UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

GOLF GALAXY, INC. |

(Name of Registrant as Specified In Its Charter) |

|

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

|

x | No fee required. |

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

| |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on August 9, 2006

Notice is hereby given that the Annual Meeting of Shareholders of Golf Galaxy, Inc. will be held at the offices of Robins, Kaplan, Miller & Ciresi L.L.P. located at 2800 LaSalle Plaza, 800 LaSalle Avenue, Minneapolis, Minnesota, on Wednesday, August 9, 2006 at 9:00 a.m. for the following purposes:

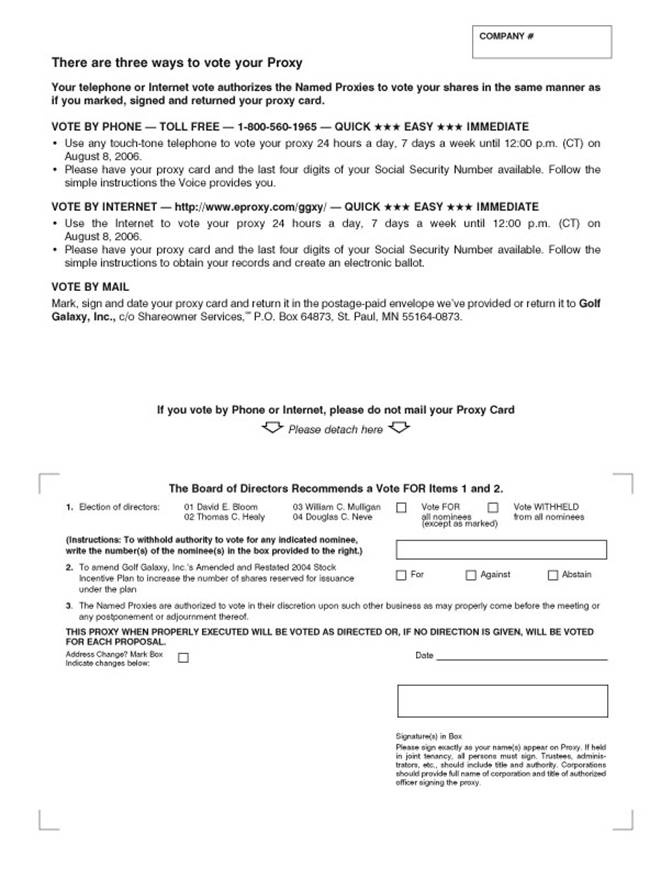

1. To elect four Directors;

2. To amend Golf Galaxy, Inc.’s Amended and Restated 2004 Stock Incentive Plan to increase the number of shares reserved for issuance under the plan; and

3. To transact such other business as may properly come before the meeting or any postponement or adjournment thereof.

The Board of Directors has fixed the close of business on June 12, 2006, as the record date for the determination of shareholders entitled to notice of and to vote at the meeting.

| By Order of the Board of Directors, |

|

|

| Gregory B. Maanum |

| Secretary |

Eden Prairie, Minnesota | |

June 26, 2006 | |

To assure your representation at the Meeting, please sign, date and return your proxy on the enclosed proxy card, or vote electronically through the Internet or by telephone as described on the proxy card, whether or not you expect to attend in person. Shareholders who attend the Meeting may revoke their proxies and vote in person if they so desire.

GOLF GALAXY, INC.

7275 Flying Cloud Drive

Eden Prairie, MN 55344

PROXY STATEMENT

Annual Meeting of Shareholders

August 9, 2006

SOLICITATION OF PROXIES

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Golf Galaxy, Inc. (“Golf Galaxy” or “we” or “us”) for the 2006 Annual Meeting of Shareholders (the “Meeting”) of Golf Galaxy to be held at the offices of Robins, Kaplan, Miller & Ciresi L.L.P. located at 2800 LaSalle Plaza, 800 LaSalle Avenue, Minneapolis, Minnesota, on Wednesday, August 9, 2006 at 9:00 a.m., Central Daylight Time, or any postponement or adjournment thereof. This Proxy Statement and the enclosed proxy card are being mailed to shareholders on or about June 26, 2006.

Golf Galaxy’s Annual Report for the fiscal year ended February 25, 2006 (“fiscal 2006”), including audited financial statements, is being mailed to shareholders concurrently with this Proxy Statement.

ABOUT THE MEETING

What is the purpose of the Meeting?

At our Meeting, shareholders will act upon the matters described in the accompanying notice of annual meeting of shareholders. This includes (1) the election of four directors and (2) the amendment of Golf Galaxy, Inc.’s Amended and Restated 2004 Stock Incentive Plan to increase the number of shares reserved for issuance under the plan. In addition, our management will report on the performance of the Company and respond to questions from shareholders.

Who is entitled to vote?

Only shareholders of record of our outstanding common stock at the close of business on the record date, June 12, 2006, are entitled to receive notice of and to vote at the Meeting, or any postponement or adjournment of the Meeting. Each outstanding share of common stock entitles its holder to cast one vote on each matter to be voted upon.

Who can attend the Meeting?

All shareholders as of the record date, or their duly appointed proxies, may attend the Meeting.

What constitutes a quorum?

The presence at the Meeting, in person or by proxy, of the holders of a majority of the shares of our common stock outstanding on the record date will constitute a quorum. A quorum is required for business to be conducted at the Meeting. As of the record date, 10,978,859 shares of common stock of the Company were outstanding. If you submit a properly executed proxy card or vote your proxy electronically through the Internet or by telephone as described on the proxy card, even if you abstain from voting, then you will be considered part of the quorum. Abstentions and broker non-votes will be counted as present for purposes of determining the existence of a quorum.

1

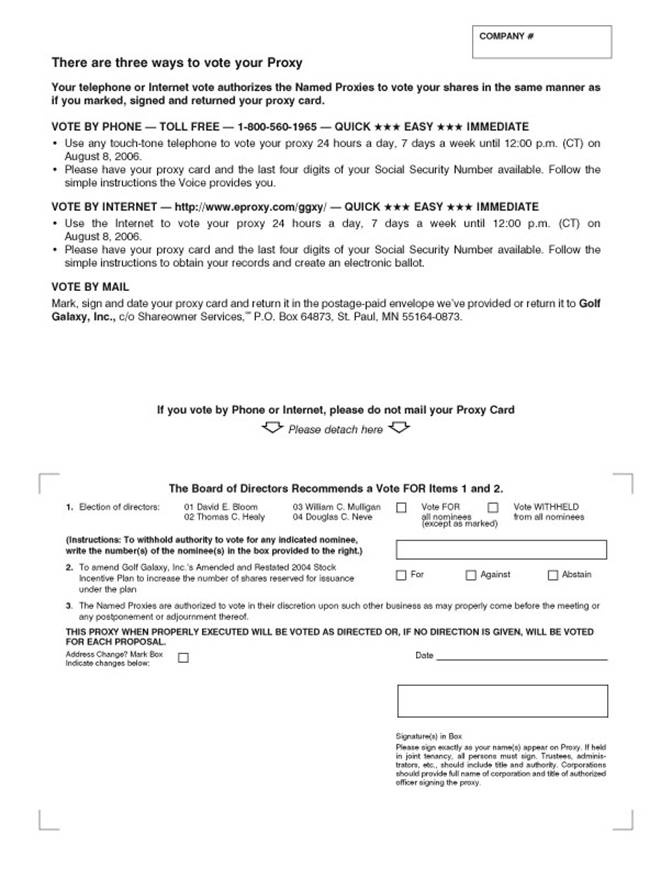

How do I vote?

Sign and date each proxy card you receive and return it in the prepaid envelope or vote electronically through the Internet or by telephone by following the instructions on the proxy card. If you return a properly executed proxy card without specific voting instructions, your shares will be voted FOR all directors in Proposal 1 and FOR Proposal 2.

If you wish to vote by Internet or telephone, you must do so before 12:00 p.m. Central Daylight Time on August 8, 2006. After that time, Internet and telephone voting will not be permitted and a shareholder wishing to vote, or revoke an earlier proxy, after such time must submit a signed proxy card or vote in person.

Can I change my vote after I return my proxy card or vote electronically?

Yes. Even after you have submitted your proxy or voted electronically through the Internet or by telephone, you may change your vote at any time before the proxy is exercised at the Meeting. You may change it by:

1) Returning a later-dated proxy (by mail, Internet or telephone);

2) Delivering a written notice of revocation to our Secretary at our principal executive office at 7275 Flying Cloud Drive, Eden Prairie, MN 55344; or

3) Attending the Meeting and voting in person at the Meeting (although attendance at the Meeting without voting at the Meeting will not, in and of itself, constitute a revocation of your proxy).

