QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on , 2005

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

155 East Tropicana, LLC

155 East Tropicana Finance Corp.

(Exact name of registrant as specified in its charter)

NEVADA

NEVADA

(State or other jurisdiction

of incorporation or organization) | | 7990

7990

(Primary Standard Industrial

Classification Code Number) | | 20-1363044

20-2546581

(I.R.S. Employer

Identification No.) |

115 East Tropicana Avenue

Las Vegas, Nevada 89109

(702) 597-6076

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) |

Michael Hessling

Chief Operations Officer and Manager

115 East Tropicana Avenue

Las Vegas, Nevada 89109

(702) 597-6076

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

with a copy to: |

Sherwood N. Cook, Esq.

Kummer Kaempfer Bonner & Renshaw

3800 Howard Hughes Parkway,

7th Floor

Las Vegas, Nevada 89109

(702) 792-7000 |

Approximate date of commencement of proposed sale of the securities to the public:As soon as practicable after the effective date of this registration statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, please check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Amount to

be Registered(1)

| | Proposed Maximum

Offering Price

Per Note(1)

| | Proposed Maximum

Aggregate

Offering Price(1)

| | Amount of

Registration Fee

|

|---|

|

| 83/4% Senior Secured Notes due 2012 | | $130,000,000 | | 100% | | $130,000,000 | | $15,301 |

|

| Guaranties* | | — | | | | — | | (2) |

|

- *

- Although there is no direct or indirect subsidiary of 155 East Tropicana, LLC that currently exists that is a guarantor of the notes, any future subsidiary that becomes a guarantor of the securities registered hereby, is hereby deemed to be a registrant.

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933, as amended.

- (2)

- No separate consideration will be received for the Guaranties, and therefore no additional registration fee is required.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant files a further amendment which specifically states that this registration statement will thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement becomes effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), determines.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2005

PROSPECTUS

155 East Tropicana, LLC

155 East Tropicana Finance Corp.

OFFER TO EXCHANGE

$130,000,000 aggregate principal amount

83/4% Senior Secured Notes Due 2012

We are offering to exchange any and all outstanding 83/4% Senior Secured Notes due 2012, or the old senior secured notes, for a like aggregate principal amount of 83/4% Senior Secured Notes due 2012 that have been registered under the Securities Act of 1933, or the new senior secured notes. We refer to the older senior secured notes as the old notes. We refer to the new senior secured notes as the new notes. We refer to the old notes together with the new notes as the Notes. The new notes are identical to the old notes, except that the new notes have been registered under the federal securities laws, are not entitled to certain registration rights relating to such old notes and do not contain provisions for liquidated damages. The new notes will represent the same debt as the applicable old notes and we will issue the new notes under the same indenture as the applicable old notes.

The primary features of the exchange offer are as follows:

- •

- The exchange offer will expire at 5:00 p.m., New York City time, on , 2005, unless extended.

- •

- The exchange offer is not subject to any condition other than that the exchange offer not violate applicable law or any applicable interpretation of the Staff of the Securities Exchange Commission.

- •

- We will exchange all outstanding notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer.

- •

- You may withdraw tendered old notes at any time before the expiration of the exchange offer.

- •

- We do not intend to apply for listing of the new notes on any securities exchange or arrange for them to be quoted on any automated quotation system.

- •

- We will not receive any proceeds from the exchange offer. We will pay all expenses incurred by us in connection with the exchange offer and the issuance of the exchange notes.

You should carefully consider the Risk Factors beginning on page 14 of this prospectus before participating in the exchange offer.

Neither the Securities Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

NONE OF THE NEVADA GAMING COMMISSION, THE NEVADA STATE GAMING CONTROL BOARD OR ANY OTHER GAMING AUTHORITY HAS APPROVED OR DISAPPROVED OF THESE NOTES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

The date of this prospectus is , 2005

You should rely only upon the information contained in this prospectus. We have not authorized any other person to provide you with different information. In anyone provides you with different or inconsistent information, you should not rely on it.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-4, together with any amendments thereto, with the Securities and Exchange Commission, or the Commission, under the Securities Act of 1933, or Securities Act, with respect to the new notes. This prospectus, which constitutes a part of the registration statement, omits certain information contained in the registration statement and reference is made to the registration statement and the exhibits and schedules thereto for further information with respect to us and the new notes offered hereby. This prospectus contains summaries of the material terms and provisions of certain documents and in each instance reference is made to the copy of the such document filed as an exhibit to the registration statement. Each such summary is qualified in its entirety by such reference.

Upon effectiveness of the registration statement, we will be subject to the informational reporting requirements of the Securities Exchange Act of 1934, or Exchange Act. We have agreed that, whether or not required to do so by the rules and regulations of the Commission (and within the time periods that are or would be prescribed thereby), for so long as any of the notes remains outstanding, we will furnish to the holders of the notes and file with the Commission (unless the Commission will not accept such filing) (i) all quarterly and annual financial information that would be required to be contained in a filing with the Commission on Forms 10-Q and 10-K if we were required to file such forms, including a "Management's Discussion and Analysis on Financial Condition and Results of Operations" and, with respect to the annual information only, a report thereon by our certified independent accountants/auditors and (ii) all reports that would be required to be filed with the Commission on Form 8-K if we were required to file such reports. In addition, for so long as any of the old notes remain outstanding, we have agreed to make available, upon request, to any prospective purchaser or beneficial owner of the old notes in connection with any sale thereof the information required by Rule 144A(d)(4) under the Securities Act. Information also may be obtained from us at 155 East Tropicana Avenue, Las Vegas, Nevada 89109, Attention: Michael Hessling, telephone (702) 597-6076.

The registration statement (including the exhibits and schedules thereto) and the periodic reports and other information may be inspected and copied at the public reference facilities of the Commission, Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C., 20549. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. Copies of such material can be obtained from the Commission by mail at prescribed rates. Requests should be directed to the Commission's Public Reference Section, Room 1024, Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549. In addition, the Commission maintains a website (http://www.sec.gov) that contains such reports and other information we have filed.

TRADEMARKS

We have rights to trademarks or trade names we will use in conjunction with the operation of our business. These trademarks include: Hooters®, Dan Marino's Fine Food & Spirits and Martini Bar, and Pete & Shorty's®.

FORWARD LOOKING STATEMENTS

This prospectus includes "forward-looking statements" within the meaning of the federal securities laws. These statements relate to matters that are not historical facts that we refer to as "forward-looking statements" regarding, among other things, our business strategy, our plans and prospects, our

i

financial position, projections of future results of operations or financial condition, expectations for our hotel casino, expectations of the continued availability of capital resources and all statements with respect to the renovation, equipping and re-opening of the hotel casino and the receipt of requisite gaming approvals in connection therewith. These statements may be identified by the use of forward-looking terminology such as "believes," "estimates," "expects," "plans," "predicts," "intends," "may," "will," "should," "could," "would," "likely," "continue," or "anticipates" or the negative or other variation of these or similar words, or by discussion of strategy or risks and uncertainties.

Although we believe that these forward-looking statements are reasonable, they are based upon our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. Forward-looking statements should not be regarded as a representation by us or any other person that the forward-looking statements will be achieved. Given these uncertainties, undue reliance should not be placed on any forward-looking statements.

