|

Exhibit 99.3

|

LINN Energy

Supplemental Emergence Presentation

February 28, 2017

LINN Energy

Forward-Looking Statements and Risk Factors

Statements made in these presentation slides and by representatives of LINN Energy (“LINN” or the “Company”) during the course of this presentation that are not historical facts are “forward-looking statements.” These statements are based on certain assumptions and expectations made by the Company, which reflect management’s experience, estimates and perception of historical trends, current conditions, and anticipated future developments. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or anticipated in the forward-looking statements. These include risks relating to financial performance and results, ability to improve our financial results and profitability following emergence from bankruptcy, availability of sufficient cash flow to execute our business plan, continued low or further declining commodity prices and demand for oil, natural gas and natural gas liquids, ability to hedge future production, ability to replace reserves and efficiently develop current reserves, and the regulatory environment and other important factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. These and other important factors could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Please read “Risk Factors” in the Company’s

Annual Reports on Form10-K, Quarterly Reports on Form10-Q and other public filings. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information or future events.

LINN Energy

Reserve Estimates

The SEC permits oil and natural gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions for such terms. The Company may use terms in this presentation that the SEC’s guidelines strictly prohibit in SEC filings, such as “estimated ultimate recovery” or “EUR,” “resources,” “net resources,” “total resource potential” and similar terms to estimate oil and natural gas that may ultimately be recovered. These estimates are by their nature more speculative than estimates of proved, probable and possible reserves as used in SEC filings and, accordingly, are subject to substantially greater uncertainty of being actually realized. These estimates have not been fully risked by management. Actual quantities that may be ultimately recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery include the scope of the Company’s actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual drilling results and recoveries of oil and natural gas in place, and other factors. These estimates may change significantly as the development of properties provides additional data.

PV-10

PV-10 represents the present value, discounted at 10% per year, of estimated future net cash flows. The Company’s calculation of PV-10 herein differs from the standardized measure of discounted future net cash flows determined in accordance with the rules and regulations of the SEC in that it is calculated before income taxes and including the impact of helium, using strip prices as of February 15, 2017, rather than after income taxes and not including the impact of helium, using the average price during the 12-month period, determined as an unweighted average of the first-day-of-the-month price for each month. The Company’s calculation of PV-10 should not be considered as an alternative to the standardized measure of discounted future net cash flows determined in accordance with the rules and regulations of the SEC.

The New LINN

LINN Energy

Successfully emerged from financial restructuring

Reduced debt by more than $5 billion to total debt of $1,012 (pro forma net debt of $962 million(1)) and recently initiated a sale process ofnon-core assets to furtherde-lever

~185,000 net acres in SCOOP/STACK/Merge – a premier onshore U.S. play

~49,000 net acres in the highly prospective Merge, where LINN holds a dominant position and operates a 60 MMcf/d refrigeration plant with expansion capability

2.6+ million net acres (98%+ HBP) with exposure to emerging stacked pay opportunities inMid-Continent, Rockies, East Texas and North Louisiana

Ample liquidity of ~$730 million to accelerate growth in core areas

Predictable,low-cost production base of ~828 MMcfe/d (13% decline rate) with significant upside levers and growth opportunities

Operating cost structure reduced by ~27% to position the Company as a premier,low-cost, operator with the ability to further improve margins

Simplified corporate structure with the separation of Berry and all associated costs

Proved DevelopedPV-10 of ~$3.1 billion(2&3)

(1) See reconciliation of net debt (anon-GAAP measure) on slide 29. Financial projections from Exhibit C in the disclosure statement adjusted for $40 million GUC payment

(2) Strip pricing as of February 15, 2017 shown as Natural Gas / Oil per year: 2017 $3.27/$54.17 | 2018 $3.03/$54.93 | 2019 $2.85/$54.50 | 2020 $2.84/$54.32 | 2021 $2.84/$54.46 | 2022 $2.85/$54.96 (3) Refer to slide 3 for thePV-10 disclosure | Note: Unless indicated otherwise, all operational and reserve data is as of December 31, 2016 4

Table of Contents

LINN Energy

Slides Overview of Assets 6 Asset Detail 7 Proved Reserves 8 Net Asset Value 9 Asset Sales 10 SCOOP / STACK / Merge & Midstream11-18 Arkoma –Mid-Continent Growth 19 Rockies Growth20-23 East Texas and North Louisiana Growth24-25 Hugoton – Legacy Low Decline Asset 26 Permian – Mature Waterfloods 27 California – Shallow Decline Oil Asset 28 Diverse Long Life Producing Assets 29 Pro Forma Capitalization 30 Debt Reduction 31 Reorganized Capital Structure 32 Commodity Hedge Portfolio 33 New Board of Directors 34

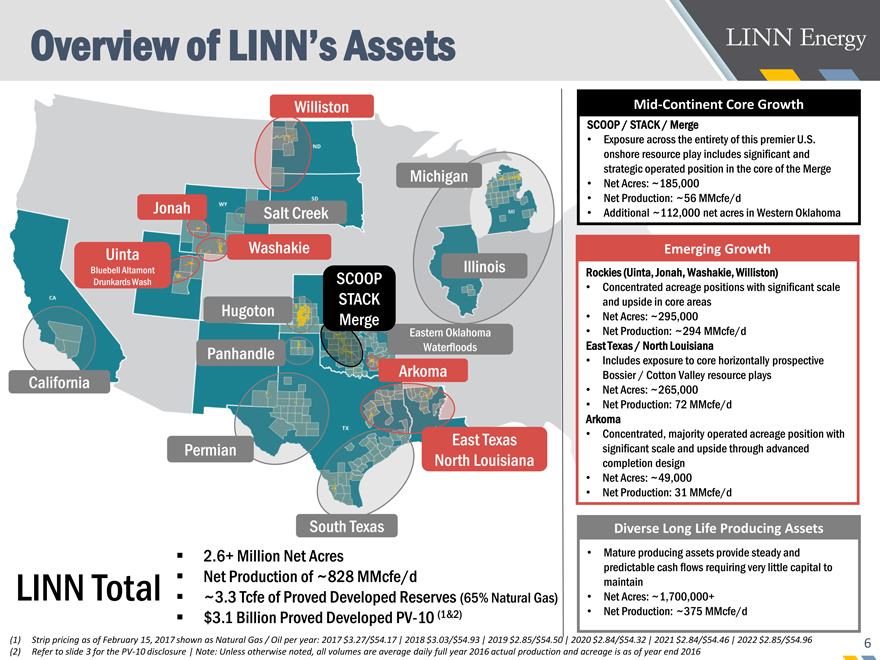

Overview of LINN’s Assets

LINN Energy

Williston

Michigan

Jonah

Salt Creek

Illinois

Washakie

Uinta

Bluebell Altamont Drunkards Wash

Hugoton

SCOOP STACK Merge

Eastern Oklahoma Waterfloods

Panhandle

California

Permian

Arkoma

East Texas North Louisiana

Mid-Continent Core Growth

SCOOP / STACK / Merge

• Exposure across the entirety of this premier U.S. onshore resource play includes significant and strategic operated position in the core of the Merge

• Net Acres: ~185,000

• Net Production: ~56 MMcfe/d

• Additional ~112,000 net acres in Western Oklahoma

Emerging Growth

Rockies (Uinta, Jonah, Washakie, Williston)

• Concentrated acreage positions with significant scale and upside in core areas

• Net Acres: ~295,000

• Net Production: ~294 MMcfe/d East Texas / North Louisiana

• Includes exposure to core horizontally prospective Bossier / Cotton Valley resource plays

• Net Acres: ~265,000

• Net Production: 72 MMcfe/d Arkoma

• Concentrated, majority operated acreage position with significant scale and upside through advanced completion design

• Net Acres: ~49,000

• Net Production: 31 MMcfe/d

Diverse Long Life Producing Assets

• Mature producing assets provide steady and predictable cash flows requiring very little capital to maintain

• Net Acres: ~1,700,000+

• Net Production: ~375 MMcfe/d

South Texas??2.6+ Million Net Acres LINN Total??Net Production of ~828 MMcfe/d

??~3.3 Tcfe of Proved Developed Reserves (65% Natural Gas)??$3.1 Billion Proved DevelopedPV-10 (1&2)

(1) Strip pricing as of February 15, 2017 shown as Natural Gas / Oil per year: 2017 $3.27/$54.17 | 2018 $3.03/$54.93 | 2019 $2.85/$54.50 | 2020 $2.84/$54.32 | 2021 $2.84/$54.46 | 2022 $2.85/$54.96 (2) Refer to slide 3 for thePV-10 disclosure | Note: Unless otherwise noted, all volumes are average daily full year 2016 actual production and acreage is as of year end 2016

LINN Energy

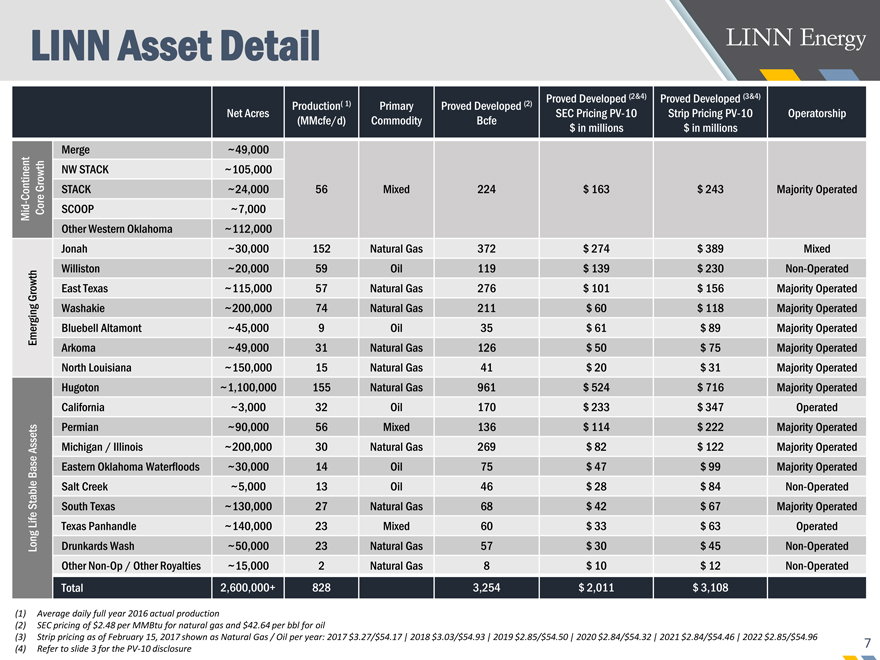

LINN Asset Detail

Production( 1) Primary Proved Developed (2) Proved Developed (2&4) Proved Developed (3&4)

Net Acres SEC PricingPV-10 Strip PricingPV-10 Operatorship (MMcfe/d) Commodity Bcfe $ in millions $ in millions Merge ~49,000 Growth NW STACK ~105,000 STACK ~24,000 56 Mixed 224 $ 163 $ 243 Majority Operated Continent Mid—Core SCOOP ~7,000 Other Western Oklahoma ~112,000 Jonah ~30,000 152 Natural Gas 372 $ 274 $ 389 Mixed Williston ~20,000 59 Oil 119 $ 139 $ 230Non-Operated Growth East Texas ~115,000 57 Natural Gas 276 $ 101 $ 156 Majority Operated Washakie ~200,000 74 Natural Gas 211 $ 60 $ 118 Majority Operated Emerging Bluebell Altamont ~45,000 9 Oil 35 $ 61 $ 89 Majority Operated Arkoma ~49,000 31 Natural Gas 126 $ 50 $ 75 Majority Operated North Louisiana ~150,000 15 Natural Gas 41 $ 20 $ 31 Majority Operated Hugoton ~1,100,000 155 Natural Gas 961 $ 524 $ 716 Majority Operated California ~3,000 32 Oil 170 $ 233 $ 347 Operated Permian ~90,000 56 Mixed 136 $ 114 $ 222 Majority Operated Assets Michigan / Illinois ~200,000 30 Natural Gas 269 $ 82 $ 122 Majority Operated Base Eastern Oklahoma Waterfloods ~30,000 14 Oil 75 $ 47 $ 99 Majority Operated Stable Salt Creek ~5,000 13 Oil 46 $ 28 $ 84Non-Operated South Texas ~130,000 27 Natural Gas 68 $ 42 $ 67 Majority Operated Life Texas Panhandle ~140,000 23 Mixed 60 $ 33 $ 63 Operated Long Drunkards Wash ~50,000 23 Natural Gas 57 $ 30 $ 45Non-Operated OtherNon-Op / Other Royalties ~15,000 2 Natural Gas 8 $ 10 $ 12Non-Operated Total 2,600,000+ 828 3,254 $ 2,011 $ 3,108

(1) Average daily full year 2016 actual production

(2) SEC pricing of $2.48 per MMBtu for natural gas and $42.64 per bbl for oil

(3) Strip pricing as of February 15, 2017 shown as Natural Gas / Oil per year: 2017 $3.27/$54.17 | 2018 $3.03/$54.93 | 2019 $2.85/$54.50 | 2020 $2.84/$54.32 | 2021 $2.84/$54.46 | 2022 $2.85/$54.96 (4) Refer to slide 3 for thePV-10 disclosure

