- TRUE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

TrueCar (TRUE) DEF 14ADefinitive proxy

Filed: 8 Apr 20, 4:10pm

Use these links to rapidly review the document

Table of Contents

Compensation Discussion and Analysis

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| TrueCar, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Notice of 2020 Annual Meeting of Stockholders |

DATE

Thursday, May 21, 2020

TIME

8:30 a.m. Pacific Time

PLACE

www.virtualshareholdermeeting.com/True2020

RECORD DATE

March 26, 2020

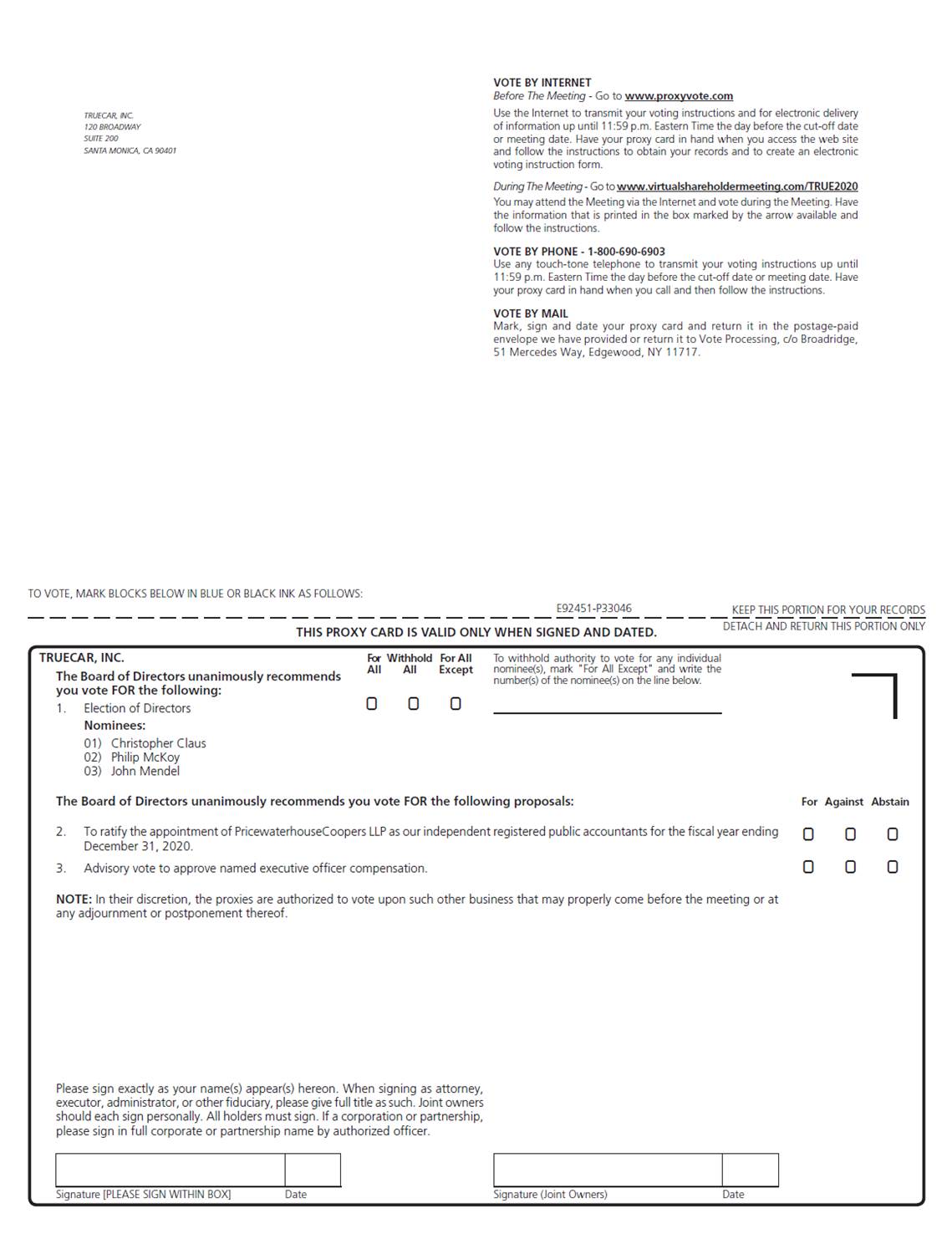

| YOU CAN VOTE IN ONE OF THREE WAYS | ||||

| | | | | |

INTERNET Visit the website noted on your proxycard to vote online. | ||||

| | | | | |

TELEPHONE Use the toll-free telephone number on your proxy card to vote by telephone. | ||||

| | | | | |

Sign, date, and return your proxy card in the enclosed envelope to vote by mail. | ||||

We are pleased to invite you to attend our 2020 Annual Meeting of Stockholders. Our board of directors has fixed the close of business on March 26, 2020 as the record date for the Annual Meeting. Only stockholders of record as of March 26, 2020 are entitled to notice of and to vote at the Annual Meeting or any postponements or adjournments thereof. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

Sincerely,

Michael Darrow

President and Chief Executive Officer

Santa Monica, California

April 8, 2020

Your vote is important. Whether or not you plan to attend the Annual Meeting by live webcast, we urge you to submit your vote on the Internet or by telephone or mail to ensure your shares are represented. For specific instructions on how to vote your shares, please refer to the section entitled "General Information" and the instructions on the Notice of Internet Availability. For additional instructions on voting by telephone or the Internet, please refer to your proxy card. Returning the proxy does not deprive you of your right to attend the virtual meeting and to vote your shares at the virtual meeting. Please vote as soon as possible.

The Annual Meeting will be a completely virtual meeting of stockholders. All stockholders are cordially invited to attend the Annual Meeting by live webcast.You will not be able to attend the Annual Meeting in person. As described in more detail in the accompanying proxy statement, our board of directors believes that holding a virtual stockholder meeting facilitates attendance, increases participation and communication and offers significant time and cost savings to us and our stockholders and therefore has chosen this over an in-person meeting. To participate, vote or submit questions during the Annual Meeting by live webcast, please visit www.virtualshareholdermeeting.com/True2020.

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission, we are once again pleased to provide our stockholders access to our proxy materials on the Internet at http://materials.proxyvote.com/89785L rather than in paper form. The Notice of Internet Availability, which contains instructions on how to access the proxy materials and our 2019 Annual Report to Stockholders, is first being given or sent on or about April 8, 2020 to our stockholders entitled to vote at the Annual Meeting. Our stockholders will also have the ability to request that a printed set of the proxy materials be sent to them by following the instructions in the Notice of Internet Availability.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 21, 2020: This proxy statement, along with the 2019 Annual Report to Stockholders, is available at the following website: http://materials.proxyvote.com/89785L.

By furnishing a Notice of Internet Availability and access to our proxy materials by the Internet, we are lowering the costs and reducing the environmental impact of our Annual Meeting.

The Notice of Internet Availability will also provide instructions on how you may request electronic or paper delivery of future proxy materials. If you choose to receive electronic delivery of future proxy materials, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by electronic or paper delivery will remain in effect until you terminate it. We encourage you to choose to receive future proxy materials by electronic delivery, which will (i) allow us to provide you with the information you need in a more timely manner, (ii) reduce printing and mailing documents to you and (iii) conserve natural resources.

