UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(AMENDMENT NO. 2)

SEARCHLIGHT MINERALS CORP.

(Name of Issuer)

COMMON STOCK, $0.001 PER SHARE PAR VALUE

(Title of Class of Securities)

812224 20 2

(CUSIP Number)

K. IAN MATHESON

2215 Lucerne Circle

Henderson, NV 89014

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 5, 2010

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(b)(3) or (4), check the following box [ ].

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,seethe Notes).

1

| 1. | Names of Reporting Persons K. Ian Matheson |

| | I.R.S. Identification Nos. of above persons (entities only): Not Applicable |

| | |

| | |

| 2. | Check the Appropriate Box if a Member of a Group (SeeInstructions) |

| (a) | [_] |

| (b) | [_] |

| | |

| 3. | SEC Use Only: |

| | |

| | |

| 4. | Source of Funds (See Instruction): PF(Personal Funds) |

| | |

| | |

| 5. | Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e):N/A |

| | |

| | |

| 6. | Citizenship or Place of Organization: Canadian Citizen |

| | |

Number of Shares Beneficially by Owned by Each Reporting Person With:

| 7. | Sole Voting Power: | 7,140,002 Shares*(1) |

| | | |

| 8. | Shared Voting Power: | 1,222,502 Shares(1) |

| | | |

| 9. | Sole Dispositive Power: | 7,140,002 Shares*(1) |

| | | |

| 10. | Shared Dispositive Power: | 1,222,502 Shares(1) |

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person:8,362,504 Shares*(1) |

| | |

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions):

Not Applicable |

| 13. | Percent of Class Represented by Amount in Row (11): 7.5% |

| | |

| 14. | Type of Reporting Person (SeeInstructions) IN |

| | |

| * | Based on 105,854,691 shares of Common Stock of Searchlight Minerals Corp. outstanding as of March 11, 2010. |

| | |

| (1) | Includes 1,140,002 shares held directly by K. Ian Matheson, 1,222,502 shares held by Mr. Matheson’s spouse and related companies and warrants to purchase an additional 6,000,000 shares of Searchlight. |

2

This Schedule 13D/A (Amendment No. 2) is being filed by K. Ian Matheson to amend and supplement the Schedule 13D/A (Amendment No. 1) of the Reporting Person filed on February 28, 2006 with the Securities and Exchange Commission. Except as specifically amended hereby, the disclosure set forth in the previously filed Schedule 13D/A shall remain unchanged.

| ITEM 1. | SECURITY AND ISSUER |

The class of equity securities to which this Statement relates is shares of common stock, par value $0.001 per share (the “Shares”), of Searchlight Minerals Corp., a Nevada Corporation (the “Company”). The principal executive offices of the Company are located at #120 - 2441 W. Horizon Ridge Pkwy, Henderson, NV 89052.

| ITEM 2. | IDENTITY AND BACKGROUND |

Item 2 of the previously filed Schedule 13D/A is amended to read as follows:

| (a) | Name of Person filing this Statement: |

| | |

| | K. Ian Matheson(the “Reporting Person”) |

| | |

| (b) | Residence or Business Address: |

| | |

| | The business address of the Reporting Person is 2215 Lucerne Circle, Henderson, NV 89014 |

| | |

| (c) | Present Principal Occupation and Employment: |

| | |

| The Reporting Person is the interim Chief Executive Officer and a Director of Royal Mines And Minerals Corp., a Nevada company quoted on the Over-The-Counter Bulletin Board. The principal executive office of Royal Mines And Minerals Corp. is located at 2580 Anthem Village Drive, #112, Henderson, NV 89052. The Reporting Person was a member of the Company’s board of directors from February 10, 2005 to February 16, 2007. The Reporting Person is a member of the British Columbia Institute of Chartered Accountants and the Canadian Institute of Chartered Accountants. The Reporting Person has been a director and officer of numerous private companies that have been involved in the research and development of precious metals in the southern Nevada area. |

| | |

| (d) | Criminal Convictions: |

| | |

| The Reporting Person has not been convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors) during the last five years. |

| | |

| (e) | Civil Proceedings: |

| | |

| The Reporting Person has not been a party to any civil proceeding of a judicial or administrative body of competent jurisdiction where, as a result of such proceeding, there was or is a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. |

| | |

| (f) | Citizenship: The Reporting Person is a citizen of Canada. |

3

| ITEM 3. | SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

Item 3 of the previously filed Schedule 13D/A is amended to read as follows:

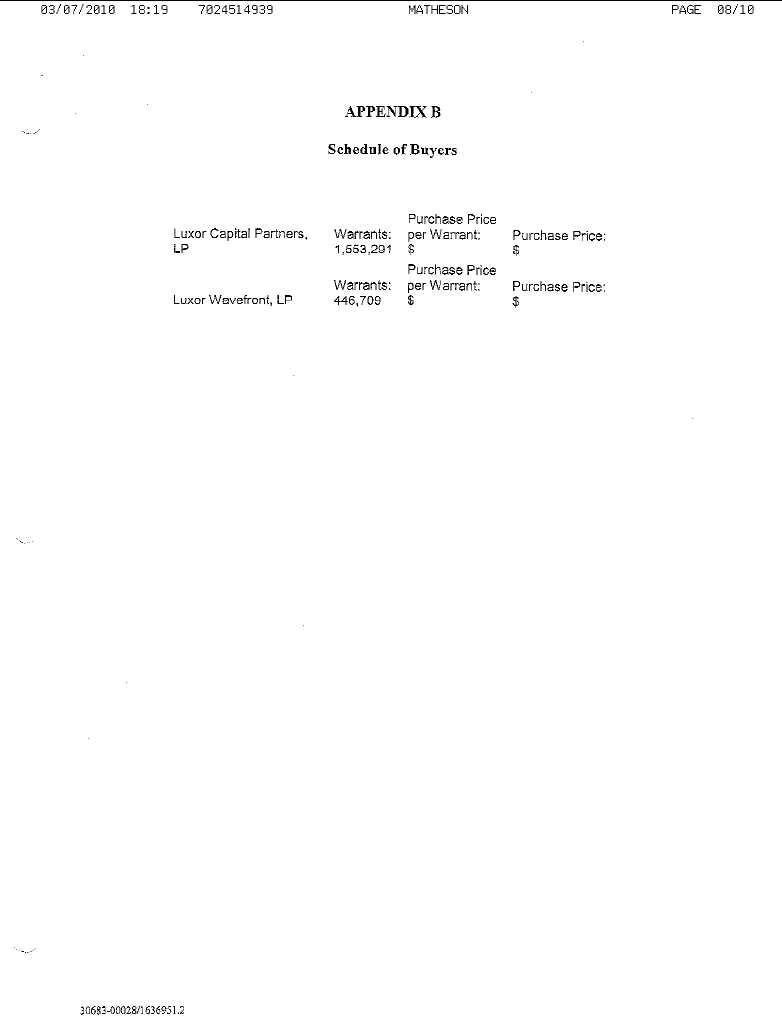

On February 5, 2010, the Reporting Person sold 2,000,000 Warrants, with an exercise price of $0.375 per share and an expiration date of June 1, 2015, for net monies of $2,630,000 ($1.335 per warrant less a commission of $0.02 per warrant).

On June 30, 2006 the Reporting Person indirectly acquired 131,250 Shares issued by the Company pursuant to certain mineral property acquisition agreements dated February 8, 2005 between the Company and Debra Matheson, the spouse of the Reporting Person, Pass Minerals Inc. and Kiminco Inc., each of which is a private company controlled by the Reporting Person. The Shares were issued in consideration of the Company’s acquisition of an interest in certain mining claims located in Searchlight, Nevada.

On January 31, 2006 the Reporting Person transferred 1,940,000 of the Shares held by him in private transactions that were exempt from registration under the Securities Act.