Forward-looking statements included in this prospectus are made as of the date of this prospectus. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur, and you should read this prospectus completely with the understanding that actual future results may differ materially from what we expect. We note that the safe harbor provided in Section 27A of the Securities Act of 1933 does not apply to statements made in connection with this prospectus.

ii

PROSPECTUS SUMMARY

This summary highlights information from this prospectus, but is not complete and may not contain all the information that may be important to you. You should carefully read this entire prospectus and the documents we have referred you to carefully before you decide whether to participate in the exchange offer. This summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial data, including the combined financial statements and notes thereto, appearing elsewhere in this prospectus. In this prospectus, unless indicated otherwise, "155 East Tropicana," "Hooters Casino Hotel," "Company," "we," "us," and "our" refer to 155 East Tropicana, LLC, together with 155 East Tropicana Finance Corp.

The Company

We own the Hotel San Remo Casino and Resort in Las Vegas, Nevada, or the Hotel San Remo, which we have begun renovating and intend to re-brand as a Hooters Casino Hotel. Our property is located one-half block from the intersection of Tropicana Avenue and Las Vegas Boulevard, a major intersection on the Las Vegas Strip, or The Strip, that is within walking distance to approximately 25,000 hotel rooms. The Hotel San Remo currently features 711 hotel rooms, including 17 suites, and an approximately 24,000 square-foot casino with 532 slot and video poker machines, 16 table games, a sports book and Keno. We have a license that gives us the right to use the Hooters brand and certain related intellectual property solely for the purposes of a Hooters Casino Hotel located at our property. We plan to spend approximately $65.1 million to renovate, equip and re-open the property. Our strategy will be to build on Hooters' reputation as a casual, relaxed, fun, and welcoming environment. We believe that Hooters' strong brand name recognition and our favorable location will generate significant visitor traffic.

Hooters Casino Hotel

The Hooters Casino Hotel will feature the famous Hooters décor, and the Hooters brand will be a prominent component of the facility. Our renovations will refresh and upgrade the property, and provide for several new restaurant offerings. The renovation commenced immediately after the closing of the old notes, and is in its initial stages. The Hooters Casino Hotel is planned to feature:

- •

- an approximately 30,000 square foot "Hooters" themed casino floor with approximately 622 state-of-the-art slot and video poker machines and 32 table games;

- •

- 686 newly renovated hotel rooms, including 17 suites;

- •

- tropical pool area featuring beach sand, palm trees, lagoon style waterfall, cabanas, and Nippers Pool Bar;

- •

- distinctive dining and entertainment options, including:

- •

- a world famous Hooters restaurant;

- •

- Dan Marino's Fine Food and Spirits, a restaurant co-developed with the former Miami Dolphins football star featuring American cuisine;

- •

- "13" Martini Bar, a retro martini lounge featuring live music and nightly entertainment;

- •

- The Bait Shoppe, a gourmet food café and sushi bar conveniently located at poolside;

- •

- Porch Dogs, a Caribbean themed casual indoor-outdoor club offering music and cocktails;

- •

- Pete & Shorty's Tavern, a casual and comfortable restaurant bar featuring a sports book and a poker room; and

- •

- Owl's Nest Café, a 24-hour café offering both buffet style food and tableside food service;

1

- •

- a retail store selling Hooters branded merchandise.

Business Strategy

Leverage the Strong Hooters Brand. We expect to benefit significantly from the national exposure and recognition of the Hooters brand. A key component of our strategy will be to leverage the successful Hooters brand and the existing Hooters organization to generate national awareness of our property. We also intend to leverage the Hooters organization's extensive network of contacts in the sports and entertainment world to attract a number of sports, music and movie celebrities to the casino.

"Must See" Attraction. We believe that Hooters Casino Hotel will be regarded by many visitors as a "must see" attraction in Las Vegas. We will utilize extensive advertising within the Las Vegas market that will target visitors to make them aware that they can enjoy a Hooters experience at our hotel casino conveniently located near The Strip.

Deliver the Hooters Experience. One of the cornerstones of our business strategy is to provide customers with an extraordinary level of friendly and personal service modeled after the successful Hooters experience. The Hooters experience will start with the world famous Hooters Girls who will welcome our guests, serve food and beverage, and interact with our guests to make their visit memorable. We will also make sports a key part of the Hooters experience at our property. In addition, our entertainment and dining offering will be designed to attract customers who are looking for value-priced entertainment options in a non-intimidating and relaxed atmosphere.

Develop Customer Loyalty. We will use the hotel casino's player tracking system to identify, focus promotional and direct marketing efforts on and reward our best gaming customers in order to develop customer loyalty, maximize customer casino play and generate repeat business. Offering rewards and promotional tie-ins at the 381 Hooters restaurants worldwide will also be used to build on our player database and extend the Hooters experience for our customers when they leave our property.

Benefit from Upgraded Property and New Slot Machines. By re-branding the Hotel San Remo as a Hooters Casino Hotel, renovating the facilities, upgrading the accommodations, and investing in new state-of-the-art slot machines with ticket-in-ticket-out technology, we believe that we will benefit from increased traffic through our property, increased customer casino play and increased average daily room rate and occupancy level in our hotel.

The Renovation

The total cost to renovate, equip, and re-open the property is expected to be approximately $65.1 million. We expect to spend approximately $47.7 million on renovations, which includes a $36.5 million guaranteed maximum price construction contract with The PENTA Building Group, Inc. and approximately $11.2 million on design fees, permits, and non-gaming equipment (of which $1.2 million has been spent to date from cash from operations). In addition, we expect to spend approximately $7.1 million on state-of-the-art gaming equipment and approximately $10.3 million for working capital and pre-opening expenses. The PENTA Building Group has extensive experience renovating and building casinos, having completed several renovation projects for, among others, Caesars Entertainment, Flamingo Las Vegas, Harrah's Las Vegas Casino & Hotel and MGM Grand Hotel & Casino. C&B Nevada, Inc. is the architect for the renovation project. C&B Nevada, Inc.'s casino related experience includes the Mandalay Bay Resort & Casino, where the company participated in the design and construction of the resort from the initial field surveys to the fast-track civil design for the entire site. Maverick Architectural and Design, LLC was also engaged to assist in developing the design plans for the renovation. Based on its design experience with several Hooters and Dan Marino restaurants, Maverick Architectural and Design, LLC was integral in capturing the Hooters spirit and ambience and applying them to a hotel casino environment. We intend to began renovations

2

in April 2005 and expect to complete renovations by February 2006. We will continue to keep the existing operations open while we complete the renovation in phases, except for a planned shutdown period of approximately 30 days prior to the grand opening of the Hooters Casino Hotel.

Competition

We face competition in the market in which we are located as well as in or near any geographic area from which we attract or expect to attract a significant number of our customers. As a result, our casino property faces direct competition from all other casinos and hotels in Las Vegas and to a lesser extent, in the Mesquite, Laughlin, Reno and Lake Tahoe areas of Nevada and in Atlantic City, New Jersey, and in the California gaming market, as well as from other forms of gaming.

Las Vegas, Nevada. The hotel casino industry in Las Vegas is highly competitive. The Hotel San Remo competes, and the Hooters Casino Hotel will compete, on the basis of overall atmosphere, range of amenities, level of service, price, location, entertainment offered, theme and size. The Hotel San Remo competes, and the Hooters Casino Hotel will compete, with numerous resorts and hotel casinos on The Strip and in downtown Las Vegas, as well as a large number of hotels and motels in and near Las Vegas. We will seek to differentiate the Hooters Casino Hotel from other major Las Vegas hotel casino resorts by concentrating on the design, atmosphere, personal service and amenities that we will provide and the added value of the Hooters brand.