Table of Contents |

Proxy Statement Summary | 1 | |

| | | |

Executive Officers, Directors and Corporate Governance | 4 | |

| | | |

Executive Officers and Directors | 4 | |

Board Composition | 10 | |

Board Meetings and Director Communications | 10 | |

Policy Regarding Nominations | 10 | |

Director Independence | 11 | |

Board Committees | 11 | |

Compensation Committee Interlocks and Insider Participation | 15 | |

Code of Business Conduct and Ethics | 15 | |

Board Leadership Structure | 16 | |

Board's Role in Risk Oversight | 16 | |

Information on Compensation Risk Assessment | 16 | |

Non-Employee Director Compensation | 17 | |

Outside Director Compensation Policy | 17 | |

Security Ownership of Certain Beneficial Owners and Management | 19 | |

| | | |

Compensation Discussion and Analysis | 23 | |

| | | |

Summary Compensation Table | 42 | |

Grants of Plan Based Awards | 44 | |

Outstanding Equity Awards at Fiscal Year-End | 46 | |

Option Exercises and Stock Vested | 49 | |

Executive Employment Arrangements | 49 | |

Potential Payments Upon Termination, Change in Control or Certain Other Events | 51 | |

Equity Compensation Plan Information | 60 | |

CEO Pay Ratio Disclosure | 61 | |

Certain Relationships and Related Party and Other Transactions | 63 | |

| | | |

Audit Committee Report | 65 | |

| | | |

Proposal One: Election of Directors | 66 | |

| | | |

Proposal Two: Ratification of Selection of Independent Registered Public Accountants | 67 | |

| | | |

Proposal Three: Advisory Vote to Approve Named Executive Officer Compensation | 69 | |

| | | |

General Information | 71 | |

| | | |

ANNEX A — Reconciliation of Adjusted EBIDTA to GAAP Net Loss | 78 | |

| | | |

| | |

2020 ANNUALPROXY STATEMENT | | |

Proxy Statement Summary |

This summary highlights selected information in this Proxy Statement. Please review the entire document before voting.

ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | |

| | | ||||||

| | DATE | TIME | PLACE | RECORD DATE | ||||

| | May 21, 2020 | 8:30 a.m. Pacific Time | www.virtualshareholder meeting.com/True2020 | March 26, 2020 | ||||

| | | | | | | | | |

PROPOSALS AND BOARD RECOMMENDATIONS

| Proposals | Board Recommendation | Page Reference | ||||

|---|---|---|---|---|---|---|

1 | Election of Directors | FOR | 66 | |||

2 | Ratification of independent registered public accounting firm | FOR | 67 | |||

3 | Advisory vote on executive compensation | FOR | 69 | |||

| | | | | | | | | | | |

INTERNET Visit the website noted on your proxycard to vote online. | Sign, date, and return your proxy card in the enclosed envelope to vote by mail. | |||||||||

| | | | | | | | | | | |

TELEPHONE Use the toll-free telephone number on your proxy card to vote by telephone. | IN PERSON You will not be able attend the Annual Meeting in Person. | |||||||||

| | |

| | 1 |

| | |

2020 ANNUALPROXY STATEMENT | | Proxy Summary |

SNAPSHOT OF BOARD OF DIRECTORS

| TrueCar Committees | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Age | Director Since | Independent | Audit Committee | Compensation & Workforce Committee | Executive Committee | Nominating and Corporate Governance Committee | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Michael D. Darrow Director and President & CEO | 62 | 2020 | NO | | | | | | | | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Robert E. Buce Director | 71 | 2005 | YES | o | | | | · | | | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Christopher W. Claus* Director and Chairman of the Board | 59 | 2014 | YES | · | | · | | o | | | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| John Krafcik(1) Director | 58 | 2014 | YES | | | | | | | | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Erin N. Lantz Director | 40 | 2016 | YES | · | | | | | | · | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Philip G.J. McKoy Director | 47 | 2018 | YES | | | | | | | · | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| John W. Mendel Director | 65 | 2017 | YES | | | · | | · | | o | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Wesley A. Nichols Director | 55 | 2016 | YES | | | o | | · | | · | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

| Ion A. Yadigaroglu Director | 50 | 2007 | YES | | | | | | | | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

o Chairperson · Member * Chairman of the Board | ||

| | |

2 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Proxy Summary |

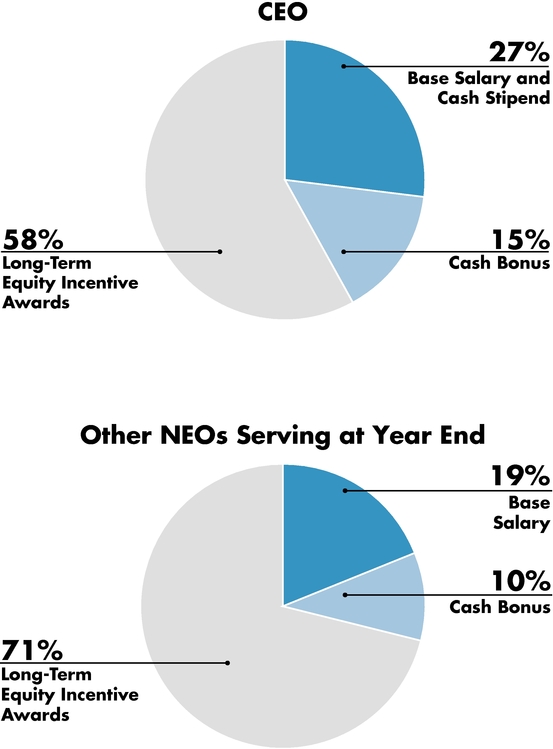

Below are the primary components of our 2019 executive compensation program:

| | |

| | 3 |

| | |

2020 ANNUALPROXY STATEMENT | | |

Executive Officers, Directors and Corporate Governance |

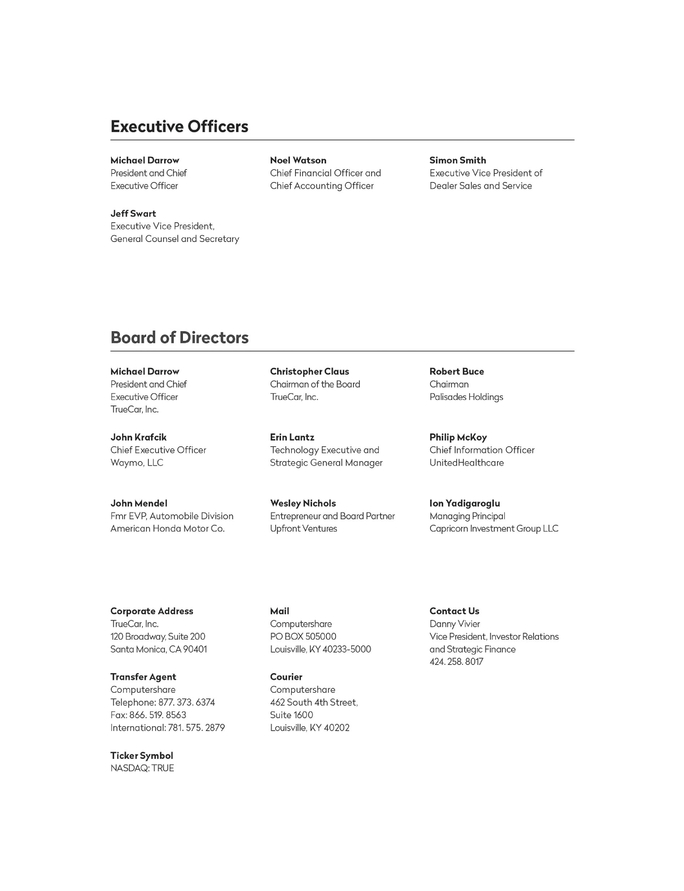

Executive Officers and Directors

The following table sets forth the names, ages and positions of our executive officers and directors as of March 31, 2020:

Name | Age | Position | ||

Executive Officers | ||||

Michael D. Darrow | 62 | President and Chief Executive Officer, and a Director | ||

Noel B. Watson | 44 | Chief Financial Officer and Chief Accounting Officer | ||

Simon E. Smith | 50 | Executive Vice President of Dealer Sales & Service | ||

Jeffrey J. Swart | 52 | Executive Vice President, General Counsel and Secretary | ||

Non-Employee Directors | ||||

Robert E. Buce | 71 | Director | ||

Christopher W. Claus | 59 | Director and Chairman of the Board | ||

John Krafcik(1) | 58 | Director | ||

Erin N. Lantz | 40 | Director | ||

Philip G.J. McKoy | 47 | Director | ||

John W. Mendel | 65 | Director | ||

Wesley A. Nichols | 55 | Director | ||

Ion A. Yadigaroglu | 50 | Director | ||

| | | | | |

Executive Officers

Michael D. Darrow has served as our President, Chief Executive Officer and a member of our Board since March 2020. From November 2017 until March 2020, he served as our Executive Vice President of Partner and OEM Development and served as our Executive Vice President of OEM Development from March 2017 to November 2017. Mr. Darrow has also served as the President of our subsidiary, ALG, Inc., since January 2018. From June 2016 until he joined us, Mr. Darrow was an Automotive Industry Consultant for Inventory Command Center LLC, before which Mr. Darrow served in numerous roles at Edmunds.com Inc. from July 2000 to August 2014, including as Chief Executive Officer of Edmunds Data Services, Executive Vice President of Sales and Chief Sales Officer. Mr. Darrow holds a B.S. in Economics from Allegheny University.

| | |

4 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

We believe that Mr. Darrow is qualified to serve as a member of our Board because of his substantial industry, operational and business strategy expertise, developed over more than 20 years of service in the online automotive industry, and his working relationships with many key customers, partners and industry participants.

