Fourth Quarter 2024 Conference Call

Safe Harbor 2 This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of First Western Financial, Inc.’s (“First Western”) management with respect to, among other things, future events and First Western’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “position,” “project,” “future” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about First Western’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond First Western’s control. Accordingly, First Western cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although First Western believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. The following risks and uncertainties, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: integration risks in connection with acquisitions; the risk of geographic concentration in Colorado, Arizona, Wyoming, California, and Montana; the risk of changes in the economy affecting real estate values and liquidity; the risk in our ability to continue to originate residential real estate loans and sell such loans; risks specific to commercial loans and borrowers; the risk of claims and litigation pertaining to our fiduciary responsibilities; the risk of competition for investment managers and professionals; the risk of fluctuation in the value of our investment securities; the risk of changes in interest rates; and the risk of the adequacy of our allowance for credit losses and the risk in our ability to maintain a strong core deposit base or other low-cost funding sources. Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in our Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 15, 2024 and other documents we file with the SEC from time to time. All subsequent written and oral forward- looking statements attributable to First Western or persons acting on First Western’s behalf are expressly qualified in their entirety by this paragraph. Forward-looking statements speak only as of the date of this presentation. First Western undertakes no obligation to publicly update or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise (except as required by law). This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. Our common stock is not a deposit or savings account. Our common stock is not insured by the Federal Deposit Insurance Corporation or any governmental agency or instrumentality. This presentation is not an offer to sell any securities and it is not soliciting an offer to buy any securities in any state or jurisdiction where the offer or sale is not permitted. Neither the SEC nor any state securities commission has approved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof.

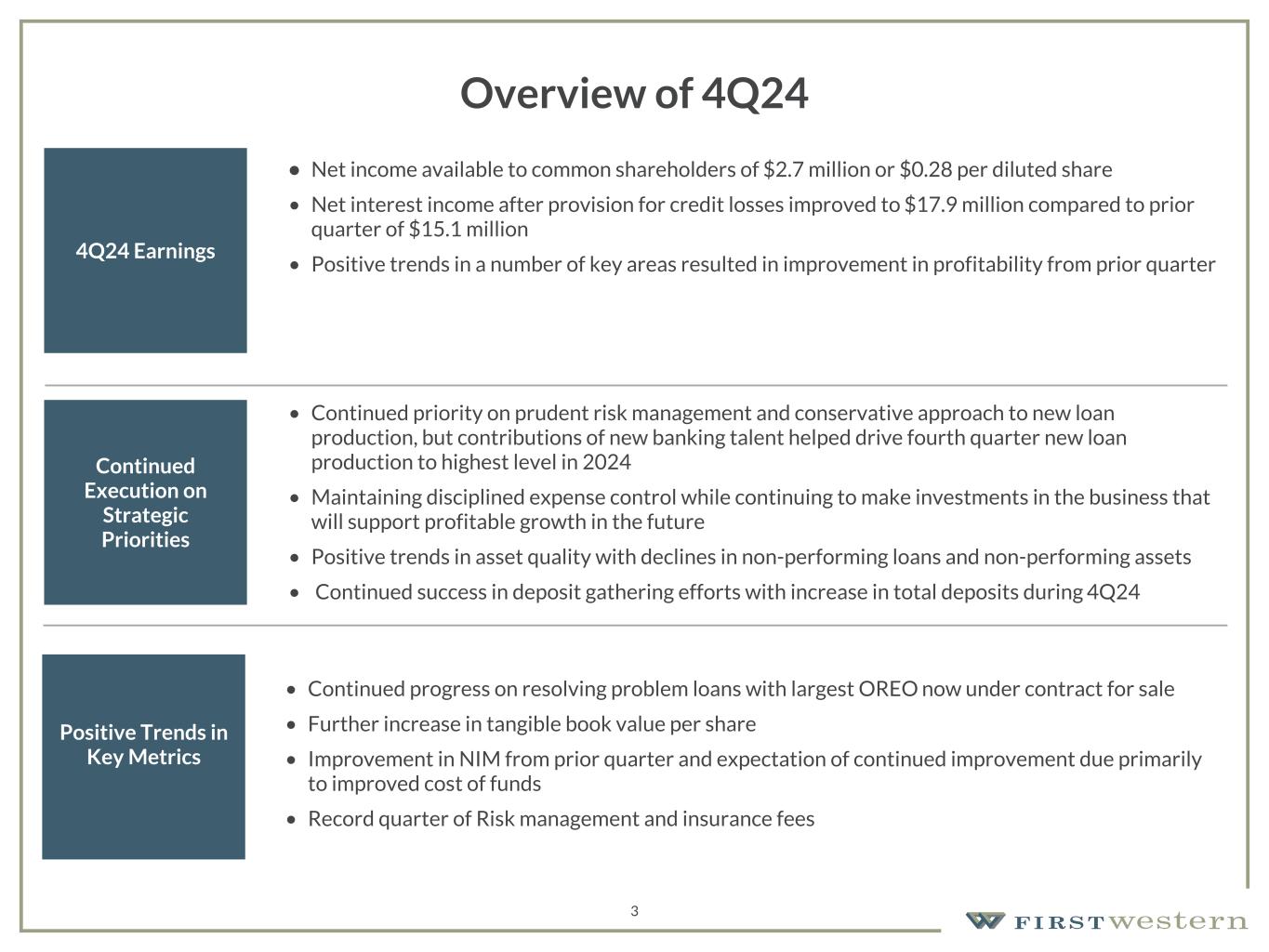

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions Overview of 4Q24 4Q24 Earnings • Net income available to common shareholders of $2.7 million or $0.28 per diluted share • Net interest income after provision for credit losses improved to $17.9 million compared to prior quarter of $15.1 million • Positive trends in a number of key areas resulted in improvement in profitability from prior quarter Continued Execution on Strategic Priorities • Continued priority on prudent risk management and conservative approach to new loan production, but contributions of new banking talent helped drive fourth quarter new loan production to highest level in 2024 • Maintaining disciplined expense control while continuing to make investments in the business that will support profitable growth in the future • Positive trends in asset quality with declines in non-performing loans and non-performing assets • Continued success in deposit gathering efforts with increase in total deposits during 4Q24 Positive Trends in Key Metrics • Continued progress on resolving problem loans with largest OREO now under contract for sale • Further increase in tangible book value per share • Improvement in NIM from prior quarter and expectation of continued improvement due primarily to improved cost of funds • Record quarter of Risk management and insurance fees 3

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato(regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 4 Net Income Available to Common Shareholders and Earnings per Share • Net income of $2.7 million, or $0.28 diluted earnings per share, in 4Q24 • Provision for credit losses decreased $1.5 million in 4Q24 • Tangible book value per share(1) increased 1.6% to $22.83 Net Income Available to Common Shareholders Diluted Earnings per Share $(3,219) $2,515 $1,076 $2,134 $2,748 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $(5,000) $(4,000) $(3,000) $(2,000) $(1,000) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $(0.34) $0.26 $0.11 $0.22 $0.28 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $(0.50) $(0.25) $— $0.25 $0.50 (1) See Non-GAAP reconciliation within the appendix