California Gaming Market. According to the California Gaming Control Commission, there were 52 operating tribal casinos in California as of December 31, 2004. The competitive impact on our gaming establishments from the continued growth of gaming in California cannot be definitively determined but, depending on the nature, extent and location of the growth, the impact could be material.

Other Forms of Gaming. We also compete, to some extent, with other forms of gaming on both a local and national level, including state-sponsored lotteries, Internet gaming, dockside casinos, riverboat casinos, on- and off-track wagering and card parlors. There can be no assurance that we will be able to continue to compete successfully in our existing markets or that we will be able to compete successfully against any such future competition.

Corporate Organization

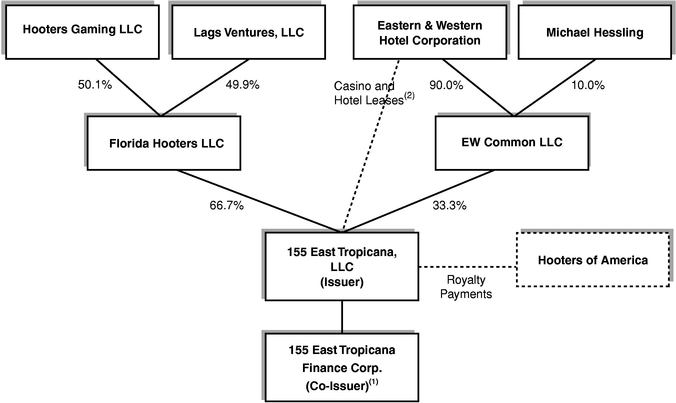

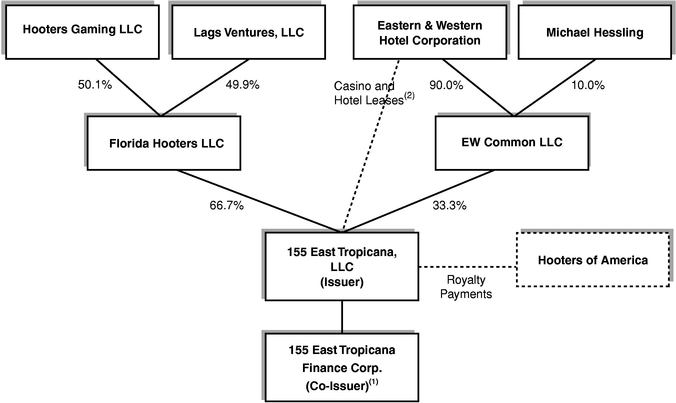

We were formed in June 2004 to acquire the Hotel San Remo from Eastern & Western Hotel Corporation, or Eastern & Western. Our common membership interests are held two-thirds through Florida Hooters LLC and one-third through EW Common LLC.

Florida Hooters LLC is a joint venture between Hooters Gaming LLC and Lags Ventures, LLC. Hooters Gaming LLC is owned by the holders of licenses to operate Hooters restaurants in the Tampa Bay, Chicago and Manhattan areas as well as for wholesale foods, calendars and Nevada hotel/gaming, and includes most of the original founders of the Hooters brand. Lags Ventures, LLC is owned by a holder of the license rights to Hooters restaurants in south Florida and the State of Nevada. Pursuant to these license rights, the owners of Florida Hooters LLC operate 39 Hooters restaurants, publish Hooters calendars, and operate a Hooters foods business. The owner of Lags Ventures, LLC is also the founder of the Dan Marino concept restaurants and owns and operates five Dan Marino concept restaurants.

EW Common LLC was formed to hold Eastern & Western's membership interest in us. Eastern & Western owns 90% of EW Common LLC while our chief operating officer, Michael Hessling, owns the balance. Eastern & Western is beneficially owned by Sukeaki and Toyoroku Izumi. Eastern & Western and its affiliates owned the hotel casino from November 1988 until our acquisition of the hotel casino, other than the gaming assets, in August 2004. Mr. Hessling served as Hotel San Remo's executive vice

3

president and chief operating officer from January 1989 until the acquisition, at which time he became our chief operating officer.

Our affiliates have granted us assignments of certain licenses pertaining to the use of the Hooters brand as well as the Dan Marino and Martini Bar and Pete & Shorty's concept restaurants, solely for the purposes of allowing us to operate a Hooters Casino Hotel located at our property. Pursuant to the Hooters license assignment, we are required to pay the owner of the Hooters trademark, HI Limited Partnership, a royalty fee. For more detailed information, see "Business—Intellectual Property" and "Certain Relationships and Related Transactions." Hooters of America, Inc. is the general partner of HI Limited Partnership and we refer to HI Limited Partnership and Hooters of America, Inc. collectively as "Hooters of America." The original founders of the Hooters brand sold the trademark rights (excluding certain rights they retained for themselves) to Hooters of America in 2001. As a result, Hooters of America is the trademark owner of the Hooters brand and the operator and franchisor of 381 Hooters restaurants. We are not affiliated with Hooters of America.

Because we have not yet received the gaming license necessary to operate a hotel casino, the Hotel San Remo is currently operated by Eastern & Western pursuant to two separate leases with us. For more detailed information, see "Material Agreements—Casino Lease" and "—Hotel Lease." We expect to receive our gaming license during 2005 and prior to our re-opening as Hooters Casino Hotel, but no assurances can be given that we will be able to obtain the license. If we do not receive the gaming license, the hotel casino will continue to be operated by Eastern & Western under the leases until the earlier of our receipt of the gaming license or the date the Notes are no longer outstanding. For more detailed information, see "Regulation and Licensing."

The following chart illustrates our corporate structure.

- (1)

- 155 East Tropicana Finance Corp. was formed for the sole purpose of facilitating the issuance of the Notes.

- (2)

- Remain in place unless and until we receive our gaming license.

4

Risk Factors

An investment in the notes involves a high degree of risk including the following risks:

- •

- Failure to Complete Renovation and Construction on Time and Within Budget—We could encounter problems during renovation and construction that could substantially increase the construction costs of the hotel casino or delay its re-opening as the Hooters Casino Hotel. There is no assurance that we will complete all portions of the planned renovation or construction on time or within budget. Construction projects such as the renovation and construction of the Hooters Casino Hotel are subject to significant development and construction risks, any of which could cause unanticipated cost increases and delays. Until renovation and construction are complete and we commence operations under the Hooters brand, we will rely exclusively on the Hotel San Remo to generate revenue. Failure to complete renovation or construction or open the Hooters Casino Hotel as currently contemplated will have a material adverse effect on our business, financial condition, results of operations and ability to meet our payment obligations under the Notes and our other indebtedness.

- •

- Substantial Debt—Our substantial level of debt could adversely affect our financial condition and prevent us from fulfilling our obligations under the Notes and our other debt. We have, and will continue to have after the completion of this exchange offer, substantial debt. Our substantial debt could have important consequences to you and significant effects on our business. For example, it could:

- •

- make it more difficult for us to satisfy our obligations under the Notes and our other debt;

- •

- result in an event of default if we fail to satisfy our obligations under the Notes or our other debt or fail to comply with the financial and other restrictive covenants contained in the indenture or our new senior secured credit facility, which event of default could result in all of our debt becoming immediately due and payable and could permit our lenders to foreclose on our assets securing such debt;

- •

- require us to dedicate a substantial portion of our cash flow from our business operations to pay our debt, thereby reducing the availability of cash flow to fund working capital, capital expenditures, development projects, general operational requirements and other purposes;

- •

- limit our ability to obtain additional financing for working capital, capital expenditures and other activities;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

- •

- increase our vulnerability to general adverse economic and industry conditions or a downturn in our business; and

- •

- place us at a competitive disadvantage compared to competitors that are not as highly leveraged.

