©2024 FHLB Cincinnati. All rights reserved. Welcome 2024 FHLB Cincinnati Annual Stockholder Meeting May 8, 2024

©2024 FHLB Cincinnati. All rights reserved. Disclaimer This presentation may contain forward-looking statements that are subject to risks and uncertainties that could affect the FHLB’s financial condition and results of operations. These include, but are not limited to, the effects of economic and financial conditions, legislative or regulatory developments concerning the FHLB System, financial pressures affecting other FHLBanks, competitive forces, and other risks detailed from time to time in the FHLB’s annual report on Form 10-K and other filings with the Securities and Exchange Commission. The forward-looking statements speak as of the date made and are not guarantees of future performance. Actual results or developments may differ materially from the expectations expressed or implied in the forward-looking statements, and the FHLB undertakes no obligation to update any such statements. 1

©2024 FHLB Cincinnati. All rights reserved. FHLBank System at 100: Focusing on the Future J. Lynn Anderson Chair, FHLB Cincinnati Board of Directors

©2024 FHLB Cincinnati. All rights reserved. Council of FHLBanks; FHLBank System at 100 • Council of FHLBanks • Chair, Vice Chair, President of each FHLBank • Lynn Anderson, Jim Vance, Andy Howell • FHLBank System at 100: Focusing on the Future • Mission • Membership • Housing • Operations 3

©2024 FHLB Cincinnati. All rights reserved. Board Commitment for Housing & Community Investment • Affordable Housing Program • Community Investment Program • Economic Development Program • Voluntary Programs • Disaster Reconstruction Program • Carol M. Peterson Housing Fund • Zero Interest Fund • Rise Up Program 4

©2024 FHLB Cincinnati. All rights reserved. FHLB Cincinnati 2024 Senior Staff 5

©2024 FHLB Cincinnati. All rights reserved. Trusted Partners – Your 2024 Board of Directors 6

©2024 FHLB Cincinnati. All rights reserved. Trusted Partners – Your 2024 Board of Directors 7

©2024 FHLB Cincinnati. All rights reserved. Looking Forward: The 2024 Director Election On June 13, Survey & Ballot Systems (SBS) will email your designated Primary Contact with your unique credentials and a link to your online nominating ballot and election materials. • To ensure that you receive FHLB Election nominating and voting emails from SBS, please add the following address to your email contacts list as an approved sender from FHLBank Election Coordinator, noreply@directvote.net. • Director Elections electronic voting information will also be communicated through a Member NewsLine and to your Members Only inbox. • If you have questions, contact Melissa Dallas or Kevin Hanrahan at DirectorElection2024@fhlbcin.com. 8

©2024 FHLB Cincinnati. All rights reserved. FHLB: Well-Positioned to Serve Members Today . . . and Tomorrow • Reliable Source of Liquidity • Mortgage Purchase Program • Affordable Housing Program/Welcome Home • Community Investment Cash Advances • Voluntary Programs 9

©2024 FHLB Cincinnati. All rights reserved. A Continuing Commitment: Building Stronger Communities Andrew Howell President and CEO, FHLB Cincinnati

©2024 FHLB Cincinnati. All rights reserved. Building Stronger Communities • Federal Reserve Actions • Loan & Deposit Trends in the Fifth District • FHLB Business Activity & Earnings Performance • Legislative & Regulatory Landscape • Looking Forward 11

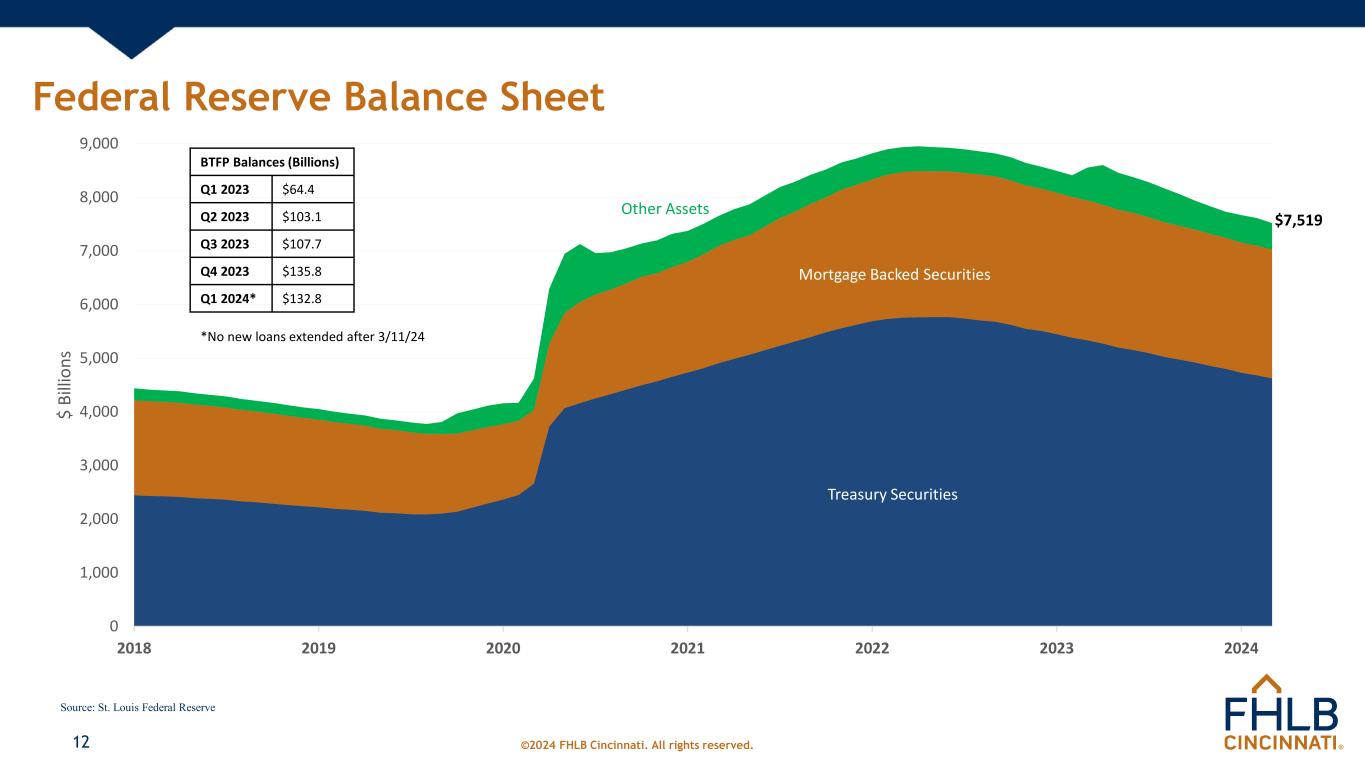

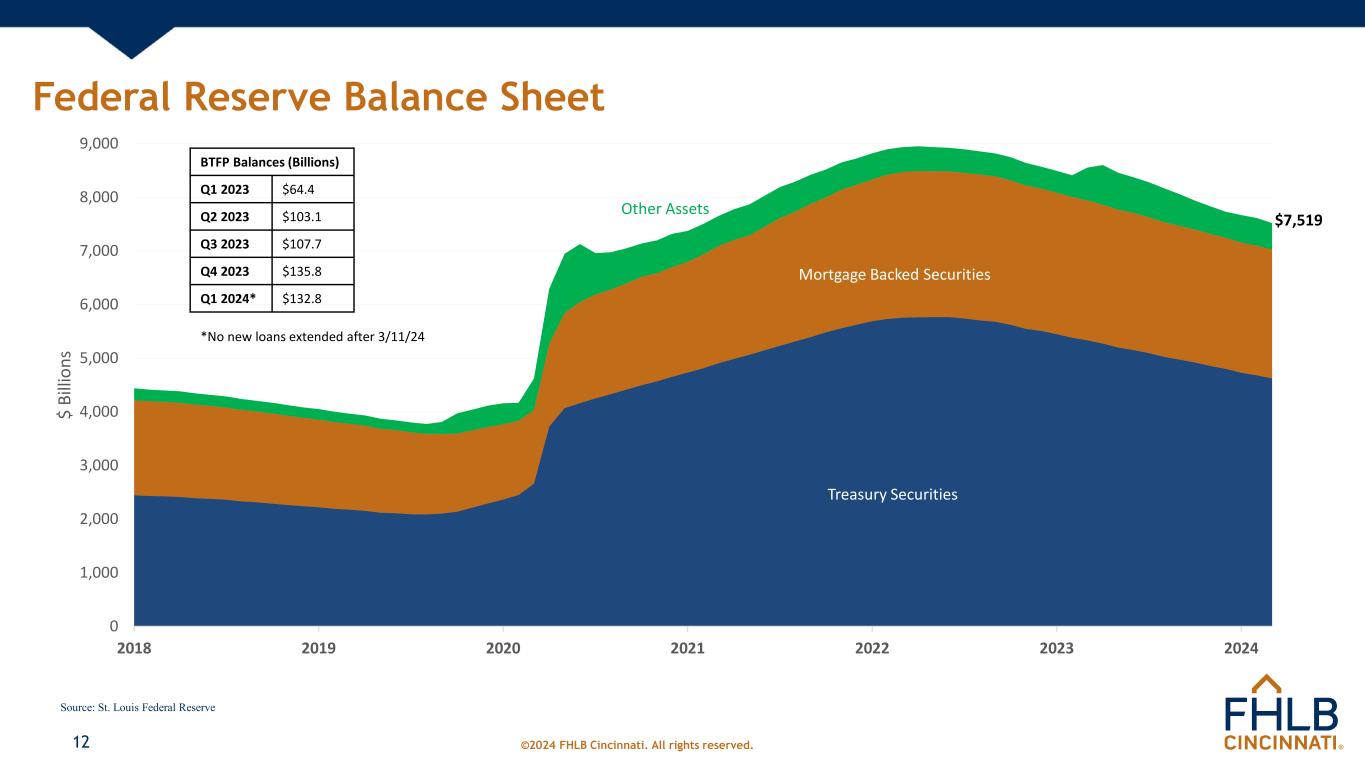

©2024 FHLB Cincinnati. All rights reserved. Federal Reserve Balance Sheet 12 Source: St. Louis Federal Reserve 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 2018 2019 2020 2021 2022 2023 2024 $ Bi lli on s Treasury Securities Mortgage Backed Securities Other Assets $7,519 BTFP Balances (Billions) Q1 2023 $64.4 Q2 2023 $103.1 Q3 2023 $107.7 Q4 2023 $135.8 Q1 2024* $132.8 *No new loans extended after 3/11/24

