Primary Factors Used to Evaluate our Balance Sheet

The primary factors we use to evaluate our balance sheet include asset and liability levels, asset quality, capital, liquidity, and potential profit production from assets.

We manage our asset levels to ensure our lending initiatives are efficiently and profitably supported and to ensure we have the necessary liquidity and capital to meet the required regulatory capital ratios. Funding needs are evaluated and forecasted by communicating with clients, reviewing loan maturity and draw expectations, and projecting new loan opportunities.

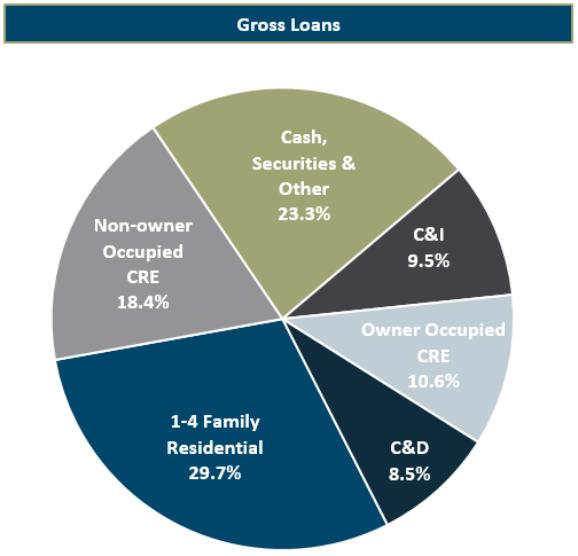

We manage the diversification and quality of our assets based upon factors that include the level, distribution, severity and trend of problem assets such as those determined to be classified, delinquent, non-accrual, non-performing or restructured; the adequacy of our allowance for loan losses; the diversification and quality of loan and investment portfolios; the extent of counterparty risks, credit risk concentrations, and other factors.

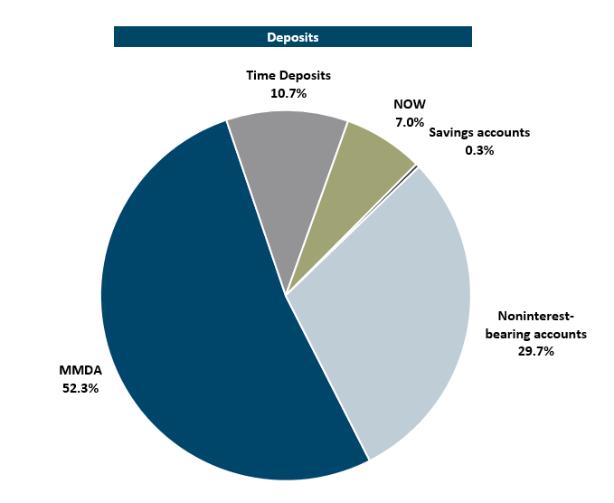

We manage our liquidity based upon factors that include the level and quality of capital and our overall financial condition, the trend and volume of problem assets, our balance sheet risk exposure, the level of deposits as a percentage of total loans, the amount of non-deposit funding used to fund assets, the availability of unused funding sources and off-balance sheet obligations, the availability of assets to be readily converted into cash without undue loss, the amount of cash and liquid securities we hold, and other factors.

Financial institution regulators have established guidelines for minimum capital ratios for banks and bank holding companies. The Company has adopted the Basel III regulatory capital framework. As of December 31, 2020, the Bank’s capital ratios exceeded the current well capitalized regulatory requirements established under Basel III.

Branch Acquisition

On February 10, 2020, the Company entered into a branch purchase and assumption agreement with Simmons Bank, pursuant to which the Company agreed to acquire all of Simmons’ Colorado locations, including three branches and one loan production office located in metro Denver, as well as certain deposits and loans and other assets. On May 15, 2020, the Branch Acquisition was successfully completed. See Note 2 - Acquisitions of the accompanying Notes to Consolidated Financial Statements for additional information.

Recent Events

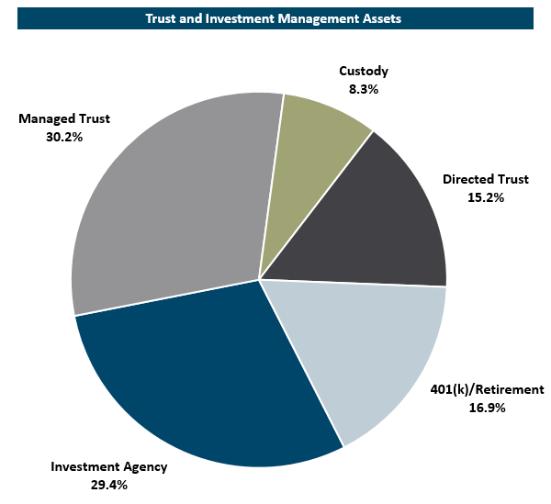

On September 18, 2020, the Company entered into an agreement to sell its LA fixed income team and certain related advisory and sub-advisory arrangements to Lido Advisors, LLC and Oakhurst Advisors, LLC. On November 13, 2020, the Company completed the sale. On an ongoing basis, the sale of the LA fixed income team is expected to be earnings neutral to the Company, as the revenue decrease will be approximately in-line with the expected expense reduction. The sale is not expected to have an impact on Bank clients but reduced the Company’s assets under management by $330.6 million. As a result of the sale, the Company evaluated its reportable segments and determined the remaining assets following the sale in the Capital Management segment no longer meet the thresholds of income before income tax to be a reportable segment. The residual assets that remained in the Capital Management segment are now included in the Wealth Management segment.

Results of Operations

Overview

The year ended December 31, 2020 compared with the year ended December 31, 2019. For the year ended December 31, 2020, we reported net income available to common shareholders of $24.5 million, compared to net income available to common shareholders for December 31, 2019 of $8.0 million, a $16.5 million, or 206.3% increase. For the year ended December 31, 2020, our income before income tax was $33.1 million, a $22.9 million, or 224.4%, increase from December 31, 2019. For the year ended December 31, 2020, compared to the year ended December 31, 2019, income before income tax increased primarily as a result of a $14.0 million, or 43.8%, increase in net interest income and an increase of $18.6 million, or 57.1%, in non-interest income. The increase in non-interest income was primarily the result