Any of the above-listed factors could have a material adverse effect on our business, financial condition and results of operations and our ability to meet our payment obligations under the Notes and our other debt.

- •

- Governmental Regulations—We face extensive regulation from gaming and other government authorities. As owners and operators of gaming facilities, we are subject to extensive Nevada state and local regulation. Nevada state and local government authorities require us and our subsidiaries to obtain gaming licenses and require our officers and key employees to demonstrate suitability to hold gaming licenses. The Nevada state and local government may limit, condition, suspend or revoke a license for any cause deemed reasonable by the respective

5

For a more extensive discussion of factors that you should consider in connection with your participation in the exchange offer, see "Risk Factors" beginning on page 14 of this prospectus.

You should carefully consider the above risks, as well as other information set forth in this prospectus, before tendering your old notes in the exchange offer. In any of the following risks actually occurs, our business, financial condition and/or operating results could be materially adverse affected, which, in turn, could adversely affect our ability to pay interest or principal on the notes. In such a case, you may lose all or part of your original investment.

6

The Exchange Offer

The following summary of the exchange offer is not intended to be complete. For a more complete description of the terms of the exchange offer, see "The Exchange Offer" in this prospectus. The section of this prospectus entitled "Description of Notes" contains a more detailed description of the terms of the Notes. In the summary below, references to "we," "our" and "us" refer only to 155 East Tropicana, LLC and 155 East Tropicana Finance Corp. and not our subsidiaries.

| The Old Notes | | On March 29, 2005, we issued $130.0 million aggregate principal amount of our 83/4% Senior Secured Notes due 2012 to Jefferies & Company, Inc. and Wells Fargo Securities, LLC in a private placement. We refer to Jefferies & Company, Inc. and Wells Fargo Securities, LLC as the "initial purchasers." The initial purchasers then sold the notes to qualified institutional buyers in reliance on Rule 144A and Regulation S under the Securities Act. Because they have been sold pursuant to exemptions from registration under the Securities Act, the old notes are subject to transfer restrictions. In connection with the issuance of the old notes, we entered into a registration rights agreement with the initial purchasers in which we agreed to file with the Commission a registration statement covering the new notes, use our best efforts to cause the registration statement to become effective under the Securities Act, and prior to the 30th business day after the registration statement has become effective, complete the exchange offer. |

The Exchange Offer |

|

We are offering to exchange up to $130.0 million aggregate principal amount of new notes for an identical principal amount of the applicable old notes. The terms of each of the new notes are identical to the applicable old notes, except that the new notes have been registered under the federal securities laws, are not entitled to certain registered rights relating to such old notes and do not contain provisions for liquidated damages. Each of the new notes will represent the same debt as the applicable old notes and we will issue the new notes under the same indenture as the applicable old notes. |

Resale of the New Notes |

|

We believe you may offer for resale, resell or otherwise transfer the new notes you receive in the exchange offer without further compliance with the registration and prospectus delivery provisions of the Securities Act unless you: |

|

|

• |

|

are an "affiliate" of ours within the meaning of Rule 405 under the Securities Act; |

|

|

• |

|

are a broker-dealer who purchased old notes directly from us for resale under Rule 144A or Regulation S or any other exemption under the Securities Act: |

|

|

• |

|

acquired the new notes other than in the ordinary course of your business; or |

|

|

• |

|

have an arrangement with any person to engage in the distribution of new notes. |

| | | | | |

7

|

|

Each broker-dealer who is issued new notes in the exchange offer for its own account in exchange for old notes acquired by the broker-dealer as a result of market-making or other trading activities must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the new notes issued in the exchange offer. A broker-dealer may use this prospectus for an offer to resell, a resale or any other transfer of the new notes issued to it in the exchange offer. |

Expiration Date |

|

5:00 p.m., New York City time, on , 2005, unless extended, in which case the term "expiration date" shall mean the latest date and time to which the exchange offer is extended. See "The Exchange Offer—Expiration Date; Extensions." |

Withdrawal Rights |

|

You may withdraw old notes you tendered by furnishing a notice of withdrawal to the exchange agent or by complying with DTC's Automated Tender Offer Program System ("ATOP") withdrawal procedures at any time before 5:00 p.m. New York City time on the expiration date. See "The Exchange Offer—Withdrawal Rights." |

Conditions to the Exchange Offer |

|

The exchange offer is subject only to the following conditions: |

|

|

• |

|

the compliance of the exchange offer with applicable securities laws; |

|

|

• |

|

the proper tender of the applicable old notes; and |

|

|

• |

|

our receipt of certain representations made by the holders of the applicable old notes, as described below. |

Representations |

|

By participating in the exchange offer, you will represent to us that, among other things: |

|

|

• |

|

you will acquire the new notes you receive in the exchange offer in the ordinary course of your business; |

|

|

• |

|

you are not engaging in and do not intend to engage in a distribution of the new notes; |

|

|

• |

|

you do not have an arrangement or understanding with any person to participate in the distribution of the new notes or resale of the new notes in violation of the Securities Act; and |

|

|

• |

|

you are not an "affiliate," as defined under Rule 405 of the Securities Act, of ours. |

Procedures for Tendering Old Notes |

|

To accept the exchange offer, you must send the exchange agent either: |

|

|

• |

|

a properly completed and validly executed letter of transmittal; or |

|

|

• |

|

a computer-generated agent's message transmitted pursuant to ATOP; and either |

|

|

• |

|

tendered old notes held in certificated form; or |

|

|

• |

|

a timely confirmation of book-entry transfer of your old notes into the exchange agent's account at DTC. |

| | | | | |

8

|

|

Additional documents may be required if you tender pursuant to the guaranteed delivery procedures described below. For more information, see "The Exchange Offer—Procedures for Tendering." |

Tenders by Beneficial Owners |

|

If you are a beneficial owner whose old notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee or are a holder in book-entry form and wish to tender those old notes in the exchange offer, you should contact the registered holder as soon as possible and instruct the registered holder to tender on your behalf. See "The Exchange Offer — Procedures for Tendering." |

Guaranteed Delivery Procedures |

|

If you are unable to comply with the procedures for tendering, you may tender your old notes according to the guaranteed delivery procedures described in this prospectus under the heading "The Exchange Offer—Guaranteed Delivery Procedures." |

United States Federal Income Tax Consequences |

|

See "Certain United States Federal Income Tax Considerations" for a discussion of U.S. federal income tax considerations you should consider before tendering old notes in the exchange offer. |

Exchange Agent |

|

The Bank of New York Trust Company, N.A. is serving as exchange agent for the exchange offer. The address and telephone number for the exchange agent is listed under "The Exchange Offer—Exchange Agent; Assistance." |

Use of Proceeds |

|

We will not receive any proceeds upon completion of the exchange offer. |

Fees and Expenses |

|

We will pay all expenses relating to the exchange offer and compliance with the registration rights agreements. |

Accounting Treatment |

|

The new notes will be recorded at the same carrying value as the old notes, as reflected in our accounting records on the date of the exchange. Accordingly, we will recognize no gain or loss for accounting purposes. The expenses of the exchange offer will be amortized over the term of the new notes. |

9

Summary of the Terms of the Notes

The terms of the new notes to be issued in the exchange offer are identical to the terms of the applicable outstanding old notes except that we have registered the new notes under the Securities Act. The new notes issued in the exchange offer will evidence the same debt as the applicable old notes, and both the old notes and the new notes are governed by the same applicable indenture. We refer to the old notes together with the new notes as the "Notes."

