UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21765 | |||||||

| ||||||||

Macquarie Global Infrastructure Total Return Fund Inc. | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

125 West 55th Street, New York, NY |

| 10019 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Tane T. Tyler | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | (303) 623-2577 |

| ||||||

| ||||||||

Date of fiscal year end: | November 30 |

| ||||||

| ||||||||

Date of reporting period: | May 31, 2006 |

| ||||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

Item 1. Reports to Stockholders.

2

MACQUARIE GLOBAL INFRASTRUCTURE TOTAL RETURN FUND, INC. (MGU) |

|

SEMI-ANNUAL REPORT 2006 | |

| |

MGU/06 |

Shareholder Letter

May 31, 2006 (Unaudited)

INTRODUCTION

We are pleased to provide the following report to shareholders of the Macquarie Global Infrastructure Total Return Fund Inc. (“MGU” or the “Fund”) for the six months ended May 31, 2006.

The net asset value (“NAV”) of the Fund increased by 7.0% from $22.93 on November 30, 2005 to $24.53 on May 31, 2006. During this period the Fund paid two quarterly distributions to its shareholders. The first quarterly distribution of $0.375 per share was paid on December 20, 2005 and the second quarterly distribution of $0.375 per share was paid on March 31, 2006. MGU’s NAV increased 10.7% on a total return basis over the period from November 30, 2005 to May 31, 2006 after including these total distribution payments of $0.75.

INVESTMENT OBJECTIVE AND STRATEGY

The Fund’s investment objective is to provide investors with a high level of total return consisting of dividends and other income, and capital appreciation. The Fund seeks to achieve its objective by investing at least 80% of its total assets in equity and equity-like securities issued by U.S. and non-U.S. issuers that own or operate infrastructure assets (“Infrastructure Issuers”).

It is anticipated that most of the Infrastructure Issuers in which the Fund will invest will be public companies listed on national or regional stock exchanges.

In pursuit of the Fund’s investment objective, MGU will seek to manage its investments so that at least 25% of its distributions may qualify as tax-advantaged “qualified dividend income” for U.S. federal income tax purposes.

We believe that infrastructure assets have a number of features that make this an appealing asset class for investors:

Essential Services: Many infrastructure issuers are the sole providers of an essential product or service to a segment of the population;

Competitive Advantage: Often these businesses have a strategic competitive advantage;

Inelastic Demand: Demand for infrastructure-related products or services is often linked to underlying economic or demographic growth, which makes demand for infrastructure

1

products or services more stable, and less sensitive to changes when compared to other products and services;

Long-Life, Inflation-Linked Assets: Typically infrastructure assets are long-life assets and may operate under long-term concessions/agreements. The underlying revenue of infrastructure assets may be linked to inflation, sometimes directly through a regulatory framework or through contracts/concession agreements linking price/tariff growth to inflation;

Leverage on Fixed-Cost Basis: Once developed, on-going operational costs for many infrastructure assets are relatively low and stable. Increases in revenue generated by such infrastructure assets may not result in a proportionate increase in operating costs, thereby increasing cash flow.

FUND COMMENTARY

The NAV total return for the Fund and comparative benchmarks from December 1, 2005 to May 31, 2006 are summarized in the table below:

Total NAV Return: December 1, 2005 - May 31, 2006

Macquarie Global Infrastructure Total Return Fund (MGU) |

| 10.7 | % |

Macquarie Global Infrastructure Index (1) |

| 13.9 | % |

S&P U.S. Utilities Accumulation Index (2) |

| 3.1 | % |

Both MGU and the Macquarie Global Infrastructure Index (the ‘“Benchmark”) benefited from favorable equity market conditions during this period, including merger and acquisition activities in the European infrastructure/utility sector.

Macquarie Fund Adviser (the “Manager”), investment advisor to MGU, believes that the major difference relative to the Benchmark can be attributed to the Fund’s relatively limited exposure to competitive utility-type businesses that in part

(1) The Macquarie Global Infrastructure Index consists of 255 infrastructure/utilities stocks in the FTSE Global All-Cap Index, and has a combined market capitalization of approximately $1.8 trillion as of May 31, 2006.

(2) The Standard & Poor’s Utilities Index is an unmanaged, capitalization-weighted index representing 31 of the largest utility companies listed on the NYSE.

2

have benefited more directly from energy price movements.

General weakness of the U.S Dollar also contributed to positive returns to the Fund’s NAV. For example, during the six months ended May 31, 2006, the U.S. Dollar depreciated in excess of 7% against both the British Pound and the Euro. As of May 31, 2006, approximately 36% of the MGU portfolio was denominated in these two currencies.

MGU’s share price appreciated from $20.69 on November 30, 2005 to $21.34 on May 31, 2006, an increase of 3.1%. Including paid distributions of $0.75 during the period, MGU’s share price increased 6.8% on a total return basis. As of May 31, 2006, the MGU share price of the Fund was at a 13.0% discount to NAV.

The Fund has continued to invest the proceeds from the Fund’s IPO and the Fund’s $150 million revolving credit facility. As of May 31, 2006, approximately 97% of the proceeds available to the Fund had been invested in the securities of Infrastructure Issuers. The Manager has been able to establish a broad portfolio of investments based on the Fund’s investment criteria and the Fund has been able to pay its first two distributions from returns generated by the investments.

3

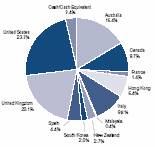

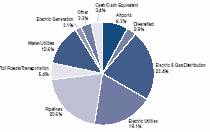

A summary of the geographic and industry diversification of the portfolio as of May 31, 2006, is illustrated in the charts below:

Portfolio Diversification by |

| Portfolio Diversification by |

Geographic Region (1) |

| Industry Sector (1) |

|

|

|

|

|

|

(1) Diversification of the Fund based on Total Assets as defined by the Fund’s prospectus.

Consistent with the overall investment strategy of the Fund, the Manager has focused on securities of Infrastructure Issuers that the Manager believes have strong strategic positions in their respective businesses and are able to generate sustainable and growing cash flow streams. As illustrated in the charts above, the top three concentration of Infrastructure Issuers in the MGU portfolio are in the U.S. (23%), U.K. (20%) and Australia (16%).

In the U.S., MGU has focused on pipeline infrastructure with a high component of fee-based income and utilities with predominantly regulated earnings. In the U.K., investments have reflected a combination of airport, port, energy infrastructure (including gas/electricity transmission and distribution networks) and water utilities. In Australia, the Fund has invested in energy infrastructure as well as toll road and diversified infrastructure businesses. MGU’s investments in Australia have materially increased with the participation in initial public offerings of Spark Infrastructure and SP AusNet in December 2005.

Going forward, the Manager expects that overall exposure to the U.S. will remain below 30% of the portfolio while the rest of the portfolio would be invested in securities of infrastructure issuers located outside of the U.S.