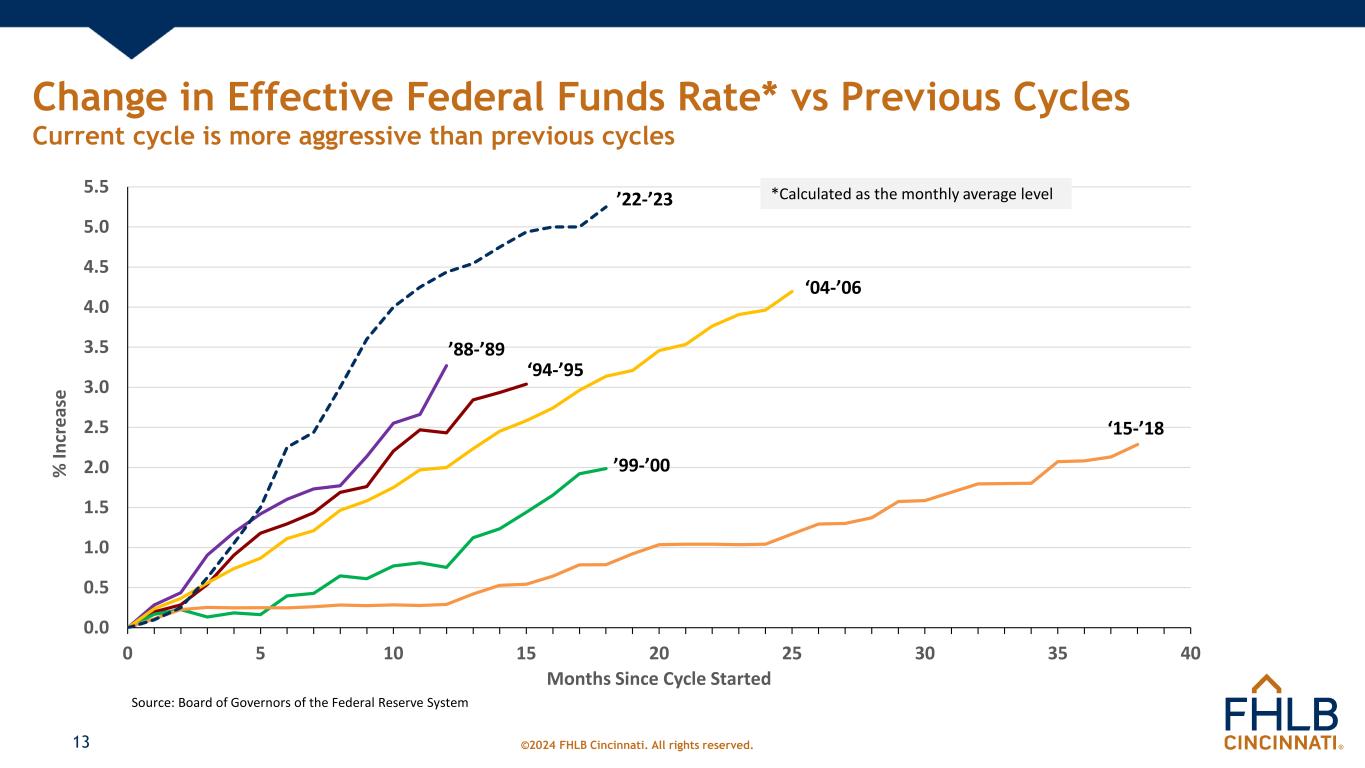

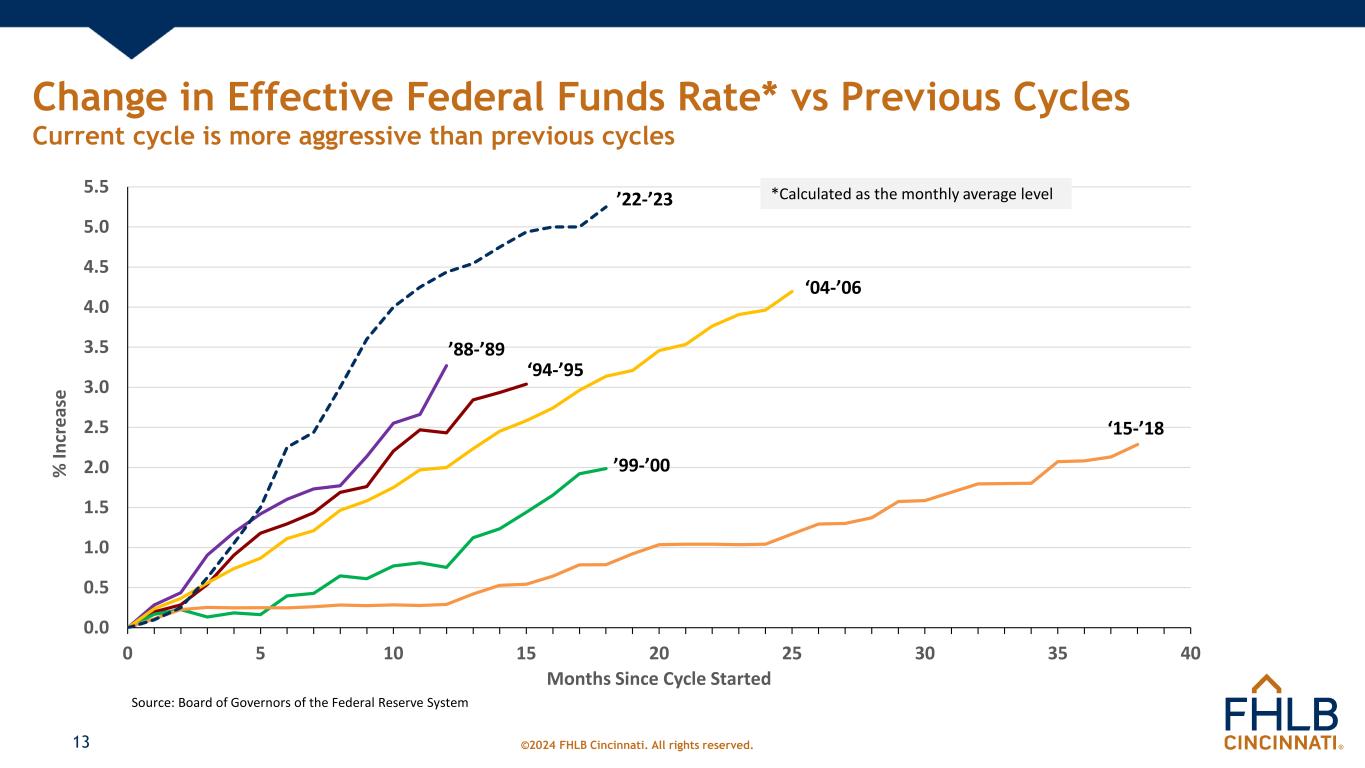

©2024 FHLB Cincinnati. All rights reserved. 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 0 5 10 15 20 25 30 35 40 % In cr ea se Months Since Cycle Started ’22-’23 ’88-’89 ‘15-’18 Change in Effective Federal Funds Rate* vs Previous Cycles Current cycle is more aggressive than previous cycles 13 ‘94-’95 ‘04-’06 ’99-’00 *Calculated as the monthly average level Source: Board of Governors of the Federal Reserve System

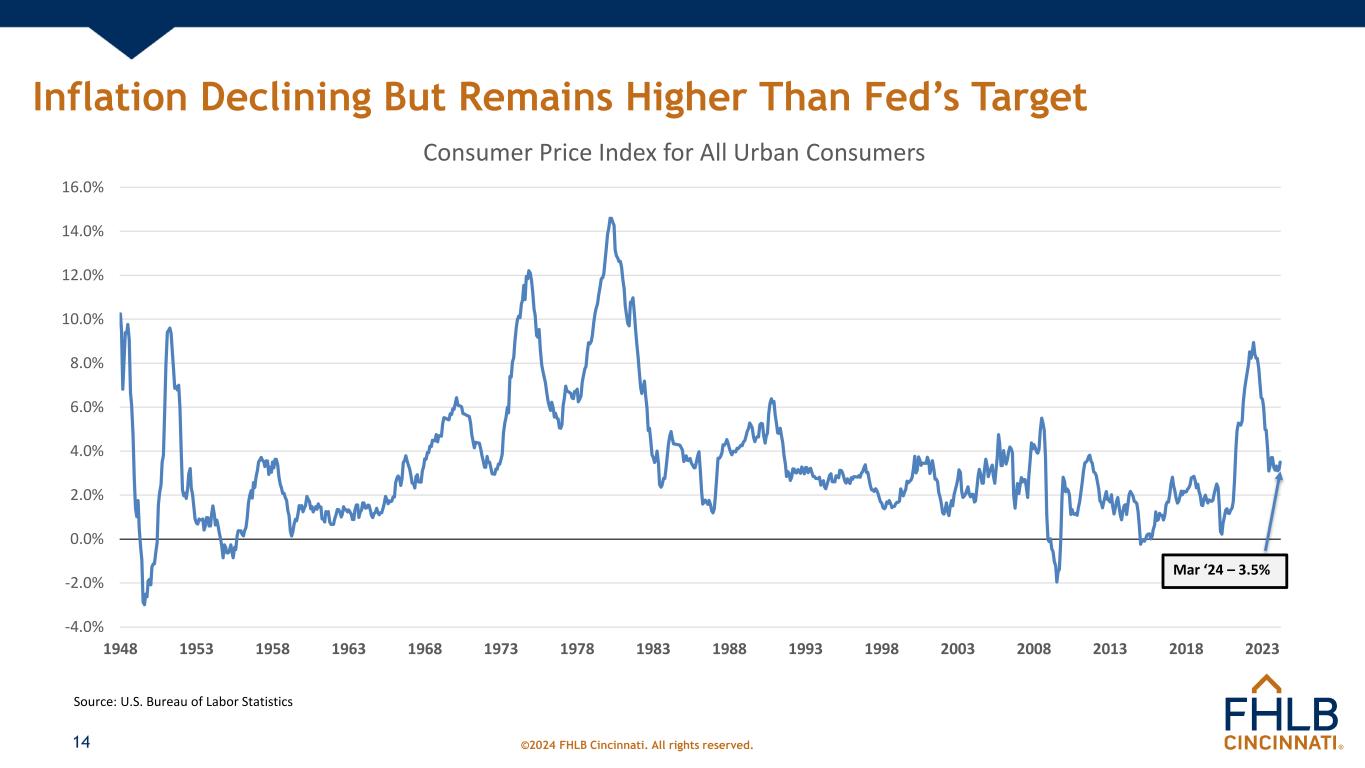

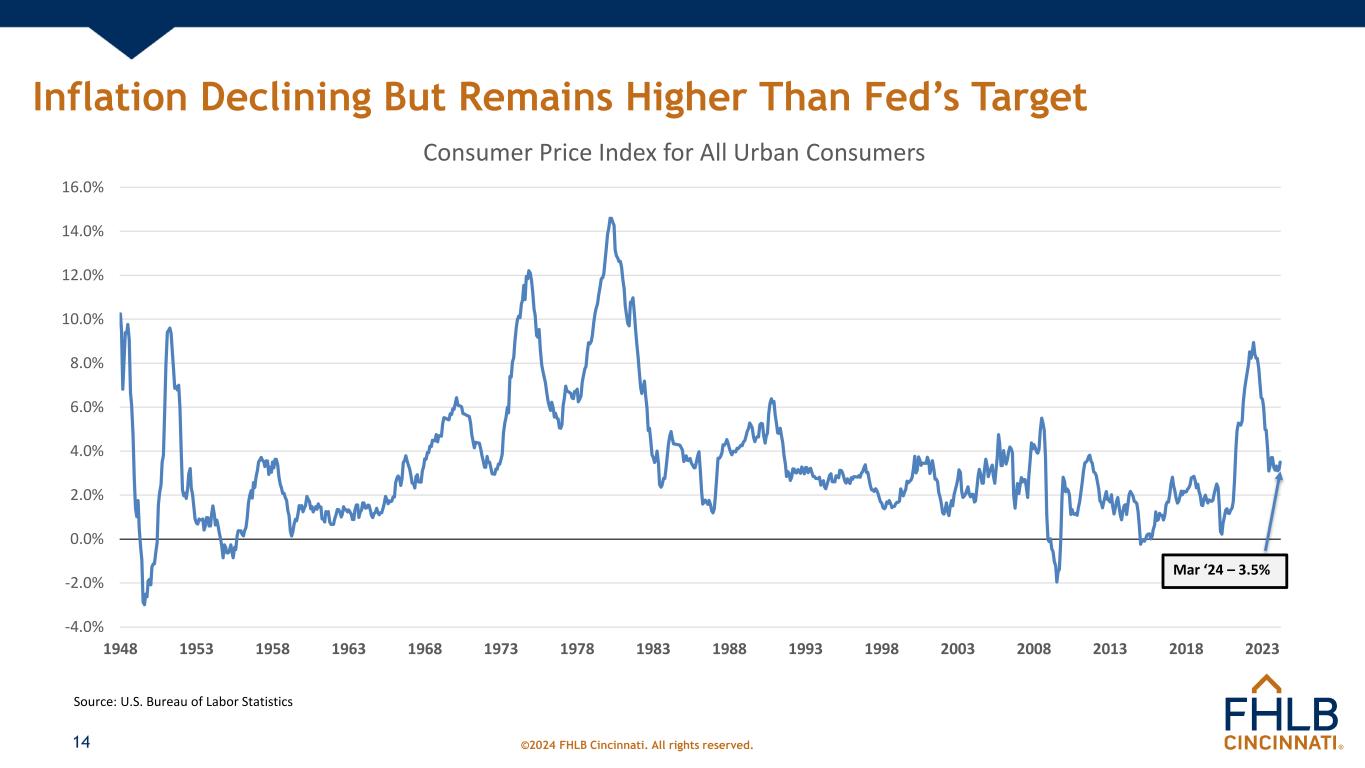

©2024 FHLB Cincinnati. All rights reserved. Inflation Declining But Remains Higher Than Fed’s Target 14 -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 1948 1953 1958 1963 1968 1973 1978 1983 1988 1993 1998 2003 2008 2013 2018 2023 Consumer Price Index for All Urban Consumers Mar ‘24 – 3.5% Source: U.S. Bureau of Labor Statistics

©2024 FHLB Cincinnati. All rights reserved. Loan/Deposit Gap Continuing to Decline 15 $130 $150 $170 $190 $210 $230 2019Q4 2020Q2 2020Q4 2021Q2 2021Q4 2022Q2 2022Q4 2023Q2 2023Q4 Loans and Deposits in Fifth District, Members with Assets < $10 Billion ($ in billions) Deposits $22 B $40 B $61 B $46 B $40 B Loans Source: Call Report Data; current bank/thrift members