Noel B. Watson has served as our Chief Financial Officer and Chief Accounting Officer since June 2019. From February 2016 until he joined us, Mr. Watson was the Chief Accounting Officer and Vice President of Finance and Accounting of TripAdvisor, Inc., an online travel company that assists travelers by providing user-generated content, price comparison tools and online reservation and related services for accommodations, travel activities and restaurants around the world, and from February 2013 to February 2016, he served as TripAdvisor's Vice President of Accounting and Controller. Before that, Mr. Watson worked in various other accounting roles for TripAdvisor and Expedia, Inc., a travel booking website. Mr. Watson holds a B.A. in Accounting from Bryant University.

Simon E. Smith has served as our Executive Vice President of Dealer Sales & Service since June 2019. From July 2015 until June 2019, he served as our Senior Vice President of Dealer Development, and as our Vice President of Trade Operations from July 2012 until July 2015. Before joining us, Mr. Smith was the National Sales Director for AutoNation, Inc., the largest automotive retailer in the United States, and before that he spent eight years at CarsDirect.com, Inc. (now known as Internet Brands, Inc.), an online automotive research portal and car-buying service as Vice President of Sales and Operations, after beginning his career at Mercedes-Benz UK Ltd., the UK subsidiary of Daimler AG, a German multinational automobile manufacturer. Mr. Smith attended the University of Canterbury in New Zealand.

Jeffrey J. Swart has served as our Executive Vice President, General Counsel and Secretary since July 2017. From January 2016 to July 2017, Mr. Swart served as our Senior Vice President, General Counsel and Secretary and he served as our Senior Vice President & Deputy General Counsel from April 2014 until December 2015. From May 1998 until he joined us, Mr. Swart practiced law at the law firm of Alston & Bird LLP, where he was a litigation partner. Before joining Alston & Bird, Mr. Swart served for two years as a law clerk to Judge Edward Carnes of the United States Court of Appeals for the Eleventh Circuit. Mr. Swart has substantial experience in complex commercial litigation. Mr. Swart holds a J.D. from the Emory University School of Law and a B.B.A. from the Goizueta Business School at Emory University.

| | |

| | 5 |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Board of Directors

Age: 71 Independent Current Committee Memberships: • Audit Committee • Executive Committee | ROBERT E. BUCE Recent Business Experience: Robert E. Buce has served as a member of our Board since April 2005. Mr. Buce served as our Executive Vice President and Chief Financial Officer from September 2005 to September 2008. Before joining us, Mr. Buce founded and served as Chief Financial Officer and a senior member of the management team of Build-To-Order, Inc., an automotive company focused on modularized outsourced manufacturing of vehicles. Before Build-To-Order, Mr. Buce held a variety of senior management positions, including Managing Partner, at KPMG LLP, an accounting and advisory firm, and served as Managing Director at BearingPoint, Inc., a related consulting firm. Mr. Buce also served on the board of directors of KPMG LLP from March 1991 to November 1995. Since July 2000, Mr. Buce has served as Chairman of PalisadesHoldings, a sole proprietorship providing independent advisory assistance to a variety of technology services and consumer products and services commercial enterprises. From 2011 to 2013, Mr. Buce served on the board of directors of Intersection Technologies, Inc., the parent company of F&I Express, a provider of software and services to the automotive industry. Mr. Buce is a Certified Public Accountant (inactive) in the State of California and a member of the American Institute of Certified Public Accountants and the California Society of Certified Public Accountants. Mr. Buce holds a B.S. in Mechanical Engineering from Lehigh University and an M.B.A. from the Anderson School of Management at the University of California, Los Angeles. Reasons for Nomination: We believe that Mr. Buce is qualified to serve as a member of our Board because of the experience he gained from serving as our Chief Financial Officer, the substantial corporate governance, operational and financial expertise he gained from serving as Managing Partner at KPMG LLP, as Managing Director at BearingPoint and on the boards of directors and boards of advisors of several private companies. As the longest-serving member of our Board, we also value his deep understanding of our business as it has evolved over time. | |||

| | | | | |

| | |

6 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Board Chair Since: 2016 Age: 59 Independent Current Committee Memberships: • Compensation and Workforce Committee • Executive Committee • Audit Committee | CHRISTOPHER W. CLAUS Recent Business Experience: Christopher Claus has served as a member of our Board since April 2014 and as Chairman of the Board since February 2016. From December 1994 to March 2014, Mr. Claus served in various senior executive roles at the United Services Automobile Association, or USAA, a Fortune 150 diversified financial services company, most recently as Executive Vice President of USAA Enterprise Advice Group and President of USAA Financial Services Group. Previously, he served as the Senior Vice President and then President of USAA Investment Management Company. Mr. Claus also served as USAA's Vice President of Investment Sales and Service. Before USAA, Mr. Claus was Vice President of Equity Trading and Retirement Plans at Norwest Investment Services, Inc, a venture and growth equity investment firm. In June 2017, Mr. Claus joined the board of directors of Citizens, Inc., a provider of insurance and reinsurance services. Mr. Claus holds a B.A. in Business Administration from the University of Minnesota Duluth and an M.B.A. from the University of St. Thomas. Reasons for Nomination: We believe that Mr. Claus is qualified to serve as a member of our Board because of his substantial business strategy and corporate development and governance expertise gained as an executive and counselor at several companies in the finance industry. | |||

| | | | | |

Age: 40 Independent Current Committee Memberships: • Audit Committee • Nominating and Corporate Governance Committee | ERIN N. LANTZ Recent Business Experience: Erin N. Lantz has served as a member of our Board since November 2016. Ms. Lantz is a technology executive and strategic general manager. Most recently she was the Vice President and General Manager of Mortgages at Zillow Group, Inc., an online real estate database company, where she worked from 2010 through October 2019. Just before joining Zillow, Ms. Lantz was Senior Vice President at Bank of America Corporation, a U.S. multinational investment bank and financial services company, where she led the Direct-to-Consumer purchase home loan business. Before entering the mortgage industry, Ms. Lantz worked at the Boston Consulting Group, a global management consulting firm, as an Associate. From September 2016 until August 2018, Ms. Lantz served on the board of directors of Washington Federal, Inc., a bank holding company. Ms. Lantz holds a B.A. in Political Science, Philosophy and Economics from the University of Pennsylvania and an M.B.A. from Harvard Business School. Reasons for Nomination: We believe that Ms. Lantz is qualified to serve as a member of our Board because of her extensive knowledge in finance, consumer behavior, online marketplaces and financial consumer technology. | |||

| | | | | |

| | |

| | 7 |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Age: 47 Independent Current Committee Memberships: • Nominating and Corporate Governance Committee | PHILIP G.J. MCKOY Recent Business Experience: Philip G.J. McKoy has served as a member of our Board since October 2018. Since July 2016, Mr. McKoy has served as the Chief Information Officer of United Healthcare Services, Inc., a business of UnitedHealth Group, a diversified health and well-being company. From January 2016 to June 2016, Mr. McKoy served as Senior Vice President and Chief Information Officer for Global Loyalty Solutions at Aimia Inc., a data-driven marketing and loyalty analytics company, and from July 2014 to December 2015, Mr. McKoy served as Aimia's Senior Vice President and Chief Information Officer of the U.S. Region. Before joining Aimia, Mr. McKoy served in various roles at Target Corporation, a U.S. department store retailer, including as Vice President of Target.com from November 2011 through January 2014, where he was responsible for leading the customer-facing digital experience. Mr. McKoy has a B.A. in Political Science from Washington and Lee University and an M.A. in International Affairs from the Josef Korbel School of International Studies at the University of Denver. Reasons for Nomination: We believe that Mr. McKoy is qualified to serve as a member of our Board because of his extensive knowledge in information security, technology strategy and digital business operations. | |||