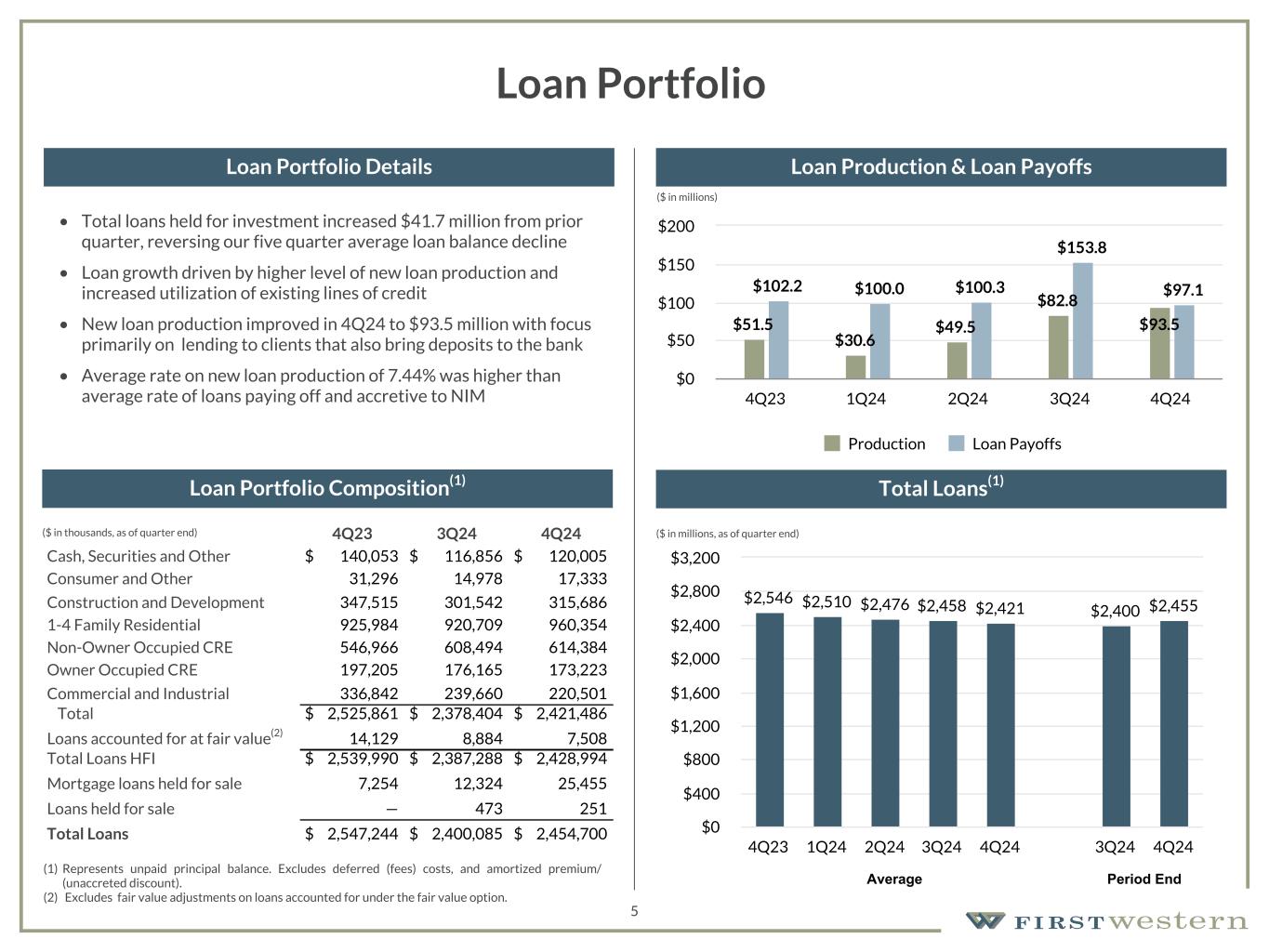

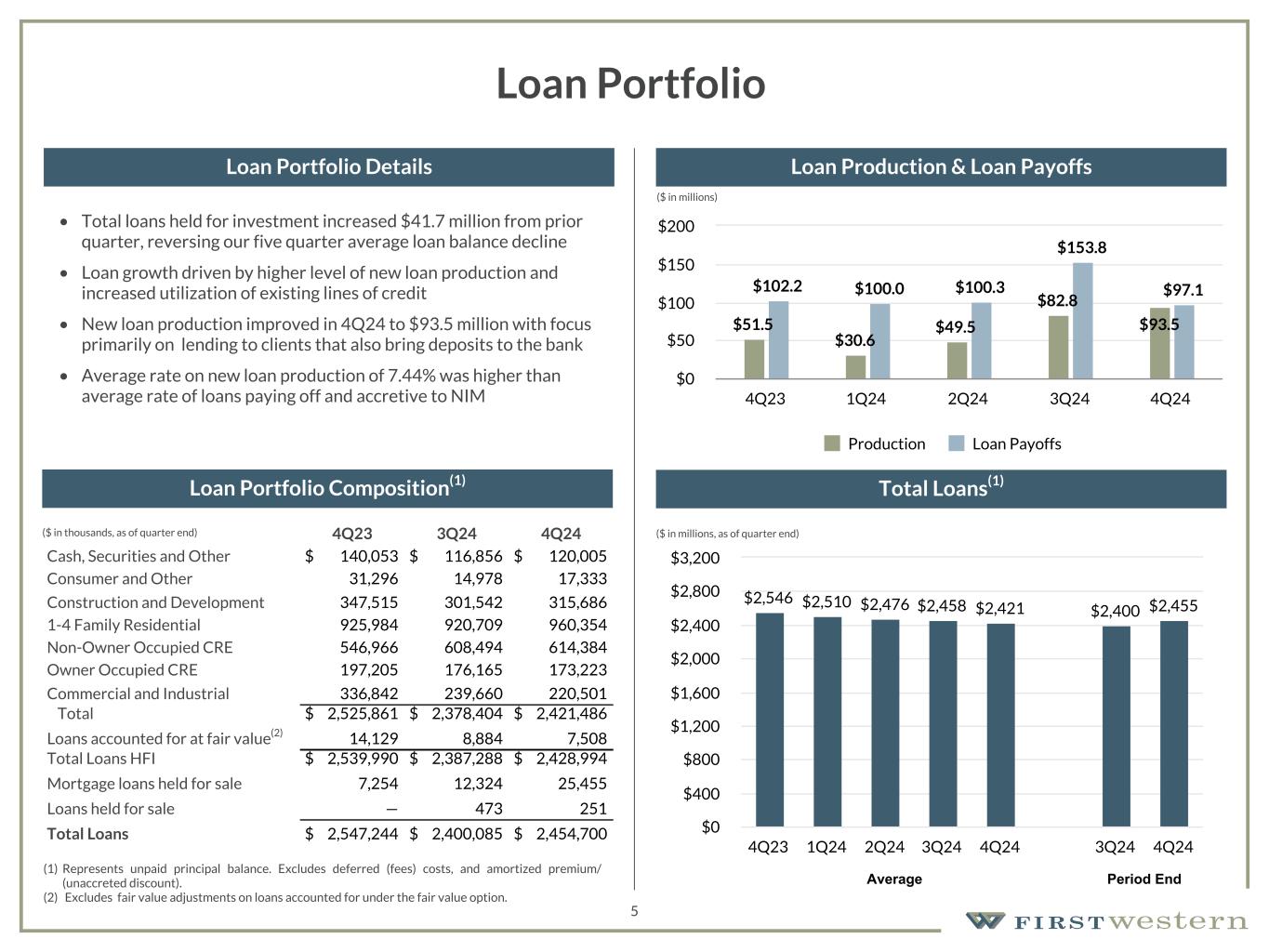

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 5 Loan Portfolio • Total loans held for investment increased $41.7 million from prior quarter, reversing our five quarter average loan balance decline • Loan growth driven by higher level of new loan production and increased utilization of existing lines of credit • New loan production improved in 4Q24 to $93.5 million with focus primarily on lending to clients that also bring deposits to the bank • Average rate on new loan production of 7.44% was higher than average rate of loans paying off and accretive to NIM 4Q23 3Q24 4Q24 Cash, Securities and Other $ 140,053 $ 116,856 $ 120,005 Consumer and Other 31,296 14,978 17,333 Construction and Development 347,515 301,542 315,686 1-4 Family Residential 925,984 920,709 960,354 Non-Owner Occupied CRE 546,966 608,494 614,384 Owner Occupied CRE 197,205 176,165 173,223 Commercial and Industrial 336,842 239,660 220,501 Total $ 2,525,861 $ 2,378,404 $ 2,421,486 Loans accounted for at fair value(2) 14,129 8,884 7,508 Total Loans HFI $ 2,539,990 $ 2,387,288 $ 2,428,994 Mortgage loans held for sale 7,254 12,324 25,455 Loans held for sale — 473 251 Total Loans $ 2,547,244 $ 2,400,085 $ 2,454,700 (1) Represents unpaid principal balance. Excludes deferred (fees) costs, and amortized premium/ (unaccreted discount). (2) Excludes fair value adjustments on loans accounted for under the fair value option. ($ in thousands, as of quarter end) Loan Portfolio Composition(1) Loan Portfolio Details Loan Production & Loan Payoffs Total Loans(1) $2,546 $2,510 $2,476 $2,458 $2,421 $2,400 $2,455 4Q23 1Q24 2Q24 3Q24 4Q24 3Q24 4Q24 $0 $400 $800 $1,200 $1,600 $2,000 $2,400 $2,800 $3,200 Average Period End $51.5 $30.6 $49.5 $82.8 $93.5 $102.2 $100.0 $100.3 $153.8 $97.1 Production Loan Payoffs 4Q23 1Q24 2Q24 3Q24 4Q24 $0 $50 $100 $150 $200 ($ in millions) ($ in millions, as of quarter end)

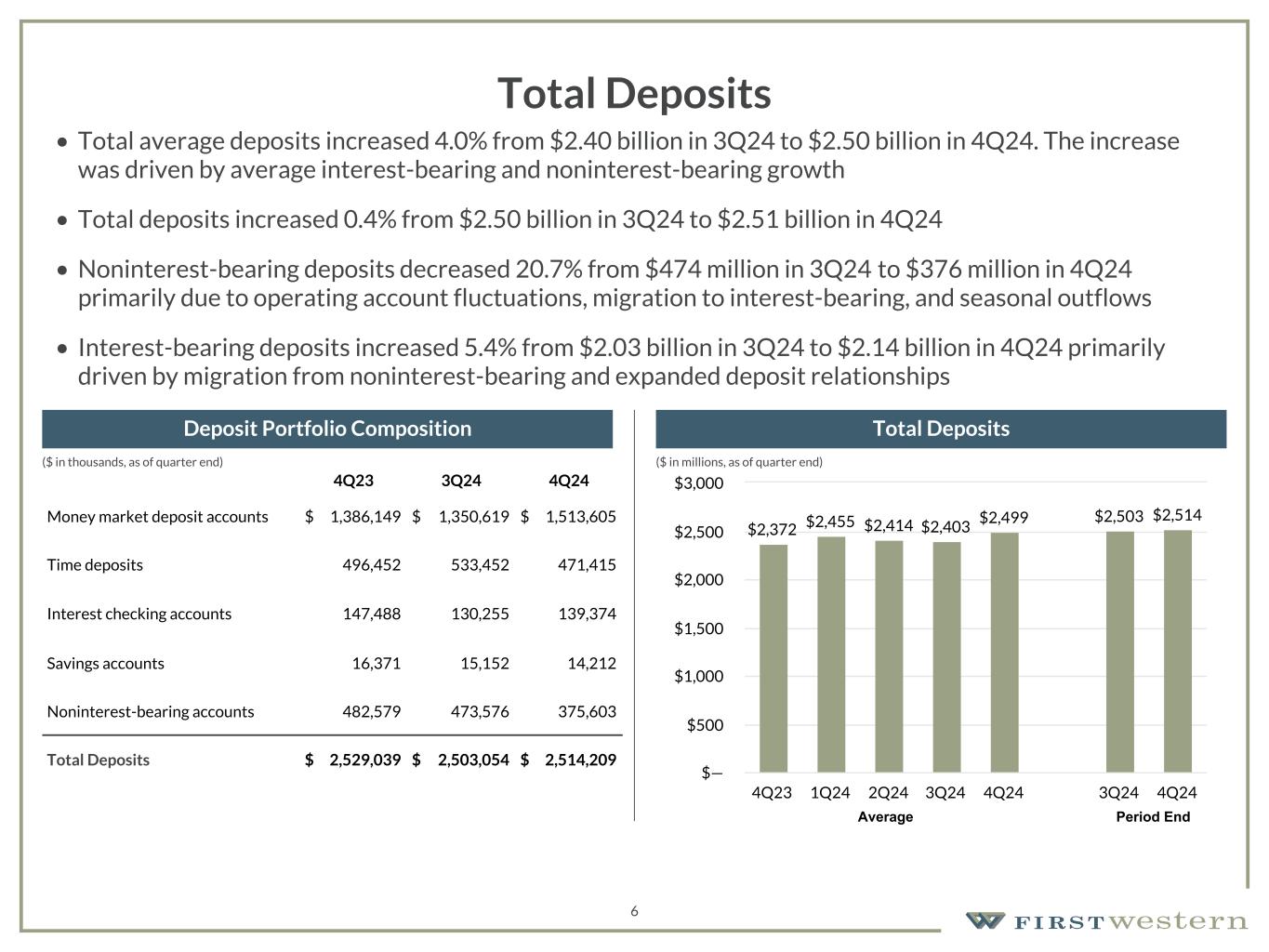

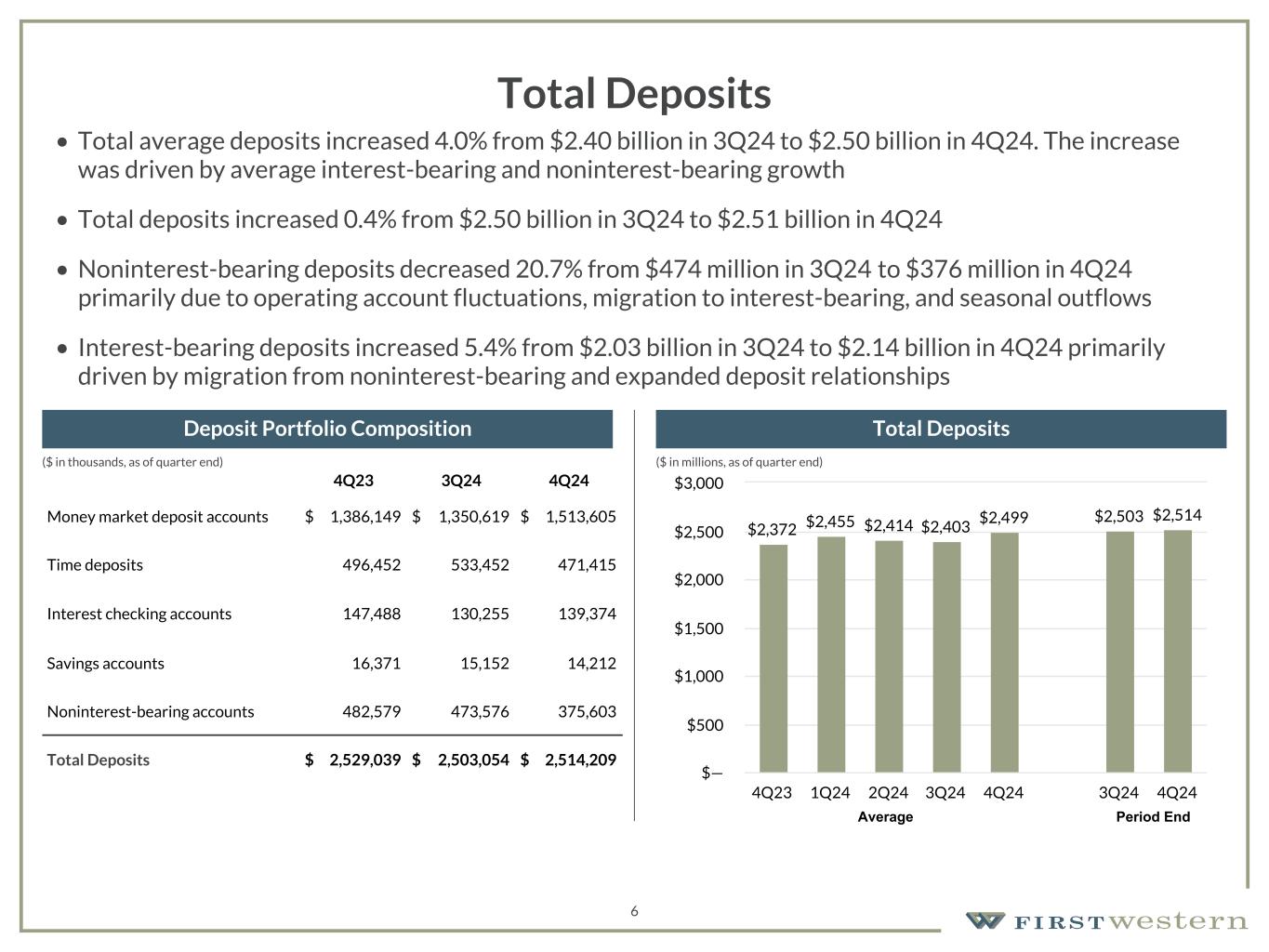

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 6 Total Deposits • Total average deposits increased 4.0% from $2.40 billion in 3Q24 to $2.50 billion in 4Q24. The increase was driven by average interest-bearing and noninterest-bearing growth • Total deposits increased 0.4% from $2.50 billion in 3Q24 to $2.51 billion in 4Q24 • Noninterest-bearing deposits decreased 20.7% from $474 million in 3Q24 to $376 million in 4Q24 primarily due to operating account fluctuations, migration to interest-bearing, and seasonal outflows • Interest-bearing deposits increased 5.4% from $2.03 billion in 3Q24 to $2.14 billion in 4Q24 primarily driven by migration from noninterest-bearing and expanded deposit relationships 4Q23 3Q24 4Q24 Money market deposit accounts $ 1,386,149 $ 1,350,619 $ 1,513,605 Time deposits 496,452 533,452 471,415 Interest checking accounts 147,488 130,255 139,374 Savings accounts 16,371 15,152 14,212 Noninterest-bearing accounts 482,579 473,576 375,603 Total Deposits $ 2,529,039 $ 2,503,054 $ 2,514,209 Deposit Portfolio Composition Total Deposits $2,372 $2,455 $2,414 $2,403 $2,499 $2,503 $2,514 4Q23 1Q24 2Q24 3Q24 4Q24 3Q24 4Q24 $— $500 $1,000 $1,500 $2,000 $2,500 $3,000 Average Period End ($ in millions, as of quarter end)($ in thousands, as of quarter end)