The summary below describes the principal terms of the notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The section of this prospectus entitled "Description of Notes" contains a more detailed description of the terms and conditions of the new notes. In the summary below, references to "we," "our" and "us" refer only to 155 East Tropicana, LLC and 155 East Tropicana Finance Corp., exclusive of their subsidiaries.

| Issuers | | 155 East Tropicana, LLC and 155 East Tropicana Finance Corp., jointly and severally as co-issuers of the Notes. |

Securities Offered |

|

$130.0 million aggregate principal amount of 83/4% Senior Secured Notes due 2012. |

Maturity Date |

|

April 1, 2012. |

Interest Rate |

|

We will pay cash interest on the Notes at an annual rate of 83/4%. |

Interest Payment Dates |

|

We will make interest payments on the Notes semiannually, on each April 1 and October 1, beginning on October 1, 2005. |

Issue Price |

|

100.000%. |

Security Interest |

|

The Notes and any guarantees thereof are secured by a (1) security interest in substantially all of our and any guarantors' existing and future assets (other than certain excluded assets), (2) our equity interest in the equity interest of any guarantors and (3) the renovation disbursement and interest reserve accounts. The indenture covering the Notes required us to incur up to $15.0 million of indebtedness under a new secured credit facility as a condition to the closing of the offering of the old notes. Our obligations under such new senior secured credit facility are secured by a lien on the collateral securing the Notes and any guarantees (other than the interest reserve account). Pursuant to an intercreditor agreement, this lien is senior (except for the lien on the renovation disbursement account, which is subordinated) to the lien of the collateral securing the Notes and any guarantees. The collateral does not include gaming equipment purchased through furniture, fixture and equipment purchase money financing and certain other purchase money financing, and there will not be any restrictions on the amount of gaming equipment financed in this manner. |

Guarantees |

|

Notes will be guaranteed on a senior secured basis by any future domestic restricted subsidiaries. These subsidiaries also will guarantee our new senior secured credit facility. As of the issue date of the old notes, there were no subsidiary guarantors. |

| | | |

10

Ranking |

|

The Notes are our senior secured obligations, will rank equally in right of payment with all of our existing and future senior debt, including our new senior secured credit facility, and will rank senior in right of payment to all of our existing and future subordinated debt. Any guarantees of the Notes will rank equally in right of payment with all other of the senior debt of any guarantors, including guarantees of our new senior secured credit facility (subject to the prior lien thereof), and will rank senior in right of payment to all of the subordinated debt of any guarantors. As of December 31, 2004, $ of our existing debt rankspari passu with the Notes. |

|

|

However, because of the intercreditor agreement, lenders under our new senior secured credit facility will be entitled to be repaid up to $15.0 million principal amount (plus related interest, fees, indemnities, costs and expenses) from the proceeds of the collateral securing our new senior secured credit facility (other than the renovation disbursement account), before any payment is made to holders of the Notes from such proceeds. The holders of the Notes will be entitled to be repaid from the amount in the renovation disbursement account prior to lenders under our senior secured credit facility receiving any such amount. Only the Notes, and not our senior secured credit facility, will be secured by the interest reserve account. |

Optional Redemption |

|

On or after April 1, 2009, we may, at our option, redeem some or all of the Notes at any time and from time to time at the redemption prices (expressed as percentages of principal amount) set forth below, plus accrued and unpaid interest, if any, to the applicable date of redemption, if redeemed during the 12-month period beginning on April 1 of the years indicated below: |

| | For the period

| | Percentage

| |

|---|

| | | 2009 | | 104.375 | % |

| | | 2010 | | 102.188 | % |

| | | 2011 and thereafter | | 100.000 | % |

| | | Prior to April 1, 2008, we may, at our option, use the net proceeds of certain equity offerings to redeem up to 35% of the original aggregate principal amount of the Notes at a redemption price equal to 108.750% plus accrued and unpaid interest to the applicable date of redemption, provided that at least 65% of the original principal amount of the Notes remains outstanding. |

Change of Control Offer |

|

If a change of control occurs, the holders of the Notes will have the right to require us to purchase their Notes at 101% of the principal amount, plus accrued and unpaid interest to the date of repurchase. |

| | | |

11

Asset Sale Offer |

|

If we sell assets or an event of loss occurs, we may use the proceeds in our discretion to retire certain debt or to invest the proceeds in our business assets. Any funds we do not apply to those purposes shall be categorized as excess proceeds. Any funds we do not apply to these purposes shall be categorized as excess proceeds. If we do not use the excess proceeds for specified purposes, and the excess proceeds reach $5,000,000, we will be required to use such excess proceeds to offer to repurchase some of the Notes at a price equal to 100% of the principal amount, plus accrued and unpaid interest to the date of repurchase. |

Certain Indenture Provisions |

|

The indentures governing the Notes will limit our ability and the ability of our restricted subsidiaries to, among other things:

• incur more debt;

• pay dividends, redeem stock or make other distributions;

• issue stock of restricted subsidiaries; • make investments;

• create liens;

• enter into transactions with affiliates;

• merge or consolidate; and

• transfer or sell assets. |

|

|

These covenants are subject to a number of important exceptions. See "Description of Notes-Certain Covenants." |

Absence of a Public Market; PORTAL Trading |

|

The Notes are new issues of securities, and there is currently no established market for them. The Notes will not be listed on any securities exchange or included in any automated quotation system. The Notes are eligible for trading in PORTAL. The initial purchasers have advised us that they intend to make a market in the Notes. The initial purchasers, however, are not obligated to do so and any such market may be discontinued by the initial purchaser in its discretion at any time without notice. See "Risk Factors—Risks Related to the Offering of the Old Notes—No Existing Trading Market for the Notes" and "Plan of Distribution." |

12

Summary Historical Financial Data

The summary historical financial data for Hotel San Remo for the years ended December 31, 2002, 2003, and 2004 are derived from the audited combined financial statements of Hotel San Remo, a Division of S.I. Enterprises, Inc., appearing elsewhere in this prospectus. The balance sheet data at December 31, 2004 for 155 East Tropicana, LLC (a development stage company) are derived from the audited financial statements of 155 East Tropicana, LLC appearing elsewhere in this prospectus.

The information presented below summarizes certain selected financial data, which you should read in conjunction with the financial statements and the related notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained elsewhere in this prospectus.