4

A summary of the top 10 holdings as of May 31, 2006 is included in the following table:

TOP TEN HOLDINGS

Company |

| Description of Business |

| % Total Assets |

|

|

|

|

|

|

|

British Airport Authority Plc |

| Airports Owner (U.K.) |

| 4.92 | % |

|

|

|

|

|

|

Magellan Midstream Partners, LP |

| Pipeline Infrastructure and Bulk Storage (USA) |

| 4.83 | % |

|

|

|

|

|

|

Transurban Group |

| Toll Roads (Australia) |

| 4.43 | % |

|

|

|

|

|

|

Kinder Morgan Energy Partners, LP |

| Pipeline Infrastructure and Bulk Storage (USA) |

| 4.29 | % |

|

|

|

|

|

|

Enbridge Energy Partners, LP |

| Petroleum Transportation (USA) |

| 4.22 | % |

|

|

|

|

|

|

AmeriGas Partners, LP |

| Propane Marketer (USA) |

| 3.85 | % |

|

|

|

|

|

|

Severn Trent Plc |

| Water and Wastewater Utility Services (U.K.) |

| 3.78 | % |

|

|

|

|

|

|

Pembina Pipeline Income Fund |

| Petroleum Transportation (Canada) |

| 3.70 | % |

|

|

|

|

|

|

Terna S.p.A. |

| Electricity Transmission (Italy) |

| 3.64 | % |

|

|

|

|

|

|

SP AusNet |

| Electricity and Gas (Australia) |

| 3.62 | % |

The top performer in terms of share prices movement in the MGU portfolio over the six months ended May 31, 2006, was Beijing Capital International Airport the share price of which has appreciated 44% during that period. The manager believes the two main factors contributing to the significant increase in the stock’s share price are robust passenger growth and heightened demand for China-related investments.

Strong performers during the six months ended May 31, 2006 included Electricite De France (“EDF”) and also British Airport Authority Plc (“BAA Plc”); share prices of both companies appreciated in excess of 37%. High wholesale electricity prices during the period contributed to the strong performance of the EDF share price, while the BAA Plc share price increased dramatically due to a takeover bid. In June 2006

5

the Board of BAA Plc confirmed that it had accepted, subject to final documentation, a revised definitive proposal from a consortium led by Grupo Ferrovial SA, a Spanish construction group.

The manager believes weakness in the portfolio can be largely attributed to concerns about rising interest rate and inflation fears. Positions in U.S., Canada and Australia have been particularly affected and have consequently underperformed the rest of the portfolio. Kinder Morgan Energy Partners (pipes), Northland Power (contracted generation) and Spark Infrastructure Group (energy distribution) are examples of stocks whose price performance has been impacted by interest rate concerns during the period. Zhejiang Expressway (Chinese toll roads) was also weak, reflecting market concerns with respect to underlying short term business fundamentals.

LEVERAGE

In December 2005 the Fund entered into a $150 million revolving credit facility. As of May 31, 2006, this credit facility had been fully drawn down.

It is important to point out that the overall level of leverage (26% of total assets) is well within the limits outlined in the Fund’s prospectus. The Manager believes the prudent application of leverage can be instrumental in maximizing total returns generated by the Fund.

To limit exposure to potentially adverse interest rate movements, MGU has locked in interest rates for the whole $150 million borrowing through a number of 3-5 year swaps.

DISTRIBUTIONS

The Fund’s first regularly scheduled quarterly distribution payment of $0.375 per share was declared on November 2, 2005, and paid on December 20, 2005. MGU’s second regularly scheduled quarterly distribution payment of $0.375 per share was declared on March 3, 2006 and paid on March 31, 2006.

On June 2, 2006, MGU declared a regular distribution for the period ending June 30, 2006 of $0.40 per share, representing an increase of $0.025 per share, (6.7%) from the previous quarterly distribution of $0.375 per share. Based on the Fund’s NAV of $24.53 and closing price of $21.34 on May 31, 2006, the $0.40 per share distribution is equal to an annualized distribution rate of 6.5% at NAV and 7.5% at market price, respectively. This distribution was paid on June 30, 2006.

6

MARKET OUTLOOK

The Manager believes renewed interest rate uncertainties are likely to prevail in the short term. With respect to interest rate concerns, the Manager believes that while the Fund will not be immune to broader market uncertainties, two factors should mitigate concerns with respect to the underlying MGU portfolio. First, the MGU portfolio has exposure across both a number of countries (reducing the exposure of the portfolio to the interest rate environment of any one particular country) and a number of different infrastructure businesses (providing exposure to businesses exposed to different dynamics and growth rates). Second, the investment process followed by the Manager specifically examines the sustainability of a company’s cash flow stream, including the impact of higher interest rates on underlying fundamentals.

The Manager expects that a number of the themes highlighted in the MGU Annual Report on November 30, 2005 will continue to provide an attractive investment environment for MGU. These themes include industry consolidation and increased investment in gas and electricity transmission infrastructure in the U.S. resulting from legislative changes; new energy infrastructure projects in Canada; sector consolidation, regulatory reform, new asset privatizations and capital management initiatives in the U.K. and Europe; further new listings in Australia and New Zealand; and increasing demand for basic infrastructure services in emerging markets such as China and India.

The Manager remains optimistic about the growth potential for the infrastructure sector and the range of current and potential investment opportunities that the sector presents.

7

CONCLUSION

The Fund has performed well during the six months ending May 31, 2006. There are a number of global trends that make the current environment attractive for the Fund to invest in infrastructure stocks and assist the Fund in delivering a high level of total return consisting of dividends and other income and capital appreciation. The Manager believes that MGU continues to provide U.S. investors with an attractive vehicle to access the expanding global universe of infrastructure securities.

We appreciate your investment in the Fund. For any questions or comments you may have, please call 1-800-910-1434, e-mail us at MGU-Questions@macquarie.com, or visit us at www.macquarie.com/mgu.

Yours sincerely,

Jon Fitch

President

Portfolio Manager

8

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This Semi-Annual Report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933. Forward-looking statements include statements regarding the goals, beliefs, plans or current expectations of Macquarie Fund Adviser, LLC and its respective representatives, taking into account the information currently available to them. Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,” “estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would,” or other words that convey uncertainty of future events or outcomes. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Fund’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this Semi-Annual Report, you are cautioned not to place undue reliance on these forward-looking statements, which reflect the judgment of Macquarie Fund Adviser, LLC and its respective representatives only as of the date hereof. We undertake no obligation to publicly revise or update these forward-looking statements to reflect events and circumstances that arise after the date hereof.

Capitalized terms, used but not defined herein, have the meaning assigned to them in the Fund’s prospectus.

Investments in the Fund are not deposits with or other liabilities of Macquarie Bank Limited ABN 46 008 583 542, or any entity in the Macquarie group, and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. None of Macquarie Bank Limited, Macquarie Fund Adviser, LLC, or any member company of the Macquarie group guarantees any particular rate of return or the performance of the Fund, nor do they guarantee the repayment of capital from the Fund or any tax treatment of any distribution by the Fund.

9

Statement of Investments

May 31, 2006 (Unaudited)