What are the Board’s recommendations?

The Board’s recommendations are set forth after the description of the proposals in this proxy statement. In summary, the Board recommends a vote:

· FOR the election of each of the nominated directors (see Proposal 1).

· FOR the amendment of Golf Galaxy, Inc.’s Amended and Restated 2004 Stock Incentive Plan to increase the number of shares reserved for issuance under the Plan as described in this proxy statement (See Proposal 2).

If you return a properly executed proxy card without specific voting instructions, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board.

With respect to any other matter that properly comes before the Meeting, the proxy holders will vote as recommended by the Board or, if no recommendation is given, in their own discretion.

What vote is required to approve each Proposal?

For Proposal 1, the election of directors, each shareholder will be entitled to vote for four nominees and the four nominees with the greatest number of votes will be elected.

For Proposal 2, the amendment of Golf Galaxy, Inc.’s Amended and Restated 2004 Stock Incentive Plan to increase the number of shares reserved for issuance under the Plan, each shareholder will be entitled to one vote for each share held, and the affirmative vote of the holders of a majority of the shares of common stock represented in person or by proxy and entitled to vote on the proposal will be required for approval.

With respect to any other matter that properly comes before the Meeting, the affirmative vote of the holders of a majority of the shares of common stock represented in person or by proxy and entitled to vote on the proposal will be required for approval.

2

A properly executed proxy marked “ABSTAIN” with respect to any proposal will not be voted, although it will be counted for purposes of determining whether there is a quorum. A “WITHHELD” vote is the same as an abstention. Accordingly, abstentions (or “withhold authority” as to directors) will have the same effect as a negative vote.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to the proposal to be acted upon. If you do not give your broker instructions as to how to vote your shares, your broker has authority under New York Stock Exchange rules to vote those shares for or against “routine” matters, such as the election of directors. Brokers cannot vote on their customers’ behalf on “non-routine” proposals. These rules apply to us notwithstanding the fact that shares of our common stock are traded on the Nasdaq National Market. If your brokerage firm votes your shares on “routine” matters because you do not provide voting instructions, your shares will be counted for purposes of establishing a quorum to conduct business at the Meeting and in determining the number of shares voted for or against the routine matter. If your brokerage firm lacks discretionary voting power with respect to an item that is not a routine matter and you do not provide voting instructions (a “broker non-vote”), your shares will be counted for purposes of establishing a quorum to conduct business at the Meeting, but will not be counted in determining the number of shares voted for or against the non-routine matter.

Who will count the vote?

An Inspector of Elections will be appointed for the Meeting and will work with a representative of Wells Fargo Shareowner Services, our independent stock transfer agent, to count the votes.

What does it mean if I receive more than one proxy card?

If your shares are registered differently and are in more than one account, you will receive more than one proxy card. To ensure that all your shares are voted, sign and return all proxy cards or vote electronically through the Internet or by telephone for each proxy card. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our stock transfer agent, Wells Fargo Shareowner Services, at 1-800-468-9716.

How will voting on any other business be conducted?

Although we do not know of any business to be considered at the Meeting other than the matters described in this Proxy Statement, if any other business is presented at the Meeting, your proxy gives authority to each of Randall K. Zanatta and Richard C. Nordvold to vote on such matters at their discretion.

When are shareholder proposals for the 2007 annual meeting of shareholders due?

To be considered for inclusion in our proxy statement for the 2007 annual meeting of shareholders, shareholder proposals must be received at our offices no later than February 27, 2007. Proposals must be in compliance with Rule 14a-8 under the Securities Exchange Act of 1934, and must be submitted in writing and delivered or mailed to our Secretary, at Golf Galaxy, Inc., 7275 Flying Cloud Drive, Eden Prairie, Minnesota 55344.

Under Rule 14a-4(c)(1), any shareholder who wishes to have a proposal considered at the 2007 annual meeting of shareholders, but not submitted for inclusion in our proxy statement, must set forth such proposal in writing and file it with the Secretary of the Company no later than May 12, 2007. Failure to notify the Company by that date would allow our proxy holders to use their discretionary voting authority (to vote for or against the proposal) when the proposal is raised at the 2007 annual meeting of shareholders without any discussion of the matter being included in our proxy statement.

3

How are proxies solicited?

In addition to use of the mail, proxies may be solicited by officers, directors, and other regular employees of Golf Galaxy by telephone, through electronic transmission or facsimile transmission, or personal solicitation, and no additional compensation will be paid to such individuals. We will request that banks, brokerage houses, other custodians, nominees and certain fiduciaries forward proxy materials and annual reports to the beneficial owners of our common stock.

Who pays for the cost of this proxy solicitation?

The entire cost of preparing, assembling, printing and mailing the Notice of Annual Meeting of Shareholders, this Proxy Statement, the proxy itself, and the cost of soliciting proxies relating to the Meeting will be borne by us. We will, if requested, reimburse banks, brokerage houses, and other custodians, nominees and certain fiduciaries for their reasonable expenses incurred in mailing proxy material to their principals.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board is currently divided into three classes of directors, each class having a three-year term. Each year only one class of directors is subject to a shareholder vote, and generally one-third of the directors belong to each class. This year, upon recommendation of the Nominating and Governance Committee, the Board, including all of the independent directors, has nominated Mr. David E. Bloom, Mr. Thomas E. Healy and Mr. William C. Mulligan, incumbent Class I directors, and Mr. Douglas C. Neve, a newly appointed Class III director. If elected, Messrs. Bloom’s, Healy’s and Mulligan’s terms will expire at the 2009 annual meeting of shareholders and Mr. Neve’s term will expire at the 2008 annual meeting of shareholders. It is intended that the proxies will be voted for such nominees. Unless otherwise directed, the proxies solicited by the Board will be voted for the election as directors of the nominees named below. We believe that each nominee named below will be able to serve, but should any nominee be unable to serve as a director, the persons named in the proxies have advised that they will vote for the election of such substitute nominee as the Board may propose.

With the exception of Mr. Zanatta and Mr. Maanum, each director has been determined by the Nominating and Governance Committee or the Board to qualify as an “independent director” under applicable rules of the National Association of Securities Dealers for companies listed on the Nasdaq Stock Market. It is the recommendation of our Board that Messrs. Bloom, Healy and Mulligan be reelected, and Mr. Neve be elected, as directors, to serve as directors until the annual meeting of shareholders in 2009 or 2008, as applicable, and until their successors shall be duly elected as directors.

The names and ages of the nominees, and other directors, and their principal occupations and tenure as directors, are set forth below based upon information furnished to us by the nominees and other directors.

Name and Age | | | | Principal Occupation | | Director

Since |

Nominated for a term ending at the 2009

annual meeting of shareholders: | | | | |

David E. Bloom (56) | | Mr. Bloom has been a director of our company since February 1999. Mr. Bloom is an advisor to the board of directors of Le Gourmet Chef, a national retailer of gourmet foods, chef’s tools and gadgets, and cookware, having previously served as president, chief executive officer and director of Le Gourmet Chef from May 2001 to May 2006. From 1994 to 1998, he served as chief executive officer of Sneaker Stadium, an athletic shoe retail company that he founded. From 1984 to 1994, he served as president of two other retail companies, Herman’s World of Sporting Goods and Record World. Mr. Bloom is a director of Emergency Filtration Products, Inc., a publicly held manufacturer of masks and filters for medical devices. | | 1999 |

5

Name and Age | | | | Principal Occupation | | Director

Since |

Thomas C. Healy (44) | | Mr. Healy has been a director of our company since August 2004. Mr. Healy is executive vice president—Best Buy For Business of Best Buy Co., Inc., a consumer electronics retailer, where he has been employed since 1990. He has served Best Buy in several capacities, including as a senior vice president—segment lead from 2003 to 2004, and as president—Best Buy International from 2001 to 2003. | | 2004 |

William C. Mulligan (52) | | Mr. Mulligan has been a director of our company since January 1998. Mr. Mulligan has been a managing director of Primus Venture Partners, Inc. a private equity investment firm, since July 1985. Mr. Mulligan serves on the board of directors of Universal Electronics, Inc., a publicly held developer and manufacturer of universal remote controls. Mr. Mulligan also serves on the boards of directors of several privately held companies. | | 1998 |

