QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on May 13, 2005

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Wexford Shipping Company

(Exact name of Registrant as specified in its charter)

Republic of the Marshall Islands

(State or other jurisdiction of

Incorporation or organization) | | 4412

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(I.R.S. Employer

Identification Number) |

Wexford Plaza

411 West Putnam Avenue

Greenwich, CT 06830

(203) 862-7000

(Address, including zip code, and telephone number, including

area code, of Registrant's principal executive office)

Frederick B. Simon

Chief Executive Officer

Wexford Shipping Company

Wexford Plaza

411 West Putnam Avenue

Greenwich, CT 06830

(203) 862-7000

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

Gregg J. Berman, Esq.

Fulbright & Jaworski L.L.P.

666 Fifth Avenue

New York, NY 10103

(212) 318-3000

Facsimile: (212) 318-3400 | | Alan P. Baden, Esq.

Vinson & Elkins L.L.P.

666 Fifth Avenue

New York, NY 10103

(212) 237-0000

Facsimile: (917) 849-5337 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box: o

CALCULATION OF REGISTRATION FEE

|

Title Of Each Class Of Securities To Be Registered

| | Proposed Maximum Aggregate Offering Price(1)(2)

| | Amount Of Registration Fee

|

|---|

|

| Common Stock, $.001 par value | | $100,000,000 | | $11,770 |

|

- (1)

- Estimated solely for purposes of calculating the registration fee in accordance with Rule 457 of the Securities Act of 1933.

- (2)

- Includes common stock, if any, that may be sold pursuant to the underwriters' over-allotment option.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment specifically stating that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion Dated May , 2005

Prospectus

Shares

Wexford Shipping Company

Common Stock

We are offering shares of our common stock. This is our initial public offering. We estimate that the initial public offering price will be between $ and $ per share. Currently, no public market exists for the shares. We intend to apply to list our common stock on the under the symbol " ."

Investing in our common stock involves risks that are described in the "Risk Factors" section beginning on page 10 of this prospectus.

| | Per Share

| | Total

|

|---|

| Initial public offering price | | $ | | | $ | |

| Underwriting discount | | $ | | | $ | |

| Proceeds, before expenses, to us | | $ | | | $ | |

We have granted the underwriters a 30-day option to purchase up to an additional shares of our common stock from us on the same terms and conditions as set forth above. The net proceeds from any exercise of the underwriters' option to purchase additional shares of our common stock will be used for working capital and other corporate purposes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver shares of our common stock to purchasers on or about , 2005.

Jefferies & Company, Inc.

The date of this prospectus is , 2005.

TABLE OF CONTENTS

| | Page

|

|---|

Prospectus Summary |

|

2 |

| Risk Factors | | 10 |

| Use of Proceeds | | 23 |

| Dividend Policy | | 24 |

| Capitalization | | 25 |

| Dilution | | 26 |

| Selected Financial Information | | 27 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 29 |

| The International Dry Bulk Shipping Industry | | 37 |

| Business | | 53 |

| Management | | 66 |

| Related Party Transactions | | 71 |

| Security Ownership of Certain Beneficial Owners and Management | | 73 |

| Description of Capital Stock | | 74 |

| Marshall Islands Company Considerations | | 78 |

| Tax Considerations | | 81 |

| Shares Eligible for Future Sale | | 92 |

| Underwriting | | 94 |

| Legal Matters | | 98 |

| International Dry Bulk Shipping Industry Data | | 99 |

| Experts | | 100 |

| Where You Can Find Additional Information | | 101 |

| Special Note Regarding Forward-Looking Statements | | 102 |

| Glossary of Shipping Terms | | 103 |

| Index to Financial Statements | | F-1 |

�� You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

Through and including , 2005 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

1

PROSPECTUS SUMMARY

This prospectus summary highlights information and financial data that appear later in this prospectus and is qualified in its entirety by the more detailed information and financial statements that appear later. This summary may not contain all of the information that may be important to you. As an investor or prospective investor, you should review carefully the entire prospectus, including the risk factors and the more detailed information and financial statements that appear later. We refer you to "Glossary of Shipping Terms" beginning on page 103 for definitions of certain shipping industry terms that we use in this prospectus.

Unless otherwise indicated, all references in this prospectus to our fleet refers to the fleet of six dry bulk carriers that we will own after the closing. Three of these vessels, referred to as the "Wexford Vessels", will be contributed prior to the closing of this offering by affiliates of our majority shareholder, Wexford Capital LLC, referred to as "Wexford", and three of these vessels (the "Identified Vessels") will be acquired by us, contemporaneously with the closing of this offering, from entities controlled by VOC Shipholdings B.V., referred to as "VOC." Unless otherwise indicated, all information in this prospectus assumes that the underwriters' 30-day option to purchase up to additional shares from us will not be exercised. Unless otherwise indicated, references in this prospectus to "Wexford Shipping Company," "we", "us", "our", and "the Company" refer to Wexford Shipping Company and our subsidiaries. We sometimes refer to the contribution of the Wexford Vessels and acquisition of the Identified Vessels as the "Transaction." All references in this prospectus to "$", "U.S.$" and "Dollars" refer to U.S. dollars.

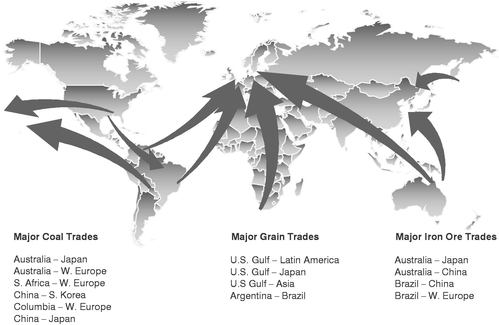

Our Company

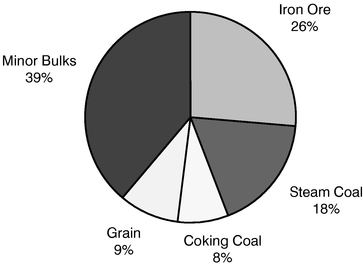

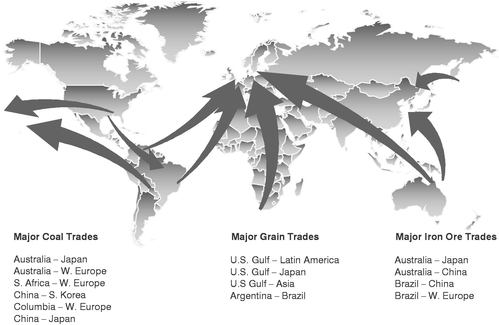

We are a newly formed Marshall Islands company that will own and manage dry bulk carriers that transport a variety of dry bulk commodities including major bulks such as coal, iron ore and grains, and minor bulks such as bauxite, phosphate, fertilizers and steel products along worldwide shipping routes. Prior to this offering, we are a majority owned subsidiary of Wexford, an SEC registered investment advisor with approximately $2.5 billion of assets under management as of March 31, 2005.

Our initial operating fleet will consist of three modern dry bulk carriers to be contributed prior to the closing of this offering by Wexford. The Wexford Vessels have a combined carrying capacity of 190,508 dwt and weighted average age by market value of 8.5 years. Contemporaneously with the closing of this offering, we will acquire an additional three dry bulk vessels which have a combined carrying capacity of 174,595 dwt and a weighted average age by market value of 3.0 years. Together, these six ships comprise our combined fleet (the "Combined Fleet"), which will have a combined carrying capacity of 365,103 dwt and weighted average age by market value of 5.8 years. A description of the fleet follows in the table below.

Vessel Name

| | Flag

| | Vessel Type

| | Size (dwt)

| | Year Built

| | Shipyard

|

|---|

| Wexford Vessels | | | | | | | | | | |

| Anita | | Malta | | Panamax | | 72,495 | | 1999 | | Koyo Dock, Japan |

| Koby | | Malta | | Panamax | | 72,495 | | 1998 | | Imabari S.B., Japan |

| Paige | | Malta | | Handymax | | 45,518 | | 1994 | | Tsuneishi, Zosen, Japan |

Identified Vessels |

|

|

|

|

|

|

|

|

|

|

| VOC Orchid | | Bahamas | | Handymax | | 45,512 | | 1996 | | Jiangnan, China |

| VOC Enterprise | | Bahamas | | Ultrahandymax | | 52,483 | | 2005 | | Tsuneishi Heavy Industries, Philippines |

| Clipper Sussex | | Hong Kong | | Panamax | | 76,600 | | 2005 | | Sasebo, Japan |

2

The Identified Vessels will be purchased with approximately $ of the net proceeds from this offering, together with approximately shares of our common stock and borrowings under our new credit facility.