| | | | | |

Age: 65 Independent Current Committee Memberships: • Compensation and Workforce Committee • Nominating and Corporate Governance Committee • Executive Committee | JOHN W. MENDEL Recent Business Experience: John W. Mendel has served as a member of our Board since May 2017. Mr. Mendel served as the Executive Vice President, Automobile Division, of American Honda Motor Company, the U.S. subsidiary of Honda Motor Company, Ltd., a Japanese multinational automaker, from November 2004 until April 2017. Before Honda, Mr. Mendel worked for Ford Motor Company, a U.S. multinational automaker, from July 1976 until November 2004 in various roles, serving most recently as Chief Operating Officer of Mazda Motor of America, Inc., the U.S. subsidiary of Mazda Motor Corporation, a Japanese multinational automaker and, at the time, a business partner of Ford. Since August 2018, Mr. Mendel has served on the board of directors of LKQ Corporation, a global distributor of vehicle products. Mr. Mendel has a B.A. in Business and Economics from Austin College and an M.B.A. from the Fuqua School of Business at Duke University. Reasons for Nomination: We believe that Mr. Mendel is qualified to serve as a member of our Board because of his substantial corporate development, business strategy and automotive expertise gained as an executive in the automotive industry. | |||

| | | | | |

| | |

8 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Age: 55 Independent Current Committee Memberships: • Compensation and Workforce Committee • Nominating and Corporate Governance Committee • Executive Committee | WESLEY A. NICHOLS Recent Business Experience: Wesley A. Nichols has served as a member of our Board since November 2016. Since April 2018, Mr. Nichols has served as a strategic adviser to Snap Inc., a camera application company, and since January 2017, Mr. Nichols has been advising select portfolio companies of Upfront Ventures as a Board Partner and select multinational companies as a strategic adviser through Incrementum LLC, a strategic advisory and investment firm he co-founded in 2017. Mr. Nichols was the Chief Strategy Officer of Neustar, Inc., a global provider of real-time information services and analytics, from December 2015 until February 2017. Mr. Nichols co-founded MarketShare, LLC, a provider of advanced analytic solutions and software, in 2005 and served as its Chief Executive Officer from January 2005 until its acquisition by Neustar in December 2015. Mr. Nichols served on the board of directors of BJ's Restaurants, Inc. from December 2013 until June 2018, and on the board of directors of comScore, Inc. from October 2017 until October 2018. Mr. Nichols holds a B.A. in Psychology from Randolph-Macon College and an M.A. in Business Management from Johns Hopkins University. Reasons for Nomination: We believe that Mr. Nichols is qualified to serve as a member of our Board because of his extensive knowledge in analytics, marketing optimization and digital technology. | |||

| | | | | |

Age: 50 Independent Current Committee Memberships: | ION A. YADIGAROGLU Recent Business Experience: Ion A. Yadigaroglu has served as a member of our Board since August 2007. Since July 2004, Mr. Yadigaroglu has served as a Managing Principal at Capricorn Investment Group LLC, an investment firm. Mr. Yadigaroglu holds a Masters in Physics from Eidgenössische Technische Hochschule Zürich in Switzerland and a Ph.D. in Astrophysics from Stanford University. Reasons for Nomination: We believe that Mr. Yadigaroglu is qualified to serve as a member of our Board because of his substantial corporate finance, business strategy and corporate development expertise gained from his holding various executive positions and from his significant experience in the capital industry, analyzing, investing in and serving on the boards of directors of various private technology companies. We also value his perspective as a representative of one of our significant stockholders. | |||

| | | | | |

Our executive officers are appointed by, and serve at the discretion of, our Board. There are no family relationships among any of our directors or executive officers.

| | |

| | 9 |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Board Composition

Our business and affairs are managed under the direction of our Board. The number of directors is fixed by our Board, subject to the terms of our Amended and Restated Certificate of Incorporation, or Charter, and our Amended and Restated Bylaws, or Bylaws, that became effective at the completion of our initial public offering. As of April 1, 2020, our Board consists of eight directors, seven of whom qualify as "independent" under the listing standards of the Nasdaq Stock Market, which we refer to as Nasdaq.

In accordance with our Charter and Bylaws, our Board is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Our directors are divided among the three classes as follows:

Messrs. Claus, McKoy and Mendel are standing for election at the Annual Meeting.

The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control. Under Delaware law, our directors may only be removed for cause by the affirmative vote of the holders of a majority of our outstanding voting stock. Our directors may not be removed by our stockholders without cause.

Any increase or decrease in the number of directors must be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Board Meetings and Director Communications

During 2019, the Board held nine meetings. With the exception of Mr. Yadigaroglu, who attended 27% of the aggregate of the total number of meetings of the Board and the total number of meetings of the nominating and corporate governance committee of the Board, each director attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which he or she served during the periods that he or she served in 2019. Directors are also encouraged to attend our annual stockholder meetings absent an unavoidable and irreconcilable conflict. Each member of our Board attended our 2019 annual meeting of stockholders.

Stockholders and other interested parties may communicate with the non-management members of the Board by mail to our principal executive offices addressed to the intended recipient and care of our Corporate Secretary. Our Corporate Secretary will review all incoming stockholder communications (except for mass mailings, product complaints or inquiries, job inquiries, business solicitations and patently offensive or otherwise inappropriate material) and route such communications as appropriate to the Board or an individual director.

Policy Regarding Nominations

Our Board is responsible for identifying and nominating candidates for election to the Board. The Board considers recommendations from directors, stockholders and others, as it deems appropriate. In evaluating director candidates, our Board considers factors such as character, integrity, judgment, diversity, including diversity in terms of gender, race, ethnicity and experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest and other commitments. Our Board evaluates these factors, among others,

| | |

10 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

and does not assign any particular weighting or priority to any of these factors. Our Board considers these factors in light of the specific needs of the Board at that time and also considers advice and recommendations from our President and Chief Executive Officer.

We have paid fees to a third party search firm to assist the Board in identifying and evaluating potential candidates for nomination. Search firms retained to assist our Board in seeking candidates for the Board are instructed to seek to include diverse candidates in terms of race and gender.

Director Independence

Our Board reviewed the independence of each director. Based on information provided by each director concerning his or her background, employment and affiliations, our Board determined that none of Ms. Lantz or Messrs. Buce, Claus, Krafcik, McKoy, Mendel, Nichols or Yadigaroglu has a relationship that would interfere with the exercise of his or her independent judgment in carrying out the responsibilities of a director and that each of these directors is "independent" as that term is defined under the applicable rules and regulations of the SEC and Nasdaq's listing standards. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with our Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director. The Board also determined that each of Messrs. Claus, Mendel and Nichols is a non-employee director, as defined by Rule 16b-3 promulgated under the Exchange Act.

Board Committees

Our Board has an audit committee, a compensation and workforce committee, an executive committee and a nominating and corporate governance committee. The Company also has a standing disclosure committee. The composition and responsibilities of each of the committees of our Board are described below. Members serve on these committees until their resignation or until otherwise determined by our Board. Each of these committees operates under a written charter adopted by our Board that is available on the Investor Relations section of our website at http://ir.truecar.com/corporate-governance.

Audit Committee

Our audit committee is comprised of Messrs. Buce and Claus and Ms. Lantz. Mr. Buce serves as the chairperson of the audit committee. Each member of our audit committee meets the requirements for independence of audit committee members under current Nasdaq listing standards and SEC rules and regulations. Each member of our audit committee meets the financial literacy requirements of the current Nasdaq listing standards. In addition, our Board has determined that Mr. Buce qualifies as an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Exchange Act. During 2019, the audit committee held eight meetings. The responsibilities of our audit committee include, among other things:

| | |

| | 11 |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Our audit committee operates under a written charter that satisfies the applicable rules of the SEC and Nasdaq's listing standards.