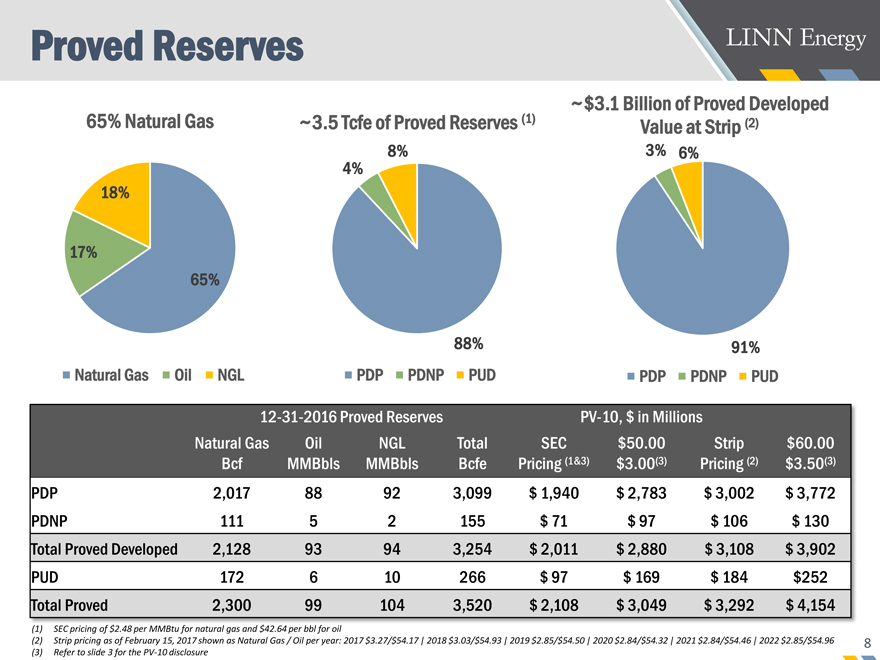

Proved Reserves

LINN Energy

(1) ~$3.1 Billion of Proved Developed 65% Natural Gas ~3.5 Tcfe of Proved Reserves Value at Strip (2)

8% 3% 6% 4% 18%

17%

65%

88% 91% Natural Gas Oil NGL PDP PDNP PUD PDP PDNP PUD

12-31-2016 Proved ReservesPV-10, $ in Millions

Natural Gas Oil NGL Total SEC $50.00 Strip $60.00 Bcf MMBbls MMBbls Bcfe Pricing (1&3) $3.00(3) Pricing (2) $3.50(3) PDP 2,017 88 92 3,099 $ 1,940 $ 2,783 $ 3,002 $ 3,772 PDNP 111 5 2 155 $ 71 $ 97 $ 106 $ 130 Total Proved Developed 2,128 93 94 3,254 $ 2,011 $ 2,880 $ 3,108 $ 3,902 PUD 172 6 10 266 $ 97 $ 169 $ 184 $252 Total Proved 2,300 99 104 3,520 $ 2,108 $ 3,049 $ 3,292 $ 4,154

(1) SEC pricing of $2.48 per MMBtu for natural gas and $42.64 per bbl for oil

(2) Strip pricing as of February 15, 2017 shown as Natural Gas / Oil per year: 2017 $3.27/$54.17 | 2018 $3.03/$54.93 | 2019 $2.85/$54.50 | 2020 $2.84/$54.32 | 2021 $2.84/$54.46 | 2022 $2.85/$54.96 (3) Refer to slide 3 for thePV-10 disclosure

LINN Energy

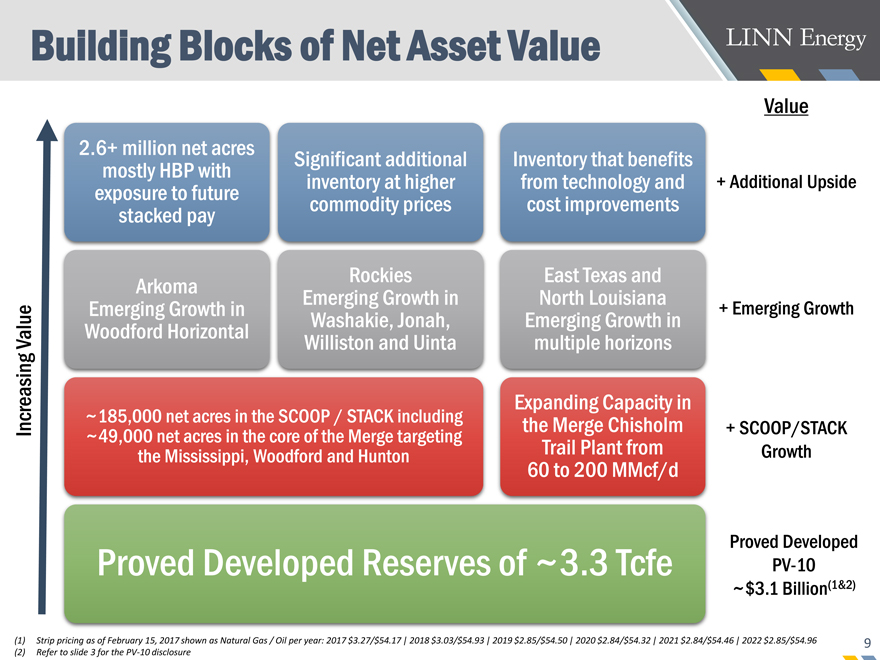

Building Blocks of Net Asset Value

Value

2.6+ million net acres

Significant additional Inventory that benefits mostly HBP with inventory at higher from technology and + Additional Upside exposure to future commodity prices cost improvements stacked pay

Rockies East Texas and Arkoma

Emerging Growth in North Louisiana

Emerging Growth in + Emerging Growth Washakie, Jonah, Emerging Growth in Value Woodford Horizontal Williston and Uinta multiple horizons

Expanding Capacity in

~185,000 net acres in the SCOOP / STACK including the Merge Chisholm

Increasing ~49,000 net acres in the core of the Merge targeting Trail Plant from + SCOOP/STACK the Mississippi, Woodford and Hunton Growth

60 to 200 MMcf/d

Proved Developed

Proved Developed Reserves of ~3.3 TcfePV-10

~$3.1 Billion(1&2)

(1) Strip pricing as of February 15, 2017 shown as Natural Gas / Oil per year: 2017 $3.27/$54.17 | 2018 $3.03/$54.93 | 2019 $2.85/$54.50 | 2020 $2.84/$54.32 | 2021 $2.84/$54.46 | 2022 $2.85/$54.96 (2) Refer to slide 3 for thePV-10 disclosure

LINN Energy

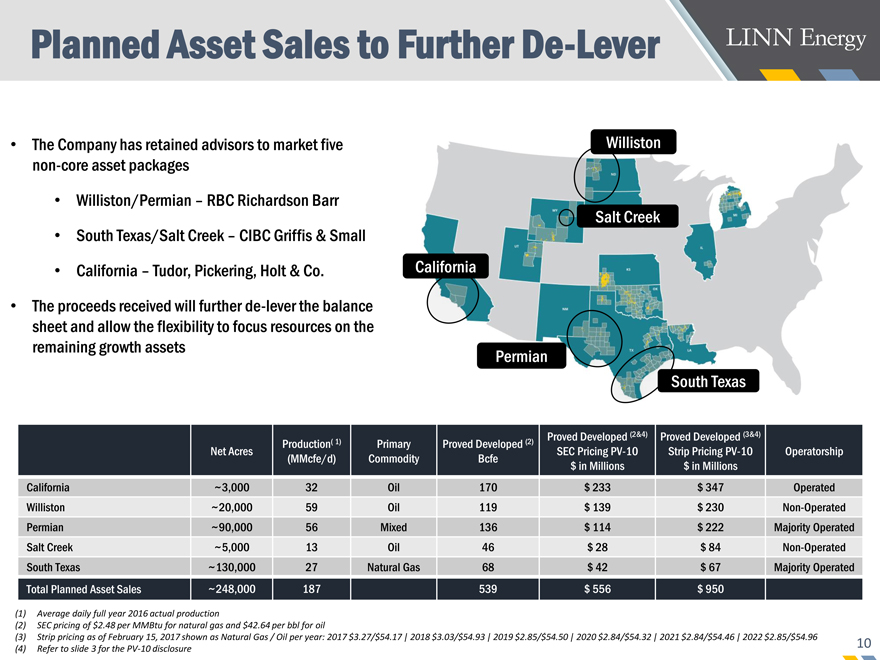

Planned Asset Sales to FurtherDe-Lever

• The Company has retained advisors to market five Willistonnon-core asset packages

• Williston/Permian – RBC Richardson Barr

Salt Creek

• South Texas/Salt Creek – CIBC Griffis & Small

• California – Tudor, Pickering, Holt & Co. California

• The proceeds received will furtherde-lever the balance sheet and allow the flexibility to focus resources on the remaining growth assets

Permian

South Texas

Production( 1) Primary Proved Developed (2) Proved Developed (2&4) Proved Developed (3&4)

Net Acres SEC PricingPV-10 Strip PricingPV-10 Operatorship (MMcfe/d) Commodity Bcfe $ in Millions $ in Millions California ~3,000 32 Oil 170 $ 233 $ 347 Operated Williston ~20,000 59 Oil 119 $ 139 $ 230Non-Operated Permian ~90,000 56 Mixed 136 $ 114 $ 222 Majority Operated Salt Creek ~5,000 13 Oil 46 $ 28 $ 84Non-Operated South Texas ~130,000 27 Natural Gas 68 $ 42 $ 67 Majority Operated Total Planned Asset Sales ~248,000 187 539 $ 556 $ 950

(1) Average daily full year 2016 actual production

(2) SEC pricing of $2.48 per MMBtu for natural gas and $42.64 per bbl for oil

(3) Strip pricing as of February 15, 2017 shown as Natural Gas / Oil per year: 2017 $3.27/$54.17 | 2018 $3.03/$54.93 | 2019 $2.85/$54.50 | 2020 $2.84/$54.32 | 2021 $2.84/$54.46 | 2022 $2.85/$54.96 (4) Refer to slide 3 for thePV-10 disclosure

Linn energy

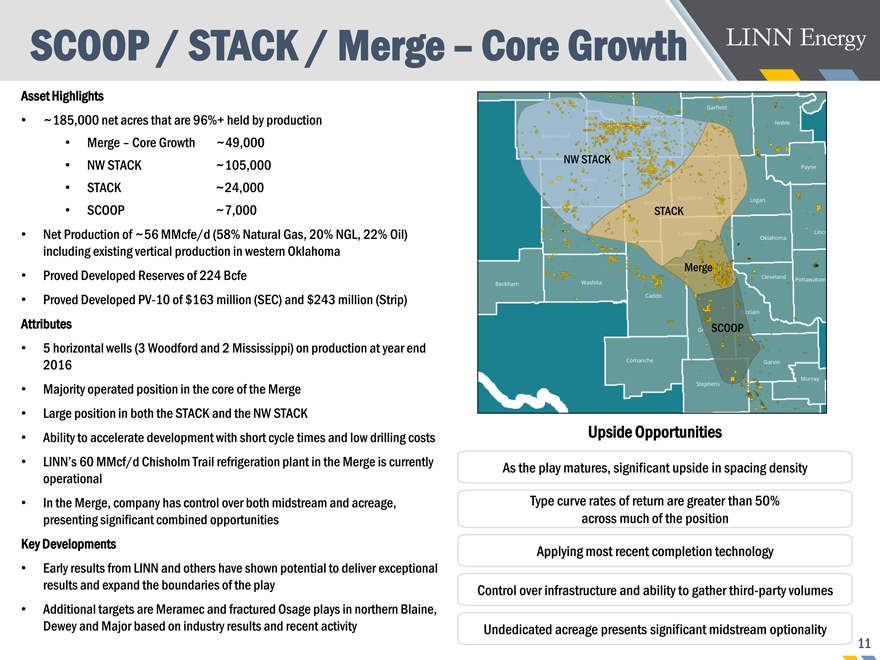

SCOOP / STACK / Merge – Core Growth

Asset Highlights

• ~185,000 net acres that are 96%+ held by production

• Merge – Core Growth ~49,000

• NW STACK ~105,000 NW STACK

• STACK ~24,000

• SCOOP ~7,000 STACK

• Net Production of ~56 MMcfe/d (58% Natural Gas, 20% NGL, 22% Oil) including existing vertical production in western Oklahoma

Merge

• Proved Developed Reserves of 224 Bcfe

• Proved DevelopedPV-10 of $163 million (SEC) and $243 million (Strip)

Attributes SCOOP

• 5 horizontal wells (3 Woodford and 2 Mississippi) on production at year end 2016

• Majority operated position in the core of the Merge

• Large position in both the STACK and the NW STACK

• Ability to accelerate development with short cycle times and low drilling costs Upside Opportunities

• LINN’s 60 MMcf/d Chisholm Trail refrigeration plant in the Merge is currently As the play matures, significant upside in spacing density operational

• In the Merge, company has control over both midstream and acreage, Type curve rates of return are greater than 50% presenting significant combined opportunities across much of the position Key Developments

