Safe Harbor 2 This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of First Western Financial, Inc.’s (“First Western”) management with respect to, among other things, future events and First Western’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “position,” “project,” “future” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about First Western’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond First Western’s control. Accordingly, First Western cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although First Western believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. The following risks and uncertainties, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward- looking statements: integration risks in connection with acquisitions; the risk of geographic concentration in Colorado, Arizona, Wyoming, California, and Montana; the risk of changes in the economy affecting real estate values and liquidity; the risk in our ability to continue to originate residential real estate loans and sell such loans; risks specific to commercial loans and borrowers; the risk of claims and litigation pertaining to our fiduciary responsibilities; the risk of competition for investment managers and professionals; the risk of fluctuation in the value of our investment securities; the risk of changes in interest rates; and the risk of the adequacy of our allowance for credit losses and the risk in our ability to maintain a strong core deposit base or other low-cost funding sources. Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 15, 2023 and other documents we file with the SEC from time to time. All subsequent written and oral forward- looking statements attributable to First Western or persons acting on First Western’s behalf are expressly qualified in their entirety by this paragraph. Forward-looking statements speak only as of the date of this presentation. First Western undertakes no obligation to publicly update or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise (except as required by law). Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and the sources from which it has been obtained are reliable; however, the Company cannot guaranty the accuracy of such information and has not independently verified such information. This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. Our common stock is not a deposit or savings account. Our common stock is not insured by the Federal Deposit Insurance Corporation or any governmental agency or instrumentality. This presentation is not an offer to sell any securities and it is not soliciting an offer to buy any securities in any state or jurisdiction where the offer or sale is not permitted. Neither the SEC nor any state securities commission has approved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof.

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions Overview of 3Q23 3Q23 Earnings • Net revenue increased $2.0 million, or 9.6%, to $22.5 million in Q3 2023, compared to $20.6 million in Q2 2023 • Net income available to common shareholders of $3.1 million, or $0.32 per diluted share • Pre-tax, pre-provision net income of $4.6 million(1), an increase of 17% from $3.9 million(1) in the prior quarter • Strong earnings and disciplined balance sheet management resulted in further increase in tangible book value per share and increase in all capital ratios Prudent Balance Sheet Growth • Deposit growth exceeded loan growth in the third quarter • 7.5% annualized deposit growth • 5.6% annualized loan growth while maintaining conservative underwriting criteria and disciplined pricing Strong Execution on Key Priorities • Disciplined expense control resulted in operating expenses coming in at low end of targeted range • Increased focus on deposit gathering reduced loan-to-deposit ratio • Conservative underwriting and proactive portfolio management continues to result in immaterial credit losses • Increase in NPAs driven by one relationship consisting of $42 million in loans that are collateralized with minimal loss exposure (1) See Non-GAAP reconciliation 3