We expect to employ our fleet of modern dry bulk carriers on an opportunistic basis in the spot charter market, under period time charters and in dry bulk carrier pools. We believe that this flexible employment strategy will allow us to take advantage of favorable market conditions.

Our Fleet Managers

The operations of the Wexford Vessels are currently managed by Franco Compania Naviera S.A. ("Franco"), a Panamanian company. The Wexford Vessels currently have management agreements under which Franco provides the vessels with a wide range of shipping services such as technical support and maintenance, insurance, chartering, financial and accounting services, for a monthly management fee of $15,200 per vessel plus 1.25% of gross revenue.

After the closing of this offering, we intend to outsource both commercial and technical fleet management to third parties in arm's length transactions at standard market terms. It is intended that VOC Bulk Shipping USA, Inc. (our "Commercial Manager") will provide us with commercial management services for which we will pay $8,500 per vessel per month. Our Commercial Manager is an affiliate of VOC. We intend to employ a technical manager (our "Technical Manager") which will provide us with technical management services for which we expect to pay $ per vessel per year. Prior to the closing of this offering we will enter into an administrative services agreement with Wexford to provide us with general management, oversight and administrative functions for a fee of $1.5 million per year for the Combined Fleet. See "Related Party Transactions."

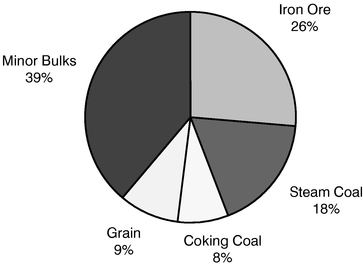

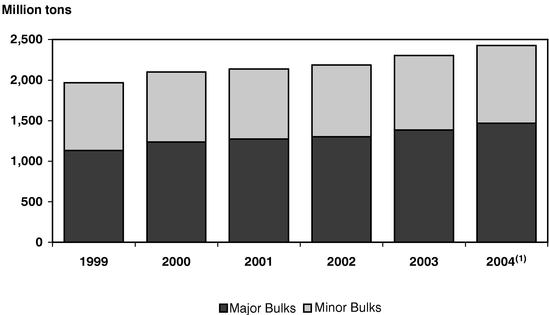

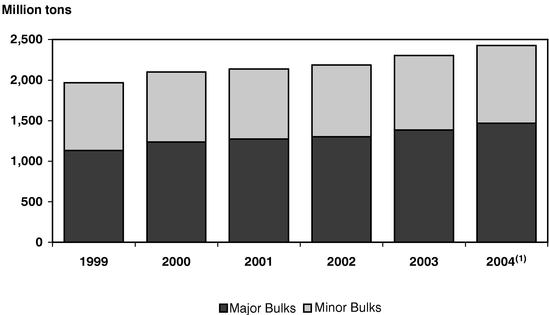

The Dry Bulk Shipping Industry

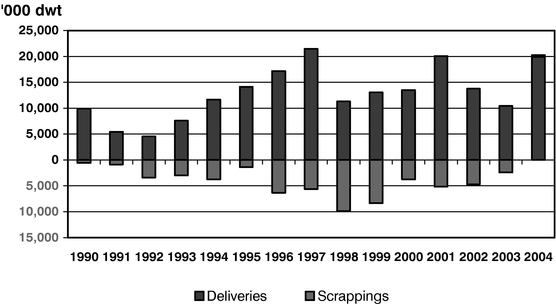

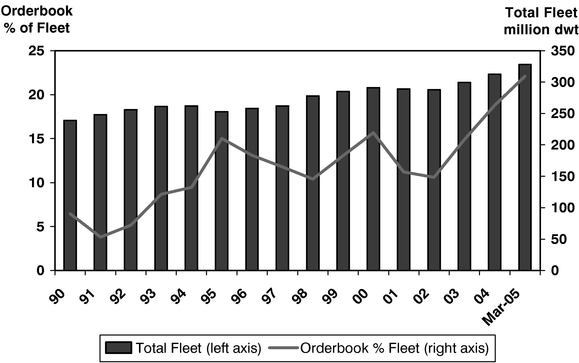

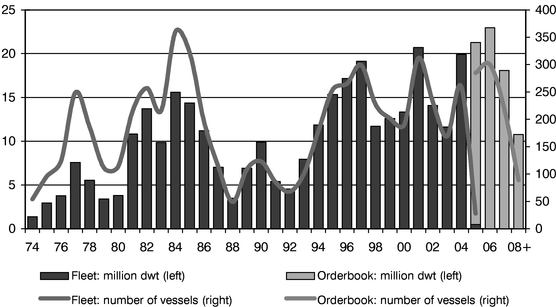

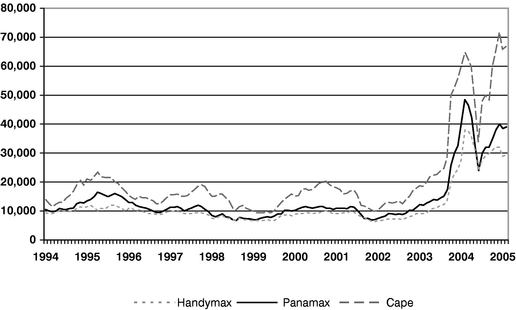

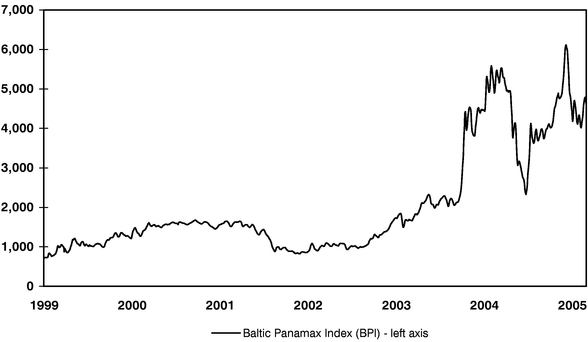

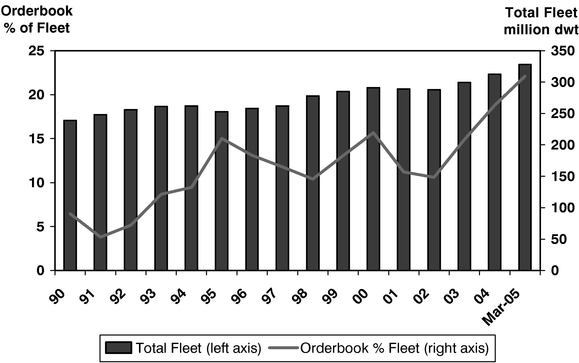

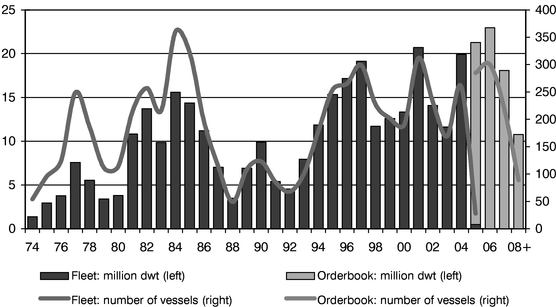

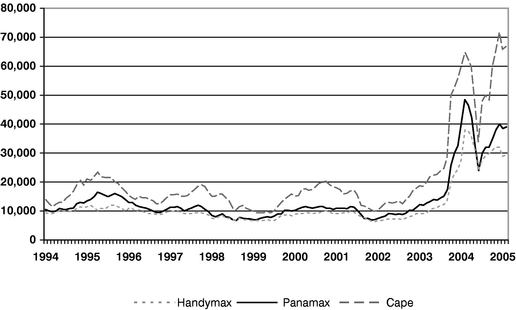

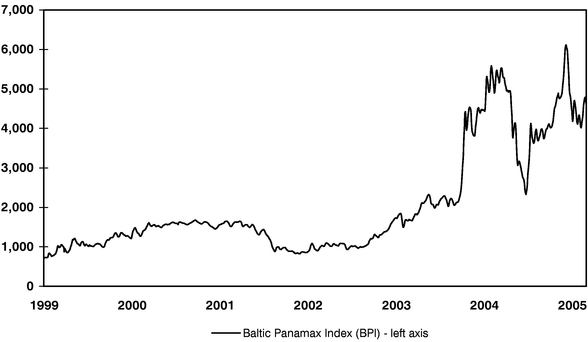

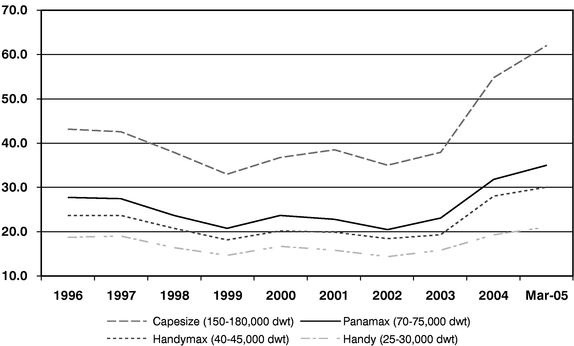

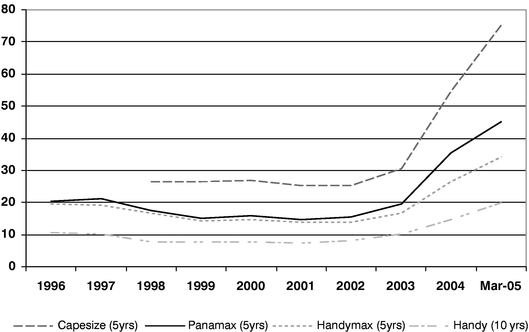

The dry bulk shipping industry is an essential link in international trade, with ocean-going vessels representing the most efficient, and often the only, method of transporting large volumes of basic commodities and finished products. In 2004, approximately 2.5 billion tons of dry bulk cargo were transported by sea, comprising more than one-third of all international seaborne trade. According to Drewry Shipping Consultants, since the fourth quarter of 2002, the shipping industry has experienced the highest charter rates and vessel values in its modern history due to the favorable imbalance between the supply of and demand for ships. For dry bulk shipping, this imbalance is currently a function of:

Supply:

- •

- Shipyards where new ships are constructed are fully booked until 2008, limiting the number of new vessels that will enter the market in coming years.

- •

- The supply of dry bulk carriers is a result of both the number of ships in service and also the operating efficiency of the worldwide fleet. Port congestion absorbed additional tonnage and therefore tightened the underlying supply/demand balance.

Demand:

- •

- The increased demand for dry bulk carrier capacity has been driven by the underlying demand for commodities transported in dry bulk carriers. Between 1999 and 2004, trade in all dry bulk commodities increased from 1.97 billion tons to 2.46 billion tons, an increase of 25% overall.

- •

- China has been the main driving force behind the recent increase in seaborne dry bulk trades and the demand for bulk carriers. In addition to coal and iron ore, Chinese imports of steel

3

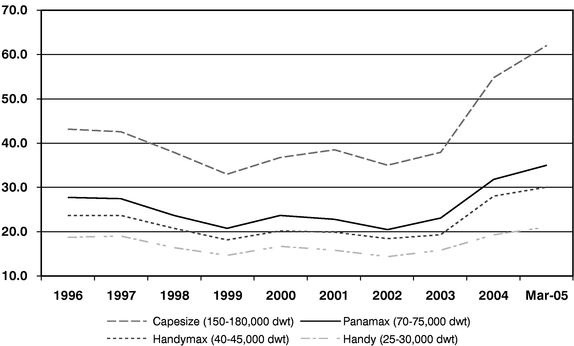

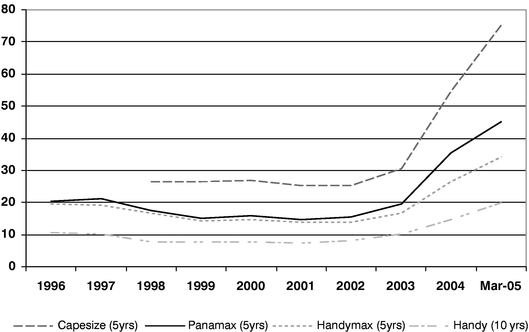

Charter hire rates and vessel values are primarily a function of the underlying balance between vessel supply and demand, although at times other factors may play a role including demand for commodities that are transported by sea. However, vessel charter rates and vessel values historically have been volatile and are affected by numerous factors outside our control.

Our Competitive Strengths

We believe that we possess a number of strengths that distinguish our Company within the dry bulk shipping industry:

Wexford relationship. Wexford manages a series of hedge funds and private equity funds and has extensive experience investing in a wide range of industries and asset classes. Wexford has been active in managing and operating both asset-based and non-asset based companies at all stages of development, including from inception, and as an investment manager with substantial access to both public and private markets. Wexford also has experience in arranging a wide variety of equity and debt financings for these companies. We will be managed by Wexford under an administrative services agreement that we believe will enable us to manage our business more efficiently than could otherwise be achieved on a stand alone basis. This will give us access to an established infrastructure and a team of professionals with significant expertise.

Management experience in the shipping industry. Wexford executives will determine the strategic direction of our Company and manage our business operations as they have historically done with the Wexford Vessels. In addition to management and operations, this team has successfully invested in the shipping sector through individual vessel purchases, consolidation of a number of shipping operations, and investing in an existing shipping company. We believe that the combination of Wexford's management experience and investment expertise will be a competitive advantage as we grow and manage our business.

Modern, high quality fleet. Following the Transaction, we will have a fleet of six modern dry bulk carriers with a weighted average age by market value of 5.8 years. We are focused on maintaining our fleet to a high standard of operational excellence. We believe that a young, well-maintained and well-built fleet of dry bulk carriers will attract high quality charterers at favorable charter hire rates. Additionally, we believe that modern vessels that have been properly maintained will realize superior returns as a result of lower operating expenses and will initially require lower amounts of capital spending than older vessels.

Quality service. We expect our Combined Fleet to serve a variety of quality customers engaged in industrial, commodity and raw material production and trading. We expect to maintain rigorous standards for vessel quality, condition and operations while providing reliable and dependable service. We believe that, as a result of our high standards and the level of service provided by the Wexford Vessels, we have an excellent reputation among our customer base.

Conservative balance sheet management. As adjusted for the Transaction and this offering, our ratio of debt to total capitalization will be . We intend to finance our future growth with a combination of cash flow from operations and debt and equity issuances. We intend to access the capital markets opportunistically while maintaining a conservative leverage structure, which will provide financial stability throughout shipping market cycles and give us the flexibility to pursue our acquisition strategy.

4

Our Growth Strategy

We intend to grow our fleet and our margins as we seek to become a leading vessel provider in the dry bulk shipping sector. The principal elements of our growth strategy are as follows:

Strategically grow our fleet. We believe that the dry bulk shipping industry is highly fragmented and can be consolidated. We intend to participate in this consolidation and to grow our fleet primarily through the timely acquisition of high quality second hand dry bulk carriers. Our goal is to create a diversified fleet of dry bulk carriers, across all sizes, which will be capable of supplying a broad spectrum of global transportation solutions to our customers worldwide. We intend to continually monitor market conditions for opportunities to acquire modern second hand vessels that represent favorable investment opportunities.

Pursue balanced and opportunistic charter strategy. We intend to employ our fleet on an opportunistic basis in the spot charter market, under period time charters and in dry bulk carrier pools managed by third parties. We believe this chartering strategy will balance the predictability of earnings achieved through time charters with the opportunity to realize superior charter rates in the spot market and thus maximize our return on our vessel investment. We also intend to continually monitor market conditions and relevant global macroeconomic trends and adjust our strategy in order to take advantage of the full variety of options available in the chartering market.

Leverage operational and financial model. We believe that the Transaction will result in managerial and operational efficiencies for our Combined Fleet. The increased scale of the Company will allow us to achieve lower capital costs than previously realized. We believe that these benefits will continue to be realized as we add to our fleet. Additionally, we believe that an expanded fleet operated by a professional management team should attract high quality, high volume customers over time. As a result, we believe our fleet acquisition strategy will enhance revenue and profit potential.