Applying most recent completion technology

• Early results from LINN and others have shown potential to deliver exceptional results and expand the boundaries of the play Control over infrastructure and ability to gather third-party volumes

• Additional targets are Meramec and fractured Osage plays in northern Blaine,

Dewey and Major based on industry results and recent activity Undedicated acreage presents significant midstream optionality

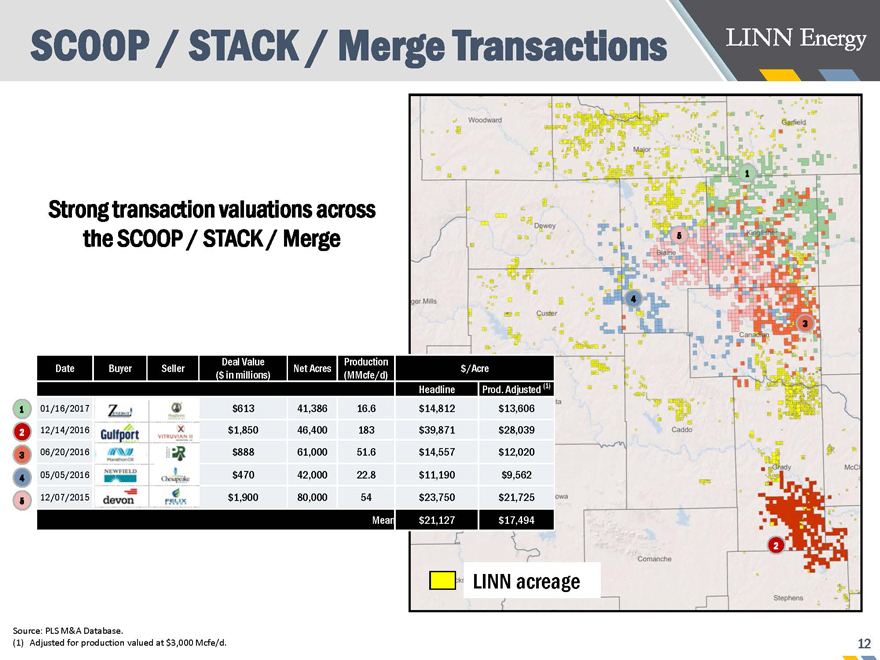

SCOOP / STACK / Merge Transactions

1

Strong transaction valuations across

the SCOOP / STACK / Merge 5

4

3

Deal Value Production

Date Buyer Seller Net Acres $/Acre

($ in millions) (MMcfe/d)

Headline Prod. Adjusted (1)

1 01/16/2017 $613 41,386 16.6 $14,812 $13,606

2 12/14/2016 $1,850 46,400 183 $39,871 $28,039

3 06/20/2016 $888 61,000 51.6 $14,557 $12,020

4 05/05/2016 $470 42,000 22.8 $11,190 $9,562

5 12/07/2015 $1,900 80,000 54 $23,750 $21,725

Mean $21,127 $17,494

2

LINN acreage

Source: PLS M&A Database.

(1) Adjusted for production valued at $3,000 Mcfe/d. 12

Linn energy

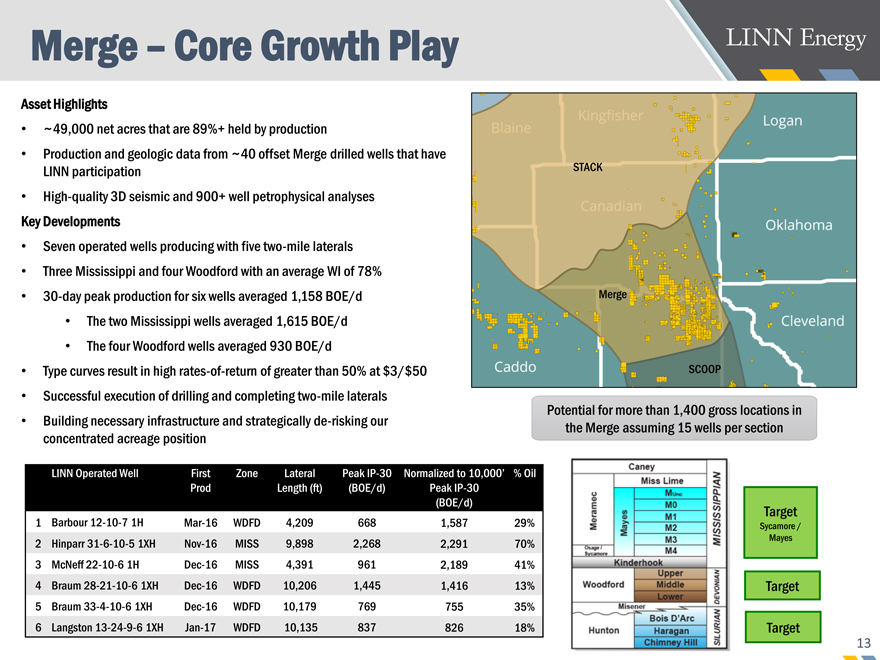

Merge – Core Growth Play

Asset Highlights

• ~49,000 net acres that are 89%+ held by production

• Production and geologic data from ~40 offset Merge drilled wells that have

LINN participation STACK

• High-quality 3D seismic and 900+ well petrophysical analyses Key Developments

• Seven operated wells producing with fivetwo-mile laterals

• Three Mississippi and four Woodford with an average WI of 78%

•30-day peak production for six wells averaged 1,158 BOE/d Merge

• The two Mississippi wells averaged 1,615 BOE/d

• The four Woodford wells averaged 930 BOE/d

• Type curves result in highrates-of-return of greater than 50% at $3/$50 SCOOP

• Successful execution of drilling and completingtwo-mile laterals

Potential for more than 1,400 gross locations in

• Building necessary infrastructure and strategicallyde-risking our the Merge assuming 15 wells per section concentrated acreage position

LINN Operated Well First Zone Lateral PeakIP-30 Normalized to 10,000’ % Oil Prod Length (ft) (BOE/d) PeakIP-30 (BOE/d)

Target

1 Barbour12-10-7 1HMar-16 WDFD 4,209 668 1,587 29% Sycamore / Mayes

2 Hinparr31-6-10-5 1XHNov-16 MISS 9,898 2,268 2,291 70%

3 McNeff22-10-6 1HDec-16 MISS 4,391 961 2,189 41%

4 Braum28-21-10-6 1XHDec-16 WDFD 10,206 1,445 1,416 13% Target

5 Braum33-4-10-6 1XHDec-16 WDFD 10,179 769 755 35%

6 Langston13-24-9-6 1XHJan-17 WDFD 10,135 837 826 18% Target

Linn energy

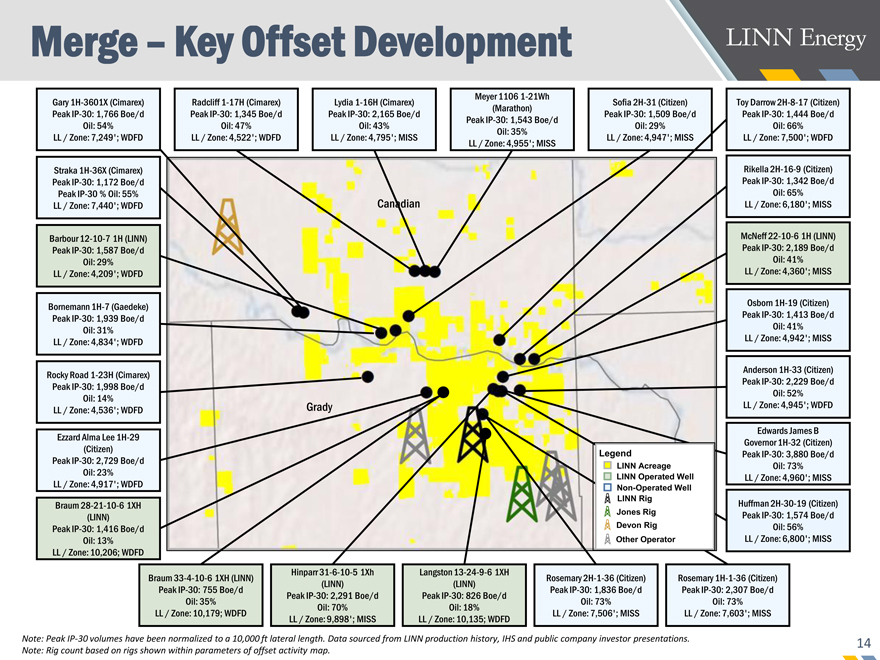

South Texa Merge – Key Offset Development

Meyer 11061-21Wh

Gary1H-3601X (Cimarex) Radcliff1-17H (Cimarex) Lydia1-16H (Cimarex) Sofia2H-31 (Citizen) Toy Darrow2H-8-17 (Citizen) (Marathon) PeakIP-30: 1,766 Boe/d PeakIP-30: 1,345 Boe/d PeakIP-30: 2,165 Boe/d PeakIP-30: 1,509 Boe/d PeakIP-30: 1,444 Boe/d PeakIP-30: 1,543 Boe/d Oil: 54% Oil: 47% Oil: 43% Oil: 29% Oil: 66% Oil: 35% LL / Zone: 7,249’; WDFD LL / Zone: 4,522’; WDFD LL / Zone: 4,795’; MISS LL / Zone: 4,947’; MISS LL / Zone: 7,500’; WDFD

LL / Zone: 4,955’; MISS

Straka1H-36X (Cimarex) Rikella2H-16-9 (Citizen) PeakIP-30: 1,172 Boe/d PeakIP-30: 1,342 Boe/d PeakIP-30 % Oil: 55% Oil: 65% LL / Zone: 7,440’; WDFD Canadian LL / Zone: 6,180’; MISS

Barbour12-10-7 1H (LINN) McNeff22-10-6 1H (LINN) PeakIP-30: 1,587 Boe/d PeakIP-30: 2,189 Boe/d Oil: 29% Oil: 41% LL / Zone: 4,209’; WDFD LL / Zone: 4,360’; MISS

Bornemann1H-7 (Gaedeke) Osborn1H-19 (Citizen) PeakIP-30: 1,939 Boe/d PeakIP-30: 1,413 Boe/d Oil: 31% Oil: 41% LL / Zone: 4,834’; WDFD LL / Zone: 4,942’; MISS

Anderson1H-33 (Citizen) Rocky Road1-23H (Cimarex) PeakIP-30: 2,229 Boe/d PeakIP-30: 1,998 Boe/d Oil: 52% Oil: 14% Grady LL / Zone: 4,945’; WDFD

LL / Zone: 4,536’; WDFD

Edwards James B Ezzard Alma Lee1H-29 Governor1H-32 (Citizen) (Citizen) Legend PeakIP-30: 3,880 Boe/d PeakIP-30: 2,729 Boe/d

LINN Acreage Oil: 73% Oil: 23%

LINN Operated Well LL / Zone: 4,960’; MISS LL / Zone: 4,917’; WDFDNon-Operated Well LINN Rig Huffman2H-30-19 (Citizen) Braum28-21-10-6 1XH

Jones Rig PeakIP-30: 1,574 Boe/d (LINN) Devon Rig

PeakIP-30: 1,416 Boe/d Oil: 56%

Oil: 13% Other Operator LL / Zone: 6,800’; MISS LL / Zone: 10,206; WDFD

Hinparr31-6-10-5 1Xh Langston13-24-9-6 1XH

Braum33-4-10-6 1XH (LINN) Rosemary2H-1-36 (Citizen) Rosemary1H-1-36 (Citizen) (LINN) (LINN) PeakIP-30: 755 Boe/d PeakIP-30: 1,836 Boe/d PeakIP-30: 2,307 Boe/d PeakIP-30: 2,291 Boe/d PeakIP-30: 826 Boe/d Oil: 35% Oil: 73% Oil: 73% Oil: 70% Oil: 18% LL / Zone: 10,179; WDFD LL / Zone: 7,506’; MISS LL / Zone: 7,603’; MISS

LL / Zone: 9,898’; MISS LL / Zone: 10,135; WDFD

ote: PeakIP-30 volumes have been normalized to a 10,000 ft lateral length. Data sourced from LINN production history, IHS and public company investor presentations. ote: Rig count based on rigs shown within parameters of offset activity map.