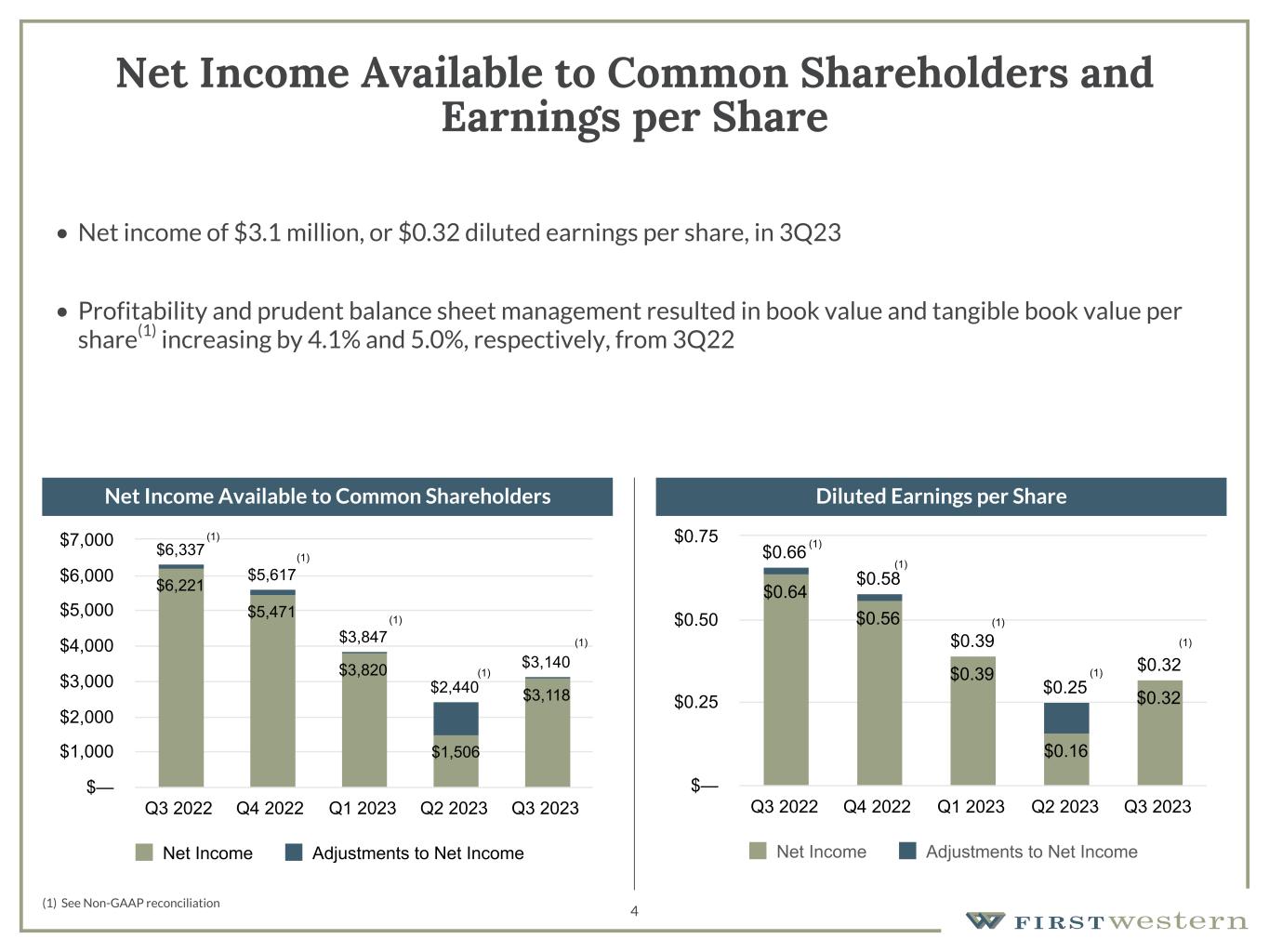

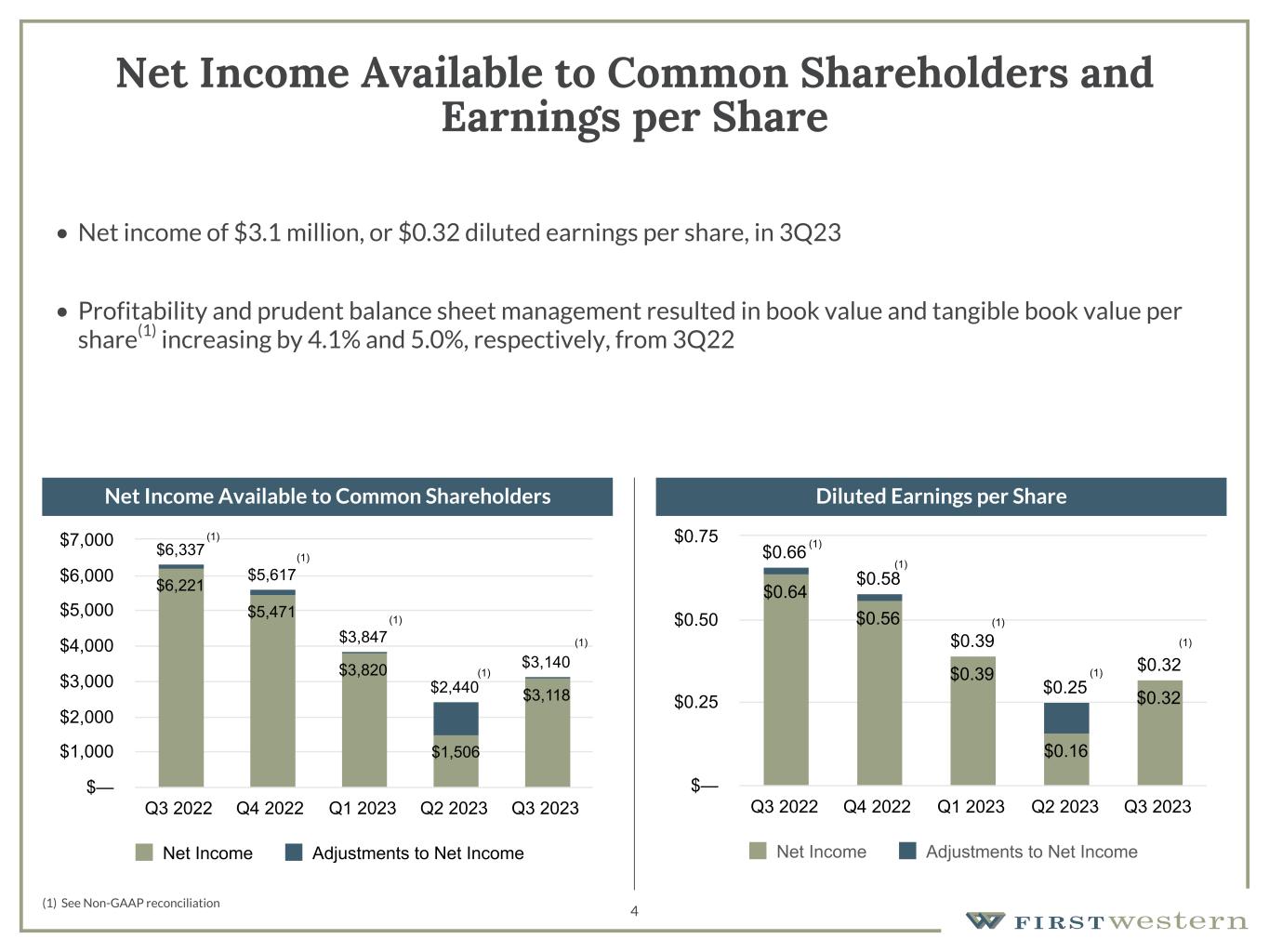

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 4 Net Income Available to Common Shareholders and Earnings per Share • Net income of $3.1 million, or $0.32 diluted earnings per share, in 3Q23 • Profitability and prudent balance sheet management resulted in book value and tangible book value per share(1) increasing by 4.1% and 5.0%, respectively, from 3Q22 Net Income Available to Common Shareholders Diluted Earnings per Share (1) See Non-GAAP reconciliation $6,337 $5,617 $3,847 $2,440 $3,140 $6,221 $5,471 $3,820 $1,506 $3,118 Net Income Adjustments to Net Income Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $0.66 $0.58 $0.39 $0.25 $0.32 $0.64 $0.56 $0.39 $0.16 $0.32 Net Income Adjustments to Net Income Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $0.25 $0.50 $0.75(1) (1) (1) (1) (1) (1) (1) (1) (1) (1)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 5 Loan Portfolio • Total loans held for investment increased $34.6 million from prior quarter • Growth driven by commercial and industrial loans, residential mortgage loans, and draws on existing construction lines, partially offset by a decrease in CRE loans due to an increase in payoffs • New loan production of more than $100 million represents largest quarter of new loan production of the year • Average rate on new loan production increased 51 bps to 7.92% compared to prior quarter 3Q 2022 2Q 2023 3Q 2023 Cash, Securities and Other $ 154,748 $ 150,679 $ 148,669 Consumer and Other 27,781 21,866 23,975 Construction and Development 228,060 313,227 349,436 1-4 Family Residential 822,796 878,670 913,085 Non-Owner Occupied CRE 527,836 561,880 527,377 Owner Occupied CRE 220,075 218,651 208,341 Commercial and Industrial 350,954 338,679 349,515 Total $ 2,332,250 $ 2,483,652 $ 2,520,398 Loans accounted for at fair value(2) 22,648 18,274 16,105 Total Loans HFI $ 2,354,898 $ 2,501,926 $ 2,536,503 Loans held-for-sale (HFS) 12,743 19,746 12,105 Total Loans $ 2,367,641 $ 2,521,672 $ 2,548,608 (1) Represents unpaid principal balance. Excludes deferred (fees) costs, and amortized premium/ (unaccreted discount). (2) Excludes fair value adjustments on loans accounted for under the fair value option. ($ in thousands, as of quarter end) Loan Portfolio Composition(1) Loan Portfolio Details Loan Production & Loan Payoffs Total Loans(1) $2,253 $2,445 $2,487 $2,487 2,515 $2,522 $2,549 3Q22 4Q22 1Q23 2Q23 3Q23 2Q23 3Q23 $— $400 $800 $1,200 $1,600 $2,000 $2,400 $2,800 $3,200 Average Period End

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 6 Total Deposits • Total deposits increased by $44.6 million in 3Q23 • Success in new business development, with $26 million in new deposit relationships added in 3Q23 • Continued migration of noninterest-bearing deposits into interest-bearing categories as clients seek higher rates for their excess liquidity 3Q 2022 2Q 2023 3Q 2023 Money market deposit accounts $ 1,010,846 $ 1,297,732 $ 1,388,726 Time deposits 186,680 376,147 373,459 NOW 277,225 168,537 164,000 Savings accounts 30,641 18,737 17,503 Noninterest-bearing accounts 662,055 514,241 476,308 Total Deposits $ 2,167,447 $ 2,375,394 $ 2,419,996 Deposit Portfolio Composition Total Deposits $2,154 $2,242 $2,352 $2,375 $2,359 $2,375 $2,420 3Q22 4Q22 1Q23 2Q23 3Q23 2Q23 3Q23 $— $500 $1,000 $1,500 $2,000 $2,500 $3,000 Average Period End