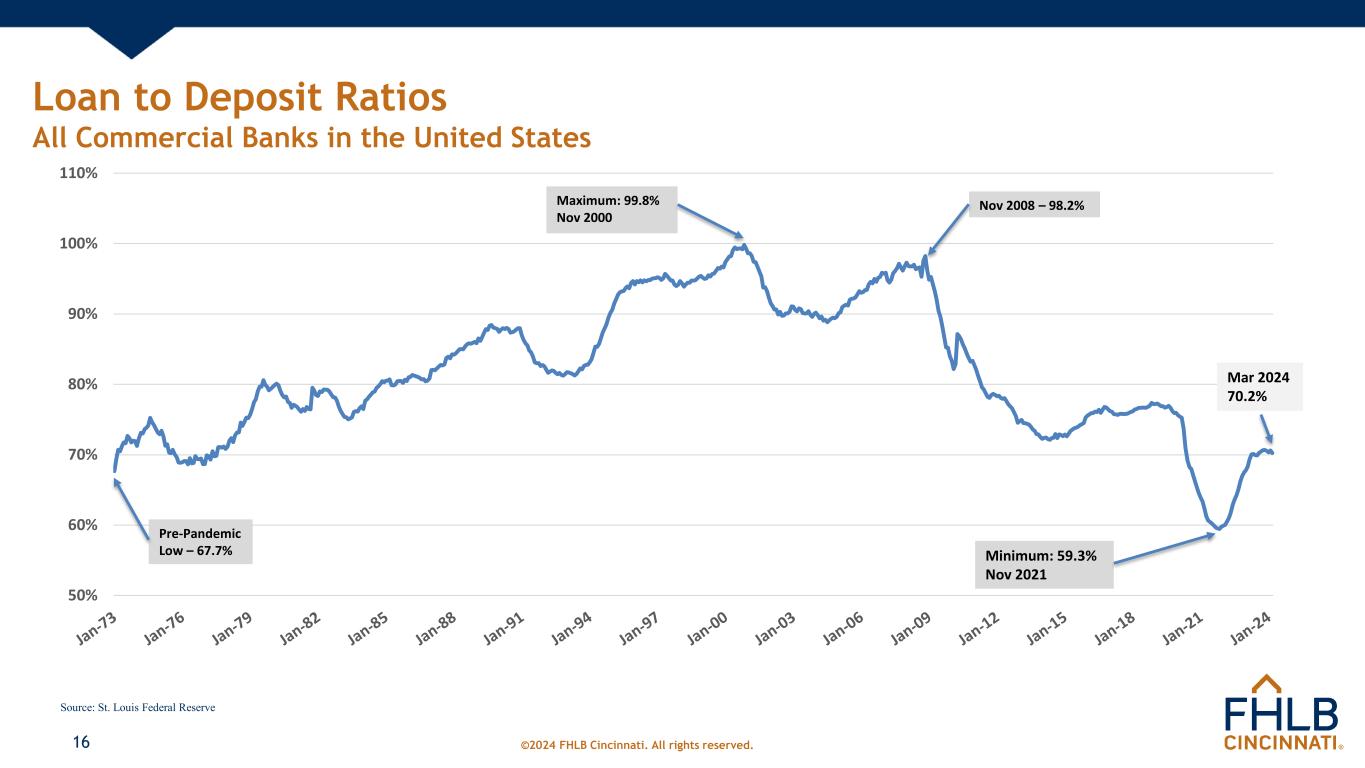

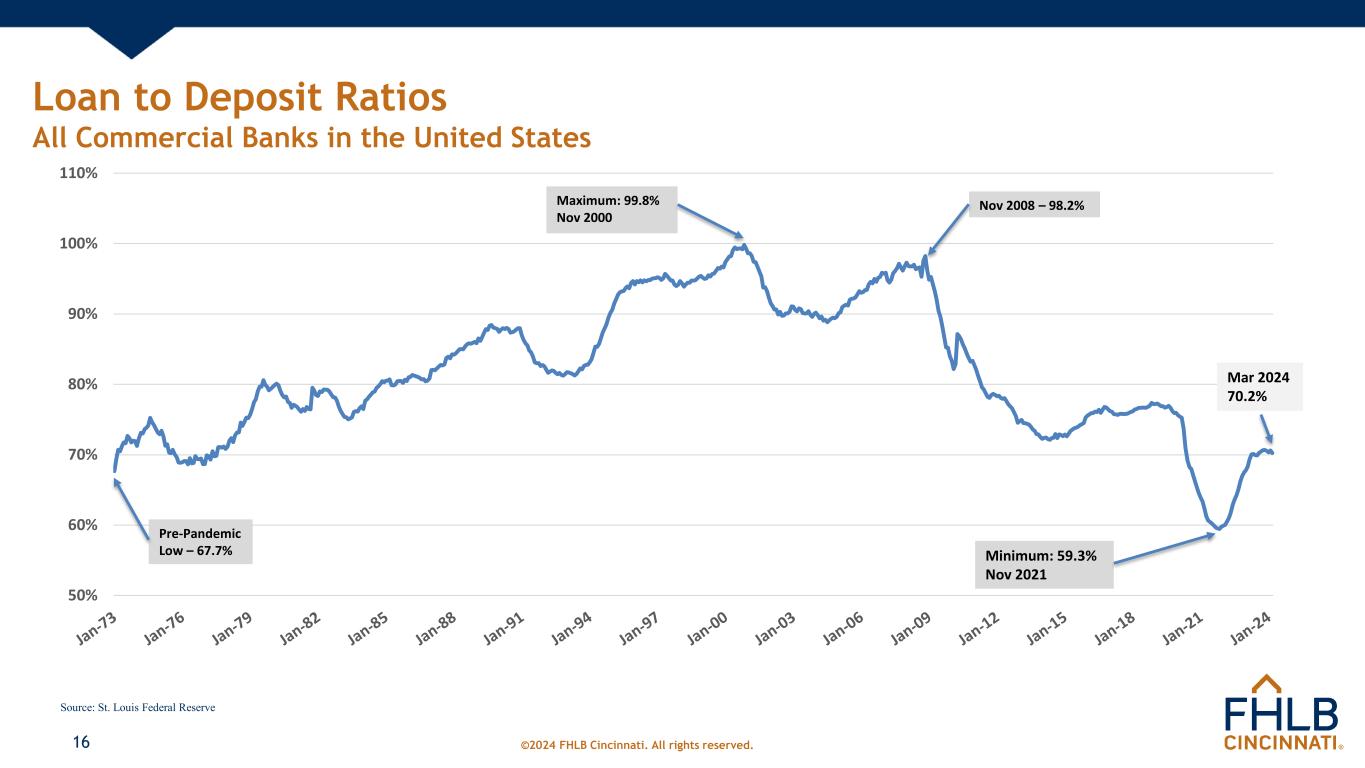

©2024 FHLB Cincinnati. All rights reserved. Loan to Deposit Ratios All Commercial Banks in the United States 16 50% 60% 70% 80% 90% 100% 110% Pre-Pandemic Low – 67.7% Maximum: 99.8% Nov 2000 Minimum: 59.3% Nov 2021 Mar 2024 70.2% Nov 2008 – 98.2% Source: St. Louis Federal Reserve

©2024 FHLB Cincinnati. All rights reserved. Small Banks Growing Loans and Deposits More Than Larger Banks Member Banks/Thrifts with Assets < $10 Billion vs Large Domestically Chartered Commercial Banks* 17 -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% QoQ% Growth in Loans Source: Call Report Data; current bank/thrift members; Board of Governors of the Federal Reserve System QoQ% Growth in Deposits Member Banks/Thrifts Large U.S. Commercial Banks **Large Domestically Chartered Commercial Banks defined as the top 25 domestically chartered commercial banks ranked by size

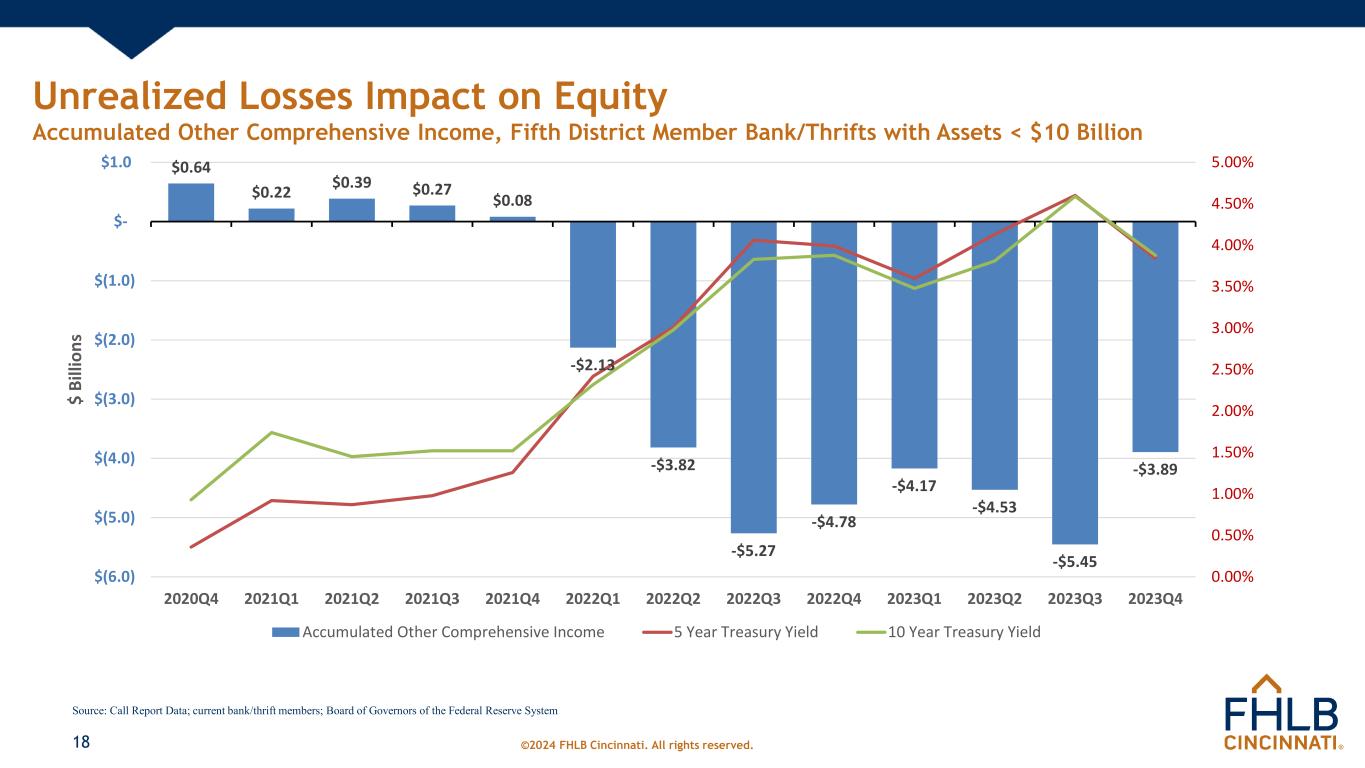

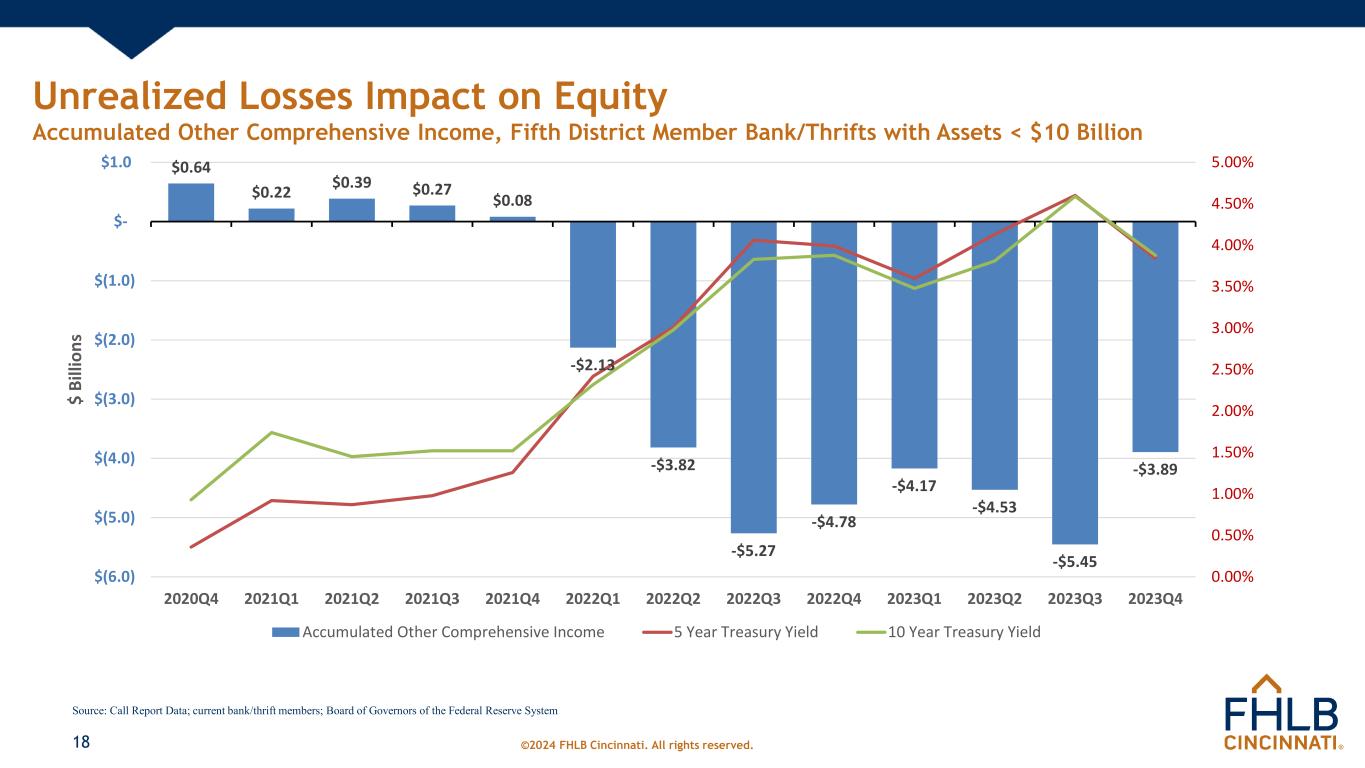

©2024 FHLB Cincinnati. All rights reserved. Unrealized Losses Impact on Equity Accumulated Other Comprehensive Income, Fifth District Member Bank/Thrifts with Assets < $10 Billion 18 $0.64 $0.22 $0.39 $0.27 $0.08 -$2.13 -$3.82 -$5.27 -$4.78 -$4.17 -$4.53 -$5.45 -$3.89 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% $(6.0) $(5.0) $(4.0) $(3.0) $(2.0) $(1.0) $- $1.0 2020Q4 2021Q1 2021Q2 2021Q3 2021Q4 2022Q1 2022Q2 2022Q3 2022Q4 2023Q1 2023Q2 2023Q3 2023Q4 $ Bi lli on s Accumulated Other Comprehensive Income 5 Year Treasury Yield 10 Year Treasury Yield Source: Call Report Data; current bank/thrift members; Board of Governors of the Federal Reserve System