s

linn energy

15

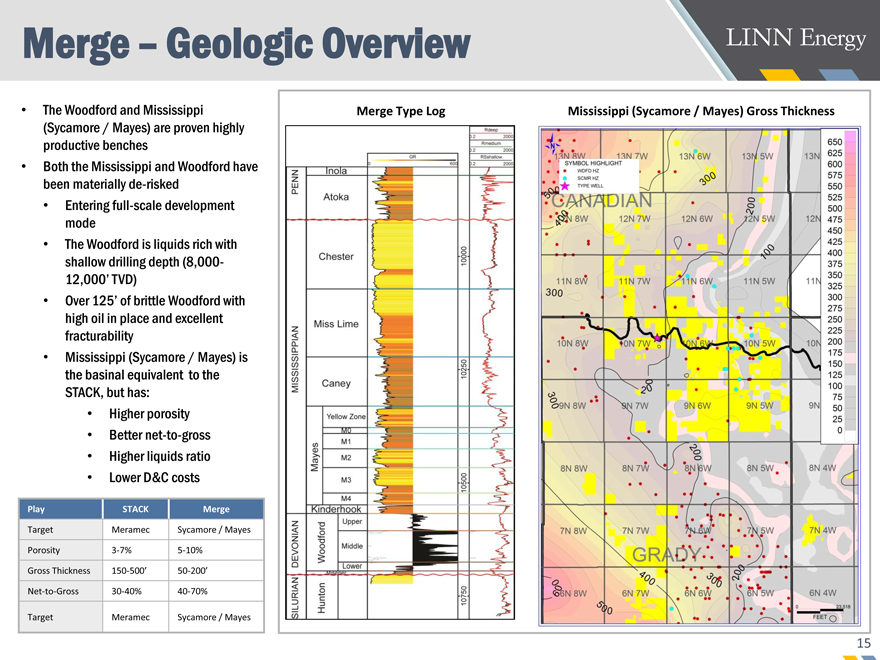

Merge – Geologic Overview

Merge Type Log Mississippi (Sycamore / Mayes) Gross Thickness

Play STACK Merge

Target Meramec Sycamore / Mayes

Porosity3-7%5-10%

Gross Thickness150-500’50-200’

Net-to-Gross30-40%40-70%

Target Meramec Sycamore / Mayes

• The Woodford and Mississippi

(Sycamore / Mayes) are proven highly

productive benches

• Both the Mississippi and Woodford have

been materiallyde-risked

• Entering full-scale development

mode

• The Woodford is liquids rich with

shallow drilling depth (8,000-

12,000’ TVD)

• Over 125’ of brittle Woodford with

high oil in place and excellent

fracturability

• Mississippi (Sycamore / Mayes) is

the basinal equivalent to the

STACK, but has:

• Higher porosity

• Betternet-to-gross

• Higher liquids ratio

• Lower D&C costs

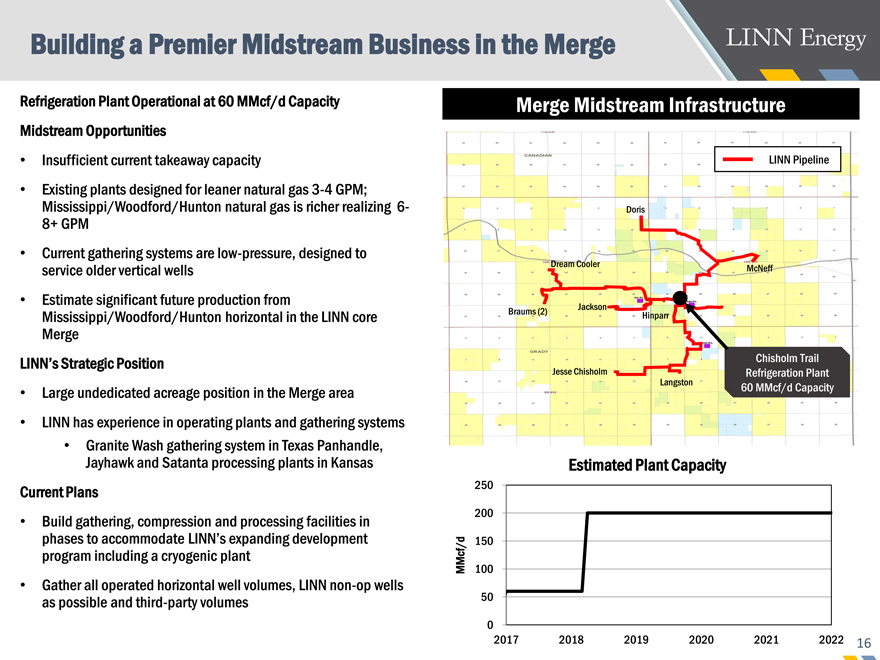

Braums (2)

Doris

McNeff

Hinparr

Jackson

Dream Cooler

Langston

Jesse Chisholm

Refrigeration Plant Operational at 60 MMcf/d Capacity

Midstream Opportunities

• Insufficient current takeaway capacity

• Existing plants designed for leaner natural gas3-4 GPM;

Mississippi/Woodford/Hunton natural gas is richer realizing 6-

8+ GPM

• Current gathering systems arelow-pressure, designed to

service older vertical wells

• Estimate significant future production from

Mississippi/Woodford/Hunton horizontal in the LINN core

Merge

LINN’s Strategic Position

• Large undedicated acreage position in the Merge area

• LINN has experience in operating plants and gathering systems

• Granite Wash gathering system in Texas Panhandle,

Jayhawk and Satanta processing plants in Kansas

Current Plans

• Build gathering, compression and processing facilities in

phases to accommodate LINN’s expanding development

program including a cryogenic plant

• Gather all operated horizontal well volumes, LINNnon-op wells

as possible and third-party volumes

16

Building a Premier Midstream Business in the Merge

0

50

100

150

200

250

2017 2018 2019 2020 2021 2022

MMcf/d

Estimated Plant Capacity

Merge Midstream Infrastructure

Chisholm Trail

Refrigeration Plant

60 MMcf/d Capacity

LINN Pipeline

17

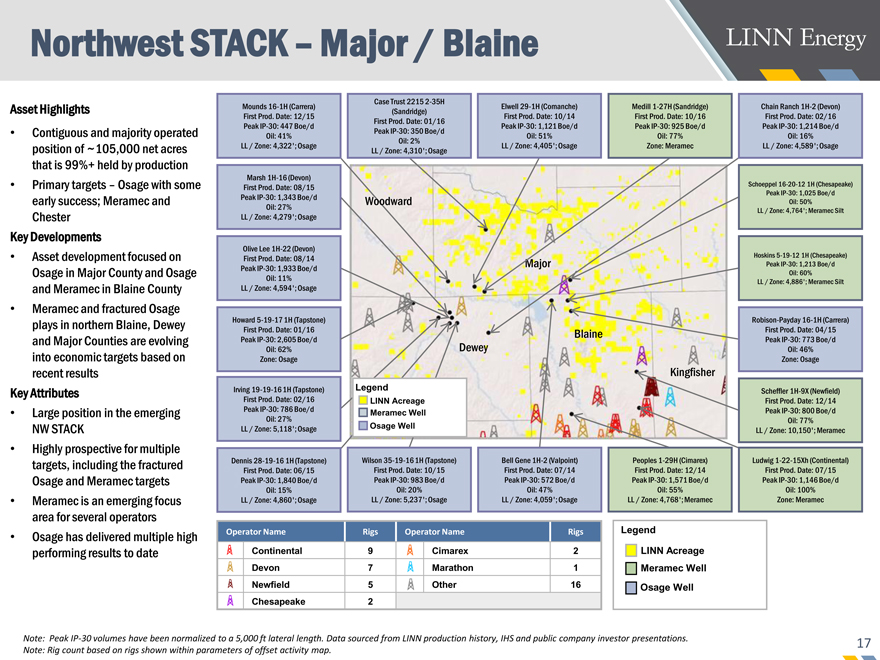

Northwest STACK – Major / Blaine

Asset Highlights

• Contiguous and majority operated

position of ~105,000 net acres

that is 99%+ held by production

• Primary targets – Osage with some

early success; Meramec and

Chester

Key Developments

• Asset development focused on

Osage in Major County and Osage

and Meramec in Blaine County

• Meramec and fractured Osage

plays in northern Blaine, Dewey

and Major Counties are evolving

into economic targets based on

recent results

Key Attributes

• Large position in the emerging

NW STACK

• Highly prospective for multiple

targets, including the fractured

Osage and Meramec targets

• Meramec is an emerging focus

area for several operators

• Osage has delivered multiple high

performing results to date

Dewey Blaine

Operator Name Rigs Operator Name Rigs

Continental 9 Cimarex 2

Devon 7 Marathon 1

Newfield 5 Other 16

Chesapeake 2

Note: PeakIP-30 volumes have been normalized to a 5,000 ft lateral length. Data sourced from LINN production history, IHS and public company investor presentations.

Note: Rig count based on rigs shown within parameters of offset activity map.

Legend

Osage Well

Meramec Well

LINN Acreage

Dennis28-19-16 1H (Tapstone)

First Prod. Date: 06/15

PeakIP-30: 1,840 Boe/d

Oil: 15%

LL / Zone: 4,860’; Osage

Olive Lee1H-22 (Devon)

First Prod. Date: 08/14

PeakIP-30: 1,933 Boe/d

Oil: 11%

LL / Zone: 4,594’; Osage

Chain Ranch1H-2 (Devon)

First Prod. Date: 02/16

PeakIP-30: 1,214 Boe/d

Oil: 16%

LL / Zone: 4,589’; Osage

Wilson35-19-16 1H (Tapstone)

First Prod. Date: 10/15

PeakIP-30: 983 Boe/d

Oil: 20%

LL / Zone: 5,237’; Osage

Elwell29-1H (Comanche)

First Prod. Date: 10/14

PeakIP-30: 1,121 Boe/d

Oil: 51%

LL / Zone: 4,405’; Osage

Irving19-19-16 1H (Tapstone)

First Prod. Date: 02/16

PeakIP-30: 786 Boe/d

Oil: 27%

LL / Zone: 5,118’; Osage

Robison-Payday16-1H (Carrera)

First Prod. Date: 04/15

PeakIP-30: 773 Boe/d

Oil: 46%

Zone: Osage

Bell Gene1H-2 (Valpoint)

First Prod. Date: 07/14

PeakIP-30: 572 Boe/d

Oil: 47%

LL / Zone: 4,059’; Osage

Hoskins5-19-12 1H (Chesapeake)

PeakIP-30: 1,213 Boe/d

Oil: 60%

LL / Zone: 4,886’; Meramec Silt

Schoeppel16-20-12 1H (Chesapeake)

PeakIP-30: 1,025 Boe/d

Oil: 50%

LL / Zone: 4,764’; Meramec Silt

Scheffler1H-9X (Newfield)

First Prod. Date: 12/14

PeakIP-30: 800 Boe/d

Oil: 77%

LL / Zone: 10,150’; Meramec

Ludwig1-22-15Xh (Continental)

First Prod. Date: 07/15

PeakIP-30: 1,146 Boe/d

Oil: 100%

Zone: Meramec

Peoples1-29H (Cimarex)

First Prod. Date: 12/14

PeakIP-30: 1,571 Boe/d

Oil: 55%

LL / Zone: 4,768’; Meramec

Marsh1H-16 (Devon)

First Prod. Date: 08/15

PeakIP-30: 1,343 Boe/d

Oil: 27%

LL / Zone: 4,279’; Osage

Case Trust 22152-35H

(Sandridge)

First Prod. Date: 01/16

PeakIP-30: 350 Boe/d

Oil: 2%

LL / Zone: 4,310’; Osage

Major

Dewey

Blaine

Woodward

Kingfisher

Mounds16-1H (Carrera)

First Prod. Date: 12/15

PeakIP-30: 447 Boe/d

Oil: 41%

LL / Zone: 4,322’; Osage

Legend

Osage Well

Meramec Well

LINN Acreage

Howard5-19-17 1H (Tapstone)

First Prod. Date: 01/16

PeakIP-30: 2,605 Boe/d

Oil: 62%

Zone: Osage

Medill1-27H (Sandridge)

First Prod. Date: 10/16

PeakIP-30: 925 Boe/d

Oil: 77%

Zone: Meramec

18

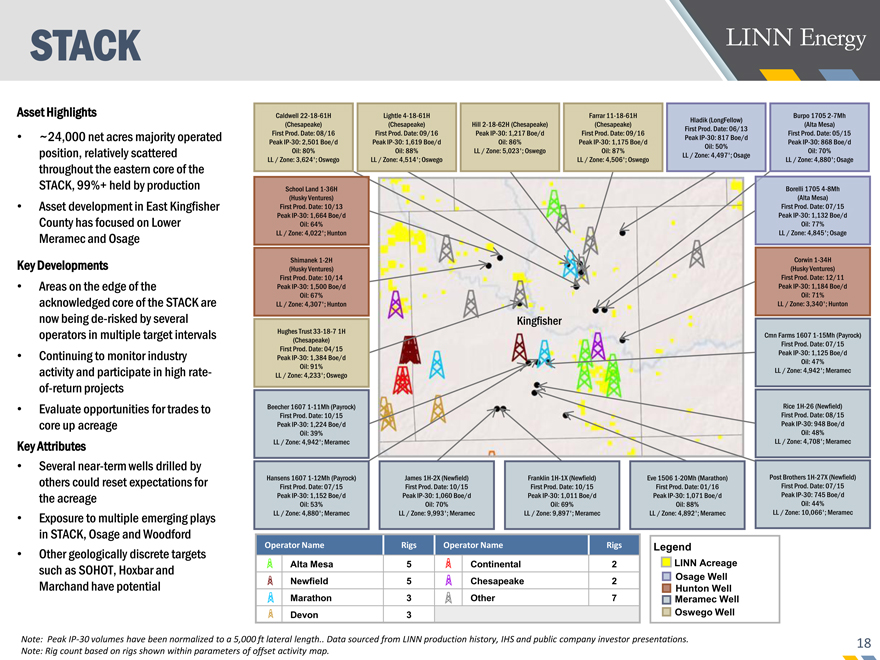

STACK

Asset Highlights

• ~24,000 net acres majority operated

position, relatively scattered

throughout the eastern core of the

STACK, 99%+ held by production

• Asset development in East Kingfisher

County has focused on Lower

Meramec and Osage

Key Developments

• Areas on the edge of the

acknowledged core of the STACK are

now beingde-risked by several

operators in multiple target intervals

• Continuing to monitor industry

activity and participate in high rateof-

return projects

• Evaluate opportunities for trades to

core up acreage

Key Attributes

• Several near-term wells drilled by

others could reset expectations for

the acreage

• Exposure to multiple emerging plays

in STACK, Osage and Woodford

• Other geologically discrete targets

such as SOHOT, Hoxbar and

Marchand have potential

Note: PeakIP-30 volumes have been normalized to a 5,000 ft lateral length.. Data sourced from LINN production history, IHS and public company investor presentations.