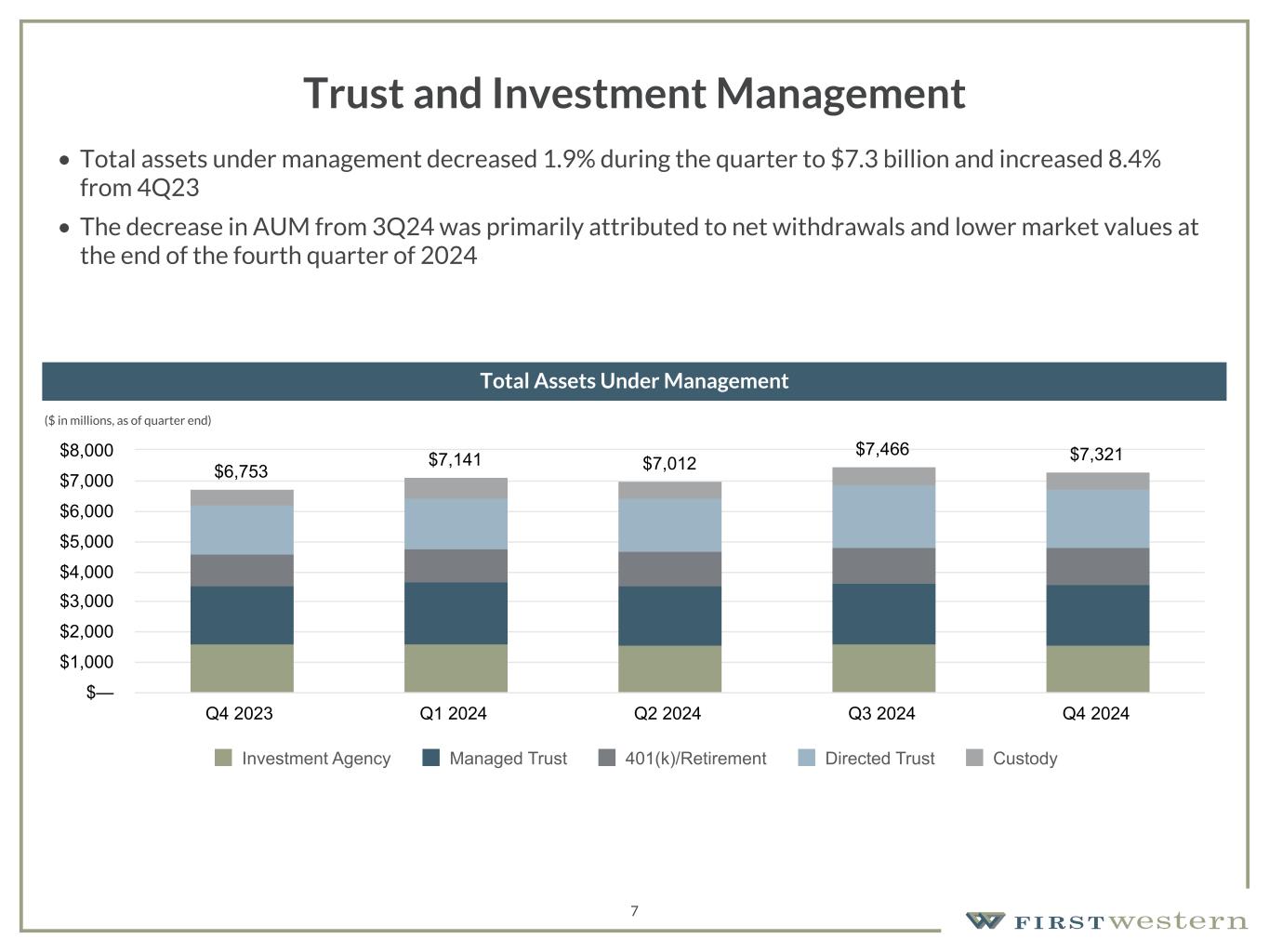

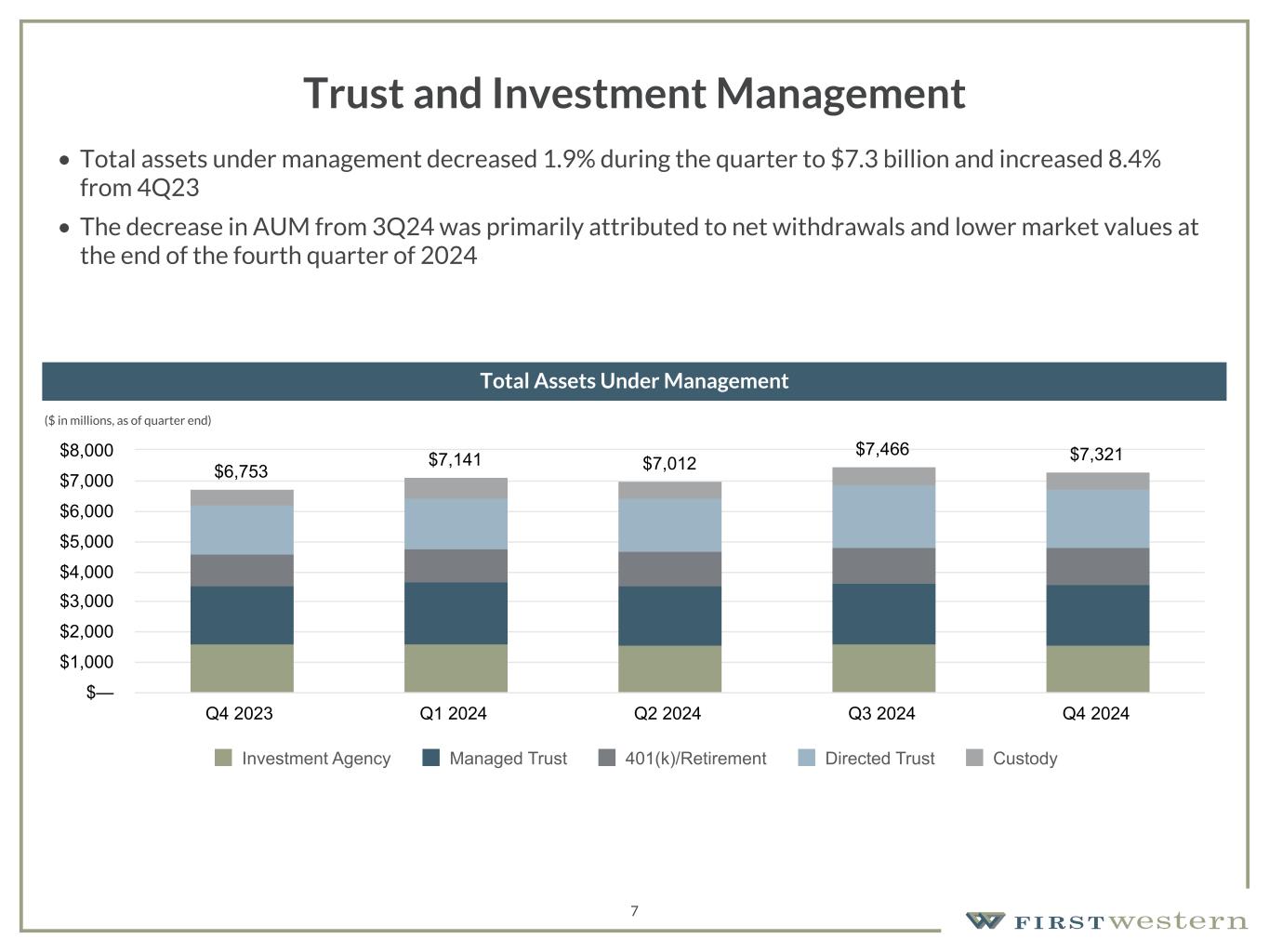

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 7 Trust and Investment Management • Total assets under management decreased 1.9% during the quarter to $7.3 billion and increased 8.4% from 4Q23 • The decrease in AUM from 3Q24 was primarily attributed to net withdrawals and lower market values at the end of the fourth quarter of 2024 ($ in millions, as of quarter end) Total Assets Under Management $6,753 $7,141 $7,012 $7,466 $7,321 Investment Agency Managed Trust 401(k)/Retirement Directed Trust Custody Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $— $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000