Nominated for a term ending at the 2008

annual meeting of shareholders: | | | | |

Douglas C. Neve (50) | | Mr. Neve was appointed a director of our company in June 2006. Mr. Neve has been the executive vice president and chief financial officer of Ceridian Corporation, an information services company primarily involved in the human resource, transportation and retail markets, since February 2005. Mr. Neve was a senior audit partner with Deloitte & Touche LLP, an international public accounting firm, from June 2002 until February 2005 and an audit partner with Arthur Andersen, an international public accounting firm, from September 1989 through May 2002. | | 2006 |

6

Name and Age | | | | Principal Occupation | | Director

Since |

Other directors whose terms of office will continue after the Meeting and whose terms expire at the 2007 annual meeting of shareholders: | | | | |

Jack W. Eugster (60) | | Mr. Eugster has been a director of our company since October 2000. Mr. Eugster was the chairman of the board, president and chief executive officer of Musicland Stores Corporation, a pre-packaged music and movie retailer, when he retired in 2001. Mr. Eugster is a director of Donaldson Company, Inc., a manufacturer of filtration systems and replacement parts; a director of Graco, Inc., a manufacturer of pumps and spraying equipment; and a director of Black Hills Corp., an integrated power company based in Rapid City, South Dakota. | | 2000 |

Gregory B. Maanum (44) | | Mr. Maanum is our Chief Operating Officer and a director of our company. Mr. Maanum co-founded our company with Mr. Zanatta in December 1995. Mr. Maanum directly oversees our merchandising and inventory planning functions. He also directs our real estate selection process, store design and construction activities. In addition, Mr. Maanum has overall responsibility for our retail sales and operations. Before co-founding our company, Mr. Maanum spent 12 years with Best Buy Co., Inc., most recently as vice president—visual merchandising after founding Best Buy’s visual merchandising department. | | 1995 |

Gregg S. Newmark (47) | | Mr. Newmark has been a director of our company since January 1998. Mr. Newmark has been with William Blair Capital Partners, a private equity investment firm, since 1985, serving as managing director since 1995, and is a principal of William Blair & Company. Mr. Newmark’s principal responsibilities at William Blair Capital Partners include sourcing and managing investments. Mr. Newmark also serves on the boards of directors of several privately held companies. | | 1998 |

7

Name and Age | | | | Principal Occupation | | Director

Since |

Other directors whose terms of office will continue after the Meeting and whose terms expire at the 2008 annual meeting of shareholders: | | | | |

David S. Gellman (48) | | Mr. Gellman has been a director of our company since July 1999. Since 1995, Mr. Gellman has been a managing director of FdG Associates, a private equity investment firm. From 1988 to 1995, he was an investment professional with AEA Investors Inc., a private equity firm. Mr. Gellman also serves on the boards of directors of several privately held companies. | | 1999 |

Randall K. Zanatta (48) | | Mr. Zanatta is our President, Chief Executive Officer and Chairman of our board of directors. Mr. Zanatta co-founded our company with Mr. Maanum in December 1995. Before co-founding our company, Mr. Zanatta spent 17 years with Best Buy Co., Inc., most recently as senior vice president—marketing and merchandising. During Mr. Zanatta’s tenure at Best Buy, Mr. Zanatta also served on the executive committee, which was the primary guiding body of the organization. | | 1995 |

Vote Required. Each shareholder will be entitled to vote for four nominees and the four nominees with the greatest number of votes will be elected.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH NOMINEE.

Meetings. During fiscal 2006, the Board met four times, including one telephonic meeting. Each director attended 75% or more of the meetings of the Board and any committee on which he served. It is our policy that all directors should attend the Annual Meeting of Shareholders. We did not hold a 2005 Annual Meeting of Shareholders.

Board Committees. The Board has established an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The Audit Committee, which met four times, including two telephonic meetings, during the last fiscal year, is currently composed of Messrs. Mulligan (Chairman), Newmark and Eugster. Mr. Neve is expected to be appointed to the Audit Committee concurrent with the Meeting and has been determined by the Board to qualify as an “audit committee financial expert” under applicable Securities and Exchange Commission (“SEC”) rules. Although all members of the Audit Committee meet all requirements of the SEC and the National Association of Securities Dealers for companies listed on the Nasdaq National Market, previously we have had no designated “audit committee financial expert” because no member of the Audit Committee so qualified. All current members of our Audit Committee, as well as Mr. Neve, are independent directors as defined by the rules of the National Association of Securities Dealers for companies listed on the Nasdaq Stock Market. Among other duties, the Audit Committee (i) selects our independent registered public accounting firm; (ii) reviews and evaluates significant matters relating to our audit and internal controls; (iii) reviews the scope and results

8

of the audits by, and the recommendations of, our independent registered public accounting firm; and (iv) pre-approves, in accordance with Golf Galaxy’s Pre-Approval Policy, all audit and permissible non-audit services provided by our independent registered public accounting firm. The Audit Committee also reviews our audited financial statements and meets prior to public release of quarterly and annual financial information and prior to filing of our quarterly and annual reports containing financial statements with the SEC. A report of the Audit Committee is contained in this Proxy Statement. The Audit Committee operates under a written charter adopted by the Board, which is attached as Appendix A to this Proxy Statement.

The Compensation Committee, which met one time during the last fiscal year, is currently composed of Messrs. Bloom (Chairman), Gellman and Newmark. All members of our Compensation Committee are independent directors as defined by the rules of the National Association of Securities Dealers for companies listed on the Nasdaq Stock Market. The Compensation Committee reviews and makes recommendations to the Board regarding compensation, including salaries, incentive pay plans, stock options, restricted stock awards and benefits for officers and employees.

The Nominating and Governance Committee, which is currently composed of Messrs. Newmark (Chairman), Gellman and Eugster, met one time during the last fiscal year. All members of the Nominating and Governance Committee are independent directors as defined by the rules of the National Association of Securities Dealers for companies listed on the Nasdaq Stock Market. The primary purpose of the Nominating and Governance Committee is to ensure an appropriate and effective role for the Board in the governance of Golf Galaxy. The primary recurring duties and responsibilities of the Nominating and Governance Committee include (1) reviewing and recommending to the Board corporate governance policies and procedures; (2) reviewing the Golf Galaxy Code of Business Conduct and Ethics and compliance thereof; (3) selecting and educating our directors; and (4) evaluating the Board. The Nominating and Governance Committee charter is available on our Internet site located at www.GolfGalaxy.com—select the “Investors” link and then the “Corporate Governance” link.

In identifying prospective director candidates, the Nominating and Governance Committee considers its personal contacts, recommendations from shareholders and recommendations from business and professional sources, but historically has not paid a fee to any third party. The Nominating and Governance Committee’s policy is to consider qualified candidates for positions on the Board recommended in writing by shareholders. Shareholders wishing to recommend candidates for Board membership should submit the recommendations in writing to our Secretary at least ninety (90) days prior to the date corresponding to the previous year’s annual meeting, with the submitting shareholder’s name and address, and pertinent information about the proposed nominee similar to that set forth for the nominees named herein. When evaluating the qualifications of potential new Directors, or the continued service of existing Directors, the Nominating and Governance Committee will consider a variety of criteria, including the individual’s integrity, inquisitiveness, experience dealing with complex problems, specialized skills or expertise, diversity of background, independence, financial expertise, freedom from conflicts of interest, ability to understand the role of a Director and ability to fully perform the duties of a Director. While candidates recommended by shareholders generally will be considered in the same manner as any other candidate, special consideration will be given to existing Directors desiring to stand for re-election given their history of service and their knowledge of Golf Galaxy, as well as the Board’s knowledge of their level of contribution, resulting from such service. Shareholders wishing to recommend for nomination or nominate a director should contact our Secretary for a copy of the relevant procedure for submitting nominations and a full delineation of the criteria considered by the Nominating and Governance Committee when evaluating potential new Directors or the continued service of existing Directors.

Director Compensation. Beginning in fiscal 2007, each non-employee member of the Board (except Mr. Healy, who has declined any director compensation) receives a $20,000 retainer, paid quarterly, plus $1,500 per meeting for each Board meeting they attend. Non-employee directors are paid $500 per

9

telephonic meeting. In addition, each non-employee director is compensated for Committee participation. Non-employee directors are paid $750 per audit committee meeting and $500 for all other committee meetings. The Audit Committee Chairperson receives $2,000 annually as a retainer and the other Committee chairs receive an annual retainer of $1,000. Non-employee directors are granted options to purchase 1,500 shares of our common stock each year. Newly appointed or elected directors receive a one-time grant of options to purchase 10,000 shares of our common stock. All of our directors are reimbursed for reasonable travel expenses incurred in attending our meetings. Employee directors are not compensated for their services as directors.

