Exhibit 99.1

| First Western Financial, Inc. The First, Western-Based Private Trust Bank Investor Presentation February 2019 |

| Safe Harbor 2 This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of First Western’s management with respect to, among other things, future events and First Western’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about First Western’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond First Western’s control. Accordingly, First Western cautions you that any such forward- looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although First Western believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. All subsequent written and oral forward-looking statements attributable to First Western or persons acting on First Western’s behalf are expressly qualified in their entirety by this paragraph. We undertake no obligation to publicly update or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise (except as required by law). Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and the sources from which it has been obtained are reliable; however, the Company cannot guaranty the accuracy of such information and has not independently verified such information. This presentation contains certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial measures to GAAP financial measures are provided at the end of this presentation. Numbers in the presentation may not sum due to rounding. Our common stock is not a deposit or savings account. Our common stock is not insured by the Federal Deposit Insurance Corporation or any governmental agency or instrumentality. This presentation is not an offer to sell any securities and it is not soliciting an offer to buy any securities in any state or jurisdiction where the offer or sale is not permitted. Neither the SEC nor any state securities commission has approved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof. |

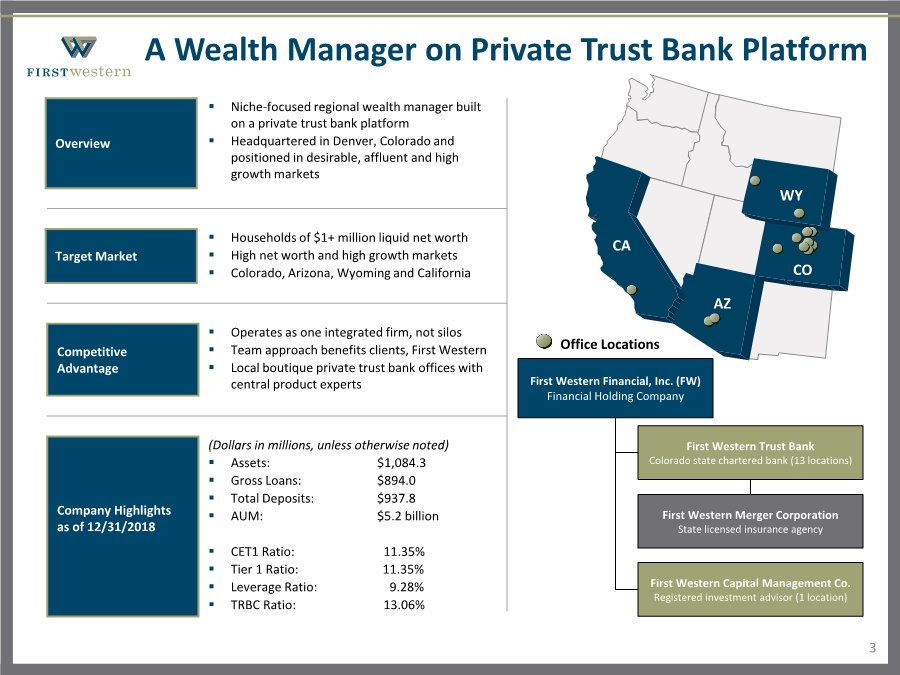

| A Wealth Manager on Private Trust Bank Platform 3 Overview .. Niche-focused regional wealth manager built on a private trust bank platform .. Headquartered in Denver, Colorado and positioned in desirable, affluent and high growth markets Target Market .. Households of $1+ million liquid net worth .. High net worth and high growth markets .. Colorado, Arizona, Wyoming and California Company Highlights as of 12/31/2018 Competitive Advantage (Dollars in millions, unless otherwise noted) .. Assets: $1,084.3 .. Gross Loans: $894.0 .. Total Deposits: $937.8 .. AUM: $5.2 billion .. CET1 Ratio: 11.35% .. Tier 1 Ratio: 11.35% .. Leverage Ratio: 9.28% .. TRBC Ratio: 13.06% .. Operates as one integrated firm, not silos .. Team approach benefits clients, First Western .. Local boutique private trust bank offices with central product experts First Western Financial, Inc. (FW) Financial Holding Company First Western Trust Bank Colorado state chartered bank (13 locations) First Western Capital Management Co. Registered investment advisor (1 location) First Western Merger Corporation State licensed insurance agency • Office Locations CA AZ WY CO |

| First Western’s core strengths provide the foundation for driving shareholder value MYFW: Our Five Core Strengths Experienced, Tested Team .. Niche-focused franchise headquartered in Denver, Colorado .. Well-positioned in many attractive markets in Arizona, California, Colorado and Wyoming .. Specialized central expertise to compete with siloed national, regional firms .. Delivered through local, boutique trust banking teams so clients “owned” by MYFW, not associates Built in Operating Leverage .. Strong profit center margins at maturity, growth opportunities in current and new markets .. Revenue growth in both fee income and net interest income, with asset sensitive balance sheet .. Scalable, leverageable high fixed cost Product and Support Centers .. Operating expense investment already in place for growth and expansion Highly Desirable Recurring Fee Income .. ~50% fee income, consistently through MYFW history .. Primarily recurring trust and investment management (“TIM”) fees .. Low risk, “sticky” wealth/trust business with comprehensive product offering .. Multiple entry points with ConnectView® – proprietary review process to service, cross-sell Differentiated, Proven in the Marketplace .. At critical mass but small market share, many current and new market opportunities .. Proven ability to expand: (1) Organically, (2) By expansion and (3) By acquisition .. Few large Colorado bank alternatives for investors and clients, creating lift-out opportunities .. MYFW was been capital constrained: IPO provided growth capital, paid off high cost capital, debt Unique Opportunity for Investors .. Executives are major bank/professional firm trained, with deep relationships in communities .. Achieved growth through business and economic cycles, capital constraints .. Healthy relationship with all regulators with strong risk management culture .. CEO with proven track record for creating value in previous bank ownership 4 |

