate agreed business combinations (SeaChange International) Auditor refused to stand for re-election (CCUR Holdings) Significant reverse stock splits (Concurrent Computer(1), LiveWire Mobile, Arbinet Corporation) Investment in a Ponzi scheme which resulted in significant loss (Concurrent Computer(1)) Promptly implemented the Singer agenda to declare a substantial special dividend upon joining the Board (MRV Communications) See further details for each company on page 66 – 68. 1) Concurrent Computer was renamed to CCUR in 2018.

Companies where Pons served as a director underperformed or declined in value during his tenure Source: FactSet. Note: Certain companies on whose Boards Pons was a director were renamed or otherwise are successors to other companies. These consists of Primus Telecommunications Group, Inc., PTGI Holdings Inc., and HC2 Holdings, Inc.; Concurrent Computer Corp. and CCUR Holdings, Inc.; Novatel Wireless, Inc. and Inseego Corp. 49

SETTING THE RECORDSTRAIGHT 50

Do NOT let Economou’s claims mislead you 51 Jim Dolphin has little alignment with shareholders Genco has instituted stock ownership guidelines to align all director interests with shareholders Mr. Dolphin holds restricted stock units worth more than $2 million Genco is undervalued Our good faith efforts have been ignored Genco’s Board thoroughly reviewed every proposal put forth from Economou, from the buy-back to the flip-flop to a tender offer at a premium with its advisors Capital allocation has been a top focus of the Board for years and has been a subject of regular review Genco’s trading in line with its closest U.S.-listed shipping peers based on P / NAV Genco’s TSR outperforms peers on a 1, 3, and 5-year basis ECONOMOU’S CLAIMS GENCO’S ACTIONS

Do NOT let Economou’s claims mislead you (cont’d) 52 A new independent voice is imperative, and Pons would be additive The Board already appointed a new independent voice with its addition of Paramita Das in March 2024 Ms. Das brings deep commodities industry experience and a new perspective to the Board The Board has failed to articulate a credible alternative use for excess cash Genco has consistently articulated its value strategy since its implementation in 2021 Genco has been successfully executing its strategy to sustain dividends, repay debt, and invest in vessels as per our long-term value strategy While Economou baselessly references the Company’s “excess cash” in his materials, our Board prudently manages our cash position with the goal of paying sustainable dividends. Implementing Economou’s suggestions would require increasing our debt or selling assets ECONOMOU’S CLAIMS GENCO’S ACTIONS

Do NOT let Economou’s claims mislead you (cont’d) 53 Ms. Das’ appointment follows a comprehensive search process with the assistance of a leading executive search firm that began mid-last year, well before Economou’s involvement No member of the board had ever known of Ms. Das before her name surfaced The appointment of Ms. Das was only taken in reaction to our public involvement ECONOMOU’S CLAIMS GENCO’S ACTIONS A subsidiary of Ms. Das’ most recent employer, Rio Tinto, was listed as Genco’s top customer for vessel charters, accounting for 16.1% of voyage revenues in 2023 Ms. Das does not work for the key customer anymore, though her experience with the customer and the commodities industry add value for our board Ms. Das has a deep understanding of our customer base and is exactly what we were looking for in a board candidate

Vote FOR Genco 55 Genco Is Executing its Clear Strategy Designed to Drive Value Through Volatile Drybulk Cycles Genco Has Made Significant Progress on its Comprehensive Value Strategy, Outperforming the Market and Peers Genco Has a Highly Qualified and Engaged Board Overseeing Sustainable, Long-Term Value Creation Genco Has Industry-Leading Corporate Governance Standards George Economou’s Unclear Agenda for Genco & His Track Record The Board Has Concluded that Economou’s Suggestions Are NOT in the Best Interest of All Shareholders The Board Believes Pons is NOT Additive to Genco’s Board Vote FOR Genco’s Board of Directors Nominees Genco is poised to drive sustainable long-term value Vote FOR Genco’s Board of Directors Nominees

Source: Clarksons Research Services Limited 2024 Iron Ore Coal Grain Minor Bulks U.S. Headquarters Corporate strategy Finance/accounting Commercial Technical Operations Copenhagen Commercial Operations Minor Bulk focus Singapore Commercial Operations Capesize focus Global drybulk trade and key routes 57 ~90% of global trade is carried by the international shipping industry – Genco’s global footprint maximizes revenue generation by capturing market trends in real-time