Our Principal Equity Sponsor

Wexford was formed in 1994. As of March 31, 2005, Wexford's assets under management were approximately $2.5 billion, consisting of approximately $1.5 billion in hedge funds and approximately $1.0 billion in private equity investments. Wexford has made private equity investments in many different sectors with particular expertise in bankruptcy/distressed, energy/natural resources, real estate, technology/telecommunications and transportation. Wexford has made a number of successful investments in the shipping sector and made its first private equity shipping investment in 1995, when it purchased the first of five tankers which were later merged into General Maritime Corporation as part of its initial public offering in 2001. Wexford was a significant owner of that company until 2004. From 1999 until 2003, Wexford owned a significant equity position in Seabulk International.

Corporate Structure

We are a holding company incorporated under the laws of the Republic of the Marshall Islands. We maintain our principal executive offices at c/o Wexford Capital LLC, Wexford Plaza, 411 West Putnam Avenue, Greenwich, Connecticut 06830. Our telephone number at that address is (203) 862-7000.

5

The Offering

Common stock offered |

|

shares |

Common stock outstanding after the offering |

|

shares(1) |

Underwriters' 30-day option to purchase additional shares of common stock |

|

shares |

Use of proceeds |

|

We intend to use the net proceeds from this offering, together with approximately shares of our common stock and borrowings under our new credit facility, to acquire the Identified Vessels contemporaneously with the closing of this offering. |

|

|

The net proceeds from any exercise of the underwriters' 30-day option to purchase additional shares of our common stock will be used for working capital and other corporate purposes. |

Exchange listing |

|

We currently intend to apply to list our common stock on under the symbol " ". |

- (1)

- The number of shares outstanding after the offering:

- •

- excludes shares of common stock reserved for issuance upon exercise of stock options which will be granted in conjunction with this offering at an exercise price equal to the initial public offering price hereof; and

- •

- includes approximately shares of common stock to be issued as a portion of the consideration for our purchase of the Identified Vessels.

Risk Factors

Investing in our common stock involves risks. You should carefully consider all of the information in this prospectus prior to investing in our common stock. In particular, we urge you to consider carefully the factors set forth in the section "Risk Factors" of this prospectus.

6

Summary Financial Information

We were formed on May 3, 2005, and did not exist during the period presented. The historical statement of operations data set out below is derived from the historical financial statements of North American Carriers Ltd. and North American Carriers II Ltd., the current owners of the Wexford Vessels, included in this prospectus. The balance sheet data is derived from the historical financial statements giving effect to the contribution of the Wexford Vessels. The following data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and such historical financial statements and the related notes included in this prospectus. The other fleet data set forth below is unaudited.

| | For the Period from

January 9, 2004 (inception)

to December 31, 2004

| |

|---|

| | (in thousands, except other fleet data)

| |

|---|

| Statement of Operations Data: | | | | |

| Revenues | | $ | 18,962 | |

| Expenses: | | | | |

| | Voyage expenses and commissions | | | 1,231 | |

| | Vessel operating expenses | | | 2,404 | |

| | Depreciation | | | 2,429 | |

| | Amortization of deferred costs | | | 124 | |

| | Management fees | | | 363 | |

| | General and administrative expenses | | | 250 | |

| | Foreign currency losses | | | 21 | |

| | |

| |

| Operating income | | | 12,140 | |

| | |

| |

| Interest and finance costs | | | (825 | ) |

| Interest income | | | 89 | |

| | |

| |

| Net income | | $ | 11,404 | |

| | |

| |

| Other Financial Data: | | | | |

| EBITDA(1) | | $ | 14,782 | |

| | |

| |

| Other Fleet Data: | | | | |

| Average number of vessels(2) | | | 1.73 | |

| Number of vessels at end of period | | | 3 | |

| Total ownership days(3) | | | 632.5 | |

| Total available days(4) | | | 607.2 | |

| Total operating days(5) | | | 602.2 | |

| Average utilization(6) | | | 96.0 | % |

| Average TCE rate(7) | | $ | 30,854 | |

| Average daily vessel operating expenses | | $ | 3,912 | |

7

| | December 31, 2004

|

|---|

| | Historical

| | As adjusted(8)

|

|---|

| | (in thousands)

|

|---|

Balance Sheet Data: |

|

|

|

|

|

| Cash | | $ | 6,148 | | |

| Total current assets | | | 9,943 | | |

| Vessels | | | 82,485 | | |

| Other non-current assets | | | 776 | | |

| Total assets | | | 93,203 | | |

| Current liabilities | | | 9,757 | | |

| Other liabilities | | | 68 | | |

| Long term debt, net of current portion | | | 36,956 | | |

| Shareholders' equity | | | 46,423 | | |

- (1)

- EBITDA represents net income plus interest expense, income tax expense, depreciation and amortization. EBITDA is included because it is used by management and certain investors as a measure of operating performance. EBITDA is used by analysts in the shipping industry as a common performance measure to compare results across peers. Our management uses EBITDA as a performance measure in monthly internal financial statements and it is presented for review at our board meetings. EBITDA may also be used by our prospective lenders in certain loan covenants. For these reasons, we believe that EBITDA is a useful measure to present to our investors. EBITDA is not an item recognized by the generally accepted accounting principles in the United States, or U.S. GAAP, and should not be considered as an alternative to net income, operating income or any other indicator of a company's operating performance required by U.S. GAAP. The definition of EBITDA used here may not be comparable to that used by other companies.

| | For the Period

January 9, 2004 through

December 31, 2004

|

|---|

| | (in thousands)

|

|---|

| Net income | | $ | 11,404 |

| Interest expense | | | 825 |

| Income tax expense | | | — |

| Depreciation | | | 2,429 |

| Amortization | | | 124 |

| | |

|

| | EBITDA | | $ | 14,782 |

| | |

|

- (2)

- Average number of vessels is the number of vessels that constituted our fleet for the relevant period, as measured by the sum of the number of days each vessel was a part of our fleet during the period divided by the number of calendar days in the period.

- (3)

- We define ownership days as the total number of days in a period during which each vessel in our fleet was in our possession including off hire days associated with major repairs, drydockings or special or intermediate surveys. Ownership days are an indicator of the size of our fleet over a period and affect both the amount of revenues and the amount of expenses that we record during that period.

- (4)

- We define available days as the total number of days in a period during which each vessel in our fleet was in our possession net of off hire days associated with major repairs, drydockings or special or intermediate surveys and the aggregate amount of time that we spend positioning our vessels. The shipping industry uses available days (also referred to as voyage days) to measure the number of days in a period during which vessels should be capable of generating revenues.

8

- (5)

- We define operating days as the number of our available days in a period less the aggregate number of days that our vessels are off-hire due to any reason, including unforeseen circumstances. The shipping industry uses operating days to measure the aggregate number of days in a period during which vessels actually generate revenues.

- (6)

- We calculate fleet utilization by dividing the number of our available days during a period by the number of our ownership days during that period. The shipping industry uses fleet utilization to measure a company's efficiency in finding suitable employment for its vessels and minimizing the amount of days that its vessels are off hire for reasons such as scheduled repairs, vessel upgrades or drydockings and other surveys.

- (7)

- We define TCE rates as our voyage and time charter revenues less voyage expenses during a period divided by the number of our available days during the period, which is consistent with industry standards. TCE rate is a shipping industry performance measure used primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charter hire rates for vessels on voyage charters are generally not expressed in per day amounts while charter hire rates for vessels on time charters generally are expressed in such amounts.

- (8)

- As adjusted for the sale of shares of common stock hereby at an assumed offering price of $ per share, the mid-point of the filing range, and the application of the net proceeds as set forth in "Use of Proceeds."

9

RISK FACTORS

Any investment in shares of our common stock involves a high degree of risk. You should consider carefully the following information about these risks, together with all of the other information contained in this prospectus, before making an investment in our common stock. If any of the following risks actually occur, our business, financial condition or results of operations could be adversely affected. Any adverse effect on our business, financial condition or results of operations could result in a decline in the trading price of our common stock and the loss of all or part of your investment.

Risks Related to Our Operations

Because we are a new company with a limited performance record and operating history, we may be less successful in implementing our growth strategy than a more seasoned company.

We are a recently formed entity and have a limited performance record, operating history and historical financial statements based on the operation of the Wexford Vessels upon which you can evaluate us. We cannot assure you that we will be successful in implementing our growth strategy.

We will depend entirely on our Commercial Manager and Technical Manager to charter and manage our fleet.