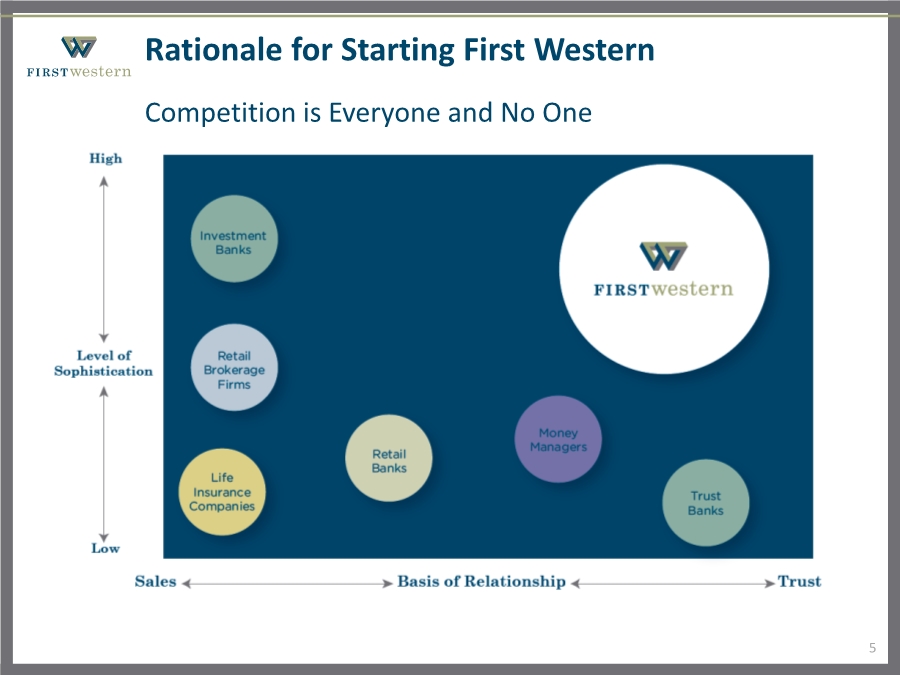

| 5 Rationale for Starting First Western Competition is Everyone and No One |

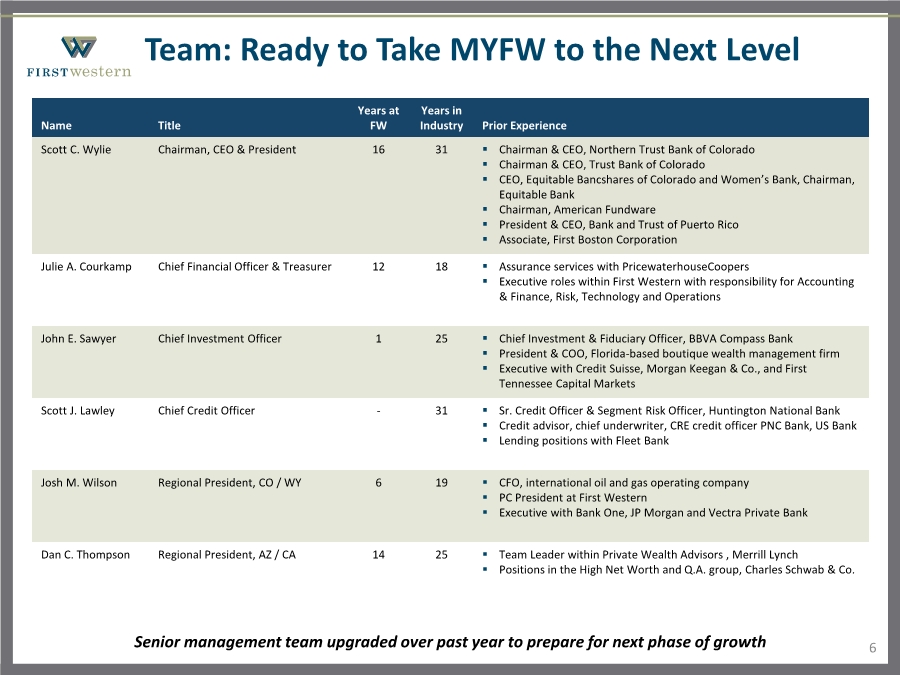

| 6 Team: Ready to Take MYFW to the Next Level Name Title Years at FW Years in Industry Prior Experience Scott C. Wylie Chairman, CEO & President 16 31 . Chairman & CEO, Northern Trust Bank of Colorado .. Chairman & CEO, Trust Bank of Colorado .. CEO, Equitable Bancshares of Colorado and Women’s Bank, Chairman, Equitable Bank .. Chairman, American Fundware .. President & CEO, Bank and Trust of Puerto Rico .. Associate, First Boston Corporation Julie A. Courkamp Chief Financial Officer & Treasurer 12 18 . Assurance services with PricewaterhouseCoopers .. Executive roles within First Western with responsibility for Accounting & Finance, Risk, Technology and Operations John E. Sawyer Chief Investment Officer 1 25 . Chief Investment & Fiduciary Officer, BBVA Compass Bank .. President & COO, Florida-based boutique wealth management firm .. Executive with Credit Suisse, Morgan Keegan & Co., and First Tennessee Capital Markets Scott J. Lawley Chief Credit Officer - 31 . Sr. Credit Officer & Segment Risk Officer, Huntington National Bank .. Credit advisor, chief underwriter, CRE credit officer PNC Bank, US Bank .. Lending positions with Fleet Bank Josh M. Wilson Regional President, CO / WY 6 19 . CFO, international oil and gas operating company .. PC President at First Western .. Executive with Bank One, JP Morgan and Vectra Private Bank Dan C. Thompson Regional President, AZ / CA 14 25 . Team Leader within Private Wealth Advisors , Merrill Lynch .. Positions in the High Net Worth and Q.A. group, Charles Schwab & Co. Senior management team upgraded over past year to prepare for next phase of growth |

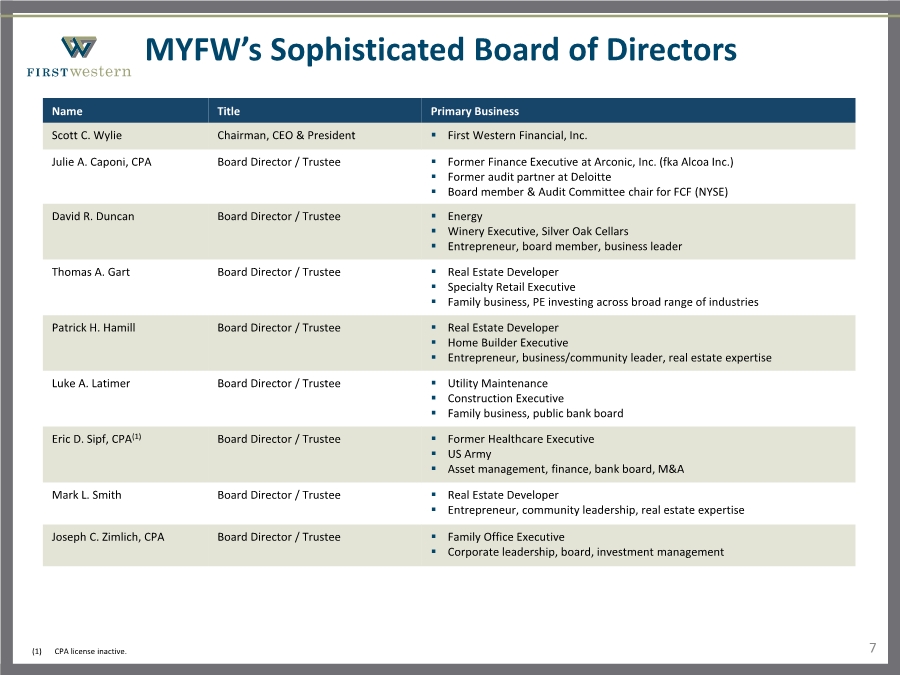

| Name Title Primary Business Scott C. Wylie Chairman, CEO & President . First Western Financial, Inc. Julie A. Caponi, CPA Board Director / Trustee . Former Finance Executive at Arconic, Inc. (fka Alcoa Inc.) .. Former audit partner at Deloitte .. Board member & Audit Committee chair for FCF (NYSE) David R. Duncan Board Director / Trustee . Energy .. Winery Executive, Silver Oak Cellars .. Entrepreneur, board member, business leader Thomas A. Gart Board Director / Trustee . Real Estate Developer .. Specialty Retail Executive .. Family business, PE investing across broad range of industries Patrick H. Hamill Board Director / Trustee . Real Estate Developer .. Home Builder Executive .. Entrepreneur, business/community leader, real estate expertise Luke A. Latimer Board Director / Trustee . Utility Maintenance .. Construction Executive .. Family business, public bank board Eric D. Sipf, CPA(1) Board Director / Trustee . Former Healthcare Executive .. US Army .. Asset management, finance, bank board, M&A Mark L. Smith Board Director / Trustee . Real Estate Developer .. Entrepreneur, community leadership, real estate expertise Joseph C. Zimlich, CPA Board Director / Trustee . Family Office Executive .. Corporate leadership, board, investment management (1) CPA license inactive. MYFW’s Sophisticated Board of Directors 7 |

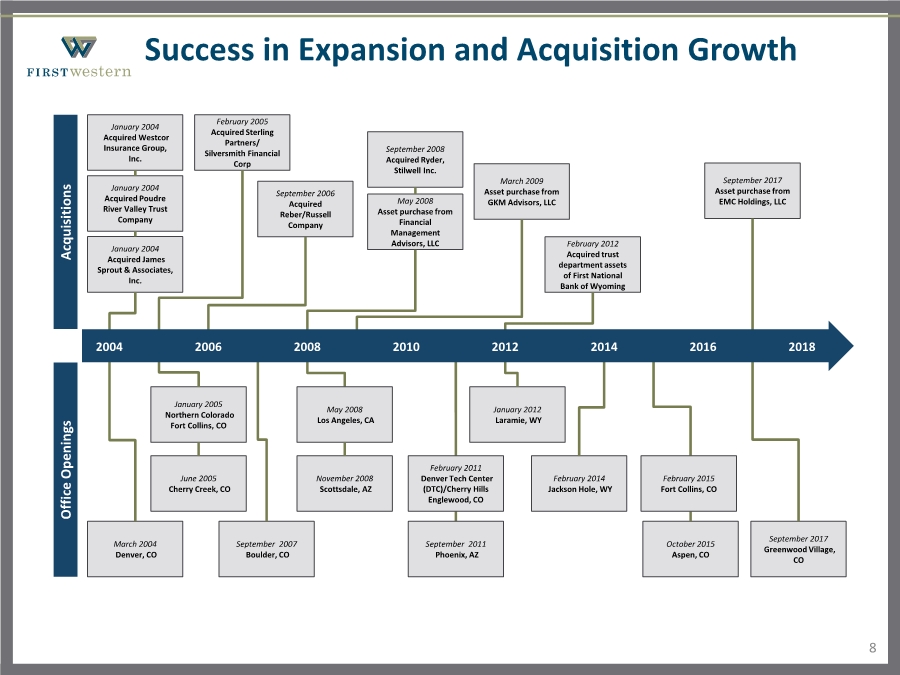

| Success in Expansion and Acquisition Growth January 2004 Acquired Westcor Insurance Group, Inc. January 2004 Acquired James Sprout & Associates, Inc. January 2004 Acquired Poudre River Valley Trust Company February 2005 Acquired Sterling Partners/ Silversmith Financial Corp September 2006 Acquired Reber/Russell Company May 2008 Asset purchase from Financial Management Advisors, LLC September 2008 Acquired Ryder, Stilwell Inc. March 2009 Asset purchase from GKM Advisors, LLC February 2012 Acquired trust department assets of First National Bank of Wyoming September 2017 Asset purchase from EMC Holdings, LLC Acquisitions Office Openings February 2011 Denver Tech Center (DTC)/Cherry Hills Englewood, CO February 2014 Jackson Hole, WY June 2005 Cherry Creek, CO September 2007 Boulder, CO January 2005 Northern Colorado Fort Collins, CO March 2004 Denver, CO January 2012 Laramie, WY September 2017 Greenwood Village, CO September 2011 Phoenix, AZ October 2015 Aspen, CO 2004 2006 2008 2010 2012 2014 2016 2018 November 2008 Scottsdale, AZ May 2008 Los Angeles, CA 8 February 2015 Fort Collins, CO |