155 East Tropicana, LLC, as a limited liability company, is classified as a partnership for federal income tax purposes. Accordingly, a provision for income taxes is not included in our financial data.

| | Hotel San Remo

|

|---|

| | Year Ended December 31,

|

|---|

| | 2002

| | 2003

| | 2004

|

|---|

| | (dollars in thousands)

|

|---|

| Statement of Operations Data: | | | | | | | | | |

| Net revenues | | $ | 28,201 | | $ | 29,825 | | $ | 33,106 |

| Total operating expenses | | | 24,837 | | | 25,958 | | | 29,476 |

| Operating income | | | 3,364 | | | 3,867 | | | 3,630 |

| Net income | | | 214 | | | 694 | | | 1,921 |

| | 155 East Tropicana, LLC

|

|---|

| | At December 31, 2004

|

|---|

| | Actual

| | As Adjusted(1) (unaudited)

|

|---|

| | (dollars in thousands)

|

|---|

| Balance Sheet Data: | | | | | | |

| Cash and cash equivalents | | $ | 1,221 | | $ | 15,521 |

| Restricted cash—non-current(2) | | | 4,000 | | | 62,000 |

| Total assets | | | 75,580 | | | 154,480 |

| Long-term debt | | | 48,500 | | | 130,000 |

| Total liabilities | | | 50,260 | | | 130,460 |

| Members' equity(3) | | | 25,320 | | | 24,020 |

- (1)

- As Adjusted data gives effect to the offering of the old notes and the application of the net proceeds therefrom as described in "Use of Proceeds," including the extinguishment of existing indebtedness and payment of related fees and expenses, as if such transactions had been consummated on December 31, 2004, and assumes no borrowings under our new senior secured credit facility.

- (2)

- As Adjusted restricted cash includes $50.8 million of net proceeds from the sale of the old notes deposited into the renovation disbursement account, of which $4.3 million are working capital funds that will be held until 155 East Tropicana, LLC receives its gaming license, and $11.2 million of restricted cash in the interest reserve account. The $4.0 million in restricted cash at December 31, 2004 became unrestricted with the repayment of existing debt from the net proceeds from the sale of the old notes.

- (3)

- A $20.0 million portion of the members' equity is EW Common LLC's membership interest with priority return. The capital account of EW Common LLC will increase by $5.0 million if and at such time as we receive our gaming license and Eastern & Western contributes its gaming assets to us. (For more information see "Material Agreements—Joint Venture Agreement" and "—Operating Agreement.")

13

RISK FACTORS

An investment in the Notes involves a high degree of risk. You should carefully consider the following risks, as well as other information set forth in this prospectus, before tendering your old notes in the exchange offer. If any of the following risks actually occurs, our business, financial condition and/or operating results could be materially adversely affected, which, in turn, could adversely affect our ability to pay interest or principal on the Notes. In such a case, you may lose all or part of your original investment.

Risks Related to Our Business

Failure to Complete Renovation and Construction on Time and Within Budget—We could encounter problems during renovation and construction that could substantially increase the construction costs of the hotel casino or delay its re-opening as the Hooters Casino Hotel.

There is no assurance that we will complete all portions of the planned renovation or construction on time or within budget. The renovation and construction is scheduled to be completed in February 2006 and the hotel casino is scheduled to be opened under the Hooters brand in February 2006. However, construction projects such as the renovation and construction of the Hooters Casino Hotel are subject to significant development and construction risks, any of which could cause unanticipated cost increases and delays. These include the following:

- •

- shortages of energy, material and skilled labor;

- •

- delays in obtaining or inability to obtain necessary permits, licenses and approvals;

- •

- changes in law applicable to gaming projects;

- •

- changes to the plans or specifications;

- •

- weather interference or delays;

- •

- engineering problems;

- •

- labor disputes and work stoppages;

- •

- disputes with contractors;

- •

- environmental and real property issues;

- •

- fire, earthquake, flood and other natural disasters; and

- •

- changes in political, financial or economic conditions, including as a result of international conflict.

The total cost to renovate, equip, and re-open the property is expected to be approximately $65.1 million. We deposited an aggregate of approximately $50.8 million of the net proceeds of the offering of the old notes into a renovation disbursement account to fund a portion of the costs of the design, renovation and equipping of the Hooters Casino Hotel. Funds are disbursed from the renovation disbursement account upon our delivery of an officers' certificate containing certain certifications (including invoices) specified by the cash collateral and disbursement agreement. Such certifications are not be subject to independent verification by the disbursement agent or any other third party, and neither the architect nor the contractor is required to sign off on any disbursements.

We have entered into a $36.5 million guaranteed maximum price contract which is based upon the current specifications and drawings of the renovation and provides for further development by the architect of such specifications and drawings. The guaranteed maximum price may be subject to a material increase if there are changes in the scope of the project or changes in the systems, kinds and

14

quality of materials, finishes or equipment specified for the project. There can be no assurance that such changes will not be required.

In addition, we expect to obtain approximately $5.9 million in furniture, fixtures and equipment financing in connection with the purchase of such assets for the hotel casino. However, this financing is not currently in place, and no assurances can be given that such financing or any additional financing that we require will be obtained on a timely basis or at all. If such financing is not obtained, we will be required to use available cash, borrowings under our new senior secured credit facility or other sources of funds to purchase such assets, although no assurances can be given that any such other funds will be available.

Numerous regulatory licenses, permits and approvals are necessary to renovate, equip and re-open the property. There can be no assurance that we will be able to obtain all necessary permits and, even if obtained, such permits could have conditions and restrictions that could adversely affect the completion of the renovation and the re-opening of the hotel casino.

Until renovation and construction are complete and we commence operations under the Hooters brand, we will rely exclusively on the Hotel San Remo (or, until we receive our gaming license, rent payments under the hotel and casino leases) to generate revenue. There can be no assurance that the re-opening as the Hooters Casino Hotel will occur on schedule or at all. Failure to complete renovation or construction or open the Hooters Casino Hotel as currently contemplated will have a material adverse effect on our business, financial condition, results of operations and ability to meet our payment obligations under the Notes and our other indebtedness.

Disruption of Operations—Construction and renovations to the hotel casino will disrupt our operations.

The Hotel San Remo will continue to operate during construction and renovation. We intend to conduct the construction and renovation in phases and otherwise attempt to reduce disruption to the Hotel San Remo's business to the extent possible although various facilities and areas will not be operational or accessible during periods of the construction and renovation process. It is likely that the renovation process will result in a decrease in hotel occupancy and use of the casino, and we cannot assure that this will not have a material adverse effect on our business, financial condition and results of operations. In addition, we are planning to completely cease operations for approximately 30 days prior to the opening of the Hooters Casino Hotel. We will not receive rent from Eastern & Western under the casino lease or the hotel lease during any period that the casino is shut down prior to re-opening. We cannot assure you that the shutdown period will not be longer than 30 days. If the period is longer, it could have a material adverse effect on our business, financial condition and results of operations.

License Agreement—We are required to utilize certain intellectual property related to the Hooters brand in connection with hotel casino operations prior to September 2006 or risk termination of the license. We also are required to pay numerous royalty and other fees to the licensors, some of whom are our affiliates, for the right to use this intellectual property.

The Hooters trademark and logo insignia are the exclusive property of Hooters of America. Pursuant to certain licenses and an assignment of those license rights to us, we have a royalty-bearing license to use certain intellectual property related to the Hooters brand solely for purposes of the operation of a Hooters Casino Hotel located at our property. The license agreement may be terminated by Hooters of America if we have not begun using the licensed intellectual property in connection with licensed activities prior to September 2006 unless, prior to the exercise of such termination right, we commence such activities or unless, at that date, we have substantially completed facilities in which to commence such activities and complete such facilities within a reasonable period of time thereafter. We cannot be certain that we will be open and operating as a Hooters Casino Hotel prior to September 2006. In addition, our operation of the Hooters Casino Hotel is conditioned on

15

payment of certain royalty fees to Hooters of America and some of our affiliates based on percentages of revenues and sales generated by our gaming and restaurant activities, as described below under "Business—Intellectual Property" and "Certain Relationships and Related Transactions," and satisfaction of other conditions under the license. Failure to satisfy the conditions could result in termination of the license. Furthermore, in a bankruptcy of a licensor, the bankruptcy court could conclude that the trademark license agreements are executory contracts and, subject to certain legal requirements, may approve rejection of the license agreements. Although we would take the position that our license agreement with Hooters of America is not an executory contract, there can be no assurance that a bankruptcy court would so conclude in a bankruptcy of Hooters of America. Rejection would give rise to a claim for damages for breach of the license and might prevent us from continuing to use the trademark or on the same terms. The loss of our license rights could prevent us from operating as the Hooters Casino Hotel, which would have a material adverse effect on our business, financial condition and results of operations.