Thoughtful asset acquisition is critical to long-term sustainability 58 Capital intensive industry with a need for fleet renewal requires prudent stewardship Capesize Bulkers Ultramax Bulkers Asset Values Day Rates (Spot / 1YR Timecharter) Asset Values Day Rates (Spot / 1YR Timecharter) Last 10 Yrs Spot 1YR TC Average 16,139 16,085 Median 14,065 14,888 Min 2,166 5,400 Max 64,669 30,900 Last 10 Yrs Spot 1YR TC Average 12,418 12,217 Median 10,270 10,975 Min 2,800 4,875 Max 38,018 29,000 Last 10 Yrs 5Yr 10Yr Average 38.4 25.4 Median 35.8 24.3 Min 23.0 12.0 Max 63.5 45.0 Last 10 Yrs 5Yr 10Yr Average 22.0 15.0 Median 20.8 13.8 Min 12.0 6.0 Max 35.0 27.5 Source: Clarksons Research Services Limited.

Low financial leverage through voluntary debt repayments 59 Paid down>$300m to Q3 2023 New $500m revolving credit facility increases flexibility to: Continue to voluntarily repay debt Opportunistically drawing down capital w/o losing borrowing capacity Draw for 2 xCapesize acquisitions

Evaluation of buyback program impact on share price 60 Share price performance of shipping equities is strongly correlated to underlying shipping markets with no definitive evidence that buyback programs are an effective tool for long-term shareholder value creation Impact on Share Price Over the last seven years, there have been 52 buyback program announcements among the U.S.-listed peers Approximately 53% were initiated in the last two years during a cyclically-robust day rate environment, where companies commenced a re-evaluation of capital allocation policies due to excess cash flow generation Overall, buyback programs do not appear to have a conclusive or material impact on future share price performance, as shipping equities are strongly correlated to the underlying shipping market data drivers (e.g. rates) Buyback observations produced a muted impact in share price (3.9% at T+30) as day rates appear to be the underlying driver of performance – in 133 observations over seven years, 66% of future share price development followed the direction of underlying asset day rate movement, with a number of outliers in either direction Day Rate Performance at T+30 Price Performance at T+30 66% of observations Share Price vs. Day Rate Performance at T+30 from Buyback Announcement Sources: Clarksons Shipping Intelligence, public filings, Capital IQ. Our Board and management team, together with its financial advisors, thoroughly reviewed Economou’s informal request of a share repurchase. Analysis included comprehensive review of last eight years of buybacks in shipping industry Included 52 buyback programs and 133 buyback executions separately Analysis Overview

Dry bulk asset values are currently in the 4th quartile 61 Given the narrow P/NAV discount, share repurchases would imply acquiring Genco’s ships are at a historically high price Index Drybulk values are currently in the 4th quartile, making share repurchases and fleet acquisitions less desirable Secondhand Drybulk Index Sources: Clarksons Shipping Intelligence Limited.

Net Asset Value accretion / dilution 62 George Economou’s $100m tender offer proposal at $23.00 per share would only add 0.3% in NAV accretion while doubling net debt Genco’s NAV Build Balance Sheet As of 12/31/23 Genco Impact of Repurchases (at $23/share) Genco Pro Forma Assets Cash $46.9 $46.5 Fleet Value 1,106.7 1,106.7 Agreed Asset Sales 65.4 65.4 Net Working Capital 22.3 22.3 Liabilities Debt Outstanding (200.0) (100.0) (300.0) Net Asset Value $1,041.6 ($100.0) $941.6 Shares Outstanding 44.1 (4.3) 39.8 NAV / Share $23.62 $23.69 % Change in NAV 0.3% Loan-to-Value 18% 27% Net Loan-to-Value 8% 17% Sources: Genco management, Clarksons Shipping Intelligence, public filings, VesselsValues. Illustrative sensitivity analysis of share repurchases at various levels, including $23/share as suggested by George Economou Overall, for share repurchases to have meaningful accretion they need to be in large scale and thus lead to increased leverage levels Asset value volatility can have a significant impact on leverage levers, while simultaneously increased cash breakeven levels from incremental debt interest and amortization Proposed tender offer price by Economou