On January 17, 2006, the Reporting Person acquired a warrant pursuant to Section 4(2) of the Securities Act to purchase up to 8,000,000 Shares at a price of $0.375 per Share until June 1, 2015 from Nanominerals Corp. for a total purchase price of $5,000, and sold 16,000,000 of the Shares held by the Reporting Person pursuant to Section 4(2) of the Securities Act to Nanominerals for a total purchase price of $4,640.50.

On October 4, 2005 the Reporting Person transferred 1,600,000 of the Shares held by him in private transactions that were exempt from registration under the Securities Act.

On June 6, 2005 the Reporting Person (i) transferred 100,000 of the Shares held by him in private transactions that were exempt from registration under the Securities Act.

On April 29, 2005 the Reporting Person cancelled 35,000,000 of the Shares held by him for no consideration.

On April 12, 2005, the Reporting Person acquired 48,850,002 (pre-split) restricted shares of common stock from Caisey Harlingten, one of the Company’s founding shareholders, for nominal consideration, pursuant to Section 4(2) of the Securities Act of 1933. The shares were acquired as part of the reorganization of the Company from a biotechnology research and development company to a company focused on the development and acquisition of mineral properties.

| ITEM 4. | PURPOSE OF TRANSACTION |

Item 4 of the previously filed Schedule 13D/A is amended to read as follows:

The Reporting Person sold 2,000,000 Warrants of the Issuer on February 5, 2010 to diversify his asset holdings.

On June 30, 2006 the Reporting Person indirectly acquired 131,250 Shares issued by the Company pursuant to certain mineral property acquisition agreements dated February 8, 2005 between the Company and Debra Matheson, the spouse of the Reporting Person, Pass Minerals Inc., Gold Crown Minerals Inc. and Kiminco Inc., each of which is a private company controlled by the Reporting Person. The Shares were issued in consideration of the Company’s acquisition of an interest in certain mining claims located in Searchlight, Nevada. The acquisition of the Shares was completed pursuant to Section 4(2) of the Securities Act of 1933.

4

On January 17, 2006, the Reporting Person acquired a warrant to purchase up to 8,000,000 Shares at a price of $0.375 per Share until June 1, 2015 from Nanominerals Corp. for a total purchase price of $5,000. The warrants were acquired for investment purposes. The transfer was completed pursuant to Section 4(2) of the Securities Act of 1933.

The Reporting Person acquired the 48,850,002 (pre-split) shares in order to acquire a controlling interest in the Company. The shares were acquired as part of the reorganization of the Company from a biotechnology research and development company to a company focused on the development and acquisition of mineral properties.

Except as otherwise described herein, the Reporting Person does not have any plans or proposals as of the date hereof which relate to or would result in any of the transactions described in clauses (a) through (j) of Item 3 of Schedule 13D.

| ITEM 5. | INTEREST IN SECURITIES OF THE ISSUER |

Item 5 of the previously filed Schedule 13D/A is amended to read as follows:

| (a) | Aggregate Beneficial Ownership: |

As of March 11, 2010, the Reporting Person beneficially owns the following securities of the Company:

| Title of Security | | Amount | | Percentage of Shares of Common Stock |

| Common Stock | | 7,140,002 Shares Direct(2) | | 7.5%(1) |

| | | 1,222,502 Shares Indirect(3) | | |

Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding on the date of this Statement.

| | (1) | Applicable percentage of ownership is based on 105,854,691 shares of common stock outstanding as of March 11, 2010, plus any securities held by such security holder exercisable for or convertible into common shares within sixty (60) days after the date of this Report, in accordance with Rule 13d-3(d)(1) under the Securities Exchange Act of 1934, as amended. |

