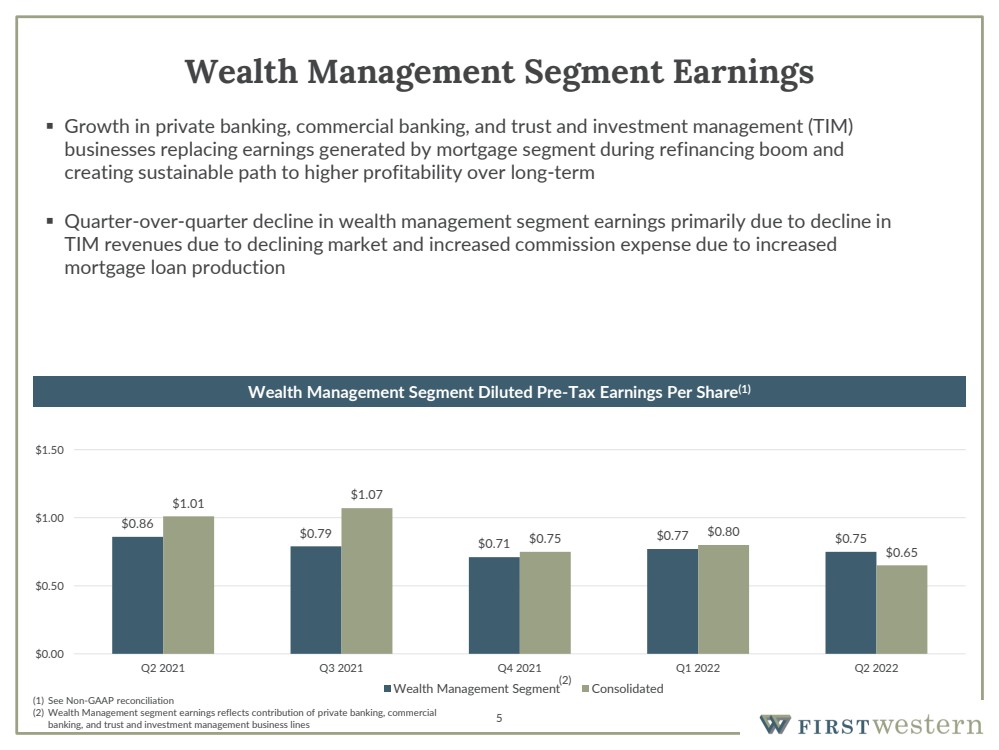

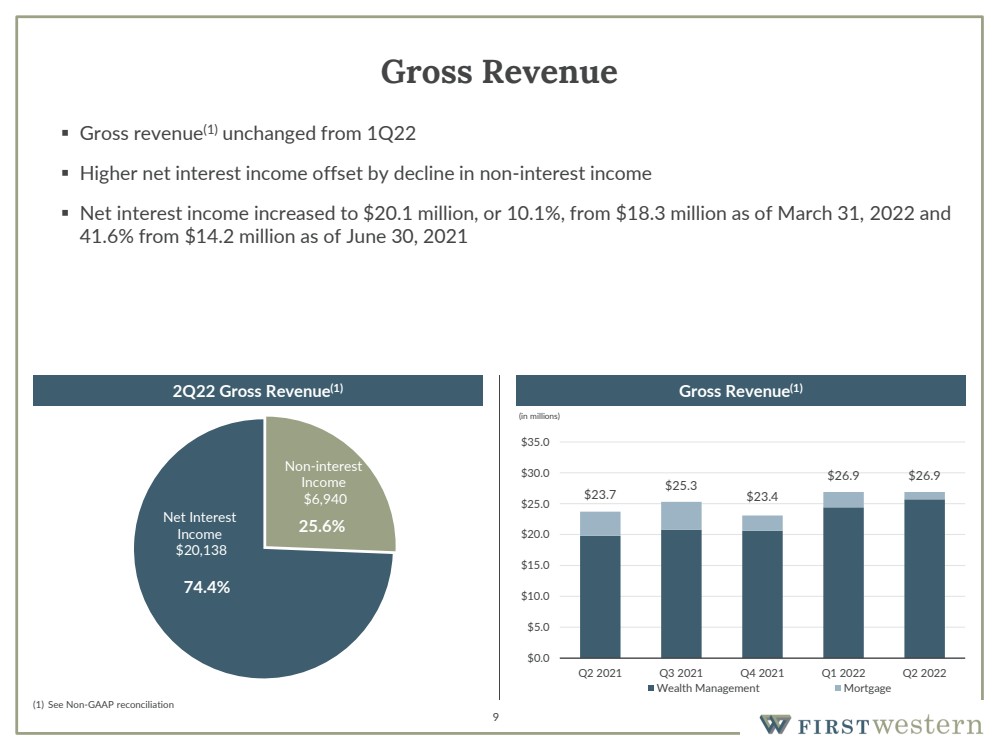

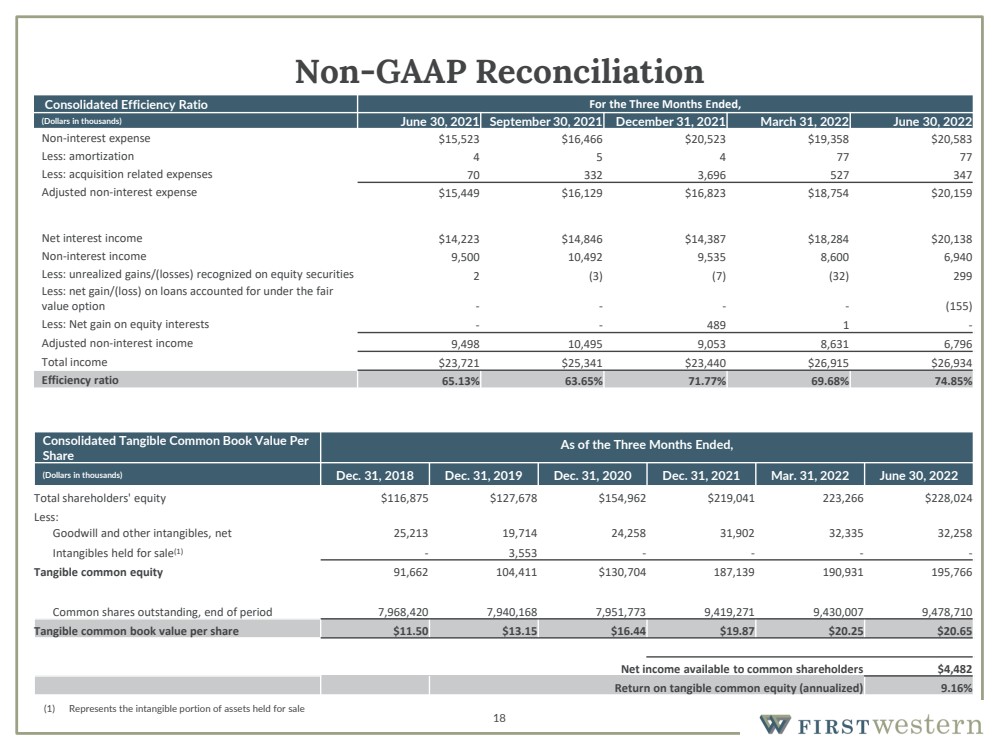

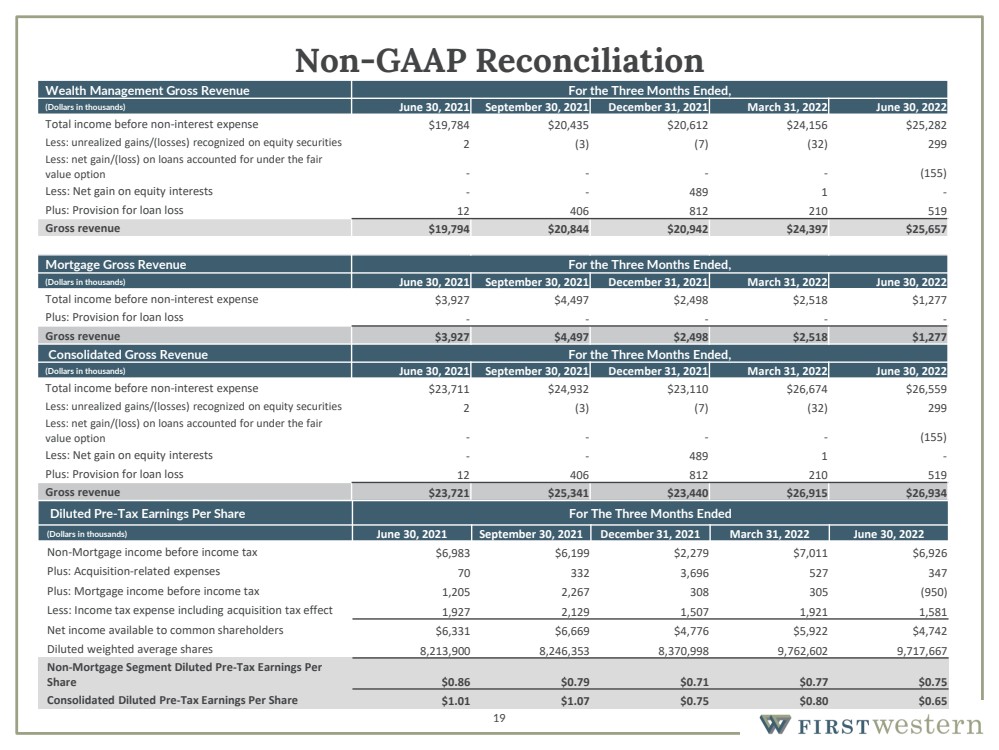

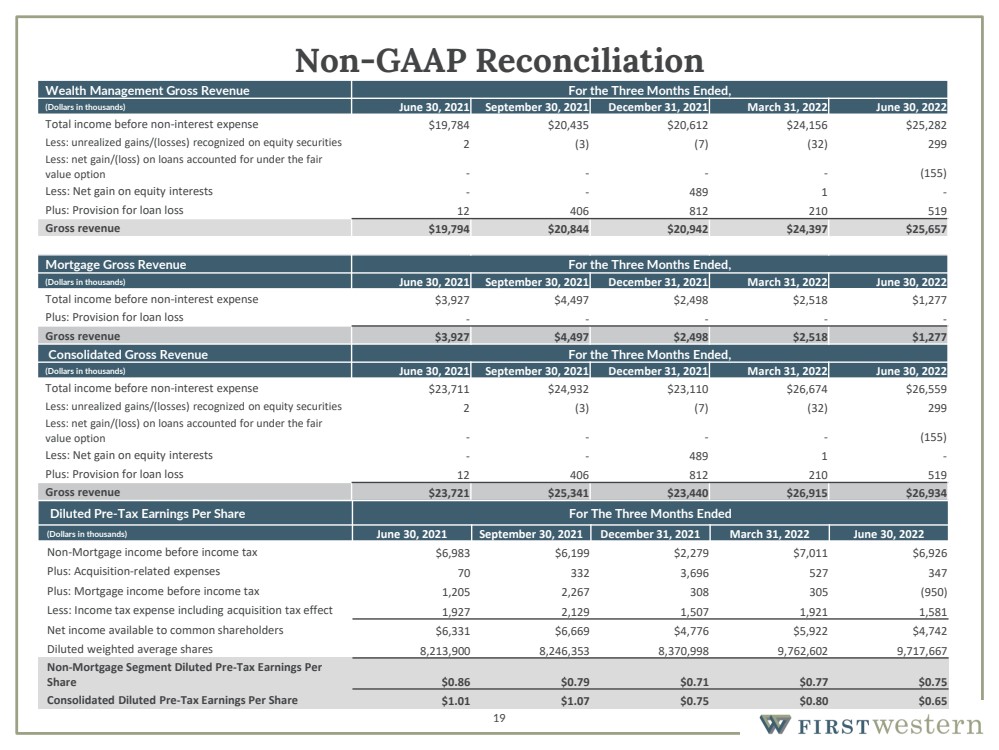

| 19 Non - GAAP Reconciliation Wealth Management Gross Revenue For the Three Months Ended, (Dollars in thousands) June 30, 2021 September 30, 2021 December 31, 2021 March 31, 2022 June 30, 2022 Total income before non - interest expense $19,784 $20,435 $20,612 $24,156 $25,282 Less: unrealized gains/(losses) recognized on equity securities 2 (3) (7) (32) 299 Less: net gain/(loss) on loans accounted for under the fair value option - - - - (155) Less: Net gain on equity interests - - 489 1 - Plus: Provision for loan loss 12 406 812 210 519 Gross revenue $19,794 $20,844 $20,942 $24,397 $25,657 Mortgage Gross