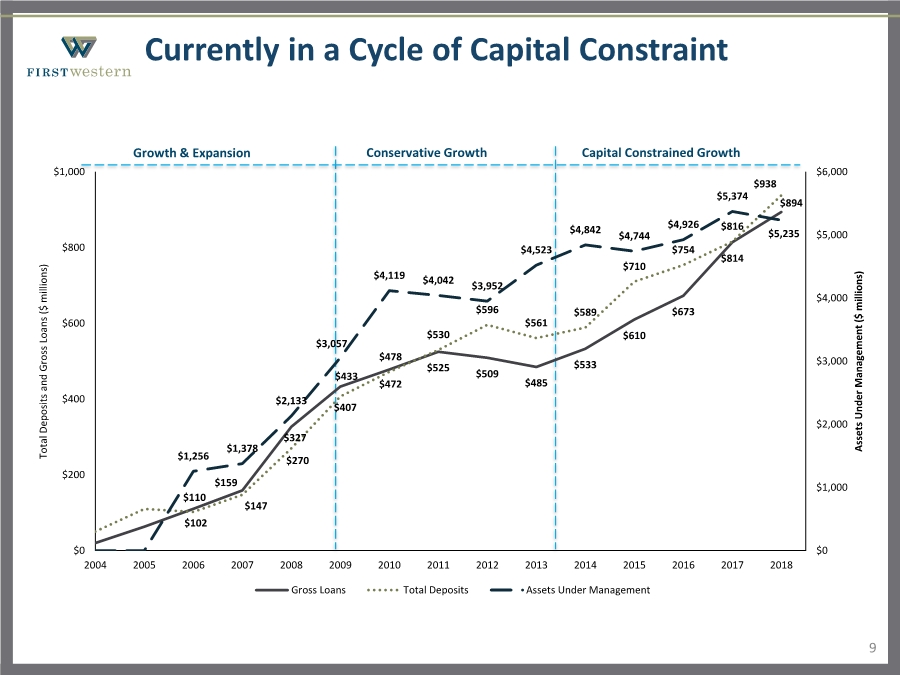

| 9 Currently in a Cycle of Capital Constraint Growth & Expansion Conservative Growth Capital Constrained Growth $110 $159 $327 $433 $478 $525 $509 $485 $533 $610 $673 $814 $894 $102 $147 $270 $407 $472 $530 $596 $561 $589 $710 $754 $816 $938 $1,256 $1,378 $2,133 $3,057 $4,119 $4,042 $3,952 $4,523 $4,842 $4,744 $4,926 $5,374 $5,235 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $0 $200 $400 $600 $800 $1,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Assets Under Management ($ millions) Total Deposits and Gross Loans ($ millions) Gross Loans Total Deposits Assets Under Management |

| MSA State Market Share Projected % Change in HHI of $200M + (2019-2024)(3) Denver-Aurora-Lakewood CO 0.45 35.49 Fort Collins CO 2.15 44.99 Phoenix-Mesa-Scottsdale AZ 0.13 41.62 Boulder CO 0.83 28.76 Jackson WY/ID 2.90 21.42 Glenwood Springs CO 1.17 24.61 National Average 31.93 10 (1) Source: 2018 Downtown Denver Partnership Report; Ft. Collins Chamber of Commerce; University of Arizona; Fed Funds Info; Realtor.com. (2) Source: S&P Global Market Intelligence as of 06/30/2018. (3) Percentage income growth for households with over $200,000 in current household income (HHI). Note: Demographic data provided by Nielsen per US Census data. Small market share and growing high household income means lots of room to grow Deposits by MSA(2)First Western Market Favorability(1) Great Markets, Scarce Investment Opportunity .. Denver, Colorado (2018) •#1 best metro for small business employment •#5 best economy among large U.S. cities, population tripled (’00) • Employment reached record-high in 2Q 2018 (up 4.1% YoY) .. Fort Collins, Colorado (2017) •#1 for stable & growing housing market • Manufacturing for Anheuser-Busch, Broadcom, Intel .. Phoenix, Arizona (2017) • Total personal income rose 4.3% for state • Employment increased 3.5% for state •#3 in personal income growth, #5 for economic momentum Deposits by State Colorado 77% Arizona 15% Wyoming 8% Colorado Chartered Banks (Assets > ~$1.0 billion) Denver, CO 44% Fort Collins, CO 20% Phoenix, AZ 15% Boulder, CO 10% Glenwood Springs, CO 3% Jackson, WY 8% As of September 30, 2018 Current Ownership Total Assets ($bn) FirstBank Private 18.4 NBH Bank Public (NYSE: NBHC) 5.6 Bank of Colorado Private (Sub. of Pinnacle Bancorp-NE) 3.9 CoBiz Bank BOKF (Acquired in 2018) 3.8 Guaranty B&TC IBTX (Acquired in 2018) 3.8 Sunflower Bank Private 3.7 Alpine Bank Private 3.7 ANB Bank Private 2.6 Citywide Banks HTLF (Acquired in 2017) 2.3 First Western Trust Bank Public (Nasdaq: MYFW) 1.1 |

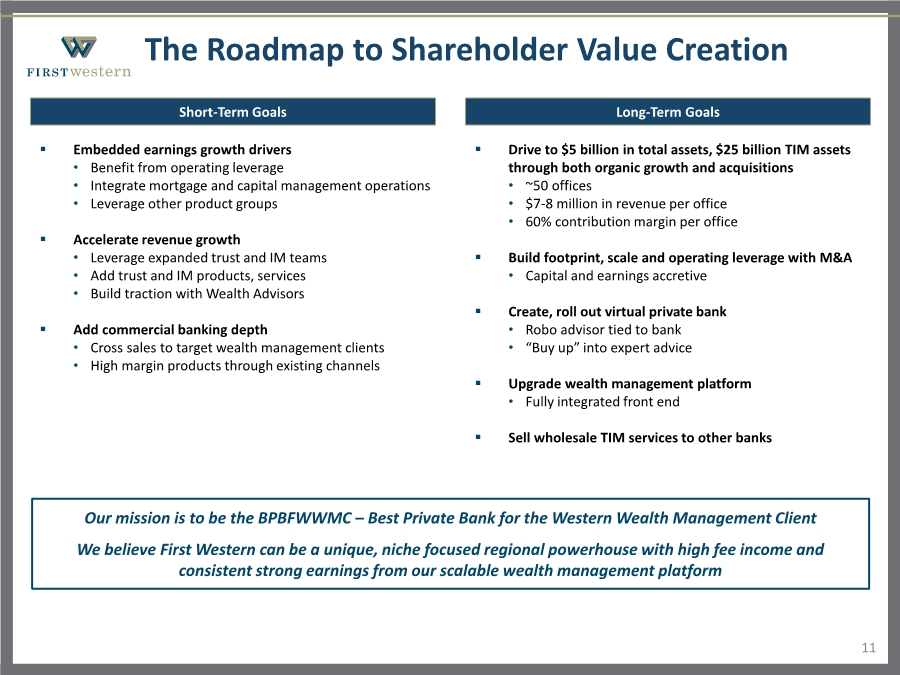

| 11 The Roadmap to Shareholder Value Creation Short-Term Goals Long-Term Goals Our mission is to be the BPBFWWMC – Best Private Bank for the Western Wealth Management Client We believe First Western can be a unique, niche focused regional powerhouse with high fee income and consistent strong earnings from our scalable wealth management platform .. Embedded earnings growth drivers • Benefit from operating leverage • Integrate mortgage and capital management operations • Leverage other product groups .. Accelerate revenue growth • Leverage expanded trust and IM teams • Add trust and IM products, services • Build traction with Wealth Advisors .. Add commercial banking depth • Cross sales to target wealth management clients • High margin products through existing channels .. Drive to $5 billion in total assets, $25 billion TIM assets through both organic growth and acquisitions • ~50 offices • $7-8 million in revenue per office • 60% contribution margin per office .. Build footprint, scale and operating leverage with M&A • Capital and earnings accretive .. Create, roll out virtual private bank • Robo advisor tied to bank •“Buy up” into expert advice .. Upgrade wealth management platform • Fully integrated front end .. Sell wholesale TIM services to other banks |

| . Finance & Accounting .. Risk & Compliance .. Enterprise Technology .. Human Capital .. Credit Analysis .. Bank & Trust/Investment Operations .. Marketing/Branding Our local, boutique private trust bank offices compete with the biggest wealth managers in the country… First Western Product Groups (PG) Support Centers (SC) Profit Centers (PC) Organizational Structure Built for Scale .. Investment Management .. Fiduciary/ Trust .. Wealth Planning .. Retirement Services .. Insurance .. Mortgage Services .. Treasury Management Full Bank and Trust: .. Aspen, CO .. Boulder, CO .. Cherry Creek, CO .. Denver, CO .. DTC/Cherry Hills, CO .. Northern Colorado .. Jackson Hole, WY .. Scottsdale, AZ .. Phoenix, AZ Loan Production Offices: .. Ft. Collins, CO .. Greenwood Village, CO Trust Offices: .. Century City, CA .. Laramie, WY 12 Big operating leverage from expert, high fixed cost teams Very profitable when mature |