In fiscal 2006, Messrs. Bloom and Eugster were paid $1,500 for each board meeting they attended. In addition, on July 28, 2005, in conjunction with our initial public offering (“IPO”), we granted Messrs. Bloom and Eugster each an option under the Amended and Restated 2004 Stock Incentive Plan to purchase 10,000 shares of common stock at an exercise price of $14.00 per share, the price per share of our common stock sold in the IPO. The options were 50% vested on the grant date and the remaining 50% will vest on the first anniversary of the grant date. On February 8, 2006, we granted each non-employee director, except Mr. Healy, who declined receipt of the option, an option under the Amended and Restated 2004 Stock Incentive Plan to purchase 1,500 shares of common stock at an exercise price of $18.77 per share, the closing market price of our common stock on that date. The options vested immediately upon grant.

Communications with the Board. Our Board provides a process for security holders to send communications to the Board. The manner in which shareholders can send communications to the Board is set forth on our Internet site located at www.GolfGalaxy.com—select the “Investors” link and then the “Corporate Governance” link.

Executive Sessions of Non-Employee Directors. In order to promote open discussion among non-employee directors, the Board has a policy of conducting executive sessions of non-employee directors in connection with each regularly scheduled, quarterly Board meeting.

10

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary of Cash Compensation and Certain Other Compensation Information

The following table shows, for fiscal years 2006, 2005 and 2004, the cash compensation paid by us, as well as certain other compensation paid or accrued for those years, to Randall K. Zanatta, our Chief Executive Officer, and to our four other most highly compensated executive officers whose total salary and bonus cash compensation exceeded $100,000 during fiscal 2006 (together with Mr. Zanatta, the “Named Executives”).

SUMMARY COMPENSATION TABLE

| | | | | | Long-Term

Compensation | | | |

| | | | Annual Compensation | | Securities

Underlying | | All Other | |

Name and Principal Position | | | | Year | | Salary ($) | | Bonus($)(1) | | Options (#) | | Compensation($)(2) | |

Randall K. Zanatta | | 2006 | | $ | 256,923 | | | $ | — | | | | 43,500 | | | | $ | 4,793 | | |

President, Chief Executive Officer | | 2005 | | 237,500 | | | 118,750 | | | | 10,000 | | | | 4,777 | | |

and Chairman | | 2004 | | 224,385 | | | 112,192 | | | | — | | | | 4,608 | | |

Gregory B. Maanum | | 2006 | | 236,923 | | | — | | | | 43,500 | | | | 4,793 | | |

Chief Operating Officer | | 2005 | | 217,692 | | | 108,846 | | | | 10,000 | | | | 4,777 | | |

| | 2004 | | 205,231 | | | 102,615 | | | | — | | | | 4,608 | | |

Michael W. McCormick | | 2006 | | 227,231 | | | — | | | | 45,000 | | | | 4,793 | | |

Chief Marketing Officer | | 2005 | | 209,692 | | | 104,846 | | | | 10,000 | | | | 4,777 | | |

| | 2004 | | 200,000 | | | 100,000 | | | | 25,000 | | | | 919 | | |

Ronald G. Hornbaker | | 2006 | | 181,923 | | | — | | | | 47,500 | | | | 4,793 | | |

Senior Vice President—Sales and | | 2005 | | 163,269 | | | 81,634 | | | | 10,000 | | | | 4,777 | | |

Operations | | 2004 | | 148,731 | | | 74,365 | | | | — | | | | — | | |

Richard C. Nordvold | | 2006 | | 170,154 | | | — | | | | 20,000 | | | | 4,793 | | |

Chief Financial Officer | | 2005 | | 147,692 | | | 73,846 | | | | 75,000 | | | | 3,858 | | |

| | 2004 | | — | | | — | | | | — | | | | — | | |

| | | | | | | | | | | | | | | | | | | | | | |

(1) Earned in respect of a fiscal year but paid in the following year.

(2) Consists of medical and dental health insurance premiums paid on behalf of the officers which are not available generally to all our employees.

11

Stock Options

The following table contains information concerning individual grants of stock options to each of the Named Executives during the last fiscal year.

| | Individual Grants | | Potential realizable

value at assumed annual

rates of appreciation

for option term(1) | |

Name | | | | Number of

securities

underlying

Options

granted | | Percent of total

options granted

to employees in

fiscal year | | Exercise

price | | Expiration date | | 5% | | 10% | |

Randall K. Zanatta | | | 22,500 | | | | 6.25 | % | | | $ | 8.00 | | | | 5/3/2015 | | | $ | 113,201 | | $ | 286,874 | |

| | | 21,000 | | | | 5.83 | % | | | 14.00 | | | | 7/28/2015 | | | 184,895 | | 468,560 | |

Gregory B. Maanum | | | 22,500 | | | | 6.25 | % | | | 8.00 | | | | 5/3/2015 | | | 113,201 | | 286,874 | |

| | | 21,000 | | | | 5.83 | % | | | 14.00 | | | | 7/28/2015 | | | 184,895 | | 468,560 | |

Michael W. McCormick | | | 22,500 | | | | 6.25 | % | | | 8.00 | | | | 5/3/2015 | | | 113,201 | | 286,874 | |

| | | 22,500 | | | | 6.25 | % | | | 14.00 | | | | 7/28/2015 | | | 198,102 | | 502,029 | |

Ronald G. Hornbaker | | | 32,500 | | | | 9.03 | % | | | 8.00 | | | | 5/3/2015 | | | 163,513 | | 414,373 | |

| | | 15,000 | | | | 4.17 | % | | | 14.00 | | | | 7/28/2015 | | | 132,068 | | 334,686 | |

Richard C. Nordvold | | | 5,000 | | | | 1.39 | % | | | 8.00 | | | | 5/3/2015 | | | 25,156 | | 63,750 | |

| | | 15,000 | | | | 4.17 | % | | | 14.00 | | | | 7/28/2015 | | | 132,068 | | 334,686 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) In accordance with the rules of the SEC, the amounts shown on this table represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock appreciation of 5% and 10%, compounded annually, and do not reflect our estimates or projections of the future price of our common stock. These amounts represent assumed rates of appreciation in the value of our common stock from the fair value of our common stock as of the date of grant. The gains shown are net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercise. Actual gains, if any, on stock option exercises will depend on the future performance of our common stock, the option holder’s continued employment through the option period, and the date on which the options are exercised.

The price of one share of our common stock acquired at $8.00 and $14.00 would equal $13.03 and $22.80, respectively, when compounded at 5% over a 10-year term, and $20.75 and $36.31, respectively, when compounded at 10% over a 10-year term.

12

The following table sets forth information with respect to the Named Executives concerning the exercise of options during fiscal 2006 and unexercised options held as of February 25, 2006:

Aggregated Option Exercises in Fiscal 2006 and Year-End Option Values

| | Shares

acquired on | | Value | | Number of

securities underlying

unexercised options

at fiscal year end | | Value of unexercised

in-the-money options

at fiscal year end(1) | |

Name | | | | exercise | | Realized | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

Randall K. Zanatta | | | — | | | | $ | — | | | | 105,000 | | | | 51,000 | | | $ | 1,569,350 | | | $ | 452,850 | | |

Gregory B. Maanum | | | — | | | | — | | | | 105,000 | | | | 51,000 | | | 1,569,350 | | | 452,850 | | |

Michael W. McCormick | | | — | | | | — | | | | 71,250 | | | | 83,750 | | | 912,000 | | | 860,500 | | |

Ronald G. Hornbaker | | | — | | | | — | | | | 37,500 | | | | 57,500 | | | 491,600 | | | 565,250 | | |

Richard C. Nordvold | | | — | | | | — | | | | 18,750 | | | | 76,250 | | | 240,000 | | | 852,000 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Based on the closing market price of $19.10 per share of common stock on February 25, 2006.