Compensation and Workforce Committee

We refer to our compensation and workforce committee as the compensation committee. Our compensation committee is comprised of Messrs. Nichols, Claus and Mendel. Mr. Nichols serves as the chairperson of the compensation committee. The composition of our compensation committee meets the requirements for independence under current Nasdaq listing standards and SEC rules and regulations. Each member of the compensation committee is also a non-employee director, as defined by Rule 16b-3 under the Exchange Act. The purpose of our compensation committee is to oversee our compensation policies, plans and benefit programs, significant matters related to our workforce and to discharge the responsibilities of our Board relating to the compensation of our executive officers. During 2019, the compensation committee held six meetings. The responsibilities of our compensation committee include, among other things:

Our compensation committee operates under a written charter that satisfies the applicable rules of the SEC and Nasdaq's listing standards.

| | |

12 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Executive Committee

Our executive committee is comprised of the chairperson of the Board and the chairpersons of each of the committees of the Board. Mr. Claus serves as the chairperson of the executive committee. The executive committee was established in February 2020, and so did not hold any meetings during 2019. The purpose of the executive committee is to assist with coordinating the Board's activities and to be in a position to act expeditiously with the full authority of the Board in the intervals between meetings of the Board, but the executive committee may not:

The executive committee operates under a written charter.

Nominating and Corporate Governance Committee

We refer to our nominating and corporate governance committee as our nominating committee. From January 1, 2019 until March 20, 2019, the nominating committee was comprised of Messrs. Mendel, McKoy, Nichols and Yadigaroglu and Ms. Lantz. On March 20, 2019, Mr. Yadigaroglu was removed from the nominating committee. Mr. Mendel served as the chairperson of the nominating committee throughout 2019. The composition of our nominating committee meets the requirements for independence under current Nasdaq listing standards and SEC rules and regulations. During 2019, the nominating and corporate governance committee held two meetings. The responsibilities of our nominating committee include, among other things:

| | |

| | 13 |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Our nominating committee believes that candidates for director should have certain minimum qualifications, including the highest professional and personal ethics and values, consistent with our Code of Business Conduct and Ethics, which is posted in the corporate governance section of our investor relations website at www.ir.truecar.com. Candidates should have broad experience and demonstrated excellence in their fields. In addition, candidates for director should have:

Each director must represent the interests of all stockholders. Their service on the boards of directors of other public companies should be limited to a number that permits them, given their individual circumstances, to perform responsibly all director duties. The nominating committee retains the right to modify these qualifications from time to time.

The nominating committee reviews candidates for director in the context of the current composition of our Board, our operating requirements and the long-term interests of our stockholders. In conducting this assessment, the nominating committee considers the appropriate skills, experience and characteristics for members of the Board, including the appropriate role of diversity and such other factors as it deems appropriate given our current needs and those of our Board, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors, the nominating committee reviews a director's overall service during his or her term, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair his or her independence. The nominating committee also determines whether the Board can determine that the nominee is independent under Nasdaq's listing standards.

The nominating committee uses a variety of methods for identifying and evaluating nominees for director. The committee periodically assesses the appropriate size of our Board and whether any vacancies on our Board are expected due to retirement or otherwise. Candidates may come to the attention of the nominating committee through current members of our Board, professional search firms, stockholders or other persons. The nominating committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of our Board. The nominating committee meets to discuss and consider the candidates' qualifications and then selects a nominee for recommendation to our Board by majority vote. The nominating committee evaluates these candidates at its meetings, which may take place at any point during the year.

The nominating committee will consider candidates for our Board who meet the minimum qualifications as described above if properly recommended by stockholders holding at least one percent of the fully-diluted capitalization of the Company continuously for at least 12 months before the proposal. Proper recommendations will include the nominee's name, contact information, biography and qualifications as well as a consent signed by the nominee and a statement from the recommending stockholder in support of the nominee and should be directed to our Corporate Secretary at our principal executive offices.

Our nominating committee operates under a written charter that satisfies the applicable rules of the SEC and Nasdaq's listing standards.

Disclosure Committee

Our disclosure committee is comprised of Mr. Watson, our Chief Financial Officer and Chief Accounting Officer; Mr. Darrow, our President and Chief Executive Officer; Mr. Swart, our General Counsel and Secretary, and other members of our management team. Messrs. Watson and Swart co-chair our disclosure committee. During 2019,

| | |

14 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

the disclosure committee held four meetings, one before the filing of each quarterly and annual report filed in 2019. The responsibilities of our disclosure committee include, among other things:

Our disclosure committee operates under a written charter adopted by our Chief Executive Officer and Chief Financial Officer.

Compensation Committee Interlocks and Insider Participation

No member of our compensation committee has ever been an executive officer or employee of ours. Messrs. Nichols, Claus and Mendel served on our compensation committee throughout 2019. None of our executive officers currently serves, or has served during the last completed fiscal year, on the compensation committee or board of directors of any other entity that has one or more executive officers serving as a member of our Board or compensation committee.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that is applicable to all of our employees, officers and directors, including our President and Chief Executive Officer, Chief Financial Officer and other executive and senior financial officers. The Code of Business Conduct and Ethics is available on our website at http://ir.truecar.com/corporate-governance. We intend to disclose on our website any amendments to the code, or any waivers of its requirements.

| | |

| | 15 |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Board Leadership Structure

Our Board currently believes that we are best served by separating the roles of a Chairman of the Board and Chief Executive Officer. Mr. Darrow, our President and Chief Executive Officer, is the director with the most in-depth understanding of and experience in our industry. Consequently, Mr. Darrow is most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Christopher Claus serves as the Chairman of the Board. Independent directors and management have different perspectives and roles in strategy development. Our independent directors bring experience, oversight and expertise from both within and outside the automotive industry, while our President and Chief Executive Officer brings company-specific perspective and industry expertise. Our Board believes that separating the roles of Chairman of the Board and Chief Executive Officer is the best leadership structure for us at the current time because it promotes the efficient and effective development and execution of our strategy and facilitates information flow between management and our Board, which are essential to effective governance. Additionally, we established an executive committee of the Board in February 2020 to allow the independent Board leadership a forum to meet, communicate and act more expeditiously.

Board's Role in Risk Oversight

Management, which is responsible for day-to-day risk management, continually monitors the material enterprise risks we face, including strategic risks, operational risks, financial risks, credit risks, liquidity risks and legal and compliance risks.

The Board is responsible for overseeing our identification and management of, as well as planning for, those risks. The Board has delegated to certain committees oversight responsibility for those risks that are directly related to their area of focus (see descriptions of our Board committees' areas of responsibilities above) to identify, assess and mitigate risks facing the Company. The Board and its committees exercise their risk oversight function by receiving and evaluating reports from management and by making inquiries of management, as appropriate. In addition, the Board and its committees receive reports from our auditors and other consultants, and meet in executive sessions with these outside consultants. Each of our committees provides reports to the full Board, which enhances the Board's oversight of risk.

Information on Compensation Risk Assessment

Management periodically reviews our incentive compensation programs at all levels within the organization. Employee cash bonuses are based on company-wide and individual performance, and management (with respect to our non-executive employees) and our compensation committee (with respect to our executive officers) have discretion to adjust bonus payouts. Equity awards for new hires are based on the employee's position, prior experience, qualifications and the market for particular types of talent; and any additional grants are based on employee performance and retention objectives. Equity awards generally have long-term vesting requirements to ensure that recipients' focus is on our long-term success. The compensation committee reviewed our incentive compensation structure during 2019. Based on this review, the compensation committee does not believe that our compensation policies and practices, taken as a whole, create risks that are reasonably likely to have a material adverse impact on us.

| | |

16 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

2019 Non-Employee Director Compensation

The following table presents compensation information for our non-employee directors during the year ended December 31, 2019. Directors who are also our employees receive no additional compensation for service as a director. Compensation paid to Mr. Darrow is discussed in "Executive Compensation."