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 7 Trust and Investment Management • Total assets under management decreased $108.2 million from June 30, 2023 to $6.40 billion as of September 30, 2023 • Primarily attributable to a decrease in market values throughout the quarter resulting in a decrease in the value of assets under management balances (in millions, as of quarter end) Total Assets Under Management $5,918 $6,107 $6,382 $6,504 $6,396 Investment Agency Managed Trust 401(k)/Retirement Directed Trust Custody Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions (1) See Non-GAAP reconciliation Gross Revenue 3Q23 Gross Revenue(1) Gross Revenue(1) 8 $29.3 $29.0 $26.1 $24.8 $23.1 Wealth Management Mortgage Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 • Gross revenue(1) declined 6.6% from prior quarter • Decline in net interest income, partially offset by an increase in noninterest income • Non-interest income mix increased to 26.7% from 17.7% in prior quarter

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 9 Net Interest Income and Net Interest Margin • Net interest income decreased to $16.8 million, or 9.1%, from $18.4 million in 2Q23 • Net interest income decreased from 2Q23 due to an increase in average cost of deposits • Net interest margin decreased 27 bps to 2.46%, driven by the increase in interest bearing deposit costs ◦ 20 bps of the 27 bps quarterly change directly impacted by the addition of $45.9 million of non- performing assets • Pressure on net interest margin expected to moderate in 4Q23 (in thousands) (1) See Non-GAAP reconciliation Net Interest Income Net Interest Margin $23,062 $21,842 $19,560 $18,435 $16,766 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $5,000 $10,000 $15,000 $20,000 $25,000

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 10 Non-Interest Income • Non-interest income increased 54% from prior quarter, primarily due to impacts in 2Q23: ◦ $1.2 million impairment to carrying value of contingent consideration assets in 2Q23 ◦ $1.1 million of losses on loans accounted for under fair value option in 2Q23 vs. $0.3 million of losses in 3Q23 • Trust and investment management fees increased 5.3% from prior quarter due to an increase in fee structure implemented during 3Q23 • Net gain on mortgage loans decreased slightly to $0.7 million as higher rates continue to impact loan demand (in thousands) Total Non-Interest Income Trust and Investment Management Fees $6,189 $6,561 $5,819 $3,962 $6,099 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $(2,000) $— $2,000 $4,000 $6,000 $8,000 $4,639 $4,358 $4,635 $4,602 $4,846 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 (in thousands)