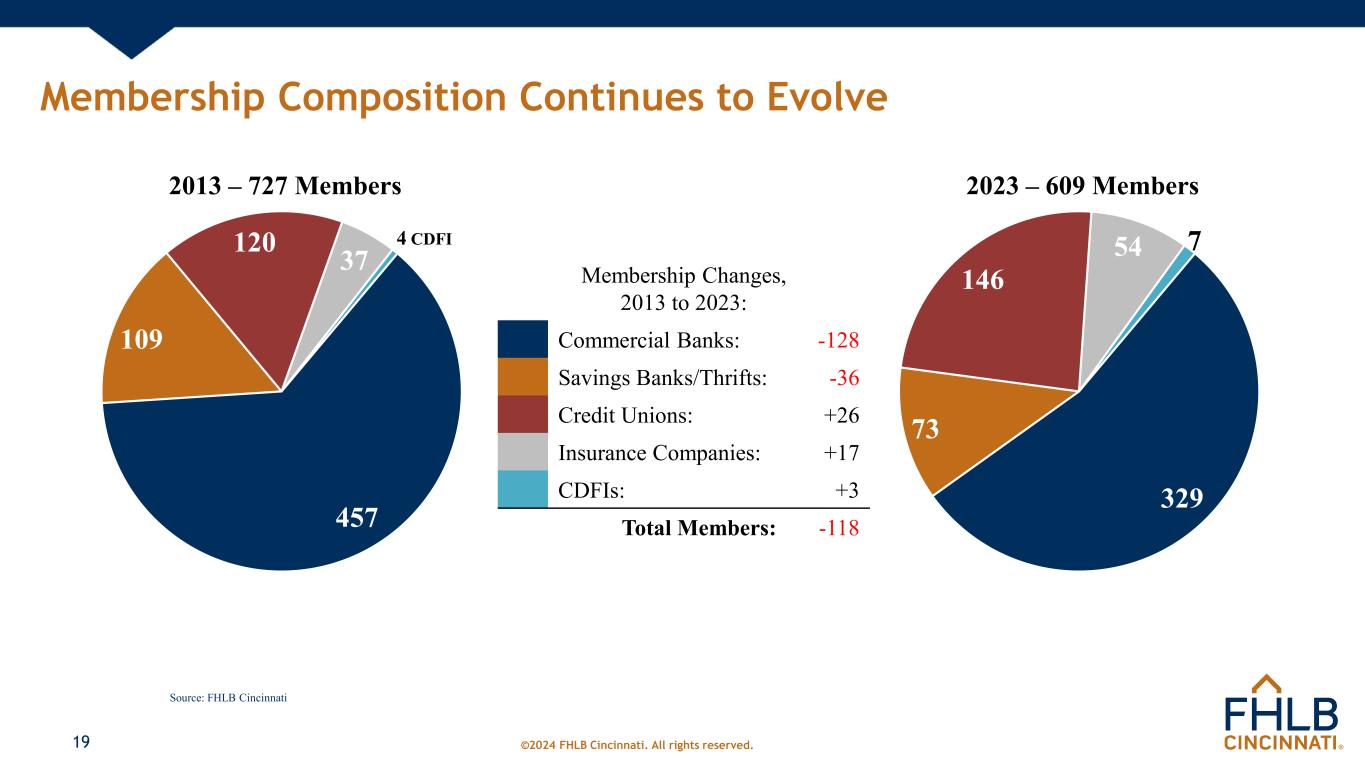

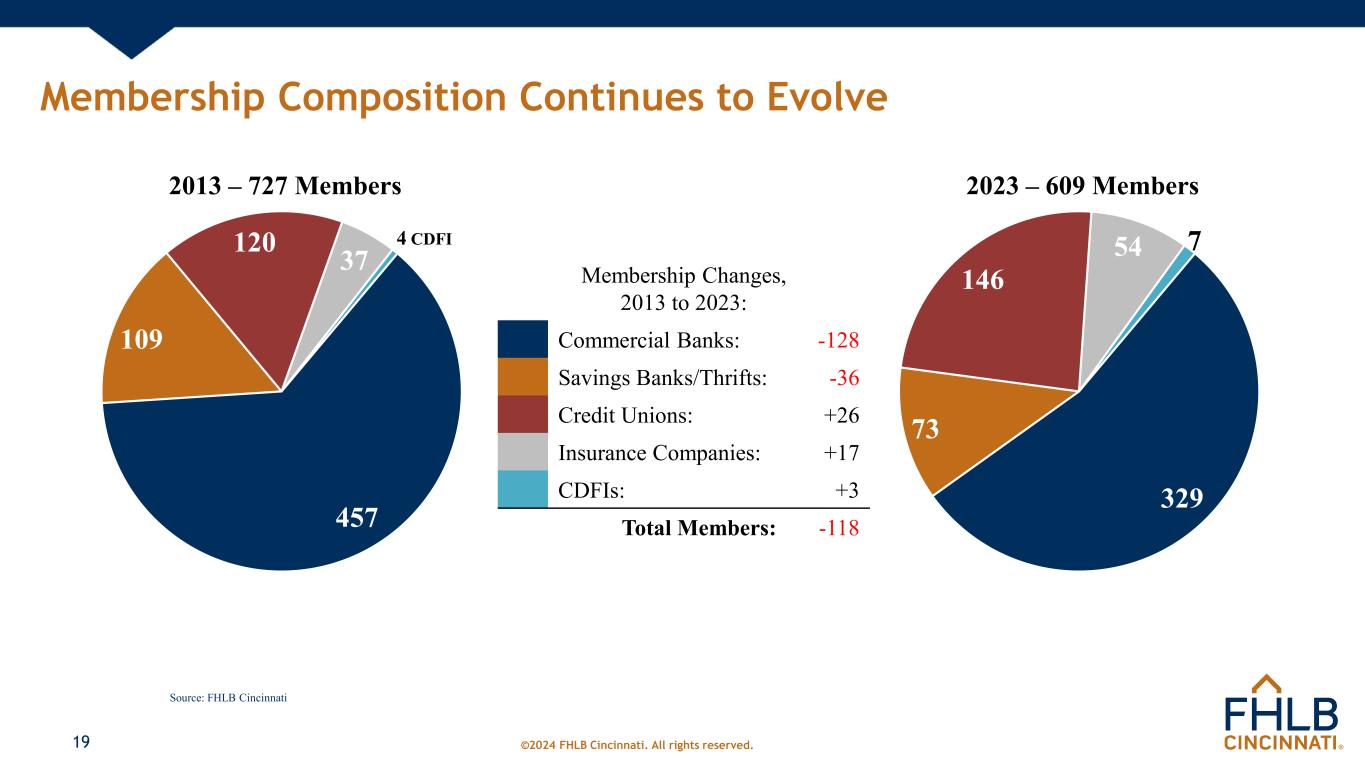

©2024 FHLB Cincinnati. All rights reserved. Membership Composition Continues to Evolve 19 329 73 146 54 7 2023 – 609 Members Membership Changes, 2013 to 2023: Commercial Banks: -128 Savings Banks/Thrifts: -36 Credit Unions: +26 Insurance Companies: +17 CDFIs: +3 Total Members: -118457 109 120 37 4 CDFI 2013 – 727 Members Source: FHLB Cincinnati

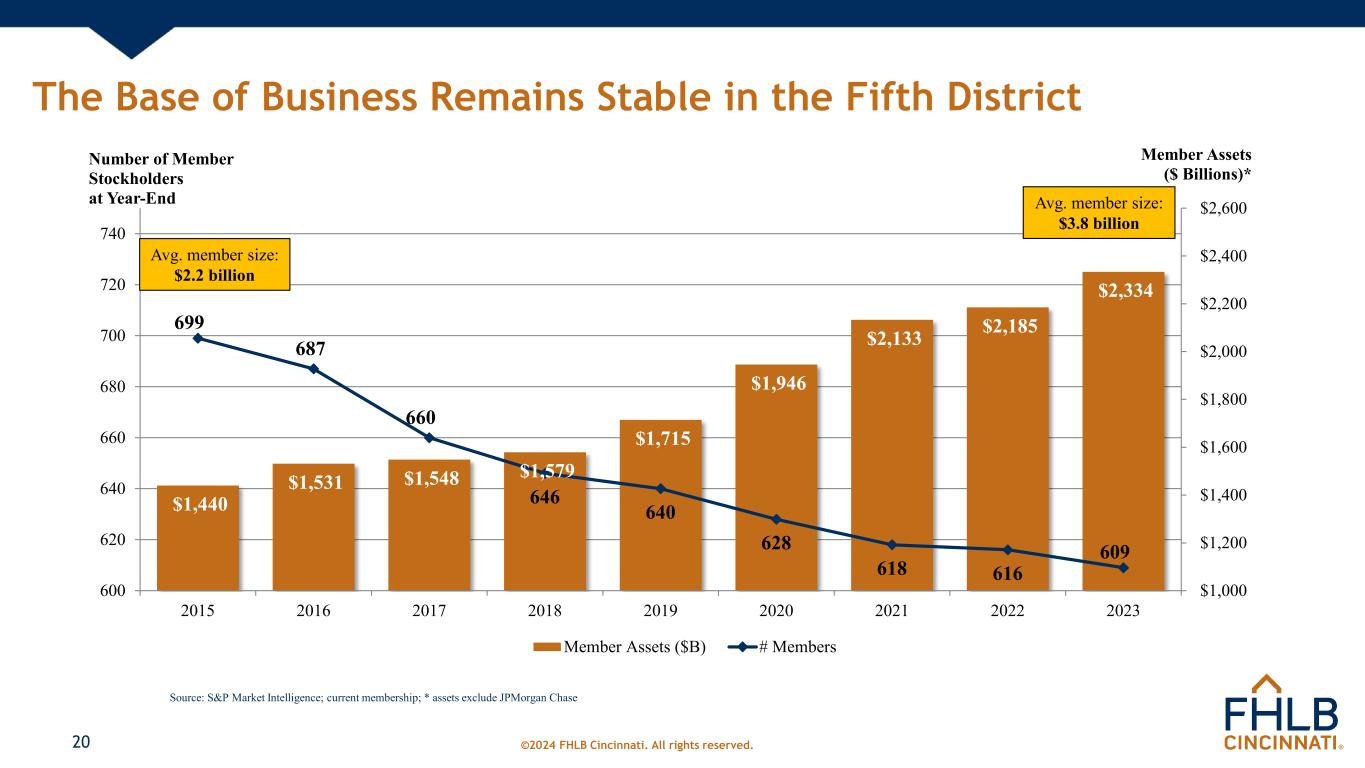

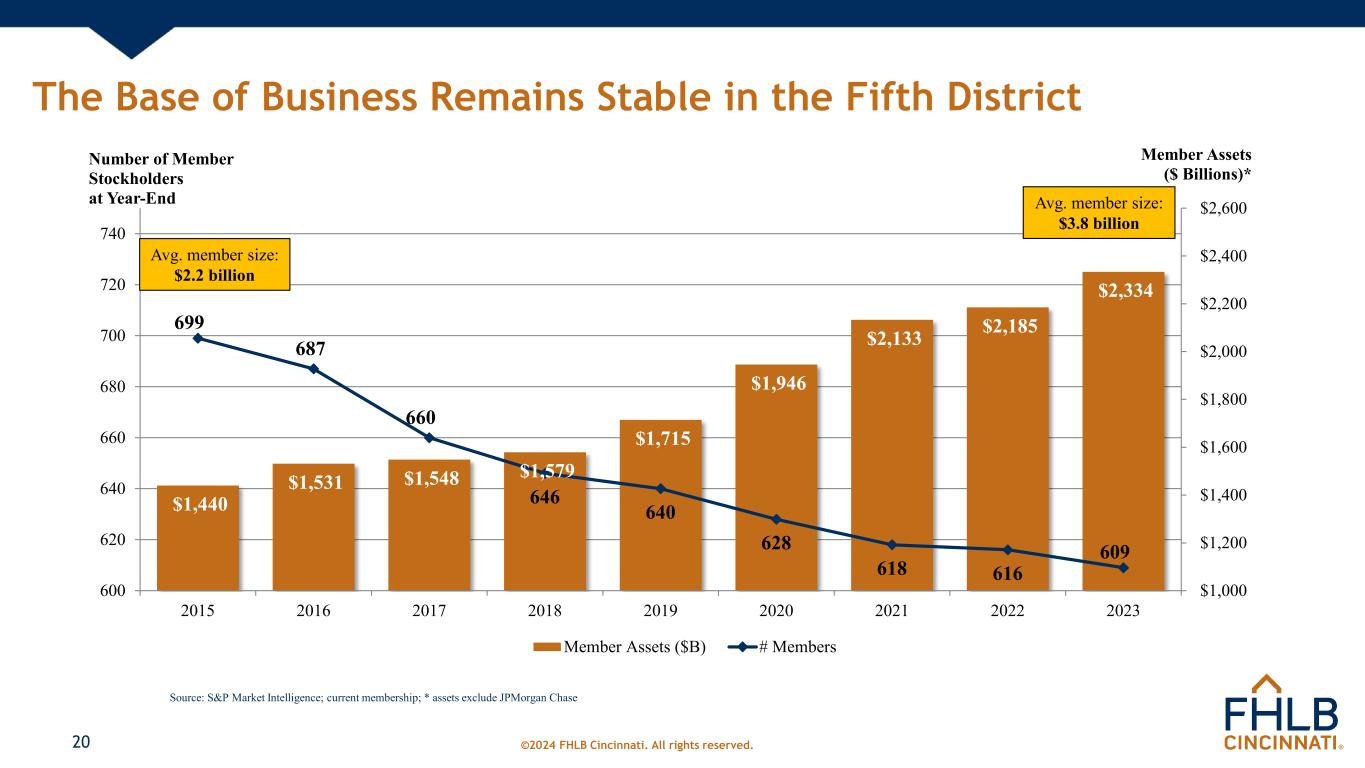

©2024 FHLB Cincinnati. All rights reserved. The Base of Business Remains Stable in the Fifth District 20 $1,440 $1,531 $1,548 $1,579 $1,715 $1,946 $2,133 $2,185 $2,334 699 687 660 646 640 628 618 616 609 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 $2,400 $2,600 600 620 640 660 680 700 720 740 2015 2016 2017 2018 2019 2020 2021 2022 2023 Member Assets ($ Billions)* Number of Member Stockholders at Year-End Member Assets ($B) # Members Source: S&P Market Intelligence; current membership; * assets exclude JPMorgan Chase Avg. member size: $2.2 billion Avg. member size: $3.8 billion