Note: Rig count based on rigs shown within parameters of offset activity map.

Franklin1H-1X (Newfield)

First Prod. Date: 10/15

PeakIP-30: 1,011 Boe/d

Oil: 69%

LL / Zone: 9,897’; Meramec

Post Brothers1H-27X (Newfield)

First Prod. Date: 07/15

PeakIP-30: 745 Boe/d

Oil: 44%

LL / Zone: 10,066’; Meramec

School Land1-36H

(Husky Ventures)

First Prod. Date: 10/13

PeakIP-30: 1,664 Boe/d

Oil: 64%

LL / Zone: 4,022’; Hunton

Shimanek1-2H

(Husky Ventures)

First Prod. Date: 10/14

PeakIP-30: 1,500 Boe/d

Oil: 67%

LL / Zone: 4,307’; Hunton

Beecher 16071-11Mh (Payrock)

First Prod. Date: 10/15

PeakIP-30: 1,224 Boe/d

Oil: 39%

LL / Zone: 4,942’; Meramec

Hansens 16071-12Mh (Payrock)

First Prod. Date: 07/15

PeakIP-30: 1,152 Boe/d

Oil: 53%

LL / Zone: 4,880’; Meramec

Borelli 17054-8Mh

(Alta Mesa)

First Prod. Date: 07/15

PeakIP-30: 1,132 Boe/d

Oil: 77%

LL / Zone: 4,845’; Osage

Eve 15061-20Mh (Marathon)

First Prod. Date: 01/16

PeakIP-30: 1,071 Boe/d

Oil: 88%

LL / Zone: 4,892’; Meramec

Rice1H-26 (Newfield)

First Prod. Date: 08/15

PeakIP-30: 948 Boe/d

Oil: 48%

LL / Zone: 4,708’; Meramec

Burpo 17052-7Mh

(Alta Mesa)

First Prod. Date: 05/15

PeakIP-30: 868 Boe/d

Oil: 70%

LL / Zone: 4,880’; Osage

Corwin1-34H

(Husky Ventures)

First Prod. Date: 12/11

PeakIP-30: 1,184 Boe/d

Oil: 71%

LL / Zone: 3,340’; Hunton

Hughes Trust33-18-7 1H

(Chesapeake)

First Prod. Date: 04/15

PeakIP-30: 1,384 Boe/d

Oil: 91%

LL / Zone: 4,233’; Oswego

Cmn Farms 16071-15Mh (Payrock)

First Prod. Date: 07/15

PeakIP-30: 1,125 Boe/d

Oil: 47%

LL / Zone: 4,942’; Meramec

Hladik (LongFellow)

First Prod. Date: 06/13

PeakIP-30: 817 Boe/d

Oil: 50%

LL / Zone: 4,497’; Osage

James1H-2X (Newfield)

First Prod. Date: 10/15

PeakIP-30: 1,060 Boe/d

Oil: 70%

LL / Zone: 9,993’; Meramec

Caldwell22-18-61H

(Chesapeake)

First Prod. Date: 08/16

PeakIP-30: 2,501 Boe/d

Oil: 80%

LL / Zone: 3,624’; Oswego

Hill2-18-62H (Chesapeake)

PeakIP-30: 1,217 Boe/d

Oil: 86%

LL / Zone: 5,023’; Oswego

Lightle4-18-61H

(Chesapeake)

First Prod. Date: 09/16

PeakIP-30: 1,619 Boe/d

Oil: 88%

LL / Zone: 4,514’; Oswego

Farrar11-18-61H

(Chesapeake)

First Prod. Date: 09/16

PeakIP-30: 1,175 Boe/d

Oil: 87%

LL / Zone: 4,506’; Oswego

Operator Name Rigs Operator Name Rigs

Alta Mesa 5 Continental 2

Newfield 5 Chesapeake 2

Marathon 3 Other 7

Devon 3

Kingfisher

Legend

Osage Well

Hunton Well

Meramec Well

Oswego Well

LINN Acreage

19

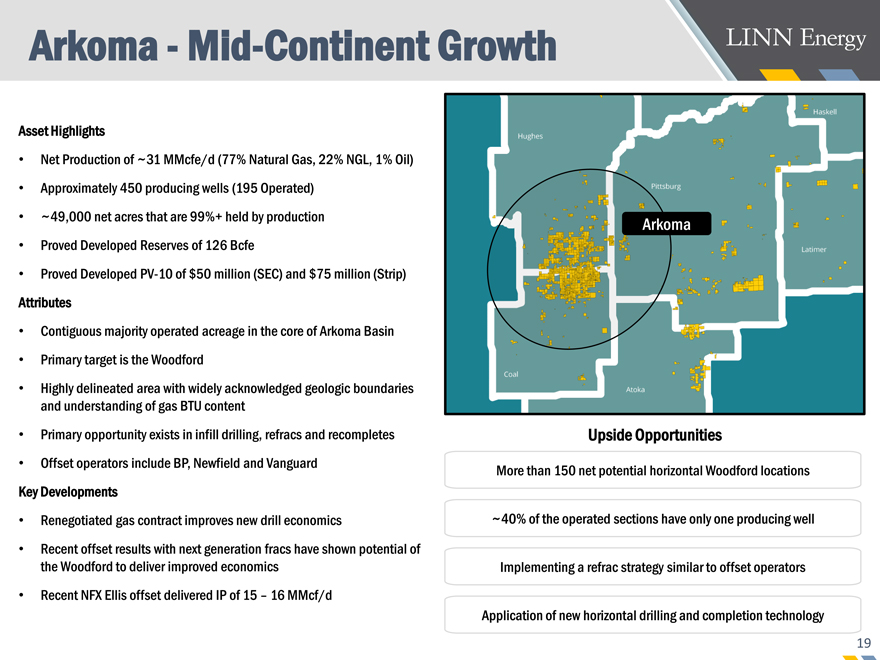

Arkoma—Mid-Continent Growth

Asset Highlights

• Net Production of ~31 MMcfe/d (77% Natural Gas, 22% NGL, 1% Oil)

• Approximately 450 producing wells (195 Operated)

• ~49,000 net acres that are 99%+ held by production

• Proved Developed Reserves of 126 Bcfe

• Proved DevelopedPV-10 of $50 million (SEC) and $75 million (Strip)

Attributes

• Contiguous majority operated acreage in the core of Arkoma Basin

• Primary target is the Woodford

• Highly delineated area with widely acknowledged geologic boundaries

and understanding of gas BTU content

• Primary opportunity exists in infill drilling, refracs and recompletes

• Offset operators include BP, Newfield and Vanguard

Key Developments

• Renegotiated gas contract improves new drill economics

• Recent offset results with next generation fracs have shown potential of

the Woodford to deliver improved economics

• Recent NFX Ellis offset delivered IP of 15 – 16 MMcf/d

More than 150 net potential horizontal Woodford locations

~40% of the operated sections have only one producing well

Upside Opportunities

Implementing a refrac strategy similar to offset operators

Arkoma

Application of new horizontal drilling and completion technology

20

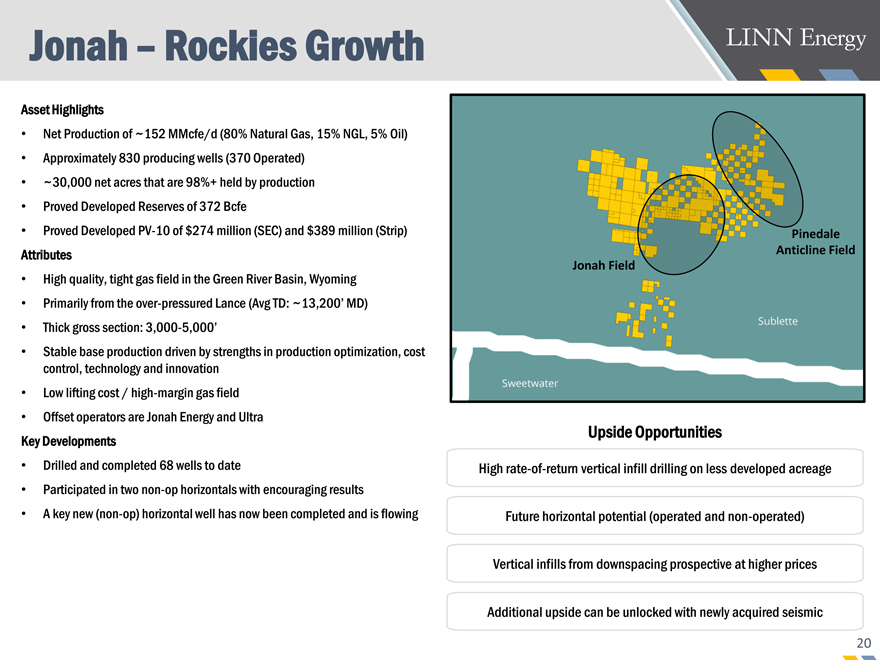

Jonah – Rockies Growth

Asset Highlights

• Net Production of ~152 MMcfe/d (80% Natural Gas, 15% NGL, 5% Oil)

• Approximately 830 producing wells (370 Operated)

• ~30,000 net acres that are 98%+ held by production

• Proved Developed Reserves of 372 Bcfe

• Proved DevelopedPV-10 of $274 million (SEC) and $389 million (Strip)

Attributes

• High quality, tight gas field in the Green River Basin, Wyoming

• Primarily from the over-pressured Lance (Avg TD: ~13,200’ MD)

• Thick gross section:3,000-5,000’

• Stable base production driven by strengths in production optimization, cost

control, technology and innovation

• Low lifting cost / high-margin gas field

• Offset operators are Jonah Energy and Ultra

Key Developments

• Drilled and completed 68 wells to date

• Participated in twonon-op horizontals with encouraging results

• A key new(non-op) horizontal well has now been completed and is flowing

Highrate-of-return vertical infill drilling on less developed acreage

Future horizontal potential (operated andnon-operated)

Upside Opportunities

Vertical infills from downspacing prospective at higher prices

Additional upside can be unlocked with newly acquired seismic

Pinedale

Anticline Field

Jonah Field

21

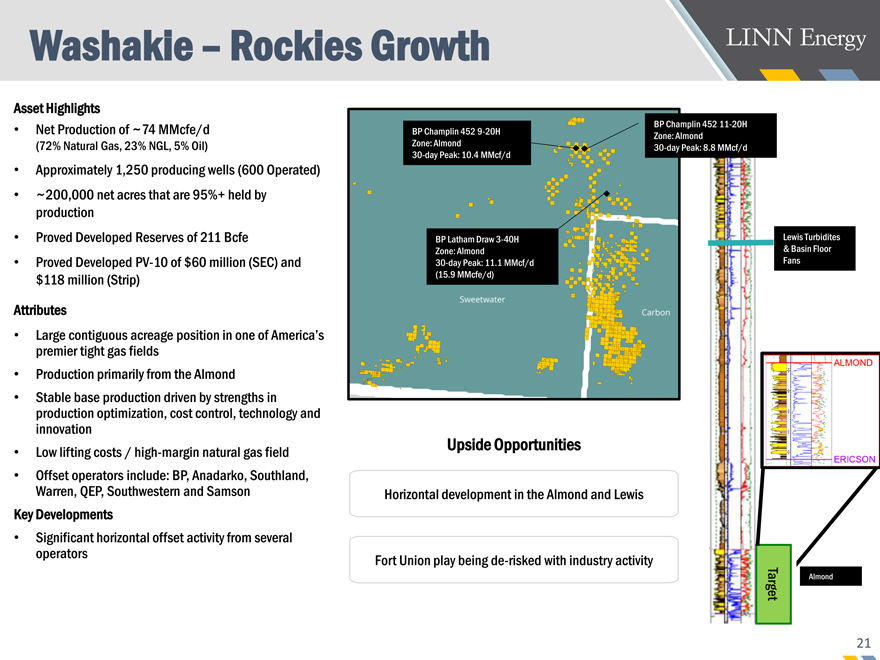

Washakie – Rockies Growth

Asset Highlights

• Net Production of ~74 MMcfe/d

(72% Natural Gas, 23% NGL, 5% Oil)

• Approximately 1,250 producing wells (600 Operated)

