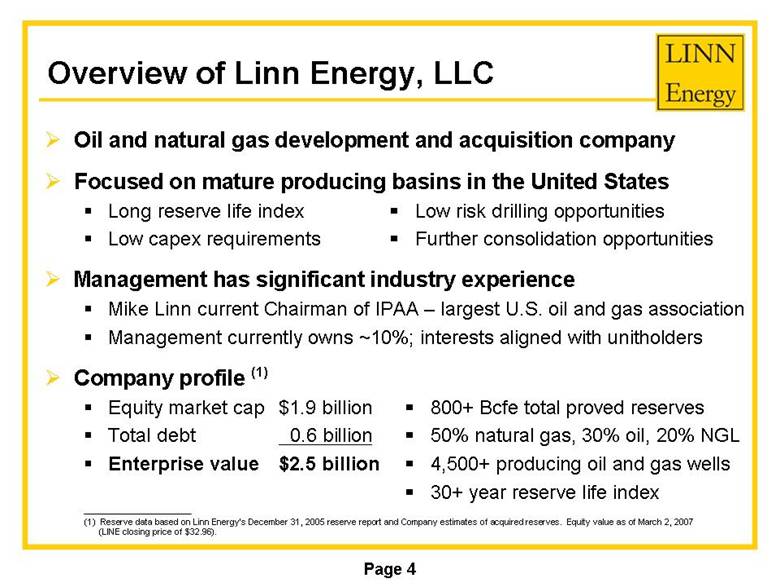

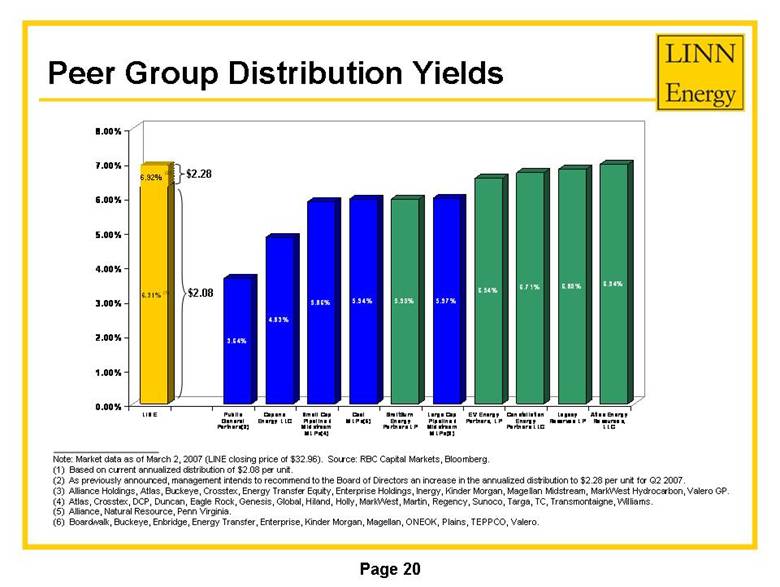

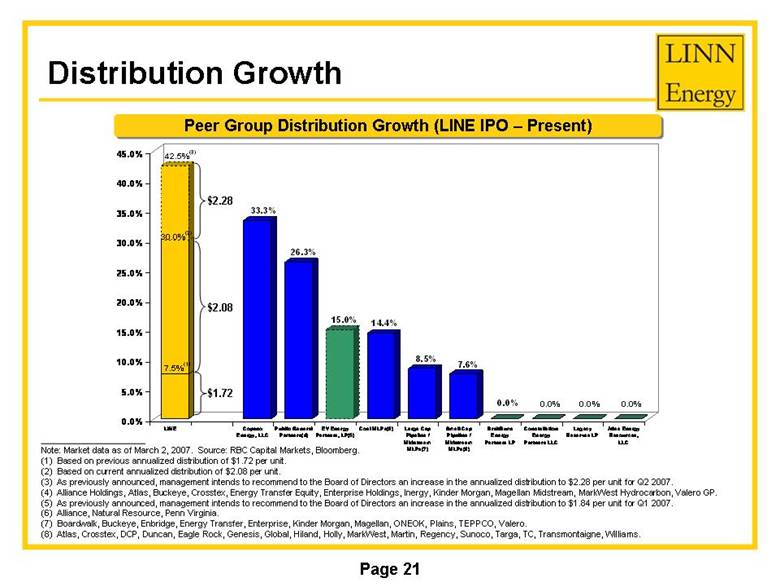

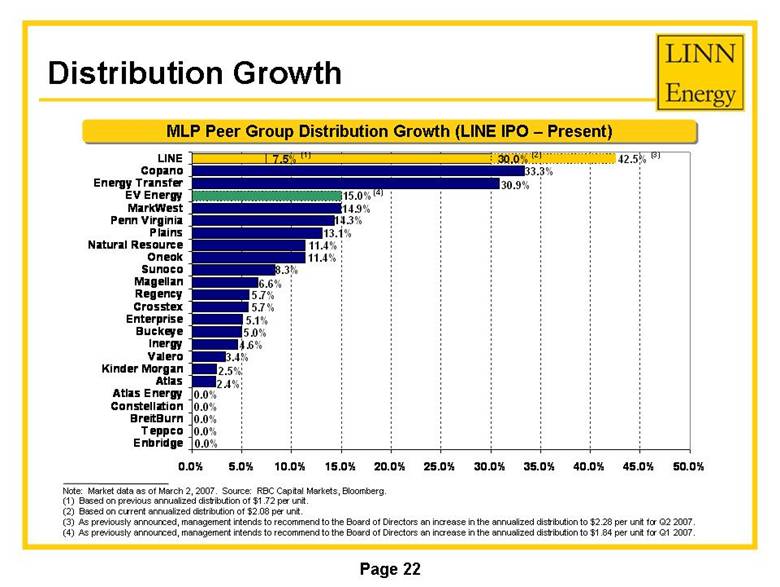

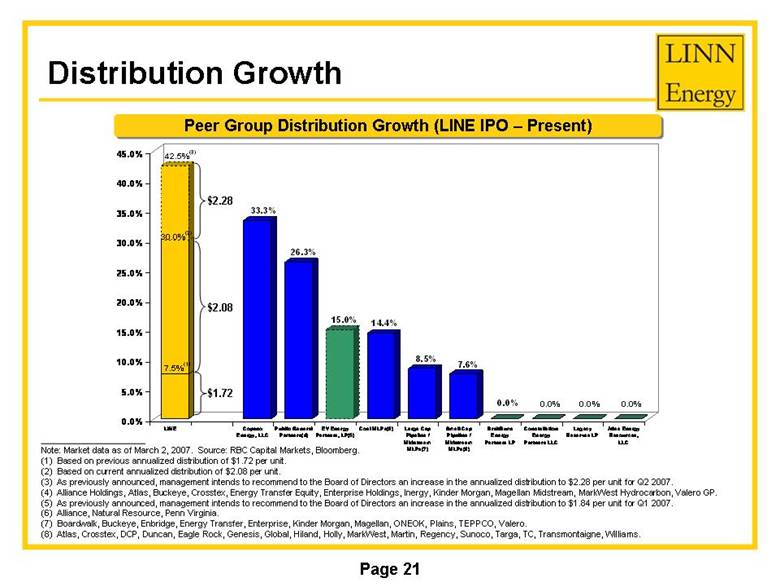

| Distribution Growth Note: Market data as of March 2, 2007. Source: RBC Capital Markets, Bloomberg. (1) Based on previous annualized distribution of $1.72 per unit. (2) Based on current annualized distribution of $2.08 per unit. (3) As previously announced, management intends to recommend to the Board of Directors an increase in the annualized distribution to $2.28 per unit for Q2 2007. (4) Alliance Holdings, Atlas, Buckeye, Crosstex, Energy Transfer Equity, Enterprise Holdings, Inergy, Kinder Morgan, Magellan Midstream, MarkWest Hydrocarbon, Valero GP. (5) As previously announced, management intends to recommend to the Board of Directors an increase in the annualized distribution to $1.84 per unit for Q1 2007. (6) Alliance, Natural Resource, Penn Virginia. (7) Boardwalk, Buckeye, Enbridge, Energy Transfer, Enterprise, Kinder Morgan, Magellan, ONEOK, Plains, TEPPCO, Valero. (8) Atlas, Crosstex, DCP, Duncan, Eagle Rock, Genesis, Global, Hiland, Holly, MarkWest, Martin, Regency, Sunoco, Targa, TC, Transmontaigne, Williams. Peer Group Distribution Growth (LINE IPO – Present) $2.08 $1.72 $2.28 7.5%(1) 30.0%(2) 42.5%(3) 33.3% 26.3% 15.0% 14.4% 8.5% 7.6% 0.0% 0.0% 0.0% 0.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% LINE Copano Energy, LLC Public General Partners(4) EV Energy Partners, LP(5) Coal MLPs(6) Large Cap Pipeline / Midstream MLPs(7) Small Cap Pipeline / Midstream MLPs(8) BreitBurn Energy Partners LP Constellation Energy Partners LLC Legacy Reserves LP Atlas Energy Resources, LLC |