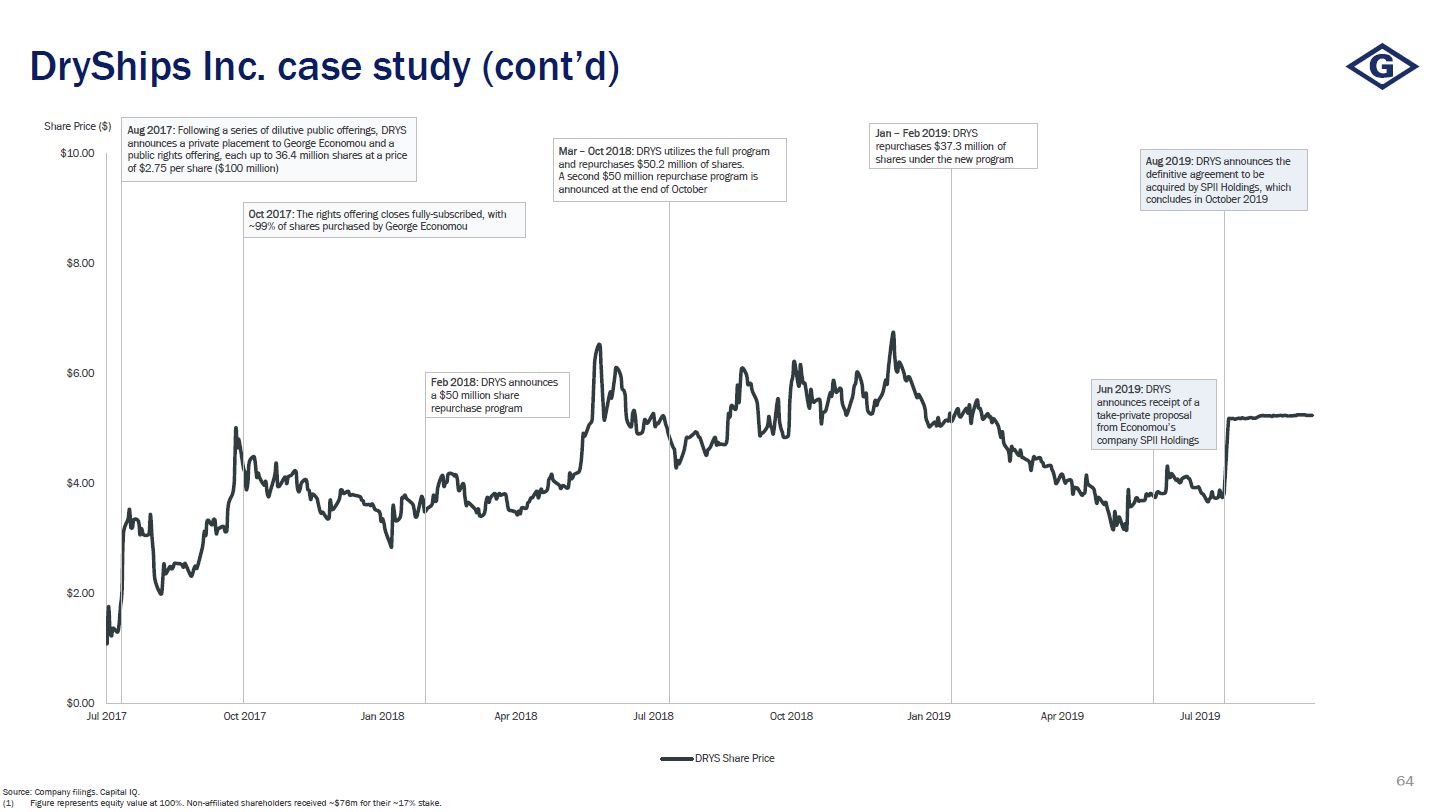

Share Price ($) Source: Company filings. Capital IQ. Figure represents equity value at 100%. Non-affiliated shareholders received ~$76m for their ~17% stake. DRYS share count and George Economou’s ownership evolution since August 2017 Date Event Event Description $ Amount Issued / Repurchased Share Price Shares Issued / (Repurchased) Total Shares Outstanding Economou Ownership SB # Shares % Total Pre-Aug ’17 Pre-private Placement Raised over $600m in a series of dilutive equity offerings between 2016 and mid-2017, while it completed 8 reverse splits during the same period na na 31.5 - 0.0% Aug 4, ’17 Private Placement DRYS announces an in-kind private placement to George Economou $100m $2.75 36.4 67.9 36.4 53.5% Oct 4, ’17 Rights Offering Public rights offering, at a price of $2.75 per share ($100 million), with 99% of shares purchased by George Economou $100m $2.75 36.4 104.3 72.4 69.5% Feb 7, ’18 Buyback Program 1 DRYS utilizes the full $50m program and repurchases $50.2 million of shares $50.2m $4.65 (10.8) 93.5 72.4 77.4% Oct 29, ’18 Buyback Program 2 DRYS authorized a second $50m repurchase program of which $37.3 million was utilized $37.3m $5.72 (6.5) 87.0 72.4 83.2% Aug 19, ’19 Take-Private Take private by George Economou $456.7m(1) $5.25 na 87.0 87.0 100% Share Price ($) Raised over $600m from 2016 to mid-2017, with share price declining ~99.9% Summary DryShips raised over ~$600m in a series of dilutive equity offerings between 2016 and mid-2017, with the share price declining 99.9% During the period, the company executed eight reverse splits, with the final split completed in July 2017 after the last equity raise Therefore, in August and October 2017, DryShips raised $200m in two separate transactions from George Economou (in-kind private placement and backstopped rights offering), resulting in an ownership stake of ~70% During the period of February 2018 – February 2019, DryShips completed ~$88m in stock repurchases at a weighted average price of $5.05 per share, while Economou’s stake increased to ~83% (due to the share count reduction) In October 2019, DryShips was taken private by Economou at a price of $5.25 per share for the remaining stake not yet accumulated, representing a 21% discount to NAV DryShips Inc. case study 63