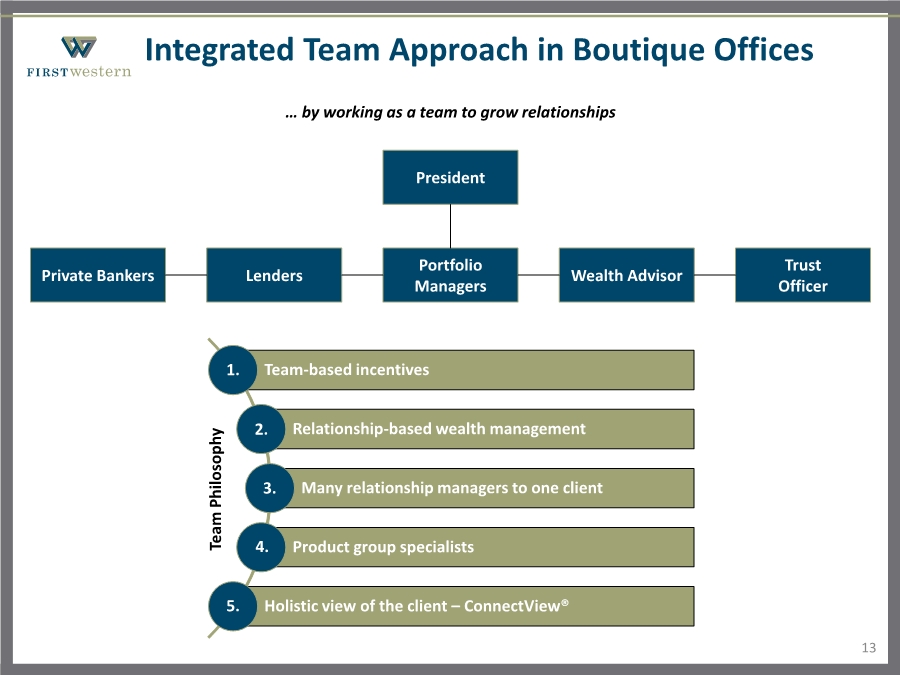

| Integrated Team Approach in Boutique Offices President Private Bankers Wealth Advisor Trust Officer 13 Lenders Portfolio Managers Team-based incentives Relationship-based wealth management Many relationship managers to one client Product group specialists Holistic view of the client – ConnectView® Team Philosophy 1. 2. 3. 4. 5. … by working as a team to grow relationships |

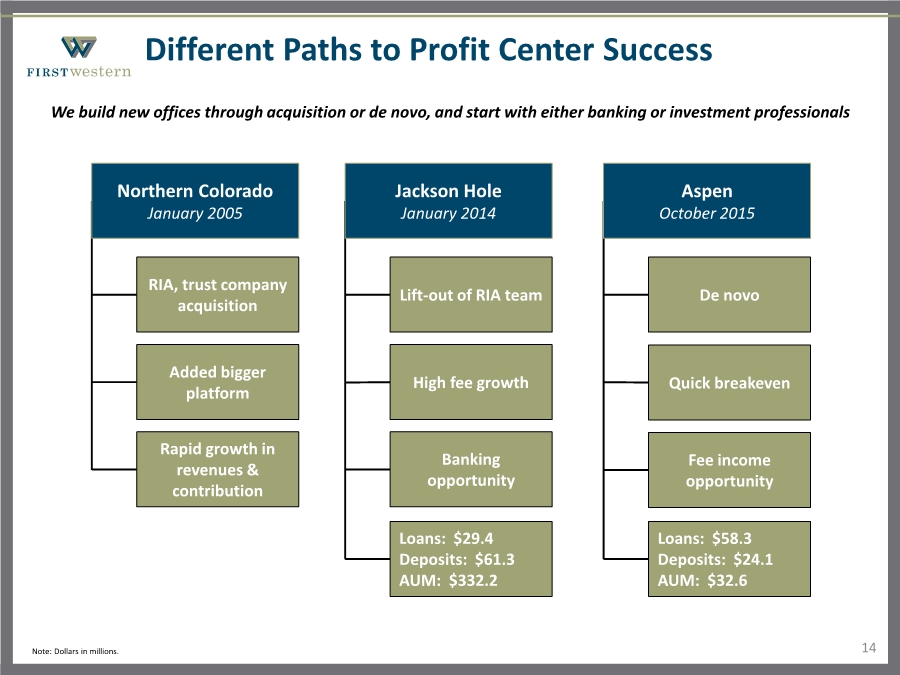

| Different Paths to Profit Center Success 14 We build new offices through acquisition or de novo, and start with either banking or investment professionals Jackson Hole January 2014 Northern Colorado January 2005 Aspen October 2015 RIA, trust company acquisition Added bigger platform Rapid growth in revenues & contribution Lift-out of RIA team High fee growth Banking opportunity De novo Quick breakeven Fee income opportunity Loans: $58.3 Deposits: $24.1 AUM: $32.6 Loans: $29.4 Deposits: $61.3 AUM: $332.2 Note: Dollars in millions. |

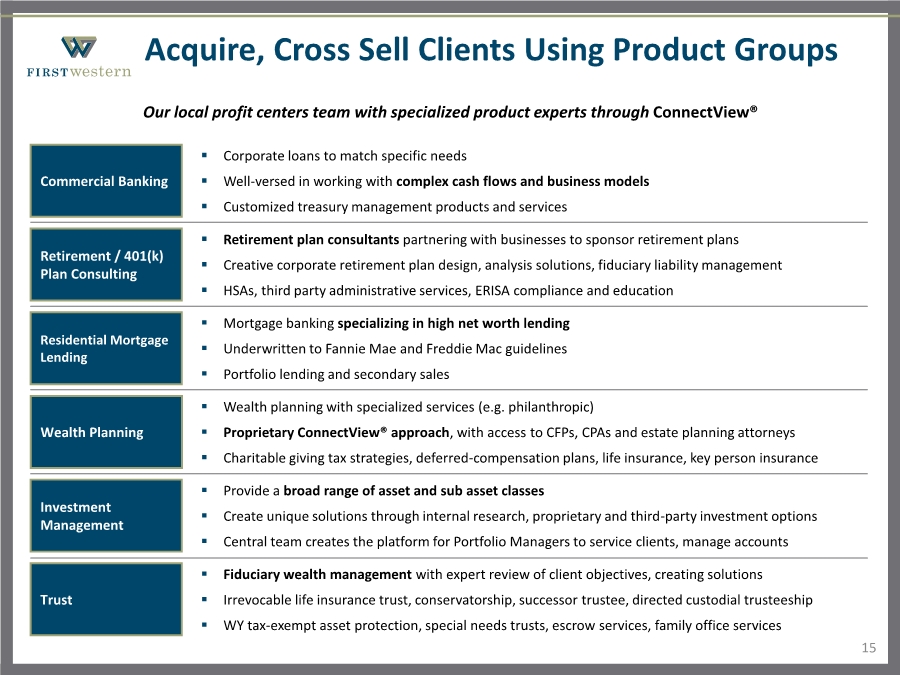

| Acquire, Cross Sell Clients Using Product Groups 15 Wealth Planning Commercial Banking Investment Management Residential Mortgage Lending Retirement / 401(k) Plan Consulting Trust .. Wealth planning with specialized services (e.g. philanthropic) .. Proprietary ConnectView® approach, with access to CFPs, CPAs and estate planning attorneys .. Charitable giving tax strategies, deferred-compensation plans, life insurance, key person insurance .. Corporate loans to match specific needs .. Well-versed in working with complex cash flows and business models .. Customized treasury management products and services .. Provide a broad range of asset and sub asset classes .. Create unique solutions through internal research, proprietary and third-party investment options .. Central team creates the platform for Portfolio Managers to service clients, manage accounts .. Mortgage banking specializing in high net worth lending .. Underwritten to Fannie Mae and Freddie Mac guidelines .. Portfolio lending and secondary sales .. Retirement plan consultants partnering with businesses to sponsor retirement plans .. Creative corporate retirement plan design, analysis solutions, fiduciary liability management .. HSAs, third party administrative services, ERISA compliance and education .. Fiduciary wealth management with expert review of client objectives, creating solutions .. Irrevocable life insurance trust, conservatorship, successor trustee, directed custodial trusteeship .. WY tax-exempt asset protection, special needs trusts, escrow services, family office services Our local profit centers team with specialized product experts through ConnectView® |