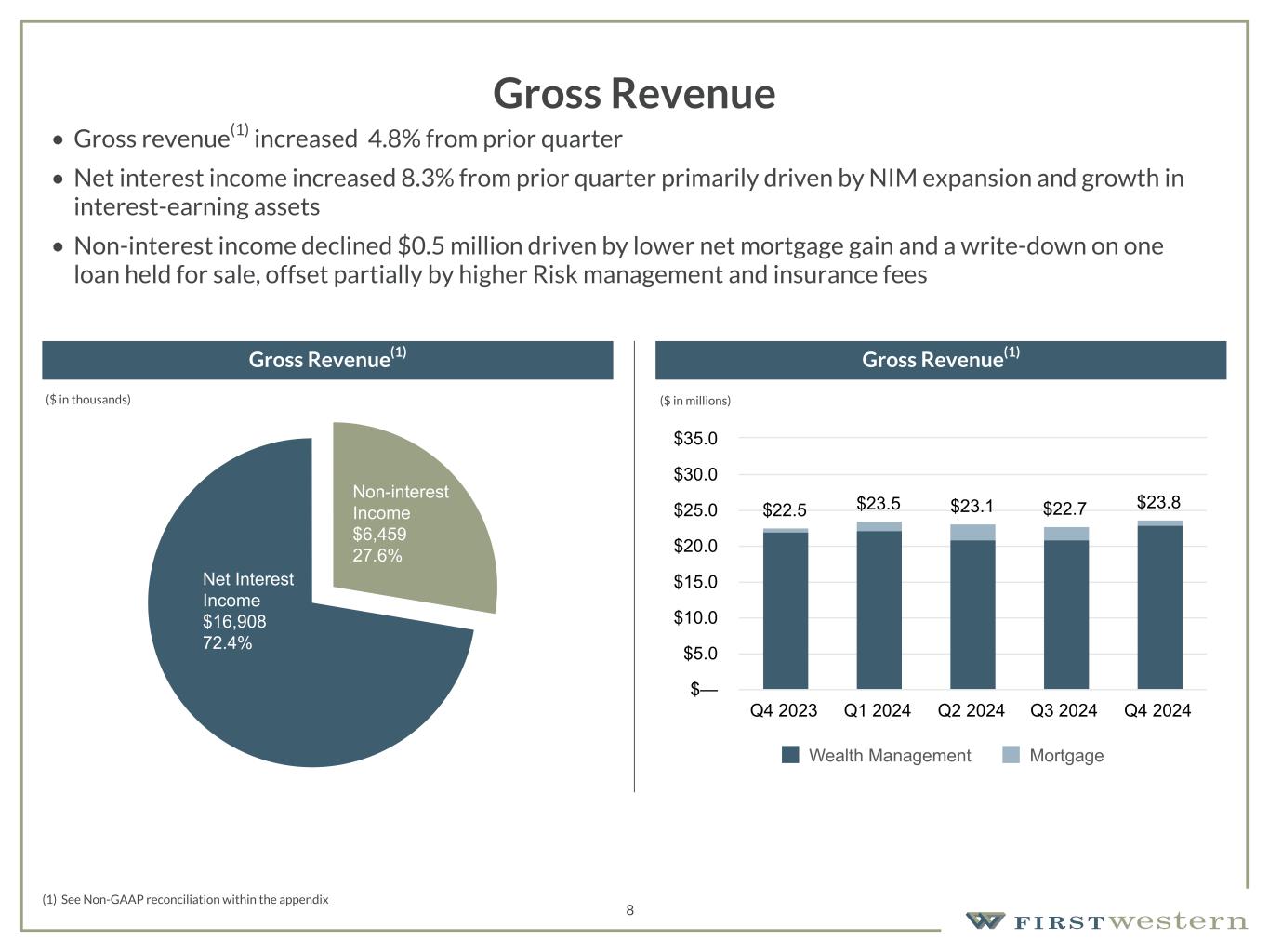

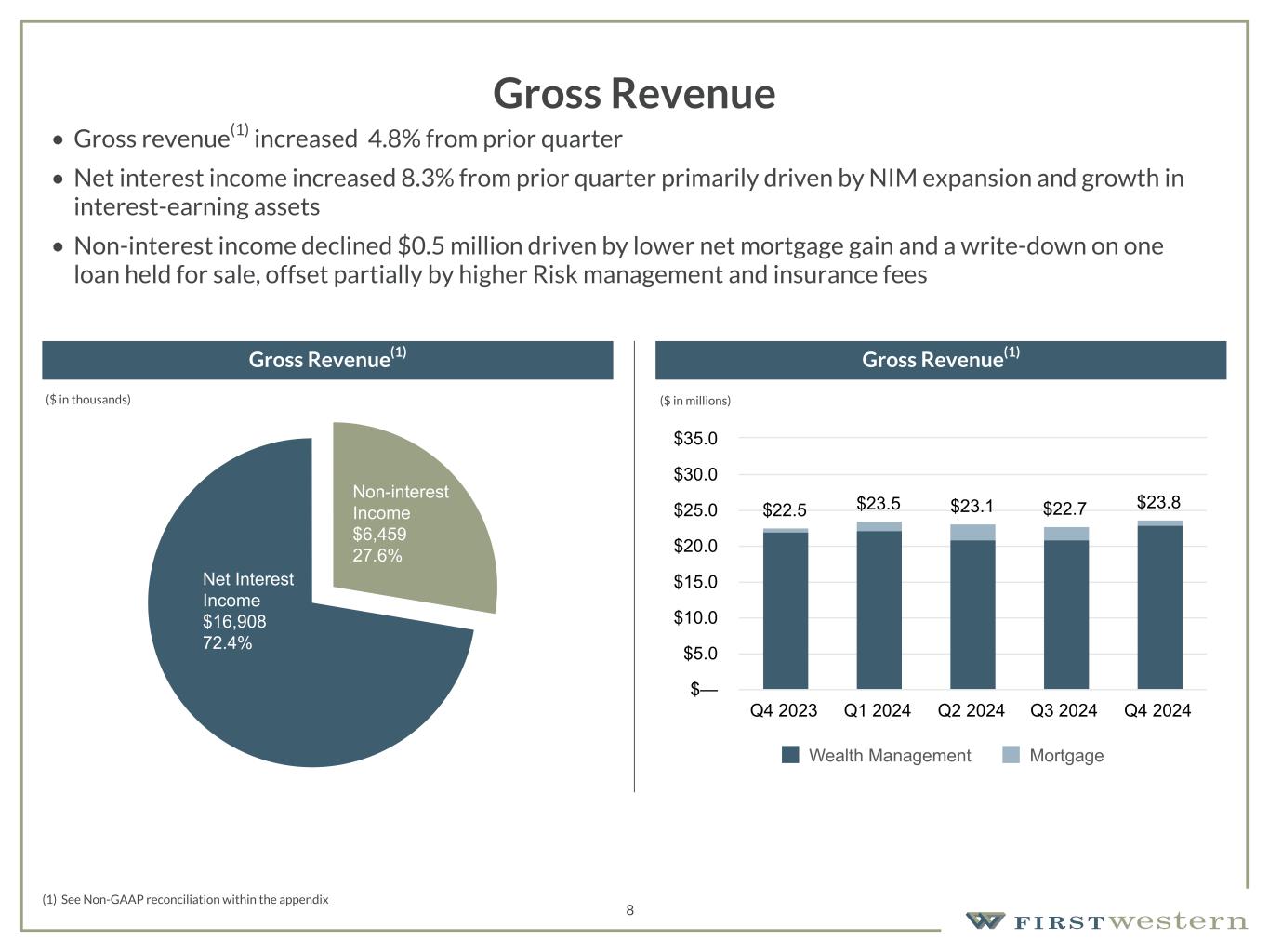

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions (1) See Non-GAAP reconciliation within the appendix Gross Revenue Gross Revenue(1) Gross Revenue(1) 8 $22.5 $23.5 $23.1 $22.7 $23.8 Wealth Management Mortgage Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $— $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 • Gross revenue(1) increased 4.8% from prior quarter • Net interest income increased 8.3% from prior quarter primarily driven by NIM expansion and growth in interest-earning assets • Non-interest income declined $0.5 million driven by lower net mortgage gain and a write-down on one loan held for sale, offset partially by higher Risk management and insurance fees Non-interest Income $6,459 27.6% Net Interest Income $16,908 72.4% ($ in thousands) ($ in millions)

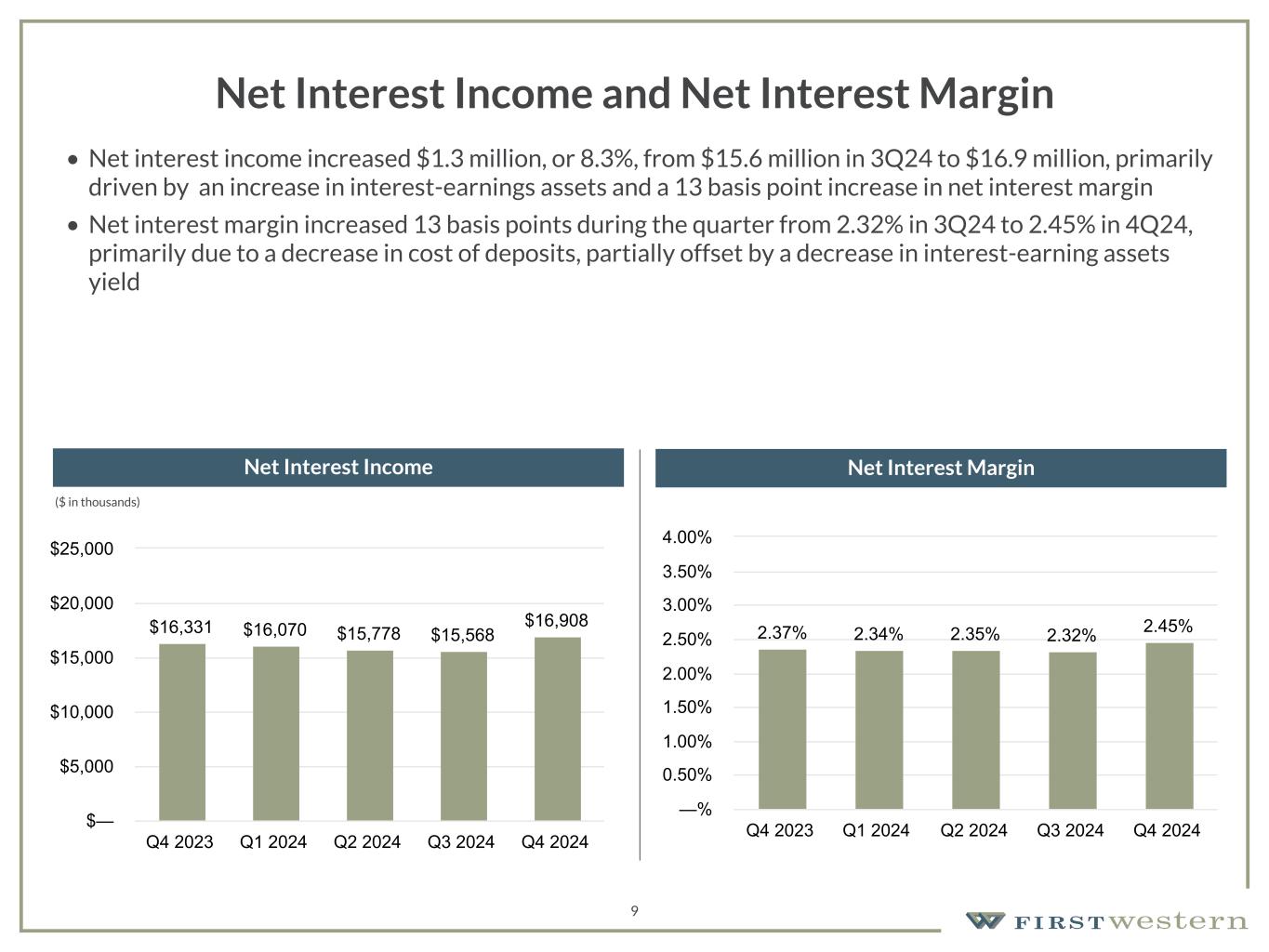

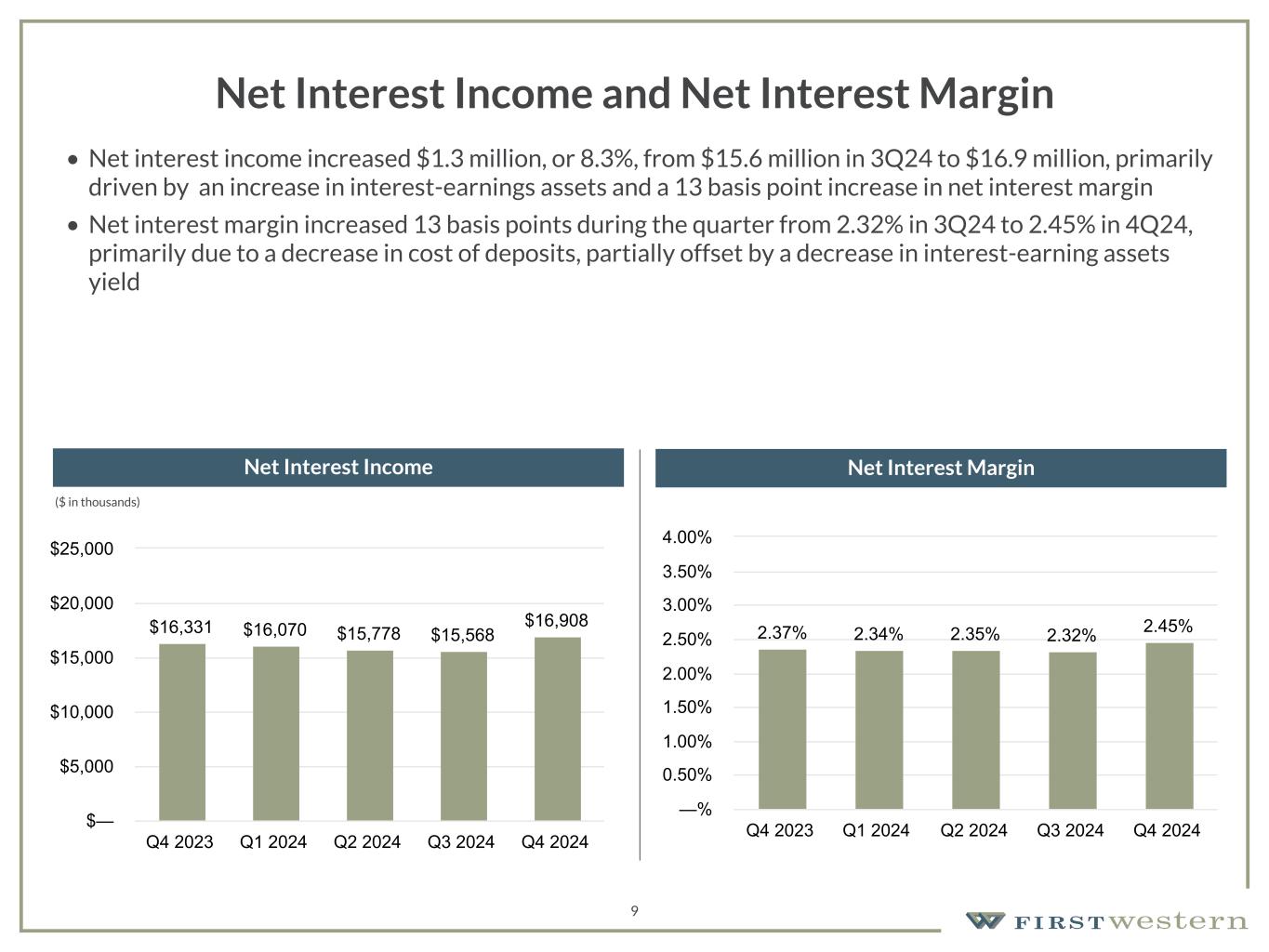

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 9 Net Interest Income and Net Interest Margin • Net interest income increased $1.3 million, or 8.3%, from $15.6 million in 3Q24 to $16.9 million, primarily driven by an increase in interest-earnings assets and a 13 basis point increase in net interest margin • Net interest margin increased 13 basis points during the quarter from 2.32% in 3Q24 to 2.45% in 4Q24, primarily due to a decrease in cost of deposits, partially offset by a decrease in interest-earning assets yield Net Interest Income Net Interest Margin $16,331 $16,070 $15,778 $15,568 $16,908 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $— $5,000 $10,000 $15,000 $20,000 $25,000 2.37% 2.34% 2.35% 2.32% 2.45% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 —% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% ($ in thousands)

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 10 Non-Interest Income • Non-interest income decreased $0.5 million to $6.5 million from the prior quarter driven by a decrease in Net gain on mortgage loans and a write-down on one loan held for sale, offset partially by an increase in Risk management and insurance fees • Record quarter of Risk management and insurance fees of $1.1 million, which doubled the level recorded in 4Q23 • Higher mortgage rates and seasonality in Colorado drove a 35% reduction in lock volume quarter over quarter • Non-interest income increased $0.4 million from 4Q23, primarily due to the record quarter in risk management and insurance fees Total Non-Interest Income Trust and Investment Management Fees $6,081 $7,277 $6,972 $6,972 $6,459 Trust and Investment Management Fees Bank Fees Net Gain on Mortgage Loans Risk Management and Insurance Fees Other Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $(4,000) $(2,000) $— $2,000 $4,000 $6,000 $8,000 $10,000 $4,705 $4,930 $4,875 $4,728 $4,660 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $— $2,000 $4,000 $6,000 ($ in thousands) ($ in thousands)