DryShips Inc. case study (cont’d) 64 Share Price ($) Source: Company filings. Capital IQ. Figure represents equity value at 100%. Non-affiliated shareholders received ~$76m for their ~17% stake. Feb 2018: DRYS announces a $50 million share repurchase program Aug 2017: Following a series of dilutive public offerings, DRYS announces a private placement to George Economou and a public rights offering, each up to 36.4 million shares at a price of $2.75 per share ($100 million) Oct 2017: The rights offering closes fully-subscribed, with ~99% of shares purchased by George Economou Mar – Oct 2018: DRYS utilizes the full program and repurchases $50.2 million of shares. A second $50 million repurchase program is announced at the end of October Jun 2019: DRYS announces receipt of a take-private proposal from Economou’s company SPII Holdings Aug 2019: DRYS announces the definitive agreement to be acquired by SPII Holdings, which concludes in October 2019 Jan – Feb 2019: DRYS repurchases $37.3 million of shares under the new program

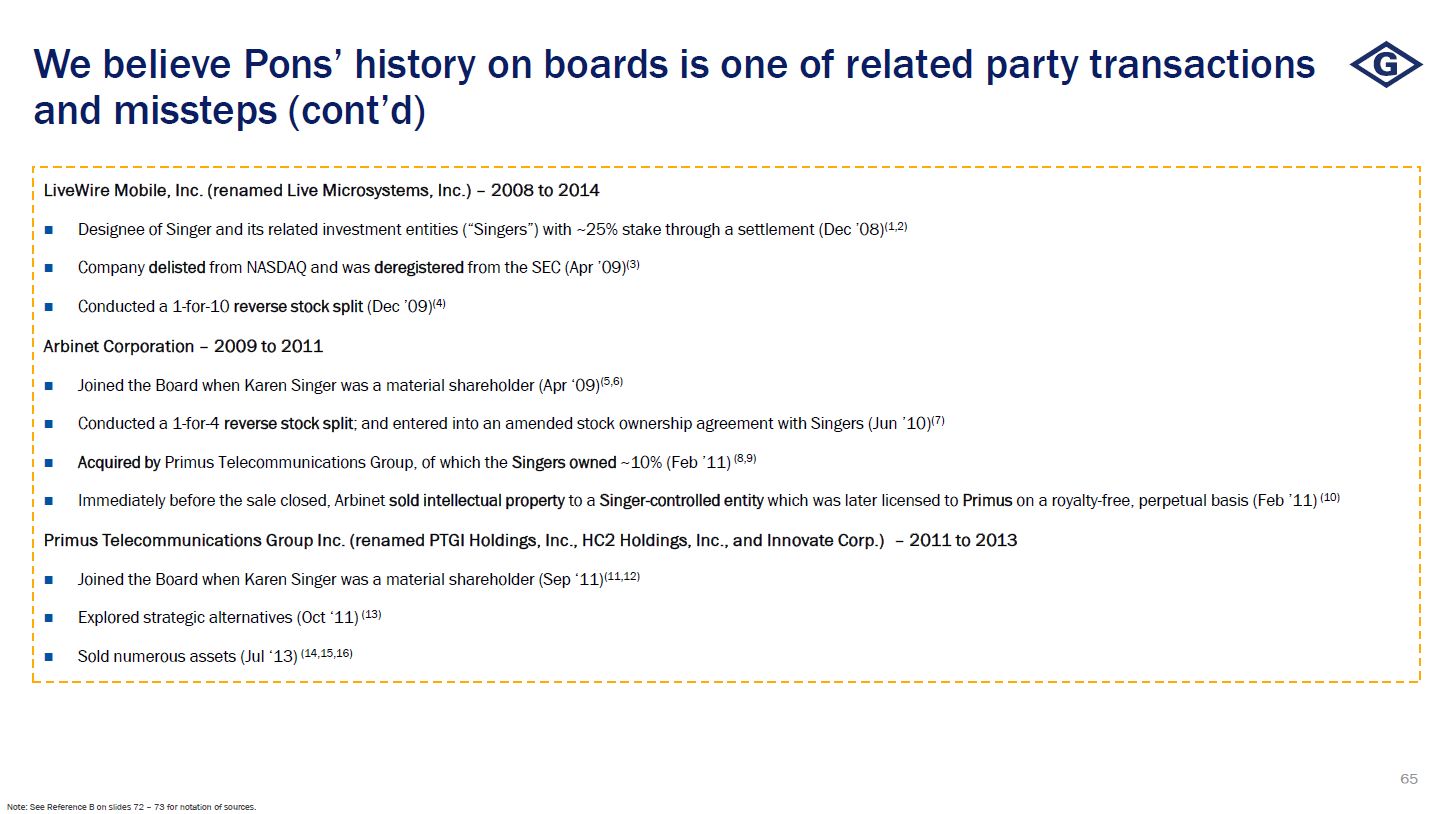

We believe Pons’ history on boards is one of related party transactions and missteps (cont’d) 65 LiveWire Mobile, Inc. (renamed Live Microsystems, Inc.) – 2008 to 2014 Designee of Singer and its related investment entities (“Singers”) with ~25% stake through a settlement (Dec ’08)(1,2) Company delisted from NASDAQ and was deregistered from the SEC (Apr ’09)(3) Conducted a 1-for-10 reverse stock split (Dec ’09)(4) Arbinet Corporation – 2009 to 2011 Joined the Board when Karen Singer was a material shareholder (Apr ‘09)(5,6) Conducted a 1-for-4 reverse stock split; and entered into an amended stock ownership agreement with Singers (Jun ’10)(7) Acquired by Primus Telecommunications Group, of which the Singers owned ~10% (Feb ’11) (8,9) Immediately