Equity Compensation Plan Information

The following table sets forth aggregate information regarding grants under our equity compensation plans as of February 25, 2006:

Plan Category | | | | Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights | | Weighted-average

exercise price of

outstanding options,

warrants and rights | | Number of securities

remaining available for future

issuance under equity

compensation plans

(excluding securities reflected

in column (a)) | |

| | (a) | | (b) | | (c) | |

Equity compensation plans approved by security holders | | | 1,238,944 | | | | $ | 7.58 | | | | 639,075 | | |

Equity compensation plans not approved by security holders | | | N/A | | | | N/A | | | | N/A | | |

Total | | | 1,238,944 | | | | $ | 7.58 | | | | 639,075 | | |

Employment and Separation Agreements

We have employment agreements with all of our Named Executives. On December 31, 1997, we entered into employment agreements with Mr. Zanatta and Mr. Maanum pursuant to which Mr. Zanatta is serving as our President and Chief Executive Officer and Mr. Maanum is serving as our Chief Operating Officer. On January 6, 2003, we entered into an employment agreement with Michael W. McCormick pursuant to which he is serving as our Chief Marketing Officer. On March 15, 2004, we entered into an employment agreement with Mr. Nordvold pursuant to which he is serving as our Chief Financial Officer. On May 11, 2005, we entered into an employment agreement with Mr. Hornbaker pursuant to which he is serving as our Senior Vice President—Sales and Operations.

Each employment agreement will continue in effect until either party terminates it. Pursuant to the terms of each employment agreement, the executive officer receives, among other things, an annual base salary as determined by the board of directors and a bonus from time to time at the sole discretion of the board of directors. In the event we terminate the executive officer’s employment without cause or the executive officer terminates his employment with us for good reason, we must pay to the executive officer his then-current annual base salary for the six-month period immediately following his termination of employment, plus any bonuses that the executive officer would have received had he remained an employee during the six-month period following his termination assuming all performance criteria had been met. We also must continue for such six-month period to provide benefits to the executive officer at

13

the same levels and with the expenses allocated as they were immediately before the executive officer’s termination. In addition, all options granted to the executive officer would immediately vest and become exercisable.

On December 31, 1997, we entered into retention agreements with Mr. Zanatta and Mr. Maanum. In the event we terminate the executive officer’s employment in connection with a change in control or within one year after a change in control, and other than for cause or initiated by the executive officer for other than good reason, we must pay to the executive officer his then-current annual base salary for the six-month period immediately following his termination of employment, plus any bonuses that the executive officer would have received had he remained an employee during the six-month period following his termination assuming all performance criteria had been met. We also must continue for such six-month period to provide benefits to the executive officer at the same levels and with the expenses allocated as they were immediately before the executive officer’s termination. In addition, all options granted to the executive officer would vest immediately and become exercisable. Each retention agreement may be terminated on August 31 of any year by the affirmative vote of a majority of the Board prior to June 1 of that year and prior to the occurrence or active consideration of a change in control.

Each Named Executive has agreed, for the period of his employment with us and for a period of six months thereafter, that he will not compete with us and he will not solicit our employees to terminate their employment with us.

14

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board, consisting of Messrs. Bloom (Chairman), Gellman and Newmark, reviews and makes recommendations to the Board regarding compensation for our executives. All recommendations by the Compensation Committee relating to the compensation of our executive officers are reviewed, sometimes modified and then formally approved by the independent directors of our full Board. Pursuant to rules promulgated by the SEC designed to enhance disclosure of companies’ policies with regard to executive compensation, set forth below is a report submitted by the Compensation Committee addressing our compensation policies for fiscal 2006 as they affected Mr. Randall K. Zanatta, President, Chief Executive Officer and other executive officers.

The following report shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933 (the “1933 Act”) or the Securities Exchange Act of 1934 (the “1934 Act”), except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under the 1933 Act or the 1934 Act.

Overview

The Compensation Committee is responsible for, among other things, the development and evaluation of our executive compensation policies and determining the compensation paid to our Chief Executive Officer and other executive officers.

The committee oversees the management and administration of all executive compensation programs, including our employee benefit plans. The components of our executive officer compensation, which are subject to the discretion of the committee on an individual basis, include base salary, an annual incentive, long-term incentives, employee benefits and miscellaneous perquisites. We believe the sum of these components provides a total compensation package that is comparable to that provided at comparable companies within the retail industry and general industry.

We currently maintain several benefit plans in which our executive officers and other selected employees participate. These plans include the Amended and Restated 2004 Stock Incentive Plan and the 1996 Stock Option Plan, as amended. We also maintain the Golf Galaxy 401(k) Savings Plan (the “401 (k) Plan”), which is a defined contribution retirement plan in which substantially all full-time employees, including our executive officers, are eligible to participate.

Executive Compensation Philosophy

Our executive compensation programs are guided by the following principles:

· Compensation should be linked to increasing shareholder value;

· Compensation should be fairly balanced between cash and equity-based components to create strong individual motivation and alignment with shareholder interests;

· Compensation should be competitive in comparison to other companies of similar size in order to attract and retain management talent;

· The ratio of variable to fixed compensation should increase with the level of responsibility within the organization; and

· Compensation should reflect performance against attainment of company goals.

Consistent with these principles, the compensation of our executive officers is weighted toward annual incentives and long-term incentives. The mix of base salary, annual incentives and long-term incentives is consistent with our philosophy of providing competitive compensation overall and enhanced compensation for superior performance.

15

The committee annually reviews and evaluates the compensation and benefits of our executive officers. In its review, the committee considers market compensation and benefits data from a variety of sources, including our peer group of companies and several national compensation surveys. This review ensures that the market data represent companies with which we compete for business and executive talent, and that our compensation programs are in line with our stated objectives and market conditions.

Base Salary. The committee generally determines base salary levels for executive officers early in the fiscal year, with pay changes becoming effective during the first quarter of each fiscal year. Salaries are established by considering the following factors: i) the range of base pay for the position or a similar position as reported by companies within our defined competitive market; ii) individual performance for the prior year; iii) overall company performance for the prior year; and iv) additional responsibilities assigned to the position based on individual skills, experience and the leadership needs of our core, emerging and new businesses.

Annual Incentive. For fiscal 2006, our executive officers were eligible for performance-based bonus awards. These awards, payable in cash, were expressed as a percentage of each executive officer's base salary. The short-term incentive target for each of our executive officers was 50% of base salary.

These incentive awards were based solely on actual company earnings before interest, taxes, depreciation and amortization (“EBITDA”) performance as compared with a goal approved by the committee. Based on actual performance compared with specific established goals, award recipients could earn an incentive amount from 0% to 100% of their incentive target. With respect to EBITDA, our actual results for fiscal 2006 did not exceed the minimum required levels of performance needed to provide a payout under the award. As a result, our executive officers received no annual incentive compensation for fiscal 2006.

Long-Term Incentives: Periodic Awards. We make periodic stock option awards to our executive officers and other selected employees. The objectives of the stock option grants are to retain employees, support the long-term performance of our company and our common stock and to encourage employee ownership of our stock. All stock options granted in fiscal 2006 were made under the Amended and Restated 2004 Stock Incentive Plan.

Long-Term Incentives: Special Awards. In addition to the periodic awards of stock options in fiscal 2006, the committee granted a discretionary award of options to purchase 167,500 shares of our common stock to our executive officers and other selected employees in the second quarter of the fiscal year in conjunction with our IPO. The discretionary stock option grants were made under the Amended and Restated 2004 Stock Incentive Plan, have a term of ten years, and become exercisable over a four-year period at the rate of 25% per year, beginning one year from the date of grant. The option exercise price is equal to $14.00 per share, the price per share of our common stock sold in our IPO. Of the discretionary options granted during fiscal 2006, options to purchase 94,500 shares were granted to executive officers.

Perquisites

We prefer to compensate our executive officers in cash and equity rather than with perquisites. Consequently, the value of executive perquisites falls within the bottom quartile of the market data for comparable companies within the retail industry and the general industry. We reimburse our executive officers for medical and dental benefits and executive physicals. In addition, each of our executive officers receives a company-paid mobile phone for business and personal use. In all cases, the perquisites provided to any executive officer do not exceed the lesser of $50,000 or 10% of the executive officer's base salary.

16

Chief Executive Officer Compensation

Mr. Zanatta has served as our President, Chief Executive Officer and Chairman since our inception. The base salary, annual incentive and long-term incentives paid to Mr. Zanatta in fiscal 2006 were determined in accordance with the guidelines described above, and his compensation consists of the same elements as all other executive officers. The committee's process for evaluating the Chief Executive Officer's performance includes an evaluation by both the committee and the Board of the Chief Executive Officer's performance against specific financial, non-financial and strategic goals.