• ~200,000 net acres that are 95%+ held by

production

• Proved Developed Reserves of 211 Bcfe

• Proved DevelopedPV-10 of $60 million (SEC) and

$118 million (Strip)

Attributes

• Large contiguous acreage position in one of America’s

premier tight gas fields

• Production primarily from the Almond

• Stable base production driven by strengths in

production optimization, cost control, technology and

innovation

• Low lifting costs / high-margin natural gas field

• Offset operators include: BP, Anadarko, Southland,

Warren, QEP, Southwestern and Samson

Key Developments

• Significant horizontal offset activity from several

operators

Horizontal development in the Almond and Lewis

Fort Union play beingde-risked with industry activity

Upside Opportunities

Lewis Turbidites

& Basin Floor

Fans

Almond

Target

BP Champlin 4529-20H

Zone: Almond

30-day Peak: 10.4 MMcf/d

BP Latham Draw3-40H

Zone: Almond

30-day Peak: 11.1 MMcf/d

(15.9 MMcfe/d)

BP Champlin 45211-20H

Zone: Almond

30-day Peak: 8.8 MMcf/d

22

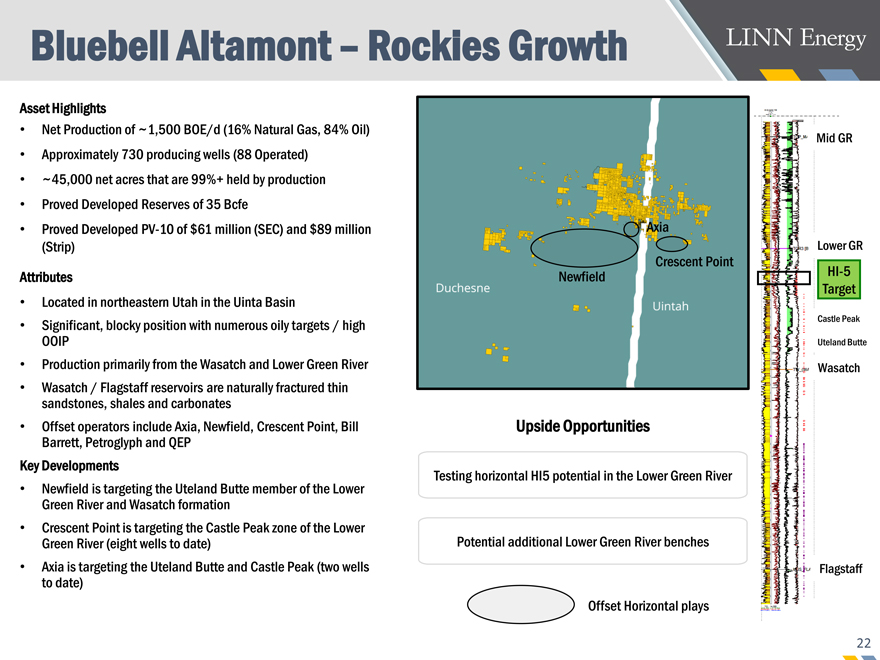

Bluebell Altamont – Rockies Growth

Asset Highlights

• Net Production of ~1,500 BOE/d (16% Natural Gas, 84% Oil)

• Approximately 730 producing wells (88 Operated)

• ~45,000 net acres that are 99%+ held by production

• Proved Developed Reserves of 35 Bcfe

• Proved DevelopedPV-10 of $61 million (SEC) and $89 million (Strip)

Attributes

• Located in northeastern Utah in the Uinta Basin

• Significant, blocky position with numerous oily targets / high OOIP

• Production primarily from the Wasatch and Lower Green River

• Wasatch / Flagstaff reservoirs are naturally fractured thin sandstones, shales and carbonates

• Offset operators include Axia, Newfield, Crescent Point, Bill Barrett, Petroglyph and QEP

Key Developments

• Newfield is targeting the Uteland Butte member of the Lower Green River and Wasatch formation

• Crescent Point is targeting the Castle Peak zone of the Lower Green River (eight wells to date)

• Axia is targeting the Uteland Butte and Castle Peak (two wells to date)

Testing horizontal HI5 potential in the Lower Green River

Potential additional Lower Green River benches

Upside Opportunities

Lower GR

Flagstaff

HI-5

Target

Mid GR

Wasatch

Offset Horizontal plays

Castle Peak

Uteland Butte

Newfield

Crescent Point

Axia

23

Williston Basin – Rockies Growth

Asset Highlights

• Net Production of ~9,800 BOE/d (57% Oil , 22% NGL, 21% Natural Gas)

• Approximately 1,100 producing wells (Allnon-Operated)

• ~20,000 net acres that are 98%+ held by production

• Proved Developed Reserves of 119 Bcfe

• Proved DevelopedPV-10 of $139 million (SEC) and $230 million (Strip)

Attributes

• Improved completions have led to attractive economics

• High-quality partners (including NFX, HES, XTO, WLL and CLR)

• 2016 capital spend of $23 million with partners

• More than 50 wells drilled and awaiting completion

More than 700 gross horizontal locations in the Bakken and Three Forks

Ongoing evolution of completions improving type curves

Upside Opportunities

Further downspacing in both the Bakken and the Three Forks

Basin focused midstream projects to improve economics

Source Rock

Source Rock

Reservoir

Reservoir

Reservoir

Middle Bakken

Upper Three Forks

Middle Three Forks

Upper Bakken Shale

Lower Bakken Shale

TARGET

TARGET

Parshall

Nesson

Ant

icline 24

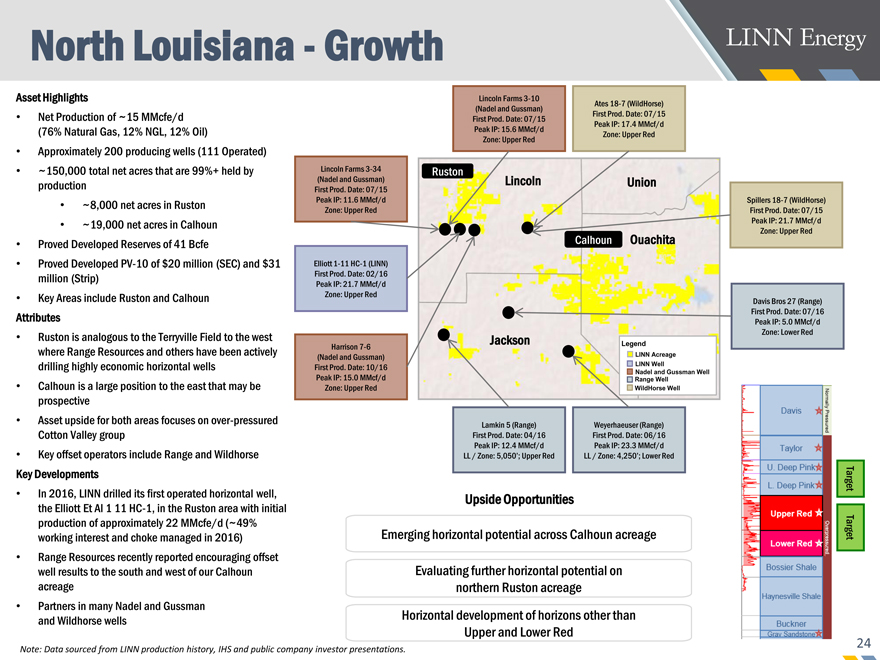

North Louisiana—Growth

Asset Highlights

• Net Production of ~15 MMcfe/d (76% Natural Gas, 12% NGL, 12% Oil)

• Approximately 200 producing wells (111 Operated)

• ~150,000 total net acres that are 99%+ held by production

• ~8,000 net acres in Ruston

• ~19,000 net acres in Calhoun

• Proved Developed Reserves of 41 Bcfe

• Proved DevelopedPV-10 of $20 million (SEC) and $31 million (Strip)

• Key Areas include Ruston and Calhoun

Attributes

• Ruston is analogous to the Terryville Field to the west where Range Resources and others have been actively drilling highly economic horizontal wells

• Calhoun is a large position to the east that may be prospective

• Asset upside for both areas focuses on over-pressured Cotton Valley group

• Key offset operators include Range and Wildhorse

Key Developments

• In 2016, LINN drilled its first operated horizontal well, the Elliott Et Al 1 11HC-1, in the Ruston area with initial production of approximately 22 MMcfe/d (~49% working interest and choke managed in 2016)

• Range Resources recently reported encouraging offset well results to the south and west of our Calhoun acreage

• Partners in many Nadel and Gussman and Wildhorse wells

Emerging horizontal potential across Calhoun acreage

Evaluating further horizontal potential on

northern Ruston acreage

Upside Opportunities

Target

Horizontal development of horizons other than

Upper and Lower Red

Lincoln Farms3-10 (Nadel and Gussman) First Prod. Date: 07/15

Peak IP: 15.6 MMcf/d

Zone: Upper Red

Lincoln Farms3-34 (Nadel and Gussman) First Prod. Date: 07/15

Peak IP: 11.6 MMcf/d

Zone: Upper Red

Spillers18-7 (WildHorse) First Prod. Date: 07/15

Peak IP: 21.7 MMcf/d

Zone: Upper Red

Ates18-7 (WildHorse) First Prod. Date: 07/15

Peak IP: 17.4 MMcf/d

Zone: Upper Red

Elliott1-11HC-1 (LINN) First Prod. Date: 02/16

Peak IP: 21.7 MMcf/d

Zone: Upper Red

Harrison7-6 (Nadel and Gussman) First Prod. Date: 10/16

Peak IP: 15.0 MMcf/d Zone: Upper Red

Lamkin 5 (Range) First Prod. Date: 04/16

Peak IP: 12.4 MMcf/d

LL / Zone: 5,050’; Upper Red

Davis Bros 27 (Range) First Prod. Date: 07/16

Peak IP: 5.0 MMcf/d

Zone: Lower Red

Weyerhaeuser (Range) First Prod. Date: 06/16

Peak IP: 23.3 MMcf/d

LL / Zone: 4,250’; Lower Red

Ouachita

Lincoln

Union

Jackson Legend LINN Well Nadel and Gussman Well Range Well WildHorse Well LINN Acreage

Ruston

Calhoun

Note: Data sourced from LINN production history, IHS and public company investor presentations.

Target

25

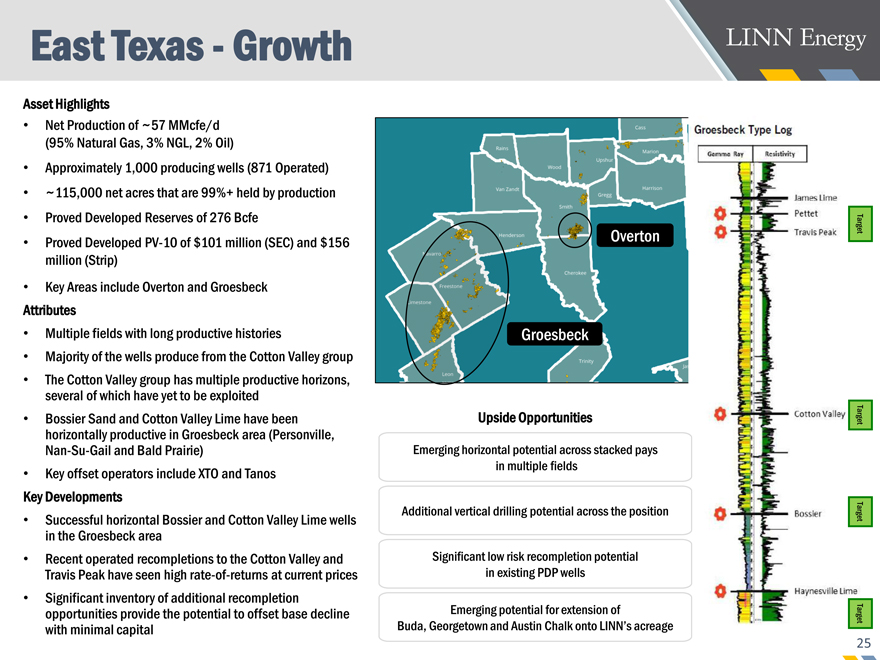

East Texas—Growth

Asset Highlights

• Net Production of ~57 MMcfe/d (95% Natural Gas, 3% NGL, 2% Oil)

• Approximately 1,000 producing wells (871 Operated)

• ~115,000 net acres that are 99%+ held by production

• Proved Developed Reserves of 276 Bcfe

• Proved DevelopedPV-10 of $101 million (SEC) and $156 million (Strip)

• Key Areas include Overton and Groesbeck

Attributes

• Multiple fields with long productive histories

• Majority of the wells produce from the Cotton Valley group

• The Cotton Valley group has multiple productive horizons, several of which have yet to be exploited

• Bossier Sand and Cotton Valley Lime have been horizontally productive in Groesbeck area (Personville,Nan-Su-Gail and Bald Prairie)

• Key offset operators include XTO and Tanos

Key Developments

• Successful horizontal Bossier and Cotton Valley Lime wells in the Groesbeck area

• Recent operated recompletions to the Cotton Valley and Travis Peak have seen highrate-of-returns at current prices

• Significant inventory of additional recompletion opportunities provide the potential to offset base decline with minimal capital