|

| Shares |

| Value $ |

| |

|

|

|

|

|

| |

COMMON STOCK - 94.91% |

|

|

|

|

| |

Australia - 22.38% |

|

|

|

|

| |

Australian Infrastructure Fund |

| 3,038,065 |

| $ | 4,777,083 |

|

Babcock & Brown Infrastructure Group |

| 10,205,149 |

| 11,862,256 |

| |

Envestra, Ltd. |

| 14,556,370 |

| 12,156,135 |

| |

Hastings Diversified Utilities Fund |

| 1,059,005 |

| 2,127,300 |

| |

Spark Infrastructure† |

| 20,791,365 |

| 16,737,333 |

| |

SP AusNet† |

| 21,943,231 |

| 20,553,671 |

| |

Transurban Group |

| 5,000,000 |

| 25,128,464 |

| |

|

|

|

| 93,342,242 |

| |

|

|

|

|

|

| |

France - 1.90% |

|

|

|

|

| |

Electricite de France† |

| 145,520 |

| 7,937,963 |

| |

|

|

|

| 7,937,963 |

| |

|

|

|

|

|

| |

Hong Kong - 8.72% |

|

|

|

|

| |

Beijing Capital International Airport, Ltd. |

| 5,724,000 |

| 3,523,063 |

| |

Cheung Kong Infrastructure Holdings, Ltd. |

| 2,861,000 |

| 8,463,460 |

| |

China Light & Power Holdings, Ltd. |

| 1,500,000 |

| 8,603,966 |

| |

HongKong Electric Holdings, Ltd. |

| 2,894,500 |

| 12,778,549 |

| |

Zhejiang Expressway Co., Ltd. |

| 5,580,000 |

| 3,020,862 |

| |

|

|

|

| 36,389,900 |

| |

|

|

|

|

|

| |

Italy - 13.41% |

|

|

|

|

| |

Enel S.p.A |

| 2,300,000 |

| 20,497,822 |

| |

Snam Rete Gas S.p.A |

| 3,361,954 |

| 14,787,170 |

| |

Terna S.p.A |

| 7,625,000 |

| 20,640,457 |

| |

|

|

|

| 55,925,449 |

| |

|

|

|

|

|

| |

Malaysia - 0.53% |

|

|

|

|

| |

Plus Expressways Berhad |

| 3,000,000 |

| 2,214,266 |

| |

|

|

|

| 2,214,266 |

| |

|

|

|

|

|

| |

New Zealand - 3.67% |

|

|

|

|

| |

Auckland International Airport, Ltd. |

| 11,614,694 |

| 15,292,035 |

| |

|

|

|

| 15,292,035 |

| |

10

|

| Shares |

| Value $ |

| |

|

|

|

|

|

| |

South Korea - 2.67% |

|

|

|

|

| |

Korea Electric Power Corp. |

| 125,000 |

| $ | 5,181,347 |

|

Korea Gas Corp. |

| 175,000 |

| 5,958,549 |

| |

|

|

|

| 11,139,896 |

| |

|

|

|

|

|

| |

Spain - 5.98% |

|

|

|

|

| |

Enagas, S.A. |

| 250,000 |

| 5,324,193 |

| |

Iberdrola, S.A. |

| 72,500 |

| 2,327,172 |

| |

Red Electrica de Espana, S.A. |

| 500,000 |

| 17,298,821 |

| |

|

|

|

| 24,950,186 |

| |

|

|

|

|

|

| |

United Kingdom - 27.41% |

|

|

|

|

| |

AWG Plc |

| 592,700 |

| 12,104,062 |

| |

British Airport Authority Plc |

| 1,710,000 |

| 27,901,986 |

| |

Kelda Group Plc |

| 300,000 |

| 4,224,641 |

| |

National Grid Plc |

| 1,300,000 |

| 14,745,100 |

| |

Pennon Group Plc |

| 609,295 |

| 14,448,423 |

| |

Severn Trent Plc |

| 1,018,801 |

| 21,453,657 |

| |

United Utilities Plc |

| 1,575,000 |

| 19,454,808 |

| |

|

|

|

| 114,332,677 |

| |

|

|

|

|

|

| |

United States - 8.24% |

|

|

|

|

| |

Ameren Corp. |

| 347,300 |

| 17,187,877 |

| |

Consolidated Edison, Inc. |

| 390,000 |

| 17,199,000 |

| |

|

|

|

| 34,386,877 |

| |

Total Common Stock (Cost - $389,086,780) |

|

|

| 395,911,491 |

| |

|

|

|

|

|

| |

MASTER LIMITED PARTNERSHIPS - 23.36% |

|

|

|

|

| |

AmeriGas Partners, LP |

| 752,000 |

| 21,808,000 |

| |

Enbridge Energy Partners, LP* |

| 550,200 |

| 23,944,704 |

| |

Kinder Morgan Energy Partners, LP |

| 515,000 |

| 24,308,000 |

| |

Magellan Midstream Partners, LP |

| 790,200 |

| 27,372,528 |

| |

Total Master Limited Partnerships |

|

|

|

|

| |

(Cost - $105,599,185) |

|

|

| 97,433,232 |

| |

|

|

|

|

|

| |

CANADIAN INCOME TRUSTS - 13.24% |

|

|

|

|

| |

Enbridge Income Fund |

| 478,800 |

| 5,776,897 |

| |

Northland Power Income Fund |

| 918,100 |

| 11,660,662 |

| |

11

|

| Shares |

| Value $ |

| |

|

|

|

|

|

| |

Pembina Pipeline Income Fund |

| 1,424,300 |

| $ | 21,012,143 |

|

UE Waterheater Income Fund |

| 1,212,500 |

| 16,786,768 |

| |

Total Income Trust (Cost - $52,970,049) |

|

|

| 55,236,470 |

| |

|

|

|

|

|

| |

SHORT TERM INVESTMENTS - 4.14% |

|

|

|

|

| |

Mutual Funds - 0.14% |

|

|

|

|

| |

Bank of New York Cash Reserve Money Market Fund |

| 571,275 |

| 571,275 |

| |

Total Mutual Funds (Cost - $571,275) |

|

|

| 571,275 |

| |

|

|

|

|

|

| |

Repurchase Agreements - 4.00% |

|

|

|

|

| |

Agreement with Deutsche Bank , 4.98%, dated 5/31/06 and maturing 6/01/2006 with a repurchase amount of $16,702,310, 102% collateralized by Federal National Mortgage Association, 5.67% due 4/26/2011 with a value of $17,034,000. |

|

|

| $ | 16,700,000 |

|

Total Repurchase Agreements |

|

|

|

|

| |

(Cost - $16,700,000) |

|

|

| 16,700,000 |

| |

Total Short Term Investments (Cost - $17,271,275) |

|

|

| 17,271,275 |

| |

|

|

|

|

|

| |

Total Investments (Cost - $564,927,289) |

| 135.65 | % | 565,852,468 |

| |

Other Assets in Excess of Liabilities |

| 0.31 | % | 1,304,703 |

| |

Leverage Facility (1) |

| -35.96 | % | (150,000,000 | ) | |

Net Assets |

| 100.00 | % | $ | 417,157,171 |

|

† Represents an Initial Public Offering.

* Security, or portion of security, is segregated as collateral for the Interest Rate Swaps.

(1) Analysis for leverage is based on Total Assets.

A portion of the securities are pledged as collateral for the Revolving Credit Facility.

See Notes to Financial Statements.

12

SWAP AGREEMENT:

As of May 31, 2006 , the Fund had entered into the following interest rate swap agreements:

|

|

|

| Fixed |

| Floating |

|

|

|

|

|

|

| ||

|

|

|

| Rate |

| Rate |

|

|

|

|

|

|

| ||

|

| Paid |

| Received |

| Floating |

|

|

|

|

| Unrealized |

| ||

Swap |

| Notional |

| by the |

| by the |

| Rate |

| Termination |

| Appreciation/ |

| ||

Counterparty |

| Amount |

| Fund |

| Fund |

| Index |

| Date |

| Depreciation |

| ||

|

|

|

|

|

| US 1mt |

| USD LIBOR |

|

|

|

|

| ||

Citibank, N.A. |

| 60,000,000 |

| 4.426 | % | Libor |

| BBA 1MT |

| Nov 17 2008 |

| $ | 1,394,725 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

National |

|

|

|

|

| US 1mt |

| USD LIBOR |

|

|

|

|

| ||

Australia Bank |

| 40,000,000 |

| 4.865 | % | Libor |

| BBA 1MT |

| Dec 9 2010 |

| $ | 857,044 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| 30,000,000 USD |

| 4.15 | % | US 1mt |

| USD LIBOR |

|

|

|

|

| ||

Citibank, N.A. |

| 34,572,000 CAD |

| CAD |

| Libor |

| BBA 1MT |

| Jan 6 2009 |

| $ | (1,425,249 | ) | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

| 20,000,000 USD |

| 4.15 | % | US 1mt |

| USD LIBOR |

|

|

|

|

| ||

Citibank, N.A. |

| 23,242,000 CAD |

| CAD |

| Libor |

| BBA 1MT |

| Jan 6 2009 |

| $ | (789,820 | ) | |

See Notes to Financial Statements.