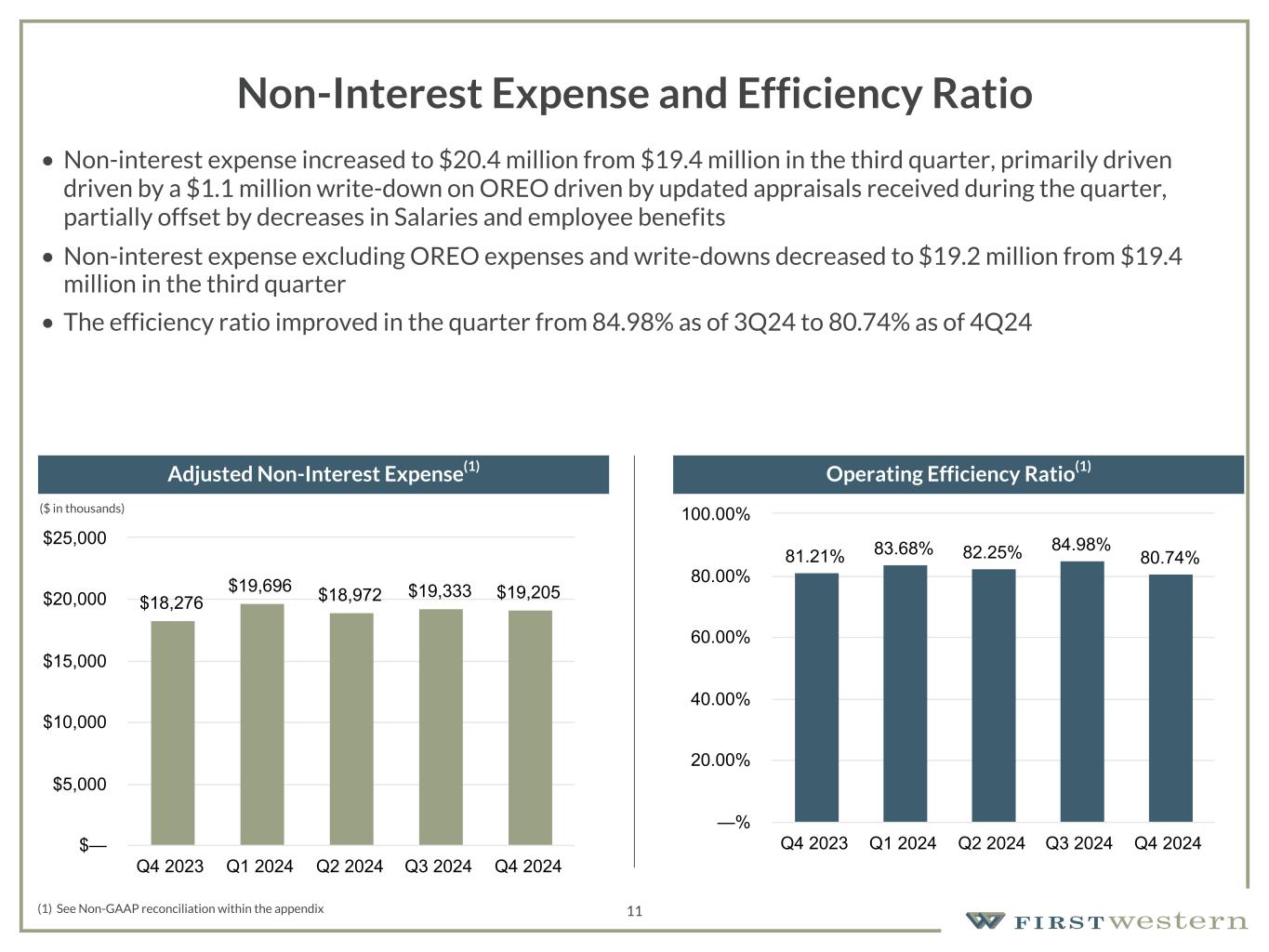

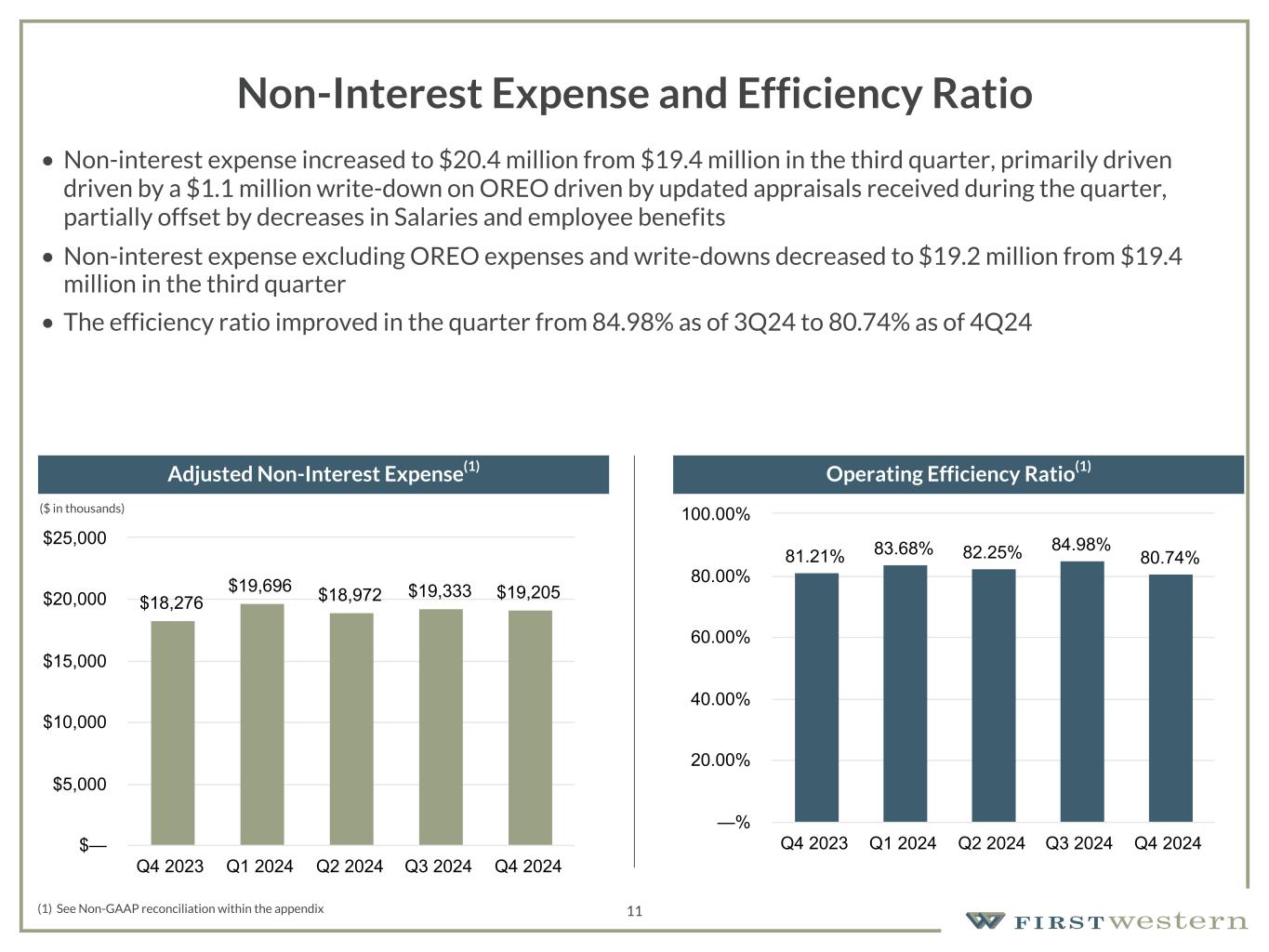

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 11 Non-Interest Expense and Efficiency Ratio • Non-interest expense increased to $20.4 million from $19.4 million in the third quarter, primarily driven driven by a $1.1 million write-down on OREO driven by updated appraisals received during the quarter, partially offset by decreases in Salaries and employee benefits • Non-interest expense excluding OREO expenses and write-downs decreased to $19.2 million from $19.4 million in the third quarter • The efficiency ratio improved in the quarter from 84.98% as of 3Q24 to 80.74% as of 4Q24 (1) See Non-GAAP reconciliation within the appendix Adjusted Non-Interest Expense(1) Operating Efficiency Ratio(1) (1) (1) (1) $18,276 $19,696 $18,972 $19,333 $19,205 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $— $5,000 $10,000 $15,000 $20,000 $25,000 81.21% 83.68% 82.25% 84.98% 80.74% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 —% 20.00% 40.00% 60.00% 80.00% 100.00%($ in thousands)

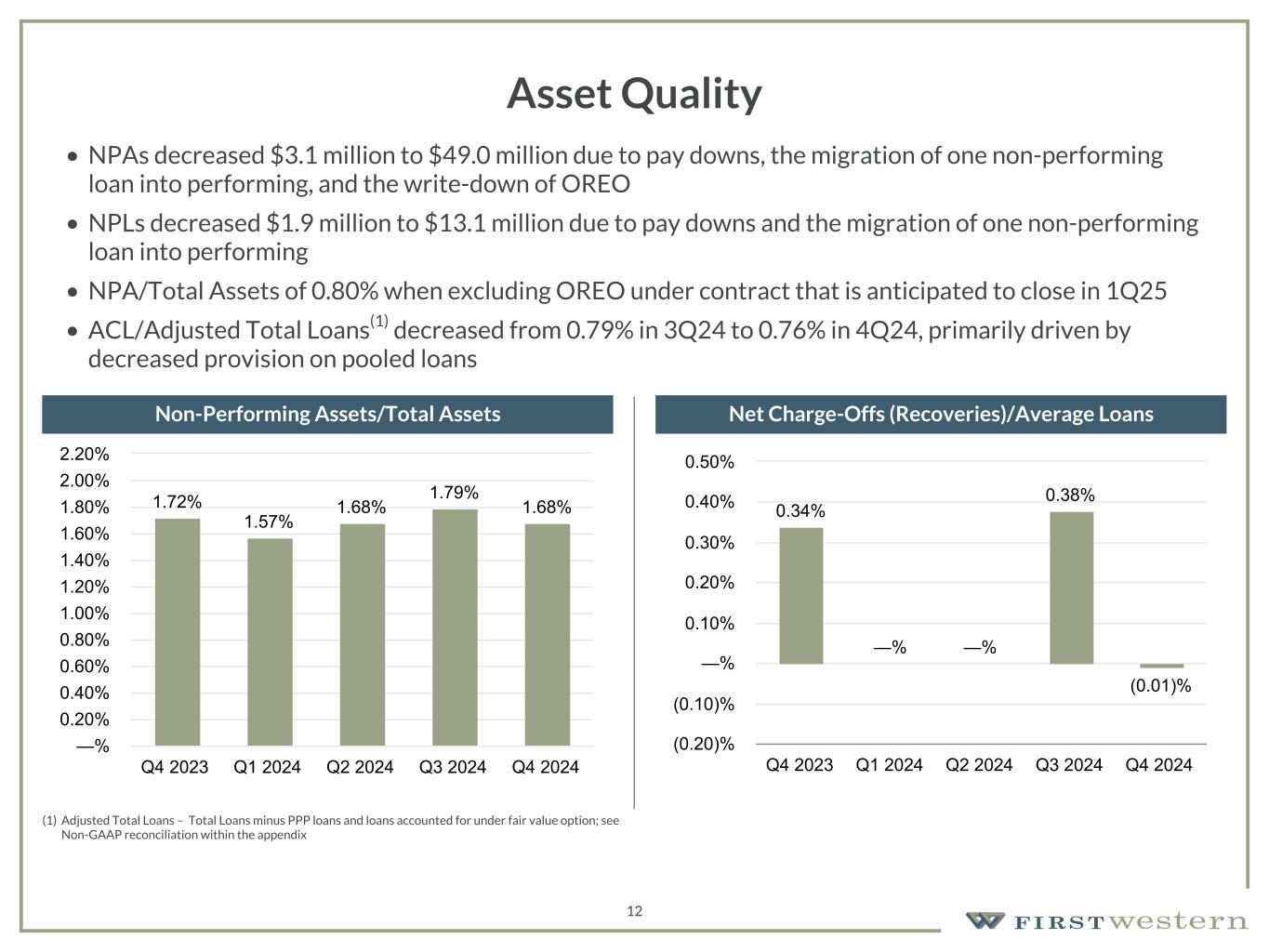

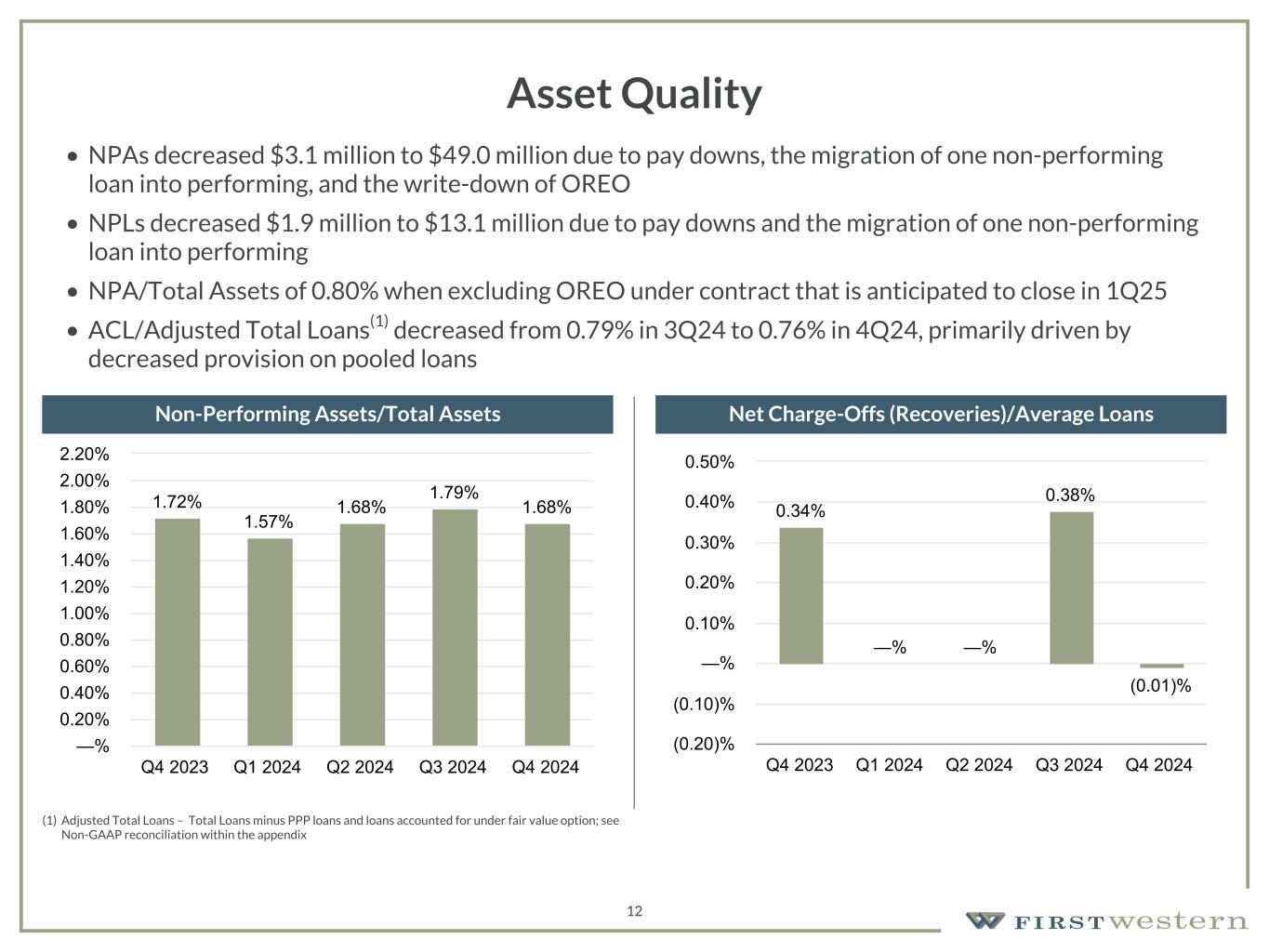

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 12 Asset Quality • NPAs decreased $3.1 million to $49.0 million due to pay downs, the migration of one non-performing loan into performing, and the write-down of OREO • NPLs decreased $1.9 million to $13.1 million due to pay downs and the migration of one non-performing loan into performing • NPA/Total Assets of 0.80% when excluding OREO under contract that is anticipated to close in 1Q25 • ACL/Adjusted Total Loans(1) decreased from 0.79% in 3Q24 to 0.76% in 4Q24, primarily driven by decreased provision on pooled loans Non-Performing Assets/Total Assets Net Charge-Offs (Recoveries)/Average Loans (1) Adjusted Total Loans – Total Loans minus PPP loans and loans accounted for under fair value option; see Non-GAAP reconciliation within the appendix 1.72% 1.57% 1.68% 1.79% 1.68% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 —% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 0.34% —% —% 0.38% (0.01)% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 (0.20)% (0.10)% —% 0.10% 0.20% 0.30% 0.40% 0.50%