We are a newly formed company with a chief executive officer and a chief financial officer whose services will be supplied by Wexford pursuant to the terms of an administrative services agreement. We currently have no plans to hire any employees. We intend to subcontract the commercial and technical management of our fleet, including crewing, maintenance and repair, to our Commercial Manager and Technical Manager. See "Business—Our Fleet Managers." The loss of one of our managers or a manager's failure to perform its obligations to us could adversely affect our results of operations and financial condition. Although we may have rights against our managers if they default on their obligations to us, you will have no recourse against our managers. Further, although we have not finalized any credit arrangements, if we do (of which there can be no assurance), we expect that we will need to seek approval from our lenders to change our managers.

Our Commercial Manager and Technical Manager are privately held companies and there is little or no publicly available information about them.

The ability of our Commercial Manager and Technical Manager to continue providing services for our benefit will depend in part on their own financial strength. Circumstances beyond our control could impair the financial strength of either or both of our Commercial Manager and Technical Manager. Because they are privately held, it is unlikely that information about their financial strength would become public unless they began to default on their obligations. As a result, we might have little advance warning of problems affecting our Commercial Manager or Technical Manager, even though these problems could have an adverse effect on our results of operations and financial condition.

Our chief executive officer and chief financial officer have divided responsabilities.

Our chief executive officer, Frederick B. Simon, and our chief financial officer, Jay L. Maymudes, are also principals of Wexford. While they will provide management services to us pursuant to our administrative services agreement with Wexford, they will not devote their full time and resources to us.

Wexford and its affiliates may engage in competition with us.

Wexford and its affiliates may engage in competition with us. Pursuant to the administrative services agreement, Wexford has agreed to give us a right of first refusal with respect to any purchase, lease or similar investment opportunities in Capesize, Panamax, Handymax or Handysize dry bulk vessels presented to or originated by Wexford or us, but excluding any opportunity that constitutes an

10

investment of any nature whatsoever in a publicly-held company or any derivative transaction relating or indexed to the equity or debt of a publicly-held company. Therefore, this right of first refusal does not limit the ability of Wexford and its affiliates to acquire the common stock, including a controlling interest, in any publicly-held company that owns, directly or through its subsidiaries, dry bulk vessels, including companies which compete with us. See "Business—Corporate Matters; Administrative Services Agreement."

Companies affiliated with our Commercial Manager own and may acquire vessels that compete with our fleet.

Companies affiliated with our intended Commercial Manager own multiple dry bulk carriers. In addition, our intended Commercial Manager or its multiple affiliates may acquire additional dry bulk carriers in the future. These vessels could be in competition with our fleet, and our intended Commercial Manager might be faced with conflicts of interest with respect to its own interests and its obligations to us.

We may have difficulty properly managing our planned growth through the acquisition of additional vessels.

We intend to continue to grow our business through selective acquisitions of additional vessels. Our growth will primarily depend on:

- •

- locating and acquiring suitable vessels;

- •

- identifying and consummating vessel acquisitions or joint ventures relating to vessel acquisitions;

- •

- enlarging our customer base;

- •

- managing our expansion; and

- •

- obtaining required financing on acceptable terms.

Growing any business through acquisitions presents numerous risks, such as obtaining additional qualified personnel, managing relationships with customers and integrating newly acquired assets and operations into existing infrastructures.

Prior to the closing of this offering, we will enter into an administrative services agreement with Wexford to provide us with general management, oversight and administrative functions (excluding vessel management functions). In addition, after the closing of this offering, we intend to outsource both commercial and technical fleet management to third parties. The current operating and financial systems of Wexford, our intended Commercial Manager and our Technical Manager may not be adequate as we commence operations and implement our plan to expand the size of our fleet, and any attempts to improve those systems may be ineffective. In addition, expanding our fleet will impose additional responsibilities on our management as well as on the personnel of Wexford, our intended Commercial Manager and our Technical Manager, and may necessitate that we, and they, hire additional qualified personnel. We cannot guarantee that we, Wexford, our intended Commercial Manager or our Technical Manager will be able to hire suitable personnel as we expand our fleet. If we, Wexford, our intended Commercial Manager or our Technical Manager are unable to develop and maintain effective operating and financial systems or to recruit suitable personnel as we expand our fleet, our results of operations and financial condition could be adversely affected.

Unless we maintain cash reserves for vessel replacement, we may be unable to replace the vessels in our fleet upon the expiration of their useful lives and our revenue will decline.

Unless we maintain cash reserves for vessel replacement, we may be unable to replace the vessels in our fleet upon the expiration of their useful lives. Our cash flows and income are dependent on the revenues earned by the chartering of our vessels to customers. If we are unable to replace the vessels

11

in our fleet upon the expiration of their useful lives, our results of operations and financial condition will be adversely affected.

We may be dependent on spot charters.

At any time, any or all of our vessels may be chartered on a spot charter basis. The spot charter market is highly competitive and spot charter rates may fluctuate significantly based upon available charters and the supply of and demand for dry bulk seaborne shipping capacity. Such dependence makes us vulnerable to declining market rates for spot charters.

We cannot assure you that we will be successful in keeping our vessels fully employed in these short-term markets or that future spot rates will be sufficient to enable us to operate our vessels profitably. A decrease in spot charter rates could adversely affect our results of operations and financial condition.

The international dry bulk shipping industry is highly competitive and we may not be able to compete for charters with new entrants or established companies with greater resources.

We will employ our vessels in a highly competitive market that is capital intensive and highly fragmented. Competition arises primarily from other vessel owners, some of whom may have substantially greater resources than we do. Competition for the transportation of dry bulk cargo by sea is intense and depends on price, location, size, age, condition and the acceptability of the vessel and its managers to the charterers. Due in part to the highly fragmented market, competitors with greater resources could operate larger fleets and may be able to offer more competitive charter hire rates than we are able to offer.

We depend upon a few customers for all of our revenue.

For the period ended December 31, 2004, the Wexford Vessels derived all of their revenues from four customers. If one or more of these customers is unable to perform under one or more charters with us and we are not able to find a replacement charter, or if a customer exercises certain rights to terminate the charter, our results of operations and financial condition would be adversely affected.

We could lose a customer or the benefits of a time charter for many different reasons, including if:

- •

- the customer fails to make charter payments because of its financial inability, disagreements with us or otherwise; or

- •

- the customer terminates the charter because we fail to deliver the vessel within a fixed period of time, the vessel is lost or damaged beyond repair, there are serious deficiencies in the vessel or prolonged periods of off-hire, or we default under the charter.

If we lose a key customer, we may be unable to obtain charters on comparable terms or may have increased exposure in the volatile spot market, which is highly competitive and subject to significant price fluctuations. The loss of any of our customers, time charters or vessels, or a decline in payments under our charters, would adversely affect our results of operations and financial condition.

We may be unable to retain key members of our management team.

Our success depends to a significant extent upon the abilities and efforts of our management team. We will enter into an administrative services contract with Wexford providing for the services of our chief executive officer and our chief financial officer. See—"Business—Corporate Matters; Administrative Services Agreement." Our success will depend upon our ability to retain key members of our management team. The loss of any key member could adversely affect our results of operations and financial condition. We do not intend to maintain key man life insurance on any of our officers.

12

Our vessels may suffer damage and we may face unexpected costs.

If our vessels suffer damage, they may need to be repaired. The costs of repairs are unpredictable and can be substantial. The loss of revenue while our vessels are being repaired and repositioned as well as the actual cost of these repairs could adversely affect our results of operations and financial condition. We may not have insurance sufficient to cover all or any of these costs or losses and may have to pay costs not covered by our insurance.

Purchasing and operating second hand vessels may result in increased operating costs and reduced fleet utilization.

Our inspection of second hand vessels prior to purchase does not provide us with the same knowledge about their condition that we would have had if these vessels had been built for and operated exclusively by us. Second hand vessels may have conditions or defects that we were not aware of when we bought the vessels and that may require us to incur costly repairs to the vessels. If this were to occur, such hidden defects or problems, when detected, may be expensive to repair, and if not detected, may result in accidents or other incidents for which we may become liable to third parties. Repairs may require us to put a vessel into drydock which would reduce our fleet utilization and increase our costs. Furthermore, we do not expect to receive the benefit of warranties on second hand vessels.

The aging of our fleet may result in increased operating costs in the future.

In general, the cost of maintaining a vessel in good operating condition increases with the age of the vessel. Assuming the Transaction, as of March 31, 2005, the weighted average age by market value of the vessels in our fleet was 5.8 years. As our fleet ages, we will incur increased costs. Older vessels are typically less fuel efficient and more costly to maintain than more recently constructed vessels due to improvements in engine technology. Cargo insurance rates increase with the age of a vessel, making older vessels less desirable to charterers.