13

Statement of Assets & Liabilities

May 31, 2006 (Unaudited)

ASSETS: |

|

|

| |

Investments, at value (Cost - $564,927,289) |

| $ | 565,852,468 |

|

Unrealized appreciation on interest rate swap contracts |

| 2,251,769 |

| |

Dividends receivable |

| 769,024 |

| |

Interest receivable |

| 2,768 |

| |

Interest receivable on interest rate swap contracts |

| 54,424 |

| |

Receivable for investments sold |

| 7,637,313 |

| |

Other assets |

| 30,251 |

| |

Total Assets |

| 576,598,017 |

| |

|

|

|

| |

LIABILITIES: |

|

|

| |

Payable for investments purchased |

| 4,853,428 |

| |

Unrealized depreciation on interest rate swap contracts |

| 2,215,069 |

| |

Loan payable to bank |

| 150,000,000 |

| |

Interest on loan payable to bank |

| 546,913 |

| |

Accrued investment advisory fee (1) |

| 1,313,341 |

| |

Accrued administration fee |

| 62,755 |

| |

Accrued trustees fee |

| 6,998 |

| |

Accrued offering costs |

| 315,108 |

| |

Other payables and accrued expenses |

| 127,234 |

| |

Total Liabilities |

| 159,440,846 |

| |

|

|

|

| |

Net Assets |

| $ | 417,157,171 |

|

|

|

|

| |

COMPOSITION OF NET ASSETS: |

|

|

| |

Paid in capital |

| 405,051,907 |

| |

Accumulated net realized gain on investments |

| 11,100,565 |

| |

Net unrealized appreciation on investments |

| 1,004,699 |

| |

Net Assets |

| $ | 417,157,171 |

|

Shares of common stock outstanding of $.001 par value, unlimited shares authorized |

| 17,004,189 |

| |

Net asset value per share (1) |

| $ | 24.53 |

|

(1) An adjustment was made to the advisory fees which affected the net asset value for financial reporting purposes.

See Notes to Financial Statements.

14

Statement of Operations

For the Six Months Ended May 31, 2006 (Unaudited)

INVESTMENT INCOME: |

|

|

| |

Dividends (Net of foreign withholding of $784,157) |

| $ | 13,409,952 |

|

Interest |

| 633,239 |

| |

Total Income |

| 14,043,191 |

| |

|

|

|

| |

EXPENSES: |

|

|

| |

Investment advisory fee |

| 2,546,980 |

| |

Administration fee |

| 355,565 |

| |

Printing fee |

| 31,741 |

| |

Transfer agent fee |

| 17,296 |

| |

Legal fee |

| 62,745 |

| |

Audit fee |

| 46,685 |

| |

Trustees fee |

| 49,862 |

| |

Excise tax expense |

| 120,000 |

| |

Interest on loan |

| 3,627,561 |

| |

Custody fee |

| 56,626 |

| |

Insurance fee |

| 109,100 |

| |

Miscellaneous |

| 44,877 |

| |

Total Expenses |

| 7,069,038 |

| |

|

|

|

| |

Net Investment Income |

| 6,974,153 |

| |

|

|

|

| |

Net realized gain on: |

|

|

| |

Investment securities |

| 8,239,523 |

| |

Foreign currency transactions |

| 15,083 |

| |

Interest rate swaps |

| 63,401 |

| |

Net change in unrealized appreciation on investments and foreign currency translation |

| 24,666,593 |

| |

Net gain on investments |

| 32,984,600 |

| |

Net Increase in Net Assets From Operations |

| 39,958,753 |

| |

See Notes to Financial Statements.

15

Statement of Changes in Net Assets

|

| For the |

| For the Period |

| ||

|

| Six Months |

| August 26, |

| ||

|

| Ended |

| 2005 to |

| ||

|

| May 31, 2006 |

| November 30, |

| ||

|

|

|

|

|

| ||

COMMON SHAREHOLDER OPERATIONS: |

|

|

|

|

| ||

Net investment income |

| $ | 6,974,153 |

| $ | 7,886,053 |

|

Net realized gain (loss) from: |

|

|

|

|

| ||

Investment securities |

| 8,239,523 |

| 609,405 |

| ||

Foreign currency transactions |

| 15,083 |

| (7,016 | ) | ||

Interest rate swaps |

| 63,401 |

| — |

| ||

Net change in unrealized appreciation/depreciation on investments and foreign currency translation |

| 24,666,593 |

| (23,661,894 | ) | ||

Net increase/(decrease) in net assets attributable to Common Shares from operations |

| 39,958,753 |

| (15,173,452 | ) | ||

|

|

|

|

|

| ||

DISTRIBUTIONS TO COMMON SHAREHOLDERS: |

|

|

|

|

| ||

Net decrease in net assets from distributions |

| (12,753,142 | ) | — |

| ||

|

|

|

|

|

| ||

CAPITAL SHARE TRANSACTIONS: |

|

|

|

|

| ||

Proceeds from sales of common shares, net of offering costs |

| — |

| 405,025,000 |

| ||

Net increase in net assets from capital share transactions |

| — |

| 405,025,000 |

| ||

Net Increase in Net Assets |

| 27,205,611 |

| 389,851,548 |

| ||

Net Assets Attributable to Common Shares: |

|

|

|

|

| ||

Beginning of period |

| $ | 389,951,560 |

| $ | 100,012 |

|

End of period |

| $ | 417,157,171 |

| $ | 389,951,560 |

|

(1) The Fund began operations on August 26, 2005.

See Notes to Financial Statements.