Use of Hooters Brand—Use of the Hooters brand by entities other than us, including in Las Vegas and other areas of Nevada, could adversely affect our business, financial condition and results of operations.

We will benefit from the name recognition and reputation generated by the Hooters restaurants that are operated worldwide. We have the right to use the Hooters brand and certain related intellectual property solely for purposes of a Hooters Casino Hotel located at our property. Hooters Gaming Corporation, an affiliate under common ownership with Hooters Gaming LLC, is the sole owner of the right to use the Hooters brand in connection with the conduct of gaming and the operation of hotels elsewhere in the state of Nevada. Hooters Gaming Corporation has agreed not to operate (or license or assign its rights to operate) another Hooters Casino Hotel on The Strip until the Notes are no longer outstanding. Additionally, Hooters Gaming Corporation has agreed not to operate (or license or assign its rights to operate) another Hooters Casino Hotel in Clark County, Nevada for a period of four years from the issuance of the Notes or such earlier time as none of the Notes is outstanding. However, Hooters Gaming Corporation or its assignee can exploit the Hooters brand and logo in connection with hotel casinos and casinos in other areas of Nevada and elsewhere, including marketing worldwide, and once the Notes are no longer outstanding, on The Strip. For example, other Hooters Casino Hotels could be opened in areas (other than The Strip) in Las Vegas and Nevada and throughout the world where gaming operations are permitted. In addition, Las Vegas Wings, Inc., an affiliate under common ownership with Lags Ventures, LLC, owns the exclusive right to use the Hooters brand, marks and trade dress on restaurant services elsewhere in Las Vegas (although it has agreed not to open or license another person to open a Hooters restaurant on The Strip) and the remainder of the State of Nevada and currently owns two restaurants in Nevada. As a result, Las Vegas Wings, Inc. or its assignees can exploit the Hooters brand and logo in connection with additional restaurants in Las Vegas or elsewhere in Nevada. See "Certain Relationships and Related Transactions." We cannot assure that the development of other hotel casinos, casinos or restaurants using the Hooters brand in Nevada or elsewhere will not adversely affect our business, financial condition and results of operations. Nor can we assure that our business, financial condition and results of operations will not be adversely affected by the management of the Hooters brand or any negative public image or other adverse event that becomes associated with the Hooters brand.

Licensing—We are required to obtain, and thereafter maintain, gaming, liquor and other licenses to operate the Hooters Casino Hotel. The gaming industry is highly regulated and the licensing process is extensive.

Our operation of the Hooters Casino Hotel is contingent upon the receipt and maintenance of various regulatory licenses, permits, approvals, registrations, findings of suitability, orders and authorizations. The laws, regulations, and ordinances requiring these licenses, permits and other approvals generally relate to the responsibility, financial suitability and character of the owners and managers of our gaming operations, as well as persons financially interested or involved in our gaming operations, almost all of whom have never been licensed previously. The scope of the approvals

16

required to operate a facility is extensive. We are currently in the process of obtaining required state and local licenses and related approvals necessary for us to conduct our gaming operations and to serve liquor. However, we cannot be certain that we and all our owners, managers and others interested or involved in our gaming operations will obtain the required approvals and licenses at all or on a timely basis. Failure to obtain or maintain the necessary approvals could adversely affect our ability to operate the Hooters Casino Hotel. See "Regulation and Licensing."

Dependence Upon a Single Gaming Site—Our cash flow to meet our payment obligations under the Notes and our other indebtedness and to fund our operations is dependent solely on the hotel casino or, until we receive our gaming license, rent payments under the hotel and casino leases.

We deposited a portion of the net proceeds from the offering of the old notes into an interest reserve account to fund, together with interest to be earned thereon, the first two payments of interest on the Notes. Once funds in the interest reserve account have been depleted, we will rely exclusively on cash flow generated by the hotel casino or, until we receive our gaming license, rent payments under the hotel and casino leases, as well as borrowings under the new senior secured credit facility to meet our payment obligations under the Notes and our other indebtedness and to fund our operations. The casino lease provides for rent payments by Eastern & Western to us of $125,000 per month, prior to the re-opening of the Hooters Casino Hotel, and $450,000 per month commencing on the re-opening (subject to increase, at our election, to fair market value six months and 18 months after the re-opening). Any cash flow from casino operations remaining after making the rent payments and the reserves required under the casino lease is required to be deposited by Eastern & Western into an account to secure Eastern & Western's Notes guarantee, to be held in trust for the benefit of the holders of the Notes and the lenders under our new senior secured credity facility until such time all Notes cease to be outstanding. The amount of funds required to be on deposit in this account is determined on a cumulative basis over the term of the casino lease and may fluctuate from month to month. There can be no assurance as to what amount, if any, will be on deposit in this account at any given time. The hotel lease provides for rent payments by Eastern & Western to us of $250,000 per month plus 100% of all revenues received from the operation of the hotel, less actual operational expenses (including the $250,000 monthly payment) and mutually agreed upon working capital reserves. See "Material Agreements—Casino Lease" and "—Hotel Lease." We will not receive rent from Eastern & Western under the casino lease or the hotel lease during any period that the casino is shut down prior to re-opening. If we have insufficient funds available under the new senior secured credit facility and the hotel casino is not generating sufficient cash flow (or, if we have not received our gaming license and rent payments under the hotel and casino lease are not sufficient) to meet our payment obligations under the Notes by the date on which we are required to make the third interest payment on the Notes and our other indebtedness, we may be unable to make the required interest payments to you, to meet our payment obligations under our other indebtedness and to fund our operations. See "—Risks Related to the Offering of the Old Notes and the Notes—Ability to Service Debt."

Dependence on Eastern & Western as Operator—If Eastern & Western ceases to provide its services as our hotel and casino operator for any reason or if for any reason the leases are terminated before we receive all necessary gaming approvals, our business and our ability to satisfy our obligations under the Notes and our other indebtedness could be materially adversely affected.

We have entered into a casino lease and a hotel lease to Eastern & Western to operate the hotel casino until we receive the necessary gaming approvals. Although the leases terminate on the earlier of the date the Notes are no longer outstanding or the date that we receive all necessary gaming approvals, there can be no assurance that Eastern & Western could continue to perform its obligations as operator or that the leases will remain in effect for their duration. If we were unable to find a replacement operator for the hotel casino, our business, financial condition, results of operations and ability to satisfy our obligations under the Notes and our other indebtedness could be materially

17

adversely affected. In addition, the failure by Eastern & Western to comply with its obligations under the lease (which failure is not cured within a specified period) or to possess all necessary licenses for the operation of the hotel casino would constitute an event of default under the leases and an immediate Event of Default under the indenture governing the Notes.

Risk of a New Venture—We do not have any prior operating history or history of earnings as the Hooters Casino Hotel.