Governmental regulations, including environmental regulations, safety or other equipment standards related to the age of vessels, may require expenditures for alterations, or the addition of new equipment, to older vessels and may restrict the type of activities in which the vessels may engage. We cannot assure you that, as our vessels age, market conditions will justify such expenditures or enable us to operate our vessels profitably during the remainder of their useful lives.

An increase in the price of bunker fuel could adversely affect our results of operations.

In spot chartering, the shipowner is typically responsible for paying both operating and voyage costs, including bunker fuel costs. Since we bear the cost of an increase in the price of bunker fuel in connection with any of our vessels that are chartered on a spot basis, such an increase could adversely affect our results of operations and financial condition.

The shipping industry has inherent operational risks that may not be adequately covered by our insurance.

We procure insurance for our fleet against risks commonly insured against by vessel owners and operators. Our current insurance includes hull and machinery insurance, war risks insurance, protection and indemnity insurance, which includes environmental damage and pollution insurance. We can give no assurance that we are adequately insured against all risks or that our insurers will pay a particular claim. Even if our insurance coverage is adequate to cover our losses, we may not be able to timely obtain a replacement vessel in the event of a loss. Furthermore, we may not be able to maintain or obtain adequate insurance coverage at reasonable rates for our fleet. We may also be subject to calls, or premiums, in amounts based not only on our own claim records but also the claim records of all other members of the protection and indemnity associations through which we receive indemnity

13

insurance coverage for tort liability. Our insurance policies also contain deductibles, limitations and exclusions which increase our costs in the event of a claim.

Servicing future debt would limit funds available for other purposes.

We intend to finance our future fleet expansion program in part with secured indebtedness. We also may incur other indebtedness in the future. While we may seek to refinance amounts drawn or incurred, we cannot assure you that we will be able to do so on terms that are acceptable to us or at all. If we are not able to refinance these amounts on terms acceptable to us or at all, we will have to dedicate cash flow from operations to pay the principal and interest of this indebtedness. If we are not able to satisfy these obligations, we may have to undertake alternative financing plans. The actual or perceived credit quality of our charterers, any defaults by them and the market value of our fleet, among other things, may materially affect our ability to obtain alternative financing. In addition, debt service payments under any future debt agreements or alternative financing may limit funds otherwise available for working capital, capital expenditures and other purposes. If we are unable to meet our debt obligations, or if we otherwise default under any future debt agreements or alternative financing arrangements, our lenders could declare the debt, together with accrued interest and fees, to be immediately due and payable and foreclose on our fleet, which could result in the acceleration of other indebtedness that we may have at such time and the commencement of similar foreclosure proceedings by other lenders.

We are a holding company, and we depend on the ability of our subsidiaries to distribute funds to us in order to satisfy our financial obligations.

We are a holding company and our subsidiaries conduct all of our operations and own all of our operating assets. We have no significant assets other than the equity interests in our subsidiaries. As a result, our ability to satisfy our financial obligations depends on our subsidiaries and their ability to distribute funds to us. The ability of a subsidiary to make these distributions could be affected by a claim or other action by a third party, including a creditor, or by Maltese law, which regulates the payment of dividends by companies. If we are unable to obtain funds from our subsidiaries, we may not be able to satisfy our financial obligations.

Because we generate all of our revenue in U.S. dollars but may incur a significant portion of our expenses in other currencies, exchange rate fluctuations could hurt our results of operations.

We generate all of our revenue in U.S. dollars. We expect to incur a portion of our expenses in currencies other than U.S. dollars. This difference could lead to fluctuations in net income due to changes in the value of the U.S. dollar relative to the other currencies, in particular the Euro. Expenses incurred in foreign currencies against which the U.S. dollar falls in value will be higher in U.S. dollar terms, resulting in a decrease in our operating income. We have not hedged these risks. Our results of operations could suffer as a result.

U.S. holders may be subject to adverse U.S. federal income tax consequences as a result of our possible status as a passive foreign investment company.

Based on our proposed method of operation, we do not believe that we will be a passive foreign investment company, or PFIC, with respect to any taxable year. There is, however, no direct legal authority under the PFIC rules addressing our proposed method of operation. Accordingly, no assurance can be given that the IRS or a court of law will accept our position, and there is a risk that the IRS or a court of law could determine that we are a PFIC. Moreover, no assurance can be given that we would not constitute a PFIC for any future taxable year if there were to be changes in the nature and extent of our operations.

14

If we are a PFIC for any tax year, U.S. holders who owned our common stock during such year may be subject to increased U.S. federal income tax liabilities and reporting requirements for such year and succeeding years, even if we are no longer a PFIC in such succeeding years. We urge purchasers of the common stock to review "Tax Considerations—U.S. Federal Income Taxation of U.S. Holders" and to consult their own tax advisors with respect to the U.S. federal income tax consequences of an investment in our common stock.

Risks Associated With the International Dry Bulk Shipping Industry

Risks associated with operating ocean-going vessels could adversely affect our results of operations and financial condition.

The operation of ocean-going vessels carries inherent risks. These risks include the possibility of:

- •

- marine disaster;

- •

- environmental accidents;

- •

- cargo and property losses or damage;

- •

- business interruptions caused by mechanical failure, human error, war, terrorism, political action in various countries, labor strikes or adverse weather conditions; and

- •

- piracy.

Any of these circumstances or events could adversely affect our results of operations and financial condition. Furthermore, certain of these incidents may harm our reputation as a safe and reliable vessel owner and operator.

The operation of dry bulk carriers has certain unique operational risks.

With a dry bulk carrier, the cargo itself and its interaction with the ship may create operational risks. By their nature, dry bulk cargoes are often heavy, dense and easily shifted, and they may react badly to water exposure. In addition, dry bulk carriers are often subjected to battering treatment during unloading operations with grabs, jackhammers (to pry encrusted cargoes out of the hold), and small bulldozers. This treatment may cause damage to the vessel. Vessels damaged due to treatment during unloading procedures may be more susceptible to breach to the sea. Hull breaches in dry bulk carriers may lead to the flooding of the vessels' holds. If a dry bulk vessel suffers flooding in its forward holds, the bulk cargo may become so dense and waterlogged that its pressure may buckle the vessel's bulkheads, leading to the loss of a vessel. If we are unable to adequately maintain our vessels, we may be unable to prevent these events. Any of these circumstances or events could negatively impact our results of operations and financial condition. In addition, the loss of any of our vessels could harm our reputation as a safe and reliable vessel owner and operator.

The dry bulk shipping industry is cyclical, which may lead to volatility in our charter hire rates and vessel values.

The dry bulk shipping industry is cyclical with attendant volatility in charter hire rates and vessel values. The degree of charter hire rate volatility among different types of dry bulk carriers has varied widely, and charter hire rates for dry bulk carriers are currently near historically high levels. We cannot assure you that we will be able to successfully charter our vessels in the future or renew existing charters at the same or similar rates. If we are required to enter into a charter when charter hire rates are low, our results of operations could be adversely affected.

In addition, the market value of our vessels may fluctuate significantly. A decline in charter hire rates, for example, may cause the value of our vessels to decline. If we sell vessels at a time when

15

vessel prices have fallen and before we have recorded an impairment adjustment, the sale may be at less than the vessel's carrying amount, resulting in a loss. A decline in the market value of our vessels could also lead to a default under any prospective credit facility to which we become a party and/or limit our ability obtain additional financing.

Because the factors affecting the supply and demand for vessels are outside of our control and are unpredictable, the nature, timing, direction and degree of changes in industry conditions, such as charter hire rates and vessel values, are also unpredictable. Factors that influence demand for vessel capacity include:

- •

- demand for and production of dry bulk products;

- •

- global and regional economic conditions;

- •

- environmental and other regulatory developments;

- •

- the distance dry bulk is to be moved by sea; and

- •

- changes in seaborne and other transportation patterns.