before the sale closed, Arbinet sold intellectual property to a Singer-controlled entity which was later licensed to Primus on a royalty-free, perpetual basis (Feb ’11) (10) Primus Telecommunications Group Inc. (renamed PTGI Holdings, Inc., HC2 Holdings, Inc., and Innovate Corp.) – 2011 to 2013 Joined the Board when Karen Singer was a material shareholder (Sep ‘11)(11,12) Explored strategic alternatives (Oct ‘11) (13) Sold numerous assets (Jul ‘13) (14,15,16) Note: See Reference B on slides 72 – 73 for notation of sources.

We believe Pons’ history on boards is one of related party transactions and missteps (cont’d) 66 MRV Communications, Inc. – 2011 to 2017 Singers (5.3% stake) called for a payment of a special dividend up to $120mm (Jun ‘11)(17,18) Pons joined the Board upon the recommendation of the Singers (Oct ‘11)(19) MRV announced dividends of $75mm in Oct ’11, and $58mm through 2012(20,21) Concurrent Computer Corp. (renamed CCUR Holdings) – 2012 to 2018 and 2020-2021 Appointed as part of a settlement agreement between the Singers (12% stake) and the company (Jul ’12) )(22,23) Incurred significant loss in FY’16 due in part to an increased “income tax provision” noting it faced a potential loss of some or all of its deferred tax assets (24) Deloitte declined to stand for reappointment as the company’s auditor (Jan ’18) (25) Entered a letter of intent for a loan to SeaChange International, a related party, where Pons and Julian Singer were directors (Jul ’20) (26) Amended management agreement with Julian Singer (Jan ’21) (27) Invested in an aircraft financing Ponzi scheme connected to drug traffickers that led to a loss of $13.8mm (Jan ’21) (28) Conducted 1-for-3000 reverse stock split and delisted (Apr ’21) (29) Note: See Reference B on slides 72– 73 for notation of sources.