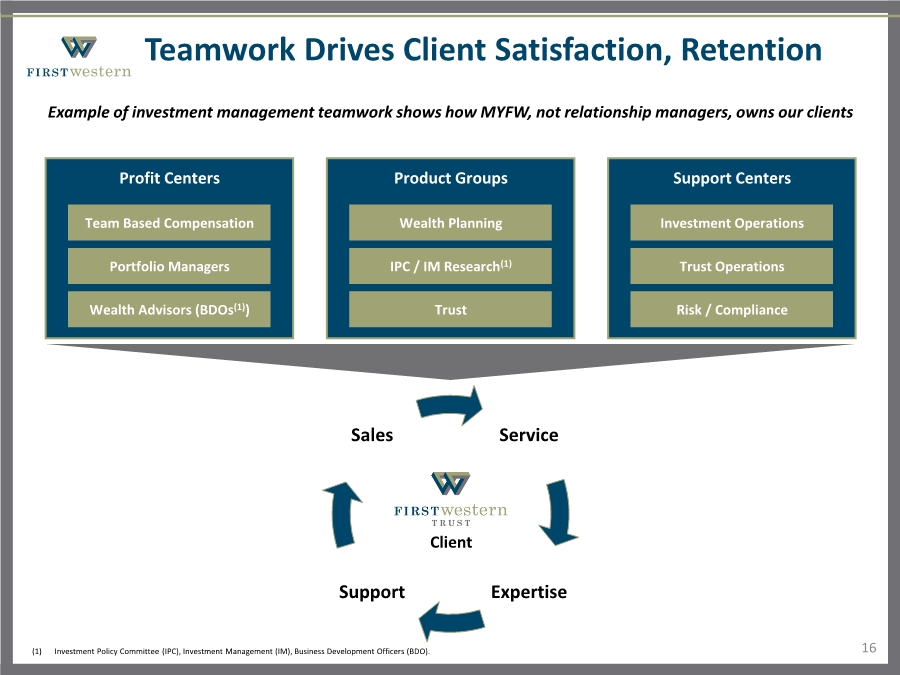

| (1) Investment Policy Committee (IPC), Investment Management (IM), Business Development Officers (BDO). Teamwork Drives Client Satisfaction, Retention 16 Example of investment management teamwork shows how MYFW, not relationship managers, owns our clients Profit Centers Product Groups Support Centers Team Based Compensation Portfolio Managers Wealth Advisors (BDOs(1)) Wealth Planning IPC / IM Research(1) Trust Investment Operations Trust Operations Risk / Compliance Service ExpertiseSupport Sales Client |

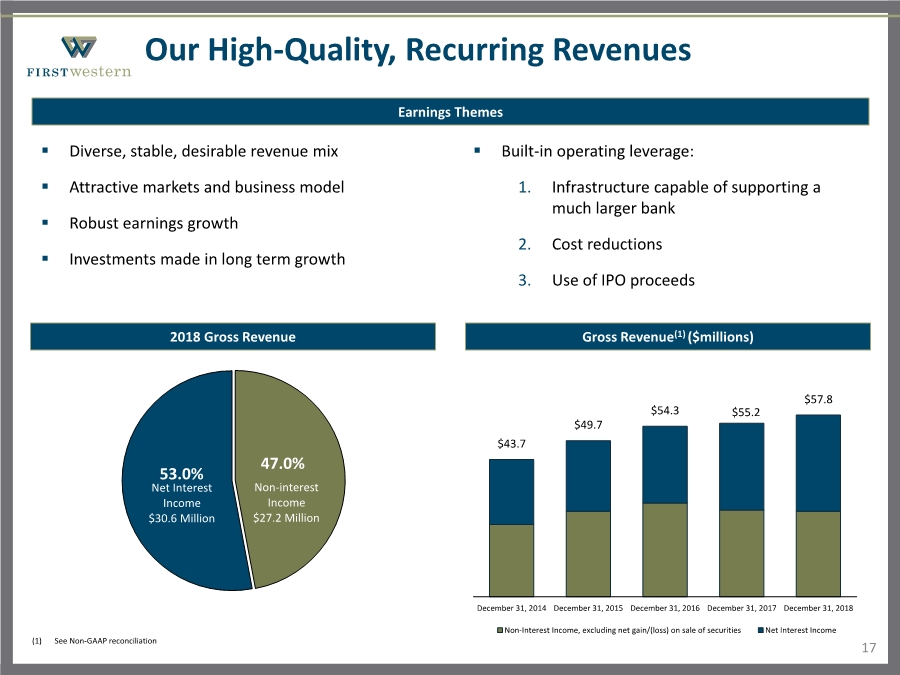

| $43.7 $49.7 $54.3 $55.2 $57.8 December 31, 2014 December 31, 2015 December 31, 2016 December 31, 2017 December 31, 2018 Non-Interest Income, excluding net gain/(loss) on sale of securities Net Interest Income Our High-Quality, Recurring Revenues 17(1) See Non-GAAP reconciliation Earnings Themes .. Diverse, stable, desirable revenue mix .. Attractive markets and business model .. Robust earnings growth .. Investments made in long term growth .. Built-in operating leverage: 1. Infrastructure capable of supporting a much larger bank 2. Cost reductions 3. Use of IPO proceeds Gross Revenue(1) ($millions) Non-interest Income $27.2 Million Net Interest Income $30.6 Million 53.0% 47.0% 2018 Gross Revenue |

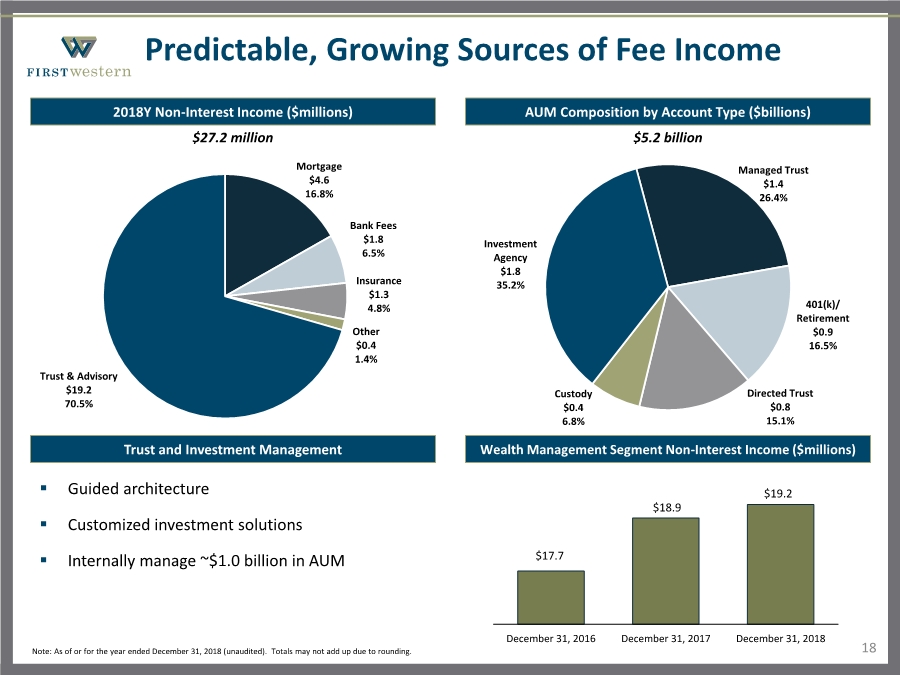

| $17.7 $18.9 $19.2 December 31, 2016 December 31, 2017 December 31, 2018 Predictable, Growing Sources of Fee Income 18Note: As of or for the year ended December 31, 2018 (unaudited). Totals may not add up due to rounding. AUM Composition by Account Type ($billions)2018Y Non-Interest Income ($millions) Trust and Investment Management .. Guided architecture .. Customized investment solutions .. Internally manage ~$1.0 billion in AUM $5.2 billion Wealth Management Segment Non-Interest Income ($millions) $27.2 million Mortgage $4.6 16.8% Bank Fees $1.8 6.5% Insurance $1.3 4.8% Other $0.4 1.4% Trust & Advisory $19.2 70.5% Managed Trust $1.4 26.4% 401(k)/ Retirement $0.9 16.5% Directed Trust $0.8 15.1% Custody $0.4 6.8% Investment Agency $1.8 35.2% |