Base Salary. The committee set Mr. Zanatta’s base salary at $260,000, effective May 2005. This was an increase from his previous base salary of $240,000, and was based on our Executive Compensation Philosophy and Mr. Zanatta’s performance against established goals for fiscal 2005. These goals included EBITDA growth, net sales and net income growth and the achievement of certain strategic initiatives.

Annual Incentive. Mr. Zanatta’s annual incentive compensation for fiscal 2006 was determined by the performance-based bonus award established by the committee. With respect to EBITDA, our actual results for fiscal 2006 did not exceed the minimum required levels of performance needed to provide a payout under the award. As a result, Mr. Zanatta received no annual incentive compensation for fiscal 2006.

Long-Term Incentives: Periodic Award. In May 2005, the committee awarded Mr. Zanatta options to purchase 22,500 shares of common stock. The options were awarded under the Amended and Restated 2004 Stock Incentive Plan, have a term of ten years, and become exercisable over a four-year period at the rate of 25% per year, beginning one year from the date of grant. The option exercise price was determined by the committee in consideration of an appraisal performed by a third party.

Long-Term Incentives: Special Award. In fiscal 2006, the committee awarded Mr. Zanatta a discretionary award of options to purchase 21,000 shares of common stock in conjunction with our IPO. The discretionary stock option grants were made under the Amended and Restated 2004 Stock Incentive Plan, have a term of ten years, and become exercisable over a four-year period at the rate of 25% per year, beginning one year from the date of grant. The option exercise price is equal to $14.00 per share, the price per share of our common stock sold in our IPO.

We believe Mr. Zanatta’s total compensation for fiscal 2006 is in alignment with the compensation principles expressed in our Executive Compensation Philosophy. For fiscal 2006, we achieved 78.9% EBITDA growth (excluding a non-recurring gain in fiscal 2005), generated 50.4% net sales growth, generated an increase in comparable store sales of 7.3% and increased our operating income as a percentage of net sales from 3.2% to 4.1%.

SUBMITTED BY THE COMPENSATION COMMITTEE

OF GOLF GALAXY’S BOARD OF DIRECTORS

David E. Bloom (Chairman) | David S. Gellman | Gregg S. Newmark |

17

Certain Relationships and Related Party Transactions

Services from SASH Management, LLC d/b/a Gift Card Solutions. SASH Management, LLC d/b/a Gift Card Solutions (“Gift Card Solutions”) provides gift card data storage and processing services to us. Gift Card Solutions is an indirect, wholly-owned subsidiary of Ceridian Corporation. Mr. Neve, a new member of our Board, is the Chief Financial Officer of Ceridian Corporation. We purchased $150,429 worth of services from Gift Card Solutions during fiscal 2006.

Acquisition of The GolfWorks. In March 2006, we acquired all of the outstanding shares of Ralph Maltby Enterprises, Inc. a/k/a The GolfWorks (“The GolfWorks”). Mark R. McCormick, our Senior Vice President—CEO of The GolfWorks, was an executive officer of The GolfWorks prior to the acquisition and is the brother of Michael W. McCormick, our Chief Marketing Officer. The purchase price, excluding direct costs of the acquisition, consisted of $3.7 million in cash ($500,000 of which has been deposited into an indemnification escrow); 250,862 shares of our common stock valued at $4.8 million based on the average closing price of our common stock on the Nasdaq National Market during the five-day trading period beginning three trading days prior to our announcement of the acquisition; and warrants to purchase 150,000 shares of our common stock with a fair value of $1.4 million, determined using the Black-Scholes option pricing model. The warrants have an exercise price of $17.94 per share and a 10-year term expiring on March 16, 2016. In addition, we assumed $5.4 million in debt from The GolfWorks. Of the purchase price, Mark R. McCormick received an allocation of $168,163 of the cash deposited in the indemnification escrow, 145,214 shares of our common stock, and a warrant to purchase 50,450 shares of our common stock.

In addition, The GolfWorks entered into a lease for a golf design studio located in Granville, Ohio with Ralph D. Maltby and Donna D. Maltby as lessor. Ralph D. Maltby is our Senior Vice President—Chief Technology Officer, Research and Development. The terms of the lease provide that from March 16, 2006 to March 16, 2011, annual rent will be $45,000, or $3,750 per month. The lease will expire on March 16, 2011, subject to a five-year renewal at the option of Ralph D. Maltby and Donna D. Maltby. The renewal option provides that from March 17, 2011 to March 16, 2016, annual rent will be $51,000, or $4,250 per month.

Purchase of Inventory from The GolfWorks. Prior to our acquisition of The GolfWorks in the first quarter of fiscal 2007, for several years we purchased certain inventory from The GolfWorks. Our decision to conduct business with The GolfWorks was based on both qualitative and quantitative factors including product offerings, pricing and customer service. Our Chief Executive Officer and Chief Operating Officer reviewed our transactions with The GolfWorks, determined that the transactions were at arm’s length and approved The GolfWorks as an ongoing supplier of certain inventory. Total purchases from The GolfWorks during fiscal 2006 were $1,352,374.

Sublease of Property from Best Buy Co., Inc. On August 6, 2004, we entered into a sublease for our Gurnee, Illinois store with Best Buy Co., Inc. as sublessor. As of February 25, 2006, Best Buy owned 1,276,001 shares of our common stock. Thomas C. Healy, Best Buy’s executive vice president-Best Buy For Business, serves as a member of our board of directors. The terms of the sublease provide that from December 1, 2004 to January 31, 2010, minimum annual rent will be $232,499, or $19,375 per month. From February 1, 2010 to January 31, 2015, minimum annual rent will be $243,727, or $20,311 per month. The sublease will expire on January 31, 2015. The total amount paid to Best Buy, including payments for real estate taxes and common area charges, was $242,286 for fiscal 2006.

18

Performance Graph

The following performance graph compares the total cumulative shareholder returns for Golf Galaxy common stock, The Nasdaq Stock Market (U.S.) Index and the Standard & Poor’s (S&P) Retail Index. The S&P Retail Index is a capitalization-weighted index of domestic equities traded on the New York Stock Exchange, American Stock Exchange and Nasdaq. The stocks that comprise the S&P Retail Index are high-capitalization stocks representing a sector of the S&P 500. The comparison assumes $100 was invested on July 29, 2005 in each of Golf Galaxy common stock, The Nasdaq Stock Market (U.S.) Index and the S&P Retail Index, and assumes reinvestment of all dividends. The comparisons in the tables are required by the SEC and are not intended to be a forecast or to be indicative of future investment performance.

COMPARISON OF 7 MONTH CUMULATIVE TOTAL RETURN*

AMONG GOLF GALAXY, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND A PEER GROUP

| | Cumulative Total Return | |

| | 07/05 | | 08/05 | | 11/05 | | 02/06 | |

GOLF GALAXY | | $ | 100.00 | | $ | 99.41 | | $ | 83.23 | | $ | 102.63 | |

NASDAQ STOCK MARKET (U.S.) INDEX | | $ | 100.00 | | $ | 98.43 | | $ | 102.72 | | $ | 104.63 | |

S&P RETAIL INDEX | | $ | 100.00 | | $ | 93.12 | | $ | 96.00 | | $ | 95.32 | |

* The Nasdaq Stock Market (U.S.) Index and the S&P Retail Index is calculated on a month-end basis. Comparison represents the performance of $100 invested on July 29, 2005 in Golf Galaxy common stock, The Nasdaq Stock Market (U.S.) Index and the S&P Retail Index, including reinvestment of dividends.

The performance graph above shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the 1933 Act or the 1934 Act, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under the 1933 Act or the 1934 Act.

Source: Research Data Group, Inc.

19

BENEFICIAL OWNERSHIP OF

COMMON STOCK

The following table presents information provided to us as to the beneficial ownership of our common stock as of May 5, 2006 by (i) the only shareholders known to us to hold 5% or more of such stock, (ii) each of our directors and Named Executives and (iii) our directors and executive officers as a group. Unless otherwise indicated, all shares represent sole voting and investment power. The mailing address for each person listed is 7275 Flying Cloud Drive, Eden Prairie, Minnesota 55344, except as otherwise provided.