Name | Fees Earned ($) | Stock Awards ($)(1) | Total ($) | |||

Robert E. Buce | 75,000 | 149,995 | 224,995 | |||

Christopher W. Claus | 97,500 | 149,995 | 247,495 | |||

John Krafcik | 55,000 | 149,995 | 204,995 | |||

Erin N. Lantz | 70,000 | 149,995 | 219,995 | |||

Philip G.J. McKoy | 60,000 | 149,995 | 209,995 | |||

John W. Mendel | 72,500 | 149,995 | 222,495 | |||

Wesley A. Nichols | 75,000 | 149,995 | 224,995 | |||

Ion A. Yadigaroglu | — | 149,995 | 149,995 | |||

| | | | | | | |

The following table presents the aggregate number of stock awards and the aggregate number of option awards outstanding for each non-employee director as of December 31, 2019:

Name | Outstanding Stock Awards at December 31, 2019(1) | Outstanding Options at December 31, 2019(2) | ||

Robert E. Buce | 23,219 | 155,865 | ||

Christopher W. Claus | 23,219 | 97,976 | ||

John Krafcik | 23,219 | 662,124 | ||

Erin N. Lantz | 23,219 | 62,885 | ||

Philip G.J. McKoy | 32,147 | 28,753 | ||

John W. Mendel | 26,069 | 37,601 | ||

Wesley A. Nichols | 23,219 | 62,885 | ||

Ion A. Yadigaroglu | 23,219 | 83,812 | ||

| | | | | |

Outside Director Compensation Policy

Our Board has adopted a policy for the compensation of non-employee directors, or Outside Directors, which we refer to as our Outside Director Compensation Policy. Under the Outside Director Compensation Policy, our Outside Directors receive compensation in the form of equity under the terms of our 2014 Equity Incentive Plan, which we refer to as the 2014 Plan, as described below, and Outside Directors who are not affiliated with a

| | |

| | 17 |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

venture capital investor in the Company, or Non-Affiliated Directors, also receive cash compensation for their service.

Our compensation committee regularly reviews and evaluates the Outside Director Compensation Policy in consultation with Semler Brossy Consulting Group, LLC, or Semler Brossy, an independent compensation consulting firm it has retained as described elsewhere in this proxy statement. Semler Brossy provides the compensation committee with competitive data and analysis regarding non-employee director compensation that the compensation committee considers in reviewing our Outside Director Compensation Policy. The compensation committee endeavors to update the Outside Director Compensation Policy such that it provides reasonable compensation to our Outside Directors that is appropriately aligned with our peers and is commensurate with the services and contributions of our Outside Directors.

Initial Award. Under the Outside Director Compensation Policy, each person who first becomes an Outside Director is granted an award of RSUs with a grant date fair value of $300,000, which we refer to as an Initial Award. Each Initial Award is automatically granted on the date the recipient first becomes an Outside Director. If a director's status changes from an employee director to an Outside Director, he or she will not receive an Initial Award.

Except as set forth below, an Initial Award vests in three approximately equal annual installments over three years from the 15th day of the month during which the individual commenced service as an Outside Director, subject to continued service as a director through the applicable vesting dates.

Any RSUs under an Initial Award that are scheduled to vest on or after the date of the third annual meeting following the annual meeting at which the Initial Award is granted, in the case of an Initial Award granted at an annual meeting, or the date of the fourth annual meeting following the grant of the Initial Award, in the case of other Initial Awards, will instead vest on the day before that date.

Annual Award. On the date of each annual meeting, each Outside Director who has served on our Board for at least the preceding six months will be automatically granted an award of RSUs with a grant date fair value of $150,000, which we refer to as an Annual Award. Except as set forth below, the RSUs under an Annual Award will vest on the last day of the month that includes the 12-month anniversary of the date of grant of the Annual Award, subject to continued service as a director through the vesting date.

Any RSUs under an Annual Award that are scheduled to vest on or after the date of the following year's annual meeting will instead vest on the day before the following year's annual meeting.

Under the terms of the 2014 Plan, if the service of an Outside Director is terminated on or after a change in control, other than by a voluntary resignation, his or her restricted stock units will vest fully. Awards granted under our Outside Director Compensation Policy are granted under, and subject to the other terms and conditions of, our 2014 Plan. Our 2014 Plan provides that no Outside Director may be granted, in any fiscal year, stock-settled equity awards with a grant date fair value (determined in accordance with GAAP) of more than $750,000, with this limit increased to $1,500,000 in connection with grants awarded upon his or her initial appointment or election, or cash-settled awards with a grant date fair value of more than $750,000, increased to $1,500,000 in connection with grants awarded upon his or her initial appointment or election.

Cash Compensation. Each Non-Affiliated Director receives an annual retainer of $55,000 in cash for serving on our Board, or the Annual Fee. In addition to the Annual Fee, a Non-Affiliated Director who serves as chairman of the Board or lead independent director, as applicable, will be entitled to an additional annual retainer of $25,000 in cash.

| | |

18 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

Non-Affiliated Directors serving as chairperson and members of the committees of our Board are entitled to the annual cash retainers set forth below.

Board Committee | Chairperson Fee ($) | Member Fee ($) | ||

Audit Committee | 20,000 | 10,000 | ||

Compensation and Workforce Committee | 15,000 | 7,500 | ||

Executive Committee | — | — | ||

Nominating and Corporate Governance Committee | 10,000 | 5,000 | ||

| | | | | |

All cash retainers under the Outside Director Compensation Policy will be paid in quarterly installments to each Non-Affiliated Director that served in the relevant capacity at any point during the immediately preceding fiscal quarter no later than 30 days following the end of such preceding fiscal quarter.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

The following table sets forth information regarding beneficial ownership of our common stock as of February 29, 2020 by:

We have determined beneficial ownership in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares that they beneficially own, subject to community property laws where applicable. In computing the number of shares of our common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of our common stock subject to options or RSUs held by that person that are currently exercisable or exercisable within 60 days of February 29, 2020. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. We have based percentage ownership of our common stock on 107,083,724 shares of our common stock outstanding as

| | |

| | 19 |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

of February 29, 2020. Unless otherwise indicated, the address of each beneficial owner listed on the table below is c/o TrueCar, Inc., 120 Broadway, Suite 200, Santa Monica, California 90401.

Name of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Shares Outstanding | ||

5% Stockholders: | ||||

Caledonia (Private) Investments Pty Limited(1) | 18,626,859 | 17.4 | ||

PAR Capital(2) | 10,299,504 | 9.6 | ||

United Services Automobile Association(3) | 9,042,992 | 8.4 | ||

Vanguard Group(4) | 8,984,300 | 8.4 | ||

BlackRock, Inc.(5) | 8,125,927 | 7.6 | ||

Pacific Sequoia Holdings LLC(6) | 6,363,569 | 5.9 | ||

Named Executive Officers and Directors: | ||||

Michael D. Darrow(7) | 338,245 | * | ||

Victor A. "Chip" Perry(8) | 3,164,908 | 2.9 | ||

Noel B. Watson(9) | 56,510 | * | ||

Charles C. Thomas(10) | 52,645 | * | ||

John E. Pierantoni(11) | 289,527 | * | ||

Simon E. Smith(12) | 212,767 | * | ||

Jeffrey J. Swart(13) | 704,550 | * | ||

Robert T. "Tommy" McClung | — | — | ||

Neeraj Gunsagar(14) | 50,000 | * | ||

Robert E. Buce(15) | 466,506 | * | ||

Christopher W. Claus(16) | 204,123 | * | ||

John Krafcik(17) | 711,851 | * | ||

Erin N. Lantz(18) | 91,213 | * | ||

Philip G.J. McKoy(19) | 18,842 | * | ||

John W. Mendel(20) | 51,923 | * | ||

Wesley A. Nichols(21) | 91,213 | * | ||

Ion A. Yadigaroglu(22) | 1,606,876 | 1.5 | ||

All current executive officers and directors as a group (12 persons)(23) | 4,554,619 | 4.2 | ||

| | | | | |

| | |

20 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

| | |

| | 21 |

| | |

2020 ANNUALPROXY STATEMENT | | Executive Officers, Directors andCorporate Governance |

| | |

22 | | |

| | |

2020 ANNUALPROXY STATEMENT | | |

Compensation Discussion and Analysis |

| Table of Contents | Page | | |||

| Introduction | 23 | | |||

| Named Executive Officers (NEOs) | 23 | | |||

| Executive Summary | 24 | | |||

| Compensation Philosophy and Design Strategies | 27 | | |||

| Establishing Compensation Levels | 27 | | |||

| Role of the Compensation Committee | 27 | | |||

| Role of Management | 28 | | |||

| Role of the Compensation Consultant | 28 | | |||

| Use of Competitive Market Data | 28 | | |||

| Compensation Elements and 2019 Pay Decisions | 30 | | |||

| Base Salary | 30 | | |||

| Annual Cash Incentive Program | 31 | | |||

| Long-Term Incentive Opportunities | 35 | | |||

| Coronavirus Response Preview | 37 | | |||

| Other Governance Items | 38 | | |||

| Employment Agreements and Severance and Changes in Control Protections | 38 | | |||

| Separation and Consulting Agreements | 38 | | |||

| Hedging Policies | 39 | | |||

| Stock Ownership Guidelines | 39 | | |||

| Recoupment of Incentive Compensation, or | 39 | | |||

| Accounting Treatment and Deductibility of | 39 | | |||

| Equity Grant Timing and Equity Plan | 40 | | |||

| Taxation of "Parachute" Payments | 40 | | |||

| | | | | | | |

Our named executive officers, or NEOs, for 2019 consist of our current and former principal officers, our current and former principal financial officers, our next two most highly compensated executive officers and two former executive officers who would have been among our three most highly compensated executive officers had they remained executive officers as of December 31, 2019.