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 13 2025 Outlook and Priorities • First Western's markets continue to perform well and the strength of our balance sheet and franchise provides opportunities to capitalize on market disruption and challenges being faced by competing banks to add new clients and banking talent • Addition of banking talent over past several quarters should lead to higher level of loan growth in 2025 while still maintaining disciplined underwriting and pricing criteria • Deposit gathering will remain a top priority throughout the organization • Expected drivers of improved financial performance in 2025 ◦ Increased loan growth ◦ Continued expansion in net interest margin ◦ Redeployment of cash generated from sale of OREO properties into interest-earning assets ◦ More robust business development activities in Wealth Management business ◦ More operating leverage resulting from disciplined expense control • Addition of MLOs will positively impact mortgage banking fees if environment is favorable for loan demand in 2025 • Positive trends in key areas expected to continue, which should result in steady improvement in financial performance and further value being created for shareholders

Appendix 14

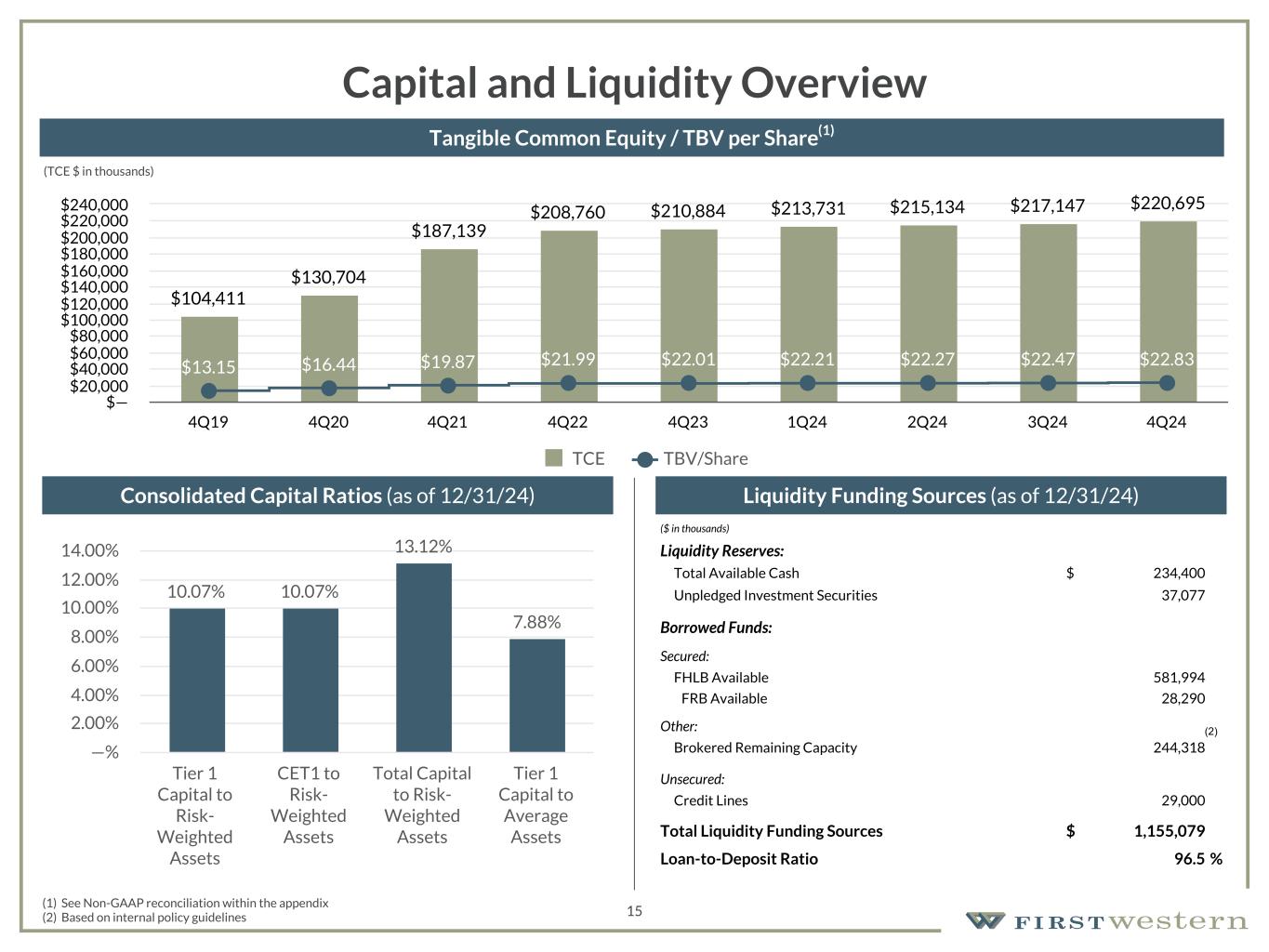

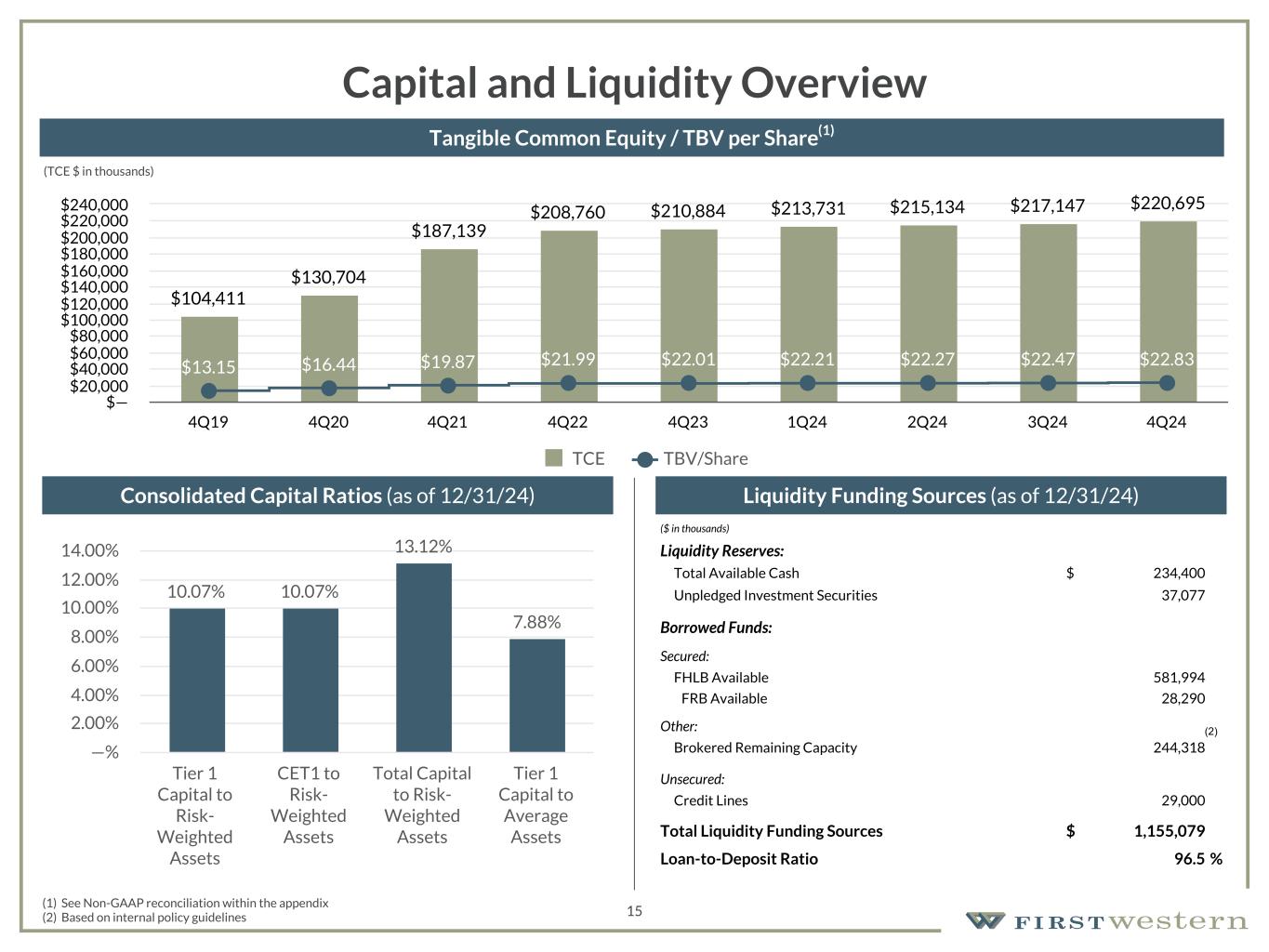

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 15 Capital and Liquidity Overview Liquidity Funding Sources (as of 12/31/24) (1) See Non-GAAP reconciliation within the appendix (2) Based on internal policy guidelines Consolidated Capital Ratios (as of 12/31/24) Tangible Common Equity / TBV per Share(1) ($ in thousands) Liquidity Reserves: Total Available Cash $ 234,400 Unpledged Investment Securities 37,077 Borrowed Funds: Secured: FHLB Available 581,994 FRB Available 28,290 Other: Brokered Remaining Capacity 244,318 Unsecured: Credit Lines 29,000 Total Liquidity Funding Sources $ 1,155,079 Loan-to-Deposit Ratio 96.5 % 10.07% 10.07% 13.12% 7.88% Tier 1 Capital to Risk- Weighted Assets CET1 to Risk- Weighted Assets Total Capital to Risk- Weighted Assets Tier 1 Capital to Average Assets —% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% $104,411 $130,704 $187,139 $208,760 $210,884 $213,731 $215,134 $217,147 $220,695 $13.15 $16.44 $19.87 $21.99 $22.01 $22.21 $22.27 $22.47 $22.83 TCE TBV/Share 4Q19 4Q20 4Q21 4Q22 4Q23 1Q24 2Q24 3Q24 4Q24 $— $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 $220,000 $240,000 (2) (TCE $ in thousands)