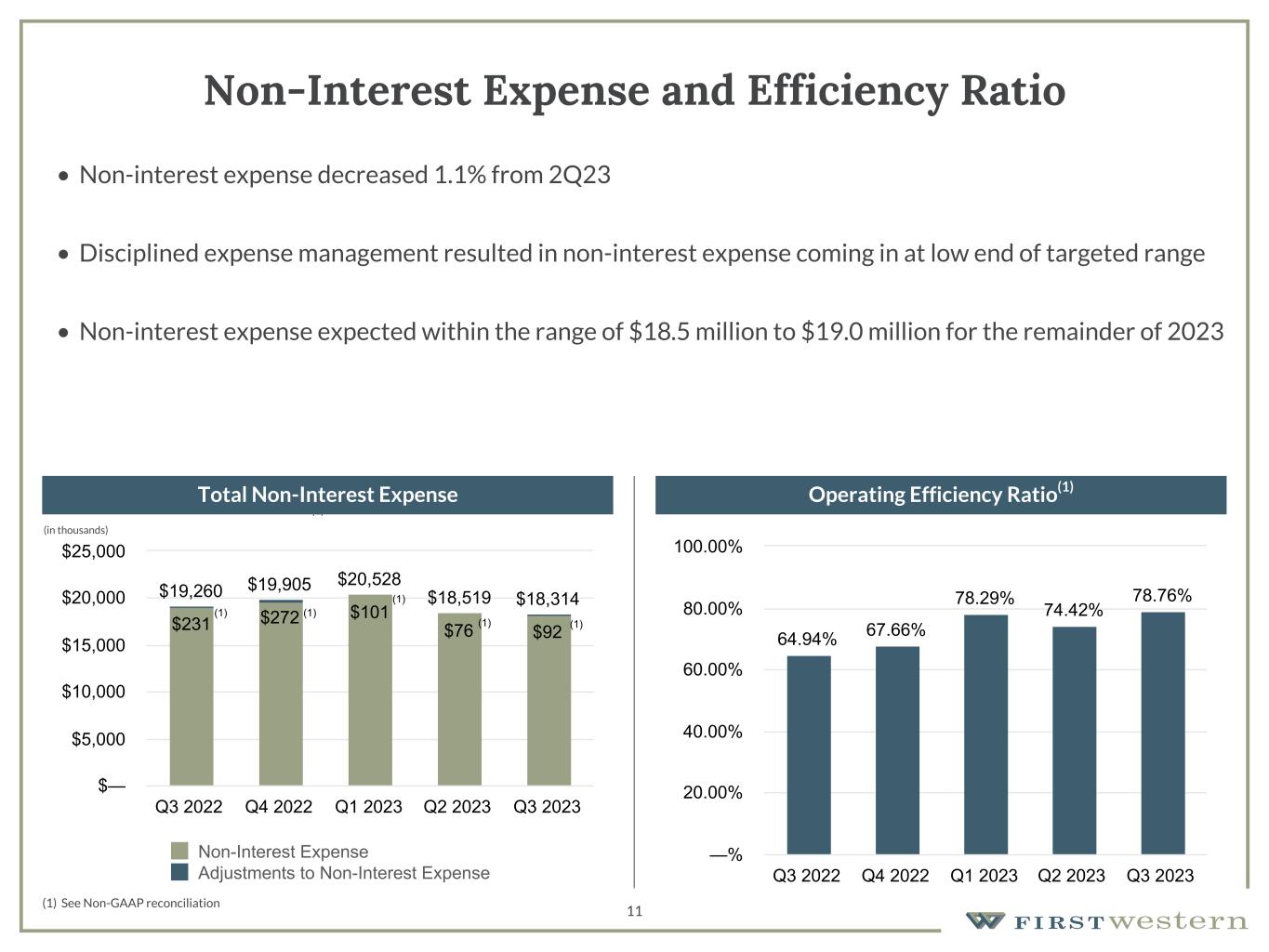

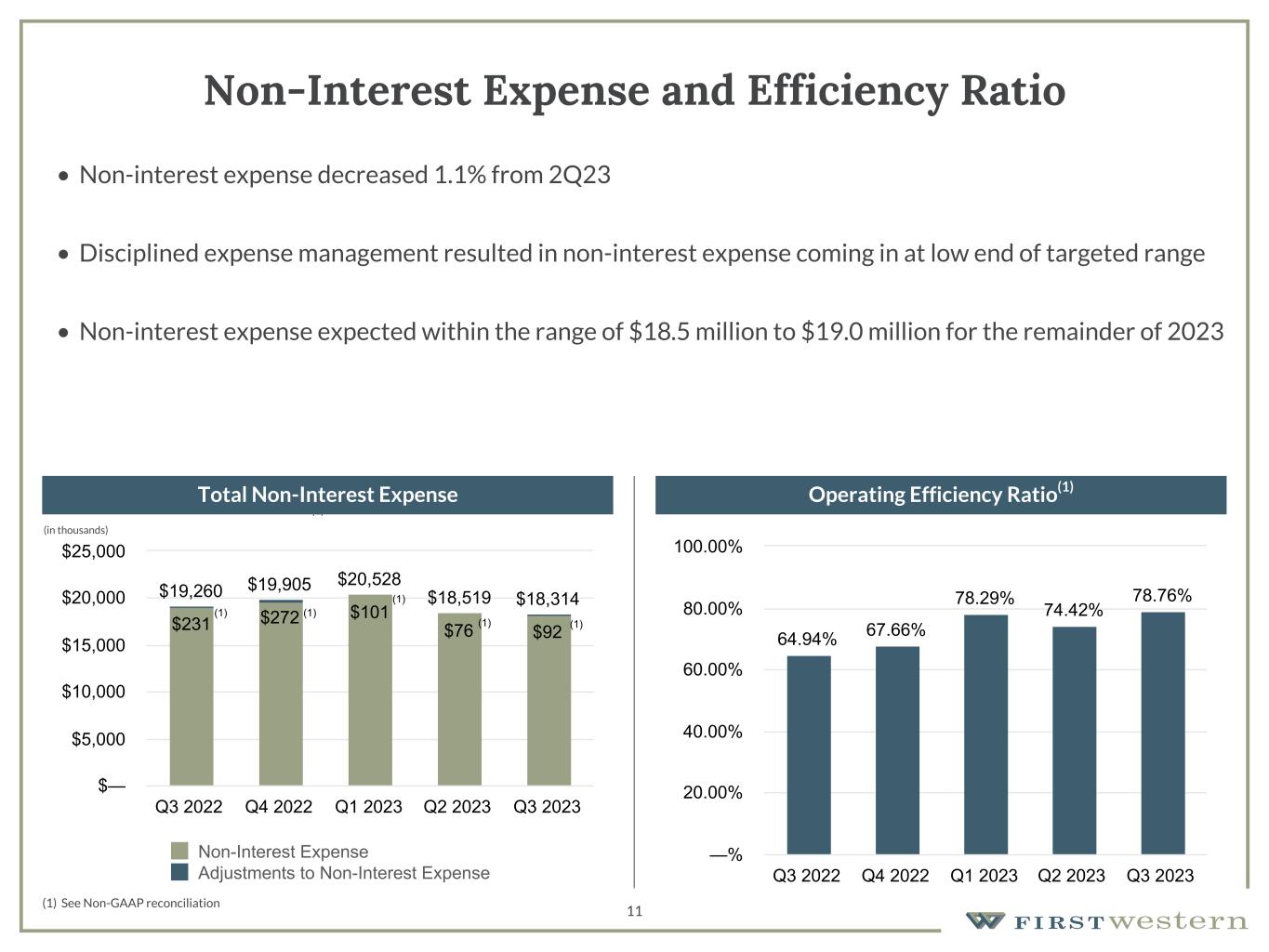

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 11 Non-Interest Expense and Efficiency Ratio • Non-interest expense decreased 1.1% from 2Q23 • Disciplined expense management resulted in non-interest expense coming in at low end of targeted range • Non-interest expense expected within the range of $18.5 million to $19.0 million for the remainder of 2023 (1) (1) See Non-GAAP reconciliation Total Non-Interest Expense Operating Efficiency Ratio(1) (in thousands) (1) (1) (1) (1) $19,260 $19,905 $20,528 $18,519 $18,314 $231 $272 $101 $76 $92 Non-Interest Expense Adjustments to Non-Interest Expense Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 $— $5,000 $10,000 $15,000 $20,000 $25,000 64.94% 67.66% 78.29% 74.42% 78.76% Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 —% 20.00% 40.00% 60.00% 80.00% 100.00% (1) (1) (1) (1) (1)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 12 Asset Quality • NPAs increased $45.9 million primarily due to four additional loans, under one relationship, moving to non-accrual during 3Q23 • New additions to NPAs are primarily collateralized with real estate assets in attractive markets and did not require an allowance on individually analyzed loans • $0.3 million provision for credit losses • ACL/Adjusted Total Loans(1) increased to 0.92% in 3Q23 from 0.89% in 2Q23 • Continue to experience immaterial amount of credit losses Non-Performing Assets/Total Assets Net Charge-Offs/Average Loans (1) Adjusted Total Loans – Total Loans minus PPP loans and loans accounted for under fair value option; see non-GAAP reconciliation 0.14% 0.43% 0.42% 0.36% 1.87% Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 —% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 —% 0.20% 0.40% 0.60% 0.80% 1.00%

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 13 Consistent Value Creation TBV/Share(1) Up 144% Since July 2018 IPO Consistent increases in tangible book value per share driven by: • Organic growth that has increased operating leverage • Accretive acquisitions that have been well priced and smoothly integrated to realize all projected cost savings • Conservative underwriting criteria that has resulted in extremely low level of losses in the portfolio throughout the history of the company • Prudent asset/liability management including not investing excess liquidity accumulated during the pandemic in low-yielding bonds