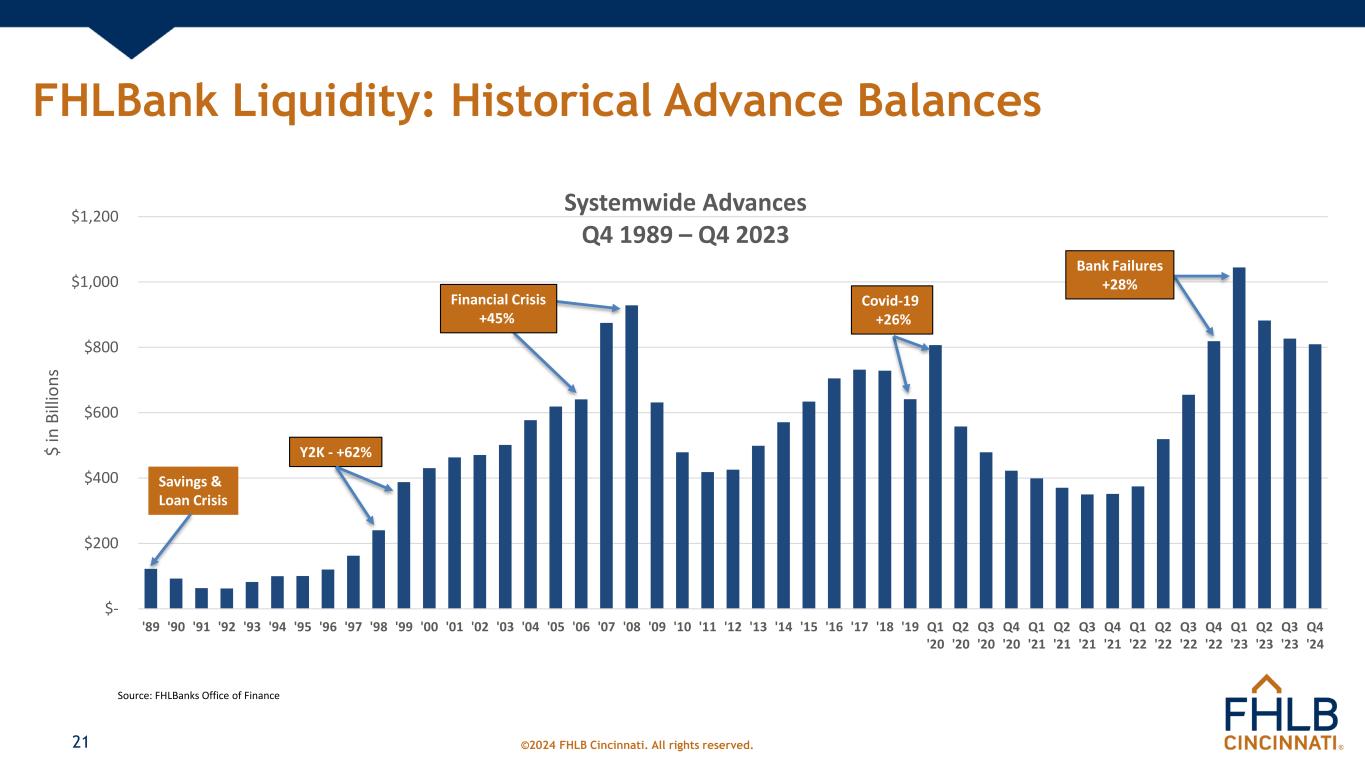

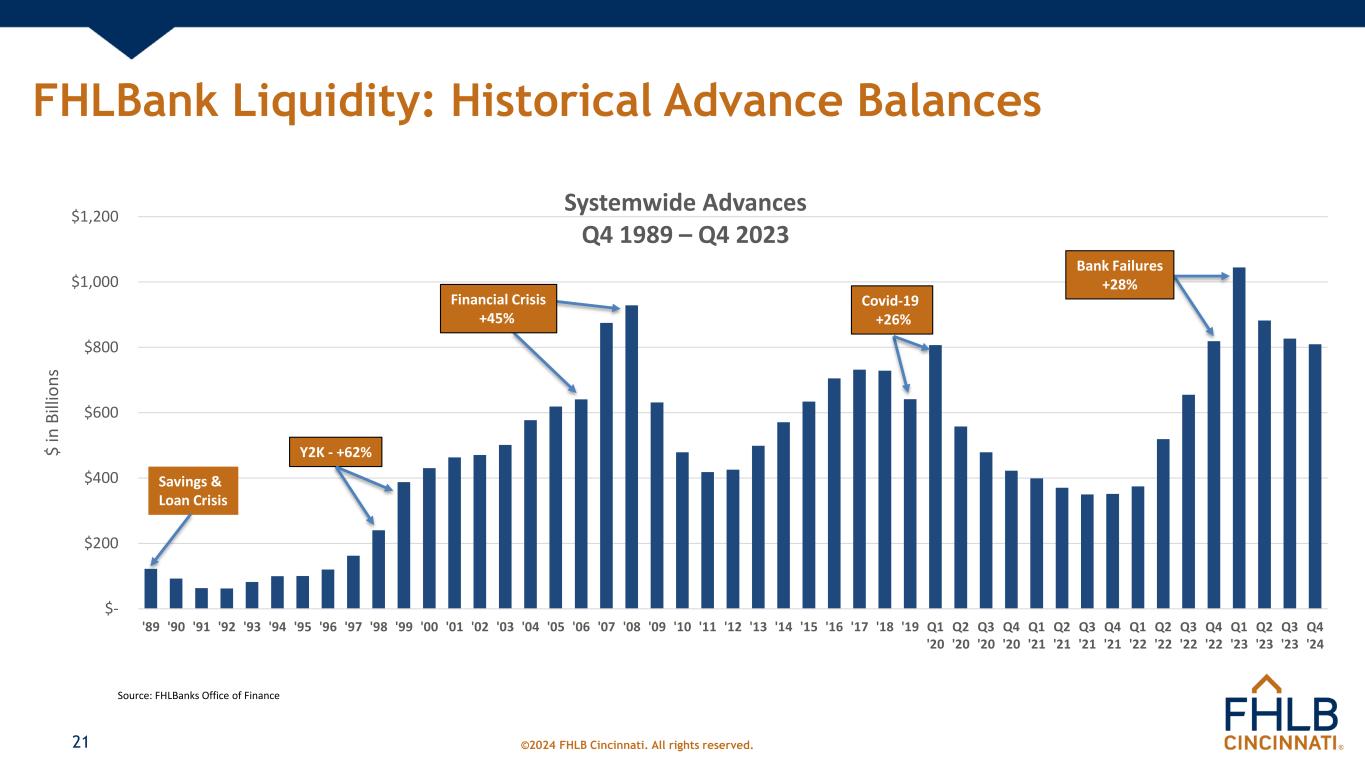

©2024 FHLB Cincinnati. All rights reserved. FHLBank Liquidity: Historical Advance Balances 21 $- $200 $400 $600 $800 $1,000 $1,200 '89 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Q4 '24 $ in B ill io ns Systemwide Advances Q4 1989 – Q4 2023 Y2K - +62% Financial Crisis +45% Covid-19 +26% Bank Failures +28% Savings & Loan Crisis Source: FHLBanks Office of Finance

©2024 FHLB Cincinnati. All rights reserved. 50% 6% 44% Y/E 2021 Member Advance Composition by Charter Type 22 79% 4% 17% Y/E 2023 Member Advance Balances by Charter Type $ in Billions Charter Type Y/E 2021 Y/E 2023 Banks/Thrifts $11.5 $57.9 Credit Unions $1.3 $3.3 Insurance Companies $10.1 $12.4 Total $22.9 $73.6 Percentage of Total Member Advances Source: FHLB Cincinnati

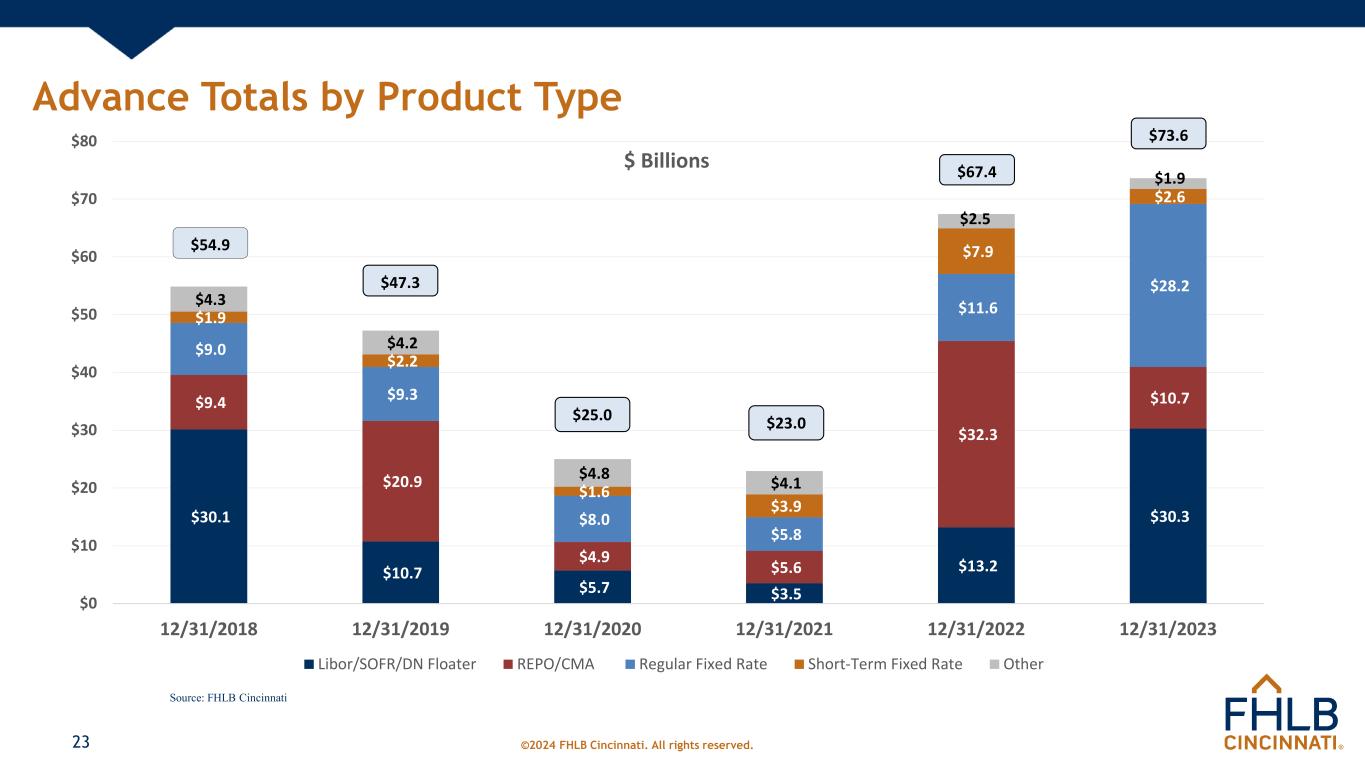

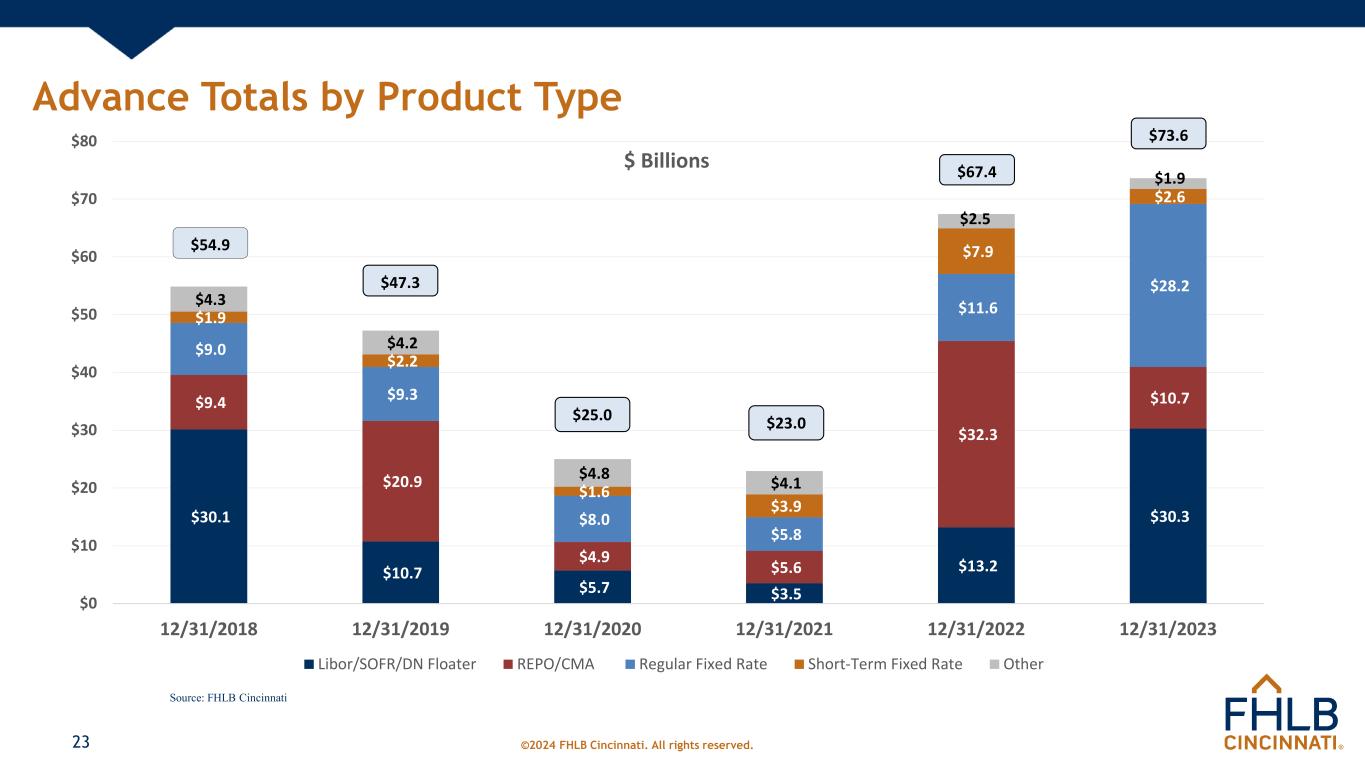

©2024 FHLB Cincinnati. All rights reserved. Advance Totals by Product Type 23 $30.1 $10.7 $5.7 $3.5 $13.2 $30.3 $9.4 $20.9 $4.9 $5.6 $32.3 $10.7 $9.0 $9.3 $8.0 $5.8 $11.6 $28.2 $1.9 $2.2 $1.6 $3.9 $7.9 $2.6 $4.3 $4.2 $4.8 $4.1 $2.5 $1.9 $0 $10 $20 $30 $40 $50 $60 $70 $80 12/31/2018 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 $ Billions Libor/SOFR/DN Floater REPO/CMA Regular Fixed Rate Short-Term Fixed Rate Other $47.3 $67.4 Source: FHLB Cincinnati $54.9 $25.0 $23.0 $73.6