We believe Pons’ history on boards is one of related party transactions and missteps (cont’d) 67 SeaChange International, Inc. – 2019 – 2022 Joined under a cooperation agreement between a Singer family entity (20% stake) and the company (Feb ’19)(30) Then-CEO abruptly resigned protesting the unfair nature of the corporate agreement with Singers to other large shareholders, including Neuberger Berman (Feb ’19)(31) Co. added Julian Singer to the Board while Pons was the Chairman (Jul ’20)(32,33) Announced reverse merger with Triller Hold Co. (Dec ’21) (34) The deal was mutually terminated by Triller and SeaChange stock fell 31% on the news (Jun ’22) (35,36) Karen Singer called to remove Pons, claiming he “oversaw a massive reduction in revenue, … led to the destruction of shareholder value, all while compensating himself generously as both chairman and Interim CEO” (Jul ’22) (37,38) Note: See Reference B on slides 72 – 73 for notation of sources.

Pons has mostly served on the boards of nano-cap technology companies, representing the Singers in many of them 68 Source: FactSet, SEC. See Reference C on slide 74 for notation of sources. Note: Certain companies on whose Boards Pons was a director were renamed or otherwise are successors to other companies. These consist of Primus Telecommunications Group, Inc., PTGI Holdings Inc., and HC2 Holdings, Inc.; Concurrent Computer Corp. and CCUR Holdings, Inc.; Novatel Wireless, Inc. and Inseego Corp. Company NameDuring Pons Tenure Business Description Market Cap ($M) (When Joined) Date Joined Board Date Left Board Singers Invested in Entity SmartServ Online, Inc. Wireless device services $2.1 8/28/2003(1) 4/20/2007(2) No Network-1 Security Solutions, Inc. Telecommunications $3.3 1/26/2004(3) 12/20/2012(4) No LiveWire Mobile, Inc. Telecom. / Media services $3.3 12/10/2008(5) 7/24/2014(6) Yes MRV Communications, Inc. Ethernet equipment maker $204.7 10/17/2011(7) 8/14/2017(8) Yes Arbinet Corporation VoIP Services $38.7 4/13/2009(9) 2/28/2011(10) Yes Acquired by Primus Telecommunications Group, Inc. Primus Telecommunications Group, Inc. Communications services provider $165.7 9/16/2011(11) 10/15/2013(12) Yes Renamed to PTGI Holdings, Inc. Diversified holding company $48.9 10/16/2013(12) 4/9/2014(13) Yes Renamed to HC2 Holdings, Inc. Diversified holding company $54.5 4/10/2014(13) 6/14/2016(14) No

Pons has mostly served on the boards of nano-cap technology companies, representing the Singers in many of them (cont’d) 69 Source: FactSet, SEC. See Reference C on slide 74 for notation of sources. Note: Certain companies on whose Boards Pons was a director were renamed or otherwise are successors to other companies. These consist of Primus Telecommunications Group, Inc., PTGI Holdings Inc., and HC2 Holdings, Inc.; Concurrent Computer Corp. and CCUR Holdings, Inc.; Novatel Wireless, Inc. and Inseego Corp. Company NameDuring Pons Tenure Business Description Market Cap ($M) (When Joined) Date Joined Board Date Left Board Singers Invested in Entity Concurrent Computer Corp. Video and media data solutions provider $36.3 7/23/2012(15) 12/31/2017(16) Yes Renamed to CCUR Holdings, Inc. Lending and real estate development $29.3 6/17/2020(17) 6/1/2021(18) Yes Dragonwave Inc. Supplier of radio systems for mobile networks $69.0 12/10/2013(19) 4/14/2015(20) No Novatel Wireless, Inc. Electronic technology $148.1 10/7/2014(21) 11/8/2016(22) No Renamed to Inseego Corp. Electronic technology $136.5 11/9/2016(22) 9/30/2019(23) No Alaska Communications Systems Group, Inc. Broadband provider $81.3 5/9/2018(24) 5/29/2019(25) Yes SeaChange International, Inc. Software solutions for video and advertising $53.0 3/1/2019(26) 7/12/2022(27) Yes Marpai, Inc. Third-party administrator for employer health plans $16.4 12/7/2023(28) current No

Time charter equivalent reconciliation(1) 70 We define TCE rates as our voyage revenues less voyage expenses, charter-hire expenses, and realized gains or losses on fuel hedges divided by the number of the available days of our owned fleet during the period. TCE rate is a common shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charterhire rates for vessels on voyage charters are generally not expressed in per-day amounts, while charterhire rates for vessels on time charters generally are expressed in such amounts.