16

Financial Highlights

|

|

|

| For the Period |

| ||

|

| For the |

| August 26, |

| ||

|

| Six Months |

| 2005 to |

| ||

|

| Ended |

| November 30, |

| ||

|

| May 31, 2006 |

| 2005(4) |

| ||

|

| (Unaudited) |

|

|

| ||

|

|

|

|

|

| ||

PER COMMON SHARE OPERATING PERFORMANCE |

|

|

|

|

| ||

Net asset value - beginning of period |

| $ | 22.93 |

| $ | 23.88 |

|

Income from investment operations: |

|

|

|

|

| ||

Net investent income |

| 0.41 |

| 0.46 |

| ||

Net realized and unrealized gain (loss) on investments |

| 1.94 |

| (1.36 | ) | ||

Total from investment operations |

| 2.35 |

| (0.90 | ) | ||

|

|

|

|

|

| ||

DISTRIBUTIONS TO COMMON SHAREHOLDERS FROM: |

|

|

|

|

| ||

From net investment income |

| (0.75 | ) | — |

| ||

Total distributions |

| (0.75 | ) | — |

| ||

|

|

|

|

|

| ||

CAPITAL SHARE TRANSACTIONS: |

|

|

|

|

| ||

Common share offering costs charged to paid in capital |

| — |

| (0.05 | ) | ||

Total capital share transactions |

| — |

| (0.05 | ) | ||

Net asset value - end of period |

| $ | 24.53 |

| $ | 22.93 |

|

Market price - end of period |

| $ | 21.34 |

| $ | 20.69 |

|

|

|

|

|

|

| ||

Total Investment Return - Net Asset Value (1): |

| 10.73 | % | (3.96 | )% | ||

Total Investment Return - Market Price (1): |

| 6.76 | % | (17.24 | )% | ||

|

|

|

|

|

| ||

RATIOS AND SUPPLEMENTAL DATA |

|

|

|

|

| ||

Net assets attributable to common shares, end of period (000s) |

| $ | 417,157 |

| $ | 389,952 |

|

Total assets attributable to common shares, end of period (000s) |

| $ | 567,157 |

|

|

| |

Ratios to average net assets attributable to common shareholders: |

|

|

|

|

| ||

Expenses |

| 3.48 | %(2) | 1.34 | %(2) | ||

Net investment income |

| 3.44 | %(2) | 7.48 | %(2) | ||

Ratios to average total assets attributable to common shareholders: (3) |

|

|

|

|

| ||

Expenses |

| 2.58 | % |

|

| ||

Portfolio turnover rate |

| 12.17 | % | 3.47 | % | ||

(1) Total investment return is calculated assuming a purchase of a common share at the opening on the first day and a sale at closing on the last day of each period reported. Total investment returns do not reflect brokerage commissions. Total investment returns for less than a full year are not annualized. For the year ended November 30, 2005 total investment return on net asset value excludes the sales load of $1.125 per share. Past performance is not a guarantee of future results.

(2) Annualized.

(3) The prospectus for the Fund defines Total Assets as Total Net Asset plus Leverage (See Note 7 under Notes to Financial Statements).

(4) The Fund began operations on August 26, 2005.

See notes to financial statements.

17

Notes to Financial Statements

May 31, 2006 (Unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Macquarie Global Infrastructure Total Return Fund Inc. (the “Fund”) is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940 and organized under the laws of the State of Maryland. The Fund’s investment objective is to provide to its common stockholders a high level of total return consisting of dividends and other income, and capital appreciation. The Fund commenced operations on August 26, 2005. The Fund had no operation prior to August 26, except for the sale of shares to Macquarie Fund Adviser, LLC (“MFA” or the “Adviser”). The Fund’s common shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “MGU”.

The Fund has elements of risk, including the risk of loss of principal. There is no assurance that the investment process will consistently lead to successful results. An investment concentrated in sectors and industries may involve greater risk and volatility than a more diversified investment.

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America. This requires Management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

The following summarizes the significant accounting policies of the Fund.

Security Valuation: The net asset value (“NAV”) of the common shares will be computed based upon the value of the securities and other assets and liabilities held by the Fund. The NAV is determined as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern Standard Time) on each day the NYSE is open for trading. U.S. debt securities and non-U.S. securities will normally be priced using data reflecting the earlier closing of the principal markets for those securities (subject to the fair value policies described below).

Readily marketable portfolio securities listed on any U.S. exchange other than the NASDAQ National Market are valued, except as indicated below, at the last sale price on

18

the business day as of which such value is being determined, or if no sale price, at the mean of the most recent bid and asked prices on such day. Securities admitted to trade on the NASDAQ National Market are valued at the NASDAQ official closing price as determined by NASDAQ. Securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities. U.S. equity securities traded in the over-the-counter market, but excluding securities admitted to trading on the NASDAQ National Market, are valued at the closing bid prices.

Non-U.S. exchange-listed securities will generally be valued using information provided by an independent third party pricing service. The official non-U.S. security price is determined using the last sale price at the official close of the security’s respective non-U.S. market. Non-U.S. securities, currencies and other assets denominated in non-U.S. currencies are translated into U.S. dollars at the exchange rate of such currencies against the U.S. dollar as provided by a pricing service. When price quotes are not available, fair market value is based on prices of comparable securities.

In the event that the pricing service cannot or does not provide a valuation for a particular security, or such valuation is deemed unreliable, especially with unlisted securities or instruments, fair value is determined by the Board or a committee of the Board or a designee of the Board. In fair valuing the Fund’s investments, consideration is given to several factors, which may include, among others, the following:

• the projected cash flows for the issuer;

• the fundamental business data relating to the issuer;

• an evaluation of the forces that influence the market in which these securities are purchased and sold;

• the type, size and cost of holding;

• �� the financial statements of the issuer;

• the credit quality and cash flow of issuer, based on the Adviser’s or external analysis;

• the information as to any transactions in or offers for the holding;

• the price and extent of public trading in similar securities (or equity securities) of the issuer, or comparable companies;

• the business prospects of the issuer/borrower, including any ability to obtain money or resources from a parent or affiliate and an assessment of the issuer’s or borrower’s Management;

19

• the prospects for the issuer’s or borrower’s industry, and multiples (of earnings and/or cash flow) being paid for similar businesses in that industry

Foreign Securities: The accounting records of the Fund are maintained in U.S. dollars. Prices of securities and other assets and liabilities denominated in non-U.S. currencies are translated into U.S. dollars using the exchange rate at 12:00 p.m., Eastern Standard Time. Amounts related to the purchases and sales of securities, investment income and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions.

Net realized gain or loss on foreign currency transactions represents net foreign exchange gains or losses from the closure of forward currency contracts, disposition of foreign currencies, currency gains or losses realized between the trade and settlement dates on security transactions and the difference between the amount of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amount actually received or paid. Net unrealized currency gains and losses arising from valuing foreign currency denominated assets and liabilities, other than security investments, at the current exchange rate are reflected as part of unrealized appreciation/depreciation on foreign currency translation.

Forward currency exchange contracts which are traded in the U.S. on regulated exchanges are valued by calculating the mean between the last bid and asked quotation supplied to a pricing service by certain independent dealers in such contracts. Non-U.S. traded forward currency contracts are valued using the same method as the U.S. traded contracts. Exchange traded options and futures contracts are valued at the closing price in the market where such contracts are principally traded. These contracts may involve market risk in excess of the unrealized gain or loss reflected in the Fund’s Statement of Assets & Liabilities. In addition, the Fund could be exposed to risk if the counterparties are unable to meet the terms of the contract or if the value of the currencies change unfavorably to the U.S. dollar.

The Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in the market prices of securities held at periods end. The Fund does not isolate the effect of changes in foreign exchange rates from changes in market prices of

20

equity securities sold during the year. The Fund may invest in foreign securities and foreign currency transactions that may involve risks not associated with domestic investments as a result of the level of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability, among others.

Distributions to Shareholders: The Fund intends to distribute to holders of its common shares quarterly dividends of all or a portion of its net income and/or realized short-term gains after payment of dividends and interest in connection with any leverage used by the Fund. Distributions to shareholders are recorded by the Fund on the ex-dividend date.

Income Taxes: The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies.

Securities Transactions and Investment Income: Investment security transactions are accounted for as of trade date. Dividend income is recorded on the ex-dividend date. Interest income, which includes amortization of premium and accretion of discount, is accrued as earned. Realized gains and losses from securities transactions are determined on the basis of identified cost for both financial reporting and income tax purposes.

Repurchase Agreements: Securities pledged as collateral for repurchase agreements are held by a custodian bank until the agreements mature. Each agreement requires that the market value of the collateral be sufficient to cover payments of interest and principal. In the event of default by the other party to the agreement, retention of the collateral may be subject to legal proceedings.

21

2. INCOME TAXES

Classification of Distributions:

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes.

The tax character of the distributions paid by the Fund during the period August 26, 2005 (inception) to March 31, 2006, was as follows:

Distributions paid from: |

|

|

| |

Ordinary Income |

| $ | 12,753,142 |

|

Total |

| $ | 12,753,142 |

|

Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from composition of net assets reported under accounting principles generally accepted in the United States. Accordingly, for the six months ended May 31, 2006, the effects of certain differences were reclassified. The fund decreased accumulated net investment income by $855,895, decreased paid in capital by $73,105, and increased accumulated net realized gain by $929,000. These differences were primarily due to the differing tax treatment of foreign currency, investments in partnerships and certain other investments. Net assets of the portfolio were unaffected by the reclassifications and the calculation of net investment income per share in the Financial Highlights excludes these adjustments.