The NEOs among our currently serving executives are:

The NEOs among our former executives are:

We experienced considerable change in our leadership during 2019. In May 2019, Mr. Perry, then our President and CEO, retired from his positions with us, and Mr. Darrow, who was then serving as our EVP of Partner and OEM Development, became our Interim President and CEO. In March 2020, the Board appointed Mr. Darrow as

| | |

| | 23 |

| | |

2020 ANNUALPROXY STATEMENT | | Compensation Discussion and Analysis |

our permanent President and CEO and a member of the Board. References in this Compensation Discussion and Analysis to our CEO refer to Mr. Perry before May 31, 2019 and to Mr. Darrow on and after May 31, 2019.

Mr. Pierantoni, our Interim CFO and CAO, resigned from his positions with us in April 2019 and Mr. Thomas, our Vice President and Controller, served as principal financial officer and principal accounting officer following Mr. Pierantoni's departure until Mr. Watson joined us in June 2019. Mr. Thomas continues to serve in a non-executive officer capacity as our Vice President and Controller. Also in June 2019, Mr. Smith was promoted from SVP of Dealer Development to our EVP of Dealer Sales & Service, and each of Mr. Gunsagar and Mr. McClung ceased service with us.

EXECUTIVE SUMMARY

Our full-year financial and market performance outcomes were below expectations; however, after a mid-year leadership transition, we executed several key strategic initiatives in the second half of the year and in early 2020.

Additionally, although USAA's sudden and unexpected decision in February 2020 to terminate our partnership substantially complicates our efforts to return us to growth, we were able to negotiate a transition services agreement with USAA that gives us time to capitalize on these successful initiatives and chart a course of financial independence from USAA. Nevertheless, despite these achievements, a variety of operational challenges prevented us from achieving the external financial guidance we provided at the beginning of 2019, and USAA's decision to terminate our partnership is likely to weigh on our performance in 2020 and beyond. Below is a summary of our key results in 2019:

| | |

24 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Compensation Discussion and Analysis |

Annual target compensation decisions made in early 2019 align with our pay for performance philosophy after mixed company performance in 2018 and reflect feedback from our stockholder outreach efforts in late 2018 and early 2019.

In mid-2019, we underwent a substantial leadership transition and the compensation committee took the following actions relating to the second half of the year that we believe were in the best interests of us and our stockholders:

| | |

| | 25 |

| | |

2020 ANNUALPROXY STATEMENT | | Compensation Discussion and Analysis |

We are committed to responsible executive compensation and governance practices.

The following table summarizes what we do and what we don't do in our executive compensation practices to highlight both the responsible practices we have implemented and the practices we have avoided to best serve our stockholders' long-term interests:

| What We Do | ||||||

Pay-for-performance (75% of former CEO target pay was tied to performance through equity and cash incentives) | ||||||

Include multi-year performance-vesting equity awards | ||||||

Maintain robust stock ownership guidelines and a clawback policy for performance-based compensation | ||||||

Retain an independent compensation consultant who reports directly to the compensation committee | ||||||

Solicit advisory votes on our executive compensation program annually and engage in stockholder outreach | ||||||

| | | | | | | |

| What We Don't Do | ||||||

No automatic "single trigger" cash or vesting acceleration upon a change in control | ||||||

No option repricings or exchanges without stockholder approval | ||||||

No hedging or pledging by executive officers or directors | ||||||

No tax gross ups on severance or change in control benefits | ||||||

No excessive executive perquisites | ||||||

| | | | | | | |

Say-on-Pay Vote and Stockholder Engagement

In late 2018 and early 2019, we reached out to more than 20 of our largest stockholders who collectively owned more than 93% of our outstanding shares as of year-end 2018 and met with each stockholder that expressed an interest in speaking with us. We made several changes to our compensation program in response to stockholder feedback on the design of our compensation program, including introducing performance-vesting equity awards, eliminating aspirational companies from our peer group and expanding our peer group disclosure, implementing a clawback policy and adopting stock ownership guidelines, revising our cash incentive program and providing more transparency in our disclosure of our performance goals.

In 2019, our say-on-pay proposal was supported by approximately 99% of the total votes cast, an approximate 47% increase over our 2018 say-on-pay vote. We believe this increase in support was, in part, the result of the stockholder outreach and changes we made to our executive compensation program and related disclosures. We value the views of our stockholders and have continued our stockholder outreach. Our compensation committee will monitor and continue to evaluate our executive compensation program going forward in light of our stockholders' views and our transforming business needs. Our compensation committee expects to continue to consider the outcome of our say-on-pay votes and our stockholders' views when making future compensation decisions for our executive officers.

| | |

26 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Compensation Discussion and Analysis |

COMPENSATION PHILOSOPHY AND DESIGN STRATEGIES

The compensation committee works to design a compensation program for our NEOs to facilitate the attraction and retention of key executive talent in a highly competitive technology job market, align employees' interests with those of stockholders and motivate the creation of sustainable growth in enterprise value. We recognize that our employees are our greatest asset and drive our operational results and the creation of sustainable growth. As such, we strive to provide NEO total pay packages that:

In designing our NEO compensation packages, the compensation committee reviews the competitive market data, without targeting any specific market percentile, and also takes into consideration the factors described above, as well as retention concerns with respect to key talent, the motivational impact of pay levels and mix in driving toward company goals and the creation of stockholder value, the input of our CEO (as to NEOs other than himself) and the overall cost of the compensation package.

ESTABLISHING COMPENSATION LEVELS

Role of the Compensation Committee

The compensation committee oversees our executive compensation and other compensation and benefit programs, serves as the administrator of our equity compensation plans and reviews, formulates and determines the design and amount of compensation for our executive officers, including the NEOs. Compensation decisions for our CEO are made by the compensation committee in executive session without our CEO present.

At the beginning of each year, the compensation committee reviews our executive compensation program, including incentive compensation plans and arrangements, assesses the quality, appropriateness and effectiveness of the program for its intended purposes and makes modifications to existing plans and arrangements or adopts new plans or arrangements as it deems necessary. The compensation committee also annually reviews our executive compensation strategy to ensure it is appropriately aligned with our business strategy and achieving our desired objectives. Further, the compensation committee reviews market trends and changes in competitive compensation practices, as further described below. Based on its review and assessment, the compensation committee, from time to time, makes changes in our executive compensation program and also recommends changes to the remuneration of members of our Board.

During 2019, as detailed above, we underwent numerous changes in our executive team, with the separation of four executive officers, including our former President and CEO and our former Interim CFO, the hiring of our current CFO and the promotion of two additional executives, including our current President and CEO. In each of

| | |

| | 27 |

| | |

2020 ANNUALPROXY STATEMENT | | Compensation Discussion and Analysis |

these cases, the compensation committee reviewed and reassessed elements of our executive compensation program and took actions designed to fit the needs of our business.

Role of Management

Our CEO works closely with the compensation committee in determining the compensation of our NEOs, and makes recommendations to the compensation committee as described below.