5

| (2) | Consists of 1,140,002 Shares held directly by the Reporting Person and warrants to acquire 6,000,000 Shares, with an exercise price of $0.375 per share and an expiration date of June 1, 2015. |

| | | | |

| (3) | Consists of the following indirectly held by the Reporting Person: |

| | (i) | Spouse of Reporting Person – 1,010,002 Shares; |

| | (ii) | Pass Minerals Inc. – 82,500 Shares; and |

| | (iii) | Kiminco Inc – 130,000 Shares. |

| | | | |

| (b) | Power to Vote and Dispose of the Company Shares: |

| | | | |

| Sole Power |

| | | | |

| The Reporting Person has the sole power to vote or to direct the vote of the Shares held by him in his name and has the sole power to dispose of or to direct the disposition of the Shares held by him in his name. |

| | | | |

| Shared Power |

| | | | |

| Pass Minerals Inc. – In his capacity as a 16.7% shareholder of Pass Minerals Inc., the Reporting Person has shared power to vote, direct the vote, dispose of or to direct the disposition of the 82,500 Shares held by Pass Minerals Inc. |

| | | | |

| Kiminco Inc. – In his capacity as a 16.7% shareholder of Kiminco Inc., the Reporting Person has shared power to vote, direct the vote, dispose of or to direct the disposition of the 130,000 Shares held by Kiminco Inc. |

| | | | |

| (c) | Transactions Effected During the Past 60 Days: |

In addition to the 2,000,000 warrants sold on February 5, 2010 described above, the Reporting Person has sold 260,000 shares held directly by him, 10,000 shares held indirectly by his spouse, and 27,500 shares held indirectly by Pass Minerals Inc.

| (d) | Right of Others to Receive Dividends or Proceeds of Sale: |

None.

| (e) | Date Ceased to be the Beneficial Owner of More Than Five Percent: |

Not Applicable.

| ITEM 6. | CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPSWITH RESPECT TO SECURITIES OF THE ISSUER |

None.