As of May 31, 2006, the components of distributable earnings on a tax basis were as follows:

Ordinary income |

| 6,154,351 |

|

Unrealized depreciation |

| 5,950,913 |

|

Total |

| 12,105,264 |

|

22

Net unrealized appreciation/(depreciation) of investments based on federal tax costs was as follows:

Gross appreciation on investments |

|

|

| |

(excess of value over tax cost) |

| $ | 36,037,604 |

|

Gross depreciation on investments |

|

|

| |

(excess of tax cost over value) |

| (30,166,211 | ) | |

Net unrealized appreciation |

| 5,871,393 |

| |

Total cost for federal income tax purposes |

| $ | 559,981,075 |

|

The differences between book and tax net unrealized depreciation and cost were primarily due to the differing tax treatment of foreign currency, investments in partnerships, and certain other investments.

3. CAPITAL TRANSACTIONS

|

|

|

| For the Period |

|

|

| For the |

| August 26, |

|

|

| Six Months Ended |

| 2005 to |

|

|

| May 31, 2006 |

| Nov 30, 2005 |

|

Common shares outstanding beginning of period |

| 17,004,189 |

| — |

|

Common shares issued in connection with initial public offering |

| — |

| 17,004,189 |

|

Common shares outstanding - end of period |

| 17,004,189 |

| 17,004,189 |

|

4. PORTFOLIO SECURITIES

Purchases and sales of investment securities, other than short-term securities, for the six months ended May 31, 2006 aggregated $240,660,770 and $62,543,111, respectively.

23

5. INVESTMENT ADVISORY AGREEMENT

MFA serves as the Fund’s investment adviser pursuant to an Investment Management Agreement with the Fund and is responsible for determining the Fund’s overall investment strategy and implementation through day-to-day portfolio management, subject to the general supervision of the Fund’s Board of Directors. MFA is also responsible for managing the Fund’s business affairs, overseeing other service providers and providing management services. As compensation for its services to the Fund, MFA receives an annual management fee, payable on a quarterly basis, equal to the annual rate of 1.00% of the Fund’s Total Assets (as defined below) up to and including $300 million, 0.90% of the Fund’s Total Assets over $300 million up to and including $500 million, and 0.65% of the Fund’s Total Assets over $500 million. Total Assets of the Fund, for the purpose of this calculation, includes the aggregate of the Fund’s average daily net assets plus proceeds from any outstanding borrowings used for leverage.

6. INTEREST RATE SWAP CONTRACTS

The Fund entered into interest rate swap agreements in anticipation of the leverage facility described in Note 7. In these interest rate swap agreements, the fund agrees to pay the other party to the interest rate swap (which is known as the counterparty) a fixed rate payment in exchange for the counterparty agreeing to pay the fund a variable rate payment that is intended to approximate the Fund’s variable rate payment obligation on the leverage facility. The payment obligation is based on the notional amount of the swap. Depending on the state of interest rates in general, the use of interest rate swaps could enhance or harm the overall performance of the common shares. The market value of interest rate swaps is based on pricing models that consider the time value of money, volatility, the current market and contractual prices of the underlying financial instrument. Unrealized gains are reported as an asset and unrealized losses are reported as a liability on the Statement of Assets & Liabilities. The change in value of interest rate swaps, including the accrual of periodic amounts of interest to be paid or received on swaps is reported as unrealized gains or losses in the Statement of Operations. A realized gain or loss is recorded upon payment or receipt of a periodic payment or termination of swap agreements. Swap agreements involve, to varying degrees, elements or market and counterparty risk, and exposures to loss in excess of the related amounts reflected in the Statement of Assets & Liabilities.

24

7. LEVERAGE

On December 5, 2005, the Fund entered into a 364-day senior secured revolving credit facility in the amount of $150,000,000 (the “Revolving Credit Facility”) with National Australia Bank, New York Branch (“NAB”). The Fund may draw down a loan utilizing a reference rate that may be either Fed Funds, LIBOR, or Eurodollar rate. The loans comprising each borrowing bear interest at a rate of 40 basis points per annum above the reference rate. The interest is disclosed on the Statement of Operations.

On December 5, 2005 the Fund drew down $125,000,000, and on January 4, 2006 the Fund drew down the remaining $25,000,000 from the Revolving Credit Facility. The current borrowings use one month LIBOR as the reference rate.

8. OTHER

Compensation of Directors: The Independent Directors of the Fund receive a quarterly retainer of $5,000 and an additional $2,500 for each meeting attended.

9. INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

10. SUBSEQUENT EVENTS

Distribution: The Fund paid a distribution of $6,801,676 or $0.40 per common share on June 30, 2006 to Common Shareholders of record on June 15, 2006.

Total Return Swap: On July 17, 2006 the Fund entered into a Swap agreement with the Bank of Nova Scotia. The Swap Agreement is for a period of ten years, but may be terminated earlier by the Fund.

Because the principal amount is not exchanged, it represents neither an asset nor a liability to either counterparty, and is referred to as notional. The unrealized gain (loss) related to the daily change in the valuation of the notional amount of the swap, as well as the amount due to (owed by) the Fund at termination or settlement, is combined and separately disclosed as an asset (liability). The Fund also records any periodic payments received from (paid to) the counterparty, including at termination, under such contracts as realized gain (loss). Total return swaps are subject to risks (if the counterparty fails to meet its obligations).

25

Additional Information

May 31, 2006 (Unaudited)

Dividend Reinvestment Plan

Unless a stockholder of MGU (“Stockholder”) elects to receive cash distributions, all dividends, including any capital gain dividends, on the Stockholder’s Common Shares will be automatically reinvested by the Plan Agent, The Bank of New York, in additional Common Shares under the Dividend Reinvestment Plan. If a Stockholder elects to receive cash distributions, the Stockholder will receive all distributions in cash paid by check mailed directly to the Stockholder by The Bank of New York, as dividend paying agent.

If a Stockholder decides to participate in the Plan, the number of Common Shares the Stockholder will receive will be determined as follows:

• If the Common Shares are trading at or above NAV at the time of valuation, the Fund will issue new shares at a price equal to the greater of (i) NAV per Common Share on that date or (ii) 95% of the market price on that date.

• If Common Shares are trading below NAV at the time of valuation, the Plan Agent will receive the dividend or distribution in cash and will purchase Common Shares in the open market, on the NYSE or elsewhere, for the participants’ accounts. It is possible that the market price for the Common Shares may increase before the Plan Agent has completed its purchases. Therefore, the average purchase price per share paid by the Plan Agent may exceed the market price at the time of valuation, resulting in the purchase of fewer shares than if the dividend or distribution had been paid in Common Shares issued by the Fund. The Plan Agent will use all dividends and distributions received in cash to purchase Common Shares in the open market within 30 days of the valuation date except where temporary curtailment or suspension of purchases is necessary to comply with federal securities laws. Interest will not be paid on any uninvested cash payments.

A Stockholder may withdraw from the Plan at any time by giving written notice to the Plan Agent, or by telephone in accordance with such reasonable requirements as the Plan Agent and Fund may agree upon. If a Stockholder withdraws or the Plan is terminated, the Stockholder will receive a certificate for each whole share in its account under the Plan and the Stockholder will receive a cash payment for any fraction of a share in its account. If the Stockholder wishes, the Plan Agent will

26

sell the Stockholder’s shares and send the proceeds, minus brokerage commissions, to the Stockholder.