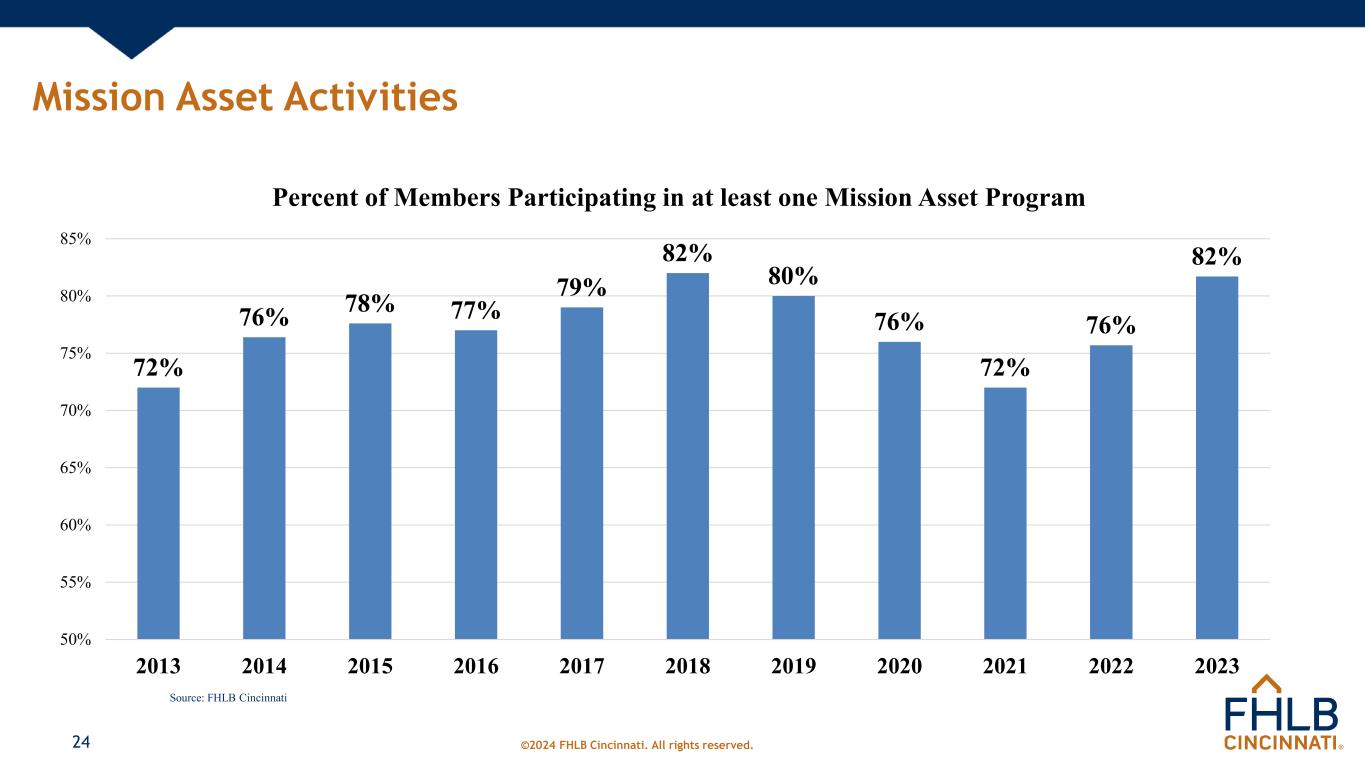

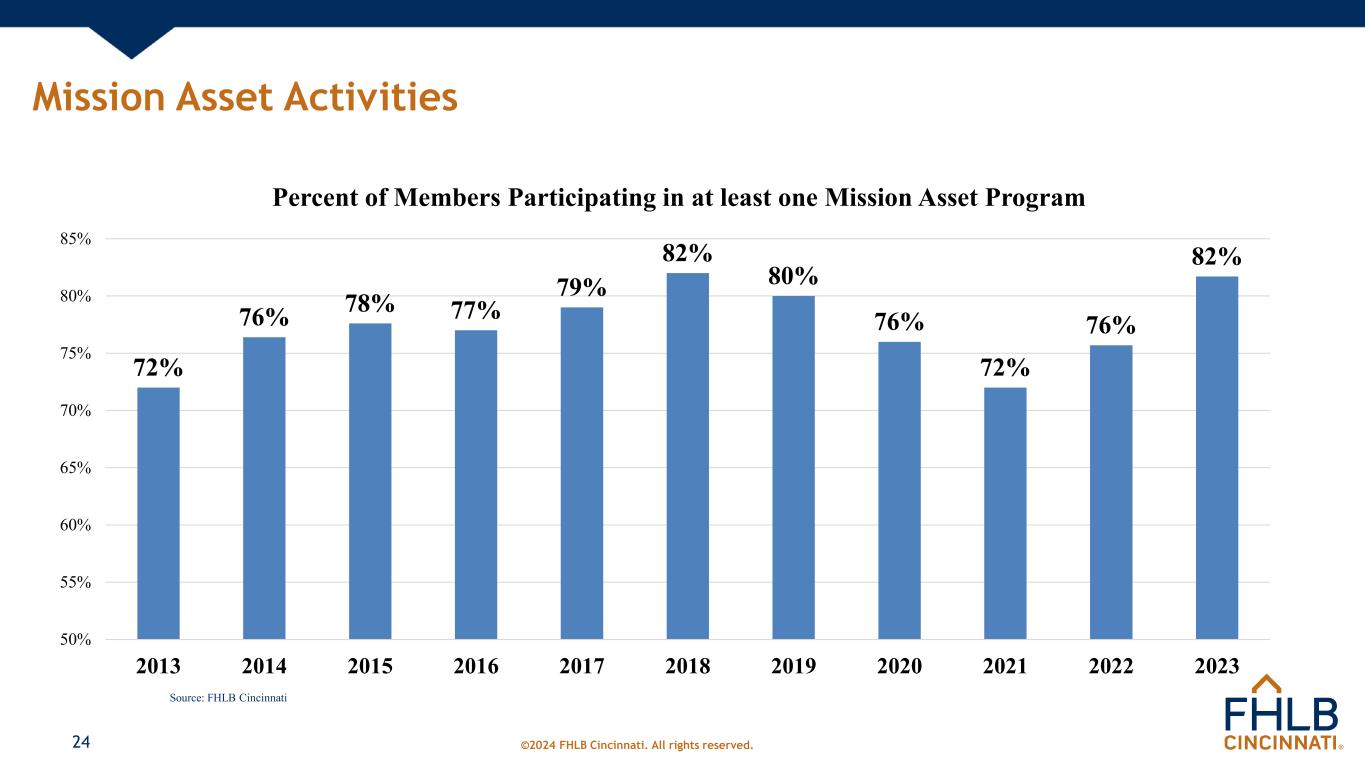

©2024 FHLB Cincinnati. All rights reserved. Mission Asset Activities 24 72% 76% 78% 77% 79% 82% 80% 76% 72% 76% 82% 50% 55% 60% 65% 70% 75% 80% 85% 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Percent of Members Participating in at least one Mission Asset Program Source: FHLB Cincinnati

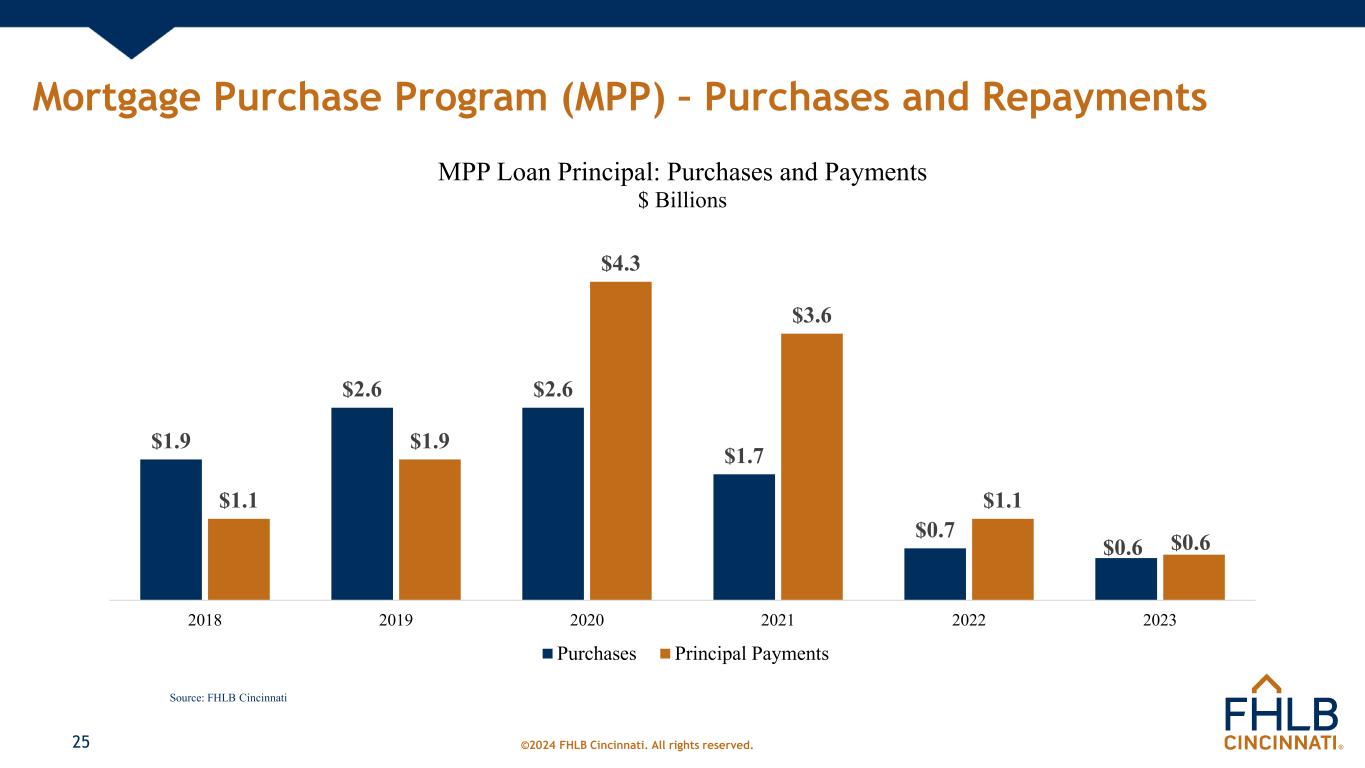

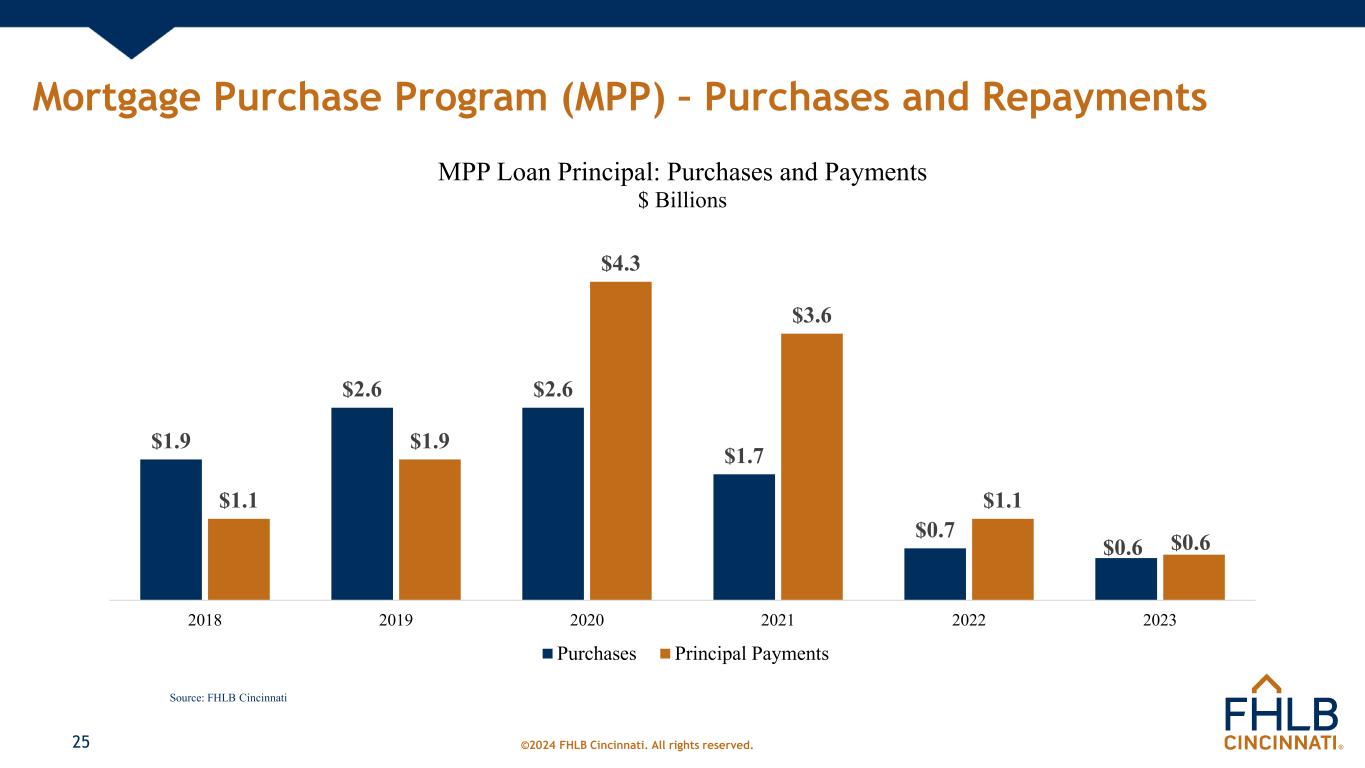

©2024 FHLB Cincinnati. All rights reserved. Mortgage Purchase Program (MPP) – Purchases and Repayments 25 $1.9 $2.6 $2.6 $1.7 $0.7 $0.6 $1.1 $1.9 $4.3 $3.6 $1.1 $0.6 2018 2019 2020 2021 2022 2023 MPP Loan Principal: Purchases and Payments $ Billions Purchases Principal Payments Source: FHLB Cincinnati