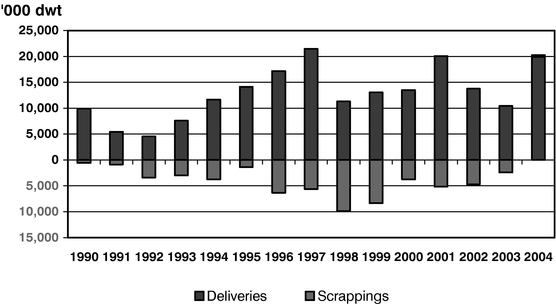

Factors that influence the supply of vessel capacity include:

- •

- the number of newbuilding deliveries;

- •

- the scrapping rate of older vessels;

- •

- vessel casualties;

- •

- the number of vessels that are out of service;

- •

- the price of steel;

- •

- environmental and other regulations that may limit the useful life of vessels; and

- •

- port congestion.

We anticipate that the future demand for our dry bulk carriers will depend upon, among other factors, continued economic growth in the world's economies, including China and India, and will be influenced by seasonal and regional changes in demand, changes in the capacity of the global dry bulk carrier fleet and the sources and supply of dry bulk cargo to be transported by sea. We believe the capacity of the global dry bulk carrier fleet will increase. If the supply of dry bulk carrier capacity increases and the demand for dry bulk carrier capacity does not increase or increases at a slower pace, the charter hire rates paid for our vessels as well as our vessel values could decline, which could adversely affect our results of operations and financial condition.

Seasonal fluctuations in demand could adversely affect our results of operations and financial condition.

We will operate our vessels in markets that have historically exhibited seasonal variations in demand and, as a result, in charter hire rates. This seasonality may result in quarter-to-quarter volatility in our results of operations. The dry bulk carrier market is typically stronger in the fall and winter months in anticipation of increased consumption of coal and other raw materials in the northern hemisphere during the winter months. As a result, we expect our revenues to be weaker during the fiscal quarters ended June 30 and September 30, and, conversely, we expect our revenues to be stronger in fiscal quarters ended December 31 and March 31. This seasonality could adversely affect our results of operations and financial condition.

16

The operation of our vessels is subject to international conventions, national, state and local laws and regulations relating to environmental protection that could require us to incur substantial costs and otherwise adversely affect our results of operations and financial condition.

The operation of our vessels is subject to international conventions, national, state and local laws and regulations in force in the jurisdictions in which our vessels operate, as well as in the country of their registration, in order to protect against potential environmental impacts. As a result of highly publicized accidents in recent years, government regulation of vessels, particularly in the area of environmental requirements, can be expected to become more stringent in the future and could require us to incur significant capital expenditures on our vessels to keep them in compliance, or even to scrap or sell certain vessels altogether. For example, various jurisdictions are considering regulating the management of ballast waters to prevent the introduction of non-indigenous species that are considered invasive. While we cannot in every instance predict the extent of the costs that will be required to comply with these requirements, environmental regulations should apply to all vessels registered in countries that have ratified the various conventions upon which such requirements are based.

These requirements can also affect the resale value or useful lives of our vessels, cause a reduction in cargo capacity, ship modifications or operational changes or restrictions, lead to decreased availability of or more costly insurance coverage for environmental matters or result in the denial of access to certain jurisdictional waters or ports, or detention in certain ports. Under national, state and local laws, as well as international treaties and conventions, we could incur material liabilities, including cleanup obligations, natural resource damages, personal injury and property damage claims, in the event that there is a release of petroleum or other hazardous materials from our vessels or otherwise in connection with our operations. Violations of, or liabilities under, environmental requirements can result in substantial penalties, fines and other sanctions, including in certain instances, seizure or detention of our vessels. Events of this nature could have an adverse affect on our results of operations and financial condition.

For additional information on these and other environmental requirements, please read "Business—Environmental and Other Regulations."

The operation of our vessels is subject to safety rules and regulations, and the failure to comply with such rules and regulations could subject us to increased liabilities and otherwise adversely affect our results of operations and financial condition.

The hull and machinery of every commercial vessel is usually classed by a classification society authorized by its country of registry. The classification society certifies that a vessel meets certain criteria in accordance with the applicable rules of the classification society.

Annual Surveys: For seagoing ships, annual surveys are conducted for the hull and the machinery, including the electrical plant, and where applicable for special equipment classed, at intervals of 12 months from the date of commencement of the class period indicated in the certificate.

Intermediate Surveys: Extended annual surveys are referred to as intermediate surveys and typically are conducted two and one-half years after commissioning and each class renewal. Intermediate surveys may be carried out on the occasion of the second or third annual survey.

Class Renewal Surveys: Class renewal surveys, also known as special surveys, are carried out for the ship's hull, machinery, including the electrical plant, and for any special equipment classed, at the intervals indicated by the character of classification for the hull. At the special survey, the vessel is thoroughly examined, including audio-gauging to determine the thickness of the steel structures. Should the thickness be found to be less than class requirements, the classification society would prescribe steel renewals. The classification society may grant a one-year grace period for completion of the special survey. Substantial amounts of funds may have to be spent for steel renewals to pass a special survey if

17

the vessel experiences excessive wear and tear. In lieu of the special survey every four or five years, depending on whether a grace period was granted, a shipowner has the option of arranging with the classification society for the vessel's hull or machinery to be on a continuous survey cycle, in which every part of the vessel would be surveyed within a five-year cycle.

The next special surveys for the Wexford Vessels are due in August 2008, January 2009 and June 2009.

The operation of our vessels is also affected by the requirements set forth in the International Maritime Organization's International Management Code for the Safe Operation of Ships and Pollution Prevention, or ISM Code. The ISM Code requires shipowners and bareboat charterers to develop and maintain an extensive "Safety Management System" that includes the adoption of a safety and environmental protection policy setting forth instructions and procedures for safe operation and describing procedures for dealing with emergencies. The ISM Code requires that vessel operators obtain a Safety Management Certificate for each vessel they operate. No vessel can obtain ISM Code certification unless its manager has been awarded a document of compliance under the ISM Code. The failure of a shipowner or bareboat charterer to comply with the ISM Code may subject such party to increased liability, may decrease available insurance coverage for the affected vessels and may result in a denial of access to, or detention in, certain ports. Currently, each of the vessels in the fleet is ISM code-certified. However, there can be no assurance that such certification will be maintained indefinitely.

For additional information, please read "Business—Environmental and Other Regulations."

International shipping is subject to various security and customs inspection and related procedures that could adversely affect our results of operations and financial condition.

International shipping is subject to various security and customs inspection and related procedures in countries of origin and destination. Inspection procedures can result in the seizure of contents of our vessels, delays in the loading, offloading or delivery and the levying of customs, duties, fines and other penalties against us.

It is possible that changes to inspection procedures could impose additional financial and legal obligations on us. Furthermore, changes to inspection procedures could also impose additional costs and obligations on our customers and may, in certain cases, render the shipment of certain types of cargo impractical. Any such changes or developments may have an adverse effect on our results of operations and financial condition.

Maritime claimants could arrest one or more of our vessels.

Crew members, suppliers of goods and services to a vessel, shippers of cargo and other parties may be entitled to a maritime lien against a vessel for unsatisfied debts, claims or damages. In many jurisdictions, a claimant may seek to enforce its lien by arresting a vessel through foreclosure proceedings. The arrest or attachment of one or more of our vessels could cause us to default on a charter, interrupt our cash flow and require us to pay large sums of money to have the arrest lifted.

Governments could requisition one or more of our vessels during a period of war or emergency.

A government could requisition one or more of our vessels for title or for hire. Requisition for title occurs when a government takes control of a vessel and becomes its owner, while requisition for hire occurs when a government takes control of a vessel and effectively becomes its charterer at dictated charter rates. Generally, requisitions occur during periods of war or emergency, although governments may elect to requisition vessels in other circumstances. Although we would be entitled to compensation in the event of a requisition of one or more of our vessels, the amount and timing of

18

payment would be uncertain. Government requisition of one or more of our vessels could adversely affect our results of operations and financial condition.

An economic slowdown in the Asia Pacific region could adversely affect our results of operations and our financial condition.

We expect that a significant number of the port calls made by our vessels will involve the loading or discharging of raw materials in ports in the Asia Pacific region. As a result, a negative change in economic conditions in any Asia Pacific country, but particularly in China, may have an adverse effect on our business, financial condition and results of operations, as well as our future prospects. In particular, in recent years, China has been one of the world's fastest growing economies in terms of gross domestic product which has had a significant impact on shipping demand. We cannot assure you that such growth will be sustained or that the Chinese economy will not experience negative growth in the future. Moreover, any slowdown in the economies of the United States, the European Union or certain Asian countries may adversely affect economic growth in China and elsewhere. An economic downturn in any of these countries could adversely affect our results of operations and financial condition.