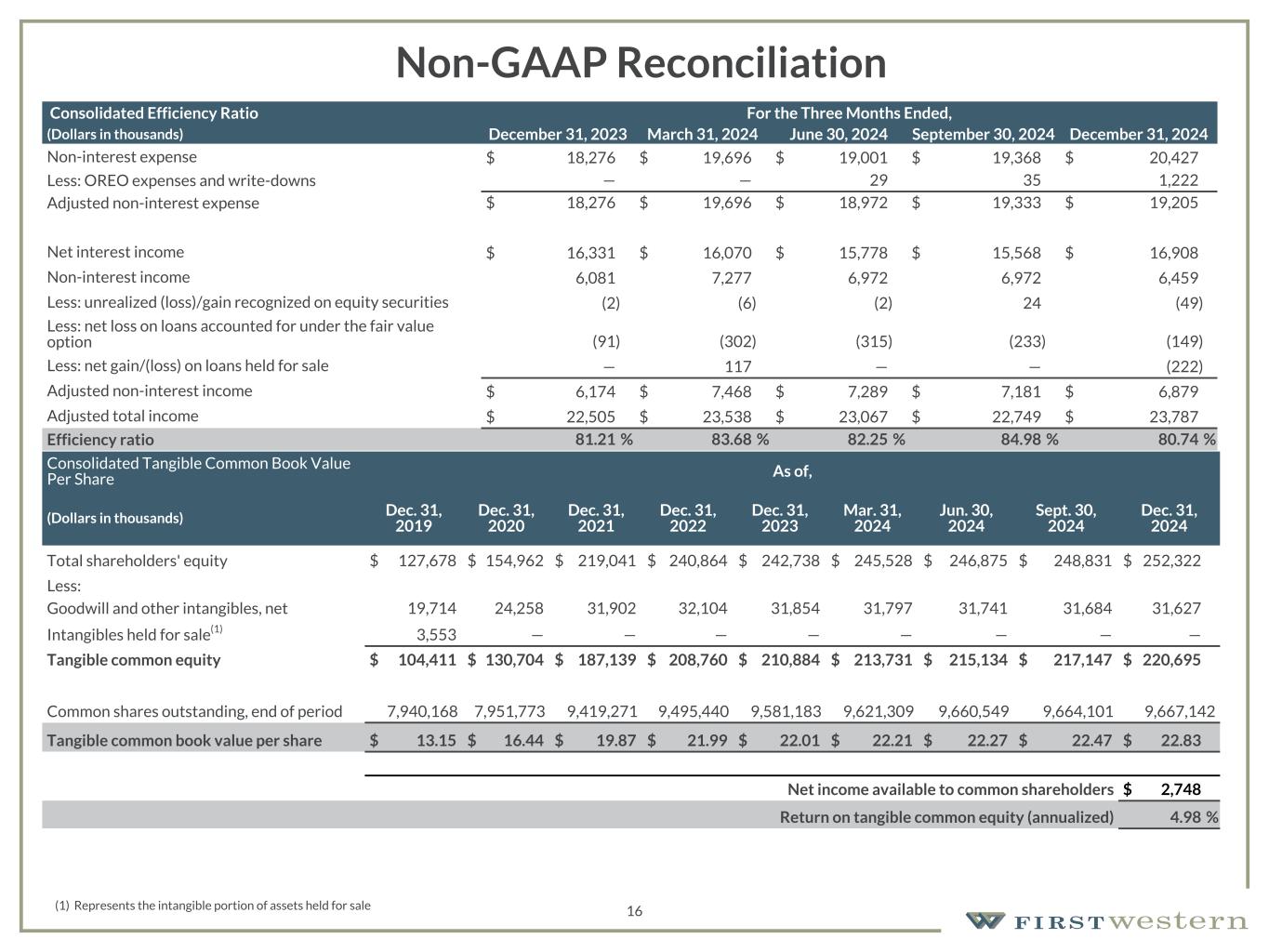

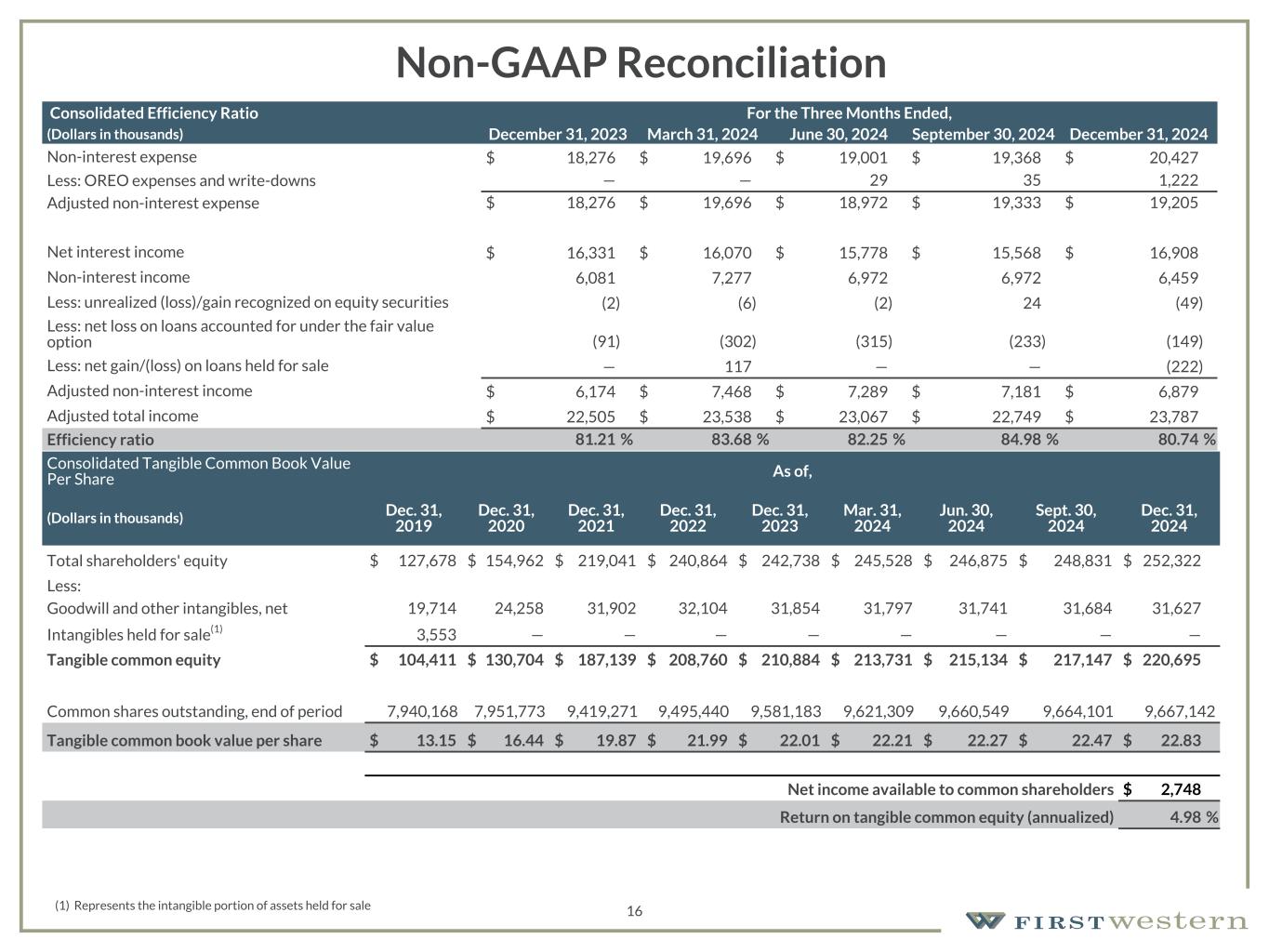

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 16 Non-GAAP Reconciliation Consolidated Tangible Common Book Value Per Share As of, (Dollars in thousands) Dec. 31, 2019 Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Mar. 31, 2024 Jun. 30, 2024 Sept. 30, 2024 Dec. 31, 2024 Total shareholders' equity $ 127,678 $ 154,962 $ 219,041 $ 240,864 $ 242,738 $ 245,528 $ 246,875 $ 248,831 $ 252,322 Less: Goodwill and other intangibles, net 19,714 24,258 31,902 32,104 31,854 31,797 31,741 31,684 31,627 Intangibles held for sale(1) 3,553 — — — — — — — — Tangible common equity $ 104,411 $ 130,704 $ 187,139 $ 208,760 $ 210,884 $ 213,731 $ 215,134 $ 217,147 $ 220,695 Common shares outstanding, end of period 7,940,168 7,951,773 9,419,271 9,495,440 9,581,183 9,621,309 9,660,549 9,664,101 9,667,142 Tangible common book value per share $ 13.15 $ 16.44 $ 19.87 $ 21.99 $ 22.01 $ 22.21 $ 22.27 $ 22.47 $ 22.83 Net income available to common shareholders $ 2,748 Return on tangible common equity (annualized) 4.98 % (1) Represents the intangible portion of assets held for sale Consolidated Efficiency Ratio For the Three Months Ended, (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Non-interest expense $ 18,276 $ 19,696 $ 19,001 $ 19,368 $ 20,427 Less: OREO expenses and write-downs — — 29 35 1,222 Adjusted non-interest expense $ 18,276 $ 19,696 $ 18,972 $ 19,333 $ 19,205 Net interest income $ 16,331 $ 16,070 $ 15,778 $ 15,568 $ 16,908 Non-interest income 6,081 7,277 6,972 6,972 6,459 Less: unrealized (loss)/gain recognized on equity securities (2) (6) (2) 24 (49) Less: net loss on loans accounted for under the fair value option (91) (302) (315) (233) (149) Less: net gain/(loss) on loans held for sale — 117 — — (222) Adjusted non-interest income $ 6,174 $ 7,468 $ 7,289 $ 7,181 $ 6,879 Adjusted total income $ 22,505 $ 23,538 $ 23,067 $ 22,749 $ 23,787 Efficiency ratio 81.21 % 83.68 % 82.25 % 84.98 % 80.74 %