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 14 Near-Term Outlook • Prudent risk management will remain top priority while economic uncertainty remains, which will impact level of profitability in short term • Continued focus on executing well on the areas that we can control • Balance sheet management • Attracting new clients with particular focus on core deposit relationships and Trust and Investment Management assets • Providing exceptional service to existing clients • Tightly managing expenses • While maintaining a conservative approach to operating in the current environment, investments continue to be made in areas that will further enhance business development capabilities including first full office in Bozeman market • By balancing near-term conservative approach with continued long-term investments, First Western is well positioned to continue capitalizing on our attractive markets to consistently add new clients, realize more operating leverage as we increase scale, generate profitable growth, and further enhance the value of our franchise

Appendix 15

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 16 Capital and Liquidity Overview Liquidity Funding Sources (as of 9/30/23) (1) See Non-GAAP reconciliation (2) Based on internal policy guidelines Consolidated Capital Ratios (as of 9/30/23) Tangible Common Equity / TBV per Share(1) (in thousands) Liquidity Reserves: Total Available Cash $269,805 Unpledged Investment Securities 21,264 Borrowed Funds: Secured: FHLB Available 624,762 FRB Available 14,873 Other: Brokered Remaining Capacity 152,841(2) Unsecured: Credit Lines 29,000 Total Liquidity Funding Sources $1,112,545 Loan to Deposit Ratio 104.6 % 9.32% 9.32% 12.45% 7.96% Tier 1 Capital to Risk- Weighted Assets CET1 to Risk- Weighted Assets Total Capital to Risk- Weighted Assets Tier 1 Capital to Average Assets —% 5.00% 10.00% 15.00%