The Plan Agent maintains all Stockholders’ accounts in the Plan and gives written confirmation of all transactions in the accounts, including information a Stockholder may need for tax records. Common Shares in an account will be held by the Plan Agent in non-certificated form. The Plan Agent will forward to each participant any proxy solicitation material and will vote any shares so held only in accordance with proxies returned to the Fund. Any proxy a Stockholder receives will include all Common Shares received under the Plan.

There is no brokerage charge for reinvestment of a Stockholder’s dividends or distributions in Common Shares. However, all participants will pay a pro rata share of brokerage commissions incurred by the Plan Agent when it makes open market purchases.

Automatically reinvesting dividends and distributions does not mean that a Stockholder does not have to pay income taxes due upon receiving dividends and distributions. If a Stockholder holds Common Shares with a brokerage firm that does not participate in the Plan, the Stockholder will not be able to participate in the Plan and any dividend reinvestment may be effected on different terms than those described above. Stockholders should consult their financial advisor for more information.

The Fund reserves the right to amend or terminate the Plan if in the judgment of the Board the change is warranted. There is no direct service charge to participants in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable by the participants.

All correspondence or questions concerning the Plan should be directed to the Plan Administrator, The Bank of New York, 101 Barclay Street, New York, NY 10286, 20th Floor, Transfer Agent Services, 1-800-433-8191.

27

Consideration of Approval of the Investment Advisory and Management Agreement

At a Board meeting held on July 13, 2005, all of the Directors, including the non-interested Directors, approved the Investment Management Agreement for an initial two-year term. In their consideration, the Directors took into account: (i) a presentation about the services to be rendered to the Fund by the Adviser, the experience of the person expected to serve as principal portfolio manager, the experience of the Adviser’s affiliates in advising funds and other accounts that invest in Infrastructure Assets and Infrastructure Issuers, and the fees proposed to be paid by the Fund to the Adviser; and (ii) a memorandum describing the legal duties of the Directors under the 1940 Act. The Directors also received information prepared by Lipper, Inc. (“Lipper”) comparing the Fund’s fee rate for advisory and administrative services to those of other funds selected by Lipper and information prepared by Citigroup Global Markets Inc. and MFA concerning adviser fees, administrative fees and total expenses for 66 closed-end funds generally investing in equity securities. In particular, the Directors considered the following:

(a) The nature, extent and quality of services to be provided by the Adviser. The Directors reviewed the services that the Adviser would provide to the Fund. The Directors discussed in detail with representatives of the Adviser the proposed management of the Fund’s investments in accordance with the Fund’s stated investment objective and policies and the types of transactions that would be entered into on behalf of the Fund. In addition to the investment advisory services to be provided to the Fund, the Directors considered that the Adviser also will oversee Fund service providers. The Directors discussed the Adviser’s compliance framework and considered a presentation by the Chief Compliance Officer of the Adviser and the Fund. The Directors also considered presentations by representatives of the Adviser containing an overview of the Fund and its investment strategy, and the experience of the Adviser and its affiliates, and global reputation for infrastructure investing, their track record and their organization. Based on this presentation, the Directors concluded that the services to be provided to the Fund by the Adviser under the Investment Management Agreement were likely to be of a high quality and would benefit the Fund.

28

(b) Investment performance of the Fund and the Adviser. Because the Fund is newly formed, the Directors did not consider its investment performance. However, Directors reviewed the performance of another closed-end fund for which the Adviser serves as subadviser, and discussed information provided by the Adviser with respect to the exposure of the Adviser and its affiliates to investments in Infrastructure Issuers, including through non-U.S. funds advised by affiliates of the Adviser. The Directors, recognizing that past performance does not assure future results, believed that this information demonstrated the considerable experience and expertise of the Adviser in managing investments in Infrastructure Issuers. Based on their review, the Directors determined that the Adviser would be an appropriate investment Adviser for the Fund.

(c) Cost of the services to be provided and profits to be realized by the Adviser from the relationship with the Fund. The Directors also considered the anticipated cost of the services to be provided by the Adviser. Because the Fund is newly formed, had not commenced operations as of July 13, 2005, and the eventual aggregate amount of Fund assets was uncertain, the Adviser was not able to provide the Directors with specific information concerning the cost of services to be provided to the Fund and the profits to be realized by the Adviser from its relationship with the Fund. The Directors, however, did discuss with the Adviser the general level of its anticipated profitability and noted that the Adviser would provide the Directors with profitability information from time to time after the Fund commences operations. The Directors concluded that the Adviser’s anticipated profitability for managing the Fund was expected to be within the range determined by appropriate court cases to be reasonable.

(d) The extent to which economies of scale would be realized as the Fund grows and whether fee levels would reflect such economies of scale. Because the Fund is newly formed, had not commenced operations as of July 13, 2005, and the eventual aggregate amount of Fund assets was uncertain, the Adviser was not able to provide the Directors with specific information concerning the extent to which economies of scale would be realized. However, the Directors noted that the proposed advisory fee schedule contained breakpoints at three levels of assets. The Directors determined that the breakpoints permitted the Fund to share in the potential benefits of economies of scale as the Fund’s assets increased. The

29

Directors also discussed the renewal requirements for investment advisory agreements, and determined that they would revisit this issue no later than when they next review the investment advisory fee after the initial two-year term of the Investment Management Agreement.

(e) Comparison of services to be rendered and fees to be paid to those under other investment advisory contracts, such as contracts of the same and other investment advisers or other clients. The Directors compared both the services to be rendered and the fees to be paid under the Investment Management Agreement to the services that the Adviser provides as subadviser to another registered closed-end fund and to contracts of other investment advisers with respect to other generally similar closed-end registered investment companies. When comparing the fee to be charged to the Fund by the Adviser to the fee charged to the other closed-end fund for providing sub-advisory services, the Directors considered the difference in the nature and extent of the services to be provided by the Adviser to the Fund compared to nature and extent of the sub-advisory services, and concluded that the fee differential is justified by the additional services provided to the Fund and related additional costs to the Adviser of servicing the Fund.

In reviewing the advisory fee proposed to be paid by the Fund, the Board also considered that the Fund’s use of leverage would increase the base of assets subject to the advisory fee and so would increase the advisory fee payable to the Adviser. The Board discussed in detail with the Adviser the circumstances under which the Adviser would leverage the Fund’s assets and accepted the Adviser’s explanation that the Adviser would only leverage the Fund’s assets in an attempt to enhance the Fund’s overall returns (that is, produce excess returns after the deduction of advisory fees paid on leveraged assets).

In addition, the Directors evaluated the Fund’s proposed fee schedule for advisory services as compared to the fee rate and expense ratios of the funds enumerated in the materials prepared by Lipper, MFA and Citigroup Global Markets Inc. and concluded that the Fund’s proposed fee schedule and anticipated expense ratio were within the respective ranges borne by those other funds.

Conclusion. No single factor was determinative to the decision of the Directors. Based on the foregoing and such other matters as were deemed relevant, all of the Directors, including the non-interested Directors, concluded that the proposed advisory fee and projected total

30

expense ratio are reasonable in relation to the services to be provided by the Adviser to the Fund, as well as the costs to be incurred and benefits to be gained by the Adviser in providing such services. As a result, all of the Directors, including the non-interested Directors, approved the Investment Management Agreement. The non-interested Directors were represented by independent counsel who assisted them in their deliberations.