Emerging horizontal potential across stacked pays

in multiple fields

Additional vertical drilling potential across the position

Upside Opportunities

Significant low risk recompletion potential

in existing PDP wells

Emerging potential for extension of

Buda, Georgetown and Austin Chalk onto LINN’s acreage

Groesbeck

Overton

Target

Target

Target

Target

26

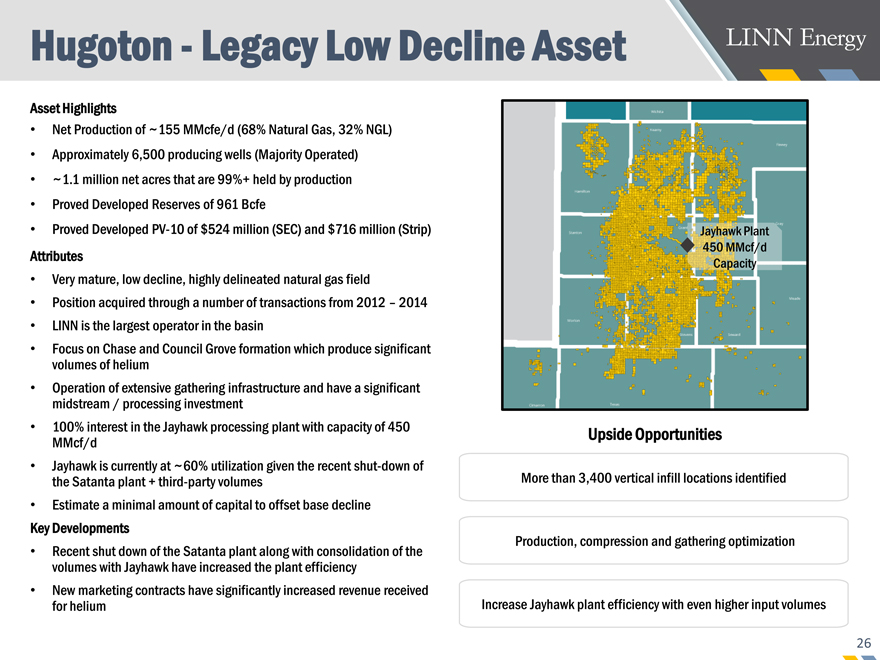

Hugoton—Legacy Low Decline Asset

Asset Highlights

• Net Production of ~155 MMcfe/d (68% Natural Gas, 32% NGL)

• Approximately 6,500 producing wells (Majority Operated)

• ~1.1 million net acres that are 99%+ held by production

• Proved Developed Reserves of 961 Bcfe

• Proved DevelopedPV-10 of $524 million (SEC) and $716 million (Strip)

Attributes

• Very mature, low decline, highly delineated natural gas field

• Position acquired through a number of transactions from 2012 – 2014

• LINN is the largest operator in the basin

• Focus on Chase and Council Grove formation which produce significant volumes of helium

• Operation of extensive gathering infrastructure and have a significant midstream / processing investment

• 100% interest in the Jayhawk processing plant with capacity of 450 MMcf/d

• Jayhawk is currently at ~60% utilization given the recent shut-down of the Satanta plant + third-party volumes

• Estimate a minimal amount of capital to offset base decline

Key Developments

• Recent shut down of the Satanta plant along with consolidation of the volumes with Jayhawk have increased the plant efficiency

• New marketing contracts have significantly increased revenue received for helium

More than 3,400 vertical infill locations identified

Upside Opportunities

Production, compression and gathering optimization

Increase Jayhawk plant efficiency with even higher input volumes

Jayhawk Plant

450 MMcf/d Capacity

27

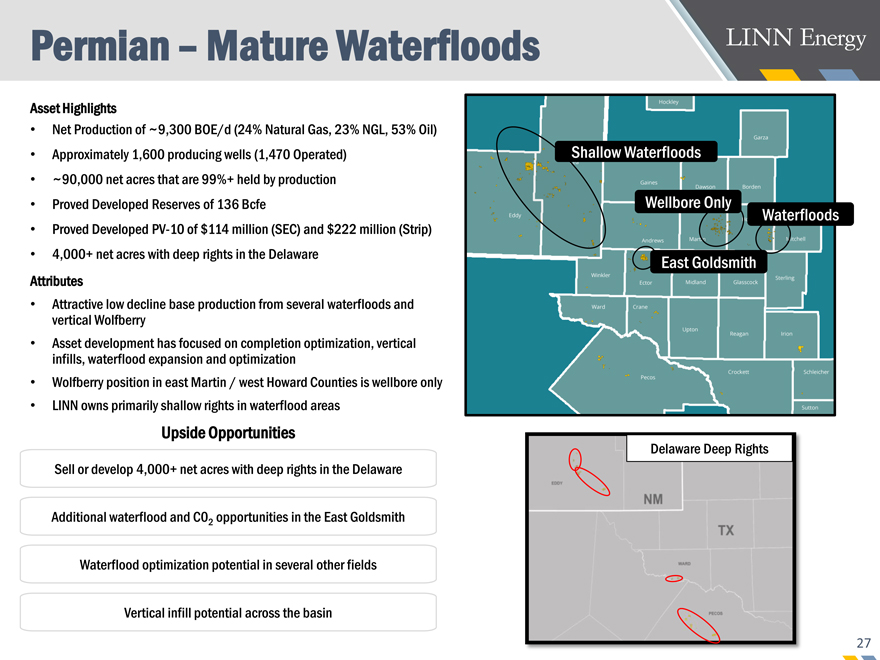

Permian – Mature Waterfloods

Asset Highlights

• Net Production of ~9,300 BOE/d (24% Natural Gas, 23% NGL, 53% Oil)

• Approximately 1,600 producing wells (1,470 Operated)

• ~90,000 net acres that are 99%+ held by production

• Proved Developed Reserves of 136 Bcfe

• Proved DevelopedPV-10 of $114 million (SEC) and $222 million (Strip)

• 4,000+ net acres with deep rights in the Delaware

Attributes

• Attractive low decline base production from several waterfloods and vertical Wolfberry

• Asset development has focused on completion optimization, vertical infills, waterflood expansion and optimization

• Wolfberry position in east Martin / west Howard Counties is wellbore only

• LINN owns primarily shallow rights in waterflood areas

Sell or develop 4,000+ net acres with deep rights in the Delaware

Additional waterflood and C02 opportunities in the East Goldsmith

Upside Opportunities

Waterflood optimization potential in several other fields

Vertical infill potential across the basin

Shallow Waterfloods

Waterfloods

East Goldsmith

Wellbore Only

Delaware Deep Rights

28

California – Shallow Decline Oil Asset

CA

Belridge

Brea

Asset Highlights

• Net Production of ~5,300 BOE/d (99% Oil, 1% NGL)

• Approximately 800 producing wells with high working interest

• ~3,000 net acres that are 100% held by production

• Proved Developed Reserves of 170 Bcfe

• Proved DevelopedPV-10 of $233 million (SEC) and $347 million (Strip)

Belridge

• Asset development has focused on waterflood down spacing and thermal development opportunities

• Concentrated acreage position with stacked reservoirs (Diatomite and Tulare) and significant resource in place

• Uniquely developed asset relative to offset positions in area and proven reservoir and geologic model

• Offset operators include Aera, CRC, and Berry

Brea

• Stable long life oil field with ~4% base decline

• Natural gas is converted to electricity to power the field, reducing operating expenses and assisting emissions requirements

• Natural gas processing facility

~100 gross infill locations in the Tulare steamflood

withrates-of-return greater than 30% at $3 / $50

Over 800 gross infill locations in the Diatomite waterflood

~230 withrates-of-return greater than 30% at $3 / $50

Upside Opportunities

Continued base optimization and margin improvement

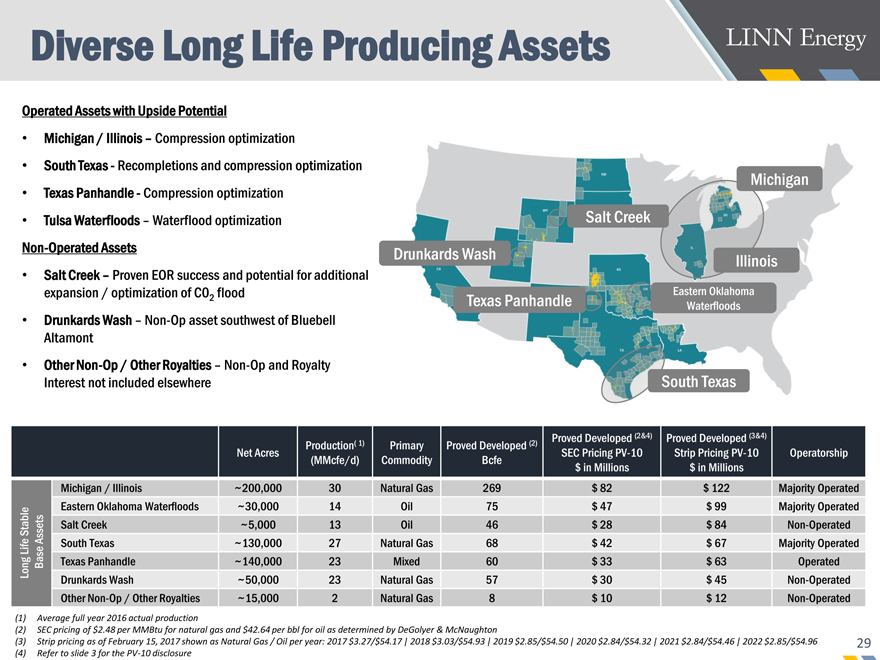

Operated Assets with Upside Potential

• Michigan / Illinois – Compression optimization

• South Texas—Recompletions and compression optimization

• Texas Panhandle—Compression optimization

• Tulsa Waterfloods – Waterflood optimization

Non-Operated Assets

• Salt Creek – Proven EOR success and potential for additional expansion / optimization of C02 flood

• Drunkards Wash –Non-Op asset southwest of Bluebell Altamont

• OtherNon-Op / Other Royalties –Non-Op and Royalty Interest not included elsewhere

Diverse Long Life Producing Assets

Drunkards Wash

Michigan

Salt Creek

Illinois

South Texas

Texas Panhandle

(1) Average full year 2016 actual production

(2) SEC pricing of $2.48 per MMBtu for natural gas and $42.64 per bbl for oil as determined by DeGolyer & McNaughton

(3) Strip pricing as of February 15, 2017 shown as Natural Gas / Oil per year: 2017 $3.27/$54.17 | 2018 $3.03/$54.93 | 2019 $2.85/$54.50 | 2020 $2.84/$54.32 | 2021 $2.84/$54.46 | 2022 $2.85/$54.96

(4) Refer to slide 3 for thePV-10 disclosure

Net Acres

Production( 1)

(MMcfe/d)

Primary

Commodity

Proved Developed (2)

Bcfe

Proved Developed (2&4) SEC PricingPV-10

$ in Millions

Proved Developed (3&4) Strip PricingPV-10

$ in Millions

Long Life Stable

Base Assets

Michigan / Illinois

~200,000

30

Natural Gas

269

$82

$122

Eastern Oklahoma Waterfloods

~30,000

14

Oil

75

$47

$99

Salt Creek

~5,000

13

Oil

46

$28

$84

South Texas

~130,000

27

Natural Gas

68

$42

$67

Texas Panhandle

~140,000

23

Mixed

60

$33

$63

Drunkards Wash

~50,000

23

Natural Gas

57

$30

$45

OtherNon-Op / Other Royalties

~15,000

2

Natural Gas

8

$10

$12

30

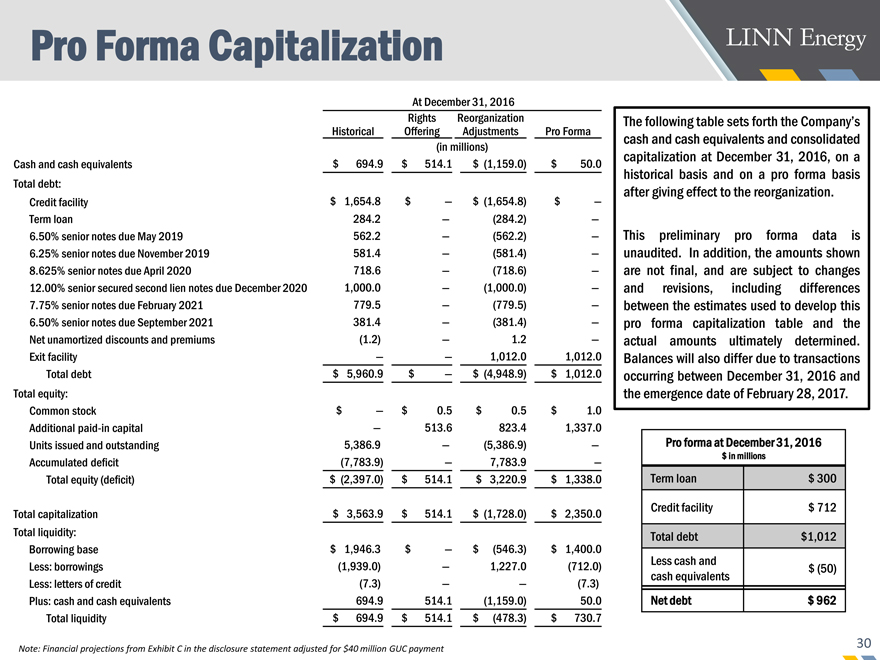

Pro Forma Capitalization At December 31, 2016

Historical

Rights Offering

Reorganization Adjustments

Pro Forma

(in millions)