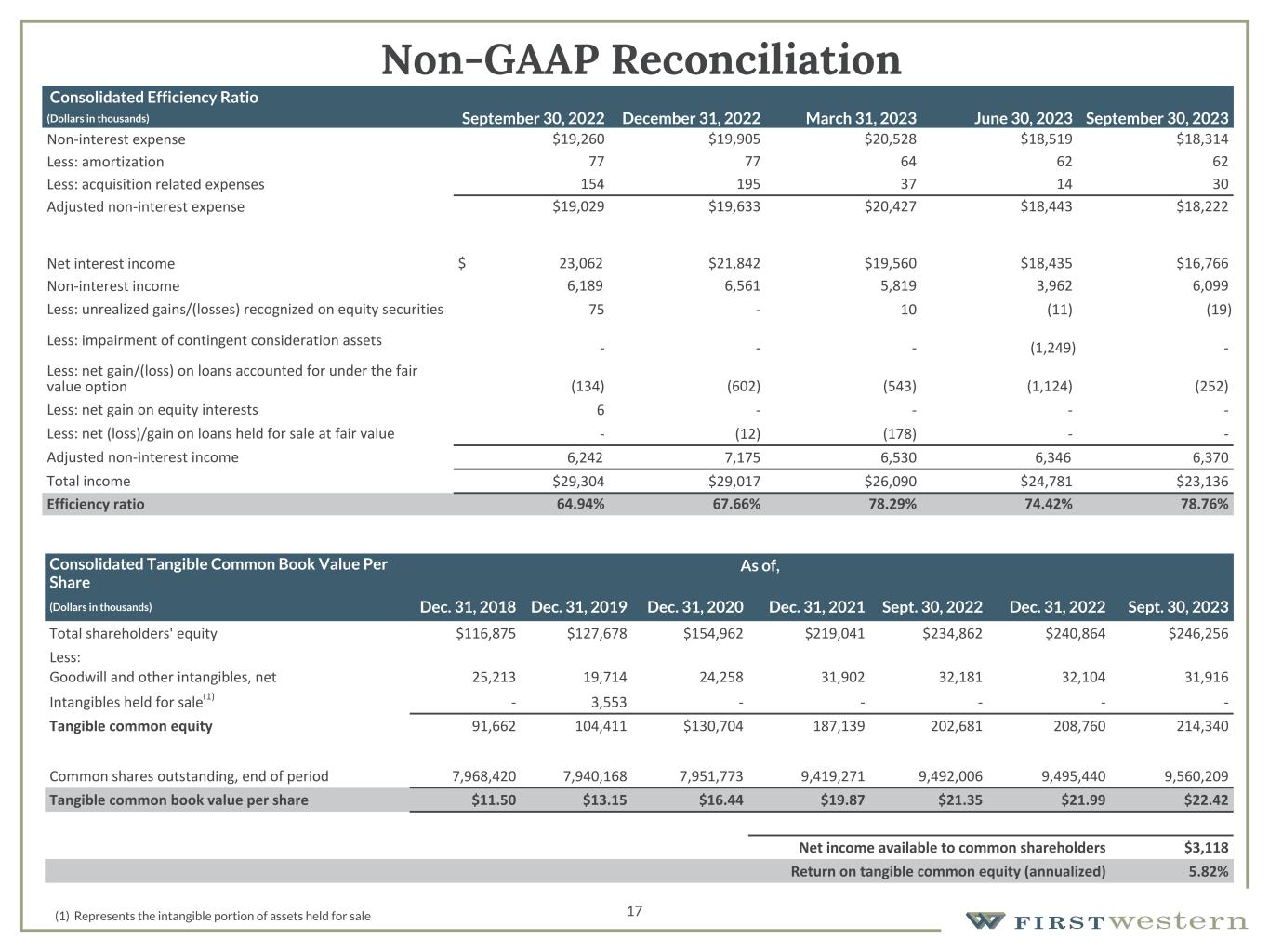

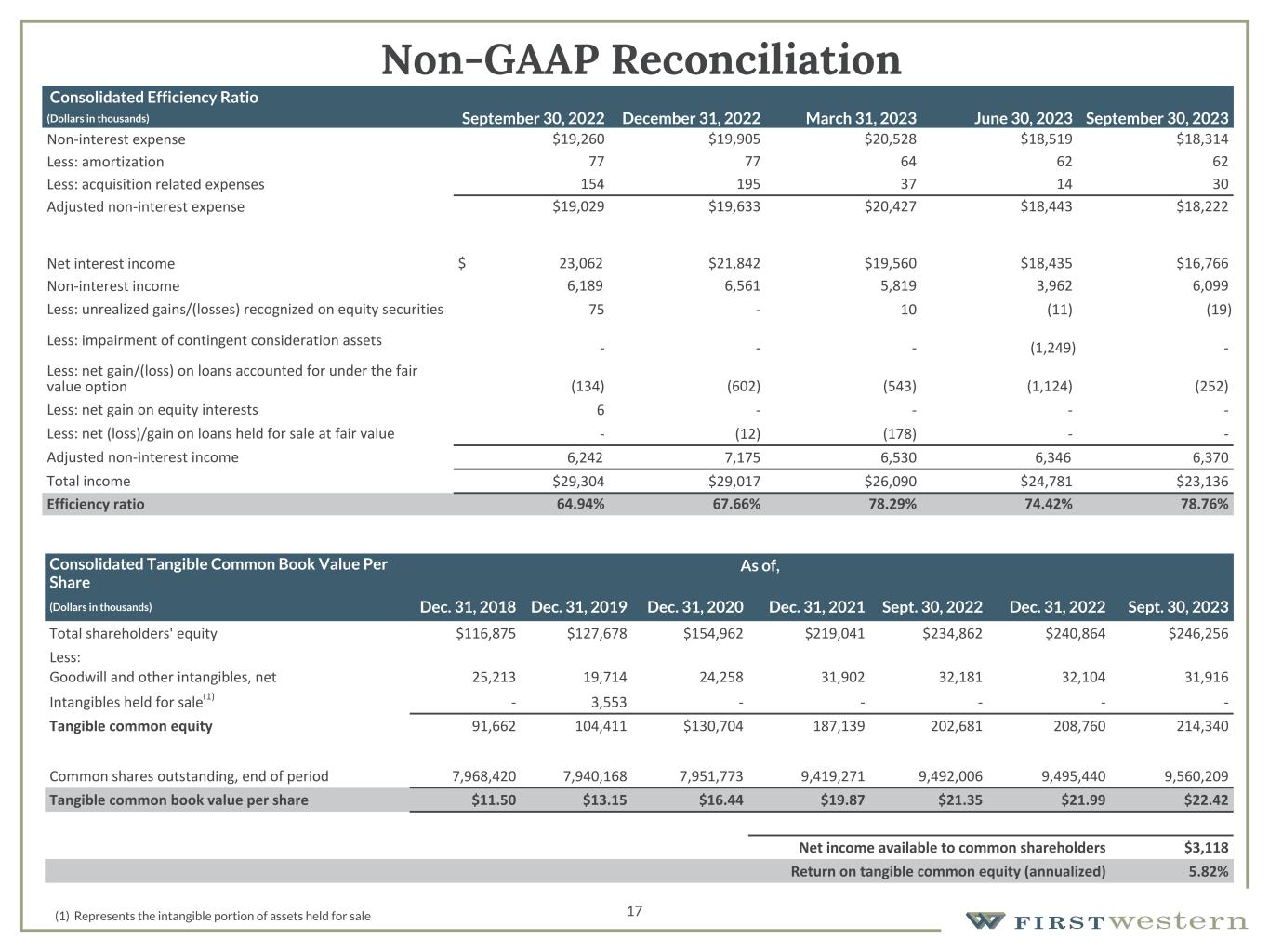

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 17 Non-GAAP Reconciliation Consolidated Tangible Common Book Value Per Share As of, (Dollars in thousands) Dec. 31, 2018 Dec. 31, 2019 Dec. 31, 2020 Dec. 31, 2021 Sept. 30, 2022 Dec. 31, 2022 Sept. 30, 2023 Total shareholders' equity $116,875 $127,678 $154,962 $219,041 $234,862 $240,864 $246,256 Less: Goodwill and other intangibles, net 25,213 19,714 24,258 31,902 32,181 32,104 31,916 Intangibles held for sale(1) - 3,553 - - - - - Tangible common equity 91,662 104,411 $130,704 187,139 202,681 208,760 214,340 Common shares outstanding, end of period 7,968,420 7,940,168 7,951,773 9,419,271 9,492,006 9,495,440 9,560,209 Tangible common book value per share $11.50 $13.15 $16.44 $19.87 $21.35 $21.99 $22.42 Net income available to common shareholders $3,118 Return on tangible common equity (annualized) 5.82% (1) Represents the intangible portion of assets held for sale Consolidated Efficiency Ratio (Dollars in thousands) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Non-interest expense $19,260 $19,905 $20,528 $18,519 $18,314 Less: amortization 77 77 64 62 62 Less: acquisition related expenses 154 195 37 14 30 Adjusted non-interest expense $19,029 $19,633 $20,427 $18,443 $18,222 Net interest income $ 23,062 $21,842 $19,560 $18,435 $16,766 Non-interest income 6,189 6,561 5,819 3,962 6,099 Less: unrealized gains/(losses) recognized on equity securities 75 - 10 (11) (19) Less: impairment of contingent consideration assets - - - (1,249) - Less: net gain/(loss) on loans accounted for under the fair value option (134) (602) (543) (1,124) (252) Less: net gain on equity interests 6 - - - - Less: net (loss)/gain on loans held for sale at fair value - (12) (178) - - Adjusted non-interest income 6,242 7,175 6,530 6,346 6,370 Total income $29,304 $29,017 $26,090 $24,781 $23,136 Efficiency ratio 64.94% 67.66% 78.29% 74.42% 78.76%