Revenue For the Three Months Ended, (Dollars in thousands) June 30, 2021 September 30, 2021 December 31, 2021 March 31, 2022 June 30, 2022 Total income before non - interest expense $3,927 $4,497 $2,498 $2,518 $1,277 Plus: Provision for loan loss - - - - - Gross revenue $3,927 $4,497 $2,498 $2,518 $1,277 Consolidated Gross Revenue For the Three Months Ended, (Dollars in thousands) June 30, 2021 September 30, 2021 December 31, 2021 March 31, 2022 June 30, 2022 Total income before non - interest expense $23,711 $24,932 $23,110 $26,674 $26,559 Less: unrealized gains/(losses) recognized on equity securities 2 (3) (7) (32) 299 Less: net gain/(loss) on loans accounted for under the fair value option - - - - (155) Less: Net gain on equity interests - - 489 1 - Plus: Provision for loan loss 12 406 812 210 519 Gross revenue $23,721 $25,341 $23,440 $26,915 $26,934 Diluted Pre - Tax Earnings Per Share For The Three Months Ended (Dollars in thousands) June 30, 2021 September 30, 2021 December 31, 2021 March 31, 2022 June 30, 2022 Non - Mortgage income before income tax $6,983 $6,199 $2,279 $7,011 $6,926 Plus: Acquisition - related expenses 70 332 3,696 527 347 Plus: Mortgage income before income tax 1,205 2,267 308 305 (950) Less: Income tax expense including acquisition tax effect 1,927 2,129 1,507 1,921 1,581 Net income available to common shareholders $6,331 $6,669 $4,776 $5,922 $4,742 Diluted weighted average shares 8,213,900 8,246,353 8,370,998 9,762,602 9,717,667 Non - Mortgage Segment Diluted Pre - Tax Earnings Per Share $0.86 $0.79 $0.71 $0.77 $0.75 Consolidated Diluted Pre - Tax Earnings Per Share $1.01 $1.07 $0.75 $0.80 $0.65 |