We were formed to acquire, operate, renovate and re-brand the Hotel San Remo. While the Hotel San Remo has a history of operations and a history of earnings, we do not. Moreover, in the past, the Hooters brand has not been associated with hotels or casinos. Consequently, we cannot be certain that our planned construction and renovation to the Hotel San Remo and transformation of the Hotel San Remo into the Hooters Casino Hotel will attract the number and type of hotel and casino customers and other visitors we desire to achieve our objective of improving the profitability of the hotel casino.

We will be subject to significant business, economic, regulatory and competitive uncertainties frequently encountered by new businesses in competitive environments, many of which are beyond our control. Because we have no operating history, it may be more difficult for us to prepare for and respond to these types of risks, and the other types of risks described in this prospectus, as compared with an established business. As a result, you must evaluate our business prospects in light of the difficulties frequently encountered by companies in the early stages of gaming projects and the risks inherent in the establishment of a new business enterprise. There can be no assurance that we will be able to successfully operate the hotel casino or manage these risks successfully, that the hotel casino will be profitable or that we will generate sufficient cash flow to meet our payment obligations under the Notes and our other indebtedness, which would in turn negatively affect our business, financial condition and results of operations.

Competition—We are subject to intense local competition as well as competition in the gaming industry that could hinder our ability to operate profitably.

Competition in Las Vegas has increased over the last several years as a result of significant increases in hotel rooms, casino sizes and convention, trade show and meeting facilities. Our success is dependent upon the success of the hotel casino and its continuing ability to attract visitors and operate profitably. The hotel casino, located one-half block east of The Strip, competes with high-quality Las Vegas resorts and other Las Vegas hotel casinos, including those located on The Strip and in downtown Las Vegas, on the basis of overall atmosphere, range of amenities, level of service, price, location, entertainment offered, theme and size. Currently, there are approximately 30 major gaming properties located on or near The Strip, 13 additional major gaming properties in the downtown area and additional gaming properties located in other areas of Las Vegas. Some of these facilities are operated by companies that have more than one operating facility, and many have greater name recognition and financial and marketing resources than us and market to the same target demographic group as we do. Furthermore, additional major hotel casinos and significant expansion of existing properties, containing a significant number of hotel rooms and attractions, are expected to open in Las Vegas this year and within the coming years. There can be no assurance that the Las Vegas market will continue to grow or that hotel casino resorts will continue to be popular. A decline or leveling off of the growth or popularity of such facilities would adversely affect our business, financial condition and results of operations. See "Business—Competition."

There also is substantial competition among gaming companies in the gaming industry generally, which includes land-based casinos, dockside casinos, riverboat casinos, casinos located on Native American land, including in California, and other forms of legalized gambling. If other casinos operate more successfully, if existing properties are enhanced or expanded, or if additional hotels and casinos are established in and around the locations where we conduct business, we may lose market share. We also compete, to some extent, with other forms of gaming on both a local and national level, including

18

state-sponsored lotteries, Internet gaming, on-and off-track wagering and card parlors. In particular, the legalization of gaming or the expansion of legalized gaming in or near any geographic area from which we attract or expect to attract a significant number of our customers could have a significant adverse effect on our business, financial condition and results of operations.

Increased competition may also require us to make substantial capital expenditures to maintain and enhance the competitive positions of our properties. Because we are highly leveraged, after satisfying our obligations under our outstanding indebtedness, there can be no assurance that we will have sufficient financing to make such expenditures. If we are unable to make such expenditures, our competitive position and our results of operations could be materially adversely affected.

Governmental Regulations—We face extensive regulation from gaming and other government authorities.

As owners and operators of gaming facilities, we are subject to extensive Nevada state and local regulation. Nevada state and local government authorities require us and our subsidiaries to obtain gaming licenses and require our officers and key employees to demonstrate suitability to hold gaming licenses. The Nevada state and local government may limit, condition, suspend or revoke a license for any cause deemed reasonable by the respective licensing agency. They may also levy substantial fines against us or the individuals involved in violating gaming laws or regulations. The occurrence of any of these events could have a material adverse effect on our business, financial condition and results of operations.

No assurances can be given that any new licenses, registrations, findings of suitability, permits and approvals, including for any proposed expansion of our properties, will be given or that existing ones will be renewed when they expire. Any failure to renew or maintain our licenses or receive new licenses when necessary would have a material adverse effect on us.

We are subject to a variety of other rules and regulations, including zoning, environmental, construction and land-use laws and regulations governing the serving of alcoholic beverages. We also pay substantial taxes and fees in connection with our operations as a gaming company, which taxes and fees are subject to increase or other change at any time. Any changes to these laws could have a material adverse effect on our business, financial condition and results of operations.

The compliance costs associated with these laws, regulations and licenses are significant. A change in the laws, regulations and licenses applicable to our business or a violation of any current or future laws or regulations or our gaming licenses could require us to make material expenditures or could otherwise materially adversely effect our business, financial condition or results of operations.

For more detailed information, see "Regulation and Licensing."

Union Efforts to Organize Employees—Our business, financial condition, and results of operations may be harmed by union efforts to organize our employees.

Our employees are not covered by collective bargaining agreements. If any union seeks to organize any of our employees, we could experience disruption in our business and incur significant costs, both of which could have a material adverse effect on our results of operation and financial condition. If a union were successful in organizing any of our employees we could experience significant increases in our labor costs which could also have a material adverse effect on our business, financial condition, and results of operations. We may face an increased risk of union activity after our opening as Hooters Casino Hotel due to the high profile of the Hooters brand.

Possible Conflicts of Interest—The relationship of our chief executive officer to Hooters Inc. and related entities creates potential for conflicts of interest.

Neil Kiefer, our chief executive officer is the President, Chief Executive Officer and director of Hooters Inc. and related entities, which are based in Florida and some of which may have interests

19

adverse to us. Due to Mr. Kiefer's responsibilities to serve both companies, there is potential for conflicts of interest. At any particular time, the needs of Hooters Inc. could cause Mr. Kiefer to devote attention to Hooters Inc. at the expense of devoting attention to us. In addition, matters may arise that place Mr. Kiefer in conflicting positions. No assurance can be given that material conflicts will not arise which could be detrimental to our business, financial condition and results of operations.

Factors Beyond Our Control—Our business, financial condition and results of operations are dependent in part on a number of factors that are beyond our control.

The economic health of our business is generally affected by a number of factors that are beyond our control, including:

- •

- continued increases in healthcare costs;

- •

- general economic conditions and economic conditions specific to our primary markets;

- •

- inaccessibility to our property due to construction on adjoining or nearby properties, streets or walkways;

- •

- levels of disposable income of casino customers;

- •

- increased transportation costs;

- •

- local conditions in key gaming markets, including seasonal and weather-related factors;

- •

- increase in gaming taxes or fees;

- •

- decline in tourism and travel due to occurrences or threats of terrorism or other destabilizing events;

- •

- substantial increase in the cost of electricity, natural gas and other forms of energy;

- •

- competitive conditions in the gaming industry, including the effect of such conditions on the pricing of our games and products;

- •

- the relative popularity of entertainment alternatives to casino gaming that compete for the leisure dollar;

- •

- the adoption of anti-smoking regulations; and

- •

- an outbreak or suspicion of an outbreak of an infectious communicable disease.

Any of these factors could negatively impact our property or geographic location in particular or the casino industry generally, and as a result, our business, financial condition and results of operations.

Environmental Matters—We are subject to environmental laws and potential exposure to environmental liabilities. This may cause us to incur costs or affect our ability to develop, sell or rent our property or to borrow money using such property as collateral.