Fund Proxy Voting Policies & Procedures

Policies and procedures used in determining how to vote proxies relating to portfolio securities and a summary of proxies voted by the Fund are available without a charge, upon request, by contacting the Fund at 1-800-910-1434 and on the Commission’s web site at http://www.sec.gov.

Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q within 60 days after the end of the period. Copies of the Fund’s Forms N-Q are available without a charge, upon request, by contacting the Fund at 1-800-910-1434 and on the Commission’s web site at http://www.sec.gov. You may also review and copy Form N-Q at the Commission’s Public Reference Room in Washington, D.C. For more information about the operation of the Public Reference Room, please call the Commission at 1-800-SEC-0330.

Notice

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that the Fund may purchase at market prices from time to time shares of its common stock in the open market.

Shareholder Meeting

On June 28, 2006, the Fund held its Annual Meeting of Shareholders (the “Meeting”) for the purpose of voting on a proposal to re-elect one director of the Fund. The results of the proposal are as follows:

Proposal 1: To Elect One (1) Class I Director of the Fund

Gordon A. Baird

For |

| 16,448,835 |

|

Withheld |

| 162,767 |

|

31

Directors & Officers

May 31, 2006 (Unaudited)

Certain biographical and other information relating to the non-interested Directors of the Fund is set out below, including their ages, their principal occupations for at least the last five years, the length of time served, the total number of portfolios overseen in the complex of funds advised by the Adviser (“MFA-Affiliate Advised Funds”), and other public directorships

Biographical Information of the Non-Interested Directors of the Fund

Name, Age and |

| Position(s) Held with |

| Term of Office and |

Address (1) of Director |

| the Fund |

| Length of Time Served |

|

|

|

|

|

Gordon A. Baird, 38 |

| Director |

| Since – July 22, 2005 |

|

|

|

| Term expires 2006. |

|

|

|

|

|

Thomas W. Hunersen, 48 |

| Director |

| Since – July 12, 2005 |

|

|

|

| Term expires 2007. |

|

|

|

|

|

Chris LaVictoire Mahai, 51 |

| Director |

| Since – July 12, 2005 |

|

|

|

| Term expires 2008. |

(1) Each non-interested Director may be contacted by writing to the Director, c/o Macquarie Global Infrastructure Total Return Fund, 1625 Broadway, Suite 2200, Denver, CO 80202.

32

| Number of MFA-Affiliate |

| Public | |

|

|

|

|

|

Mr. Baird has been Chief Executive Officer, partner and member of the Board of Paramax Capital Group (investment management firm) since 2003. He was Director of Fixed Income and Structured Finance Group, Citigroup Global Markets Inc. (formerly Salomon Smith Barney Inc.) (2002-2003); President and member of the Board of Directors, IBEX Capital Markets Inc. (1996-2001). |

| 1 |

| None |

|

|

|

|

|

Mr. Hunersen has been a consultant since 2005. He was Head of Strategy Projects—North America, Global Wholesale Banking—Bank of Ireland, Greenwich, Connecticut (2004), Chief Executive Officer, Slingshot Game Technology Incorporated, Natick, Massachusetts (2002-2003), and Executive Vice President, General Manager, Global Head of Energy & Utilities—Global Wholesale Banking—National Australia Bank Limited (1987-2001). |

| 1 |

| None |

|

|

|

|

|

Ms. Mahai has been Owner/Managing Member/Partner of Avenus, LLC (general management consulting) since 1999. |

| 1 |

| None |

33

Biographical Information of the Interested Directors of the Fund

Name, Age and |

| Position(s) Held with |

| Term of Office and |

Address of Director |

| the Fund |

| Length of Time Served (1) |

|

|

|

|

|

Oliver Yates, 40 |

| Director |

| Since – May 4, 2005 |

Biographical Information of the Executive Officers of the Fund

Name, Address and |

| Position(s) Held with |

| Term of Office and |

Age of Director |

| the Fund |

| Length of Time Served (1) |

|

|

|

|

|

Jon Fitch, 41 |

| Chief Executive Officer |

| Since – July 13, 2005 |

|

|

|

|

|

John Mullin, 44 |

| Treasurer, Chief Financial Officer and Secretary |

| Since – July 13, 2005 |

|

|

|

|

|

Diana Bergherr, 53 |

| Chief Compliance Officer |

| Since – June 1, 2006 |

(1) Each officer serves an indefinite term.

34

Principal Occupation(s) During Past |

| Number of MFA-Affiliate |

| Public |

|

|

|

|

|

Co-head of the Macquarie Group’s Financial Products group and an Executive Director of Macquarie Bank Limited (July 2004–present); President of Macquarie Holdings USA (2000–July 2004). |

| 1 |

| None |

Principal Occupation(s) During Past |

|

|

|

|

|

|

|

|

|

CEO, Macquarie Fund Adviser, LLC (February 2004–present); Equity Analyst, Macquarie Equities Limited (2001–2003: established Hong Kong-based research team; 1997–2000: led coverage of the Australian infrastructure and utility sector) |

|

|

|

|

|

|

|

|

|

CFO & Head of CAG, Macquarie Holdings (USA) Inc (September 2004–present); Executive Vice President & Chief Financial Officer, Blaylock & Partners, LP (May 2002 to August 2004); Chief Financial Officer Tucker Anthony Inc (September 1997 to April 2002) |

|

|

|

|

|

|

|

|

|

CCO & Head of Compliance North America, Macquarie Holdings (USA) Inc. |

|

|

|

|

35

|

| 1-800-910-1434 |

|

|

|

|

| Macquarie Global Infrastructure Total Return Fund |

|

| 125 West 55th Street |

|

| New York, NY 10019 |

|

|

|

|

| MGU-Questions@macquarie.com |

|

|

|

|

| www.macquarie.com/mgu |

Item 2. Code of Ethics.

Not applicable to semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable to semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable to semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable to semi-annual report.

Item 6. Schedule of Investments.

The Schedule of Investments is included as part of the Report to Stockholders filed under Item 1 of this form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to semi-annual report.

Item 8. Portfolio Managers of Closed-End Management Investment Companies as of February 6, 2006

Not applicable to semi-annual report.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

3

Not applicable.

Item 10. Submission of Matters to Vote of Security Holders.

The Fund’s Bylaws provide that, with respect to an annual meeting of Stockholders, nominations of persons for election to the Board of Directors and the proposal of business to be considered by Stockholders may be made only (1) pursuant to the notice of the meeting, (2) by the Board of Directors or (3) by a Stockholder who is entitled to vote at the meeting and who has complied with the advance notice procedures of the Bylaws. With respect to special meetings of Stockholders, only the business specified in the notice of the meeting may be brought before the meeting. Nominations of persons for election to the Board of Directors at a special meeting may be made only (1) pursuant to the notice of the meeting, (2) by the Board of Directors or (3) provided that the Board of Directors has determined that directors will be elected at the meeting, by a Stockholder who is entitled to vote at the meeting and who has complied with the advance notice provisions of the Bylaws.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date.

(b) There was no change in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940, as amended) during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable.

(a)(2) The certifications required by Rule 30a-2(a) of the Investment Company Act of 1940, as amended, and Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto as Ex99.Cert.

(a)(3) Not applicable.

4

(b) The certifications by the registrant’s Principal Executive Officer and Principal Financial Officer, as required by Rule 30a-2(b) of the Investment Company Act of 1940, as amended, and Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto as Ex99.906Cert.

5

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Macquarie Global Infrastructure Total Return Fund

By: | /s/ Jon Fitch |

|

| Jon Fitch | |

| Chief Executive Officer (Principal Executive Officer) | |

|

| |

Date: | August 1st, 2006 | |