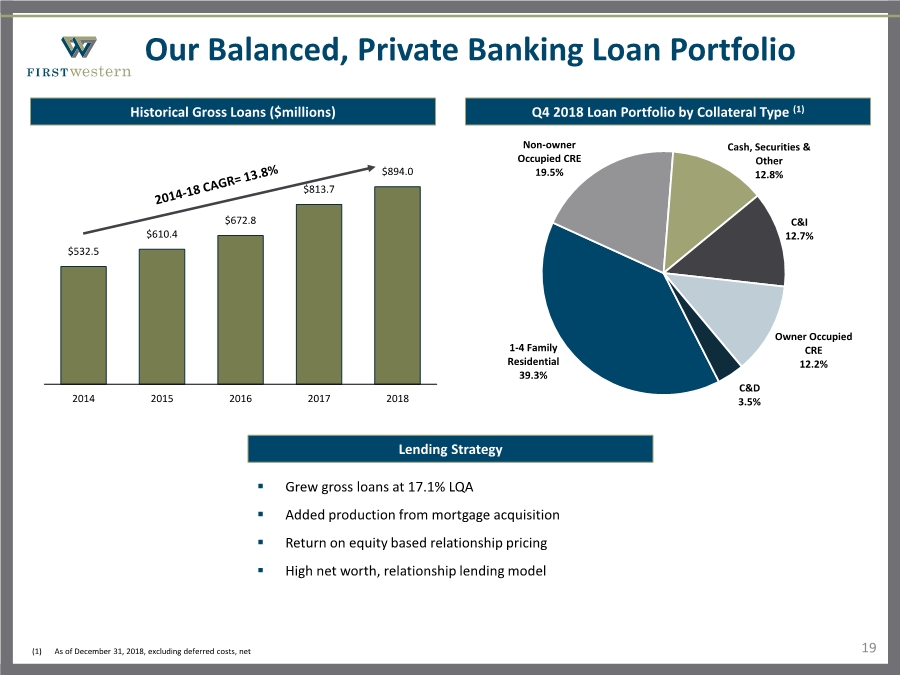

| $532.5 $610.4 $672.8 $813.7 $894.0 2014 2015 2016 2017 2018 Our Balanced, Private Banking Loan Portfolio 19 Historical Gross Loans ($millions) Q4 2018 Loan Portfolio by Collateral Type (1) Lending Strategy (1) As of December 31, 2018, excluding deferred costs, net .. Grew gross loans at 17.1% LQA .. Added production from mortgage acquisition .. Return on equity based relationship pricing .. High net worth, relationship lending model 1-4 Family Residential 39.3% Non-owner Occupied CRE 19.5% Cash, Securities & Other 12.8% C&I 12.7% Owner Occupied CRE 12.2% C&D 3.5% |

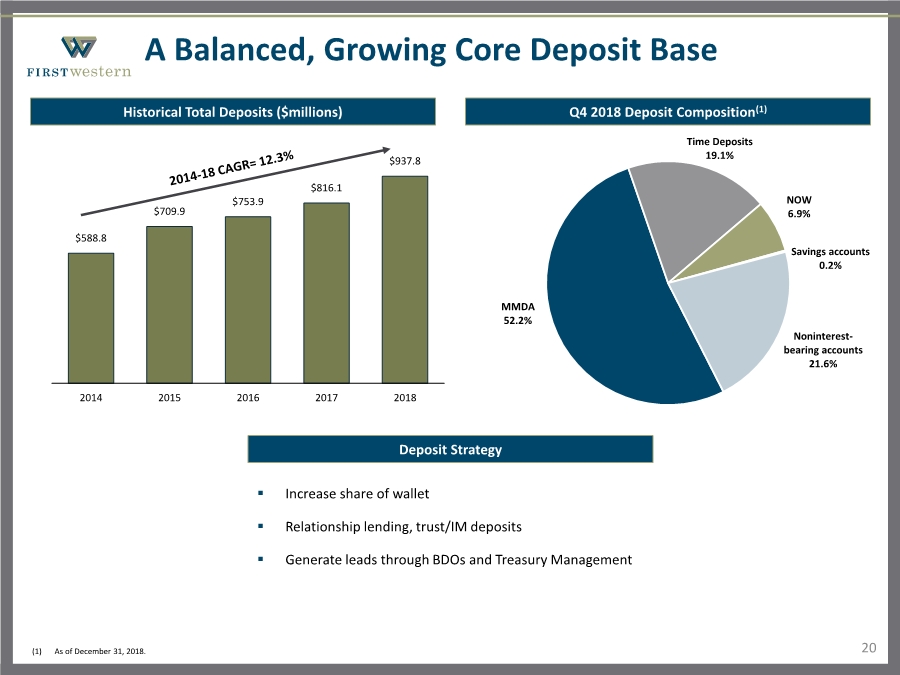

| $588.8 $709.9 $753.9 $816.1 $937.8 2014 2015 2016 2017 2018 A Balanced, Growing Core Deposit Base 20 Historical Total Deposits ($millions) Q4 2018 Deposit Composition(1) Deposit Strategy (1) As of December 31, 2018. .. Increase share of wallet .. Relationship lending, trust/IM deposits .. Generate leads through BDOs and Treasury Management MMDA 52.2% Time Deposits 19.1% NOW 6.9% Savings accounts 0.2% Noninterest- bearing accounts 21.6% |

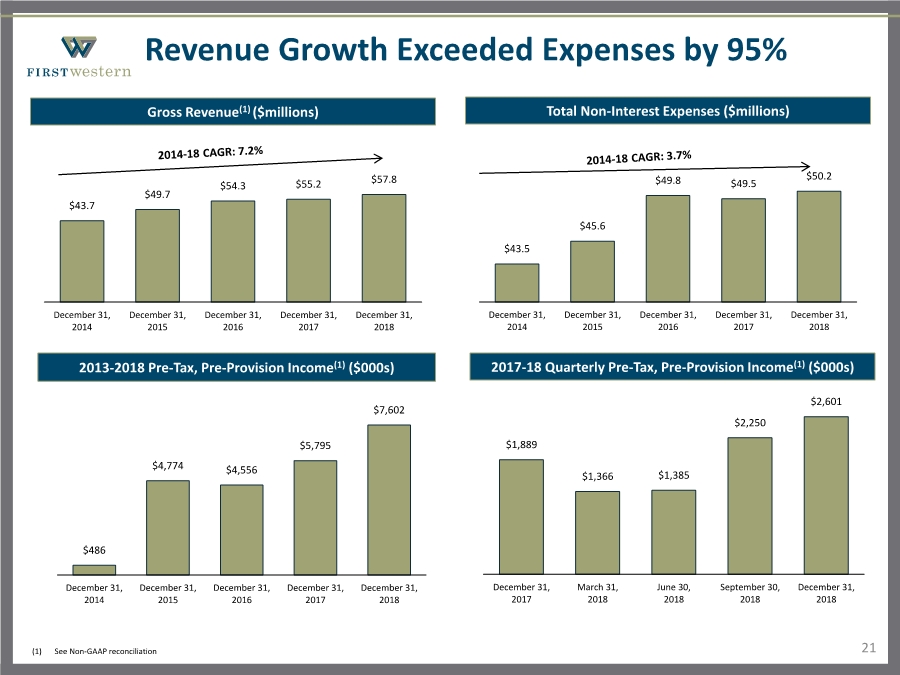

| $43.5 $45.6 $49.8 $49.5 $50.2 December 31, 2014 December 31, 2015 December 31, 2016 December 31, 2017 December 31, 2018 $43.7 $49.7 $54.3 $55.2 $57.8 December 31, 2014 December 31, 2015 December 31, 2016 December 31, 2017 December 31, 2018 Revenue Growth Exceeded Expenses by 95% 21 Gross Revenue(1) ($millions) Total Non-Interest Expenses ($millions) (1) See Non-GAAP reconciliation $486 $4,774 $4,556 $5,795 $7,602 December 31, 2014 December 31, 2015 December 31, 2016 December 31, 2017 December 31, 2018 2013-2018 Pre-Tax, Pre-Provision Income(1) ($000s) $1,889 $1,366 $1,385 $2,250 $2,601 December 31, 2017 March 31, 2018 June 30, 2018 September 30, 2018 December 31, 2018 2017-18 Quarterly Pre-Tax, Pre-Provision Income(1) ($000s) |