Reference A 71 “Cooper Companies and former head are indicted,” The New York Times, November 11, 1992 at https://www.nytimes.com/1992/11/11/business/cooper-companies-and-former-head-are-indicted.html “Former official of Cooper gets prison term,” The New York Times, August 10, 1995 at https://www.nytimes.com/1995/08/10/business/former-official-of-cooper-gets-prison-term.html SEC Litigation Release No. 15278, March 10, 1997 at https://www.sec.gov/files/litigation/litreleases/lr15278.txt “SEC charges investment adviser and associated individuals with causing violations of Regulation SHO,” SEC press release No. 2021-156, August 17, 2021 at https://www.sec.gov/news/press-release/2021-156. Statement of Allegations, dated November 9, 2022, In the Matter of Cormark Securities Inc., et al., Ontario Securities Commission File No. 2022-24 at https://www.capitalmarketstribunal.ca/en/proceedings/cormark-securities-inc-re/statement-allegations-matter-cormark-securities-inc#:~:text=Cormark%20and%20Kennedy’s%20dealings%20with,fund%20demand%20for%20Canopy’s%20shares

Reference B 72 LiveWire Mobile Inc., 8-K filed December 11, 2008 at https://www.sec.gov/Archives/edgar/data/915866/000104746908013103/a2189552z8-k.htm LiveWire Mobile Inc., 2009 definitive proxy statement filed April 24, 2009, page 10, at https://www.sec.gov/Archives/edgar/data/915866/000104746909004499/a2192455zdef14a.htm LiveWire Mobile Inc., 8-K filed April 30, 2009 at https://www.sec.gov/Archives/edgar/data/915866/000110465909027733/a09-12168_18k.htm “LiveWire announces common stock will begin trading on an adjusted bases on December 21, 2009, following one-for-ten reverse stock split,” LiveWire press release, December 18, 2009. Arbinet Form 8-K filed on April 13, 2009, at https://www.sec.gov/Archives/edgar/data/1136655/000114420409020164/v146038_8k.htm Amendment No. 13 to Schedule 13D of Karen Singer filed February 18, 2009, at https://www.sec.gov/Archives/edgar/data/1136655/000095012309002983/y74714sc13dza.htm “Arbinet Corporation announces one-for-four reverse stock split; Stock will begin trading on a split-adjusted basis on June 14, 2020,” Arbinet press release, June 11, 2010 at https://www.sec.gov/Archives/edgar/data/1136655/000114420410033152/v188066_ex99-1.htm “Arbinet Corporation to be acquired by Primus Telecommunications Group in stock-for-stock transaction,” Arbinet press release, November 11, 2010 at https://www.sec.gov/Archives/edgar/data/1136655/000114420410059223/v202001_ex99-1.htm Schedule 13D of Karen Singer filed June 15, 2010 at https://www.sec.gov/Archives/edgar/data/1006837/000095012310058233/0000950123-10-058233-index.htm, and 13D filed November 16, 2010 at https://www.sec.gov/Archives/edgar/data/1006837/000095012310106172/y04206sc13d.htm Primus Telecommunications Group Inc., Form 8-K, filed February 17, 2011 at https://www.sec.gov/Archives/edgar/data/1006837/000119312511039503/d8k.htm Amendment No. 1 to Schedule 13D of Karen Singer filed on March 9, 2011at https://www.sec.gov/Archives/edgar/data/1006837/000095012311023480/y04640sc13dza.htm Primus Telecommunications Group Inc., Form 8-K, filed September 16, 2011 at https://www.sec.gov/Archives/edgar/data/1006837/000119312511250532/0001193125-11-250532-index.htm “Primus Telecommunications Group Inc. retains Jefferies & Company, Inc.,” Primus press release, October 4, 2011 at https://www.sec.gov/Archives/edgar/data/1006837/000119312511263603/d239492dex991.htm Primus Telecommunications Group Inc., Form 8-K, filed June 1, 2012 at https://www.sec.gov/Archives/edgar/data/1006837/000119312512257352/d361789d8k.htm Primus Telecommunications Group Inc., Form 8-K, filed April 17, 2013 at https://www.sec.gov/Archives/edgar/data/1006837/000119312513158920/d522815d8k.htm “PTGi completes initial closing of North American telecom sale to affiliates of York Capital Management,” Primus press release, July 31, 2013 at https://www.sec.gov/Archives/edgar/data/1006837/000119312513312797/d575363dex991.htm Schedule 13D of Karen Singer and Lloyd Miller filed September 8, 2011 at https://www.sec.gov/Archives/edgar/data/887969/000095012311083481/y92578sc13d.htm Schedule 13D of Karen Singer and Lloyd Miller filed September 8, 2011, Exhibit 99.1 at https://www.sec.gov/Archives/edgar/data/887969/000095012311083481/y92578exv99w1.htm “Shareholders want changes at MRV Communications,” San Fernando Valley Business Journal, February 5, 2012 at https://sfvbj.com/regional/shareholders-want-changes-mrv-communications/ MRV Communications Inc., 8-K filed October 21, 2011 at https://www.sec.gov/Archives/edgar/data/887969/000110465911057201/a11-28383_18k.htm, and 2013 definitive proxy statement, page 15, at https://www.sec.gov/Archives/edgar/data/887969/000104746913005647/0001047469-13-005647-index.htm MRV Communications Inc., 2013 definitive proxy statement, page 17 at https://www.sec.gov/Archives/edgar/data/887969/000104746914004426/a2219940zdef14a.htm