Beneficial Owners | | | | Common Stock

Beneficially Owned | | Percentage of

Outstanding Shares

of Common Stock | |

William Blair Capital Partners V, L.P. | | | 1,231,755 | (1) | | | 11.2 | % | |

222 West Adams Street

Chicago, Illinois 60606 | | | | | | | | | |

Primus Capital Fund IV L.P. | | | 739,053 | (2) | | | 6.7 | % | |

5900 Landerbrook Drive, Suite 200

Cleveland, Ohio 44124 | | | | | | | | | |

Primus Executive Fund L.P. | | | 739,053 | (2) | | | 6.7 | % | |

5900 Landerbrook Drive, Suite 200

Cleveland, Ohio 44124 | | | | | | | | | |

FdG Capital Partners LLC | | | 963,158 | (3) | | | 8.8 | % | |

299 Park Avenue, 16th Fl.

New York, New York 10171 | | | | | | | | | |

FdG—Chase Capital Partners LLC | | | 963,158 | (3) | | | 8.8 | % | |

299 Park Avenue, 16th Fl.

New York, New York 10171 | | | | | | | | | |

Best Buy Co., Inc. | | | 1,276,001 | (6) | | | 11.6 | % | |

7601 Penn Avenue South

Richfield, Minnesota 55423 | | | | | | | | | |

The Northwest Mutual Life Insurance Company | | | 622,550 | (4) | | | 5.7 | % | |

720 East Wisconsin Avenue

Milwaukee, Wisconsin 53202 | | | | | | | | | |

Mazama Capital Management, Inc. | | | 587,600 | (4) | | | 5.4 | % | |

One Southwest Columbia Street, Suite 1500

Portland, Oregon 97258 | | | | | | | | | |

Randall K. Zanatta | | | 813,125 | (5) | | | 7.3 | % | |

Gregory B. Maanum | | | 613,125 | (5) | | | 5.5 | % | |

Michael W. McCormick | | | 92,125 | (5) | | | * | | |

Ronald G. Hornbaker | | | 53,125 | (5) | | | * | | |

Richard C. Nordvold | | | 39,250 | (5) | | | * | | |

David E. Bloom | | | 36,500 | (5) | | | * | | |

20

Jack W. Eugster | | | 54,000 | (5) | | | * | | |

2655 Kelly Avenue

Excelsior, Minnesota 55331 | | | | | | | | | |

David S. Gellman | | | 964,658 | (3)(5) | | | 8.8 | % | |

FdG Associates

299 Park Avenue, 16th Fl.

New York, New York 10171 | | | | | | | | | |

Thomas C. Healy | | | 1,276,001 | (6) | | | 11.6 | % | |

Best Buy Co., Inc.

7601 Penn Avenue South

Richfield, Minnesota 55423 | | | | | | | | | |

William C. Mulligan | | | 740,553 | (2)(5) | | | 6.7 | % | |

Primus Venture Partners, Inc.

5900 Landerbrook Drive, Suite 200

Cleveland, Ohio 44124 | | | | | | | | | |

Gregg S. Newmark | | | 1,233,255 | (1)(5) | | | 11.2 | % | |

William Blair Capital Partners, LLC

222 West Adams Street

Chicago, Illinois 60606 | | | | | | | | | |

All executive officers and directors as a Group (13 persons) | | | 6,316,579 | (7) | | | 54.5 | % | |

*Less than 1%

(1) Includes 1,231,755 shares of our common stock held by William Blair Capital Partners V, L.P. (WBCP Partnership). William Blair Capital Partners, LLC (WBCP) is the general partner of WBCP Partnership and, through a six-person board of managers composed of certain of its members, has voting and investment power over the shares held by the WBCP Partnership. Decisions of the board of managers of WBCP are made by a majority vote of its members plus Edgar D. Jannotta, and, as a result, no single member of the board of managers has voting or investment power over the shares. Mr. Newmark is a managing director and Timothy Burke, David G. Chandler, John Ettelson, Mr. Jannotta, Timothy M. Murray, and Thomas C. Theobald are the members of the board of managers of WBCP. No single managing director or member of the board of managers of WBCP has voting or investment power over the shares. Consequently, each managing director and member of the board of directors, including Mr. Newmark, disclaims beneficial ownership of the shares held by the WBCP Partnership except to the extent of his pecuniary interest therein.

(2) Includes 709,491 shares of our common stock held by Primus Capital Fund IV L.P. (PCF IV) and 29,562 shares of our common stock held by Primus Executive Fund L.P. (PEF). The sole General Partner of both PCF IV and PEF is Primus Venture Partners IV Limited Partnership (PVP LP). Each of PCF IV, PEF, and PVP LP is a Delaware limited partnership. The sole General Partner of PVP LP is Primus Venture Partners IV, Inc. (PVP Inc.), a Delaware corporation. Voting power and investment power over our shares is shared among the five individuals who are the directors of PVP Inc. The five individuals are William C. Mulligan, Loyal W. Wilson, James T. Bartlett, Jonathan E. Dick and Steven Rothman, each of whom disclaims beneficial ownership of all shares held by PCV IV and PEF except to the extent of his pecuniary interest therein.

21

(3) Includes 892,679 shares of our common stock held by FdG Capital Partners LLC (FdG Capital), 70,479 shares of our common stock held by FdG—Chase Capital Partners LLC. (FdG Chase). The Managing Member of both FdG Capital and FdG Chase is FdG Capital Associates LLC (FdG Associates). Each of FdG Capital, FdG Chase and FdG Associates is a Delaware limited liability company. FdG Associates is managed by a board of managers, comprised of Charles de Gunzburg, Martin Edelman, David Gellman and Mark Hauser, which has full voting power over our shares. The FdG Associates investment committee, comprised of Richard Fisher, David Gellman and Mark Hauser, has full investment discretion over our shares. No single member of the board of managers or investment committee has voting or dispositive authority over our shares. Consequently, each member, including Mr. Gellman, disclaims beneficial ownership of such securities except to the extent of his pecuniary interest therein.

(4) As reported in a Schedule 13G filed with the SEC.

(5) Includes the following number of shares of our common stock issuable upon exercise of outstanding options that are exercisable within 60 days by the person indicated: Mr. Zanatta, 113,125; Mr. Maanum, 113,125; Mr. Michael W. McCormick, 85,625; Mr. Hornbaker, 50,625; Mr. Nordvold, 38,750; Mr. Bloom, 36,500; Mr. Eugster, 16,500; Mr. Gellman, 1,500; Mr. Mulligan, 1,500; Mr. Newmark, 1,500; and all executive officers and directors as a group, 458,750.

(6) Includes shares of our common stock held by Best Buy Co., Inc., a publicly traded company. While investment decisions of Best Buy Co., Inc. are made by investment committees which do not include Mr. Healy, as an executive officer of Best Buy Co., Inc., Mr. Healy has legal power to vote and dispose of the shares and thus may be deemed to beneficially own them. However, Best Buy Co., Inc. treats the shares as a corporate asset which is not beneficially owned by any individual employee and Mr. Healy disclaims any such beneficial ownership.

(7) Includes (a) 52,824 outstanding shares and a warrant to purchase 49,775 shares of common stock held by the spouse of Mr. Ralph D. Maltby, our Senior Vice President—Chief Technology Officer, Research and Development; (b) warrants to purchase each of 49,775 and 50,450 shares of common stock exercisable within 60 days; (c) shares described in footnotes 1, 2, 3, 5 and 6; and (d) 198,038 outstanding shares and shares issuable upon exercise of outstanding options within 60 days that are owned by other executive officers.

Section 16(a) Beneficial Ownership Reporting Compliance

The rules of the SEC require us to disclose the identity of directors, executive officers and beneficial owners of more than 10% of our common stock who did not file on a timely basis reports required by Section 16 of the 1934 Act. Based solely on review of copies of those reports, or written representations from reporting persons, we believe that all directors and executive officers complied with all filing requirements applicable to them during fiscal 2006.

22

PROPOSAL 2

AMENDMENT TO THE GOLF GALAXY, INC.

AMENDED AND RESTATED

2004 STOCK INCENTIVE PLAN

On June 15, 2006, the Board approved an amendment to Golf Galaxy, Inc.’s Amended and Restated 2004 Stock Incentive Plan (the “Plan”) subject to shareholder approval. The amendment increases the number of shares reserved for issuance under the Plan from 1,000,000 shares of common stock, par value $0.01 per share, to 1,500,000 shares. Shareholder approval is sought to approve the increase authorized by the Board.