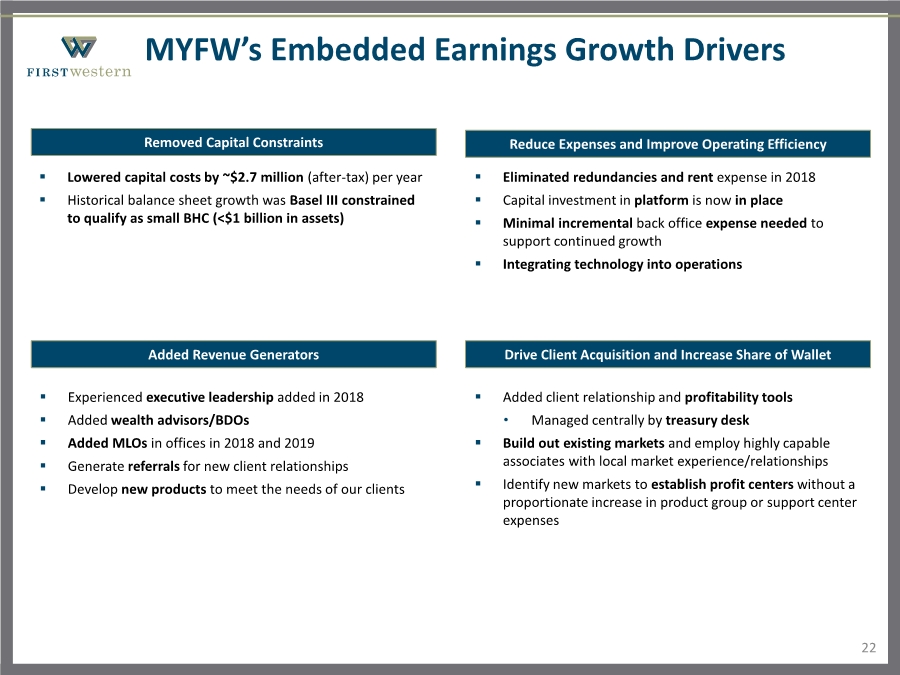

| 22 MYFW’s Embedded Earnings Growth Drivers Removed Capital Constraints Reduce Expenses and Improve Operating Efficiency Added Revenue Generators Drive Client Acquisition and Increase Share of Wallet .. Lowered capital costs by ~$2.7 million (after-tax) per year .. Historical balance sheet growth was Basel III constrained to qualify as small BHC (<$1 billion in assets) .. Eliminated redundancies and rent expense in 2018 .. Capital investment in platform is now in place .. Minimal incremental back office expense needed to support continued growth .. Integrating technology into operations .. Experienced executive leadership added in 2018 .. Added wealth advisors/BDOs .. Added MLOs in offices in 2018 and 2019 .. Generate referrals for new client relationships .. Develop new products to meet the needs of our clients .. Added client relationship and profitability tools • Managed centrally by treasury desk .. Build out existing markets and employ highly capable associates with local market experience/relationships .. Identify new markets to establish profit centers without a proportionate increase in product group or support center expenses |

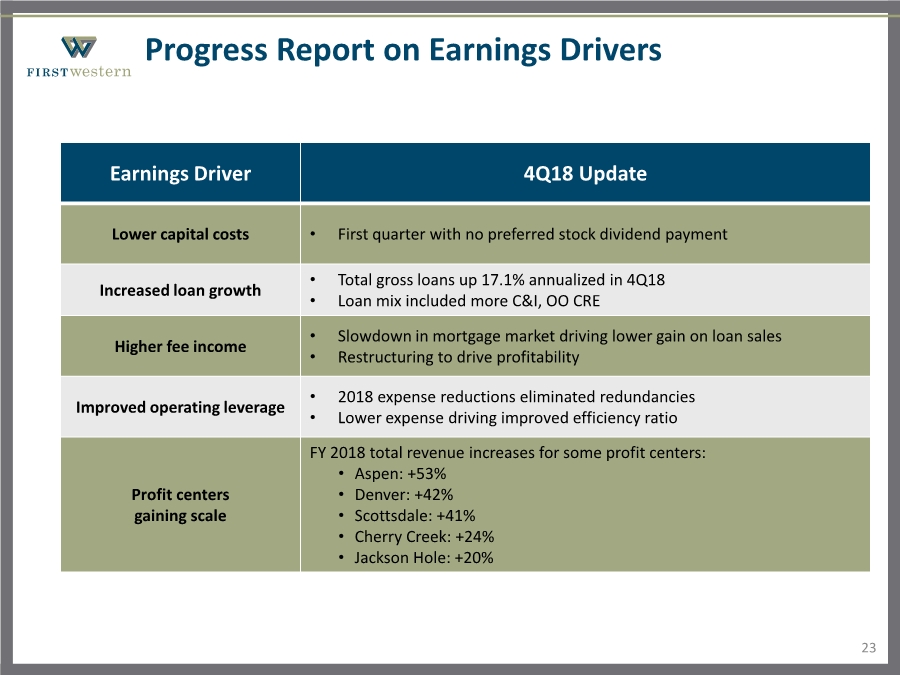

| Progress Report on Earnings Drivers 23 Earnings Driver 4Q18 Update Lower capital costs • First quarter with no preferred stock dividend payment Increased loan growth • Total gross loans up 17.1% annualized in 4Q18 • Loan mix included more C&I, OO CRE Higher fee income • Slowdown in mortgage market driving lower gain on loan sales • Restructuring to drive profitability Improved operating leverage • 2018 expense reductions eliminated redundancies • Lower expense driving improved efficiency ratio Profit centers gaining scale FY 2018 total revenue increases for some profit centers: • Aspen: +53% • Denver: +42% • Scottsdale: +41% • Cherry Creek: +24% • Jackson Hole: +20% |

| Outlook 24 .. Revenue growth driven by investments in business development platform Full executive team in place for 2019 Business Development Officers becoming more seasoned and productive Mortgage Loan Originators moving into existing offices .. Expansion of our mortgage team in the Arizona market .. Continued improvement in operating efficiencies .. Adding new client relationships and expanding existing with ConnectView® .. Opportunities to add clients and experienced talent resulting from consolidation in Colorado banking market |

| Experienced, Tested Team Built-in Operating Leverage Highly Desirable Recurring Fee Income Differentiated, Proven in the Marketplace Unique Opportunity for Investors MYFW’s core strengths provide the foundation for driving shareholder value A Unique and Attractive Investment 25 |

| Appendix |

| Holistic, Integrated Risk Management 27 Purpose .. Holistic approach for the oversight, control, and discipline to drive continuous improvement .. Everyone’s responsibility and non-compliance is not an option .. Governance framework for the process of anticipating, identifying, assessing, managing and monitoring risks Objectives .. Define risk appetite framework .. Define risk areas and responsibilities .. Identify key risk activities for the defined risk areas .. Establish risk tolerance for defined risk areas .. Establish systems for identifying and reporting risks, including emerging risks .. Monitor compliance with strategies designed to mitigate identified risks .. Ensure effective and timely implementation of corrective actions .. Integrate risk management framework objectives into performance evaluation framework Responsibilities ERM Committee: .. Oversee and support the Senior Risk Officer .. Establish risk tolerances and parameters (“risk appetite”) to assess risks and design adequate mitigation strategies Senior Risk Officer: .. ERM program to create and monitor risk management practices • Perform company-wide risk assessment, including relative risk ratings • Assign risk owners and approve action plans • Review and monitor risk mitigation initiatives and status • Review and report to ERM committee: • Specific areas of risk and respective Risk Area Owner responsible for the risks existing in that area • Magnitude of all material business risks • Processes, procedures and controls in place to manage material risks • Overall effectiveness of the risk management process • Evaluate risks and provide guidance on new or proposed products, services or businesses |

| Key Themes of ERM– In the Business 28 Ensure Compliance .. Meet regulatory requirements .. Comply with good industry practices .. Effective, efficient, and smart compliance – a change agent for better business decisions Limit Potential Losses Improve Profitability Support Growth Risk Overlay for Decision Making Improve Stakeholder Management Define Governance and Organization .. Create appropriate transparency on risk, capital and balance-sheet usage, accounting implications .. Effectively limit risks and avoid reputational damage .. Strong risk controlling and monitoring .. Maintain both economic as well as accounting perspective .. Ensure decision-oriented processes .. Maintain efficient and lean risk management – standardization and differentiation .. Improve quality of problem loan management .. Optimize ALM and transfer pricing in cooperation with CFO/treasury .. Anticipate changes in the Company’s risk profile .. Ensure scalability and flexibility of core processes .. Improve balance-sheet management .. Contribute to powerful product offering .. Integrated risk, finance and capital perspective into business planning and management process .. Strong risk and finance capabilities through frontline tools, trainings, and incentives in IT/operations, HC .. Implement a strong risk and performance culture throughout the organization .. Improve planning and steering concepts, data management with CEO, CFO and treasury .. Satisfy Board requirements on transparency and decisions support .. Maintain effective relations with regulators .. Define risk structure’s mandate and organization, create independent risk view in core decisions .. Ensure CFO’s mandate and organization in capital and balance-sheet management, ALM, treasury, funding .. Define and implement ERM approach .. Ensure appropriate people development: knowledge, experience, stature, motivation and culture |