World events could affect our results of operations and financial condition.

Terrorist attacks such as the attacks on the United States on September 11, 2001, the bombings in Spain on March 11, 2004 and the continuing response of the United States to these attacks, as well as the threat of future terrorist attacks in the United States or elsewhere, continue to cause uncertainty in the world financial markets and may affect our business, results of operations and financial condition. The continuing conflict in Iraq may lead to additional acts of terrorism and armed conflict around the world, which may contribute to further economic instability in the global financial markets. In addition, political tensions or conflicts in the Asia Pacific region, particularly involving China, may reduce the demand for our vessels. These uncertainties could also adversely affect our ability to obtain any additional financing or, if we are able to obtain additional financing, to do so on terms favorable to us. In the past, political conflicts have also resulted in attacks on vessels, mining of waterways and other efforts to disrupt shipping, particularly in the Arabian Gulf region. Acts of terrorism and piracy have also affected vessels trading in regions such as the South China Sea. Any of these occurrences could adversely affect our results of operations and financial condition.

Risks Related To Our Common Stock

After this offering, the price of our common stock may be volatile and we cannot assure you that the price of our shares will not decline.

The market price of our shares could be subject to significant fluctuations after this offering and could decline below the initial public offering price.

The initial public offering price will be determined by negotiations between the underwriters and our board of directors and may not be representative of the market price at which our shares of common stock will trade after this offering.

The market price of our common stock may fluctuate substantially due to a variety of factors, many of which are beyond our control, including:

- •

- new regulatory pronouncements and changes in regulatory guidelines;

- •

- general and industry-specific economic conditions;

- •

- changes in financial estimates or recommendations by securities analysts;

19

- •

- sales of our common stock or other actions by investors with significant shareholdings; and

- •

- general market conditions.

The stock markets in general have experienced substantial volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the market price of our common stock.

In the past, shareholders have sometimes instituted securities class action litigation against companies following periods of volatility in the market price of their securities. Any similar litigation against us could result in substantial costs, divert management's attention and resources and harm our business.

We are incorporated in the Republic of the Marshall Islands, which does not have a well-developed body of corporate law.

Our corporate affairs are governed by our articles of incorporation and by-laws and by the Marshall Islands Business Corporations Act, or BCA. The provisions of the BCA resemble provisions of the corporation laws of a number of states in the United States. However, there have been few judicial cases in the Republic of the Marshall Islands interpreting the BCA. The rights and fiduciary responsibilities of directors under the law of the Republic of the Marshall Islands are not as clearly established as the rights and fiduciary responsibilities of directors under statutes or judicial precedent in existence in certain U.S. jurisdictions. Shareholder rights may differ from the rights of shareholders of companies incorporated in the United States. While the BCA does specifically incorporate the non-statutory law, or judicial case law, of the State of Delaware and other states with substantially similar legislative provisions there have been few, if any, current cases interpreting the BCA in the Marshall Islands and we cannot predict whether Marshall Islands courts would reach the same conclusions as U.S. courts. Thus, our public shareholders may have more difficulty in protecting their interests in the face of actions by the management, directors or controlling shareholders than would shareholders of a corporation incorporated in a U.S. jurisdiction which has developed a relatively more substantive body of case law. For more information with respect to how shareholder rights under Marshall Islands law compare with shareholder rights under Delaware law, please read "Marshall Islands Company Considerations."

Because we are incorporated under the laws of the Republic of the Marshall Islands, it may be difficult to serve us with legal process or enforce judgments against us or our officers and directors.

We are incorporated under the laws of the Republic of the Marshall Islands, and all of our assets are located outside of the United States. Although our business is operated primarily from Wexford's offices in Greenwich, Connecticut, a number of our prospective officers and directors may be non-residents of the United States, and all or a substantial portion of the assets of these non-residents may be located outside the United States. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in the United States if you believe that your rights have been infringed under securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of the Republic of the Marshall Islands and of other jurisdictions may prevent or restrict you from enforcing a judgment against our assets or the assets of our officers and directors.

There is no guarantee that an active and liquid public market will develop to resell our common stock.

Prior to this offering, there has not been a public market for our common stock. A liquid trading market for our common stock may not develop. The initial public offering price will be determined in negotiations between the representatives of the underwriters and us and may not be indicative of prices that will prevail in the market. We cannot assure you that you will be able to sell your shares at or above the initial public offering price.

20

Wexford and its affiliates will beneficially own and control a significant amount of our common stock, giving them substantial influence over our corporate transactions and other matters. Their interests may conflict with yours, and the concentration of ownership of our common stock will limit the influence of public shareholders.

Upon completion of this offering, Wexford and its affiliates will beneficially own and control approximately % of our outstanding common stock (approximately % if the underwriters exercise their 30-day option in full). Due to Wexford's and its affiliates' significant ownership interest, it has the ability to exert substantial influence over our board of directors and its policies. Wexford and its affiliates will be able to control or substantially influence the outcome of stockholder votes, including votes concerning the election of directors, the adoption or amendment of provisions in our articles of incorporation or by-laws and possible mergers, corporate control contests and other significant corporate transactions. This concentration of ownership may have the effect of delaying, deferring or preventing a change in control, a merger, consolidation, takeover or other business combination. This concentration of ownership could also discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which could in turn have an adverse effect on the market price of our common stock.

Purchasers of shares of our common stock in this offering will experience immediate and substantial dilution.

Giving effect to the closing of this offering and the Transaction, we expect the initial public offering price of our common stock would be substantially higher than the net tangible book value per share of our outstanding common stock, resulting in immediate and substantial dilution. The net tangible book value of a share of our common stock purchased at an assumed initial public offering price of $ (the mid-point of the filing range) will be only $ . Additional dilution may be incurred if we issue common stock in the future or if stock options or warrants, whether currently outstanding or subsequently granted, are exercised. If the price of our common stock is greater than the exercise price of the stock options, your interest in our common stock will be diluted. As a result of this dilution, shareholders may receive significantly less than the full purchase price they paid for the shares in the event of a liquidation. Please read "Dilution."

Future sales of our common stock by our shareholders could depress the price of our common stock.

Sales of a large number of shares of our common stock in the public market, or the availability of a large number of shares for sale, could adversely affect the market price of our common stock and could impair our ability to raise funds in subsequent stock offerings. Upon completion of this offering, we will have shares of common stock outstanding. All of our current shareholders and the sellers of the Identified Vessels will be subject to agreements with the underwriters that restrict their ability to transfer their stock for 180 days after the date of this prospectus. Jefferies & Company, Inc., on behalf of the underwriters, may in its sole discretion and at any time waive the restrictions on transfer in these agreements during this period. After these agreements expire, approximately of these shares will be eligible for sale in the public market. In addition, under our administrative services agreement with Wexford, we have agreed to issue options to our employees, officers and consultants to purchase common shares representing a 6% ownership interest in us as of the completion of the offering, at an exercise price equal to the initial offering price. See "Related Party Transactions." In addition, it is contemplated that VOC Invest Ltd. ("VOC Investment"), as nominee of the sellers of the Identified Vessels, will be entitled to certain registration rights under the terms of a registration rights agreement to be entered into.

Our organizational documents and Marshall Islands law have anti-takeover provisions that could delay or prevent a change in control of our Company.

In addition to the fact that Wexford will own the majority of our common stock after this offering, our articles of incorporation and by-laws and Marshall Islands law contain provisions that could delay

21

or prevent a change in control of our Company that shareholders may consider favorable. Some of these provisions:

- •

- authorize the issuance of up to 5,000,000 shares of preferred stock that can be created and issued by our board of directors without prior shareholder approval, commonly referred to as "blank check" preferred stock, with rights senior to those of our common stock;

- •

- limit the persons who can call special shareholder meetings;

- •

- provide that a supermajority vote of our shareholders is required to amend certain provisions of our articles of incorporation; and

- •

- establish advance notice requirements to nominate directors for election to our board of directors or to propose matters that can be acted on by shareholders at shareholder meetings.

These and other provisions in our organizational documents and Marshall Islands law could allow our board of directors to affect your rights as a shareholder by making it more difficult for shareholders to replace board members. Because our board of directors is responsible for appointing members of our management team, these provisions could in turn affect any attempt to replace the current management team. In addition, these provisions could deprive our shareholders of opportunities to realize a premium on their shares of common stock.