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 18 Non-GAAP Reconciliation Wealth Management Gross Revenue For the Three Months Ended, (Dollars in thousands) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Total income before non-interest expense $26,482 $26,623 $24,543 $19,529 $21,647 Less: unrealized gains/(losses) recognized on equity securities 75 - 10 (11) (19) Less: impairment of contingent consideration assets - - - (1,249) - Less: net gain/(loss) on loans accounted for under the fair value option (134) (602) (543) (1,124) (252) Less: net gain on equity interests 6 - - - - Less: net (loss)/gain on loans held for sale at fair value - (12) (178) - - Plus: provision for credit loss 1,756 1,197 (310) 1,843 329 Gross revenue $28,291 $28,434 $24,944 $23,756 $22,247 Mortgage Gross Revenue For the Three Months Ended, (Dollars in thousands) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Total income before non-interest expense $1,013 $583 $1,146 $1,025 $889 Plus: provision for credit loss - - - - - Gross revenue $1,013 $583 $1,146 $1,025 $889 Consolidated Gross Revenue For the Three Months Ended, (Dollars in thousands) September 30, 2022 December 31, 2022 March 30, 2023 June 30, 2023 September 30, 2023 Total income before non-interest expense $27,495 $27,206 $25,689 $20,554 $22,536 Less: unrealized gains/(losses) recognized on equity securities 75 - 10 (11) (19) Less: impairment of contingent consideration assets - - - (1,249) - Less: net gain/(loss) on loans accounted for under the fair value option (134) (602) (543) (1,124) (252) Less: net gain on equity interests 6 - - - - Less: net (loss)/gain on loans held for sale at fair value - (12) (178) - - Plus: provision for credit loss 1,756 1,197 (310) 1,843 329 Gross revenue $29,304 $29,017 $26,090 $24,781 $23,136 Gross Revenue excluding net gain on mortgage loans For the Three Months Ended, (Dollars in thousands) December 31, 2021 December 31, 2022 September 30, 2023 Gross revenue $23,440 $29,017 $23,136 Less: net gain on mortgage loans 2,470 775 654 Gross revenue excluding net gain on mortgage loans $20,970 $28,242 $22,482

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 19 Non-GAAP Reconciliation Adjusted net income available to common shareholders For the Three Months Ended, (Dollars in thousands, except per share data) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Net income available to common shareholders $6,221 $5,471 $3,820 $1,506 $3,118 Plus: impairment of contingent consideration assets including tax impact - - - 924 - Plus: acquisition related expense including tax impact 116 146 27 10 22 Adjusted net income to common shareholders $6,337 $5,617 $3,847 $2,440 $3,140 Adjusted diluted earnings per share For the Three Months Ended, (Dollars in thousands, except per share data) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Diluted earnings per share $0.64 $0.56 $0.39 $0.16 $0.32 Plus: impairment of contingent consideration assets including tax impact - - - 0.09 - Plus: acquisition related expenses including tax impact 0.02 0.02 - - - Adjusted diluted earnings per share $0.66 $0.58 $0.39 $0.25 $0.32 Allowance for credit losses to Bank originated loans excluding PPP As of, (Dollars in thousands) September 30, 2022 December 31, 2022 March 31, 2023 June 30, 2023 September 30, 2023 Total loans held for investment $2,354,898 $2,476,135 $2,475,084 $2,501,926 $2,536,503 Less: Acquired loans 248,573 234,717 — — — Less: PPP loans 6,905 6,378 6,100 5,558 4,876 Less: Purchased loans accounted for under fair value ("FVO") 22,648 23,415 21,052 18,274 16,105 Adjusted Loans excluding acquired, PPP and FVO $2,076,772 $2,211,625 $2,447,932 $2,478,094 $2,515,522 Allowance for credit losses 16,081 17,183 19,843 22,044 23,175 Allowance for credit losses to adjusted loans 0.77% 0.78% 0.81% 0.89% 0.92% Pre-tax, pre-provision net income For the Three Months Ended, (Dollars in thousands) March 31, 2023 June 30, 2023 September 30, 2023 Income before income taxes $5,161 $2,035 $4,222 Plus: provision for credit losses (310) 1,843 329 Pre-tax, pre-provision net income $4,851 $3,878 $4,551 (2) (1) Subsequent to the adoption of CECL on January 1, 2023, acquired loans are included in the Allowance for Credit Losses and therefore are no longer excluded from the total adjusted loan calculation. (2)(2)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 20 Non-GAAP Reconciliation Adjusted net interest margin For the Three Months Ended September 30, 2022 For the Three Months Ended December 31, 2022 For the Three Months Ended March 31, 2023 For the Three Months Ended June 30, 2023 For the Three Months Ended September 30, 2023 (Dollars in thousands) Average Balance Interest Earned/ Paid Average Yield/ Rate Average Balance Interest Earned/ Paid Average Yield/ Rate Average Balance Interest Earned/ Paid Average Yield/ Rate Average Balance Interest Earned/ Paid Average Yield/ Rate Average Balance Interest Earned/ Paid Average Yield/ Rate Interest-bearing deposits in other financial institutions $101,824 $533 $103,190 $931 $127,608 $1,403 $135,757 $1,669 $102,510 $1,291 PPP adjustment 2,798 16 1,736 16 1,502 17 1,376 17 1,103 15 Investment securities 69,320 653 84,017 645 82,106 629 80,106 626 78,057 607 Correspondent bank stock 4,924 109 11,880 237 9,592 173 8,844 145 7,162 142 Loans 2,241,343 25,345 2,436,252 30,691 2,469,129 32,239 2,471,588 33,704 2,502,419 34,228 Loans HFS 11,535 157 9,065 146 18,036 268 15,841 230 12,680 214 PPP adjustment (9,026) (73) (7,350) (32) (6,470) (37) (5,811) (27) (5,178) (25) Purchase Accretion adjustment - 114 - (87) - (64) - (80) - (209) Adjusted total Interest- earning assets 2,422,718 26,854 2,638,790 32,547 2,701,503 34,628 2,707,701 36,284 2,698,753 36,263 Interest-bearing deposits 2,706 8,260 13,092 15,864 17,467 PPP adjustment - - - - - Federal Home Loan Bank Topeka and Federal Reserve borrowings 666 1,916 1,374 1,361 1,447 PPP adjustment (3) (6) (5) (4) (4) Subordinated notes 362 486 674 712 801 Adjusted total interest- bearing liabilities 3,731 10,656 15,135 17,933 19,711 Net interest income 23,123 21,891 19,493 18,351 16,552 Adjusted net interest margin 3.79% 3.29% 2.93 % 2.72 % 2.43 %