Cash and cash equivalents

$694.9

$514.1

$(1,159.0)

$50.0

Total debt:

Credit facility

$1,654.8

$—

$(1,654.8)

$—

Term loan

284.2

—

(284.2)

—

6.50% senior notes due May 2019

562.2

—

(562.2)

—

6.25% senior notes due November 2019

581.4

—

(581.4)

—

8.625% senior notes due April 2020

718.6

—

(718.6)

—

12.00% senior secured second lien notes due December 2020

1,000.0

—

(1,000.0)

—

7.75% senior notes due February 2021

779.5

—

(779.5)

—

6.50% senior notes due September 2021

381.4

—

(381.4)

—

Net unamortized discounts and premiums

(1.2)

—

1.2

—

Exit facility

—

—

1,012.0

1,012.0

Total debt

$5,960.9

$—

$(4,948.9)

$1,012.0

Total equity:

Common stock

$—

$0.5

$0.5

$1.0

Additionalpaid-in capital

—

513.6

823.4

1,337.0

Units issued and outstanding

5,386.9

—

(5,386.9)

—

Accumulated deficit

(7,783.9)

—

7,783.9

—

Total equity (deficit)

$(2,397.0)

$514.1

$3,220.9

$1,338.0

Total capitalization

$3,563.9

$514.1

$(1,728.0)

$2,350.0

Total liquidity:

Borrowing base

$1,946.3

$—

$(546.3)

$1,400.0

Less: borrowings

(1,939.0)

—

1,227.0

(712.0)

Less: letters of credit

(7.3)

—

—

(7.3)

Plus: cash and cash equivalents

694.9

514.1

(1,159.0)

50.0

Total liquidity

$694.9

$514.1

$(478.3)

$730.7

31

Debt Reduction

$3,088

$2,215

$662

500

500

300

1,000

1,000

3,857

3,023

$8,445

$6,738

$962

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

12/31/2015 with Berry 12/31/15 excluding Berry Est. 2/28/17

$ Millions

RBL Term Loan Second Lien Notes Unsecured Notes

Pro Forma Annual Interest

Expense

$497 million $415 million $55 million(2)

Debt Reduction Contributors

Berry Separation $1,707

Equitize Second Lien / Unsecured Notes 4,023

Hedge Unwind 1,190

New Money Investment 530

Other 33

Total $7,483

Total Net Debt and Annual Interest Expense estimated to be lowered by ~90%

(1)

(1) See reconciliation of net debt (anon-GAAP measure) on slide 29. Financial projections from Exhibit C in the disclosure statement adjusted for $40 million GUC payment

(2) 2017 estimated interest expense pro forma for a 1/1/2017 emergence date

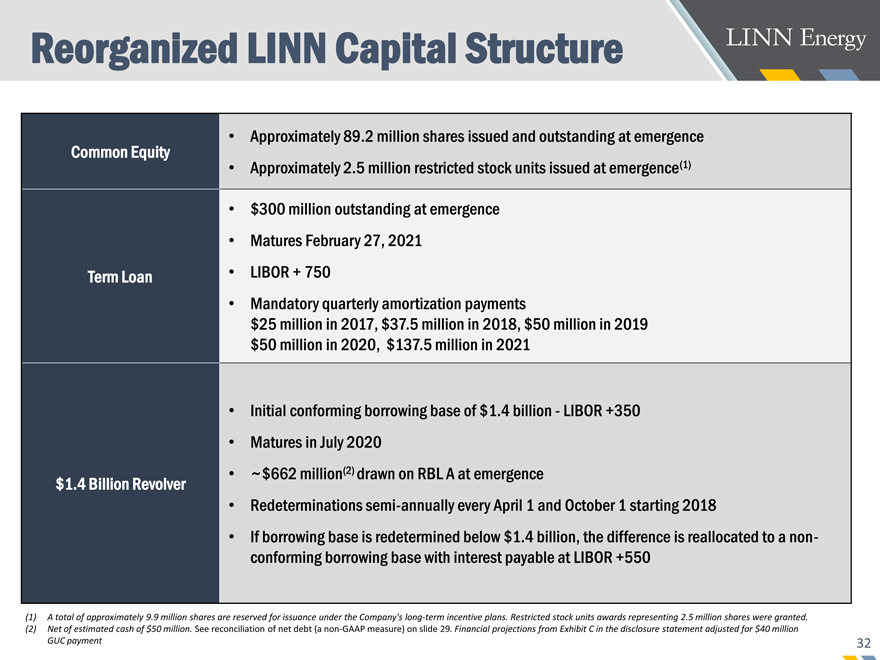

Common Equity

• Approximately 89.2 million shares issued and outstanding at emergence

• Approximately 2.5 million restricted stock units issued at emergence(1)

Term Loan

• $300 million outstanding at emergence

• Matures February 27, 2021

• LIBOR + 750

• Mandatory quarterly amortization payments

$25 million in 2017, $37.5 million in 2018, $50 million in 2019

$50 million in 2020, $137.5 million in 2021

$1.4 Billion Revolver

• Initial conforming borrowing base of $1.4 billion—LIBOR +350

• Matures in July 2020

• ~$662 million(2) drawn on RBL A at emergence

• Redeterminations semi-annually every April 1 and October 1 starting 2018

• If borrowing base is redetermined below $1.4 billion, the difference is reallocated to a nonconforming

borrowing base with interest payable at LIBOR +550

32

(1) A total of approximately 9.9 million shares are reserved for issuance under the Company’s long-term incentive plans. Restricted stock units awards representing 2.5 million shares were granted.

(2) Net of estimated cash of $50 million. See reconciliation of net debt (anon-GAAP measure) on slide 29. Financial projections from Exhibit C in the disclosure statement adjusted for $40 million

GUC payment

Reorganized LINN Capital Structure

370

110

10

-

50

100

150

200

250

300

350

400

2017 2018 2019

12,000

5,000 5,000

-

5,000

10,000

15,000

20,000

25,000

30,000

2017 2018 2019

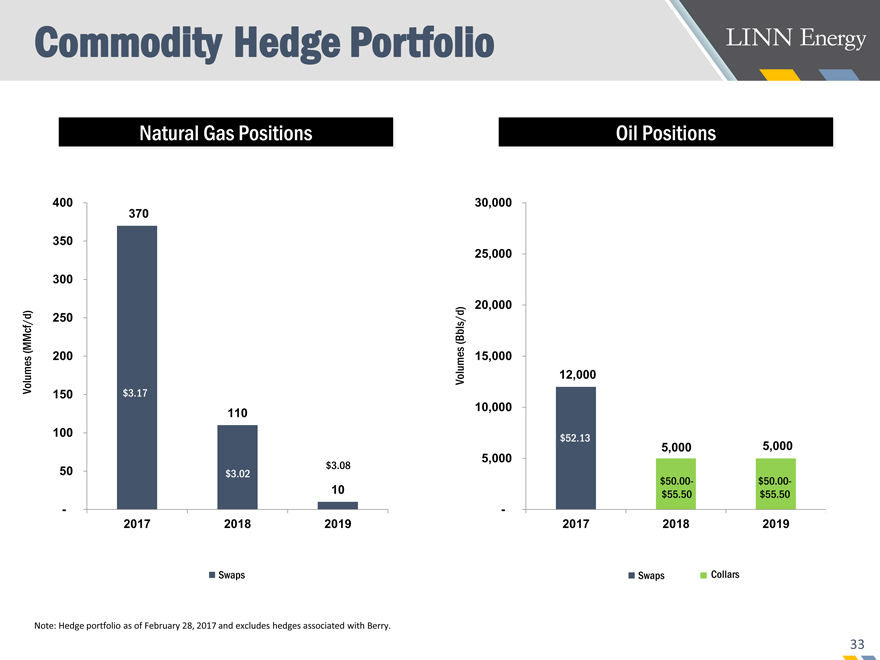

Natural Gas Positions

Volumes (MMcf/d)

33

Commodity Hedge Portfolio

Swaps

Volumes (Bbls/d)

Oil Positions

Swaps Collars

$3.17

$52.13

$3.02

$50.00-

$55.50

Note: Hedge portfolio as of February 28, 2017 and excludes hedges associated with Berry.

$50.00-

$55.50

$3.08

34

New Board of Directors

Mark E. Ellis is President and Chief Executive Officer of LINN Energy. Mr. Ellis has more than 35 years of experience in the oil and natural gas industry. He joined LINN in December 2006 as Executive Vice President and Chief Operating Officer, was promoted to President and Chief Operating Officer in December 2007, President and Chief Executive Officer in January 2010 and Chairman, President and Chief Executive Officer in December 2011. Before joining LINN, Mr. Ellis served as President of the Lower 48 for ConocoPhillips. Prior to joining ConocoPhillips, he served as Senior Vice President of North American Production for Burlington Resources. He first joined Burlington Resources in 1985 and served in roles of increasing responsibility, including President of Burlington Resources Canada Ltd., Vice President and Chief Engineer, Vice President of the San Juan Division and Manager of Acquisitions. He began his career at The Superior Oil Company, where he served in several engineering positions in the onshore and offshore divisions. Mr. Ellis holds a bachelor’s degree in petroleum engineering from Texas A&M University.

Mark E. Ellis

President and Chief Executive Officer

David B. Rottino is Executive Vice President and Chief Financial Officer of LINN Energy. Mr. Rottino oversees the accounting, tax, investor relations, business development and strategic planning functions. Mr. Rottino has over 25 years of total experience and over 20 years of experience in the oil and natural gas industry. Prior to joining LINN in June 2008, he served at El Paso Energy, ConocoPhillips and Burlington Resources in various finance, accounting and strategic planning roles. Mr. Rottino earned a bachelor’s degree in business administration from Texas Tech University and anM.B.A. from Texas Christian University.

David B. Rottino Chief Financial Officer

Matthew Bonanno joined York Capital Management in July 2010 and is a Partner of the firm. Matthew joined York from the Blackstone Group, where he worked as an associate focusing on restructuring, recapitalization and reorganization transactions. Prior to joining the Blackstone Group, he worked on financing and strategic transactions at News Corporation and as an investment banker at JP Morgan and Goldman Sachs. Mr. Bonanno is currently a member of the board, in his capacity as a York employee, of Rever Offshore AS, all entities incorporated pursuant to York’s partnership with Costamare Inc. and Augustea Bunge Maritime, Next Decade LLC and Vantage Drilling Co. He received a bachelor’s degree in history from Georgetown University and an M.B.A. in finance from TheWharton School of the University of Pennsylvania.

Matthew Bonanno

Director

Philip Brown joined P. Schoenfeld Asset Management (“PSAM”) in 2009 and is a Partner of the firm where he focuses on credit-oriented investments across various industries. Prior to joining PSAM, Mr. Brown held positions at Sun Capital Partners, Inc., an operationally-focused private equity firm, and Buckeye Capital Partners, an event-driven hedge fund. He began his career as an investment banking analyst at Wasserstein Perella & Co. Mr. Brown graduated from Georgetown University in 1999 with bachelor’s degrees in economics and history.

Phil Brown

Director

Mr. Lederman joined Fir Tree in February, 2011 and is a Managing Director,Co-Head of Restructuring and a Partner at Fir Tree Partners. Prior to joining Fir Tree, Mr. Lederman worked in the Business Finance and Restructuring groups at Weil, Gotshal & Manges LLP and Cravath, Swaine & Moore LLP. In addition to Linn Energy, Mr. Lederman is currently a member of the board, in his capacity as a Fir Tree Partner’s employee, of New Emerald Energy, LLC and Deer Finance, LLC . Mr. Lederman received a J.D. degree with honors from New York University School of Law and a B.A., magna cum laude, from New York University.

Evan Lederman

Director

Kevin Mahony is a Principal at Centerbridge Partners, which he joined in July 2014. Prior to joining Centerbridge, Mr. Mahony was an associate at Oaktree Capital Management in its Global Principal Group and an investment banking analyst at Lazard in its Restructuring Group. He is currently a member of the board of directors, in his capacity as a Centerbridge employee, of Genco Shipping & Trading. Mr. Mahony graduated with honors from the University of Virginia with a B.S. in Commerce with concentrations in finance, management and a track in entrepreneurship, and a B.A. in Art History.

Kevin Mahony

Director

Andy Taylor is a member of the investment team of Elliott Management Corporation, a New York-based trading firm, where he is responsible for various corporate investments. Prior to joining Elliott in 2015, Mr. Taylor held similar positions in BlackRock’s Distressed Products Group, R3 Capital Partners and the Global Principal Strategies team at Lehman Brothers. He earned a bachelor’s degree inmechanical engineering from Rose-Hulman Institute of Technology in 1999, and an M.B.A., with honors, from the University of Chicago Booth School of Business in 2006.

Andy Taylor Di