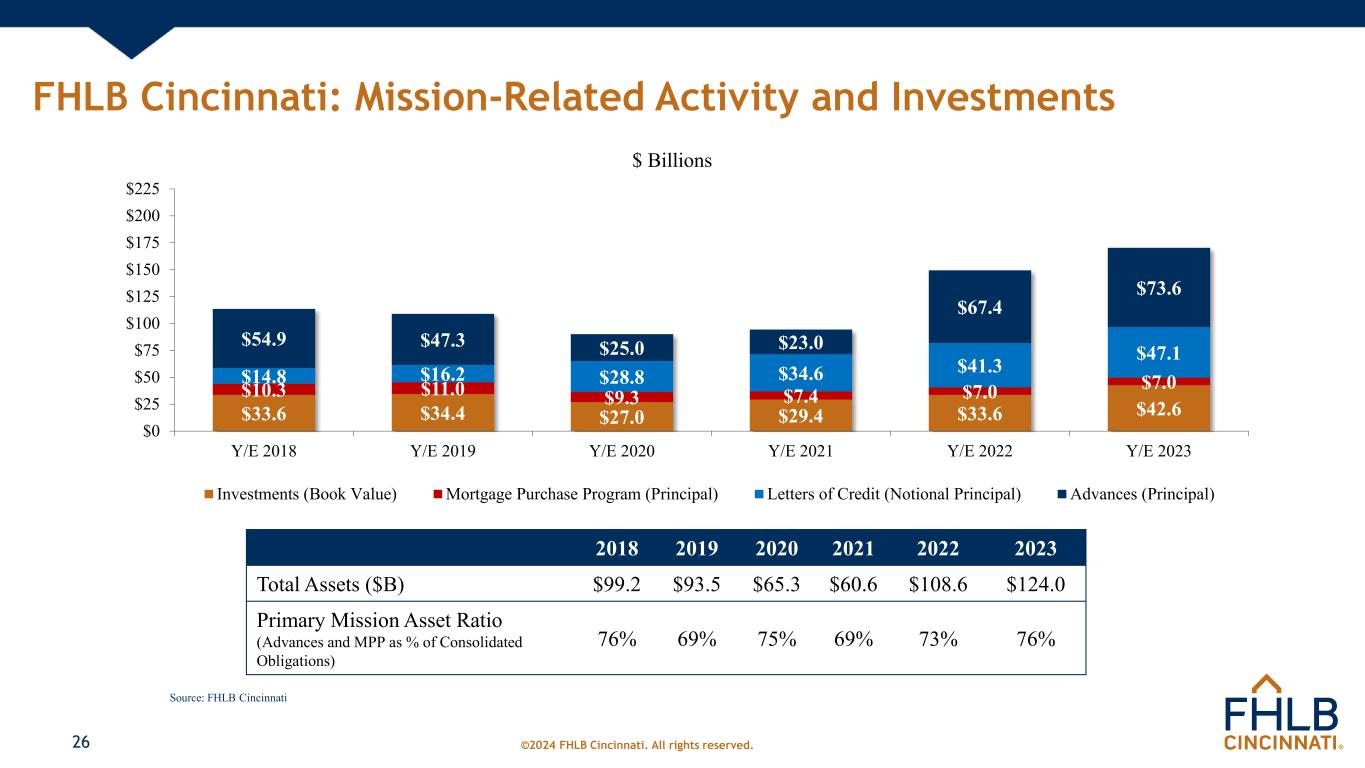

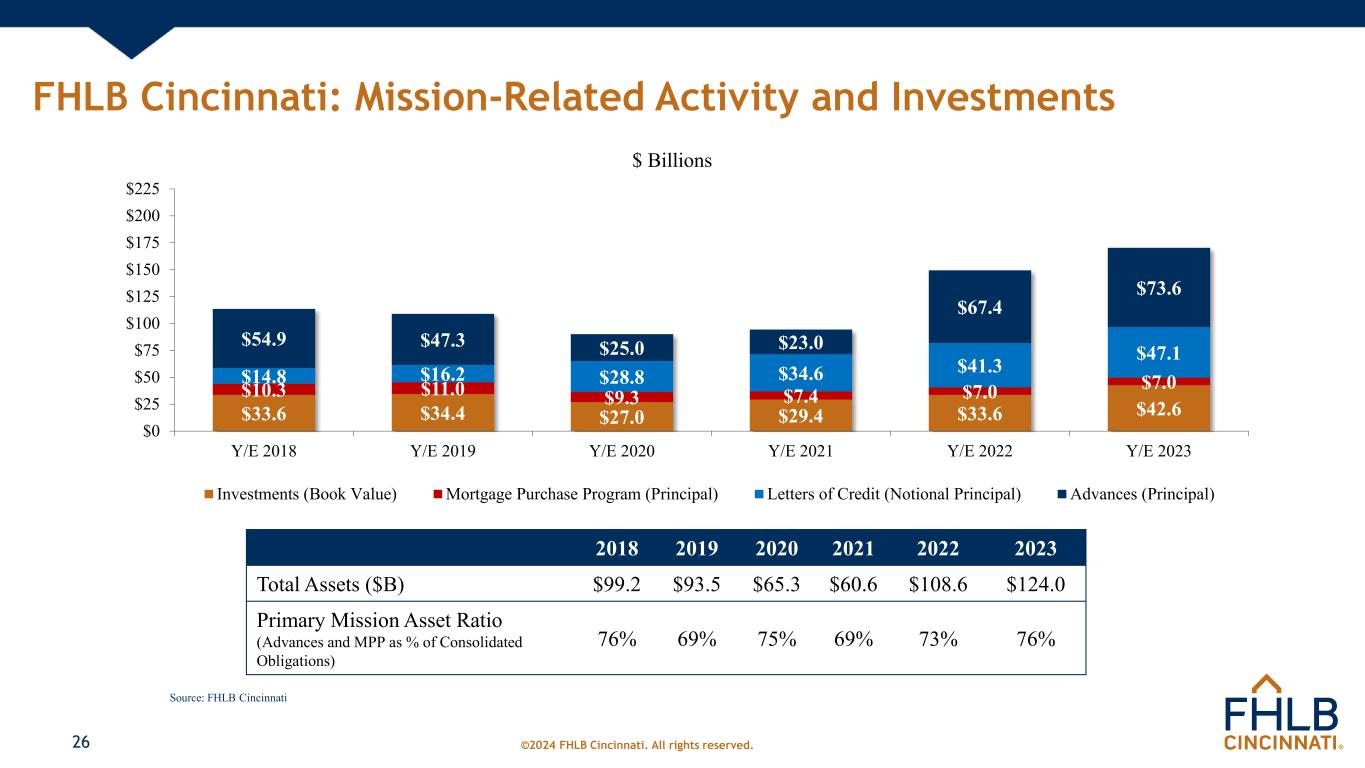

©2024 FHLB Cincinnati. All rights reserved.26 FHLB Cincinnati: Mission-Related Activity and Investments $33.6 $34.4 $27.0 $29.4 $33.6 $42.6 $10.3 $11.0 $9.3 $7.4 $7.0 $7.0 $14.8 $16.2 $28.8 $34.6 $41.3 $47.1 $54.9 $47.3 $25.0 $23.0 $67.4 $73.6 $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 Y/E 2018 Y/E 2019 Y/E 2020 Y/E 2021 Y/E 2022 Y/E 2023 $ Billions Investments (Book Value) Mortgage Purchase Program (Principal) Letters of Credit (Notional Principal) Advances (Principal) 2018 2019 2020 2021 2022 2023 Total Assets ($B) $99.2 $93.5 $65.3 $60.6 $108.6 $124.0 Primary Mission Asset Ratio (Advances and MPP as % of Consolidated Obligations) 76% 69% 75% 69% 73% 76% Source: FHLB Cincinnati