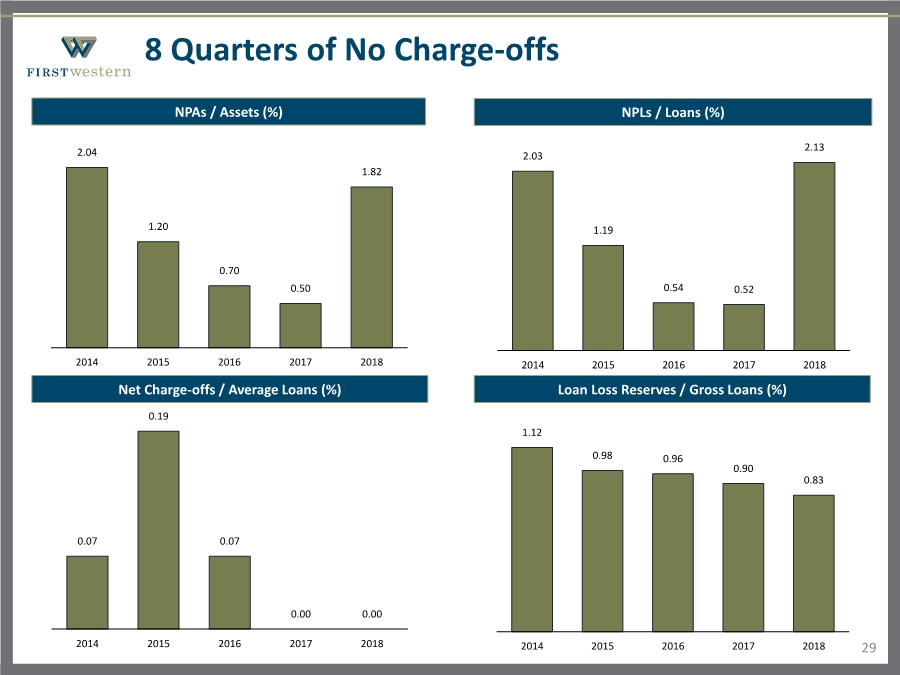

| 1.12 0.98 0.96 0.90 0.83 2014 2015 2016 2017 2018 0.07 0.19 0.07 0.00 0.00 2014 2015 2016 2017 2018 2.03 1.19 0.54 0.52 2.13 2014 2015 2016 2017 2018 2.04 1.20 0.70 0.50 1.82 2014 2015 2016 2017 2018 8 Quarters of No Charge-offs NPAs / Assets (%) NPLs / Loans (%) Net Charge-offs / Average Loans (%) Loan Loss Reserves / Gross Loans (%) 29 |

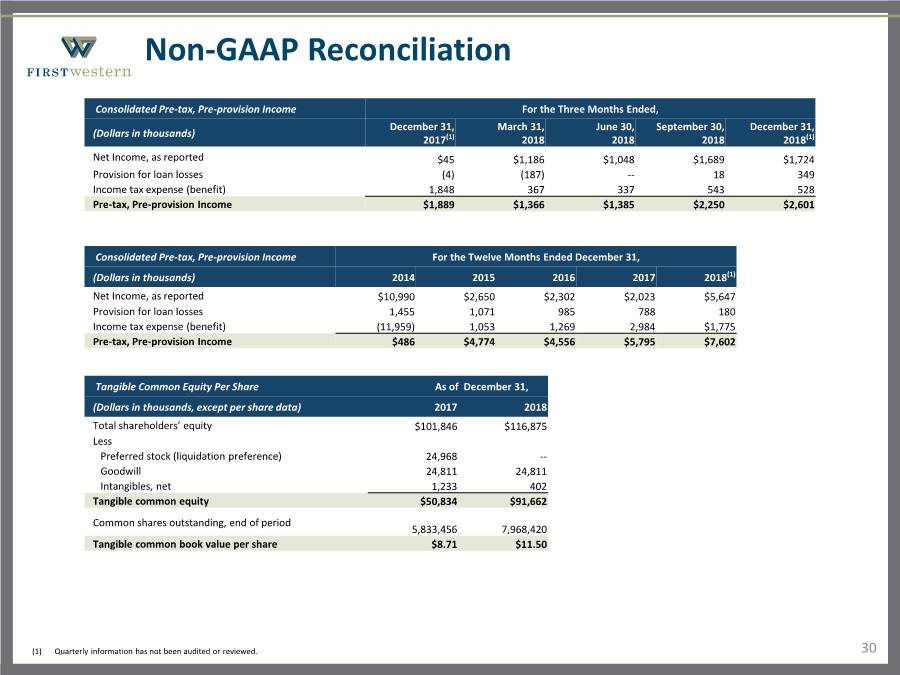

| 30 Non-GAAP Reconciliation Consolidated Pre-tax, Pre-provision Income For the Three Months Ended, (Dollars in thousands) December 31, 2017(1) March 31, 2018 June 30, 2018 September 30, 2018 December 31, 2018(1) Net Income, as reported $45 $1,186 $1,048 $1,689 $1,724 Provision for loan losses (4) (187) -- 18 349 Income tax expense (benefit) 1,848 367 337 543 528 Pre-tax, Pre-provision Income $1,889 $1,366 $1,385 $2,250 $2,601 Consolidated Pre-tax, Pre-provision Income For the Twelve Months Ended December 31, (Dollars in thousands) 2014 2015 2016 2017 2018(1) Net Income, as reported $10,990 $2,650 $2,302 $2,023 $5,647 Provision for loan losses 1,455 1,071 985 788 180 Income tax expense (benefit) (11,959) 1,053 1,269 2,984 $1,775 Pre-tax, Pre-provision Income $486 $4,774 $4,556 $5,795 $7,602 Tangible Common Equity Per Share As of December 31, (Dollars in thousands, except per share data) 2017 2018 Total shareholders’ equity $101,846 $116,875 Less Preferred stock (liquidation preference) 24,968 -- Goodwill 24,811 24,811 Intangibles, net 1,233 402 Tangible common equity $50,834 $91,662 Common shares outstanding, end of period 5,833,456 7,968,420 Tangible common book value per share $8.71 $11.50 (1) Quarterly information has not been audited or reviewed. |

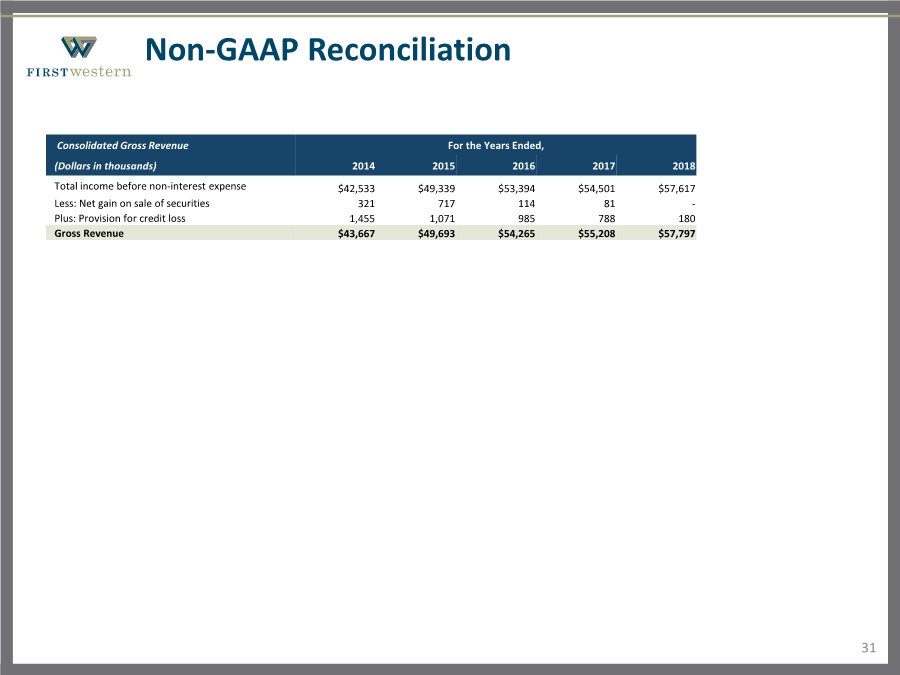

| 31 Non-GAAP Reconciliation Consolidated Gross Revenue For the Years Ended, (Dollars in thousands) 2014 2015 2016 2017 2018 Total income before non-interest expense $42,533 $49,339 $53,394 $54,501 $57,617 Less: Net gain on sale of securities 321 717 114 81 - Plus: Provision for credit loss 1,455 1,071 985 788 180 Gross Revenue $43,667 $49,693 $54,265 $55,208 $57,797 |