At the beginning of each year, our CEO reviews the performance of our other NEOs for the previous year and then shares these evaluations with, and makes recommendations to, the compensation committee for each element of compensation. These recommendations concern the base salary, performance-based cash incentives and long-term incentive compensation for each of our NEOs, other than himself, based on our results, the individual's contribution to these results and his individual performance. The compensation committee then reviews these recommendations and considers the other factors described in this proxy statement and makes decisions as to the target total direct compensation of each NEO, as well as the mixture of elements that will comprise each NEO's compensation.

While the compensation committee considers our CEO's recommendations, it only uses these recommendations as one of several factors in making its decisions on the compensation of our NEOs. In all cases, the final decisions on NEO compensation matters are made by the compensation committee. Moreover, no NEO participates in the determination of the amounts or elements of his own compensation.

At the request of the compensation committee, our CEO typically attends a portion of each compensation committee meeting in which executive compensation is discussed, including meetings at which the compensation committee's compensation consultant is present.

Role of the Compensation Consultant

Under its charter, the compensation committee has the authority to retain the services of one or more executive compensation advisers, including compensation consultants, legal counsel, accounting and other advisers, to assist in the creation of our compensation plans and arrangements and related policies and practices, as it determines necessary in its sole discretion. The compensation committee makes all determinations regarding the engagement, fees and services of these external advisers, and any external adviser reports directly to the compensation committee.

The compensation committee continued to engage Semler Brossy in 2019 to assess the competitiveness of executive compensation programs and practices to assist the compensation committee in making 2019 executive compensation decisions. During 2019, Semler Brossy also assisted in the stockholder outreach efforts, the design of the annual incentive and long-term incentive programs for 2020 and the structuring of our new-hire and promotion compensation decisions associated with our executive transition in mid-2019. The compensation committee assessed the independence of Semler Brossy, most recently in March 2020, and concluded that it was independent of management and that its work had not raised any conflict of interest.

Use of Competitive Market Data

As part of its deliberations, the compensation committee considers competitive market data and related analysis on executive compensation levels and practices that is provided by Semler Brossy. Our compensation committee reviews and considers this market data, but did not engage in any benchmarking or targeting of any specific levels of pay for 2019 compensation decisions.

In late 2018, Semler Brossy worked with the compensation committee to develop a comparator group of "peer" companies for a competitive assessment of the pay programs. The companies included in the peer group were selected based on a set of financial and industry/business parameters to best reflect a group of companies most similar to us.

| | |

28 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Compensation Discussion and Analysis |

We used initial quantitative screens primarily as guides to inform our decision-making process in reviewing current or potential peers. The screening process for 2019 used the same parameters as 2018, focusing specifically on companies within defined ranges for revenue and market capitalization, the technology industry and additional qualitative parameters (see more below).

Specifically, the criteria the compensation committee used to assess our 2019 peer group are summarized below.

In late 2018, in preparation for 2019 pay decisions, we removed two companies from our 2018 peer group whose revenue and market capitalization had grown to be much larger than ours by October 2018 (Zillow had approximately $1.2 billion in revenues and $8.1 billion market capitalization and CoStar Group had approximately $1.2 billion in revenues and $13.2 billion market capitalization at the time of our assessment) and removed another company which had been acquired and therefore was no longer public (Bazaarvoice). We added three companies to our peer group (Eventbrite, eHealth and EverQuote) that had under $300 million in revenues, less than $2.5 billion in market value and also met the additional industry and qualitative criteria above at the time of our assessment. The compensation committee made these changes to reduce the overall size of our peer group by revenue and market value to bring it more in line with TrueCar. The resulting peer group for 2019 consisted of the following 17 companies:

| | | |

| GrubHub | CarGurus | |

| Yelp | Quotient Technology | |

| LendingTree | Eventbrite | |

| Cars.com | Care.com | |

| Shutterstock | eHealth | |

| Etsy | XO Group | |

| Redfin | EverQuote | |

| QuinStreet | ||

| | | |

The compensation committee also reviewed market data from the Radford Technology survey for companies that met the same size and scale parameters described above for our peer group, were in Radford's "Software Products/Services" and "Internet/E-Commerce/Online Community" industries, had similar market valuation multiples (e.g., market cap-to-revenue multiples within one-third to three times ours) and excluded companies with materially different business models (e.g., semi-conductors, IT services, communications equipment, telecommunication services). The compensation committee used the survey data to complement the available information from the peer companies described above. Our compensation committee primarily used data from our peer group and used the data from the Radford survey only when there was a lack of sufficient comparative data available from our peer group. The data from our peer group and the data from the refined Radford Technology survey are collectively referred to in this proxy statement as market data.

In late 2019, the compensation committee again reviewed our peer group for purposes of assisting with pay decisions for 2020, taking into consideration our revised growth trajectory compared to the overall size and growth rates among our peers. After that review, the compensation committee again removed three larger peers by revenue or market value (ANGI Homeservices, GrubHub, and Trade Desk), removed one acquired peer (XO Group) and added five smaller peers (The RealReal, Cardlytics, The Rubicon Project, Leaf Group, and TechTarget). The resulting changes positioned TrueCar at median on company revenues for the new peer group going forward.

| | |

| | 29 |

| | |

2020 ANNUALPROXY STATEMENT | | Compensation Elements and 2019 Pay Decisions |

COMPENSATION ELEMENTS AND 2019 PAY DECISIONS

Our 2019 NEO compensation program was comprised primarily of a base salary, a cash incentive opportunity, and long-term incentives. This program emphasized "at-risk" pay (both cash incentives and equity incentives) while providing competitive packages to retain and motivate our key talent.

Base Salary

A base salary is a critical part of our NEO compensation program and establishes financial security for each NEO. We provide base salaries that are market-calibrated, equitable and a relatively small portion of our total compensation opportunities. Generally, we establish base salaries after taking into account an NEO's position, qualifications, experience, market practice and the base salaries of our other executives. Internal base salary parity is an important consideration for NEOs other than our CEO, as it creates a team-first culture. This philosophy promotes a team approach in problem solving and encourages focus on driving stockholder value in ways that will be rewarded through "at risk" pay. Thereafter, the compensation committee reviews the base salaries of our NEOs from time to time, as well as at the time of a promotion or other significant change in responsibility, and makes adjustments to base salaries as determined necessary or appropriate.

In February 2019, the compensation committee reviewed the base salaries of our then-serving NEOs, taking into account the considerations described above and market data. As a result, the compensation committee elected not to make any increases to base salaries at that time, determining that the base salaries continued to be market competitive and appropriately reflect our NEOs' past and expected future contribution levels. In late 2018, effective on January 1, 2019, the compensation committee increased the base salary of Mr. Swart, who at that time was not an NEO, from $375,000 to $400,000 to reflect his contributions during the year and the further the compensation committee's goal of internal pay equity. Additionally, the compensation committee approved an increase in Mr. Smith's pay from $355,000 to $400,000 in connection with his promotion to EVP of Dealer Sales & Service.

In May 2019, we hired Mr. Watson as our new CFO and CAO and the compensation committee approved a base salary of $450,000. Also in May 2019, following our former CEO's retirement, Mr. Darrow was promoted to Interim President and CEO. His annual base salary remained unchanged at $400,000, but the compensation committee approved a monthly stipend of $20,000 in addition to his base salary to recognize the fact that he assumed additional responsibilities while still maintaining his original responsibilities as EVP of OEM and Partner Development for TrueCar and President of ALG. Mr. Darrow's aggregate salary and stipend resulted in annualized non-bonus cash compensation of $640,000, representing a 20% decrease from Mr. Perry's base salary. The compensation committee, after consulting Semler Brossy and market data, determined that these amounts were appropriate compensation for Messrs. Darrow and Watson for their positions.

| | |

30 | | |

| | |

2020 ANNUALPROXY STATEMENT | | Compensation Elements and 2019 Pay Decisions |

The table below illustrates the annual base salaries of our executives as of year end 2018 and 2019. In several cases, the executive did not receive the full amount due to termination of his employment, promotion or new hire. (See the "2019 Summary Compensation Table" for the actual salary paid to each NEO in 2019.)

Executive | 2018 Base Salary | 2019 Base Salary | % Change | |||

Michael D. Darrow(1) | $400,000 | $400,000 | —% | |||

Victor A. "Chip" Perry(2) | $800,000 | $800,000 | —% | |||

Noel B. Watson(3) | N/A | $450,000 | N/A | |||