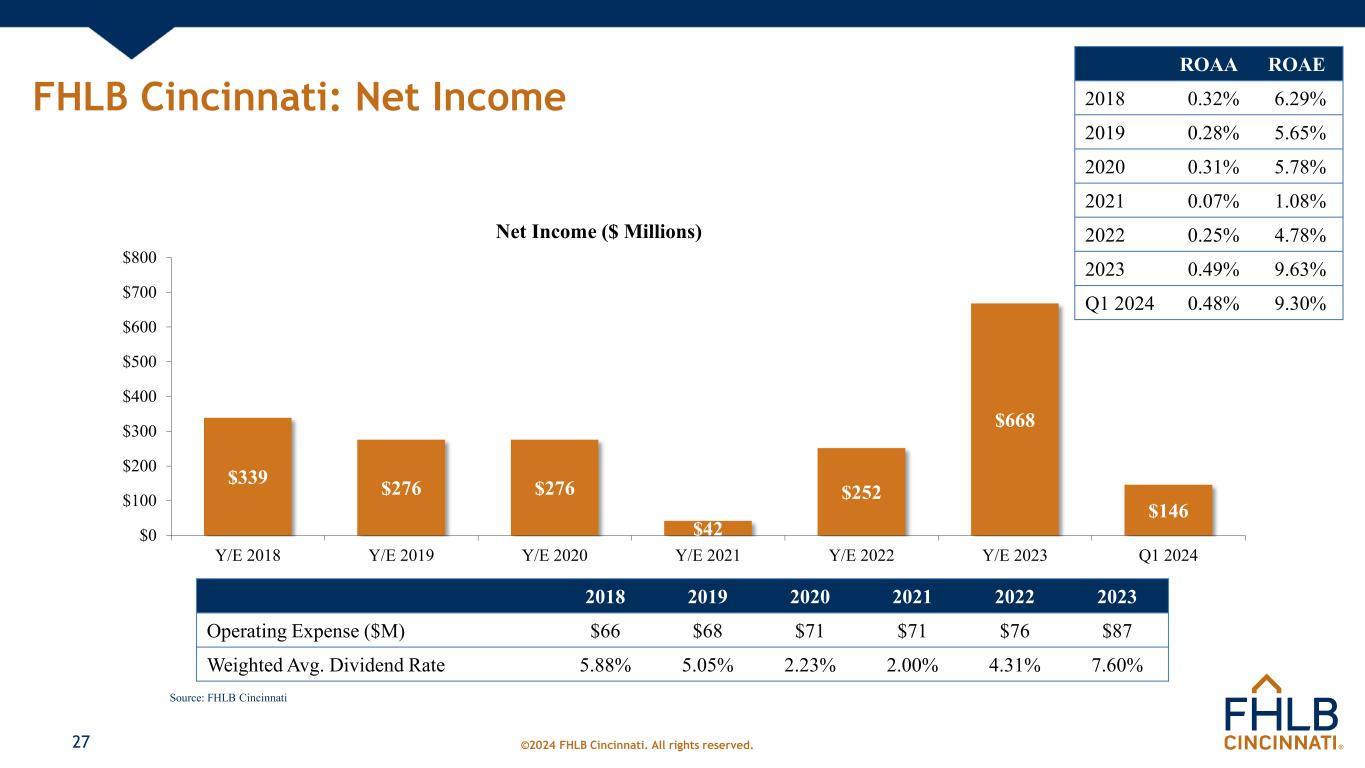

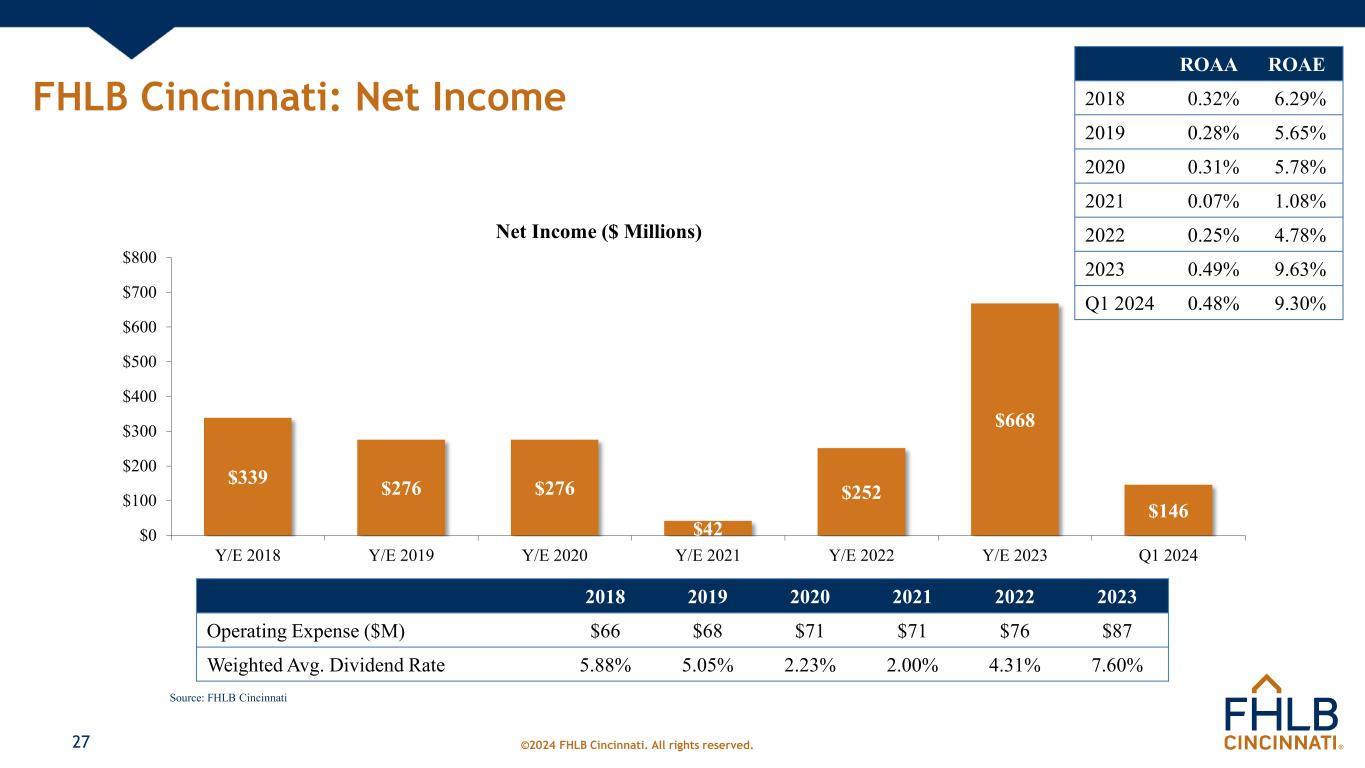

©2024 FHLB Cincinnati. All rights reserved. FHLB Cincinnati: Net Income 27 $339 $276 $276 $42 $252 $668 $146 $0 $100 $200 $300 $400 $500 $600 $700 $800 Y/E 2018 Y/E 2019 Y/E 2020 Y/E 2021 Y/E 2022 Y/E 2023 Q1 2024 Net Income ($ Millions) 2018 2019 2020 2021 2022 2023 Operating Expense ($M) $66 $68 $71 $71 $76 $87 Weighted Avg. Dividend Rate 5.88% 5.05% 2.23% 2.00% 4.31% 7.60% ROAA ROAE 2018 0.32% 6.29% 2019 0.28% 5.65% 2020 0.31% 5.78% 2021 0.07% 1.08% 2022 0.25% 4.78% 2023 0.49% 9.63% Q1 2024 0.48% 9.30% Source: FHLB Cincinnati

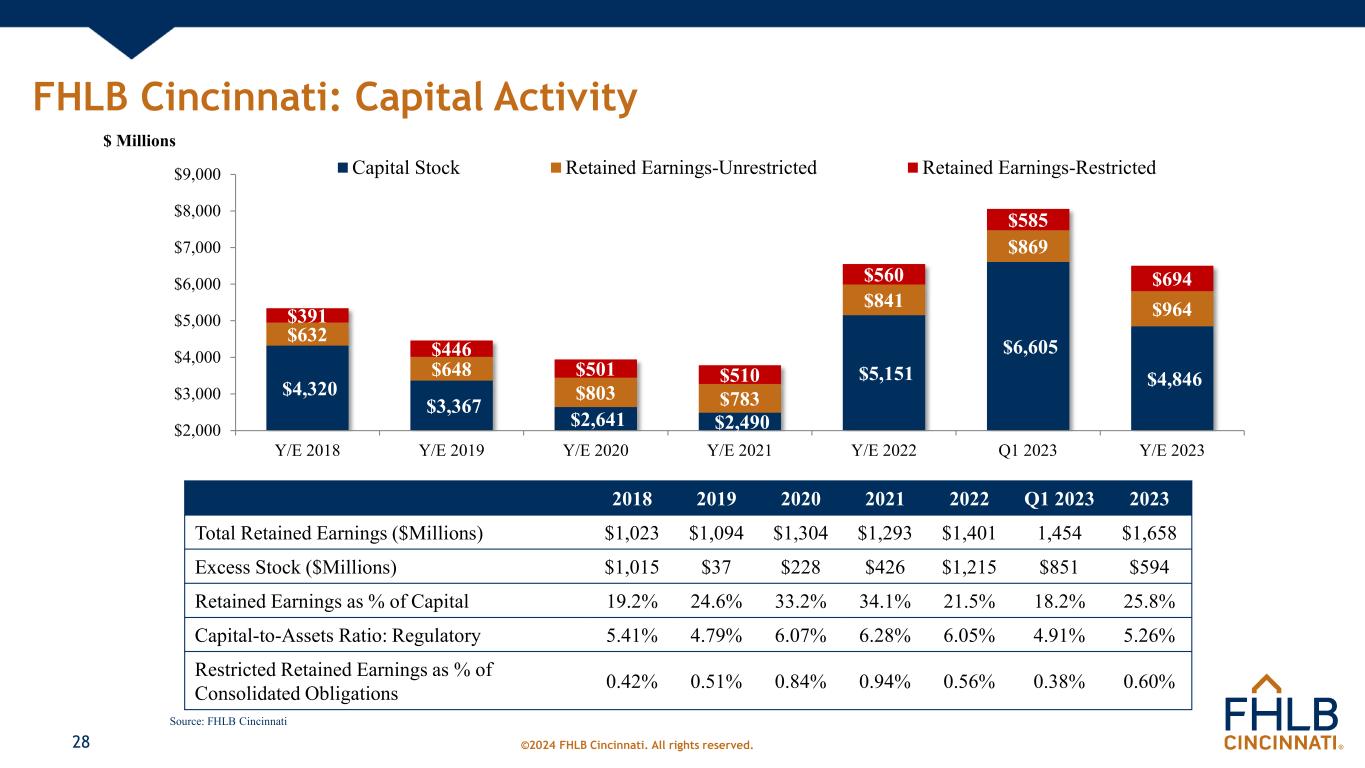

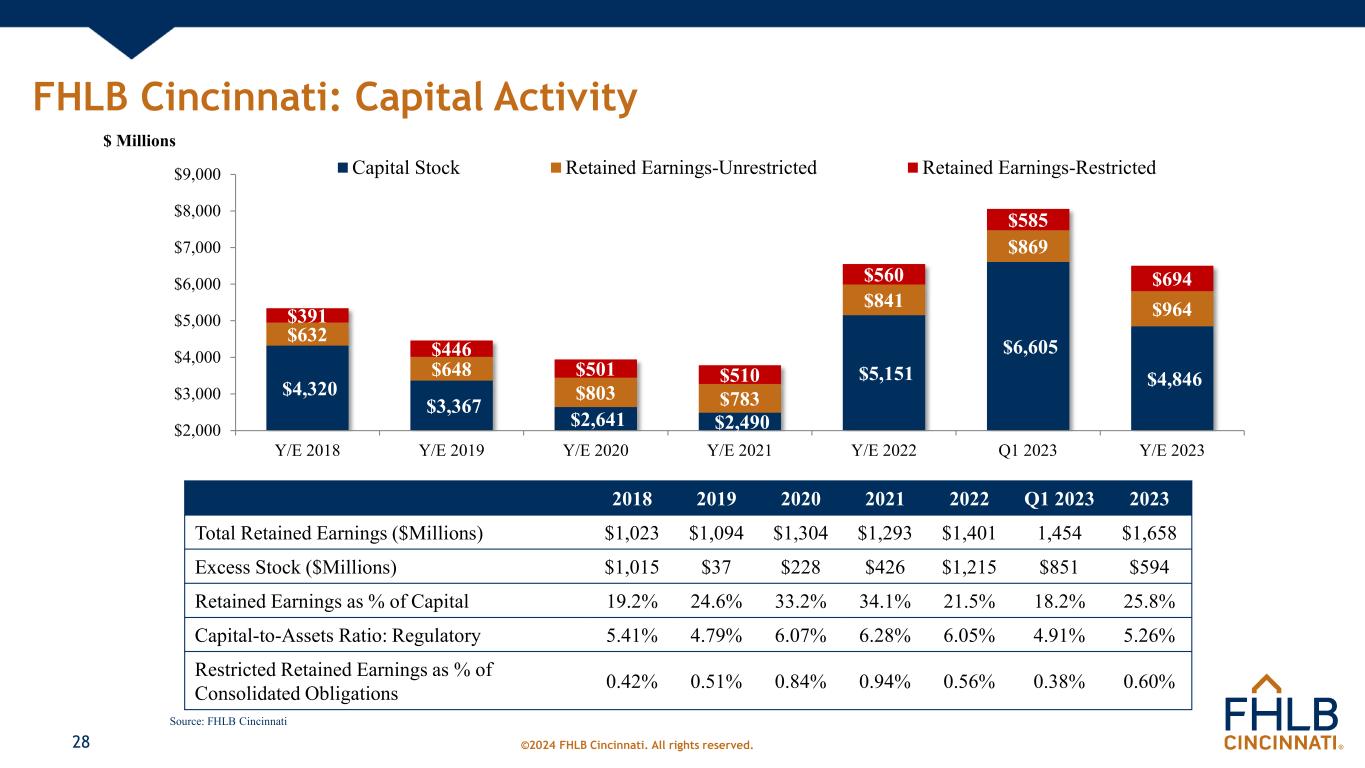

©2024 FHLB Cincinnati. All rights reserved. FHLB Cincinnati: Capital Activity 28 $4,320 $3,367 $2,641 $2,490 $5,151 $6,605 $4,846 $632 $648 $803 $783 $841 $869 $964$391 $446 $501 $510 $560 $585 $694 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 Y/E 2018 Y/E 2019 Y/E 2020 Y/E 2021 Y/E 2022 Q1 2023 Y/E 2023 $ Millions Capital Stock Retained Earnings-Unrestricted Retained Earnings-Restricted 2018 2019 2020 2021 2022 Q1 2023 2023 Total Retained Earnings ($Millions) $1,023 $1,094 $1,304 $1,293 $1,401 1,454 $1,658 Excess Stock ($Millions) $1,015 $37 $228 $426 $1,215 $851 $594 Retained Earnings as % of Capital 19.2% 24.6% 33.2% 34.1% 21.5% 18.2% 25.8% Capital-to-Assets Ratio: Regulatory 5.41% 4.79% 6.07% 6.28% 6.05% 4.91% 5.26% Restricted Retained Earnings as % of Consolidated Obligations 0.42% 0.51% 0.84% 0.94% 0.56% 0.38% 0.60% Source: FHLB Cincinnati

©2024 FHLB Cincinnati. All rights reserved. Modernizing Member Experience – Enhanced Security 29 In March, we implemented Multi-Factor Authentication (MFA) login • Enhanced security process for interacting with all FHLB online systems • Members Only • LAS - MPP • OASYS – housing programs and services • Members can utilize one or more identity authentication options: • App-based • Text message (to-date, chosen by 75% of member users) • Landline call • If you have not registered yet, please contact our Service Desk for assistance

©2024 FHLB Cincinnati. All rights reserved. Modernizing Member Experience – Online Advances 30 On April 16th, we introduced Online Advance Transaction Requests in the Members Only portal • The most commonly-requested Advance products are currently available: • REPO • CMA Fixed and Variable • Short-Term and Long-Term Fixed Rate • An easy-to-use option providing members timely and enhanced transparency • Feedback (which will guide future enhancements) has been extremely positive • More than 50 member institutions have now used the process

©2024 FHLB Cincinnati. All rights reserved. HCI Changes for 2024 Welcome Home Program • Increased per-household maximum from up to $15,000 to $25,000 • Established $10,000 as the minimum grant request • Board approved additional voluntary funding of $5 million Affordable Housing Program • Increased the maximum subsidy per project from $1,000,000 to $1,500,000 • Increased the maximum subsidy per Member from $5,000,000 to $9,000,000 Disaster Reconstruction Program • Replenished with an additional $3.9 Million, bringing the total funding available to $5.0 Million Voluntary Contributions • Beginning in 2023, Board has committed providing an additional 5% of net earnings to support our members affordable housing and economic development initiatives 31

©2024 FHLB Cincinnati. All rights reserved. FHLBank System at 100: FHFA 2024 Priorities FHFA Implementation Updates • Mission: clarify FHLBank System mission statement • Liquidity: distinguish FHLBanks’ core lending (Advances) from Federal Reserve financial facilities • Housing: expand FHLBanks’ housing and community development focus • Operations: structure FHLBanks to promote operational efficiency, member mission orientation, and balanced governance over safety & soundness and mission achievement 32 FHLBank System at 100: Report Implementation | Federal Housing Finance Agency (fhfa.gov)

©2024 FHLB Cincinnati. All rights reserved. Legislative Landscape • Connecting with key Congressional contacts • Monitoring legislation • Engaging with members and stakeholders • Engaging with regulators 33

©2024 FHLB Cincinnati. All rights reserved. Looking Forward: Our Continuing Priorities • Valued Business Partner • Reliable and Competitive Funding Source • Quality Service (Information, Transactions, Communications) • Impactful Housing Support Programs o AHP – CIP – EDP o CMP – DRP – Welcome Home o Rise Up Program 34

©2024 FHLB Cincinnati. All rights reserved. The 2024 Financial Management Conference 35 • August 13-14, 2024 • Cincinnati, OH • Subjects Will Include: o Economic Update o Asset Liability Management Strategies o Technology Trends o Deposit Environment • Cincinnati Reds Game vs. St. Louis Cardinals