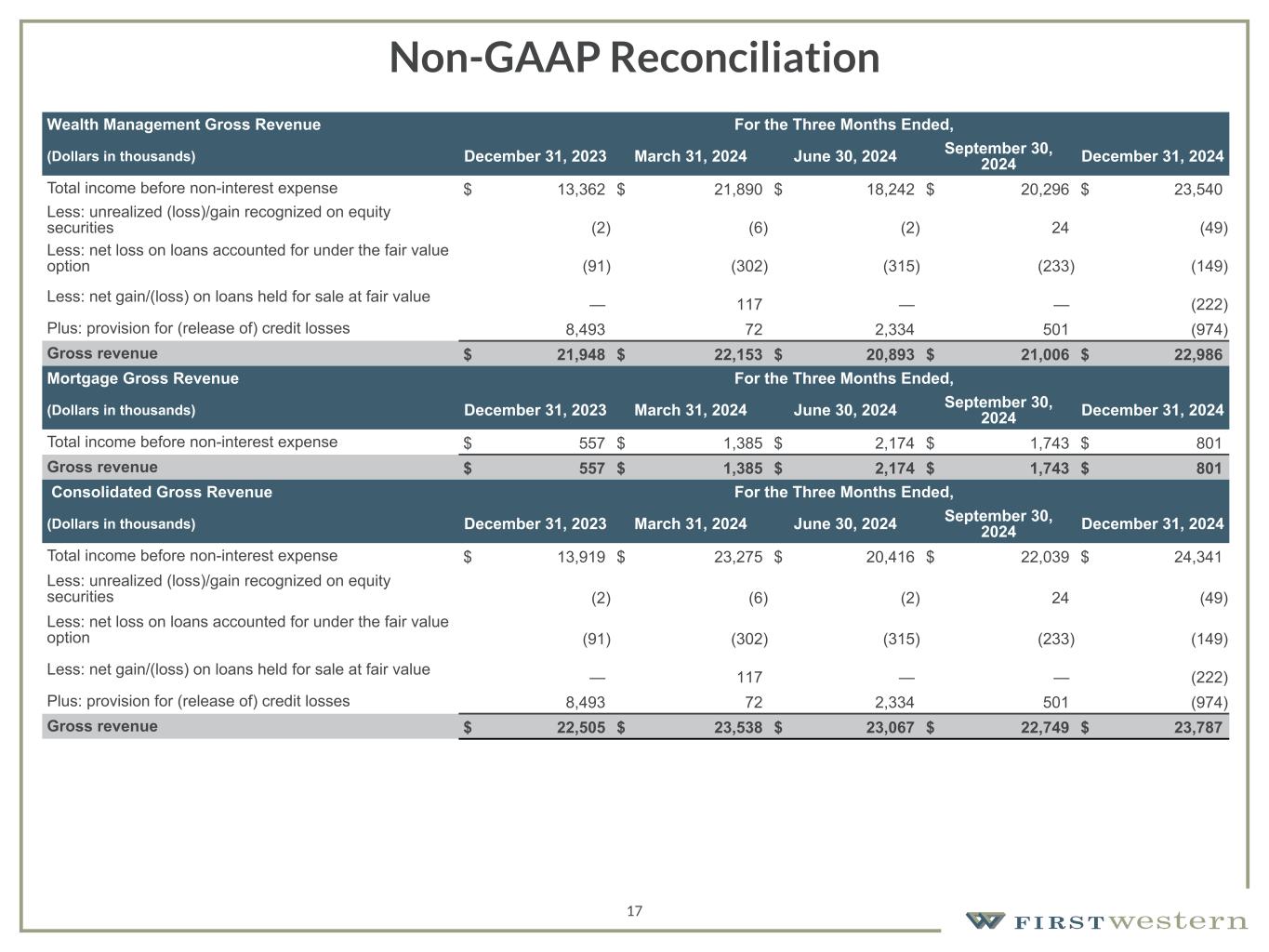

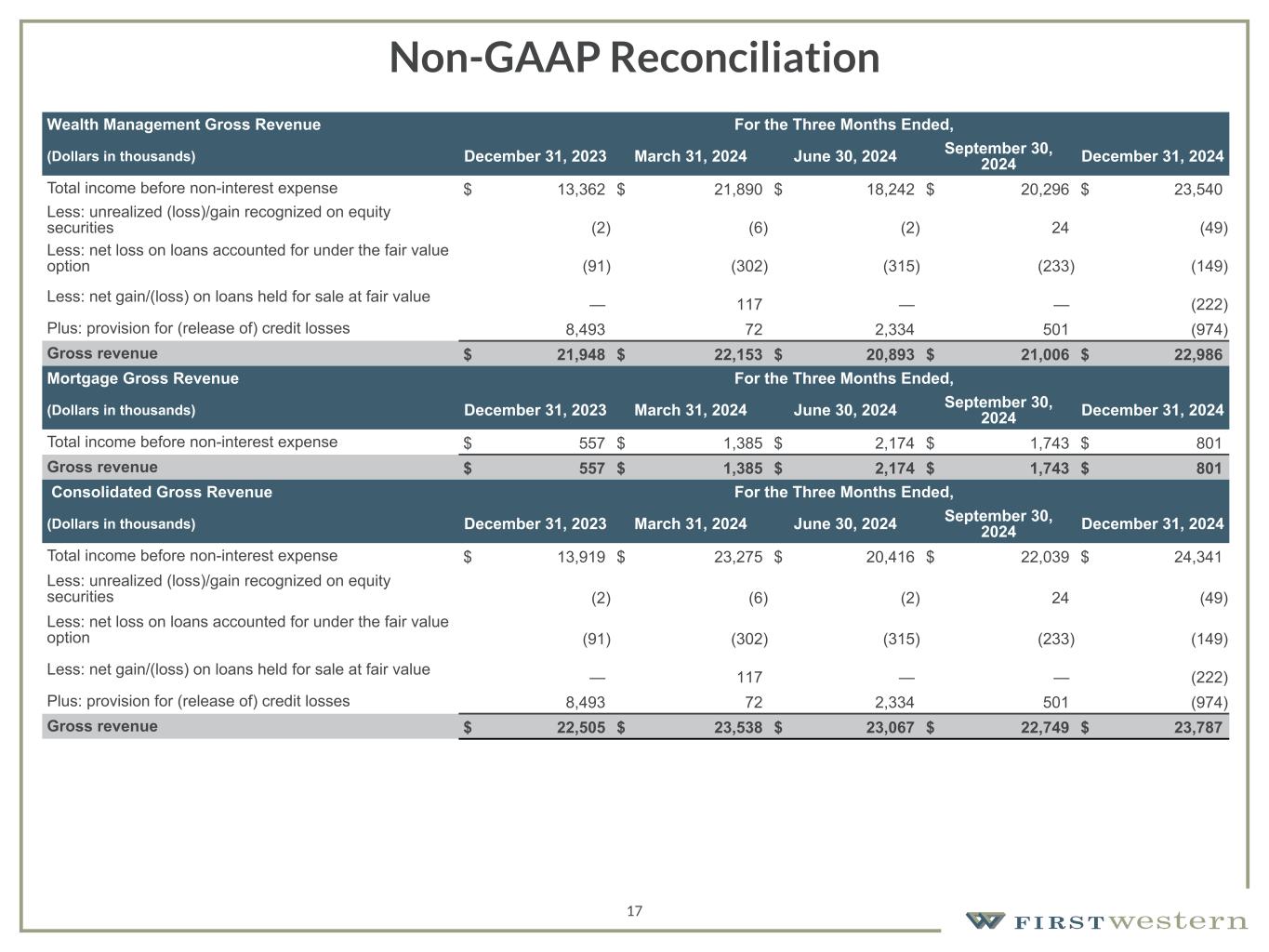

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 17 Non-GAAP Reconciliation Wealth Management Gross Revenue For the Three Months Ended, (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Total income before non-interest expense $ 13,362 $ 21,890 $ 18,242 $ 20,296 $ 23,540 Less: unrealized (loss)/gain recognized on equity securities (2) (6) (2) 24 (49) Less: net loss on loans accounted for under the fair value option (91) (302) (315) (233) (149) Less: net gain/(loss) on loans held for sale at fair value — 117 — — (222) Plus: provision for (release of) credit losses 8,493 72 2,334 501 (974) Gross revenue $ 21,948 $ 22,153 $ 20,893 $ 21,006 $ 22,986 Mortgage Gross Revenue For the Three Months Ended, (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Total income before non-interest expense $ 557 $ 1,385 $ 2,174 $ 1,743 $ 801 Gross revenue $ 557 $ 1,385 $ 2,174 $ 1,743 $ 801 Consolidated Gross Revenue For the Three Months Ended, (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Total income before non-interest expense $ 13,919 $ 23,275 $ 20,416 $ 22,039 $ 24,341 Less: unrealized (loss)/gain recognized on equity securities (2) (6) (2) 24 (49) Less: net loss on loans accounted for under the fair value option (91) (302) (315) (233) (149) Less: net gain/(loss) on loans held for sale at fair value — 117 — — (222) Plus: provision for (release of) credit losses 8,493 72 2,334 501 (974) Gross revenue $ 22,505 $ 23,538 $ 23,067 $ 22,749 $ 23,787

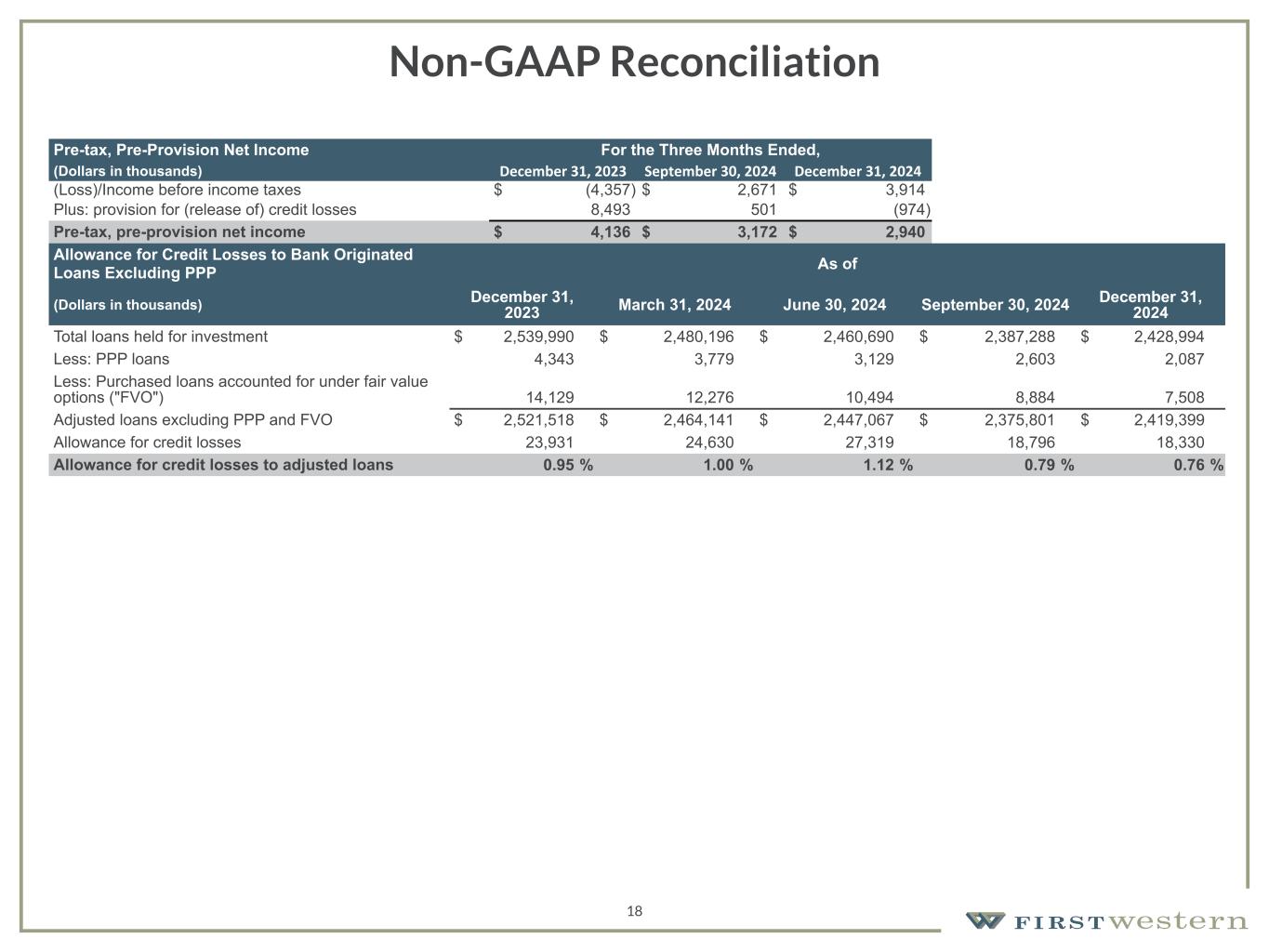

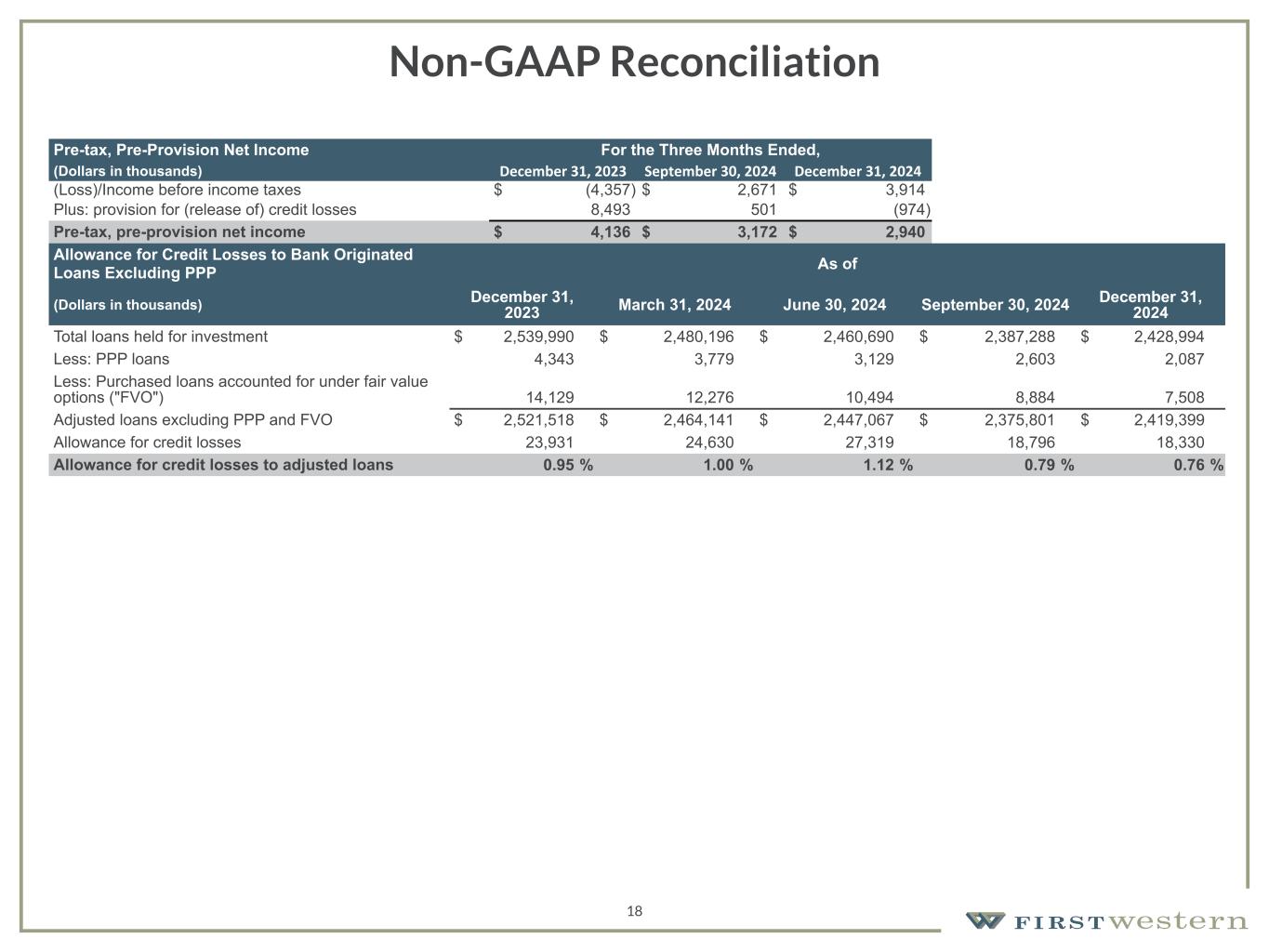

157 180 196 164 166 168 62 94 111 154 161 132 122 125 129 76 78 86 255 255 255 Chart color Table color Special Headlines Slide Headlines / Text on light background Primary Colors Secondary Colors Primary Background / Call Out Boxes / Text on dark background Chart color Table Color Tertiary Colors Chart color Table Color Chart Color Chart Color Approved Fonts AaBbCc 123 Lora (bold) Slide Headlines / Special Headlines AaBbCc 123 Lato (regular, bold, italics) Body Copy / Subheadings / Small Text Descriptions 18 Non-GAAP Reconciliation Allowance for Credit Losses to Bank Originated Loans Excluding PPP As of (Dollars in thousands) December 31, 2023 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 Total loans held for investment $ 2,539,990 $ 2,480,196 $ 2,460,690 $ 2,387,288 $ 2,428,994 Less: PPP loans 4,343 3,779 3,129 2,603 2,087 Less: Purchased loans accounted for under fair value options ("FVO") 14,129 12,276 10,494 8,884 7,508 Adjusted loans excluding PPP and FVO $ 2,521,518 $ 2,464,141 $ 2,447,067 $ 2,375,801 $ 2,419,399 Allowance for credit losses 23,931 24,630 27,319 18,796 18,330 Allowance for credit losses to adjusted loans 0.95 % 1.00 % 1.12 % 0.79 % 0.76 % Pre-tax, Pre-Provision Net Income For the Three Months Ended, (Dollars in thousands) December 31, 2023 September 30, 2024 December 31, 2024 (Loss)/Income before income taxes $ (4,357) $ 2,671 $ 3,914 Plus: provision for (release of) credit losses 8,493 501 (974) Pre-tax, pre-provision net income $ 4,136 $ 3,172 $ 2,940