Summary of the Plan

On July 15, 2004, the Board adopted the Plan and on July 26, 2004, the Plan was approved by the shareholders at a Special Meeting of the Shareholders. On June 23, 2005, the Plan was amended to stipulate that of the aggregate Plan limit of 1,000,000 shares that may be subject to awards granted under the Plan, up to 1,000,000 of such shares may be issued as Incentive Stock Options (as defined below). On June 15, 2006, the Plan was amended to require, rather than merely permit, in the event of any change in the outstanding shares of common stock by reason of any stock dividend or split, recapitalization, reclassification, combination, or exchange of shares or other similar corporate change, mandatory adjustment to prevent substantial dilution or enlargement of the rights granted to, or available for, participants in the Plan. The purpose of the Plan is to promote the growth and profitability of our company and our affiliates by providing our directors, officers, employees, consultants and other service providers (“Eligible Persons”) with an incentive to achieve long-term corporate objectives, to attract and retain persons of outstanding competence, and to provide such persons with an equity interest in our company. Currently, approximately 600 directors, officers and employees are eligible as a class to receive awards under the Plan.

Administration and Eligibility. Any Eligible Persons who provide services to Golf Galaxy or any of our affiliates are eligible to receive awards under the Plan. Eligible Persons may be selected to receive awards individually or by group or category (for example, by pay grade). The Plan is administered by the Compensation Committee of the Board, or such other committee of the Board as the Board may from time to time designate (the “Committee”) of not less than such number of directors as shall be required to permit awards granted under the Plan to qualify under Rule 16b-3 promulgated by the SEC under the 1934 Act, or any successor rule or regulation, and no member of the Committee shall be an employee of the Company or an affiliate within the meaning of Rule 16b-3.

The selection of officers of our company to receive awards under the Plan and the terms of any award granted to such officers must be approved by the Committee. The Committee, in its sole discretion, may delegate to one or more officers of our company the authority to select persons who are not officers of our company to receive awards under the Plan and to establish the terms of awards granted to such persons.

The Committee has authority to make rules and regulations governing the administration of the Plan; to select the Eligible Persons to whom awards shall be granted; to determine the type, amount, size and terms of awards; to determine the time when awards shall be granted; to determine whether any restrictions shall be placed on shares purchased pursuant to any option or issued pursuant to any award; and to make all other determinations necessary or advisable for the administration of the Plan.

Amendments. The Board may at any time, and from time to time, amend the Plan in any respect; provided, however, that no amendment may materially increase the benefits accruing to participants under the Plan, increase the number of shares available for issuance or sale pursuant to the Plan (except as permitted by adjustment, merger or reorganization) or materially modify the requirements for eligibility under the Plan without the affirmative vote of the holders of at least a majority of our voting stock.

23

Awards. The Committee may make awards to Eligible Persons in the form of (i) stock options which are intended to qualify as “Incentive Stock Options” within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), or any successor provision, (ii) non-qualified stock options, (iii) awards of restricted stock, or (iv) any combination thereof.

Adjustments for Corporate Changes. In the event of any change in the outstanding shares of common stock by reason of any stock dividend or split, recapitalization, reclassification, combination, or exchange of shares or other similar corporate change, the number and kind of shares subject to the Plan, the number and kind of shares subject to an award and the Exercise Price (as defined below) and value of an award shall be appropriately adjusted consistent with such change in such manner as the Committee may deem equitable to prevent substantial dilution or enlargement of the rights granted to, or available for, participants in the Plan.

Stock Options Under the Plan

A stock option granted pursuant to the Plan shall entitle the optionee, upon exercise, to purchase shares at a specified price during a specified period. Options shall be subject to such terms and conditions as the Committee shall from time to time approve. The purchase price of shares subject to an option (“Exercise Price”) shall be payable in full at the time the option is exercised. Payment may be made in cash, in shares of our common stock having an aggregate fair market value on the date of exercise which is not less than the Exercise Price, or by a combination of cash and such shares, as the Committee may determine, and subject to such terms and conditions as the Committee deems appropriate. Except to the extent permitted by the instrument evidencing such option, no option shall be transferable by the optionee other than by will or by the laws of descent and distribution. No option granted under the Plan may be pledged, alienated, attached or otherwise encumbered, and any purported pledge, alienation, attachment or encumbrance thereof shall be void and unenforceable against us.

Incentive Stock Options may be granted only to persons who are employees of Golf Galaxy or of any of our affiliates. The Exercise Price of shares that are subject to an Incentive Stock Option shall not be less than 100% of the fair market value of such shares on the date the option is granted, as determined in good faith by the Committee. The aggregate fair market value (determined on the date the option is granted) of the shares with respect to which Incentive Stock Options are exercisable by the optionee for the first time during any calendar year, under this Plan or any other plan of Golf Galaxy or any of our affiliates, shall not exceed $100,000.

The Exercise Price of shares that are subject to an Incentive Stock Option granted to an employee who, at the time such option is granted, owns 10% or more of the total combined voting power of all classes of stock of Golf Galaxy or any of our affiliates shall not be less than 110% of the fair market value of such shares on the date such option is granted, and such option may not be exercisable more than five years after the date on which it is granted. Subject to the foregoing, options may be made exercisable in one or more installments, upon the happening of certain events, upon the fulfillment of certain conditions, or upon such other terms and conditions as the Committee shall determine.

Restricted Stock Under the Plan

Restricted stock awards granted pursuant to the Plan shall entitle the holder to receive shares, subject to forfeiture if specified conditions are not satisfied at the end of a specified period. The Committee will establish a period at the time an award is granted during which the holder will not be permitted to sell, transfer, assign, pledge or otherwise encumber the shares subject to the award (“the Restricted Period”). Except to the extent otherwise provided in the Plan or under the terms of any instrument, during the Restricted Period the holder of restricted shares shall have all of the rights of one of our shareholders with respect to such shares, including the right to vote the shares and to receive dividends and other

24

distributions with respect to the shares; provided, that all stock dividends, stock rights and stock issued upon split-ups or reclassifications of shares shall be subject to the same restrictions as other shares.

Except to the extent otherwise provided in any restricted stock instrument, all shares subject to any restriction shall be forfeited to us if the holder shall cease to provide services to us or one of our affiliates, or if any condition established by the Committee shall not have occurred, prior to the expiration of the Restricted Period. The Committee may permit a gift of restricted stock to the holder’s spouse, child, stepchild, grandchild, or legal dependent, or to a trust whose sole beneficiary or beneficiaries shall be the holder and/or any one or more of such persons.

Federal Income Tax Consequences

Grant of Stock Options. The grant of a stock option is not expected to result in any taxable income for the recipient.

Exercise of Stock Options. The holder of an Incentive Stock Option generally will have no taxable income upon exercising the option (except that an alternative minimum tax liability may arise and any dispositions in connection with “cashless” exercises will be taxable), and we will not be entitled to an income tax deduction. Upon exercising a non-qualified stock option, the option holder must recognize ordinary income equal to the excess of the fair market value of the shares of common stock acquired on the date of exercise over the exercise price, and we will generally be entitled at that time to an income tax deduction for the same amount. The amount recognized as ordinary income by the holder of a non-qualified stock option will generally increase the holder’s tax basis in the shares acquired pursuant to the exercise of the non-qualified stock option.

Disposition of Shares Acquired Upon Exercise of Stock Options. If the holder of shares acquired upon exercise of an Incentive Stock Option does not dispose of the shares acquired upon such exercise for a period of (i) two years from the granting of the incentive stock option and (ii) one year after exercise of the option, the holder will receive long-term capital gains treatment on any gain recognized when he or she sells the shares. If the holder of shares acquired upon exercise of an Incentive Stock Option disposes of the shares before the applicable holding periods above are satisfied (i.e. a “disqualifying disposition”), then any gain recognized will generally be taxable as ordinary income in the year in which the disposition occurred, in the amount by which the lesser of (i) the fair market value of such shares on the date of exercise, or (ii) the amount recognized on the disposition of the shares, exceeds the exercise price. The balance of any gain or loss recognized on such a disqualifying disposition will be characterized as a capital gain or loss.

Upon the disposition of shares acquired from the exercise of a non-qualified stock option, any resulting gain or loss generally will be taxable to the holder as long-term or short-term capital gain or loss, depending upon his or her holding period for such shares.

Generally, there will be no tax consequence to us in connection with the disposition of shares acquired pursuant to exercise of an option, except that we are entitled to an income tax deduction equal to the amount of ordinary income recognized by an option holder as a result of a disqualifying disposition of shares acquired under an Incentive Stock Option.