Reference B (cont’d) 73 “Concurrent’s appointment of directors,” Concurrent press release, July 23, 2012 at https://www.prnewswire.com/news-releases/concurrents-appointment-of-directors-163397036.html Concurrent Computer Corp., Form 8-K, filed July 23, 2012 at https://www.sec.gov/Archives/edgar/data/749038/000114036112033638/form8k.htm Concurrent Computer Corp., Form 10-K, filed August 30, 2016 at https://www.sec.gov/Archives/edgar/data/749038/000114420416122127/v447184_10k.htm Concurrent Computer Corp., Form 8-K, filed October 20, 2017 at https://www.sec.gov/Archives/edgar/data/749038/000114420417053446/tv477441_8k.htm CCUR Holdings Inc., 2020 definitive proxy statement, page 16 at https://www.sec.gov/Archives/edgar/data/749038/000110465920116153/tm2033832-2_def14a.htm CCUR Holdings Inc., 10-Q filed February 16, 2021, Exhibit 10.6 at https://www.sec.gov/Archives/edgar/data/749038/000110465921023664/tm213835d1_10q.htm For more about CCUR Holdings’ role in the Ponzi scheme, see its explanation in CCUR Holdings, Inc. definitive information statement, page 24-25, filed March 26, 2021 at https://www.sec.gov/Archives/edgar/data/749038/000114036121010184/nt10022320x1_def14c.htm#tIODA CCUR Holdings 8-K filed on April 22, 2021, at https://www.sec.gov/Archives/edgar/data/749038/000114036121013814/brhc10023331_8k.htm “SeaChange reaches cooperation agreement with largest shareholder, TAR Holdings,” SeaChange press release, March 1, 2019 at https://ir.seachange.com/news-events/press-releases/detail/6/seachange-reaches-cooperation-agreement-with-largest “Can SeaChange mop up its mess?” Light Reading, April 19, 2019 at https://www.lightreading.com/services/can-seachange-mop-up-its-mess- SeaChange International Inc., 2020 definitive proxy statement, page 11 at https://www.sec.gov/Archives/edgar/data/1019671/000156459020027052/seac-def14a_20200709.htm SeaChange International Inc., 8-K filed July 29, 2020, and 2021 definitive proxy statement, pages 7 and 14 at https://www.sec.gov/Archives/edgar/data/1019671/000119312520201844/d944632d8k.htm, at https://www.sec.gov/Archives/edgar/data/1019671/000119312521176968/d125903ddef14a.htm#toc125903_6 “Triller to the ‘ILLR’ – Triller Hold Co LLC expected to become publicly traded on Nasdaq through a reverse merger with publicly-traded company SeaChange International (NASDAQ: SEAC),” Triller and SeaChange joint press release, December 22, 2021 at https://ir.seachange.com/news-events/press-releases/detail/470/triller-to-the-illrtriller-hold-co-llc SeaChange International Inc., 8-K filed June 14, 2022 at https://www.sec.gov/ix?doc=/Archives/edgar/data/0001019671/000119312522173916/d292141d8k.htm “SeaChange-Triller deal is a no-go,” Light Reading, June 14, 2022 at https://www.lightreading.com/cable-technology/seachange-triller-deal-is-a-no-go Amendment No. 6 to Schedule 13D of Karen Singer filed June 24, 2022 at https://www.sec.gov/Archives/edgar/data/1019671/000117152022000385/eps10323.htm Amendment No. 8 to Schedule 13D of Karen Singer filed July 18, 2022 at https://www.sec.gov/Archives/edgar/data/1019671/000117152022000415/eps10365.htm