6

| ITEM 7. | MATERIAL TO BE FILED AS EXHIBITS |

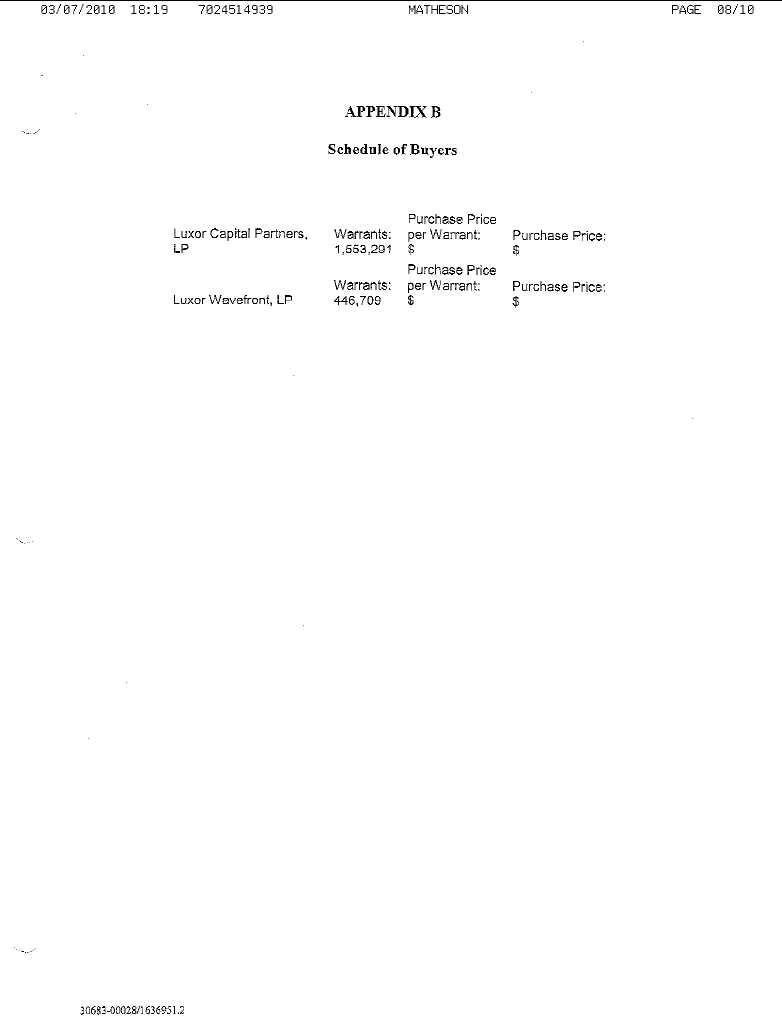

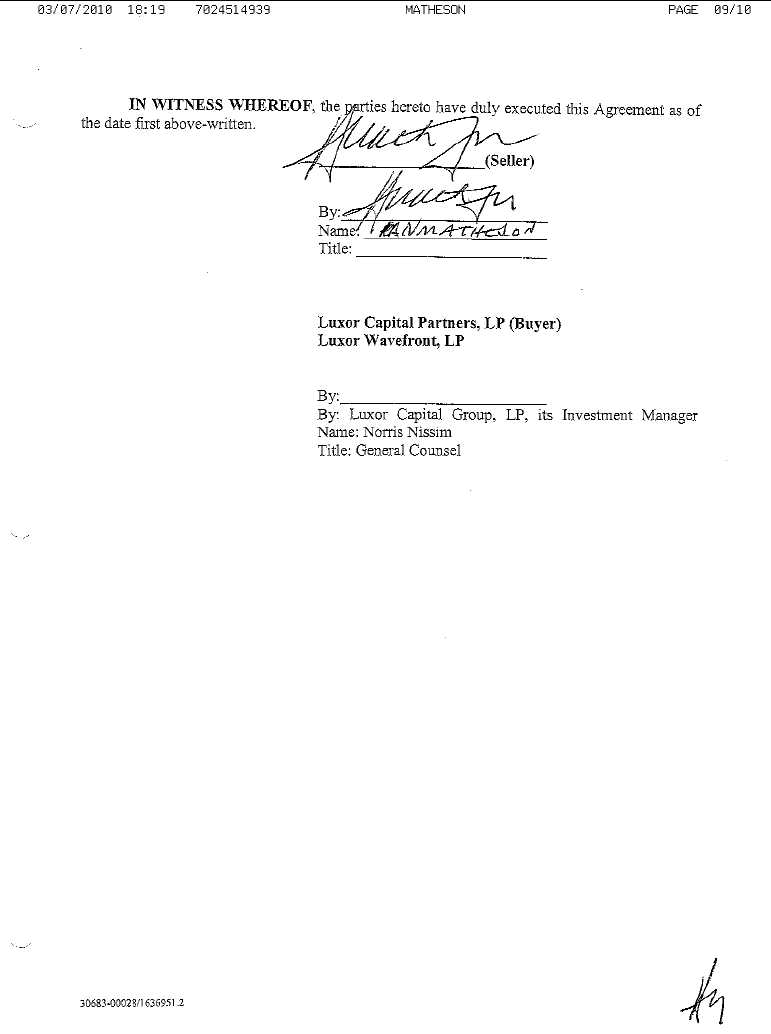

| 1. | Warrant Purchase And Sale Agreement dated February 4, 2010 between Luxor Capital Partners, LP, Luxor Wavefront, LP and Ian Matheson. |

| | |

| 2. | Warrant Transfer Agreement dated January 17, 2006 between Nanominerals Corp. and K. Ian Matheson (previously filed with Schedule 13D/A (Amendment No. 1) of the Reporting Person filed on February 28, 2006 with the Securities and Exchange Commission). |

| | |

| 3. | Share Transfer Agreement dated January 17, 2006 between Nanominerals Corp. and K. Ian Matheson (previously filed with Schedule 13D/A (Amendment No. 1) of the Reporting Person filed on February 28, 2006 with the Securities and Exchange Commission). |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| | March 29, 2010 |

| | Date |

| | |

| | |

| | /s/ K. Ian Matheson |

| | Signature |

| | |

| | K. IAN MATHESON |

| | Name |

7